- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Industrial Production (YoY) | July | -3.8% | 0.7% |

| 04:30 | Japan | Industrial Production (MoM) | July | -3.3% | 1.3% |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 09:00 | Eurozone | Trade balance unadjusted | July | 20.6 | 17.4 |

| 12:30 | U.S. | Retail Sales YoY | August | 3.4% | |

| 12:30 | U.S. | Retail sales excluding auto | August | 1% | 0.1% |

| 12:30 | U.S. | Retail sales | August | 0.7% | 0.2% |

| 12:30 | U.S. | Import Price Index | August | 0.2% | -0.4% |

| 14:00 | U.S. | Business inventories | July | 0% | 0.3% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | September | 89.8 | 90.9 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | September | 738 |

Major US stock indexes rose slightly against the backdrop of a news block that gives the impression that the US and China are attempting to de-escalate the trade war.

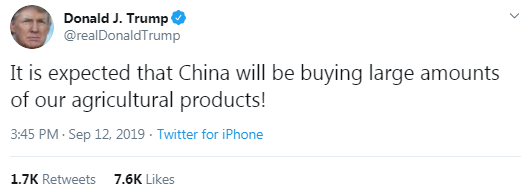

US President Donald Trump announced the decision to postpone the planned increase in tariffs on Chinese goods by $ 250 billion. The decision, which Trump called a “goodwill gesture”, was made after China announced the release of 16 items of American goods from additional tariffs before the scheduled meeting between negotiating teams of the two largest economies in the world next month. According to the head of the White House on Twitter, the increase in duties by 5% (from 25% to 30%), scheduled for October 1, will be postponed for two weeks (until October 15).

A senior Trump administration official has denied reports that the US is considering an interim deal with China that would delay or cancel tariffs on a number of Chinese imports. The administration is "absolutely not considering" the possibility of an interim agreement with China, an administration spokesman told CNBC. Earlier, Bloomberg News reported that advisers to President Donald Trump are considering making such a deal, which pushed major indices to their session highs. US Treasury Secretary Stephen Mnuchin told CNBC that President Trump can make a deal with China at any time, but wants a “good” deal for US workers.

Investors also analyzed US consumer inflation data. A Labor Department report showed that the U.S. core inflation rate rose more than forecasted in August to a one-year high, signaling that inflation is already strengthening ahead of new Chinese commodity tariffs this month, which could push prices up. According to the report, the base consumer price index, which excludes food and energy, grew by 0.3% compared to the previous month and increased by 2.4% compared to a year earlier. This exceeded the average forecasts of economists, while the broader consumer price index rose 0.1% per month and 1.7% year on year, which is below the forecast.

A steady increase in inflation may give some pause to the policies of the Federal Reserve System, as they weigh the need for further cuts in interest rates this year. Nonetheless, market participants continue to expect the central bank to lower rates next week as global growth prospects fade, and trade policy uncertainty weakens the investment business.

Most DOW components completed trading in positive territory (23 out of 30). The biggest gainers were Visa Inc. (V; + 1.96%). The outsider was Walgreens Boots Alliance (WBA; -4.03%).

Almost all S&P sectors recorded an increase. The financial sector grew the most (+ 0.7%). Only the health sector declined (-0.1%).

At the time of closing:

Dow 27,182.45 +45.41 + 0.17%

S&P 500 3,009.57 +8.64 + 0.29%

Nasdaq 100 8,194.47 +24.79 + 0.30%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | Industrial Production (YoY) | July | -3.8% | 0.7% |

| 04:30 | Japan | Industrial Production (MoM) | July | -3.3% | 1.3% |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 09:00 | Eurozone | Trade balance unadjusted | July | 20.6 | 17.4 |

| 12:30 | U.S. | Retail Sales YoY | August | 3.4% | |

| 12:30 | U.S. | Retail sales excluding auto | August | 1% | 0.1% |

| 12:30 | U.S. | Retail sales | August | 0.7% | 0.2% |

| 12:30 | U.S. | Import Price Index | August | 0.2% | -0.4% |

| 14:00 | U.S. | Business inventories | July | 0% | 0.3% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | September | 89.8 | 90.9 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | September | 738 |

Nick Kounis, the head of financial markets research at ABN AMRO, suggests that the ECB announcements were broadly in line with expectations in terms of rate cuts (a 10bp reduction in the deposit rate and a signal of more to come) and mitigating measures for banks (more generous TLTRO conditions and a tiered deposit rate system).

- “The restart of net asset purchases was a mixed bag, as the size was relatively modest (EUR 20bn per month), but the programme is open-ended for the first time since the ECB launched the APP. The ECB said the programme would last as ‘long as necessary’.

- Despite the open-ended nature of the programme, the size of the QE programme is very small and, as such, the macroeconomic impact of these measures will be relatively modest. As such we doubt whether this package of measures will be sufficient to raise inflation significantly over the next 2-3 years. Given this, and the modest pace of net asset purchases, QE will likely last for the foreseeable future, and a step up in the pace looks likely at some point.”

According to sources, the U.S. President Donald Trump is considering an interim trade deal with China, which would delay and even roll back some tariffs for commitments on intellectual property and agricultural purchases.

Jacqui Douglas, the chief European macro strategist at TD Securities, says that the ECB disappointed on the headline numbers themselves, with a 10bps rate cut and only €20bn of QE, but exceeded on the forward expectations by effectively shifting to QE infinity which will run until the inflation outlook robustly converges to close to 2%, and almost right up until the point they are ready to hike rates.

- “Importantly, while there is only €20bn/month in buying, the stock announced, if you are to believe the ECB's and consensus forecasts, implies it could be around €500bn in QE that will be delivered and likely running well into 2021, all depending on the inflation outlook.

- The word-something is obvious and will likely increase the headline volatility in the coming months as both the hawks and doves can talk up their preferred timing and delivery of this policy and the onus is now on the press conference today for Draghi to reinforce what the collective expectation will be.

- Still to come in the press conference will be details on how tiering will work, whether they have made changes to the buying limits on QE, and the changes to the macro forecasts which still have scope to turn this initial dovish market interpretation around.”

Nathan Janzen, the senior economist at Royal Bank of Canada (RBC), notes that the U.S. core CPI inflation rose 2.4% year-over-year in August while the headline index increased 1.7% year-over-year.

- “Core prices rose 0.3% month-over-month for a third straight month.

- There is still little if any evidence that US inflation is at risk of coming unhinged on the upside. Nonetheless, the third straight 0.3% increase in price growth excluding food & energy products marks the longest such stretch since 1995 – and the year-over-year rate at 2.4% matches a cycle high.

- US tariffs on a widening variety of goods imports from China may be filtering through to higher consumer prices, but do not explain all of the increase. Prices for services ex-energy products also increased 0.3% in each of the last three months. The US Fed pays more attention to the core PCE deflator, which has held under a 2% rate, but could presumably follow CPI prices higher in the near-term.

- We continue to pencil in another two 25 basis point rate cuts from the Fed this year, the next being next week in September.”

Statistics

Canada reported on Thursday the New Housing Price Index (NHPI) edged down 0.1

percent m-o-m for the third straight month in July.

Economists had

forecast the NHPI to remain unchanged m-o-m in July.

According to

the report, Edmonton (-0.8 percent m-o-m) registered the largest price drop in

July, with builders offering promotions and cash rebates to stimulate sales. In

addition, the prices of new homes fell in Toronto (-0.6 percent m-o-m) and

Vancouver (-0.5 percent m-o-m), due to unfavorable market conditions and lower

negotiated selling prices. At the same time, prices of new homes continued to grow

in Montreal (+1.6 percent m-o-m) and Ottawa (+0.9 percent m-o-m) because of a combination

of factors including, higher construction costs and increased demand coupled

with low supply in the housing market.

In y-o-y terms,

NHPI was fell 0.4 in July after dropping 0.2 percent in the previous month.

That marked the largest decrease in almost a decade.

U.S. stock-index futures rose on Thursday, as investors cheered President Trump’s decision to delay scheduled tariff hikes on $250-billion worth of Chinese imports along with a large bond-buying program from the European central bank (ECB).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,759.61 | +161.85 | +0.75% |

Hang Seng | 27,087.63 | -71.43 | -0.26% |

Shanghai | 3,031.24 | +22.42 | +0.75% |

S&P/ASX | 6,654.90 | +16.90 | +0.25% |

FTSE | 7,357.91 | +19.88 | +0.27% |

CAC | 5,665.50 | +47.44 | +0.84% |

DAX | 12,460.78 | +101.71 | +0.82% |

Crude oil | $54.69 | -1.90% | |

Gold | $1,524.40 | +1.41% |

- The protracted slowdown in the eurozone economy is more marked than expected

- Probability of a hard Brexit has gone up lately

- Baseline doesn't include trade tensions escalation

- There is no more calendar dependence, this should offer a clear guidepost

- There was a unanimous consensus, mainly that fiscal policy should become the main instrument (crowd laughs)

- It's high time for fiscal policy to take charge

- There was broad consensus on most monetary measures

- There were more diverse views on QE but the consensus was so broad there was no need to take a vote

- There was broad consensus forward guidance, rate cut, reinvestments and TLTRO

- There was unanimity on the need to act

- One reason to act now was that inflation expectations are re-anchoring at 1.0%-1.5%

- Draghi says ECB has QE headroom for quite a long time

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 169 | 0.92(0.55%) | 354 |

ALCOA INC. | AA | 22.35 | 0.17(0.77%) | 6636 |

ALTRIA GROUP INC. | MO | 44.83 | 0.11(0.25%) | 40512 |

Amazon.com Inc., NASDAQ | AMZN | 1,841.22 | 18.23(1.00%) | 30371 |

American Express Co | AXP | 118.5 | 0.50(0.42%) | 17727 |

AMERICAN INTERNATIONAL GROUP | AIG | 56.35 | -0.25(-0.44%) | 900 |

Apple Inc. | AAPL | 225 | 1.41(0.63%) | 357226 |

AT&T Inc | T | 38.45 | -0.29(-0.75%) | 193751 |

Boeing Co | BA | 383.4 | 0.46(0.12%) | 19996 |

Caterpillar Inc | CAT | 132.06 | -1.03(-0.77%) | 10500 |

Chevron Corp | CVX | 120.27 | -1.01(-0.83%) | 6664 |

Cisco Systems Inc | CSCO | 50.34 | 0.31(0.62%) | 16856 |

Citigroup Inc., NYSE | C | 67.85 | -1.05(-1.52%) | 19137 |

Deere & Company, NYSE | DE | 164.1 | -1.05(-0.64%) | 2580 |

Exxon Mobil Corp | XOM | 71.5 | -0.43(-0.60%) | 3359 |

Facebook, Inc. | FB | 189.76 | 1.27(0.67%) | 36517 |

Ford Motor Co. | F | 9.35 | -0.07(-0.74%) | 62784 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.15 | 0.07(0.69%) | 74269 |

General Electric Co | GE | 9.38 | 0.02(0.21%) | 294136 |

General Motors Company, NYSE | GM | 39.62 | 0.16(0.41%) | 1006 |

Goldman Sachs | GS | 214.5 | -2.30(-1.06%) | 7215 |

Hewlett-Packard Co. | HPQ | 19.12 | 0.06(0.31%) | 157 |

Home Depot Inc | HD | 233.75 | 1.09(0.47%) | 547 |

Intel Corp | INTC | 53.1 | 0.31(0.59%) | 29397 |

International Business Machines Co... | IBM | 144.32 | 0.72(0.50%) | 2329 |

International Paper Company | IP | 42.5 | 0.66(1.58%) | 1802 |

Johnson & Johnson | JNJ | 131.26 | 0.09(0.07%) | 1477 |

JPMorgan Chase and Co | JPM | 115.73 | -1.46(-1.25%) | 27710 |

McDonald's Corp | MCD | 211 | 0.80(0.38%) | 3040 |

Merck & Co Inc | MRK | 83.45 | 0.53(0.64%) | 3195 |

Microsoft Corp | MSFT | 137.08 | 0.96(0.71%) | 72705 |

Nike | NKE | 87 | 0.25(0.29%) | 1222 |

Pfizer Inc | PFE | 37.6 | 0.19(0.51%) | 6263 |

Procter & Gamble Co | PG | 121.63 | 0.36(0.30%) | 2613 |

Starbucks Corporation, NASDAQ | SBUX | 91.7 | 0.72(0.79%) | 11530 |

Tesla Motors, Inc., NASDAQ | TSLA | 247.61 | 0.51(0.21%) | 50235 |

The Coca-Cola Co | KO | 55 | 0.23(0.42%) | 7135 |

Twitter, Inc., NYSE | TWTR | 43.69 | 0.44(1.02%) | 28524 |

United Technologies Corp | UTX | 136.75 | 0.80(0.59%) | 357 |

UnitedHealth Group Inc | UNH | 235.7 | 1.49(0.64%) | 2206 |

Verizon Communications Inc | VZ | 59.86 | -0.27(-0.45%) | 5228 |

Visa | V | 176.71 | 1.73(0.99%) | 24715 |

Wal-Mart Stores Inc | WMT | 116.61 | 0.59(0.51%) | 9880 |

Walt Disney Co | DIS | 136.65 | 0.46(0.34%) | 7606 |

Yandex N.V., NASDAQ | YNDX | 38.05 | 0.39(1.04%) | 1250 |

The Labor

Department announced on Thursday the U.S. consumer price index (CPI) edged up

0.1 percent m-o-m in August, following a 0.3 percent m-o-m increase in the

previous month.

Over the last

12 months, the CPI rose 1.7 percent y-o-y last month, following a 1.8 percent

m-o-m advance in the 12 months through July.

Economists had

forecast the CPI to increase 0.1 percent m-o-m and 1.8 percent y-o-y in the

12-month period.

According to

the report, gains in the indexes for shelter (+0.2 percent m-o-m) and medical

care (+0.9 percent m-o-m) were the major factors in the seasonally adjusted

all-items monthly increase, outweighing a drop in the energy index (-1.9 percent

m-o-m). The food index was unchanged for the third month in a row.

Meanwhile, the

core CPI excluding volatile food and fuel costs increased 0.3 percent m-o-m in August,

the same pace as in the previous month.

In the 12

months through August, the core CPI rose 2.4 percent after a 2.2 percent increase

for the 12 months ending July. It was the largest increase since July 2018.

Economists had

forecast the core CPI to rise 0.2 percent m-o-m and 2.3 percent y-o-y last

month.

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment benefits decreased more than expected last week, signaling the labor market remains healthy despite cooling in some parts of the economy.

According to

the report, the initial claims for unemployment benefits fell by 15,000 to a

seasonally adjusted 204,000 for the week ended September 7. That marked the biggest

one-week decline in claims since May.

Economists had

expected 215,000 new claims last week.

Claims for the

prior week were revised upwardly to 219,000 from the initial estimate of 217,000.

Meanwhile, the four-week moving average of claims decreased by 4,250 to 212,500 last week, the lowest since late July.

- U.S. expects China to buy American agricultural products

- President Trump prepared to keep tariffs in place and raise them if necessary

The European

Central Bank (ECB) left its main refinancing rate unchanged at 0.00 percent on

Thursday, while most analysts expected a cut.

Its interest

rate on the marginal lending facility was also left unchanged at 0.25%, while

the interest rate on the deposit facility was cut by 10 basis points to -0.50%..

In its policy

statement, the ECB noted the Governing Council expects its key interest rates

to remain at their present or lower levels until it has seen the inflation

outlook robustly converge to a level sufficiently close to, but below, 2%

within its projection horizon, and such convergence has been consistently

reflected in underlying inflation dynamics.

In addition, the

European regulator also announced that net purchases would be restarted under

the Governing Council’s asset purchase programme (APP) at a monthly pace of EUR20

billion as from 1 November. According to the Bank, these purchases would run

for as long as necessary to reinforce the accommodative impact of its policy

rates, and would end shortly before it starts raising the key ECB interest

rates.

The ECB also

said that the modalities of the new series of quarterly targeted longer-term

refinancing operations (TLTRO III) would be changed to preserve favorable bank

lending conditions, ensure the smooth transmission of monetary policy and

further support the accommodative stance of monetary policy.

Bert Colijn, a senior Eurozone economist at ING, notes that Eurozone's industrial production fell by 0.4% month on month, and 2% on an annual basis in July, confirming the declining trend that has been in place since December 2017.

- "The poor start to the third quarter will make it difficult to see a positive contribution from manufacturing to GDP growth in 3Q, which confirms prolonged slowdown concerns in the eurozone.

- The breakdown of production by type of good makes it quite clear that consumer demand is currently crucial in keeping GDP growth in the positive territory as the production of consumer goods, both durable and non-durable continues to grow on an annual basis, while intermediate and capital goods production is currently -3% and -3.4% lower than in July 2018.

- Out of the larger countries, Germany is by far the worst performer with -5.3% annual growth in production. However, other large economies are not experiencing strength in industrial performance like France. Italy is experiencing negative annual growth rates and Spain saw production slow from 1.3% to 0.3% in July. While some of the issues facing the industry are impacting Germany more than other countries, it seems unlikely that many of the larger economies are isolated from those concerns.

- For the ECB, the already wrapped up staff projections will be more important than today’s production figures, but today’s figures do come as a confirmation of the sluggish environment that the ECB is trying to battle. If minds have not been made up until now whether QE will be included in today’s package or not, perhaps these disappointing production figures may play a small role in the decision after all."

Analysts at TD Securities are expecting the U.S. headline CPI to slow a tenth to 1.7% y/y in August (flat m/m) on the back of a notable decline in energy prices.

- “Core inflation should tick up a tenth to 2.3% y/y, reflecting a firm 0.2% m/m advance — though slightly softer than in Jun-Jul as core goods inflation was likely flat m/m. That said, a steady 0.2% m/m gain in services should support core CPI.”

Deutsche Bank's analysts think the package today from ECB will likely include the first cut in the deposit rate since 2016 at what will be President Draghi’s penultimate meeting in charge.

“Our European economists wrote that they expect the ECB to announce a broad policy easing package, but they think the likelihood of QE being a part of that package have declined, as a result of opposition to new QE from some Governing Council members, along with the risk that further QE which flattens the yield curve would be counterproductive for banks. Their view is that there’ll be a 10bp deposit facility rate cut, upgraded forward guidance, and tiering, which would be more positive for banks.

In terms of the specifics, they expect the 10bp deposit rate cut will be followed by another 10bps in December, after Draghi has left office, and think the “or lower” easing bias will be maintained. On tiering, they think that the ECB will keep the mechanism simple, although this may come at the expense of a dynamic solution (one that adjusts continuously to the volume of excess liquidity). And on forward guidance, they think that the more likely option will be using guidance to strengthen the symmetry of the inflation target.

The highest level of uncertainty relates to QE. After Draghi’s dovish Sintra speech, QE became part of baseline expectations. However, our economists are concerned about the inconsistency between QE – big QE at least – and tiering if the latter signals an emergent sensitivity to banking, especially given the fact that some ECB officials have spoken out against new QE over the last few weeks. Even the hawks haven’t really pushed back against rate cut expectations.

Our economists adjusted their view on QE last week to anticipate a moderately more pro-banking outcome. That is, a steeper curve which results from no QE or QE targeted at the short end or QE targeted at private assets only. Less QE rather than more, which might be the compromise between hawks and doves, fits with the argument.

So this could be the meeting where the ECB implicitly acknowledges that the reversal rate across the whole curve is near to being breeched or has already been.”

- Parliament will have time to discuss a deal after European Council summit

- If we can't get a deal at the end of next month, we will be ready to leave

- Says that a no-deal Brexit planning paper is the worst-case scenario

- Says UK is making sensible preparations for such a circumstance

- Denies lying to the Queen over parliament prorogation

Jan von Gerich, an analyst at Nordea Markets, suggests that the ECB is set to announce an easing package today but given the contradictory comments from ECB members and a large number of variables, the meeting is bound to include surprises.

- “At the July meeting, Draghi sent clear signals that an easing package would be launched at the meeting on 12 September. This message was reinforced further by the meeting account, which confirmed the merits of the package approach.

- We expect the ECB to reveal an easing package consisting of several steps next week:

- to be accompanied by moving to a tiered reserve system, which implies more room to cut rates going forward

2) Restarting net asset purchases at a pace of EUR 30bn per month (with the purchases starting in October)

- consisting of public-sector, corporate and covered bonds

- to be accompanied by raising the issuer limit for public-sector issuers from 33% to 49%

3) Strengthening forward guidance by linking it more concretely to the inflation outlook.

- In our view, the economic uncertainties have continued to increase since the June meeting and the economic and inflation outlook is more negative compared to the ECB’s staff forecasts. We think that the ECB will be forced to revise its growth and inflation forecasts downwards, which will strengthen the case for further easing at the September meeting.”

According to Sean Callow, analyst at Westpac, the mood over US-China trade has obviously improved quite a bit but US data has not really encouraged recession talk lately.

“After the dismal sub-50 print on the Aug manufacturing ISM, the key Aug services sector reading was a great relief, the ISM bouncing to 56.4 (vs 53.8 in China, 53.5 in the Eurozone). The Aug employment report should not have upset the Fed either, with NFP growth of 1.4%yr, a 3.7% unemployment rate and 3.2%yr earnings growth surely consistent with the consensus FOMC forecast. Resilient growth but sub-target inflation and ongoing international political risks argue for a 25bp cut with no explicit commitment to further easing. This should leave DXY higher on the week, probing above 99.”

Germany's Ifo Institute said that recession is likely in Europe's biggest economy and joined other economic institutes in lowering growth forecasts for 2019 and 2020.

For 2019, Ifo now expects growth of 0.5% compared with a previous forecast of 0.6%. For 2020, the economic institute slashed its growth forecast to 1.2% from 1.7%.

"Like an oil slick, the weakness in industry is gradually spreading to other sectors of the economy, such as logistics," said Timo Wollmershaeuser, Ifo's head of forecasts.

The German economy shrank by 0.1% percent in the second quarter and Ifo expects another 0.1% decline in the third quarter, two consecutive quarters of contraction.

"Technically speaking, that would be a recession," Mr. Wollmershaeuser says. A slight recovery in the fourth quarter plus the 0.4% increase of 0.4% achieved in the first quarter would result in growth of 0.5% for 2019 as a whole.

According to estimates from Eurostat, in July 2019 compared with June 2019, seasonally adjusted industrial production fell by 0.4% in the euro area (EA19) and by 0.1% in the EU28. Economists had expected a 0.1% decrease in the euro area. In June 2019, industrial production fell by 1.4% in both the euro area and EU28.

In July 2019 compared with July 2018, industrial production decreased by 2.0% in the euro area and by 1.2% in the EU28.

In the euro area in July 2019, compared with June 2019, production of non-durable consumer goods fell by 0.8%, energy by 0.7% and intermediate goods by 0.3%, while production of durable consumer goods rose by 1.2% and capital goods by 1.8%.

In the EU28, production of energy fell by 1.1%, while production of capital goods rose by 1.5%, durable consumer goods by 1.2%, non durable consumer goods by 0.1% and intermediate goods remained stable.

In the euro area in July 2019, compared with July 2018, production of capital goods fell by 3.4%, intermediate goods by 3.0% and energy by 1.4%, while production of non-durable consumer goods rose by 1.5% and durable consumer goods by 1.8%. In the EU28, production of capital goods fell by 2.6%, intermediate goods by 2.2% and energy by 1.7%, while production of durable consumer goods rose by 1.8% and non-durable consumer goods by 2.3%.

Danske Bank analysts note that overnight, the US President Donald Trump announced that the scheduled 5pp rise in tariffs on USD250bn worth of Chinese imports on 1 October will be postponed by two weeks.

“The decision comes after last week's announcement that the two parties will meet in the beginning of October and on the request of Chinese Vice Premier Lie He, as the 1 October marks the 70 th anniversary of the People's Republic of China. The news also comes after China yesterday announced a broad list of US goods suspended from tariffs. The announcement eased trade war escalation fears with broad equities, yields and the CNY moving higher, while safe havens in CHF, JPY and gold weakened further early this session. Importantly, while we remain sceptical of an eventual trade deal being reached already in October, this morning's announcement could drive an extension of the more upbeat market environment seen since last Wednesday, which stands in stark contrast to most sessions during August when trade and recession fears dominated.”

The International Energy Agency (IEA) expects the U.S. to challenge Saudi Arabia’s position as the world’s leading oil exporter, after briefly overtaking the OPEC kingpin to claim the number one spot earlier this year.

“Booming shale production has allowed the U.S. to close in on, and briefly overtake, Saudi Arabia as the world’s top oil exporter. The installation of the necessary pipelines and terminals is continuing apace, which will ensure that the trend continues,” the IEA said in its closely-watched monthly report on Thursday.

The U.S. momentarily surpassed Saudi Arabia as the leading oil exporter in June, after crude exports surged above 3 million barrels per day (b/d), the IEA said. That lifted total exports of crude and products to nearly 9 million b/d. At the same time, Saudi Arabia cut back on both crude and refined product exports.

The IEA left its oil demand growth forecasts for oil demand growth unchanged at 1.1 million b/d for 2019, and 1.3 million b/d in 2020. It based these projections on the assumption that there would be no further deterioration in the economic climate and in trade disputes.

According to TD Securities analysts, today all eyes will be on the ECB decision, where another easing package is widely expected.

“Our base case sees a 20bps rate cut (mkts -10bps) with tiering, €40bn/month of QE (mkt ~€30bn), and no rate hikes until at least mid-2021. We're more comfortable with our rates view than QE, as even the hawks seemed to be open to cutting rates further, while the QE decision is likely going to be much more contentious. Looking at the risks around our base case, we see a much higher probability of seeing a more hawkish outcome than a guns-blazing dovish package. While we attribute about a 40% probability to our base case, we see fairly high 30% odds of an outcome roughly in line with consensus, and an uncomfortably high 20% chance that the ECB disappoints with no QE announced at all, and a message that Draghi has been steamrolled by the hawks. We hope though that the deteriorating staff GDP and HICP forecasts will be enough to convince the hawks that more QE is needed, allowing Draghi to cement his status as the President who did "whatever it takes" to save the Eurozone.”

Hopes that US can create favourable conditions for trade talks

Mid-level trade teams to meet soon to prep for high-level talks

Trade teams are in effective communication

Will roll out supportive measures to stabilise trade at appropriate time

Possible purchases of US agriculture may include soybeans, pork

There is an almost 60% chance that the German economy could fall into recession, according to a monthly index gauging the health of Europe’s largest economy published by the Macroeconomic Policy Institute (IMK).

The forward-looking index by the private economic research body put the risk of recession at 59.4%, up from 43% in August. This is its highest recession risk reading since the winter months of 2012/2013.

The German economy has weakened as its export-dependent manufacturing sector languishes in recession due to trade conflicts and uncertainty linked to Britain’s planned departure from the European Union which have stifled demand. The government has been facing calls to inject a stimulus package into the economy, which shrank in the second quarter.

“The hope that domestic demand could save Germany from a recession is fading increasingly,” said IMK’s Sebastian Dullien. “This increases the pressure on the European Central Bank to further loosen monetary policy.”

Danske Research discusses USD/JPY and EUR/JPY outlook and maintains a structural bearish bias on the 2 pairs in the medium-term.

"In the past two weeks, USD/JPY has moved from low 105s to around 107.5 and markets have been unwinding hedges across the board. We remain reluctant, however, to extrapolate the momentum. Ironically, stabilising markets may be just what tips Fed in a more hawkish direction next week. On trade, optimism has been brewing for the October meeting but nothing is tangible as of yet. We view tail risk as elevated going into the coming weeks and maintain our view that USD/JPY and EUR/JPY remain in a downtrend," Danske adds.

According to the report from INSEE, in August 2019, the Consumer Prices Index (CPI) recovered, to +0.5% over a month, after a 0.2% downturn in July. This rebound resulted from that, seasonal, in manufactured product prices (+0.9% after −2.8% in July) due to the end of summer sales. Energy prices were stable after an accentuated drop in the previous month (−1.1% in July). Services prices slowed down (+0.4% after +1.0%), essentially due to airfares and accommodation services prices. Food prices rose by 0.5%, as in the previous month. Finally, tobacco prices were stable over a month.

Seasonally adjusted, consumer prices barely increased: +0.1% over a month, as in July.

Year on year, consumer prices slightly slowed down: +1.0% in August, after +1.1% in July. This slight fall in inflation came from a more marked year-on-year drop in manufactured products prices, partly offset by a barely sharper rise in food prices. Moreover, the inflation in energy and services was stable.

Year on year, core inflation dropped in August: +0.7% year on year, after +0.9% in the previous month. The Harmonised Index of Consumer Prices (HICP) rebounded over a month, to +0.5% after −0.2% in July; year on year, it rose by 1.3%, as in the previous month.

The Federal Statistical Office (FSO), the Producer and Import Price Index fell in August 2019 by 0.2% compared with the previous month, reaching 101.4 points (December 2015 = 100). The decline is due in particular to lower prices for rubber and plastic products as well as basic metals and semi-finished metal products. Compared with August 2018, the price level of the whole range of domestic and imported products fell by 1.9%.

The decline in the producer price index compared with the previous month was mainly due to lower prices for waste collection and recovery, mineral oil products, metals and metal semi-finished products, paper and paper products and plastic products. Rising prices were observed for paints, printing ink and mastics chemicals, pharmaceutical raw materials, raw milk, and other chemical products.

Lower prices compared with July 2019 were recorded in the import price index, in particular for chemical raw materials, rubber and plastic products, metals and metal semi-finished products, and paper and paper products. Price declines were also seen in computers, wood products, basic pharmaceutical products, vegetables and potatoes. However, citrus fruits became more expensive.

According to the report from Federal Statistical Office (Destatis), the inflation rate in Germany as measured by the consumer price index (CPI) was 1.4% higher in August 2019 than in August 2018. Destatis also reports that the rate of inflation was down (July 2019: +1.7%).

Energy product prices rose 0.6% from August 2018 to August 2019. This increase was much smaller than the overall price increase. In July 2019 energy prices had risen by as much as +2.4% year on year. Food prices rose above average (+2.7%) in August 2019 compared with August 2018. The year-on-year increase in food prices thus accelerated for the fifth consecutive month (July 2019: +2.1%). The prices of goods (total) were 1.3% higher in August 2019 than in the same month a year earlier. Service prices rose more strongly (+1.6%) than goods prices from August 2018 to August 2019.

Compared with July 2019, the consumer price index fell by 0.2% in August 2019. The prices of energy (total) were down 1.0% in the same period. Price decreases were recorded for both motor fuels (-2.4%) and heating oil (-2.0%). There were sizeable price decreases also in the education sector for pre-primary and primary education services (-3.0%) and for package holidays (-2.5%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1193 (2166)

$1.1163 (1793)

$1.1122 (941)

Price at time of writing this review: $1.1014

Support levels (open interest**, contracts):

$1.0963 (4122)

$1.0926 (3361)

$1.0884 (2061)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 4 is 79423 contracts (according to data from September, 11) with the maximum number of contracts with strike price $1,1050 (5273);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2478 (482)

$1.2434 (266)

$1.2405 (181)

Price at time of writing this review: $1.2330

Support levels (open interest**, contracts):

$1.2203 (971)

$1.2125 (1167)

$1.2082 (640)

Comments:

- Overall open interest on the CALL options with the expiration date October, 4 is 14751 contracts, with the maximum number of contracts with strike price $1,2500 (1740);

- Overall open interest on the PUT options with the expiration date October, 4 is 13931 contracts, with the maximum number of contracts with strike price $1,1900 (1467);

- The ratio of PUT/CALL was 0.94 versus 0.94 from the previous trading day according to data from September, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.52 | -2.79 |

| WTI | 55.83 | -3.27 |

| Silver | 18.09 | 0.72 |

| Gold | 1496.356 | 0.72 |

| Palladium | 1570.74 | 0.84 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 205.66 | 21597.76 | 0.96 |

| Hang Seng | 475.38 | 27159.06 | 1.78 |

| KOSPI | 17.12 | 2049.2 | 0.84 |

| ASX 200 | 23.9 | 6638 | 0.36 |

| FTSE 100 | 70.08 | 7338.03 | 0.96 |

| DAX | 90.36 | 12359.07 | 0.74 |

| CAC 40 | 24.85 | 5618.06 | 0.44 |

| Dow Jones | 227.61 | 27137.04 | 0.85 |

| S&P 500 | 21.54 | 3000.93 | 0.72 |

| NASDAQ Composite | 85.52 | 8169.68 | 1.06 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68594 | -0.03 |

| EURJPY | 118.686 | -0.08 |

| EURUSD | 1.10081 | -0.36 |

| GBPJPY | 132.874 | 0.01 |

| GBPUSD | 1.23214 | -0.29 |

| NZDUSD | 0.64112 | -0.18 |

| USDCAD | 1.31911 | 0.35 |

| USDCHF | 0.99292 | 0.16 |

| USDJPY | 107.807 | 0.28 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.