- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | Australia | Consumer Inflation Expectation | September | 3.5% | |

| 04:30 | Japan | Tertiary Industry Index | July | -0.1% | |

| 06:00 | Germany | CPI, m/m | August | 0.5% | -0.2% |

| 06:00 | Germany | CPI, y/y | August | 1.7% | 1.4% |

| 06:30 | Switzerland | Producer & Import Prices, y/y | August | -1.7% | |

| 06:45 | France | CPI, y/y | August | 1.1% | 1.1% |

| 06:45 | France | CPI, m/m | August | -0.2% | 0.5% |

| 09:00 | Eurozone | Industrial Production (YoY) | July | -2.6% | -1.3% |

| 09:00 | Eurozone | Industrial production, (MoM) | July | -1.6% | -0.1% |

| 11:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 12:30 | U.S. | Continuing Jobless Claims | 1662 | 1685 | |

| 12:30 | Canada | New Housing Price Index, MoM | July | -0.1% | |

| 12:30 | Canada | New Housing Price Index, YoY | July | -0.2% | |

| 12:30 | U.S. | Initial Jobless Claims | 217 | 217 | |

| 12:30 | Eurozone | ECB Press Conference | |||

| 12:30 | U.S. | CPI excluding food and energy, m/m | August | 0.3% | 0.2% |

| 12:30 | U.S. | CPI, m/m | August | 0.3% | 0.1% |

| 12:30 | U.S. | CPI, Y/Y | August | 1.8% | 1.8% |

| 12:30 | U.S. | CPI excluding food and energy, Y/Y | August | 2.2% | 2.3% |

| 18:00 | U.S. | Federal budget | August | -120 | |

| 22:30 | New Zealand | Business NZ PMI | August | 48.2 |

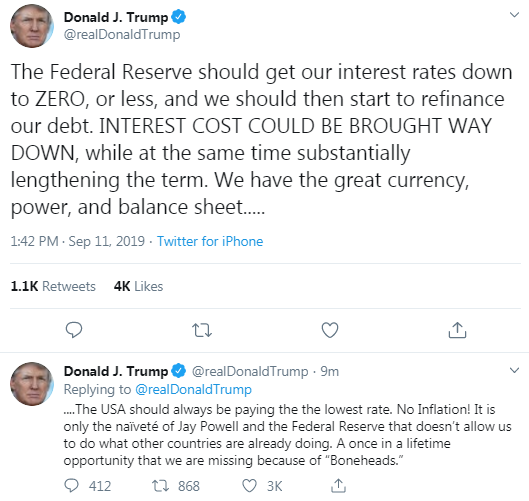

The main US stock indexes rose significantly, as China's efforts to ease trade tensions with the United States reassured investors, while Apple (AAPL) stocks rose significantly after the launch of new products.

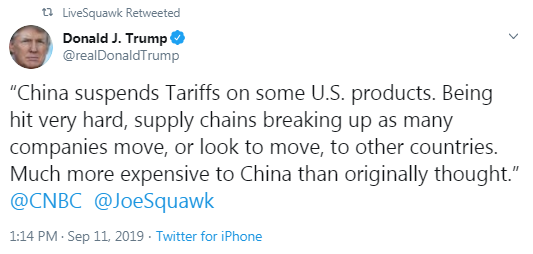

China's Treasury Department announced this morning that it would release 16 additional US goods from additional tariffs ahead of a planned meeting between the negotiating teams of the two largest economies in the world next month. Although this move is seen as a friendly maneuver to soften relations with the United States, analysts are not convinced that this is a turning point in a trade war that has damaged the global economy.

Apple's stock price (AAPL) jumped 3.18% after the company introduced three new iPhones the day before along with a new Apple Watch and streaming video service with a lower subscription cost than Disney (DIS) and Netflix (NFLX).

Further growth, however, was constrained by expectations of central bank incentive decisions to stop the global slowdown. The US Federal Reserve and the European Central Bank are expected to cut rates at their meetings over the next two weeks.

Investors also studied inflation data. A Labor Department report showed that US producer prices rose slightly in August. According to the report, producer price index for final demand rose in August by 0.1% after rising by 0.2% in July. In the 12 months to August, the producer price index rose 1.8% after rising 1.7% in July. At the same time, excluding food, energy and trade services, producer prices jumped 0.4% last month after falling 0.1% in July, the first decline since October 2015. The so-called core producer price index for the 12 months to August rose 1.9% after rising 1.7% in July.

Most DOW components completed trading in positive territory (21 out of 30). The biggest gainers were The Boeing Co. (BA; + 3.64%). Outsiders were shares of International Business Machines Corporation (IBM; -1.00%).

All S&P sectors recorded an increase. The consumer goods sector grew the most (+ 1.3%).

At the time of closing:

Dow 27,137.04 +227.61 + 0.85%

S&P 500 3,000.93 +21.54 + 0.72%

Nasdaq 100 8,169.68 +85.52 + 1.06%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | Australia | Consumer Inflation Expectation | September | 3.5% | |

| 04:30 | Japan | Tertiary Industry Index | July | -0.1% | |

| 06:00 | Germany | CPI, m/m | August | 0.5% | -0.2% |

| 06:00 | Germany | CPI, y/y | August | 1.7% | 1.4% |

| 06:30 | Switzerland | Producer & Import Prices, y/y | August | -1.7% | |

| 06:45 | France | CPI, y/y | August | 1.1% | 1.1% |

| 06:45 | France | CPI, m/m | August | -0.2% | 0.5% |

| 09:00 | Eurozone | Industrial Production (YoY) | July | -2.6% | -1.3% |

| 09:00 | Eurozone | Industrial production, (MoM) | July | -1.6% | -0.1% |

| 11:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 12:30 | U.S. | Continuing Jobless Claims | 1662 | 1685 | |

| 12:30 | Canada | New Housing Price Index, MoM | July | -0.1% | |

| 12:30 | Canada | New Housing Price Index, YoY | July | -0.2% | |

| 12:30 | U.S. | Initial Jobless Claims | 217 | 217 | |

| 12:30 | Eurozone | ECB Press Conference | |||

| 12:30 | U.S. | CPI excluding food and energy, m/m | August | 0.3% | 0.2% |

| 12:30 | U.S. | CPI, m/m | August | 0.3% | 0.1% |

| 12:30 | U.S. | CPI, Y/Y | August | 1.8% | 1.8% |

| 12:30 | U.S. | CPI excluding food and energy, Y/Y | August | 2.2% | 2.3% |

| 18:00 | U.S. | Federal budget | August | -120 | |

| 22:30 | New Zealand | Business NZ PMI | August | 48.2 |

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

decreased by 6.912 million barrels in the week ended September 6. Economists

had forecast a drop of 2.900 million barrels.

At the same

time, gasoline stocks reduced by 0.682 million barrels, while analysts had

expected a decline of 1.000 million barrels. Distillate stocks rose by 2.704

million barrels, while analysts had forecast a decrease of 0.900 million

barrels.

Meanwhile, oil

production in the U.S. was unchanged at 12.400 million barrels a day.

U.S. crude oil

imports averaged 6.7 million barrels per day last week, down by 180,000 barrels

per day from the previous week.

The Commerce

Department announced on Wednesday the U.S. wholesale inventories rose 0.2

percent m-o-m in July, after being unchanged m-o-m in June.

Economists had

forecast wholesale inventories growing 0.2 percent m-o-m in July.

On a y-o-y

basis, wholesale inventories surged 7.1 percent.

According to

the report, wholesale auto stocks rose 0.5 percent m-o-m in July, following a 0.1

percent m-o-m drop in the previous month. There were also gains in professional

equipment and furniture inventories. Meanwhile, apparel, hardware and

electrical goods inventories declined and machinery inventories dropped by the

most since December 2017.

Wholesale sales

rose 0.3 percent m-o-m in July, following a 0.3 percent m-o-m fall in June.

Carsten Brzeski, the chief economist at ING, notes that there seems to be a broad agreement at the ECB to do something this week, but the latest comments by several hawks suggest that there still is a heated debate on which policy measures the ECB should implement.

- “The traditional hawks like Jens Weidmann from Germany, Klaas Knot from Netherlands and Sabine Lauthenschläger on the ECB's Executive Board voiced their opposition at least against a restart of QE.

- In our view, even if the group of QE-skeptical hawks has grown, it still looks like a vocal minority. With inflation expectations probably deviating further from the ECB’s target, there will in our view be a vast majority in favour of new action. And despite the hawks opposition, it is doubtful that only a rate cut will be sufficient. In this regards and to better understand how many at the ECB are currently thinking, a speech by ECB Chief Economist Philip Lane from last week provides interesting insights.

- According to estimates Lane presented, the ECB’s unconventional measures since 2014 had lifted both growth and inflation some 0.5 percentage points higher. Interestingly, almost half of the impact came from QE. Don’t forget that when the ECB started QE in 2015, the staff projections predicted an acceleration of inflation from 0.5% in 2014 to 1.3% in 2016. Currently, the risk of dropping from an environment of de facto economic stagnation and low inflation into deflation is probably as high as in 2014/5.

- Therefore, we continue to see the ECB starting a final monetary firework at this week’s meeting: a 20bp rate cut of the deposit rate, a small tiering system, a repricing of the TLTROs and a restart of QE with some 30 billion euro per month. Even though there is the risk that the hawks’ opposition could lead to a delay of QE.”

U.S. stock-index futures rose slightly on Wednesday, as easing U.S.-China trade tensions were not enough to provoke investors to buy stocks ahead of the Federal Reserve’s decision on interest rates next week.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,597.76 | +205.66 | +0.96% |

Hang Seng | 27,159.06 | +475.38 | +1.78% |

Shanghai | 3,008.81 | -12.39 | -0.41% |

S&P/ASX | 6,638.00 | +23.90 | +0.36% |

FTSE | 7,334.76 | +66.81 | +0.92% |

CAC | 5,619.28 | +26.07 | +0.47% |

DAX | 12,372.82 | +104.11 | +0.85% |

Crude oil | $57.99 | +1.03% | |

Gold | $1,500.00 | +0.05% |

Analysts at TD Securities say that their base case sees a 20bps rate cut with tiering, €40bn/m of QE, and no rate hikes from ECB tomorrow until at least mid-2021.

- “We're more comfortable with the rates view than QE, as QE will likely be a contentious decision.

- FX: Our dovish ECB call has us looking for downside risks to EURUSD. We think spot will be more sensitive to a large QE announcement than rate cuts as much of the expected Fed/ECB policy path differential already looks priced.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 169.2 | 0.34(0.20%) | 458 |

ALCOA INC. | AA | 21.33 | 0.50(2.40%) | 14473 |

ALTRIA GROUP INC. | MO | 44.4 | 0.16(0.36%) | 14425 |

Amazon.com Inc., NASDAQ | AMZN | 1,812.20 | -8.35(-0.46%) | 28498 |

Apple Inc. | AAPL | 217.52 | 0.82(0.38%) | 265298 |

AT&T Inc | T | 37.95 | 0.37(0.98%) | 286438 |

Boeing Co | BA | 368.84 | -0.65(-0.18%) | 5421 |

Caterpillar Inc | CAT | 130.4 | 0.11(0.08%) | 2800 |

Chevron Corp | CVX | 122.48 | 0.63(0.52%) | 241 |

Cisco Systems Inc | CSCO | 49.46 | 0.25(0.51%) | 17134 |

Citigroup Inc., NYSE | C | 68.84 | -0.14(-0.20%) | 1449 |

Deere & Company, NYSE | DE | 164.5 | 0.46(0.28%) | 279 |

Exxon Mobil Corp | XOM | 72.6 | 0.53(0.74%) | 4579 |

Facebook, Inc. | FB | 186.74 | 0.57(0.31%) | 34140 |

Ford Motor Co. | F | 9.36 | -0.06(-0.64%) | 82081 |

General Electric Co | GE | 9.13 | -0.01(-0.11%) | 68726 |

General Motors Company, NYSE | GM | 38.98 | -0.60(-1.52%) | 7520 |

Goldman Sachs | GS | 215.5 | -0.13(-0.06%) | 5020 |

Home Depot Inc | HD | 232.98 | -0.02(-0.01%) | 634 |

HONEYWELL INTERNATIONAL INC. | HON | 169.75 | 0.14(0.08%) | 145 |

Intel Corp | INTC | 51.73 | -0.09(-0.17%) | 5509 |

International Business Machines Co... | IBM | 145.05 | 0.00(0.00%) | 2877 |

Johnson & Johnson | JNJ | 129.75 | 0.20(0.15%) | 1248 |

JPMorgan Chase and Co | JPM | 116.62 | -0.25(-0.21%) | 2048 |

McDonald's Corp | MCD | 210.65 | 0.97(0.46%) | 5261 |

Merck & Co Inc | MRK | 82 | 0.31(0.38%) | 4674 |

Microsoft Corp | MSFT | 136.45 | 0.37(0.27%) | 45122 |

Nike | NKE | 86.98 | 0.15(0.17%) | 799 |

Pfizer Inc | PFE | 37.34 | -0.04(-0.11%) | 3514 |

Procter & Gamble Co | PG | 120.5 | 0.62(0.52%) | 8157 |

Starbucks Corporation, NASDAQ | SBUX | 90.7 | 0.35(0.39%) | 3865 |

Tesla Motors, Inc., NASDAQ | TSLA | 236.6 | 1.06(0.45%) | 14610 |

The Coca-Cola Co | KO | 54.63 | 0.23(0.42%) | 1044 |

Twitter, Inc., NYSE | TWTR | 43.4 | 0.15(0.35%) | 30014 |

UnitedHealth Group Inc | UNH | 233 | 0.54(0.23%) | 692 |

Verizon Communications Inc | VZ | 59.85 | 0.14(0.23%) | 3385 |

Visa | V | 178.05 | 1.70(0.96%) | 27853 |

Wal-Mart Stores Inc | WMT | 116.35 | 0.30(0.26%) | 1728 |

Walt Disney Co | DIS | 135.76 | -0.03(-0.02%) | 9882 |

Yandex N.V., NASDAQ | YNDX | 37.82 | 0.34(0.91%) | 1200 |

Cisco Systems (CSCO) initiated with Outperform at Evercore ISI; target $60

Apple (AAPL) target lowered to $204 from $211 at Maxim Group

Alcoa (AA) upgraded to Outperform from Neutral at Credit Suisse; target raised to $27

Micron (MU) upgraded to Buy from Neutral at Longbow; target $66

The Labor

Department reported on Wednesday the U.S. producer-price index (PPI) edged up

0.1 percent m-o-m in August, following a gain of 0.2 percent m-o-m July.

For the 12

months through August, the PPI rose 1.8 percent after a 1.7 percent advance in

the previous month.

Economists had

forecast the headline PPI would increase 0.1 percent m-o-m and 1.8 percent over

the past 12 months.

According to

the report, the August rise in final demand prices was attributable to a

0.3-percent m-o-m increase in the index for final demand services. In contrast,

prices for final demand goods dropped 0.5 percent m-o-m.

Excluding

volatile prices for food and energy, the PPI rose 0.3 percent m-o-m and 2.3

percent over 12 months. Economists had forecast gains of 0.2 percent m-o-m and

2.2 percent y-o-y, respectively.

Piotr Matys, the emerging markets FX strategist at Rabobank, thinks that all eyes on Thursday will be on ECB President Draghi whose era is coming to an end as in November he will hand it over to Lagarde, the former IMF chief.

- “Market expectations are very high that the ECB will reveal a comprehensive stimulus package.

- Our ECB watchers Bas van Geffen and Elwin de Groot anticipate a wide range of easing measures including a 10bps deposit rate cut; forward guidance tied to the duration of asset purchases (i.e. rates to stay at present or lower levels until ‘well past’ the end of net asset purchases); and a EUR 40bn per month asset purchase programme running for 12 months starting from October.

- \An initial response from the CEEMEA currencies – particularly the Polish zloty and its peers due to their strong ties with the Eurozone – is likely to be positive if the ECB announces a major package of monetary policy stimulus. That said, we do not anticipate an outburst of optimism that will trigger a sustainable wave of capital inflows into the CEE assets. There seems to be growing scepticism about the ability of central banks to offset the negative impact of trade war.

- Essentially, there is a risk that QE could be delayed or watered down leaving the markets disappointed with the Polish zloty and other currencies in the CEE affected the most.”

Analysts at TD Securities are projecting U.S. PPI inflation to be flat m/m in August, following a 0.2% increase in July.

- “The underlying measures are expected to rebound 0.2% after negative prints in the month before. On an annual basis, headline PPI and core inflation are likely to print 1.7% and 2.2%, respectively.”

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. rose 2.0 percent in the week ended September 6, following a 3.1

percent drop in the previous week.

According to

the report, applications to purchase a home rose 5.0 percent, while refinance

applications increased 0.4 percent.

Meanwhile, the

average fixed 30-year mortgage rate decreased to 3.82 percent from 3.87

percent.

Refinances were

essentially unchanged, but August overall was the strongest month of activity

so far in 2019,” noted Joel Kan, an MBA economist.

- The downwards forecast revision is due to the ongoing economic slowdown

- OPEC warns producers not to pump too much crude amid waning global economic growth

Analysts at TD Securities note that China’s August Aggregate financing rose by CNY 1,980bn from CNY 1,010bn in July (mkt CNY 1,604.5bn) and new loans in August climbed by CNY 1,210bn from CNY 1,060bn in July.

- “M2 Money supply rose 8.2% y/y in August (mkt 8.2% y/y). The pace of aggregate financing, new loans and money supply growth slowed sharply in July. A rebound in all three was widely expected in August as the authorities likely opened the credit taps further, albeit in a calibrated manner, while credit demand likely picked up slightly. Banks balance sheets shrank in July but some of this was expected to have reversed in August.”

Britain’s governing Conservatives retain a significant lead over the opposition Labour Party according to a poll published on Wednesday as the country could soon hold an election to break the Brexit stalemate.

Prime Minister Boris Johnson’s party had the support of 38% of voters in the Kantar online survey conducted between September 5 and September 9 whilst the opposition Labour Party took 24%. Both parties are down four percentage points.

Just over half of respondents also support any final Brexit deal being put to another referendum.

Petr Krpata, Chief EMEA FX and IR Strategist at ING, notes that the UK Parliament has now been suspended for the next five weeks, with legislation against a no deal Brexit in place and for now, GBP may enjoy a calmer period with occasional upside caused by the still-stretched positioning.

“Given our base case for early elections in late November / early December (likely to be triggered by a vote of no confidence) we expect GBP to come back under pressure. Among other things, the possible victory of the Conservative party under the leadership of Boris Johnson would mean an increased likelihood of no deal Brexit should Conservatives achieve a Parliamentary majority. This suggests that the current subdued risk premium in the pound will increase, in turn weighing on the currency. We expect EUR/GBP to converge towards the 0.95 level and GBP/USD to fall below 1.20 over the next three months.”

OPEC and its allies will discuss whether there is a need for deeper production cuts at a ministerial committee meeting on Thursday, Iraq's oil minister said.

Decisions over output policy are group decisions and Iraq does not want to decide on its own, Thamer Ghadhban said, adding that he was meeting with the Saudi and Russian energy ministers later on Wednesday.

The previous OPEC meeting had discussed cuts of 1.6-1.8 million barrels per day, he said, but because some members resisted they agreed on a cut of 1.2 million barrels per day.

Ghadhban also said that Iraq's Kurdish region should respect its obligations with regards to oil exports and its share in federal budget. The Kurdish Regional Government is supposed to give 250,000 barrels per day of oil to the federal government but is so far not complying, he said.

According to ANZ analysts, crude oil market faces an important decision point, as OPEC and its allies meet to review OPEC’s oil production strategy and the weakening macro backdrop is further complicated by changes in Saudi Arabia’s ministerial responsibilities.

“The surprise replacement of Saudi Arabia’s Energy Minister, Khalid Al-Falih, with Prince Abdulaziz al Salman raises questions about the kingdom’s oil policy. We don’t see the move as a prelude to significant change. The prince is a long time energy ministry official and has been part of the Saudi delegation that has set the OPEC production policy. As OPEC and its allied producers (such as Russia) meet in Abu Dhabi, they face unprecedented uncertainty. In particular, tension between the US and Iran/Venezuela continues to impact the market. We have subsequently reduced our forecast oil demand growth to 1mb/d this year (from 1.2mb/d). Even so, we see sizeable stock drawdowns in Q4. With crude oil well below Saudi Arabia’s target of USD80/bbl, we feel they have no choice but to continue the current production cut agreement to help support current prices. However, the ability to push prices higher looks limited.”

The German economy will slide into a recession in the current quarter, the Kiel Institute for the World Economy (IfW) said as it slashed its growth forecasts for Europe's biggest economy due to trade disputes and Brexit uncertainty.

The IfW institute said it expected the German economy to contract by 0.3% quarter-on-quarter in the third quarter after a 0.1% contraction in the previous quarter.

The institute also cut its 2019 growth forecast for the German economy to 0.4% from 0.6% previously and said it sees a growth rate of 1.0% for 2020, down from its earlier estimate of 1.6%.

Iris Pang, economist at ING, points out that China's State Council has exempted some tariffs on US goods and the 16 items exempted from the additional 25% tariffs are mostly lubricants and fodder.

“China is not the first to offer exemptions during this trade war. The US also exempted 110 imported Chinese products from tariffs back in July. Most of these included medical equipment and parts, which are high-value products. If exemptions are viewed as a form of concession, then the US has given more. The exemption could be seen as a gesture of sincerity towards the US ahead of negotiations in October but is probably more a means of supporting the economy. There are still many uncertainties in the coming trade talks. An exemption list of just 16 items will not change China's stance. We believe that China will stand very firm in the negotiations, which will be similar to the last round of talks. Our house view is that the two countries are unlikely to reach a deal this year.”

In view of Axel Rudolph, analyst at Commerzbank, GBP/USD’s advance from its current September low at 1.1958 still has the May and June lows at 1.2506/59 in its sights and between these levels and the mid-July high at 1.2580 the cross may short-term struggle.

“Further up lies strong resistance between the seven month resistance line, 200 day ma and the June high at 1.2715/84. Once a weekly Friday chart close above the 1.2310 August high has been made, we will change our weekly outlook to a bullish one. Minor support below yesterday’s low at 1.2233 is seen between the early and mid-August lows at 1.2080/15 and major support at the 1.1958 current September low. A slip through the 1.1958 recent low would put the 1.1491 October 2016 low (according to CQG) on the cards.”

The Chinese yuan is set to weaken further against the dollar as trade tensions between the United States and China continue, according to CLSA Chief Economist Eric Fishwick.

Fishwick predicts the yuan will reach around 7.3 per dollar by the end of the year. On Wednesday morning, the yuan traded around 7.1225 against the U.S. currency on the Chinese mainland.

“Looking at how the currency trades, it is very clearly demonstrated that it is being used as a way to offset the effects of tariffs,” Fishwick told. “So, the yuan is allowed to weaken whenever the U.S. ratchets the tensions higher.”

“I think that the forces that are pushing the yuan lower are still in place,” he added.

The yuan has been closely watched by investors, economists and other market watchers in recent months because it is seen as one of the tools China can use in response to rising U.S. tariffs.

Last month, the currency weakened past a psychologically important level of 7 against the greenback. A weaker yuan, which is also known as the renminbi, would make China’s exports relatively cheaper on the international markets. The U.S. has repeatedly accused Beijing of keeping its currency weaker in order to gain a trade advantage over its competitors.

Going into 2020, the yuan could be modestly stronger because of the U.S. dollar, according to Fishwick. “Looking into next year, for the first time in a long time, we’re able to talk about the prospects for the dollar weakening again,” he said. The U.S. economy is going to slow further as the effects from earlier tax cuts wind down, he said.

Auto sales in China fell for a 14th consecutive month in August, with the number of new energy vehicles (NEVs) sold contracting for the second month in a row.

Total auto sales fell 6.9% from the same month a year earlier, the China Association of Automobile Manufacturers (CAAM) said.

That followed declines of 4.3% in July and 9.6% in June, as well as the first annual contraction last year since the 1990s against a backdrop of slowing economic growth and a crippling trade war with the United States.

Sales of new energy vehicles (NEVs) fell 15.8% in August, CAAM said, following a 4.7% fall in July - their first decline since January 2017. NEV sales jumped almost 62% last year even as the broader auto market contracted.

According to Axel Rudolph, analyst at Commerzbank, EUR/USD pair has seen a strong bounce from its current September low at 1.0926 and is still trying to reach last week’s high at 1.1084 and if bettered, the April and May lows at 1.1110/1.1106 as well as the three month resistance line at 1.1116 will be in focus.

“Only a daily chart close above the August 26 high at 1.1164 would confirm a bottoming formation and put the 200 day ma at 1.1263 back on the cards. Ideally we would like the 55 week ma at 1.1318 to be exceeded as well. Support below the minor psychological 1.1000 mark comes in at the current September low at 1.0926. Below the 1.0926 low lie the June 2016 low and the March 2017 high at 1.0912/07. Further down sit the January 2017 low at 1.0829 and the 78.6% Fibonacci retracement of the 2017-2018 advance at 1.0814. The cross will need to regain the 55 week ma and downtrend channel resistance line at 1.1318/40 to generate upside interest.”

Some American companies in China are speeding up their move away from the mainland as increasing tariffs continue to hurt their businesses. That’s according to a survey released by the American Chamber of Commerce in Shanghai.

More than a quarter of the respondents – or 26.5% – said that in the past year, they have redirected investments originally planned for China to other regions. That’s an increase of 6.9 percentage points from last year, the AmCham report said, noting that technology, hardware, software and services industries had the highest level of changes in investment destination.

The research, conducted in partnership with PwC, surveyed 333 members of the American Chamber of Commerce in Shanghai. It was conducted from June 27 to July 25 — during the period when U.S. President Donald Trump and Chinese President Xi Jinping agreed to resume trade talks, and before the latest escalation in retaliatory tariffs.

U.S. firms in the mainland also said restrictions to accessing the local market have made it difficult for them to carry out their business, the report said.

Asked about the best possible scenarios in ongoing trade negotiations, more than 40% of respondents said greater access to the domestic market would be the most important outcome to help their businesses succeed. That was followed by more than 28% that ranked improved intellectual property protection as key.

Societe Generale Research maintains a structural bearish bias on USD/JPY and EUR/JPY targeting the 2 pairs at 105 and 115.50 respectively by year-end.

"First things first: This is a correction to an outsized move in yields during August, not a turn in the trend. Last Friday's US labour market data show, clearly enough for me, that the US economy is slowing slowly but steadily as the global trade slowdown infects it. The US economy is less vulnerable to global trade than Germany's, but it's not immune and it can't rely on the equity market to bail it out for ever. The world will drag the US economy down and Bund yields will drag Treasury yields down. Finally, a chart of old friends re-united as USD/JPY re-correlates with relative 10-year yields. The more US yields rise, the higher USD/JPY can go. We don't believe we've seen the lows for this cycle, in US yields, relative yields, USD/JPY or even EUR/JPY," SocGen adds.

Xinhua, the Chinese state news agency, reports that Beijing unveils its first list for tariff exemptions on US goods.

China's tariffs exemption list for products takes effect on September 17.

Items on China's tariffs exemption list will not be subject to additional tariffs imposed by China on US goods as countermeasures to US trade actions.

Items on China's tariffs exemption list include food products, lubricants.

Doesn't list corn, soybeans, pork in first tariff exclusion.

China will consider tariff exemptions for additional products imported from the US.

Whey and modified whey products part of the exemption list for goods from the US.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1206 (1732)

$1.1181 (1798)

$1.1150 (941)

Price at time of writing this review: $1.1051

Support levels (open interest**, contracts):

$1.1014 (3568)

$1.0977 (4189)

$1.0935 (3010)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 4 is 76070 contracts (according to data from September, 10) with the maximum number of contracts with strike price $1,1100 (4481);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2498 (482)

$1.2459 (246)

$1.2434 (181)

Price at time of writing this review: $1.2355

Support levels (open interest**, contracts):

$1.2207 (968)

$1.2126 (1163)

$1.2083 (629)

Comments:

- Overall open interest on the CALL options with the expiration date October, 4 is 14713 contracts, with the maximum number of contracts with strike price $1,2500 (1734);

- Overall open interest on the PUT options with the expiration date October, 4 is 13766 contracts, with the maximum number of contracts with strike price $1,1900 (1491);

- The ratio of PUT/CALL was 0.94 versus 0.90 from the previous trading day according to data from September, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.