- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- EUR/USD seesaws near the highest levels since early May after rising the most in 4.5 months.

- ECB announced 25 bps rate hike and signals more to hawk-out Fed.

- Details of economic forecasts and President Lagarde’s comments, mixed US data raise needs for more clues for Euro traders.

EUR/USD makes rounds to 1.0950 as bulls catch a breather after a stellar run-up, the biggest since early February, amid sluggish hours of Friday’s Asian session. In doing so, the Euro pair also portrays the market’s need for more clues to defend the hawkish bias about the European Central Bank (ECB), as well as to confirm the doubts about the Federal Reserve’s (Fed) July rate hike.

That said, the European Central Bank (ECB) matched market forecasts by announcing a 25 basis points (bps) interest rate hike. More importantly, ECB President Christine Lagarde advocated for a July rate hike and ruled out rate cuts to allow the European Currency (Euro or EUR) to drum the victory over the previous day’s Federal Reserve’s (Fed) hawkish halt.

On the negative side, the ECB’s latest growth projections marked a softer economic run-up for 2023 and 2024 than previously estimated whereas ECB President Lagarde also stated that both growth and inflation are quite unpredictable.

On the other hand, the mixed US data and the Fed’s first status quo after fueling the rates in the last 10 consecutive meetings prod the US Dollar. With this, the US Dollar Index (DXY) bears take a breather at the lowest levels in over a month, flirting with 102.10 of late, after falling the most in three months by the press time.

Talking about the data, US Retail Sales growth marks an increase of 0.3% for May versus -0.1% expected and 0.4% previous readings while the Core readings, mean Retail Sales ex Autos, match 0.1% market forecasts for the said month, compared to 0.4% prior. Further, NY Fed Empire State Manufacturing Index jumps to 6.6 in June versus -15.1 expected and -31.8 prior whereas Philadelphia Fed Manufacturing Index drops to -13.7 for the said month from -10.4 prior and compared to -14 market forecasts. Additionally, US Industrial Production for May cools down to -0.2% against 0.1% estimated and 0.5% prior while Initial Jobless Claims reprints the upwardly revised figures of 262K for the week ended on June 09 versus 249K expected.

Following the data, the CME’s FedWatch Tool, market players place nearly 67% bets on the July Fed rate hike of around 25 basis points (bps). The same depicts the traders’ lack of conviction in the Federal Reserve’s (Fed) almost clear signals for a hawkish move in July.

Against this backdrop, Wall Street benchmarks rallied more than 1.0% each whereas the US 10-year Treasury bond yields plummeted to 3.72%. Further, the US Dollar Index (DXY) dropped the most in three months while poking the lowest levels since May 12, to 102.15 at the latest.

Looking ahead, the final readings of Eurozone inflation data for May, as per the Harmonized Index of Consumer Prices (HICP) details, will precede the preliminary readings of the Michigan Consumer Sentiment Index (CSI) for June and five-year inflation expectations to direct immediate EUR/USD moves. Above all, bond market moves and the central bank clues should be eyed closely for clear direction.

Technical analysis

The nearly overbought RSI (14) line suggests a pullback in the EUR/USD price towards the 50-DMA support of around 1.0880.

Silver Price (XAG/USD) grinds higher at around $23.90 amid the usual inactive hours of Friday’s Asian session.

The bright metal portrayed a stellar rebound from the monthly low the previous day amid broad US Dollar weakness. The same allows the options market players to convey their bullish bias and suggest further advances in the XAG/USD price.

It should be noted that the US Dollar Index (DXY) bears take a breather at the lowest levels in over a month, flirting with 102.10 of late, after falling the most in three months by the press time.

That said, the one-month risk reversal (RR) of the Silver price, a gauge of the spread between the call and put options, prints the strongest bullish level of 0.055 in three days by the end of Thursday’s North American session. With this, the weekly RR eyes the biggest jump in four weeks, around 0.105 by the press time.

Also read: Silver Price Analysis: XAG/USD recovery falters despite falling bond yields, sellers in charge

- US Dollar Index seesaws at monthly low after falling the most since early March.

- Unimpressive US Retail Sales growth, mixed activity data and downbeat Jobless Claims to push back hawkish Fed concerns.

- Firmer sentiment, ECB moves also weigh on US Treasury bond yields and DXY.

- US consumer sentiment numbers, inflation clues eyed for further directions as hawkish Fed bets ease.

US Dollar Index (DXY) bears take a breather at the lowest levels in over a month, flirting with the 102.00 round figure amid the early hours of Friday’s Asian session. In doing so, the greenback’s gauge versus six major currencies justifies the market’s easing hawkish concerns for the Federal Reserve’s July rate hike, as well as the risk-on mood, ahead of mid-tier US data.

As per the latest readings of the CME’s FedWatch Tool, market players place nearly 67% bets on the July Fed rate hike of around 25 basis points (bps). The same depicts the traders’ lack of conviction in the Federal Reserve’s (Fed) almost clear signals for a hawkish move in July amid mostly downbeat US data.

That said, US Retail Sales growth marks an increase of 0.3% for May versus -0.1% expected and 0.4% previous readings while the Core readings, mean Retail Sales ex Autos, match 0.1% market forecasts for the said month, compared to 0.4% prior. Further, NY Fed Empire State Manufacturing Index jumps to 6.6 in June versus -15.1 expected and -31.8 prior whereas Philadelphia Fed Manufacturing Index drops to -13.7 for the said month from -10.4 prior and compared to -14 market forecasts. Additionally, US Industrial Production for May cools down to -0.2% against 0.1% estimated and 0.5% prior while Initial Jobless Claims reprints the upwardly revised figures of 262K for the week ended on June 09 versus 249K expected.

It’s worth noting that the European Central Bank’s (ECB) victory over the Fed, by announcing 25 basis points (bps) interest rate hikes and suggesting more such moves ahead, also weighed on the US Dollar and the DXY. Furthermore, the PBoC cut its one-year interest rate for the first time in 10 months, by 10 basis points (bps), which in turn bolstered the market’s sentiment and exert downside pressure on the US Dollar Index.

US Dollar Index previously cheered the Fed’s hawkish halt but the aforementioned catalysts propelled the risk-on mood and drowned the US Treasury bond yields to recall the DXY bears. With this, Wall Street benchmarks rallied more than 1.0% each whereas the US 10-year Treasury bond yields plummeted to 3.72%.

Looking ahead, the preliminary readings of the Michigan Consumer Sentiment Index (CSI) for June and five-year inflation expectations will be in the spotlight as the Fed hawks find less acceptance. Additionally, the Bank of Japan (BoJ) Monetary Policy Meeting and Fed talks will also be crucial for clear directions

Technical analysis

A daily closing below the 50-DMA level of around 102.60 directs DXY bears toward an upward-sloping support line from mid-April, at 101.55 by the press time.

- NZD/USD eases from three-week high to print the first daily loss, so far, in four days.

- Business NZ PMI marks activity contraction for the third consecutive month in June.

- 100-DMA, previous resistance line join bullish MACD signals to favor Kiwi buyers.

NZD/USD takes offers to refresh intraday low around 0.6230 amid the early hours of Friday’s Asian session. In doing so, the Kiwi pair takes a U-turn from the highest levels since May 24, marked the previous day, while also snapping a three-day uptrend, amid downbeat New Zealand (NZ) data.

NZ Business PMI for June came in at 48.9 versus 50.2 expected and 49.1 prior. With this, the Pacific nation’s activity gauge marked the third consecutive monthly contraction in business performance.

Not only the downbeat NZ data but the above 50.0 levels of the RSI (14) line also allowed the NZD/USD bulls to take a breather at the multi-day high.

However, the 100-DMA support of around 0.6220 joins the bullish MACD signals to put a floor under the NZD/USD price for intraday traders, a break of which can quickly drag the quote to the 38.2% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6150.

Following that, the resistance-turned-support line stretched from early May, around 0.6120 at the latest, will be in the spotlight.

In a case where the NZD/USD drops below 0.6120 support, the odds of witnessing a south-run towards the previous monthly low of around 0.5985 can’t be ruled out.

Meanwhile, the NZD/USD buyers can aim for the 23.6% Fibonacci retracement level of around 0.6300 on crossing the latest peak of 0.6250.

Though, a 4.5-month-old resistance line and a horizontal area comprising multiple levels marked since early February, respectively near 0.6330 and 0.6385-90, appear tough nuts to crack for the Kiwi pair buyers to keep the reins afterward.

NZD/USD: Daily chart

Trend: Limited downside expected

- NZD/JPY trades flat at 87.40, retracing slightly after reaching a new YTD high.

- Buyers remain in charge; however, a flat slope suggests potential near-term consolidation.

- Caution is warranted as RSI and Rate of Change indicate weakening buyer momentum.

NZD/JPY retraces slightly as the Asian session begins after posting solid gains on Thursday of 0.58% and reaches a new year-to-date (YTD) high of 87.59. At the time of writing, the NZD/JPY is almost flat, exchanging hands at 87.40.

NZD/JPY Price Analysis: Technical outlook

The NZD/JPY is still upward biased from a daily chart perspective, as the pair remains above the Ichimoku cloud. In addition, the cross-over of the Tenkan-Sen line above the Kijun-Sen, suggests that buyers remain in charge. But the slope of the latter for the last nine days shifted flat, suggesting some consolidation lies ahead before the NZD/JPY attacks the next resistance level at 88.17, the December 13 high.

If the NZD/JPY breaks the abovementioned price level, the next stop would be the 89.00 psychological level, as the pair gets on its way toward testing the 2015 high at 92.42. Conversely, the NZD/JPY first support would be the May 23 high at 87.31, which, once cleared, would expose the May 24 daily high turned support at 86.68. The following support levels would be the Tenkan-Sen line at 86.00 and the Kijun-Sen line at 85.56.

Given that the Ichimoku cloud suggests the NZD/JPY is upwards, oscillators like the Relative Strength Index (RSI) indicate that the pair is approaching overbought territory, but its slope aims down. The three-day Rate of Change (RoC) shows buyers are losing momentum.

Trend: Neutral-upward biased, but caution is warranted.

NZD/JPY Price Action – Daily chart

- AUD/USD retreats from the highest levels since late February, consolidating the biggest daily jump in two months.

- Upbeat sentiment, PBoC rate cut and fewer threats to the hawkish RBA concerns propel Aussie pair.

- Downbeat US data, ECB play drowned US Dollar and favored AUD/USD bulls.

- Mid-ties US statistics, yields eyed for clear directions on July Fed rate hike.

AUD/USD dribbles at the highest levels since February 21, making rounds to 0.6880-90, amid the early hours of Friday’s Asian session after rising the most since mid-April the previous day. In doing so, the Aussie pair traders portray the market’s consolidation move amid a lack of major data/events after a volatile day.

That said, the risk-barometer pair benefited from the strong Aussie jobs report versus downbeat US data, as well as the People’s Bank of China (PBoC) rate cut to post the stellar run-up.

On Thursday, Australia’s Consumer Inflation Expectations for June rose to 5.2% versus the 4.8% expected and 5.0% prior. Further, the Employment Change rallied by 75.9K in May compared to 15K market forecasts and -4.3K previous readings. Additionally, Australia's Unemployment Rate drops to 3.6% against expectations of witnessing a no-change figure of 3.7%.

On the other hand, US Retail Sales growth marks an increase of 0.3% for May versus -0.1% expected and 0.4% previous readings while the Core readings, mean Retail Sales ex Autos, match 0.1% market forecasts for the said month, compared to 0.4% prior. Further, NY Fed Empire State Manufacturing Index jumps to 6.6 in June versus -15.1 expected and -31.8 prior whereas Philadelphia Fed Manufacturing Index drops to -13.7 for the said month from -10.4 prior and compared to -14 market forecasts. Additionally, US Industrial Production for May cools down to -0.2% against 0.1% estimated and 0.5% prior while Initial Jobless Claims reprints the upwardly revised figures of 262K for the week ended on June 09 versus 249K expected.

It should be noted that the PBoC cut its one-year interest rate for the first time in 10 months, by 10 basis points (bps), which in turn unleashed hopes of more liquidity in Australia’s biggest customer and favored the AUD/USD price.

Elsewhere, the European Central Bank’s (ECB) 25 basis points (bps) interest rate hike and clues of more such moves ahead also weighed on the US Dollar and propelled the price.

In doing so, the AUD/USD pair pays little heed to the downbeat China Retail Sales and Industrial Production while also failing to justify a nearly 67% chance of the Fed’s July rate hike.

Amid these plays, Wall Street benchmarks rallied more than 1.0% each whereas the US 10-year Treasury bond yields plummeted to 3.72%. Further, the US Dollar Index (DXY) dropped the most in three months while poking the lowest levels since May 12, to 102.15 at the latest.

Moving on, preliminary readings of the Michigan Consumer Sentiment Index (CSI) for June and five-year inflation expectations will be in the spotlight as the Fed hawks find less acceptance.

Also read: AUD/USD Forecast: Aussie not getting tired, accelerates higher

Technical analysis

Although the overbought RSI conditions challenge the AUD/USD bulls at a multi-day high, a daily closing beyond a 3.5-month-old ascending resistance line, now support around 0.6835, keeps the Aussie pair buyers hopeful despite the latest pullback in the price.

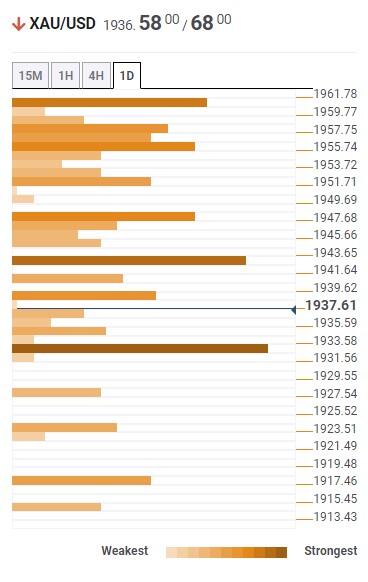

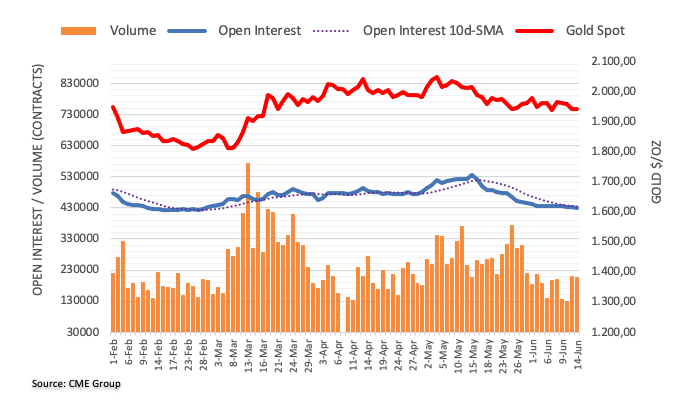

- Gold Price grinds higher after bouncing off the lowest level in three months.

- Pullback in United States Treasury bond yields, mixed US data weigh on US Dollar and propel XAU/USD.

- ECB rate hike versus hawkish Fed halt, China news also down US Dollar, favoring the Gold Price in turn.

- US Michigan Consumer Sentiment Index, Inflation expectations eyed for intraday XAU/USD directions.

Gold Price (XAU/USD) dribbles near $1,958-59 during early Friday after a volatile day that initially refreshed a multi-day low before bouncing off $1,924, as well as posted snapping the four-day losing streak. That said, the XAU/USD previously dropped to the three-month low as the US Dollar licked Federal Reserve (Fed) inflicted wounds amid hopes of a July rate hike before cheering the USD weakness on downbeat data and the market’s cautious optimism to recover from the lowest level since March.

Gold Price rebound relies on US Dollar weakness

Gold Price portrayed a perfect contrasting play with the US Dollar as the XAU/USD initially refreshed the monthly low on the greenback’s recovery amid hopes of a July rate hike from the Federal Reserve (Fed) before downbeat US data weighed on the yields and the USD.

That said, the US central bank kept the benchmark interest rate unchanged at 5.0-5.25%, matching market expectations of pausing the multi-month-old hawkish cycle after 10 consecutive rate increases. However, the upbeat FOMC Economic Projections and Federal Reserve (Fed) Chairman Jerome Powell’s speech backed the hawkish Fed bias surrounding the July meeting and weighed on the Gold Price on early Thursday, before bouncing off $1,924.

On the other hand, Thursday’s United States statistics haven’t been impressive and hence pushed back the July rate hike concerns, which in turn joined other risk-positive catalysts to weigh on the US Dollar and propel the Gold Price.

On Thursday, US Retail Sales growth marks an increase of 0.3% for May versus -0.1% expected and 0.4% previous readings while the Core readings, means Retail Sales ex Autos, match 0.1% market forecasts for the said month, compared to 0.4% prior.

Further, NY Fed Empire State Manufacturing Index jumps to 6.6 in June versus -15.1 expected and -31.8 prior whereas Philadelphia Fed Manufacturing Index drops to -13.7 for the said month from -10.4 prior and compared to -14 market forecasts.

Additionally, US Industrial Production for May cools down to -0.2% against 0.1% estimated and 0.5% prior while Initial Jobless Claims reprints the upwardly revised figures of 262K for the week ended on June 09 versus 249K expected.

Apart from the US data, the European Central Bank’s (ECB) 25 basis points (bps) interest rate hike and clues of more such moves ahead also weighed on the US Dollar.

Elsewhere, the People’s Bank of China (PBoC) cut its one-year interest rate for the first time in 10 months, by 10 basis points (bps), which in turn unleashed hopes of more liquidity in one of the world’s biggest Gold consumer and favor the metal price. It should be noted that downbeat prints of China Retail Sales and Industrial Production and fears of labor problems in Beijing-based factories prod the XAU/USD bulls.

Amid these plays, market players portrayed an optimistic day with upbeat Wall Street performance and a steep fall in the US Treasury bond yields, not to forget the US Dollar Index (DXY) drop to the three-week low. The same offered the Gold Price the much-needed rebound to pare weekly losses inside a bullish chart pattern.

More clues to defy July Fed hike needed for clear XAU/USD direction

Although the latest United States data have been helpful to push back the concerns about the Federal Reserve’s (Fed) July rate increase, the CME’s FedWatch Tool still shows around a 67% chance of the US central bank’s 0.25% rate hike in the next month. Hence, more data rejecting the hawkish bias needs to defend the latest Gold Price rebound.

As a result, today’s preliminary readings of the Michigan Consumer Sentiment Index (CSI) for June and five-year inflation expectations will be in the spotlight. Also important to watch will be the US Treasury bond yields and the US Dollar moves.

Also read: Gold Price Forecast: XAU/USD could well rally on any data showing inflation pressures are easing – TDS

Gold Price technical analysis

Gold Price fades upside momentum within a fortnight-old falling wedge bullish chart formation.

Adding strength to the XAU/USD recovery hopes is the looming bull cross on the Moving Average Convergence and Divergence (MACD) indicator, as well as a U-turn by the Relative Strength Index (RSI) line, placed at 14, from the oversold territory.

It’s worth noting, however, that the 200-bar Exponential Moving Average (EMA) adds strength to the wedge’s top line and makes it harder to cross the $1,968 hurdle.

Also challenging the Gold Price upside is a one-month-old horizontal resistance zone surrounding $1,983-87.

Meanwhile, the stated bullish chart pattern’s lower line, close to $1,923 at the latest, precedes the mid-March consolidation around $1,910-15 to challenge the short-term XAU/USD downside.

Following that, the Gold Price downside towards the $1,900 threshold, $1,890 dynamic support and the early March swing high of near $1,858 will be on the XAU/USD bear’s radar.

Gold Price: Four-hour chart

-16062023-638224642206860912.png)

Trend: Further downside expected

- EUR/GBP sees modest gains, trading at 0.8562, following ECB’s 25 bps rate hike.

- ECB pushes inflation prospects up, sparking expectations for further rate hikes.

- BoE’s hawkish expectations spark Sterling’s strength, capping the Euro’s rally.

EUR/GBP trades with modest gains after the European Central Bank (ECB) raised rates by 25 basis points (bps) and telegraphed additional increases. However, expectations of further tightening by the Bank of England (BoE) capped the Euro’s (EUR) rally at 0.8591, recovering ground after Wall Street closed. At the time of writing, the EUR/GBP is trading at 0.8562, up 0.13%.

Rate hike prospects for the BoE temper Euro’s rise despite ECB’s bold monetary tightening

On Thursday, the European Central Bank (ECB) raised rates by 25 bps as expected, leaving the deposit rates at 2.50%, its highest level in 22 years. Besides increasing rates, the ECB staff revised inflation prospected to the upside, from 4.6% to 5.1%.

In the meantime, ECB President Christine Lagarde cemented the case for a rate hike in July but pushed back against expectations for a September increase. Lagarde added, “Wage pressures, while partly reflecting one-off payments, are becoming an increasingly important source of inflation.”

Even though inflation cooled somewhat, it is still three times the ECB’s goal of 6.1%. It should be said that prices have come down at the expense of slow economic growth, as recent GDP reports from the bloc suggest the economy hit a recession. Back-to-back negative quarters revealed that growth was cut to -0.1% in Q4 2022 and Q1 2023.

Aside from this, expectations for a hawkish Bank of England (BoE) capped the Euro’s gains, which was set to challenge the 0.86 handle. Nevertheless, money market futures estimates for the BoE to raise rates at least 100 bps in the next twelve months spurred an appreciation in the Sterling (GBP), which posted solid gains against the US Dollar.

EUR/GBP Price Analysis: Technical outlook

From a daily chart perspective, the EUR/GBP is tilted downwards, but since June 9, when it hit a low of 0.8540, the cross failed to extend its losses past the new year-to-date (YTD) low of 0.8536. since then, the EUR/GBP has been exchanging hands in a 70-pip range capped by the 20-day Exponential Moving Average (EMA) on the upside at 0.8610. Nevertheless, the ongoing downtrend started in February is still in place, and the path of least resistance is downwards.

The EUR/GBP first support would be the 0.8541, June 14 low. A breach of the latter will expose the YTD low of 0.8536 before dropping toward 0.8500. Upward risks lie above 0.8600, particularly at the 20-day EMA, followed by resistance at the 50-day EMA at 0.8677.

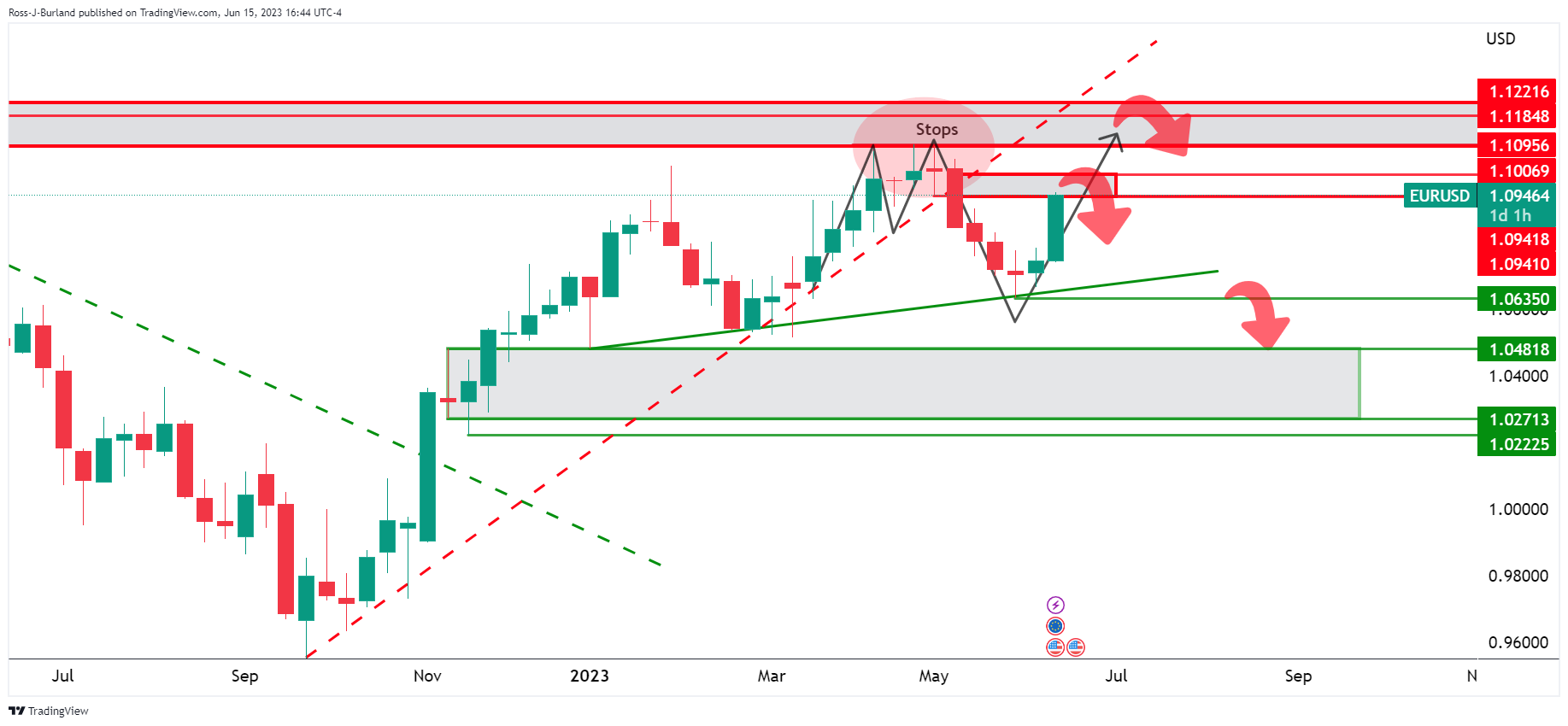

- EUR/USD bulls move into a key area of potential weekly resistance.

- Bears need to show up at this juncture for prospects of a move into the 1.0820s or face pressures to and above 1.1000.

EUR/USD moved to a five-week high on Thursday on the back of the European Central Bank increasing rates for the eighth straight time and signalled further tightening to bring eurozone inflation to its medium-term target of 2%.

At 3.5%, rates are the highest in 22 years and the ECB's inflation projection for this year was raised to 5.1% from 4.6%. Consequently, the price has moved into what could be regarded as a resistance area from trendline support. The following illustrates, however, prospects of a move through 1.1000 and into the tops of where the weekly M-formation shorts were established in the lows 1.1100s:

EUR/USD weekly charts

A move lower from here, however, opens risk to the 1.0820s as follows:

EUR/USD daily chart

The 1.0820s align with the 61.8% Fibonacci and prior resistance structure as illustrated above.

- On Thursday, the GBP/JPY rocketed to a multi-year high of 179.40 for the first time since December 2015.

- Hot labour market and GDP data from the UK support a hawkish BoE.

- BoJ expected to keep its monetary policy unchanged.

The GBP/JPY gained more than 100 pips on Thursday, rallying to a high of 179.40 and then stabilizing at the 179.30 zone. In that sense, the GBP seems to be gaining ground on the back of hawkish bets on the Bank of England (BoE) after strong labour-market and Gross Domestic Product (GDP) data which supports more rate hikes. On the other hand, policy divergence seems to be weakening the Yen ahead of the Bank of Japan (BoJ) meeting on Friday.

British Yields hold the Pound afloat ahead of next week's BoE meetings

Along this week, labour-market data from the UK showed that unemployment decreased in the three months prior to April while average earnings, including and excluding bonuses, accelerated during the same period. In addition, monthly expanded by 0.2% in April after a decline in March while growing by 0.1% in the three months prior to April.

As the labour market remains robust and economic activity resilient, investors are expecting that the BoE will take a more aggressive path in its fight for inflation. In that sense, according to WIRP (World Interest Rate Probability), the market suggests that a 25 bps hike to 4.75% its already priced, which has small odds of a 15% of a larger 50 bps hike for next week meeting and that a 25 bps hike is already priced in for August, September and November.

Meanwhile, the British yields saw gains across the curve. The 10-year bond yield rose to 4.41%, while the 2-year yield stood at 4.93% and the 5-year yielded 4.56%, respectively.

GBP/JPY Levels to watch

According to the daily chart, the GBP/JPY holds a bullish outlook for the short term, but the pair trading in multi-year highs and at overbought conditions signalled by the Relative Strength Index (RSI) suggest that a healthy downward correction may be on the horizon.

In case the pair continues to gain traction, the following resistance line up at the 179.50 area, followed then by the psychological mark at 180.00 and the 180.50 zone. On the other hand, if the pair corrects to the downside, immediate support levels are seen at the 177.40 area, followed by the psychological mark at 175.00 and the 20-day Simple Moving Average (SMA) at 174.05.

GBP/JPY Daily chart

-638224610991030981.png)

The last top-tier event of the week will be the Bank of Japan's decision during the Asian session. Later in the day, the University of Michigan will release its Consumer Sentiment report in the US. On Friday, market participants will continue to biggest the latest central bank meetings.

Here is what you need to know on Friday, June 16:

The US Dollar tumbled on Thursday and it looks vulnerable to further losses. The improvement in risk sentiment and falling US yields triggered a sharp decline. Wall Street indexes ended with gains of more than 1%. Crude oil prices rose more than 3%, and Gold and Silver rebounded sharply, erasing heavy losses. Economic data from the US came in mixed.

- Retail Sales rise 0.3% in May vs. -0.1% expected

- Industrial Production drops 0.2% in May missing expectations of 0.1% increase

- NY Fed Empire State Manufacturing Index jumps to 6.6 in June vs. -15.1 expected

- Philadelphia Fed Manufacturing Index drops to -13.7 in June vs. -14 expected

- Weekly Initial Jobless Claims remain at 262K vs. 249K expected

Following the European Central Bank's (ECB) rate hike and Lagarde's hawkish tone, the Euro strengthened, boosting the EUR/USD pair. Later in the day, the rally was driven by the slide of the US Dollar. The pair hit monthly highs at 1.0950 and closed near the top, keeping the momentum intact. Inflation data from the Eurozone (EZ) is due on Friday, but is not expected to be relevant as it is the final reading. Also EZ Q1 labors costs are due

Analysts at Commerzbank:

ECB President Lagarde today surprisingly announced another rate hike for July. We are adjusting our forecast for July accordingly, but consider further rate hikes thereafter unlikely despite Lagarde's hawkish statements. This is because the economy is likely to disappoint the ECB's still optimistic expectations. Moreover, inflation will probably have fallen to around 4% by the meeting in mid-September. Moreover, a deposit rate of 3.75% in mid-September would be well above the neutral rate, which the ECB sees at only 2%.

The EUR/GBP peaked at 0.8595 but then pulled back to 0.8560. The GBP/USD posted its highest daily close in a year, slightly below 1.2800. Next week, the Bank of England will have its monetary policy meeting.

The USD/JPY peaked at 141.50, the highest level in seven months, and then pulled back to 140.25 amid falling US yields. The Bank of Japan will announce its decision on Friday and is expected to maintain its monetary policy stance. Any surprise will trigger sharp moves. The EUR/JPY jumped to the highest level since 2008 above 153.00, reflecting the divergence between the Bank of Japan and the ECB, alongside risk appetite.

The Australian Dollar outperformed on Thursday, boosted by the employment data from Australia and also by risk appetite and speculation about Chinese economic stimulus. AUD/USD rose for the sixth consecutive day, moving towards 0.6900.

The Kiwi lagged and was affected by the New Zealand GDP report. NZD/USD rose, reaching a fresh monthly high at 0.6241. AUD/NZD gained almost a hundred pips, posting the highest close since November at 1.1035.

Like this article? Help us with some feedback by answering this survey:

- EUR/JPY pierces through 153.50 for the first time since 2008.

- ECB hiked rates by 25 bps and hinted at more increases.

- BoJ is expected to take the dovish path on Friday.

The EUR/JPY sets four-day winning strike trading at 153.55 as the Euro rallied against most of its rivals on Thursday following the European Central Bank (ECB) meeting. In that sense, Christine Lagarde’s hawkish comments in the presser hinting at more hikes, fueled the Euro’s rally.

Rising German Bond yields favour the Euro

On Thursday, the ECB increased the main financing rate to 4.00%, the marginal lending to 4.25% and the deposit facility rate to 3.50%, all by 25 basis points as expected. Regarding the updated macroeconomic forecast, the central bank expects the Gross Domestic Product (GDP) to pick up later this year. They consider inflation will remain high, at least until 2025.

Looking forward, Christine Lagarde mentioned in the presser, that they are “not done yet”, and that there is still “more ground to cover”, stating that she is not satisfied with the progress being made. In relation to the recent deceleration of inflationary pressures in the Eurozone (EZ), she considered it as “broad-based” and that the central bank should focus on the long-term inflation expectations. All in all, she also confirmed that it is “very likely” that the ECB will hike again in July.

As a reaction, the German yields rose across the curve. The 10-year bond yield climbed to 2.46%, seeing a daily increase of 1.34%, while the 2-year yield stands at 3.13%, gaining 2.80%.

On the other hand, investors await the Bank of Japan (BoJ) decision on Friday. The central bank is expected to keep its monetary policy unchanged.

EUR/JPY Levels to watch

Based on the daily chart, the EUR/JPY holds a clear bullish bias in the short term, as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both deep in positive territory, suggesting a strong upward momentum. However, the pair reached overbought conditions and uncharted territory, suggesting that a downward correction may be on the horizon.

If EUR/JPY manages to move higher, the next resistances to watch are at the 153.80 area, followed by the psychological mark at 154.00 and the 154.50 zone. On the other hand, in case the cross loses ground, support levels line up at the psychological mark at 152.00,the 150.50 area and the 20-day Simple Moving Average (SMA) at 150.05.

EUR/JPY Daily chart

-638224576885006391.png)

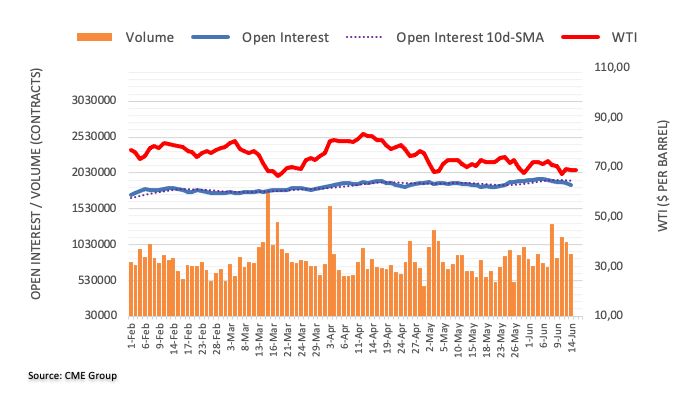

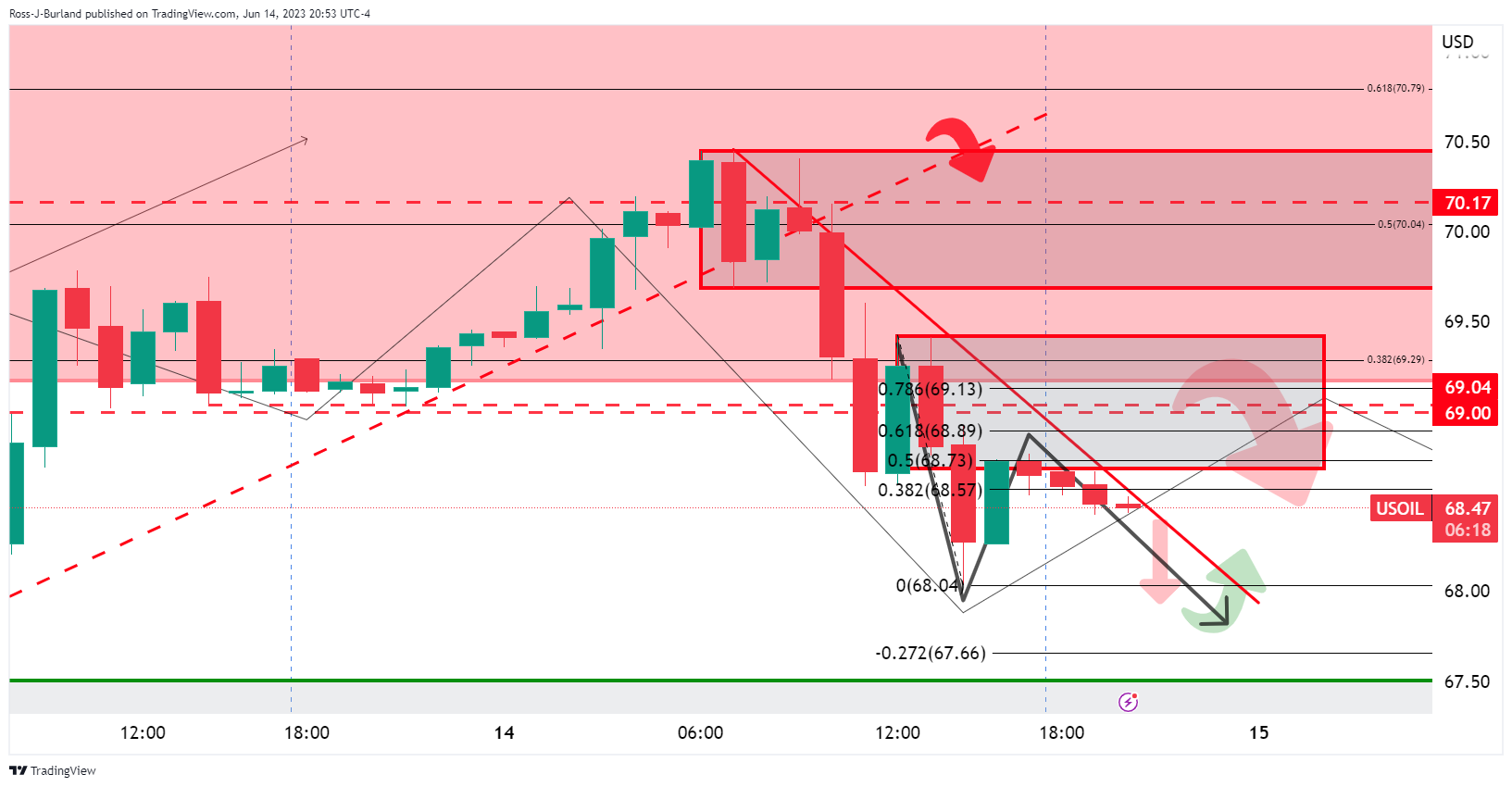

- WTI has rallied into a potential area of resistance on the daily chart.

- Bears need to commit at this juncture or face pressures towards $72.00 and then the $73.20s.

West Texas Intermediate WTI crude oil was headed for a higher close on Thursday marking the largest one-day percentage gain, so far, since the start of the month. The rise comes after the International Energy Agency on Wednesday hiked its 2023 demand forecast and Chinese refinery data showed rising demand from the world's No.1 importer.

At the time of writing, the black gold is trading 2.71% higher after rallying from a low of $68.03 to a high of $70.93 so far. This has seen the price move into the M-formation's neckline and a potential resistance zone. However, as the following analysis illustrates, the bulls could well commit at this juncture to complete the final leg of the W-formation:

WTI daily chart

This will expose $72 the figure in the coming session and then $73.20s.

- The Swiss Franc is on the march but a correction is eyed for.

- USD/CHF bulls are lurking in what could be a support area for the coming sessions.

The Swiss Franc rallied in tandem with the Euro on Thursday which made a fresh four-week high against the US Dollar after the European Central Bank lifted interest rates to a two-decade high of 3.5% and guided towards more hikes ahead. This has seen USD/CHF subsequently plummet on the day towards a critical support area as the following technical analysis will illustrate:

USD/CHF H4 chart

We have seen a breakdown in the market structure which has left behind the M-formation, a reversion pattern that leaves scope for a correction back towards prior support structures.

USD/CHF H1 charts

Zooming down to the hourly charts, we see the structure on the left where the price could be headed before a deceleration might come into play leading to a phase of accumulation.

Zooming into the present, bulls will be monitoring for that deceleration and a bullish structure within the accumulation schematic to lean against and targetting the imbalance to the upside.

- XAG/USD sees resistance, trading at $23.82, down 0.36% amidst weakened US Treasury yields.

- Despite the downward tilt, breaking June 9 daily high could shift Silver’s bias to neutral upwards.

- Oscillators predict near-term downside, indicating sellers’ continued market control.

Silver price erases some of its earlier losses which witnesses XAG/USD’s printing a two-week low at $23.22 before reversing its direction. However, XAG/USD’s recovery stalled at a resistance area, with several technical indicators capping the uptrend. At the time of writing, the XAG/USD is trading at $23.82, down 0.36%.

XAG/USD Price Analysis: Technical outlook

The XAG/USD remains neutrally biased, tilted downwards as the white metal can’t reclaim the April 25 swing low of $24.49, an inflection point that can pave the way for further upside. Should be said Silver failed to rally, despite a drop in US Treasury bond yields. Therefore, XAG/USD’s momentum in the short term could be fading, warranting a bearish resumption.

To the downside, XAG/USD would find first support at the 100-day Exponential Moving Average (EMA) at $23.53, which, once cleared, would put at risk $23.00. Break below, and the 200-day EMA will be up for grabs at $22.94 before challenging May 26 low at $22.68, with further downside expected past the latter.

Conversely, the XAG/USD must crack the June 9 daily high for a bullish resumption at $24.52. The break above will put into play a higher trading range and shift Silver’s bias to neutral upwards. The next resistance would be $25.00, followed by May 11 high at $25.47.

However, oscillators suggest further downside expected in the near term, with the Relative Strength Index (RSI) at a bearish area and the three-day Rate of Change (RoC), portraying sellers remaining in control.

XAG/USD Price Action – Daily chart

- The NZD/USD jumped to 0.6235 and now trades above the 20,100, and 200-day SMAs.

- US Jobless Claims for the first week of June came in above expectations.

- New Zealand confirmed it entered into a technical recession.

In Thursday’s session, the Kiwi gained further traction to jump above the 100-day SMA as the US Dollar weakened post Jobless Claims and Retail Sales. In that sense, US bond yields are falling while US stocks are rising reflecting a positive market environment and applying further pressure on the USD. On the other hand, the NZD managed to clear losses after weak Gross Domestic Product (GDP) data from New Zealand.

Investors asses Fed decision after Jobless Claims data

The recent data from the US Census Bureau revealed that Retail Sales from May (MoM) experienced a growth of 0.3% compared to the previous reading vs the 0.1% decline expected. On the other hand, Jobless Claims for the week ending June 9 increased slightly to 262K, surpassing the predicted number of 249k but remaining at the same level as the previous week.

Despite the hawkish tone of Wednesday’s monetary policy statement from the Fed, US bond yields declined following the data as a weak labor market may reduce the pressure from Fed officials to continue to hike rates. Its worth noticing that Chair Powell stated that the labour market remains robust and that is the main engine of the US economy. That being said, the 2,5 and 10-year yields all saw declines, with the latter falling sharply to 3.72%, seeing a 1.60% contraction, and making the USD lose interest.

On the other hand, the NZD managed to shrug off weak-GDP-related losses. The report showed that the economy contracted by 0.1% QoQ in Q1, and as two consecutive contractions in quarterly figures is considered to be a technical recession.

NZD/USD Levels to watch

According to the daily chart, the bulls clearly have the upperhand in the short term. The Relative Strength Index (RSI) stands above its midline with a positive slope while the Moving Average Convergence Divergence (MACD) prints rising green bars suggesting a strong bullish momentum.

In case the pair continues to move upwards, resistance levels can be found at around 0.6250, followed by the 0.6280 area and the psychological mark at 0.6300. On the other hand, supports line up at the 100-day SMA at 0.6220 and below at the 20 and 200-day SMA at 0.6150 and 0.6111, respectively.

NZD/USD Daily Chart

-638224502470371043.png)

- USD/MXN registers minimal gains of 0.15%, trading around 17.1320, amidst a weakened USD.

- Surprise expansion in US Retail Sales countered by skepticism over projected Fed rate hikes.

- Upcoming US and Mexican data eyed by USD/MXN traders amid mixed signals on monetary policy.

USD/MXN found bids around the year-to-date (YTD) low area and climbed to fresh two-day highs before reversing its path as the US Dollar (USD) weakened. Nevertheless, the USD/MXN is still registering minimal gains of 0.15%, trading at around 17.1320, after reaching a YTD low of 17.0783.

Surprise expansion in US Retail Sales meets Skepticism over Fed’s rate hike expectations

The Mexican Peso (MXN) weakened amidst a risk-on impulse, as shown by Wall Street trading with gains. Market participants were surprised by the US Federal Reserve’s (Fed) hawkish dot plots, with 12 of 18 officials lifting their dots past the 5.50% threshold and revising Fed Funds peak rates upward. Although it briefly extended the US Dollar recovery, Jerome Powell’s press conference stabilized things sending the greenback lower.

Data-wise, the US economic docket revealed a surprising expansion in Retail Sales, topping expectations, increasing 0.3% MoM in May, above estimates of a 0.1% contraction. At the same time, the US Department of Labor updated unemployment claims data for the June 10 week, growing above estimates of 249K, at 262K, the same as the prior’s week upward revised figures.

Recently revealed data, Industrial Production contracted in May -0.2% MoM, missed the forecast of 0.1% growth, while the New York and Philadelphia Fed Manufacturing Indices came mixed, with the NY rebounding unexpectedly after May’s plunge, while the Philly further deteriorated but at a slower pace.

Reacting to the data, US Treasury bond yields tumbled, a headwind for the buck. The US Dollar Index (DXY), which tracks the greenback’s value against a basket of six rivals, drops 0.77%, down at 102.209 after hitting a one-month low.

Regarding upcoming monetary policy meetings, the CME FedWatch Tool shows odds for a 25 bps rate hike in July stand at 67%. Notably, traders contradict Fed Chair Powell’s words regarding two more rate hikes, as the swaps market expects no further increases. Investors speculate the Fed would slash rates as early as January 2024, expecting six rate cuts towards December 2024, with the Federal Funds Rate (FFR) seen at 3.50%-3.75%.

Upcoming events

The US agenda will feature Fed speakers, the US Consumer Sentiment from the University of Michigan (UoM), and American inflation expectations. On the Mexican front, next week’s Retail Sales and Bank of Mexico (Banxico) monetary policy decision are eyed by USD/MXN traders.

USD/MXN Price Analysis: Technical outlook

Despite slashing some of its losses, the USD/MXN remains downward biased as it remains below the May 16 low of 17.4038 turned resistance, seen as an inflection pivot that could shift the USD/MXN bias to neutral. That would put into play the 17.40-17.7720 area, surrounded by the 20 and 50-day Exponential Moving Averages (EMAs) at 17.4443 and 17.7238, respectively. Once those levels are cleared, USD/MXN buyers could remain hopeful the pair would challenge the 18.00 psychological level in the medium term. Otherwise, the path of least resistance is downwards, with the 17.0000 figure up next, followed by 16.50, before diving toward October 2015 low of 16.3257.

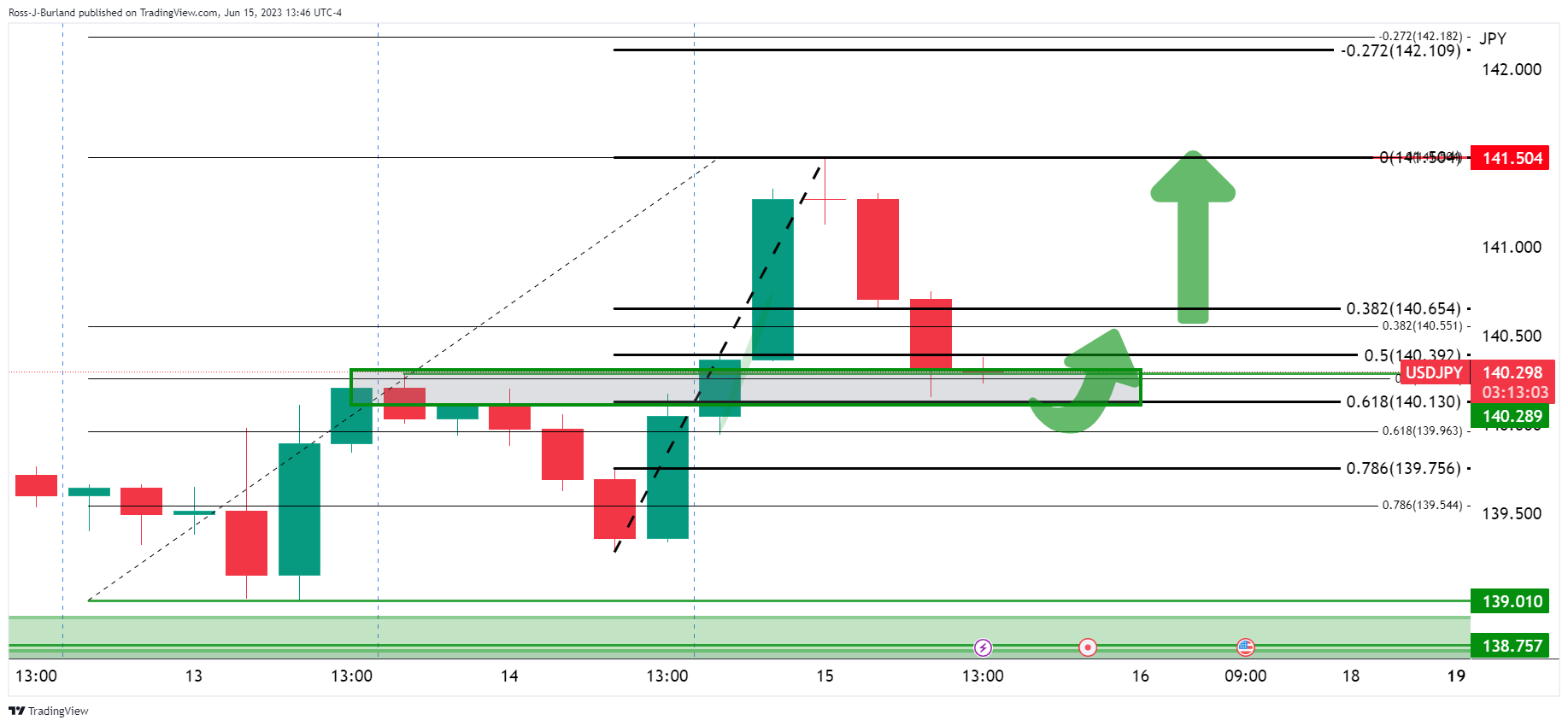

- USD/JPY bulls take a step back but eye higher highs.

- The price is meeting a prior area of resistance eyed as potential support.

USD/JPY has reached the highest levels since November 2022 as the US Federal Reserve maintained a hawkish stance in Wednesday's interest rate announcement with the dot plot hinting at two more quarter-point rate increases this year. However, a big wick is being left on the day's candle currently as the US Dollar and US Treasury yields pared gains. At the same time, investors digested the European Central Bank's interest rate hike and a flurry of economic data. Nevertheless, should support on the 4-hour charts hole, there will be prospects of a bullish extension in the coming sessions and days as the following analysis illustrates:

USD/JPY daily charts

USD/JPY H4 chart

The support on the 4-hour chart could be where the price is meeting old resistance that is aligned with the 50% mean reversion of the 4-hour bullish impulse.

- AUD/USD sets a sixth consecutive day of gains, jumping to the 0.6870 area.

- Strong US Retails Sales and Jobless Claims data support a dovish Fed.

- Falling US yields and a positive market sentiment favour the AUD.

On Thursday, the AUD/USD pair surged to its highest level since February, gaining 90 pips. In that sense, post the release of US Retail Sales and Jobless Claims data, falling US bond yields and a positive market sentiment weakened the US Dollar and favoured the AUD.

US Economic activity data post-Fed decision weakened the USD Dollar

The latest data from the US Census Bureau revealed a surprising expansion in Retail Sales, surpassing expectations as they increased by 0.3% MoM in May, defying the anticipated contraction of 0.1%. Furthermore, Jobless Claims for the week ending June 9 rose to 262,000, slightly higher than the forecasted 249,000 and the same as the previous week's reading of 262,000.

In Wednesday’s session, the Fed decided to hold rates steady in order to assess additional information regarding its implication on monetary policy. In addition, Fed Chair Powell, in the press conference, stated that the labour market remains robust and drives the US economy, so weakness in this area makes investors think that the Fed may take a more dovish stance for its next meetings.

Reacting to the data, US bond yields are seeing losses across the curve. The 10-year bond yield slid to 3.75% while the 2-year yield stood at 4.68% and the 5-year yields at 3.95%, with all three seeing declines of between 0.30-1%, applying further pressure to the US Dollar. Stocks, on the other hand, continued to trade strong, with the S&P 500 (SPX) gaining over 0.40%, signalling a positive market environment.

AUD/USD Levels to watch

Technically speaking, the AUD/USD maintains a clear bullish outlook for the short term, as the pair managed to rally above the 20,100 and 200-day Simple Moving Averages (SMA) and the technical indicators suggest that the buyers have the upperhand. However, the pair approaches overbought conditions, suggesting that a downward correction may be on the horizon.

In case the AUD/USD continues to gain traction, the following resistance line up at the daily high at 0.6875, followed by the psychological mark at 0.6900 and the 0.6950 area. On the other hand, to the downside, the next support levels to watch are the 100-day Simple Moving Average (SMA) at 0.6730, followed by the 200-day and 20-day SMA at 0.6690 and 0.6630, respectively.

AUD/USD Daily chart

-638224472903316044.png)

- XAU/USD experiences an uptick of 0.86% in the trading, spurred on by a softer US Dollar and falling bond yields.

- Despite the Fed’s projected rate hikes, US Treasury yields are retreating, signaling broad market skepticism over monetary tightening.

- US Retail Sales see an unexpected rise in May, bucking predictions, but the labor market shows signs of easing amid higher jobless claims.

Gold price bounced off three-month lows of $1925.06, spurred on by a soft US Dollar (USD) and falling US bond yields as the main factors underpinning Gold. At the time of writing, the XAU/USD is trading at $1958.50 a troy ounce, up 0.86%.

Market skepticism over Fed’s rate hikes projections boosts Gold

Sentiment remains upbeat, even though the Fed’s announced additional hikes needed after holding rates unchanged. Even though the Fed’s decision weakened Gold prices, market participants remain skeptical about the Fed, as US Treasury bond yields retraced from Wednesday’s highs.

The US economic agenda revealed that Retail Sales surprisingly rose in May by 0.3% MoM surpassing estimates but trailing April’s figures. At the same time, the US Department of Labor released the Initial Jobless Claims for the last week, topping forecasts of 249K, it came at 262K, printing back-to-back negative jobs data, indicating the labor market is easing.

Industrial Production showed a further deterioration, contracting -0.2% MoM, missing estimates of 0.1% expansion. Recently, the New York and Philadelphia Fed Manufacturing Indices came mixed, with the NY rebounding unexpectedly after May’s plunge, while the Philly further deteriorated but at a slower pace.

The US Dollar Index (DXY), a gauge that measures the buck’s value vs. a basket of six currencies, tumbles 0.77%, down at 102.209 after hitting a one-month low, while the US 10-year benchmark note yields 3.729%, losses six basis points, from its opening price.

The CME FedWatch Tool shows odds for a 25 bps rate hike in July stand at 67%, but traders in the swaps market expect no additional hikes. Investors estimate the Fed would slash rates as early as January 2024, expecting six rate cuts towards December 2024, with the Federal Funds Rate (FFR) seen at 3.50%-3.75%.

Upcoming events

The Fed parade would begin once officials are officially released from the blackout period, ahead of the June meeting, led by the St. Louis Fed President James Bullard. On the data front, the US Consumer Sentiment from the University of Michigan (UoM) and American inflation expectations are expected.

XAU/USD Price Analysis Technical outlook

From a technical perspective, the XAU/USD will likely remain sideways after reclaiming the 100-day Exponential Moving Average (EMA) at $1939.26, as the yellow metal slipped to new three-month lows of $1925.06 earlier. On the upside, XAU/USD is capped by the 20 and 50-day EMAs, each at $1961.52 and $1965.76, respectively. Up next, a resistance trendline from the broken descending symmetrical triangle lies around the $1965-75 area before Gold’s test of June 2 high at $1983.44. On the downside, the XAU/USD first support would be the psychological $1950 level, followed by the 100-day EMA.

- USD/CAD targets November 2022 lows at 1.3260.

- US Retail Sales data came in strong, and Jobless Claims in the first week of June picked up.

- Rising Oil prices and positive market sentiment support the CAD.

In Thursday’s session, the USD/CAD dropped more than 60 pips towards the 1.3245 level amid US Dollar weakness. In that sense, US bond yields are declining while Wall Street indexes trade with gains. On the other hand, amid the positive market sentiment and rising Oil prices, the CAD gained traction

US Yields decline following Jobless Claims and Retail Sales data

The US Census Bureau confirmed that Retail Sales in the US expanded by 0.3% vs the 0.1% contraction expected, while Jobless Claims in the week that ended in June 9 came in at 262K vs the 249K expected – the same as the previous weekly reading of 262k. It's worth noticing that US Federal Reserve (Fed) Chairman Jerome Powell noted at Wednesday’s press conference that the labor market in the US remains robust, so signs of unemployment rising make a dovish stance by the Fed more likely.

As a reaction, the US bond yields have weakened across the curve. The 10-year bond yield fell to 3.73%, while the 2-year yield sits at 4.65% and the 5-year yields 3.93% with a 2.03% drop, respectively. In addition, as stocks and bond yields tend to be negatively correlated, the expectations of a less aggressive Fed made the major Wall Street indexes rise with the S&P 500 (SPX) rising more than 0.40% standing at highs since April 2022.

Moreover, the positive market sentiment made Oil prices rise. The Western Texas Intermediate (WTI) rose more than 1% to the $69.80 area benefiting the CAD as Canada is a world-leading oil exporter.

USD/CAD Levels to watch

According to the daily chart, the USD/CAD holds a bearish outlook for the short term as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) both suggest that the sellers are in control while the pair trades below its main moving averages. However, both indicators are near oversold conditions suggesting an upwards correction could come into play.

If USD/CAD manages to move higher, the next resistances to watch are at the 1.3250 zone, followed by the 1.3300 area and the psychological mark at 1.3330. On the other hand, if the pair continues to lose ground, immediate support levels are seen at the November 2022 low at 1.3225, followed by the 1.3200 area.

USD/CAD Daily chart

-638224425732222225.png)

Economists at TD Securities discuss Gold (XAU/USD) outlook after the Fed meeting.

Gold to average $2,100 in the final three months of the year

The yellow metal could well move into the low $1,900 in the not-too-distant future if data remains strong enough to corroborate the Fed's interest rate forecast and technical supports are breached.

Given the world is looking like the Fed will not actually pull the trigger two more times, as suggested by the ‘meaningless’ median dots, our outlook for the yellow metal is positive.

Gold could well rally on any data showing inflation pressures are easing and the economy is reversing gears.

We see Gold averaging $2,100 in the final three months of the year, as we suspect the US central bank will cut rates aggressively thereafter, potentially before the two percent inflation target is reached.

- GBP/USD nears 1.2800 amid BoE hawkish signals, soft US Dollar.

- US Treasury yields lower despite forecasted hikes; a headwind for the greenback bolstered the GBP/USD.

- An unexpected jump in US Retail Sales; labor market cools.

GBP/USD rallies sharply in the North American session, propelled by an interest rate hike by the European Central Bank (ECB) and a hold of the US Federal Reserve (Fed). Expectations that the Bank of England (BoE) could be the more hawkish central bank amongst G10 FX countries keep the GBP/USD underpinned toward the 1.2800 mark. At the time of writing, the GBP/USD is trading at 1.2764 after hitting a low of 1.2628.

BoE hawkish expectations propel Sterling as US markets fight the Fed

Wall Street is trading with gains following the Fed’s decision to keep rates unchanged. Even though Jerome Powell and Co. telegraphed two more 25 bps rate hikes, the markets are not buying their narrative, as US Treasury bond yields drift lower, with the 10-year note yielding 3.753%, down four basis points (bps), while the greenback weakens across the board. In the meantime, the ECB lent a lifeline to the Pound Sterling (GBP) after lifting rates by 25 bps and suggesting more increases are coming.

Regarding economic data, US Retail Sales unexpectedly jumped in May by 0.3% MoM, against estimates for a 0.1% contraction, though it eased a tick compared to April’s data. Regarding the labor market, Initial Jobless Claims for the week ending June 10 rose 262K above the 249K analysts foresee, with back-to-back increases in claims, flashing that the labor market is cooling.

In other data, Industrial Production in the US, reported by the Fed, grew 0.2% YoY, though monthly figures showed a contraction of -0.2%. Aside from this, the Philadelphia Fed Manufacturing Index came better than expected but trailed May’s report; while the New York Empire State Manufacturing Index improved unexpectedly, exceeding estimates of -15.1, crushed last month’s reading of -31.8 at 6.6.

Across the pond, money market futures estimates the Bank of England (BoE) would continue to raise rates after solid employment data and April’s GDP figures. WIRP suggests a 25 bps hike in June is fully priced in, as well as August, September, and November, bringing the Bank Rate to 5.75%. Further data will be revealed the next week, with CPI for May expected at 8.5% YoY, compared to April’s 8.7%.

GBP/USD Price Analysis: Technical outlook

Once the GBP/USD conquered 1.2700, that exposed last year’s April 26 high at 1.2772 as the only resistance between the current exchange rate and the 1.28 handle. A breach of the latter will clear the path towards 1.3000, with resistance found at April 25 high at 1.2843 and April 13 low at 1.2972. Conversely, if GBP/USD drops below 1.2700, that would expose the May 10 high at 1.2679 before the major dips toward the 1.2600 figure. Downside risks lie at the 20-day Exponential Moving Average (EMA) at 1.2521, ahead of testing the June 12 low of 1.2487.

Economists at ING discuss USD/JPY outlook after the pair moved above 140, sparking the ire of Japanese officials again.

Market is under-pricing the risk of further normalisation in the BoJ’s YCC policy on 16 June

The question is whether policymakers in Tokyo are prepared to ride out another summer of strength in USD/JPY – or will be prepared to take action.

We think the market is under-pricing the risk of further normalisation in the Bank of Japan’s Yield Curve Control policy on 16 June. By the end of Q3, the Dollar decline should be underway.

USD/JPY – 1M 135.00 3M 130.00 6M 125.00 12M 120.00

The Bank of Japan (BoJ) will announce its monetary policy decision on Friday, June 16 and as we get closer to the release time, here are the expectations forecast by the economists and researchers of 10 major banks.

The BoJ is unlikely to tweak its Yield Curve Control (YCC), maintaining the current ultra-dovish stance.

Nordea

When it comes to the BoJ, after three decades of unconventionally loose monetary policy, it will take time for the BoJ to be convinced that sustainable 2% inflation is in sight. Thus, we expect no news from this week’s meeting. But we still believe that normalization is in the cards, however, the risk is that it might not come until next year.

Standard Chartered

We expect the BoJ to keep the policy rate unchanged. At his first policy meeting in April, BoJ Governor Kazuo Ueda sent a dovish signal and said major policy changes are unlikely in the near term. Still, we think there are reasons for the central bank to make changes to its policy; Japan’s core CPI inflation has stayed above 3% since September 2022 and wage growth for 2023 may exceed 3%. Also, with Japan posting strong Q1 GDP growth, the central bank may shift focus to CPI (rather than just growth). We do not rule out YCC band widening at this meeting, although this is not our baseline scenario.

Danske Bank

We expect the BoJ to tweak the YCC at one of the upcoming meetings. Widening of the yield curve control band to e.g. +/-100 bps can be explained as a move to improve market functioning, but will essentially be tightening. We still deem it most likely that the BoJ will stay put at the Friday meeting, though.

TDS

We expect BoJ to leave policy settings unchanged but think the prospects of a move in July to adjust the YCC band is much higher. BoJ also carries out its quarterly review in July, and it is likely that inflation forecasts are revised higher then. BoJ Governor Ueda has sounded cautious about a premature tightening of policy though this does not rule out a tweak in YCC.

SocGen

The BoJ will likely apply a -0.1% rate to the policy rate balance in the current account. It will also probably purchase the necessary amount of JGBs without setting an upper limit so that the 10y JGB yield remains at around 0%. On the other hand, it will allow 10y JGB yields to fluctuate in the range of around plus and minus 1 percentage point from the target level.

ING

We expect the BoJ to keep all its current policy settings unchanged. Likewise, a potential tweak in BoJ’s yield curve control policy is not likely to happen this month. However, should inflation remain at current levels in the second half of the year, we could still see a possible adjustment in the YCC policy over the next few months.

Deutsche Bank

We don't expect changes to the current policy. Given there won't be an Outlook Report, we see the central bank as likely continuing to focus on downside inflation risks but emphasises that inflation and currency are among key catalysts for a policy change.

Wells Fargo

While we do not anticipate the BoJ to change monetary policy settings at its June meeting, we do forecast a shift later this year in October, when the global monetary policy and bond yield backdrop may allow for a smoother adjustment. We expect the BoJ's policy adjustment to be a further step toward normalizing Japan's government bond market. Specifically, we expect the BoJ to lift the target for the 10-year Japanese government bond yield to 0.25% from 0% and widen the tolerance band around that target to +/- 75 bps. Should this adjustment proceed smoothly, we would view it as a probable precursor to the BoJ fully ending yield curve control, perhaps sometime in 2024.

ANZ

We expect the BoJ to leave its policy settings unchanged at its meeting this week. There is little incentive to change amid improved Japanese Government Bond (JGB) market functioning and soft wages growth. We maintain our view that the impetus to change the current policy stance of negative interest rates and yield curve control (YCC) will come from its negative side effects. We expect the BoJ to shorten the tenor of its target to 2y from 10y in coming meetings. The BoJ is likely to abandon YCC around the time it completes its comprehensive review of monetary policy.

Citi

We now expect the BoJ to keep all policy parameters, including YCC, unchanged and delay the decision to adjust YCC to July’s meeting.

The ECB hiked rates by 25 bps as expected. Economists at Nordea discuss the prospect of future hikes.

Hiking very likely to continue in July

The ECB raised rates by 25 bps, as expected, while Lagarde argued that the ECB still has more ground to cover and is very likely to hike rates again in July.

Staff forecasts put core inflation at 2.3% still in 2025, and Lagarde confirmed the ECB is not happy with the inflation outlook.

We think the July hike could end up being the last one of the cycle, but risks are clearly tilted toward the hiking cycle continuing after the summer.

The initial market reaction was hawkish, with rates rising, but rates started to fall soon after, and continued downwards, as Lagarde did not signal more than one more hike in July.

Despite the hawkish surprise contained in the Fed message – primarily in the dot plot – the Dollar failed to rebound. Economists at ING discuss the USD outlook.

Caution before jumping on a bearish Dollar trend just yet

The post-FOMC pricing is telling us that markets accord higher credibility to data than the Fed’s communication, so more evidence of US disinflation/economic slowdown can prompt more Dollar weakness moving ahead. However, with markets underpricing rate hikes compared to the dot plot, we’d be cautious before jumping on a bearish Dollar trend just yet, given the high risk of market pricing converging to the Fed’s projections and pushing short-term swap rates higher again.

So, Dollar bulls can probably cling on to the hawkish dot plot for now, or at least until (and if) data indicates more unequivocally that there is no longer a necessity to raise rates.

Economists at Standard Chartered now expect the Central Bank of the Republic of Türkiye (CBRT) to raise the weekly repo rate by 550 bps on 22 June.

CBRT likely to pivot with a 550 bps rate hike

We now expect the CBRT to raise the one-week repo rate by 550 bps to 14.0% on 22 June; we previously expected no change.

We now expect the CBRT to move gradually from a highly accommodative monetary policy stance towards a neutral or hawkish stance to address renewed TRY weakness, a widening current account deficit, and persistently high inflation (despite slowing economic activity).

- The USD Index has retreated from 103.28 despite Retail Sales have unexpectedly expanded.

- US Retail Sales report shows that demand for automobiles was extremely solid though inflation has squeezed real income of households.

- Fed Powell didn’t announce victory over inflation as core CPI is still persistent.

The US Dollar Index (DXY) has attracted plenty of offers that were capable of retreating bulls around 103.28 in the early New York session. The greenback basket has dropped vertically to near 102.80 despite households’ demand in the United States economy turning out to be resilient.

S&P500 futures are entering into the American session with significant losses generated in Europe as fears of a recession in the US are high despite a skip in the rate-hiking spell by the Federal Reserve (Fed). Fed chair Jerome Powell has paused its policy-tightening spell but has not ruled out more interest rates amid a battle against sticky inflation.

Retail Sales surprisingly expanded and Weekly jobless claims remain steady

US Census Bureau has reported that monthly Retail Sales (May) have surprisingly expanded by 0.3% while the street was anticipating a contraction of 0.1% but the pace of expansion has slowed against the prior pace of 0.4%. Scrutiny of the Retail Sales report shows that demand for automobiles was extremely solid though inflationary pressures have squeezed the real income of households.

Meanwhile, the Department of Labor has shown that initial jobless claims for the week ending June 09 have remained steady at 262K. The street was expecting a decline to 249K.

Fed announces a neutral policy with a hawkish dot plot

Fed Chair Jerome Powell didn’t announce victory over inflation as the core Consumer Price Index (CPI) is still persistent due to tight labor market conditions and resilience in consumer demand. While announcing the dot plot plan, Fed Powell confirmed two more interest rate hikes this year and cleared that rate cuts are not appropriate.

Investors should note that a skip in the interest rate regime by the Fed lacks optimism as the policy-tightening spell is not concluded now.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in June.

Key takeaways

"We had a harmonious discussion at the meeting."

"There was a very broad consensus behind the decision."

"There is some lag, but not that much, between 18 and 24 months."

"End of APP reinvestments should be well absorbed by markets."

"We see wages continuing to increase in the future."

"Services to continue to go strongly."

"We're not seeing 2nd round effects or a wage-price spiral."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- Industrial Production in the US contracted unexpectedly in May after a 0.5% increase in April.

- US Dollar Index stays in negative territory below 103.00.

Industrial Production in the US edged down 0.2% in May following April's increase of 0.5%, the Federal Reserve reported on Friday. This reading came in below the expectation for a growth of 0.1%.

Key takeaways:

“Industrial production edged down 0.2 percent in May following two consecutive months of increases.”

“In May, the index for manufacturing ticked up 0.1 percent, while the indexes for mining and utilities fell 0.4 and 1.8 percent, respectively.”

“At 103.0 percent of its 2017 average, total industrial production in May was 0.2 percent above its year-earlier level.”

“Capacity utilization moved down to 79.6 percent in May, a rate that is 0.1 percentage point below its long-run (1972–2022) average.”

Market reaction:

The US Dollar remains in negative territory across the board. The DXY is testing Wednesday’s low around the 102.65/70 area.

Economists at ING analyze the JPY outlook ahead of the Bank of Japan (BoJ) policy announcement.

It is a “skip” from the BoJ

We don’t expect real surprises from the BoJ policy announcement. Still, with little-to-nothing being priced in terms of a hawkish surprise, the downside risks for JPY also appear limited.

We continue to see good chances that the BoJ will make some changes to its YCC policy at the end of July – although the Fed decisions will admittedly play an important role.

Incidentally, further USD/JPY strength (possibly driven by carry trade strategies) may well lead Japanese authorities to restart FX intervention, which was deployed around the 145 area last September.

We may not be far from the peak in USD/JPY, even though a reversal of the bullish trend may take some time.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in June.

Key takeaways

"We still have ground to cover."

"Barring material change, very likely that we will continue to raise rates in July."

"We're not thinking about pausing."

"Inflation is projected to remain too high for too long."

"Future decisions will ensure that rates are sufficiently restrictive."

"Rates will be kept at those levels as long as necessary."

"We will continue to follow a data dependent approach."

"We need to be confident that core inflation is heading down. We're not satisfied with the inflation outlook."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

The headline General Business Conditions Index of the Federal Reserve Bank of New York's Empire State Manufacturing survey recovered to 6.6 in June from -31.8 in May. This reading came in better than the market expectation of -15.1.

“New orders inched up, while shipments grew strongly. Delivery times held steady, and inventories moved lower. Both employment and hours worked continued to contract, and input and selling price increases slowed considerably. Planned increases in capital spending remained weak. Looking ahead, firms became more optimistic about the six-month outlook”, the NY Fed noted in its publication.

Key takeaways:

“At -3.6, the index for number of employees remained negative for a fifth consecutive month, and the average workweek index also held below zero at -5.8, pointing to another monthly decline in employment and hours worked.”

“Price increases moderated significantly: the prices paid index fell thirteen points to 22.0, and the prices received index fell fifteen points to 9.0.”

“The index for future business conditions increased nine points to 18.9, its second consecutive monthly increase, suggesting firms have become more optimistic that conditions will improve over the next six months.”

“New orders and shipments are expected to increase modestly, and employment is expected to expand. After falling close to zero last month, the capital spending index increased only seven points to 8.0, suggesting that capital spending plans remained soft.”

Market reaction:

The US Dollar pulled back after the release of US economic reports that also included Retail Sales, Jobless Claims and the Philly Fed. The DXY printed fresh daily lows under 103.00 as US Treasury Yields declined further.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in June.

Key takeaways

"Euro area growth is likely to stay weak, then strengthen."

"Manufacturing continues to weaken."

"Governments should roll back energy support measures."

"Past increases in energy are still pushing up prices, along with pent-up demand."

"Wage pressures are becoming an increasingly important source of inflation."

"Firms in some sectors able to keep profits high."

"Longer term inflation expectations warrant monitoring."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

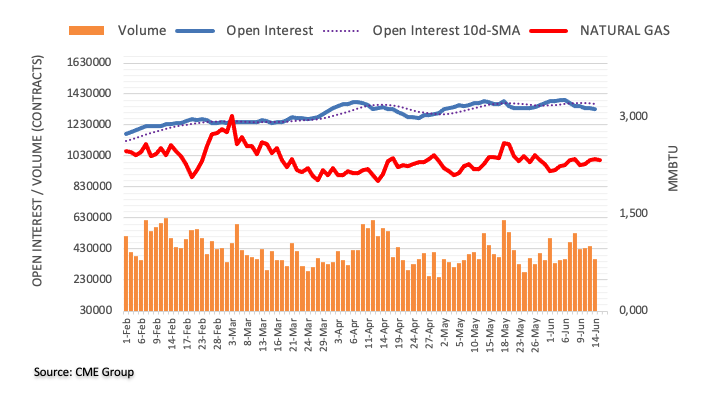

- Natural Gas surges, piercing through the 100-day SMA after ECB raises all three rates by 25 bps and revises up inflation forecasts.

- Gas market demand bubble and supply headwinds further underpin the commodity.

- Technically speaking, Natural Gas price is mounting a recovery despite remaining in a long-term downtrend.

Natural Gas price continues its run of recent gains on Thursday supported by a weaker US Dollar following the European Central Bank (ECB) interest rate decision, at which the ECB raised interest rates by 0.25%, as expected, and revised up its inflation forecasts, thus paving the way for hikes in the future. This strengthened the Euro and led to a steep decline in the US Dollar Index (DXY).

XNG/USD is further boosted by forecasts of hotter summer weather which is likely to stoke demand for Natural Gas in cooling systems. Increased demand from Asia, outages in Norwegian fields and disruptions to Russian pipeline gas flows are further factors cited for the recovery.

At the time of writing, Natural Gas is trading 2.75% higher on the day at $2.467 MMBtu.

Natural Gas news and market movers

- Natural Gas pops higher following the ECB meeting and decision to increase all three of its key interest rates by 0.25%, to 4.00%, 4.25% and 3.50% for the main refinancing, marginal lending and deposit facilities respectively.

- More importantly the ECB revised up its forecasts for core inflation in 2023-4.

- This will probably lead to higher interest rates in the future and contrasts with the US Federal Reserve’s relatively less hawkish outlook.

- A key phrase in the ECB’s monetary policy statement was, “The Governing Council’s future decisions will ensure that the key ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary."

- That said, the ECB also revised down growth estimates for 2023-4 – a dovish sign.

- Natural Gas price is further underpinned by a mixture of increased Asian demand, forecasts of hotter weather, Russian pipeline disruptions and Norwegian outages.

- Traders now await the press conference with ECB President Christine Lagarde for further clues about the ECB’s outlook and the key EIA Natural Gas inventory data out at 14:30 GMT.

Natural Gas Technical Analysis: Recovering within a longer-term downtrend

Natural Gas price is in a long-term downtrend after turning lower from its peak of $9.960 MMBtu achieved in August 2022. It continues to make lower lows, though bearish momentum has tapered off considerably since February 2023, as evidenced by the bullish convergence of the Relative Strength Index (RSI) momentum indicator since May. A bullish convergence occurs when price makes new lows but RSI fails to. It can indicate a propensity for price to rebound.

Nevertheless, unless Natural Gas can break above the last lower high of the long-term downtrend at $3.079 MMBtu, the odds continue to favor the bear trend, and shorts over longs.

A break below the $2.110 MMBtu year-to-date lows would solidify the bearish outlook and suggest a continuation down to a target at $1.546 MMBtu, the 61.8% Fibonacci extension of the height of the roughly sideways consolidation range that has unfolded during 2023.

-638224303782869931.png)

Natural Gas: Weekly Chart

Scoping into the daily chart, it can be seen that price has broken above the 50-day Simple Moving Average (SMA) but has been rebuffed by the 100-day SMA during the early session on Thursday. The 100-day SMA is likely to present a considerable hurdle for bulls and would require a decisive break to overcome.

Decisive bullish breaks are characterized by a break through a level by a longer-than-average green daily candle, which closes near to its high or three green daily candles in a row.

-638224304124113360.png)

Natural Gas: Daily Chart

Looking at the 4-hour chart, the current decisive break happening above the May 31 high of $2.433 MMBtu, is a bullish sign that suggests a continuation higher is likely in the short term, assuming the bullish break holds, and the current 4-hour period closes near to its high.

-638224304455467762.png)

Natural Gas: 4-hour Chart

This falls in line with the bullish RSI convergence observed on the weekly chart. On the 4-hour chart, meanwhile, the RSI is tracking price higher, peaking in the short term with price. This keeps the torch burning for bulls and indicates the possibility of higher prices to come, particularly in the near term.

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

- AUD/USD has attracted significant bets around 0.6800 despite US Retail Sales having expanded by 0.3% vs. a contraction of 0.1% as expected.

- The US Dollar Index has shown a sharp sell-off after a short-lived pullback to near 103.27.

- The synergic effect of a tight labor market and high inflationary pressures is going to force the RBA to remain hawkish ahead.