- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The daily chart reveals a subtle change in buyers' momentum, noted by decreasing MACD green bars and a neutral RSI.

- Hourly indicators picture a balanced scenario for the session.

At the end of the week, the NZD/USD has lost 0.21% as buyers seem to have run out of steam. The sluggish trend momentum might suggest an emerging bearish grip, although the short-term positive outlook remains largely unbroken.

Despite the Relative Strength Index (RSI) sitting in the neutral zone and displaying a positive outlook, the overall trend appears to be flattening. The Moving Average Convergence Divergence (MACD) also echoes the slowing momentum, printing decreasing green bars.

NZD/USD daily chart

The hourly view shows a neutral bias with a mild lack of traction for either party reflected by the flat RSI and MACD.

NZD/USD hourly chart

A broader inspection highlights the NZD/USD residing beneath the crucial 100 and 200-day Simple Moving Averages (SMAs), lending credence to a bearish outlook. The alleged sellers' strength is verified at the 200-day SMA barrier, further solidifying the short-term bearish slant as it rejected the buyers in Friday’s session. However, if the bulls manage to hold the key short-term 20-day SMA, the downside in the next sessions will be limited.

Federal Reserve (Fed) Bank of Richmond President Thomas Barkin hit newswires late Friday reaffirming a "patient" approach from the Fed will eventually reduce inflation to the US central bank's desired target level.

Key highlights

The current economy calls for a deliberate and patient approach.

With appropriate policy and time, inflation will hit 2%.

Demand is solid, and not overheating.

I am looking for inflation progress to sustain and broaden.

- GBP/JPY up 0.26% on Friday, totaling a 1.74% weekly gain, now at 195.10.

- Technicals show upward trend, rebounding from 50-day MA at 193.50.

- Resistance at Kijun-Sen (195.26); breaking this could push towards 196.00 and April 26 high of 197.92.

The Pound Sterling (GBP) will finish the week on a higher note against the Japanese Yen (JPY), posting gains of more than 0.26% on Friday and 1.74% weekly. At the time of writing, the GBP/JPY exchanges hands at 195.10, testing key resistance levels.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is upward biased after recovering from the Bank of Japan intervention during the last week. Since then, the pair bottomed out at around the 50-day moving average (DMA) at around 193.50 and recovered some ground.

Even though the uptrend remains intact, the GBP/JPY faces key resistance at the Kijun-Sen at 195.26. A breach of the latter will expose the 196.00 psychological level, followed by the April 26 high at 197.92.

On the other hand, if the cross-pair falls below the Senkou Span A of 194.82, that could open the door to challenge the Senkou Span B at 194.24. Further losses are seen at 194.00.

GBP/JPY Price Action – Daily Chart

- Silver retreats from a three-week high reached at $28.74.

- Momentum favors bulls in the medium term; but shooting star looming paves the way for a retracement.

- Uptrend to resume with buyers clearing $28.74.

Silver prices reversed on Friday amid high US Treasury yields and a stronger US Dollar. The grey metal slipped 0.48% and exchanges hands at around $28.19, at the time of writing.

XAG/USD Price Analysis: Technical outlook

From a technical perspective, Silver is still upward biased, though the formation of a ‘shooting star,’ can pave the way for a pullback. Even though momentum favors bulls, as depicted by the Relative Strength Index (RSI) with readings between 60-70, its slope aims downwards.

Therefore, XAG/USD is bearishly biased in the short term. However, sellers will face solid support levels, like the $28.00 psychological level. Once cleared, the non-yielding metal could dive toward the 38.20% Fib retracement at $27.70, confluence with the April 62 high.

On the other hand, a bullish resumption could occur, if buyers reclaim the current week high of $28.76, followed by the $29.00 mark. A breach of the latter and buyers could challenge the year-to-date (YTD) high at $29.79.

XAG/USD Price Action – Daily Chart

- The daily EUR/JPY RSI reveals ongoing bullish momentum, demonstrating a stable shift from 44 to 60 in the last sessions.

- Daily MACD perspectives align with the RSI, implying further progression of the positive momentum.

- Hourly chart shows a dip in RSI to 53 and indicates rising sellers' traction, suggesting a temporary pause in ongoing bullish momentum.

The EUR/JPY has been dominating with a steady bullish trend. It rose to 167.85 on Friday, reflecting a positive momentum primarily driven by market buyers. However, short-term sellers seem to be upping their game, implying potential transient pullbacks as indicators are flashing overbought signals in the hourly chart.

On the daily chart, the Relative Strength Index (RSI) for the EUR/JPY. A stable increase from since last week 44 to the current reading of 60 reveals an ongoing bullish momentum, primarily driven by market buyers. The Moving Average Convergence Divergence (MACD) corresponds with this perspective by showcasing rising green bars, indicating that the positive momentum is further progressing.

EURJPY daily chart

Looking at the hourly chart, the RSI presents a slight pullback to 53.26 after peaking at 67.40. While this indicates a potential slowing of buying dominance, the MACD, emphasized by rising red bars, suggests the formation of negative momentum. Despite the noticeable shift in the hourly chart, the dominant daily bullish outlook remains unchanged.

EURJPY hourly chart

In assessing the bigger picture, the EUR/JPY is positioned above its Simple Moving Averages (SMA) for the 20, 100, and 200-day periods which suggests that the buyers are clearly in command.

- Gold rebounds from daily lows, propelled by a sharp drop in US consumer sentiment and future economic outlook.

- High US Treasury yields weren’t an excuse for Gold’s advance.

- US consumers expect inflation to remain above 3% over a one-year period.

- Fed officials are cautious about rate cuts, with mixed signals from different Fed governors.

Gold prices advanced sharply late in the North American session on Friday, up by more than 1% despite US Treasury bond yields remaining high. A University of Michigan (UoM) survey showed that Americans had become pessimistic about the economy as Consumer Sentiment plunged to its lowest level in six months.

The XAU/USD trades at $2,369 after bouncing off daily lows of $2,343. Friday’s sentiment data and the weaker labor market figures revealed since the beginning of May paint a gloomy outlook for the economy of the United States (US). Although fears of a pronounced economic slowdown remain low, market participants seeking safety drove the golden metal and the US Dollar higher.

Federal Reserve officials continued to cross newswires. Atlanta’s Fed President Raphael Bostic remained hawkish, saying the Fed is on track to just one rate cut in 2024. Later, Fed Governor Michelle Bowman said that policy needs to be kept “steady” and doesn’t see rate cuts as warranted this year. The Dallas Fed’s Lorie Logan disregarded the idea of cutting interest rates.

Minneapolis Fed Neel Kashkari has recently said he is in “wait and see mode” about future monetary policy.

Next week, the US docket will feature the release of inflation figures, retail sales, building permits and Fed speeches.

Daily digest market movers: Gold strengthens as US data increases Fed rate cut hopes

- Gold prices fell amid lower US Treasury yields and a strong US Dollar. The US 10-year Treasury note yields 4.504% and gained almost five basis points (bps) from its opening level. The US Dollar Index (DXY), which tracks the Greenback's performance against six other currencies, rose 0.12% to 105.32.

- The University of Michigan Consumer Sentiment Index significantly declined in May, falling from 77.2 in April to 67.4 and did not meet the analysts' expectations of 76. Joanne Hsu, the Director of the UoM Survey, highlighted that the 10-point drop is statistically significant and marks the lowest level of consumer sentiment recorded in approximately six months.

- Additionally, inflation expectations have escalated. Inflation expectations rose from 3.2% to 3.5% in May for the one-year outlook. Over a 10-year period, expectations increased slightly from 3.0% to 3.1%.

- Softer-than-expected labor market figures, as shown by last month’s US employment report and unemployment claims data, may exert pressure on the Fed. Officials recognized that the risks to achieving the Fed's dual mandate of fostering maximum employment and price stability have become more balanced over the past year.

- After the data release, Fed rate cut probabilities increased from around 33 basis points (bps) to 34 bps points of rate cuts toward the end of 2024.

Technical analysis: Gold price resumes its uptrend, climbs above $2,350

Gold remains bullishly biased even though it retreated some 6% from its all-time high of $2,431, hit on April 12. Momentum shows that buyers are gathering steam, which is visible in the Relative Strength Index (RSI) shifting bullish since the start of May.

XAU/USD buyers cleared the April 26 high at $2,352. Despite that, Gold has consolidated at around $2,360-$2,378, with buyers unable to test the $2,400 figure. Once cleared, the next stop would be the April 19 high at $2,417, followed by the all-time high of $2,431.

Conversely, further losses are seen if Gold slides beneath the $2,300 mark. The next support would be the 50-day Simple Moving Average (SMA) at $2,249.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- Despite hot inflation readings from Norway, the Fed’s hawkish stance limits the downside.

- Markets are gearing up for next week’s US CPI reading which may likely set the pace of the pair.

The USD/NOK pair is trading with mild losses around 10.85. The Federal Reserve's (Fed) hawkish approach seems to be aiding the USD, while strong economic recovery signals in Norway aren't offsetting this impact on the NOK. As the American calendar remains empty, all eyes are on next week’s Consumer Price Index (CPI) report from April from the US.

Norway's April CPI showed that the headline number rose to 3.6% year-on-year, which was slightly higher than anticipated, although it showed a slight drop from March's 3.9%. Meanwhile, the underlying inflation rate surprised by coming in at 4.4% year-on-year, two ticks higher than expected, and up from March's 4.5%.

Last week, the Norges Bank opted to maintain rates at 4.5% and highlighted the possibility of needing to sustain a tight monetary policy stance for a longer duration than previously anticipated, citing the current data trends. Markets are expecting only 50 bps of easing in the next 12 months.

On the US side, US Fed officials are keeping the hawkish bets steady and as for now, investors are delaying the start of the easing cycle to September.

USD/NOK technical analysis

The daily Relative Strength Index (RSI) for the USD/NOK pair remains largely within the negative territory. Today's reading is at 46.66, which suggests a somewhat bearish short-term outlook. Due to its fluctuation, with an initial high near-overbought conditions and a subsequent drop, the RSI indicates the potential for bearish pressure. However, the consistent presence within the negative territory also warns of a continuous downtrend possibility.

Simultaneously, the Moving Average Convergence Divergence (MACD) histogram strengthens this view. Rising red bars signify an increasing negative momentum, with sellers gaining a more dominant position in the market.

USD/NOK technical analysis

Upon evaluation of the bigger picture, the USD/NOK chart exhibits a strong stance above the 20, 100, and 200-day Simple Moving Averages (SMAs). As the pair trades above these key moving averages, it indicates a bullish long-term trend, considering both minor and major aspects. However, given the significant trading above these levels, traders should be mindful of the potential pullback risks, which could provide possible buying opportunities.

In conclusion, despite a bearish short-term view provided by the daily RSI and MACD indicators, the placement above the SMAs suggests an overall bullish trajectory for the USD/NOK pair. Caution is warranted due to possible volatility and the likelihood of pullbacks, hence the need for continuous monitoring of market trends and indicators.

USD/NOK daily chart

Minneapolis Federal Reserve (Fed) President Neel Kashkari added his voice to the procession of Fed officials giving their views on the US inflation outlook and the Fed's policy stance on Friday. Minneapolis Fed President Kashkari responded to questions during an interview with CNBC.

Key highlights

I am cautious about how restrictive monetary policy is.

I am in wait-and-see mode about the future of monetary policy.

The bar is high for another rate hike, but can't rule it out.

The Fed will keep rates steady if inflation data warrants.

Earlier comments from Kashkari:

The current baseline is that strong productivity rates will moderate.

The US has a long-term housing supply challenge.

Higher rates will lead to less housing supply in the short term.

- Dow Jones climbs 0.25% as investors grapple with pullback in consumer confidence.

- UoM Consumer Sentiment, Inflation Expectations come in worse than expected.

- Fedspeak dominates the headlines as policymakers talk down rate cut hopes.

The Dow Jones Industrial Average (DJIA) gained around a hundred points on Friday as equities try to shake off a decline in the University of Michigan’s Consumer Sentiment Index which showed US consumers are increasingly concerned about long-run inflation taking hold. Consumer 5-year Inflation Expectations ticked higher as the US economy begins to buckle under the weight of price growth runner even hotter and longer than previously expected.

The UoM’s Consumer Sentiment Index for May declined sharply to 67.4 in May, falling well below the market forecast 76.0 and hitting its lowest figure in six months as consumer confidence deteriorates. 5-year Consumer Inflation Expectations also ticked higher to 3.1% in May compared to the previous 3.0%.

Multiple Federal Reserve (Fed) officials hit the newswires on Friday as central planners try to talk down broad-market expectations for rate cuts in 2024 in the face of recent stubborn inflation figures.

Read more:

Fed’s Bowman: I don't see rate cuts as warranted this year

Fed's Goolsbee: Housing remains a significant inflation challenge

Fed's Logan: Too early to think about cutting rates

Dow Jones news

The Dow Jones Industrial Average is the top performing US equity index on Friday, gaining around a fifth of a percent heading into the last stretch of the trading week. Around half of the equities that makes up the DJIA are in the red, limiting upside momentum.

Nike Inc. (NKE) shed 2.25% during Friday trading, declining two points and falling below $92.00 per share. On the upside, 3M Co. (MMM) and McDonald’s Corp. (MCD) are competing for top spot, gaining 1.88% and 1.8%, respectively.

Dow Jones technical outlook

Despite hobbled risk appetite, the Dow Jones managed to set a new peak for the week, trading into 39,579.23 before settling back below 39,500.00. Top side momentum is set to stall with the Dow Jones appearing overextended. The major equity index is trading well above the 200-day Exponential Moving Average (EMA) at 36,893.00.

The Dow Jones is on pace to end a seventh consecutive day in the green, and the index is up around 2% for the week.

Dow Jones five-minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Further comments from Chicago Federal Reserve (Fed) President Austan Goolsbee highlighted the Fed's ongoing battle with stubborn inflation that refuses to cool off to the US central bank's 2% target. Chicago Fed President Goolsbee's comments come on the heels of comments the policymaker made earlier while speaking at the Economic Club of Minnesota.

Key highlights

If the uptick in inflation means overheating, the Fed has to do whatever we have to do to get inflation to 2%.

Housing remains a significant inflation challenge.

If housing inflation comes down, there will be an "optimistic lane" towards 2% inflation.

I don't accept we are stuck at the "last mile" of inflation.

The supply chain is mostly healed, but benefits of the increase in labor supply may last during 2024.

Fed's Goolsbee's earlier comments: We hit an inflation bump this year, now we wait

- Mexican Peso edges up against US Dollar for second consecutive day.

- Banxico’s decision to maintain the interest rate at 11.00%, sponsored the latest leg down on USD/MXN.

- Bank of Mexico cited higher prices as reason to pause lowering rates.

- US consumers become pessimistic on economy due to inflation, unemployment, interest rates.

The Mexican Peso extended its gains for the second straight day after the Bank of Mexico (Banxico) decided to keep rates at 11.00% due to a reacceleration of inflation. In the meantime, the University of Michigan (UoM) Consumer Sentiment deteriorated in May, weighing on the performance of the Greenback versus the Mexican currency. The USD/MXN trades at 16.77, down 0.01%

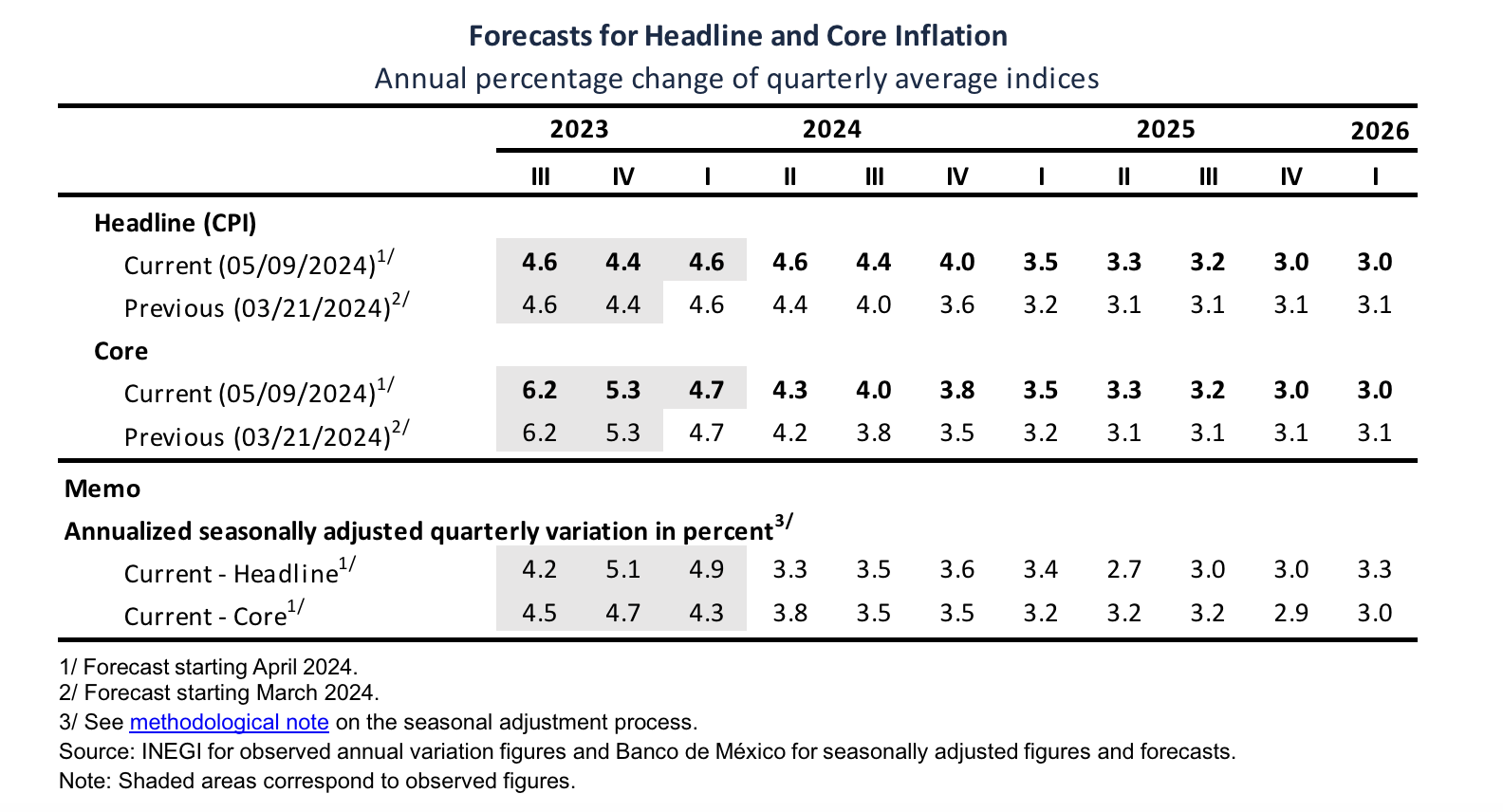

On Thursday, Banxico’s Governing Council decided to keep rates unchanged, citing the latest uptick in inflation. The bank said that even though the disinflation process is expected to continue, the central bank revised its inflation projection.

In its policy statement, Banxico noted, "Considering that inflationary shocks are foreseen to take longer to dissipate, the forecasts for headline and core inflation have been revised upwards for the next six quarters. In particular, services inflation is foreseen to show more persistence, as compared to what had been previously anticipated.”

The US economic docket revealed that American consumers became less optimistic about the economy. The University of Michigan survey said they’re concerned about inflation, unemployment and interest rates.

Recently, two Federal Reserve (Fed) officials made statements that have drawn attention. Fed Governor Michelle Bowman emphasized that the US central bank should act "carefully and deliberately" in its policy decisions. Meanwhile, her colleague, Lorie Logan of the Dallas Fed, expressed that it is too early to consider cutting interest rates.

Next week, the US docket will feature the release of inflation figures, retail sales, building permits and Fed speeches.

Daily digest market movers: Mexico’s high inflation prompted Banxico to hold rates flat

- Banxico unanimously decided to keep rates at 11.00% due to recent data signaling that inflation is accelerating.

- The central bank revised its estimates that inflation would converge toward its 3% goal until the last quarter of 2025, later than March’s estimates for Q2 2025. Core inflation is projected to hit 3% in Q2 2025.

- April's data show that Mexico’s headline inflation is reaccelerating. However, core prices are falling.

- The UoM Consumer Sentiment Index retreated in May from 77.2 in April to 67.4, missing analysts’ estimates of 76. According to Joanne Hsu, Director of the UoM Survey, the 10-point decline “is statistically significant and brings sentiment to its lowest reading in about six months.”

- Inflation expectations for one year rose from 3.2% to 3.5% in May. For a 10-year period, they increased to 3.1%, a tenth up from 3.0%.

- US labor market continues to cool. April’s Nonfarm Payrolls and the release of the latest unemployment claims data can put pressure on Fed officials, who acknowledged that risks to achieving its dual mandate on employment and inflation “moved toward better balance over the past year.”

- Data from the futures market show odds for a quarter-percentage-point Fed rate cut in September at 74% versus 85% ahead of the UoM Consumer Sentiment report.

Technical analysis: Mexican Peso gains traction as USD/MXN tumbles below 16.80

The USD/MXN downtrend remains intact as the Peso’s strength drives the pair lower. Momentum favors sellers as the Relative Strength Index (RSI) remains in bearish territory, suggesting that lower prices are expected.

If the USD/MXN remains below the 50-day Simple Moving Average (SMA) of 16.79, that could pave the way for additional losses. The next support will be the 2023 low of 16.62, followed by the current year-to-date low of 16.25.

On the other hand, if buyers claim the 100-day SMA at 16.92, that could sponsor a leg up to the 17.00 psychological level. A breach of the latter would expose the 200-day SMA at 17.17, followed by the January 23 swing high of 17.38 and the year-to-date high of 17.92.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Chicago Federal Reserve (Fed) President Austan D. Goolsbee added his voice to the procession of Fed officials commenting on interest rates and inflation on Friday. Chicago Fed President Goolsbee spoke at the Economic Club of Minnesota.

Key highlights

Fed's 2% inflation target acts as an anchor on expectations.

At this time not much evidence that inflation is stalling out at 3%.

We hit an inflation bump this year, and now we wait.

We're relatively restrictive on policy.

Goolsbee is hesitant to focus too much on the recent inflation data; we've made a lot of progress.

- Canadian Dollar climbed on Friday, but Greenback remains popular bid.

- Canada added far more jobs than expected in April.

- US consumer sentiment tumbled, Fedspeak crimping rate cut hopes.

The Canadian Dollar (CAD) surged on Friday after the Canadian economy added five times as many jobs as analysts expected. However, risk-off market sentiment is limiting the CAD’s gains as the Greenback remains a popular destination for investors leery of hawkish Fedspeak and sour US consumer sentiment data.

Canada saw its highest net job gains in April since February of 2023, adding nearly 100K jobs to the Canadian economy, while the unemployment rate remained pinned at 6.1%. On the US side, both consumers and Federal Reserve (Fed) policymakers both see inflation sticking around higher and longer than rate-cut-hungry market participants have been hoping for. Risk appetite on Friday is on the wobbly side, limiting gains for the CAD.

Daily digest market movers: Canadian Dollar supported by jobs growth, but markets keep one foot in safe havens

- Canada gained 90.4K net jobs in April, beating the 18K forecast fivefold and erasing previous month’s -2.2K decline.

- Canadian Unemployment Rate held steady at 6.1%, beating market’s expected uptick to 6.2%.

- University of Michigan’s US Consumer Sentiment Index for May declines to 67.4, the sentiment survey’s lowest print in six months.

- UoM 5-year Consumer Inflation Expectations also rose to 3.1% as US consumers expect to be beleaguered by continued price acceleration looking forward.

- Souring consumer sentiment and still-high inflation expectations are hampering market hopes for rate cuts, keeping investors bid into the safe-haven Greenback.

- Fedspeak is doing little to bolster markets as Fed officials talk down odds of rate cuts in 2024.

- Read more:

- Fed’s Bowman: I don't see rate cuts as warranted this year

- Fed's Logan: Too early to think about cutting rates

Technical analysis: Canadian Dollar gains ground on Friday, but Greenback close behind

The Canadian Dollar (CAD) saw broad-market gains on Friday, hitting the green against all of its major currency peers. The CAD is up around a third of a percent against the New Zealand Dollar (NZD) and the Japanese Yen (JPY), while gaining around a quarter of a percent against the Australian Dollar (AUD). However, the CAD is close to flat against the US Dollar (USD) and the Pound Sterling (GBP), trading within a tenth of a percent at the time of writing.

USD/CAD tested below 1.3620 after plunging deep into a near-term demand zone before recovering back above 1.3660. The pair remains capped by the 200-hour Exponential Moving Average (EMA) at the 1.3700 handle.

The pair continues to find technical support from the 50-day EMA at 1.3637, but topside momentum remains limited. USD/CAD is beginning to consolidate after pulling back from the last swing high into 1.3850.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Notable monetary divergence between Fed, G10 peers keeps USD afloat.

- Markets await further economic reports for insights into the US economy's health for potential adjustments to Fed expectations.

- Next week’s highlight will be April’s US CPI.

The US Dollar Index (DXY) is currently trading around the 105.35 mark, posting mild gains on Friday near the end of the trading week. The Greenback holds its ground but seems stuck as markets await drivers to continue placing their bets on the next Federal Reserve (Fed) decisions.

The US economy remains on shaky ground, and markets are expecting signs of decelerating inflation, which gives the Fed confidence to start cutting. In the meantime, the bank’s officials remain hawkish.

Daily digest market movers: DXY remains firm as markets digest Fed speaker's words

- San Francisco Fed President Mary Daly emphasizes need for prolonged restrictive policy to achieve Fed's inflation targets.

- Atlanta Fed President Raphael Bostic hinted at a possible economic deceleration. The exact timeline for rate cuts, however, remains uncertain in his view.

- Overall, Fed remains careful concerning initiation of easing policy. Despite a few Fed officials expecting a single rate cut this year, majority of market predictions foresee rate cuts starting in September. This conservative Fed strategy starkly opposes Powell's dovish indications from last week.

- Outcome of April’s Consumer Price Index (CPI) will be key for markets to continue shaping their expectations.

DXY technical analysis: DXY showcases mixed sentiment with both bulls and bears struggling for strength

The indicators on the daily chart are radiating a rather mixed picture. On one hand, the Relative Strength Index (RSI) plots a positive slope but remains in negative territory. This indicates that while the selling pressure is currently stronger, buying momentum is slowly creeping up, suggesting a potential shift in the near future.

Similarly, the Moving Average Convergence Divergence (MACD) sticks with flat red bars, indicating no strong impulse from either side.

The Simple Moving Averages (SMAs) also carry a mixed signal. Despite the DXY falling below the 20-day SMA due to bearish interference, it remains above both the 100-day and 200-day SMAs. This scenario indicates that while bears have been successful in shaping the short-term trajectory, bulls retain control over the medium to long-term trend.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Federal Reserve (Fed) Board of Governors member Michelle W. Bowman noted that she is skeptical about the chances of a rate cut in 2024 while speaking at the Texas Bankers Association Annual Convention in Arlington, Texas.

Key highlights

I don't see rate cuts as warranted this year.

If we saw unexpected shocks, that would be a case for a rate cut.

I want to see a number of months of better inflation data.

It's probably a number of meetings before I'm ready to cut.

- GBP/USD erased its earlier gains as buyers failed to reclaim 200-DMA.

- Deterioration in the US economy spurred flows to USD amid its safe-haven appeal.

- Momentum remains bearish, as RSI stays below 50, key resistance lie above spot price.

The Pound Sterling weakened against the US Dollar on Friday, even though economic data from the UK was better than expected. Fears that the US economy may slow more sharply than expected as consumer sentiment deteriorates. The GBP/USD trades at 1.2510, down 0.10%.

GBP/USD Price Analysis: Technical outlook

From a technical standpoint, the GBP/USD retracement toward 1.2500 keeps sellers hopeful of lower spot prices. Buying momentum is fading as buyers failed to crack the 200-day moving average (DMA) at 1.2541. That and the Relative Strength Index (RSI) remaining bearish could pave the way for further losses.

For a bearish continuation, sellers must conquer the May 9 low of 1.2445. Once cleared, it would emerge the psychological 1.2400 level, followed by the year-to-date (YTD) low of 1.2299.

On the flip side, if buyers hold GBP/USD’s exchange rate above 1.2500, they could test the 200-DMA, followed by the 50-DMA at 1.2594. the next resistance would be the 100-DMA at 1.2635.

GBP/USD Price Action – Daily Chart

- USD/JPY climbs after worse-than-expected US consumer sentiment data.

- Recession fears reignited as Americans became less optimistic about the economy.

- A jump in US inflation expectations underpins US yields and the Greenback.

The USD/JPY advanced steadily during the North American session, following a worse-than-expected University of Michigan (UoM) poll that showed that American consumers are becoming pessimistic about the economy. Despite that, the major trades at 155.83, up 0.24%.

USD/JPY rises after UoM Consumer Sentiment survey, eyes on next week US inflation

The UoM Consumer Sentiment Index retreated in May from 77.2 in April to 67.4, missing analysts’ estimates of 76. According to Joanne Hsu, the Director of the UoM Survey, the 10-point decline “is statistically significant and brings sentiment to its lowest reading in about six months.” According to the survey, Americans are becoming concerned about inflation, unemployment, and interest rates.

Inflation expectations for one year rose from 3.2% to 3.5% in May and stood at 3.1%, a tenth up from 3.0% for a ten-year period.

The US 10-year Treasury note yield rose four basis points (bps) to 4.498% following the data release. The US Dollar Index (DXY) has also advanced 0.14%, up to 105.35, as recession fears reignited, as the UoM survey suggests consumer spending could weaken in the near term.

In the meantime, two Federal Reserve officials had crossed the newswires. Fed Governor Michelle Bowman commented that the US central bank should proceed “carefully and deliberately.” Her colleague, the Dallas Fed Lorie Logan, said it's too early to think about cutting rates.

Next week, the US docket will feature the release of inflation figures, retail sales, building permits, and Fed speeches.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, the USD/JPY rally is set to continue, as momentum is on the side of buyers, as depicted by the Relative Strength Index (RSI). That, along with prices standing above the Ichimoku Cloud, could pave the way for bulls to challenge 156.00 in the near term. On the other hand, a drop below the Kijun-Sen at 155.78 could pave the way to challenge the Senkou Span A at 155.22, followed by the Tenkan Sen at 154.92.

The Greenback saw a decent recovery during this week, against the backdrop of the generalized erratic performance in the FX space, the continuation of the monetary policy divergence, and a cautious Fedspeak.

The US Dollar managed to reverse two weeks of losses and reclaim the area beyond the 105.00 barrier amidst some consolidative mood in US yields. On May 14, Producer Prices are due, seconded by CPI prints, Retail Sales, Business Inventories, and the NAHB Housing Market Index, all due on May 15. On May 16, the Philly Fed Manufacturing Index is expected, along with the usual weekly Initial Jobless Claims, Building Permits, Housing Starts, and Industrial Production. Finally, the CB Leading Index is due on May 17.

EUR/USD managed to clinch its fourth consecutive week of gains, although a test or surpass of the 1.0800 barrier seems elusive for the time being. Germany’s final Inflation Rate is due on May 14, along with the ZEW’s Economic Sentiment in Germany and the broader euro area. On May 15, another revision of the EMU’s GDP Growth Rate is expected, followed by the final Inflation Rate in the euro bloc on May 17.

GBP/USD retreated markedly and ended the week in negative territory amidst the bounce in the Greenback, while investors continued to assess the BoE event and positive results from key fundamentals. The UK labour market report is due on May 14, while the BoE will release its Financial Stability Report on May 16.

USD/JPY resumed its uptrend largely on the back of the increasing depreciation of the Japanese yen, despite the spectre of FX intervention continuing to linger. Producer Prices are expected on May 14, followed by preliminary GDP Growth Rate and Foreign Bond Investment figures on May 16. Final Industrial production prints will close the docket on May 17.

A choppy week prompted AUD/USD to close the week slightly on the defensive around the key 0.6600 region. The Australian Wage Price Index is due on May 15, and the labour market report is expected on May 16.

Anticipating Economic Perspectives: Voices on the Horizon

- Fed’s Mester and Jefferson speak on May 13.

- Fed’s Powell and Cook speak on May 14 along with BoE’s Pill.

- Fed’s Bowman speaks on May 15.

- Fed’s Mester, Barr and Bostic speak on May 16, along with RBA’s Hunter and BoE’s Greene.

- Fed’s Waller and BoE’s Mann speak on May 17.

Central Banks: Upcoming Meetings to Shape Monetary Policies

- The Bangko Sentral ng Pilipinas (BSP) will hold its meeting on May 16.

- Silver price holds gains above $28.00 amid firm speculation for Fed rate cuts.

- Steadily cooling US labor market conditions keep the US Dollar’s upside limited.

- Investors shift focus to the US Inflation data.

Silver price (XAG/USD) holds onto gains above the crucial figure of $28.00 in Friday’s New York session. The white metal remains firm as investors’ confidence in the Federal Reserve (Fed) starting to reduce interest rates from the September meeting has strengthened.

The CME FedWatch tool shows that traders see a 71% chance that interest rates will decline from their current levels in September, which are higher than 66% recorded a month ago. The speculation for the Fed pivoting to rate cuts has strengthened as investors lose conviction over United States labor market strength.

The US Department of Labor showed that individuals claiming jobless benefits for the first time at 231K for the week ending May 3 were higher in more than eight months. Also, recent official labor market data showed that job growth was the slowest in six months. The overall data suggests that the US labor market is struggling to bear the consequences of the Fed’s restrictive monetary policy framework.

The situation is favorable for non-yielding assets such as Silver but weighs on the US Dollar and bond yields. In spite of that the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds above the 105.00 support. 10-year US Treasury yields jump to 4.49%.

Next week, US economic calendar will be data-packed as the Producer Price Index (PPI) and Consumer Price Index (CPI), and the Retail Sales data are lined-up for release. The major event will be the consumer price inflation data, which will influence market expectations for Fed rate cuts.

Silver technical analysis

Silver price recovers sharply after discovering buying interest near the horizontal support plotted from 14 April 2023 high around $26.09 on a daily timeframe. The above-mentioned support was earlier a major resistance for the Silver price bulls. The near-term outlook of Silver has improved as it returns above the 20-period Exponential Moving Average (EMA), which trades around $27.30.

The 14-period Relative Strength Index (RSI) shifts into the bullish range of 60.00-80.00, suggesting that a bullish momentum has been triggered.

Silver daily chart

On Friday, Dallas Federal Reserve President Lorie Logan remarked that there are "uncertainties" regarding whether monetary policy is adequately restrictive to lower inflation to the Fed's target, emphasizing that it is "premature" to consider interest rate cuts at this stage.

Key Takeaways

We've made substantial progress on inflation, with labor market and economy strong.

Not a soft landing yet.

Q1 inflation data disappointing.

There are important upside risks to inflation.

There are uncertainties if policy is sufficiently restrictive.

Too early to think about cutting rates.

We need to remain flexible on policy.

The neutral interest rate level may have risen.

Events of March 2023 have really impacted how we need to think about liquidity risk.

Critically important that banks have a broad set of funding arrangements; one of them has to be the Fed's discount window.

We want to see every bank sign up for discount window.

We want to see every bank testing the discount window on a regular basis.

Safe, healthy banks use the discount window all the time; that's a good thing.

Once banks are signed up, discount window is an easy system to use.

- Consumer confidence in the United States contracted by more than anticipated in May.

- UoM survey showed one-year and five-year inflation expectations edged higher.

Consumer confidence in the US fell in May, with the University of Michigan's preliminary Consumer Sentiment Index plummeting to 67.4 in May from 77.2 in April. The reading also missed the market expectation of 76.

The Current Conditions Index declined to 68.8 from 79 in the previous month. More worrisome, 1-year inflation expectations were up to 3.5% vs 3.2% previously, while 5-year inflation expectations increased to 3.1% from 3.0%.

Market reaction

The US Dollar remains on the back foot after the report, showing no reaction to the news. Meanwhile, stock markets continue to pressure weekly highs, in line with the dominant optimism.

(This story was corrected on May 10 at 14:22 GMT to say that the index fell to 67.4 in May, not April, from 77.2 in April, not March)

- `USD/CAD drops sharply to 1.3630 after strong Canadian Employment data.

- Canadian job market expanded by 90.4K fresh payrolls while annual wage growth slowed to 4.8%.

- Fed Bostic said the central bank is uncertain about when and how much interest rates should be reduced.

The USD/CAD pair faces a sharp sell-off to 1.3630 in Friday’s early New York session as Statistics Canada has posted strong Canadian Employment data. The agency showed that the employers hired 90.4K job-seekers in April, significantly higher than the consensus of 18K. In March, the job market recorded a lay-off of 2.2K employees.

The Unemployment Rate remains steady at 6.1% while investors estimated the joblessness to rise to 6.2%. However, the annual Average Hourly Wages declined to 4.8% from 5.0% in March. Average Hourly Wages data is a leading indicator of wage growth. Slower wage growth reduces the consumer spending pace, which exhibits a soft inflation outlook.

The impact of overall Employment data is expected to be lower on Bank of Canada’s (BoC) interest rate outlook as strong job additions will offset slower wage growth.

Meanwhile, the appeal of the Canadian Dollar remains strong due to a sharp recovery in the Oil price. West Texas Intermediate (WTI), futures on NYMEX, continues its winning spell for the third trading session on Friday amid firm speculation that the Federal Reserve (Fed) will pivot to policy normalization from the September meeting. It is worth noting that Canada is the leading exporter of Oil to the United States and higher Oil prices support the Canadian Dollar.

On the US Dollar front, steadily cooling US labor market conditions have kept the US Dollar’s upside limited. The US Dollar Index, which tracks the Greenback’s value against six major currencies, rebounds slightly from the crucial support of 105.00. While investors remain optimistic that the Fed will start to reduce interest rates in September, policymakers are still uncertain about rate cuts. In the American session, Atlanta Federal Reserve President Raphael Bostic said the central bank is considering rate cuts this year but is uncertain about when and how much quantitative easing will occur.

- Natural Gas is correcting within a short-term uptrend.

- The RSI is giving a sell-signal further increasing the chances of a pullback evolving.

- The trend is expected to continue after the correction has finished.

Natural Gas price is in a short-term uptrend evidenced by the rising sequence of peaks and troughs on the 4-hour chart, and the fact it is trading above all its key Moving Averages.

Given the old adage that “the trend is your friend,” the commodity is likely to continue rallying over the short-term horizon (up to 6 weeks) unless and until the evidence suggests otherwise.

Natural Gas 4-hour Chart

The Relative Strength Index (RSI) momentum indicator has been fluctuating at overbought extremes since May 3 and consistently showing bearish divergence with price. This occurs when price reaches new highs but the RSI fails to follow suit. It is a sign of underlying weakness.

The RSI has just moved out of overbought and re-entered neutral territory during the last bar, giving a sell signal. Taken together with the pullback in price it suggests the possibility of a deeper correction unfolding.

The zone of support between $2.42 and $2.32 MMBtu is likely to underpin any declines, however, and provide a springboard to a resumption of the uptrend eventually.

After the correction Natural Gas will probably continue to new highs in line with the dominant uptrend. A break above the $2.50 MMBtu level would indicate a continuation higher, potentially to an initial target at roughly $2.60 MMBtu.

If Natural Gas price breaks below $2.32 MMBtu it will bring the uptrend into doubt and suggest the possibility that a reversal has occurred and a new downtrend is beginning. In such a scenario, short positions as opposed to long positions would be favored.

BoE's Chief Economist, Huw Pill, was on the wires on Friday. Pill aligned with the majority of the BoE's MPC on Thursday in maintaining interest rates at 5.25%. However, he expressed afterward an increasing conviction that the time for rate cuts would soon arrive.

Key Takeaways

We must focus on persistent components of inflation, not headline rate.

MPC has sent a relatively clear signal that bank rate can be cut when there is sufficient evidence of a downward path in persistent components of inflation.

Focusing just on the next boe meeting is a little ill advised.

BOEs medium-term inflation forecasts don't necessarily give a signal on rate moves at the next meeting or the one after.

Market Reaction

GBP/USD clings to daily gains amidst the broad-based flat mood in the FX galaxy, although the earlier advance appears to have met a decent hurdle near the 200-day SMA around 1.2540.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | 0.04% | -0.17% | -0.02% | -0.21% | -0.35% | -0.14% | |

| EUR | 0.02% | 0.06% | -0.17% | -0.02% | -0.18% | -0.34% | -0.11% | |

| GBP | -0.04% | -0.06% | -0.21% | -0.07% | -0.23% | -0.37% | -0.16% | |

| JPY | 0.17% | 0.17% | 0.21% | 0.06% | -0.08% | -0.19% | 0.02% | |

| CAD | 0.02% | 0.02% | 0.07% | -0.06% | -0.18% | -0.31% | -0.12% | |

| AUD | 0.21% | 0.18% | 0.23% | 0.08% | 0.18% | -0.13% | 0.05% | |

| NZD | 0.35% | 0.34% | 0.37% | 0.19% | 0.31% | 0.13% | 0.21% | |

| CHF | 0.14% | 0.11% | 0.16% | -0.02% | 0.12% | -0.05% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- The USD Index struggles to sustain above 105.00 amid signs that the US labor market cools down.

- Firm speculation for Fed rate cuts in September keeps the US Dollar on its toes.

- Investors shift focus to the US inflation data for fresh guidance.

The US Dollar Index (DXY) trades close to the crucial support of 105.00 in Friday’s European session. The USD Index struggles to hold the above-mentioned support as conviction among investors over the Federal Reserve (Fed) starting to reduce interest rates from the September meeting has strengthened. This has also improved the risk appetite of investors. S&P 500 futures have posted significant gains, exhibiting strong demand for risk-sensitive assets.

Cooling US labor market conditions boost Fed rate cut bets

The expectations for the Fed to begin reducing interest rates from the September meeting have escalated as a recent set of job data has indicated that labor market conditions are steadily cooling.

The United States Department of Labor reported on Thursday that individuals claiming jobless benefits for the first time were highest in the last eight months. For the week ending May 3, Initial Jobless Claims (IJC) were 231K, significantly higher than the consensus of 210K and the prior reading of 209K, upwardly revised from 208K. In addition to rising jobless claims, US employers added fewer jobs in April. Fresh Nonfarm Payrolls (NFP) were 175K, the lowest in six months.

Focus shifts to US Inflation

This week, investors relied on commentary from Fed policymakers to project US Dollar’s moves due to absence of top-tier economic data. Next week, US economic calendar will be data-packed as the Producer Price Index (PPI) and Consumer Price Index (CPI), and the Retail Sales data are lined-up for release. The major event will be the consumer price inflation data, which will influence market expectations for Fed rate cuts.

US Dollar technical analysis

The USD Index trades in a Rising Channel chart pattern on a daily timeframe in which each corrective move is considered as buying opportunity by the market participants. The near-term outlook of the USD Index is uncertain as the asset fails to sustain above the 20-day Exponential Moving Average (EMA), which trades around 105.40.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00, suggesting indecisiveness among market participants.

USD Index daily chart

- Oil is falling in a descending channel on the short-term horizon.

- Within the channel it is currently correcting higher, however, it is likely to capitulate and resume its downtrend.

- Only a decisive break out of the channel would reverse the short-term bearish outlook.

Oil price is trading higher, exchanging hands in the 79.50s at the time of writing on Friday, as it rises up within a falling channel.

West Texas Intermediate (WTI) Crude Oil is in a short-term downtrend which, given the old adage “the trend is your friend,” is expected to eventually continue once the current correction has finished.

US WTI Oil 4-hour Chart

WTI Oil will probably continue rising first, however, given there are no signs yet that the correction is running out of steam. The price might well reach the upper channel line at around $80.00, however, when it gets there it will almost certainly meet tough resistance, and probably reverse lower.

Oil has broken above the 50 Simple Moving Average (SMA) – a bullish sign – but it has not yet broken above the 100 or 200 SMAs. Oil price would have to decisively break out of the falling channel and the 100 SMA to mark a change of trend and suggest a more bullish technical outlook.

A decisive break would be one accompanied by a long green candle that closed near its high or three green candles in a row that broke above the channel line.

Such a break, if it were to happen, could see Oil rally to an initial target at roughly $83.10, the Fibonacci 0.681 ratio of the height of the channel extrapolated higher.

The Moving Average Convergence Divergence (MACD) momentum indicator has risen above the zero-line and is painting green histogram bars suggesting the current up leg is likely to extend. Resistance from the channel line, however, will probably eventually push price back down. The overall bear trend suggests the possibility of Oil falling back down to $76.00 lows eventually.

According to an interview with Reuters, Atlanta Federal Reserve President Raphael Bostic suggested that the Fed is probably still planning to reduce interest rates this year, despite uncertainty regarding when and by how much policy easing will occur, as well as the gradual pace of inflation declines.

Key Quotes

Most firms say pricing power is at or near its limit, with wage growth moving to pre-pandemic levels.

Optimistic disinflation will continue, though the path back to the Fed's 2% target may take until late next year or early 2026.

He is thinking less about the extent of rate cuts this year and more about getting the timing right for the start of easing.

Job growth needs to slow to be consistent with the 2% target, though that does not mean unemployment will spike.

Gain of 175,000 jobs in april may be low for pandemic-era, but still above what economy needs to account for population, labor force growth.

Market Reaction

The Greenback keeps its slight buying bias in the low 105.00s when tracked by the USD Index (DXY) ahead of the release of the advanced Michigan Consumer Sentiment and speeches by Bowman, Barr and Goolsbee.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | 0.08% | -0.17% | -0.02% | -0.15% | -0.32% | -0.09% | |

| EUR | 0.03% | 0.10% | -0.17% | -0.01% | -0.12% | -0.31% | -0.05% | |

| GBP | -0.08% | -0.10% | -0.25% | -0.12% | -0.21% | -0.39% | -0.15% | |

| JPY | 0.17% | 0.17% | 0.25% | 0.07% | -0.01% | -0.16% | 0.08% | |

| CAD | 0.02% | 0.01% | 0.12% | -0.07% | -0.12% | -0.29% | -0.04% | |

| AUD | 0.15% | 0.12% | 0.21% | 0.01% | 0.12% | -0.17% | 0.06% | |

| NZD | 0.32% | 0.31% | 0.39% | 0.16% | 0.29% | 0.17% | 0.24% | |

| CHF | 0.09% | 0.05% | 0.15% | -0.08% | 0.04% | -0.06% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

- Gold rallies as investors turn to safety amid worsening geopolitical tensions.

- Weak US labor market data reignites speculation of early Fed rate cuts further driving Gold higher.

- Gold price enters a short-term uptrend with the bias favoring long-holders.

Gold price (XAU/USD) trades almost a percentage point higher in the $2,360s on Friday. The precious metal rises as increasing geopolitical tensions over Gaza solidify its safe-haven appeal.

The upside also results from concerns over the US labor market due to recent data, which have sparked speculation the Federal Reserve (Fed) may lower interest rates sooner than previously expected, increasing the attractiveness of the non-yielding precious metal.

Gold price rises on end of peace talks, US labor market concerns

Gold price rises due to its safe-haven appeal as peace talks between Hamas and Israel in Cairo break down and Israeli armor and military personnel amass around the city of Rafah, the last major urban center in Gaza not reduced to rubble.

The US, meanwhile, is withholding shipments of weapons and military aid to Israel after President Biden warned the country against mounting a full-scale attack on Rafah. Despite the warning, reports have come in of strikes to a mosque and several houses in the city, leading to the deaths of over a dozen people, including women and children, according to Reuters.

US Jobless Claims surprise to the upside

In the US, further evidence of a weakening labor market has reanimated expectations the Federal Reserve will need to cut interest rates sooner than previously thought.

US Initial Jobless Claims data for the week of May 3, released on Thursday, showed a higher-than-expected 231,000 rise when 210,000 had been expected from an upwardly revised 209,000 in the previous week.

This comes on the back of a Nonfarm Payrolls report that showed below-estimated readings for April in almost all key metrics measured.

The data suggests the US economy is struggling under the weight of the currently high interest rates environment and increases speculation the Fed may move to cut rates sooner than previously thought.

Commentary from Federal Reserve officials, however – most recently from Boston Fed President Susan Collins and Minneapolis Fed President Neel Kashkari – has leaned hawkish, with both arguing that inflationary pressures remain too high to consider reducing interest rates.

Major central banks mark a shift in stance

Globally most central banks are either cutting interest rates or signaling a willingness, leading to an environment in which interest rates appear to be peaking and declining – a positive for Gold.

On Wednesday, Sweden’s Riksbank cut interest rates for the first time since 2016, and the number of Bank of England (BoE) officials voting to cut rates on Thursday increased. At its March meeting, the Swiss National Bank (SNB) also opted to cut interest rates.

The European Central Bank (ECB) has all but guaranteed it will cut interest rates in June, and the Reserve Bank of Australia (RBA) accompanied its decision to hold interest rates steady at the last meeting, with dovish rhetoric.

Technical Analysis: Gold price breaks higher, beginning short-term uptrend

Gold price (XAU/USD) has broken through the ceiling of a mini-range and rallied sharply.

A reversal in the sequence of peaks and troughs on the 4-hour time frame chart now suggests the precious metal is in a short-term uptrend, which is biased to extend higher.

XAU/USD 4-hour Chart

The Relative Strength Index (RSI) momentum indicator is overbought, suggesting Gold may be overstretched and could be at risk of a pullback. A move down into neutral territory again would give a sell signal and indicate more clearly a correction. In the meantime, the advice for long-holders is not to add to their positions.

That said, the uptrend remains in progress and the price keeps pushing higher.

The next target to the upside for Gold is at around $2,400, roughly at the height of the April highs.

The bullish trend on both the medium and long-term charts (daily and weekly), overall add a supportive backdrop for Gold.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Last release: Thu May 09, 2024 12:30

Frequency: Weekly

Actual: 231K

Consensus: 210K

Previous: 208K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

- AUD/USD is consolidating after reversing its short-term trend and beginning a new uptrend.

- A break above 0.6624 would confirm more upside for the pair.

- AUD/USD may have formed a Measured Move with a final target at around 0.6690.

AUD/USD is trading in the 0.6610s on Friday after pulling back from resistance at the 0.6624 barrier.

The pair is probably in a short-term uptrend, evidenced by the rising sequence of peaks and troughs since the April 19 lows, visible on the 4-hour chart

AUD/USD 4-hour Chart

Given the old saying that “the trend is your friend” the resumption of the uptrend suggests AUD/USD will continue higher.

A re-break above the 0.6624 highs would provide confirmation of further upside to the next target at the 0.6649 resistance level of the May 3 high. Following that, the next target would be at around 0.6680-90.

The second target is generated by a possible Measured Move pattern that AUD/USD has formed since the April 19 lows. These patterns are like large zig-zags composed of three waves, labeled A, B and C on the chart. The general expectation is that wave C will be either the same length as A or a Fibonacci 0.681 of A.

Wave C has already reached the Fibonacci 0.681 target of the Measured Move at the May 3 highs, however, there is a chance it could go all the way to the second target where C=A at 0.6690.

The Moving Average Convergence Divergence (MACD) momentum indicator has crossed above its signal line, giving a buy signal. The MACD has also started printing green histogram bars, further adding to the weight of bullish evidence.

That said, it is still possible the correction from the May 3 highs may have further to run before the uptrend properly resumes.

In the advent of more weakness, the rectangular pale green zone drawn on the chart just above the lower trendline is likely to provide a cushion of support for price. From there price will probably resume its uptrend.

Alternatively, a decisive break below the trendline would be a bearish sign, suggesting a potential reversal of the trend.

A decisive break would be one accompanied by a long red candle which closes near its low or three red candles in a row that break below the trendline.

- USD/JPY gained ground due to the recovery in the US Dollar on Friday.

- Japan’s Current Account Surplus was lower than market expectations, weakening the Japanese Yen.

- US Initial Jobless Claims rose to an eight-month high of 231K, surpassing estimates of 210K.

USD/JPY is retracing its recent losses from the previous session, trading around 155.70 during the European session on Friday. However, verbal intervention from Japanese authorities is expected to curb the upward movement of the USD/JPY pair. Japanese Finance Minister Shunichi Suzuki reiterated on Friday that he is prepared to take necessary measures concerning foreign exchange if deemed necessary.

On the data front, Japan’s Current Account Surplus (YoY) rose to JPY 3,398.8 billion in March from JPY 2,360.0 billion. This marked the 14th consecutive month of surplus in the current account but fell short of the expected increase of JPY 3,489.6 billion. The data showed that capital inflows into Japan were lower than market expectations, weakening the Japanese Yen.

The USD/JPY pair received support from the upward correction in the US Dollar (USD), driven by the hawkish sentiment surrounding the Federal Reserve (Fed) maintaining higher interest rates for an extended period.

However, the Greenback encounters resistance due to lower US Treasury yields, influenced by the lower-than-expected US Initial Jobless Claims data released on Thursday. The US Bureau of Labor Statistics (BLS) reported that the number of individuals filing for unemployment benefits exceeded expectations, with Initial Jobless Claims for the week ending May 3 rising to 231,000, surpassing estimates of 210,000 and increasing from the previous week's reading of 209,000.

Later in the day, the preliminary US Michigan Consumer Sentiment Index for May is scheduled for release, with forecasts indicating a slight decrease. This survey assesses sentiment among US consumers, covering three primary areas: personal finances, business conditions, and buying conditions.

- EUR/USD holds gains near 1.0780 as Fed rate-cut speculation keeps the US Dollar on edge.

- Easing US labor market conditions strengthens Fed rate-cut prospects.

- The ECB is projected to deliver three rate cuts this year due to easing Eurozone inflation.

EUR/USD is struck in a tight range slightly below the crucial resistance of 1.0800 in Friday’s European session after a sharp recovery from 1.0725. The major currency pair holds strength as investors have already discounted the fact that the European Central Bank (ECB) will start lowering its borrowing rates in June.

However, ECB policymakers are divided over extending the rate-cut cycle after the June meeting. A few policymakers believe that additional interest rate cuts from the July meeting could revamp price pressures.

ECB policymaker and Bank of Greece Governor Yannis Stournaras said in an interview with a Greek media outlet last week that he sees three rate cuts this year. He sees a rate cut in July as possible and added that an economic rebound in the first quarter made a three-cuts scenario more likely than four. The Eurozone economy expanded by 0.3% in the January-March period, beating expectations of a 0.1% growth.

On the contrary, ECB Governing Council member and Governor of Austria's central bank, Robert Holzmann, said on Wednesday that he doesn't see a reason to cut key interest rates "too quickly or too strongly," Reuters reported.

This week, EUR/USD has been driven by market sentiment due to the absence of tier-1 Eurozone and United States economic data. However, next week, investors will focus on the US Consumer Price Index (CPI) data for April, which will be published on Wednesday.

Daily digest market movers: EUR/USD holds strength amid improved market sentiment

- EUR/USD shows strength slightly below the round-level resistance of 1.0800 at 1.0780 due to improved market sentiment. The appeal for risk-perceived assets is strong amid firm speculation that the Federal Reserve (Fed) will start reducing interest rates in September. S&P 500 futures have posted significant gains in the European session, signalling investors’ higher risk appetite.

- Expectations for the Fed to begin lowering interest rates in September have strengthened as the US labor market showed further signs of cooling. On Thursday, the US Department of Labor reported that Initial Jobless Claims rose significantly to 231K (the highest level since November 10 week), exceeding the consensus of 210K and the prior reading of 209K.

- Apart from the higher-than-expected jobless claims, weak Nonfarm Payrolls (NFP) for April and slower job openings in March have dented investors’ confidence in the strength of the US labor market. Job growth was the lowest in six months and job postings were the lowest in three years.

- Cooling US labor market conditions indicate that the job market is struggling to bear the burden of the Fed’s restrictive monetary policy framework. The context has boosted Fed interest rate-cut prospects for September. The CME FedWatch tool shows that traders see a 71% chance that interest rates will decline from their current levels in September, which is higher than the odds of 66% recorded a month ago.

- This week, Minneapolis Fed Bank President Neel Kashkari said that weakness in the job market could justify a rate cut. However, he remained lean towards maintaining the current interest rate framework for the entire year. Kashkari signalled concerns over stalling progress in inflation declining to 2% amid a strong housing market.

Technical Analysis: EUR/USD is slightly below 1.0800

EUR/USD is steadily approaching the downward-sloping border of a Symmetrical Triangle pattern formed on a daily time frame, which is plotted from December 28 high around 1.1140. The upward-sloping border of the triangle pattern is marked from the October 3 low at 1.0448. The Symmetrical Triangle formation exhibits a sharp volatility contraction.

The major currency pair has come closer to the 200-day Exponential Moving Average (EMA), which trades around 1.0780.

The 14-period Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting indecisiveness among market participants.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.