- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The data released from the Bank of Japan (BoJ) showed on Wednesday that the Japanese Producer Price Index (PPI) for August came in at 3.2% YoY from 3.6% in the previous reading and in line with market expectation.

On a monthly basis, the PPI improved to 0.3% in August compared to 0.1% in July.

Market reaction

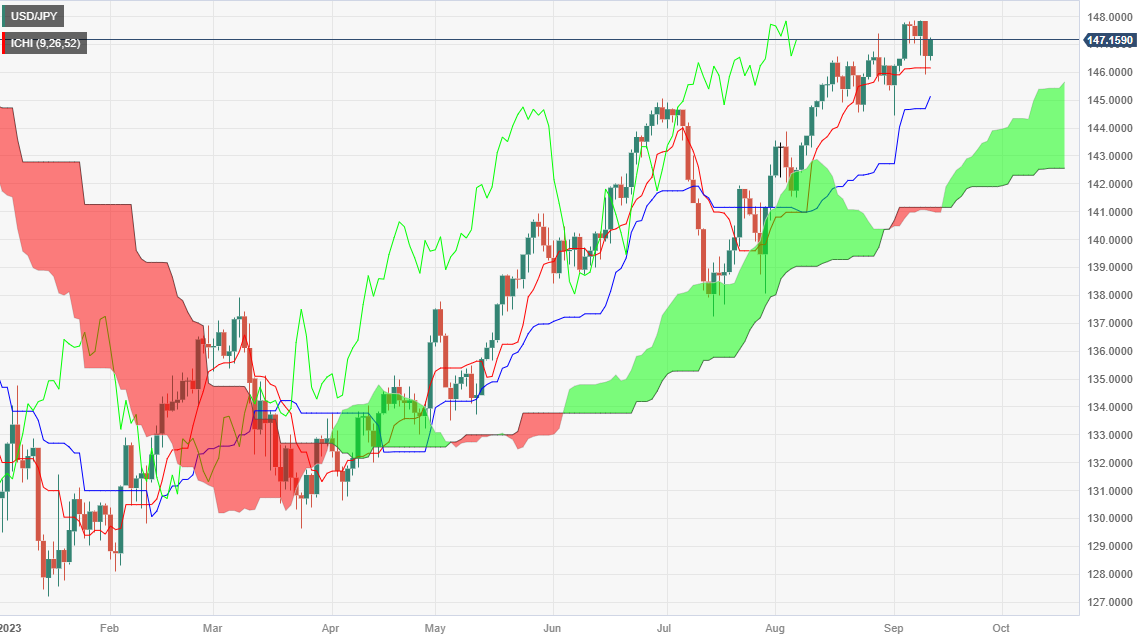

USD/JPY is posting modest gains following the data. The pair is trading near 147.14, gaining 0.04% in the day.

- The AUD/NZD is floating near the top of recent consolidation.

- Aussie traders will be hoping to catch a bid if China data recovers.

- The Kiwi has a thin showing on the calendar this week, leaving it exposed to broader market flows.

The AUD/NZD is on the high side for the week, pinning into recent highs near 1.0885 heading into the midweek trading session.

The pairing has struggled to develop meaningful directional momentum as of late, and the Aussie (AUD) continues to waffle in familiar territory against the Kiwi (NZD), trading in familiar territory for the past two months.

Westpac’s Consumer Confidence measure for September landed in the early Tuesday session, printing a 1.5% contraction against the previous decline of 0.4%. The worsening data implies Aussie consumers are increasingly bearish on the Australian economy, but the win is still tipped towards the AUD side of the Aussie-Kiwi pair as the NZD takes a backseat.

The AUD has been benefitting from bouts of positive economic news from China, and Friday will see annualized figures for Chinese Industrial Production and Retail Sales, both of which are expected to show improvements. China Industrial Production for the annualized period into August is forecast to print at 4% (previous: 3.7%), while China Retail Sales for the same period are likewise expected to uptick slightly from 2.5% to 2.8%.

China’s economic data has struggled of late, increasing investor fears of a global slowdown sparked by souring data from within China, and investors will be looking for any reason to latch onto some good news. As China’s closest trading partner, the Aussie will benefit from good news from China and could take a leg higher if investors are pleased with the showing.

Aussie, Kiwi data slated for the economic calendar in the mid-week

Before China data on Friday though, there will be a smattering of Antipodean data: Australian labor and unemployment figures will be dropping early Thursday, with New Zealand showing up later in the day with the BusinessNZ Manufacturing Purchasing Manager Index (PMI) figures for August.

The August Australian Unemployment Rate is expected to tick lower from 3.7% to 3.6%, while Employment Change for the same month is expected to jump from a 14.6K decline to a positive 24.3K.

On the Kiwi side, BusinessNZ PMIs last printed at 46.3 in September. The manufacturing PMI traditionally does not carry a market forecast, but the indicator has steadily printed to the downside since May’s 49.1 showing, and has been on the sub-50.0 side of the indicator since March.

AUD/NZD technical outlook

Daily candlesticks for the AUD/NZD have rebounded on the 100- and 50-day Simple Moving Averages (SMAs), which are consolidating near 1.0820 and 1.0825, respectively.

2023’s late May bottom near 1.0575 still remains intact, and June’s peak of 1.0150 remains well out of reach as the Antipodean cross pair struggles to break out of sideways action, consolidating around the 1.0850 level.

Technical momentum appears to be evaporating at the current level, and a downturn towards the 1.0800 major handle could be on the cards if Aussie bulls can’t catch enough bids to push the pair into new territory and force a challenge of the 1.0900 psychological level that currently sits just out of reach.

AUD/NZD daily chart

AUD/NZD technical levels

According to Reuters, confidence among major Japanese manufacturers has dropped the most in eight months, while morale in the services sector has also fallen amid concerns that a slowing Chinese economy would drag on global and domestic growth, a Reuters poll for September showed on Wednesday.

Key Quote

"Our business conditions are not so good due to uncertainty surrounding the global economy such as geopolitical risks stemming from a prolonged war in Ukraine and rising tension between U.S.-China frictions,”

"Overseas markets, particularly in China, are slumping and domestic demand is also languishing,”

Market reaction

The above statement fails to move the needle around the Japanese Yen. USD/JPY is trading at 147.10, up 0.01% on the day.

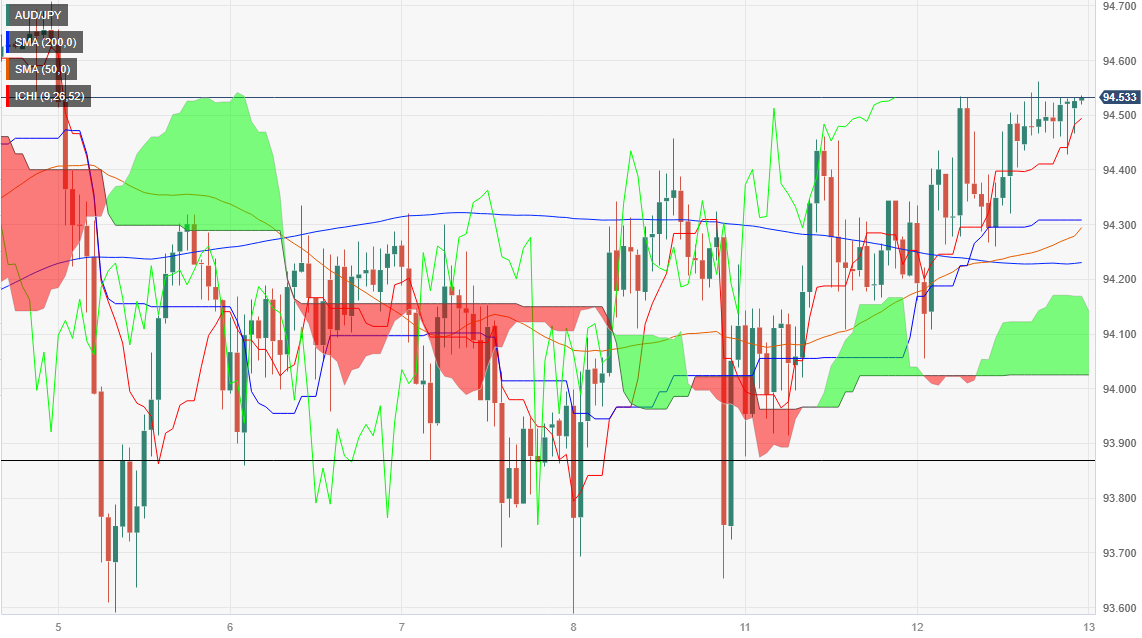

- The daily chart portrays the cross-currency pair in consolidation as bulls eye 95.00.

- Short term, the AUD/JPY uptrend remains in charge, with bulls eyeing 95.00.

The Australian Dollar (AUD) exchanges hands near the weekly highs vs. the Japanese Yen (JPY(, but remains trading sideways amidst the lack of clear catalysts that boost or undermine the former. As Wednesday’s Asian session begins, the AUD/JPY is trading at 94.48, down by 0.02%.

AUD/JPY Price Analysis: Technical outlook

The daily chart depicts the pair as neutral to upward based, capped on the upside by the September 5 swing high of 94.71. If the pair breaks that level, the next resistance would be the 95.00 figure, followed by the July 25 swing high at 95.85. On the downside, the AUD/JPY finds support at the top of the Ichimoku Cloud (Kumo) at 94.20. A breach of the latter, the pair could edge toward the September 8 low of 93.58 before dropping toward the August 18 low of 92.78.

The AUD/JPY hourly chart depicts the pair consolidating around the weekly highs. Although buyers are in charge, they would need a decisive break of the September 4 high at 94.52, followed by the August 31 high at 94.93, before testing 95.00. On the downside, the pair’s first support would be the Tenkan-Sen at 94.48; once cleared, the next support would be the Kijun-Sen at 94.30, followed by the psychological 94.00 figure.

AUD/JPY Price Action – Daily chart

- AUD/USD oscillates around the 0.6410-0.6427 region in a narrow trading band.

- Australian consumer confidence data fell into the negative territory in August.

- Traders expected a 93% chance that interest rates will remain steady in September at 5.25%-5.50%.

- Investors will monitor the US Consumer Price Index (CPI) on Wednesday.

The AUD/USD pair oscillates in a narrow range around 0.6425 during the early Asian session on Wednesday. Meanwhile, the US Dollar Index (DXY) hovers around 104.50 after retreating from the 105.00 area. Markets turn cautious ahead of the key US inflation data.

The further upside of the Aussie is capped by the downbeat Australian consumer confidence data, which fell into the negative territory in August. Data released on Tuesday revealed that Australia’s Westpac Consumer Confidence for September fell by 1.5% to 79.7, following a 0.4% drop In the previous reading. The figures fueled concern about the impact of the economic slowdown in China.

Furthermore, US Commerce Secretary Gina Raimondo is set to meet with the CEOs of key American corporations this week, two weeks after visiting China and raising worries about business conditions, per Reuters. The renewed trade war tension between the US and China might exert some selling pressure and act as a headwind for the China-proxy Australian Dollar (AUD).

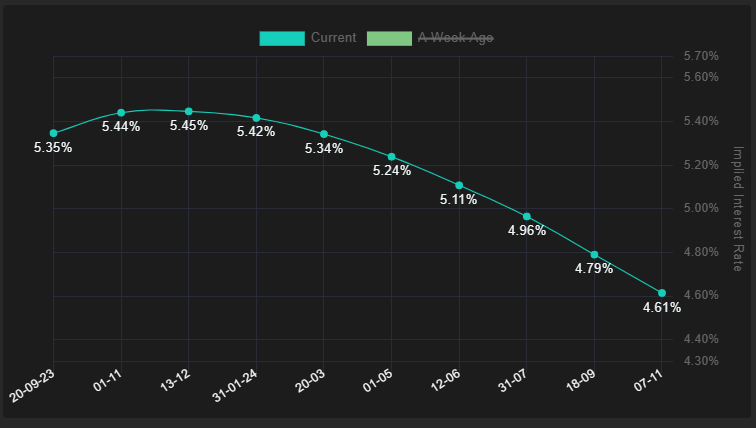

On the other hand, the higher for longer interest rate narrative in the US might lift the US Dollar (USD) against the Aussie. Traders anticipate a 93% chance that interest rates will remain steady in September at 5.25%-5.50% and a 56% chance that the Fed will hold its current monetary policy unchanged, according to the CME Fedwatch Tool.

Nevertheless, the August US Consumer Price Index (CPI) will be the highlight on Wednesday. The annual figure is anticipated to rise from 3.2% to 3.6%, while the core figure is expected to fall from 4.7% to 4.3%. The data might trigger volatility in the FX market and influence an expectation of the Federal Reserve's monetary policy.

Looking ahead, market participants will closely watch the US Consumer Price Index for August due later in the day. The stronger-than-expected data might convince the Fed to hike an additional rate. On Thursday, attention will shift to the Australian employment data and the US Producer Price Index (PPI) for August. Traders will take cues from these figures and will find trading opportunities around the AUD/USD pair.

- USD/CAD trades nearly flat at 1.3552, as high oil prices offset minor gains in the US Dollar Index (DXY).

- US CPI data due Wednesday could be pivotal; expected at 3.6% YoY, up from July’s 3.2%, with core CPI at 4.3%.”

- Bank of Canada remains cautious; October meeting could see rates held at 5% as mixed economic data looms.

The Canadian Dollar (CAD) dropped on Tuesday’s session against the US Dollar (USD), underpinned by high oil prices, amid the lack of catalyst in the financial markets. With traders bracing for the August US inflation report, we could expect the USD/CAD to trade within a choppy trading range. The USD/CAD is trading at 1.3552, almost unchanged.

Loonie holds steady vs. the US Dollar, ahead of US CPI report for August

On Wednesday, the US Bureau of Labor Statistics (BLS) will reveal the US Consumer Price Index (CPI) report, which is expected to climb above the prior month’s figure. The CPI is estimated at 3.6% YoY, above July’s 3.2%. Excluding volatile items, the so-called core CPI is foreseen at 4.3% YoY, down from July 4.7%.

Even though the Greenback recovered some ground against a basket of six currencies, the US Dollar Index (DXY) finished with minuscule gains of 0.01%, at 104.54. In addition, it failed to bolster the USD/CAD pair, as oil prices finished with gains of more than 1.70%.

Up north across the US border, Canada’s economy has shown mixed data. Although the second quarter Gross Domestic Product (GDP) sounded the alarms of a recession, the latest employment report suggests the economy remains robust.

That triggered a reaction by the Bank of Canada (BoC), who decided to sit on their hands, awaiting more data, before committing to keep rates on hold or opening the door for additional tightening. Interest rate probabilities show the BoC is expected to hold rates at 5% for the upcoming meeting in October 25.

Nevertheless, Tiff Macklem, the BoC’s Governor, stressed that interest rates may not be high enough to tame inflation. He added, “Going forward, we will look for further evidence that price pressures are easing.”

Given the backdrop, if US inflation decelerates in both readings, USD/CAD traders could expect further downside, with sellers eyeing a test of the 200-DMA. Otherwise, speculations the US Federal Reserve would continue to tighten monetary conditions could pave the way for buyers to reclaim 1.3600.

USD/CAD Price Analysis: Technical outlook

After extending its losses for three straight days, the USD/CAD has fallen from around 1.3600 towards the 1.3550s area, closing near the day’s lows. Therefore, the USD/CAD path of least resistance is downwards and will face first support at the current week’s low of 1.3543. Once cleared, the pair could dive to the 1.3500 figure, followed by the 200-day Moving Average (DMA( at 1.3464. On the flip side, the USD/CAD could shift upwards if the pair stages a comeback toward the September 11 high at 1.3593.

- S&P 500 takes a step down on flagging technology sector components.

- Equities on softer footing ahead of key US CPI data due on Wednesday.

- Despite declines, S&P tech component up nearly 40% for 2023.

The Standard & Poor’s (S&P) 500 equity index is seeing red for Tuesday, slipping to the $4,460.00 area after opening the day neat $4,480.00.

Apple Inc’s highly-anticipated marketing event on Tuesday couldn’t provide support for the S&P 500 as Apple shares slumped nearly 2% following the announcement of the next version of their flagship iPhone line as the announcement failed to inspire investors.

Techs down on Tuesday despite stellar performance for the year

The technology sector component of the S&P 500 is broadly lower for Tuesday, down 1.5% for the day. Despite this, the technology facet of the major index is still up more than 37% for 2023.

S&P 500 technical outlook

The S&P spent most of Tuesday in the green, but couldn’t hold onto the gains heading into the close and finished the trading day slightly down.

The large-cap index is currently hung in the middle of a bullish inversion of the 100- and 50-period Simple Moving Averages (SMAs), with the 100-period SMA providing near-term support from $4,450.00 while a rising trendline from August’s lows near $4,350.00 represents rising support to fend off any bearish pushes.

Immediate resistance rests at the peak of September’s early highs near $4,530.00 but remains capped by the overshot 50-period SMA parked near $4,490.00.

S&P 500 4-hour chart

S&P 500 technical levels

- EUR/GBP closed above 0.8600 and saw 0.20% gains.

- A Reuters report indicated that the ECB will hike rates on Thursday on higher-than-expected inflation forecasts.

On Wednesday, the EUR/GBP closed above 0.8600, and the EUR gained ground over the GBP as investors are preparing for an announcement of a 25 basis point (bps) hike by the European Central Bank (ECB) on Thursday.

In line with that, Reuters reported that the European Central Bank (ECB) foresees eurozone inflation remaining above 3% next year, exceeding the previous 2% projection, which would justify a tenth consecutive interest rate hike at its upcoming meeting on Thursday. In the meantime, market expectations are divided between the bank maintaining current rates and a 25 basis point increase due to concerns about high inflation and looming recession fears.

Despite this projection strengthening the case for a hike, analysts still believe that the decision will be a close call.

EUR/GBP Levels to watch

The daily chart analysis indicates a neutral to bullish outlook for EUR/GBP as the bulls show signs of resurgence but face challenges ahead. Having turned flat in positive territory, the Relative Strength Index (RSI) suggests a potential market equilibrium with balanced buying and selling pressure, while the Moving Average Convergence (MACD) histogram exhibits increasing green bars. Furthermore, the pair is above the 20-day Simple Moving Average (SMA) but below the 100- and 200-day SMAs, indicating that the bulls aren't done yet and that the outlook is still positive for the short term.

Support levels: 0.8590, 0.8567 (20-day SMA), 0.8550.

Resistance levels: 0.8615 (100-day SMA), 0.8630, 0.8650.

EUR/GBP Daily Chart

-638301518231486545.png)

- Euro lurches higher on increased odds of ECB rate hike.

- Euro rate call slated for Thursday, leaked memo implies increased inflation expectations from the ECB.

- US CPI reading still in the barrel for Wednesday, promises refreshed market momentum.

The EUR/USD pairing has punched higher in Tuesday’s late trading session, bolstered by reports that the European Central Bank (ECB) has internally raised its inflation forecasts ahead of the ECB’s rate announcement later this week.

Read more: ECB to hike inflation forecasts, Euro surges

The Euro (EUR) pushed higher on the headlines, tapping the 1.0765 region, and now sits poised to close out Tuesday’s markets in the green for the day.

Market participants have been mixed on ECB expectations in recent days, with about 40% of investors anticipating a rate hike at the next ECB rate meeting on Thursday. However, if the still-unconfirmed ECB leak proves valid, it could very well see the EU central bank peg in another rate hike this week.

The news wasn’t enough to reclaim Tuesday’s early high of 1.0769, but markets in Asia could see an extended reaction as they kick off the Wednesday trading session.

Meanwhile, the Greenback (USD) side of the EUR/USD sees investors waiting for Wednesday’s US Consumer Price Index (CPI) figures, where market forecasts are anticipating an increase in headline US inflation to 0.6% for the month of August, an uptick from the previous month’s showing of 0.2%. With inflation expectations on the high side for the US, the EUR/USD is set to duke it out over competing rate hike cycles from the Federal Reserve (Fed) and the ECB

EUR/USD technical outlook

Hourly candlesticks for the EUR/USD are extending a rebound from the 100-hour Simple Moving Average (SMA) currently carving out an upswing near 1.0720, and a bullish inversion of the 50-day SMA pushing higher from 1.0730.

On the downside, a rising trendline from last week’s swing low into 1.0690 is providing rising support, and a break of the line could see an extended bearish challenge of June’s swing low near 1.0640.

EUR/USD hourly chart

EUR/USD technical levels

- GBP/USD declined towards 1.2490 and saw losses in five out of the last six days.

- UK labour market data came in soft.

- British yields are diving as markets discount a less aggressive BoE.

In Tuesday’s session, the GBP/USD fell below the 1.2500 area near 1.2490, seeing nearly 0.14% losses. The main downward driver of the Cable is investors placing dovish bets on the Bank of England (BoE) and the Greenback recovering ground, and markets remain cautious ahead of inflation figures from the US from August.

The UK reported weak labour market data on Wednesday’s European session. The Unemployment rate in the three months ending in July rose to 4.3%, as expected, while the Employment Change figure declined by 207,000, higher than the 185,000 expected in July. In addition, wage inflation measured by the Average Earnings in the three months up to July rose to 8.5% YoY, vs. the 8.2% expected, and while inflation rose as well as unemployment, it is not good news for the UK’s economy.

According to the World Interest Rate Probabilities tool (WIRP), markets are now discounting higher odds of a hike in the September and February meetings, which would lift the target rate to 5.75%.

On the other hand, the US’s calendar had nothing relevant to offer that its drivers on the session where investors seeking refuge in the Greenback ahead of the release of the Consumer Price Index (CPI) data from the US from August on Wednesday. The headline and core figure are expected to have accelerated on a monthly basis, and hot reading may boost hawkish bets on the Federal Reserve (Fed), which could open the upside for the USD.

GBP/USD Levels to watch

The daily chart analysis indicates a bearish outlook for the GBP/USD in the short term. The Relative Strength Index (RSI) is below its midline in negative territory, with a negative slope, aligning with the negative signal from the Moving Average Convergence Divergence (MACD), which displays red bars, reinforcing the strong bearish sentiment. Additionally, the pair is below the 20 and 100-day Simple Moving Averages (SMAs) but above the 200-day SMA, suggesting that despite the recent bearish sentiment, the bulls are still resilient, holding some momentum.

That being said, if the Cable loses the 200-day SMA at 1.2428, it would exacerbate the bearish momentum with the next targets at 1.2400 and 1.23800. On the upside, resistances line up at 1.2500, 1.2540 and 1.2570.

GBP/USD Daily Chart

-638301491665812447.png)

Reuters has reported, citing unnamed sources, that the European Central Bank (ECB) is expected to raise its inflation forecast while cutting economic growth projections, aligning with market expectations.

An increase in the inflation forecast brings the ECB closer an interest rate hike at its Governing Council meeting on Thursday. As a result of this report, the Euro surged.

The EUR/USD pair gained more than 30 pips, approaching Tuesday's highs, and is currently hovering around 1.0760. EUR/GBP broke above 0.8600, reaching the highest level in almost a month.

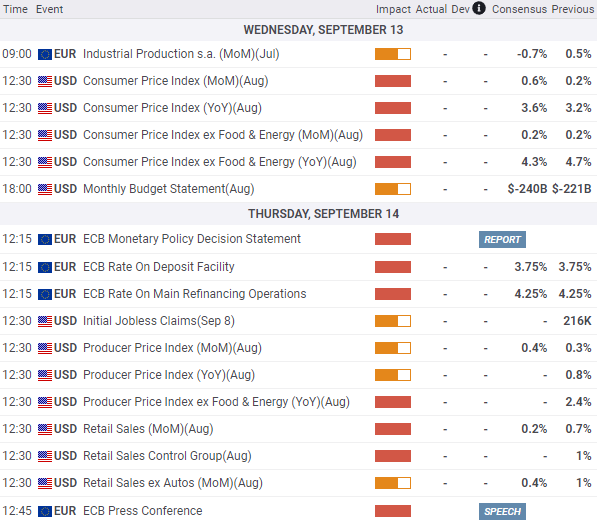

It's US CPI day. Those numbers will trigger actions and are crucial before next week's FOMC meeting. During the Asian session, Japan will release the Producer Price Index. Later, monthly UK GDP data is due, as well as Eurozone Industrial Production figures.

Here is what you need to know on Wednesday, September 13:

The US Dollar Index experienced a modest rise on Tuesday, approaching 105.00 before pulling back. It was a relatively quiet session as market participants awaited key US data.

The most crucial report of the day and the week is set to be released on Wednesday the August US Consumer Price Index (CPI). The annual rate is expected to rebound from 3.2% to 3.6%, while the Core rate is projected to slow down from 4.7% to 4.3%. Volatility is anticipated as these figures will influence expectations regarding the Federal Reserve's monetary policy. More inflation data is scheduled for Thursday with the the Producer Price Index (PPI).

US CPI Preview: Forecasts from 10 major banks, strong headline with rising energy prices

UK labor market data came in mixed, indicating a worsening economic situation. The Unemployment Rate edged higher to 4.3% (the highest since September 2021) after a decrease in employment by 207K. Average hourly weekly earnings rose 8.5% compared to the previous year, exceeding market consensus of 8.2%. Following these numbers, the Pound weakened. On Wednesday, the UK will report July GDP, Industrial Production, and trade data.

GBP/USD approached the monthly low but then rebounded towards 1.2500. The bias remains on the downside, holding above the 200-day Simple Moving Average (SMA) at 1.2440.

EUR/USD reached a weekly high at 1.0769 and then retraced, resuming the upside movement during the American session, rising towards 1.0750. The pair faces resistance at 1.0770 while holding above 1.0700. Eurozone Industrial Production data is due on Wednesday, and the European Central Bank will have its Governing Council meeting on Thursday.

The Japanese yen was among the worst performers. USD/JPY rose above 147.00 and encountered resistance at 147.20. Japan will release the August Producer Price Index (PPI) expected at 3.3% YoY.

NZD/USD managed to recover the 0.5900 mark with limited price action. The rebound from monthly lows remains cautious. In New Zealand, the August food price inflation is due on Wednesday.

AUD/USD pulled back after surging on Monday but held above 0.6400. Australia will report employment data on Thursday.

The Canadian Dollar outperformed the NZD and the AUD, supported by the rally in crude oil prices. The WTI barrel broke above $88.00 and then $89.00, reaching fresh monthly highs. USD/CAD dropped to the lower levels in almost two weeks and stabilized around 1.3550.

Precious metals had mixed performance, with Silver recovering to $23.00, ending the day flat, while Gold tumbled to the lowest level in two weeks at $1,907, even as US yields remained relatively steady.

Like this article? Help us with some feedback by answering this survey:

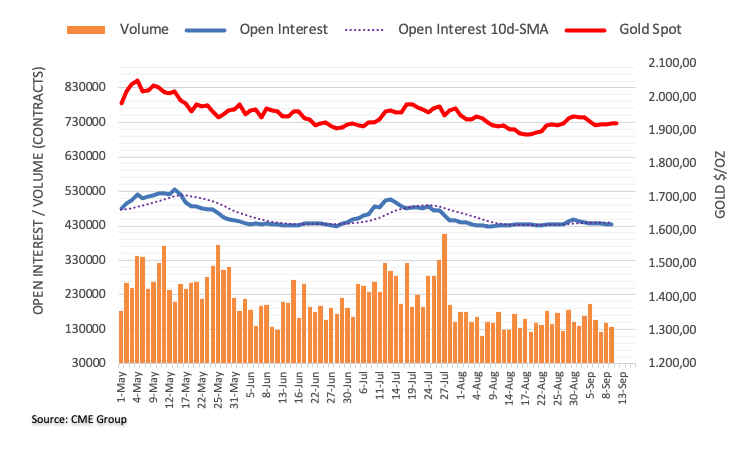

- Gold is seeing a soft retreat as US inflation data looms ahead.

- An upbeat US CPI read could send Gold lower.

- USD flows to determine the direction of XAU/USD as investors react to market inflation outlook.

The XAU/USD is stepping lower in Tuesday trading, testing the $1,910.00 level as investors await US inflation figures on Wednesday’s Consumer Price Index (CPI) data release.

Metals investors will be taking a step back ahead of US inflation figures due tomorrow, and a firming up of the US Dollar (USD) index is taking the yellow metal down a peg, dropping below near-term bottoms and etching in a new low for the month of September.

US CPI figures to drive Gold flows on Wednesday

If US CPI figures come in or above expectations, it could put further downside pressure on Gold. Headline CPI data for the month of August is forecast to come in at 0.6%, a step up from the previous month’s 0.2%. Core CPI (CPI excluding food and energy prices) for the same period is expected to hold steady at 0.2%.

Looking ahead to Thursday, US Retail Sales growth figures are expected to show a slight cooling off. August’s Retail Sales data is expected to print at 0.2%; still a positive number, but a reduced showing from the previous month’s 0.7% growth.

A disappointing showing for economic calendar data could see a firm round of support for the XAU/USD, but increasing economic activity will send the Greenback higher and push Gold another step down.

XAU/USD technical outlook

Gold is slightly lower in the early trading week, down from Monday’s opening prices near $1,920.00, and daily candlesticks are so far getting suppressed by a descending trendline from May’s high peak above $2,050.00. Adding to the resistance cloud gathering above Gold prices, the 100-day Simple Moving Average is descending to $1,950.00, and an inversion of the 50-day Exponential Moving Average sees the EMA building resistance into $1,930.00.

On the short side, support is coming from August’s swing low into $1,890.00, and despite consecutive lower lows on the daily chart, bearish momentum is waning as the fast and slow EMAs on the MACD indicator begin to consolidate.

XAU/USD daily chart

XAU/USD technical levels

- EUR/JPY trades at 157.85, up 0.19%, as it hovers above the Ichimoku Cloud, indicating a neutral to bullish outlook.

- First resistance for buyers lies at the Kijun-Sen level of 158.05; breaching this could target year-to-date high at 159.76.

- Immediate support found at September 11 daily low of 156.58; breaking this could see the pair slide toward 155.58.

The Euro (EUR) advances against the Japanese Yen (JPY) for the second straight day after forming a hammer, which suggests the cross-currency pair could be headed for higher prices. As the North American session winds down, the EUR/JPY is trading at 157.85, gaining 0.19% at the time of writing.

EUR/JPY Price Analysis: Technical outlook

After peaking at around 158.15, the EUR/JPY remains neutral to a downward bias despite trading above the Ichimoku Cloud (Kumo). As the pair continued to print successive series of lower highs and lows, today’s upward correction is being capped by the Kijun-Sen at 158.05, seen as the first resistance for buyers if they would like to retest yearly highs. A breach of the latter would expose 159.00, followed by the year-to-date (YTD) high at 159.76.

Conversely, the EUR/JPY first support would be the September 11 daily low of 156.58, which, once cleared, the pair would dive towards the Senkou Span B at 155.58. In the scenario of sliding below that level, the top of the Kumo will emerge as the next support at 154.70.

EUR/JPY Price Action – Daily chart

- Polish Zloty swoons on Ukraine grain spat.

- The bad news is accumulating for the PLN, which is still reeling from surprise rate cuts.

- Polish grain bans from Ukraine to face legal contention.

The USD/PLN has tipped into six-month highs near 4.3850 as the Polish Zloty (PLN) continues to sag against the Greenback (USD) following agriculture comments from Polish Prime Minister Mateusz Morawiecki, who is threatening to extend Poland’s embargo on Ukrainian corn, wheat, sunflower, and canola.

Early Tuesday saw another test for the PLN after Prime Minister Mateusz Morawiecki announced that he had formally requested that the European Commission, the executive arm of the European Union (EU), extend current restrictions on the volume of Ukrainian agricultural products that are allowed to cross the border into Poland.

The ruling Law & Justice party of Poland, a far-right ultra-nationalist party, is courting the farm vote ahead of the general election due to begin October 15th. Prime Minister Mateusz Morawiecki declared on the app formerly known as Twitter that, “Poland will not allow Ukraine grain to flood us”. The Polish Prime Minister telegraphed that Poland would continue to keep grain at the border regardless of the Commission’s decision, continuing on the social media app, “Regardless of the decisions of the clerks in Brussels, we will not open up our borders.”

Poland and several other regional neighbors all agreed on an EU embargo on grains produced by Kyiv from April until September 15th in an effort to prevent knock-on market effects on their farmers. Russia’s blockade on Ukrainian exports has left Ukraine with more grains than its domestic market can absorb.

EU Agriculture Commissioner Janusz Wojciechowski, who is Poland’s former agriculture minister, announced on Tuesday that he was actively trying to extend the embargo.

Ukraine grains threaten Poland, says Polish Prime Minister

Ukraine’s Prime Minister Denys Shmygal has threatened legal action on the ban extension, citing potential violations of the General Agreement on Tariffs and Trade (GATT). The Prime Minister declared that Kyiv will seek World Trade Organization (WTO) arbitration to recover losses, citing that the embargo extension represents “political populism before the (Polish) elections”.

The Polish Zloty knocked lower on news of the agriculture spat, and the PLN is on pace for its biggest single-month decline since September of last year. The end of 2022 saw the PLN hit record historical lows, with a single Greenback (USD) able to purchase over 5 Zloty at the peak.

The grains groans follow closely on the heels of Poland’s recent Zloty headaches, sparked by an unexpected rate cut from the Polish National Bank (PNB). PNB Governor Adam Glapiński gave a surprise 0.75% rate cut despite inflation still clearing 10% in the Polish economy.

PNB Governor Adam Glapiński has come under fire for the move, being accused on multiple fronts of politically motivated banking policies. Glapiński, an open supporter of the Law & Justice party, has been accused of trying to bolster political support ahead of the general election next month by reducing borrowing and lending rates at the future expense of the domestic economy.

Further reading: Zloty crumbles on the back of PNB rate cut, inflation still over 10%

USD/PLN technical outlook

The Zloty continues to lose ground against the USD, and the USD/PLN pairing was knocked higher on Tuesday, cracking near-term highs around 4.3350. The pair briefly broke through the 4.3800 handle, and the floor is looking very far away. A significant bottom has been priced into July’s swing low near 3.9500, and any downside momentum sees dynamic support rising from a bullish inversion of the 50-day Exponential Moving Average (EMA) and 100-day Simple Moving Average (SMA).

The Zloty is looking incredibly over-extended against the Greenback, but significant macro conditions are breaking the technicals.

USD/PLN daily chart

USD/PLN technical levels

- GBP/CAD trades at 1.6924, pressured by rising oil prices and a UK unemployment rate increase to 4.3%.

- Bank of England hints at a rate cap at 5.50%, while the Bank of Canada eyes further tightening amid strong job growth.

- Upcoming monetary policy decisions could dictate the pair's direction, but higher oil prices may tilt the scales in favor of the Loonie.

The Loonie (CAD) extends its gains against the Pound Sterling (GBP) due to increasing oil prices and mixed UK economic data. Hence, the GBP/CAD is trading at 1.6924 after hitting a daily high of 1.7020.

Loonie strengthens against the Pound amid rising Oil prices and mixed UK economic indicators

During the European session, the Office for National Statistics (ONS) in the UK revealed the Unemployment Rate climbed to 4.3% in the three months to July, above the prior month’s 4.2%, while wages excluding bonuses grew by 7.8%, as expected, unchanged to the last reading.

Although the labor market is cooling, as the UK economy feels the impact of higher interest rates imposed by the Bank of England (BoE), higher wages suggest the central bank’s job isn’t done. The BoE’s expectations for another rate hike remained below last week’s estimates, which foresaw the bank rate to end at around 5.73%. Nevertheless, the latest data round suggests that Bailey and Co would refrain from exceeding the 5.50% threshold.

On the Canadian front, as the economy added more jobs than expected, as revealed last week, it has opened the door for additional tightening by the Bank of Canada (BoC). The BoC has expressed that people demanding higher wages would make it harder to curb stickier inflation.

The latest BoC monetary decisions witnessed the BoC keeping rates unchanged at 5%. But the chances for additional tightening remain, as money market futures show 15 bps of further tightening for BoC’s June 2024 monetary policy decision.

In his latest remarks last Thursday, Tiff Macklem, the BoC’s Governor, stressed that interest rates may not be high enough to tame inflation. He added, “Going forward, we will look for further evidence that price pressures are easing.”

Given the fundamental backdrop, the GBP/CAD could consolidate ahead of the upcoming monetary policy decisions in the near term. Nevertheless, higher oil prices could offset the interest rate differential in favor of the Pound Sterling (GBP) and open the door for further weakness in the cross-currency pair.

GBP/CAD Price Analysis: Technical outlook

The daily chart depicts the pai as neutral to downward biased, despite the fact the GBP/CAD remains above the 200-day Moving Average (DMA). However, successive series of lower peaks and throughs suggest the cross would test the 1.6900 figure. A breach of the latter would expose the July 24 daily low of 1.6883, followed by the 200-DMA at 1.6729. Conversely, if buyers reclaim the 100-DMA at 1.6958, that could pave the way towards 1.7000.

- The EUR/USD took a stepdown in early Tuesday trading, and bidders are looking to recover.

- US and EU economic data in the mid-week to complicate the charts.

- ECB rate call is around the corner, alongside US inflation figures due.

The EUR/USD pairing is determined to restore balance on Tuesday and is pushing into 1.0735 in afternoon trading after sliding to the day’s lows near 1.0705.

The Euro (EUR) is on the low end against the Greenback (USD) for the day, down from Tuesday’s opening prices near 1.0747, and down even further from the day’s early peak of 1.0770.

The tug-of-war is likely to continue in the short term as the mid-week sees a healthy economic calendar, with both the US and the Eurozone (EU) represented on the data docket for Wednesday and Thursday.

US, EU data in the pipe

Wednesday’s economic calendar sees US Consumer Price Index (CPI) figures as well as the federal government’s Monthly Budget Statement. Market analysts broadly expect US headline CPI for August to tick upwards to 0.6%, an increase from the previous month’s 0.2%. August’s Core CPI (CPI less food and energy costs) meanwhile is forecast to hold steady at 0.2% from the previous month’s reading.

The US federal budget deficit for the month of August is also expected to backslide, down $240 billion compared to the previous month’s $221 billion deficit.

Thursday will see the European Central Bank (ECB) giving its latest rate announcement; investors are expecting the ECB to hold steady on interest rates, though recent hawkish comments from ECB officials have seen an uptick in the number of market participants expecting an additional rate increase.

30 minutes after the ECB rate call there will be a press conference with ECB officials, where investors will be listening closely for any hints about the path forward for the European central bank’s interest rate policy.

Thursday also brings US Producer Price Index (PPI) figures, as well as Retail Sales. The monthly PPI for August is expected to tick upwards, albeit slightly, from 0.3% to 0.4%. Meanwhile, Retail Sales growth is expected to decline to 0.2% from July’s 0.7%. While a positive figure, but a contraction in growth figures could signal a softening economy, and market participants will be keeping a close eye on the print.

EUR/USD economic calendar for Wednesday and Thursday; all times in GMT.

EUR/USD technical outlook

The Euro got knocked lower against the USD in early Tuesday trading after an initial climb up the charts, and the pair is struggling to build meaningful momentum from the 100-hour Simple Moving Average (SMA). The hourly MACD histogram indicator is beginning to rotate bullish, with the fast-moving average gearing up to swap places with the indicator line.

The EUR/USD has closed in the red for the past eight consecutive weeks, and buyers will be looking to reverse the pair’s recent rejection from the 100-day SMA, which has gone flat and is threatening to turn bearish. A bearish inversion of the 100-day SMA and 50-day Exponential Moving Average (EMA) is likewise complicating bidding efforts.

Meanwhile, the MACD on daily candlesticks is showing oversold conditions, though the slow line histogram of the MACD is showing further room for the EUR/USD to stoop even lower in the event a failed bid to re-establish bullish momentum.

EUR/USD daily chart

EUR/USD technical levels

- USD/BRL rose to a high near 4.9680 and then settled at 4.9450.

- Brazilian IPCA from August showed no surprises.

- Markets are cautious, awaiting inflation figures from the US on Wednesday.

The USD/BRL gathered momentum in Tuesday’s session after the BRL decline after the release of the Brazilian inflation figures from August. On the USD side, it is recovering ground after trading soft on Monday while markets seem cautious ahead of Wednesday’s inflation readings from the US.

The Instituto Brasileiro de Geografia e Estatistica revealed that the IPCA inflation advanced 0.23% MoM and matched expectations.

Recent upward movements of the pair may be attributed to recent rate cuts by the Bank of Brazil’s Monetary Policy Committee (COPOM), and markets are expecting the bank to cut further the target rate next week by 50 basis points to 12.75% which could exacerbate the downside for the Brazilian currency.

On the other hand, the USD is trading firm against its rivals, driven by a cautious market mood and US Treasury yields remaining high. That being said, Wednesday’s Consumer Price Index (CPI) figures will be crucial for the Greenback’s and bond price dynamics as they will play a big rol in modelling expectations of the next Federal Reserve (Fed) decisions. As for now, a pause in next week’s meeting is practically priced in while there's still a 40% chance of one last interest rate hike in either December or November, according to the World Interest Rate Probabilities tool.

USD/BRL Levels to watch

Observing the daily chart, USD/BRL displays a neutral to bullish technical outlook for the short term as the bulls gain momentum. The Relative Strength Index (RSI) demonstrates a favourable upward trend above its midline, while the Moving Average Convergence (MACD) shows stagnant red bars. Additionally, the pair is above the 20 and 100-day Simple Moving Averages (SMAs), but below the 200-day SMA, suggesting that the bulls are in command over the bears on the bigger picture.

Support levels: 4.9350 (20-day SMA), 4.9330, 4.9150.

Resistance levels: 4.9680, 4.9840, 4.9900.

USD/BRL Daily Chart

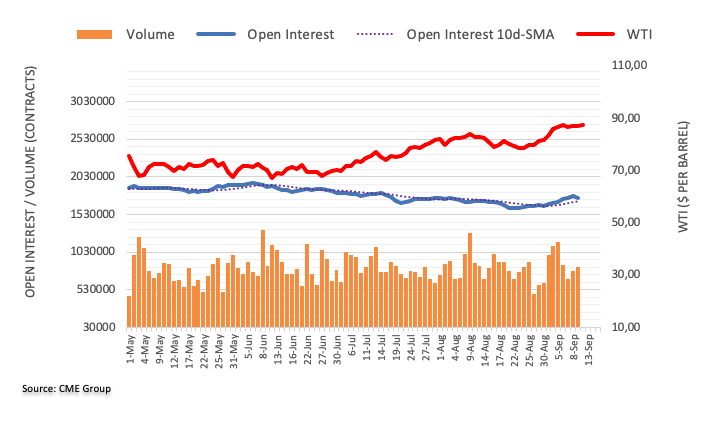

- WTI trades at $88.49 per barrel, up 1.95%, driven by Saudi Arabia and Russia’s output cuts of 1.3 million bpd.

- OPEC projects a rise of 2.25 million barrels per day in oil demand by 2024, signaling robust global economic growth.

- US inflation data due this week could impact WTI prices; a higher-than-expected reading may trigger speculations of a Fed rate hike.

Western Texas Intermediate (WTI), the US crude oil benchmark, climbed more than 2% to a 10-month high in the mid-North American session, as oil supply is projected to remain tight. That, alongside supply cuts by oil exporting countries, underpins WTI price. At the time of writing, WTI is trading at $88.49 per barrel, up 1.95%.

Oil prices soar amid OPEC projections, geopolitical factors as markets eye US CPI

The latest report from the Organization of Petroleum Exporting Countries (OPEC) foresees oil demand will rise by 2.25 million barrels per day (bpd) in 2024. The OPEC stuck to its robust growth projections in global oil demand in 2023 and 2025, suggesting that major economies are stronger than expected.

Saudi Arabia and Russia’s crude oil output cut of 1.3 million barrels per day until December 2023 is the main driver behind the recent climb in oil prices. Also, floods and storms in Eastern Lybia continued to weigh on the oil supply, as the four major oil exports remained closed since the weekend.

In the meantime, Kazakhstan revealed that its oil production fell to 213,8000 metric tons on September 11 from 243,500 tons as maintenance work began on the pipelines.

Aside from this, traders are bracing for data released by the US Energy Information Administration (EIA) office and the International Energy Agency (IEA). A Reuters poll shows analysts estimate a drop of 2 million barrels of crude from US stockpiles during the week ending on September 8.

Oil traders are also watching data from the US Department of Labor, which would unveil US inflation numbers. If the data exceeds estimated to the upside, that could weigh on the WTI price, as speculations for another Fed rate hike will rise, implying the US Dollar would climb. Otherwise, expect further WTI upside.

WTI Price Action – Daily chart

- The GBP/JPY is pushing higher after getting knocked lower in Tuesday trading, looking to chalk in a green day.

- UK GDP figures around the corner for Wednesday, investors are looking to position ahead of industrial production figures.

- BoJ comments are bolstering JPY traders eager for hawkish policy changes.

The GBP/JPY pair is recovering into the green for Tuesday, testing the 183.70 region after slipping to the 183.00 handle earlier in the session.

The Guppy kicked off the trading day near 183.45, briefly clambering above the 183.90 level before getting knocked lower in European trading. The Pound Sterling (GBP) faces headwinds on the back of a dovish Bank of England (BoE), and a firming Yen (JPY) on the back of recent hawkish Bank of Japan (BoJ) comments is complicating matters.

The BoE has struck a notably softer tone recently, highlighted by the BoE’s Governor Andrew Bailey noting recently that the UK central bank is quickly approaching the peak of the rate hike cycle. Inflation remains a stubbornly sticky complication for the UK, but the BoE is caught between a rock and a hard place, as too much action on interest rate hikes could pose a threat to the British economy.

On the Yen side, the BoJ’s Governor Kazuo Ueda hit news wires recently alluding to the eventual end of the Japanese central bank’s negative interest rate policy if data continues to improve into the end of the year. Before major policy adjustments can be made, however, the BoJ needs to be confident that it has successfully attained its 2% inflation target alongside rising wages. While Japanese inflation has been above the 2% target for some time, inflation is expected to undershoot BoJ targets in the coming months, and market expectations of rate adjustments may be premature.

UK GDP, industrial production figures in the pipe

Investors are jostling for position ahead of a smattering of mid-tier UK economic data due on Wednesday. Gross Domestic Product (GDP) figures for the month of July are expected to decline 0.2% versus the previous month’s 0.5% increase, and Industrial Production for July is likewise forecast to decline 0.6% versus the previous month’s growth of 1.6%.

UK Manufacturing Production for July is also anticipated to decline by 1% after climbing 2.4% in June, while the annualized figure is expected to slide from 3.1% to 2.7%.

GBP/JPY technical outlook

The Guppy is pushing upwards for Tuesday, testing 183.70 while a descending 100-hour Simple Moving Average (SMA) is providing resistance as it punches into 183.80.

The Pound Sterling slipped against the Yen from August’s peak just beneath the 187.00 major handle and is currently trapped between the 38.2% and 61.8% Fibonacci retracement levels from August’s swing low into 180.60, at 184.40 and 183.00 respectively, while the 50-day Exponential Moving Average (EMA) is lifting to provide dynamic support as the indicator consolidates with the 61.8% Fibonacci level.

GBP/JPY daily chart

GBP/JPY technical levels

- XAG/USD wanders around $23.00, but the bullish momentum seems weak.

- A stronger USD and yields remaining high don’t allow precious metals to make a significant upwards move.

- All eyes are on Wednesday’s US CPI figures from August.

On Tuesday’s session, Silver’s spot price XAG/USD traded neutral around $23.00, mainly limited to a strong USD whose DXY index jumped to a high of 104.90 and US yields slightly increased.

In addition, the economic calendar had nothing relevant to offer, and markets remained cautious ahead of the August US Consumer Price Index (CPI, expected to have accelerated by 0.5% MoM, while the Core measure is projected to increase by 0.2% MoM. At the same time, the expectations for Federal Reserve (Fed) tightening remain steady. The CME FedWatch tool indicates that while the market has already priced in a pause for the upcoming September 20 meeting, there's still a 40% chance of one last interest rate hike in either December or November.

A hot inflation reading may fuel a rise in US bond yields, which could negatively impact Silver prices as they are considered the opportunity cost of holding non-yielding metals.

In the meantime, US Yields are edging higher on the day. The 10-year bond yield is seen at 4.29%, with mild gains on the day. The 2-year yield stands at 5.00% with 0.20% gains, and the 5-year yield is at 4.42%, also with mild gains.

XAG/USD Levels to watch

Upon analysing the daily chart, a neutral to bearish is seen for the XAG/USD, with the bears maintaining control and bulls struggling to make a significant move. With a flat slope below its midline, the Relative Strength Index (RSI) suggests a period of stability in negative territory, while the Moving Average Convergence (MACD) exhibits shorter red bars. On the larger time frame, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting that the buyers are struggling to overcome the overall bearish trend and the bears are still in charge.

Support levels: $22.80, $22.60, $22.30

Resistance levels: $23.50 (20 and 200-day SMA convergence), $23.70, $24.00.

XAG/USD Daily Chart

-638301355827355848.png)

- USD/MXN trades at 17.2607, with the dollar gaining 0.20% as risk-off sentiment prevails in the market.

- US inflation data due Wednesday could be a game-changer; CPI expected to rise from 3.2% to 3.6% YoY.

- Mexico’s 2024 economic package proposes fiscal deficit increase to 4.9% of GDP, the highest in 36 years.

The Mexican Peso (MXN) loses some ground vs. the US Dollar (USD) after strengthening to 17.2688, but the latter regains some composure as the North American session progresses. A scarce economic docket in the US and a risk-off impulse keep investors seeking safety ahead of US inflation data. The USD/MXN is trading at 17.2607.

Mexican Peso retraces slightly as investors await US CPI, digests Mexico’s 2024 economic package

Risk aversion is boosting the Greenback vs. the Mexican Peso, as US equities remain trading with losses, except for the Dow Jones. Market participants are bracing for the release of August’s inflation data in the US on Wednesday. The Consumer Price Index (CPI) is expected to rise from 3.2% to 3.6% YoY, while core CPI will drop from 4.7% to 4.3%.

Ahead of the data, the buck is printing gains of 0.20%, as shown by the US Dollar Index (DXY), which tracks the American Dollar’s performance against six counterparts. The DXY is at 104.74, underpinned by the advancement of the US 2-year Treasury note yield, peaking at 5.00%.

A risk-off impulse and firm US Treasury bond yields are backing the US Dollar (USD) ahead of the release of August inflation data in the United States. The US 10-year benchmark note sits at 4.292%, unchanged compared to yesterday, contrary to the American Dollar (USD), as shown by the US Dollar Index (DXY). The DXY tracks the buck’s performance against a basket of six peers and prints solid gains of 0.30% at 104.83 after dropping to a four-day low of 104.42.

On the US front, the US Bureau of Labor Statistics (BLS) will release August’s inflation data on Wednesday. The Consumer Price Index (CPI) is expected to jump from 3.2% to 3.6% YoY, while core CPI will drop from 4.7% to 4.3%. A higher-than-expected inflation reading would reignite speculations about another rate hike by the US Federal Reserve.

Across the border, the economic package in Mexico for 2024 proposes an increase in the fiscal deficit from 3.3% to 4.9% of GDP in 2023, the most significant negative balance in 36 years. The budget assumes the USD/MXN exchange rate would average 17.60 by the end of 2025 while considering the Mexican oil exports would be selling at around $56.7 per barrel next year.

Given the fundamental backdrop, the USD/MXN would likely continue to edge lower unless tomorrow’s CPI data rises above estimates and put another interest rate increase into the table. Otherwise, expect further Mexican Peso strength, which could drive the pair back towards the 17.0000 barrier.

USD/MXN Price Analysis: Technical outlook

From a daily chart perspective, the pair is challenging technical support at the 100-day Moving Average (DMA) at 17.2558, which capped the USD/MXN drop. A daily close below the latter, and the pair could test the 20-DMA at 17.0929 before slumping toward the psychological 17.0000 price level. For an upward resumption, the exotic pair must reclaim the 17.5000 area before testing the September 11 high at 17.5927.

- The NZD/USD is swamped near 0.5900, unable to develop meaningful momentum.

- It's the USD's ballgame as investors look ahead to key US inflation figures on Wednesday.

- The Federal Reserve looks set to step back from the rate hike cycle as long as inflation continues to ease.

The NZD/USD pair is struggling to find firmer footing after slipping to the 0.5900 level through Tuesday’s market session, dipping from the day’s high of 0.5923 as the US Dollar (USD) takes a step higher against the Kiwi (NZD).

It’s strictly a low-impact showing for the NZD on the economic calendar this week. Food Price Index and Business Purchasing Manager Index (PMI) figures are not expected to draw much market reaction, and it will be up to the Greenback (USD) side of things to push momentum.

US inflation figures keyed up for the midweek, CPI to set the tone

Investors are looking forward to the US Consumer Price Index (CPI) figures due on Wednesday. Market participants broadly believe that the Federal Reserve (Fed) will pause on further rate hikes at their upcoming meeting in September, however, expectations could swing if the CPI print surprises to the upside. Investors expect the CPI for August to show a 0.5% annualized rise in prices, mostly in the cost of energy and fuel, with the core CPI forecast to hold steady at 0.2%.

Over the weekend, US Treasury Secretary Janet Yellen declared her optimism that the US could successfully control inflation without any damage to the employment market. Yellen also noted that inflation indicators across the board have been declining recently, and there has yet to be any sign of a wave of layoffs.

NZD/USD technical outlook

The Kiwi is mostly flat on the week’s opening prices near 0.5900, but the NZD/USD pair is notably on the downside of recent action, having closed in the red for seven of the last eight consecutive trading weeks. Kiwi bulls are struggling to lift the pair from the year’s lows near 0.5860, and sustained selling pressure will send the NZD tumbling back to 2022’s lows near the 0.5600 handle.

Hourly candles have the pair trying to build a rally from the day’s lows near 0.5890, but 0.5900 appears to be a significant level to overcome, with 0.5980 waiting further above and acting as a ceiling for near-term momentum.

The 4-hour candle overview shows the NZD/USD pairing on the low end, struggling to hold onto near-term consolidation levels. Despite the bearish stance, higher lows are marked in for September, and Kiwi bidders will be looking to build up enough momentum to grab ahold of the 0.6000 handle.

NZD/USD 4-hour chart

- USD/CHF continues to consolidate above the 100-day SMA trading neutral at 0.8910.

- Markets turned cautious ahead of the inflation readings from August from the US.

- Risk aversion is strengthening the USD.

On Tuesday’s sessions, the USD/CHF tallied mild gains and traded near 0.8910. The USD is recovering ground after two consecutive days of trading weak against most of its rivals, while US yields are trading mixed in anticipation of Wednesday’s Consumer Price Index (CPI) from August. On the CHF’s side, the Swiss calendar had nothing relevant to offer in the session.

In that sense, the August CPI is expected to show a 0.5% increase MoM, while the Core measure is forecasted to rise by 0.2% on a monthly basis, and those inflation figures will play a big role in the model of expectations of the next Federal Reserve (Fed) decisions.

Meanwhile, according to the CME FedWatch tool, the market still believes that the Fed will take a break at the September 20 meeting. However, investors anticipate a 40% chance that the Fed might opt for one last interest rate hike in either November or December, which would lift rates to 5.75%.

USD/CHF Levels to watch

The daily chart analysis shows that the short-term outlook for USD/CHF appears bullish. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) maintain positive positions, with the RSI above its midline and displaying an upward trend, while the MACD exhibits green bars. On the other hand, the pair is above the 20 and 100-day Simple Moving Averages (SMAs) but below the 200-day SMA, suggesting that the bulls are in command over the bears on the bigger picture.

Support levels: 0.8900, 0.8877 (100-day SMA), 0.8850.

Resistance levels: 0.8950, 0.9000, 0.9030.

USD/CHF Daily Chart

-638301313932882539.png)

- USD/JPY climbs to 147.20, up 0.43%, after BoJ Governor Ueda hints at ending negative interest rates.

- US 10-year Treasury yield holds steady at 4.292%, bolstering the dollar ahead of crucial August inflation data.

- Market anticipates Consumer Price Index (CPI) to rise from 3.2% to 3.6% YoY, potentially influencing Fed rate decisions.

The Greenback (USD) stages a comeback against the Japanese Yen (JPY) following hawkish remarks by the Bank of Japan (BoJ) Governor Kazuo Ueda over the weekend, as he spoke on the removal of negative interest rates. Hence, the USD/JPY retreated, but as Tuesday’s North American session began, the pair is exchanging hands at 147.20, gaining 0.43% after hitting a weekly low of 145.89.

Greenback gains ground against the Yen following hawkish remarks by BoJ governors, awaiting key US inflation numbers

A risk-off impulse and firm US Treasury bond yields are backing the US Dollar (USD) ahead of the release of August inflation data in the United States. The US 10-year benchmark note sits at 4.292%, unchanged compared to yesterday, contrary to the American Dollar (USD), as shown by the US Dollar Index (DXY). The DXY, which tracks the buck’s performance against a basket of six peers, prints solid gains of 0.30% at 104.83 after dropping to a four-day low of 104.42.

During the weekend, BoJ Governor Ueda said the bank could end its negative policy rate if inflation sustainably hits its 2% inflation target. After his remarks, the JPY strengthened against most G8 FX currencies, while the 10-year Japanese Government Bond (JGB) yield reached 0.70%.

Nevertheless, most JPY gains have been erased as market participants assessed Ueda’s remarks.

On the US front, the US Bureau of Labor Statistics (BLS) will release August’s inflation data on Wednesday. The Consumer Price Index (CPI) is expected to jump from 3.2% to 3.6% YoY, while core CPI to drop from 4.7% to 4.3%. A higher-than-expected inflation reading would reignite speculations about another rate hike by the US Federal Reserve.

For the Fed’s upcoming meeting on September 21, money market futures expect no change to the Federal Fund Rates (FFR). For the November meeting, investors saw the FFR at around 5.48%, 15 bps above the effective FFR, as shown in the picture below.

Federal Reserve Interest Rate Probabilities

Source: Financialsource

In other data, the National Federation of Independent Business (NFIB) revealed that the Small Business Optimism Index fell to 91.3 in August from an eight-month high of 91.9 in July.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, Monday’s price action formed a hammer that breached the Tenkan-Sen line but ended the session at around 146.50s. If the USD/JPY achieves a new weekly high above 147.27, further confirmed with a daily close, the pair’s next stop would be the year-to-date (YTD) high of 147.87 before challenging the 148.00 mark. Downside risks would emerge with a daily close below the Tenkan-Sen line at 146.15.

AUD faced a difficult August. Economists at CIBC Capital Markets analyze Aussie’s outlook.

August sell-off to partially reverse over the medium-term

We have revised our AUD/USD forecast for Q4 and beyond lower, given the backdrop of weak Chinese growth and risks to global growth.

While the continuation of negative Chinese sentiment and potential downside in risk will be a major headwind for the AUD, a potential hawkish repricing of the RBA should limit AUD downside.

CPI and employment reports will be vital for our call of one more RBA hike

AUD/USD – Q4 2023: 0.63 | Q1 2024: 0.63

The US Bureau of Labor Statistics (BLS) will release the most important inflation measure, the US Consumer Price Index (CPI) figures, on Wednesday, September 13 at 12:30 GMT. As we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming United States inflation print for the month of August.

Headline is expected at 3.6% year-on-year vs. 3.2% in July, while core is expected at 4.3% YoY vs. 4.7% in July. On a monthly basis, headline and core CPI are seen at 0.6% and 0.2%, respectively.

TDS

We expect the report to provide additional evidence that the core segment has taken a step down in terms of sequential price gains: We are projecting another 0.2% MoM increase, which would mark the core's third consecutive month running at that pace. On the contrary, headline CPI inflation likely accelerated to 0.6% MoM largely as a result of surging gasoline prices in August. We are assuming a very strong 11% jump for the latter, though a chunk of that increase reflects an unfavorable seasonal adjustment. In YoY terms the headline CPI will likely rise to 3.6% from 3.2% in July, while the core segment will actually lose momentum, dropping to 4.3% from 4.7% YoY.

RBC Economics

We expect headline CPI to tick up to 3.6% YoY in August, up from 3.2% in July. This increase is almost entirely explained by higher global energy prices. Aside from energy, US price pressures have eased substantially in recent months. Food price growth has moderated sharply and we look for ‘core’ (ex-food & energy) price growth to slow to 4.3% YoY in August from 4.7% the month before. That will drop the measure further below a 6.6% peak in September last year.

NBF

The energy component is likely to have had a sizeable positive impact on the headline index given the sharp rise in gasoline prices during the month. This, combined with another healthy gain in shelter costs, should result in a 0.6% increase in headline prices. If we’re right, the YoY rate could move up from 3.2% to 3.7%, marking the biggest increase in nearly a year and a half for this indicator. The advance in core prices could have been more subdued (+0.3% MoM) thanks in part to a decline in the price of used vehicles. This monthly gain should allow the annual rate to come down three ticks to 4.4%, its lowest level in nearly two years.

Citi

We expect a stronger increase in core inflation in August after two consecutive 0.16% MoM increases, with core CPI rising 0.3% MoM. However, at 0.252% MoM unrounded, core CPI would be close to printing another 0.2% increase, albeit still a stronger gain compared to June and July. We also expect some further slowing in shelter prices with 0.44% primary rents and 0.46% owners’ equivalent rent. Meanwhile, headline CPI should rise a strong 0.6%, the strongest increase since June 2022. This will be due to both a rise in retail gas prices and further strength in other energy components like utility gas.

ING

For inflation, we look for fairly big jumps in August’s MoM headline readings with upside risk relative to consensus predictions. Higher gasoline prices will be the main upside driver, but we also see the threat of a rebound in airfares and medical care costs, plus higher insurance prices. These factors are likely to also contribute to core CPI coming in at 0.3% MoM rather than the 0.2% figures we have seen in the previous two months. Slowing housing rents will be evident, but it may not be enough to offset as much as the market expects. Nonetheless, the year-on-year rate of core inflation will slow to perhaps 4.4%. We are hopeful we could get down to 4% YoY in the September report and not too far away from 3.5% in October. We would characterise this relatively firm MoM inflation prints as a temporary blip in what is likely to be an intensifying disinflationary trend.

Wells Fargo

We forecast core CPI gained 0.18% in August, equating to a 4.3% YoY rate. If realized, the Fed would achieve its elusive 2% target on a three-month annualized basis. Within core, commodities and shelter likely propelled the deceleration. However, we expect a roughly 10% jump in gas prices to lift the headline rate to 0.6%. This would mark the largest monthly jump in headline CPI in over one year, bringing the YoY headline rate to 3.6%. Despite recent progress in core inflation, it strikes us as unlikely that the Fed will be able to meet its 2% target on a sustained basis over the next couple of quarters. Although we expect core goods prices to decline in August, the disinflationary momentum from normalizing commodity prices is set to fade. The drag from health insurance prices will also likely come to an end in October, setting up core inflation for an acceleration in Q4.

CIBC

The August CPI will be the final piece of the puzzle for the Fed ahead of its September meeting. We expect the last few soft readings to start to form a trend, with core CPI in August expected to come in at a meagre 0.1% MoM as the easing supply chains will weigh further on core goods prices. We look for service prices to remain firm given solid demand but will be around the pace in recent months. Favourable base effects will also help push the 12-month change in core inflation down meaningfully to 4.2%. Headline CPI will tick up on higher gasoline prices to 3.5%. Given the Fed is sitting in a data dependent position and will continue to weigh risk management considerations heavily, a downside surprise should be slightly bullish for fixed income markets.

Deutsche Bank

Since gas prices have risen nearly 7% in August, headline CPI (+0.61% DB forecast vs. +0.17% previously) will see its largest monthly increase since June 2022. However, core (+0.22% vs. +0.16% last month) is likely to remain relatively becalmed. On these estimates, the YoY number for core CPI inflation should fall 0.4pp to 4.3%, whereas headline would rise 0.4pp to 3.7%, the highest for three months. With core inflation still relatively subdued, we think the positive momentum should continue, with the three-month annualised rate falling by about 90 bps to 2.2%, while the six-month annualised rate should fall by 50 bps to 3.6%. In both cases that would be the lowest since early 2021. So for now the strong headline print should be offset by the positive news on core. However, the risk is always that the longer headline edges up, the more risk of second-round effects down the road. See the fuller preview of what to look for in all the components in the preview link above.

Danske Bank

While higher energy prices likely lifted headline CPI by 0.5% MoM (3.6% YoY), we look for another low core CPI print at 0.2% MoM (4.3% YoY).

ANZ

We forecast US core CPI to rise by 0.2% MoM in August. Higher energy prices should result in the headline CPI rising by a more substantive 0.5% MoM.

The US Dollar Index (DXY) is approaching the hurdle from January/March highs of 105.40/105.80. Economists at Société Générale analyze DXY’s technical outlook.

Recent pivot low near 102.90 should be an important support

DXY formed an important trough near 99.50 in July and quickly re-entered within the previous multi-month range; this has resulted in a rebound phase. The index has recently approached the peaks of last January/March near 105.40/105.80, which is also the upper limit of a steeper ascending channel. An initial pullback can’t be ruled out, however, the recent pivot low near 102.90 should be an important support.

It would be interesting to see if the index can overcome the resistance zone at 105.40/105.80. This break is essential for affirming a larger uptrend.

- Silver price juggles around $23.00 as the focus shifts to the US CPI data for August.

- Investors remain worried about the US inflation outlook due to stronger wage growth and a steady labor market.

- Silver price remains sideways in a range of $22.80-23.20 from the past four trading sessions.

Silver price (XAG/USD) trades back and forth around $23.00 in the New York session. The white metal has remained inside the woods for the past four trading sessions as investors have been sidelined ahead of the United States inflation data for August, which will be published on Wednesday at 12:30 GMT.

The S&P500 has opened on a bearish note as investors remained cautious about the US Consumer Price Index (CPI). Investors remain worried about the inflation outlook due to stronger wage growth and a steady labor market. Inflation in excess of the desired rate of 2% seems most persistent and won’t be easily contained by the Federal Reserve (Fed). This would keep hopes of one more interest rate increase from the Fed alive.

The US Dollar Index (DXY) recovered significantly to near 104.90 but is struggling to extend the upside as investors await the US CPI data for further guidance. As per the estimates, US headline inflation is seen expanding at a stronger pace of 0.6% due to recovered gasoline prices. The core CPI that doesn’t inculcate volatile oil and food prices is expected to grow at a steady pace of 0.2%.

Silver technical analysis

Silver price remains sideways in a range of $22.80-23.20 from the past four trading sessions ahead of the US inflation data. The white metal demonstrates a volatility squeeze, which is being followed by a breakout in the same. The 100-period Exponential Moving Average (EMA) at $23.17 continues to act as a major barricade for the Silver price bulls. Horizontal support is plotted from August 15 low at $22.23.

The Relative Strength Index (RSI) (14) skids into the bearish range of 20.00-40.00, which indicates that the bearish impulse has been triggered.

Silver hourly chart

-638301254495492130.png)

Economists at Société Générale analyze EUR/USD outlook ahead of the ECB decision on Thursday.

Euro way out?

Economists in the Bloomberg survey are almost evenly split between a pause and +25 bps by the ECB on Thursday. No change in rates would have to be accompanied by indication of faster QT (steeper long end of the Bund curve, higher real rates) to avoid a new round of selling EUR/USD and potentially broader EUR/G10.

The record of past ECB meetings when new staff forecasts are published is mixed for EUR/USD with gains and losses evenly split. There is a stronger bias for gains in EUR/JPY and EUR/GBP.

A 25 bps increase instead of a pause this Thursday would surprise investors considering current pricing but would probably not turn the tide for EUR/USD in a meaningful or durable fashion. Growth differentials on both sides of the Atlantic and the gap in real yields handicap the outlook for the Euro.

We think further depreciation towards 1.05 is possible unless markets pare back expectations again of the Fed raising rates beyond 5.50%.

A steepening of the euro bond curve and rise in real yields could be achieved by speeding up QT, but our house view is that this will not be discussed until December. A discussion this week is a tail risk and could give the Euro a lift.

Markets look ahead to the US CPI data. Economists at Commerzbank analyze how the figures could impact Gold price.

US inflation figures could lend tailwind to Gold

After the Gold price had begun sliding in the wake of the robust US labour market data at the beginning of the month, it could receive some tailwind again from US data this week. This is because Wednesday’s US inflation figures are likely to signal a further easing of the price pressure.

No serious moves are likely ahead of next week’s Fed meeting, however, nor would they be particularly justified. After all, the US Fed could still leave the door wide open to a further tightening of monetary policy despite the declining (core) inflation, which would be bad news for Gold.

- EUR/USD comes under heavy pressure after climbing to 1.0770.

- The loss of 1.0700 should put 1.0685 back on the radar.

EUR/USD fully fades the auspicious start of the new trading week and confronts the 1.0700 zone following an early bull run to the 1.0770 region, or four-day highs.

The underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, the breach of the 1.0700 region could encourage sellers to embark on a probable visit to the September low of 1.0685 (September 7) ahead of the May low of 1.0635 (May 31).

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0824.

EUR/USD daily chart

- DXY leaves behind Monday’s pullback to the 104.50/40 band.

- Further recovery shifts the attention to the 105.00 hurdle.

DXY sets aside Monday’s bearish performance and looks to revisit the key 105.00 zone on Tuesday.

The continuation of the multi-week rally appears well and sound and a breakout of 105.00 should encourages the index to retest the September top of 105.15 (September 7) prior to the 2023 peak of 105.88 (March 8).

While above the key 200-day SMA, today at 103.02, the outlook for the index is expected to remain constructive.

DXY daily chart

- USD/CAD extends losses amid a solid recovery in oil price due to an upbeat outlook.

- US headline inflation is seen growing at a 0.6% pace in August due to rising gasoline prices.

- Stronger-than-anticipated Canadian labor market data could force the BoC to raise interest rates further

The USD/CAD pair extends its two-day losing spell after slipping below Monday’s low of 1.3560 in the early New York session. The Loonie asset faces selling pressure as the oil price soars to near $90.00. Investors channel funds into the oil price as OPEC sees robust demand for energy, knowing that the learning curve of various economies in absorbing the burden of higher interest rates will improve significantly.

It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices are strengthening the Canadian Dollar.

S&P500 is expected to open on a slightly bearish note, considering negative cues from overnight futures. Meanwhile, investors remained cautious over August inflation data, which is scheduled for Wednesday.

As per the estimates, the headline inflation grew at 0.6% vs. the former reading of 0.2% due to rising gasoline prices. While core CPI that excludes volatile oil and food prices rose at a steady pace of 0.2%. The US Dollar Index (DXY) recovers further to near 104.90 as investors remain worried about the global slowdown.

A surprise rise in the inflationary pressures would force Federal Reserve (Fed) policymakers to focus more on further policy tightening as the ‘last mile’ of inflation above the desired rate of 2% will be a hard nut to crack.

On the Canadian Dollar front, stronger-than-anticipated labor market data could force the Bank of Canada (BoC) to raise interest rates further. The Canadian labor market witnessed 39.9K new payrolls in the overall laborforce in August, more than doubled the expectations of 15K. In July, the labor force witnessed a reduction of 6.4K payrolls. The Unemployment Rate remains unchanged at 5.5% while investors forecasted a higher jobless rate at 5.6%.

The USD has been making a comeback lately, with the US Dollar Index (DXY) gaining more than 5% from the year-to-date lows in mid-July. Economists at HSBC analyze Greenback’s outlook.

The return of a strong USD

The USD has already been making a comeback but we see more upside ahead.

As monetary tightening increasingly takes its toll on the global economy, this should bode well for the counter-cyclical USD.

The convergence of rate cut expectations for the Fed and other major central banks should also bolster the USD.

Against this backdrop, we change our view on the broad USD, now seeing it strengthening through the end of this year and come the end of 2024.

Economists at Société Générale analyze USD/MXN technical outlook.

Probing upper limit of previous base at 17.40

USD/MXN evolved within a base after reaching an intermittent low near 16.60 in July. It has recently broken above the upper limit suggesting a regain of upward momentum. This is also highlighted by daily MACD, which has been posting positive divergence and has recently crossed above the equilibrium line.

The pair bounced towards the descending trend line drawn since September 2022 at 17.73. A pullback is currently underway, however, the upper band of the base at 17.40 should provide support. Defence of this level is expected to result in a move higher towards the 200-DMA near 17.95/18.00.

- EUR/JPY trades with small gains in a tight range above 157.00.

- Initial resistance comes at the monthly peaks near 158.50.

EUR/JPY leaves behind Monday’s small losses and edges a tad higher well north of the 157.00 hurdle on Tuesday.

In the meantime, the cross continues to face some side-lined trading prior to the potential resumption of the uptrend. That said, a minor hurdle emerges at the so far monthly highs around 158.50 (September 5-7) ahead of the 2023 peak at 159.76 (August 30) and before the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 148.50.

EUR/JPY daily chart

The Organization of the Petroleum Exporting Countries (OPEC) has released its monthly report, which has provided support for the upside in crude oil prices. In the report, OPEC maintained its forecast for global oil demand growth in 2023 at 2.4 million barrels per day (bpd). For 2024, the forecast predicts economic growth of 2.6% (unchanged) and a global demand increase of 2.2 million bpd.

According to the report, the overall OPEC crude oil output rose by 113,000 barrels per day in August, reaching 27.45 million barrels per day. The increase was primarily driven by higher production in Iran and Nigeria. The report also mentioned that, based on secondary sources, Saudi Arabia's crude oil output decreased by 88,000 barrels in August to 8.97 million bpd.

They raised the 2023 non-OPEC supply increase forecast by 100,000 barrels per day to 1.6 million bpd.

Market reaction

Crude oil prices rose further after the report. The WTI barrel is up by 0.89% trading at $88.20, its highest level since November.

- AUD/USD defends immediate support of 0.6400 despite the strengthening of the US Dollar.

- A surprise upside in the US inflation could improve the US Dollar’s appeal significantly.

- The Australian Dollar will remain in action ahead of the Aussie Employment report.

The AUD/USD pair remains sideways above the round-level support of 0.6400 in the early European session. The upside in the Aussie asset seems restricted due to a solid recovery in the US Dollar while the downside seems supported as Aussie-Sino trade relations improved.

S&P500 futures posted decent losses in the London session, portraying caution among market participants ahead of the United States Consumer Price Index (CPI) data for August, which will be published at 12:30 GMT. The US Dollar Index (DXY) rebounds strongly above 104.80 as the market mood dampens due to the rising risks of a global slowdown.

For August inflation data projections, investors anticipated that headline inflation expanded at a higher pace of 0.5% vs. July’s reading of 0.2%. Thanks to the global oil rally, which lifted gasoline prices and elevated the burden on households.

A surprise upside in inflation could improve the US Dollar’s appeal significantly and boost hopes for one more interest rate increase by the Federal Reserve (Fed) in the last three monetary policy meetings of this year.

As per the CME Fedwatch Tool, traders see a 93% chance for interest rates to remain unchanged at 5.25%-5.50% in September. For the rest of the year, traders anticipate almost a 54% chance for the Fed to keep the monetary policy unchanged.

The Aussie-Sino trade relationship strengthened after China’s Premier Li Qiang cited that the economy is willing to work with Australia to jointly safeguard peace and stability in Asia-Pacific. Opening of the Chinese economy to Australia will provide it with a larger market to expand operations.