- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The Bank of Japan's (BoJ) former policy board member, Makoto Sakurai, said that the central bank “is completely ready” to end negative rates in April 2024.

Key quotes

“The BOJ is completely ready.”

“They are just waiting for one last push from one or two economic data.”

“April is the most likely timing for a rate hike after authorities peruse initial results of spring wage talks due in March.”

“The BOJ will only go slowly. It’s completely different from” the Federal Reserve and European Central Bank.”

“What Japan’s economy needs is the continuation of an appropriate level of monetary easing.”

Market reaction

USD/JPY edges lower following the above comments from the former BoJ policymaker. At the time of press, the pair was down 0.11% on the day at 145.64.

Bank of Japan FAQs

What is the Bank of Japan?

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

What has been the Bank of Japan’s policy?

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

How do Bank of Japan’s decisions influence the Japanese Yen?

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

Is the Bank of Japan’s ultra-loose policy likely to change soon?

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. Still, the Bank judges that the sustainable and stable achievement of the 2% target has not yet come in sight, so any sudden change in the current policy looks unlikely.

- AUD/USD hovers around 0.6700 amid the USD weakness.

- Fed’s Williams said financial markets continue to be highly sensitive to new data.

- The Australian monthly CPI eased to the lowest rate since January 2022.

- Australian Trade Balance and US CPI will be in the spotlight on Thursday.

The AUD/USD pair extends the range-bound theme around the 0.6700 mark during the early Asian session on Thursday. Investors await the release of the Australian Trade Balance report on Thursday ahead of US inflation data, as measured by the Consumer Price Index (CPI). AUD/USD currently trades near 0.6699, gaining 0.04% on the day.

Wednesday's lack of economic data prompted financial markets to look at the interest rate cuts that central banks have already priced in for the current year. Nonetheless, the US CPI on Thursday might trigger volatility in the market. The markets estimated an increase of 0.2% MoM in headline inflation and 0.3% MoM in the core figure.

Investors place their bets on five rate cuts in 2024, largely dismissing the Fed forecast of only 75 bps of easing. On Thursday, New York Federal Reserve (Fed) President John Williams said that financial markets continue to be highly sensitive to new data. Williams added that the Fed is in a good place and that the time has come to consider the future of interest rates. The Fed will eventually be compelled to return to neutral policy levels.

The Australian Bureau of Statistics revealed on Wednesday that the nation’s monthly CPI eased to 4.3% YoY in November from 4.9% in the previous reading, the lowest rate since January 2022. These figures supported the view that the cash rate would remain unchanged at its February meeting.

Looking ahead, market participants will monitor the Australian Trade Balance on Thursday, which is projected to see a trade surplus of 7,500M. On the US docket, the US CPI report and weekly Initial Jobless Claims will be released.

- USD/JPY climbs further as Yen declines across the board.

- Yen weakness sparked by tumbling Japanese real wages, down 3% YoY.

- Backsliding real wages leaves the BoJ less likely to start raising interest rates.

The USD/JPY witnessed a notable upswing in Wednesday’s trading, reaching 145.80 and approaching the key resistance level of 146.00 as markets gear up for Thursday’s Asia market session. This upward movement is attributed to a significant depreciation of the Japanese Yen (JPY) across the market, sparked by disappointing Japanese wage figures released earlier in the day. Consequently, the Yen is undergoing a decline across various market segments mid-week.

Japan's economic landscape faces challenges as nominal wages rose by 0.2%, but real incomes experienced a 3% decline for the year ending November. Ongoing inflation is eroding consumers' earnings and purchasing power, contributing to this downturn.

The likelihood of the Bank of Japan (BoJ) implementing rate hikes, contingent on rising real wages, is diminishing. This has resulted in a weakening Yen and is triggering another extended flight away from the JPY.

Japanese real wages tumble 3% despite 0.2% increase in nominal wages

Despite inflation's persistent impact on real wages, the BoJ maintains a highly accommodative monetary policy, with slightly negative rates at or near -0.1%. This cautious stance stems from concerns about inflation falling below the 2% threshold in 2025. Japanese annual inflation stood at 2.8% in November, down from its peak of 4.3% in January of the preceding year.

Looking ahead, the USD/JPY may gain additional momentum on Thursday as the United States publishes its latest Consumer Price Index (CPI) inflation figures for December.

US headline CPI inflation is expected to slightly increase month-over-month, from 0.1% to 0.2%. The annualized inflation for the year ending in December is projected to climb from 3.1% to 3.2%.

US CPI Preview: Forecasts from 10 major banks

In contrast, core US CPI inflation, excluding volatile food and energy prices, is predicted to remain stable month-over-month in December at 0.3%. However, the year-over-year Core CPI is forecasted to decrease slightly from 4.0% to 3.8%.

Investors are closely monitoring any signs that could prompt the Federal Reserve (Fed) to initiate the next rate-cut cycle. A decline in US inflation may boost risk appetite, while an unexpected increase in US CPI inflation could lead to a decrease in risk appetite and potentially drive up the value of the US Dollar against major currencies.

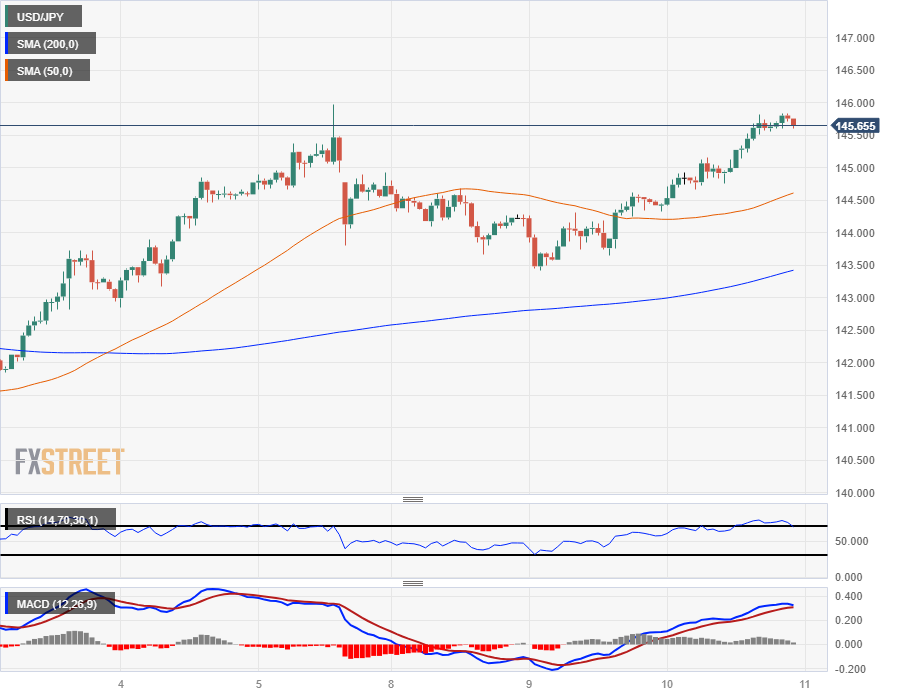

USD/JPY Technical Outlook

The recent decline in the Yen on Wednesday has propelled the USD/JPY pair, positioning it for a potential retest of last week's peak at the 146.00 level. Short-term momentum suggests a bullish trend, with the 200-hour Simple Moving Average (SMA) ascending towards 143.50, aligning with Wednesday's low point.

Despite the current consolidation between the 50-day and 200-day SMAs, the 2024 price action signals a bullish trend following the recent rebound of the USD/JPY from the 200-day SMA around 143.00.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

- GBP/JPY's strong rally fueled by improved risk appetite and speculations on BoJ's policy stance.

- Technical analysis suggests a neutral to bullish trend; breaking 186.00 could lead to further gains towards 187.00 and 188.00.

- Downside risks for GBP/JPY include potential support at 184.30, 183.49 (Senkou Span B), and around 182.26/23.

The Pound Sterling (GBP) soared on Wednesday and posted gains of more than 1% against the Japanese Yen (JPY) as risk appetite improved ahead of the release of important economic data from the United States (US). That, alongside weaker economic data in Japan, decreased the likelihood that the Bank of Japan (BoJ) would normalize monetary policy. As Thursday’s Asian session begins, the GBP/JPY exchanges hands at 185.56, down by a minuscule 0.10%.

From a technical perspective, the GBP/JPY is neutral to bullish biased, but buyers must break the top of the Ichimoku Cloud (Kumo) at 186.00 to open the door for higher prices. Upside risks remain above 187.00, and on additional bullish strength, the next stop would be the 188.00 figure.

If sellers regain control and keep the GBP/JPY below the 186.00 figure, they could remain hopeful of lower prices. Nevertheless, they must drag prices below the January 5 daily high turned support at 184.30, followed by the Senkou Span B at 183.49, ahead of the confluence of the Kijun and Tekan-Sen at around 182.26/23, respectively.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels

- New York Fred President Williams gave economic outlook remarks at an event.

- Fed Williams: Fed needs to think about balance sheet end game.

- Fed Williams: Volatility has not affect the Fed funds rate.

New York Federal Reserve (Fed) President John Williams delivered overarching remarks about the Fed’s policy stance looking forward while attending an event in New York hosted by RM Friedland and Webster Bank.

As a member of the Federal Open Market Committee (FOMC) and Vice Chair of the Fed, NY Fed President Williams is a key policymaker within the US central bank.

Key highlights:

- Financial markets remain highly reactive to new data.

- Money market volatility has not affected the Fed funds rate.

- Demand for reserves likely higher now relative to the past.

- Fed needs to start considering the balance sheet end game in 2024.

- Fed policy remains quite restrictive.

- Fed is in a good place, time to think about what’s next for interest rates.

- Eventually, the Fed will have to return to neutral policy levels.

- Fed Williams: not caught up on every twist of the financial market shift.

- Not surprised to see money market rate volatility.

- EUR/JPY's significant rally driven by a neutral to upward trend, with buyers targeting the 160.00 mark.

- Resistance at top of Ichimoku Cloud (161.26) and 162.00 level in sight for continued bullish movement.

- Downside risks include potential supports at 159.32 (Kumo bottom), 158.73, and 157.51 (Tenkan-Sen).

The Euro (EUR) rallied sharply against the Japanese Yen (JPY) on Wednesday, posting gains of 1.27% or more than 200 pips as the EUR/JPY traded at 159.92, at the brisk of conquering 160.00.

The EUR/JPY daily chart suggests the pair is neutral to upward biased after buyers pushed the pair inside the Ichimoku Cloud (Kumo). if they would like to resume the uptrend, they must reclaim the 160.00 figure, followed by the top of the Kumo at 161.26. on further upside strength, the next resistance would be 162.00.

On the other hand, if sellers would like prices to edge lower, they must cap EUR/JPY’s uptrend at 162.00. That might open the door for further losses, exposing the bottom of the Kumo at 159.32. Further downside is seen at the Senkou Span B at 158.73, followed by the Tenkan-Sen at 157.51, before diving toward the Senkou Span A at 157.02.

EUR/JPY Price Action – Daily Chart

EUR/JPY Key Technical Levels

- New Zealand Building Permits broadly missed expectations, printing at -10.6%.

- Markets expected an 8.5% rebound in new building approvals.

- NZ Building Permits down 24% YoY.

New Zealand Building Permits fell to a 15-month low of -10.6% in November, falling well short of the market forecast of an 8.5% increase.

New Zealand Building Permits are down 24% for the year ended in November, with the annualized number of new home consents continuing to decline from an all-time peak of 51,015 for the year ended May 2022. Annualized rolling Building Permits have fallen back to a multi-year low last seen in late 2020.

Market Reaction

The Kiwi (NZD) is rangebound in early Thursday action, trading into a tight range just above 0.6220 as markets gear up for Thursday’s trading session.

About New Zealand Building Permits

The Building Permits s.a. released by the Statistics New Zealand show the number of permits for new construction projects. It is considered as a leading indicator for the housing market. The more growing number of permits, the more positive (or bullish) for the NZD, while a low reading is seen as negative, or bearish.

- The EUR/GBP registers 0.12%, currently trading at 0.8608 after peaking at 0.8620.

- Daily and four-hour chart indicators reveal mixed signals.

- As long as the pair remains below the 20,100, and 200-day SMAs, the overall outlook will be bearish.

On Wednesday's session, the EUR/GBP was noted at 0.8608, capturing a gain of 0.12% that saw peaks to 0.8620. The daily chart signals a neutral to bullish environment, with bulls gaining ground, while the four-hour chart presents a mixed outlook on the pair.

In a general perspective, the indicators on the daily chart reflect a slight bearish dominance despite daily gains. The pair's position below its Simple Moving Averages (SMAs) for 20,100 and 200 days underscores the ongoing supremacy of sellers in the market. That being said, a slightly positive slope in the Relative Strength Index (RSI), even while persisting in the negative territory, signals a hint of increasing bullish momentum but the flat green bars of the Moving Average Convergence Divergence (MACD) suggest that the buying momentum is still weak.

Shifting to the four-hour chart, the technical situation still appears mixed. The negative slope for the four-hour RSI suggests a decline of bullish momentum for the immediate short-term, aligning with the flat green bars of the four-hour MACD, depicting an ongoing equilibrium between buyers and sellers. At this juncture, the selling momentum prevails, but with a persistent struggle from the bulls to regain the ground. This outlines a mixed outlook, with the market exhibiting an undecided short-term path until either of the momentum gains a strong foothold.

EUR/GBP technical levels

EUR/GBP daily chart

-638405188548094281.png)

- US stocks printed in the green on Wednesday, led by megacap and tech gains.

- Nvidia hits a record high, while Meta and Alphabet post 12-month gains.

- Investors are leaning bullish in the run-up to Thursday’s US CPI inflation reading.

The overwhelming majority of US equity indexes closed in the green on Wednesday, fueled in large part by record-setting highs in chipmaker Nvidia, while Facebook owner Meta and Google operator Alphabet both posted 12-month highs through the day. Tech and megacap gains led broader indexes deeper into the green, and investors will be pivoting towards Thursday’s upcoming US Consumer Price Index (CPI) inflation print.

Equities have clawed back most of the losses seen at the outset of 2024 following a stellar ramp-up in market bets that the Federal Reserve (Fed) would get pushed into a faster and deeper pace of rate cuts in 2024, with money markets pricing in upwards of a 90% chance of rate cuts coming as soon as March.

The first US Nonfarm Payrolls of 2024 splashed cold water on market expectations as a still-firm labor market in the US keeps odds of impending rate cuts much lower than the market buildup was hoping for, sending market bets of a first cut in March back down to a reasonable but still hopeful 60%.

US CPI Preview: Forecasts from 10 major banks

Despite broad-market hopes, market forecasts see the headline US CPI inflation print for December to come in at 0.2% MoM compared to November’s print of 0.1%. Annualized US CPI inflation through December is likewise expected to tick slightly higher from 3.1% to 3.2%, while Core MoM CPI is expected to hold steady at 0.3%.

With investors hoping for signs of easing long-term inflation to kickstart the next rate cut cycle, markets will be focusing on annualized Core CPI through December, which is forecast to slightly decline from 4.0% to 3.8%.

The Dow Jones Industrial Average climbed 170.57 points to close up 0.45% at $37,695.73, while the NASDAQ Composite gained 111.94 points, ending Wednesday at $14,969.65 and climbing 0.75% on the day. The S&P 500 also added just under 27 points to close up 0.57% at $4,783.45.

S&P 500 Technical Outlook

The Standard & Poor’s 500 (S&P) major equity index is back within touch range of late December’s 22-month high of $4,794.65, and is one good push away from setting new all-time highs beyond 2021’s peak bids of $4,812.38.

The S&P has muscled its way back over the 200-hour Simple Moving Average (SMA) just above $4,740.00, set for a challenge of the $4,800.00 handle with the index clawing back almost all of 2024’s early declines. The S&P bottomed out near $4,680.00 after a 2.75% decline from late December’s peak, and has rallied into the top end once more.

S&P 500 Hourly Chart

S&P 500 Daily Chart

S&P 500 Technical Levels

- The Euro is broadly higher on Wednesday, gaining ground across the board.

- ECB’s de Guindos noted that the Eurozone could be in a technical recession.

- Still-firm Unemployment Rate bolstering Euro even as it swamps out ECB rate cut hopes.

The Euro (EUR) saw thin but insistent broad-market gains on Wednesday, climbing against the rest of the major currency bloc in thin markets on equally thin data, with Tuesday’s Eurozone Unemployment Rate continuing to bolster the Euro as investors shrug off bearishly cautionary statements from European Central Bank (ECB) policymakers.

Europe saw its November Unemployment Rate tick lower on Tuesday, helping to prop up the Euro through the first half of the trading week, and despite the broad expanse of economic activity figures largely coming in at contractionary levels, key data continues to print better than initial investor expectations.

Daily digest market movers: Euro buoyed by not-bad-enough datapoints, ECB warnings sail passed Euro

- Euro outperforms the rest of the major currency market, in the green across the board for Wednesday and the week overall.

- European Unemployment Rate ticked down to 6.4% in November from October’s 6.5%, bolstering the EUR even as it weighs on ECB rate cut hopes and European equities.

- European equities softened on Wednesday as risk appetite wanes

- ECB Vice President de Guindos noted that Europe was likely in a technical recession in 2023’s fourth quarter as growth continues to disappoint.

- Head of Spain’s central bank Banco de España (BdE) and ECB Governing Council Member Pablo Hernandez de Cos struck a balancing tone against de Guindos’ bearish outlook.

- De Cos: “In addition to geopolitical developments, the transmission of monetary policy has been surprising us for its strength, which, if extended in the coming years, would translate into lower growth.”

- ECB’s de Guindos: Rapid pace of disinflation likely to slow down in 2024.

- The Euro sees one more speech from ECB Chief Economist Philip Lane before investors turn towards next week’s final Eurozone Consumer Price Index (CPI) figures, slated for next Wednesday.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.32% | -0.20% | -0.08% | -0.23% | 0.86% | 0.30% | -0.11% | |

| EUR | 0.31% | 0.11% | 0.23% | 0.09% | 1.17% | 0.60% | 0.22% | |

| GBP | 0.19% | -0.12% | 0.11% | -0.02% | 1.05% | 0.49% | 0.10% | |

| CAD | 0.07% | -0.23% | -0.11% | -0.12% | 0.95% | 0.38% | 0.01% | |

| AUD | 0.21% | -0.12% | 0.00% | 0.12% | 1.06% | 0.49% | 0.10% | |

| JPY | -0.87% | -1.19% | -1.07% | -0.96% | -1.09% | -0.58% | -0.97% | |

| NZD | -0.30% | -0.62% | -0.50% | -0.38% | -0.51% | 0.53% | -0.44% | |

| CHF | 0.07% | -0.23% | -0.11% | 0.01% | -0.12% | 0.94% | 0.39% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Despite stubborn topside momentum, significant headwinds remain for the Euro

The Euro is rising to claim top spot of the major currency bloc on Wednesday, in the green against its major counterparts on the day and also on the week thus far. The Euro has gained a third of a percent against the US Dollar (USD) on Wednesday, and is up around 1.2% against the beleaguered Japanese Yen (JPY), while climbing six-tenths of a percent against the New Zealand Dollar (NZD) and a fifth of a percent against the Canadian Dollar (CAD).

Despite bullish intraday momentum, the EUR/USD is set for a near-term rejection of the 200-hour Simple Moving Average (SMA), running into a technical ceiling at the top of a recent sideways channel forming on intraday charts between 1.0970 and 1.0910.

Despite intraday headwinds, the EUR/USD looks well-supported on daily candlesticks, with the pair trading just north of a bullish crossover of the 50-day and 200-day SMAs near 1.0850, though a bearish pullback into the 1.0800 handle will see the pair set for a fresh run into 2023’s low bids below 1.0500.

EUR/USD Hourly Chart

EUR/USD Daily Chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver's decline influenced by high US bond yields, impacting the metal's trading direction.

- Technical analysis indicates a sideways yet slightly bearish trend, with key support levels in focus.

- For a potential upward shift, Silver needs to reclaim $23.00 and surpass the 100-DMA at $23.28.

Silver price slumps late in the North American session as high US Treasury bond yields hit precious metals prices across the board. At the time of writing, XAG/USD trades at $22.70 a troy ounce, down 0.24%.

XAG/USD’s daily chart shows the non-yielding metal is trading sideways though slightly tilted to the downside. This is because Silver dropped below the 100-day moving average (DMA) on January 3. Since then, the 100-DMA remains a key resistance level respected by buyers, exacerbating Silver’s fall below $23.00.

That said, the path of least resistance is to the downside. Silver’s first support would be the January 4 low of $22.69, followed by the December 13 swing low of $22.51. Once those two levels are cleared, the next demand area would be $22.00.

Buyers must reclaim the $23.00 figure for a bullish resumption, followed by the 100-DMA at $23.28. A breach of the latter will expose the confluence of the 50 and 200-DMAs around $23.62/65.

XAG/USD Price Action – Daily Chart

XAG/USD Technical Levels

- Gold's drop influenced by heightened anticipation of US inflation report and rising Treasury yields.

- Expectations of higher headline CPI and a decline in core CPI shape market sentiment, impacting Gold's value.

- Upcoming US CPI data crucial for market expectations around Fed's rate decisions and its impact on Gold prices.

Gold price dropped 0.33% late in the North American session as traders awaited Thursday's release of the latest inflation report in the United States (US). Expectations that headline inflation would exceed the previous month’s reading remain high, as witnessed by the rise of US bond yields. The XAU/USD trades at $2021.22 after hitting a daily high of $2040.27.

XAU/USD drops influenced by elevated US bonds yields as traders brace for US inflation report

Market sentiment shifted positively, though US Treasury bond yields remained high, particularly the 10-year benchmark note rate, up two basis points at 4.034%. That’s weighing on Gold despite the weak US Dollar (USD).

The economic docket on Wednesday was scarce with the release of Wholesale Inventories slipping 0.2% as expected by economists, a minuscule improvement compared to October’s -0.3% plunge. Aside from this, traders are bracing for the release of the latest Consumer Price Index (CPI) figures in the US. Headline CPI is expected at 3.3% in 12 months to date data, while core CPI is projected to dive to 3.8%, according to the consensus.

Speculators expect the data as they seem convinced that the US Federal Reserve (Fed) would slash rates by close to 150 basis points toward the year’s end after Fed Chairman Jerome Powell and Co. commented rates are near peaking. Therefore, softer-than-expected US CPI readings could be positive for XAUs and negative for the Greenback, as US Treasury bond yields would be expected to drop.

On the other hand, if US inflation picks up, it would catch traders off guard, as they are highly positioned for a dovish Fed.

Ahead of the day, the New York Fed President John Williams would cross wires at around 19:00 GMT.

XAU/USD Price Analysis: Technical outlook

Gold’s daily chart portrays the yellow metal as neutral biased due to buyers' inability to crack the latest cycle high witnessed on December 28 at $2088.48. In the short-term, XAU/USD has shifted slightly bearish, and if sellers push prices below the 50-day moving average (DMA) of $2015.39, that will exacerbate a drop to challenge the $2000 mark. Otherwise, if buyers move in and lift prices above $2050, that could pave the way for testing the abovementioned cycle high around $2090 before regaining $2100.

XAU/USD Price Action – Daily Chart

- European stocks mostly saw declines on Wednesday.

- Major indexes added to recent declines despite DAX holding steady for the day.

- Rate cut expectancy from the ECB is getting readjusted, easing investor appetite.

European major stock equities largely saw declines on Wednesday, driven lower as markets readjust their bets on the pace of rate cuts from the European Central Bank (ECB). The European Unemployment Rate continues to hold relatively steady, printing at 6.4% in November compared to the previous 6.5%, and the lack of declining employment is chipping away at odds of a faster pace of rate cuts from the ECB.

ECB policymaker reaffirmed their current stance on rate hikes, noting that a technical session could be hiding behind the data, but market hopes for rate declines could have run too far ahead of what central banks are prepared to deliver at this time.

With rate cut hopes fading, European equities are facing overall declines, with the pan-European EUROSTOXX 600 equity index declining nearly a fifth of a percent, falling 0.84 points to close at €476.42. France’s CAC 40 slipped a scant 0.01%, falling half a point to €7.426.08, while Germany’s DAX 40 held relatively steady, stepping up a slim 0.01%, closing up 1.45 points at €16,689.81.

Meanwhile, London’s FTSE 100 major equity index fell 32.2 points to close down 0.42% at £7,651.76.

FTSE Technical Outlook

The FTSE 100 fell 0.51% peak-to-trough on Wednesday, getting knocked back into near-term lows as the index corkscrews through technical barriers at the 50-hour and 200-hour Simple Moving Averages (SMA), with the longer moving average rotating into a flat stance near £7,700.

Despite near-term downside pressure, the FTSE 100 has managed to hold onto bullish territory, trading north of the 200-day SMA near £7,575, and London’s leading equity index is up 5.5% from last October’s low bids near £7,255.70.

FTSE Hourly Chart

FTSE Daily Chart

FTSE Technical Levels

The improvement in sentiment surrounding the risk-linked galaxy weighed on the greenback and sponsored a corrective knee-jerk in the USD Index (DXY) amidst increasing prudence ahead of the release of key US CPI on Thursday. Early in the Asian trading hours, the Australian Trade Balance results will take centre stage, seconded by flash prints of the Japanese Coincident Index and Leading Economic Index.

Here is what you need to know on Thursday, January 11:

Renewed selling pressure hurt the dollar against the backdrop of muted US yields and steady expectation ahead of US CPI. Other than US inflation, usual weekly Initial Claims should also grab attention on Thursday.

Looking at US stocks markets, the three major stock indices edged higher amidst solid performance of tech megacaps and the broad-based upbeat mood in the risk appetite trends.

EUR/USD took advantage of the selling pressure in the greenback and revisited the 1.0970 zone, or two-day highs, in tandem with higher German yields and despite speculation of several rate cuts by the ECB this year.

GBP/USD remained in the upper end of the weekly range well north of the 1.2700 hurdle bolstered by investors’ preference for the riskier assets. There was no news from the testimony by BoE Governor A. Bailey before the Parliament.

The firm tone in the risk-associated space sponsored further selling in the Japanese yen and encouraged USD/JPY to advance to weekly highs and flirt with the so-far yearly peaks in levels just shy of 146.00 the figure.

AUD/USD reversed Tuesday’s marked pullback and regained some upside traction, although a convincing breakout of the 0.6700 hurdle remained elusive. Lower-than-expected inflation figures in Oz also seems to have propped up the view of a pause by the RBA at its next event in February.

The modest sell-off in the dollar weighed on USD/CAD, prompting the pair to partially reverse the weekly advance, leaving a decent resistance around the 1.3400 region.

Both Gold and Silver grinded lower and revisited the lower end of the so-far yearly range prior to the release of US inflation on Thursday.

- The AUD/JPY sees a promising rally, standing at 97.50, its highest since December 4.

- Indicators are riding towards overbought conditions on the four-hour chart.

- A healthy consolidation may be on the papers to correct the rally..

On Wednesday, the AUD/JPY rallied to a high of 97.60, with bulls increasing their dominance on the daily chart. However, further upside may be limited as the four-hour indicators proceed towards overbought conditions.

In consideration of the positioning of the key indicators on the daily chart, it is discernible that the bulls are in command. The Relative Strength Index (RSI) demonstrates a positive inclination within bullish territory, which indicates increasing buying power. Moreover, the Moving Average Convergence Divergence (MACD) continues its ascent, marked by swelling green bars that reinforce the ongoing bullish momentum. In addition, the overall trend also appears optimistic as the pair navigates above the 20,100,200-day Simple Moving Averages (SMAs).

Zooming into the four-hour chart, the short-term market momentum is leaning towards a possible overbought state. The stairway to overbought conditions is becoming increasingly visible, with the four-hour Relative Strength Index (RSI) demonstrating a strong surge. Concurrently, the four-hour Moving Average Convergence Divergence (MACD) underscores this buying momentum with its progressively burgeoned green bars. Yet, traders should tread carefully as these overbought conditions can often precede reversals, suggesting a possible moderation of the bullish drive in the near term.

AUD/JPY technical levels

AUD/JPY daily chart

- USD/JPY climbs further on Wednesday in a broad-market Yen selloff.

- Japanese wages plummeted in real terms, sparking a Yen weakening.

- With real wages declining, the BoJ is less likely to begin hiking rates.

The USD/JPY rose on Wednesday, tapping 145.80 as the pair grinds towards the 146.00 handle. A broad-market Japanese Yen (JPY) sell-off, sparked by a wide miss in Japanese wage figures published early Wednesday, is dragging the Yen down across the board in mid-week market action.

Japanese real wages tumble 3% despite 0.2% increase in nominal wages

Despite a 0.2% rise in nominal wages, Japanese real incomes tumbled 3% for the year ended November as inflation continues to eat away at Japanese consumers’ earnings and purchasing power.

With the Bank of Japan (BoJ) hinging rate hikes on rising real wages, odds of a tightening cycle from the Japanese central bank are evaporating, sending the Yen skidding across the floorboards and is set to spark another long-run flight out of the JPY. Despite high inflation continuing to erode real wages, the BoJ is stubbornly entrenched in a hyper easy monetary policy stance, with Japanese central planners keeping rates pinned in slightly negative territory at or near -0.1% as the BoJ fearfully looks ahead to the possibility of inflation declining too far past the 2% barrier sometime in 2025. Japanese annual inflation currently stands at 2.8% through last November, declining from a peak of 4.3% in January of last year.

Markets could see further momentum added to the USD/JPY from the Greenback side on Thursday, when the US will publish its latest Consumer Price Index (CPI) inflation figures for December.

US CPI Preview: Forecasts from 10 major banks

US headline CPI inflation is expected to tick slightly higher MoM in December, forecast to rise from 0.1% to 0.2%, while annualized inflation for the year ended December is seen rising from 3.1% to 3.2%.

Core US CPI inflation (headline inflation less volatile food and energy prices) is expected to hold steady MoM in December at 0.3%, but YoY Core CPI is forecast to tick down slightly from 4.0% to 3.8%.

With global markets keen for the Federal Reserve (Fed) to kick off the next rate cut cycle, investors will be scrambling for any signs that US inflation is continuing to recede, while an upside beat to US CPI inflation prints will see risk appetite slumping, and could drive the US Dollar (USD) even higher against the major currency bloc.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.33% | -0.23% | -0.07% | -0.20% | 0.80% | 0.18% | -0.08% | |

| EUR | 0.33% | 0.09% | 0.26% | 0.14% | 1.13% | 0.51% | 0.24% | |

| GBP | 0.23% | -0.09% | 0.16% | 0.04% | 1.03% | 0.40% | 0.17% | |

| CAD | 0.06% | -0.26% | -0.16% | -0.12% | 0.87% | 0.24% | 0.01% | |

| AUD | 0.19% | -0.14% | -0.04% | 0.12% | 0.98% | 0.37% | 0.08% | |

| JPY | -0.81% | -1.13% | -1.06% | -0.88% | -1.01% | -0.63% | -0.89% | |

| NZD | -0.17% | -0.50% | -0.41% | -0.24% | -0.36% | 0.63% | -0.28% | |

| CHF | 0.07% | -0.23% | -0.13% | 0.03% | -0.08% | 0.90% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

USD/JPY Technical Outlook

Wednesday’s broad-market Yen backslide has the USD/JPY pair surging, set to rechallenge last week’s peak bids at the 146.00 handle as near-term momentum tilts bullish with the 200-hour Simple Moving Average (SMA) rising into 143.50, a confluence level with Wednesday’s swing low.

Despite a bullish lean in the USD/JPY, the pair remains constrained between the 50-day and 200-day SMAs as the two moving averages push into the middle, but 2024’s price action looks decidedly bullish after the USD/JPY’s recent bounce from the 200-day SMA near 143.00.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

- AUD/USD slumped back toward Wednesday’s opening bids after a CPI-fueled run.

- The Aussie couldn’t hold onto territory above 0.6710.

- US CPI inflation expectations are weighing down risk appetite for the midweek.

The AUD/USD initially rose on Wednesday after Australian Consumer Price Index (CPI) inflation figures showed inflation cooling faster than market forecasts predicted. The pair climbed over the 0.6700 handle to hit an intraday high of 0.6713, but the pair is waffling back into the low side of 0.6700 as markets gear up for Thursday’s US CPI inflation print.

Australia’s November CPI comes in at 4.3% YoY vs. 4.4% expected

Australian CPI inflation for the year ended November slipped to 4.3% versus the median market forecast of 4.4% and fell even further from October’s YoY print of 4.9%. With inflation pressures easing, Aussie bulls found a reason to bid, but buying pressure proved short-lived as markets turn broad-face to look towards Thursday’s US CPI inflation print.

US CPI Preview: Forecasts from 10 major banks

Market participants are hoping for signs that the Federal Reserve (Fed) will get pushed into the next rate-cutting cycle sooner rather than later, and major investors are looking for easing inflation to be the spark the Fed needs to begin slashing its main reference rate. Despite broad-market hopes, market forecasts see the headline US CPI inflation print for December to come in at 0.2% MoM compared to November’s print of 0.1%.

Annualized US CPI inflation through December is likewise expected to tick slightly higher from 3.1% to 3.2%, while Core MoM CPI is expected to hold steady at 0.3%.

With investors hoping for signs of easing long-term inflation to kickstart the next rate cut cycle, markets will be focusing on annualized Core CPI through December, which is forecast to slightly decline from 4.0% to 3.8%.

AUD/USD Technical Outlook

The AUD/USD is cycling the 50-hour Simple Moving Average (SMA), hitting the price median for a fifth consecutive day as momentum drains out of the pair. The AUD/USD sees descending resistance from a declining 200-hour SMA falling into 0.6740.

The AUD/USD has fallen around 2.5% from late December’s swing high into 0.68711, but near-term technical support is priced in from a 50-day and 200-day SMA crossover near the 0.6600 handle.

AUD/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Technical Levels

- The NZD/USD is suffering losses, moving downwards towards the 0.6220 level.

- The market mood remains cautious, as no significant highlight was seen on Wednesday’s economic docket.

- US Core CPI is seen easing, which may boost the pair.

In Wednesday's trading session, the NZD/USD pair decreased, landing around 0.6226. The drop, which tallied a 0.25% loss, comes on a quiet Wednesday while market players brace themselves for upcoming Consumer Price Index (CPI) data on Thursday. In addition, the pair faced rejection at the 20-day Simple Moving Average (SMA), which contributed to the downside.

The Consumer Price Index for December is anticipated to be 3.2% YoY, a slight progression from the preceding 3.1%. The Core measure figure is projected to soften at 3.8%, a dip from November’s 4%.

Recent data shows that the US economy is still going strong thanks to favorable financial conditions, helping the USD hold its ground. However, the Dollar remains vulnerable due to persistent dovish bets on the Federal Reserve easing, which has yet to materialize. Investors look upon watching remarks from Fed's Williams at the end of the American session for any potential clues on the bank’s next steps. As for now, investors re seeing rate cuts anticipated in March and May and a total of five in 2024, contradicting the Fed’s protected three. However, those bets may change on the outcome of December’s CPI.

NZD/USD levels to watch

The daily chart suggests that the pair has a tinge of selling momentum building in the immediate term. This is reflected by the declining position of the Relative Strength Index (RSI) within negative territory, indicating the potential strengthening of selling pressure. Moreover, this bearish sentiment is echoed by the rising red bars on the Moving Average Convergence Divergence (MACD), with sellers potentially gaining momentum.

Meanwhile, the pair's position across multiple Simple Moving Averages (SMAs) puts a different spin on the picture. It's positioned below the 20-day SMA, a signal that might usually indicate bearishness. However, with the pair above both the 100-day and 200-day SMAs, it suggests that buyers still hold the reins in a broader perspective.

In spite of the near-term neutral to bearish sentiment, the pair's position above longer-term SMAs indicates a dominant buying momentum, at least on a broader horizon. This hints that while sellers may seek to push the pair lower in the immediate future the buyers still have strength to limit any downside.

NZD/USD daily chart

-638405058553206867.png)

- GBP/USD's uptick influenced by Governor Bailey's comments on inflation control and stable UK employment levels.

- Expectations of BoE rate cuts and upcoming US inflation report keep the pair's movements within known ranges.

- Investors to closely monitor US CPI data and unemployment claims for further insights into economic trends.

The Pound Sterling (GBP) registers decent gains of 0.13% against the US Dollar (USD) during the North American session after reaching a daily low of 1.2670. Investors bracing for the Bank of England’s (BoE) Governor Andrew Bailey’s speech, along with the release of US inflation data on Thursday, keeps price action within familiar levels. The GBP/USD trades at 1.2724.

Pound Sterling in the driver’s seat as traders brace of US CPI report on Thursday

The BoE Governor Baley recently testified before the Treasury Select Committee during the day. He expressed that it’s important to curb inflation towards its 2% target and added that the UK hasn’t witnessed a rise in unemployment. He states household incomes have risen recently, and those factors helped ease the impact of higher rates.

Meanwhile, sources cited by Reuters expressed they expect three 25 basis points rate cuts instead of two, stating that inflation most likely fall to around 1.5% in the third quarter.

In the United States, the economic docket is relatively light, with market participants eagerly anticipating the upcoming inflation report set to be released on Thursday. The Consumer Price Index (CPI) for December is projected to increase to 3.2% year-over-year, up from 3.1% in November. In contrast, the Core CPI, which excludes volatile food and energy prices, is expected to decelerate from 4% to 3.8% year-over-year. Concurrently, the US Bureau of Labor Statistics (BLS) is scheduled to release the latest unemployment claims data for the week ending January 6.

GBP/USD Price Analysis: Technical outlook

From a technical standpoint, the pair is neutral to upward biased, with buyers unable to lift spot prices above the 1.2800 figure. In that event, the GBP/USD could aim toward the December 28 high of 1.2827, followed by the July 27 high at 1.2995. On the other hand, if bears step in and drag prices below the 1.2700 mark, that could pave the way for testing January’s 5 swing low of 1.2611, ahead of 1.2600.

- Crude Oil took a hit on Wednesday after EIA crude stocks climbed again.

- Downstream oil products also rose significantly.

- Middle East complications continue to prop up Crude Oil on supply concerns.

West Texas Intermediate (WTI) US Crude Oil slipped from a fresh daily high after the Energy Information Administration (EIA) released their updated US Crude Oil stocks numbers, revealing another buildup of Crude Oil barrels, as well as burgeoning numbers of oil derivative products in supply lines.

Crude Oil prices popped early Wednesday after it was reported that Iran-backed Houthi rebels in Iran launched their largest wave of attacks to-date on civilian cargo ships in the waterways leading towards the Suez Canal. Houthis launched a combination of 21 drones and missiles at shipping vessels in the key waterway that connects supply lines between Europe and Asia.

No damage was reported and coalition naval forces from the US and the UK reported 100% destruction of all Houthi weapons that were in transit at the time. According to reporting by the BBC, citing US military sources, Houthi rebels in Yemen have carried out 26 attacks on commercial shipping vessels since November 19.

Despite the successful fending off of further rebel attacks, Crude Oil caught a fear-based bid as energy markets continue to fret about the possibility of conflicts hampering global trade in oil barrels. WTI climbed to $73.55 before getting knocked back once again after the EIA released their Crude Oil barrel counts for the week ended January 5, showing another buildup in both Crude Oil barrels and downstream oil derivatives.

According to the EIA, US Crude Oil Stocks climbed 1.338 million barrels versus the forecast 675K decline, taking a bite out of the previous week’s 5.5 million barrel decline.

Gasoline reserves also climbed well above expectations, adding a further 8.29 million barrels vs the expected 2.489 million. Oil Distillates also climbed 6.528 million versus the forecast 2.382 million uptick. The EIA also estimates that US Crude Oil production remained above 13 million barrels per day.

WTI Technical Outlook

WTI US Crude Oil stumbled back from Wednesday’s peak bids near $73.60 to retest the $72.00 handle as bids continue to get hampered by the 200-hour Simple Moving Average (SMA). Rough chop on the intraday level continues to be the name of the game, with WTI prices whipsawing in a rough range in the early weeks of 2024.

Daily candlesticks have WTI pressured into the low side, with near-term price action capped by a declining 50-day SMA with a technical ceiling priced in at the 200-day SMA near $78.00.

Technical momentum has drained out of the WTI chart as technical indicators drift into the midrange, and US Crude Oil remains down nearly 24% from last September’s top bids near $94.00.

WTI Hourly Chart

WTI Daily Chart

WTI Technical Levels

- Mexican Peso registers loss of more than 0.20% on Wednesday amid risk-off impulse.

- Banxico’s potential rate cut for Q1 2024 in danger as Mexican inflation rises.

- USD/MXN traders prepare for Thursday’s US inflation data.

The Mexican Peso (MXN) extended its losses for two straight days against the US Dollar (USD) during the North American session as USD/MXN buyers stepped in and lifted the exchange rate past 17.00 to reach a daily high of 17.02. At the time of writing, the exotic pair is trading at 16.99, gaining 0.32%.

Mexico’s economic docket remains scarce, though it revealed that Gross Fixed Investment improved in October. The latest inflation report in Mexico was mixed as core inflation cooled while headline inflation advanced. Given the fact that two Bank of Mexico (Banxico) officials expressed their intentions of easing policy toward the end of Q1 2024, prices remain elevated, which might deter Banxico from cutting rates.

Daily digest market movers: Mexican Peso gives way against US Dollar amid mixed Mexican data

- Mexico’s Gross Fixed Income rose 1.9% MoM in October, exceeding September’s -1.5% plunge, while annually-based figures exceeded forecasts of 22.8%, coming at 25.5%.

- The economy in Mexico is facing several challenges as inflation data was mixed alongside consumer confidence showing signs of deterioration. Elevated prices and a deceleration in economic growth could weigh on the Mexican Peso and cause its depreciation.

- Even though the latest Banxico meeting minutes indicate the central bank might consider easing policy, December’s inflation report might prevent the central bank from relaxing policy.

- On Tuesday, Mexico’s Consumer Price Index (CPI) rose by 4.66% YoY in December, exceeding forecasts of 4.55%.November’s print was 4.32%. Core figures came at 5.09% YoY, less than the consensus, and the previous month’s 5.15% and 5.30%, respectively.

- Consumer Confidence in Mexico deteriorated in December as households remained concerned about the future economic outlook.

- On January 5, a Reuters Poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in 12 months from December.

- Federal Reserve officials expressed that interest rates should remain at current levels. Fed’s Bostic emphasized that policy needs to stay tight, while Fed’s Bowman added that policy is sufficiently restrictive.

- The US economy continues to paint a mixed economic outlook as the latest US jobs data was mixed, while business activity in manufacturing contracted and the service sector deteriorated. Although a soft-landing scenario looms, the chance of a mild recession has increased, so caution is warranted.

Technical analysis: Mexican Peso is on the backfoot after reaching a three-day high above 17.00

The USD/MXN remains bearishly biased, though it briefly tested the 17.00 figure but was quickly rejected. The spot price is aimed toward the 16.97 area. If buyers achieve a daily close above the latest cycle low seen on November 27 at around 17.03, that could open the door for further gains. On further strength, the pair could test the 17.20 mark, followed by the 50-day Simple Moving Average (SMA) at 17.24, ahead of challenging the confluence of the 100 and 200-day SMAs at around 17.40

On the other hand, If sellers prevent the exotic pair from piercing the 17.00 figure, a test of last year’s low is on the cards. But sellers must conquer the 16.80 area, followed by the August 28 swing low of 16.69 ahead of the 2023 low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar sees little momentum in tight Wednesday trading.

- Markets await the next update on US CPI inflation due Thursday.

- CAD finds little support from struggling Crude Oil bids.

The Canadian Dollar (CAD) is stuck within a tight intraday range on Wednesday as broader markets pivot to focus on Thursday’s upcoming US Consumer Price Index (CPI) inflation print for December. Rate-cut-hungry markets will be looking for continued easing in price growth pressures from the US, but market forecast models are currently expecting a slight uptick in headline inflation figures.

Crude Oil caught a short-lived bounce on Wednesday, fueled by ongoing Middle East tensions and a fresh round of attacks on cargo ships by Houthi rebels. West Texas Intermediate (WTI) US Crude Oil fell back on the day after the Energy Information Administration (EIA) showed another surprise buildup in US Crude Oil stockpiles. The Canadian Dollar is getting less support from rising but choppy Crude Oil prices than usual as currency markets hunker down ahead ofUS CPI inflation.

Daily digest market movers: Canadian Dollar hamstrung in the midrange

- A quiet Wednesday for the Loonie with no further Canadian data releases on the economic calendar docket for the week.

- Canadian Dollar traders will be looking out for Canadian CPI inflation and Retail Sales next week, on Tuesday and Friday, respectively.

- US CPI inflation will dominate headlines and price action this week and is slated for release on Thursday.

- Broader markets are keeping an eye out for any data that will help tilt the Federal Reserve (Fed) into a rate-cutting cycle sooner rather than later.

- Thursday’s MoM US CPI from December is forecast to tick upward slightly from 0.1% to 0.2%.

- Annualized December CPI is also expected to shift from 3.1% to 3.2%.

- December’s MoM Core US CPI is forecast to hold steady at 0.3%, while the annualized Core CPI is seen ticking down from 4.0% to 3.8%.

- An upside beat to inflation data bodes poorly for the market’s rate-cutting hopes, could sever risk appetite if inflation continues to run above expectations.

- US CPI Preview: Forecasts from 10 major banks

- Crude Oil continues to struggle, rising and falling back as supply concerns centered around Middle East tensions play tug-of-war with downside pressure from rising US barrel counts.

- EIA US Crude Stocks climbed by 1.338 million barrels for the week ended January 5 versus the expected drawdown of 675K barrels, taking a chunk out of the previous week’s 5.5 million barrel drawdown.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.20% | -0.09% | -0.06% | -0.07% | 0.94% | 0.29% | -0.05% | |

| EUR | 0.20% | 0.11% | 0.13% | 0.14% | 1.14% | 0.48% | 0.17% | |

| GBP | 0.08% | -0.11% | 0.02% | 0.03% | 1.03% | 0.37% | 0.03% | |

| CAD | 0.06% | -0.13% | -0.03% | 0.01% | 1.01% | 0.35% | 0.03% | |

| AUD | 0.06% | -0.15% | -0.04% | -0.02% | 0.99% | 0.33% | 0.00% | |

| JPY | -0.93% | -1.13% | -1.03% | -1.01% | -1.01% | -0.68% | -0.97% | |

| NZD | -0.28% | -0.49% | -0.38% | -0.35% | -0.34% | 0.65% | -0.34% | |

| CHF | 0.03% | -0.15% | -0.05% | -0.02% | 0.01% | 0.98% | 0.34% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar skews sideways as markets mix in US CPI run-up

The Canadian Dollar (CAD) is mixed against the major currencies cadre on Wednesday, shedding a little less than a fifth of a percent against the Euro (EUR) but gaining about three-tenths of one percent against the New Zealand Dollar (NZD). The CAD has also climbed around a full percent against the battered Japanese Yen (JPY) thanks to a broad-market sell-off in the Yen.

The USD/CAD pair is swamped just below 1.3400, with intraday pressure skewing to the downside as the Loonie-Greenback pairing middles. Near-term price action remains buoyed by the 200-hour Simple Moving Average (SMA) near 1.3325, and bidders will be looking for continued support from a pattern of intraday higher lows driving the pair into the top end in early 2024 trading.

Daily candlesticks have the USD/CAD bid facing a slowdown of bullish momentum from the 1.3400 handle, and a technical ceiling is forming up near 1.3500 as the 50-day SMA heads for a bearish cross of the 200-day SMA. With topside action capped, a pullback could see the pair heading back into December’s lows near the 1.3200 handle.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- DXY Index registers minor losses, trading around 102.40.

- Investors are on standby awaiting CPI figures to be released on Thursday.

- Lower US yields limit the US Dollar advance.

The US Dollar (USD) observed modest losses on Wednesday, trailing at 102.4 in the US Dollar Index, as market participants stick to the sidelines awaiting drivers. The trading floors were relatively quiet with no significant reports fuelling reactions during the session. The focus is set on the release of the US Consumer Price Index (CPI) from December, due on Thursday.

For now, markets are betting on five rate cuts in 2024, largely dismissing the Federal Reserve (Fed) forecast of only 75 bps of easing. Strong labor market data from the US economy was largely offset by a weak US ISM PMI print, so December’s CPI reading will play a big role in shaping expectations of the central bank’s easing calendar.

Daily digest market movers: US Dollar edges lower on quiet Tuesday, Fed Williams will be on the wires

- The US economy demonstrates continued expansion above trend with Q4 and possibly Q1 growth, bolstered by loose financial conditions.

- The US Dollar remains vulnerable as market easing expectations for the Federal Reserve remain high yet unmet. Fed’s Williams will be on the wires by the end of the American session, which may move markets.

- For Thursday, the December Consumer Price Index is projected to come in at 3.2% YoY, above the previous 3.1%. The core annual reading, however, is expected at 3.8%, easing from 4% in November.

- US bond yields, specifically for the 2, 5 and 10-year bonds, are on a downward trajectory. The yields are seen at 4.35%, 3.96% and 4.02%, which should limit upside for the USD.

- Market anticipations gauged through the CME FedWatch Tool suggest a hold on rates in the upcoming January meeting is priced in. Cuts in interest rates are, however, expected around March and May 2024.

Technical Analysis: DXY bulls are undecided as sellers sit just around the corner

The indicators on the daily chart reflect a decrease in buying momentum and increase in selling pressure. The Relative Strength Index (RSI), which is on a negative slope and in negative territory, suggests that bears are around the corner.

In addition, a decreasing histogram of green bars in the Moving Average Convergence Divergence (MACD) indicator confirms the growing bearish sentiment, indicative of a decrease in bullish momentum. Despite bulls taking a breather, they still are struggling to make a decisive upward move.

This lack of bullish momentum is also confirmed by the position of the index in relation to the Simple Moving Averages (SMAs). While it remains above the 20-day SMA, it is under the broader 100 and 200-day SMAs, suggesting bears are maintaining a bullish grip on the larger time horizon.

Support levels: 102.30, 102.00 (20-day SMA), 101.80.

Resistance levels: 102.70, 102.90, 103.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Swiss Franc declines versus the Pound Sterling after BoE governor Bailey insists on significance of lowering inflation.

- Bailey said households were coping better than expected and wages were rising.

- The GBP/CHF gains for seventh consecutive day, extending its recovery.

The Swiss Franc (CHF) weakens against the Pound Sterling (GBP) for the seventh day in a row on Wednesday as the Governor of the Bank of England (BoE), Andrew Bailey, testifies before members of Parliament at the UK Treasury Select Committee.

Overall market sentiment is positive, with the Dow Jones Industrial Average and S&P 500 both edging higher at the time of writing. This marginally aids the Pound more than the safe-haven Swiss Franc.

Daily digest market movers: Swiss Franc trades lower versus the Pound Sterling as Bailey emphasizes inflation prerogative

- The Swiss Franc loses ground against the Pound as BoE’s Bailey reiterates the importance of returning inflation to target at a Treasury Select Committee meeting.

- UK households with mortgages are nowhere near as stretched as during the global financial crisis and household incomes in the UK have risen in recent months, says Bailey.

- This suggests the BoE is unlikely to cut interest rates anytime soon, a stance that contrasts with most other central banks, including the Federal Reserve, which is eyeing cuts in 2024.

- The Chairperson of the Swiss National Bank (SNB), Thomas Jordan, however, sidestepped questions from journalists about when and whether the SNB was considering cutting interest rates in Switzerland at the December meeting of the bank.

- The two central banks have similar stances at the moment, although inflation is higher in the UK, perhaps indicating the Pound could strengthen longer term.

Swiss Franc technical analysis: GBP/CHF short-term recovery extends

GBP/CHF – the number of Swiss Francs (CHF) that one Pound Sterling (GBP) can buy – rises for the seventh consecutive day, extending the short-term recovery rally.

The pair is in no clear trend on any time frame, however, and despite the recovery rally entering its seventh day, even the short-term trend is debatable.

-638405001148583533.png)

Pound Sterling vs Swiss Franc: 4-hour Chart

Analyzing GBP/CHF’s short-term trend using the 4-hour chart gives a mixed picture. Whilst the peaks and troughs are rising in a month-long series of higher highs and lows ever since the late November lows, the pair still has not broken above the critical 1.0900 level (last key lower high of the prior downtrend), which would provide more confidence that the trend had flipped from down to up.

The Relative Strength Index (RSI) is rising in line with price, suggesting the uptrend retains underlying strength. It has not entered the overbought region, which would indicate a growing risk of a pullback.

A further indication of strength is that it has broken above the 50 and 100 four-hour Simple Moving Averages (SMA).

That said, the speed of the move higher since the November lows has been rather slow when compared to the down move that preceded it – a sign this recovery could merely be a pullback within a broader downtrend.

A break below 1.0794 would suggest a recapitulation and the beginning of a new leg lower. A break above the day’s highs would suggest a continuation higher to just below the key 1.0900 level. A break above that would confirm a change in trend and more upside.

Swiss Franc FAQs

What key factors drive the Swiss Franc?

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

Why is the Swiss Franc considered a safe-haven currency?

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

How do decisions of the Swiss National Bank impact the Swiss Franc?

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

How does economic data influence the value of the Swiss Franc?

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

How does the Eurozone monetary policy affect the Swiss Franc?

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

With the potential for Fed rate cuts, the Canadian Dollar (CAD) is set to extend its gains, economists at Société Générale report.

Scandies are due for rehabilitation

The most interest rate sensitive developed-economy currencies are the ones sensitive to housing.

Lower Fed rates will help CAD extend recent modest gains and should also help SEK and NOK recover after a dire performance as rates rose.

The Scandinavian currencies will over-react to every twist and turn in risk sentiment, and NOK will remain sensitive to oil prices, but over time, both are due rehabilitation. If nothing else, they have gone very expensive tourist destinations to much more affordable ones, which will further help already sizeable current account surpluses, especially when Northern Hemisphere evenings start to lengthen on the fjords.

Dollar has started 2024 on the front foot. Economists at Rabobank analyze EUR/USD outlook for the coming months.

EUR to perform poorly in the months ahead

Despite this year’s adjustment in market pricing, in our view, investors are still too optimistically positioned for Fed rate cuts. The market currently sees scope for a 64 bps reduction in the Fed funds target on a 6-month view. We expect further correction in this outlook and consequently expect the USD to see some support on a 1-to-3-month view.

Additionally, we expect the EUR to perform poorly in the months ahead largely on the back of weakness in the German economy.

We see scope for EUR/USD to dip to 1.05 on a 3-month view before the impact of Fed rate cuts boosts risk appetite and weakens the USD in the second half of the year.

The US Bureau of Labor Statistics (BLS) will release the most important inflation measure, the US Consumer Price Index (CPI) figures, on Thursday, January 11 at 13:30 GMT. As we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming United States inflation print for December.

Headline CPI is expected to pick up a tick to 3.2% year-on-year while core is expected to fall two ticks to 3.8% YoY. On a monthly basis, headline inflation is seen at 0.2% while core CPI is expected at 0.3% for the second consecutive month.

TDS

We look for core inflation to slow down to 0.1% MoM from 0.3% in Nov, with the headline likely strengthening a tenth to 0.2%. Our unrounded core CPI forecast at 0.14% MoM suggests it will be a close call between a 0.1% and a 0.2% gain. The report is likely to show that used vehicle prices were a large drag on inflation, while OER/rents are expected to head modestly lower.

Deutsche Bank

We expect headline CPI (0.26%) to come in roughly in line with core (0.28%). This would equate to 3.9% and 3.3% YoY, a tenth ahead of consensus. We were at 4.0% and 3.1% last month. So core is not yet breaking through 3% on the downside and the 3 and 6m annualised rates are also likely to stay slightly above this mark.

ANZ