- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The high-impact UK CPI data will be released by the Office for National Statistics on Wednesday.

- Headline and core annual inflation from the United Kingdom are set to fall, while monthly CPI is expected to rebound.

- The UK CPI report could significantly influence the BoE policy outlook, impacting the Pound Sterling.

With increased bets for an interest cut by the Bank of England (BoE) as early as April, the all-important Consumer Price Index (CPI) data from the United Kingdom (UK) will be closely scrutinized for gauging the timing of the BoE policy pivot and its impact on the Pound Sterling.

The Office for National Statistics (ONS) will release the UK inflation data at 07:00 GMT on Wednesday.

What to expect from the next UK inflation report?

The headline annual UK Consumer Price Index is seen growing by 3.8% in December, a modest slowdown from November’s 3.9% increase. The reading would be its lowest since September 2021, but still almost double the BoE’s 2.0% target.

The Core CPI inflation is seen falling further to 4.9% YoY in December, compared with a 5.1% growth recorded in November. Meanwhile, the British monthly CPI is expected to jump 0.2% after falling 0.2% in November.

Analysts at TD Securities (TDS) cited key reasons behind the likely easing in the headline inflation data, noting that “We don't expect a rebound from the weak Nov report, and instead look for more weakness in Dec. A rise in tobacco duty adds some upside pressure on the headline, but softness in leisure and travel should support a decent fall in services to 6.0% YoY— a notable 0.9 ppts below the MPC. This should support a dovish pivot soon from the MPC in Feb, but cuts likely won't come until May.”

At a hearing of the Treasury committee earlier this month, BoE Governor Andrew Bailey said he hoped the recent fall in the cost of mortgages would continue. Bailey refrained from commenting on the monetary policy outlook but said, “let’s just take the market for a moment – obviously that is feeding through into mortgage costs and I hope that is something that continues.”

After the UK central bank held the policy rate at 5.25% at its December meeting, Governor Bailey pushed back against speculation in the financial markets that the interest rates would soon be reduced, stressing that the fight to bring inflation down to 2% is “hard work.”

A surprise fall in inflation in November, however, raised hopes that the BoE would begin cutting interest rates sooner than expected. The ONS said that falling petrol prices were largely behind the surprise drop in inflation last month, alongside easing food and household goods price inflation.

In the quarter to November, UK wages grew at the slowest pace in almost a year, adding to signs of easing inflationary pressures and BoE’s worries. Average Earnings Excluding Bonus in the UK rose 6.6% 3M YoY in November, slowing from October’s 7.2% increase.

Meanwhile, Britain's Gross Domestic Product (GDP) expanded by 0.3% in November after October’s 0.3% decline. But the economy remains at high risk of slipping into a recession as households continue to bear the burden of high energy bills and borrowing costs.

Against this backdrop, the upcoming UK inflation data could help estimate the pace and timing of the central bank’s interest rate cuts this year, which could have a significant impact on the value of the Pound Sterling.

When will the UK Consumer Price Index report be released and how could it affect GBP/USD?

The UK CPI data will be published on Wednesday at 07:00 GMT. The Pound Sterling is correcting from two-week highs of 1.2786 against the US Dollar in the run-up to the United Kingdom’s inflation showdown. The US Dollar is regaining its safe-haven status amid an escalation of geopolitical tensions in the Middle East.

An unexpected uptick in the headline and core inflation data could pour cold water on expectations of a BoE rate cut as early as April, providing the much-needed lift to the Pound Sterling. In such a case, GBP/USD could revert toward the 1.2785 region. Conversely, GBP/USD could extend its correction toward 1.2600 if the UK CPI data shows a rapid fall in inflation and affirms BoE April rate cut bets.

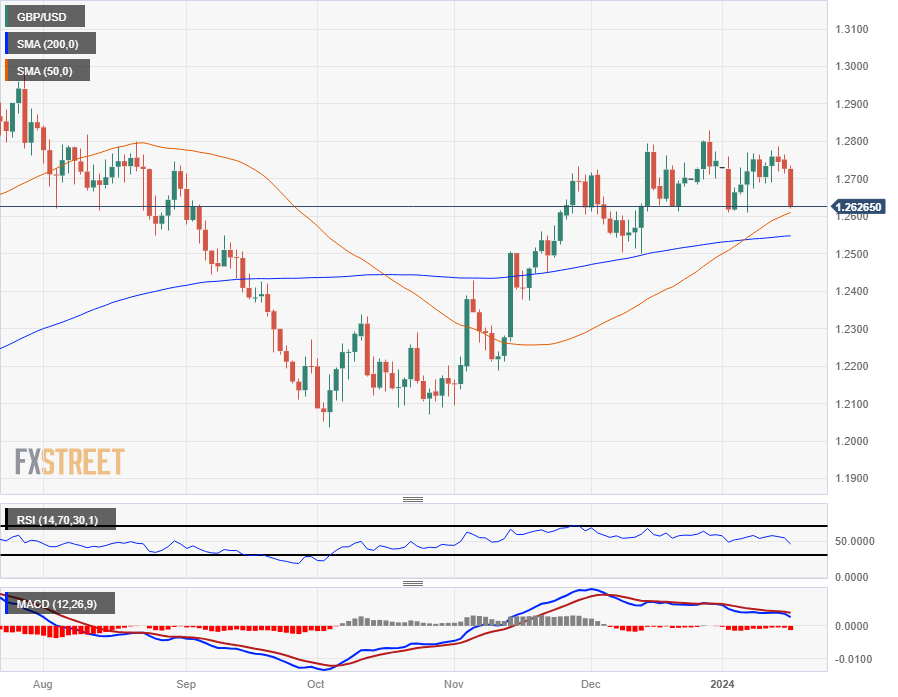

Dhwani Mehta, Asian Session Lead Analyst at FXStreet, offers a brief technical outlook for the major and explains: “The GBP/USD pair has breached the 21-day Simple Moving Average (SMA) at 1.2712, as the downside correction unfolds. The 14-day Relative Strength Index (RSI) is piercing the midline from above, suggesting more pain ahead of the Pound Sterling.”

“A sustained move below the ascending 50-day SMA at 1.2611 could intensify selling pressure on the Pound Sterling. The next downside targets are seen at the critical 200-day SMA at 1.2548 and the 1.2500 round level. Alternatively, any recovery in GBP/USD will need acceptance above the 21-day SMA support-turned-resistance at 1.2712, above which doors will reopen for a test of the two-week high of 1.2786,” Dhwani adds.

Economic Indicator

United Kingdom Consumer Price Index (YoY)

The United Kingdom (UK) Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. It is the inflation measure used in the government’s target. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: 01/17/2024 07:00:00 GMT

Frequency: Monthly

Source: Office for National Statistics

Why it matters to traders

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

In a speech at the World Economic Forum, Premier Li Qiang said on Tuesday that China’s economy grew by about 5.2% in 2023, slightly better than the official target Beijing had set.

Key quotes

“We did not seek short-term growth while accumulating long-term risks, rather we focused on strengthening the internal drivers.”

“Just as a healthy person often has a strong immune system, the Chinese economy can handle ups and downs in its performance. The overall trend of long-term growth will not change.”

“Even if there are twists and turns in China’s economic operation, its overall long-term positive trend will not change.”

“Choosing the Chinese market is not a risk, but an opportunity. So we embrace investments across businesses of all countries with open arms.”

Market reaction

At the time of writing, the AUD/USD pair is trading around 0.6587, up 0.07% on the day.

- AUD/USD holds below the 0.6600 mark, its largest drop since November.

- Fed’s Waller advocates moving carefully with rate cuts.

- China’s Premier Li Qiang said China’s economy grew by about 5.2% in 2023.

- The Chinese economic data and December US Retail Sales will be in the spotlight on Wednesday.

The AUD/USD pair trades in negative territory for the fifth consecutive day during the early Asian session on Wednesday. The downtick of the pair is backed by the stronger US Dollar (USD) as investors decline their bet on rate cut speculation from the Federal Reserve (Fed). AUD/USD currently trades near 0.6583, up 0.02% on the day.

On Tuesday, the US NY Empire State Index for January came in at -43.7 versus -14.5 prior, weaker than the market expectation of -5. The figure registered the lowest reading since 2020.

The Fed Governor Christopher Waller said on Tuesday that interest rate cuts are likely this year, but the central bank should not rush to cut its benchmark interest rate until it is clear that lower inflation will be sustained. The markets have priced in 60% odds on a rate cut in March, down from 80% at the end of last week. This, in turn, boosts the Greenback broadly and acts as a headwind for the AUD/USD pair.

There will be no economic data releases from the Australian docket on Wednesday. China’s Premier Li Qiang said on Tuesday at the World Economic Forum’s annual meeting in Davos that China’s economy grew by about 5.2% in 2023, slightly better than the official target Beijing had set. Investors await the key Chinese data release later in the day, including the Industrial Production, Retail Sales, and Q4 Gross Domestic Product for fresh impetus. The stronger-than-expected data might cap the downside of the China-proxy Australian Dollar (AUD).

Apart from this, the US Retail Sales for December will be released on Wednesday, which is forecast to grow by 0.4% MoM from 0.3% in the previous reading. Furthermore, the Fed’s Beige Book will be due, and FOMC Barr, Bowman, Woods, and Williams will speak.

- GBP/JPY briefly hit multi-week highs at 186.19.

- UK labor figures showed an uptick in new jobs while unemployment held steady.

- Japanese Yen sees declines across the board on Tuesday.

GBP/JPY briefly ticked into a new multi-week high above the 186.00 handle on Tuesday as the Japanese Yen (JPY) saw broad-market declines and the Pound Sterling (GBP) caught a brief ride up the charts after UK labor figures showed more jobs added in December than the previous month.

The UK’s Claimant Count change showed 11.7K new jobless benefits seekers in December, but November’s initial print of 16K saw a steep revision down to just 600. UK Claimant Count Change is notorious for seeing late revisions after-the-fact, and markets will be looking for a similar downside revision to December’s figure when January’s unemployment claims figures are released.

Average Hourly Earnings Including Bonuses eased more than expected, printing at 6.5% for the quarter ended in November, below the forecast 6.8% and easing further back from the previous quarter’s 7.2%.

The UK Employment Change also jumped to a six-month high of 73K in November, compared to October’s 50K, with the UK adding the highest amount of net job gains since last July’s 102K.

Pacific market participants will want to keep an eye out for China’s Gross Domestic Product (GDP), Industrial Production, and Retail Sales figures all due early Wednesday at 02:00 GMT. The UK also sees a second round of GBP data with UK Consumer Price Index (CPI) inflation figures and Producer Price Index (PPI), as well as the Retail Price Index.

UK CPI for December is expected to rebound from -0.2% to 0.2%, and the Retail Price Index is forecast to increase from -0.1% to 0.4% MoM for the same period. The non-seasonally-adjusted PPI - Output for the year ended December is expected to also increase from -0.2% to 0.4%.

GBP/JPY Technical Outlook

The GBP/JPY continues to trade into the high end as broad-market Yen selling forces down the JPY, keeping the Guppy buoyed at near-term highs near 186.00.

The 200-hour Simple Moving Average (SMA) is straining to keep up with near-term bidding pressure, currently rising through 184.50, and intraday bids haven’t touched the moving average since crossing the key level since early January.

A bullish rejection of the 200-day SMA crystallized in January, and daily candlesticks have the GBP/JPY bidding above the 50-day SMA near the 184.00 handle.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

GBP/JPY Technical Levels

- AUD/JPY falls to four-day low at 96.58, rebounds slightly amid weak risk appetite and Wall Street losses.

- Technical analysis: AUD/JPY has an upward bias but faces resistance near 97.00/10; breach could lead to more gains.

- Sellers target below 97.00, eyeing Senkou Span A and January 16's 96.58 low, with further downside to 96.00.

The AUD/JPY printed modest losses on Tuesday, as risk appetite took its toll as worldwide central bank policymakers pushed back against rate cut expectations. Therefore, Wall Street ended the session with losses, while risk-perceived currencies, like the Aussie Dollar (USD) and the New Zealand Dollar (NZD), registered losses vs. safe-haven peers. The pair is trading at 96.89 as Wednesday’s Asian session begins.

The daily chart suggests the pair is biased upward, though refreshed at a four-day low at 96.58 before paring its earlier losses. That formed a hammer, which usually is a bullish signal, though AUD/JPY is facing stir resistance at a two-month-old downslope resistance trendline that passes at around 97.00/10, which, once cleared, could pave the way for further upside.

In the outcome of reclaiming that level, buyers' next stop would be the January 11 high at 97.79, followed by the 98.00 figure. A breach of the latter will expose last year’s high at 98.58.

Conversely, if sellers keep prices below the 97.00 threshold and drag the spot price toward the confluence of the Senkou Span A and January 16 lows of 96.58, they could remain hopeful of aiming toward the 96.00 figure. Though on its way toward that level, they must conquer the Kijun-Sen and the Senkou Span B convergence at around 96.18/14.

AUD/JPY Price Action – Daily Chart

AUD/JPY Technical Levels

- NZD/JPY currently stands at 90.33 amid mild losses and cleared most of its daily losses.

- Daily chart indicators reveal a resilient buying momentum.

- In the broader context, the pair remains above the 20,100,200-day SMAs, asserting bull's control.

On Tuesday's session, the NZD/JPY stands at 90.33, with mild losses after dropping earlier in the session towards 89.90. Generally, the daily technical chart presents a neutral to bullish outlook, with the bulls firmly securing their turf. Similarly, the four-hour chart mirrors this bullish dominance, demonstrating the current strength of buyers.

The daily chart indicators reflect a firm grasp by the bulls despite the losses seen during the session asserted from the pairs's position above the three key Simple Moving Averages (20,100,200 days), which signifies a bullish bias in the broader perspective. Moreover, the Relative Strength Index (RSI) now lingers in positive territory, reinforcing the buyers' strength. Simultaneously, the Moving Average Convergence Divergence (MACD) prints green bars, further affirming the bullish control. The positive bias is also confirmed by the buyers, who effectively defended the 20-day SMA earlier in the session and quickly rejected the sellers.

Turning to the four-hour chart, the dominance of buyers becomes more pronounced. Their fortification is reflected in the Relative Strength Index (RSI), which is not only in the positive region but also on a positive incline. The Moving Average Convergence Divergence (MACD) further echos this strength with continuous green bars indicating sustained buying momentum. This demonstrates an encouraging short-term technical outlook that could distract from the daily charts' temporary losses.

NZD/JPY technical levels

NZD/JPY daily chart

-638410392142305892.png)

- Crude Oil markets see frothy action as barrel traders whipsaw on Houthi headlines.

- EIA US Crude Oil production seen net higher, albeit with some regional declines.

- Canadian Crude oil output set to increase as Trans Mountain nears completion.

West Texas Intermediate (WTI) US Crude Oil roiled on Tuesday, trading into consolidation just above $72.00 per barrel as geopolitical concerns surrounding ongoing Houthi attacks on civilian cargo ships in the Red Sea continues to prop up barrel bids in fearful, uneven market action.

Iran-backed Houthi rebels continue to vow to attack civilian cargo ships heading towards the Suez Canal past the coast of Yemen, and a front-loaded assault by coalition naval forces from the US and the UK has energy traders concerned that Houthi rebels will continue to target ships passing through the key waterway that connects Europe and Asia.

Despite ongoing supply line concerns, US Crude Oil stocks remain well-supplied, and oil derivative pipelines remain healthily full.

US, Canadian production continues to climb into all-time highs

According to the Energy Information Administration (EIA), US Crude oIl production facilities slightly increased net output this week after production from the Permian Basin climbed 5.5K barrels per day to 5.974 million bpd, pushing US Crude Oil output even higher despite slight easing in production from the Eagle Ford production center (down 2K bpd to 1.147 million bpd) and the Bakken oil production facility (down 500 bpd at 1.303 million bpd).

US oil production continues to entirely outpace global production cuts from the Organization of the Petroleum Exporting Countries (OPEC), and North American Crude Oil output is set to climb even further with Canadian oil producers ramping up production as the Trans Mountain pipeline nears completion. According to reporting by The Canadian Press via BNN Bloomberg, Alberta oil output hit a record high in November of 4.2 million barrels per day, an 8.8% increase from the previous month. By comparison, Alberta produced an average of 3.8 million bpd through the first eleven months of 2023.

November’s increase in Canadian Crude Oil production makes Canada the fourth-largest producer of barrels globally.

WTI Technical Outlook

WTI US Crude Oil continues to trade into the midrange around the 200-hour Simple Moving Average (SMA) near $72.50 as barrel bids continue to shuffle around key levels, looking for a definitive push in either direction.

Long-term potential for a bullish push is declining as WTI trades laterally into a declining 50-day SMA, and topside momentum sees a technical ceiling from the 200-day SMA at $78.00.

WTI is up a scant 5.7% from December’s bottom bids near $67.97, and limited topside recovery sees US Crude Oil still down nearly 24% from last September’s peak bids near $94.00.

WTI Hourly Chart

WTI Daily Chart

WTI Technical Levels

- Silver falls 1% influenced by surging US Treasury yields and Fed's resistance to a March rate cut.

- Technical analysis shows XAG/USD with a neutral to downward bias; key support at $22.48, and $22.00.

- Potential rebound above $23.00 could challenge the 100-day DMA at $23.23, with further targets at $23.58/66 and the $24.00 level.

Silver price slumps below $23.00 a troy ounce, down 1% on the day, as US Treasury yields soar due to Federal Reserve (Fed) officials pushing back against a March rate cut. Consequently, the non-yielding metal has dropped and printed a two-day low at around $22.86.

From a technical standpoint, XAG/USD is neutral to downward biased, though the grey metal hasn’t been able to drop below the January 11 daily low of $22.48, which could pave the way for further downside. The formation of an ‘evening star’ exacerbated Silver’s fall, with the next support level seen as the $22.00 figure, followed by the November 13 swing low of $21.88.

On the other hand, if XAG/USD’s buyers lift prices above $23.00, they could threaten to challenge the 100-day moving average (DMA) at $23.23. Further upside is seen at the confluence of the 200 and 50-day moving averages (DMAs) at $23.58/66, before testing the $24.00 threshold.

XAG/USD Price Action – Daily Chart

XAG/USD Technical Levels

As US markets returned to their daily routine, investors’ declining speculation on interest rate cuts by the Fed lent strong support to the Greenback, while ECB officials also remained at odds with markets’ perceptions of the timing of interest rate reductions, eventually weighing on the European currency. Markets’ attention is expected to remain on US Retail Sales, Fedspeak, and Lagarde’s speech at the WEF.

Here is what you need to know on Wednesday, January 17:

The demand for the US Dollar gathered extra pace on Tuesday and lifted the USD Index (DXY) to new YTD peaks well past the 103.00 mark along with a similar advance in US yields, all in response to further repricing of the Fed’s timing of interest rate reduction. Next of relevance in the US data space will be December Retail Sales, Industrial Production and the Fed’s Beige Book. In addition, FOMC Barr, Bowman, Woods, and Williams will speak.

EUR/USD accelerated its losses and collapsed to the sub-1.0900 region, printing new 2024 lows near 1.0860 amidst the strong resurgence of demand for the greenback. In the domestic calendar, the final December Inflation Rate is due along with the speech of ECB President C. Lagarde at the WEF in Davos.

GBP/USD maintained its bearish performance well in place and dropped to the vicinity of the 1.2600 neighbourhood as the dollar’s strength continued to weigh on the risk complex. The general positive tone from the UK labour market report failed to ignite any reaction in the British pound. On Wednesday, all the attention across the Channel will be on the publication of the Inflation Rate for the month of December.

USD/JPY extended its bounce past the 147.00 barrier and recorded a new YTD peak against the backdrop of the sharp improvement in the Dollar and rising US yields across the curve. The release of the Reuters Tankan Index will be in the limelight on Wednesday.

AUD/USD dropped for the fourth session in a row and put the 200-day SMA to the test around the 0.6580 zone as the sentiment around the high-beta currency remained sour. Absent data releases in Oz on Wednesday, AUD should closely follow the Chinese docket, which includes the Q4 GDP Growth Rate, Industrial Production, Retail Sales, and the House Price Index, among others.

Both Gold and Silver navigated a “sea of red” on the back of strong gains in the greenback and the move higher in US yields.

- Futures market adjusts expectations, reducing bets on quick Fed rate cuts, leading to a rise in US Treasury yields across various maturities.

- Atlanta Fed President Bostic and Fed Governor Waller emphasize a measured approach to rate cuts, citing risks of inflation and policy calibration.

- Inversion in US Treasury yield curve deepens, signaling potential recession concerns, while key US economic data and Fed speeches loom this week.

US Treasury yields rose across the board as interest rate traders in the futures market trimmed their bets that the US Federal Reserve (Fed) would cut rates as quickly as expected. Global bond yields are climbing as central bankers from the Federal Reserve (Fed) push back against market participants' projections that they would relax monetary policy even though the risks of overtightening have emerged.

US bond yields rise as Fed officials signal slower rate cuts

Over the weekend, the Atlanta Fed president Raphael Bostic warned that a “second wave” of inflation could emerge should the central banks cut rates too soon and warned that getting inflation towards the Fed’s 2% target would take some time, according to the Financial Times.

Bostic added that he expects inflation progress to slow down, adding that there were “some risks that inflation may stall out altogether.”

Recently, Fed Governor Christopher Waller commented the Fed is in no rush to easy policy as inflation is “within striking distance.” Although he supports the idea of cutting rates, he warned that until any risks of inflation resurging have subsided, policy changes should “be carefully calibrated and not rushed.”

Following the Fed’s Waller speech, Fed funds futures traders expect a 65% chance of 25 basis points, lower than the 76.9% expected yesterday.

The US 10-year Treasury note climbed 12 basis points, up to 4.07%, while the 2-year note rose 9 basis points at 4.24%. Even though the short and the mid-term of the curve are rising, the US 10s-2s yield curve disinsertion continued, as the spread hit its highest level since October of 2023, at -0.163%. When inverted, that part of the US Treasury yield curve Is usually seen as a warning sign of an upcoming recession.

Ahead of the week, the US economic docket will feature US Retail Sales and Industrial Production housing data and Fed speeches on Wednesday. On Thursday, Initial Jobless Claims and further Fed speakers would cross the wires, followed by Friday’s University of Michigan (UoM) Consumer Sentiment.

US 10s-2s Yield spread chart

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

- The XAU/USD exhibits a strong downward trend, moving near the $2,025 level.

- The US Dollar measured by the DXY Index rose to its highest since mid-December.

- Higher US yields are also driving demand away from the US Dollar.

In Tuesday's trading session, the XAU/USD showcased a significant downward trajectory, trading near the $2,025 mark. This downward movement is predominantly attributed to the strengthening US Dollar and higher US yields. With the US economy showing resilience, precious metals such as gold XAU are witnessing downward pressure but as long as dovish bets on the Federal Reserve (Fed) remain high, the downside is limited.

The Federal Reserve closely observes Core inflation, which unexpectedly picked up in December. In addition, they also monitor the labor market, which showed strong figures in the last month of 2023, with job creation and earnings accelerating and Unemployment declining. While the Fed officials keep a cautious tone as an overheated economy may threaten their fight against inflation, the markets are confident that the easing cycle will begin in March, and those dovish bets may limit the downside for the metal. As for now, the CME FedWatch Tool suggests that the probabilities of cuts in March and May are high, above 50%.

Presently, US Treasury yields are up. The 2-year rate is 4.20%, the 5-year rate is 3.90%, and the 10-year yield is recorded at 4%. Higher yields drove attention to the US dollar as it tends to attract foreign investors.

XAU/USD levels to watch

The indicators on the daily chart suggest a mixed outlook for the metal. The Relative Strength Index (RSI) shows a downward trajectory and it currently resides in negative territory. This condition usually hints at a strong selling momentum. Simultaneously, the Moving Average Convergence Divergence (MACD) is displaying increasing red bars. This points to a scenario where the selling pressure is progressively strengthening, adding further weight to the bearish bias in the short-term dynamics.

However, zooming out to the broader perspective, the metal remains in a bullish context as it stays above both the 100-day and 200-day Simple Moving Averages (SMAs). This reveals that, while sellers are attempting to seize control in the immediate term, the overarching buying momentum remains robust, maintaining a buffer against a complete trend reversal.

In summary, while the day-to-day fluctuations may appear towards a continued downward path, the bearish sentiment may be seen as temporary noise within a larger bullish trend.

XAU/USD daily chart

-638410293492306549.png)

- GBP/USD fails to recover on upbeat macro data as US Dollar drives the market.

- UK Unemployment Rate steadies at 4.2% for the quarter ended November.

- Previous Claimant Count Change figures saw a steep revision from 16K to just 600.

The GBP/USD fell to a near-term low of 1.2620 in Tuesday trading as broader markets shrug off upbeat economic data from the UK in favor of bidding up the US Dollar (USD) across the board, sending the Pound Sterling (GBP) into the new year’s lows and putting further pressure on the pair.

Broad-market bets of a rate cut from the Bank of England (BoE) are steadying after Tuesday’ labor data print, with money markets now pricing in a total of 134 basis points in rate cut from the BoE through 2024.

The UK’s Claimant Count Change in December printed at 11.7K, the indicator’s highest print since June’s 16.2. November’s initial print of 16K was steeply revised to just 600, or 0.6K, and revisions continue to be the norm for UK jobless claims. Markets will be looking for a similarly steep revision to December’s figure at the next print.

The UK’s Unemployment Rate held steady at 4.2% for the quarter ended November, in-line with market expectations, though Average Earnings Including Bonuses slipped to 6.5% compared to the forecast decline from 7.2% to 6.8%.

The UK also had its best jobs additions figure since May, adding 73K in November compared to the previous print of 50K.

Wednesday brings another bout of UK economic figures, with the UK Consumer Price Index (CPI) for December landing alongside the UK Retail Price Index and the Producer Price Index (PPI) as the UK gets all of its inflation figures out of the way in one fell swoop.

US Retail Sales for December will also be landing later on Wednesday, which could easily knock the GBP/USD deeper if markets pile back into the Greenback.

GBP/USD Technical Levels

The GBP/USD fell further past the 200-hour Simple Moving Average (SMA) on Tuesday, testing into 2024’s low bids. The pair is poised for a continued drop into the 1.2600 handle, but a reversal into the top end will have to overcome a bearish crossover of the 50-hour and 200-hour SMAs in the near-term.

Looking longer-term, downside potential in the GBP/USD could be capped as the pair slides into the 50-day SMA near 1.2600, with a fresh bullish crossover of the 200-day SMA around 1.2550 pricing in a technical floor just below.

The pair is down 1.6% from the last swing high into 1.2828, but still remains up nearly 5% from October’s bottom bids near 1.2037.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

European Central Bank (ECB) Governing Board Member and Governor of the Central Bank of Estonia Madis Müller added his comments to his cohort's messages to the market on Tuesday.

ECB policymaker Madis Müller noted that market rate cut hopes have run too far ahead of the ECB's current trajectory, and that wage growth figures continue to run against the grain of current inflation expectations.

Key highlights:

- Market expectations for ECB rate cuts in 2024 are too aggressive, don't match the data currently facing the central bank.

- Euro area wage growth remains misaligned with current inflation targets.

- ECB can't move on rates until the data reflects desires price growth conditions.

- European equity indexes retreated on Tuesday, STOXX600 dropped a quarter of a percent.

- ECB officials continue to press down on market rate cut hopes.

- UK’s FTSE sees five-week lows as declines extend.

European equities broadly ended Tuesday in the red as central bank policymakers saw a rapid-fire rotation of comments during the World Economic Forum in Davos, Switzerland. European Central Bank (ECB) policymakers diverged slightly on their comments, but the overall outline of policymakers’ was clear-cut enough that money markets balked on rate-cut hopes in March.

Investors are no longer fully priced-in on the first 25 basis point rate cut from the ECB in April as key ECB policymakers press down on market expectations by reaffirming the ECB remains data-dependent, and wary of potential shocks in price growth moving forward.

Read More: ECB policymakers hit the wires on Tuesday

- ECB’s Villeroy: Too early to declare victory over inflation

- ECB’s Centeno: Need to be prepared for all topics, including rate cuts

- ECB’s Välimäki: Must not jump the gun on rate cuts

- ECB's Simkus: doesn't see rate cuts until summer

European economic data further hampered market momentum on Tuesday as German inflation remains stubbornly above-target, despite deteriorating economic sentiment in the near-term.

Germany’s Harmonized Index of Consumer Prices (HICP) for the year ended December stuck to 3.8% as markets broadly expected, holding steady with the previous print, flummoxing market hopes of inflation in key European markets leading the way down towards the ECB’s key policy target of 2%. The pan-European ZEW Economic Sentiment Survey in January declined less than expected to print at 22.7 versus the forecast backslide to 21.9, but still coming in lower than December’s 23.0.

Germany’s Zew Economic Sentiment Survey for the same period improved to 15.2 versus the forecast decline from 12.8 to 12.0, but Germany’s January ZEW Current Situation Sentiment Survey ticked down to -77.3 from -77.1, coming in below the forecast -77.1.

Germany’s DAX index declined three-tenths of a percent to close at €7,558.34, down 50.54 points, while France’s CAC 40 shed nearly a fifth of a percent, sliding 13.68 points to close at €7,398.00.

The pan-European STOXX600 major equity index lost a quarter of a percent to close down 1.13 points at €473.06, while London’s FTSE 100 index tumbled nearly half a percent to close down 36.57 points at £7,558.34.

DAX Technical Outlook

Germany’s DAX equity index tested into near-term lows on Tuesday, setting a new low for the week and challenging familiar lows from earlier in the month near €16,450.00. The DAX remains on the low side of near-term consolidation that has plagued the index since the start of 2024, which kicked off the new trading year with a brief ramp-up into €16,945.00.

The DAX has failed to drive additional bullish momentum since chalking in all-time highs in mid-December near €16,985.00, but the consolidating index still sees plenty of technical support from a bullish 50-day Simple Moving Average near €16,200.00 climbing higher above the 200-day SMA near €15,800.00.

DAX Hourly Chart

DAX Daily Chart

DAX Technical Levels

- USD/JPY pair ascends and gains 1.04%, driven by higher US Treasury bond yields and global risk aversion sentiment.

- Fed Governor Waller's cautious approach to rate cuts influences market expectations, reducing March rate cut bets from 78.9% to 63%.

- Japanese economic data shows producer prices rising, but cooling core CPI projections may hold back BoJ from tightening monetary policy.

The US Dollar (USD) gains traction against the Japanese Yen (JPY) bolstered by a rise in US Treasury bond yields amid a risk aversion environment. That, along with Japanese economic data revealed during the month, brushing aside the chances for the Bank of Japan (BoJ) to raise rates has faded. Therefore, the USD/JPY trades at 147.18, gains 1.04%.

US Dollar gathers steam bolstered by yields, Fed’s Waller comments

The US 10-year Treasury bond yield is climbing more than ten basis points, up at 4.06%, sponsored by worldwide central bankers pushing back against rate cuts, a tailwind for the Greenback (USD). The US Dollar Index (DXY), a gauge of the buck’s value against a basket of rivals, climbs 0.70%, up at 103.39.

In the meantime, Federal Reserve’s Governor Christopher Waller said the Fed is closing to reach its 2% goal, and adding that even though he supports rate cuts, the US central bank shouldn’t rush to ease policy until it is clear that lower inflation would be sustained. He said the Fed should proceed “methodically and carefully,” adding that he “sees no reason to move as quickly or cut as rapidly as in the past.” Consequently, traders pared bets that the Fed would cut rates in March from 78.9% to 63%.

Data-wise, the US economic docket featured the New York Fed Empire State Manufacturing Index for January, which plunged to -43.7, below forecasts of -5 and a December reading of -14.5

On the Japanese front, prices paid by producers in December rose on a monthly basis by 0.3%, exceeding forecasts of 0%, and the annual basis slid to 0% from 0.3%. The data comes ahead of Friday’s inflation data, with the core Consumer Price Index (CPI) expected to cool down from 2.5% to 2.3% YoY, as foreseen by analysts. If the data continues to cool down, that might refrain the BoJ from normalizing monetary policy, despite BoJ’s Governor Ueda's comments that he’s confident that Japan would emerge from a deflationary mindset.

USD/JPY Technical Levels

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.73% | 0.65% | 0.38% | 1.02% | 0.99% | 0.91% | 0.68% | |

| EUR | -0.73% | -0.07% | -0.32% | 0.30% | 0.27% | 0.19% | -0.04% | |

| GBP | -0.65% | 0.07% | -0.26% | 0.37% | 0.34% | 0.24% | 0.01% | |

| CAD | -0.39% | 0.34% | 0.27% | 0.63% | 0.60% | 0.52% | 0.29% | |

| AUD | -1.00% | -0.29% | -0.36% | -0.64% | -0.02% | -0.10% | -0.34% | |

| JPY | -1.00% | -0.27% | -0.38% | -0.62% | 0.03% | -0.09% | -0.32% | |

| NZD | -0.89% | -0.18% | -0.24% | -0.50% | 0.12% | 0.11% | -0.23% | |

| CHF | -0.68% | 0.04% | -0.03% | -0.29% | 0.33% | 0.32% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

- The DXY Index rose near 103.40 but was rejected by the 100-day SMA.

- Rising US yields made the US Dollar gain interest.

- Dovish bets on the Fed remain high.

The US Dollar (USD) started the trading session by surging to the 103.40 mark, quickly being pulled back by the resistance of the 100-day SMA. This swift rebound was primarily due to US traders returning from their holiday, further catalyzed by a progressive rise in yields.

The markets are anticipating that the Fed’s easing cycle will begin in March, followed by another rate cut in May, which may limit any upside for the US Dollar. Despite higher CPI numbers, the market remains stubborn and expects the Fed to initiate its easing cycle sooner rather than later, and the soft PPI readings gave markets a reason to bet on a less aggressive approach.

Daily digest market movers: US Dollar finds strength as US traders return, bond yields rise

- No significant reports were released during the session.

- US bond yields are edging higher, with the 2-year yield at 4.20%, the 5-year yield at 3.90% and the 10-year yield at around 4%.

- Forward-looking markets anticipate that for the upcoming January meeting, the CME FedWatch Tool points toward no hike, with low probabilities of a rate cut. Additionally, markets are now pricing in higher odds of rate cuts in March and May 2024.

- This week, the US will release Retail Sales figures from December and the Fed’s Beige Book, which may have an impact on those expectations.

Technical Analysis: DXY gets additional ground must regain the 100-day SMA to confirm a reversal

The Relative Strength Index (RSI), showcasing a positive slope in positive territory, points toward increasing bullish momentum. The Moving Average Convergence Divergence (MACD) affirms this trend with rising green bars, suggesting a build-up of buying pressure. The ongoing bullish control is further emphasized by the asset standing above the 20-day Simple Moving Average (SMA) - a sign of short-term strength.

On the contrary, the index's position below the 100-day and 200-day Simple Moving Averages (SMAs) portrays an overarching bearish stance. This position indicates that despite short-term bullish advances, sellers still hold a broader market control and that buyers must regain the 100-day average to start considering the upward movements a reversal.

Support levels: 103.00, 102.80, 102.50.

Resistance levels: 103.40 (100-day SMA), 103.60, 103.80.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Euro tumbled against the high-stepping US Dollar on Tuesday.

- ECB’s Senteno, Villeroy, and Nagel reiterate familiar policy stance.

- ZEW Economic expectations in Germany improved, because of rate cut hopes.

The Euro (EUR) mixed on Tuesday, holding mostly steady against its peers but seeing steep declines against the US Dollar (USD). European Central Bank (ECB) officials continue to tow the company line, reiterating that it’s too soon for the ECB to pivot into rate cuts.

Euro area data was thin on Tuesday, and markets will be focusing on headlines from the World Economic Forum (WEF) in Davos, Switzerland where policymakers are meeting for a five-day retreat.

Daily digest market movers: Euro tumbles against US Dollar as policymakers talk down markets

- The euro area’s ZEW Economic Sentiment Survey in January declined slightly from 23.0 to 22.7, but beat the forecast decline to 21.9.

- Germany’s ZEW Economic Sentiment Survey improved in January, jumping from 12.8 to 15.2 versus the forecast 12.0.

- Germany’s ZEW Current Situation Survey deteriorated further, dropping from -77.1 to 7.3 versus the expected uptick to -77.0.

- ECB’s Valimaki: ECB will continue to be data-dependent, better to wait longer than to cut too early.

- Can’t jump the gun too early on rate changes.

- Restrictive monetary policy still called for according to ECB’s Valimaki.

- ECB’s Centeno: Inflation is coming down sustainably, shouldn’t be worried about a resurgence in inflation rate.

- ECB needs to be prepared for all topics, including rate cuts, according to ECB’s Centeno.

- ECB’s Villeroy: Still too early to declare victory over inflation.

- ECB’s Villeroy reaffirms that the ECB’s next move will be a rate cut sometime this year, but inflation outlook needs to see 2% first.

- The ECB is more patient on rate cut outlook than markets, according to ECB’s Villeroy.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.70% | 0.56% | 0.34% | 0.95% | 0.95% | 0.83% | 0.66% | |

| EUR | -0.71% | -0.13% | -0.35% | 0.25% | 0.25% | 0.13% | -0.05% | |

| GBP | -0.58% | 0.12% | -0.25% | 0.40% | 0.36% | 0.25% | 0.05% | |

| CAD | -0.37% | 0.36% | 0.21% | 0.58% | 0.58% | 0.46% | 0.29% | |

| AUD | -0.96% | -0.25% | -0.37% | -0.61% | -0.01% | -0.12% | -0.30% | |

| JPY | -0.95% | -0.25% | -0.37% | -0.61% | 0.01% | -0.10% | -0.31% | |

| NZD | -0.87% | -0.12% | -0.25% | -0.49% | 0.12% | 0.12% | -0.17% | |

| CHF | -0.66% | 0.07% | -0.06% | -0.30% | 0.34% | 0.30% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Euro sheds weight against firmer US Dollar, mixed on Tuesday

The Euro (EUR) slid around six-tenths of a percent against the US Dollar on Tuesday, also declining about a third of a percent against the Canadian Dollar (CAD) while gaining about a quarter of a percent against both the Australian Dollar (AUD) and Japanese Yen (JPY).

The EUR/USD fell to its lowest bids since mid-December, knocking below the 1.0900 handle and testing into 1.0870 as bearish pressure builds enough to knock the pair out of near-term consolidation.

The EUR/USD is approaching the 200-day Simple Moving Average (SMA) near 1.0850, cutting cleanly through the 50-day SMA at 1.0900 as the pair heads into a technical congestion zone. Short-sellers will be looking for a continued push into December’s bottom bids near 1.0750, while a price action rebound from here will keep a higher-lows pattern intact and allow bidders to push for a rebound into the 1.1000 major handle.

EUR/USD Hourly Chart

EUR/USD Daily Chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

European Central Bank (ECB) Board Member and Chairman of the Lithuanian Central Bank Gediminas Šimkus hit the newswires on Tuesday, noting that market expectations of rate cuts from the ECB continue to run well ahead of what the ECB is looking at.

Key highlights:

Simkus: remains far less optimistic on the frequency and pace of rate cuts compared to money markets.

Interest rate cuts might begin around summer, but that will depend entirely on the data.

Simkus reiterates that wage data will be very important moving forward as it anchors inflation expectations.

- The Canadian Dollar gave up further ground to the US Dollar despite a broad recovery.

- Canadian CPI inflation printed mostly as expected, market bets of a BoC rate cut eased.

- Crude Oil roils again as geopolitical concerns weigh on fossil fuel market flows.

The Canadian Dollar (CAD) climbed against most of its currency trading peers on Tuesday, but fell back against the US Dollar (USD), which took top spot as the best-performing major currency.

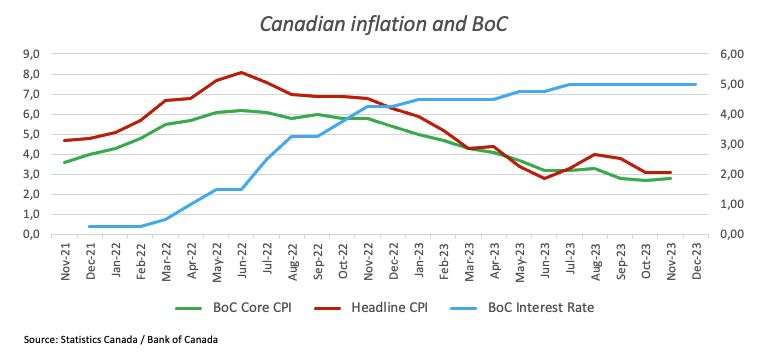

Canada’s Consumer Price Index (CPI) inflation in December mostly came in at expectation, but a lack of price growth easing has trimmed market bets of a March rate cut from the Bank of Canada (BoC).

Daily digest market movers: Canadian inflation hits forecasts, but gives little else for rate cut hopes

- Canadian MoM CPI inflation in December printed as expected as -0.3% versus November’s 0.1%.

- Annualized Canadian CPI rose, printed at market forecasts of 3.4% for the year through December compared to the previous period’s 3.1%.

- Canadian money markets now see a 34% chance of a BoC rate cut in March, down from 46% pre-CPI inflation print.

- Canadian annualized Housing Starts rose to 249.3K for the year through December, over the previous 210.9K (revised from 212.6K), beating the forecast of 243K.

- Federal Reserve (Fed) officials continue to talk down market bets of rate cuts, Fed Governor Christopher Waller notes that inflation needs to be on a gradual pace to 2%.

- Fed's Waller: Near-term data allows Fed to discuss policy cuts in 2024

- Crude Oil markets continue to churn on geopolitical factors surrounding Houthi attacks targeting civilian cargo ships through the Red Sea.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.70% | 0.57% | 0.35% | 0.97% | 0.96% | 0.85% | 0.65% | |

| EUR | -0.71% | -0.13% | -0.35% | 0.26% | 0.25% | 0.15% | -0.05% | |

| GBP | -0.58% | 0.12% | -0.23% | 0.39% | 0.37% | 0.26% | 0.07% | |

| CAD | -0.35% | 0.36% | 0.23% | 0.62% | 0.61% | 0.50% | 0.30% | |

| AUD | -0.97% | -0.27% | -0.39% | -0.62% | -0.01% | -0.12% | -0.31% | |

| JPY | -0.96% | -0.25% | -0.37% | -0.61% | 0.00% | -0.11% | -0.30% | |

| NZD | -0.81% | -0.09% | -0.21% | -0.47% | 0.17% | 0.13% | -0.15% | |

| CHF | -0.66% | 0.06% | -0.06% | -0.30% | 0.31% | 0.30% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar broadly gains but recedes against Greenback

The Canadian Dollar (CAD) is down around a quarter of a percent against the US Dollar on Tuesday but is climbing against the rest of its major currency peers. The Canadian Dollar gained around half a percent against the Japanese Yen (JPY) and the Australian Dollar (AUD), while climbing over a third of a percent against the New Zealand Dollar (NZD) and the Euro (EUR).

The USD/CAD rose back into the 1.3500 handle for the first time since mid-December as the US Dollar gained against the Loonie, dragging the pair higher after last week’s late bounce from the 200-hour Simple Moving Average (SMA) near 1.3350.

Daily candlesticks have the USD/CAD climbing directly into the 200-day SMA, and continued bullish momentum faces a technical quagmire with the 50-day SMA descending into 1.3500 and set for a bearish cross of the long-term moving average.

Continued bidding pressure will have the pair set for a fresh challenge of November’s peak near 1.3900, while the technical floor sits at December’s swing low into 1.3200.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Mexican Peso drops for a second consecutive day, falling 1.64% against a robust US Dollar buoyed by risk aversion and a less dovish Fed outlook.

- USD/MXN pair approaches the critical 50-day SMA as risk aversion hits Wall Street in exchange for US Dollar safety.

- Fed Governor Waller's latest remarks hint at the possibility of easing monetary policy, though it would be slower than investors’ expectations.

The Mexican Peso posts back-to-back days with losses and plummets sharply against the US Dollar (USD), which benefits from risk aversion, and traders pricing in a less dovish Federal Reserve (Fed), according to Chicago Board of Trade (CBOT) data. That, alongside a jump in US Treasury bond yields, has sponsored the USD/MXN with a substantial leg up, trading at 17.13 or 1.51% higher.

Market sentiment remained sour on Tuesday as Wall Street resumed trading and began a short week in the red as market participants came back from a holiday. Traders in the futures market trimmed bets that the Fed would cut rates aggressively, bolstering the Greenback as the US Dollar Index (DXY) rises 0.60% to 103.29. Consequently, the USD/MXN pair edged toward the 50-day Simple Moving Average (SMA) near 17.18, with buyers threatening to reclaim that level, posing their eyes on the confluence of the 100 and 200-day SMAs.

In the meantime, Fed Governor Christopher Waller is crossing the newswires, saying that data could “allow” the Fed to consider easing monetary policy.

Daily digest market movers: Mexican Peso tumbles as Fed’s Waller supports cuts if inflation stays low

- Fed’s Waller added that policy could be adjusted as long as inflation doesn’t rebound or stay high and emphasized the Fed could cut rates by 75 basis points in 2024. He added rate cuts should be made methodically, adding that there’s no reason to cut as quickly as in the past.

- The New York Fed Empire State Manufacturing Index for January declined to -43.7 compared to estimates of -5 and a December reading of -14.5. This sharp slump raises concerns about the potential for a recovery in the manufacturing sector. Furthermore, in the latest month, the ISM Manufacturing PMI continued to indicate a contraction in the sector, marking 14 consecutive months of contractionary readings.

- Mexico’s economic data released in January shows the economy is encountering several challenges. Inflation in the country increased from 4.32% to 4.66% YoY in December, surpassing the projected figure of 4.55%. Additionally, the same report showed that while underlying inflation is trending downward toward 5%, it remains elevated. This persistent high level of underlying inflation could potentially discourage officials at Banxico (the Central Bank of Mexico) from implementing an easing of monetary policy in the first quarter of 2024.

- In addition to that, Industrial Production plunged -1.0% MoM after achieving eight months of expansion, indicating that higher interest rates set by Banxico at 11.25% are beginning to impact the economy.

- In that regard, Auto Production for December slumped from 18.1% to -9.9% YoY.

- Confidence surveys released on January 3 and 8 showed that business confidence remained high at 54.6, bolstered by “nearshoring” prospects. However, consumers have begun to turn pessimistic as they expect inflation and economic deceleration to weigh on their economies.

- The week’s Mexican economic docket will feature Retail Sales for November, expected to remain unchanged at 3.4% YoY, according to the consensus.

- Although December’s meeting minutes from Banxico (the Central Bank of Mexico) suggest that the central bank might contemplate easing its monetary policy, the inflation report for December could hinder any move toward policy relaxation.

- Analysts at Standard Chartered noted, “We expect the policy rate to be lowered to 9.25% by end-2024, although an official downward revision in the output gap could open the door for more aggressive rate cuts.”

- On January 5, a Reuters poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

Technical analysis: Mexican Peso slumps sharply as USD/MXN climbs toward 17.15

The USD/MXN has shifted to a neutral bias as buyers lifted the exchange rate past the 17.00 figure, opening the door to challenge the 50-day SMA at 17.18. A breach of the latter would expose the confluence of the 200 and 100-day SMAs at around 17.38/17.40. Further upside is seen at December’s high of 17.56, followed by the May 23 high of 17.99.

On the contrary, if bears drag prices below 17.00, that could exacerbate a retest of the January 12 low of 16.82, followed by the January 8 low of 16.78. Once those two levels are cleared, the next stop would be the August 28 cycle low of 16.69, ahead of last year’s low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP trades mildly lower at 0.8596 after hitting a high of 0.8620.

- Daily chart indicators hint at strengthening selling momentum: RSI is in negative terrain, and MACD's histogram depicts rising red bars.

- The four-hour chart affirms a bearish outlook with weakened bullish power.

In Tuesday's session, the EUR/GBP was observed trading mildly lower at 0.8596 after hitting a daily high of 0.8621 as the bulls struggled to hold their momentum. In the four-hour chart, the selling dominance is more evident.

Indicators on the daily chart are reflecting a bearish dominance currently in play. The negative Relative Strength Index (RSI) slope, in conjunction with its present location in the negative territory, underscores the strengthened bearish momentum. Concurrently, the red bars of the Moving Average Convergence Divergence (MACD) supplement this bearish tilt. In addition, the pair's position below the 20, 100, and 200-day Simple Moving Averages (SMAs) reiterates the widespread bearish control, creating a tough landscape for buyers to recuperate. In addition, the 200 and 100-day averages are about to perform a bearish crossover at around 0.8650, which may add further momentum to the sellers.

In the shorter time frame, as denoted by the four-hour chart, the bears appear to have an even greater grip. The negative slope and negative territory of the four-hour RSI amplify the bearish trend, indicating that sell-offs are predominant at this juncture. Similarly, the rising red bars of the four-hour MACD underpin a growing downtrend in the short-term outlook.

EUR/GBP technical levels

EUR/GBP daily chart

-638410183893952184.png)

Federal Reserve (Fed) Governor Christopher Waller crossed headlines warning that despite data developments in the inflation outlook allowing the Fed to begin outlining plans for rate cuts looking forward, markets shouldn't be expecting the Fed to rush anytime soon.

Money markets adjusted rate cut bets after Waller's notes, Fed swaps now see 15 basis points of easing in March versus last Friday's bets of 19 bps.

Key highlights:

- Recent data allows Fed to consider policy rate cuts, but only if inflation continues to moderate.

- Markets need to be aware of revision risks in inflation prints.

- Waller believes current policy is set properly.

- Fed needs to be "cautious", cannot rush into rate cuts.

- Waller reaffirms his outlook is consistent with dot plot; three 25 bps cuts by the end of 2024.

- Believes the Fed is "within striking distance" of 2% inflation.

The Mexican Peso (MXN) continues to perform well. Economists at ING analyze USD/MXN outlook.

Will Peso strength lead to early Banxico easing?

The market is starting to consider some early Banxico easing. 50 bps of cuts are priced over the next six months and 175 bps over the next 12. We think that could be too conservative and that the strong, real trade-weighted Peso could spark some early easing. Remember, the 575 bps policy spread over the Fed is wide.

With real rates so high in Mexico, we doubt early Banxico easing damages the Peso – and see it staying in a 16.75/17.25 range.

The US Dollar has strengthened this week. Economists at Rabobank analyze Greenback’s outlook.

Politics can be expected to creep back into the picture

The USD will clearly be buffeted by the ‘will they, won’t they’ debate around rate cut decisions this year. On top of that, politics can be expected to creep back into the picture.

Trump’s easy win in the Iowa caucus this week appears to increase the odds that the US presidential election will be another race between himself and Biden.

Another Trump term in the White House would raise questions about Nato which could have serious implications for European defence spending. The US could also be less of a partner in issues related to climate change while the issue of tariffs on some European goods could again be a feature. This would come at a time when European national budgets have been stretched by Covid support and when growth is softening. These risks could add to downside pressure on the EUR vs. the USD.

We see risk of EUR/USD dipping to 1.05 on a thee-month view mostly on the back of the market pushing back its expectations regarding Fed rate cuts.

- AUD/USD dips pressured by rising US Treasury yields and a robust 0.60% gain in the US Dollar Index (DXY).

- Deteriorating risk appetite and expectations of less aggressive Fed rate cuts contribute to the AUD's weakness; Fed Governor Waller's speech highly anticipated.

- Australian consumer sentiment wanes amid higher mortgage rates and living costs, despite potential RBA restraint in further rate hikes due to slowing inflation.

The Australian Dollar (AUD) tumbles sharply against the US Dollar (USD) as US Treasury yields climb and the Greenback (USD) posts solid gains of more than 0.50% via the US Dollar Index (DXY). Expectations that the US Federal Reserve (Fed) would cut rates in the year had been tempered, a headwind for the AUD/USD pair, which trades at 0.6596, down 0.93%.

Aussie Dollar’s dropped sharply weighed by deterioration in Australia’s consumer sentiment

Risk appetite had deteriorated while US Treasury bond yields had risen as investors trimmed overaggressive bets that the Fed would ease monetary policy as soon as March. The lack of economic data in the docket, except for the New York Fed Empire State Manufacturing Index for January plummeting sharply at -43.7 vs. estimates of -5, and December’s -14.5, casting doubts of a recovery in the manufacturing sector. For the latest month, the ISM Manufacturing PMI remained in contractionary territory for 14 consecutive months.

Aside from this, traders are awaiting a speech of Fed Governor Christopher Waller, which shifted from one of the strongest hawks to a dove in his latest speech in December, which opened the door for the Santa Claus rally in US equities in December.

In the meantime, the AUD/USD is driven by a strong US Dollar. The DXY, which measures the buck's performance against six currencies, posted solid gains of 0.60%, at 103.28, underpinned by the 10-year benchmark note rate at 4.01%, gaining six basis points.

On the Australian front, January’s consumer sentiment deteriorated, which was blamed on higher mortgage rates and the cost of living, according to the report. It should be said the Reserve Bank of Australia (RBA) hiked rates up to 4.35%, a 12-year high, and kept the door open for further tightening if inflationary figures remain high. Nevertheless, a downtick in the latest monthly inflation report could deter the RBA from increasing rates.

AUD/USD Price Analysis: Technical outlook

Given the fundamental backdrop, the AUD/USD shifted neutral to slightly downwards, extending its losses and breaking support at the 50-day moving average (DMA) at 0.6629, putting into play a challenge of the 200-DMA at 0.6581. If sellers could decisively break the latter, expect additional selling pressure, which could cause prices to tumble towards December’s 7 low of 0.6525. On the other hand, if buyers defend the 200-DMA and reclaim 0.6600, that could pave the way to re-test the January 5 swing low seen at 0.6640.

The United Kingdom will release the Consumer Price Index (CPI) report on Wednesday, January 17 at 07:00 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of four major banks regarding the upcoming UK inflation print.

December’s data follows the particularly weak November report as core inflation came down slightly to just below 5% year-on-year for the first time since January 2022.

Headline inflation for December is expected to fall a tick to 3.8% YoW while core is expected to fall two ticks to 4.9% YoY. If so, headline would be the lowest since September 2021. Furthermore, services CPI inflation is forecast to ease two ticks to 6.1% YoY.

TDS

We expect another soft report and see headline falling a tick to 3.8% YoY and core declining to 4.9% YoY. Moreover, services inflation will likely fall to 6.0% YoY. We continue to look for the BoE to start cutting Bank Rate in May, but another weak inflation report will make a dovish pivot at the February meeting even easier to justify.

ING

UK services inflation looks set to come in at 6.1%, well below where the BoE had forecast it back in its November policy report. Along with wage growth, which has also finally started to moderate, these are the key metrics upon which the Bank has signalled it will base its rate cut decisions. For now though, 6%+ services CPI is still too high and it’s likely to stay in this region into the first couple of months of 2024. But things will start to change as we head towards summer. Thanks to moderating food and consumer goods inflation, as well as lower petrol prices, headline inflation is set to fall to 1.6% in May on our current forecasts. Services inflation should be down to 4% by the summer too. Assuming we get a fiscal boost in March – we forecast the Chancellor’s £13bn headroom will double at the next budget, enabling tax cuts – the BoE may be tempted to wait a little longer before cutting rates. We’re forecasting an August cut, though faster-than-expected declines in services CPI and/or wage growth could conceivably see that date come forward.

SocGen