- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The AUD/USD is catching gentle bids at the top of the Thursday trading session after getting knocked back in Wednesday trading.

- The Aussie fell to an intraday low of 0.6388 on Wednesday, after opening near 0.6445.

- Early Thursday sees Aussie inflation expectations, with US CPI inflation figures due later in the day.

The AUD/USD is trading into 0.6420 as markets head into Thursday, and an early Australian Consumer Inflation Expectations reading, which last printed at 4.6%.

The Aussie (AUD) fell lower against the US Dollar (USD) before staging a mild recovery, as the USD eased back following underwhelming market reaction to US PPI figures which beat expectations and the Federal Reserve's latest meeting minutes, which saw officials spreading their bets to the middle with inflation risks still on the board, but not bad enough to move on rates.

Forex Today: Dollar remains weak despite PPI and FOMC Minutes, CPI Next

Thursday's early Aussie inflation expectation read remains the last meaningful data point on the economic calendar for the AUD, and market participants will be turning their eyes ahead to US Consumer Price Index (CPI) inflation figures due later in the day.

US CPI inflation is expected to show a slight downtick in the headline annualized figure for September, forecast at 3.6% against the previous reading of 3.7%.

AUD/USD Technical Outlook

Wednesday saw the AUD/USD break it's upside closing streak, with the Aussie closing to the upside against the US Dollar for the previous five consecutive trading sessions, and the AUD/USD is heading into the Thursday market window trading directly into the 50-day Simple Moving Average (SMA), and upside momentum could struggle to develop a foothold.

Higher up, the 200-day SMA remains high above current bids, turning bearish into 0.6650, and the AUD/USD remains on the low end of 2023 after etching in a new low for the year last week at 0.6285.

AUD/USD Daily Chart

AUD/USD Technical Levels

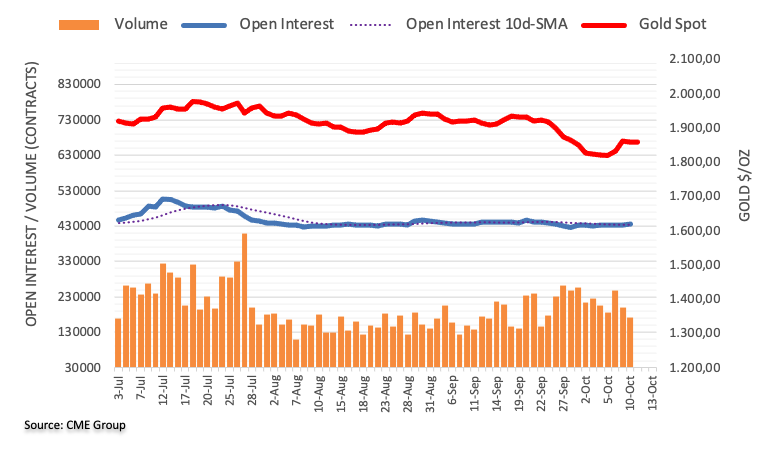

- Gold price ascends to a two-week peak at $1877.21, buoyed by declining US Treasury yields.

- Fed minutes reveal concerns over dual-sided risks to inflation and economic activity, influencing policy outlook.

- US producer-side inflation data and varied Fed official stances complicate the gold price trajectory.

Gold price (XAU/USD) climbed for the second straight day and printed a two-week high at around $1877.21 on Wednesday, courtesy of falling US Treasury bond yields spurred by the latest Fed meeting minutes. At the time of writing, the XAU/USD is trading at 1874.73, almost flat as the Asian session begins.

XAU/USD navigates through Fed minutes, inflation data, and official commentary

In the meantime, the US Dollar Index retreated further from the 11-month highs reached last week, a tailwind for XAU/USD prices. Additionally, benchmark yields on the US 10-year Treasury note pulled back from their highest levels since 2007. These factors contributed to the rise in Gold prices.

The US Federal Reserve recently released minutes from its September monetary policy meeting. According to these minutes, participants acknowledged both upside risks to inflation and downside risks to economic activity. This suggests a two-sided challenge in achieving the Fed's objectives. Policymakers also noted that as policy approaches its peak, decisions, and communications should start shifting toward a longer horizon of keeping rates higher for an extended period.

Furthermore, the US Department of Labor (DoL) reported that producer-side inflation figures exceeded expectations, with most figures surpassing those from August. However, the monthly reading for the Producer Price Index (PPI) expanded less than the previous month, indicating that inflation remains a concern, possibly influenced by high energy prices and the automobile union strike.

In terms of recent statements from Fed officials, many have adopted a more neutral stance, except for Fed Governor Michelle Bowman, who emphasized the need for further tightening to address inflationary pressures.

XAU/USD Technical Levels

A flash from Natixis analysts is noting that if the Eurozone unemployment rate remains below the perceived structural unemployment level, then inflation will continue to run hotter than expected.

Inflation will be higher than expected

A commonly accepted result of economic analysis is that if the unemployment rate is lower than the structural uneployment rate, inflation will be higher than expected inflation.

If we represent expected inflation in the eurozone by inflation swaps (5-years in 5 years, in 10 years, etc.), it is currently 2.7%. It is quite clear that the unemployment rate in the eurozone is now lower than the structural unemployment rate, (this can be seen from the level of hiring difficulties and the ratio of job vacancies to the number of job seekers).

The fact that productivity gains are negative in the eurozone means that, even with zero growth, employment continues to rise and the unemployment rate continues to fall as the working-age population shrinks.

So, in this situation, the unemployment rate will remain below the structural unemployment rate and, as a result, inflation will remain above 2.7%, the level of expected inflation.

- USD/JPY caught a light bid back above the 149.00 handle on Wednesday, but momentum remains thin.

- US PPI, FOMC minutes failed to spark a meaningful drive in the US Dollar as investors await Thursday's CPI release.

- Inflation data to remain the key driver for markets heading into the back half of the trading week.

The USD/JPY reclaimed the 149.00 handle once again in Wednesday trading, and now heads into Thursday's market session looking to hold onto the major level with thin Japan data on the offering for the Asia market window and investors bracing for a fresh printing of US Consumer Price Index (CPI) inflation figures later in the day.

The US Dollar (USD) kicked off Wednesday trading near 148.60, tapping in an early intraday low of 148.42 before recovering steadily throughout the midweek market session, setting a near-term high of 149.32 before settling back into the 149.00 handle.

US Producer Price Index figures broadly beat market expectations, and the Federal Reserve's (Fed) latest meeting minutes release did little to ignite interest in firm USD bidding in either direction.

Forex Today: Dollar remains weak despite PPI and FOMC Minutes, CPI Next

Japan's Producer Price Index (PPI) and Machinery Orders are due at the top of Thursday's trading, but market impact is likely to remain muted.

Japan's PPI for September is forecast to tick down slightly from 0.3% to 0.1%, while Machinery Orders for August are seen rebounding to 0.4% from the previous month's -1.1%.

US CPI inflation figures will be the big showdown for Thursday, and markets are expecting the headline annualized CPI reading for September to edge lower from 3.7% to 3.6%. Inflation expectations are mixing poorly with rising odds of a recession in the US domestic economy in the coming months, and a significant beat for the US CPI will see investors dog-piling back into the US Dollar in short order.

USD/JPY Technical Outlook

The Dollar is up 0.6% against the Yen from the week's low bids, but intraday price action is finding itself hung up along the 200-hour Simple Moving Average (SMA), and the figure to beat for short-term bidders will be last week's peak just beneath 149.60.

The USD/JPY remains firmly entrenched in bullish territory on the longer timeframes, with daily candlesticks still well-supported by the 50-day SMA near 147.00 and the 200-day SMA trading far below current prices, twisting bullish into the 139.00 handle.

USD/JPY Daily Chart

USD/JPY Technical Levels

- GBP/USD hovers around 1.2310, after a brief ascent to a weekly high of 1.2337.

- Potential death-cross formation on the horizon signals possible further downtrend for the pair.

- Key levels to watch: 1.2300 support and 1.2400 resistance, with broader implications for trend direction.

GBP/USD prints minuscule losses as Thursday’s Asian session begins after enjoying modest gains of 0.22%, which dragged the exchange rate towards a weekly high of 1.2337. However, late in the New York session, the major retreated towards 1.2310, where the exchange rate oscillates at the time of writing.

Data from the United States (US) did little to help the Greenback (USD) offset its losses versus the Pound Sterling (GBP).

From a technical standpoint, the GBP/USD remains in a downtrend, which could be confirmed with the 50-day moving average (DMA) about to cross below the 200-DMA, forming a death-cross that implies the major could extend its losses. In that event, the major first support would be 1.2300, which, once cleared, could pave the way for a dip to the October 4 cycle low of 1.2037. A breach of the latter would expose the year-to-date (YTD) low of 1.1802.

Conversely, the GBP/USD must reclaim 1.2400 for a bullish continuation before launching an attack toward the 200-DMA at 1.2442.

GBP/USD Price Action - Daily chart

GBP/USD Technical Levels

Toronto-Dominion Securities strategists have increased their forward-looking interest rate expectations from the US Federal Reserve (Fed) in the face of higher rates for longer than expected, despite the very real risk of an impending recession. Emphasis added for clarity.

H4L and the Case for a US Recession

The resilience of the US economy so far this year means the normalization process will take longer than initially anticipated. It has also led the Fed to double-down on its “higher for longer” (H4L) policy signaling.

Still, we remain of the view that a recession is the most likely outcome for next year despite recent strength in activity data. However, we are pushing back our expectation for the start of a US recession by a quarter to 24Q2.

We now look for the Fed to start reducing rates in June 2024 rather than in March and forecast less overall monetary policy easing of 250bp from 300bp before. We also continue to expect the Fed to discontinue quantitative tightening (QT) when rate cuts begin.

The move higher in rates over the past several months has been driven by a number of factors, including expectations of a higher for longer Fed, supply concerns, oil price worries, and technical weakness. Given our expectation for a later start to the US recession, we raise our forecast for the 10y to 4.3% at the end of 2023 and 3.15% at the end of 2024.

During the Asian session, the New Zealand Food Price Index is due to be released; in Japan, the Producer Price Index and Machinery Orders. Additionally, the Melbourne Institute will release its inflation expectations survey. Later in the day, market attention will be on the UK monthly GDP data, the ECB minutes, and the US Consumer Price Index.

Here is what you need to know on Thursday, October 12:

The US Dollar finished flat despite higher-than-expected US wholesale inflation and the release of the FOMC minutes. The Greenback remains weak as US yields continue to pull back. The stock market in Wall Street saw another rise, driven by a risk-on sentiment late in the session, which did not help the US Dollar.

The US Producer Price Index (PPI) accelerated unexpectedly in September, rising from 2.0% to 2.2% compared to the expected 1.6%. However, this did not trigger major concerns. The crucial moment will be on Thursday with the release of the Consumer Price Index (CPI). The annual rate is expected to decrease in September to 3.6% from 3.7%. Volatility is expected. The weekly Jobless Claims report will also be released.

The FOMC minutes showed a divergence of perspectives, reinforcing the data-dependent approach and indicating that a significant rebound in inflation would be necessary to reach a consensus for more rate hikes.

FOMC minutes:

Several participants commented that, with the policy rate likely at or near its peak, the focus of monetary policy decisions and communications should shift from how high to raise the policy rate to how long to hold the policy rate at restrictive levels.

Following the FOMC minutes, the DXY pulled back and finished flat at 105.75, rebounding from near the strong support at 105.50. The 10-year US Treasury yield dropped to 4.55%.

UR/USD held onto recent gains and remained near the strong resistance area at 1.0630. The pair maintains a bullish tone, but after continuous rising for over a week, a consolidation phase is looming. However, the US CPI number could bring volatility and decisive breaks. The European Central Bank (ECB) will release the accounts of the September meeting.

USD/JPY rose and closed above 149.00. It continues to move sideways between 148.20 and 149.10. Japanese data due on Thursday includes Machinery Orders and the Producer Price Index.

GBP/USD posted a second consecutive daily close above the 20-day Simple Moving Average (SMA) as the recovery continues. It is hovering around 1.2300, showing some signs of exhaustion. The UK will release GDP, Industrial Production, and trade data on Thursday.

AUD/USD remains near the 20-day SMA, and the 55-day SMA awaits at 0.6450; above that area, the Aussie dollar could rise further. Below 0.6375, the outlook could turn neutral. The Melbourne Institute will release the Survey of Consumer Inflationary and Wage Expectations.

NZD/USD declined after rising for five consecutive days but remained above 0.6000 and held above the 20-day SMA. The pair peaked near the 100-day SMA at 0.6056. The Food Price Index is due early on Thursday in New Zealand.

USD/CAD moved sideways for the second day in a row around 1.3600. The Canadian Dollar held relatively well despite the decline in crude oil prices.

Gold broke above $1,860 and jumped to $1,875, boosted by lower yields and the weaker dollar. Silver joined the rally, climbing above $22.00.

Like this article? Help us with some feedback by answering this survey:

- XAG/USD taps a new one-week high after US FOMC minutes land meekly.

- Silver spot has an opportunity to extend a near-term rebound.

- Downside risks remain as US inflation fears continue to be a thorn in the side of precious metals.

The XAG/USD tapped into a fresh high for the week near $22.14 after the US Federal Reserve's (Fed) latest meeting minutes release shows the US central bank stuck in the middle, holding steady on rates but seeing several inflation risks in the future.

Spot Silver has seen a moderate recovery and is trading north of $22.00, though XAG/USD still has a lot of ground to recover after tumbling nearly 13% peak-to-trough from September's peak of $23.77.

FOMC minutes: Members agreed rates should stay restrictive for some time

With the Fed's meeting minutes landing with barely a whisper, markets will be turning eyes ahead to Thursday's US Consumer Price Index (CPI) data release, where headline CPI inflation is expected to tick down slightly from 3.7% to 3.6% for the annualized period into September.

US annual PPI rises 2.2% in September vs. 1.6% expected

Markets are keeping their appetite on-balance for the time being, but after Wednesday's upside surprise in US Producer Price Index (PPI) figures,additional inflation-based data beats could see market expectations of a Fed rate cut get pushed even further into the future, driving precious metals down against the US Dollar.

XAG/USD Technical Outlook

Silver spot prices are staging a successful rebound from the last swing low into $20.75, but a continued upswing will quickly run into a descending trendline from August's late swing high into $25.00, and the 200-day Simple Moving Average (SMA) sits above price action near $23.25.

The 50-day SMA has confirmed a bearish cross of the longer moving average, and the trick for Silver bugs will be to keep a potential bearish downturn in XAG/USD from spiraling out of control and sending spot Silver back into 2023's lows near the $20.00 handle.

XAG/USD Daily Chart

XAG/USD Technical Levels

Analysts at Natixis are out with a note highlighting how long-term rates are unlikely to see declines, even after central banks start to chop down rates after the cycle peak.

Long-term interest rates will not fall, even when central banks cut interest rates

We argue that the current rise in nominal long-term interest rates (in the United States, the United Kingdom, the eurozone) is irreversible. Even when central banks cut interest rates, long-term interest rates will remain high.

The fall in short-term interset rates is already anticipated... expected short-term (3-month) interest rates for the end of 2024 and the end of 2025, and see that they are already expected to fall.

The rise in expected inflation in the eurozone and the United Kingdom reflects a decline in central bank credibility, which is very difficult to correct.

US real 10-year interest rates have returned to close to their average level of the past, but UK and eurozone rates are still well below this level.

Two mechanisms will drive up real long-term interest rates: the fact that spontaneous inflation will be higher than 2%, due to the inflation effects of the energy transition, reshoring and persistent labour market tightness; and the shortfall in savings relative to investment.

- USD/SEK rose to a daily high of 10.9485 and settled near 10.9050.

- The pair lost nearly 1% on Tuesday, driven by dovish remarks from Fed officials.

- FOMC minutes from September didn’t reveal any surprises; the bank will still proceed “carefully”.

- Focus set on the US and Sweden’s September CPI figures to be released this week.

In Tuesday’s session, the USD/SEK rose to a high of 10.9485 and then consolidated near 10.9050 as bullish momentum seemed limited. The Greenback recovered some ground after hot Producer Price Index (PPI) figures from September and after the Federal Open Market Committee (FOMC) minutes revealed that members are not ruling out another hike in this cycle. Sweden and the US will release their respective Consumer Price Index figures from September later this week.

Inflation figures from both countries will be crucial for the Federal Reserve (Fed) and the Swedish Riksbank's next decisions. Earlier in the session, the US reported that the Producer Price Index (PPI) from September from the US came in higher than expected at 2.2% vs the 1.6% forecasted by markets and accelerating from 1.6%.

In line with that, Jerome Powell from the Fed left the door open for another hike, stating that the monetary policy decisions will still depend on incoming data. In addition, the FOMC minutes revealed that members are considering the lags of financial tightening and the recent data volatility, confirming that the upcoming decisions will be decided “carefully”. On the other hand, the Riksbank’s September minutes warned that rates might need to be raised further beyond 4%. For the US side, inflation figures will be published on Thursday with the headline and core Consumer Price Index (CPI) figures are expected to decline to 3.6% and 4.1% YoY, while the Swedish headline numbers remain steady at 7.5% YoY due on Friday.

USD/SEK Levels to watch

Upon analysing the daily chart, a neutral to bearish trend becomes evident for USD/SEK, with the bears holding momentum but seeming to be taking a hiatus. The Relative Strength Index (RSI) has a positive slope below its midline, while the Moving Average Convergence (MACD) presents neutral red bars. Moreover, the pair is below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, highlighting the continued dominance of bulls in the broader perspective but warning that the bears are gaining traction.

Support levels: 10.8580, 10.8083 (100-day SMA), 10.7750.

Resistance levels: 10.9250, 10.9610, 11.040 (20-day SMA).

- AUD/JPY trades with slight gains at 95.65, lingering below the weekly high of 95.73.

- Bullish technical indicators hint at upward potential, including a favorable Ichimoku Cloud setup.

- Key resistance and support levels were identified at 96.00 and 95.12, respectively, framing the short-term outlook.

AUD/JPY marches high late in the New York session but remains trading below the daily/weekly high reached earlier during the North American session at around 95.73, though it remains trading with minuscule gains of 0.02%, at around 95.65.

Price action depicts the cross-currency pair remaining sideways, though slightly tilted to the upside. The AUD/JPY sits above the Ichimoku Cloud (Kumo), a bullish signal, with the Tenkan and Kijun-Sen located in an orderly bullish way, while Chikou Span turned bullish three days ago. Hence, in the near-term, the pair is upward biased.

The AUD/JPY first resistance would be the 96.00 figure, followed by the September 29 swing high at 96.92, before testing the 97.00 mark. On the flip side, the cross-pair first support would be the October 10 daily low of 95.12, followed by the 95.00 mark. Once those two levels are cleared, the AUD/JPY could slide towards testing the October 3 low of 93.01.

AUD/JPY Price Action – Daily chart

AUD/JPY Key Technical Levels

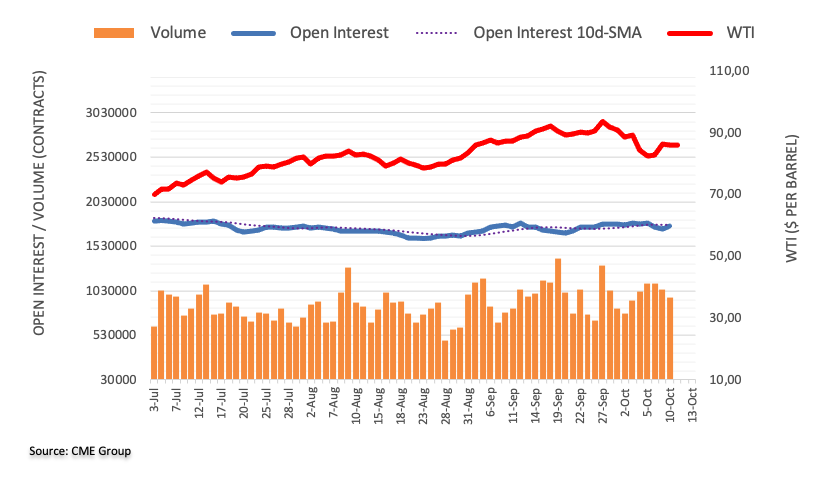

- WTI crude drops to $85.97, despite earlier surge amidst Israel-Hamas conflict concerns.

- Saudi Arabia’s commitment to market stability and potential intervention tempers price spikes.

- Global inflation data and production choices from Russia and the US add layers to price influences.

West Texas Intermediate (WTI), the US crude Oil benchmark, tumbled more than 1.80% on Wednesday, as Saudi Arabia pledged to stabilize the market amid fears the conflict in the Middle East would disrupt supplies. Therefore, WTI is trading at $85.97, after hitting a daily high of $88.20 per barrel.

Oil prices navigate through geopolitical worries

Oil prices surged on Monday amid concerns that the fight of Israel and Hamas could escalate, dampening global supplies.

Nevertheless, Saudi Arabia stepped in and said It was working with regional and international partners to prevent an escalation, reaffirming their commitment to stabilize the markets. Sources cited by Reuters speculated that WTI would rise to $100 if the conflict escalates.

In the meantime, news that inflation is cooling in Germany suggests the European Central Bank (ECB) would not raise rates again, expecting its economy to contract by 0.4%.

Contrarily, Russia stick to its 300K crude Oil output cut, said the Russian President Vladimir Putin.

Data-wise, the US economic calendar featured the Producer Price Index (PPI) for September, with data slightly higher than expected, suggesting another rate hike looms, but Thursday’s data on the consumer side, could refrain policymakers to increase rates.

WTI Price Analysis: Technical outlook

After rallying sharply toward a multi-month high of $95.91 per barrel, WTI has retraced somewhat below the 20 and 50-day moving averages (DMAs), each at $90.86 and $88.31, respectively, implying that crude is on a pullback. This is because the US crude Oil benchmark remains above the 200-DMA and the latest cycle low, each at around $81.99 and $81.65, respectively. An extension below would expose the $80.00 per barrel. Conversely, if WTI reclaims the 50-DMA at $88.31, that could reveal the $90.00 figure.

- AUD/USD dropped to 0.6405, already tallying more than 0.50% losses on the day.

- FOMC minutes from the September meeting didn’t reveal any surprise.

- Members are set to proceed “carefully” in the next meetings.

In Wednesday’s session, the AUD/USD is seeing more than 0.50% losses, mainly weighted by the US Dollar recovering some ground after the Federal Open Market Committee (FOMC) minutes from the September meetings. On the Aussie's side, no relevant highlights were seen on the Australian economic calendar.

In line with that, the minutes revealed that the members are considering the lags of monetary policy and the latest data volatility in their decisions, noting that they will still proceed carefully regarding their next decisions. In summary, the bank doesn’t rule out an additional hike in 2023.

As decisions will be made on the incoming data, the September US Consumer Price Index (CPI) figures will be closely watched on Thursday. Headline CPI is seen declining to 4.1% YoY, while the Core measure is expected to decelerate to 3.6% YoY. Jobless Claims from the first week of October are also due in Thursday’s session and are expected to have increased to 211,000 from 207,000.

AUD/USD Levels to watch

Considering the daily chart, AUD/USD presents a neutral to bearish technical outlook, with the bulls displaying signs of fatigue. The Relative Strength Index (RSI) displays a negative slope in the bullish territory, hinting at a potential shift in momentum, while the Moving Average Convergence (MACD) presents neutral green bars. Also, the pair is below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, pointing towards the prevailing strength of the bulls in the larger context.

Support levels: 0.6405 (20-day SMA),0.6370, 0.6350.

Resistance levels: 0.6450, 0.6500, 0.6530.

AUD/USD Daily Chart

- Gold holding onto near-term highs, but bull runs into $1,900 are failing on Wednesday.

- XAU/USD set to be exposed to US inflation figures due Thursday with US CPI in the barrel.

- Despite a technical ceiling, spot Gold remains well-bid, up nearly 3.5% from last week's lows near $1,810.

Gold spot prices find themselves on the high side for Wednesday, up from the day's opening bids around $1,859 with the day's high etched in near $1,877. The Federal Reserve's (Fed) latest meeting minutes failed to spark a notable market reaction, with Fed officials spreading their bets on comments about inflation risks and policy measures.

FOMC minutes: Members agreed rates should stay restrictive for some time

XAU/USD is struggling to find momentum to make a meaningful run into $1,880, and intraday action could see itself constrained into the back end as markets head into Thursday's US Consumer Price Index (CPI) reading.

The US CPI printing on Thursday is expected to see a mild decline from 3.7% to 3.6% for the headline annualized period into September. An upside beat could see a resurgence of inflation concerns in the market, which would see the Greenback (USD) pushed firmly higher once again. For the meantime though, US Dollar flows remain limited, but Gold traders so far remain unable to claim further ground for the XAU/USD today.

XAU/USD Technical Outlook

Gold's minor gain on Wednesday has the pair pushing back to the 50% retracement region of the last top-to-bottom swing on the daily candles, and spot Gold bids are set for a challenge of the 50-day Simple Moving Average (SMA) near the $1,900 handle.

Gold remains notably down from the year's average bids, after XAU/USD's last swing low saw Gold knocking into new lows for 2023. Price action has fallen well below the 200-day SMA currently near $,1925, and the challenge for Gold bulls will be to keep spot prices on-balance and grinding higher as long as US inflation concerns remain subdued.

XAU/USD Daily Chart

XAU/USD Technical Levels

- GBP/USD hamstrung near 1.2300 after the early day's peak into 1.2337 failed to extend.

- The Pound Sterling fell to an intraday low of 1.2268 and finds bids hung up in the midrange.

- An uptick in US PPI figures is keeping the US Dollar on-balance as investors to look ahead to CPI.

The GBP/USD kicked off Wednesday trading near 1.2290, sagging into the day's low of 1.2268 before an early US session rally into 1.2337, but market flows into the US Dollar (USD) sent the pair back into the midrange near where the trading day kicked off, testing the 1.2300 handle.

US Producer Price Index (PPI) figures came in above expectations, printing at 2.7% versus the expected 2.3%, and the previous reading getting revised upwards from 2.2% to 2.5%.

The Federal Open Market Committee's (FOMC) latest published meeting minutes were largely a non-starter for the GBP/USD, with the Federal Reserve (Fed) noting that risks to achieving their long-term inflation goal continue to stick around longer than many expected.

FOMC minutes: Members agreed rates should stay restrictive for some time

Investors will now be looking ahead to Thursday's US Consumer Price Index (CPI) release, which is anticipated to decline from 2.7% to 2.6% for the annualized headline reading into September.

Before that, though, Pound Sterling (GBP) traders will want to keep an eye out for UK Gross Domestic Product and production figures.

UK Gross Domestic Product is forecast to come in at 0.2% against the previous -0.5%, while Industrial Production for August is seen printing at -0.2% (previous -0.7%), with Manufacturing Production for the same period is seen declining 0.4% against the previous 0.8% decline.

GBP/USD Technical Outlook

The Pound Sterling is trading down from the day's early high against the US Dollar, testing ground below 1.2300 and struggling to find lift. The pair is catching technical support from the 50-hour Simple Moving Average (SMA) near 1.2270, with the overall near-term trend pushing bullish from the 200-hour SMA near 1.2180.

On the daily candlesticks, the Pound Sterling has caught a much-needed lift against the Greenback, climbing higher and closing in the green for the past five consecutive trading days. Technical resistance is sitting close by from the 200-day SMA near 1.2442, with a bearish 50-day SMA accelerating into the downside and set for a bearish cross of the longer moving average.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

- EUR/USD trades down at 1.0598, influenced by neutral ECB stances and US inflation data.

- US PPI data comes in mixed, sparking further concerns about the trajectory of inflation.

- Central bank minutes and officials' comments from both the Fed and ECB provide mixed signals.

The Euro (EUR) registers modest losses against the US Dollar (USD) courtesy of a slew of European Central Bank (ECB) officials adopting a neutral approach, while data from the United States (US) increased concerns the US Federal Reserve (Fed) could lift rates, after an inflation report. The EUR/USD is trading at 1.0598, down 0.13%.

EUR/USD navigates through ECB’s neutrality and rising US inflation

Recently, the US Federal Reserve revealed its latest minutes from the September monetary policy meeting, with participants seeing upside risks on inflation but downside risks t economic activity, acknowledging that achieving the Fed’s goal has become two-sided. Fed policymakers noted that with policy about to peak, decisions and communications should shift towards the time horizon of keeping rates higher for longer.

After the minutes' release, the EUR/USD reaction was muted, remaining below the 1.0600 figure.

Earlier, the US Department of Labor (DoL) announced that inflation figures on the producer side were above estimates, and except for the Producer Price Index (PPI) monthly reading, expanding below the prior month’s number, most figures exceeded August data’s, suggesting inflation is reigniting, blamed on high energy prices, and the automobile union strike.

Aside from this, the latest Fed officials have struck a neutral approach, except for Fed Governor Michelle Bowman, who stressed that further tightening is needed.

Across the pond, ECB’s Kazaks said interest rates are appropriate to tame inflation to 2% in the second half of 2025 but kept the door open to additional hikes. On the data front, the Eurozone (EU) economic docket witnessed inflation in Germany continued to ease as expected.

EUR/USD Price Analysis: Technical outlook

After bouncing from new year-to-date (YTD) lows reached on October 3 at around 1.0448, the EUR/USD upward correction could be coming to an end after piercing the 1.0600 figure, but buyers' failure to cling to that figures could exacerbate a re-test of yearly lows. If EUR/USD reclaims 1.0600, that could open the door to test 1.0700; otherwise, the next support level to be challenged would be the October 6 swing low of 1.0482 before testing YTD lows of 1.0448.

- Federal Reserve released the minutes from its September 19-20 meeting.

- The minutes showed that officials saw risks to achieving goals had become more two-sided.

- US Dollar drops marginally after the minutes.

The Federal Open Market Committee (FOMC) released the minutes of its September meeting, which had a limited reaction across financial markets. According to the document, members generally judged the risks to achieving goals had become more two-sided. Most members continued to see upside risks to inflation.

At the September meeting, the Federal Reserve (Fed) decided to maintain the federal funds rate within the range of 5.25% to 5.5%, as expected. The staff projections showed the possibility of another rate hike before the end of the year. The next FOMC decision is on November 1.

Key takeaways from the minutes:

Participants also noted that they expected that real GDP growth would slow in the near term. Participants judged that the current stance of monetary policy was restrictive and that it broadly appeared to be restraining the economy as intended.

Participants stressed that current inflation remained unacceptably high while acknowledging that it had moderated somewhat over the past year.

Participants observed that the labor market was tight but that supply and demand conditions were continuing to come into better balance.

Participants generally noted there was still a high degree of uncertainty surrounding the economic outlook. One new source of uncertainty was that associated with the autoworkers' strike, and many participants observed that an intensification of the strike posed both an upside risk to inflation and a downside risk to activity.

A majority of participants pointed to upside risks to inflation from rising energy prices that could undo some of the recent disinflation or to the risk that inflation would prove more persistent than expected.

Almost all participants judged it appropriate to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent at this meeting.

A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted.

All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

All participants agreed that policy should remain restrictive for some time until the Committee is confident that inflation is moving down sustainably toward its objective.

Several participants commented that, with the policy rate likely at or near its peak, the focus of monetary policy decisions and communications should shift from how high to raise the policy rate to how long to hold the policy rate at restrictive levels.

Participants generally judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee's goals had become more two sided. But with inflation still well above the Committee's longer-run goal and the labor market remaining tight, most participants continued to see upside risks to inflation. These risks included the imbalance of aggregate demand and supply persisting longer than expected, as well as risks emanating from global oil markets, the potential for upside shocks to food prices, the effects of a strong housing market on shelter inflation, and the potential for more limited declines in goods prices.

Market reaction

The US Dollar Index is rising after falling for five consecutive days, hovering slightly below 106.00. It remains around that area after the minutes, that have little impact on markets.

- GBP/JPY clipping back towards 184.00 as market risk appetite takes a cautious bite.

- Markets are leaning risk-on, but tone remains overly cautious, market moves to stay thin.

- Pound Sterling traders will be looking ahead to Thursday's UK production figures.

The GBP/JPY is catching a thin but determined bid for Wednesday, with the pair easing higher into 183.35, with bull's eyes set on 184.00.

The Guppy set an intraday high of 183.75 on the day, and bidders will be looking to gear up for another run higher as long as market pressures continue to push down on the Yen (JPY).

Japanese activity indicators are due late Wednesday at 23:50 GMT, when Tokyo markets will be heading into their early Thursday trading session, but data is likely to be low-impact with much of the release already priced in.

Japanese Bank Lending for the year into September is seen holding steady at 3.1%; Machinery Orders for August are expected to rebound to 0.4% from the previous decline of 1.1%; and Japan's Producer Price Index (PPI) for September is seen slipping from 0.3% to 0.1% against the previous month.

On the Pound Sterling (GBP) side of the Guppy coin, traders will be looking ahead to Thursday's UK Industrial & Manufacturing Production numbers, as well as a monthly read on UK Gross Domestic Product(GDP). UK Industrial Production for August is expected to decline by 0.2%, against the previous month's -0.7% backslide, while Manufacturing Production for the same period is forecast to rebound from -0.8% to -0.4%, a better number but still in the red.

UK Gross Domestic Product for August is seen recovering from the previous month's -0.5% contraction to an on-balance 0.2%, and GBP traders will want to keep an eye out for any nasty surprises from Thursday's UK Goods Trade Balance, which is expected to be low-impact but could see a shot in the arm of Pound Sterling markets if numbers deviate wildly.

GBP/JPY Technical Outlook

The Guppy's near-term recovery sees the pair knocking into the 50-day Simple Moving Average (SMA), sticking close to the midpoint of the last fifty trading days as the Pound Sterling struggles to develop meaningful momentum against the Japanese Yen.

Looking longer-term, the GBP/JPY remains in firmly bullish territory, with price action trading well above the 200-day SMA near 173.00, and it's GBP bulls' game to lose from here, though upside potential could remain limited with Yen-based pairs consistently trading into areas that are prone to draw FX market intervention by the Bank of Japan (BoJ)_ if bids run too far out of control.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

- US Dollar continues to struggle to gain momentum.

- US PPI from September rose to 2.2% YoY, beating expectations

- The FOMC will release its minutes from the September meeting later in the session.

- Markets remain cautious amid the conflict between Israel and Hamas.

The US Dollar (USD) measured by the US Dollar DXY Index trades with mild losses after the release of hot Producer Price Index (PPI) figures and ahead of the Federal Open Market Committee (FOMC) minutes. In addition, the conflict in Palestine has escalated, which could make investors seek refuge in the green currency.

As the United States economic data doesn’t show evidence of a cool-down, the minutes from the September meeting from the FOMC will be closely monitored by investors to look for clues regarding the Federal Reserve's (Fed) next step. It's worth noting that in the last decision, the bank decided to hold rates steady at the 5.25-5.50% range, but the so-called “dot plot” revealed that most of the members are seeing high chances of an additional hike in this cycle. Also, projections revealed that rate cuts may be delayed, meaning that the Fed could maintain its restrictive policy at higher levels for longer.

Daily Digest Market Movers: US Dollar consolidates last week’s rally; resilient US economy and Middle East geopolitical tensions could reignite its bullish momentum.

- The US Dollar DXY index continues consolidating and trades neutral at 105.80.

- The September US Producer Price Index (PPI) rose to 2.2%, higher than the expected 1.6% and the same as the previous 2.2%.

- Investors will look for further clues of the Federal Reserve's (Fed) stance in the Federal Open Market Committee (FOMC) minutes, to be released later in the session.

- Regarding the last Fed forecast, the dot plot interest rate projections from the Fed remained at 5.6% for 2023, meaning higher chances of an additional 25 basis point (bps) hike.

- For 2024, the median Fed funds target rate was revised to 4.6% vs the 4.3% March projections, meaning that the Fed is delaying rate cuts.

- During the Press conference, Jerome Powell noted that monetary policy decisions will still depend on incoming data.

Technical analysis: US Dollar Index bullish momentum wanes, rejected by the 20-day SMA

The US Dollar Index DXY sees a neutral to bearish technical outlook for the short term, and the buyers fail to regain the 20-day Simple Moving Average (SMA), which could pave the way for further downside. On the daily chart, the Relative Strength Index (RSI) displays a negative slope near the 50 middle-point while the Moving Average Convergence Divergence (MACD) stands in negative territory, indicating that the bears hold the upper hand over the short term. However, the index is comfortably above the 100 and 200-day Simple Moving Averages (SMA), indicating that the bulls command the broader scale. As the sellers are gaining momentum, pushing the index below the 20-day average at 105.90, more downside may be on the horizon to continue consolidating the last week’s rally, with support lining up at 105.50, 105.30 and 105.00.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- USD/CHF bounces near 0.9001, with the 200-DMA at 0.9022 emerging as a pivotal battleground.

- A sustained move below the 200-DMA could unlock the path towards the psychological 0.9000.

- Recovery above 0.9022 necessitates reclaiming 0.9100 to rekindle upside aspirations towards 0.9147.

The USD/CHF slides towards 0.9001 weekly lows but bounces off, trying to trim some of its earlier losses. Buyers are trying to reclaim the 200-day moving average (DMA) at 0.9022, which so far has been accomplished it, as the pair exchanges hands at 0.9030, down 0.14%.

the ongoing pullback, after reaching a seven-month high of 0.9245, brought the USD/CHF towards the 200-DMA, which so far is capping the pair’s fall. Nevertheless, a daily close below that area would expose the 0.9000 figure, followed by a drop toward the 50-DMA at 0.8926. On the other hand, if buyers keep the spot price above 0.9022, the 200-DMA could pave the way for a recovery, but they must reclaim 0.9100. Once cleared, the next resistance would be the May 31 daily high at 0.9147, followed by 0.9200.

USD/CHF Price Action – Daily chart

USD/CHF Techniacl Levels

- Canadian Dollar is easing off the pressure as Crude Oil prices soften.

- Canada economic data remains thin for the week, US data dominating the market.

- US inflation data to remain key market driver for the back half of the trading week.

The Canadian Dollar (CAD) is stepping back slightly on Wednesday, giving the US Dollar (USD) some breathing room and sending the USD/CAD back into near-term highs.

Inflation expectations remain the pivotal market focus for this week, and with Canada-based data almost entirely absent on the economic calendar, chart direction will be determined by market reaction to US inflation figures through the rest of the week.

The USD/CAD has slipped back into yesterday’s highs as the Greenback catches a soft bid on data beats, and the Loonie is following softening Crude Oil prices slightly lower.

Daily Digest Market Movers: Canadian Dollar giving a pause in lockstep with barrel prices

- Bidding pressure for the CAD is abating, sending the USD/CAD pair back to Tuesday’s highs.

- Canadian economic data is almost entirely absent, save for low-impact data.

- Canada Building Permits for August managed a beat, printing at 3.4% versus the forecast 0.5%.

- Previous reading on Building Permits was revised down significantly, from -1.5% to -3.8%.

- Crude Oil prices are softening further, fading back the early week’s bid spike following the weekend’s Gaza Strip escalation between Israel and Palestinian Hamas.

- US data on Wednesday beat forecasts across the board.

- US Producer Price Index (PPI) for the year into September climbed to 2.7%, beating the 2.3% expectations. The previous reading was revised to 2.5% from 2.2%.

- US Consumer Price Index (CPI) inflation reading due on Thursday, will be significant, and likely to impact broad-market risk sentiment.

Technical Analysis: Canadian Dollar loosening its grip enough for the USD/CAD to reclaim 1.36 handle

Wednesday’s bounce in the USD/CAD sends the pair back into the upper bound of the previous day’s highs, trading above the 1.3600 handle with daily candlesticks set to catch technical support from the 50-day Simple Moving Average (SMA) near 1.3550 with the 200-day SMA sitting just north of 1.3450.

The USD/CAD got knocked down nearly 1.6% peak-to-trough from last week’s swing high into 1.3785, with the Canadian Dollar catching a Crude Oil-fueled bid. Downside pressure has eased off for the time being, but markets are awaiting a firmer read on US inflation data before plunging too far into either side of the USD.

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- NZD/USD recoils to 0.6021 after reaching a weekly peak, influenced by a strengthening USD.

- US PPI data exceeds expectations, introducing a complex layer to the ongoing inflation dialogue.

- Contrasting stances among Fed officials and RBNZ’s rate would keep NZD/USD traders uncertain.

NZD/USD retreats after hitting a weekly high of 0.6055 due to a mixed market impulse witnessed in the North American session that bolstered appetite for the Greenback (USD). Speculations of the US Federal Reserve (Fed) forgetting a rate hike, as dovish comments and neutral postures amongst officials emerged. The pair exchanges hands at around 0.6021.

Kiwi Dollar tempers gain as USD was bolstered by US PPI data

US economic data revealed by the Department of Labor (DoL) showed that September’s inflation in the producer side was higher than expected and, in some cases, above August’s figures. The Producer Price Index (PPI) rose by 2.2% YoY, exceeding August and forecasts of 1.6%, while the core PPI rose by 2.7%, above projections and the previous month.

Recently, Federal Reserve officials have adopted a neutral stance; of late, Fed Governor Christopher Waller said the US central bank can watch and see developments on rates, adding that financial markets tightening “would do some of the work for us.” Earlier, Fed Governor Michelle Bowman said that she favors another rate hike as inflation remains above the Fed’s 2% target.

Given the backdrop, money market futures do not expect another rate hike by the Fed, as shown by the CME FedWatch Tool.

On the New Zealand (NZ) front, the Reserve Bank of New Zealand's (RBNZ) decision to keep rates unchanged at 5.5% could undermine its appeal. The RBNZ said that rates need to be maintained at a restrictive level.

NZD/USD Price Analysis: Technical outlook

The NZD/USD daily chart portrays the pair as neutral to downward biased after testing the latest cycle high of 0.6048, which was briefly pierced and could pave the way to test 0.6100. if the pair decisively breaks the latter, that could pave the way to test the 200-day moving average (DMA). Despite challenging 0.6048, price action in the last couple of days is forming a bearish harami candlestick chart pattern, which, if confirmed, could open the door for the BZD/USD to dive below 0.6000.

- USD/JPY rose above 149.00, gaining 0.20% on the day.

- US PPI from September accelerated, beating expectations.

- FOMC minutes from September will be released later in the session.

On Wednesday, the USD/JPY gained additional ground, rising back above 149.00. Hot Producer Price Index (PPI) failed to trigger a significant move on the USD, and the trajectory of the pair seems to be determined by the dovish stance of the Bank of Japan (BoJ). Later in the session, markets will monitor the Federal Open Market Committee (FOMC) minutes from the September meeting to look for clues on forward guidance.

In line with that, the September PPI from the US rose to 2.2% YoY, higher than the 1.6% expected and the previous 2%. On Thursday, the US will report the Consumer Price Index (CPI), with the headline and core measure expected to decelerate. Its worth noticing that each inflation data point is crucial for the Federal Reserve (Fed) and could generate volatility in the bond markets and in the USD price dynamics.

Regarding the minutes, investors will look for additional clues on the last decision of the Fed delivering a hawkish pause. Interest rate projections indicated that bank members have a high chance of an additional hike this year while rate cuts were delayed. In the press conference, Chair Powell was very clear, stating that the bank will remain data-dependent and ready to hike again if needed.

USD/JPY Levels to watch

The daily chart analysis indicates a neutral to a bearish outlook for USD/JPY, as the bears show signs of taking control but still face challenges ahead. The Relative Strength Index (RSI) has a positive slope above its midline but with a clear downward trend, while the Moving Average Convergence (MACD) lays out neutral red bars. Additionally, the pair is above the 20,100, 200-day SMAs, suggesting that the bulls are in command over the bears on the bigger picture.

Support levels: 148.66 (20-day SMA), 148.00, 147.30.

Resistance levels: 149.50, 150.00, 150.50.

USD/JPY Daily Chart

-638326370274433836.png)

- Mexican Peso four-day rally keeps the USD/MXN pair trading below 18.00, near the 200-day SMA.

- Mexico’s currency strengthens on speculations about the US Federal Reserve as officials disregard a pending rate hike.

- US Producer Price Index exceeds estimates: A precursor to Thursday’s CPI?

Mexican Peso (MXN) extends its rally versus the Greenback (USD) for a fourth consecutive day amid speculations the US Federal Reserve (Fed) might skip the supposedly “last” rate hike, as shown by the latest Fed monetary policy “dot-plots.” Meanwhile, economic data from the United States (US) limited the USD/MXN downtrend, which exchanges hand at around 17.82, registering losses of more than 0.50% on the day.

Mexico’s economic calendar is empty, but USD/MXN traders are getting cues from the US. The US Bureau of Labor Statistics (BLS) revealed that prices paid by producers rose above estimates, although the headline Producer Price Index (PPI) MoM slowed compared to August data. Other readings were higher than the previous month, which could open the door for an uptick on consumer side inflation, to be revealed on Thursday. In the meantime, Fed Governor Michelle Bowman, the dissident amongst Fed officials during the week, emphasized that rates must rise further as “Inflation remains well above the FOMC's 2% target.”

Daily Digest Market Movers: Mexican Peso gains more than 1% as the Greenback continues to weaken

- Mexican Peso remains bolstered by a risk-on impulse despite the ongoing escalation of the Israel-Hamas conflict.

- The September US Producer Price Index (PPI) rose by 0.5% MoM, above estimates of 0.3%, while core PPI expanded by 0.3%, exceeding estimates of 0.2%.

- Annually based, the PPI rose by 2.2%, above forecasts and August’s figures, of 1.6% and 2%, while the core PPI rate stood at 2.7%, exceeding projections and the prior month’s data.

- Fed Governor Michelle Bowman: As inflation remains above the FOMC’s target, “This suggests that the policy rate may need to rise further and stay restrictive for some time to return inflation to the FOMC's goal.”

- Mexico’s Consumer Price Index (CPI) grew by 4.45% YoY in September, below the 4.47% of estimates.

- The core CPI inflation in Mexico stood stickier at 5.76% YoY, as widely estimated, but has broken below the 6% threshold.

- The Bank of Mexico (Banxico) held rates at 11.25% in September and revised its inflation projections from 3.5% to 3.87% for 2024, above the central bank’s 3% target (plus or minus 1%).

Technical Analysis: Mexican Peso lurking around the 200-day Simple Moving Average at 17.77

Mexican Peso appreciated during the week as the USD/MXN has dived more than 3%, below the 18.00 figure, with sellers targeting the 200-day Simple Moving Average (SMA) at 17.77. A breach of the latter will expose the 20-day SMA at 17.57 before challenging the low seen on September 30 at 17.34. If USD/MXN sellers break that level, the pair will shift to a neutral-downward bias. On the flip side, buyers must reclaim the 18.00 figure for a bullish continuation.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Federal Reserve (Fed) Governor Christopher Waller noted on Wednesday that inflation data in the last three months has been "very good," per Reuters. "If current trends continue, inflation will basically be back to the target," Waller added.

Key quotes

"Long-term rates are market determined."

"It's astounding how resilient the job market has been given the tight Fed policy."

"The real side of the economy is doing well."

"The Fed can watch and see what happens on rates."

"Financial markets are tightening and that will do some of the work for us."

"Will see how higher long-term rates feed into the Fed policy."

"Hard to see a direct link from the Middle East violence to the Fed policy unless there is a broader conflict."

Market reaction

The US Dollar Index stays under modest bearish pressure following these comments and was last seen losing 0.1% on the day at 105.65.

- AUD/USD manages to shift auction above 0.6400 amid correction in the US Dollar.

- A stronger US PPI report has prompted expectations of a hot consumer inflation report for September.

- Investors await the FOMC minutes which will provide a detailed explanation behind a steady rate decision.

AUD/USD seems stabilized above the round-level resistance of 0.6400 in the early New York session. The Aussie asset strengthens as the US Dollar falls back after the release of the stronger Producer Price Index (PPI) report for September.

The S&P500 opens on a bullish note as US Treasury yields drop from their multi-year highs. The 10-year US Treasury yields have dropped to 4.6%, resulting in an improvement in the risk appetite of the market participants.

The US Dollar Index (DXY) drops below 105.60 though stronger producer inflation has prompted expectations of a hot consumer inflation report for September, which will be published on Thursday at 12:30 GMT. The US Bureau of Labor Statistics reported the annual core PPI at 2.7%, accelerated from expectations of 2.5% and the former release of 2.3%. On a monthly basis, headline and core PPI rose by 0.5% and 0.3% respectively.

Meanwhile, neutral commentary from Federal Reserve (Fed) policymakers has pushed the US Dollar on the backfoot. Rate-setters commented that higher yields could reduce the pace of spending and investment. Therefore, the Fed could avoid raising rates further.

Going forward, the focus will be on the Federal Open Market Committee (FOMC) minutes for the September monetary policy, which will provide a detailed explanation behind a steady rate decision.

On the Aussie front, rising expectations of one more interest rate increase from the Reserve Bank of Australia (RBA) in the remainder of 2023 have improved the appeal of the Australian Dollar. Improved oil price outlook due to deepening Middle East tensions could elevate inflationary pressures ahead.

- EUR/USD advances to two-week tops near 1.0630 midweek.

- North from here comes the weekly peak around 1.0770.

EUR/USD adds to Tuesday’s gains and climbs to multi-session peaks in the 1.0625/30 band on Wednesday.

In case bulls maintain control, the pair should now retarget the weekly high of 1.0767 (September 12). Once cleared, spot could then move to the critical 200-day SMA (1.0823).

Meanwhile, further losses remain on the table as long as the pair navigates the area below the key 200-day SMA.

EUR/USD daily chart

- Silver price climbs to near $22.00 after a symmetrical triangle breakout.

- The US Dollar retreats despite the surprisingly hot US PPI report.

- The US inflation outlook turns hotter led by strong US PPI data.

Silver price (XAU/USD) extended upside to near $22.00 after the release of the surprisingly hotter Producer Price Index (PPI) report for September. The US Bureau of Labor Statistics reported that monthly headline PPI rose at a higher pace of 0.5% vs. expectations of 0.4% and core PPI grew by 0.3% against the estimates of 0.2%.

On an annualized basis, the headline PPI accelerated to 2.2%, higher than expectations of 1.6% and the former reading of 2%. The prices of core goods and services at factory gates jumped to 2.7%.

An unexpectedly hotter PPI report indicates that robust consumer spending forced producers to raise prices of goods at factory gates. This indicates that consumer inflation data that is scheduled for Thursday could be stronger and set a hawkish undertone for the Federal Reserve’s (Fed) November monetary policy meeting.

Meanwhile, the US Dollar Index (DXY) looks set for a fresh breakdown below the immediate support of 105.60. The neutral commentary from Fed policymakers over the interest rate outlook has weakened the appeal for the US Dollar. Rate-setters are worried about multi-year high US Treasury yields.

Silver technical analysis

Silver price delivers a breakout of the Symmetrical Triangle chart pattern on an hourly scale, which results in wider ticks and heavy volume. The 50-period Exponential Moving Average (EMA) at $21.82 continues to act as a cushion for the Silver price bulls.

The Relative Strength Index (RSI) (14) shifts into the bullish range of 60.00-80.00, which indicates that the bullish impulse has been triggered.

Silver two-hour chart

-638326285302346261.png)

- DXY keeps the bearish performance unchanged on Wednesday.

- Extra retracement could force the index to revisit the 104.40 region.

The continuation of the sell-off drags DXY to the area of two-week lows around 105.60 on Wednesday.

In case bears push harder, then index could then slip back to the weekly low of 104.42 (September 11), which appears reinforced by the proximity of the interim 55-day SMA, today at 104.31.

In the meantime, while above the key 200-day SMA, today at 103.18, the outlook for the index is expected to remain constructive.

DXY daily chart

- EUR/JPY adds to Tuesday’s advance and retakes the 158.00 barrier.

- Extra gains should meet the next target around 158.60.

EUR/JPY picks up further pace and surpasses the 158.00 mark, or three-day highs, on Wednesday.

The continuation of the rebound is expected to put the September high of 158.65 (September 13) to the test ahead of the 2023 top at 159.76 (August 30), which precedes the key round level at 160.00.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 150.08.

EUR/JPY daily chart

Building Permits in Canada increased 3.4% on a monthly basis in August. This reading followed the 3.8% decline (revised from 1.5%) recorded in July and came in better than the market expectation for a decrease of 0.8%.

What is the Canada Building Permits (MoM)?

The Building Permits released by the Statistics Canada shows the number of permits for new construction projects. It implies the movement of corporate investments (the Canadian economic development). It tends to cause some volatility to the CAD. The more growing number of permits, the more positive (or bullish) for the CAD.

When is the next Canada Building Permits (MoM) report released?

The next Canada Building Permits (MoM) data will be published on November 2 at 12:30 GMT

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.02% | -0.10% | 0.13% | 0.24% | 0.23% | 0.41% | -0.24% | |

| EUR | 0.04% | -0.06% | 0.16% | 0.25% | 0.26% | 0.44% | -0.22% | |

| GBP | 0.14% | 0.16% | 0.22% | 0.36% | 0.33% | 0.52% | -0.09% | |

| CAD | -0.13% | -0.11% | -0.21% | 0.11% | 0.08% | 0.29% | -0.37% | |

| AUD | -0.24% | -0.21% | -0.33% | -0.11% | -0.04% | 0.16% | -0.46% | |

| JPY | -0.20% | -0.21% | -0.33% | -0.09% | 0.05% | 0.22% | -0.42% | |

| NZD | -0.41% | -0.40% | -0.53% | -0.29% | -0.14% | -0.19% | -0.62% | |

| CHF | 0.24% | 0.21% | 0.09% | 0.32% | 0.46% | 0.42% | 0.60% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

- Producer inflation in the US accelerated in September.

- US Dollar Index stays below 106.00 after the PPI data.

The Producer Price Index (PPI) for final demand in the US rose 2.2% on a yearly basis in September, up from the 2% increase recorded in August, the data published by the US Bureau of Labor Statistics revealed on Wednesday. This reading came in higher than the market expectation of 1.6%.

The annual Core PPI increased 2.7% in the same period, higher than the August reading and analysts' estimate of 2.2% and 2.3%, respectively. On a monthly basis, the Core PPI rose 0.3%.

Market reaction

The US Dollar Index edged slightly higher with the immediate reaction and was last seen gaining 0.1% on the day at 105.90.

- EUR/GBP prints a fresh three-week low at 0.8620 as the ECB is expected to keep policy steady ahead.

- The Eurozone GDP for Q3 is expected to contract due to the consequences of higher interest rates.

- The Pound Sterling will dance to the tune of the UK factory data.

The EUR/GBP pair printed a fresh three-week low at 0.8620 on Wednesday as European Central Bank (ECB) Governing Council member and Bank of France President, Francois Villeroy de Galhau see monetary policy sufficiently restrictive.

ECB Villeroy warned that further policy tightening is not the right thing at this time amid a positive oil price outlook due to escalating Middle East tensions.

Meanwhile, the Eurozone economy is underperforming on the grounds of employment, output, and consumer spending, which are consequences of higher interest rates by the central bank. ECB policymaker Pablo Hernandez de Cos expects a negative reading of Gross Domestic Product (GDP) in the third quarter of 2023.

ECB policymakers have been emphasizing the need to keep interest rates higher for a longer period as the last leg of inflation could turn out sticky ahead. A survey from the ECB showed that Eurozone consumers see inflation three years ahead at 2.5% in August vs. 2.4% in July.

On the Pound Sterling front, investors await the United Kingdom factory data, which will be released on Thursday at 06:00 GMT. Investors see monthly Manufacturing Production contracting by 0.3% against the 0.8% contraction recorded for July. Monthly Industrial Production is foreseen to decline at a slower pace of 0.2% against a contraction of 0.7% in July. The monthly Gross Domestic Product (GDP) data is seen expanding by 0.5% against a decline of 0.5% in July.

Investors seem confused about the interest rate outlook after hawkish guidance from Bank of England (BoE) policymaker Katherine Mann, which supported for aggressively tightening approach this week. She discussed the need to bring down inflation to 2% and wipe out consumer inflation expectations.

Antje Praefcke, FX Analyst at Commerzbank, assesses the central bank’s (MNB) monetary policy prospects for the remainder of the year.

Key Takeaways

The Hungarian central bank (MNB) on the other hand has no scope for key rate cuts in the near future. In Hungary too the inflation rate in September eased more significantly than expected from previously 16.4% to 12.2%, so that real interest rates have even become positive now, as key and overnight rate stand at 13%, but the fall is mainly due to base effects, whereas prices for food and services have continued to rise.

The MNB is aware of the price pressure that is also reflected in the monthly change rates of still 0.4% which is why it has taken a more cautious approach after it had lowered the overnight rate to the level of the key rate in a number of steps. More recently members of the MNB had increasingly sounded more restrictive so that key rate cuts seem unlikely until year-end.

This becomes even more significant for the forint as the government is putting increasing pressure on the central bank, as it did with its demand to change the inflation target or with its demand to commercial banks to set an upper limit for mortgage rates. If the MNB didn't stand up to inflation and government pressure, the market would punish the forint in a major way, with the MNB risking further price pressure.

- The Greenback is losing steam against most major peers for this week.

- All eyes are on PPI numbers this Wednesday, CPI on Thursday.

- The US Dollar Index settles below 106 and could result in more losses with the longer-term rally ending overnight.

The US Dollar (USD) sees markets looking beyond recent developments in Israel and Gaza. It appears that several countries and participants around this war do not want to see further escalation of violence. This means, for now, a proxy war is out of the way. Safe havens are starting to abate with the Swiss Franc and the Greenback retreating to weaker levels.

Meanwhile, traders have used the brief moment of US Dollar strength on Monday to sell the US Dollar, steering it substantially lower throughout Tuesday, after comments from several Federal Reserve officials signaled the Fed is done hiking. With Producer Price Index (PPI) numbers today and Consumer Price Index (CPI) data on Thursday, markets will now look for clues if the Greenback needs to be devalued even more and might see the US Dollar Index (DXY) print more losses later this week.

Daily digest: US Dollar wounded

- At 11:00 GMT, the Mortgage Bankers Association (MBA) will issue its weekly Mortgage Applications Index. Previous number was at -6% week-on-week.

- Near 12:30 GMT the main event for Wednesday arrives with the Producer Price Index numbers. For the monthly gauge, expectations are for it to head from 0.7% to 0.4%. The yearly number is expected to stay stable at 1.6%. The monthly Core PPI, without Food and Energy, is expected to stay stable at 0.2%. The yearly Core PPI is expected to head from 2.2% to 2.3%.

- Christopher Waller from the Board of Governors at the Fed is due to speak at 14:15 GMT. Raphael Bostic from the Atlanta Fed will be taking the stage near 16:15 GMT.

- The US Treasury is looking for some funding in the market. This time the 10-year note is up for auction at 17:00 GMT.

- Traders can look for clues or confirmation on the possible end of rate hikes with the Fed’s latest FOMC minutes due at 18:00 GMT.

- Equities are a bit mixed with Asian stocks up and European stocks down. That last one is not a big surprise after the substantial surge European equities had on Tuesday. It must be some small profit-taking action there. US equity futures are flat and hold on to Tuesday’s gains.

- The CME Group FedWatch Tool shows that markets are pricing in an 84.3% chance that the Federal Reserve will keep interest rates unchanged at its meeting in November.

- The benchmark 10-year US Treasury yield trades at 4.63%, which is still in the lower range of this week.

US Dollar Index technical analysis: Did it fall off its pedestal?

The US Dollar snapped a very important trendline on the US Dollar Index chart. This is true for both the weekly and the daily time frames. The Indian summer rally that started in July and extended all the way up to last week came to an end with the DXY breaking below the respected trendline from throughout that period. From a pure technical point of view, this means some US Dollar weakness will further take place before initial support is met.

The DXY opens below 106, which means that that will be the first initial hurdle to recapture. On the topside, 107.19 is important to see if the DXY can get a daily close above that level. If this is the case, 109.30 is the next level to watch.

On the downside, the recent resistance at 105.88 did not do a good job supporting any downturn. Instead, look for 105.12 to keep the DXY above 105.00. If that does not do the trick, 104.33 will be the best level to look for some resurgence in US Dollar strength with the 55-day Simple Moving Average (SMA) as a support level.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.