- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- US Dollar Index grinds higher as bulls seek more clues to extend four-day uptrend at monthly high.

- China-inflicted risk aversion, firmer US Retail Sales and fears of credit rating downgrade of major US companies propel DXY.

- Cautious mood ahead of FOMC Minutes prod US Dollar Index bulls at the highest levels in seven weeks.

- Headlines about China growth, second-tier US/China data eyed for immediate directions.

US Dollar Index (DXY) edges higher past 103.00 as bulls keep the reins despite early Asian session inaction on Wednesday. That said, the Greenback’s gauge versus the six major currencies teased bears by falling to 102.80 amid the initial hours of Tuesday’s trading but China-induced risk aversion joined upbeat US data to recall the buyers. It’s worth noting that the anxiety ahead of China’s market opening and the cautious mood before the Federal Open Market Committee’s (FOMC) latest Monetary Policy Meeting Minutes seem to prod the DXY traders of late. Furthermore, hawkish Fed talks are an additional factor supporting the USD Index of late.

Recently, Minneapolis Federal Reserve President Neel Kashkari ruled out talks of policy pivot by citing hot inflation and the uncertainty about the Fed’s progress in taming the same. The policymaker also said that he is not ready to say that the Fed is done raising rates, per Reuters.

Fed’s Kashkari seemed to have followed the upbeat US data while ringing the hawkish bells. On Tuesday, US Retail Sales grew 0.7% MoM in July versus 0.4% expected and 0.3% reported in June (revised from 0.2%). The details suggested that the Core Retail Sales, namely the Retail Sales ex Autos, grew 1.0% versus 0.4% market forecasts whereas the Retail Sales Control Group doubled from 0.5% previous readouts (revised from 0.6%) to 1.0% for the said month.

Further, the US NY Empire State Manufacturing Index slumped to -19.0 from 1.1 prior and -1.0 market forecasts while the US Export Price Index and Import Price Index improved on MoM in July but edged lower on a yearly basis for the said month.

Apart from that, the Analysts at the global rating agency Fitch Ratings told CNBC on Tuesday that the agency could downgrade several big lenders, including JPMorgan, as reported by Reuters, which in turn bolstered the risk aversion and favored the DXY.

Above all, downbeat China data and the People’s Bank of China’s (PBoC) surprise rate cuts renew economic fears about the world’s second-largest economy and propel the US Dollar’s haven demand. The People’s Bank of China (PBOC), surprised markets by lowering the one-year Medium-term Lending Facility (MLF) rate to 2.50% from 2.65% previous and the Standing Lending Facility rates (SLFs), as well as by cutting the Reverse Repo Rate to 1.8% from 1.9% previously. The same joined China’s downbeat July Retail Sales that rose 2.5% YoY vs. 4.8% expected and 3.1% previous, as well as the Industrial Production that came in at 3.7% YoY vs. 4.5% estimated and 4.4% prior, to flag the fears surrounding the Dragon Nation and fuel the DXY.

While portraying the mood, Wall Street closed in the red and the US 10-year Treasury bond yields refreshed the yearly high. It should be noted that the S&P500 Futures remain lackluster by the press time.

Moving on, China’s House Price Index for July and the US housing data, as well as the Industrial Production, may entertain the DXY traders ahead of the Fed Minutes.

Technical analysis

A clear upside break of the downward-sloping resistance line from early March, close to 103.30 at the latest, becomes necessary for the US Dollar Index bulls to keep the reins. That said, the RSI and MACD signals challenge the bulls but the DXY pullback remains elusive unless breaking a one-month-old rising support line surrounding 102.50.

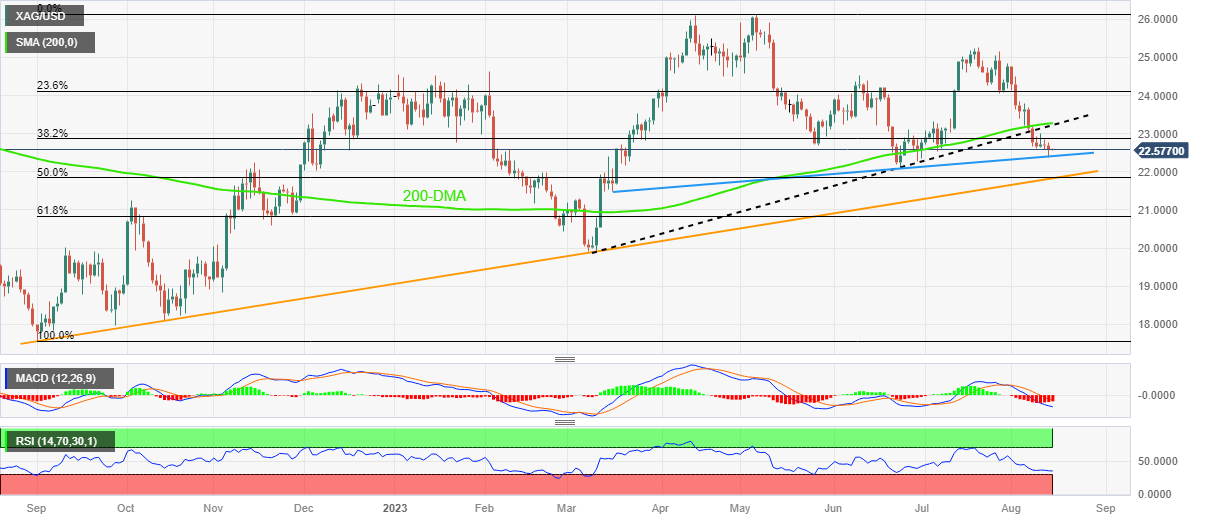

- Silver Price retreats towards seven-week-old horizontal support amid cautious mood.

- Economic fears emanating from China, firmer US Dollar weigh on XAG/USD price.

- RSI conditions, multi-day-long horizontal region prod Silver sellers.

- Bear cross, sustained trading below the key resistance line and SMAs challenge XAG/USD recovery hope.

Silver Price (XAG/USD) remains pressured at the lowest level in seven weeks despite making rounds to $22.50 during the early Asian session on Wednesday. In doing so, the bright metal fades the previous day’s corrective bounce off the key support zone amid the market’s broad risk-off mood and the firmer US Dollar and the Federal Reserve (Fed) monetary policy meeting minutes.

It’s worth noting that China-inflicted market pessimism joins the firmer US data to underpin the US Dollar’s run-up and weigh on the XAG/USD ahead of this week’s top-tier catalyst.

Technically, the 100-SMA stays beneath the 200-SMA and portrays the “Bear Cross”, which in turn suggests further downside of the Silver Price. Also keeping the XAG/USD sellers hopeful is the commodity’s sustained trading below a three-week-long descending resistance line.

However, a horizontal area comprising multiple levels marked since June 23, close to $22.10–30, puts a floor under the XAG/USD price amid a nearly oversold RSI (14) line.

In a case where the Silver Price breaks the $22.10 support, it becomes vulnerable to testing the early March swing high of around $21.30 with the $22.00 threshold likely acting as an intermediate halt.

On the flip side, a clear break of the immediate resistance line, close to $22.85 at the latest, will direct the XAG/USD toward the 100-SMA hurdle of around $23.65. Though, the 200-SMA level of near $23.80 acts as the final defense of the Silver sellers.

Silver Price: Four-hour chart

Trend: Limited downside expected

- USD/CHF remains confined in a tight range amid a subdued US Dollar.

- US Retail Sales came in above expectations.

- Swiss Producer and Import Prices YoY for July came in at -0.6%, against the expectation of 0.5%.

- The FOMC Minutes will be the key event this week.

The USD/CHF oscillates around the 0.8745–0.8800 region in a narrow trading band during the early Asian session on Wednesday. Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD against six other major currencies, consolidates its recent gains near 103.20.

The economic data released on Tuesday revealed that US Retail Sales came in above expectations. The headline figure climbed by 0.7% MoM, higher than the 0.4% estimated. Sales excluding the Automobile sector came in at 1%, versus the expected 0.4%. Lastly, the NY Empire Manufacturing Index for August declined to -19 from -1.

Minnesota’s Federal Reserve (Fed) President Neil Kashkari stated that he is pleased with the progress on inflation, but it is still too high. Kashkari noted the uncertainty regarding whether the Fed has done enough or needs to do more.

On the Swiss franc front, the Swiss Producer and Import Prices YoY for July came in at -0.6%, against the expectation of 0.5%. On a monthly basis, the figure contracted at 0.1% versus 0% prior. According to Bloomberg, the Swiss National Bank (SNB) will hike interest rates by 25 basis points (bps) to 2% in its September meeting.

Furthermore, the headling surrounding the US-China relationship remains in focus. As a result of President Joe Biden's decision to restrict certain US technology investments in China, US investors have expressed concern that Beijing may retaliate or cease purchasing American technology. The renewed trade tension might benefit the safe-haven Swiss Franc and act as a headwind for the USD/CHF pair.

Moving on, the US Building Permits, Housing Starts, and Industrial Production will be released on Wednesday. However, the FOMC minutes will be the key event this week. Traders will take cues from the data and find trading opportunities around the USD/CHF pair.

As per the latest Reuters Tankan monthly survey for August, optimism at Japan’s big manufacturing and non-manufacturing companies improves even as concerns about China prod the optimism.

That said, the headline big manufacturers' Sentiment Index came in at 12 versus 3 marked in July whereas the non-manufacturers’ Sentiment Index jumps to 32 for August from 23 marked the previous month. Further details unveil that the big manufacturer's Outlook Index was seen at 14 in November while the same for the services sector could flash the 26 mark in November.

As an additional finding, the survey report also stated that the Japanese business mood improves but China's impact dims outlook.

Market impact

The news fails to move the needle of the USD/JPY pair as it stays firmer around 145.60 while targeting the yearly peak from which the Yen pair reversed the previous day, due to the initial pullback in the US Dollar.

Also read:USD/JPY trades flat following US Retail Sales, still above 145.00

- WTI retreats towards weekly low as fears about China join upbeat US Dollar.

- Downbeat China data, PBoC rate cut underpin concerns about likely reduction in energy demand from the world’s biggest industrial player.

- API Crude Oil Stock marked surprise draw and offered a corrective bounce.

- Fed Minutes, EIA Crude Oil Stocks Change eyed for clear directions.

WTI crude oil drops back to $80.50 as it fails to defend late Tuesday’s corrective bounce amid early Wednesday in Asia. In doing so, the black gold resumes the one-week-old bearish trend amid the risk-off mood and the firmer US Dollar, especially when the world’s biggest Oil customer China flashes negative signals.

As per the latest Weekly Crude Oil Stock from the American Petroleum Institute (API), the oil inventories dropped by 6.195 million barrels during the week ended on August 11 versus the previous addition of 4.067 million barrels.

On the other hand, the People’s Bank of China (PBOC), surprised markets by lowering the one-year Medium-term Lending Facility (MLF) rate to 2.50% from 2.65% previous, as well as by cutting the Reverse Repo Rate to 1.8% from 1.9% previously. The same joined China’s downbeat July Retail Sales that rose 2.5% YoY vs. 4.8% expected and 3.1% previous, as well as the Industrial Production that came in at 3.7% YoY vs. 4.5% estimated and 4.4% prior, to flag the fears of easing energy demand from the Dragon Nation.

It’s worth noting, however, that China State Bureau Spokesperson ruled out deflation views for China by saying, per Reuters, “There is no deflation in China,” as well as adding that there will be no deflation in the future. The Diplomat also accepted the challenges the economic recovery faces and conveyed expectations that China's economy to maintain steady operations in the second half of the year.

Elsewhere, the US Dollar Index (DXY) regained upside momentum after an initial pullback from the monthly high as the risk-aversion joined upbeat US Retail Sales. That said, Analysts at the global rating agency Fitch Ratings told CNBC on Tuesday that the agency could downgrade several big lenders, including JPMorgan, as reported by Reuters. The same bolstered the risk-off mood as Wall Street opened, which in turn pared the US Dollar’s initial losses and allowed it to regain upside momentum targeting the monthly high, marked earlier in the week.

Talking about the US data, the US Retail Sales for July contrasted with the downbeat US NY Empire State Manufacturing Index for August but managed to strengthen the US Dollar amid the downbeat risk profile. Elsewhere, Minneapolis Federal Reserve President Neel Kashkari ruled out talks of policy pivot by citing hot inflation and the uncertainty about the Fed’s progress in taming the same. The policymaker also said that he is not ready to say that the Fed is done raising rates, per Reuters.

Against this backdrop, Wall Street closed in the red and the US 10-year Treasury bond yields refreshed the yearly high.

Moving on, China’s House Price Index for July and the US housing data, as well as the Industrial Production may entertain the WTI traders ahead of the weekly US Oil inventory data from the US Energy Information Administration (EIA) and the Fed Minutes.

Technical analysis

A clear downside break of a seven-week-old rising support line, now resistance near $83.90, keeps the WTI crude oil bears hopeful of testing the 200-DMA support of around $76.20, with the $80.00 round figure acting as immediate support.

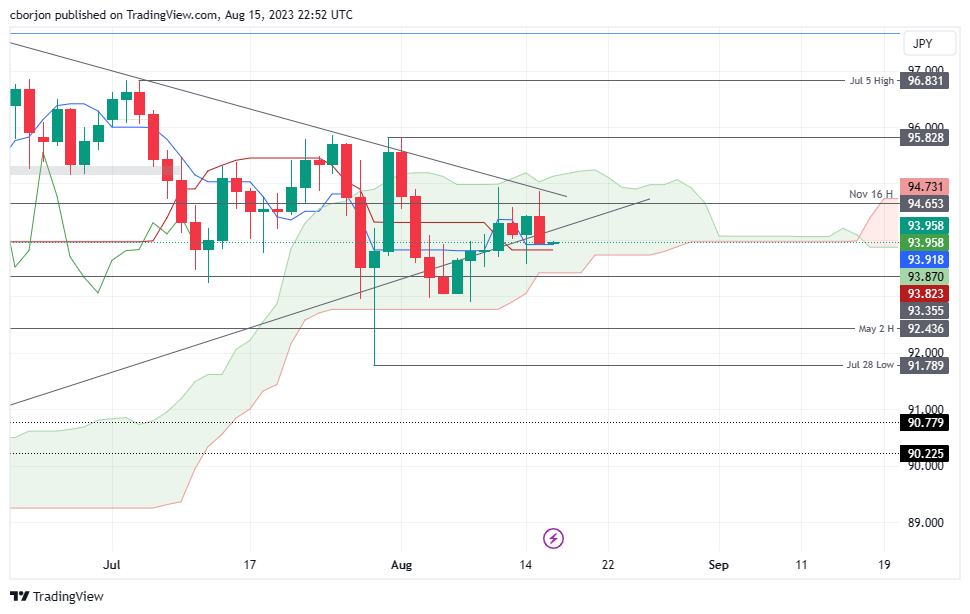

- AUD/JPY faces resistance from Tenkan and Kijun-Sen lines, currently trading just above at 93.93.

- Downside potential targets include the bottom of the Ichimoku Cloud at 93.45 and the 93.00 psychological level.

- On the upside, reclaiming 94.00 could see challenges at the August 15 high (94.86) and the Kumo top near 95.00/05.

The AUD/JPY retraces from weekly highs reached during Tuesday’s session at around 94.86, prolonging its losses after cracking a five-month-old upslope support trendline that intersects with the 94.00 mark. At the time of writing, the AUD/JPY is trading at 93.93, down by a minimal 0.01%.

AUD/JPY Price Analysis: Technical outlook

The daily chart portrays the AUD/JPY pair as subdued, capped on the downside by the Tenkan and Kijun-Sen lines at 93.92 and 93.82. If AUD/JPY slides past that area, the next support will emerge at the bottom of the Ichimoky Cloud (Kumo) at 93.45 before challenging 93.00.

Conversely, if AUD/JPY buyers reclaim the 94.00 figure, the first resistance would be the August 15 high of 94.86 ahead of testing the top of the Kumo at around 95.00/05. Once cleared, the next resistance would emerge at 95.83, the July 31 daily high.

AUD/JPY Price Action - Daily chart

- GBP/USD fades corrective bounce off six-week low within short-term triangle.

- Sustained trading below 200-SMA, steady RSI keeps Cable hears hopeful.

- Multiple technical levels beyond 1.2600 stand tall to challenge Pound Sterling’s downside.

GBP/USD retreats to 1.2700 as bulls fail to keep the reins ahead of Wednesday’s top-tier US/UK catalysts, after a surprise entry the previous day.

That said, the Cable pair eases within a 1.5-month-old symmetrical triangle following a corrective bounce after the UK’s latest employment report. It’s worth noting that the Pound Sterling’s latest restoration of the original trend could also be linked to the market’s cautious mood ahead of British inflation data and Monetary Policy Meeting Minutes of the Federal Open Market Committee (FOMC).

Also read: GBP/USD upthrust spurred by UK’s wage growth, despite US retail sales surge

Technically, the GBP/USD pair’s sustained trading below the 200-SMA and failure to defy the stated triangle formation by an upside break of the 1.2750 immediate hurdle favor the sellers. Adding credence to the downside bias is the steady RSI (14) line.

However, the quote needs to provide a successful downside break of the triangle’s bottom line, close to 1.2670 at the latest to convince the sellers.

Even so, the double bottoms around 1.2620 and a two-month-old horizontal area surrounding 1.2600 can test the GBP/USD bears before giving them control.

On the flip side, a clear break of the 1.2750 isn’t enough for the GBP/USD bulls to retake the driver’s seat as the 200-SMA level of around 1.2830 could challenge the upside momentum.

Following that, the Cable pair’s run-up towards the late July peak surrounding the 1.3000 threshold can’t be ruled out.

GBP/USD: Four-hour chart

Trend: Further downside expected

- NZD/USD holds below the 0.5950 area in the early Asian session.

- US Retail Sales climbed by 0.7% MoM, higher than the 0.4% estimated.

- The Kiwi declines as investors worry about China's economy.

- Investors will monitor the Reserve Bank of New Zealand (RBNZ) interest rate decision.

The NZD/USD pair remains on the defensive below the 0.5950 mark during the early Asian session on Wednesday. Meanwhile, the US Dollar attracts some buyers following the US Retail Sales data. The pair currently trades around 0.5948, losing 0.04% for the day. Markets anticipate the Reserve Bank of New Zealand (RBNZ) to maintain 5.5% interest rates.

The US Retail Sales came in above expectations. The headline figure climbed by 0.7% MoM, higher than the 0.4% estimated. Sales excluding the Automobile sector came in at 1%, versus the expected 0.4%. Meanwhile, the NY Empire Manufacturing Index fell to -19 from -1. In response to the data, the Greenback edges higher across the board and trades above 103.20, reaching multi-week highs.

The New Zealand Dollar is losing ground as investors worry about China's deteriorating economic outlook. On Tuesday, Chinese Retail Sales for July came in at 2.5% YoY compared to 4.8% expected and 3.1% previously, while the country's Industrial Production fell to 3.7% YoY compared to 4.5% expected and 4.1% previously. The downbeat Chinese data capped the upside of China-proxy Kiwi.

The focus now shifts to the RBNZ interest rate decision. Markets expect the Reserve Bank of New Zealand (RBNZ) to maintain rates at 5.50%, a 14-year high, for the second consecutive meeting on Wednesday.

Looking ahead, the US Building Permits, Housing Starts, and Industrial Production will be released on Wednesday. However, the FOMC minutes will be the key event this week. The data will be critical for determining a clear movement for the NZD/USD pair.

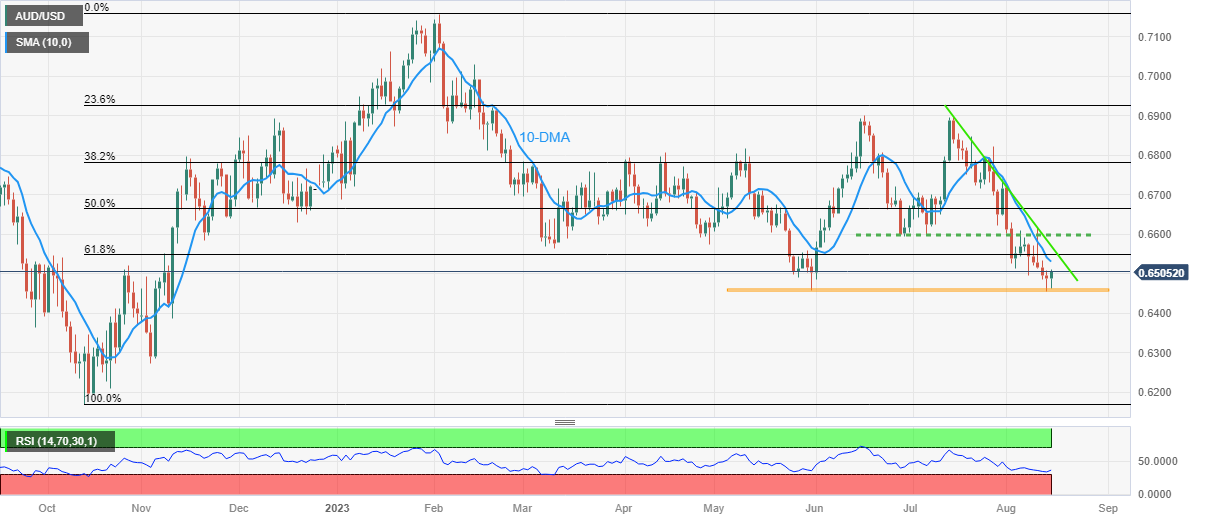

- AUD/USD licks its wounds at the lowest level of the year after falling in the last six consecutive days.

- RBA Minutes, China updates join risk aversion to exert downside pressure on Aussie price.

- Mixed US data, higher yields defend US Dollar bulls despite initial retreat from monthly peak.

- Second-tier Australia/China data, RBNZ may entertain traders ahead of FOMC Minutes, bears seek hawkish tone of Fed officials.

AUD/USD holds lower grounds at the yearly bottom surrounding 0.6450 as it seeks fresh clues to extend the six-day downtrend amid Wednesday’s Asian session. In doing so, the Aussie pair justifies its risk-barometer catalysts, as well as bears the burden of the downbeat catalysts from home and the biggest customer China, to keep the bears hopeful. However, the market’s cautious mood ahead of the key Monetary Policy Meeting Minutes of the Federal Open Market Committee (FOMC) prod the quote’s further downside near the lowest level since November 2022.

Mixed statements from the Reserve Bank of Australia’s (RBA) Minutes of the August monetary policy meeting join downbeat statistics from Australia and China, as well as fears of another round of rating cut fears, to weigh on the AUD/USD prices. Further, hawkish comments from the Fed official also help the Aussie bears.

Late on Tuesday, Minneapolis Federal Reserve President Neel Kashkari ruled out talks of policy pivot by citing hot inflation and the uncertainty about the Fed’s progress in taming the same. The policymaker also said that he is not ready to say that the Fed is done raising rates, per Reuters.

That said, the market’s risk-off mood preceded the hawkish comments from Kashkari to favor the Aussie sellers. Analysts at the global rating agency Fitch Ratings told CNBC on Tuesday that the agency could downgrade several big lenders, including JPMorgan, as reported by Reuters. The same bolstered the risk-off mood as Wall Street opened, which in turn pared the US Dollar’s initial losses and allowed it to regain upside momentum targeting the monthly high, marked earlier in the week.

It should be observed that the firmer prints of the US Retail Sales for July contrasted with the downbeat US NY Empire State Manufacturing Index for August but managed to strengthen the US Dollar amid the downbeat risk profile. While portraying the mood, Wall Street closed in the red and the US 10-year Treasury bond yields refreshed the yearly high.

At home, the RBA highlighted the fact that a need for further hikes would depend on data and evolving assessment of risks. “Staff inflation forecast had assumed one more hike, rates notably lower than in other countries,” adds the RBA Minutes. Further, the Australian Bureau of Statistics (ABS) unveiled the second-quarter (Q2) Wage Price Index details while suggesting a reprint of 0.8% QoQ figures, versus 1.0% expected, whereas the yearly data eased to 3.6% YoY from 3.7% market forecasts and previous readings.

Talking about China, the People’s Bank of China (PBOC), surprised markets by lowering the one-year Medium-term Lending Facility (MLF) rate to 2.50% from 2.65% previous, as well as by cutting the Reverse Repo Rate to 1.8% from 1.9% previously. Further, China’s July Retail Sales rose 2.5% YoY vs. 4.8% expected and 3.1% previous while the Industrial Production came in at 3.7% YoY vs. 4.5% estimated and 4.4% prior.

Additionally, Reuters cited an anonymous source to state that China's major state-owned banks were seen selling US Dollars to defend the China Yuan (CNY) in the onshore spot foreign exchange (Forex) market.

At last, China State Bureau Spokesperson ruled out deflation views for China by saying, per Reuters, “There is no deflation in China,” as well as adding that there will be no deflation in the future. The Diplomat also accepted the challenges the economic recovery faces and conveyed expectations that China's economy to maintain steady operations in the second half of the year.

Looking ahead, Australia’s Westpac Leading Index for July and China’s House Price Index for the said month will precede the monetary policy announcements from the Reserve Bank of New Zealand (RBNZ) to direct AUD/USD moves in Asia. More importantly, the risk catalysts and the Fed Minutes will be crucial to watch for clear directions.

Technical analysis

A daily closing beneath May’s low of around 0.6460 and sustained trading below a one-month-old falling resistance line, around 0.6560 by the press time, keeps the AUD/USD bears hopeful of witnessing further downside towards the mid-November 2022 swing low of around 0.6385.

- US Retail Sales outpace expectations, with core sales jumping 1%, influencing the GDP consumer spending outlook.

- Wall Street banks, including Goldman Sachs, adjust Q3 GDP predictions in light of robust US economic indicators.

- Fed’s Kashkari highlights persistent inflation concerns and the resilience of the US economy, keeping rate hike speculations alive.

EUR/USD extended its losses on Tuesday for two straight days and clings above the 1.0900 figure after solid data from the United States (US) reignited worries of additional tightening by the Federal Reserve (Fed) amidst a resilient US economy. At the time of writing, the EUR/USD exchanges hands at 1.0903, gaining 0.02% as the Asian session begins.

Solid US economic data and Wall Street’s revised GDP forecasts put pressure on the Euro, as EUR/USD hovers above 1.0900

The EUR/USD seesawed during the session after the US Department of Commerce revealed that Retail Sales in the US exceeded forecasts of 0.4% MoM, with July sales growing by 0.7%, while excluding Autos, also called core retail sales, jumped 1%, smashing estimates of 0.4%. Core Retail Sales correspond closely with the Gross Domestic Product (GDP) consumer spending component.

Initially, the data sent the EUR/USD sliding but options expiring at 10:00 AM NY cut, at around 1.0930-3 topping 1.1 billion and at 1.0940 2.3 billion, triggered a rally in the pair. Past the cut, the EUR/USD reversed its course, finishing the session near the day’s lows.

Following the data, some banks on Wall Street, like Goldman Sachs, revised their Q3 Gross Domestic Product (GDP) forecasts to a 2.2% annualized rate. The Atlanta’s Fed GDPNow model, which estimates GDP expectations, updated its model after Retail sales data showed GDP jumping to 5% from 4.1% foreseen on August 8.

Meanwhile, bets for a pause on hikes by the Federal Reserve (Fed) in September remain intact at 89% after the data, while for November, it stood above 30% chance.

Other data from the US Department of Labor showed that Import and Export Prices rose above estimates. At the same time, the New York Federal Reserve revealed its Manufacturing Index plunged to -19, exceeding projections of -1, after business conditions improved in July.

Minnesota’s Fed President Neil Kashkari crossed the wires, expressing that inflation is still too high, even though he feels good about its progress while noting uncertainty about whether the Fed has done enough or needs to do more. He added US central bank officials are surprised by the economy’s resilience.

EUR/USD Price Analysis: Technical outlook

The EUR/USD remains neutral to downward bias, with the pair continuing to print lower highs and lower lows, seen as a pivotal reason for defining a downtrend. On Tuesday, sellers stepped in, dragging the exchange rate below the 100-day Exponential Moving Average (EMA), as they eye a break below the current week’s low of 1.0874. A breach of the latter will expose the July 6 daily low of 1.0833, followed by the 1.0800 mark and the 200-day EMA at 1.0784. Contrarily, EUR/USD buyers must keep prices above 1.0900 if they want to challenge the daily EMAs as first resistance levels, with the 100-day EMA at 1.0930, the 50-day EMA at 1.0972 and the 20-day EMA at 1.0994.

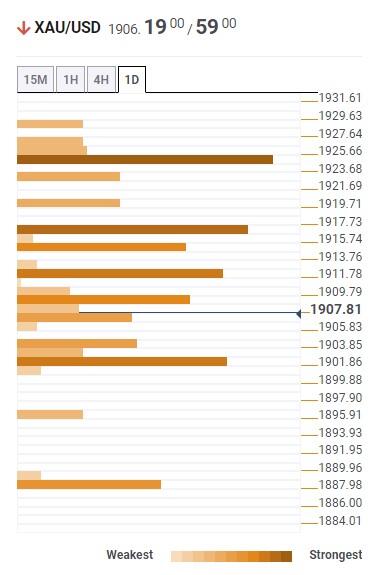

- XAU/USD fell near the $1,900 zone, below the 200-day SMA.

- Economic figures from the US point out that the Fed may still have room to hike.

- Investors await Wednesday’s FOMC minutes to look for further clues.

In Tuesday’s session, the XAU/USD faced selling pressure, lost the 200-day Simple Moving Average, and fell to $1,900 an ounce. In that sense, bearish pressure can be attributed to markets gearing up for another Federal Reserve (Fed), not in September but in November. The latest data revealed that the headline and core Consumer Price Index (CPI) decelerated in July, but the Producer Price Index (PPI) accelerated. In addition, July’s Retail Sales from the US were reported to have increased higher than expected.

As for now, according to the CME FedWatch tool, markets discount low odds of a hike in the upcoming September meeting, but the odds of a hike in November rise nearly 40%. In that sense, the July meeting's Federal Open Market Committee (FOMC) minutes will help investors model their expectations.

XAU/USD Levels to watch

The daily chart analysis indicated that the XAU/USD has a bearish technical bias for the short term, with Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) residing in negative territory. The RSI also exhibits a southward slope below its midline, emphasising the presence of intense selling pressure, while the MACD, with its red bars, highlights the strengthening bearish momentum for the XAU/USD. Furthermore, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), indicating that the sellers dominate the broader perspective.

Support levels: $1,890, $1,870, $1,850

Resistance levels: $1,905 (200-day SMA), $1,930, $1,950.

XAU/USD Daily chart

-638277323878765737.png)

The Reserve Bank of New Zealand will announce its decision on monetary policy. The UK inflation report is due. The Eurozone will release GDP, employment, and industrial production data. Later in the day, the Fed will release its meeting minutes.

Here is what you need to know on Wednesday, August 16:

The US Dollar Index remains strong. On Tuesday, it posted its fourth consecutive daily gain and reached the highest level in a month. The DXY managed to recover from losses, supported by a rebound in Treasury yields and increased risk aversion. Stocks on Wall Street, on average, lost more than 1%. The US 10-year Treasury yield initially dropped to 4.16% and then climbed back above 4.20%, while the 2-year yield rose from 4.90% to 4.95%.

The US Retail Sales exceeded expectations, rising by 0.7% in July, surpassing the market consensus of 0.2%. However, the NY Empire Manufacturing Index dropped to -19 from -1. On Wednesday, economic indicators such as Building Permits, Housing Starts, and Industrial Production will be released. Nevertheless, the key event to watch will be the release of the FOMC meeting minutes.

EUR/USD reached a peak at 1.0950 before retracing to 1.0900, driven by a rebound in the US Dollar. In the Eurozone, GDP, Employment, and Industrial Production data will be released on Wednesday.

The UK released stronger-than-expected wage data, boosting expectations of another rate hike from the Bank of England (BoE) and bolstering the Pound. The currency outperformed on Tuesday, with GBP/USD rising steadily and ending the day above 1.2700. On Wednesday, the UK will release the July Consumer Price Index (CPI) inflation report, which will be closely watched. The CPI is expected to decline from an annual rate of 7.9% in June to 6.7% in July.

USD/JPY remained flat, hovering around 145.50 after testing the downside near 146.00 and finding support above 145.00.

The Consumer Price Index rebounded in July in Canada to 3.3%, surpassing the expected 3%. The Canadian Dollar gained momentum briefly after the data. USD/CAD continued its upward trend and closed slightly below 1.3500, the highest level in more than two months.

Analysts at RBC:

We look for a softening economy to ease inflation pressures further going forward, and expect the odds are still tilted towards the Bank of Canada foregoing another increase in the overnight rate in September.

The Russian Ruble stabilized after the USD/RUB pulled back from above 100.00. The Central Bank of Russia (CBR) raised interest rates by 350 basis points to 12% after an extraordinary monetary policy meeting.

The Antipodean currencies remain under pressure as Chinese data continues to disappoint, and commodity prices remain weak. NZD/USD dropped for the sixth consecutive day, closing below 0.6000. The Reserve Bank of New Zealand will announce its monetary policy on Wednesday, and no change is expected. Similarly, AUD/USD also lost ground and was trading slightly above the key support area of 0.6450.

Like this article? Help us with some feedback by answering this survey:

- The pair is about to reach overbought conditions, trading around the 1.3500 zone, showing more than 0.30% of daily gains.

- Canadian’s CPI came in higher than expected, while US Retail Sales showed strong figures.

- Lower Oil prices limited the CAD’s potential.

The USD/CAD saw green on Tuesday and increased near highs since early June, trading around 1.3500. On the one hand, the optimistic US Retail Sales from July made the market discount a more aggressive bet by the Federal Reserve (Fed) and favoured the USD. On the other hand, the Consumer Price Index (CPI) from July came in higher than expected, favouring the Canadian dollar, while lower Oil prices limited the upside potential.

Canadian CPI from July came in higher than expected, as well as US Retail sales

Canadian inflation for July came in hot. The Consumer Price Index (CPI), advanced 0.3% Mom while the annualised measure accelerated to 3.2%, higher than the 3% expected and the previous 2.8%. The Core figure rose to 3.2% vs the 2.8% expected from the last 2.8%.

Regarding the next Bank of Canada (BoC), according to the World Interest Rate Possibilities (WIRP) tool, markets discount high odds of a 25% chance of a hike on September 6 and then increase to approximately 55% by October 25. Looking further ahead, it climbs to about 60% by December 6. In that sense, hawkish bets on the BoC may support the CAD in the following sessions.

On the other hand, July’s US Retail Sales exceeded expectations. The headline rose by 0.7% MoM, higher than the 0.4% expected. Sales Excluding the Automobile sector also met expectations and came in at 1% vs the 0.4% expected. The USD gained some momentum as a reaction, but the DXY traded relatively flat during the session. With that said, attention now turns to the Federal Open Market Committee (FOMC) meeting minutes released scheduled for Wednesday, where investors will look for clues regarding the Federal Reserve's (Fed) next steps. As for now, the stronger case, according to the CME FedWatch tool, is that the Fed will skip in September and then hike in November by 25 basis points (bps)

USD/CAD Levels to watch

According to the daily chart analysis, short-term prospects for USD/CAD look bullish. Both Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain positive and are near overbought conditions. Moreover, the pair is above the 20,100,200-day Simple Moving Averages (SMA), indicating that the buyers command the broader perspective.

Support levels: 1.3450 (200-day SMA), 1.3400, 1.3380 (100-day SMA).

Resistance levels: 1.3510, 1.3550, 1.3570.

USD/CAD Daily chart

-638277298461411897.png)

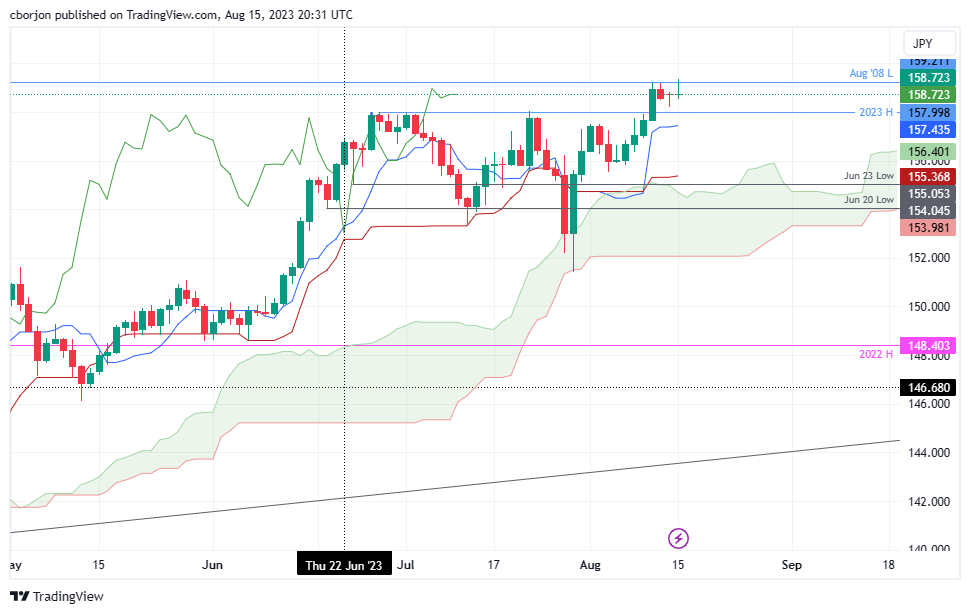

- EUR/JPY touches a new YTD peak but retracts swiftly as intervention fears loom with JPY’s softening stance.

- Consecutive ‘doji’ candlestick patterns signal uncertainty and potential price tug-of-war between buyers and sellers.

- Break above the recent high may challenge the 160.00 threshold, while a descent risks testing the Tenkan-Sen and Senkou-Span A lines in succession.

The EUR/JPY rallied to a new year-to-date (YTD) high of 159.33 but failed to hold above the 159.00 figure as sellers gained momentum due to fears that Japanese authorities might intervene in the Forex market as the Japanese Yen (JPY) weakens. The EUR/JPY is trading at 158.74, printing minuscule gains of 0.02% as the New York session winds down.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY cross-currency pair sits at around the 158.50/159.00 range for the second straight day in the week, failing to break above the 160.00 figure amidst a soft JPY. Technically speaking, in those days, back-to-back ‘doji’ suggests indecision lying ahead.

If EUR/JPY buyers lift the pair past the current YTD high, the next resistance would emerge at the 160.00 handle. Once cleared, the next resistance emerges at the August 2008 monthly high of 169.47.

Conversely, if EUR/JPY extends its losses below the current week’s low of 158.18, first support would emerge at the psychological 158.00 mark. If sellers push prices below that level, the Tenkan-Sen line surfaces as support at 157.43, followed by the Senkou-Span A line at 156.40 ahead of 156.00.

EUR/JPY Price Action – Daily chart

- UK wages excluding bonuses soar to the highest growth rate since 2001, pushing unemployment to 4.2%.

- US Retail Sales outperform expectations, prompting Goldman Sachs to uplift Q3 GDP projections.

- BoE’s potential rate hike in focus as traders anticipate Wednesday’s inflation report; GBP/USD eyes 1.2800 resistance.

GBP/USD rises following Monday’s session, which portrayed a ‘hammer’ formation, suggesting that further upside is expected. Jobs data in the UK overshadowed upbeat economic data from the United States (US), as wages grew above estimates, adding to the Bank of England’s (BoE) inflation pressures. Hence, the GBP/USD trades at 1.2705, above its opening price by 0.21%.

UK’s robust wage data adds to BoE’s inflation concerns, while US economic indicators paint a mixed picture

The Office for National Statistics (ONS) revealed that wages excluding bonuses rose 7.8% YoY in the three months to June, which according to Reuters, represents “the highest annual growth rate since comparable records began in 2001.” The same report highlighted the Unemployment Rate climbed to 4.2% from 4%.

In the meantime, traders brace for Wednesday’s inflation report. Any upside surprise could increase BoE’s chances of raising rates. Money market traders are fully pricing in a 25 basis point hike at its September meeting, with around a 12% chance they lift rates by a larger size of 50 basis points.

On the US front, US Retail Sales in the US exceeded estimates of 0.4% MoM, with July sales growing by 0.7%, while excluding Autos, also called core retail sales, jumped 1%, smashing forecasts of 0.4%. Core Retail Sales correspond most closely with the Gross Domestic Product (GDP) consumer spending component.

The report triggered a revision of US growth prospects, with Goldman Sachs raising Q3’s Gross Domestic Product (GDP) to a 2.2% annualized rate. Today’s data was computed by Atlanta’s Fed GDPNow model, which forecasts GDP expectations, jumping to 5% from 4.1% foreseen on August 8.

Meanwhile, bets for a pause on hikes by the Federal Reserve (Fed) in September remain intact at 89% after the data, while for November, it stood above 30% chance.

Other data from the US Department of Labor showed that Import and Export Prices rose above estimates. At the same time, the New York Federal Reserve revealed its Manufacturing Index plunged to -19, exceeding projections of -1, after business conditions improved in July.

Minnesota’s Fed President Neil Kashkari crossed the wires, expressing that inflation is still too high, even though he feels good about its progress while noting uncertainty about whether the Fed has done enough or needs to do more. He added US central bank officials are surprised by the economy’s resilience.

Given the backdrop, the GBP/USD could test the 1.2800 figure if UK’s inflation becomes higher than estimated. On the other hand, expect GBP/USD weakness if prices continue to cool down, as expected.

GBP/USD Price Analysis: Tech ical outlook

Although the GBP/USD remains in consolidation, it acquired a slight bullish bias, but its advancement is being capped by the 50 and 20-day Exponential Moving Average (EMA), each at 1.2734 and 1.2756, respectively. A daily close above those levels could impulse the GBP/USD exchange rate toward the 1.2800 figure, followed by 1.2900 and the July 27 pivot high at 1.2995. Conversely, if GBP/USD fails to print a daily close above 1.2700, expect the pair to dive towards the current week’s low of 1.2616 before challenging 1.2600.

- USD/JPY trades neutral at the 145.55 area after hitting a low of 145.10.

- US Retail Sales came in strong, and the markets bet on a hike by the Fed in November.

- Monetary Policies divergences weight on the JPY which couldn’t benefit from robust GDP data.

On Tuesday, the USD/JPY traded flat while the USD seemed to consolidate. On the other hand, the JPY continues to trade vulnerable amid the extreme dovish stance of the Bank of Japan (BoJ) and monetary policy divergence between its peers.

US Retail Sales revealed that the US economy is holding strong. The headline Sales increased by 0.7% MoM, higher than the 0.4% expected, while the ones excluding the Automobile sector also came in strong and came in at 1% vs the 0.4% expected.

Regarding the next Federal Reserve (Fed) meeting, there's a prevailing market expectation of a no hike in September. However, the chances of a 25 basis point adjustment in November reach a peak of around 40%. That said, the focus now pivots to Wednesday's Federal Open Market Committee (FOMC) gathering, as investors seek hints in the forward guidance to attain a distinct perspective on the officials' position.

Despite reporting strong Gross Domestic Product (GDP) data, the JPY continues to trade weak. On Tuesday, it was reported that during the second quarter, the economy expanded by 1.5% QoQ at a 6% annualised pace in both figures. On the bright side, speculations of a potential Bank of Japan (BoJ) intervention to stop the currency's loss is the only hope for the Yen while the USD/JPY consolidated above the 145.00 level.

USD/JPY Levels to watch

The technical analysis of the daily chart supports a bullish view of USD/JPY in the short term. The relative Strength Index (RSI) maintains its favourable position above the midline, displaying an upward inclination. Moreover, Moving Average Convergence Divergence (MACD) showcases green bars, underlining the strengthening bullish momentum. Furthermore, the pair is above the 20,100,200-day SMAs, suggesting that the bulls are firmly in control of the bigger picture.

Support levels: 145.00, 144.70, 144.00.

Resistance levels: 145.70, 146.00, 146.50.

USD/JPY Daily chart

-638277218873176010.png)

- EUR/GBP slips past 50 and 20-day EMAs, reflecting increased bearish sentiment, trading 0.14% below the opening.

- EUR/GBP’s breaking daily EMAs and one-month-old support trendline, deeper losses loom for the cross as sellers gain momentum.

- A close below 0.8600 could accelerate the slide toward July 27 swing low, with a focus on the year’s lowest point. Immediate resistance at 0.8600-0.8610 zone.

The EUR/GBP dropped for the third consecutive day, extending its losses past the 50 and 20-day Exponential Moving Averages (EMAs), the last time seen each at 0.8610 and 0.8603. At the time of writing, the EUR/GBP is trading at 0.8582, below its opening price by 0.14%.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP is trading sideways, slightly tilted to the downside, after prices fell below all the daily Exponential Moving Averages (EMAs), opening the door for further losses. Notably, the EUR/GBP fell to a new two-week low, and on its way down, it has broken a one-month-old support trendline drawn from the yearly lows, suggesting that sellers are gathering momentum.

If EUR/GBP achieves a daily close below 0.8600, the cross could extend its downtrend to the July 27 swing low of 0.8544 before challenging the year-to-date (YTD) low of 0.8504.

On the flip side, if EUR/GBP buyers reclaim 0.8600, the first resistance levels would be the 0.8601/10 area, followed by the 100-day EMA at 0.8646.

EUR/GBP Price Action – Daily chart

- XAG/USD found support at a daily low of $22.20, then recovered towards $22.55, trading flat.

- US retail sales came in higher than expected.

- Despite robust data, the USD consolidates and limits Silver’s losses.

On Tuesday, the XAG/USD cleared daily gains and its losses were limited by the USD consolidating its previous day’s gains. Focus now shifts to the July meeting's Federal Open Market Committee (FOMC) minutes.

US Retail Sales showed the US economy is holding firm. The headline Sales rose by 0.7% MoM, higher than the 0.4% expected, while the ones excluding the Automobile sector also came in strong and came in at 1% vs the 0.4% expected.

Regarding the next Federal Reserve (Fed) meeting, there's a prevailing market expectation of a no hike in September. However, the chances of a 25 basis point adjustment in November reach a peak of around 40%. That said, the focus now pivots to Wednesday's Federal Open Market Committee (FOMC) gathering, as investors seek hints in the forward guidance to attain a distinct perspective on the officials' position.

Considering this, the US bond yields, considered the opportunity cost of holding Silver, are edging lower. The 10-year bond yield trades at 4.18%, down by 0.62 % losses on the day. The 2-year yield stands at 4.95% with 0.81 % losses, and the 5-year yield is at 4.33% with 0.62 % losses.

XAG/USD Levels to watch

The technical analysis of the daily chart suggests a neutral to bearish stance for XAG/USD as the bears work on staging a recovery and exerting their influence. Having turned flat in negative territory, the Relative Strength Index (RSI) suggests a potential market equilibrium with balanced selling and buying pressure. At the same time, the Moving Average Convergence (MACD) shows flat red bars. In addition, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), highlighting the continued dominance of bears on the broader scale, requiring the buyers to take action.

Support levels: $22.15, $22.00, $21.80.

Resistance levels: $23.30 (200-day SMA), $23.50, $24.00.

XAG/USD Daily chart

-638277176385847785.png)

- China’s central bank slashes key lending rates in response to slowing economic recovery, impacting global oil demand outlook.

- OPEC+ supply cuts by Saudi Arabia and Russia provide limited support as WTI retreats from YTD highs.

- Barclay’s revises China’s GDP forecast downwards, while WTI finds some relief in rising Chinese refinery throughput.

Western Texas Intermediate (WTI), the US crude oil benchmark, registers losses of more than 2%, as economic data from China portrays a slowing recovery, while the People’s Bank of China (PBoC) unexpectedly cut rates in key rates to stir the economy after the Covid-19 pandemic. WTI is trading at $80.49 per barrel, down 2.35%.

China’s disappointing Retail Sales and Industrial Production data weigh on crude; PBoC’s rate adjustments add to concerns

The latest round of economic data from China, with Retail Sales coming below estimates and Industrial Production disappointing market participants, spurred a reaction by the PBoC. China’s central bank cut its 7-day lending rates by ten basis points to 2.80% and applied the same measures to the overnight Standing Facility (SLF) rate from 2.75% to 2.65%.

That, alongside the supply cuts implemented by Saudi Arabia and Russia, which are part of the Organization of Petroleum Exporting Countries and its allies (OPEC+), have helped to lend a lifeline to oil’s rally, with prices reversing from year-to-date (YTD) highs.

The investment community’s concern about China’s meeting its 5% growth target in the year would likely pressure WTI’s prices. On Tuesday, Barclay’s cut China’s GDP forecast to 4.5%, citing the ongoing deterioration in the housing market.

Conversely, WTI’s fall was cushioned by the technical support level, and China’s refinery thought, climbing 17.4% in July from a year earlier. WTI traders’ focus shifts to US crude inventories.

WTI Price Analysis: Technical outlook

WTI reversed its course and dipped towards the 20-day Exponential Moving Average (EMA( at $80.47 per barrel, seen as first support, which, if broken, can pave the way for WTI to edge below $80.00. A breach of the latter will expose the August 3 daily low of $78.74, followed by the 200-day EMA at $77.89. Conversely, if WTI holds its ground above $80.00, that would be positive for buyers, which could re-test the year-to-date (YTD) high of $84.85, but firstly they need to break above the April 23 daily high of $83.49.

- NZD/USD trades with losses below 0.6000, its lowest in nine months.

- China reported weak Retail Sales and Industrial Production data from July.

- American Retail Sales from the US were higher than expected.

In Tuesday’s session, the NZD/USD traded lower, mainly driven by China’s fragile economic situation. On the other hand, the USD, despite solid Retail Sales data, the USD trades weakly and consolidates the previous session's gains. Eyes on the Reserve Bank of New Zealand’s (RBNZ) decision, expected to hold rates at 5.5%.

Investors digest Retail Sales figures from the US and China

US Retail Sales came in higher than expected. The headline rose by 0.7% MoM, higher than the 0.4% expected. Sales Excluding the Automobile sector also met expectations and came in at 1% vs the 0.4% expected. The USD gained some traction as a reaction, but the DXY remains in negative territory and is consolidating, as well as the US Treasury yields.

On the other hand, the Kiwi is losing traction amid the worrying economic situation. On Monday, real-state downturn figures applied selling pressure and was exacerbated on Tuesday following weak Retail Sales and Industrial Production from July. Focus now shift to the RBNZ decision on Wednesday, where markets expect the bank to hold rates steady at 5.5%.

NZD/USD Levels to watch

Observing the daily chart, NZD/USD suggests a bearish sentiment for the near term. The relative Strength Index (RSI) remains in the negative zone below its midline, near oversold conditions. Concurrently, Moving Average Convergence Divergence (MACD) reflects rising red bars, reinforcing the bearish momentum. Furthermore, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), indicating a challenging position for the buyers in the bigger picture as the bears remain in command.

Support levels: 0.5950, 0.5930, 0.5920.

Resistance levels: 0.6000, 0.6020, 0.6050.

NZD/USD Daily chart

-638277148408650144.png)

Analysts at TD Securities note that the annual Consumer Price Index (CPI) in Canada rose 3.3% in July, at a much stronger pace than the market expectation of 3%.

BoC to hold rates at 5% into 2024

"Details were slightly less hawkish, with core measures matching the market consensus for 3.6%/3.7%, and core goods were much softer with a 0.2% m/m decline."

"The headline surprise is alarming given ongoing concerns around the persistence of inflation pressures, but we do not think it's enough to tip the scales towards another hike in September. Today's report follows a 0.2pp disappointment in June, and viewing the June/July CPI reports together paints a less alarming picture for the BoC. We continue to look for the Bank to hold rates at 5.00% into 2024, but the Bank will need to see more evidence of slowing activity to stay on the sidelines through Q4."

- US Retail Sales for July surpass expectations, buoyed by Amazon’s Prime Day, pushing core sales up by 1%.

- New York Fed’s Manufacturing Index sees a surprising dip, while Kashkari comments on inflation concerns and economic resilience.

- Despite the Greenback’s strength, interest rate differential may limit USD/MXN’s rally, with risk aversion playing a potential role.

USD/MXN climbs in the North American session by more than 0.40% as the Greenback stages a recovery, spurred by solid economic data from the United States (US) igniting rate jitters. Hence, the USD/MXN advanced to new weekly highs, exchanging hands at 17.1181.

Greenback’s rally spurred by robust Retail Sales and rate hike expectations; USD/MXN eyes stability above 17.0000

Market sentiment remains downbeat, as reflected by Wall Street printing losses. Retail Sales in the US exceeded estimates of 0.4% on a monthly basis, with July sales expanding by 0.7%, propelled by Amazon’s Prime Day. Excluding Autos, also called core retail sales, jumped 1%, crushing estimates of 0.4%. Core Retail Saeles correspond most closely with the Gross Domestic Product (GDP) consumer spending component.

Other data from the US Department of Labor showed that Import and Export Prices rose above estimates. At the same time, the New York Federal Reserve revealed its Manufacturing Index plunged to -19, exceeding projections of -1, after business conditions improved in July.

In the meantime, US Treasury bond yields paired their earlier gains, with the US 10-year Treasury note yield standing at 4.187% after touching a high of 4.274%, while the US Dollar reversed some of its earlier gains. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of rivals,

In the meantime, Minnesota’s Fed President Neil Kashkari is crossing the wires, expressing he feels that inflation is still too high, despite feeling good about the progress while noting uncertainty about whether the Fed has done enough or needs to do more. He added US central bank officials are surprised by the economy’s resilience.

Even though market participants remain skeptical about another rate hike by the Fed, expectations stay at 32.2% for November’s monetary policy meeting, higher than a week ago’s 28% chances.

Given the backdrop, the USD/MXN might remain above the 17.0000 price level; even though the Mexican Peso (MXN) has been under pressure, the interest rate differential benefits the emerging market currency. That would put a lid on USD/MXN’s rally, and if the pair is to edge higher, it could do it steadily unless risk-aversion triggers outflows from riskier assets.

USD/MXN Price Analysis: Technical outlook

As of writing, the USD/MXN spot price is above the 20 and 50-day Exponential Moving Averages (EMAs), each at 17.0171 and 17.1234, which could pave the way for further upside. Even though it looks like the exotic currency pair achieved a bottom, USD/MXN buyers must reclaim the May 17 daily low-turned resistance at 17.4038, which could pave the way to test the 100-day EMA at 17.4605 before challenging 17.5000. Otherwise, further downside is expected below the psychological 17.0000 level, with the year-to-date (YTD) low lingering around 16.6238.

Minneapolis Federal Reserve President Neel Kashkari said noted on Tuesday that he is feeling good about the progress on inflation but added that it was still too high, per Reuters.

"The question is, have we done enough, or do we need to do more," Kashkari added said that they have been surprised by the economy's resilience.

Market reaction

These comments had little to no impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was down 0.15% on the day at 103.00.

- The US Dollar weakens despite US Retail Sales beating expectations.

- The EUR/USD pair holds below the 1.0950 key short-term resistance area.

The EUR/USD is rising on Tuesday, recovering modestly from monthly lows. The pair hit a fresh daily high at 1.0953 and is hovering around 1.0940 as the upside remains limited after US data.

Mixed US data

Retail sales rose in July by 0.7% in the US, surpassing the expected increase of 0.4%. Additionally, June figures were revised higher from 0.2% to 0.3%. However, a different report indicated that the NY Empire State Manufacturing Index dropped to -19, against the market consensus of -1.

Following the release of retail sales figures, the US Dollar briefly rose, causing the EUR/USD pair to fall to 1.0896. However, it quickly rebounded and reached a fresh daily high at 1.0953.

The US Dollar is currently weakening after a strong performance over the past three days. The DXY is trading below 103.00, moving away from the one-month high it reached on Monday at 103.45.

The decline in the Greenback is happening alongside lower US yields. The 10-year Treasury yield spiked to 4.27% and as of writing, stands at 4.17%, while the 2-year yield briefly reached levels above 5.00% and is now moving toward 4.90%. Equity prices on Wall Street are falling, with the Dow Jones losing 0.85% after the first hour of trading.

Technical outlook

The EUR/USD pair is testing the 1.0950 area, which also coincides with the 20-period Simple Moving Average (SMA) on the 4-hour chart. A consolidation above 1.0950 would strengthen the short-term outlook for the Euro, favoring a potential extension.

On the contrary, if the pair fails to regain 1.0950, it could weaken, with a break below 1.0895 exposing the weekly low at 1.0874, and further below the 1.0830 support area.

Technical levels

Fitch Ratings analyst told CNBC on Tuesday that the agency could downgrade several big lenders, including JPMorgan, as reported by Reuters.

The financial-heavy Dow Jones Industrial Average opened in negative territory following this headline and was last seen losing 0.6% on a daily basis. Reflecting the poor performance of bank stocks, the S&P 500 Financials Index was down more than 1% at the time of press.

Meanwhile, the benchmark 10-year US Treasury bond yield turned negative on the day below 4.2%, causing the US Dollar Index to erase the gains it posted after the upbeat US Retail Sales data for July.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.28% | -0.36% | -0.01% | 0.10% | -0.05% | -0.02% | -0.18% | |

| EUR | 0.29% | -0.06% | 0.31% | 0.40% | 0.21% | 0.27% | 0.13% | |

| GBP | 0.35% | 0.08% | 0.35% | 0.45% | 0.31% | 0.33% | 0.16% | |

| CAD | 0.00% | -0.30% | -0.36% | 0.10% | -0.09% | -0.02% | -0.21% | |

| AUD | -0.16% | -0.45% | -0.52% | -0.14% | -0.25% | -0.18% | -0.33% | |

| JPY | 0.07% | -0.22% | -0.24% | 0.06% | 0.15% | 0.06% | -0.12% | |

| NZD | 0.02% | -0.28% | -0.35% | 0.01% | 0.12% | -0.04% | -0.16% | |

| CHF | 0.17% | -0.13% | -0.19% | 0.18% | 0.27% | 0.08% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

- USD/CAD drops sharply to near 1.3450 as US Dollar loses resilience.

- US Retail Sales for July expanded at a stronger pace of 0.7% amid higher disposable income.

- Canadian inflation expanded at a robust pace, discomforting BoC policymakers.

The USD/CAD pair witnesses selling pressure after sensing immense selling interest near a two-month high of around 1.3500 in the early New York session. The Loonie asset dropped amid a sell-off in the US Dollar despite upbeat United States Retail Sales and higher-than-expected Canadian inflation data for July.

S&P500 opens on a negative note as robust consumer spending momentum elevates consumer inflation expectations. The US Dollar Index tests territory below the crucial support of 103.00.

US Census Bureau reported that consumer spending in July expanded at a higher momentum. The economic data rose by 0.7% vs. expectations of 0.4% and the former release of 0.2%. It seems that higher disposable income due to sustained wage growth allows individuals to spend heavily. Retail Sales excluding automobiles rose by 1.0%, indicating robust demand for durables and quick consumables.

A moderate increase in inflation and resilient consumer spending would force the Federal Reserve (Fed) to keep interest rates higher for a longer period. Going forward, investors will focus on the Federal Open Market Committee (FOMC) minutes for July’s monetary policy, which will be released on Wednesday.

Meanwhile, the Canadian Dollar strengthens as the Consumer Price Index (CPI) for July expanded strongly. Headline CPI grew at a 0.6% pace, outperforming surprisingly higher estimates of 0.3%. Core inflation that excludes volatile oil and food prices expanded strongly by 0.5%. Annual headline inflation accelerated to 3.3% while core CPI remained stable at 3.2%. Hotter-than-expected Canadian inflation would discomfort Bank of Canada (BoC) policymakers and force them to deliver hawkish commentary.

- Annual inflation in Canada rebounded to 3.3% in July from 2.8% in June.

- USD/CAD slides to 1.3470 after the CPI data and US Retail Sales.

Inflation in Canada, as measured by the change in the Consumer Price Index (CPI), rebounded to 3.3% on a yearly basis in July from 2.8% in June, which was the lowest since March 2021. This reading came in above the market expectation of 2.8%. On a monthly basis, the CPI rose 0.6%, compared to analysts' estimate for an increase of 0.3%.

Moreover, the Bank of Canada reported that the monthly Core CPI, which excludes volatile food and energy prices, rose 0.5%, while the annual Core CPI stayed at 3.2%, against expectations of a decline to 2.8%.

Market reaction

The USD/CAD edged lower following the Canadian CPI and also US Retail Sales data. The pair dropped from 1.3490 to 1.3470, as the positive impact on the Canadian Dollar was being offset by a larger-than-expected increase in US Retail Sales.

- The oil price is on the verge of delivering a breakdown ahead of the US Retail Sales data.

- US consumer spending momentum expanded at a higher pace of 0.4% vs. the former pace of 0.2%.

- A confident breakdown of the Rising Channel pattern will trigger a bearish reversal.

West Texas Intermediate (WTI), futures on NYMEX, skid below the $82.00 support and expose to further downside. The oil price faces significant selling pressure after printing a fresh eight-month high of around $84.85 as a moderate increase in the United States inflation would force the Federal Reserve (Fed) to keep interest rates higher for a longer period.

The oil price could resume its upside journey as Saudi Arabia considered an oil support cut to achieve price stability in the oil market.

Meanwhile, the US Dollar Index (DXY) struggles to maintain an auction around 103.00 ahead of the US Retail Sales data for July. As per the estimates, consumer spending momentum expanded at a higher pace of 0.4% vs. the former pace of 0.2%.

The oil price is on the verge of delivering a breakdown of the Rising Channel chart pattern formed on a two-hour scale. A confident breakdown of the aforementioned chart pattern will trigger a bearish reversal, which will strengthen bears. The 50-period Exponential Moving Average (EMA) at $82.23 is consistently acting as a barricade for the oil bulls.

The Relative Strength Index (RSI) (14) slips into the range of 20.00-40.00, which indicates an activation of a bearish impulse.

A downside move below August 1 low at $80.40 would drag the oil price toward August 3 low at $78.50, followed by July 24 low at $76.38.

In an alternate scenario, a recovery move above April 14 high near $82.50 would drive the asset toward April 10 high at $84.32. Breach of the latter would expose the oil price to a fresh nine-month high near $86.00.

WTI two-hour chart

-638276987601159378.png)

Economists at Rabobank expect GBP/USD to trade around 1.2600 on a 3-month view.

Cable to turn lower into autumn

"Before the BoE next meets on September 21, there will be plenty more economic data to digest. This will include another labour report and, including tomorrow’s release, two more sets of CPI inflation data. Although another rate hike in September looks all but certain, clearly policymakers will be hoping for further signs that inflation and wage growth have started to ease and that the peak in Bank rate is moving closer."

"We expect cable to turn lower into the autumn on the expectation that the peak in rates will then be close. We see cable edging back to GBP/USD 1.26 on a 3-month view and towards 1.22 in 6 months. We maintain the view that risks between GBP and the EUR are fairly evenly balanced and look for further range trading around the EUR/GBP 0.96 level on a 1-to-3-month view."

FX option expiries for August 15 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0800-05 1.5b

- 1.0810 685m

- 1.0900 1.3b

- 1.0930-35 1.1b

- 1.0940 2.3b

- 1.0990 2.1b

- 1.1000 2.1b

- GBP/USD: GBP amounts

- 1.2650 570m

- 1.2700 585m

- USD/JPY: USD amounts

- 143.50 1.0b

- 145.00 1.3b

- 145.25 595m

- 146.00 900m

USD/CAD: USD amounts

- 1.3100 830m

- 1.3400 620m

Analysts at Standard Chartered Global Research expect the People’s Bank of China (PBoC) to lower the reserve requirement ratio (RRR) by 25 basis points both in Q3-2023 and Q1-2024.

China can still achieve growth target

"Fiscal spending fell behind the budget in H1. We expect the government to adopt a more expansionary fiscal policy in the remainder of 2023, fully utilising this year’s budgeted broad deficit of 7.5% of GDP."

"Despite a weak start to Q3, we still think China can achieve its GDP growth target of c.5% in 2023, thanks to favourable base effects, a reopening boost to the services sector, and increased policy stimulus. We maintain our full-year 2023 GDP growth forecast for China at 5.4%."

- Gold price continues its south-side move amid resilient US Dollar and Treasury yields.

- Investors await the US Retail Sales data for July, which is seen expanding with higher momentum.

- An economic slowdown in China improves the appeal of the US Dollar Index as a safe haven.

Gold price (XAU/USD) has remained in bearish territory for more than three weeks due to a resilient US Dollar. The precious metal faces the wrath despite elevated hopes of a steady interest rate decision to be taken by the Federal Reserve (Fed) in its September monetary policy. The context that the Fed will keep interest rates higher for a longer period as US economic resilience and a historically low jobless rate will appear as a difficulty in shredding the “last mile” of inflationary pressures.

As the Fed conveyed in July’s policy meeting that the central bank will be data-dependent from now on, investors will keenly watch the July US Retail Sales data. Consumer spending is seen expanding at a higher momentum as payroll bills expanded at a steady pace in July. After a modest inflationary recovery, higher consumer spending momentum would force Fed policymakers to keep interest rates higher for longer.

Daily Digest Market Movers: Gold price falls ahead of US Retail Sales data

- Gold price looks set to test the round-level support of $1,900.00 amid strength in the US Dollar and US Treasury yields.

- 10-year US Treasury yields jump to 4.22% as investors hope that Federal Reserve policymakers will face difficulties getting the economy to 2% core inflation.

- The US Dollar strengthens as investors lose confidence in China’s economic outlook due to persistent deflation risks.

- An economic slowdown in China improves the appeal of the US Dollar Index (DXY) as a safe haven.

- The US Dollar will remain in the spotlight on Tuesday as the US Census Bureau will report the monthly Retail Sales data for July, which will be published at 12:30 GMT.

- The significance of the US Retail Sales is high as Fed policymakers conveyed in their July monetary policy meeting that further policy action will be data dependent.

- Analysts at TD Securities expect Retail Sales to rise for a fourth consecutive month in July after 0.2%-0.5% MoM gains in Q2. Volatile auto sales will likely add to growth while sales in gas stations might be a minor obstacle. Importantly, the control group is expected to stay firm, with online sales benefiting from Amazon's Prime Day. Sales in bars/restaurants to expand at a brisk pace.”

- In spite of a slower-than-expected jump in US inflation and a decent increase in the Producer Price Index (PPI) for July, the Fed is expected to keep the interest rate policy unchanged in September.

- A moderate increase in US inflation is majorly contributed by higher rentals, which indicates that inflation is confidently returning to 2%.

- No doubt, the Fed is expected to keep policy rates unchanged in September, the context which is hurting the Gold price is the hope that the central bank will keep interest rates elevated for a longer period.

- Atlanta Fed Assistant Vice President and chief inflation watcher Brent Meyer suggests in a new analysis that the road to 2% inflation may in fact be smooth, rather than filled with the setbacks and difficult choices many Fed officials have said they expect.

- In the latest survey of consumer inflation expectations by the New York Fed, inflation one year from now will be at 3.5% vs. an expectation of 3.8% recorded in June.

- On Monday, US Treasury Secretary Janet Yellen said that President Joe Biden's policies are powering historic job growth and rebuilding competitiveness, Reuters reported.

- This week, investors will also focus on the Federal Open Market Committee (FOMC) minutes, which will be released on Wednesday at 18:00 GMT. Investors would look for cues about inflation and the interest rate guidance for the rest of 2023.

Technical Analysis: Gold price tests below the 200-day EMA

Gold price continues its declining spell after failing to sustain above the crucial support of $1,910.00. The precious metal is expected to extend its downside toward the $1,900.00 support amid sheer strength in the US Dollar. The yellow metal tests territory below the 200-day Exponential Moving Average (EMA), followed by a bearish crossover from the 20 and 50-day EMAs. Momentum oscillators indicate the activation of a bearish impulse.

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

- USD/CHF drops to near 0.8750 amid subdued US Dollar ahead of Retail Sales data.

- Monthly consumer spending momentum is seen expanding at a higher pace of 0.4% vs. June’s pace of 0.2%.

- The SNB will raise interest rates by 25 bps in September to 2%.

The USD/CHF pair drops to near its immediate support of 0.8750 in the European session. The Swiss Franc asset faces pressure amid the directionless US Dollar Index (DXY) ahead of the United States Retail Sales data for July, which will be released at 12:30 GMT.

S&P500 futures posted some losses in London, portraying a cautious market mood amid an economic slowdown in the Chinese economy due to rising deflation risks. Economic risks in China have improved the appeal of the US Dollar as a safe haven significantly.

The USD Index oscillates in a narrow range of 103.00 as investors await the consumer spending data for further guidance. As per the estimates, monthly consumer spending momentum is seen expanding at a higher pace of 0.4% vs. June’s pace of 0.2%. A similar performance is expected in retail sales data excluding automobiles.

Resilience in consumer spending and tight labor market conditions could force the Federal Reserve (Fed) policymakers to keep interest rates elevated for a longer period. The sustainability of higher interest rates could also propel fears of a recession in the US economy.

In addition to the US consumer spending data, investors will also focus on the Federal Open Market Committee (FOMC) minutes, which will be released on Wednesday. Investors would look for cues about the interest rate guidance.

Meanwhile, the Swiss Franc remains subdued as July’s Producer and Import prices display deflation. Monthly economic data contracted at a 0.1% pace while annual figures remained deflated at 0.6%. This indicates that Swiss inflation is under control and the Swiss National Bank is well-handling the inflation situation. A survey from Bloomberg showed that the SNB will raise interest rates by 25 basis points (bps) in September to 2%.

- Germany’s ZEW Economic Sentiment Index improved in August, while Current Situation Index declined.

- EUR/USD stays in daily range above 1.0900 following the latest data.

The German ZEW headline number showed that the Economic Sentiment Index improved to -12.3 in August from -14.7 in July. This reading came in better than the market expectation of -14.4. Similarly, Economic Sentiment Index for the Eurozone rose to -5.5 from -12.2 in the same period.

On a negative note, the Current Situation Index for Germany declined to -71.3 from -59.5, missing analysts' estimate of -63.

Key takeaways

"Indicator of economic sentiment remains in negative territory, though it shows a slight improvement compared to the previous month."

"Financial market experts thus anticipate a slight uptick in the economic situation by yearend."

"However, these heightened expectations need to be viewed in the context of a significantly worsened assessment of the current economic situation in Germany."

"Respondents, by and large, do not anticipate any further interest rate hikes in the eurozone and the United States and the economic outlook for the USA has seen a significant increase – these factors contribute to the improved expectations for Germany."

Market reaction

EUR/USD showed no immediate reaction to mixed sentiment reading and the pair was last seen rising 0.2% on the day at 1.0925.

- USD/JPY scales higher for the seventh straight day and hits a fresh YTD peak on Tuesday.

- The recent move up along an ascending channel points to a well-established positive trend.

- Intervention fears hold back bulls from placing fresh bets and cap the upside for the major.

The USD/JPY pair gains some positive traction for the seventh successive day on Tuesday and climbs to its highest level since November 2022, around the 145.85 region during the early part of the European session.

The Japanese Yen (JPY) continues with its underperformance in the wake of a more dovish stance adopted by the Bank of Japan (BoJ), which is the only central bank in the world to maintain a negative benchmark interest rate. This, in turn, is seen as a key factor acting as a tailwind for the USD/JPY pair amid the underlying bullish tone around the US Dollar (USD), supported by expectations that the Federal Reserve (Fed) will keep rates higher for longer.

Even the upbeat Japanese GDP report, showing that the economy expanded by 1.5% during the second quarter and a 6% annualized pace, fails to provide any respite to the JPY. That said, speculations for a possible intervention by Japanese authorities to curb any further fall in the domestic currency hold back bulls from placing fresh bets. The fundamental backdrop, however, suggests that the path of least resistance for the USD/JPY pair is to the upside.

From a technical perspective, the recent strong move-up witnessed over the past one-and-half week or so has been along an upward sloping trend-channel. This, along with last week's breakout through the 145.00 psychological mark, adds credence to the positive outlook for the USD/JPY pair. That said, the Relative Strength Index (RSI) on the 1-hour chart is flashing slightly overbought conditions and warrants caution for bullish traders.

Hence, any subsequent move up is more likely to confront stiff resistance and remain capped near the 146.00 mark, representing the top boundary of the aforementioned trend channel. The said handle should act as a pivotal point, which if cleared will be seen as a fresh trigger for bullish traders and lift the USD/JPY pair beyond an intermediate hurdle near the 146.35 area, towards the 146.75-146.80 region en route to the 147.00 round figure.

On the flip side, any meaningful corrective decline might now find decent support near the 145.00 resistance breakpoint. This is followed by the lower end of the ascending channel, currently pegged around the 144.60 region. A convincing break below the latter might negate the constructive setup and shift the near-term bias in favour of bearish traders. The subsequent fall could then drag the USD/JPY pair to the 144.00 mark and then to the 143.30 horizontal support.

USD/JPY 4-hour chart

Technical levels to watch

- AUD/USD turns lower for the sixth straight day and slides back closer to the YTD low.

- China’s economic woes continue to exert pressure on the Aussie amid a bullish USD.

- Bets for one more Fed rate hike push US bond yields higher and underpin the buck.

The AUD/USD pair fades an intraday bullish spike to the 0.6520 region and retreats to the lower end of its daily range during the early part of the European session on Tuesday. Spot prices currently trade around the 0.6470 area, down for the sixth straight day and well within the striking distance of the YTD trough touched on Monday.

The initial market reaction to a surprise rate cut by the People's Bank of China (PBoC) fizzles out rather quickly on the back of concerns that China's post-pandemic recovery has slowed after a brisk start in the first quarter. The fears were further fueled by another round of disappointing macro data from China – including Retail Sales, Industrial Production, Fixed Asset Investment and the urban unemployment rate. This, in turn, undermines the China-proxy Australian Dollar (AUD), which, along with the underlying bullish sentiment surrounding the US Dollar (USD), continues to exert some downward pressure on the AUD/USD pair.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, trades just below its highest level in more than two months and remains supported by expectations that the Federal Reserve (Fed) will stick to its hawkish stance. The outlook pushes the yield on the benchmark 10-year US government bond to a nine-month peak and supports prospects for a further near-term appreciating move for the buck. The Aussie bulls, meanwhile, seem unimpressed by the Reserve Bank of Australia's (RBA) August meeting minutes, which showed that policymakers saw a "credible path" back to the inflation target with the current cash rates at 4.1%.

The aforementioned fundamental backdrop, along with a confirmed bearish double-top breakdown, suggests that the path of least resistance for the AUD/USD pair is to the downside. Some follow-through selling below mid-0.6400s, or the lowest level since November 2022 set the previous day, will reaffirm the negative bias and pave the way for an extension of a one-month-old downtrend. Traders now look to the US economic docket, featuring monthly Retail Sales and the Empire State Manufacturing Index, later during the early North American session. Apart from this, the broader risk should provide a fresh impetus to the major.

Technical levels to watch