- Analytics

- News and Tools

- Market News

Новини ринків

- Gold price remains under pressure near $1,980 after the US inflation report.

- The Federal Reserve (Fed) is widely expected to leave rates unchanged at its December meeting on Wednesday.

- Chinese authorities will focus on industrial policy next year, which disappointed investors seeking a big stimulus to boost growth amid China’s worsening deflation.

- Investors await the US PPI and Fed interest rate decision for fresh impetus.

Gold price (XAU/USD) edges lower to $1,980 during the early Asian session on Wednesday. The yellow metal reversed previous gains after the release of US inflation figures. The report reinforced views that the Federal Reserve (Fed) would need to maintain rates higher for longer to bring inflation to the 2% target.

Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD against a weighted basket of currencies used by US trade partners, hovers around 103.80 after retreating from the 104.30 zone. The Treasury yields edge lower, with the 10-year yield dropping slightly from 4.23% to 4.21%.

On Tuesday, the US inflation, as measured by Consumer Price Index (CPI) rose 0.1% MoM in November, in line with the market expectation. The annual figure grew 3.1% in November from 3.2% in October, as estimated. Additionally, the Core CPI, which excludes volatile food and energy prices, rose by 0.3% MoM and 4.0% YoY, matching the market consensus.

The US inflation remains elevated and market players anticipate that the Fed will need to keep rates higher for longer to contain price increases. However, market players will take cues from the Fed monetary policy meeting and Chair Jerome Powell's comments. The Fed is widely expected to leave rates unchanged on Wednesday, with 80% odds of a rate cut in May, according to the CME FedWatch Tool.

Late Tuesday, the Chinese government emphasized the importance of industrial policy next year. The Chinese authorities will guide financial institutions to increase support for technological innovation, green transformation, inclusive small and micro businesses, and the digital economy. This headline disappointed investors seeking a big stimulus to boost growth amid China’s worsening deflation, liquidity crunch in the property sector, weak trade data, and a slowing recovery after Covid lockdowns.

Market participants will monitor the US Producer Price Index (PPI) ahead of the Fed monetary policy meeting on Wednesday. Traders will take cues from the Fed Chair Jerome Powell’s comments after the meeting. If the Fed officials deliver the hawkish remarks, this could exert some selling pressure on the gold price.

- Bearish harami candle pattern emerges at the USD/JPY daily chart.

- The pair will resume its downtrend below 144.97.

- Buyers would gather momentum if they reclaim the Senkou Span A at around 145.86.

On Tuesday, the USD/JPY registered losses of 0.48% as a bearish harami candlestick chart pattern formed, suggesting the major is headed to extend its losses. At the time of writing, as the Asian session begins, the pair is trading at 145.43, virtually unchanged.

The USD/JPY is neutral to downward based after diving below key support levels, like the Ichimoku Cloud. In addition, the Tenkan and Kijun-Sen levels turned bearish, with the latter sitting above of the former, which is the first support level at around 144.97. if the pair heads toward the latter and breaks that level, the next demand area would be the December 8 low of 142.49, followed by the December 7 at 141.60.

On the upside, the USD/JPY must reclaim the Senkou Span A at 145.86, ahead of the confluence of the Kijun-Sen and the Senkou Span B at 146.75.

USD/JPY Price Analysis – Daily Chart

USD/JPY Technical Levels

- AUD/USD remains on the defensive around 0.6558 ahead of the key event.

- US Consumer Price Index (CPI) for November rose 0.1% MoM and 3.1% YoY, matching expectations.

- Chinese government emphasized the importance of industrial policy next year, which disappointed investors seeking big stimulus to boost growth.

- Traders will closely monitor the US PPI and Fed rate decision.

The AUD/USD pair trades in negative territory for the fourth consecutive day around the mid-0.6500s during the early Asian session on Wednesday. The pair faces a rejection after reaching the 0.6600 mark amid modest US Dollar (USD) strength. The Federal Reserve will announce the interest rate decision on Wednesday, with no change in rates expected. The pair currently trades near 0.6558, down 0.02% on the day.

Data from the US Bureau of Labor Statistics revealed on Tuesday that the US Consumer Price Index (CPI) for November rose 0.1% MoM and 3.1% YoY. Both figures aligned with market consensus. The Core CPI, which excludes volatile food and energy prices, climbed by 0.3% MoM and 4.0% YoY, as expected.

The Federal Reserve (Fed) is expected to hold interest rates steady for the third consecutive time at its December meeting on Wednesday. The market will closely watch Fed signals for the future. Fed Chair Jerome Powell is anticipated to push back against expectations for lower interest rates while acknowledging that some progress against inflation is being achieved.

On the Aussie front, Chinese Communist Party leaders began a closed-door meeting on Monday to discuss economic targets and stimulus measures for 2024 and the meeting ended on Tuesday. According to a readout from China's annual economic work conference, no major fiscal stimulus measures were proposed.

Instead, the Chinese government emphasized the importance of technical innovation and artificial intelligence (AI), which disappointed investors seeking big stimulus to boost growth. This, in turn, weighs on the China-proxy Australian Dollar (AUD) and acts as a headwind for the AUD/USD pair.

Looking ahead, market players will keep an eye on the US Producer Price Index (PPI) due later on Wednesday. The annual PPI figure is expected to ease from 1.3% to 1.0% in November, while the PPI rate ex Food & Energy is estimated to drop from 2.4% to 2.2% in November. Later on Wednesday, the Fed will end the monetary policy meeting. Traders will examine Fed Chair Jerome Powell’s comments after the meeting.

- NZD/USD continues to hold above 0.6100 with limited pullback.

- NZ GDP to be overshadowed by Fed's last meeting of 2023.

- Fed dot plot to be the key highlight for Wednesday.

The NZD/USD continues to cycle in a rough range between 0.6100 and 0.6180 in a sideways grind that has kept the pair strung in place for December trading.

New Zealand's Gross Domestic Product (GDP) for the third quarter is slated to be released in the early Thursday session, but before that can happen the NZD/USD pair is set to run headfirst into Wednesday’s Federal Reserve (Fed) rate call, and broader markets are shifting to turn focus onto the US central bank’s interest rate outlook.

The Federal Reserve will be releasing their updated Dot Plot, the Fed’s own forward-looking Interest Rate Projections, and global markets eager for a ‘sooner rather than later’ path toward Fed rate cuts will be looking keenly at the dot plot to see if the Fed’s rate outlook matches investor expectations. Markets are currently expecting the Fed to be battled back into a rate cut cycle as soon as the end of the first quarter in 2024.

The Fed is broadly expected to hold flat on rates at 5.5% for its last rate call of 2023, but investors will be keeping a close eye on the Fed’s Monetary Policy Statement to sniff out the extent to which the Fed is leaning into either a hawkish or dovish stance.

NZ’s GDP is expected to come in broadly softer, with QoQ GDP growth forecast to decline from 0.9% to 0.2%, and the annualized figure is expected to trim back from 1.8% to 0.5% as the New Zealand economy teeters on the edge of a recession.

NZD/USD Technical Outlook

The Kiwi’s intraday action sees the NZD/USD capped by the 200-hour Simple Moving Average (SMA) near 0.6150, and near-term chart action has been largely constrained into the midrange.

Despite the NZD/USD’s near-term flat trading, the pair remains on the high side of the 200-day SMA, buoyed above the 0.6100 handle and the pair has seen little pullback after getting vaulted from year-long lows near 0.5800 in late October.

The 50-day SMA is accelerating towards bullish territory, pushing into the 0.6000 major handle as bids remain pinned in high ground.

NZD/USD Hourly Chart

NZD/USD Daily Chart

NZD/USD Technical Levels

- EUR/JPY trades down 0.16%, maintaining its downward bias.

- The bearish sentiment persists as price action drops below Ichimoku Cloud, and the Tenkan-Sen crosses below the Kijun-Sen.

- A less probable bullish scenario requires EUR/JPY to rally past a five-month-old resistance trendline at around 157.35/45.

The EUR/JPY is set to finish Tuesday’s session on a lower note, cementing its bearish bias ahead of major central banks' monetary policy decisions, including the European Central Bank (ECB). At the time of writing, the pair is trading at 157.04, down 0.16%.

The daily chart portrays the pair as downward biased due to price action falling below the Ichimoku Cloud and crossing the Tenkan-Sen below the Kijun-Sen. For a bearish resumption to continue, bears need to step and push prices below the December 11 daily low of 155.86. Once cleared, the next support would be the December 8 low of 153.86, ahead of the December 7 swing low of 153.11

On the flip side, and the least probable scenario if EUR/JPY rallies past a five-month-old resistance trendline at around 157.35/45, the first resistance would be the Tenkan-Sen at 157.44. Once cleared, the next stop would be the Senkou Span A at 158.07, followed by the Kijun-Sen at 158.71.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical outlook

According to self-published statistics from StatsNZ, New Zealand's seasonally adjusted Current Account deficit widened by nearly $400 million to $7.4 billion for the third quarter ended in September. Annualized Current Account for the year into September saw a narrowing, however, contracting to an annualized $30.6 billion, or 7.6% of Gross Domestic Product (GDP) compared to the year ended September 2022 of 8.3% of GDP.

According to StatsNZ, the widening of the quarterly Current Account was only partly offset by a $579 million narrowing of the services deficit, compared with the $633 million widening of the goods deficit and an additional $292 million widening of the primary income deficit.

Market Reaction

The NZD/USD is holding steady heading into Wednesday's early Asia market session, trading just above 0.6130.

About Stats NZ's Current Account

The Current Account released by the Statistics New Zealand is a net flow of current transactions, including goods, services, and interest payments into and out of New Zealand. A current account surplus indicates that the flow of capital into New Zealand exceeds the capital reduction. Normally, a high reading is seen as positive (or Bullish) for the NZD, whereas a low reading is seen as negative (or Bearish).

- The NZD/JPY pair is still under strain, losing 0.20% at 89.20 as bulls struggle to maintain momentum.

- Negative signals are seen on the daily chart, with downward-sloping RSI and rising red bars in MACD's histogram.

- Broader bullish control was established above 100 and 200-day SMA.

In Tuesday's session, the NZD/JPY is observed trading at 89.20, reflecting a 0.20% loss. The daily chart indicators suggest a neutral to bearish outlook, with bulls seemingly taking a pause, showing difficulty in gaining traction. Similarly, indicators on the four-hour chart yield a flat outlook, indicating a constant stand-off between buyers and sellers.

Upon observing the indicators on the daily chart, the negative inclination in the Relative Strength Index (RSI) indicates increasing selling momentum, which further entrenches in negative territory. Meanwhile, the Moving Average Convergence Divergence (MACD) is showing an upward trend but with red bars, which also points toward selling pressure. Furthermore, the pair's position concerning the Simple Moving Averages (SMAs) hints at a more favorable position for the bulls. The pair trading beneath the 20-day SMA but above the 100 and 200-day SMAs demonstrates that the buyers still maintain a decisive hand in the long-term trend, albeit they seem to lose some ground in the near-term as evidenced by the trajectory of the 20-day SMA.

Shifting to the four-hour chart, the indicators turned flat. With the RSI neutral and standing in negative territory, it signals a lack of clear directional bias in the near term. In addition, the MACD is showing an upward trajectory with red bars, which aligns with the selling momentum reflected in the daily chart.

Support Levels: 88.70, 88.15 (100-day SMA), 87.70

Resistance Levels: 89.80, 90.00 (20-day SMA), 90.30.

NZD/JPY daily chart

-638380136448643584.png)

- The AUD/JPY is struggling to develop bullish momentum, struggling below 96.00.

- Aussie data continues to pull the rug out from beneath the AUD.

- This week sees a steady smattering of Aussie and Japan data, forecasts remain mixed.

The AUD/JPY couldn’t hold the 96.00 handle on Tuesday, falling back into 94.50 through the day and settling back into the low end. The Australian Dollar (AUD) is one of the worst-performing currencies on Tuesday, falling back against nearly all major currencies on the FX boards for the day.

Early Wednesday brings Japanese Tankan Large Manufacturing Index figures for the fourth quarter, forecast to tick up from 9.0 to 10.0. Tankan Large All Industry Capex for the fourth quarter is forecast to tick down slightly from 13.6% to 12.4%, while the Manufacturing Outlook is expected to shift down from 10.0 to 9.0.

Australian data has been thin this week, though Westpac’s Consumer Confidence for December recovered from -2.6% to 2.7% early Tuesday, providing only minor support for the Aussie (AUD).

Looking further out into the week, Thursday will see Australian employment figures, to be followed up by Judo Bank Purchasing Manager Index (PMI) data early Friday. Aussie Employment Change for November is forecast to shift down from 55K to only 11K, while Friday’s Preliminary Judo Bank Composite PMI for December last came in at a low of 46.2, and further downside could be on the cards as the Australian economy continues to wobble.

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.31% | -0.12% | 0.08% | 0.08% | -0.40% | -0.16% | -0.34% | |

| EUR | 0.31% | 0.18% | 0.40% | 0.38% | -0.11% | 0.14% | -0.04% | |

| GBP | 0.12% | -0.19% | 0.21% | 0.20% | -0.28% | -0.03% | -0.22% | |

| CAD | -0.09% | -0.38% | -0.22% | 0.02% | -0.49% | -0.25% | -0.43% | |

| AUD | -0.08% | -0.39% | -0.22% | 0.02% | -0.50% | -0.24% | -0.44% | |

| JPY | 0.40% | 0.08% | 0.27% | 0.48% | 0.50% | 0.24% | 0.06% | |

| NZD | 0.15% | -0.15% | 0.04% | 0.25% | 0.24% | -0.25% | -0.19% | |

| CHF | 0.33% | 0.04% | 0.22% | 0.44% | 0.44% | -0.07% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/JPY Technical Outlook

The Aussie has steadily shed weight against the Japanese Yen in December, declining from the 98.00 handle to test into 94.00 last week, and seeing only a limited recovery that sees the AUD/JPY still capped off by a bearish 200-hour Simple Moving Average (SMA) near 96.50.

Daily candlesticks have the AUD/JPY down from November’s peaks near 98.50, but medium-term momentum continues to find technical support from the 200-day SMA rising into the 94.00 handle.

Bullish momentum remains limited with bids cycling the 50-day SMA since a bullish cross of the 200-day SMA in June near 92.00.

AUD/JPY Hourly Chart

AUD/JPY Daily Chart

AUD/JPY Technical Levels

Eyes will be on the Federal Reserve and Chair Powell on Wednesday. During the Asian session, New Zealand will report Current Account figures, and the Tankan survey will be released in Japan. More inflation data is due in the US with the Producer Price Index (PPI).

Here is what you need to know on Wednesday, December 13:

The Federal Reserve will end its December meeting on Wednesday. No change in rates is expected, and the guidance is expected to maintain the same bias. Market participants will closely examine the new macroeconomic forecasts and Chair Jerome Powell’s comments, which could influence rate expectations for the next year.

Analysts at TD Securities on FOMC:

The Fed is widely expected to again keep rates steady this week. Powell will have to walk a fine line by recognizing the ground gained towards the normalization of the economy while pushing back on the idea of early rate cuts. We expect the chairman to lean against the Committee's likely dovish guidance at 2pm, with guarded hawkishness in the post-meeting presser.

More inflation data is due in the US with the Producer Price Index (PPI), which is expected to show a month-over-month increase of 0.1% in November and an annual rate of 1%, below the 1.3% recorded in October.

On Tuesday, the US Consumer Price Index (CPI) report aligned with market consensus. The CPI rose 0.1% in November, and the annual rate stood at 3.1%, below the 3.2% recorded in October. The core rate increased by 0.3%, and the annual rate remained at 4%.

Analysts at Commerzbank on US CPI inflation:

The underlying inflationary pressure is thus decreasing, but only gradually. In view of these trends, it is unlikely that the Federal Reserve will raise interest rates again. However, a rate cut is also not realistic until mid-2024.

The US Dollar dropped and then recovered following inflation figures. The US Dollar Index (DXY) experienced a modest drop before the last Fed decision of the year. The DXY faces resistance around the 104.30 zone and continues to trade sideways. Limited price action in the bond market contributes to the overall mixed performance of the US Dollar. The 10-year Treasury yields fell slightly from 4.23% to 4.20%.

EUR/USD rose on Tuesday but failed to hold above 1.0800. The short-term outlook is biased to the upside, although without solid conviction. The European Central Bank (ECB) will announce its decision on monetary policy on Thursday, with no changes in rates expected.

USD/JPY lost ground but trimmed losses after US CPI data, consolidating above 145.50. The Tankan survey is due on Wednesday, with mixed numbers expected.

GBP/USD continues to trade around 1.2550 and the 20-day Simple Moving Average (SMA). The UK will report monthly gross domestic product growth for the three months ending in October and industrial production data. On Thursday, the Bank of England (BoE) will announce its decision on monetary policy.

NZD/USD still holds above key moving averages and remains in the 0.6100 zone. The Food Price Index and Current Account figures for the third quarter are due on Wednesday, and GDP data will be released on Thursday.

Antipodean currencies are expected to benefit from higher equity prices on Wall Street. AUD/USD dropped modestly, reaching levels below 0.6550 after briefly surpassing 0.6600. It continues to move without a clear direction.

Gold spiked to $1,996 after US inflation data but quickly attracted fresh selling pressure, pulling back to the $1,980 zone. The yellow metal is not shining. A less hawkish Fed could trigger a recovery rally.

Crude Oil prices resumed the downtrend after a three-day recovery. WTI lost more than 3.50% and posted the lowest close since June, dropping below $69.00.

Like this article? Help us with some feedback by answering this survey:

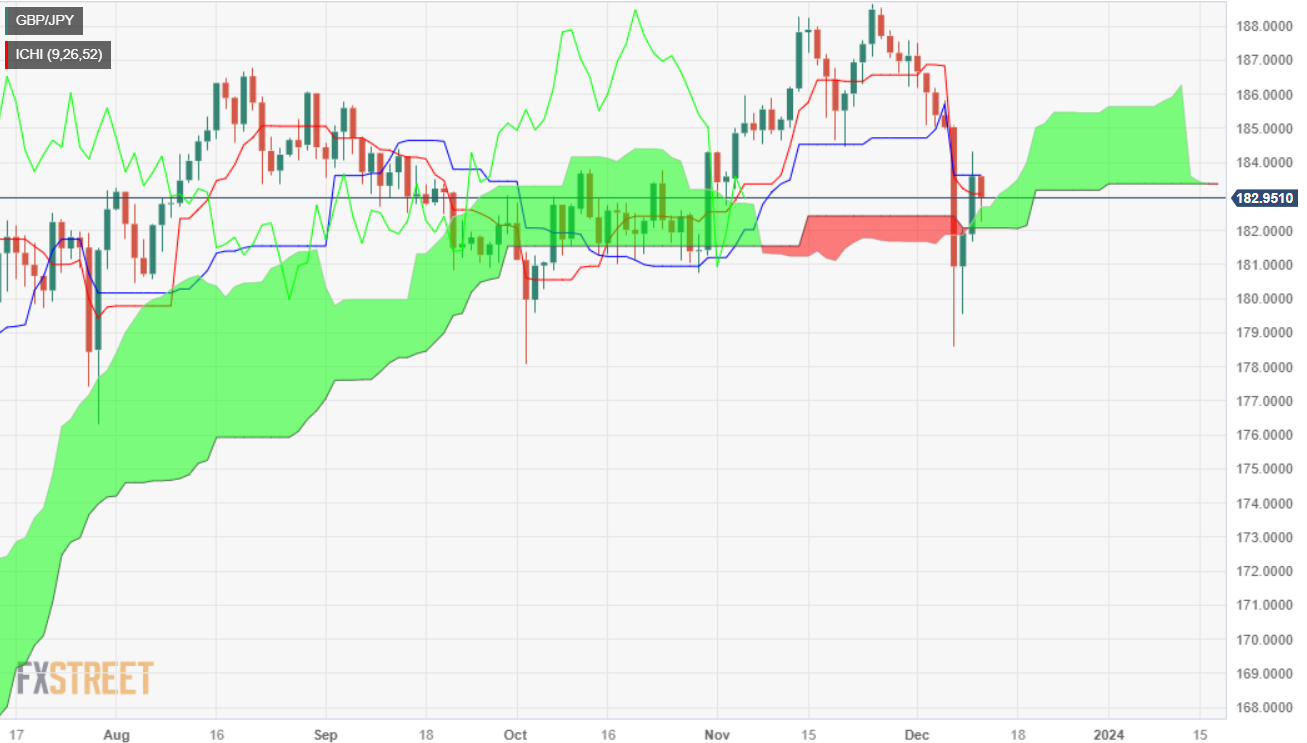

- GBP/JPY was unable to extend its gain, forming a bearish harami candlestick pattern.

- Despite being neutral, a drop inside the Kumo, and the pair could resume its downtrend.

- Buyers reclaiming a three-month-old resistance trendline could open the door to test YTD high.

Price action in the GBP/JPY remains constrained ahead of the Bank of England’s (BoE) monetary policy decision on Thursday. Although the pair has broken above the Ichimoku Cloud (Kumo), downside risks remain. At the time of writing, the cross-pair is trading at 182.94, down 0.28%.

The daily chart portrays the cross pair as neutral biased, despite breaching the Kumo. For a bullish resumption, buyers must lift the exchange rates above 185.00, breaking a three-month-old resistance trendline that passes at around that level. Once cleared, that would open the path towards the year-to-date (YTD) high at 188.80.

On the other hand, if sellers stepped in and dragged prices inside the Kumo, the pair could resume its downtrend. Key support level lies at 181.99, the bottom of the Kumo, followed by the December 11 low of 181.60. Once it drops below that level, the 180.00 mark would be up for grabs.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels

- The USD/NOK advances modestly, showcasing 0.20% gains, gravitating around the 10.975 level.

- Markets are betting on sooner rate cuts by the Fed in May after November CPI.

- US bond yields dropped across the board.

During Tuesday's trading session, USD/NOK experienced gains, currently trading around the 10.975 level. Despite the pair holding strong, its upside potential may be limited as the markets are seeing sooner rather than later rate cuts by the Federal Reserve (Fed) after the release of inflation figures from the US.

November in the US saw predicted inflationary dips, as shown by the Consumer Price Index (CPI), which only rose a slight 0.1% monthly. Year-on-year inflation dropped marginally to 3.1% from 3.2% in October, with the core inflation figure, excluding volatile components, steady at 4% annually.

For Wednesday's Fed meeting, markets anticipate the bank will maintain the rates at 5.5%, but attention is set to economic and rate predictions to determine when the easing cycle will start. In the meantime, the bank authorities continued to stress that their decisions hinge on data, pointing out that they require more proof of an economic slowdown before rate cuts begin. For November and October, inflation decelerated while the labor market has yet to show signs of cooling down, which may be the only factor that makes the Fed not call a victory on inflation.

Ahead of the decision, the US Treasury yields are declining. The 2-year rate is currently at 4.71%, while the 5 and 10-year yields stand at 4.25% and 4.23%, respectively. This decrease in yields could add pressure on the USD and limit the upside for the USD/NOK.

USD/NOK levels to watch

The daily chart suggests that the pair has a bullish resonance with the Relative Strength Index (RSI), showing positive dynamics in the chart. The positive slope and positive territory of the indicator are indicative of a strong buying momentum, overpowering its selling counterpart. In addition, the Moving Average Convergence Divergence (MACD) corroborates this bullish indication as it prints rising green bars, signaling the buyers are getting the better of the sellers.

Exhibiting similar progression, the pair stands tall above the 20,100,200-day Simple Moving Averages (SMAs), which insinuates that bulls are firmly in command of the broader time horizon.

Support Levels: 10.900, 10.870, 10.800 (20-day SMA).

Resistance Levels: 11.015, 11.075, 11.105.

USD/NOK daily chart

-638380066427723505.png)

The US government recorded a $314 billion budget deficit in November, larger than the $301 expected. The Treasury Department informed that receipts totalled $275 billion and outlays $589 billion. It compares to a deficit of $248 billion during the same month of last year.

- Gold price hits a daily high of $1996.73 but loses momentum in the aftermath of a mixed US inflation report.

- US Bureau of Labor Statistics (BLS) reveals disinflation in the US, with annual and monthly readings posting mixed results.

- Traders await the Federal Reserve’s decision, with money market futures expecting the Fed to hold rates, eyeing 100 basis points of rate cuts for 2024.

Gold price lost its bright after hitting a daily high of $1996.73, though it dropped in the aftermath of a softish inflation report in the United States (US), ahead of the upcoming Federal Reserve (Fed) monetary policy decision. The XAU/USD exchanges hands at $1979,40, down 0.11%

The yellow metal losses momentum ahead of the upcoming Fed’s decision

The US Bureau of Labor Statistics (BLS revealed the disinflation process in the US continues, as headline inflation was 3.1% YoY, below October’s 3.2%, but underlying inflation remains stickier at 4% in the twelve months to November. Monthly readings were mixed, with CPI standing at 0.1%, exceeding forecast by 0%, while core CPI was 0.3% as expected but higher than in October.

The data release underpinned Gold’s towards its daily high, though pared its gains, slumping below the $1985 mark, weighed by a recovery of US Treasury bond yields. Even though the Greenback (USD) remains soft as depicted by the US Dollar Index (DXY), down 0.23% at 103.85, the yellow metal remains unable to recover from its late losses.

Meanwhile, traders brace for the Federal Reserve’s decision on Wednesday, followed by Chairman Jerome Powell’s press conference. Despite inflation’s positive reading, money market futures had priced in 100 basis points of rate cuts for 2024 and remain cautious. Earlier in that day, the BLS would announce prices paid by producers.

XAU/USD Price Analysis: Technical outlook

Gold’s daily chart depicts the yellow metal is neutral to upward biased as long as it stays above the daily moving averages (DMAs). Nevertheless, as XAU/USD continues to drop, that would put into play the 50-DMA at $1966.41, followed by the 200-DMA at $1952.74. Further support lies at the 100-DMA at $1941.07. Once those levels are cleared, the XAU/USD would shift downwards. On the other hand, a bullish resumption looms, but bulls need to lift the spot price above the October 27 high at $2009.42.

- EUR/USD is up on the day, but paring back gains firmly into familiar levels.

- Near-term momentum is getting hamstrung by major levels.

- Markets are gearing up for the Fed's last showing of 2023.

EUR/USD climbed in early Tuesday trading before slipping back below 1.0800, driven back after US Consumer Price Index (CPI) inflation came in as markets forecast, showing an ongoing gradual easing of price growth in the US.

The Eurozone ZEW Economic Sentiment survey for December came in well above expectations, printing at 23.0 versus the forecast 12.0, vaulting easily over the November print of 13.8.

The Euro (EUR) rose through Tuesday’s early market sessions, tipping the EUR/USD into an intraday high of 1.0828 before getting dragged back down below 1.0800 after US CPI inflation came in as expected.

Read More: Forecasts from 10 major banks, crushing rate cut prospects

Headline US CPI inflation for November printed at 0.1% compared to October’s 0.0%, and annualized headline CPI price growth ticked down slightly from 3.2% to 3.1%.

Core CPI inflation came in at 4% for the year into November, and inflation appears to have been capped off in the US, but inflation continues to ebb slower than most market participants were hoping for.

Global markets wil be turning attention to Wednesday’s Federal Reserve (Fed) rate call. With the US central bank broadly expected to hold rates steady at 5.5%, investors will be paying significant attention to the Fed’s Monetary Policy Statement, as well as updates to the Fed’s Interest Rate Projections, or Dot Plot.

After the mid-week Fed hump will be the European Central Bank (ECB) on Thursday, which will also be delivering its last rate call of 2023 before heading into the new year.

EUR/USD Technical Outlook

The EUR/USD remains trapped under the 200-hour Simple Moving Average (SMA) near 1.0820, getting rejected from the intraday significance level to trade on the south side of 1.0800 once again.

The pair has remained in a near-term bearish stance since shedding 1.1000 at the tail end of November, and a bullish rebound has yet to firmly materialize.

Daily candlesticks have the EUR/USD stuck in a congestion zone between the 200-day and 50-day SMAs, at 1.0825 and 1.0716 respectively. Firm technical support rests at the 1.0-700 handle just below current price action.

EUR/USD Daily Chart

EUR/USD Technical Levels

- The DXY Index is trading with losses below the 104.00 mark.

- US November showed no surprises and confirmed a deceleration.

- Investors await Fed Interest Rate Decision due this Wednesday.

The US Dollar (USD) is currently undergoing a slight retreat as the DXY index trades at 103.95 after the release of November’s Consumer Price Index (CPI) figures from the US, which fueled dovish bets on the Federal Reserve.

Against a backdrop of cooling inflation and despite a strong labor market, the Fed appears susceptible to veering toward a more dovish stance. In that sense, Fed officials are not ruling out further policy tightening, so markets will closely monitor the bank’s stance at the upcoming meeting on Wednesday.

Daily Market Movers: US dollar dips after CPI data, markets see rate cuts in May 2024

- The US Dollar trades lower as investors assess the impact of US CPI data and dovish expectations from the Federal Reserve.

- In November, the US saw a predicted easing in inflation, according to the CPI. The CPI recorded a modest rise of 0.1% for the month. Compared to October's 3.2%, the annual inflation rate slightly decreased to 3.1%.

- Core CPI reported by the US Bureau of Labor Statistics remained unchanged at 4% YoY, matching both the previous and expected figures.

- Meanwhile, US bond yields are down with 2-year, 5-year and 10-year yields at 4.71%, 4.23%, and 4.22%, respectively.

- According to the CME FedWatch Tool, a rate hike is not expected in Wednesday’s meeting, with the market betting on rate cuts likely to happen in May 2024.

Technical Analysis: DXY bulls hold resilient, indicators still weak

The indicators on the daily chart reflect a bit of a mixed picture for the pair. The Relative Strength Index (RSI) is in negative territory with a negative slope, indicating diminishing buying momentum. This is reaffirmed by the status of the Moving Average Convergence Divergence (MACD) indicator, which is registering decreasing green bars.

Bucking short-term cues, the Simple Moving Averages (SMAs) showcase a broader bullish trend. The pair remains above the 20-day SMA and crucially above the 200-day SMA, highlighting that bulls have the upper hand in a wider time frame despite temporary bearish leanings.

However, the pair's position below the 100-day SMA suggests a note of caution and potentially a near-term consolidation or pullback phase. The ongoing action on the charts can be seen as bears taking a breather, while bulls remain resilient.

Support levels: 103.70 (20-day SMA), 103.50, 103.30.

Resistance levels: 104.50 (100-day SMA), 104.50, 104.70.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Silver extended its losses to seven consecutive days and stayed below $23.00.

- If XAG/USD drops below $22.70, further downside is seen below $22.00.

- Bulls reclaiming $23.00 could pave the way for a recovery.

Silver price erased earlier gains and turned negative, down 0.30% following a softer US inflation report, which initially bolstered XAG/USD prices. Nevertheless, as US Treasury bond yields pared its losses, the grey metal lost its shine. The XAG/USD is trading at $22.74, retesting a two-month-old support trendline.

Silver remains neutral to downward bias, at the brisk of accelerating its downtrend if sellers push prices below the above-mentioned trendline. Once done, the next demand area would be the November 13 swing low of $21.88, followed by the October 6 daily low of $20.69.

On the other hand, if XAG/USD stays above that trendline and reclaims the $23.00 figure, the first technical barrier would be the 50-day moving average (DMA) at $23.12. Additional key resistance levels lie ahead, like the 100-DMA at $23.20, followed by the 200-DMA at $23.51. Once surpassed, the $24.00 figure would be up for grabs.

XAG/USD Price Analysis – Daily Chart

XAG/USD Technical Levels

- EUR/GBP sees Tuesday gains for a fresh test of 0.8600.

- UK earnings miss the mark, EU sentiment improves sharply.

- The pair remains deeply bearish, with the momentum bias leaning bullish.

The EUR/GBP legged back into the 0.8600 handle on Tuesday, bolstered by a miss in UK Average Earnings and a better-than-expected print in the Eurozone’s ZEW Economic Sentiment Survey.

The UK’s Average Earnings, both including and excluding bonuses, missed market estimates on Tuesday, printing below expectations and softening the Pound Sterling (GBP) against the Euro (EUR).

UK Average Earnings Excluding Bonuses for the quarter ended in October showed earnings climbed 7.3% compared to the same time last year, coming in below market forecasts of 7.4% and slipping back from the previous period’s 7.8% (revised up slightly from 7.7%, further widening the gap).

UK Average Earnings Including Bonuses similarly declined, printing at 7.2% versus the forecast 7.7% and reversing direction on the previous period’s 8%, which was similarly revised upwards from 7.9%.

UK Claimant Count Change in November beat market expectations, but still printed worse than the previous month, showing 16K additional jobless benefits seekers versus the forecast 20.3K; October had 8.9K new claimants, which was revised sharply lower from 17.8K.

The Eurozone’s ZEW Economic Sentiment Survey beat expectations to print at a firm 23.0, handily climbing over the forecast 12.0 and vaulting above the previous month’s 13.8.

Market focus to shift to BoE, ECB double feature

Wednesday will take a slight breather with mid-tier Industrial Production from both the UK and the EU before Thursday’s double-header showing from both the Bank of England (BoE) and the European Central Bank (ECB).

Both central banks are broadly expected to hold steady on rates, and investors will be taking a close look at both banks’ policy statements to try and draw a bead on just how hawkish or dovish a stance the BoE and ECB are taking heading into the new year.

EUR/GBP Technical Outlook

The Pound Sterling’s (GBP) early slump on Tuesday sees the Euro (EUR) catching a bid and sending the EUR/GBP back into the 0.8600 handle. Price action is drawing tight once more and the pair is struggling to maintain a hold on the key level, but intraday bids are catching technical support from the 200-hour Simple Moving Average (SMA) near 0.8580.

Despite Tuesday’s bullish bump, the EUR/GBP remains steeply bearish, weighed down near multi-month lows with price action trading well below the 200-day SMA drifting into the 0.8660 level.

0.8560 is hardening into a firm price floor keeping bearish momentum constrained for the time being, while bullish plays will see a hard barrier near 0.8620.

EUR/GBP Hourly Chart

EUR/GBP Daily Chart

EUR/GBP Technical Levels

- The Canadian Dollar sheds weight on Tuesday, walks back the early week’s gains.

- Economic data from Canada remains absent on the calendar.

- Crude Oil is plunging as markets reassess slowing global growth causing demand declines to outpace production cuts.

The Canadian Dollar (CAD) fell back on Tuesday as markets shuffled their stance following US Consumer Price Index (CPI) inflation figures that exactly met market expectations, pointing to dwindling growth looking forward.

Canada sees little to no meaningful data on the economic calendar this week, leaving the CAD to get dragged around the charts by the broader market. Crude Oil markets are seeing broad declines on declining demand concerns, further pressuring the Loonie.

Daily Digest Market Movers: US CPI meets the street to print at expectations, price growth slowly cools

- The Canadian Dollar sees losses across the board on Tuesday, with slight to moderate declines against all of the CAD’s major currency peers.

- The CAD’s weakest performance sees it down six-tenths of a percent against the Japanese Yen (JPY), and half a percent against the Swiss Franc (CHF).

- The Loonie’s ‘strongest’ performance is against the Australian Dollar (AUD), down around a sixth of a percent against the Antipodean, with a close second going to a fifth of a percent decline against the post-CPI US Dollar (USD).

- US Consumer Price Index (CPI) inflation met the street exactly at expectations across the board, with headline annualized CPI inflation ticking down from 3.2% to 3.1%, and the MoM figure ticking up slightly from a flat 0.0% to 0.1%.

- Core CPI inflation (headline inflation less volatile food and energy prices) held steady at 4% for the YoY figure, with November’s MoM Core CPI printing slightly higher at 0.3% versus October’s 0.2%.

- Crude Oil markets are taking a leg down in the face of declining price growth from the US, adding further weight to ongoing energy market concerns about declining fossil demand eclipsing global production cuts, specifically from the Organization of the Petroleum Exporting Countries (OPEC).

- US West Texas Intermediate (WTI) Crude Oil slips back to $69.00 per barrel.

- The Canadian Dollar is getting dragged down in lockstep with deflating Crude Oil bids.

- Next up for markets will be the Federal Reserve’s (Fed) Monetary Policy Statement and updates to its Interest Rate Projections, both due on Wednesday at 19:00 GMT and to be followed up by a Press Conference at 19:30 GMT.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.23% | 0.01% | 0.21% | 0.06% | -0.34% | -0.11% | -0.28% | |

| EUR | 0.23% | 0.23% | 0.46% | 0.29% | -0.14% | 0.11% | -0.06% | |

| GBP | -0.01% | -0.24% | 0.22% | 0.05% | -0.36% | -0.11% | -0.30% | |

| CAD | -0.22% | -0.44% | -0.21% | -0.14% | -0.58% | -0.34% | -0.50% | |

| AUD | -0.06% | -0.29% | -0.06% | 0.17% | -0.43% | -0.18% | -0.36% | |

| JPY | 0.34% | 0.12% | 0.36% | 0.57% | 0.43% | 0.25% | 0.07% | |

| NZD | 0.10% | -0.12% | 0.11% | 0.33% | 0.17% | -0.25% | -0.18% | |

| CHF | 0.27% | 0.06% | 0.29% | 0.51% | 0.36% | -0.08% | 0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar trips over slumping Crude Oil, follows WTI down and sends the USD/CAD back over 1.3600

The Canadian Dollar (CAD) looks for the basement on Tuesday, backsliding across the board and shedding weight against all of its major currency peers.

The USD/CAD has regained the 1.3600 handle after catching a topside break of consolidation between the 50-hour and 200-hour Simple Moving Averages (SMA) in the 1.3580 to 1.3560 zone.

The USD/CAD is toying with last week’s highs near 1.3620 after rebounding from familiar near-term lows at 1.3550. The pair is at risk of hardening into a sideways consolidation range, but the US Dollar (USD) is setup for further breakouts following central bank action on Wednesday.

The USD/CAD continues to hold chart territory north of the 200-day SMA just above the 1.3500 handle, keeping bid above the major moving average, but immediate topside momentum remains constrained by the 50-day SMA near 1.3700.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- GBP/USD trading at 1.2556, experiencing minimal change amid a volatile session with a 90+ pip range.

- US Bureau of Labor Statistics (BLS) reports declining inflation in the US, with headline dipping, while core remains stickier at 4% YoY.

- The UK jobs market eases, after adding fewer employees than expected, while wages cooled down.

The GBP/USD is virtually unchanged amid a volatile session that witnessed the pair traveling at around 90 plus pip range, directionless after a report of inflation in the United States (US). Initially boosted the Pound Sterling (GBP), but in the end, the Greenback (USD) was bolstered. The pair is trading at 1.2556, almost flat.

GBP/USD is almost at around Tuesday’s open, as traders await central banks decisions

The major is trading within familiar ranges after the US Bureau of Labor Statistics (BLS) announced inflation is declining, even though monthly figures were slightly up in headline and core inflation. The Consumer Price Index (CPI) in November was 3.1% YoY but rose 0.1%, exceeding forecasts of 0%. The so-called core CPI met estimates of 4% YoY and monthly readings of 0.3%, up from October’s.

Earlier in the UK London session, the Office for National Statistics (ONS) revealed the jobs market is easing, with 50K new employees added to the workforce, though wages were lower than the 7.7% estimates, came at 7.2%.

Meanwhile, the US Dollar Index (DXY) resumed its downtrend after pairing earlier losses sustained on the US inflation report. The DXY is down 0.20%, at 103.88, while US Treasury bond yields remain flat.

In the meantime, the Federal Reserve would begin its two-day monetary policy meeting that would end tomorrow, with the statement release and the Chairman Jerome Powell press conference. Most market participants expect the Chair to push back against monetary policy easing.

On Thursday, it would be the turn of the Bank of England (BoE), with Governor Andrew Bailey and Co., estimated to deliver a hawkish hold and to keep rates unchanged.

Given the backdrop, the GBP/USD is expected to remain within familiar levels. Unexpected surprises would increase volatility in the pair, with only three weeks left to finish the year.

GBP/USD Price Analysis: Technical outlook

The daily chat portrays the pair is forming a doji, meaning that indecision lies amongst traders. Upside risks would emerge above today’s high of 1.2615, which could pave the way for testing 1.2700. Otherwise, if prices slump below 1.2518, could pave the way to test the 200-day moving average (DMA) at 1.2491.

- The Swiss Franc is gaining as traders position themselves ahead of major central bank meetings this week.

- Swiss Franc is gaining despite a relaxed market mood and predictable data.

- The Federal Reserve, European Central Bank and Bank of England are all scheduled to make announcements after their meetings this week.

The Swiss Franc (CHF) trades higher against most counterparts on Tuesday as individual factors come into play in each pairing.The US Dollar is down amidst an improvement in risk appetite, with the S&P 500 – a favored barometer of risk – up over 0.4% and long-duration Treasury yields mainly down. The Pound Sterling edges lower after data shows UK wage inflation slowing in October.

US Consumer Price Index (CPI) data shows little change in November and comes out exactly in line with estimates, according to data released on Tuesday. This is likely to have little impact on the expected outcome of the Federal Reserve (Fed) policy announcement on Wednesday.

Daily digest market movers: Swiss Franc gains against weakening Dollar

- The Swiss Franc rises versus the US Dollar (USD) after US CPI data for November, released by the US Bureau of Labor Statistics, shows inflation in line with economists’ expectations.

- Headline CPI rises by 3.1% YoY, slightly below the previous 3.2% result but as estimated. MoM, CPI rises at the 0.1% forecast from 0.0% in October.

- The Consumer Price Index Ex Food and Energy, or core inflation reading, rises 4.0% YoY as expected and the same as previously. MoM core inflation rises 0.3% as forecast, from 0.2% previously.

- The data is likely to make little material change to expectations regarding the outcome of the US Federal Reserve (Fed) policy meeting on Wednesday, December 13, at 19:00 GMT. Current expectations are for the Fed to leave rates unchanged.

Swiss Franc technical analysis: USD/CHF pulls back to 0.618 Fibonacci level

USD/CHF – the number of Swiss Francs that one US Dollar can buy – pulls back after a string of positive days during December’s recovery.

The pair is probably in a short-term uptrend, and the pullback is likely just a correction on the back of profit-taking ahead of the Fed meeting on Wednesday rather than the start of a reversal.

The correction found support at the 0.618 Fibonacci retracement of the recovery from the December 4 lows, finding demand and bouncing back again.

-638379945139240641.png)

US Dollar vs Swiss Franc: 4-hour Chart

More gains are likely in the short-term. The 0.8825 target, which offers soft resistance, is likely to be met once bulls take over again. If surpassed, prices could rise to the confluence of major moving averages residing at 0.8900, where tougher resistance is expected.

The pair completed a Measured Move price pattern at the December 4 lows and has since bounced. Measured moves are three wave patterns that look like zig-zags, with the first and third waves roughly of equal length. The third wave – C – likely ended at the December 4 lows.

A break below the 0.8667 December lows would negate the recovery and see bears back in charge, with likely losses to the 0.8552 July low.

Daily digest market movers: Swiss Franc gains against Euro as Eurozone economic outlook remains flat

- The Swiss Franc strengthens against the Euro on Tuesday.

- Data out on Tuesday was generally favorable, showing a rise in ZEW survey data, with the Eurozone ZEW Economic Sentiment index rising to 23 in December from 13.8 previously, when a fall to 12 had been forecast.

- German ZEW data was overall positive, with both the Current Situation and Economic Sentiment gauges rising.

- Euro traders are now waiting for the European Central Bank (ECB) meeting on Thursday for clarity on the future trajectory of interest rates.

- Recent lower-than-expected Eurozone inflation data suggests a risk the European Central Bank will cut interest rates, with negative implications for the Single Currency.

- The next main event for the Euro is the European Central Bank policy meeting on Thursday, December 14.

- Lower interest rates, or their expectation, tend to weaken a currency as they reduce capital inflows.

Swiss Franc technical analysis: EUR/CHF flips lower after run-up

EUR/CHF – the number of Swiss Francs that one Euro can buy – trades lower on Tuesday, although the lack of downside momentum suggests the current backslide is probably just a correction of the December rebound rather than a reversal.

The pair has shown weakness over the last 24 hours and corrected back down to the 0.618 Fibonacci retracement level of the rally, which began at the December 7 low. The current weakness could just be reflective of positioning ahead of the ECB rate meeting on Thursday, with another bullish move possibly following.

-638379946055786188.png)

Euro vs Swiss Franc: 4-hour Chart

The pair has probably reversed trend in the short-term, suggesting bulls may still have the upper hand temporarily. A break above the 0.9487 December 11 high would reconfirm the short-term uptrend and lead to potential gains to around 0.9540, where a confluence of resistance levels sits.

The medium and long-term trend, however, are still bearish, suggesting caution is required as a risk of recapitulation remains.

A break below the 0.9403 low would reconfirm the bearish bias and see prices fall into uncharted territory, with major whole numbers then expected to provide support at 0.9300, 0.9200, and so on.

Daily digest market movers: Sterling falls against Swiss Franc after UK wage data moderates

- The Swiss Franc weakens against the Pound Sterling (GBP) on Monday as upbeat market sentiment supports riskier currencies like the Pound Sterling over safe-havens such as the Swiss Franc.

- UK employment data, released by the Office of National Statistics (ONS) on Tuesday, came out more or less as economists had expected, except that it revealed a slowdown in wage inflation.

- The Unemployment Rate stood unchanged at 4.2% in October, with 50K new positions filled during the month, slightly down from the 54K in September.

- The Claimant Count Rate, measuring the percentage of the working age population claiming benefits, stayed unchanged at 4%, and rose 16K in October, versus the 20.3K forecast and higher than the 8.9K of September.

- Average Earnings Excluding Bonuses slowed slightly to 7.3% from 7.8% in the previous month, and was lower than the 7.4% forecast.

- Average Earnings Including Bonuses slowed slightly to 7.4% from 8.0% in the previous month, and was lower than the 7.7% forecast.

- The slowdown in wage inflation is likely to lower bets for interest rates remaining high.

- Pound Sterling traders await the Bank of England (BoE) meeting on Thursday for insight on the future course of interest rates in the UK.

- Higher interest rates, or their expectation, are generally positive for a currency as they attract greater inflows of foreign capital. The opposite is true of lower interest rates.

Swiss Franc technical analysis: GBP/CHF returns to the bottom of its autumn range

GBP/CHF – the number of Swiss Francs that one Pound Sterling can buy – is trading within a range on both a short and long-term timeframe. The medium-term trend, meanwhile, could be classified as marginally bullish.

On the 4-hour chart used to analyze the short-term trend, the pair has reversed back down after bouncing higher. It is now back at the late 1.09 lows of the range-corridor.

-638379948019949027.png)

Pound Sterling vs Swiss Franc: 4-hour Chart

The MACD has recently crossed below its signal line whilst above the zero line. This is a bearish signal and could signify more losses to come, although it lacks reliability because it occurred close to the zero-line.

If today’s 1.0979 lows hold, the pair could recover and start rising back up within the range. A decisive break cleanly below the lows, however, could indicate a breakdown from the entire month-long range. Such a breakdown would be expected to rapidly fall toward a minimum target at 1.0889, the 161.8% extension of the height of the range extrapolated lower.

From a bullish perspective, a recovery and break above the 1.1040 level would provide bullish confirmatory evidence a new leg higher was underway, toward a target at 1.1155 and the range high.

Swiss Franc FAQs

What key factors drive the Swiss Franc?

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

Why is the Swiss Franc considered a safe-haven currency?

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

How do decisions of the Swiss National Bank impact the Swiss Franc?

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

How does economic data influence the value of the Swiss Franc?

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

How does the Eurozone monetary policy affect the Swiss Franc?

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

- The USD/JPY navigates around the 145.55 level with 0.40% losses.

- US CPI recorded 3.1% in November, while the Core measure stood at 4%, matching expectations.

- US bond yields are falling ahead of Wednesday’s Fed decision.

In Tuesday's session, the USD/JPY pair is facing a downward shift, now trading at the 145.55 level. This movement comes as market participants digest the implications of the US Consumer Price Index (CPI) data which confirmed another monthly deceleration.

In that sense, inflation in the United States, as indicated by the Consumer Price Index (CPI), decreased as expected in November. The CPI experienced a monthly increase of 0.1%, and the yearly inflation rate reduced from 3.2% in October to 3.1% in November. Meanwhile, the core annual inflation rate, which excludes volatile items, remained unchanged at 4%. These figures reveal decelerating inflationary pressures in the US economy, which could influence future Federal Reserve (Fed) monetary decisions.

That being said, the Fed will make its interest rate decision in Wednesday’s session. The US Dollar seems to stand weak as lower inflation makes markets bet on a less aggressive approach from the bank for the next decision. The consensus is that the Fed will leave rates steady at 5.5%, but the focus will be on the economic and interest rate projections to look for hints on when the bank will start its easing cycle. It is worth noticing that the bank officials have recently stated that they remain data-dependent and hinted that they need to see more evidence of the economy cooling down to start cutting rates.

In the meantime, US bond yields are declining. The 2-year rate stands at 4.72%, and with the 5-year rate at 4.22%. The 10-year yield holds a similar rate of 4.23%.

USD/JPY levels to watch

The daily chart indicators are reflecting a shift towards a neutral to bullish bias for the pair. With the Relative Strength Index (RSI) on a flat slope yet still in negative territory, it points to the declining strength of buying momentum.The Moving Average Convergence Divergence (MACD), which prints flat green bars, provides further substantiation to a stagnated bullish momentum.

However, it's worth considering that the pair's position relative to its Simple Moving Averages (SMAs) paints a more nuanced picture. The pair is trading above the 200-day SMA but remains under the 100 and 20-day SMAs. This indicates that despite recent selling momentum, the long-term trend remains largely in the favor of buyers.

Support Levels: 145.00, 144.50, 144.00.

Resistance Levels: 145.70, 146.00, 146.50.

USD/JPY daily chart

-638379942790745180.png)

- Mexican Peso is at risk of extending its losses past the 100-day SMA.

- Mexico’s Industrial Production crushed the forecast, ahead of Banxico’s decision on Thursday.

- The Fed is expected to hold rates unchanged, but uncertainty looms about Powell’s speech.

Mexican Peso (MXN) is down against the US Dollar (USD) following an inflation report in the United States (US), which most likely would prevent the US Federal Reserve (Fed) from easing monetary policy faster than the expectations of market participants. The USD/MXN is trading at 17.40, gaining 0.14%, at the time of writing.

Mexico´s calendar revealed that Industrial Production in October exceeded September’s data, suggesting the economy remained robust at the beginning of Q4 2023. Across the border, the US Bureau of Labor Statistics (BLS) announced that the disinflation process continued as traders brace for the Fed’s decision on Wednesday.

The Fed is not only expected to reveal its monetary policy decision but also the Summary of Economic Projections (SEP) after its meeting on Wednesday. On the day after, the Bank of Mexico (Banxico) is set to announce its own policy decision. Both central banks are expected to hold rates unchanged – at 5.25% - 5.50% in the case of the Fed, and 11.25% for Banxico.

Daily digest movers: Mexican Peso on the defensive ahead of central bank meetings

- Industrial Production in Mexico was 5.5% in the twelve months ending in October, above September’s 3.9%. Monthly figures advanced 0.6% vs. 0.2% in the previous month.

- Mexico’s inflation data was mixed, though the disinflation process continued, as Banxico had estimated. Two officials, Governor Victoria Rodriguez Ceja and Deputy Governor Jonathan Heath, expressed that rate-cut discussions could begin in the first quarter of 2024.

- The US Consumer Price Index (CPI) for November was aligned with estimates of 3.1% YoY, lower than October’s 3.2%, with monthly readings rising 0.1%, above forecasts of 0%.

- The CPI excluding food and energy, the so-called core, stood pat at 4%, and month-over-month, at 0.3%, which aligned with forecasts, and was a tick higher than October’s 0.2%.

- Now that inflation data is out of the way and given the strengthening revealed in the US labor market by recent data, expectations of the Fed’s interest rate expectations for the next year remain volatile. Data from the Chicago Board of Trade (CBOT) has traders expecting 100 bps of rate cuts.

- On Wednesday, USD/MXN traders will scrutinize the Fed’s statement, its Summary of Economic Projections (SEP), and Chair Jerome Powell's speech. Powell is expected to push back against market speculation of monetary policy easing for next year.

- The US Dollar Index (DXY) pared some of its losses, with the DXY down 0.07% at 104.01.

Technical analysis: Mexican Peso remains soft as USD/MXN climbs towards 17.40

The USD/MXN daily chart portrays the pair as neutral to upward biased, with buyers battling at the 100-day Simple Moving Average (SMA), seen as a resistance level at 17.40. If they want to regain control, a breach of the latter is needed, followed by the 17.50 mark. Upside risks will surface at the 200-day SMA at 17.54, followed by the 50-day SMA at 17.65

On the other hand, failure to reclaim the 100-day SMA, could see sellers pile in and drag prices toward the 17.20 area, ahead of a strong demand region at around the 17.00/05 range. Once hurdled, the USD/MXN could test the year-to-date (YTD) low of 16.62.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

United States Treasury Secretary Janet Yellen said on Tuesday that she sees no reason why inflation should not come down to the Federal Reserve’s target. Shed added that there is no reason to believe that the last mile will be especially difficult.

Speaking at The Wall Street Journal’s CEO Council Summit, Yellen mentioned that the labor market remains strong but warned it is cooling. According to her, wage increases continue at a healthy pace. She added that it is no necessary to have high unemployment to lower inflation.

Regarding the Fed’s policy, the Treasury Secretary explained that rising real rates may impact the decisions of the central bank.

Market reaction

The US Dollar Index is falling modestly on Tuesday but is off lows. It recovered ground following US inflation data and is hovering around 104.00.

- US CPI inflation in line with expectation, US Dollar drops then recovers sharply.

- US Dollar Index holds in negative territory for the day.

- The AUD/USD pair faces resistance at 0.6630 and has a key support at 0.6550.

The AUD/USD spiked to 0.6612 following the release of the US inflation data, but it then fell to its daily low near 0.6550. The pair is now hovering around 0.6570 as markets digest the data ahead of Wednesday's FOMC decision.

USD down then up, after US CPI data

Inflation in the US cooled as anticipated in November, as measured by the Consumer Price Index (CPI). The CPI rose 0.1% during the month, and the annual rate slowed from 3.2% in October to 3.1% in November. The core annual reading remained steady at 4%.

The US Dollar initially hit fresh daily lows with this news, but then rebounded sharply. The DXY is currently down 0.30% for the day, trading around 103.80. Market participants continue to digest the CPI figures. On Wednesday, the Producer Price Index (PPI) is due to be released, and later, the Federal Reserve will announce its decision on monetary policy and provide new economic projections.

The AUD/USD is trading near Monday's close, around 0.6570, after finding support above Asian session lows and the 0.6555 area. The pair continues to move sideways, limited on the upside by 0.6630 and with a strong support area at 0.6550.

Technical levels

- The Euro wavers after the US CPI report meets expectations.

- All eyes are now on Wednesday's Fed monetary policy statement.

- EUR/USD’s immediate trend remains bearish while below 1.0815.

The Euro spiked higher but ended up turning lower with US yields bouncing up, pushing the US Dollar a tad higher after US CPI data met expectations.

Consumer prices remained flat in November, against the market consensus of a 0.1% increase but that was the whole surprise. Yearly inflation eased to 3.1% from 3.2% in the previous month with core inflation rising at a 0.3% monthly pace and 4.0% year-on-year, as expected.

These figures fail to clarify the Fed’s monetary policy path and maintain the interest on the outcome of the two-day monetary policy meeting. The Bank's statement, especially the interest rate projections, the so-called dot-plot, and Chairman Powell’s Press conference will be carefully watched.

EUR/USD Technical analysis

The technical picture remains unchanged, with the pair consolidating above the 50% Fibonacci retracement of the October - November rally, at 1.0730.

Immediate resistance remains at 1.0815, where previous highs meet the 4h 50 SMA and 1.0880 will come next. Supports are at the mentioned 1.0730 and early November lows at 1.0660

Technical levels to watch

- The pound is moving sideways ahead of the US CPI data.

- Upbeat UK employment data has provided some support to the Pound

- GBP/USD maintains a neutral bias between 1.2500 and 1.2600.

The Sterling is trading without a clear direction on Tuesday, moving both sides of the 1.2550 level, as the market braces for November’s US CPI reading.

UK Unemployment data supports the Pound

Earlier on Tuesday, the UK Employment report showed that the labour market remains resilient despite the restrictive interest rates, which has provided a fresh impulse to the pair.

Unemployment in the UK has remained flat at a 4.2% rate in October, with the number of jobless workers increasing by 16K, instead of the 20.3K expected by the market.

The pair’s rebound, however, has been limited, as traders are reluctant to place significant bets against the US Dollar ahead of the release of the US inflation data.

Consumer prices are expected to have risen at a 3.1% yearly pace, down from the 3.2% pace seen in September. The core inflation is seen steady at 4%. These figures will be watched with interest as they will guide Wednesday’s Fed monetary policy decision.

The technical picture shows the pair's reversal from last week's highs losing momentum with intra-day charts showing a moderate upside path from the 1.2500 area. On the upside, however, 1.2600 will likely offer a significant resistance ahead of 1.2650.

Technical levels to watch

- The US Dollar is retreating in European trading hours ahead of the US opening bell.

- Investors could keep the powder dry as they await the Fed’s decision on Wednesday.

- The US Dollar Index slides below 104.00 and could ease a bit further.

The US Dollar (USD) is dropping ahead of the US inflation numbers, which will be released on Tuesday. The weakness throughout the day could reflect traders’ expectations for another substantial downturn in US inflation. Still, it is uncertain that the figures will really move the needle as investors could wait to place bets until the last Federal Reserve (Fed) monetary policy meeting of the year on Wednesday.

On the economic front, all eyes are on the US Consumer Price Index (CPI). Expect to see substantial moves in case monthly inflation turns negative in November, although this looks unlikely amid the seasonal effects stemming from Black Friday, Thanksgiving and ahead of the New Year.

Daily Digest Market Movers: CPI data could bring short-term volatility

- All eyes on 13:30 GMT, with US Consumer Price Index release for November:

- Monthly headline inflation is expected to head from 0% to 0.1%.

- Monthly core inflation is expected to head from 0.2% to 0.3%.

- Yearly headline inflation is expected to decline from 3.2% to 3.1%.

- Yearly core inflation is expected to remain steady at 4%.

- Around 18:00 GMT, the US Treasury will allot a 30-year bond auction.

- Equities are in a wait-and-see pattern ahead of the US CPI numbers, with both European and US equities looking for direction.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 98.4% chance that the Federal Reserve will keep interest rates unchanged at its meeting on Wednesday.

- The benchmark 10-year US Treasury Note trades near 4.19%.

US Dollar Index Technical Analysis: Pressure is building

The US Dollar is gearing up for the first of two volatile days ahead, with US Consumer Price Index numbers this Tuesday and a Federal Reserve meeting on Wednesday. Expect to see some moves on the back of the US CPI numbers, though nothing substantial, as traders will want to hear from the Fed to see if markets are right in pricing in early rate cuts for 2024, or rather need to push those cuts further down the line. In that last case, the DXY US Dollar Index could jump above 104.00.

The DXY is retreating a touch, below 104.00, though an uptick in inflation might already move the needle in favor of the US Dollar. The DXY first needs to confirm its upward move by breaking above Friday’s high at 104.26. Once from there, the 100-day Simple Moving Average (SMA) near 104.55 looks very appealing before Wednesday’s Fed meeting.

To the downside, the 200-day SMA at 103.55 has done a tremendous job in supporting the DXY, with buyers coming in below 103.56 and pushing it back towards that same level near the US closing bell. If it fails this week, the lows of November near 102.46 is the next level to watch. More downside pressure could bring into view the 100.00 marker, particularly if US yields sink below 4%.

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?