- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The AUD/NZD has etched in a new weekly low at 1.0780 after a week of declines.

- The Aussie's backslide comes after reaching a technical ceiling at 1.0940.

- Buyers to be pushed to the back end for next week if they can't grab ahold of moving average barriers.

The AUD/NZD has managed to hold on for Friday, closing out the trading week close to flat on the last day after declining over 1.1% peak-to-trough from Monday's peak near 1.0900.

The pair still remains down almost 1.4% from the last meaningful swing high into 1.0945 and Aussie bidders are beginning to run out of track as the AUD/NZD rotates into a bearish technical pattern, slipping below the 200-day Simple Moving Average (SMA) and on pace to extend declines back into the last low set in October near 1.0640.

The Moving Average Convergence-Divergence (MACD) on the daily candles is confirming a bearish signal following a slow and fast moving average crossover, and a Relative Strength Index (RSI) still near the midrange but declining slowly is implying there's still room to run on the down side before hitting oversold conditions.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

- The Euro has stepped higher against the Pound Sterling for five straight trading days.

- The EUR/GBP briefly saw a fresh six-month high on Friday.

- Economic data has mixed for both the EU and the UK, but the market's hat tip goes to the Euro.

The EUR/GBP wraps up another trading week just shy of 0.8750 after seeing five straight days of gains with the Pound Sterling (GBP) waffling against the Euro (EUR) for the entire week.

EU and UK economic data mixed on forecasts across the board this week, but it's getting difficult for investors to ignore the fact that UK data beats, even when they clear forecasts, still leaves economic indicators middling at best.

UK Gross Domestic Product (GDP) figures held steady for the year into September at 1.5% instead of declining to 1.1% as markets had expected, and UK Manufacturing Production for the same period held flat at 3% versus the expected growth to 3.1%, and the previous figure being revised from 28% to 3.0%.

Next Up: hectic data schedule for EU & UK

Next Tuesday sees UK labor and wage figures, while the EU will be releasing their own GDP figures for the third quarter.

Wednesday delivers UK Consumer Price Index (CPI) inflation data, paired with EU Industrial production.

Next week will close out high-impact data with UK Retail Sales and EU Harmonized Index of Consumer Prices (HICP) on Friday.

EUR/GBP Technical Outlook

The EUR/GBP chalked in five straight green bars, climbing back over the 200-day Simple Moving Average (SMA) and pushing back into near-term high bids as the Euro rallies against the Pound Sterling.

The pair has continued to etch in higher lows along a rising trendline from August's low closes near 0.8520, and the 50-day SMA is accelerating from 0.8660 towards a bullish cross of the 200-day SMA, which is currently parked near 0.8690.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

- NZD/JPY rose nearly 0.10% towards the 89.245 area

- The cross continues to side-ways trades, slightly tilted to the downside.

- Bulls seem to be taking a breather after last week’s 3% gains.

The NZD/JPY will close a 0.30% losing week around the 89.245 area, as investors are taking profits from the early month's sharp gains.

Observing the daily chart, the NZD/JPY displays signs of bullish exhaustion after the cross gained more than 3% at the beginning of November. The Relative Strength Index (RSI) has turned flat above its midline, while the Moving Average Convergence (MACD) prints neutral green bars. On the four-hour chart, the indicators have also flattened but are also slightly lilted to the upside, suggesting that buyers are consolidating gains.

Additionally, the cross is above the 20,100,200-day Simple Moving Average (SMA), suggesting that the outlook also favours the bulls in the larger time frames. Furthermore, there could be a bullish confirmation as the 100-day SMA is converging towards the 20-day average to perform a bullish cross, which could reignite the momentum for the buyers in the short term.

Support levels: 89.000, 88.700, 88.500.

Resistance levels: 89.5000, 89.850,90.000.

NZD/JPY Daily Chart

-638352489705454998.png)

- S&P 500 rises 1.54%, closing at 4,414.57, marking its seventh consecutive week of gains.

- Nasdaq 100 and Dow Jones Industrial also post gains, with technology and consumer sectors leading.

- Market players overlook Fed Chair Jerome Powell's hawkish comments, focusing instead on mixed economic data.

- Upcoming week to focus on US inflation data, unemployment claims, and further commentary from Federal Reserve officials.

Wall Street is set to finish the week with gains, as the S&P 500 prints solid gains above the 4,400 figure, shrugging off a deteriorated consumer sentiment, while US Treasury bond yields stabilized after climbing more than 10 bps along the whole yield curve on Thursday.

Wall Street ends week on a high note as S&P 500 surpasses 4,400, despite mixed economic signals and Fed's hawkish stance

At the time of writing, the S&P 500 is gaining 1.54% late Friday, staying at 4,414.57, on track for seven-week gains, while the Nasdaq 100 rises 2.05%, at 13,798.56. The laggard was the Dow Jones Industrial, which ended up 1.20%, at 34298.

On Thursday, hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell were brushed aside by traders, who remain reluctant to accept additional rate hikes by the US central bank. In the meantime, a poll of the University of Michigan (UoM) revealed that Consumer Sentiment deteriorated, while American households upward revised inflation expectations from now to a one-year horizon at 4.4%, while for five years, at 3.2%.

Given the backdrop, the 10-year US Treasury bond yields failed to gain traction and finished almost flat at 4.618%, while the Greenback dropped 0.09%, as measured by a basket of six currencies, namely the US Dollar Index at 105.79.

Sector-wise, the leaders were Technology, Communication Services, and Consumer Discretionary, each added 2.69%, 1.67%, and 1.66%, respectively. The laggards were Utilities, Health, and Consumer Staples, gaining 0.52%, 0.60% and 0.66%, each.

Investors remained focused on the Federal Reserve, as Atlanta Fed President Raphael Bostic stated that policymakers can bring inflation to its goal with the current level of the fed funds rate. Meanwhile, San Francisco Fed President Mary Daly pushed against dovish postures, adding the Fed could need to hike again if progress on inflation stalls.

Next week's economic docket will feature US inflation data, unemployment claims, and Fed speaking will provide some clues regarding the US economy's status.

S&P 500 Price Analysis – Daily Chart

S&P 500 Technical Levels

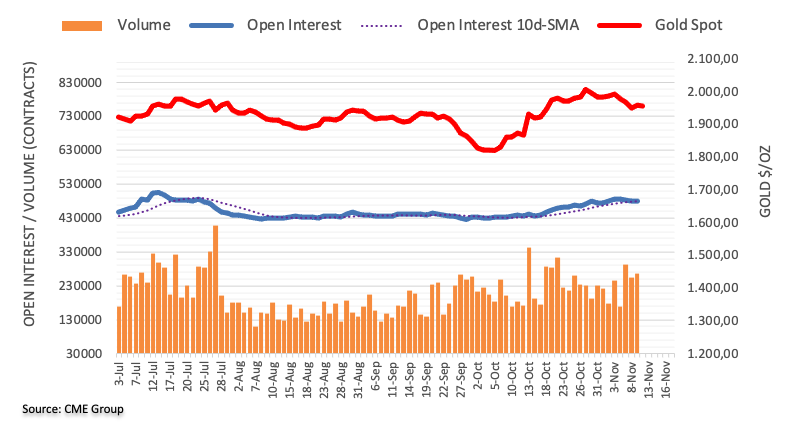

- Spot Gold prices are seeing further downside on Friday as investors pivot on Fed remarks.

- Fed looking more hawkish than market participants believed last week.

- US Dollar, US Treasury yields seeing gains for the week, Gold swoons.

XAU/USD prices are testing towards the downside on Friday, edging towards $1,930 after yesterday's hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell, who suggested that the Fed may not have achieved suitably restrictive monetary policy to contain inflation.

Alongside Fed head Powell, several Fed policymakers hit newswires this week suggesting that rates may not be high enough to sufficiently cap inflation towards the Fed's 2% target looking forward. The hawkish stance completely eviscerated the broad-market narrative that the Fed was not only done with rate hikes, but would be heading into a rate-cut cycle soon.

Investors last week heralded the end of the Fed's rate hike cycle following a worse-than-expected US Nonfarm Payrolls (NFP) print last Friday, but Fed officials have spent the week warning that a single bad labor data reading is not enough to shift the dot plot.

Up Next: US CPI inflation data to balance Fed statements

Next week's US Consumer Price Index (CPI) inflation reading will carry extra weight on Tuesday as investors peel back the layers to see if inflation will cool enough for investors to resume hoping for future rate cuts to ease borrowing costs.

US CPI inflation figures are expected to soften month-on-month, with the headline October print forecast to decline from 0.4% to 0.1%, while the annualized Core CPI for the year into October is expected to hold steady at 4.1%.

A meet-or-beat print for annualized Core CPI would mean US inflation is still running over twice as hot as the Fed's target of 2% annually.

XAU/USD Technical Outlook

Spot Gold's declines on Friday accelerate price action into bear country, seeing a rejection from the 50-hour Simple Moving Average (SMA) from $1,965.

XAU/USD has closed entirely bearish for the week with little relief bidding, seeing a rejection from the 200-hour SMA early Monday and declining nearly 3% on the week.

On the daily candlesticks, XAU/USD has slumped back into the 200-day SMA as Gold bids back into long-term median prices, and a constraining 50-day SMA on the bearish side of the longer moving average implies further downside could be on the cards.

XAU/USD Hourly Chart

XAU/USD Daily Chart

XAU/USD Technical Levels

- AUD/USD declined 0.12% for the day, marking a significant weekly drop from 0.6522 to 0.6338.

- The RBA's 25 bps rate hike under new Governor Michele Bullock's leadership fails to provide a bullish impetus for the Aussie.

- Jerome Powell's hawkish tone on US monetary policy adds to the AUD's woes, with China's economic slowdown posing additional risks.

The AUD/USD dropped 0.12% daily and extended its substantial losses during the week, which has witnessed the pair traveling from a weekly high of 0.6522 toward a low of 0.6338. At the time of writing, the pair trades at 0.6358.

Australian Dollar struggles as RBA rate hike fails to inspire, while Fed Chair's remarks bolster the US Dollar

Some reasons behind the AUD/USD price action are linked to central banks, with the Reserve Bank of Australia (RBA) hiking rates 25 bps from 4.10% to 4.35%. However, it failed to deliver a hawkish stance, which was the first monetary policy decision headed by Governor Michele Bullock. On Tuesday, that sent the pair into a tailspin, plunging more than 50 pips or 0.81%.

Despite that, dovish remarks by several Federal Reserve members kept the AUD/USD afloat until Thursday, when Fed Chair Jerome Powell was more hawkish than expected. He commented that US central bank policymakers are unsure whether the current monetary policy stance is sufficiently restrictive, emphasizing that they would raise rates if needed. In his speech, he acknowledged that inflation is slowing down but remains above the 2% target.

Given the backdrop, the AUD/USD failed to extend last week's uptrend, hampered by fundamentals and market sentiment. In addition to that, a deflationary scenario in China, hurts the prospects of the Aussie (AUD), due to Australia’s dependence on its largest trading partner. A further deterioration of China’s economy would dampen Australia’s prospects, suggesting that further AUD/USD weakness lies ahead.

The following week, the Aussie’s economic docket would feature NAB Consumer Confidence and jobs data. On the US side, inflation data, unemployment claims, and Fed speaking would provide some clues regarding the US economy's status.

AUD/USD Price Analysis: Technical outlook

AUD/USD price action portrays the pair reversing most of its losses during November, with bears remaining in charge. An initial ‘evening star’ chart pattern opened the door for consolidation, but a drop below the November 7 low of 0.6403 exacerbated the plunge below the 0.6350 mark.

The formation of an ongoing hammer could pave the way to consolidate the AUD/USD at around current exchange rates, but if sellers push prices below 0.6300, that could pave the way to test the year-to-date (YTD) low of 0.6270. On the other hand, if buyers lift the AUD/USD past the 50-day moving average (DMA) at 0.6387, that could open the door to reclaim 0.6400, ahead of retesting 0.6500.

- The USD/SEK is seen at 10.908 with 0.10% loses

- US Treasury yields retreated after sharply rising on Thursday.

- All eyes are on next week's CPI data from October from the US.

The USD/SEK showed minimal downward movements around the 10.908 area on Friday. The pair declined as the Greenback consolidated the week’s gains while falling US yields and negative consumer sentiment data from the University of Michigan are making the US Dollar struggle to gain interest.

On the data front, the University of Michigan revealed that its Consumer Sentiment index from November came in lower than expected at 60.4 vs the consensus of 63.7 and fell from its previous reading of 63.8. That being said, no other high-tier reports were published during the week as the focus is set on next week’s Consumer Price Index (CPI) figures from the US from October, which are expected to show a slight deceleration.

It's worth noticing that the Federal Reserve (Fed) hawks and Chair Powell claimed during the week that they left the door open for further tightening so the outcome of inflation or labor market data may shape the expectations of the next decisions of the bank. As for now, the odds of a 25 bps hike for the December meeting are low, around 10%.

Elsewhere, the Fed’s hawkish rhetoric revived US yields, and the 2-year Treasury yield rose back to 5%, while the 5 and 10-year rates increased to 4.59% and 4.60%, which allowed the USD to gain interest, pushing the pair upwards.

USD/SEK Levels to watch

According to the daily chart, the technical outlook for the USD/SEK remains neutral to bearish as the bears are raking a breather after bringing down the pair by more than 2%. The Relative Strength Index (RSI) has turned flat below its midline, while the Moving Average Convergence (MACD) prints flat red bars.

In the larger context, the pair is below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, indicating a favourable position for the bulls in the bigger picture.

Supports: 10.861 (100-day SMA), 10.822, 10.811.

Resistances: 10.950, 10.973, 11.000 (20-day SMA).

USD/SEK Daily chart

-638352410560701299.png)

- The Euro is seeing a thin rebound on Friday after declining steadily through the week.

- Concerns are mounting that the ECB may have to move more to cap inflation.

- Up Next: Tuesday sees EU GDP, US CPI inflation readings.

The EUR/USD is seeing a minor rebound on Friday as the US Dollar (USD) cools its heels following a week of steady gains that sent the Euro (EUR) down almost a full percent top-to-bottom from Monday's peak of 1.0756.

EU data was relatively thin this week with much of the market focus going to central bank figures. European Central Bank (ECB) President Christine Lagarde avoided making any waves on Friday during a public appearance, and markets are still chewing developments after Federal Reserve (Fed) Chairman Jerome Powell came out with unexpectedly hawkish comments on Thursday.

Fed Chair Powell noted that the Fed isn't entirely confident that they have done enough to reign in inflation, and market corkscrewed on the statements.

EU GDP, US CPI in the pipe for next week

Next week sees EU Gross Domestic Product (GDP) figures on Tuesday, to be followed by US Consumer Price Index (CPI) inflation figures.

The EU's third quarter GDP is expected to hold steady for both the monthly and annualized figures, forecast at -0.1% and 0.1% respectively.

On the US side, headline CPI for October is expected to fall back from 0.4% to 0.1%, while Core CPI for the year into October is expected to hold steady at 4.1%.

With the Fed's hawkish stance and renewed market focus on central bank statements, next week's growth and inflation figures are set to have an increased impact if figures deviate from forecasts.

EUR/USD Technical Outlook

The Euro has spent most of the week hung up on the 1.0700 price level after Monday's clean rejection from 1.0750.

The EUR/USD has been capped off by the 200-day Simple Moving Average (SMA) near 1.0800, with a bearish 50-day SMA putting a floor underneath prices, leaving the pair strung in the middle as prices consolidate between the moving averages.

Despite still being down over 5% from July's peaks near 1.1275, the EUR/USD pair has been steadily grinding higher from early October's swing low into 1.0450.

EUR/USD Daily Chart

EUR/USD Technical Levels

- EUR/GBP maintains its upward momentum, trading at 0.8731, as it solidifies the 0.8700 level as a crucial support.

- The pair shows a bullish bias, but a failure to surpass the 0.8755 high could invite bearish activity.

- Key levels to watch include resistance at 0.8800 and 0.8834, with support at the 200-DMA of 0.8688 and the 50-DMA at 0.8657.

EUR/GBP climbed during Friday’s session, extending its rally to five consecutive days, gaining so far 0.89% in the week, cementing the 0.8700 psychological level as solid support for the next week. At the time of writing, the cross-pair trades at 0.8731, up a decent 0.13%.

The EUR/GBP pair is bullish biased but downside risks remain. Unless buyers reclaim today’s high at 0.8755, bears are lurking. In the event of a bullish resumption, the cross’s first resistance would be the 0.8800 mark, followed by the May 3 high at 0.8834, followed by April’s 25 high at 0.8875.

Conversely, if EUR/GBP drops below 0.8700, the first support would be the 200-day moving average (DMA) previously broken at 0.8688 followed by the 50-DMA at 0.8657, before diving to the latest cycle low of 0.8649.

EUR/GBP Price Analysis – Daily Chart

EUR/GBP Technical Levels

The key report for the week will be on Tuesday with the US Consumer Price Index. Additionally, more US inflation data is scheduled for Wednesday with the Producer Price Index. The Eurozone will report GDP growth, and the UK will release employment and inflation data. Australia will also release jobs data. The bond market and geopolitics will continue to be important factors influencing the market.

Here is what you need to know for next week:

The US Dollar Index (DXY) rose during the five days of the week, but it was not enough to completely erase last week's losses. A correction and Powell's comments helped the Greenback, which was not affected by signs of gradual loosening in the labor market. With the US economy outperforming the Euro area, the slide of the US Dollar is poised to be limited. The DXY climbed from six-week lows under 105.00 towards 106.00.

Next week, the US Consumer Price Index (CPI) on Tuesday and the Producer Price Index (PPI) on Wednesday will be closely watched. A surprise here has the potential to be a game changer.

The bond market will remain in focus. A weak 30-year Treasury auction triggered sharp moves, as did Federal Reserve Chair Powell's comments. The rebound in yields could signal the end of the bond rally that started in October.

European Central Bank (ECB) officials offered different perspectives on the future. In the near term, the ECB is not expected to raise rates further, and the debate is about when they will start cutting rates amid a negative economic outlook. Eurostat will release employment and growth data on Tuesday.

EUR/USD failed to hold above 1.0700 and pulled back, finding support above 1.0650. The pair offers mixed signals. The upside faces a strong barrier around 1.0800, which includes the 20-week Simple Moving Average (SMA).

The Pound was affected by dovish comments from Bank of England (BoE) officials. Growth data from the third quarter came in above expectations, but only to shows the economy stagnating. Next week, the UK will report employment on Tuesday and inflation on Wednesday. These numbers will be critical ahead of the next BoE meeting on December 14. GBP/USD retreated to the 20-day SMA around the 1.2200 area, which is a crucial support. A break lower would clear the way for more losses. EUR/GBP posted the highest weekly close since April, around 0.8735.

USD/JPY rose above 151.50 and posted the highest weekly close since 1990. The pair trades at levels compatible with intervention from Japanese authorities.

The Reserve Bank of Australia (RBA) hiked interest rates by 25 basis points, but it was a dovish hike as it signaled that the tightening cycle is over and weighed on the Australian Dollar. Australian yields dropped during the week based on guidance offered by the central bank. On Wednesday, the Q3 Wage Price Index will be released, followed by the employment report on Thursday. The Aussie was the worst performer among majors. AUD/USD erased most of last week's gains, retreating from the 20-week SMA after being unable to hold above the 0.6500 zone.

NZD/USD pulled back from the 20-week SMA to levels below 0.5900. Consolidation under 0.5850 would expose 2023 lows. The New Zealand Q3 Producer Price Index is due on Friday.

The Chilean Peso was among the biggest losers during the week, with USD/CLP rising from 880.00 to 920.00 after the annual inflation rate in Chile dropped to 5%, increasing expectations of more monetary policy easing.

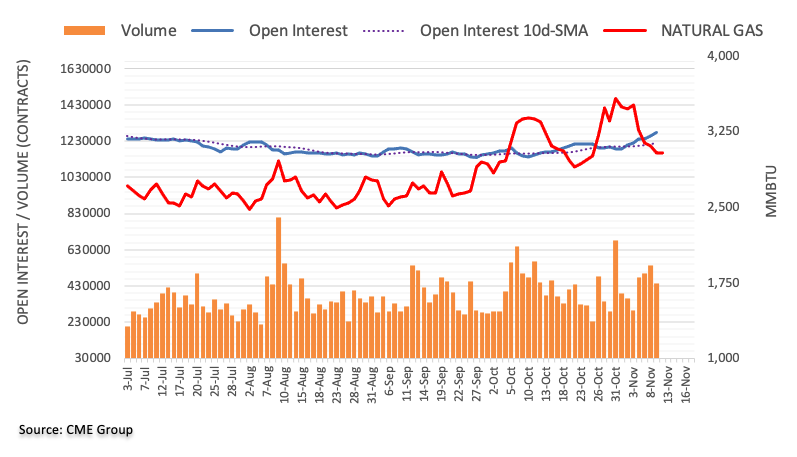

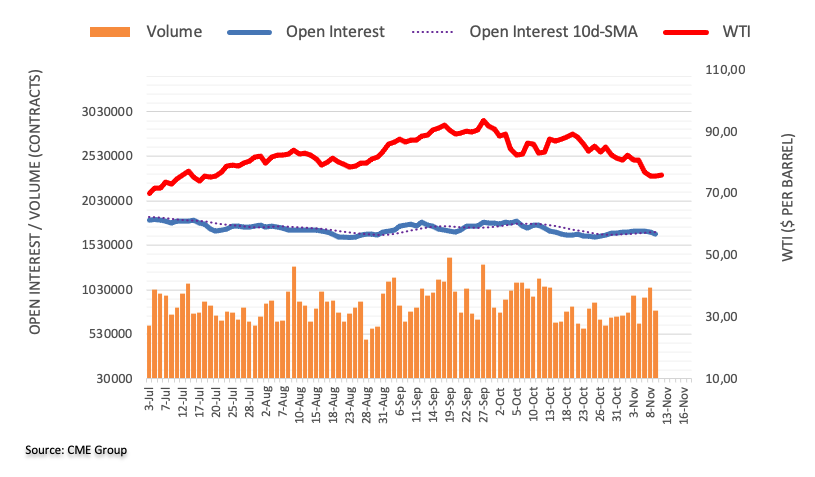

Crude oil prices fell for the third week in a row due to demand concerns. WTI dropped from above $80.00 and bottomed slightly under $75.00, settling around $77.50.

Gold experienced a significant decline, losing over $50 during the week and dropping to $1,934. This drop can be attributed to higher yields and a stronger Dollar. Similarly, Silver faced resistance around the $23.00 level and subsequently fell to $22.20, marking its lowest close since early October.

Like this article? Help us with some feedback by answering this survey:

- WTI prices are up for Friday, but Crude Oil remains significantly down from recent highs.

- Market fears about declining demand have replaced fears of spill-over from Gaza Strip conflict.

- Friday bidding likely a spot of profit-taking rather than outright reversal.

West Texas Intermediate (WTI) Crude Oil prices have rebounded 2.8% on Friday, climbing from a daily low of $75.35 and testing into $77.50 heading towards the close after a rough week that has seen WTI shed 8.61% peak-to-trough.

Broad-market concerns about further escalations and a spillover in geopolitical conflict from the Gaza Strip conflict have eroded out of markets and replaced with newfound investor fears that global Crude Oil demand is failing to grow as fast as many had predicted. The long-running assumption that global oil production would undershoot demand, which initially sent WTI climbing into year-long highs near $94.00 per barrel.

Crude Oil chronic undersupply proving nonexistent

Despite significant production cuts from key member states of the Organization of the Petroleum Exporting Countries (OPEC), global oil demand has failed to materialize in a meaningful way, specifically weighed down by a notable lack of Crude Oil demand from China.

US Crude Oil stocks declined sharply last month, but the drawdown is larger a result of oil refiners capitalizing on soaring oil prices, and Crude Oil stocks continue to rebound almost as quickly as they declined.

WTI Technical Outlook

WTI is down 14% from the last swing high into $89.65 in October, declining into a near-term low of $74.95.

Crude Oil declined into the 200-day Simple Moving Average (SMA) this week, tumbling through the technical barrier and Friday's bids are sending WTI back into the moving average as prices pin to the median.

The last technical swing low in early October that saw congestion mear the $82.00 handle has marked out a potential inflection point that could pivot into technical resistance for any topside challenges next week.

WTI Daily Chart

WTI Technical Levels

- GBP/USD continues its downward trend, dropping 0.16% despite the UK GDP narrowly avoiding a contraction in Q3.

- The Bank of England's cautious stance mirrors the Fed's, as both central banks adopt a meeting-by-meeting approach to monetary policy.

- Upcoming economic releases from the UK and US, including jobs, inflation, and retail data, are set to influence the pair's trajectory next week.

GBP/USD failed to gain traction on Friday, extended its losses to five consecutive days, is down 0.16% or 20 pips from its opening price after hitting a daily high of 1.2237. At the time of writing, the pair exchanges hands at 1.2205.

Sterling dips to 1.2205, extending its losing streak amid mixed UK economic signals and a robust US Dollar

The UK's Gross Domestic Product (GDP) for the third quarter failed to grow every month but exceeded estimates for a 0.1% contraction. On an annual basis, GDP grew by 0.6%, missing forecasts of 0.5%. Even though data portrays British dodged a recession in 2023, remains at the brisk of a stagflationary scenario, as inflation remains at higher levels, despite the Bank of England’s (BoE) efforts to curb higher prices, after more than 500 basis points of tightening.

Meantime, BoE officials delivered hawkish remarks, though adopted a meeting-by-meeting approach like the US Federal Reserve.

Across the pond, hawkish comments from Jay Powell sparked a jump in US Treasury bond yields, which underpinned the Greenback. Friday´s data revealed that Consumer Sentiment among American households deteriorated further, easing from 63.8 to 60.4. Inflation expectations rose, for one year to 4.4%, and five-year inflation is seen at 3.2%.

Meanwhile, GBP/USD traders brace for next week´s UK economic docket that will feature jobs data, inflation, and retail sales. On the US front, besides further Fed speakers, consumer, and producer inflation, along with unemployment claims and retail sales.

GBP/USD Technical Levels

- The DXY index trades neutral at 105.90, closing a 0.80% weekly gain.

- Fed hawks revived USD strength during the week.

- UoM consumer sentiment data come in lower than expected.

- The focus shifts to next week’s inflation figure from the US from October.

The US Dollar (USD) showed minimal movement on Friday. The DXY index, which measures the value of the US Dollar versus a basket of global currencies, stood flat at 105.90 as bulls seem to be taking a hiatus. The Greenback strengthened after Federal Reserve (Fed) hawks hinted that there may be further tightening, which revived the US Treasury, allowing the Dollar to gain interest.

Despite the United States’ labor market showing signs of cooling down last week, several officials, including Chair Powell, seemed unsatisfied with the progress made on inflation. They spoke with cautious tones, welcoming the recent data but leaving the door open for further tightening in case it is needed. The focus seems to have turned to next week’s October inflation figures from the US.

Daily Digest Market Movers: US Dollar flattens, consolidating weekly gains

- The US Dollar Index is mildly neutral at 105.90 after rising in three out of the last four sessions.

- The University of Michigan revealed that the Michigan Consumer Sentiment index from November came in lower than expected at 60.4 vs the consensus of 63.7, declining from its previous reading of 63.8.

- Markets await next week’s Consumer Price Index (CPI) figures from October from the US.

- The Initial Jobless Claims from the week ending November 3 came in at 217,000, lower than the expected 218,000 and fell in relation to its last reading of 220,000.

- After sharply declining last week, US Treasury yields recovered throughout the week. The 2-year Treasury yield rose back to 5%, while the longer-term 5 and 10-year rates increased to 4.59% and 4.60%, which seems to be limiting downside for the USD.

- Investors continue to be on the sidelines, awaiting high-tier reports to continue placing their bets on the next Fed decision.

- According to the CME FedWatch Tool, the odds of a 25-basis-point hike in December are extremely low, below 10%.

Technical Analysis: US Dollar Index approaches 20-day SMA, bulls must step in

Analysing the daily chart, a neutral outlook is evident for the DXY Index. What gives the outlook neutrality is the index staying below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs. Bulls are striving to regain the short-term 20-day SMA. As long as the bears hold the index below this level, the DXY will be prone to further downside.

In the meantime, the Relative Strength Index (RSI) turned flat over its midpoint, while the Moving Average Convergence (MACD) displays flat red bars suggesting that the bears momentum has flattened contributing to the neutral outlook.

Support levels: 105.80, 105.50,105.30.

Resistance levels: 106.00, 106.10 (20-day SMA), 106.30.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The USD/CHF is seeing a thin bounce for Friday, churning towards 0.9050.

- The pair is holding steady after falling into the median range near major moving averages.

- Up Next: On Tuesday, an appearance from SNB Chair Thomas Jordan, US CPI inflation.

The USD/CHF is on the high side for the week after Federal Reserve (Fed) Chairman Jerome Powell propped up the US Dollar (USD) with hawkish comments, sending broader market sentiment into a tailspin.

The USD has seen some weakness against the Swiss Franc (CHF) through October and November, and remains down 2.25% from October's peak near 0.9245.

Coming up next week, early Tuesday sees Swiss National Bank (SNB) Chairman Thomas Jordan will be delivering the opening remarks at the Third High-Level Conference on Global Risk, Uncertainty, and Volatility, in Zurich.

Later that same day will be US Consumer Price Index (CPI) inflation, and investors will be drawing additional focus to the headline figures after the Fed's hawkish showing this week.

USD/CHF Technical Outlook

The USD/CHF has been cycling around the 200-day Simple Moving Average (SMA) since September, drawing out a constraining range from 0.9100 to 0.8900, but the pair's long-term bullish momentum from July's bottom near 0.8550 sees the 50-day SMA confirming a bullish cross of the longer moving average.

This week saw a decline into 0.8950 on Monday before the USD recovered into the week's midrange, seeing a bullish push on Thursday and holding steady at the top end for Friday.

USD/CHF Daily Chart

USD/CHF Technical Levels

- The Canadian Dollar has seen little but downside this week.

- A pivot to market Fed expectations is sending investors into the US Dollar.

- Crude Oil bids try to recover, limiting Loonie losses for Friday.

The Canadian Dollar (CAD) is in the red again this week, set to close down for the fifth trading day in a row, its worst day-on-day performance since April.

Canada has seen a thin showing on the economic calendar all week, and next week is set for more of the same as broader markets focus on the US Dollar (USD) and investors get pushed around by central bank expectations.

Daily Digest Market Movers: Canadian Dollar recedes as traders pick the Greenback

The CAD is down for a fifth consecutive trading session, shedding 1.5% against the USD.

Risk aversion appears to be the general tone to overall market themes, sending the USD higher across the board.

US Michigan Consumer Sentiment Index for November dropped back to 60.4 from 63.8.

UoM 5-Year Consumer Inflation Expectations ticked up from 3% to 3.2%.

Federal Reserve Chairman Jerome Powell’s hawkish showing yesterday continues to bleed through markets as investors prove jittery around inflation.

Crude Oil is seeing soft gains for Friday, helping to support the Loonie and limit CAD losses.

Next Tuesday sees US Consumer Price Index (CPI) inflation figures that should electrify Greenback traders.

Technical Analysis: Canadian Dollar drops to 1.3850 against US Dollar

The USD/CAD has climbed 1.65% bottom-to-top this week, sending the Loonie-Greenback pair into familiar highs and etching in a Friday peak of 1.3850.

The pair kicked off the week’s trading with a clean bounce from the 50-day Simple Moving Average (SMA) near 1.3630, and the week’s price action has been notably one-sided the entire way through.

Monday’s low-side rebound also saw a rejection from a rising trendline from July’s swing low into the 1.3100 region.

The near-term ceiling for USD/CAD bulls to beat will be the 1.3900 handle, a technical barrier that rejected the pair at the beginning of the month.

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- USD/JPY extends its rally for the fifth day, flirting with the 151.00 level, driven by rising US Treasury yields and Fed Chair Powell's inflation concerns.

- Market sentiment shifts following the University of Michigan data, indicating lower confidence in the economic outlook and persistent inflation fears.

- Japanese Yen's further decline is tempered by intervention warnings from the Ministry of Finance, as officials emphasize the need for Forex movements to align with economic fundamentals.

The USD/JPY prolongs its rally to five consecutive days, exchanging hands above the 151.00 figure, shy of challenging the 15-year high reached on October 31 at 151.72. a jump in the 10-year US Treasury bond yield after a weak 30-year US bond auction and Federal Reserve (Fed) Chair Jerome Powell's hawkish pullback are tailwinds for the major. At the time of writing, the pair trades at 151.50’, posting minimal gains of 0.11%:

Yen struggles as USD/JPY approaches October peak, with US bond yields and Fed policy in focus

Marker participants continued to digest Powell{s words, which signaled the US central bank remains worried about inflation, and that it would raise rates if needed. Growing concerns that the policy is not sufficiently restrictive remain. That spurred a leg-up in the USD/JPY, along with the rise of US bond yields.

Meanwhile, a sudden improvement in market sentiment has witnessed US bond yields retreating some after data from the University of Michigan (UoM), suggests Americans are less confident regarding the economic outlook, as the index eased from 63.8 to 60.4. Regarding inflation expectations, upside risks are lingering, as households see prices climbing 4.4% in a year from now, and 3.2% in five years.

On the Japanese front, the USD/JPY remains capped due to intervention threats by authorities namely the Ministry of Finance (MoF). Officials had been jawboning that volatility and further Yen depreciation could suggest action from authorities. They remain saying that the Forex movement should reflect fundamentals.

Next week, the USD/JPY pair would get some cues of US Retail Sales, and inflation data in the United States (US). In Japan, the calendar would feature the release of GDP, Industrial Production, and the Trade Balance.

USD/JPY Price Analysis: Technical outlook

Price action is about to test the year-to-date (YTD) high, which, if broken, could expose the USD/JPY for further upside, with buyers targeting 152.00. On the flip side, a failed breakout of the YTD high could form a ‘double top’ chart pattern which implies the exchange rate would fall further. In that outcome, the USD/JPY first support would be the Tenkan-Sen at 150.36, followed by Senkou-Span A at 150.15, ahead of testing the Kijun-Sen at 149.94.

- The Silver’s spot price XAG/USD is down by more than 1%, around $22.30.

- Jerome Powell from the Fed was seen as hawkish on Thursday, fuelling US bond yields.

- Markets are pricing in rates at restrictive levels for a more extended period.

- UoM Consumer Sentiment data from the US came in lower than expected.

At the end of the week, the XAG/USD plunged toward $22.30 and will close a 3% weekly loss, mainly driven by the US Dollar and yields recovering through the week, which pushed the metal’s price downwards.

After the Greenback weakened following the Federal Reserve (Fed) held rates steady last week, which markets interpreted as the bank reaching the end of its cycle and the release of a weak jobs report from October, the USD recovered in the last sessions. This was due to Fed hawks stepping in and Chair Powell claiming that the bank’s job wasn’t done, which fueled a rise in the US bond yields.

In line with that, the Treasury rates, often seen as the cost of holding non-yielding metals, recovered after reaching multi-week lows last week, and on Thursday, they jumped back towards to their highest levels in November, which made holding Silver lose interest.

On the data front, the University of Michigan revealed that the Michigan Consumer Sentiment index from November from the US came in lower than expected at 60.4, vs the consensus of 63.7 and declined from its previous reading of 63.8. As a reaction, the negative figures seem to be limiting the upside for the USD, whose DXY index trades neutral at 105.90.

XAG/USD Levels to watch

From a technical standpoint, the XAG/USD maintains a bearish outlook for the short term, as observed on the daily chart. The Relative Strength Index (RSI) is comfortably positioned in the negative territory below its midline and has a southward slope, complemented by a negative signal from the Moving Average Convergence Divergence (MACD), which is showing red bars, signalling a growing bearish momentum. On the other hand, the pair is below the 20,100,200-day Simple Moving Average (SMA), implying that the bears retain control on a broader scale.

Resistance levels: $22.90 (20-day SMA), $23.00,$23.30 (100 and 200-day SMA convergence).

Support levels: $22.30, $22.15,$22.00.

XAG/USD Daily Chart

-638352294371282454.png)

RMB has gained significant market share in global payments. Economists at ANZ Bank analyze RMB internationalisation.

New internationalisation opportunity for RMB

As of Q3 2023, RMB has surpassed USD to become the top currency in China’s cross-border payments. It has also replaced the Euro to become the second-largest currency in the global trade financing market.

RMB debt financing is the biggest driver behind the rising use of RMB. Many borrowers, including sovereigns and corporates, have started replacing their USD debt with RMB.

Chinese authorities are happy to export RMB despite concerns related to capital outflow. Looking forward, we expect RMB to gain market share amid the global dedollarisation.

- Mexican Peso will remain soft after Banxico’s dovish hold.

- Mexico’s Industrial Production uptrend halted after two months of continuous improvement.

- Federal Reserve Chair Jerome Powell commented that the Fed would not hesitate to adjust monetary policy tighter.

Mexican Peso (MXN) remains on the defensive against the US Dollar (USD), hitting a weekly low of 17.93 as shown by the USD/MXN due to hawkish comments by US Federal Reserve (Fed) Chair Jerome Powell. Additionally, the Bank of Mexico (Banxico) adopting a “less hawkish” stance weighed on the emerging market currency. The exotic pair is trading at 17.79, gaining 0.06% on the day.

Mexico’s economic docket on Thursday witnessed Banxico holding interest rates at 11.25%, justifying that inflation remains high and stating that for “some time” rates would need to stay at current levels. The Mexican central bank language was less hawkish as they said, “In order to achieve an orderly and sustained convergence of headline inflation to the 3% target, the reference rate must be maintained at its current level for some time.” This rephrasing removed the past statement that it would maintain rates “for an extended period.”

Meanwhile, Fed Chair Jerome Powell was hawkish, saying that officials “are not confident” that monetary policy is sufficiently restrictive while adding, "If it becomes appropriate to tighten policy further, we will not hesitate to do so.”

Aside from this, Mexico’s economic docket featured Industrial Production, which surprisingly slowed more than estimates and was poised to remain above the 4% threshold. On the US front, Consumer Sentiment deteriorated, while inflation expectations ticked to the upside.

Daily digest movers: Mexican Peso drops further as Mexico’s Industrial Production eases

- Industrial Production in Mexico cooled down, revealed the National Statistics Agency (INEGI). The print was 3.9% YoY in September, below the 4.4% forecast and trailing August’s 5.2%.

- The University of Michigan's Consumer Sentiment Index in October decelerated to 60.4, missing forecasts and the previous month’s readings of 63.7 and 63.8, respectively.

- Americans expect inflation to remain higher, as they see prices a year from now up 4.4%, higher than August’s 4.2% and the five-year average at 3.2%, up from 3%.

- On Thursday, Mexico’s inflation expanded by 4.26% YoY in October, below forecasts of 4.28%, and the previous reading was 4.45%. On a monthly basis, inflation rose 0.39%, slightly above the 0.38% consensus and September’s 0.44%.

- Initial Jobless Claims in the United States for the week ending November 4 rose by 217K, below estimates of 218K and last week’s 220K.

- Fed officials continued to strike mixed signals, as the Philadelphia Fed’s Patrick Harker emphasized that rates must remain higher for longer. On the contrary, Chicago’s Fed Goolsbee turned dovish as he saw risks of overshooting rates.

- Money market futures have priced in a 25 bps rate cut by the Federal Reserve in July 2024.

- Mexico´s economy remains resilient after October’s S&P Global Manufacturing PMI improved to 52.1 from 49.8, and the Gross Domestic Product (GDP) expanded by 3.3% YoY in the third quarter.

- Banxico revised its inflation projections from 3.50% to 3.87% for 2024, which remains above the central bank’s 3.00% target (plus or minus 1%).

Technical Analysis: Mexican Peso is set to plunge further as Golden Cross emerges, USD/MXN extends its gains

The USD/MXN shifted from neutrally biased to neutrally upward biased as buyers emerged from below the 200-day Simple Moving Average (SMA) at 17.67 and lifted the pair more than 1.60% since Thursday's opening. It should be said that the 50-day SMA is above the 200-day SMA, suggesting that a Golden Cross formed a bullish signal. Hence, the pair might gain some steam as buyers have the upper hand, but they must first breach the 20-day SMA at 17.93, putting the psychological 18.00 threshold into play.

Conversely, key support levels lie at the 50 and 200-day SMAs, each at 17.00 and 17.67, respectively, followed by Monday's low of 17.40 and the 100-day Simple Moving Average (SMA) at 17.33. A breach of the latter will expose the 17.00 figure before the pair aims to test the year-to-date (YTD) low of 16.62.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

The ECB's mandate is clear: to ensure price stability in the Eurozone. Economists at Commerzbank do not believe that the ECB's current interest rate is sufficient to push inflation down.

ECB strategy with pitfalls

Fighting inflation without stifling the economy. The ECB is pursuing this goal with a strategy of not raising interest rates too much, but keeping them at this level for a longer period of time (‘lower high for longer’).

However, in doing so, it risks inflation settling at a higher level. This would leave the central bankers with no room for manoeuvre for significant rate cuts for years to come and the economy would have to drive with the handbrake on.

The Oil price is already high. Economists at Natixis analyze the maximum price Brent could reach.

How high could Oil prices go?

If the conflict in the Middle East were to spread and last, either as a result of a retaliatory movement triggered by Middle Eastern Oil producing countries against Western countries or as a result of a more severe embargo imposed by the Americans on Iranian oil production, it is possible that the Oil price will rise above its current level (around $90 for Brent).

But there is an upper limit to the Oil price, which is the price level that would trigger additional exploration and production of US shale Oil and Canadian Oil shale.

In view of the past reaction of these Oil producers to Oil price rises, the maximum price that Oil could reach before triggering a major production surge in North America is probably around $120 (Brent).

Economists at CIBC Capital Markets expect the USD/BRL pair to move back higher in the coming months.

BCB to maintain the current pace of rate cuts in December

Given President Lula’s comments suggesting expenditures will not be cut to meet the new 2024 fiscal target, we expect USD/BRL to resume its upward path towards 5.10, and on a break above that level, retest the 5.20 mark in line with our year-end forecast.

As for the Selic rate, we expect the BCB to maintain the current pace of rate cuts in December, bringing it to 11.75% by the end of 2023 and another 50 bps rate cut in the first meeting of 2024, after which we expect the BCB to adjust its forward guidance (likely a slower pace of rate cuts as fiscal risks materialize/persist).

- UoM Consumer Confidence Index declined further in November.

- US Dollar Index stays in daily range bear 106.00 after the data.

Consumer sentiment in the US continued to weaken in November, with the University of Michigan's (UoM) Consumer Confidence Index declining to 60.4 from 63.8 in October. This reading fell short of the market expectation of 63.7.

Further details of the publication revealed that the Current Conditions Index fell to 65.7 from 70.6 and the Expectations Index retreated to 56.9 from 59.3.

The one-year inflation outlook jumped rose to 4.4% from 4.2%, while the 5-year inflation outlook climbed to 3.2% from 3%.

Market reaction

The US Dollar Index showed no immediate reaction to these data and was last seen posting small daily gains at 106.00.

- EUR/USD keeps the trade below the 1.0700 hurdle so far on Friday.

- Bullish attempts are expected to meet the next hurdle near 1.0750.

EUR/USD prints humble gains in the 1.0670/80 band at the end of the week.

In case the upward bias picks up extra pace, there is an initial barrier at the round level of 1.0700 ahead of the monthly top of 1.0756 (November 6).

In the meantime, while below the 200-day SMA at 1.0801, the pair’s outlook should remain negative.

EUR/USD daily chart

Silver has underperformed Gold, both during the course of the year so far and during the latest price rally in October. Economists at Commerzbank analyze the precious metal’s outlook.

Silver suffering from weaker physical demand

One factor putting the brakes on Silver is presumably the weaker physical demand than last year. This at least is what the Silver Institute, together with Metals Focus, had predicted for this year back in April.

Having said that, industrial demand should continue to grow to reach a record level. Next week, the institute present its interim report for the Silver market in 2023. If this confirms the forecast of a declining supply deficit in response to weaker demand, we do not expect any significant reaction from the price.

We certainly anticipate higher prices in the medium term, however, given that Silver should profit from ‘green’ industrial demand.

- DXY trades in a vacillating fashion just below 106.00.

- The surpass of 106.00 should refocus the attention to 107.00.

DXY trades within a narrow range near the 106.00 region at the end of the week.

In case the buying interest gathers extra pace, the index is expected to challenge the 106.00 barrier. Once cleared, it could open the door to a rapid visit to the November top at 107.11 (November 1) prior to the 2023 peak of 107.34 (October 3).

In the meantime, while above the key 200-day SMA, today at 103.59, the outlook for the index is expected to remain constructive.

DXY daily chart

- EUR/JPY advances to new 2023 highs near 162.00.

- Further upside could lift the cross to the 2008 high near 170.00.

EUR/JPY resumes the upside and prints new yearly highs in the vicinity of the 162.00 yardstick on Friday.

Further upside appears well on the cards for the cross in the short-term horizon. Against that, the surpass of the 2023 high of 161.85 (November 10) is expected to face the next significant resistance level not before the 2008 peak of 169.96 (July 23)

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 152.13.

EUR/JPY daily chart

After an extended period of US Dollar strength in 2022, it has been a back-and-forth year for Greenback in 2023. Economists at Wells Fargo analyze USD outlook.

Dollar should be a safe place during economic storm

Given an uncertain backdrop as we head into 2024, we believe the US Dollar will remain a safe place to be for at least the next several months.

We forecast further US Dollar appreciation through at least Q1-2024 and perhaps longer. We expect USD strength could be particularly noticeable against the Euro and British Pound, where sharply slower growth along with central banks that have probably reached the end of their tightening cycles are factors likely to weigh on those currencies. Some Latin American currencies could also come under pressure.

We expect the trend of US Dollar strength will eventually wane and turn to USD weakness later in 2024, as our view remains for a mild US recession, and for the Fed to ease monetary policy by more than expected by financial market participants. That said, the outlook is shifting toward less USD weakness and less foreign currency strength, with the risks tilted toward a softer landing for the US economy and more gradual Fed easing.

We still believe the Japanese Yen could be an outperformer among the G10 currencies in 2024 as central banks eventually turn to easing.

The risk and commodity sensitive currencies of Australia, Canada and New Zealand may experience moderate gains during 2024, while the Pound and Euro might continue to underwhelm.

Economists at Commerzbank expect the EUR/USD pair to regain some ground next year.

ECB likely to cut interest rates less than the markets expect

We expect the EUR/USD exchange rate to recover moderately in 2024 (year-end forecast 2024: 1.09). This is likely to be driven primarily by the US Dollar, which is likely to suffer from the expected US interest rate cuts, just as it had previously benefited from the interest rate hikes.

EUR/USD should also receive some support from the fact that the ECB is likely to cut interest rates less than the markets expect.

- AUD/USD refreshes weekly low near 0.6560 as the broader market mood is risk-off.

- Fed Powell considered current monetary policy as inadequate to bring down inflation to 2%.

- The RBA MPS report indicated that further tightening would be largely dependent on incoming data.

The AUD/USD pair continues its losing streak for the fifth trading session as fears of a global slowdown have deepened after hawkish commentary from Federal Reserve (Fed) Chair Jerome Powell in his commentary at the International Monetary Fund (IMF) on Thursday.

The S&P500 opens on a bullish note as fears of widening Middle East tensions have started fading. Investors see conflicts remaining contained between Israel and Palestine and may Iran would not intervene. The US Dollar Index (DXY) consolidates near 105.80, struggling to extend recovery, as investors shift focus to US inflation data for October, which will be published next week.

Jerome Powell, in his commentary, showed no confidence in the current monetary policy, considering it inadequate to bring down inflation to 2% in a timely manner.

The expectations that the Fed may not be able to achieve price stability with current interest rates are prompted by a resilient US economy. The world’s largest economy is performing stronger on the grounds of consumer spending and the labor market, which could slow the progress in inflation returning towards 2%.

On the Australian Dollar front, the Reserve Bank of Australia (RBA) released its Monetary Policy Statement (MPS) on early Friday. The report indicated that further tightening would be largely dependent on incoming data. The RBA warned that inflation has turned out persistent more than expected. As per the forecasts, inflation is seen easing to 4.5% by 2023, 3.5% by 2024, and 3.0% by the end of 2025.

The USD jumped on Thursday as US yields rose strongly. Economists at Scotiabank analyze Greenack’s outlook.

Trends may steady ahead of next week’s key data

Rising yields which reflect rising risks for holding US Treasury debt rather than the underlying strength of US economic data are not necessarily going to support the USD moving forward.

The squeeze higher in the DXY averted rising technical pressure for more losses below support in the mid-105 area and gains appear to be stalling, if not reversing from 106.

There is still some underlying softness evident in the broader USD performance but trends may steady ahead of next week’s key (CPI, Retail Sales) data.

- The New Zealand Dollar declines across the board on Friday.

- Kiwi weakness comes from a combination of a negative global growth outlook and US Dollar outperformance.

- Hawkish commentary from Fed Chair Powell set the US Dollar trending higher against the Kiwi, NZD/USD resumes decline.

The New Zealand Dollar (NZD) weakens across the board on Friday as concerns about global growth continue to fester following a run of weak data from China, New Zealand’s biggest trading partner.

NZD/USD, in particular, falls as the US Dollar (USD) outperforms the Kiwi, following a speech by Federal Reserve Chairman Jerome Powell, on Thursday. Powell surprised markets by saying further rate hikes might be necessary to curb inflation. The USD rose on his remarks as higher interest rates could attract more foreign capital inflows, boosting demand for the buck.

Daily digest market movers: New Zealand Dollar falls on China data, Fedspeak

- The New Zealand Dollar trades lower against the US Dollar on Friday, reversing the previous day’s short-lived gains after a bounce off the 50-day Simple Moving Average (SMA).

- The pair fell after comments from Chairman Powell put interest rate hikes back on the table.

- The market had been lulled into expecting the Federal Reserve (Fed) to maintain the current level of the fed funds rate (5.25%-5-50%), but after Powell – and several other Fed officials – voiced dissatisfaction with the current level of tightening, the market view is shifting to potentially seeing further hikes.

- Downbeat Chinese inflation data has dampened the outlook for global growth. This weighs directly on NZD, as it is a major commodity exporter – especially of dairy products – to China.

- The Kiwi itself weakened midweek on the back of an inflation report from the RBNZ that showed both one-year-out and two-years-out inflation expectations for New Zealand falling in Q3 compared to the previous quarter.

- The lower inflation expectations imply the RBNZ is less likely to raise interest rates.

New Zealand Dollar technical analysis: NZD/USD threatens more downside

NZD/USD – the number of US Dollars one New Zealand Dollar can buy – reversed its bounce and then broke below the 50-day SMA on Friday. Previous to that it had used the SMA as a springboard for intraday gains.

-638352184562674719.png)

New Zealand Dollar vs US Dollar: Daily Chart

The bullish short-term trend is now seriously at risk of reversing. The pair trades at 0.5890 at the time of writing, only a few pips above the last major lower high of the previous uptrend, at 0.5874, made on November 2. A break below would probably indicate a reversal and deeper losses.

The next target to the downside would probably be at 0.5862, where the 61.8% Fibonacci retracement of the recovery from the year-to-date lows in late October and early November. The main target, however, sits at 0.5790.

A recovery and decisive break above the November 3 high at 0.6001, however, would reconfirm this bullish bias, with a likely target thereafter at the 0.6055 October high.

The medium and long-term trends are still bearish, suggesting the potential for more downside is strong.

-638352185024744687.png)

New Zealand Dollar vs US Dollar: Weekly Chart

Bulls would have to push above the 0.6055 October high to change the outlook in the medium term and suggest the possibility of the birth of a new uptrend.

New Zealand Dollar FAQs

What key factors drive the New Zealand Dollar?

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

How do decisions of the RBNZ impact the New Zealand Dollar?

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

How does economic data influence the value of the New Zealand Dollar?

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

How does broader risk sentiment impact the New Zealand Dollar?

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Sterling is finding some support on dips to the 1.22 area against the USD for now but appears set for a weak close on the week against the EUR, economists at Scotiabank.

EUR/GBP advance may extend

Steady losses through the course of the week have pushed Cable back to near last Friday’s low, just under 1.22. Short-term trends look soft and losses over the week suggest the soft tone may extend. The 1.22 point may be a short-term pivot, with weakness below here pointing to the risk of losses extending to retest the 1.20/1.21 area.

EUR/GBP’s high close on the week should solidify the break out from the recent trading range and target additional gains in the weeks ahead towards 0.89.

European Central Bank (ECB) President Christine Lagarde said at a Financial Times event on Friday that the interest rate level, if sustained long enough, will contribute to returning inflation to target, per Reuters.

Lagarde noted that there might be some upticks in inflation in the months ahead and added that they were uncomfortable that the EU fiscal framework has not been agreed upon yet.

Market reaction

These comments failed to trigger a reaction in the Euro. As of writing, EUR/USD was up 0.15% on the day at 1.0682.

USD/CAD holds around 1.38. Economists at Scotiabank analyze the pair’s outlook.

The rebound looks no more than a consolidation

With no domestic data ahead, external drivers will remain key influences on the direction of the market in the short run but downside potential for the CAD from here still looks limited.

There are no clear signs from short-term price action that the USD rebound cannot extend a bit more but intraday price action has stalled in the low 1.38 area, with some minor congestion resistance doing enough to slow the USD recovery so far today.

The USD has put in a solid gain over the week so far but the rebound looks no more than a consolidation after last week’s big, bearish reversal from 1.39 – which should still mark very stiff resistance for funds.

Support intraday is 1.3790 and 1.3750.

- Silver price falls after a short-lived pullback to near $23.00 as Fed Powell leans toward further policy tightening.

- Fed Barkin is less optimistic about progress in inflation easing towards 2%.

- Silver price trades in a Descending Triangle pattern, which indicates a sharp contraction in volatility.

Silver price (XAG/USD) fell sharply after facing selling pressure near the crucial resistance of $23.00. The appeal for bullions has dented significantly as investors see Middle East tensions remaining contained between Israel and Palestine.

S&P500 futures remain subdued in the European session, portraying a cautious market mood as Fed Powell is not confident that current interest rates are sufficiently high to bring down inflation to 2%. More interest rate hikes from the Fed would dampen business investment and household spending.

Richmond Fed Bank President Thomas Barkin is less optimistic about progress in inflation easing towards 2%, he remained unsure about raising rates further. Fed Barkin sees some slowdown as higher interest rates have started hitting the economy.

The US Dollar Index (DXY) gathers strength to climb above the immediate resistance of 106.00 as expectations that the Fed is done with hiking interest rates are peaking now. 10-year US Treasury yields hover around 4.6%.

Going forward, investors will focus on the inflation data for October, which will be released next week. The inflation data will set an undertone for the Fed’s monetary policy in December.

Silver technical analysis

Silver price trades in a Descending Triangle chart pattern on a two-hour timeframe, which indicates a sharp contraction in volatility. The white metal remains cushioned near $22.40 while the downward-sloping trendline from October 30 high at $23.60 continues to act as a barricade for them.

The Relative Strength Index (RSI) (14) oscillates in the 40.00-60.00 range, which indicates a consolidation ahead.

Silver two-hour chart

-638352164245793106.png)

EUR/USD consolidates in the mid-1.06 area. Economists at Scotiabank analyze the pair’s outlook.

Bullish reversal pattern developing

Intraday price signals indicate the EUR may have based, with a bullish reversal pattern developing on the six-hour chart around the daily low just under 1.0660. This is near where spot picked up support earlier this week.

Broader patterns suggest a potential bull consolidation ahead of another push higher in the EUR after the early November recovery from the low 1.05s.

Intraday EUR support is 1.0655. Resistance (bull trigger) is 1.0715.

- The Greenback traded substantially higher overnight.

- Traders got caught by surprise as Powell delivered surprisingly hawkish remarks.

- The US Dollar Index nearly broke above 106.00, but softened a bit in European trading.

The US Dollar (USD) eases mildly on Friday’s European morning after surging overnight due to Federal Reserve Chairman Jerome Powell’s hawkish comments, which caught traders by surprise. The Fed’s Chairman signalled that policymakers are not scared of increasing interest rates further if needed, which goes against market consensus that the Fed is done hiking and cuts will be soon at hand. The surprise was even more bigger as earlier Atlanta Fed President Raphael Bostic and Richmond Fed President Thomas Barkin delivered very dovish comments.

On the economic data front, traders will need to assess the words of Powell before heading into the weekend. With only one Fed speaker still to come, the focal point on Friday will be the preliminary Michigan Consumer Sentiment Index and the Consumer Inflation Expectations. Should those decline further, the US Dollar Index (DXY) could be seen squaring back its gains from late Thursday evening and close this week off flat or with a small profit.

Daily digest: US Dollar has Powell to thank for

- These are the main takeaways from US Fed Chairman Powell speech on Thursday evening:

- “We are not confident that we have achieved the right stance for inflation.”

- “Continued inflation progress is not assured.”

- “[The] Fed will not hesitate to tighten more if appropriate. We are not confident that we have done enough to achieve the stance to hit 2% inflation.”

- Dallas Fed President Lorie Logan is due to make some comments at 12:30 GMT.

- The only important data point on Friday will be the preliminary report from the University of Michigan for November:

- The Consumer Sentiment Index is expected to fall marginally, from 63.8 to 63.7.

- The 5-year Consumer Inflation Expectation came in at 3% in October.

- Equities are not digesting Powell's speech well: The Chinese Hang Seng is down over 1% and European equities are in the red over 0.50%. US equity futures are trading marginally in the green in pre-market opening.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 90.7% chance that the Federal Reserve will keep interest rates unchanged at its meeting in December.

- The benchmark 10-year US Treasury yield trades at 4.60%, after Powell reiterated that more hikes might be needed to battle inflation.

US Dollar Index technical analysis: US Dollar gets brief kick-start

The US Dollar got a boost from the hawkish comments from Fed’s Powell. However, the boost starts to fade quite quickly on Friday’s European trading. It looks like that King Dollar, tracked by the DXY Index, is not able to make a comeback, which means more downside could be in the cards.

The DXY was looking for support near 105.00, and has been able to bounce ahead of it earlier this week. Any shock events in global markets could spark a sudden turnaround and favour safe-haven flows into the US Dollar. A rebound first to 105.85 would make sense, a pivotal level from March 2023. A break above could mean a revisit to near 107.00 and recent peaks printed there.

On the downside, 105.10 is still acting as a line in the sand. Once the DXY slides back below that, a big air pocket is opening up with only 104.00 as the first big level, where the 100-day Simple Moving Average (SMA) can bring some support. Just beneath that, near 103.50, the 200-day SMA should provide similar underpinning.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

USD/JPY at just a whisper below 151.50. Economists at Rabobank analyze the pair’s outlook.

Potential for USD/JPY to move back below 145 in H2 2024