- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Japanese economic growth came in as 1.5% QoQ versus 0.8% expected and 0.7% prior, per the preliminary readings of the second quarter (Q2) 2023 Gross Domestic Product (GDP) figures.

That said, the Annualized GDP rose to 6.0% versus 3.1% expected and 2.7% prior.

Further, GDP Deflator came in as 3.4% YoY, versus expectations of being unchanged at 2.0%.

Following the data release, Japanese government Official said, “Japan Private Consumption falls for first time in 3 quarters.”

The diplomat also added that Japan Q2 annualised real GDP growth for three straight quarters, fastest since Q4 2020. The Government Official also stated that the GDP Deflator posts fastest growth since Q1 1981.

About Japan GDP

The Gross Domestic Product released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better than expected number is seen as positive for the JPY, while a low reading is negative.

- USD/CHF trades sideways below the 0.8800 barrier after retreating from a multi-week high in the early Asian session.

- The markets are convinced that the Federal Reserve (Fed) will keep the rate unchanged in its September meeting.

- The exacerbated trade war tensions between the US and China might benefit the Swiss Franc.

- Traders will take cues from the Swiss Producer and Import Prices, US Retail Sales.

The USD/CHF pair holds ground around 0.8782 during the early Asian session on Tuesday. The pair remains sideways after retreating from multi-week high of 0.8827. Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD against six other major currencies, trades The major pair remains capped around the 0.8800 barrier ahead of the Swiss Producer and Import Price Index for July and the US Retail Sales data.

Investors anticipate that the Federal Reserve (Fed) will keep the interest rate unchanged in its September meeting, but the possibility for an additional rate hike of 25 basis points (bps) increased to almost 40% in November. However, interest rates will stay high for longer in order to assure the return of inflation to 2%. This would maintain recession concerns. Market players will take more cues from US Retail Sales in July due on Tuesday and FOMC Minutes due later on Thursday. A more hawkish stance by the Fed might lift the US Dollar against its rivals.

On the other hand, market players is expected that the Swiss National Bank (SNB) will raise interest rates by 25 basis points (bps) to 2% in September, according to Bllomberg. About the data, the Swiss Unemployment Rate came in at 1.9% in July, matching expectations. The figure remained unchanged compared to the June reading and marked its lowest level since October 2022.

Furthermore, the headling surrounding the US-China relationship remains in focus. As a result of President Joe Biden's decision to restrict certain US technology investments in China, US investors have expressed concern that Beijing may retaliate or cease purchasing American technology. The renewed trade tension might benefit the safe-haven Swiss Franc and act as a headwind for the USD/CHF pair.

Moving on, the Swiss Federal Statistical Office will release the Producer and Import Prices on Tuesday. Meanwhile, US Retail Sales will be due later in the day. The monthly figure is expected to rise from 0.2% to 0.4% in July. Market participants will also monitor the FOMC minutes and the Fed officials’s comments for the Jackson Hole Symposium. Traders will take cues from the data and find trading opportunities around the USD/CHF pair.

- Natural Gas Price remains sidelined after bouncing off two-week-old rising support line.

- Multi-day-old horizontal resistance area prods immediate upside within bullish channel.

- Looming bull cross on MACD, firmer RSI and U-turn from 50-EMA lure XNG/USD bulls.

Natural Gas Price (XNG/USD) stays defensive around $2.89 as it seeks fresh clues to extend the previous two-day winning streak amid the initial Asian session on Tuesday. In doing so, the XNG/USD struggles to extend recovery from the 50-bar Exponential Moving Average (EMA) and an upward-sloping trend line from August 02.

Even so, the upbeat RSI conditions, not overbought, join the looming bull cross on the MACD to keep the Natural Gas buyers hopeful within an ascending trend channel comprising multiple levels marked since late May, currently between $2.56 and $3.08.

It’s worth noting, however, that a seven-week-old horizontal resistance area surrounding $2.90 restricts the immediate upside of the XNG/USD.

Following that, the $3.00 psychological magnet will challenge Natural Gas buyers.

In a case where the energy instrument remains firmer past $3.00, the recent multi-month high of around $3.06 may prod the XNG/USD bulls before directing them to the stated bullish channel’s top line surrounding $3.08.

Meanwhile, the aforementioned fortnight-long rising support line and the 50-EMA, respectively near $2.84 and $2.81, limit the short-term downside of the Natural Gas Price. Also challenging the XNG/USD bears is the previous monthly peak of near $2.78.

Natural Gas Price: Four-hour chart

Trend: Further upside expected

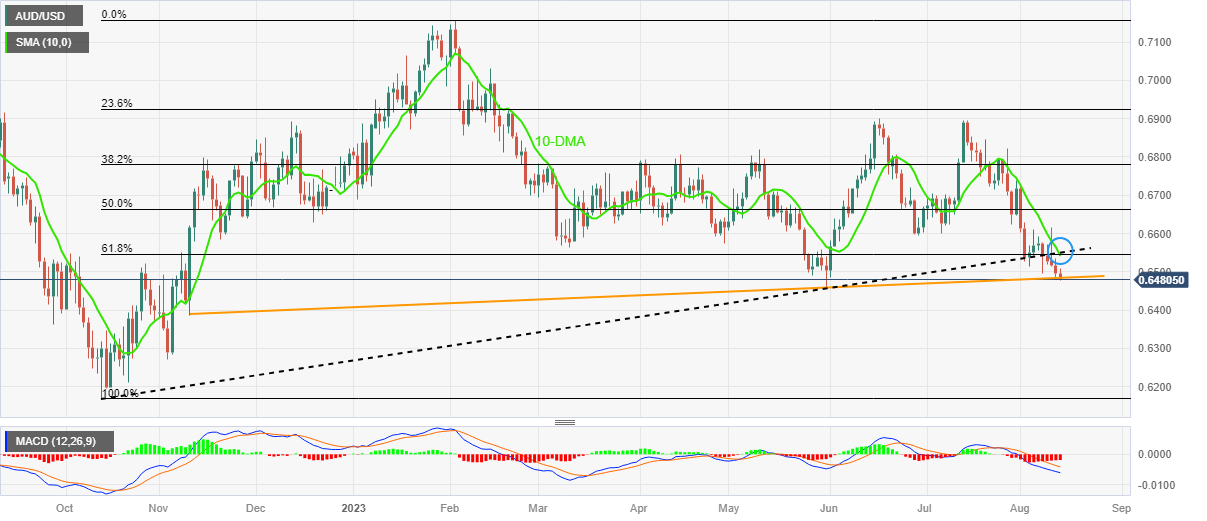

- AUD/USD struggles to defend the bounce off YTD low despite probing five-day losing streak ahead of multiple data/events.

- Fears surrounding China, firmer US Treasury bond yields weigh on Aussie pair.

- RBA Minutes need to defend hawkish interest to recall AUD/USD buyers.

- China Industrial Production, Retail Sales will be eyed closely amid economic woes, US consumer-centric data will also offer fresh impulse.

AUD/USD aptly portrays the market’s indecision ahead of a slew of top-tier data/events as it struggles to defend the late Monday’s corrective bounce off the Year-To-Date (YTD) low near 0.6490 during the early hours of Tuesday’s Asian session. In doing so, the Aussie pair also highlights the pessimism surrounding China, Australia’s biggest customer, before the key Reserve Bank of Australia (RBA) Monetary Policy Meeting Minutes, China Industrial Production and Retail Sales, as well as the US Retail Sales.

While the downbeat prints of the US inflation expectations allowed the Aussie bears to take a breather ahead of the key catalysts scheduled on the calendar, the latest chatters about China and cautious mood prior to data/events weigh on the AUD/USD price, holding it tight of late.

On Monday, the New York Fed’s one-year inflation expectations eased to 3.5% for July, down three points by falling to the lowest level since April 2021. New York Fed survey, however, also suggested confidence in positive labor market conditions and economic transition.

On the other hand, US Treasury Secretary Janet Yellen crossed wires, via Reuters, late Monday while citing the risks to the global economic developments from China’s slowdown, the Russia-Ukraine war and climate change-related disasters and their spillover effects.

The looming debt crisis in China and its contagion impact, especially amid the fears that economic recovery in the world’s biggest industrial player fades, weigh on the AUD/USD even if the easing inflation concerns allow market players to remain hopeful. Also challenging the market sentiment and the Aussie pair could be Russia’s firing of warning shots at a warship in the Black Sea and readiness to equip new nuclear submarines with hypersonic missiles.

It’s worth noting that a suspension of its bond trading by China’s Country Garden joins the non-receipt of the payments from a subsidiary of Chinese conglomerate Zhongzhi Enterprise Group to bolster the debt woes and weighed on sentiment on Monday.

Against this backdrop, the US Dollar Index (DXY) rose to its highest level since July 07 before retreating from 103.46, around 103.16 by the press time. In doing so, the greenback traces the firmer US Treasury bond yields as the 10-year Treasury bond yields rose to the highest level in nine months whereas the two-year counterpart also refreshed the monthly peak amid the market’s dumping of the Treasury bond yields. It should be observed that such higher yields previously triggered recession woes and the risk-off sentiment which in turn favored the US Dollar due to its haven appeal and drowned the AUD/USD.

Moving on, RBA Minutes will be crucial to watch as the latest statements from the Aussie central bank tried convincing markets that they can and will lift the rates if needed but there was little acceptance of the statements. Following that, China’s Industrial Production and Retail Sales for July will be closely observed amid fears of losing economic momentum in the world’s second-biggest economy. Later in the day, the US Retail Sales for the said month will be more important as market players keep betting on the Fed’s policy pivot in September, which in turn may weigh on the US Dollar and trigger the AUD/USD recovery should the scheduled data weakens.

Technical analysis

Although the AUD/USD recovery remains elusive below June’s bottom of around 0.6600, a clear downside break of May’s monthly low, close to 0.6460, becomes necessary for the sellers to tighten their grips.

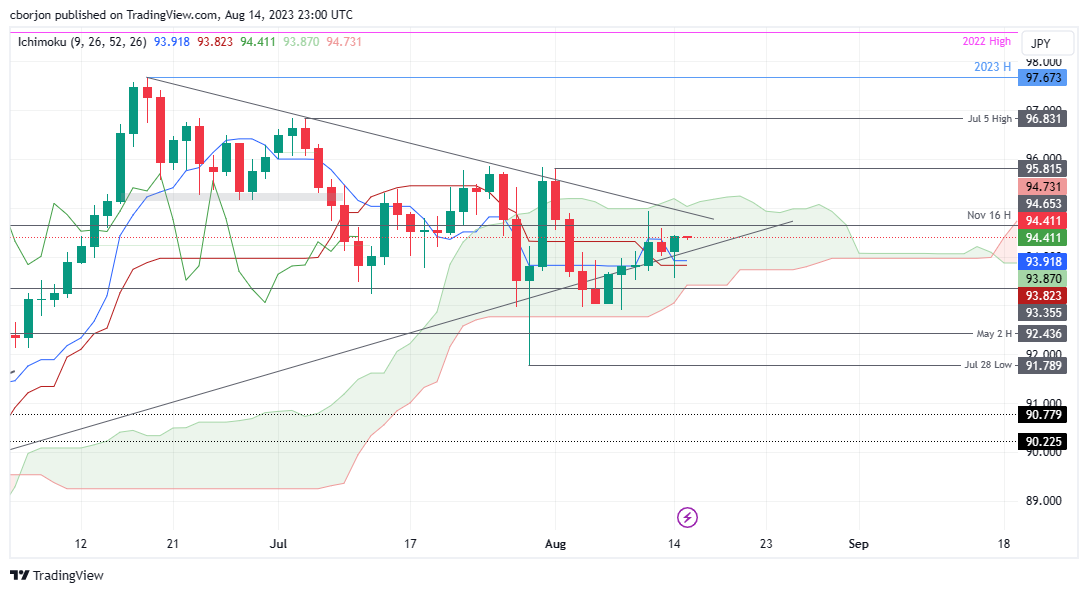

- AUD/JPY trades subdued, capped by the 94.50 figure as the first resistance level.

- The pair remaining inside the Kumo could pave the way for consolidation.

- While the 95.00 resistance trendline poses an immediate challenge, surpassing Kumo’s top could rally AUD/JPY toward the August 1 peak.

The AUD/JPY hovers around 94.40s, post-Monday’s positive session, with the cross-currency pair printing 0.33% gains, though the psychological 94.50 area capped the rally. At the time of writing, the AUD/JPY changes hands at 94.42, likely to remain sideways, as the pair stands inside the Ichimoky Cloud (Kumo).

AUD/JPY Price Analysis: Technical outlook

From a technical standpoint, the AUD/JPY remains neutral-biased, though tilted downwards. On the upside, the AUD/JPY is capped by a two-month-old downslope resistance trendline at around 95.00. The next resistance would be the top of the Kumo at 95.20, which, once cleared, would expose the August 1 at 95.82 before testing 96.00.

On the flip side, the AUD/JPY first support would be followed by the 94.00 figure. The Tenkan-Sen is up next at 93.92, followed by the Senkou Span A at 93.87, ahead of the Kijun-Sen at 93.82.

AUD/JPY Price Action – Daily chart

- NZD/USD edges lower to 0.5970, the lowest level since mid-November in the early Asian session.

- The markets are convinced that the Federal Reserve (Fed) will keep the interest rate unchanged in its September meeting.

- Analysts anticipate that the Reserve Bank of New Zealand (RBNZ) will maintain rates at 5.50%.

- Investors will closely watch the US Retail Sales Mom for July, RBNZ Interest Rate Decision.

The NZD/USD pair extends its downside and holds below the 0.6000 barrier on Tuesday. The pair trades at its lowest level since mid-November and is currently near 0.5970, losing 0.07% in the early Asian session. A rise in US yields is the main driver of the USD’s strength. The 10-year yield is at 4.20%, while the 2-year yield stays at 4.97%. Market participants await the Reserve Bank of New Zealand (RBNZ) interest rate decision on Wednesday, with the rate expected to remain unchanged at 5.5%.

Market players are convinced that the Federal Reserve (Fed) will keep the interest rate unchanged in its September meeting. However, the odds for an additional rate hike of 25 basis points (bps) increased to almost 40% in November. That said, the US Retail Sales from July and FOMC Minutes due later this week will offer hints for further monetary policy for the entire year. More hawkish comments from Fed policymakers might boost the Greenback and acts as a headwind for the NZD/USD pair.

There were no relevant economic data released from the US docket on Monday. Last week, the US Bureau of Labour Statistics revealed that the US Producer Price Index (PPI) for final demand YoY rose 0.8% in July from 0.1% in June. The figure was higher than the market expectation of 0.7%. Additionally, the University of Michigan's (UoM) Consumer Confidence Index for July fell to 71.2 from 71.6, better than 71 expected. Finally, UoM 5-year Consumer Inflation Expectations declined to 2.9% for August versus 3.0% estimated and prior.

On the Kiwi front, the majority of analysts anticipate that the Reserve Bank of New Zealand (RBNZ) will maintain rates at 5.50%, a 14-year high, for the second consecutive meeting on Wednesday, according to a Reuters poll. The New Zealand Dollar might extend its downside with a dovish stance by the RBNZ.

Looking ahead, investors will keep an eye on the RBNZ Interest Rate Decision scheduled for Wednesday and the New Zealand’s Producer Price Index due on Thursday. Also, the US Retail Sales and FOMC minutes will be the key events. The monthly Retail Sales figure is expected to rise from 0.2% to 0.4% in July. The data will be critical for determining a clear movement for the NZD/USD pair.

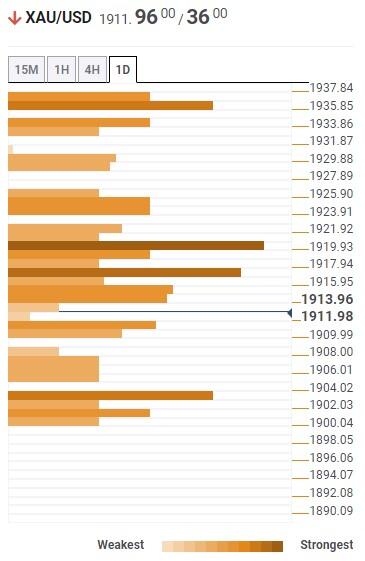

- Gold Price remains subdued at the lowest level in five weeks amid firmer US Dollar, Treasury bond yields.

- Risk-off mood, mostly upbeat US data underpins bearish bias about XAU/USD.

- China’s Country Garden, Zhongrong Trust renew debt fallout woes and weigh on sentiment, firmer yields flag recession fears.

- China/US Retail Sales, manufacturing data will direct intraday Gold Price moves but Fed Minutes are key for clear guide.

Gold Price (XAU/USD) fades the late Monday’s corrective bounce off the 200-DMA support by retreating to $1,907 during the early hours of Tuesday’s Asian session, depressed at the five-week low flashed the previous day by the press time. In doing so, the XAU/USD bears the burden of the US Dollar’s strength amid economic fears surrounding China. Also exerting downside pressure on the Gold Price could be the cautious mood ahead of the US Retail Sales for July. It’s worth noting that the US Dollar ignores the looming fears of the Federal Reserve’s (Fed) policy pivot in September, as well as recently softer United States inflation clues while tracing firmer US Treasury bond yields.

Gold Price remains bearish as yields, China underpin US Dollar strength

Gold Price remains depressed amid the firmer US Dollar and fears surrounding the biggest XAU/USD customer China. In doing so, the bright metal fails to justify its traditional haven status, as well as marks inability to cheer concerns that the US Federal Reserve (Fed) will hold rates steady in its September monetary policy meeting, backed by the recently softer US data.

The looming debt crisis in China and its contagion impact, especially amid the fears that economic recovery in the world’s biggest industrial player fades, weighs on the Gold Price even if the easing inflation concerns allow market players to remain hopeful. Also challenging the market sentiment and the XAU/USD could be Russia’s firing of warning shots at a warship in the Black Sea and readiness to equip new nuclear submarines with hypersonic missiles.

It’s worth noting that a suspension of its bond trading by China’s Country Garden joins the non-receipt of the payments from a subsidiary of Chinese conglomerate Zhongzhi Enterprise Group to bolster the debt woes and weighed on sentiment on Monday.

Recently, US Treasury Secretary Janet Yellen crossed wires, via Reuters, late Monday while citing the risks to the global economic developments from China’s slowdown, the Russia-Ukraine war and climate change-related disasters and their spillover effects.

Talking about the US data, the New York one-year inflation expectations eased to 3.5% for July, down three points, while also suggesting confidence in positive labor market conditions and economic transition.

Amid these plays, US Dollar Index (DXY) rose to its highest level since July 07 before retreating from 103.46, around 103.16 by the press time. That said, the US 10-year Treasury bond yields rose to the highest level in nine months whereas the two-year counterpart also refreshed the monthly peak amid the market’s dumping of the Treasury bond yields. It should be observed that such higher yields previously triggered recession woes and the risk-off sentiment which in turn favored the US Dollar due to its haven appeal and drowned the Gold Price.

US/China Retail Sales, risk catalysts eyed for clear XAU/USD moves

Looking ahead, China’s Industrial Production and Retail Sales for July will be closely observed amid fears of losing economic momentum in the world’s second-biggest economy. Following that, the US Retail Sales for the said month will be more important as market players keep betting on the Fed’s policy pivot in September, which in turn may weigh on the US Dollar and trigger the Gold Price recovery should the scheduled data weakens.

Gold Price Technical Analysis

Gold Price justifies the downside break of an ascending trend line from November 2022 as it prods the 200-DMA support. Also favoring the XAU/USD sellers are the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator.

It’s worth noting, however, that the Relative Strength Index (RSI) line, placed at 14, stays beneath the 50.0 level and suggests bottom-picking of the Gold Price.

The same highlights the 200-DMA support of around $1,905, as well as a seven-month-old horizontal support zone of around $1,890.

In a case where the XAU/USD drops below the $1,890 support, the odds of witnessing a slump toward an early March swing high of around $1,858 can’t be ruled out.

On the contrary, a convergence of the previous support line and the 50-DMA, around $1,940 by the press time, appears a tough nut to crack for the Gold buyers.

Following that, a downward-sloping resistance line from early May, close to $1,960 at the latest, will act as the last defense of the XAU/USD bears.

Overall, the Gold Price is likely to remain bearish but the downside room appears limited.

Gold Price: Daily chart

Trend: Limited downside expected

- EUR/USD fades corrective bounce off multi-day low, remains depressed at monthly low after two-day losing streak.

- Clear downside break of key support, broad US Dollar strength keeps Euro bears hopeful.

- Holidays in multiple markets may allow bears to take a breather amid pre-data anxiety.

- US Retail Sales will be crucial for clear directions as Greenback ignores dovish Fed bets to stay firmer.

EUR/USD remains on the back foot at the lowest levels since early July, despite making rounds to 1.0900 as markets in Asia open for Tuesday’s trading. In doing so, the Euro pair fades the late Monday’s corrective bounce off the multi-day low as traders brace for the key US Retail Sales for July amid holidays in multiple European markets. It’s worth noting that the US Dollar ignores the looming fears of the Fed’s policy pivot in September while tracing firmer US Treasury bond yields amid economic woes and jittery markets while the Euro remains depressed amid mixed concerns at home.

On Monday, Germany’s Wholesale Price Index (WPI) for July edged higher to -2.8% YoY from -2.9% previous readings but came in softer than -2.6% expected. However, the monthly WPI figures reprinted the -0.2% MoM numbers versus -1.4% market forecasts.

Following the data, the German Economy Ministry noted that current early indicators do not yet point to a sustainable economic recovery in the coming months, per Reuters. The report, however, also added that the expected cautious recovery in private consumption, services and investment is showing the first signs of hope, which are likely to strengthen as the year progresses.

On the other hand, US Dollar Index (DXY) rose to its highest level since July 07 before retreating from 103.46, around 103.16 by the press time. That said, the US 10-year Treasury bond yields rose to the highest level in nine months whereas the two-year counterpart also refreshed the monthly peak amid the market’s dumping of the Treasury bond yields. It’s worth noting that such higher yields previously triggered recession woes and the risk-off sentiment which in turn favored the US Dollar due to its haven appeal.

That said, the looming debt crisis in China and its contagion impact, especially amid the fears that the world’s biggest industrial player losses economic recovery, weighs on sentiment even if the easing inflation concerns allow market players to remain hopeful. Also challenging the market sentiment and the EUR/USD could be Russia’s firing of warning shots at a warship in the Black Sea and readiness to equip new nuclear submarines with hypersonic missiles.

Recently, US Treasury Secretary Janet Yellen crossed wires, via Reuters, late Monday while citing the risks to the global economic developments from China’s slowdown, the Russia-Ukraine war and climate change-related disasters and their spillover effects.

Amid these plays, Wall Street closed with minor gains but failed to impress buyers amid impending economic concerns.

Looking ahead, holidays in many European markets, including Germany, may restrict EUR/USD moves, especially ahead of the US Retail Sales for July. However, the latest easing in the New York one-year inflation expectations highlight the data and hence any firmer readings may help the Euro pair to extend the technical breakdown.

Technical analysis

A daily closing below the 100-DMA and an ascending trend line from September 2022, respectively near 1.0930 and 1.0980, directs EUR/USD towards a convergence of the 200-DMA and an upward-sloping support line from November 22, 2022, close to 1.0780.

- GBP/USD edges north amid slight optimism in the Asian session.

- A double bottom chart pattern could pave the way for the GBP/USD towards 1.3000.

- Immediate resistance is seen at the 50-day and 20-day EMAs. Breaking these could propel the pair toward the August 10 and July 27 highs. However, a breach below the 100-day EMA could shift momentum toward the 200-day EMA.

GBP/USD aims upward for minimal gains of 0.02% as the Asian session begins, but still printing weekly losses following Monday’s session in which the GBP/USD lost 0.10% and reached a two-week low. At the time of writing, the GBP/USD exchanges hands at 1.2682.

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD is neutral-upward biased, as the major dived towards the 100-day Exponential Moving Average (EMA) at 1.2609. Still, buyers entered the market, lifting the spot price to current levels. Notably, the GBP/USD is forming a ‘double bottom’ chart pattern that could pave the way for further gains, but first, the GBP/USD must reclaim resistance technical levels to confirm its validity.

The GBP/USD first resistance would be the 50-day EMA at 1.2733, followed by the 20-day EMA at 1.2761. Once those levels are surpassed, the GBP/USD next stop would be the August 10 high of 1.2819. If buyers push prices above those levels, the July 27 daily high at 1.2995 would be up for grabs.

On the other hand, if GBP/USD tumbled past the 100-day EMA at 1.2609, it would clear the way to challenge 1.2600 and the 200-day EMA at 1.2461.

GBP/USD Price Action – Daily chart

US Treasury Secretary Janet Yellen crossed wires, via Reuters, late Monday while citing the risks to the global economic developments from China’s slowdown, the Russia-Ukraine war and climate change-related disasters and their spillover effects.

The policymaker hesitated to comment directly on China’s looming debt woes due to the largest private realtor Country Garden’s delay in payment on a private onshore bond and its contagion effect.

“She said China's slowdown could have spillover effects on the United States, but would have the biggest impact on its Asian neighbors,” said Reuters.

The news also cites US Treasury Secretary Yellen as feeling very good about the overall US prospects while also flagging the recession risk and showing conviction about the US growth remained healthy and the job market was very strong.

Also read: Forex Today: US Dollar remains firm on the back of higher US Treasury yields

- USD/JPY finally broke with the 145.00 resistance and rose near 145.55, tallying a six-day winning streak.

- A cautious market mood supported the USD—eyes on Retail Sales from July and FOMC minutes.

- Eyes on preliminary Q2 GDP figures from Japan to be released on Tuesday.

At the start of the week, the USD/JPY rose to its highest level since November 10, 2022, mainly driven by a cautious market mood and a stronger USD. In addition, after jumping above the key resistance of 145.00, there are no signs of the Bank of Japan (BoJ) of a stealth intervention which leaves the JPY vulnerable.

On the Japanese side, Tuesday will witness the release of the Q2 Gross Domestic Product (GDP) preliminary report, with projections anticipating a rise at a yearly rate of 3.1%. Nonetheless, it's worth noting that the Bank of Japan (BoJ) has yet to show any indications of pivoting away from its accommodative monetary approach or engaging in market interference to manage the depreciation of the JPY. This lack of action could fuel an avenue for additional negative movement for the pair. However, if the Japanese economy shows signs of recovery, the BoJ might consider a pivot in its policies which could limit the Yen's losses.

On the US side, Retail Sales from July will be released on Tuesday and are expected to have expanded at a monthly pace of 0.4% from its previous figure of 0.2%. In addition, the Federal Open Market Committee (FOMC) minutes from the last July’s meeting will be closely watched by investors on Wednesday to continue placing their bets for the next Federal Reserve (Fed) decisions. As for now, according to the CME FedWatch tool, markets are confident that the Fed will skip in September while the odds of a 25 basis point (bps) hike in November rose near 40%.

USD/JPY Levels to watch

The daily chart analysis indicates a bullish outlook for the USD/JPY in the short term. The Relative Strength Index (RSI) is above its midline in positive territory, with a positive slope, aligning with the positive signal from the Moving Average Convergence Divergence (MACD), displaying green bars, and reinforcing the strong bullish sentiment. Moreover, the pair is above the 20,100,200-day Simple Moving Averages (SMAs), implying that the bulls retain control on a broader scale.

In addition, a distinct bullish dominance over sellers is evident on the four-hour chart, with indicators displaying a strong buying momentum.

Support levels: 145.00, 144.70, 144.00.

Resistance levels: 145.70, 146.00, 146.50.

USD/JPY Daily chart

-638276458025247480.png)

- GBP/JPY pair notched up a new year-to-date high at 184.77, reflecting Sterling’s strength amidst the Yen’s persistent weakness.

- Eyes on the BoJ for a potential intervention that could weigh on the GBP/JPY pair.

- GBP/JPY immediate support lies at 184.00, while resistance levels emerge at 185.

The GBP/JPY extended its uptrend to seven straight days and printed a new year-to-date (YTD) high at 184.77 amid a mixed market sentiment and a soft Japanese Yen (JPY). The GBP/JPY trades at 184.62 as the Asian session begins, printing minuscule gains of 0.03%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is upward biased though it’s at the brisk of a possible intervention by the Bank of Japan (BoJ) or the Japanese Finance Ministry. Japanese authorities could pull the trigger if the Yen continues to post losses against the US Dollar (USD). Still, unless authorities intervene, the GBP/JPY could test the 185.00 figure, followed by the December 2015 high of 186.34.

Conversely, the GBP/JPY first support level would be 184.00. Once cleared, the GBP/JPY could aim toward the August 1 high turned support at 183.25, followed by the Tenkan-Sen at 182.58.

GBP/JPY Price Action – Daily chart

- WTI fell below $83.00 and reached a daily low of $81.30 during the American session.

- County Garden Holdings, a Chinese real-state giant, announced that it would suspend part of its bond trading.

- A stronger USD also weighs on Oil prices.

At the start of the week, the West Texas Intermediate (WTI) barrel lost traction, fell to a daily low of $81.30, and settled near $82.00. A stronger USD on the back of higher US yields and Chinese real-state sector concerns are mainly responsible for the Oil’s downward trajectory.

China's major real estate firm, Country Garden Holdings, revealed a projected loss of $7.6 billion for H1 2023 and announced that it would halt trading 11 onshore bonds starting Monday. This caused a nearly 20% drop in their shares, bringing down the Shangai Composite Index. In addition, Moody’s warned of a potential crisis spillover to the country's property and financial markets, possibly delaying the sector's recovery. It's worth mentioning that China is the largest Oil importer in the world, so the weakness of the real-estate industry, an important gauge of an economy’s health, weighs on the WTI’s price.

On the other hand, the USD, measured by the DXY index, rose above 103.00, and the Greenback gained interest in higher US yields. In that sense, the bond markets are flashing signals that investors are confident that the Federal Reserve (Fed) won’t hike in September but that the odds of a 25 basis point increase in November have risen to nearly 40%, according to the CME FedWatch tool. In that sense, higher rates which tend to cool down economic activity, present another challenge to Oil prices.

WTI Levels to watch

The technical analysis of the daily chart suggests a shift towards a neutral to a bearish outlook for WTI, with indications of bullish exhaustion. The Relative Strength Index (RSI) exhibits a negative slope above its midline, while the Moving Average Convergence Divergence (MACD) displays fading green bars. That being said, the pair is above the 20,100,200-day Simple Moving Averages (SMAs), indicating a favourable position for the bulls in the bigger picture.

Support levels: $81.30, $81.00, $79.50.

Resistance levels: $83.70, $84.00, $85.00

WTI Daily chart

-638276433502947504.png)

After a quiet Monday regarding economic data, Tuesday is a busy day starting with Japan's GDP data. Later, the RBA meeting minutes and Australia's Wage Price Index are due. Chinese data will be closely watched, including Retail Sales and Industrial Production. Additionally, data due on Tuesday includes UK employment figures and US Retail Sales.

Here is what you need to know on Tuesday, August 15:

Wall Street opened the week in the green. The Dow Jones gained 0.07%, and the Nasdaq rose by 1.05%. Investors showed optimism for a soft landing in the economy.

The US Dollar Index posted its highest daily close in over a month, above 103.15. However, it finished far from the intraday high, suggesting that it could consolidate over the next few hours.

A key support for the Greenback remains US yields. The 10-year yield climbed to 4.20%, and the 2-year yield to 4.97%, reaching the highest levels in a month. The uptrend in yields remains firm, even as market participants expect the Federal Reserve to stay on hold at the next FOMC meeting.

The US will report Retail Sales, which is expected to show a 0.4% increase in July. Also due is the NY Empire Manufacturing Index.

EUR/USD dropped again, falling below key moving averages but managed to rise above 1.0900 during the American session. The Euro also lost ground against the Pound and the Swiss Franc. The ZEW Survey is due on Tuesday.

GBP/USD finished flat after recovering during the American session. The pair bottomed at 1.2616, matching the 100-day Simple Moving Average (SMA), and rebounded toward 1.2700. The UK will report employment data for the three months ended in June. On Wednesday, more data is due with the inflation report.

USD/JPY rose for the sixth consecutive day and posted the highest daily close since November, near 145.50. Japan will release Q2 Gross Domestic Product (GDP) data on Tuesday, as well as Industrial Production.

USD/CHF finished higher but below 0.8800. The pair peaked at 0.8831, the highest intraday level in a month, and then pulled back. The Swiss Producer and Import Price Index is due on Tuesday.

USD/CAD continues to move with an upward bias, holding firm above 1.3400. Inflation data is due from Canada on Tuesday. The Consumer Price Index (CPI) is expected to show a 0.3% monthly increase in July. Also due is the Manufacturing Sales report.

Analysts at TD Securities on Canada:

Tuesday's CPI report will provide the main risk event this week, where TD looks for inflation to firm 0.3pp to 3.1% as prices rise by 0.4% m/m. Manufacturing and wholesale sales will give new insight towards Q2 GDP tracking, while housing starts and existing home sales for July round out the domestic data calendar.

AUD/USD fell for the fifth consecutive day but ended off its lows. The pair found support at the 0.6450 area and climbed back to 0.6500. Antipodean currencies are being affected by the decline in commodity prices and a cautious tone across financial markets. The Reserve Bank of Australia (RBA) will release the minutes of its latest meeting, during which it kept the key interest rate unchanged at 4.10%. The Wage Price Index is also due.

NZD/USD posted its lowest daily close since mid-November, trading below the 0.6000 level. The bias points to further losses; however, the close far from the low suggests that the pair may be poised for some consolidation. On Wednesday, the Reserve Bank of New Zealand (RBNZ) will announce its decision on monetary policy. No change is expected from the central bank.

Gold continued to slide but held above $1,900, while Silver lost ground, trimming losses during the American session, ending around $22.55.

The worst-performing currency was the Argentine Peso after the government devalued the currency by 20% following Sunday's primary presidential elections. The Chinese Yuan reached its lowest level against the US Dollar since October of last year.

Like this article? Help us with some feedback by answering this survey:

- USD/CHF climbs by 0.20%, trading at 0.8780, but remains under the shadow of the 0.8800 resistance.

- The pair displays a ‘double-top’ chart pattern, suggesting potential downside movement.

- Key resistances to watch: 50-day EMA at 0.8811 and 100-day EMA at 0.8921.

- Immediate supports lie at the 20-day EMA at 0.8746 and the August 10 low of 0.8689.

The USD/CHF climbed modestly on Monday’s session though it failed to cling above the 0.8800 figure, which could weigh on the pair in the near term. Additionally, the USD/CHF failing to break a downslope resistance trendline drawn from November 2022 highs opened the door for further losses. The USD/CHF is trading at 0.8780, gains 0.20% but remains subject to selling pressure.

USD/CHF Price Analysis: Technical outlook

From a technical standpoint, the USD/CHF registered a ‘double-top’ chart pattern, which could pave the way for further downside, but mixed signals from an oscillator perspective could refrain sellers from lowering prices.

The Relative Strength Index (RSI) indicates that buyers are gathering momentum, while the three-day Rate of Change (RoC) depicts the USD/CHF as neutral.

If USD/CHF buyers reclaim 0.8800, they must reclaim the 50-day Exponential Moving Average (EMA) at 0.8811. A breach of the latter would expose the 100-day EMA at 0.8921.

Conversely, if USD/CHF sellers remain in control, the next support would be the 20-day EMA at 0.8746. Break below will expose the August 10 low of 0.8689, followed by the year-to-date (YTD) low of 0.8551.

USD/CHF Price Action – Daily chart

- AUD/USD dips slightly as US 3-month bill auction boosts demand for US bonds, impacting UST yields.

- China’s property market woes continue with Country Garden’s bond interest default, echoing Evergrande’s 2021 crisis.

- Upcoming RBA minutes and US Retail Sales data eyed; hawkish RBA surprises could influence AUD/USD trajectory.

AUD/USD pares some of its earlier losses as US Treasury bond yields turned flat after registering solid gains, but a US 3-month bills auction increased demand for US bonds, a headwind for UST yields. Consequently, the US Dollar (USD) trimmed some of its gains, and the AUD/USD exchanged hands at 0.6487, down 0.08%.

Greenback remains dominant despite improved investor sentiment; RBA minutes and US economic indicators in focus

Investors’ sentiment improved late in the New York session, but the Greenback remains in the driver’s seat in the FX space, a headwind for the Australian Dollar (AUD). US T-bond yields extend their gains, with the most sensitive to interest rate shifts, the 2-year gaining seven basis points at 4.960%. Echoing its tone, the 10-year benchmark note rate is 4.187%, climbing three basis points, a tailwind for the US Dollar.

China’s real estate jitters involving its largest private developer Country Garden, reignited worries on its property market, as the company failed to pay bond interest last week, as happened to Evergrande in 2021.

In the meantime, Tuesday’s Asian session will feature the release of the Reserve Bank of Australia’s (RBA) last meeting minutes, with no surprises expected after the RBA’s decided to hold rates at 4.10%. After that, the Wage Price Index is estimated to stay at 3.7%, though any upticks could be seen as inflation gathering momentum, triggering further action by the central bank. It should be noted that the RBA’s Governor Philip Lowe’s latest appearance was dovish as he said, “Policymakers were in the “calibration stage,” as rates are already restrictive and working to establish a balance between supply and demand.”

On the US front, the agenda would be busy during the week, with Retail Sales and Industrial Production, are expected to improve, which could be bullish for the US Dollar (USD). In addition, the latest meeting Federal Open Market Committee (FOMC) minutes could give some clues, on the Federal Reserve’s (Fed) forward path, regarding monetary policy.

On the USD bearish side, a deterioration of labor market data, namely Initial Jobless Claims, could reaffirm the market’s view the US Federal Reserve (Fed) is hiking rates. Minnesota’s Fed President Neil Kashkari is expected to cross wires twice on Tuesday.

Given that the central bank convergence and interest rate differential favors the Greenback, further AUD/USD is expected. Nevertheless, traders must stay tuned to the economic calendar. Hawkish surprises from the RBA could trigger a reaction in the AUD/USD pair.

AUD/USD Price Analysis: Technical outlook

The AUD/USD bias remains downwards, though a daily close below the May 31 daily low of 0.6458 is needed to pave the way for a dip to the November 10 swing low of 0.6386. A breach of the latter will expose the November 3 daily low of 0.6272. On the other hand, in the less likely scenario, the AUD/USD first resistance would be the 0.6500 psychological level, followed by June’s 29 low of 0.6595, before testing 0.6600.

- EUR/GBP declined for a second consecutive day, and fell towards 0.8605, below the 20-day SMA.

- All eyes are now on labour market and inflation data from the UK.

- The Eurozone will release its preliminary Q2 GDP report on Wednesday.

At the start of the week, the EUR/GBP fell below the 20-day Simple Moving Average (SMA) near the 0.8605 area. No relevant data releases will feature on Monday’s economic calendar as attention shifts fo high-tier data released from both blocks later in the week.

On the GBP’s side, on Tuesday, the Office for National Statistics (ONS) will release key labour market data, including earning figures from the three months up to June and Claimant Counts numbers from July. In addition, on Wednesday, inflation data will be released from July, and overall figures are expected to show a robust labour market and decelerating inflation. Its worth noticing that the Bank of England (BoE) no longer expects a recession but that the bank will do whatever it takes to bring down inflation, so the outcome of the data will likely shape the expectations of the BoE’s next decision and hence having an impact on the Pound’s price dynamics.

On the European side, markets await Gross Domestic Product (GDP) preliminary figures for Q2 from the Eurozone, which is expected to have stagnated, and the Harmonized Index of Consumer Prices (HIICP) from July, which will be released on Friday.

EUR/GBP Levels to watch

The daily chart suggests that a neutral to bearish trend becomes evident for EUR/GBP, with the bears gradually taking control. The Relative Strength Index (RSI) has a negative slope above its midline, indicating weakening buying pressure, while the Moving Average Convergence (MACD) prints decreasing green bars. In addition, the pair is below the 20,100 and 200-day Simple Moving Average (SMA), pointing towards the prevailing strength of the bears in the larger context.

Support levels: 0.8600, 0.8590, 0.8570.

Resistance levels: 0.8610 (20-day SMA), 0.8630, 0.8650.

EUR/GBP Daily chart

-638276335829339092.png)

- USD/MXN rebounds from 20-day EMA, trading higher despite Wall Street’s positive sentiment.

- China’s real estate troubles, starting with Evergrande, now impact Country Garde, intensifying global concerns.

- Upcoming US Retail sales and FOMC minutes eyed, while a light Mexican docket leaves traders tuned to USD dynamics.

USD/MXN began the session positively and bounced off the 20-day Exponential Moving Average (EMA) at 17.0040, even though market sentiment improved, as shown by Wall Street turning green. The USD/MXN is trading at 17.0685m, post gains of 0.42%.

Mexican Peso feels the heat as China’s real estate crisis and US economic indicators steer the market

US equities trade mixed during the North American session, while the Mexican Peso (MXN) gets battered on a risk-off impulse that spurred outflows from the emerging market currency towards the US Dollar (USD), as portrayed by the USD/MXN exchange rate. A jump in US Treasury bond yields underpinned the Greenback after the 10-year benchmark note rate touched a multi-year high of 4.20%.

China’s real estate woes, which initially involved Evergrande in 2021, spilled over its largest private developer Country Garde, which failed to pay its bond interest last week. Real estate in China has suffered tumbling sales as tight liquidity conditions triggered a series of defaults.

Aside from this, the US economic docket would reveal Retail sales for July, estimated to show consumers’ resilience, and Fed speakers on Tuesday. By Wednesday, the release of the latest Federal Open Market Committee (FOMC) minutes could shed light on the Federal Reserve’s (Fed) forward path. At the same time, Industrial Production is estimated to print gains.

Across the border, the Mexican docket is light. That would leave traders adrift to US Dollar dynamics and market sentiment. A risk-on is USD/MXN negative, while risk aversion could pave the way for further USD/MXN upside.

USD/MXN Price Analysis: Technical outlook

The USD/MXN daily chart portrays the pair as neutral to downward biased, but buyers stepping in around the day’s low opened the door for a recovery above the psychological 17.0000 figure. Of note, the Relative Strength Index (RSI) turned bullish, suggesting that the USD/MXN could be bottoming at around the 16.60-17.00 range, opening the door for further upside. USD/MXN buyers can gain tracti9on above the May 17 low of 17.4038, followed by the 100-day EMA at 17.4671, after reclaiming the 50-day EMA at 17.1228.

- EUR/JPY traded with losses for a consecutive day, and fell near the 158.60 area.

- The BoJ remains very dovish and weakens the Yen. Eyes on GDP data on Tuesday.

- Eurozone will release Q2 GDP data on Wednesday.

At the start of the week, the EUR/JPY traded with mild losses below 159.00. Both currencies traded weakly against their rivals on a quiet Monday ahead of the Gross Domestic Product (GDP) data from Japan and the Eurozone this week. On the JPY’s side, the USD/JPY broke through the 145.00 key level for the first time since November 2022, but there are still no signs of intervention from the local authorities to limit Yen’s losses.

Economic activity figures will be the week’s highlight for the pair. On the Japanese side, on Tuesday, the Q2 Gross Domestic Product (GDP) figures will be released and are expected to have grown at an annualised pace of 3.1%. That being said, there are no signs from the Bank of Japan (BoJ) to pivot its dovish monetary policy or to intervene in the markets to control the JPY’s downfall, which could pave the way for further downside for the pair.

On the European side, the Preliminary GDP figures from Q2 from the Euro area are expected to come in at 0.6% YoY matching the previous quarterly figures. In addition, inflation data will be released from the Eurozone and both sets of data will help investors to model their expectations towards the next European Central Bank (ECB) decisions.

EUR/JPY Levels to watch

The EUR/JPY suggests a neutral to bearish technical outlook on the daily chart as bullish momentum wanes. Having turned flat in positive territory, the Relative Strength Index (RSI) suggests a potential market equilibrium with balanced buying and selling pressure, while the Moving Average Convergence (MACD) histogram prints stagnant green bars. On the other hand, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating that the buyers are commanding the broader perspective.

Support levels: 158.00, 157.00, 156.00.

Resistance levels: 159.00, 160.00, 161.00.

EUR/JPY Daily chart

-638276292525778368.png)

- XAG/USD dropped to a daily low of $22.35 but then settled at around $22.60.

- Risk aversion dominates the markets, strengthening the USD.

- Eyes on Wednesday’s FOMC minutes from July’s meeting.

At the start of the week, risk-off flows predominate the markets and limit the Silver’s upside. With no relevant data released, higher US Treasury yields and a stronger USD dictate the pace of the metal.

The US bond yields are edging higher after the release of inflation from July from the US data last week. The 10-year bond yields 4.19%, with 1.29 % gains on the day. The 2-year yield stands at 4.96% with 1.25 % gains, and the 5-year yield is at 4.38% with 1.29 % gains. In line with that, the USD measured by the DXY index rose to its highest level since early July, above 103.00 and limiting the precious metal’s gains.

Regarding the next Federal Reserve decisions, rising US yields hint that tightening expectations have risen. According to World Interest Rate Possibilities (WIRP) tool, the markets

that a skip in September is likely while the odds of a 25 basis point (bps) hike in November rose nearly 40%. That being said, the Federal Open Market Committee’s (FOMC) minutes from July’s meeting will provide markets with a clearer outlook regarding the official's stance, which could generate volatility in the US bond markets and hence in the XAU/USD price dynamics.

XAG/USD Levels to watch

Analysing the daily chart, XAG/USD presents a bearish outlook for the short term, with both Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remaining in negative territory. Additionally, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting that the bears are firmly in control of the bigger picture, leaving the buyers with tasks to accomplish.

Support levels: $22.50, $22.30, $22.00.

Resistance levels: $23.27 (200-day SMA), $23.50, $24.00.

XAG/USD Daily chart

-638276238255361723.png)

- China’s property crisis and weak recovery data amplify global risk aversion, favoring the US Dollar.

- US 10-year Treasury bond yield at 4.172%, with the DXY index gaining 0.18%, pressuring the NZD/USD.

- RBNZ will likely maintain a 5.50% rate, as Kiwibank analysts predict a hold until inflation targets are met.

NZD/USD posts modest gains in the North American session amid a risk aversion spurred by China’s real estate woes triggering a flight to safe-haven assets and bolstering the Greenback, which remains underpinned by high UST bond yields. The NZD/USD is trading at 0.5985, up 0.07%, after reaching a new year-to-date (YTD) low of 0.5943.

Greenback gains strength as risk aversion dominates; RBNZ anticipates to hold rates amid New Zealand economic challenges

Wall Street has turned positive in the day, though the story favors the Greenback in the FX space. The latest week’s soft data from China portrays a weaker economic recovery, while its property crisis keeps investors uneasy.

US Treasury bond yields edged higher during the session, though they had pared their earlier gains, with the US 10-year Treasury bond yield sitting at 4.172%, clinging to gains of one basis point. The US Dollar Index (DXY), which measures the buck’s value against a basket of peers, gains 0.18% and stays at 103.034, with headwinds for the NZD/USD.

The US economic calendar will feature US Retail Sales, which are expected to improve compared to June’s data, while Import and Export prices are expected to increase a tick. Manufacturing activity in New York is expected to remain subdued, while Fed speakers could give some clues regarding the Fed’s forward path.

On the New Zealand front, the Reserve Bank of New Zealand (RBNZ) is expected to keep rates unchanged at 5.50%, as the NZ economy remains in a mild recession, while inflation has fallen to 6.0%, from 7.3% last year. Analysts at Kiwibank said, “The cash rate has peaked...and will remain there until the RBNZ is convinced inflation will return to the target.”

NZD/USD Price Analysis: Technical outlook

From a technical standpoint, the NZD/USD remains downward biased, reaching a new YTD low, but buyers entered the market, lifting the pair to test the prior’s YTD low of 0.5985. A daily close above the latter and the NZD/USD could regain the 0.6000 figure, with the next resistance emerging at 0.6024. Otherwise, the NZD/USD could extend towards 0.5900 before testing last year’s November 10 swing low of 0.5840.

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation dropped to the lowest level since April 2021 at 3.5% in July from 3.8% in June.

Key takeaways

"Three year-ahead expected inflation at 3% in July vs 2.9% in June."

"Five-year ahead expected inflation at 3% in July vs 2.9% in June."

"Survey finds retreating inflation expectations across a number of categories."

"July expected home price rise moves to 2.8% from June’s 2.9%."

"July expected rent price increase lowest since January 2021."

"Survey respondents report better personal financial situations in July."

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen rising 0.3% on the day at 103.15.

The United Kingdom will release the Consumer Price Index (CPI) data on Wednesday, August 16 at 06:00 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of six major banks regarding the upcoming UK inflation print.

Headline is expected at 6.8% year-on-year, lower than June’s reading of 7.9%. If so, headline would be the lowest since February 2022 but still well above the 2% target. Meanwhile, core is seen at 6.8% YoY vs. 6.9% in June.

TDS

A close to 20% decline in Ofgem's energy price cap and base effects will likely bring headline inflation a full percentage point lower to 6.8% YoY – in line with the MPC's August forecast – while core should edge down to 6.8% YoY. The focus for the MPC will be on services inflation though, and here we look for continued elevated momentum to keep the YoY rate at 7.2% – leaving it marginally below the MPC's forecast of 7.25%.

Nomura

We see only small falls in core (from 6.9% to 6.8%) and services (7.2% to 7.1%) inflation in July. For the headline rate, we are looking for a fall from 7.9% to 6.6% (note the BoE is looking for 6.8% for July).

SocGen

A decline in utility prices could see headline inflation fall to its lowest level since the start of the Ukraine war at 6.8% in July, down from 7.9%, while we see easing goods inflation dragging core down by 0.1pp to 6.8%, confirming core reached its cyclical peak in May.

Citi

We expect July CPI inflation to undershoot the MPC’s headline forecast – if only very marginally – with core goods and food inflation complementing the large drop in household energy bills. Services inflation, will likely print in line, with a significant increase in rental prices once again a source of upward pressure. Core inflation will likely tick down marginally to 6.8% (BoE-implied: 6.9%), with undershoots on core goods inflation offsetting what – at the margin – will be a marginal overshoot on services, if with downside risks. Over the coming months, we expect disinflation to pick up steam as lower import and commodity prices continue to feed through. For the MPC, the focus will likely remain rigidly on services inflation, where undershoots are only likely from the start of Q4.

Credit Suisse

CPI inflation should fall from 7.9% to 6.6%, with core inflation down from 6.9% to 6.8%.

Deutsche Bank

We see headline inflation at 6.8% in line with consensus, with core at 6.9%.

EUR/JPY surged to nearly 160. Economists at Société Générale expect the pair to turn back lower.

A dovish ECB hike may keep the Euro under pressure

Since start-August, EUR/USD has been stuck below 1.10, and a last 25 bps hike to 4% is expected next month. But the ECB also reckons that Euro area core inflation has probably peaked, so a dovish hike may keep the Euro under pressure.

With EUR/JPY heading towards 160, the bullish forces are running out of steam and gains seem likely to reverse.

Statistics Canada will release July Consumer Price Index (CPI) data on Tuesday, August 15 at 12:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of six major banks regarding the upcoming Canadian inflation data.

Headline CPI is seen accelerating to 3.0% year-on-year vs. the prior release of 2.8% in June. If so, it would be the first acceleration since April but would still be within the 1-3% target range. Core median and core trim are both expected to fall from June to 3.7% YoY and 3.6% YoY, respectively.

TDS

We look for CPI to firm 0.3pp to 3.1% as base effects push inflation back above the target range, while a rebound in services provides the main driver for the 0.4% MoM print. Core measures should edge 0.2pp lower to 3.6% YoY and break below the 3.5-4.0% range on a 3m saar basis, but we still look for +0.3% MoM from CPI-trim/median, keeping the BoC in wait-and-see mode.

RBC Economics

YoY inflation likely edged up to 2.9%. We expect price growth excluding food and energy products to slow further too, falling to 3% YoY from 3.5% in June.

NBF

An increase in gasoline prices could have translated into a 0.3% increase of the consumer price index in July (before seasonal adjustment). If we’re right, the 12-month rate of inflation should come up from 2.8% to 3.0%. Contrary to the headline print, the core measures preferred by the Bank of Canada should decrease in the month, with CPI-med likely moving from 3.9% to 3.6% and CPI-trim from 3.7% to 3.5%. In both cases, it would be the lowest level observed in a year and a half.

Wells Fargo

The July headline CPI print is expected to edge only moderately higher to 2.9% YoY. More important, however, will be the evolution of the core inflation measures. Those core inflation trends, when measured on a three-month annualized basis, have remained in a 3.5%-4.0% range for the past several months. Should that core inflation trend downshift to a 3.0%-3.5% three-month annualized pace, which we view as a distinct possibility, that may well be enough for the Bank of Canada to hold its policy interest rate steady at 5.00% at its early September announcement.

CIBC

With gasoline prices on the rise this July, in contrast to a decline seen twelve months ago, Canadian inflation will likely look a little hotter than it did in June. Indeed, we see headline inflation accelerating to 3.1%, from 2.8%, even with a modest deceleration in food price inflation. The monthly increase in prices excluding food & energy could also look a bit hotter than in the prior two months, with the deceleration in mortgage interest costs potentially stalling and prior negative contributions to inflation from internet and telephone services unlikely to be repeated. Still, even penciling in a monthly gain in ex-food/energy prices of 0.3% on a seasonally adjusted basis, the annual rate of inflation for that core measure would still decelerate to 3.4%, from 3.6% in June.

Citi

The most important aspect of July CPI data will be the average 3-month annualized pace of core inflation, which has been persistently in a 3.5-4% range for close to a year. There is a decent chance that this measure falls below 3.5% in July as a very strong print from April drops out of the 3-month calculation. Even if core inflation does remain in the 3.5-4% range, we expect the BoC to keep rates unchanged in September given other softer data (July employment, June retail sales, and likely softer Q2 GDP) received since the July decision.

- USD/JPY refreshes nine-month high above 145.00 amid risk-off market mood.

- Economic challenges in China improve the appeal for the US Dollar.

- US Retail Sales are seen expanding by 0.4% in July, accelerating from the 0.2% increase recorded for June.

The USD/JPY pair printed a fresh nine-month high at 145.57 on Monday, capitalizing on bearish market sentiment. The asset continues its five-day winning streak amid sheer strength in the US Dollar as investors remain worried about China’s economic outlook.

S&P500 prints some losses in early New York, portraying caution due to modest recovery in the United States Consumer Price Index (CPI) for July. The US Dollar Index rallies to near 103.46 amid improvement in its appeal as a safe haven.

Investors are worried about Chinese economic prospects as the economy is facing deflation due to weak demand and declining exports. Also, Chinese firms struggle to raise the price of goods and services at factory gates. This has improved the appeal of the US Dollar.

After a slower-than-expected inflation increase and a decent rebound in Producer Price Index (PPI) in the US economy for July, investors shift their focus to the Retail Sales data. As per the consensus, Retail Sales are seen expanding 0.4% in July, accelerating from the 0.2% increase recorded for June. A similar performance is expected for retail sales excluding autos.

Meanwhile, the Japanese Yen remains under pressure as Japan’s Ministry of Finance (MoF) doesn’t deliver any sign of stealth intervention. Preliminary Gross Domestic Product (GDP) for Q2 grew at 0.8% vs. Q1 growth of 0.7%. On an annualized basis, GDP expanded at 3.1% vs. the former release of 2.7%. An absence of monetary policy support from the Bank of Japan (BoJ) keeps the Japanese Yen on the tenterhooks.

The Reserve Bank of New Zealand (RBNZ) will announce its Interest Rate Decision on Wednesday, August 16 at 02:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of six major banks.

The RBNZ is expected to keep the key Official Cash Rate (OCR) steady at 5.50%. At the last meeting, the bank also kept rates steady and was the first hold since the RBNZ started tightening back in 2021.

ANZ

We expect the RBNZ will leave the OCR unchanged at 5.50%, reiterating their ‘watch, worry and wait’ stance. Data since the July nothing-to-see-here Monetary Policy Review has been mixed, with relatively resilient demand but inflation indicators falling according to the script – an attractive mix, but one of questionable sustainability. As always, there’s a huge amount of wiggle room in terms of how the Committee interprets the implications of the recent data flow. We don’t expect a hat-tip to the chance of more hikes in this Statement, but the OCR forecast may show rates remaining at their peak for a little longer.

Standard Chartered

We expect the RBNZ to keep the OCR at 5.50 with little reason for change in either direction. Given the still-tight labour market and elevated inflation, it would be premature for the RBNZ to mull rate cuts. Instead, we think the RBNZ will keep the OCR on ice and reiterate the need to keep the policy stance restrictive for the foreseeable future. We expect rate cuts only from Q2-2024 once higher rates and the migration-fuelled boost to labour supply percolate through the economy.

TDS

While it is an MPS month that entails an updated OCR track, we don’t expect major revisions to the Bank's OCR track as economic data have largely panned out to the RBNZ's forecasts. We expect Governor Orr to reiterate that the Bank is confident that past rate hikes are having their intended impact on consumption and inflation which implies a high bar for further hikes.

NAB

We think the Bank will publish an interest rate track that is almost identical to the May MPS. This means no change to the current 5.50% cash rate and forecasts for it to stay that way until late 2024. Markets are well priced for no change.

Westpac

The RBNZ will keep the OCR at 5.50% at its August policy meeting and retain its baseline forecast that the rate cycle has peaked. The Bank’s forecast for the OCR should continue to indicate rates on hold until August 2024, falling slowly thereafter. Economic developments will likely be viewed as broadly mixed and so will likely lead to only modest changes in the Bank’s growth and inflation forecasts. Weaker than expected March quarter GDP and a softer outlook for the external sector are balanced against a firmer housing market and persistent domestic inflation pressures. The Bank will likely emphasise that any future move in policy will depend on the emerging data flow at home and abroad.

Citi

The RBNZ is unlikely to deliver any surprises in the August MPS and keep the policy rate unchanged at 5.50%. The data since the previous MPS has been broadly neutral. One on hand, growth surprised on the downside and the economy entered a technical recession. On the other, inflation – especially non-tradeables – has surprised slightly on the upside while employment growth was also stronger than expected. Wages growth has been slightly softer but still remains above 4%. Other forward indicators such as business confidence and the housing market still point to moderation in growth over the year ahead. The Statement is also expected to remain neutral, although the risk is still tilted towards the hawkish side.

- The US Dollar Index rises toward 103.50, reaching monthly highs.

- The US 10-year Treasury yield has surpassed 4.20%, the highest since November.

- The EUR/USD is under pressure, trading below relevant support levels.

The EUR/USD accelerated its decline, falling below 1.0900 to the lowest level since July 7 amid a stronger US Dollar.

Higher yields and cautious markets

The combination of higher US yields and cautious equity markets continues to support the US Dollar. The US 10-year yield stands at 4.20%, the highest since November, while the 2-year reached 4.96%. On Wall Street, the Dow Jones is falling by 0.15%, and the Nasdaq is sliding by 0.04%.

The US Dollar index has risen from under 103.00 to 103.45, the highest since July 6. The bias remains to the upside. The US Dollar is breaking important technical and psychological levels against most of its main rivals, strengthening the upward move even as market participants expect the Federal Reserve to keep rates unchanged at the September FOMC meeting following last week's data.

As for the Euro, it is lagging on Monday, with EUR/GBP trading below 0.8610, the lowest in five days and EUR/CHF breaking below 0.9600, approaching August lows.

Technical outlook

The EUR/USD has fallen below the important support area at 1.0925 and below the 55-day and 100-day Simple Moving Averages. A consolidation below 1.0900 would point to further weakness in the Euro.

So far, the EUR/USD has bottomed at 1.0874. The next support area is located at 1.0860, and below that, attention would turn to the July low at 1.0830. A recovery above 1.0900 could alleviate the bearish pressure, but the Euro needs to rise above 1.0970 to remove the negative bias.

Technical levels

Gold price prints a fresh five-week low amid strength in the US Dollar. Economists at TD Securities analyze XAU/USD outlook.

Gold bulls will need discretionary traders to deploy their capital hoard

Under the hood, the broadening consensus for a higher-for-longer scenario in rates has catalyzed notable CTA liquidations over the past weeks, underscoring the slump in net length highlighted by the CFTC weekly report. That being said, the drip lower from ETF gold liquidations appears to be subsiding over the last few sessions, and we don't expect additional algorithmic selling activity until prices break below the $,1900 mark.

Ultimately, Gold bulls will need discretionary traders to deploy their capital hoard, which places additional attention on upcoming data trends, particularly at a time when leading economic indicators are contrasting sharply from coincident economic indicators, as is historically typical in pre-recessionary periods.

The US Census Bureau will release the July Retail Sales report on Tuesday, August 15 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of nine major banks regarding the upcoming data.

Retail Sales in the US are expected to rise 0.4% month-on-month vs. 0.2% in June. Meanwhile, sales ex-autos are expected at 0.4% MoM and the so-called control group used for GDP calculations is expected at 0.5% MoM vs. 0.6% in June.

Commerzbank

We expect only a slight gain of 0.4% from June. At least, according to the auto industry, about 0.5% more new cars were purchased. The price of gasoline had no major impact this time, remaining at the June level after adjusting for seasonal influences.

Deutsche Bank

We expect monthly Retail Sales to rise +0.3% in July with a slightly slower rise in Retail Control (+0.2%).

TDS

We expect Retail Sales to rise for a fourth consecutive month in July after 0.2%-0.5% MoM gains in Q2. Volatile auto sales will likely add to growth while sales in gas stations were a minor obstacle. Importantly, the control group is expected to stay firm, with online sales benefiting from Amazon's Prime Day. We also look for sales in bars/restaurants to expand at a brisk pace.

RBC Economics

Retail Sales likely edged up 0.4% in July, primarily supported by sales increase in the building and auto sectors, and partially offsetting the sales drop at gas stations.

NBF

Gasoline station receipts should have decreased during the month judging by the slight drop in pump prices, but total sales may still have advanced 0.4%, buoyed by an increase in spending at car dealers. Outlays on items other than vehicles could have advanced at a similar pace, supported by higher sales in the non-store retailer segment. (Recall that Amazon Prime Day took place during the month.)

Wells Fargo

We forecast a slight pickup in July and look for sales to rise 0.3% during the month. Auto sales likely somewhat held back July sales activity after three consecutive months of strong vehicle purchases. Beyond autos, sales activity has been mixed across other retailers in recent months after an unusually strong start to the year. Households' capacity to spend is dwindling as excess liquidity normalizes and credit not only becomes harder to come by but more expensive. But the tight labor market is offering up decent wage growth when met with slowing inflation. Falling goods prices are also providing some relief to consumers in terms of purchases, with the consumer price index for goods down 0.1% in July. This suggests Real Retail Sales were likely a bit stronger, closer to 0.4% last month.

CIBC

Aggregate personal income growth appears to have slowed in July, and nominal retail sales growth was likely limited as a result, compounded by a decline in core goods prices. Total Retail Sales likely rose by 0.2% MoM, with the more important control group of sales, which excludes gasoline, autos, restaurants, and building materials, that feeds more directly into non-auto goods consumption in GDP, poised to cool to a still-respectable 0.4% MoM. We’re more pessimistic than the consensus on the headline, but we’re nearly in line with the more important control group, which should limit any market reaction.

Citi

Control Group Sales have been stronger than expected these past three months and we expect another solid 0.5% MoM increase in control group sales in July. Meanwhile, total Retail Sales should increase by 0.4% MoM with only the services category in the report likely to also show a solid increase. Solid Retail Sales data would be in line with a soft-landing narrative.

Credit Suisse

We expect Retail Sales growth to continue to show modest growth in July. We expect headline Retail Sales to grow 0.4% MoM. We anticipate auto and gas sales grew roughly in line with the rest of Retail Sales in July, so aggregates that exclude them are likely to show the same growth rate. We expect the control group to come in a touch stronger at 0.5%. Going forward, we expect Retail Sales to weaken. Auto sales may continue to show strength, but we expect sales of large durable goods related to housing, including furniture, electronics, and appliances, to remain under pressure owing to housing market weakness. More broadly, tighter financial conditions, diminishing excess savings, slowing household income growth, and the resumption of student loan debt service in 3Q are likely to weigh on consumption growth.

- USD/CAD eyes the 1.3500 resistance amid strength in the US Dollar.

- US consumer spending momentum is seen expanding at a higher pace of 0.4% than June’s reading of 0.2%.

- A nominal pace in Canadian inflation might not bother the BoC for raising interest rates further.

The USD/CAD pair marches towards the psychological resistance of 1.3500 in the early New York session. The Loonie asset strengthens inspired by the solid US Dollar amid sticky inflationary pressures in the United States.

S&P500 is expected to open on a mildly negative note, following bearish cues from overnight futures. The US Dollar Index (DXY) rallied above the crucial resistance of 103.00 as investors remained worried that sticky inflationary pressures could force the Federal Reserve (Fed) to keep interest rates elevated for a longer period.

Hawkish Fed bets for September monetary policy meeting seem vanishing as the moderate pace in US inflation is in line with the central bank’s desired inflation rate of 2%. Last week, five-year consumer inflation expectations dropped to 2.9% from expectations and the former release of 3.0%.

Investors hope that Fed policymakers would be required to deliver more efforts now to rid of remaining inflationary pressures above the 2% desired above. Per estimates, consumer spending momentum remained at a higher pace of 0.4%, higher than June’s reading of 0.2%.

Meanwhile, investors shift their focus to the US Retail Sales for July, which will be released on Tuesday at 12:30 GMT.

On the Canadian Dollar front, investors await the inflation data for July, which will be published along with US Retail Sales data. Monthly headline Consumer Price Index (CPI) data is seen expanding at a higher pace of 0.3%, higher than the prior reading of 0.1%. Annual CPI is expected to land higher at 3.0% against the former release of 2.8%. A nominal inflation pace might not bother the Bank of Canada (BoC) in raising interest rates further.

USD/JPY is trading close to the 145 mark. Economists at Commerzbank analyze the pair’s outlook.

Is the MOF a toothless tiger?

If there are no interventions despite increasingly high USD/JPY levels the market might easily come to the conclusion that the MOF is a toothless tiger. If this situation arose the verbal interventions would turn out to be counterproductive in retrospect. As they would not only have turned out to be incapable of preventing medium-term JPY weakness but because very easily such a revaluation of the MOF might cause momentum, that might lead to higher USD/JPY levels than would have been seen in a scenario when the MOF had remained silent on the subject of JPY exchange rates.

And in fact, the MOF is now in a tricky situation. There is no reason for interventions at present. The period of JPY weakness is over. And it makes no sense and would be completely futile for the MOF to take action against general USD strength. However, their previous chatter means that they are now under pressure to act.

The moral of the story: ‘verbal interventions’ are not the free lunch they may seem to be at first glance.

Short-term outlook is favourable for the US Dollar, according to economists at MUFG Bank.

Higher US yields and diminished risk appetite to help Dollar

The failure of yields to decline in the wake of the US CPI report last Thursday has underlined the solid support for US yields that looks set to persist over the short-term.

If there is a source of renewed volatility and risk aversion over the short-term it looks like that could come from China. Economic data continues to be weak with increased concerns of late over the property market.

- USD/CHF looks set for a rally after remaining restricted around 0.8780 amid strength in the US Dollar.

- Fed policymakers are expected to pause its year-long rate-tightening spell.

- The SNB is expected to raise interest rates by 25 bps in September to 2%.

The USD/CHF pair gathers strength for a rally above the immediate resistance of 0.8780 in the European session. The Swiss Franc asset is expected to test the round-level resistance of 0.8800 amid strength in the US Dollar Index (DXY) inspired by the modest recovery in inflation and higher-than-expected Producer Price Index (PPI) data for July.

S&P500 futures add some gains in London on hopes that the Federal Reserve (Fed) will pause the policy tightening spell in September. Fed policymakers are expected to pause its year-long rate-tightening spell as inflation is expanding at a nominal monthly pace of 0.2%. The 0.2% monthly pace in inflation is in alignment with the Fed’s desired rate of 2%.

The Fed is highly expected to deliver an unchanged interest rate decision in September. However, interest rates will remain elevated for a longer period so that the return of inflation to 2% could be ensured. This would keep fears of recession steady.

After a modest inflation increase, investors await the United States Retail Sales data for July on Tuesday, which will be published at 12:30 GMT. Per estimates, consumer spending momentum remained at a higher pace of 0.4%, higher than June’s reading of 0.2%.

On the Swiss Franc front, investors start getting concerned about the interest rate decision from the Swiss National Bank (SNB), which will be announced in September. A survey from Bloomberg showed that the SNB will raise interest rates by 25 basis points (bps) in September to 2%. Regarding the inflation guidance, the survey indicates that the Consumer Price Index (CPI) will be at 1.5% in 2024.

GBP buyers re-emerge in the high 1.26s. Economists at Scotiabank analyze Cable’s outlook.

Technical signals shaded somewhat negatively for the GBP in the short run

Sterling looks well-supported on the session so far but technical signals are shaded somewhat negatively for the GBP in the short run after the heavy selling pressure from the low 1.28s that developed late last week.

Firm support in the upper 1.26s is notable, however, and additional gains through 1.2740/1.2750 should add to near-term upside momentum and a retest of the low 1.28 area.

Resistance to USD/CAD advancing beyond the mid-1.34 zone has been pretty consistent over the past week. Economists at Scotiabank analyze the pair’s outlook.

Risks tilted towards additional gains

At the risk of sounding like the proverbial broken clock, the CAD looks cheap and should be trading somewhat higher than it is. Very stretched valuation suggests near-term scope for the USD to extend should be limited, all else equal.

Intraday trading patterns reinforce the picture of firm resistance in the mid-1.34 zone but, taking a step back, the underlying bull trend in the USD has developed solidly on the short-term studies which suggest spot will remain well supported for now and tilts risks towards additional gains – eventually.

Support is 1.3375, with some relief for the CAD likely to develop below here.

EUR/USD pressures support in the low 1.09s again. Economists at Scotiabank analyze the pair’s outlook.

EUR may struggle to strengthen significantly

Spreads have moved against the EUR (and broadly in the USD’s favour) in recent weeks, suggesting the EUR may struggle to strengthen significantly, absent other drivers, for now.

Trend support off the September 2022 low for EUR/USD at 1.0949 remains under pressure but continues to provide some anchoring for the soft EUR, with the 50 and 100-DMA signals bracketing the trendline at 1.0966 and 1.0931 respectively).

EUR needs to extend gains through 1.1050/1.1060 to show any real technical strength in the near term.

West Texas Intermediate (WTI) crossed the $80/bbl mark after it sank below $70 for most of June. Economists at the Bank of Montreal stick to their WTI forecast.

The balance of risks has tilted more to the upside