- Analytics

- News and Tools

- Market News

Новини ринків

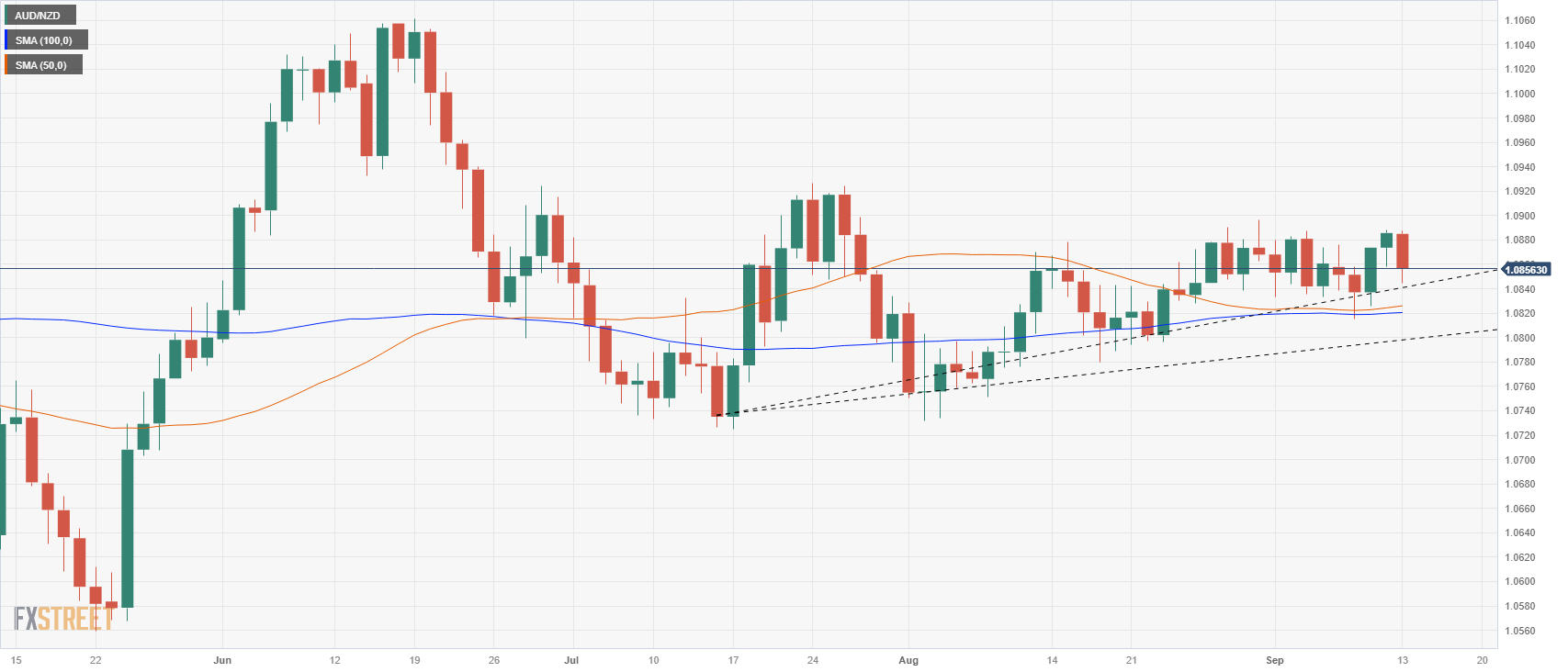

- The AUD/NZD slips back into consolidation ranges as the Aussie lacks momentum.

- Australian employment figures in the pipe will hopefully drive some fresh sentiment shifts.

- China data on Friday could produce knock-on effects for the AUD.

The AUD/NZD backslid to a daily low of 1.0840 in Wednesday’s trading, with the Aussie (AUD) backing up ahead of inbound labor market data due in the Thursday trading window. The Kiwi (NZD) remained relatively on balance, unmoved by a notable lack of economic calendar data on the docket for the New Zealand currency.

Aussie unemployment rate expected to hold steady

Markets are broadly expecting Australia’s Unemployment Rate to hold steady at 3.7% for the month of August, holding steady at the previous month’s figure.

Meanwhile, Australian Employment Change for the month of August is expected to tick higher, with market analysts anticipating a printing of 23K, versus the previous period’s reading of a 14.6K decline.

The Kiwi remains under-represented on the economic calendar, but China data due on Friday, including Chinese Industrial Production figures and annualized Retail Sales for August, could see the Aussie gain some momentum with knock-on market effects.

China’s YoY Retail Sales for the month of August are expected to move upwards, from 2.5% to 3%, while Chinese Industrial Production figures are also expected to improve, forecast to print at 3.9% versus the previous 3.5%.

AUD/NZD Technical outlook

The AUD/NZD remains trapped firmly in the middle, with Wednesday’s Aussie slip into the red sending the pair firmly back into the recent consolidation region. The 100-day Simple Moving Average (SMA) continues to provide support for the longer candlestick periods, but the 50-day SMA continues to consolidate, reinforcing the middling patterns on the Aussie-Kiwi charts.

The current ceiling rests at the last meaningful swing high near 1.0920 in late July, with the floor priced in at early August’s drop-and-rebound from 1.0740.

AUD/NZD daily chart

AUD/NZD technical levels

Shenzhen, one of China's megacities, took another move to support the property market by easing some of the country's strictest house purchase restrictions, which had been in place for years to curb speculation.

Key takeaways

"Beginning in 2016, the city of 17.6 million people implemented a series of policies that focused on curbing soaring home prices and speculation."

"Shenzhen adjusted the definition of first-time home purchasers in late August to let more individuals to qualify for lower mortgage rates and smaller down payments."

"Last Monday, the city lifted a long-standing prohibition, allowing Hong Kong and Macao citizens to invest in nonresidential buildings."

"Under the latest measures, Shenzhen will no longer disqualify nonresidents from buying a home if their income tax or social insurance payments in the city have been disrupted for less than six months."

Market reaction

The above statement fail to move the needle around the Australian Dollar. AUD/USD is trading at 0.6421, unchanged on the day.

Fitch Ratings stated in its latest economic forecast that global economic growth is deteriorating, owing to "the deepening slump in China's property market, casting a shadow over global growth prospects just as tighter financial conditions weigh on the demand outlook in the US and Europe.”

Key Quote

expects the US to fall into recession in the first half of 2024

Federal Reserve “is now close to reaching a peak on rates and we expect just one more 25-basis-point hike to 5.75%. But core inflation is still high — particularly in services — and we have pushed back the date of the first Fed rate cut to May 2024.”

- NZD/USD trades at 0.5917, down 0.01%, after failing to break the September 11 daily high of 0.5935.

- Daily chart shows a neutral to downward bias; key resistance levels emerge at 0.5950, and September 1 swing high of 0.6015.

- A break below the September 13 swing low of 0.5879 could trigger a test of the year-to-date low at 0.5859.

The New Zealand Dollar (NZD) printed gains against the US Dollar (USD) of 0.26% on Wednesday, following a mixed US inflation report, leaving the door open for the US Federal Reserve to tighten monetary policy. As Thursday’s Asian session begins, the NZD/USD trades at 0.5917, registering minuscule losses of 0.01%.

NZD/USD Price Analysis: Technical outlook

The daily chart depicts the pair as neutral to downward biased, consolidated within the year’s lows, at around 0.5920s. Despite trading near the week’s highs, the currency pair has failed to crack the September 11 daily high at 0.5935, which could open the door for further upside, exposing the 0.5950 and the September 1 swing high at 0.6015.

Conversely, if the NZD/USD extends its losses past the September 13 swing low of 0.5879, that would exacerbate a test of the year-to-date (YTD) low of 0.5859, followed by the November 3 daily low of 0.5740. A breach of the latter, the NZD/USD would reverse the last uptrend, which began around the October 13 low of 0.5512.

NZD/USD Price Action – Daily chart

- AUD/USD edges higher to 0.6420 after bouncing off the low of 0.6380.

- US inflation data pushes the market to re-pricing the odds of further rate hikes from the Fed in the November meeting.

- Australian economy is expected to see a positive change of 23K in August.

- Market players will closely watch the Australian employment report.

The AUD/USD pair holds above 0.6400 during the early Asian session on Thursday. Meanwhile, the US Dollar Index (DXY) hovers around 104.75 after retreating from 104.96 in response to the upbeat US inflation data. The pair is trading near 0.6420, losing 0.02% on the day. The market turns cautious ahead of the Australian Employment Report due later in the Asian session in the day.

Data released from the US Bureau of Labor Statistics on Wednesday revealed that the US Consumer Price Index (CPI) for August rose 0.6% MoM from 0.2% in the previous reading while the annual figure came in at 3.7% from 3.2%, beating market expectation. The annual core CPI came in at 4.3% versus 4.7% prior. In response to the data, the US Dollar (USD) surged and later lost traction.

The US inflation pushes the market to re-evaluate the odds of further rate hikes from the Federal Reserve (Fed), despite the Fed on pace to hold rates steady at its upcoming rate meeting next week. According to the CME Fedwatch Tool, traders have priced in 97% odds of interest rate unchanged in September at 5.25%-5.50%. However, the possibility of a rate hike in the November meeting increased to 49.2%. In line with that, hawkish bets may limit the downside of the USD and act as a headwind for the AUD/USD pair.

On the other hand, the Aussie’s upside was capped due to the consumer confidence data fell into negative territory in August. On Tuesday, Australia’s Westpac Consumer Confidence for September fell 1.5% to 79.7, following a 0.4% drop in the previous reading. The figures fueled concern about the impact of the economic slowdown in China.

Later in the day, the Australian Bureau of Statistics will release the Employment Report. The Australian economy is expected to see a positive change of 23K in August following the previous month's decline of 14.6 K. On the US docket, the US Retail Sales and core Producer Price Index will be released. These figures could give a clear direction to the AUD/USD pair.

- The EUR/USD slid on Wednesday as US CPI figures failed to inspire markets meaningfully.

- ECB coming down the pipe with another rate call on Thursday.

- Market economists anticipate the ECB to stand pat on rates, the majority is slim.

The EUR/USD is down into the red for heading into Thursday’s market session, wrapping up Wednesday down around 1.0730 after opening the day above 1.0750 and tapping into 1.0711 for the trading day’s low.

It’s all about the European Central Bank (ECB) heading into Thursday after markets largely shrugged off the US Consumer Price Index (CPI) beat, which showed US inflation ticking upwards to 3.7% for the annualized period into August, beating market analyst estimates of 3.5% and a healthy step up from the previous month’s 3.2% showing.

ECB on the docket for Thursday, and it’s all about the rates

The ECB is slated for another rate call on Thursday, with the European Union’s (EU) preeminent bank largely forecast to hold on rates for the time being, but inflationary concerns remain a sticking point.

ECB Preview: Forecasts from 10 major banks, a hike or a hawkish pause?

The majority of market analysts anticipate the ECB to hold steady on rates, but the margin has dwindled rapidly in recent days after an internal leak from the ECB showed the bank is set to raise their inflation expectations looking forward.

A poor showing from the ECB here could see the Euro (EUR) extend its current backslide against the Greenback (USD).

While the projection increase itself is unlikely to be enough to push the ECB off their wait-and-see stance, it does highlight that inflation remains an ongoing issue for the broader European economy.

EUR/USD technical outlook

The EUR/USD is notably on the soft side, trading into the 1.0700 major handle on the daily candlesticks. Price action has steadily declined from late July’s peaks near 1.1240, and has closed red for the past eight consecutive weeks.

While the 50- and 100-day Simple Moving Averages are still stacked bullish, with the 50-day SMA nearing 1.0925 and the 100-day SMA near 1.0900, both moving averages have turned bearish, descending into a rejection zone that has thus far held the EUR/USD on the back foot since late August’s failed bull run.

Look for any topside momentum to get capped by resistance points at lower highs, and a break below the 1.0700 handle could see bears find room to run.

EUR/USD daily chart

EUR/USD technical levels

- S&P 500 gains 0.12% to 4467.44, while Dow Jones drops 0.20%; Nasdaq 100 rises 0.29% amid mixed market sentiment.

- US CPI for August comes in at 3.7% YoY, exceeding forecasts, but core inflation drops to 4.3%, in line with expectations.

- CME FedWatch Tool suggests no rate hike in September; upcoming unemployment and retail sales data could influence the Fed’s stance.

US equities finished Wednesday’s sessions with gains, except for the Dow Jones Industrial Averages, printing its first loss in the last five days. A mixed report increased speculations the US Federal Reserve would not raise rates at the upcoming meeting while the Greenback advanced.

US equities were mixed as US CPI left the market uncertain about the US central bank’s next move

The S&P 500 stands at 4,467.44, gaining 0.12%, while the heavy-tech Nasdaq 100 finished in the green at 13,813.59, up 0.29%. The outlier was the Dow Jones Industrial Average, which dropped 0.20% and ended the session at 34,575.53

Sector-wise, the biggest winner was Utilities, followed by Consumer Discretionary and Communication Services, each gained 1.2%, 0.9% and 0.40%. On the flip side, Real Estate, Energy, and Industrials printed losses of 1.03%, 0.76% and 0.67%.

The US Department of Labor revealed that inflation data for August showed mixed results. The Consumer Price Index (CPI) came in at 3.7% year-on-year, which exceeded forecasts that had expected inflation to be at 3.6% and was also higher than July’s figure. However, core inflation, which excludes volatile items, dropped from 4.7% year-on-year in July to 4.3%, in line with analyst projections.

Despite the inflation data, the market did not anticipate additional tightening by the US Federal Reserve (Fed), as indicated by money market futures data. The CME FedWatch Tool still suggests that the Fed will likely maintain interest rates at 5.25% to 5.50% for the upcoming September meeting.

Although the Wall Street reaction suggests that traders are pricing in a peak to the Federal Funds Rates (FFR), there’s additional data that could shift market participants’ mood. For instance, if unemployment claims rise as expected and August’s Retail Sales report shows weaker figures compared to July, this could contribute to the argument for the Federal Reserve potentially considering the end of its tightening cycle.

US Treasury bond yields finished the session with the 10-year benchmark note rate at 4.254%, lost 0. 70%. The Greenback, shown by the US Dollar Index, ended positively, climbing 0.20%, at 104.76.

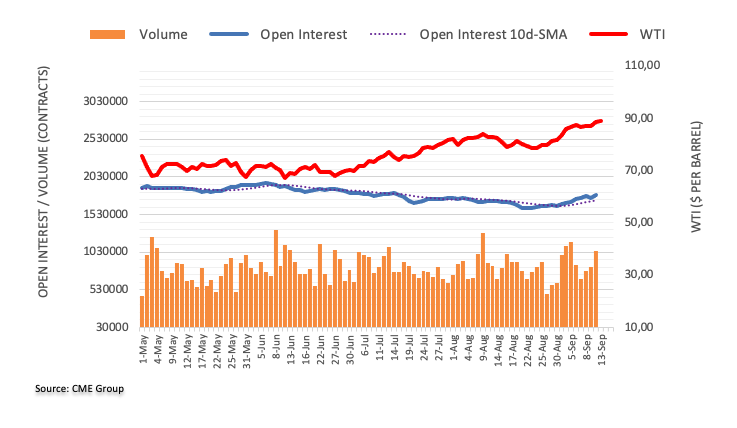

WTI rose by 0.10% daily in the commodity space underpinned by tight supplies after Saudi Arabia and Russia’s 1.3 million barrel crude oil cut.

S&P 500 Price Action – Daily Chart

S&P 500 Technical Levels

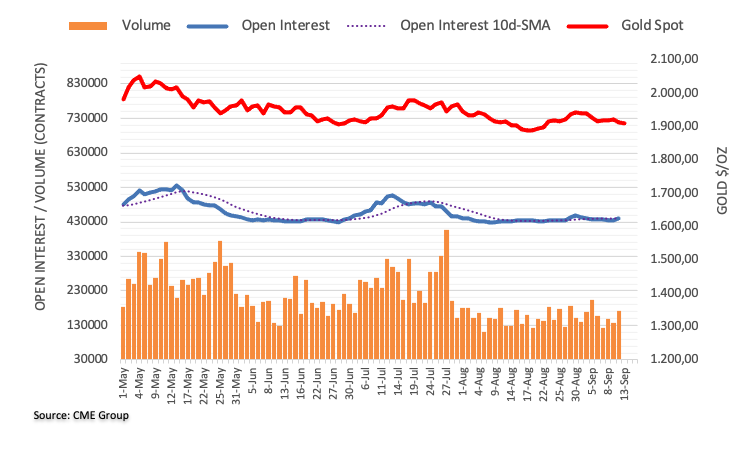

- Gold takes a step lower for Wednesday, approaching $1,900.00.

- US inflation is proving stubborn, sapping strength from the XAU/USD.

- Gold traders will need movement from the Federal Reserve on rates before bullish momentum can spin back up.

The XAU/USD wrapped up Wednesday trading clipping into its lowest prices in three weeks, tapping a fresh low of $1,905 into the ticker tape as the US inflation landscape continues to frustrate gold bugs.

Gold continues to etch in a rejection from the $1,940.00 level after last week’s action saw the yellow metal retreat as US Treasury yields and a stubborn US Dollar (USD) continue to plague the Gold chart. The precious metal is well off the year’s highs above $2,060.00.

US inflation proves a sticky weight on Gold prices

The US Consumer Price Index (CPI) printed 0.6% for the month of August, an acceleration of the previous month’s 0.2% printing, and inflation concerns are weighing down the XAU/USD. Annualized CPI rose 3.7% versus the market forecast 3.6%.

The uptick in US inflation is causing markets to re-evaluate the odds of further rate hikes from the Federal Reserve (Fed), despite the Fed on pace to hold rates steady at their upcoming rate call next week.

While inflation figures are on the rise, many investors are not entirely surprised, and the downside on Gold is limited. CPI figures, while tipping into the high end, are largely congregated in the volatile energies section, driven by rising fuel costs and tricky food prices. Core CPI, the basket of goods excluding fuels and food, rose by 0.3% last month, versus the expected 0.2%. Still above market expectations, but a significant step down from the all-prices total CPI headline figure.

The gasoline component of the CPI rose 10.6% in a single month, and overall energies climbed 5.6%. Rising shelter costs also contributed to the inflation index’s gains, with rents increasing for the 40th straight month, up 0.3% for August.

Bolstered concerns about shifts in the Fed rate hike cycle is providing broad-base support for the USD, keeping a cap on Gold prices in the near-term as investors flock to the Greenback in defensive positioning.

Gold bulls will be looking for a firmer picture about future rate cuts from the Fed moving forward, and the XAU/USD is likely to remain constrained to the downside until evidence of a reversal of the Fed’s momentum on the rate hike cycle begins to crystallize.

Elsewhere in the Gold landscape, US President Joe Biden’s White House administration is toying with the idea of instituting a royalty on precious metals extracted within the US; the royalties on hardrock minerals harvesting would be the first of its kind in the US.

A variable 4% to 8% net royalty would be applied to any precious metals pulled from federal lands within the US. The royalty would require a reversal of an 1872 law that specifically prevents the US from collecting mining royalties on hardrock mineral extraction, a measure that is unlikely to pass the Republican-held US Congress.

The royalty, if it were to succeed, would impact around 750 hardrock mines throughout the US, the majority of which are located in the West. The measure would also conflict with the White House’s current proposals to try and spur further investment in precious metals mining already under way within the US.

XAU/USD technical outlook

Daily candlesticks have Gold trading back into the low end, and is set to face a support zone around the $1,900.00 major handle. A declining trendline from May’s highs into the $2,050.00 region continues to hold as lower highs mark in an extension of topside resistance.

The 50- and 100-day Simple Moving Averages are flashing a bearish stance, with the 50-day SMA parked near $1,930.00 with the 100-day SMA sitting just beneath $1,950.00 and leaning towards the bearish side. The pullback from August’s low near $1,890.00 has sent the 50-day SMA sideways, but the longer SMA is consolidating bearish pressure.

XAU/USD daily chart

XAU/USD technical levels

- GBP/USD held steady at 1.2485 on Wednesday.

- The pair side-way traded in the last session, using the 200-day SMA as support.

- Bears are running out of steam.

On Wednesday, the GBP/USD closed the session with mild gains, at 1.2485. Bears managed to take the Cable to 1.2433 earlier in the session, near the 200-day Simple Moving Average area, but the bulls quickly reversed the fall.

Following the sharp decline seen at the beginning of last week, which saw the Cable declining by nearly 1%, the bears seem to be running out of steam, with little gas left in the tank to break below the key 200-day SMA. In that sense, on the daily chart, the Relative Strength Index (RSI) is comfortably positioned in the negative territory below its midline and has a flat slope, complemented by a negative signal from the Moving Average Convergence Divergence (MACD), which is showing red bars. Unless bears manage to gather momentum, the Cable may side-ways trade above the 1.2430 area in the next sessions to consolidate losses. That being said, traders should eye the slope of the 20-day SMA, which suggests that it is en-route to perform a bearish cross with the 200-day SMA and that could be the sparkle that reignites the bearish momentum.

If the bulls fail to defend the 200-day SMA, support below line up at 1.2400, 1.2370, and 1.2350. On the other hand, the next targets for the buyers are seen at 1.2500, 1.2540-50 and the 20-day SMA at 1.2600.

GBP/USD Daily Chart

-638302367622287346.png)

- XAG/USD declined by 0.90% to the $22.80 area.

- Headline CPI from the US from August rose to 3.7% YoY, beating expectations.

- US yields retreated but remain uncomfortably high for precious metals.

In Wednesday’s session, Silver prices retreated and failed to consolidate above $23.00, falling to the $22.80 area. After fresh inflation figures from the US, the Greenback is holding its foot trading strong against its rivals while US Treasury yields are consolidating after initially spiking to a two-week high.

The US Bureau of Labour Statistics (BLS) revealed that the Consumer Price Index (CPI) rose to 3.7% YoY, up from 3.2% in July and beating the expected 3.6%. On the other hand, the Core measure decelerated to 4.3% from its previous reading of 4.7%, as markets expected.

In the meantime, the US 2,5 and 10-year bond yields saw a volatile action during the session, spiking after the release of the inflation figures and declining, seeing daily decreases of more than 0.50%. However, they still remain high, indicating that investors are still confident that the Federal Reserve (Fed) will hike one more time in 2023, and the CME FedWatch tool suggests that market swaps are discounting nearly 40% odds of a hike in November or December. In that sense, as yields remain high and hawkish bets on the Fed steady, the XAG/USD’s bulls will have a hard time as their upside potential will be limited.

On Thursday, the BLS will report Producer Price Index (PPI) figures from August, providing additional insights to investors to place their bets on the next Fed meetings.

XAG/USD Levels to watch

The technical outlook for the XAG/USD indicates an oversold condition in the short term, suggesting a potential technical rebound in the near future. The Relative Strength Index (RSI) exhibits a negative slope below the 50 thresholds, while the Moving Average Convergence (MACD) histogram, displays larger red bars. Also, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), highlighting the continued dominance of bears on the broader scale. To add to that, the moving averages seem to be converging towards the $23.50 and are building a strong resistance at that area.

Support levels:$22.60, $22.40, $22.00.

Resistance levels: $23.00, $23.50 (200-day SMA), $23.60 (20-day SMA).

XAG/USD Daily Chart

During the Asian session, market participants will closely watch for the Australian employment report. Additionally, data from Japan, including Machinery Orders and Industrial Production, will also be released. Later in the day, the European Central Bank (ECB) will announce its decision, and key US data such as Jobless Claims, Retail Sales, and the Producer Price Index will be published.

Here is what you need to know on Thursday, September 14:

The US Dollar Index finished slightly higher on Wednesday but remained within recent ranges, mirroring the behavior of major currency pairs. US yields initially jumped but later retraced, with the 10-year yield settling at 4.25%. Wall Street experienced mixed results as investors remained cautious.

The US August Consumer Price Index (CPI) showed a 0.6% increase for the month and a rebound in the annual rate from 3.2% to 3.7%, surpassing market expectations of 3.6%. However, the annual core rate slowed as anticipated from 4.7% to 4.3%. The initial reaction in the US Dollar was positive, but it later pulled back. The numbers did not significantly alter the outlook for the upcoming Federal Open Market Committee (FOMC) meeting, and the market continues to anticipate a pause in monetary policy.

TD Securities on US consumer inflation:

In our view, today's CPI report should not make a meaningful difference for Fed officials ahead of the September FOMC meeting. However, it does keep alive the odds of an additional rate increase for the November/December meetings, particularly if we see a follow-through of accelerating core inflation in the September CPI report.

Between the ECB decision at 12:15 GMT and ECB President Lagarde's press conference at 12:45 GMT, important economic reports from the US are scheduled for release at 12:30 GMT, including Retail Sales, the Producer Price Index, and Jobless Claims. This convergence of key events is likely to result in increased market volatility across financial markets.

The European Central Bank (ECB) will hold its monetary policy meeting on Thursday. While a pause in policy is expected, reports suggesting that the staff will raise inflation forecasts have increased speculations for a potential rate hike. This event has the potential to trigger significant volatility in the Euro. Market participants will also closely watch ECB President Lagarde's press conference for further insights and guidance.

ECB Preview: Forecasts from 10 major banks, a hike or a hawkish pause?

EUR/USD is holding above 1.0700, but upside gains are being limited around 1.0770. The pair lacks a clear bias, and significant swings are likely on Thursday.

The UK economy contracted by 0.5% in July, worse than the expected 0.2% contraction, following a 0.5% expansion in June. GBP/USD initially dropped and reached the 200-day Simple Moving Average but later climbed back to 1.2500.

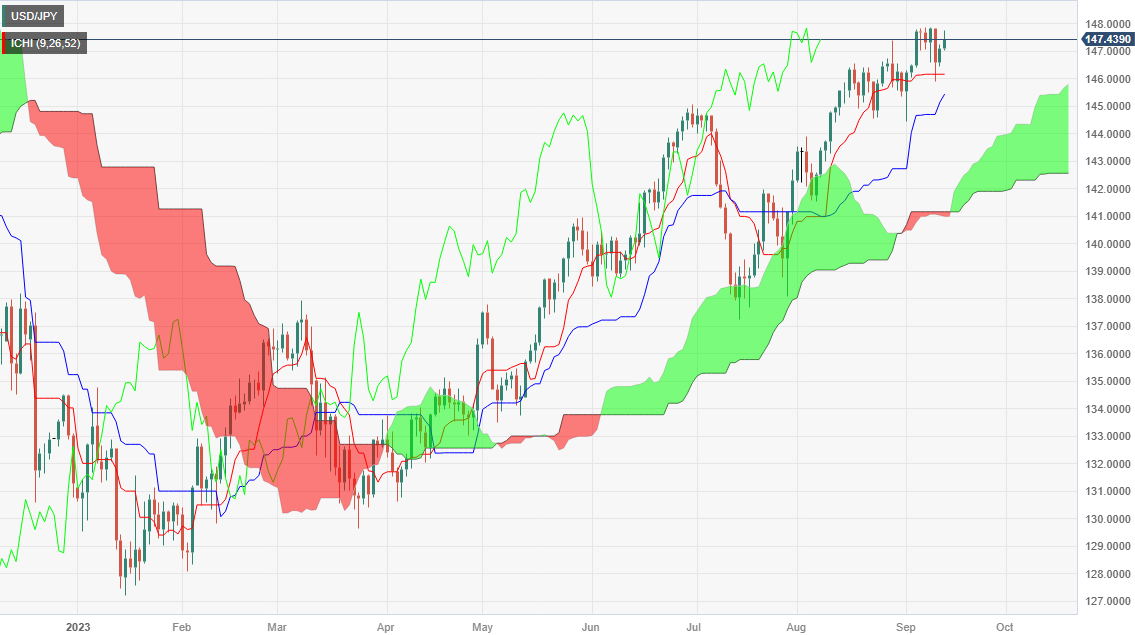

USD/JPY rose on Wednesday but remains below recent highs. The pair is hovering around 147.50, with 148.00 acting as key resistance. In Japan, on Thursday, important data including Machinery Orders for July and Industrial Production will be released.

Switzerland will release the Producer and Import Price Index on Thursday. The Swiss franc is likely to experience sharp volatility due to the ECB decision. USD/CHF posted its highest daily close in two months around 0.8930. The bias is on the upside, but the 0.8950 resistance level remains intact.

USD/CAD ended lower around 1.3550 after hitting the lowest level since September 1 at 1.3520. Canada will report July Wholesale Sales.

AUD/USD managed to hold above 0.6400 and continues to move around the 20-day SMA at 0.6420. The Melbourne Institute will release its inflation expectation report, and later the Australian Bureau of Statistics will publish the Employment Report. A positive change of 23K in employment is expected after last month's decline of 14.6K.

The New Zealand dollar outperformed on Wednesday. NZD/USD continues to test the 20-day SMA at 0.5920. AUD/NZD pulled back after reaching the lowest level in a month on Tuesday.

Metals remain bearish, with Silver trading below $23.00 and Gold looking at $1,900. XAU/USD settled at $1,908, marking the lowest close in three weeks.

Like this article? Help us with some feedback by answering this survey:

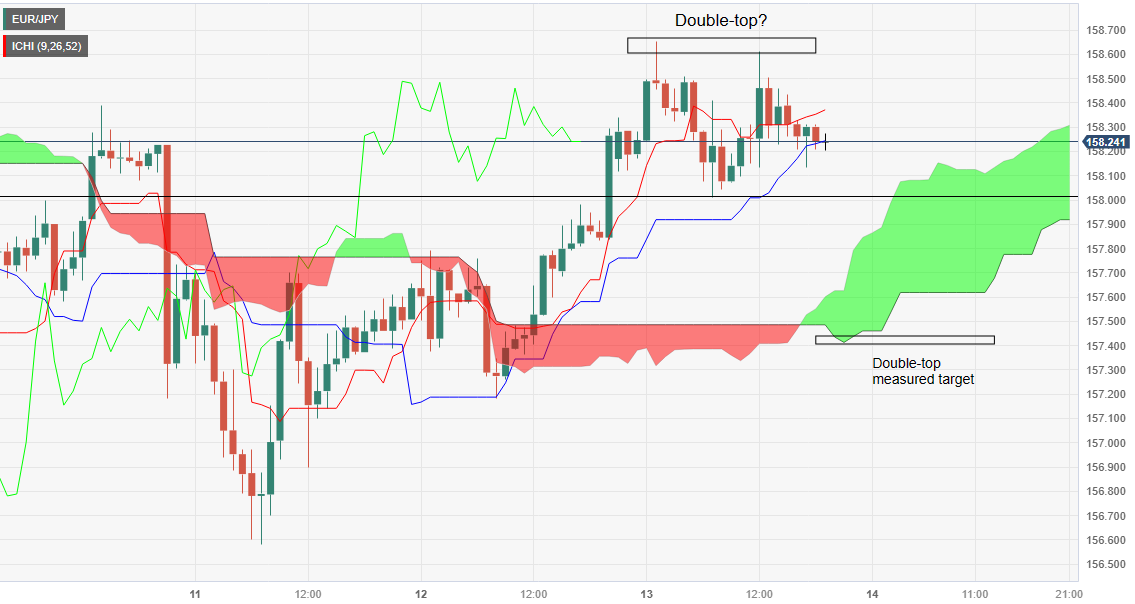

- EUR/JPY trades at 158.22, up 0.02%, after US inflation data suggests the Fed may hold off on a rate hike.

- Ichimoku Cloud indicates an upward bias, but price action suggests the pair is in consolidation.

- Hourly chart shows a potential double top around 158.60; a break below 158.00 could confirm the bearish pattern.

The EUR/JPY clings to minuscule gains after reaching a two-week high of 158.65, following the release of US inflation data, which was mixed and cemented the US central bank case to skip a rate hike. The cross-currency pair changes hands at 158.22, climbing 0.02%.

EUR/JPY Price Analysis: Technical outlook

According to the Ichimoku Cloud (Kumo), the pair is upward biased, but the space contraction between price action and the Kumo suggests the EUR/JPY is consolidating. From a price action standpoint, the cross is neutral to downward biased, unable to crack the latest swing low of 156.58. Once done, the bias would shift to a downward bias, yet it needs to clear the Kumo.

Short term, the EUR/JPY hourly chart portrays the formation of a double top, as the pair peaked at around the 158.60 area. To confirm its validity, sellers must break the last lower low at 158.00. Once cleared, the next support would be the Senko-span A at 157.91, followed by the 157.83 swing low. The double-top measured profit objective would be the bottom of the Kumo at 157.40.

EUR/JPY Price Action – Hourly chart

- The USD/CNY took a dip back in market action on Wednesday.

- Bullish momentum remains firm for the Greenback despite defensive posturing in Chinese rhetoric.

- Emerging markets continue to suffer against advanced economy currencies.

The Chinese Yuan (CNY) continues to struggle, with the USD/CNY pair sticking above the 7.2600 level despite slipping lower on Wednesday, closing down from the day’s opening bids near 7.2925.

Chinese officials have stepped up their verbal defense of the Yuan recently, including a stronger domestic fix for the currency within China’s borders. Across the emerging market (EM) space, currencies continue to backslide against firmer currencies like the US Dollar (USD). Traders are turning on central banks (CBs) in the EM sphere, especially in countries where CBs have been forced to continue easing monetary policy and cutting interest rates.

EM CBs are broadly more dovish than they were previously, and the emerging picture of a potential soft landing for the massive United States (US) economy is putting further pressure on CBs looking to defend beleaguered currencies.

Despite the Chinese defense of the CNY, the People’s Bank of China (PBoC), in lock-step with the Chinese government, continues to actively pursue stimulus measures and the diverging path between verbal support and policy-based easing is throwing a wrench in the CNY’s path forward.

Mixed messages from PBoC and Chinese government

Foreign exchange economists have noted that China’s attempted verbal steeling of the Yuan is meant to create an illusion of stability, but China is fully aware that they need the CNY to continue to weaken in order to drive economic growth in their flagging economy.

A softening of the US economy would be a boon for EM economies as it would help bolster their export revenues, but higher-for-longer interest rates in the developed world threaten those same economies’ currencies as interest rate differentials continue to widen, making the importing of necessary goods into EM economies increasingly expensive.

Upcoming economic data for China includes Friday’s Industrial Production and Retail Sales data, followed by the PBoC’s rate call next Wednesday.

Annualized Industrial Production in China is anticipated to print a step higher on Friday, with market forecasts broadly anticipating a showing of 3.9% for the year, compared to the previous showing of 3.7%. Retail Sales figures are expected to show an improvement for the same period, with market analysts expecting a print of 3% for the annualized period, up from the previous release’s 2.5%.

Next Wednesday will see the PBoC’s rate call for China’s main interest rate, which last printed at 3.45%. China will also be posting their 1- and 5-year Loan Prime Rate, the base rate that commercial banks use when lending to consumers and issuing mortgages.

The previous printing of the 1- and 5-year prime rate was forecast to decline to 4.05% in August, but the PBoC held the mechanism in place, keeping the lending rate pinned to 4.20%. Investors will be watching closely to see if the PBoC’s rate activity falls in-line with Chinese talking points about the domestic economy.

USD/CNY technical levels

The daily candlesticks for the USD/CNY pairing show the Yuan struggling to develop and maintain a foothold against the Greenback, with the pair testing ten-month highs. The USD has marched higher from the year’s low point near 6.70 set in January, and the 50- and 100-day Simple Moving Averages are stacked firmly bullish, at 7.23 and 7.15 respectively.

The 50-day SMA is especially critical to technical support on the chart, providing a frequent rebound point for bullish momentum swings, and bidders will be looking to reload on long positions if prices returns to the indicator level.

USD/CNY daily chart

USD/CNY technical levels

- USD/PLN declined by more than 0.70% towards the 4.3000 level.

- Polish government showed concerns about the zloty weakness and added that it should be considered.

- The USD is holding its foot after inflation figures from August.

The USD/PLN declined towards the 4.3000 level, as Polish policymakers have pointed out that they will consider the zloty weakness in the next monetary policy decisions.

Pawel Borys, a senior aide to Prime Minister Morawiecki, was the one who expressed concerns about the weakening of the currency beyond what he considered below the "optimal" as the USD/PLN rose by more than 4% in the last week, driven by the unexpected decision by the Polish central bank to cut rates by 75 basis points. It is worth noting that the Polish central bank governor, Adam Glapinski, justified the rate cuts due to local inflation moderating. Still, markets considered the move political with elections around the corner, which drove investors to dump the Zloty as the Narodowy Bank Polski's (NBP) credibility took a big hit.

On the US side, the Greenback is holding its foot after the US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose to 3.7% YoY, higher than the 3.2% in July and beating the expected 3.6%. Conversely, the Core measure eased to 4.3% YoY, matching expectations. As a reaction, the USD is holding its foot as, according to the CME FedWatch tool, market participants still foresee nearly 40% of the odds of a 25 basis point hike by the Fed in 2023.

USD/PLN Levels to watch

On the technical front, the USD/PLN indicates an overbought sentiment. This implies the potential for a short-term technical recovery, with a possible increase in downward movements. The Relative Strength Index (RSI) is seen above the 70 threshold, while the Moving Average Convergence (MACD) presents neutral green bars. Furthermore, the pair is above the 20,100,200-day Simple Moving Average (SMAs), indicating that the bulls are in command of the broader picture.

Support levels: 4.2400 (200-day SMA), 4.1810 (20-day SMA), 4.1700.

Resistance levels: 4.3200, 4.3500, 4.3800.

USD/PLN Daily Chart

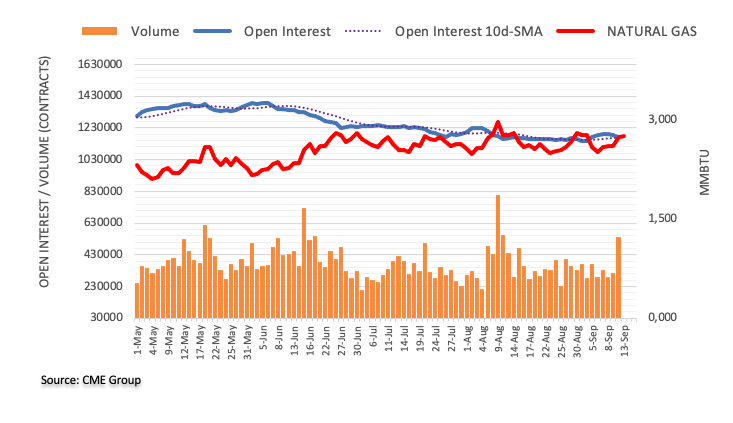

- WTI trades at $87.80, down 0.33%, after US crude inventories show a 4 million barrel increase, defying expectations.

- US inflation report reveals a 3.7% YoY rise in August, driven by a 10.6% increase in retail gasoline prices.

- Technical outlook suggests WTI could test support at $87.23; resistance levels emerge at $88.00 and year-to-date high of $88.99.

Western Texas Intermediate (WTI), the US crude oil, trims some of its daily gains spurred by a build on US oil inventories amid expectations for a drop. This and the latest US inflation report in the United States (US) boosted the Greenback (USD), a headwind for US dollar-denominated assets. WTI is trading at $87.80, down 0.33%.

WTI retreated amid unexpected surge in US inventories, rising US Dollar

The latest US crude oil inventories showed an increase of 4 million barrels last week, crushing estimates gathered by a Reuters poll for a 1.9 million barrel contraction, in data revealed by the US Energy Information Administration (EIA). Additional data showed that fuel demand dropped as the summer driving period in the US ended in the September 4 Labor Day Holiday.

The latest inflation report in the US showed headline inflation rose by 3.7% YoY in August, above estimates propelled by a 10.6% increase in retail gasoline prices. Contrarily, excluding volatile items like food and energy, inflation slowed from 4.7% to 4.3% YoY.

Oil prices had remained underpinned by Saudi Arabia and Russia’s voluntary oil production cut as both countries slashed 1.3 million barrels from the market.

WTI Price Analysis: Technical outlook

After rising to a 10-month high, WTI retraced below the September 12 daily close of $88.18 per barrel. A daily close below that level could pave the way for a pullback toward the top of an ascending-triangle top-trendline turned support at $87.23 before slumping to the $87.00 figure. A breach of the latter will expose the September 8 daily low of $85.65, ahead of slumping below the $85.00 figure. Conversely, WTI’s first resistance would be the $88.00 figure before cracking the YTD high of $88.99.

- European equities hit a bearish note ahead of ECB rate call.

- Inflation remains a sticky complication for European central banks.

- The Bank of England is caught between a rock and an even bigger rock as inflation remains, but economy lags.

European equity indexes finished Wednesday broadly lower as investors brace for the latest rate call from the European Central Bank (ECB).

Equities turned sour in Europe following better-than-expected Consumer Price Index (CPI) figures from the US, where inflation data for the American continent clipped into a 14-month high. The German DAX and France’s CAC40 both ended Wednesday trading down around 0.4% on the day, and the pan-European Stoxx600 index ended the day down 0.3%. London’s FTSE 100 index managed to hold on for the day, ending a scant 0.02% in the red.

UK, EU inflation concerns remain elevated, rate policy looms

London’s equities are taking a breather, but investors remain cautious as inflation for the United Kingdom’s (UK) economy continues to prove stickier than expected, and economic calendar data for the British economy continues to flub expectations. The Bank of England (BoE) is left in a tough spot, with inflation necessitating further rate hikes, but a wobbly economy at risk of taking a further plunge if rate hikes continue. The FTSE 100 ended the day at £7,525.

On the European Union (EU) side, the ECB is facing rate troubles of its own. An internal leak earlier this week showed the European Central Bank is set to raise its inflation expectations for the continental economy as price gains continue to prove resilient in the face of ECB actions.

The ECB is slated to release its latest rate call on Thursday’s market session, where investors will be keeping a close eye on statements. The ECB is still broadly expected to keep rates where they are for the time being, but background bets on a rate hike have been steadily increasing, and an upside surprise isn’t entirely off the table.

The DAX ended the day down near €15,654 with the French CAC40 closing at €7,222. The Euronext 100 is similar down 0.4%, to €1,335, and the EU-broad EuroStoxx 600 slipped to €453.94.

The Automotive sector in Europe provided what little support European equities received on Wednesday, with the EU set to investigate improper electric vehicle (EV) subsidies that the Chinese government has been supplying to their domestic auto manufacturers, with the President of the European Commission Ursula von der Leyen stating that while they welcome competition, they were not open to a “race to the bottom”.

The British Petroleum (BP) oil company took the top of the energy sector in London recently, with the stock slipping on Tuesday following a surprise resignation from the company’s CEO, Bernard Looney. Looney has been accused of failing to disclose the nature of his personal relationships with some colleagues. BP’s stock is down nearly 3% for the day, clipping into £508.50 to settle the day.

The US government recorded a budget surplus of $89 billion in August 2023, as reported by the Treasury Department. Total receipts for the month amounted $283 billion, while outlays stood at $198 billion, marking the lowest monthly figure in over two years.

With one month remaining in Fiscal Year 2023, the accumulated deficit reached $1.5 trillion, compared to the $1.3 trillion deficit recorded in FY 2022.

- EUR/GBP trades at 0.8595, down 0.12%, as traders position for a possible ECB rate hike of 25 basis points.

- Daily chart shows a tweezers-top inverted hammer, indicating potential for further losses; key support at 50-day MA of 0.8580.

- One-hour chart suggests next support at 0.8587; resistance levels emerge at 50-HMA of 0.8598 and 0.8600 figure.

The Euro (EUR) loses territory against the Pound Sterling (GBP), as traders brace for tomorrow’s European Central Bank (ECB) monetary policy decision. Despite odds the ECB would raise rates by 25 basis points, it was no excuse for EUR/GBP traders to short the pair ahead of the meeting. The cross-currency pair exchanges hands at 0.8595, down 0.12%.

EUR/GBP Price Analysis: Technical outlook

The daily chart portrays the pair reaching a four-week high at 0.8630 but erased those gains and formed a tweezers-top inverted hammer, which could pave the way for further losses. But a daily close at around 0.8592 is needed to cement a downward correction. In that case, the cross-currency next support would be the 50-day Moving Average (DMA) at 0.8580, followed by the September 12 swing low of 0.8569. Upside risks emerge at the current week’s high of 0.8630.

The one-hour chart portrays the pair failed to extend its gains past the daily high and retreated below the previous higher-low of 0.8603, opening the door for further downside. The next support would be 0.8587, followed by the 200-hour Moving Average (HMA) at 0.8572. On the flip side, the EUR/GBP first resistance would be the 50-HMA at 0.8598, the 0.8600 figure, and the next swing high at 0.8616.

EUR/GBP Price Action – Daily chart

- USD/CAD tallies a four-day losing streak, trading at 1.3545.

- Higher energy prices contributed to an acceleration of the US CPI in August.

- Fed tightening expectations remain steady.

- Higher Oil prices favour the CAD.

The USD/CAD continued its downward path on Wednesday, tallied a more than 1% decline in the last four days, and traded at the 1.3585 - 1.3520 range. On the USD side, the Greenback is holding its foot after the release of inflation figures as investors are still placing bets on one last hike by the Federal Reserve (Fed) in 2023. On the other hand, the CAD trades strong, mainly driven by higher Oil prices that rose to highs since November on Tuesday.

On the data front, the US Headline Consumer Price Index (CPI) rose to 3.7%, higher than the previous 3.2% and the expected figure of 3.6%, and the US Bureau of Labor Statistics (BLS) reported that an increase in energy prices drove the rise. On a positive note, the sticky Core measure eased to 4.3% from its previous reading of 4.7%, matching the expectations.

All eyes are now on Thursday's Produce Price Index (PPI) figures from the US, which is expected to accelerate to 1.2% YoY from its previous 0.8%. Retail sales from the same month will also be closely watched. As for now, the CME FedWatch tool indicates the case of one last 25 basis point hike by the Federal Reserve (Fed) remains strong as investors discount nearly 40% odds of possibilities. In line with that, hawkish bets may cushion the USD’s losses.

USD/CAD Levels to watch

Analysing the daily chart, the technical outlook for the USD/CAD remains neutral to bearish as the bears continue to show signs of gaining ground. With a negative slope below its midline, the Relative Strength Index (RSI) signals a bearish sentiment, while the Moving Average Convergence (MACD) histogram shows increasing red bars.

Support levels: 1.3520, 1.3500, 1.3490.

Resistance levels: 1.3576 (20-day SMA), 1.3600, 1.3630.

USD/CAD Daily Chart

-638302228941671807.png)

- The AUD/NZD is waffling ahead of Australian labor data.

- A lack of momentum for the pair is notable as the top continues to reinforce from 1.0880.

- Data-light Kiwi sees market flows as the primary driver.

The AUD/NZD pairing is taking a step down for Wednesday, back into familiar consolidation territory as the Aussie (AUD) struggles to find meaningful momentum against its next-door neighbor the Kiwi (NZD).

The AUD managed to squeeze past the 1.0880 handle yesterday, but couldn’t keep a grip and has slumped back, now trading into the 1.0860 region. The day’s low is currently marked in near 1.0845.

Australian employment figures coming down the pipe

The Aussie could be seeing some hesitation from traders as Australian labor data rounds the corner, with Employment Change and Unemployment Rate figures slated for early Thursday.

The Australian economy is forecast to have added 23K jobs to the landscape in August, an uptick from the previous month’s 14.6K decline. Meanwhile, the Unemployment Rate for the same period is broadly expected to hold steady at 3.7% month-over-month. Aussie bulls will no doubt be looking for a better-than-expected showing for labor data in order to push the AUD higher. Both indicators are slated to print at 01:30 GMT on Thursday.

The Kiwi remains drastically under-represented on the economic calendar this week, with little of note to bolster the NZD. BusinessNZ’s Purchasing Manager’s Index (PMI), a diffusion index of purchasing managers within New Zealand’s manufacturing sector, will be landing late Thursday. Little market reaction will be expected, and forecasts for the indicator are generally not made. The industrial PMI has printed in the sub-50.0 region since March, and no big surprises are expected.

AUD/NZD technical outlook

The Aussie has largely traded into familiar territory against the Kiwi for much of the year, cycling deep consolidation territory and well off last year’s highs of 1.1490, a region that might as well be on another planet entirely.

Daily candlesticks are implying a mildly bullish bent, with lows slowly rising, but 1.0880 appears to represent the ceiling for the time being, and the rising trendline from 1.0725 is squeezing price action into the level.

The 100- and 50-day Simple Moving Averages remain flat and consolidated, currently parked near 1.0820, and it will take significant moves in either direction to reintroduce momentum to the moving averages.

AUD/NZD daily chart

AUD/NZD technical levels

- The GBP/JPY takes a step up to reclaim green territory for the day.

- Downside risks remain, but easing Yen flows are helping to prop up the pair.

- UK data continues to disappoint, but inflation risks remain a sticking point, keeping rate expectations elevated.

The GBP/JPY is seeing some topside action as the Pound Sterling (GBP) holds the high side against the Japanese Yen (JPY), but it’s been back-and-forth action on mixed market expectations for both currencies for the mid-week trading session.

The Sterling fell to a session low of 183.20 early in Wednesday trading but has since recovered, chalking in a near-term high of 184.40 in the American trading session. The Guppy now trades into the middle, waffling into the 184.00 handle.

The economic calendar has seen some struggles for the GBP, with key indicators for the United Kingdom (UK) generally missing the mark. Industrial Production figures for July missed the mark, declining 0.7% versus the expected -0.6%, and well below the previous printing of 0.5%, erasing all of the previous month’s growth.

UK data continues to disappoint, but inflation pressures continue to complicate the BoE's path forward

Manufacturing Production for July managed to squeeze out a topside surprise, but still printed in contraction territory, coming in at -0.8% against the expected -1%. The indicator is steeply off the previous month’s 2.4% reading.

Gross Domestic Product (GDP) figures for the month of July also threw a wrench in the works, printing a 0.5% decline against the expected -0.2%, and walking back the previous period’s 0.5% increase.

Despite the lagging economic data, the Bank of England (BoE) remains in a tough spot, and market bets of continued rate hikes are increasing. Despite a wobbly economic outlook, the UK is still facing inflation pressures via rising wages, and the BoE could be forced to continue raising benchmark rates in the near term. The UK is already facing some of the highest interest rates in the G7, and continued rate hikes could threaten to tip the economy deeper into recession territory even as the BoE tries to plug the bleed from inflation.

The GBP/JPY is being helped by a receding Yen that is taking steps lower in the market as investors cool off after overextended risk appetite brought on by rate-bullish comments from the Bank of Japan (BoJ) recently. The BoJ’s Governor Kazuo Ueda hit newswires last weekend cautioning that the BoJ could be on pace to reverse their long-standing negative rate policy if economic data points to the Japanese central bank maintaining their 2% inflation target in a meaningful way.

Markets lurched on the news, sending the Yen clambering up the charts in the early week, but things are beginning to unwind. Japanese inflation, while currently holding above the BoJ’s desired level, is expected to slump in the coming months, and there are concerns the BoJ won’t be able to keep price growth at a healthy level heading into the end of the year.

GBP/JPY technical outlook

The Guppy hit a new daily high for the first time in over a month and is finding the 184.00 handle particularly sticky. The 100-hour Simple Moving Average (SMA) is threatening to turn bullish from 183.70, providing support as the 50-hour SMA consolidates and threatens to cross over into bullish territory. Higher lows on the hourly candles are also providing support from 182.80 to 183.20, while last week’s swing high point of 184.40 remains a key resistance area for the candles to overcome.

On the daily candlesticks, a descending minor trendline from late August’s high-water mark of 186.75 remains intact, and price action is getting squeezed by a rejection from the 50-day SMA near 183.00. If bids are able to congregate enough from this level, it will see a further leg up from the 50 SMA bounce, but further downside will see fresh challenges from the 100-day SMA currently parked near the 179.00 handle.

The Pound Sterling has consolidated against the Yen on a weekly basis for a month, with lows testing deeper waters, and with the GBP/JPY well-extended from 2023’s opening lows near 156.00, a downturn could see the pairing settle lower before long-term market forces re-establish the long-term bullish trend.

GBP/JPY daily chart

GBP/JPY technical levels

- USD/MXN trades at 17.1200, down 0.53%, after US CPI for August comes slightly above the 3.6% forecast.

- CME FedWatch Tool indicates a 41% chance of a 25 bps rate hike in November, keeping traders cautious.

- Upcoming US labor and retail data and Banxico’s 11.25% TIIE could push USD/MXN to test the 17.0000 level.

The Mexican Peso (MXN) shrinks its losses and stages a comeback against the US Dollar (USD), after data from the United States (US) further cemented the case for the US Federal Reserve to hike rates at the September meeting. The USD/MXN is trading at 17.1200, down 0.53, after reaching a daily high of 17.2919.

Mexican Peso rebounds vs. the Greenback amid uncertainty over US monetary policy

US inflation exceeded estimates, as August’s Consumer Price Index (CPI) came at 3.7% YoY, while forecasts saw inflation at 3.6% above July data. Contrarily, core inflation dropped from 4.7% YoY in July to 4.3%, as projected by analysts, painting a mixed picture of inflation. Nevertheless, the data failed to price in additional tightening by the US Federal Reserve (Fed), as shown by money market futures data.

The CME FedWatch Tool still sees the Fed would keep rates at around the 5.25%-5.50% range for the upcoming September meeting, but for November, odds for a 25 bps rate hike are at 41%.

Nevertheless, USD bears are not out of the woods yet, as labor market data still shows signs of a hot jobs market. Unemployment claims for the last week are expected to rise to 225K, above the previous 216K reading. That, alongside August’s Retail Sales report, which is foreseen to come weaker than July’s numbers, could cement the case for an end of the Fed’s tightening cycle.

Additional inflation data will be revealed on Thursday, with the Producer Price Index (PPI) foreseen to continue decelerating.

If the data shows signs of an economic slowdown for the US, expect the USD/MXN to test the 17.0000 figure, as the interest rate difference between Mexico and the US favors the former, with Banxico’s TIIE at 11.25%, compared to the effective Federal Funds Rate (FFR) at 5.33%.

USD/MXN Price Analysis: Technical outlook

Even though the USD/MXN has retraced somewhat, the pair remains neutral to upward bias unless Mexican Peso buyers reclaim the August 28 daily low of 16.6924. However, it could challenge the psychological 17.00 figure, but traders must crack solid support standing in its way. Before testing the former, the 20-day Moving Average (DMA) is at 17.0902, followed by the 50-DMA at 17.0108. Conversely, a bullish continuation would resume once buyers reclaim the 100-DMA at 17.2452.

- NZD/USD is seeing 0.30% gaina and rose to 0.5915.

- Inflation accelerated in August, driven by higher gasoline prices.

- US yields initially soared to two-week highs and then consolidated.

- Fed tightening expectations are still high.

In Wednesday’s session, the NZD/USD increased towards 0.5915, near the 20-day SMA of 0.5922. That being said, the upside potential during the session is limited by the US Dollar holding its foot after the release of hot inflation readings from the US.

In August, the US saw a surge in inflation, with the Consumer Price Index (CPI) increasing by 3.7% YoY, up from 3.2% in July, according to the US Bureau of Labor Statistics (BLS). This exceeded market expectations of 3.6%, while the monthly figure matched forecasts at 0.6%. The core annual reading eased to 4.3% from July's 4.7%, matching expectations.

The initial reaction was a spike of the US 2-year Treasury yield to 5.08%, it highest in over two weeks, and then consolidated near 5%. The 5 and 10-year rates saw similar movements and are consolidating at 4.41% and 4.28%. In line with that, yields remain high as, according to the CME FedWatch tool, markets still price in high odds of one last hike in November or December by the Federal Reserve (Fed).

Attention now shifts to Thursday’s Producer Price Index (PPI) figures from August from the US, which will guide investors in modelling their expectations for the next Fed meetings.

NZD/USD Levels to watch

The NZD/USD daily chart analysis points to a bearish sentiment for the short term. The Relative Strength Index (RSI) is situated below its midline while the Moving Average Convergence Divergence (MACD) prints flat green bars, signifying that despite gaining some traction, the bull’s momentum is still weak. Additionally, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), indicating that the bears are still in command on the broader picture.

Supports: 0.5900, 0.5890, 0.5850.

Resistances: 0.5922 (20-day SMA), 0.5930, 0.5960.

NZD/USD Daily Chart

-638302183461544465.png)

- USD/JPY trades at 147.58, up 0.34%, after US CPI for August rises to 3.7% YoY, beating 3.6% estimates.

- US 10-year Treasury note yield remains steady at 4.28%, despite initial volatility following the inflation report.

- Market futures price in a 97% chance the Fed will hold rates steady; focus shifts to upcoming economic data from both countries.

The Greenback (USD) extended its rally versus the Japanese Yen (JPY) on Wednesday after an inflation report in the United States (US) came mixed, though suggesting there’s a slim chance for additional monetary policy tightening. The USD/JPY is trading at 147.58, gaining 0.34%.

Greenback rises against Yen as US CPI exceeds estimates, but market skeptical of imminent Fed tightening

The US Department of Labor revealed that inflation in August’s uptick was foreseen but exceeded estimates. The Consumer Price Index (CPI) rose by 3.7% YoY, above 3.6% estimates, and crushed July’s 3.2% reading, blamed on higher energy prices. The positive news was that core CPI edged lower to 4.3% YoY, as expected, from 4.7% in July.

On the data release, the USD/JPY wavered around the 147.12/147.74 area before stabilizing at around 147.40. Since then, the pair has steadily exchanged hands at current price levels. The US 10-year Treasury note is yielding 4.28%, unchanged, after seesawing towards 4.35%.

Even though the latest round of data, with the labor market remaining tight, inflation stickier than expected, should warrant another interest rate increase, market participants think otherwise. Money market futures have priced in a 97% chance the Federal Reserve would keep the Federal Funds Rate (FFR) at the current range. However, the odds stand at 41% for the November meeting, unchanged from last week’s reading.

Aside from this, USD/JPY traders would look forward to the release of economic data to take cues on the pair’s direction. The Japanese agenda will release figures for Machinery Orders. On the US side, Initial Jobless Claims, the Producer Price Index (PPI), and Retail Sales would update the status of the US economy.

USD/JPY Price Analysis: Technical outlook

The USD/JPY has printed two straight days of positive price action, opening the door to test the year-to-date (YTD) high of 147.87. If Japanese authorities remain muted, there’s a change the major could challenge the psychological 148.00 area. Once cleared, the next stop would be the November 1 swing high at 148.82. On the flip side, a downward correction is seen if the USD/JPY drops below today’s low of 147.01.

US equities are up 16% this year. Economists at Société Générale analyze the S&P 500 Index outlook.

Moving 3Q23 target of 4,750 to 4Q23

We shift our S&P 500 Index target of 4,750 in 3Q23 to year-end 2023 (from 4,300) as the no-landing scenario is not yet priced in and should be over the coming months as recession calls are deleted/delayed. Put another way, we stay bullish near term, despite the likely jitters in 2024.

We expect a 15% shock in the S&P 500 in 2Q24, likely driven by a contraction in US consumer spending. However, with a return to 5% nominal GDP growth in 2025e, the S&P 500 should recover. Our index targets are supported by our equity risk premium projections, which assume: 1) bond yields will come down to 3-3.5% in a soft recession; and 2) aggressive Fed rate cuts in the middle of 2024.

The European Central Bank (ECB) is set to announce its Monetary Policy Decision on Thursday, September 14 at 12:15 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of 10 major banks.

Markets are split. Of the 49 analysts polled by Bloomberg, 26 see no change and 23 see a 25 bps hike to 4%, while in the Reuters poll, a small majority of experts assume that the ECB will not raise rates further.

TDS

While a hike and a hold are almost equally likely, we now expect the ECB to keep the deposit rate unchanged at 3.75% at the September meeting. We also think this will mark the end of the tightening cycle, though risks still remain around an October hike. We're neutral EURUSD heading into the ECB, highlighting the mix of stretched USD positioning and short-term valuations and a softer China backdrop.

SocGen

We expect the weakening data to allow the ECB to stay on hold to assess more data. However, we do not expect the ECB to give up on its hawkish bias before it is fully clear that the 2% target can be achieved in a timely fashion, and expect one more rate hike this year, likely in December, and more QT early next year.

Citi

With the rate decision at the 14 September ECB meeting finely balanced, the ECB staff projections will play a key role. The projections will be coordinated by ECB staff, as opposed to national central banks. In recent exercises, that has tended to produce more dovish results at least on the 2024 core inflation forecasts. We expect ECB staff to cut the euro area GDP projections substantially from 0.9% in 2023, 1.5% in 2024 and 1.6% in 2025 to 0.5% in 2023, 0.7% in 2024 and 1.4% in 2025. That should also set the unemployment rate on a modestly rising path. However, we expect higher inflation forecasts for 2023 (5.7% vs. 5.4%), broadly unchanged in 2024 at 3.0% and slightly lower in 2025 (2.1% headline and 2.2% for core).

ING

We admit that it is a very close call, but still too high inflation, a focus on actual rather than on predicted developments, and the fear of stopping prematurely will tilt the balance towards a final 25 bps rate hike.

Wells Fargo

We expect policymakers to hold rates steady at 3.75%. At the same time, policymakers may give themselves flexibility to raise rates at future meetings depending on how data evolve, especially core and super-core inflation. This mildly hawkish bias should also prevent ECB policymakers from easing monetary policy too soon. To that point, we recently adjusted our ECB forecast profile to reflect a ‘higher for longer’ stance. Rate cuts are likely to start in mid-2024, and when they begin, we expect a more gradual pace of easing than previous iterations of our ECB forecasts.

Deutsche Bank

Our economists have nervously held their 3.75% terminal deposit rate call for many months now, and as such they think the ECB will stay on hold. However, even if they don't hike this week, don't expect any sign that the council is confident that this is the last hike. A lot of uncertainty remains over European inflation, whilst GDP has been in near-stagnation since last autumn.

Danske Bank

We expect the ECB to deliver a final 25 bps rate hike due to still too strong inflation momentum and projected inflation above the target. We also expect an advancement of the end to full reinvestment process of PEPP currently guided for Dec 24 to be on the cards. Specifically, we expect ECB to 'task committees' for an announcement at the October meeting.

Rabobank

Thursday’s decision will be a close call. We narrowly favour a hold, and we expect the ECB to maintain that more hikes may still follow. The growth outlook is deteriorating, and overtightening is becoming a real possibility. But inflation remains high, and thus the odds of another hike are more than just a tail risk. We expect the ECB to leave its policy rates unchanged. We see a small risk of an increase in the minimum required reserves at this meeting.

Commerzbank

In view of the weak economy and the downward trend in the inflation rate, the ECB is unlikely to raise its key interest rates further, and interest rates are also likely to remain unchanged at subsequent meetings. the same applies to the coming year, as underlying inflation is likely to prove stubborn, especially in the services sector. Other topics could be the end of the PEPP pandemic purchase programme and the remuneration of excess liquidity, although there are unlikely to be any decisions on these.

Nordea

The ECB is torn between whether to hike rates again or not. We think the Governing Council will pause, but signal preparedness to do more at upcoming meetings, if needed. Both inflation and growth forecasts could see downward revisions.

- AUD/USD recovers as the US Dollar stays under pressure after the sticky inflation report.

- US headline inflation expanded at a 0.6% pace as anticipated due to higher gasoline prices.

- The Australian Dollar will dance to the tune of the labor market, which is scheduled for Thursday.

The AUD/USD pair discovers buying interest near 0.6380 as investors see the United States Consumer Price Index (CPI) report for August as insufficient to encourage Federal Reserve (Fed) policymakers to raise interest rates one more time in the rest of the year.

S&P500 opens on a slightly positive note as investors hope that the Fed will keep interest rates unchanged at 5.25-5.50% till the year-end. The US Dollar Index (DXY) delivers a volatile action as the United States inflation turned out stickier than expectations.

US headline inflation expanded at a 0.6% pace as anticipated by market participants. Core CPI that excludes volatile oil and food prices expanded by 0.3%, higher than estimates and July's reading of 0.2%. The US headline CPI, on an annual basis, accelerated to 3.6% from expectations of 3.6% and the prior release of 3.2%. Core CPI matched expectations of 4.3% in a similar period, remaining below the former reading of 4.7%.

According to the CME Fedwatch Tool, traders see a 97% chance in favor of an unchanged monetary policy vs. a 93% chance before the US inflation data release for the September monetary policy meeting.

On the Australian Dollar front, investors await the labor market data for August, which will be published on Thursday at 01:30 GMT. As per the expectations, Aussie employers recruited 23K job-seekers vs. 14.6 lay-offs recorded in July. The Unemployment Rate is seen unchanged at 3.7%. Tight labor market conditions could force Reserve Bank of Australia (RBA) policymakers to discuss more about resuming the policy-tightening spell.

The Turkish Lira appears to be still heavily “managed” by policymakers. Economists at Commerzbank analyze TRY’s outlook.

Credibility a long, arduous process

The Turkish Lira stabilised to some degree after the newly appointed economy management team announced a return to conventional monetary policy and hiked rates sharply. But, despite verbally supporting this tightening, President Erdogan also expresses some contradictory views, which keep the market uncertain about his support.

We retain our USD/TRY forecast for the end of the year at 30.00.

Source: Commerzbank Research

USD strength will likely stick around for longer than economists at CIBC Capital Markets envisaged at the start of the summer.

Higher for longer for the USD

We are now expecting strength in the USD to stick around for longer. That’s due to a deteriorating risk backdrop, alongside inconsistencies with how markets are pricing central banks for 2024.

DXY – Q4 2023: 106.00 | Q1 2024: 104.31

See: USD to strengthen through the end of this year and come the end of 2024 – HSBC

- EUR/USD halts three consecutive daily advances.

- The 1.0770 region emerges as the initial hurdle for bulls.

EUR/USD struggles to continue the weekly recovery and seems to have met a decent resistance around 1.0770 so far.

The underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, the breach of the 1.0700 region could encourage sellers to embark on a probable visit to the September low of 1.0685 (September 7) ahead of the May low of 1.0635 (May 31).

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0826.

EUR/USD daily chart

Economists at Commerzbank analyze BRL outlook following Brazilian inflation figures.

Inflation rate confirms BCB's path of rate cuts

Brazil's inflation rate rose as expected in August, but monthly inflation was slightly below expectations. In light of this development, even the most skeptical should forgive the Banco Central do Brasil (BCB) for kicking off the rate-cutting cycle last month with a surprisingly sharp 50 bps cut.

Furthermore, with inflation expected to remain below 5% for the time being, the expected further 50 bps easing at each of the remaining three meetings this year to a policy rate of 11.75% by year-end is, in our view, far from aggressive. We therefore continue to believe that the Brazilian Real's strong level is justified for now.

- DXY fades the earlier bull run to the boundaries of 105.00.

- Immediately to the upside emerges the monthly high at 105.15.

DXY gives away initial gains and now recedes to the 104.60 region on Wednesday.

The continuation of the multi-week rally appears well and sound and a breakout of 105.00 should encourages the index to retest the September top of 105.15 (September 7) prior to the 2023 peak of 105.88 (March 8).

While above the key 200-day SMA, today at 103.02, the outlook for the index is expected to remain constructive.

DXY daily chart

Expectations that the Fed will pause on rate hiking next week are unlikely to be changed by today's US inflation data, economists at Commerzbank report.

US core inflation somewhat above expectations

The inflation rate in August rose by half a percentage point to 3.7%. While this gasoline price-related boost had been expected, the core inflation rate also turned out to be slightly higher than forecast, even though it declined further to 4.3%.

The Fed can probably pause next week but will take a close look at further price developments.

- Silver price showed volatile moves as US inflation remained sticky in August.

- Monthly US headline inflation grew at a 0.6% pace as anticipated by market participants, due to a rally in gasoline prices.

- The 50-period EMA at $23.00 continues to act as a major barricade for the Silver price bulls.

Silver price (XAG/USD) demonstrated violent moves near the crucial resistance of $23.00 after the United States inflation in August turned out stickier than expected. The white metal is expected to find a decisive move after a scrutiny of the inflation report by investors.

US Bureau of Labor Statistics reported that monthly headline inflation grew at a 0.6% pace as anticipated by market participants, higher than the former reading of 0.2% due to a rally in gasoline prices. Annualized headline Consumer Price Index (CPI) accelerated to 3.7% vs. expectations of 3.6% and the former release of 3.2%.

Core CPI that strips off volatile food and oil prices expanded at a higher pace of 0.3% than expectations and the prior reading of 0.2%. US core CPI, on an annual basis, softened to 4.3% as projected against July’s reading of 4.7%. Persistence in US inflation figures is expected to feed hopes for one more interest rate increase by the Federal Reserve (Fed) in the rest of the year.

For the September interest rate policy, traders see a 97% chance in favor of an unchanged monetary policy vs. a 93% chance before the US inflation data release, according to the CME Fedwatch Tool. The US Dollar Index (DXY) trades volatile around 104.60.

Silver technical analysis

Silver price remains sideways in a range of $22.80-23.20 from the past four trading sessions ahead of the US inflation data. The white metal demonstrates a volatility squeeze, which is being followed by a breakout in the same. The 50-period Exponential Moving Average (EMA) at $23.00 continues to act as a major barricade for the Silver price bulls. Horizontal support is plotted from August 15 low at $22.23.

The Relative Strength Index (RSI) (14) skids into the bearish range of 20.00-40.00, which indicates that the bearish impulse has been triggered.

Silver two-hour chart

-638302089187901019.png)

- EUR/JPY improves further and adds to Tuesday’s uptick.

- Next on the upside emerges the 2023 peak around 159.80.

EUR/JPY extends the weekly rebound and pokes with the so far monthly peaks in the mid-158.00s on Wednesday.

In the meantime, the cross continues to face some side-lined trading prior to the potential resumption of the uptrend. That said, a minor hurdle emerges at the so far monthly highs around 158.50 (September 5-7) ahead of the 2023 top at 159.76 (August 30) and before the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 148.57.

EUR/JPY daily chart

Economists at TD Securities analyze Gold’s outlook following sticky US inflation report.

XAU/USD could find support fairly quickly

Gold has remained subdued as traders sold into a soft-landing theme amid fears of higher-for-longer rates. The modest upside surprise in today’s US inflation data could further compound these fears and keep the precious metals complex on the back foot.

However, the yellow metal could find support fairly quickly, with additional important data on the calendar for tomorrow. In this sense, a weaker retail sales number on Thursday could provide an offset to the inflation data and offer a challenge to the soft-landing narrative.

Economist Lee Sue Ann at UOB Group gives her views on the upcoming interest rate decision by the ECB.

Key Takeaways

There was a lack of forward guidance back at its Jul meeting on what the ECB might do next, but it modified the language to signal a shift from an explicit tightening bias towards an outright neutral stance.

Just like the ECB, we hold an “open mind as to what the decisions will be in Sep and in subsequent meetings”; though for now, we are keeping to our view of a pause in the current tightening cycle.

EUR/USD has given back some of the gains made late Tuesday. Economists at Rabobank analyze the pair’s outlook.

USD to hold firm into the start of next year

Given that the market is continuing to adapt to the view that Fed rates are set to be higher for longer, we continue to see scope for EUR/USD to edge towards 1.06 on a three-month view.

The weaker outlook for both Chinese and European growth should weigh on risk appetite and underpin the safe haven Greenback.

We expect the USD to hold firm into the start of next year and only soften as expectations for Fed rate cuts start to come into view.

- USD/CAD consolidates as investors shift focus toward the US inflation data.

- Investors underpinned the Canadian Dollar against the greenback due to rising oil prices.

- USD/CAD auctions in the Rising Channel pattern in which each pullback is considered as a buying opportunity.

The USD/CAD pair trades directionless in the European session ahead of the United States Consumer Price Index (CPI) data for August, which will be published at 12:30 GMT. The Loonie asset has been offered in the past three trading sessions due to strength in the Canadian Dollar, backed by strong oil prices.

Oil price aims to capture the crucial resistance of $90.00 for the first time since November 22 as the OPEC projected a cheerful oil demand outlook on expectations that economies are learning well about handling the burden of higher interest rates. It is worth noting that Canada is the largest exporter of oil to the United States and higher oil prices support the Canadian Dollar.

Meanwhile, investors keep focusing on the US inflation data. As per the estimates, headline inflation is seen expanding at a healthy pace of 0.6% due to recovered gasoline prices while core CPI is expected to maintain a steady pace of 0.2%. The US Dollar Index (DXY) trades inside Monday are trading range.

USD/CAD auctions in the Rising Channel chart pattern formed on a two-hour scale in which each pullback is considered as a buying opportunity by the market participants. The asset hovers near the lower portion of the aforementioned chart pattern and a breakdown of the same could warrant a bearish reversal.

The 20-period Exponential Moving Average (EMA) continues to act as a barricade for the US Dollar bulls.

Meanwhile, the Relative Strength Index (RSI) (14) oscillates in the bearish range of 20.00-40.00, which indicates bearish bias but a likelihood of a bullish reversal move also persists.

Going forward, a breakdown below August 30 low of 1.3513 would drag the asset toward August 09 high at 1.3454 followed by August 10 low at 1.3373.

On the contrary, a confident recovery move above the round-level resistance of 1.3600 would send the major toward September 05 high at 1.3670. Breach of the latter would further push the asset toward September 07 high around 1.3700.

USD/CAD two-hour chart

-638302039078095793.png)

Cable edged to a three-month low in the low 1.24s. Economists at Scotiabank analyze GBP/USD’s technical outlook.

Three tests of the 1.2440 area do set up a potential triple bottom

The intraday undertone for the GBP is weak.

Price action has been soft over the past week but support in the low 1.24 zone has held successive tests (just ahead of the 200-DMA at 1.2430). The GBP did, however, snap back from early session losses quite well and the three tests of the 1.2440 area over the past week do set up a potential triple bottom (bull trigger at 1.2550).

USD/CAD is seemingly stuck in a tight range in the mid/upper 1.35s. Economists at Scotiabank analyze the pair’s outlook.

Short-term charts suggest some softness in trend momentum

Firmer energy prices are not having any obvious, positive impact on the CAD at the moment but they might add marginally to CAD tailwinds if the USD slips back.

Short-term charts suggest some softness in trend momentum and another, bearish leaning consolidation pattern developing overnight which might cue up further, minor losses in the USD on a push under 1.3550.

Key, short-term support is 1.3500 while resistance is 1.36.

Markets are trading defensively and the USD is firmer ahead of today’s US CPI report. Economists at Scotiabank analyze Greenback’s outlook.

Sticky inflation in the US

Headline prices are expected to rise 0.6% in August month for a 3.6% rise over the year (up from 3.2% in July). But higher gasoline prices are behind the anticipated rise in headline data.

Core prices are expected to show a bit more discipline, rising 0.2% in the month and falling to 4.3% (from 4.7%) in the year. There is still work to do on inflation but a third, consecutive monthly gain of 0.2% would be the lowest run of monthly core price gains since late 2020 and would surely be welcomed by policymakers as a sign that price growth is moderating.

Low core prices might be the focal point for markets rather than the push higher in headline data which policymakers seem likely to look through in terms of immediate policy implications. Some pressure on US yields and the USD may result if consensus expectations are met.

Technically, the broader USD tone is likely to reflect whether the DXY can rise through 105 or push back under 104.50 support after the data.

- The US Dollar is mixed on the quote board, with marginal gains or losses against most important currencies.

- All eyes are on inflation data being published later this Wednesday.

- The US Dollar Index was unable to break the high of Monday on Tuesday's close and could mean issues going forward.

The US Dollar (USD) will be a difficult currency to trade this Wednesday, and not just because of the US inflation numbers. Rather because of the fact that these inflation numbers are for the month of August, while in the past two weeks a lot of elements have changed and might actually see current numbers being obsolete.

Traders will be specifically watching both the Core and headline Consumer Price Index (CPI) on a monthly basis. The Monthly Core is expected to stay steady at 0.2%, whereas the overall inflation index is expected to rise from 0.2% to 0.6%. So it looks like the US Dollar might weaken a bit, as core inflation is declining.

The element that could send the Greenback all over the place is the fact that the energy part of it was in deflation during the last few prints. Recent production cuts from Saudi Arabia and other OPEC+ members have seen oil prices shooting through the roof. The recent rise in prices at the gas pumps could mean that this Wednesday’s number is not a correct reflection of where US inflation is actually at this moment.

Daily digest: US Dollar mayhem

- Ahead of the US inflation numbers, on the other side of the Atlantic Ocean traders have cemented the possibility of one more hike from the ECB for 2023, where just a few days ago hikes were no longer expected.

- The US session will kick off at 11:00 GMT with the Mortgage Bankers Association (MBA) printing its Mortgage Applications for the week of September 8. No consensus is forthcoming, while the previous week was at -2.9%.