- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The New Zealand Business NZ PMI dropped in June to 47.5 from 48.9 in May, against expectations of an increase to 49.8. The data reflects the manufacturing sector showed further contraction in June. It is the lowest reading since November 2022 and below the long-term average of 53.0

“The key sub-index values of Production (47.5) and New Orders (43.8) dragged the June result further into contraction, while Employment (47.0) also shifted down a gear. Any return to long run activity levels needs these sub-index values returning to positive territory”, the report mentioned.

Market reaction:

The NZD/USD remained slightly below 0.6300 following the data, holding onto Wednesday’s gains when it climbed sharply from under 0.6200, boosted by a broad-based decline of the US Dollar.

- CAD/JPY extends losses for the seventh consecutive day, with minimal decline of 0.07%, trading near weekly low of 104.79.

- Despite BoC raising rates to 5%, the pair fails to gain momentum, losing 0.99% or 100 pips.

- Downward trend aims for support at June 7 high of 104.88, potentially leading to 104.00 and June 8 low of 103.70.

- Bullish continuation requires breaking above resistance at 105.00, with further hurdles at 105.45, 106.11, Kijun-Sen at 106.60, and Tenkan-Sen at 107.09.

As the Asian session begins, the CAD/JPY extends its losses to seven straight days, registering minimal losses of 0.07%. Despite the Bank of Canada (BoC) raising rates by 25 bps to 5% on Wednesday, the CAD/JPY pair failed to gain traction and lost 0.99% or 100 pips. As of writing, the CAD/JPY trades at 104.96, nearby the weekly low of 104.79.

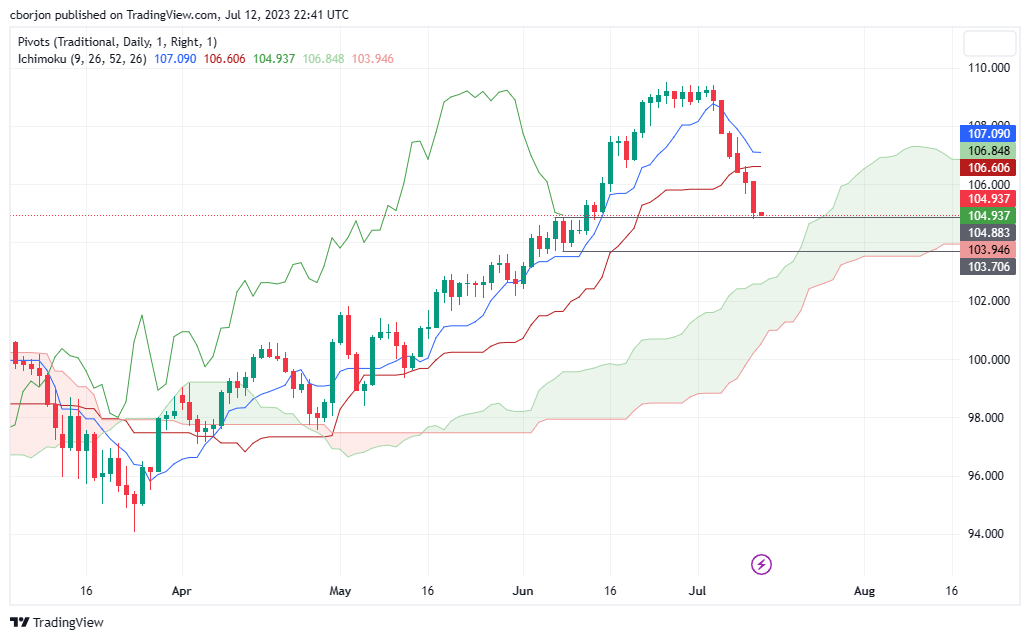

CAD/JPY Price Analysis: Technical outlook

The CAD/JPY daily chart portrays the pair as upward biased, similar to the AUD/JPY pair case published here. Even though the CAD/JPY edged lower, as long as it remains above the Ichimoku Cloudthe uptrend remains in place. But some mixed signals suggest caution is warranted, like prices sliding below the Tenkan-Sen and Kijun-Sen lines and the Chikou Span about to turn bearish can pave the way for further losses.

If CAD/JPY continues to drop, the June 7 daily high of 104.88 will be the first support level to challenge. A breach of the latter will expose the 104.00 mark, followed by the June 8 daily low of 103.70.

Conversely, the CAD/JPY first resistance would be 105.00 for a bullish continuation. Once cleared, the next resistance emerges at the June 13 daily high of 105.45, followed by the July 12 daily high of 106.11. the next resistance level would be the Kijun-Sen line at 106.60 before the Tenkan-Sen at 107.09.

CAD/JPY Price Action – Daily chart

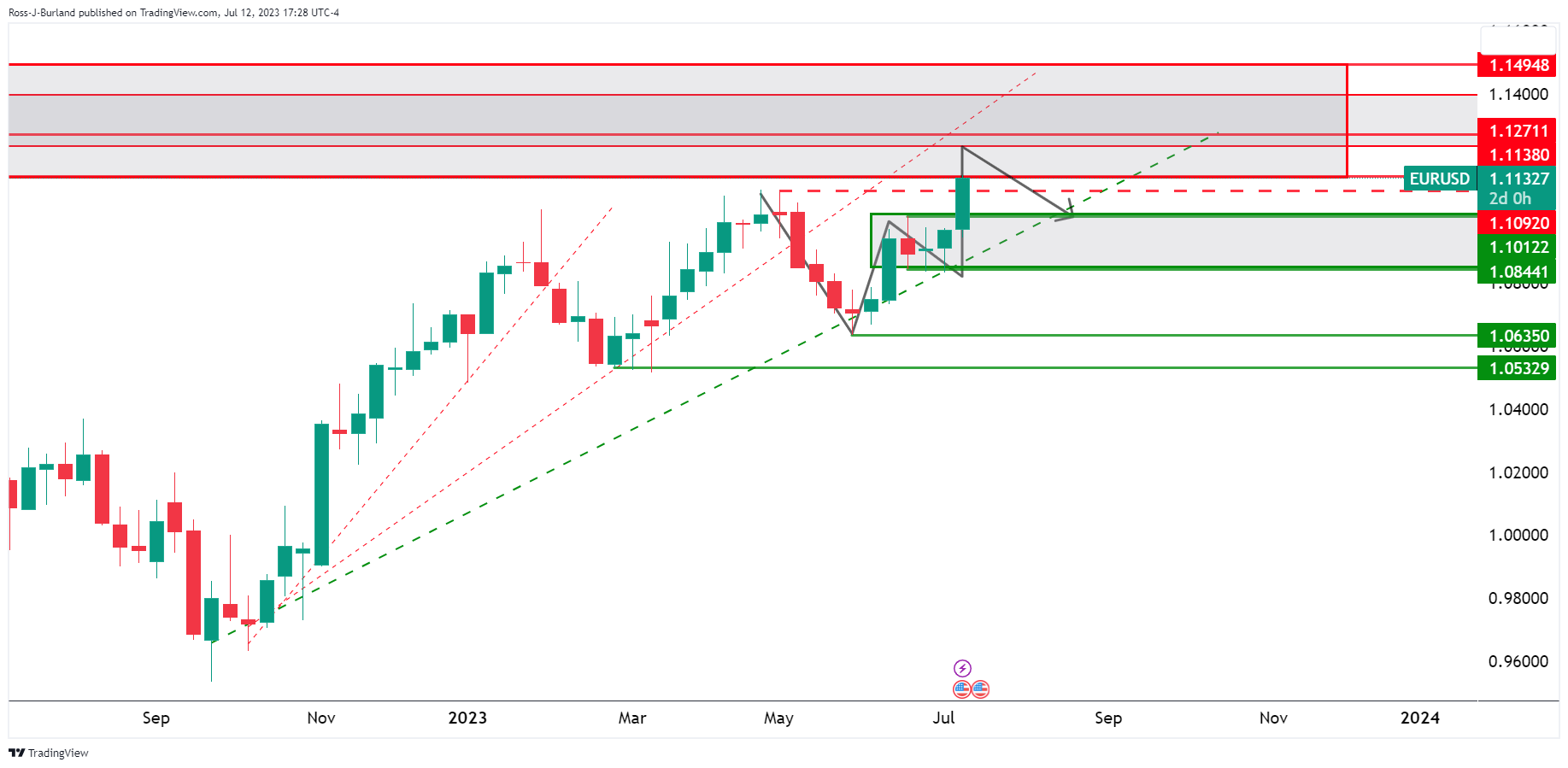

- EUR/USD bears are moving in at key resistance.

- Bears eye the 61.8% Fibo and trendline support.

EUR/USD has rallied into a resistance area and there are prospects of a correction as per the following weekly chart analysis:

EUR/USD weekly charts

The weekly chart is leaving a W-formation on the chart and the bulls have reached a resistance area which leaves the focus on the downside. However, the bears will need to be patient and wait for a deceleration of the current rally. The lower time frames can be monitored for this purpose.

EUR/USD daily chart

The daily chart shows the price leaving behind a W-formation, again, a bearish factor on the charts and a correction could be on the cards with the 38.2% ratio currently lining up with prior resistance.

EUR/USD H4 chart

This is where we are going to see the signs of deceleration as we move into Thursday. On the lower time frames, such as the 15 minutes, this will be even more evident and we can start to draw our key support areas as follows:

EUR/USD M15 chart

The price is moving into a potential distribution phase and a break of 1.1110/1.1090 could lead to a sell-off towards the trendline support and a 61.8% Fibonacci ratio.

- AUD/JPY snaps five days of losses, gaining 0.20% and bouncing off a weekly low of 93.29, showing a slight upward trend.

- Technical analysis reveals neutral to bullish sentiment, with the AUD/JPY pair lingering above the Ichimoku Cloud.

- If the pair reclaims 94.00, it could aim for 94.65 and potentially reach the 95.00 mark, indicating upward momentum.

The AUD/JPY reached a weekly low of 93.29 but bounced off, snapped five days of consecutive losses on Wednesday, and gained 0.20%. As Thursday’s Asian session begins, the AUD/JPY exchanges hand at 93.95, registering minuscule losses of 0.02%.

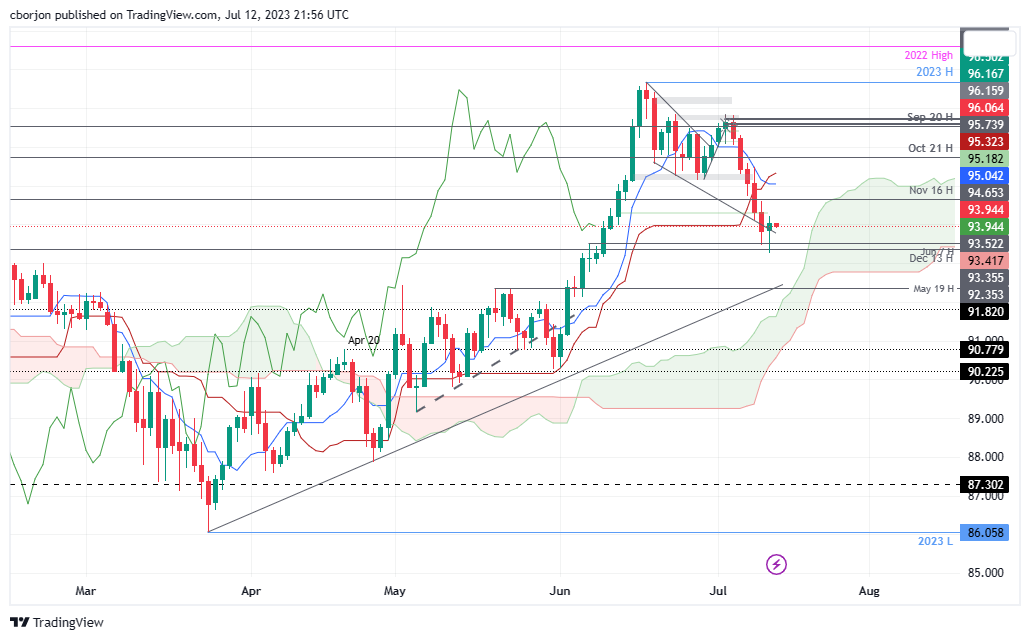

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY remains neutral to upward biased, as it remains above the Ichimoku Cloud, but turned neutral as prices fell below the Tenkan-Sen and Kijun-Sen lines. Even though the former crossed beneath the latter, the Chikou Span stays on top of prices but is about to turn bearish, which would put into consideration a possible change of the trend.

If AUD/JPY reclaims 94.00, that could open the door for a retest of the November 16 high at 94.65, ahead of the pair reaching the 95.00 mark. Once cleared, the Tenkan-Sen could be tested at 95.04, followed by the Senkou Span A line at 95.48, and then the Kijun-Sen line at 95.32.

On the flip side, if the AUD/JPY drops below the Senkou Span B line at 93.42, the weekly lows of 93.29 would be exposed. The AUD/JPY 93.00 figure would be up next. Once broken, support emerges at May 19 high turned support ate 92.35.

AUD/JPY Price Action – Daily chart

- The USD/CAD fell to a low of 1.3145 and then settled at 1.3185, closing with losses.

- BoC hiked rates by 25 bps, as expected.

- The US reported lower-than-expected inflation figures from June.

The Lonnie traded with strong gains agains the USD on Wednesday following the Bank of Canada’s announcement of a 25 basis points hike and soft inflation figures from the US. However, the CAD traded weak agains most of its rivals, including the AUD, JPY, EUR and GBP.

The Bank of Canada (BoC) announced that it raised interest rates by 25 basis points (bps) to 5%, as expected. Regarding the statement, in summary, the bank expects inflation to decline gradually but at a slower pace than previously anticipated and stated that economic activity is forecasted to slow down in the near term, despite a recent pickup in growth. Looking forward, the BoC confirmed that they will keep an eye on evidence of excess demand and sticky core and wage inflation to determine their next monetary policy decisions.

On the US’s side, the Bureau of Labor Statistics reported soft inflation figures from June, which triggered a sharp decline in US Treasury yields. The headline US Consumer Price Index (CPI) fell to 3% YoY, while the Core CPI to 4.8% YoY, both falling short of expectations. In addition, the Federal Reserve (Fed) released its Beige Book report, which stated that the US economic activity has slightly increased since late May. However, the USD held its daily losses due to soft inflation figures, and DXY Index fell to the 100.55 zone, its lowest since April 2022.

USD/CAD Levels to watch

The pair’s outlook for the short term is bearish as the USD/CAD now trades below its main Simple Moving Averages (SMAs) of 20, 100 and 200-days. In addition, technical indicators show weakness as the Relative Strength Index (RSI) stands deep in negative territory and the Moving Average Convergence Divergence (MACD), which prints rising red bars.

Support Levels: 1.3145, 1.3139, 1.3115.

Resistance Levels: 1.3200, 1.3225 (20-day SMA), 1.3275.

USD/CAD Daily chart

-638247936482037612.png)

After the sharp decline of the US Dollar, more US inflation data is due on Thursday with the Producer Price Index. During the Asian session, Australia's Consumer Inflation Expectations and China's trade data are due. Later, the UK will release GDP data.

Here is what you need to know on Thursday, July 13:

As expected, inflation data from the US led to sharp market moves. The US Dollar plummeted, commodities soared, and Wall Street cheered the potential end of the Federal Reserve's interest rate hiking cycle.

Data from the US showed the Consumer Price Index (CPI) rose 0.2% in June, and the annual rate slowed to 3.0%, the lowest since March 2021, well below the 9.1% peak of June 2022. Evidence that inflation continues to slow steadily softened expectations of more rate hikes from the Fed after the July meeting. Market participants still see the central bank hiking 25 basis points the Fed Funds rate in July, but it could be the last one.

The Dow Jones gained 0.25%, and the Nasdaq climbed 1.15%. The US 10-year Treasury yield fell to 3.85%, and the 2-year to 4.75%, the lowest since June 29. The repricing of Fed expectations pushed the US Dollar to the downside. The DXY dropped to the 100.50 area, posting its lowest daily close in a year.

Analysts at Wells Fargo:

Today's softer-than-expected print with signs of pandemic-era distortions fading provides additional evidence that disinflation is occurring in real-time. Looking ahead, we expect the more moderate pace of price growth signaled by the June CPI to continue.

The improvement relative to the 4.6% pace of core inflation in the first half of this year will likely be enough to where the FOMC believes it can sit and wait for the effects of prior tightening to work through the economy after one additional 25 bps hike at its next meeting on July 26. However, with the underlying trend in inflation likely to be stuck closer to 3% than 2%, rate cuts remain a long way off in our view.

More US inflation data is due on Thursday with the Producer Price Index (PPI), which is expected to slow from an annual rate of 6.6% to 6.1%, and the core rate from 5.3% to 4.8%. Also, the weekly jobless claims report is due.

Eurozone bond yields also declined, but nonetheless, the EUR/USD jumped to the highest level since March 2022 after breaking above 1.1100. The pair is bullish, with technical indicators at overbought levels. The European Central Bank (ECB) will release the minutes of its latest meeting on Thursday.

GBP/USD reached fresh 15-month highs boosted by the weaker US Dollar and hit 1.3000. The UK will release GDP data on Thursday.

USD/JPY dropped for the fifth consecutive day, falling below 138.50. The Japanese Yen held well despite risk appetite, supported by the decline in government bond yields.

NZD/USD jumped 1.85%, finally breaking the 0.6200/20 resistance area and climbing towards 0.6300. As expected, the Reserve Bank of New Zealand left the Official Cash Rate unchanged at 5.5% as expected. The central bank reiterated the July Monetary Policy Statement. With inflation expected to continue to fall, the RBNZ will stay on pause.

USD/CAD bounced at 1.2143 following a 25 basis point rate hike from the Bank of Canada. However, the Loonie lagged among commodity currencies.

Analysts at the National Bank of Canada:

“To us, the Bank remains very optimistic on the outlook for the economy. Growth in their MPR was revised up in 2023, never dipping below 1% through their forecast horizon. It’s no surprise then that their inflation outlook was also upgraded, the return to 2% pushed out to the middle of 2025. We’re far less optimistic that conditions will remain so rosy, and our growth outlook is well below the Bank’s. To us, we’re already seeing signs that further rate increases are not needed/appropriate”.

AUD/USD also broke a key resistance area at 0.6700 and jumped towards 0.6800. The outlook is positive for the Aussie from a technical perspective. During the Asian session, Australian inflation expectations are due. Also, Chinese trade data is scheduled to be released, which could weigh on market sentiment.

Gold rose almost $30 to the $1,960 area, boosted by the slide of the US Dollar and lower Treasury yields. Silver jumped 4%, breaking above $24.00, to the highest in a month. Cryptocurrencies failed to benefit from the positive risk tone. Bitcoin dropped 0.85% to $30,330. Crude oil prices rose 1.40%.

Like this article? Help us with some feedback by answering this survey:

- NZD/USD bulls rally toward a close above 0.6300.

- Bears are lurking looking for the correction.

NZD/USD is up 1.6% on the day and has travelled from a low of 0.6182 and reached a high of 0.6307. The bird took off in a technical breakout of last month's highs on the back of a weak US Dollar and the US inflation data.

The US Consumer Price Index arrived (YoY) in June at 3.0% (vs. the expected 3.1% and the previous 4.0%. The core data was a larger miss of 4.8% vs. 5% expected and the prior 5.3%. For the month, it arrived at 0.2% vs 0.3% expected and the 0.4% prior.

As a consequence, the Greenback's index dropped to as low as 100.51, the lowest in two months. US rate futures still show traders overwhelmingly expect the policy rate to rise a quarter point, to a 5.25%-5.5% range, at the Fed's July 25-26 meeting, but now see about a 25% chance of another rate hike before year's end, down from about 35% before the report, Reuters reported.

As for the domestic outlook, analysts at ANZ Bank explained, ''we continue to expect that the Reserve Bank of New Zealand will follow suit and recommence hikes by year-end. That is despite our expectation that inflation falls faster than the RBNZ expect in Q2.''

''Similar to Canada’s experience, while base effects and goods disinflation will support falls in headline in the near term, sticky services inflation tied to a resilient labour market will prove harder to stamp out,'' the analysts added.

NZD/USD daily chart

The price has come up into resistance territory and while the trendline could see a correction from there, a break of 0.6300 could be in order and 0.6350 will come into view.

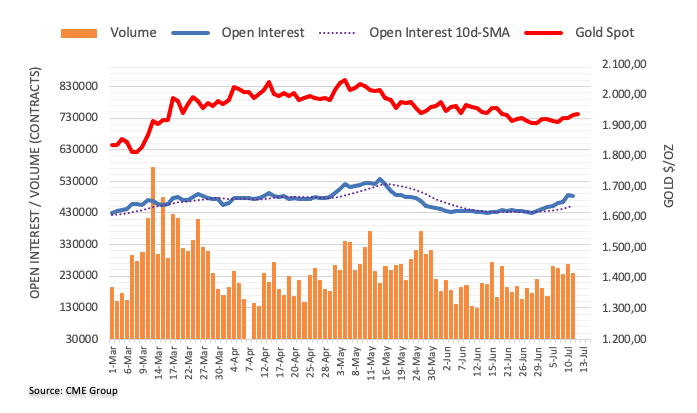

- XAU/USD jumped above the 100-day SMA to $1,958

- Fed’s Beige books stated that overall economic activity increased slightly since late May.

- Soft inflation figure weight on the USD as it made Treasury yields decline.

On Wednesday, the Gold spot XAU/USD gained more than 1% and jumped to a daily high of $1,958. In that sense, the yellow metal gained ground following the report of soft inflation figures from the US, which fueled a decline in US yields. In the meantime, the DXY index stands at its lowest level since April 2022, and the Federal Reserve Beige Book report failed to trigger a recovery.

According to the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) fell to 3% year-on-year in June, slightly lower than the expected 3.1% and down from the previous figure of 4%. The Core inflation also decreased to 4.8% year-on-year, below the anticipated 5% from the previous 5.3%. Consequently, US Treasury yields experienced significant declines across the board. The 2-year yield dropped to 4.74%, the 5-year yield fell to 4.07%, and the 10-year yield dived to 3.86% all three seeing more than 2% declines on the day.

Despite falling yields, investors continue to bet on a 25 basis points hike in the next July meeting, according to the CME FedWatch tool. That said, investors shouldn't take off the table another hike for the rest of 2023 as Jerome Powell and several Federal Reserve (Fed) officials hinted that “multiple hikes” may be appropriate.

In addition, the Federal Reserve's Beige Book revealed that the overall economic activity in the US has seen a slight increase since late May. The report also indicated that consumer spending had shown mixed results, with growth primarily observed in consumer services. However, following the report's release, its impact on the USD was limited as it continues to show weakness agains most of its rivals.

XAU/USD Levels to watch

After piercing through the 100-day Simple Moving Average, the XAU/USD confirms a bullish outlook for the short term, as it now trades above the 20, 100 and 200-day SMAs. In addition, indicators show strength with the Relative Strength Index (RSI) pointing north above its midline while the Moving Average Convergence Divergence (MACD) prints higher green bars.

Resistance levels: $1,970, $1,980, $2,000.

Support levels: 1,950 (100-day SMA), $1,930 (20-day SMA), $1,915.

XAU/USD Daily chart

-638247891378902471.png)

- EUR/GBP sees a significant bounce from YTD lows, climbing 70 pips and gaining 0.72%, spurred by rising EUR/USD.

- A bullish engulfing candlestick pattern indicates the possibility of further upside for the EUR/GBP pair, targeting 0.8600.

- Technical indicators, including the RSI and three-day RoC, show buyers gathering momentum, suggesting near-term bullishness.

EUR/GBP jumps from year-to-date (YTD) lows of 0.8504, climbs 70 pips, and gains 0.72% on Wednesday, underpinned by the rise of the EUR/USD pair. The EUR/GBP is exchanging hands at 0.8571 after hitting a daily low of 0.8505.

EUR/GBP Price Analysis: Technical outlook

After diving to a new YTD low of 0.8504, the EUR/GBP has risen sharply toward the 20-day Exponential Moving Average (EMA) at 0.8571. During the last couple of days, EUR/GBP’s price action formed a bullish engulfing candlestick pattern, suggesting further upside is expected; nevertheless, a daily close above the latter is needed to keep bulls’ hopes alive.

The EUR/GBP first supply zone to test would be the 0.8600 mark. Once cleared, the next stop will be the 50-day EMA at 0.8621, followed by the June 28 swing high at 0.8658. A breach of the latter will shift the cross-pair bias to neutral and expose key resistance levels. The next resistance will be the 200-day EMA at 0.8684, ahead of testing at 0.8700.

Notably, the Relative Strength Index (RSI) is about to turn bullish, while the three-day Rate of Change (RoC) depicts buyers gathering momentum. That said, the EUR/GBP is upward in the near term.

EUR/GBP Price Action – Daily chart

- GBP/JPY bulls have stepped in on the lower time frames.

- Bulls eye a daily M-formation neckline.

GBP/JPY is down some 0.9% and has fallen from a high of 181.51 to a low of 179.46 so far. The daily chart shows the price breaking the support structure near 179.90 which puts the emphasis on the downside, medium term, but potentially supports a meanwhile bullish bias into the bearish impulse. The M-formation is a reversion pattern that would be expected to draw in the price towards the neckline.

GBP/JPY daily chart

GBP/JPY H4 chart

GBP/JPY 4-hour chart shows a series of bearish closes with little signs of a deceleration in the offer, so far,

GBP/JPY H1 charts

GBP/JPY hourly charts are showing that the price is decelerating on the offer and has moved into a 38.2% Fibonacci retracement of the prior hourly bearish impulse. We have two trendline resistances eyed with prospects of a move towards a 78.6% Fibonacci area near 180.50.

Meanwhile, a break of resistance opens risk to the neckline of the daily M-formation.

- USD/JPY pair plunges to a one-month low as US inflation data surprise and Treasury yields fall, putting pressure on USD.

- Despite inflation dropping closer to the target, a dovish stance from the Fed weighs on the already battered USD.

- The disappointing Japanese core machinery orders data hints at a potential global economic slowdown, supporting the BoJ’s dovish outlook.

USD/JPY sinks to new one-month lows after reaching 138.15 in the North American session after US Consumer Price Index (CPI) figures for June revealed that prices are slowing down as CPI dips to its lowest level in two years. In addition, falling US Treasury bond yields weighed on the USD/JPY pair, which correlates closely to the US 10-year Treasury note yield. At the time of writing, the USD/JPY trades at 138.30, down 1.45%.

The Yen's win: Decelerating US inflation and falling bond yields undercut the US Dollar

US CPI, revealed by the US Bureau of Labor Statistics (BLS), showed inflation in the United States experiencing a significant slowdown in June. CPI annually based increased by 3.0%, below the estimated 3.1%. Furthermore, the Core CPI, which excludes volatile items such as food and energy, decreased by 0.5%, dropping from 5.3% in May to 4.8% last month. Although the report showed inflation deflating towards the Fed’s 2% target, Federal Reserve (Fed) officials stated their priority is bringing it down, as expressed today by Richmond and Minnesota Fed Presidents Thomas Barkin and Neil Kaskhari.

Barkind stated that inflation is too high while favoring higher rates. Kashkari echoed some of his comments, commenting that the Fed’s fight vs. inflation needs to be won, and rates must be lifted if prices remain elevated.

In the meantime, the already battered US Dollar (USD) continued to weaken to new two-month lows, as shown by the US Dollar Index (DXY). The DXY, a measure of the buck’s performance against a basket of peers, tumbles more than 1%, down at 100.560.

Expectations for additional tightening by the Fed remain unchanged at 92.4% for a 25 bps rate hike in July. However, further increases past the current month are off the table, as shown by the CME FedWatch Tool.

On the Japanese front, the economic docket revealed that Core Machinery Orders fell -7.6%, below estimates of a 1% gain, crushing April’s 5.5% expansion, suggesting a deceleration of the Japanese economy. Although the wages rise In Japan is the largest since 1993, the latest inflation figures in China, alongside disappointing machinery orders, put into play a possible global economic slowdown. That said, it justifies the Bank of Japan’s (BoJ) dovish stance, at least in the medium term.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart shows the pair hovering above the Ichimoku Cloud, which intersects with the 100-day Exponential Moving Average (EMA) at around 138.28/38. That area is considered solid support, but the ip below the cross-over of the Tenkan-Sen below the Kijun-Sen is seen as a bearish signal. But the size of the drop, with twice the Average True Range of 100 pips, suggests the USD/JPY price could be overextended. A bearish continuation will occur if USD/JPY slips past 138.00, which would put in play the 200-day EMA at 136.38 as the next support. Contrarily, if USD/JPY bounces off the weekly lows and reclaims 139.00, that could pave the way for recovery and resumption of the uptrend.

- The EUR/JPY records a seven-day losing streak and fell to a low near 153.40 for the first time since mid-June.

- Japan reported weak PPI and Machinery Orders data.

- Investors continue to bet on a YCC tweak by the BoJ in July.

In Wednesday’s session, the JPY gained further ground agains the EUR and managed to hold gains despite weak economic data reported during the Asian session. Despite inventors continue to bet on a liftoff by the Bank of Japan, analyst at Rabobank think otherwise.

The Cabinet Office reported that Machinery Orders dropped 7.6% in May MoM, far above the 1% decline expected, and recorded a yearly decrease of 8.7%. In addition, the Statistics Bureau reported that Produce Price Inflation (PPI) decline to 4.1% in June, below the 4.3% expected, from the previous 5.2% figure.

Investors shouldn’t be so confident about a potential BoJ monetary policy pivot as the economy is softening. That being said, analysts at Rabobank stated that concerns about the global economy outlook amid the tight monetary policy of the US suggest the BoJ’s possibility of a pivot is likely to be “narrow” and “non-existent”. In addition, China’s economic situation should be closely watched because it is showing weakness and may contribute to the downturn of Japan’s economic activity. In that sense, Thursday’s Trade Balance data from China from June will be closely watched as it can fuel volatility in the JPY’s price dynamics.

On the Euro’s side, its economic calendar had non-high-tier data released. Spain confirmed its Consumer Price Index declined below 2% to 1.9% YoY in June. Regarding the European Central Bank's (ECB) next movements, a 25 basis points (bps) hike is already priced in July, and investors bet on high probabilities of additional increases in September and October. In that sense, hawkish bets on the ECB may limit the Euro’s losses.

EUR/JPY Levels to watch

According to the daily chart, the bears are clearly in command, and oversold conditions are already seen in the 4-hour chart. That being said, after seven days of losses, an upwards technical correction should be taken of the table as bears may start to lose some traction. Meanwhile, the Relative Strength Index (RSI) points south in negative territory, while the Moving Average Convergence Divergence (MACD) stands with higher red bars.

Support Levels: 153.40, 153.00, 152.50.

Resistance Levels: 155.40, 156.11 (20-day SMA), 157.00.

EUR/JPY Daily chart

-638247871825048693.png)

- Silver price leaps toward $24.00, gaining over 4% as US inflation decelerates, indicating a softer stance from the Fed.

- Technical outlook shows the XAG/USD uptrend could gather strength with a break above $24.20.

- Should XAG/USD fail to hold above $24.00, potential losses with critical support levels are highlighted in the $23-$23.50 range.

Silver price surged toward the $24.00 region on Wednesday following the release of the US Consumer Price Index (CPI), which showed inflationary pressures tumbling, suggesting the Federal Reserve (Fed) would not need to tighten as aggressively expected. The XAG/USD is trading at $24.07, gaining more than 4%, after hitting a low of $23.11.

XAG/USD Price Analysis: Technical outlook

The XAG/USD shifted from a neutral-downward biased to upward as price action broke technical resistance levels, with buyers eyeing a downslope resistance trendline, previously broken, which remains in play at around $24.30/45. If XAG/USD surpasses the latter, April’s 29 daily low at $24.49 would be up for grabs before XAG/USD threatens $25.00 per troy ounce.

Conversely, XAG/USD’s failure to achieve a daily close above $24.00 will expose the non-yielding metal to further losses. First, support will emerge at the 50-day EMA at $23.43, the 100-day EMA at $23.36, and then the 20-day EMA at $23.17. Once those levels are cleared, the 200-day EMA is up next at $22.95.

The Relative Strength Index (RSI) at bullish territory, the same as the three-day Rate of Change (RoC), suggests XAG buyers remain in charge. The XAG/USD uptrend is in play but look for breaks above $24.20 to gather further strength.

XAG/USD Price Action – Daily chart

According to Federal Reserve’s Beige Book, “overall economic activity increased slightly since late May.” It added that “reports on consumer spending were mixed; growth was generally observed in consumer services, but some retailers noted shifts away from discretionary spending.”

This Beige Book will be used for the next FOMC meeting on July 25-26. It mentioned that employment increased modestly and prices increased at a modest pace overall, with “ several Districts noted some slowing in the pace of increase.”

Key takeaways from the Beige Book:

“Business activity expanded at a slight pace in recent weeks, with modest increases in employment and roughly even prices. Consumer spending increased by a small margin, as retail sales increased modestly and tourism was flat.”

“Manufacturers reported mixed results but sales growth was moderate on average.”

“Residential home sales increased slightly in May from the previous month but remained below seasonal norms.”

“The outlook was mostly optimistic among contacts outside of real estate.”

“Employment increased modestly and wage growth continued to moderate as labor market imbalances eased further.”

“Wage pressures were described as stable or, in most cases, declining, as wage growth rates continued to fall back to more moderate levels.”

“Prices were mostly stable, with some exceptions, as cost pressures abated further.”

“The outlook called for further moderation of pricing pressures moving forward.”

Market reaction:

The US Dollar is experiencing a sharp decline on Wednesday, largely affected by the US inflation data. The DXY is down by more than 1%, trading at its lowest level since April 2022.

- GBP/USD pair skyrockets to a 15-month high as cooling US inflation data curtails Dollar’s strength.

- Despite a potential 25 basis points rate hike in July, Fed’s further tightening seems less probable amid diminishing inflation.

- UK’s high inflation rate and expectations of a 50 basis point rate hike by the BoE provide additional buoyancy to GBP.

GBP/USD advanced sharply and touched a new 15-month high at 1.3000 during the North American session as data revealed before Wall Street opened showed the Consumer Price Index (CPI) in the US hitting its lowest level in two years, as inflation abates following 500 basis points of tightening. Hence, the GBP/USD is exchanging hands at 1.2989, gains 0.45%, after hitting a low of 1.2902.

Pound Sterling gains ground as Fed rate hikes seem uncertain

According to the latest data from the US Bureau of Labor Statistics (BLS), inflation in the United States experienced a significant deceleration in June. The Consumer Price Index (CPI) revealed a year-on-year increase of 3.0%, falling below the estimated 3.1%. Furthermore, the Core CPI, which excludes volatile items such as food and energy, decreased by 0.5%, dropping from 5.3% in May to 4.8% last month.

The latest inflation report shows that inflation is approaching the 2% target faster than expected, according to Federal Reserve (Fed) projections delivered at June’s monetary policy meeting. That could refrain policymakers from increasing rates past the July FOMC’s decision.

According to the CME FedWatch Tool, there is a high probability of 92.4% for a 25 basis points rate increase in the upcoming July meeting. However, the likelihood of additional interest rate hikes has diminished significantly, falling below 30%.

The US Dollar Index (DXY), which measures the value of the US dollar against a basket of other major currencies, continues to face downward pressure and is currently trading near its two-year lows. The DXY is at 100.597, reflecting a decline of 1.04%.

Federal Reserve speakers had crossed the wires earlier in the New York session, led by Richmond Fed President Thomas Barking, saying. that inflation is too high and emphasizing he’s comfortable doing more to tackle inflation. Recently, the Minnesota Fed President Neil Kashkari noted that the Fed’s fight against inflation must be won and that if it gets higher, hikes must be raised.

On the UK front, the latest employment report increased the odds for further tightening by the Bank of England (BoE), with the inflation level still at an 8.6% annualized rate. Expectations lie for a 50 basis point rate hike, while upcoming growth data could weigh on the BoE’s decision, which walks a fine line between raising rates to tackle inflation without slowing the economy to the point of triggering a recession.

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD daily chart shows the pair is in a strong uptrend, with buyers eyeing an April 22, 2022, daily high of 1.3035, below the 2021 yearly low of 1.3160. It should be said the Relative Strength Index (RSI) entered overbought conditions, but in a strong uptrend, the indicator could reach its extreme readings at around or past the 80.00 mark. That said, the GBP/USD could threaten 1.3000 and extend its gains to 1.3100. Conversely, if GBP/USD slumps below the July 11 low of 1.2853, that could exacerbate a test of the 1.2800 figure, followed by the 20-day Exponential Moving Average (EMA) at 1.2750.

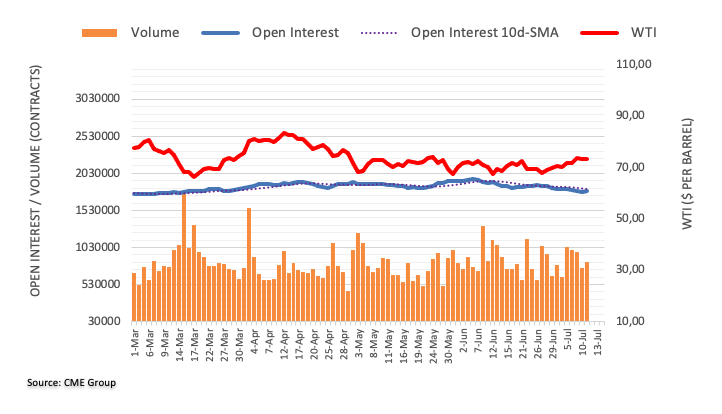

- WTI rose to a high of $76.11 and threatens the 200-day SMA at $77.23.

- US Inflation declined more than the expectations in June.

- Stocks jumped, and US Treasury yields declined following the inflation figures signalling a positive market environment.

On Wednesday, the West Texas Intermediate (WTI) rose to its highest level since May amid a risk-on market environment fueled by soft inflation figures reported by the US. In that sense, the black gold jumped to a daily high of $76.11 en route to test the 200-day Simple Moving Average at $77.23.

The US Bureau of Labor Statistics reported that the US Consumer Price Index declined to 3% YoY vs the 3.1% expected from its last figure of 4%, while the Core inflation to 4.8% YoY vs the 5% expected from 5.3%.

As a reaction, US Treasury yields decreased across the board. The 2-year yield declined to 4.72%, the 5-year yield to 4.09 and the 10-year yield to 3.90%, respectively.

Elsewhere, the US main stock indexes are displaying yearly highs. The S&P 500 (SPX) jumped to its highest level since April 2022, while the Nasdaq Composite (NDX) to a high since January 2022. The Dow Jones Industrial Average (DJI) stands near highs since December 2022. In that sense, a positive market environment signalled by rising riskier assets allowed the black gold to advance.

However, investors shouldn’t bet on a dovish Federal Reserve. According to the CME FedWatch tool, a 25 basis points(bps) hike continues to be priced in for the next meeting in July, and another hike this year shouldn’t be taken off the table. Both Jerome Powell and several Fed officials signalled their compromise with price stability and confirmed that they considered appropriate “multiple” hikes for the rest of 2023.

Attention for the rest of the session turns to the release of the Fed’s Beige Book, which would give markets a better outlook on the US economic activity outlook.

WTI Levels to watch

According to the daily chart, the technical outlook is favourable for the WTI. The price consolidated above the 20- and 100-day SMA while the technical indicators are gaining momentum in positive territory.

Resistance Levels: $77.23 (200-day SMA), $78.00, $80.00.

Support Levels: $73.52 (100-day SMA), $71.21 (20-day SMA), $69.00.

WTI Daily chart

-638247795015144650.png)

- NZD/USD rose above 0.6295, its highest since May 23.

- US CPI declined to 3% YoY vs the 3.1% expected, fuelling a decline in US Treasury yields.

- RBNZ held rates steady, just as expected.

On Wednesday, the NZD/USD gained bullish momentum following soft Consumer Price Index (CPI) inflation figures. As a reaction, the US DXY index fell to lows not seen since 2022 on the back of falling US yields giving room for the Kiwi asset to advance.

US reported soft CPI figures while the RBNZ paused

The US Bureau of Labor Statistics reported that the US Consumer Price Index declined to 3% YoY vs the 3.1% expected from its last figure of 4%, while the Core inflation fell to 4.8% YoY vs the 5% expected from 5.3%.

As a reaction, US Treasury yields displayed sharp declines across the board. The 2-year yield declined 3.20% to 4.72%, the 5-year yield to 4.09%, with a 3.38% fall and the 10-year yield to 3.90%, a 2.00% decline on the day. As lower bond yields tend to weaken the local currency, the USD, measured by the DXY index, retreated to its lowest level since April 2022, to 100.80, seeing a 0.85% loss on the day. Focus now shifts to the Federal Reserve’s (Fed) Beige book to be released later in the session.

The Reserve Bank of New Zealand (RBNZ) kept rates steady at 5.5% for the first time since the tightening cycle began in 2021. The Bank noted that high-interest rates are “constraining spending and inflation as anticipated and required”, noting that they are confident that rates remaining at a restrictive level of inflation will return to their target. However, the Bank didn’t update its macroeconomic forecast, nor did Governor Orr deliver a press conference.

According to World Interest Rate Probabilities (WIRP), markets discount only a 10% probability of the RBNZ hiking in August and 25% and 50% odds of raising rates in October and November, respectively.

NZD/USD Levels to watch

According to the daily chart, the NZD/USD has confirmed a bullish outlook for the short term. Regarding the convergence of the 20, 100 and 200-day Simple Moving Averages at 0.6170-0.6190, the pair managed to consolidate above, and the 20-day SMA is about to perform a bullish cross with the 200-day average which could give further support to the Kiwi.

Support levels: 0.6220, 0.6190 (100-day SMA), 0.6180 (200-day SMA).

Resistance levels: 0.6385 (May’s highs), 0.6420, 0.6450.

NZD/USD Daily chart

-638247755033873986.png)

- USD/CHF plunges to an 8-year low as unexpected slowing US inflation raises doubts about Fed’s future rate hikes.

- Consumer Price Index shows inflation cooling, with core CPI indicating a more balanced supply-demand situation.

- With inflation above Fed’s 2% target, odds for a significant rate increase shrink, pressuring the US Dollar further.

USD/CHF plummeted in the North American session due to data from the United States (US) showing inflation is slowing at a fast pace, which means, the US Federal Reserve (Fed) might refrain from increasing rates twice toward the end of the year. Consequently, the USD/CHF dropped to an 8-year low at 0.8659. At the time of writing, the USD/CHF pair exchanges hands at 0.8682, down more than 1%.

US Dollar’s dip: Fed’s future rate hikes in question amid cooling inflation

The US Bureau of Labor Statistics (BLS) revealed that inflation in June in the US decelerated sharply, hitting 3.0% YoY, below estimates of 3.1%, as shown by the Consumer Price Index (CPI). Core CPI, which excludes the price of volatile items like food and energy, downtick 0.5%, from 5.3% YoY in May to 4.8% last month, indicating that supply and demand are more balanced. Nevertheless, inflation remains above the US Federal Reserve (Fed) 2% target, though it might refrain the Fed from increasing rates by two times toward the year-end.

In the meantime, the CME FedWatch Tool shows that the odds for a 25 basis points rate increase in the July meeting are at 92.4%, while the chances for additional interest rate increases diminished below 30%.

Hence, the USD/CHF pair extended its losses, as the major has fallen more than 100 pips of 1.30% in the day after hitting a daily high of 0.8794. Failure to crack the 0.8800 figure, alongside weaker data in the US, opened the door to extending the USD/CHF’s downtrend.

Federal Reserve had crossed the wires earlier in the New York session, led by Richmond Fed President Thomas Barking, saying. that inflation is too high and emphasizing he’s comfortable doing more to tackle inflation. Recently, the Minnesota Fed President Neil Kashkari noted that the fight against inflation must be won and that if it gets higher, hikes must be raised.

The US Dollar Index (DXY), a gauge of the buck’s value against a basket of peers, remained downward pressured, exchanging hands near two-year lows. The DXY sits at 100.597, losses 1.04%, undermined by US Treasury bond yields plunge.

USD/CHF Price Analysis: Technical outlook

From a weekly chart perspective, the USD/CHF remains downward biased, extending its losses past the 2021 yearly low of 0.8757, which exacerbated a drop below the 0.8700 figure. Should be said, the Relative Strength Index (RSI) has turned oversold, though still showing signs the downtrend is solid. That said, USD/CHF’s next support would emerge at the psychological 0.8600 price level, with sellers eyeing a challenge of 2015 low at 0.8300. Conversely, USD/CHF buyers must reclaim 0.8700 if they aim to shift the pair bias from downwards to neutral.

Bank of Canada (BoC) Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers comment on the policy outlook following the BoC's decision to raise its policy rate by 25 basis points to 5% in July.

Key takeaways

"We are concerned, if we're not careful, the progress to price stability could stall."

"There was a clear consensus among the Governing Council there was not a big benefit of waiting to raise rates."

"In BoC's forecast, there is a path back to price stability while maintaining growth."

- The US Dollar accelerated its slide across the board after the release of US CPI data.

- Inflation slowed down in the US, and the markets are now looking at a final Fed rate hike in July.

- The EUR/USD pair gains more than a hundred pips, climbing to its highest level since March 2022.

The EUR/USD pair continued to rise after the beginning of the American session, climbing to 1.1125, which is the highest level seen since March 2022. The pair remains near the top as the US Dollar continues under pressure following the release of US inflation data.

Inflation slows down, Dollar tumbles, and Wall Street rises

In June, the Consumer Price Index (CPI) rose 0.2% in the US, which was below the expected 0.3%, and the annual rate slowed to 3%, the lowest since March 2021 and below the expected 3.1%. Following the report, the US Dollar tumbled across the board, and US yields slid.

The US Dollar Index is trading at its lowest level in a year, at 100.60, falling for the fifth consecutive day. The US 10-year bond yield is at 3.87%, down 2.50%, and at a one-week low, far from the 4.09% it reached on Monday.

Market participants still expect a rate hike at the next FOMC meeting on July 25-26. However, bets of another rate hike before year-end have significantly reduced after the inflation data.

EUR/USD above 1.1100

The EUR/USD pair is having its biggest daily gains in months. In the daily chart, the Relative Strength Index is reaching 70; however, no signs of a correction are seen, and the momentum remains firm for the Euro. The 1.1090/1.1100 area has become the immediate support. On the upside, a strong resistance level emerges around 1.1170.

Technical levels

Bank of Canada (BoC) Governor Tiff Macklem comments on the policy outlook following the BoC's decision to raise its policy rate by 25 basis points to 5% in July.

Key takeaways

"Further rate decisions will be guided by assessment of incoming data and outlook for inflation."

"Monetary policy is working but underlying inflationary pressures are proving more stubborn."

"Higher interest rates are needed to slow growth of demand in the economy and relieve price pressures."

"Labor market remains tight, even if there are some signs of easing."

"BoC is prepared to raise rates further."

"We are trying to balance the risks of under and over tightening monetary policy."

"If we don't do enough now, we'll likely have to do even more later."

"Governing Council's decision to raise the policy rate reflected persistence in both excess demand and underlying inflationary pressures."

"Consensus in Governing Council was that monetary policy needed to be more restrictive too bring inflation back to 2% target."

"Governing Council did discuss possibility of keeping rates unchanged, but cost of delaying action was larger than the benefit of waiting."

"With increases in policy rate in June and July, our outlook has inflation going gradually back to 2% target."

EUR/CHF has fallen with the contraction in Swiss bank sight deposits. Economists at Société Générale analyze the pair’s outlook.

CHF spurred by tighter liquidity

EUR/CHF is coming under strong selling pressure this week, moving below 0.97 and thus testing the support area prevailing since last October.

The pair has disconnected from EUR/USD and its own interest differential and, since the start of the year, the best driver explaining CHF appreciation is the contraction in Swiss banks’ sight deposits. The total level of sight deposits at the SNB can only be changed through monetary policy operations or through exchange against cash, and FX reserves diminished again in June.

As long as the SNB has to sell foreign assets, the Franc is likely to feel bullish pressure.

- USD/MXN plunges below 17.0000 as softer US inflation data reduces expectations of further rate hikes, while upbeat Industrial Production in Mexico boosts MXN.

- US CPI report shows inflation decelerating faster than expected, easing pressure on the Fed for aggressive tightening.

- Minnesota and Richmond Fed Presidents express concerns about high inflation and stress the need to combat it through rate increases.

USD/MXN plummets below the 17.0000 figure as a softer-than-expected inflation report in the United States (US) has traders paring bets of further rate hikes. Also, upbeat Industrial Production (IP) data in Mexico was cheered by Mexican Peso (MXN) bulls. The USD/MXN is trading at multi-year lows, exchanging hands at 16.8386 after printing a daily high of 17.0632, with more than 1% losses.

Unexpectedly low CPI figures in the US alleviate pressures for aggressive tightening of monetary policy

The US Department of Labor (DoL) showed inflation is decelerating at a higher pace, as the June Consumer Price Index (CPI) report revealed. CPI came at 3.0%, below estimates of 3.1%. Excluding volatile items like food and energy, the so-called core CPI rose by 4.8% YoY, beneath forecasts of 5.0%, and lower than May’s 5.3%. Data eases pressure on the US Federal Reserve (Fed) to continue tightening monetary policy aggressively, as most speakers throughout the week stressed the need for two rate increases. Nevertheless, traders pared November’s meeting chances for a quarter of a percentage rate hike, with odds dropping from 38.2% to 25% after the CPI report, as shown by the CME FedWatch Tool.

The central bank bonanza continued with Minnesota and Richmond’s Fed Presidents Neil Kashkari and Thomas Barkin crossing the wires. Thomas Barkin said that inflation is too high and emphasized he’s comfortable doing more to tackle inflation, while Kashkari noted that the inflation fight must be won and that if inflation gets higher, rates must be raised further.

The greenback plunges across the board, with the US Dollar Index down 0.94%, at 100.703, at its lowest level since April 2022, weighed by falling US Treasury bond yields, which are nosediving.

On the Mexican front, Industrial Production rose 1% in May from April. It was above estimates of a 1.9% expansion on yearly figures. It came at 3.9%, flashing a robust economy benefiting from a possible nearshoring, which has failed to gain more pace, as investors eye the 2024 general election.

USD/MXN Price Analysis: Technical outlook

From a technical perspective, the USD/MXN is set to continue to weaken as price action continues to show the Mexican Peso (MXN) strength, with traders eyeing the October 2015 swing low of 16.3267. Still, speculators will face solid support at 16.5000. Although the Relative Strength Index (RSI) shows the indicator approaching oversold conditions, it still warrants further USD/MXN downside. Contrarily, if USD/MXN buyers enter the market, they must reclaim the 17.0000 mark to have the opportunity to shift the pair’s bias to neutral.

Silver is currently trending at a paltry $23. Economists at TD Securities analyze XAG/USD outlook.

Silver to trend near $23 for much of the next three months

Silver is projected to trend near a low of $23 for much of the next three months.

As it becomes clear that the Fed and other central banks will start to pivot to a more dovish monetary policy stance in the early months of 2024, boosting the prospects for economic recovery on the horizon, we expect the white metal will set its sights towards $26 in the final days 2023.

In the very long term, silver is expected to trade significantly above the $26 mark and should increasingly decouple from Gold, as its ties to the interest/lease rate environment weaken.

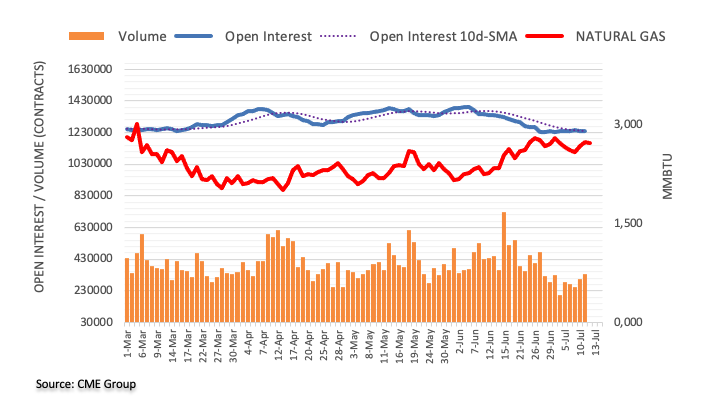

After a turbulent year in 2022, the excitement in the European Gas market has subsided. Economists at Commerzbank the outlook for Gas prices.

Calm before the (winter) storm?

There has been no real shortage in the European Gas market. On the contrary, thanks to massive savings and the development of new supply sources, the supply situation this summer is even better than usual. Looking ahead to the winter, however, nervousness is high. We expect a mild recession to slow the recovery in European Gas demand.

Provided the winter is not too harsh, the drawdown in inventories should be slow and the Gas price should not rise as much as many analysts currently expect. However, supply risks and the expected economic recovery justify higher prices next summer than this year.

Economists at Société Générale analyze EUR outlook.

The Euro needs a helping hand – from the economy

Consensus growth forecasts for 2024 are moving in the Euro’s favour, but only because 2023 ones are going the other way!

The Euro needs underlying sentiment about growth to improve, which means it needs better economic data because it’s now doing much better than rate expectations would suggest.

The last month or so has seen the Euro recover without relative rates moving in its favour. Short-covering, or a mood shift? Whatever it is, it needs to find some solid foundations soon.

- EUR/USD advances to new highs near 1.1100.

- The surpass of 1.1095 exposes 1.1184 near term.

EUR/USD gathers further steam and puts the 2023 top around 1.1090 to the test on Wednesday.

The surpass of the 2023 high at 1.1095 (April 26) should rapidly visit the round level at 1.1100 ahead of the weekly top at 1.1184 (March 31 2022).

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0635.

EUR/USD daily chart

- USD/JPY bears move in on interest rate expected convergence between BoJ and Fed.

- Bears eye a test of the key swing point at 138.42 while bulls look for a correction towards 38.2% Fibo.

138.42 is a prior swing point on the daily chart that could prove to be a key level. On the upside, if there is an immediate correction, there is an area of imbalance between 140.36 and 141.28 around a 38.2% Fibonacci retracement area.

USD/JPY is on the back foot again on Wednesday due to a deviation in the US Consumer Price Index that arrived (YoY) in June at 3.0% (vs. the expected 3.1% and the previous 4.0%. The core data was a larger miss of 4.8% vs. 5% expected and the prior 5.3%. For the month, it arrived at 0.2% vs 0.3% expected and the 0.4% prior.

The US Dollar index dived to as low as 100.876, the lowest in two months while US rate futures still show traders overwhelmingly expect the policy rate to rise a quarter point, to a 5.25%-5.5% range, at the Fed's July 25-26 meeting, but now see about a 25% chance of another rate hike before year's end, down from about 35% before the report, Reuters reported.

Meanwhile, there are expectations in the market that the Bank of Japan could tweak its yield-curve-control policy at its meeting later this month and this has also been giving a boost to the Japanese yen. However, analysts at Rabobank argued that the ''concerns about the outlook for the global economy amid tighter monetary policy in the US and other G10 economies suggest that the window of opportunity for a tweak in BoJ policy is likely to be narrow, and possibility non-existent.''

The analysts are also of the mind that while the CPI data was soft, the US dollar will be supported due to a low-world growth outlook that ''is likely to keep risk appetite in check and lend support to the safe-haven USD medium term.''

''Thus, while a soft US CPI inflation report today is set to weigh on the USD near-term,'' they said, ''we do not anticipate that this will mark the start of a long-term trend of sustained USD selling.''

USD/JPY technical analysis

138.42 is a prior swing point on the daily chart that could prove to be a key level. On the upside, if there is an immediate correction, there is an area of imbalance between 140.36 and 141.28 around a 38.2% Fibonacci retracement area.

Minneapolis Federal Reserve President Neel Kashkari stated during a panel discussion titled "Banking Solvency and Monetary Policy" in Boston that entrenched inflation could prompt the central bank to hike interest rates further.

Kashkari mentioned that higher interest rates could increase the pressure on banks.

Key takeaways from speech:

“If inflation falls as markets currently expect, allowing policy rates to fall, bank balance sheet pressures would likely reduce as longer-term rates fall, causing asset prices to climb.”

“If inflation proves to be more entrenched than expected, policy rates might need to go higher, which could further reduce asset prices, increasing pressure on banks. In such a scenario, policymakers could be forced to choose between aggressively fighting inflation or supporting banking stability.”

“Anchored inflation expectations have been foundational for economic growth over the past four decades. Central banks’ fight to bring inflation back to target and preserve anchored expectations must succeed.”

“Supervisors should consider what actions could be taken now to build resilience among regional banks in case high inflation proves to be more persistent than is currently expected by market participants.”

Market reaction:

The US Dollar is falling sharply on Wednesday following the US Consumer Price Index report that came in below expectations. The DXY is trading below 101.00, down more than 0.50% for the day, at its lowest level since mid-April.

- DXY breaks below the 101.00 support on Wednesday.

- The 2023 low near 100.80 emerges as the next target of note.

DXY’s downside picks up pace and now puts the 2023 low near 100.80 to the test.

The continuation of the decline looks the most likely scenario for the time being. Against that, the dollar now targets the YTD low in the 100.80/75 band prior to the psychological 100.00 yardstick.

Looking at the broader picture, while below the 200-day SMA at 104.50, the outlook for the index is expected to remain negative.

DXY daily chart

- EUR/JPY drops further and revisits the 153.30 zone on Wednesday.

- The breach of this level opens the door to the 55-day SMA.

EUR/JPY accelerates its losses and revisits the low-153.00s as the selling pressure in the cross remains everything but abated on Wednesday.

The cross extends further its monthly retracement and leaves the door open to extra downside in the very near term. In case losses gather impulse, then the next contention area appears at the provisional 55-day SMA at 151.78.

The daily RSI around 46 still allows for the continuation of the downward move in the very near term.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 145.75.

EUR/JPY daily chart

- Silver price has climbed above $23.80 as the US inflation has softened more than expected.

- Fed Barkin still believes that more interest rate hikes are appropriate for confirmation that inflation will return to 2% target.

- Silver price has delivered a breakout of the Rising Channel chart pattern.

Silver price (XAG/USD) has overstepped the crucial resistance of $23.80 quickly as the United States Consumer Price Index (CPI) data for June has landed softer-than-expectations. The monthly headline and core inflation were recorded at a moderate pace of 0.2% against expectations of a 0.3% pace.

On an annualized basis, headline inflation posted a deceleration to 3.0% vs. the consensus of 3.1% and the former release of 4.0%. Core CPI that excludes volatile oil and food prices has eased sharply to 4.8% than the estimates of 5.0% and the prior figure of 5.3%.

Investors would keenly watch commentaries from Federal Reserve (Fed) policymakers to understand whether the current pace of decline in inflation data is sufficient to discourage the Fed from hiking interest rates further. Considering past commentary from Fed chair Jerome Powell, two more interest rate hikes are appropriate by the year-end.

Following US inflation data, Richmond Fed Bank President has stated that more policy tightening is warranted if incoming data does not confirm that inflation will go down to the desired target. He pointed out that a relevant question is whether inflation can settle while the labor market remains as strong as it is.

Meanwhile, S&P500 futures have added stellar gains post significant softening of price pressures as decelerated inflation data has receded fears of a recession in the United States. The US Dollar Index (DXY) has dived to near the critical support of 101.00 as investors are hoping that Fed policymakers would re-discuss the monetary policy roadmap.

Silver technical analysis

Silver price has delivered a breakout of the Rising Channel chart pattern on a two-hour scale, which indicated immense strength in bulls. The 50-period Exponential Moving Average (EMA) at $23.10 is consistently providing support to the Silver bulls.

The Relative Strength Index (RSI) (14) has jumped into the 60.00-80.00 range, indicating that the bullish momentum has been triggered.

Silver two-hour chart

-638247654747472570.png)

The weaker US CPI print has seen Gold regain some of its shine. Economists at TD Securities analyze the yellow metal’s outlook.

A final 25 bps rate increase in Fed funds is still in the cards for the July FOMC meeting

While lower inflation is likely to prompt some short covering from traders and ultimately offer the yellow metal some much-needed support, the accumulation of broadly firmer-than-expected activity over the past few weeks and the Fed's clear inclination to hike again, suggests a final 25 bps rate increase in Fed funds is still in the cards for the July FOMC meeting.

Nonetheless, as fears were rising that the Fed's bark could be as bad as its bite, weaker inflation is likely to tame these concerns and could see the yellow metal solidify in a higher range as markets look toward the easing of Fed policy.

US consumer prices rose only slightly in June. The pressure for further rate hikes has eased noticeably, in the view of economists at Commerzbank.

US inflation is on the right track

In the US, there are increasing signs that inflationary pressure is easing. In June, consumer prices rose by only 0.2% compared with the previous month. The core rate (which excludes energy and food), which is important as a measure of the underlying trend, was also only 0.2%, the smallest increase since February 2021.

While the Federal Reserve is still likely to raise interest rates again at the end of the month, the data support our view that this should be the last hike.

Thomas Barkin, President of the Federal Reserve Bank of Richmond, said on Wednesday, following the release of the US Consumer Price Index (CPI), that inflation remains too high. The data showed inflation continues to slow in the US with the annual rate falling to 3% in June, the lowest since March 2021.

Barkin stated that he is comfortable with doing more policy tightening if incoming data does not confirm that inflation will return to the 2% target. He pointed out that a relevant question is whether inflation can settle while the labor market remains as strong as it is. He also warned that demand remains elevated while supply is constrained.

Market reaction:

The US Dollar is experiencing a sharp decline on Wednesday, as it was affected by the US Consumer Price Index report that came in below expectations. The DXY is currently trading at its lowest levels since early May, just slightly above 101.00 and down 0.50% for the day.

- USD/CAD is pressured on a soft US CPI print ahead of the BoC.

- USD/CAD bears are squeezing longs back to test below 1.3200 support.

USD/CAD is blowing off following a large deviation in the US Consumer Price Index that arrived (YoY) in June at 3.0% (vs. the expected 3.1% and the previous 4.0%. The core data was a larger miss of 4.8% vs. 5% expected and the prior 5.3%. For the month, it arrived at 0.2% vs 0.3% expected and the 0.4% prior.

USD/CAD was testing the London and Asian lows below 1.32 the figure within the range of between 1.3233 and 1.3197 so far. Markets are in the process of reviewing US Dollar forecasts and today’s CPI inflation release is one of the factors that is being considered.

Short-term weak US Dollar, longer-term not

Analysts at Rabobank explained that the USD tends to perform weakly when US rates are low and the outlook for global growth is good. ''In this scenario appetite for higher-yielding risky assets is high. Currently, China’s economic recovery has disappointed. Soft demand for manufactured goods in addition to pressures on domestic consumption in China stemming from factors such as falling property prices and higher youth unemployment have resulted in lacklustre growth,'' the analysts explained. ''Germany’s exposure to China through its external sector and a weak performance for its own manufacturing sector suggests low growth in the Eurozone.''

All in all, in this view, the analysts explained that this low-worth growth outlook is likely to keep risk appetite in check and lend support to the safe-haven USD medium term. ''Thus, while a soft US CPI inflation report today is set to weigh on the USD near-term, we do not anticipate that this will mark the start of a long-term trend of sustained USD selling.''

Bank of Canada eyed

The next catalyst for USD/CAD will be the Bank of Canada. The central bank is expected to hike another 25bps to 5.00% in July. Upward revisions in the July MPR would be expected to provide the main catalyst.

''We're wary of chasing the strong CAD story in the short-term as positioning looks elevated,'' analysts at TD Securities said. ''Still, the USDCAD downside will require the data to comply with our out-of-consensus view on US CPI tomorrow and a BoC hike. If realized, expect a near-term test of the recent lows ahead of 1.31.''

USD/CAD daily charts

Despite the recent rally through the prior resistance structure of 1.3270, the bears have moved in again and are squeezing longs back to test below 1.3200 support. The price is back to 1.3230 but the volatility and break of 1.3200 opens the risk of a move to 1.3182 which guards a run towards 1.3120.

Gold is set to find a floor as analysts at Credit Suisse look for following the decline to their $1,900/1,890 target, for an eventual retest of the $2,063/2,075 record highs.

Weekly close below $1,868 to reinforce the longer-term sideways range

Gold is showing signs of stabilization as looked for at our target of price support and the 38.2% retracement of the 2022/2023 uptrend at $1,900/1,890. With the key rising 200-DMA seen not far below at $1,868 and with the USD starting to weaken again, our bias remains for a major floor to be found here.

We look for a test of resistance at the 55-DMA at $1,962 initially, a close above which can add weight to our view for a retest of major resistance at the $2,063/2,075 record highs. We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move above $2,300.

A weekly close below $1,868 though would be seen to reinforce the longer-term sideways range, and a fall to support next at $1,810/05.

- US annual CPI slowed to 3%, the lowest reading since March 2021.

- US Dollar tumbled across the board after the release of the US inflation data.

- AUD/USD hit its highest level in almost three weeks, reaching 0.6752.

After the release of the US consumer inflation data, which came in below expectations, the AUD/USD pair surged from 0.6685 to 0.6752, reaching its highest level since June 23. The pair remains near the highs as markets digest the new data.

Inflation continues to slow in the US

The US Consumer Price Index (CPI) increased 0.2% in June, below the expected 0.3%. The annual rate fell from 4% to 3%, which is below the market consensus of 3.1%, and the lowest since March 2021. The annual Core rate also fell from 5.3% in May to 4.8% in June, which is below the estimated 5%.

As a result of the lower-than-expected US CPI figures, markets have priced in lower odds of a second rate hike from the Fed this year. However, a rate hike in the July meeting is almost fully priced in.

Following the release of the US CPI figures, US Treasury yields tumbled, with the US 10-year dropping from 3.95% to 3.88%, and the 2-year from 4.84% to 4.73%. The US Dollar Index (DXY) also fell to test June lows, trading near 101.00. Wall Street futures rose, and commodity prices jumped. The current context favors the upside in AUD/USD, with increased risk appetite and lower US yields.

The 0.6750 area represents immediate resistance for the pair, and consolidation above it could open the doors to more gains. The next resistance stands at 0.6765, followed by a strong barrier at 0.6800. The 0.6700/05 area is the immediate support and while above, risks are tilted towards the upside.

Technical levels

- Gold price has climbed strongly to $1,950.00 as US inflation has softened more than expectations.

- The US Dollar Index has plunged as the Fed would have the luxury of skipping interest rates further.

- Gold price is expected to deliver an Inverted H&S breakout after surpassing the neckline plotted around $1,940.00.

Gold price (XAU/USD) has displayed a stellar run as the United States Bureau of Labor Statistics has reported softer-than-expected June Consumer Price Index (CPI) data. The monthly headline and core inflation has reported a pace of 0.3% while investors were anticipating a higher velocity of 0.3%.

Annualized headline CPI has softened to 3.0% vs. the consensus of 3.1% and the former release of 4.0%. While annualized inflation has decelerated to 4.8% against the estimates of 5.0% and the prior release of 5.3%. More-than-anticipated cool-down in inflationary pressures would trim expectations of an interest rate hike by the Federal Reserve (Fed) in its July monetary policy meeting.

Meanwhile, S&P500 futures have jumped strongly as soft inflation figures have eased fears of a recession in the United States. The US Dollar Index (DXY) has demonstrated a vertical fall to near the crucial support of 101.00. The yields offered on 10-year US Treasury bonds have sharply dropped to 3.88%.

Going forward, investors will focus on Thursday’s Producer Price Index (PPI) data. As per the consensus, monthly PPI is expected to register a pace of 0.2% vs. a contraction of 0.3%. It looks like a mild recovery in gasoline prices has propelled factory gate prices.

Gold technical analysis

Gold price is gathering strength to deliver a breakout of the Inverted Head and Shoulder chart pattern formed on a two-hour scale. A breakout of the aforementioned chart pattern will result in a bullish reversal. The neckline of the chart pattern is plotted around June 21 high at $1,940.00.

The 20-period Exponential Moving Average (EMA) at $1,932.90 is providing cushion to the Gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has confidently shifted into the bullish range of 60.00-80.00, which indicates that the bullish momentum has been triggered.

Gold two-hour chart

GBP/USD slips back from intraday high. Economists at Scotiabank analyze the pair’s outlook.

Scope for losses is limited

Intraday price action is reflecting some – potential – softness.

Price action suggests some caution is warranted but solidly bullish underlying trends should mean that scope for GBP losses is limited. Support should emerge around the figure, or through the mid/upper 1.28s at worst at this point.

There is some (psychological) resistance at 1.30 but the broadly bullish technical set up suggests gains may extend towards the 1.33 area.

EUR/USD pushes through 1.10. Economists at Scotiabank analyze the pair’s outlook.

EUR/USD needs spread support for stronger advance

Short-term EZ-US rate spreads have narrowed over the past week, with the 2Y spread reaching –155 bps, supporting EUR gains. But spreads will have to narrow further still to lift the EUR meaningfully and make a run above the 1.11 zone. Soft US inflation data may be the catalyst.

EUR/USD is within reach of the 1.1095 April high but there is little reason to expect spot gains to stop there. A push higher to 1.12/1.13 is a growing risk.

- NZD/USD has surrendered its entire gains as the focus shifts to US inflation.

- The RBNZ was expected to keep interest rates steady at 5.5% as the economy has already reported a technical recession.

- S&P500 futures have posted decent gains in the London session, portraying strength in the appeal for US equities.

The NZD/USD pair has sharply dropped below the round-level support of 0.6200 after facing significant offers near 0.6240. The Kiwi asset is under severe pressure as the Reserve Bank of New Zealand (RBNZ) kept the interest rate decision unchanged as expected by the market participants.

RBNZ Governor Adrian Orr was expected to keep interest rates steady at 5.5% as the economy has already reported a technical recession and further policy restriction could has weighed more pressure on the economic outlook.

After analyzing RBNZ’s decision, economists at ANZ Bank conveyed we continue to expect a 25 bps hike in the November Monetary Policy Statement (MPS), but this is not today’s story. For now, inflation indicators continue to fall obediently, and the RBNZ’s pause is highly credible.

Meanwhile, S&P500 futures have posted decent gains in the London session, portraying strength in the appeal for US equities. The US Dollar Index (DXY) is demonstrating a non-directional performance after a fragile pullback around 101.50. Volatility in the USD Index has squeezed as investors have been sidelined ahead of the Consumer Price Index (CPI) data, which will release at 12:30 GMT.

Analysts at Well Fargo have forecasted the headline CPI to rise a modest 0.2% in June. Favorable base comparisons due to last year's surge in energy and food prices should set up the year-over-year rate to fall nearly a full percentage point to 3.1%. We look for the core CPI to downshift alongside a decline in core goods prices. The ongoing improvement in supply chains has helped to ease pressure on goods, and we expect vehicle prices to contract in June.

The USD is trading defensively ahead of the US CPI report. Economists at Scotiabank analyze the greenback’s outlook.

Slowing inflation to weigh on the USD

CPI is expected to reflect a sharp fall in headline prices in June year. The consensus call is for a drop to 3.1%, with prices rising 0.3% in the month. But a number of Wall St banks are looking for a milder 0.2%-ish rise in headline inflation that will pin inflation back to 3%.

Even if core prices growth remains slower to decelerate (forecast at 5.0% YoY, from 5.3% in May), markets may find some comfort in a low core MoM read (a 0.2% MoM gain would be the lowest since 2021).

Slowing inflation – and thoughts of perhaps a 2-handle on headline CPI in the next few months – will encourage market expectations that the Fed may have little (or no) more work to do on monetary policy after the July meeting and weigh on the USD generally.

DXY is within reach of its 2023 lows (tested in January and April) at 100.82; weakness below this point will add to already strong bearish momentum and point to a further 2-3% drop in the index in the coming months to the 98/99 region.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest jobs report in Malaysia.

Key Takeaways

The national unemployment rate and labour force participation rate held unchanged at 3.5% and 70.0% respectively in May, signaling stable labour market conditions. Labor conditions are still some way from tightness as the number of unemployed persons and workers outside the labour force remained higher than pre-pandemic amid constrained wage growth.

Total employment hit an all-time high of 16.28mn in May (Apr: 16.25mn) following positive monthly gains since Aug 2021. Hiring was broad-based across all economic sectors, led by the services industry particularly in food & beverage services, wholesale & retail trade, and information & communication activities. The employment-to-population ratio inched up to 67.6% (from 67.5% in Apr), marking a fresh record high, which indicates the ability for Malaysia’s growing economy to create employment.

We maintain our 2023 year-end unemployment rate forecast at 3.2% (BNM est: 3.3%, end-2022: 3.6%). Renewed expectations of tighter monetary and financial conditions in the advance economies coupled with a slower post-pandemic economic recovery in China have raised concerns about a more subdued global demand and growth outlook for 2H23 and 2024. Should conditions slow further in the next few months, this could delay reaching full employment by year-end.

USD/CAD tests 1.32 ahead of US data and the BoC policy decision. Economists at Scotiabank analyze the pair’s outlook.

Losses to extend back to the 1.3100/25 area on a push under 1.3200

The CAD nudged just under 1.3250 into the close of trade Tuesday and has made a little more progress on Wednesday to test 1.32. Soft US CPI and a somewhat hawkish BoC hike should drive spot through the figure.

A push under 1.3200 should see USD losses extend back to the 1.3100/25 area.

See:

- BoC Preview: Forecasts from eight major banks, enough evidence to pull the trigger on another 25 bps rate hike

-

US CPI Banks Preview: Inflation to step meaningfully lower in June

The USD has been on the backfoot ahead of the US CPI inflation report. Economists at Rabobank analyze the greenback’s outlook.

Disinflation?

The headline number is expected at 3.1% YoY, down from the May number of 4.0% YoY. This would be the lowest number since early 2021. While core inflation is stickier, the Bloomberg survey median stands at 5% for the June number down from 5.3% the previous month.

A number in line or below expectations will likely allow EUR/USD to become more comfortable above the 1.10 level in the near-term. However, continued risk of recession in the US suggests that the USD is likely to avoid a strong sell-off on a three-to-six month horizon.

See – US CPI Banks Preview: Inflation to step meaningfully lower in June

- AUD/JPY has sensed selling pressure around 93.50 as the BoJ is expected to tweak its YCC.

- Inflation in Japan is becoming more demand-driven due to rising wages and the contribution of higher import prices has started fading.

- Philip Lowe has opened doors for further policy-tightening as the picture of inflation and its outlook is complex.

The AUD/JPY pair is consistently declining for the past five trading sessions as investors are anticipating that the Bank of Japan (BoJ) could tweak its Yield Curve Control (YCC) in its upcoming interest rate policy on July 28.

The BoJ has maintained an ultra-dovish monetary policy for a decade considering the fact that overall demand is extremely weak due to which inflation has remained below the desired rate. As inflation in Japan is becoming more demand-driven due to rising wages and the contribution of higher import prices in inflationary pressures has started fading. A recovery in the overall demand could allow BoJ Governor Kazuo Ueda to tweak its YCC.

Meanwhile, the Australian Dollar is struggling to find support despite a hawkish commentary from Reserve Bank of Australia (RBA) Governor Philip Lowe. RBA Lowe has opened doors for further policy-tightening as the picture of inflation and its outlook is complex. Philip Lowe warned that economic growth will remain subdued in the next couple of years.

The RBA has made a fresh amendment to its monetary policy structure. Australian central bank will conduct monetary policy eight times from next year against 11 policy meetings.

Meanwhile, the Australian government is also looking for a new candidate to handle monetary policy operations as the tenure of Philip Lowe will be over soon.

Going forward, investors will focus on forward-year consumer inflation expectations, which will release on Thursday at 1:00 GMT. The economic data is expected to soften to 5.1% vs. the former release of 5.2%.

Economists at TD Securities discuss the Bank of Canada (BoC) Interest Rate Decision and its implications for the USD/CAD pair.

Dovish (20%)

Hold at 4.75%. BoC leaves rates unchanged despite upward revisions to GDP/CPI in July MPR. Statement cites further erosion of BOS/CSCE and expected return to below-trend growth in Q2. Core inflation momentum still elevated, but headline getting closer to target. Forward guidance left unchanged as Bank keeps the door open to hikes. USD/CAD +1.15%.

Base-Case (80%)

Hike to 5.00%. BoC delivers another 25 bps rate hike, citing substantial upgrades in July MPR. Tightening is required to ensure inflation does not get stuck above target, especially with a larger output gap in Q1. Statement cites some progress on capacity pressures and wage growth but leaves guidance open-ended. USD/CAD -0.25%.

Economists at MUFG Bank analyze how the US Dollar tends to perform after the release of the CPI report.

There is scope for downside surprises

The Dollar tends to perform poorly in the immediate period after the CPI data. In a six-hour period following the data, the USD has weakened in eight of the last ten months of CPI data releases with the data weaker than expected or in line with expectations in seven of those ten months.

The hurdle for a surprise to the downside is becoming lower in the core readings given the sharp declines in headline CPI will soon be behind us and we believe there is scope for downside surprises given those sharp falls in headline inevitably feed into underlying inflation. If that were to be evident today we would expect further falls in US rates and the Dollar albeit less than what we expected a few days ago given the Dollar selling of late.

See – US CPI Banks Preview: Inflation to step meaningfully lower in June

- US Dollar down against nearly every G10 currency.

- The economic calendar takes the spotlight with US inflation numbers this Wednesday.

- The US Dollar Index continues its slide lower and starts to get in orbit around 101.00.