- Analytics

- News and Tools

- Market News

Новини ринків

- The AUD/NZD pair is struggling to develop momentum as the Antipodeans both sink.

- New Zealand economic data is 0-for-2 in the back half of the trading week as NZ PMI declines.

- Early Friday sees RBA Monetary Policy Statement release, set to confirm dovish stance.

The AUD/NZD has fallen back into the 1.080 region as the Aussie (AUD) wins the slow race between itself and the Kiwi (NZD) for weakest links in Thursday trading, with both currencies either declining or seeing all gains erased on the day.

The Aussie slid into a three-week low against the Kiwi heading into the Friday trading session, and the AUD has closed in the red for five of the last six consecutive trading days.

Australia: RBA is seen keeping rates unchanged in December – UOB

After the Reserve Bank of Australia (RBA) struck a dovish tone at their last meeting despite delivering a 25 basis point rate hike, Aussie traders are racing each other to the exist as the Australian central bank looks set to grapple with a weak economic outlook for the immediate future. The RBA stood pat on interest rates for the previous four consecutive meetings, and concerns are rising that even with the weak economic outlook, the RBA isn't doing enough to effectively combat inflation that keeps proving stickier than the central bank is willing to accept.

On the Kiwi side, NZ Purchasing Managers' Index figures for October continued to decline, printing at 42.5 compared to September's showing of 45.3 as operators expect worsening economic conditions moving forward.

New Zealand Business PMI eases to 42.5 in October vs. 45.3 prior

The RBA is set to release their latest Monetary Policy Statement, which will do little for AUD investors but highlight the Australian central bank's dovish stance.

AUD/NZD Technical Outlook

The Aussie-Kiwi pairing has tumbled back into the bearish side of the 200-day Simple Moving Average (SMA) and the 50-day SMA is cycling close by, adding technical resistance from Thursday's peak bids near 1.0810.

Further downside will see the pair set for an extension into October's low bids near 1.0640, and there's little technical support to provide the AUD need lift in the chart paper if bears continue to apply pressure.

Australian Dollar price this week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.59% | 1.23% | 1.07% | 2.34% | 1.22% | 1.74% | 0.43% | |

| EUR | -0.59% | 0.65% | 0.48% | 1.74% | 0.63% | 1.13% | -0.16% | |

| GBP | -1.25% | -0.67% | -0.17% | 1.11% | -0.02% | 0.49% | -0.82% | |

| CAD | -1.08% | -0.49% | 0.17% | 1.26% | 0.14% | 0.65% | -0.66% | |

| AUD | -2.39% | -1.78% | -1.14% | -1.28% | -1.15% | -0.61% | -1.95% | |

| JPY | -1.24% | -0.64% | -0.20% | -0.14% | 1.11% | 0.47% | -0.78% | |

| NZD | -1.76% | -1.15% | -0.49% | -0.66% | 0.61% | -0.52% | -1.32% | |

| CHF | -0.44% | 0.16% | 0.81% | 0.64% | 1.90% | 0.78% | 1.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/NZD Daily Chart

AUD/NZD Technical Levels

The Business NZ Performance of Manufacturing Index (PMI), also known as the New Zealand Manufacturing PMI came in at 42.5 in October from September’s print of 45.3.

“Today’s PMI is not a good look for GDP and employment growth. Our GDP forecasts already include a decline in the manufacturing sector in the second half of 2023. There’s a chance that decline is bigger than we think if the PMI does not bounce in the final months of the year”, said BNZ Senior Economist Doug Steel.

Market reaction

As of writing, NZD/USD is trading at 0.5894, losing 0.10% on the day.

- NZD/USD continues its downward trend, touching the 0.5890s amid a hawkish pivot from the US Federal Reserve Chair.

- Market expectations for a Fed rate cut shift further into 2024, reflecting in a 0.35% rise in the US Dollar Index.

- New Zealand's Business PMI contraction adds to economic headwinds, with potential implications for a deeper manufacturing sector decline.

NZD/USD drops to a four-day low, extending its losses in the week to more than 1.70%, and exchanges hands at around 0.5890s as the Asian session begins.

Kiwi's weekly decline exceeds 1.70%, with the USD gaining on Fed Chair's comments and rising Treasury yields

The US Federal Reserve Chair Jerome Powell pushed back against market participants' dovish perception following the US central bank decision to hold rates on November 1. He said that Fed officials “are not confident” the policy is sufficiently restrictive. Powell reiterates the Fed “is committed to achieving a stance of monetary policy” that could bring inflation down to its 2% goal.

The swaps market scaled back expectations the Fed would cut rates from May to June 2024 as US Treasury bond yields rose ten basis points. The US Dollar Index (DXY), which measures the Greenback’s value against a basket of peers, climbs 0.35%, and stands at 105.89.

Earlier before Wall Street opened, the US Bureau of Labor Statistics (BLS) revealed that unemployment claims for the week ending November 4 rose 217,000, below forecasts of 218,000 and the previous reading of 220,000. Continuing claims, which track the number of people already receiving government unemployment benefits, increased to 1’834,000 million, above the 1’820,000 until October 28.

The New Zealand economic docket recently featured Business PMI for October at 42.5, below September’s 45.3. According to the Bank of New Zealand, “GDP forecasts already include a decline in the manufacturing sector in the second half of 2023. There’s a chance that decline is bigger than we think if the PMI does not bounce in the final months of the year."

NZD/USD Technical Levels

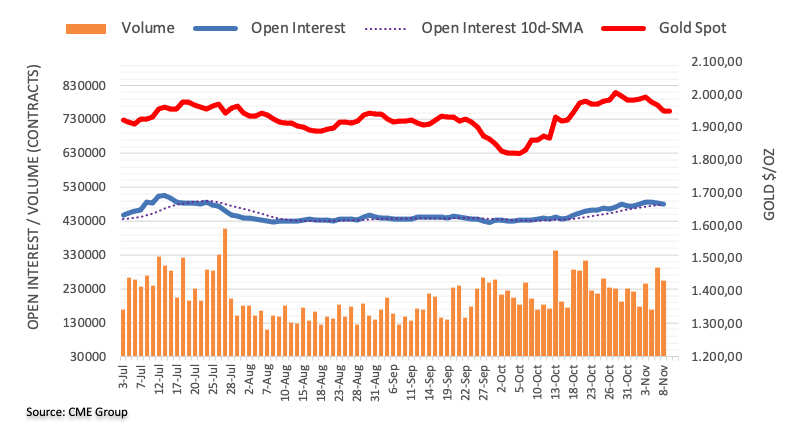

- Gold price gains ground around $1,958 despite the firmer USD.

- Hawkish comments from Federal Reserve (Fed) Chair Jerome Powell boost the US Dollar and US Treasury bond yields.

- The escalating tensions in the Middle East might cap gold's downside.

- Gold traders will monitor the US University of Michigan Consumer Sentiment survey for fresh impetus.

Gold price (XAU/USD) snaps the three-day losing streak during the early Asian session on Friday. The rise of geopolitical tension in the Middle East lifts safe-haven assets like gold, despite the higher US Treasury bond yields. The gold price currently trades around $1,958, gaining 0.03% on the day.

Meanwhile, the US Dollar Index (DXY) surges to 105.90 following the hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell. The US Treasury bond yields also edge higher, with the 10-year yield staying at 4.65% and the 2-year yield reaching 5%.

Late Thursday, Fed Chair Jerome Powell said they are not confident that they have achieved a sufficiently restrictive policy to bring inflation down to 2 percent over time. Powell further stated that if it’s appropriate to tighten policy further, the Fed will not hesitate. However, the Fed does not make a decision now about a significant bond tightening, but it is not going to ignore it. That being said, the hawkish comments from Fed Powell might boost the US Dollar (USD) and cap the upside of the Dollar-denominated gold.

On the other hand, the elevated geopolitical risks in the Middle East might lift the safe-haven gold. The White House said on Thursday that Israel has agreed to halt military operations in parts of north Gaza for four hours each day, but there was little evidence of a lull in the war.

Investors will keep an eye on the Fed's Logan speech, the preliminary US Michigan Consumer Sentiment Index for November, and UoM 5-year Consumer Inflation Expectation. These events could give a clear direction to gold price.

- The AUD/JPY is backsliding after seeing a rejection from the 97.00 handle.

- Aussie bidders are getting washed out of the market, pushing the AUD down across the board.

- Intraday momentum is firmly pinned into the bearish side.

The AUD/JPY is seeking out further downside as the Aussie markets tilt firmly into the bearish side heading into the Friday market session.

The Aussie's (AUD) near-term bullish stance from last week is cracking into pieces, marking in a technical ceiling against the Yen (JPY) after a failed push into 97.60 sees the AUD/JPY dumping chart paper. Bids have tumbled below the 200-hour Simple Moving Average (SMA) as intraday momentum rotates into bear country.

Bids are seeing near-term friction from the 96.40 region, but a short-side continuation will see the AUD/JPY extending downwards into the 96.00 handle.

The 50-hour SMA is falling back into the longer moving average but still remains on the top side, and a bearish confirmation could see any bullish pullbacks primed for a continuation lower if bidders don't step into markets and recover the AUD heading into the week's market close.

AUD/JPY Hourly Chart

AUD/JPY Daily Chart

AUD/JPY Technical Levels

- GBP/JPY sees a decline of 0.24%, as Yen is boosted following Fed Chair Powell's hawkish remarks.

- The daily chart portrays the pair as neutral, tilted to the upside, with the Kumo below price action.

- Key support levels loom below, with the Tenkan-Sen at 183.62 and the Kijun-Sen at 183.36, while a rebound above 186.00 could reignite bullish momentum.

The GBP/JPY failed to gain traction on Thursday, posting losses of 0.24% amid hawkish comments from the US Federal Reserve Chair Jerome Powell on an International Monetary Fund (IMF) event. Hence, the safe-haven status of the Japanese Yen (JPY) benefitted, a headwind for the Pound Sterling (GBP). At the time of writing, the cross-pair is trading at 184.97 after hitting a daily high of 185.89.

The pair is neutral but slightly tilted to the upside due to price action remaining above the Ichimoku Cloud (Kumo). A narrow width of the Kumo, along with price action failing to register a successive series of higher lows and higher highs, indicate the cross might be subject for a pullback.

Despite that, if GBP/JPY buyers reclaim 186.00, that could open the door for challenging the year-to-date (YTD) high at 186.76. On the other hand, a drop below 184.00, key support levels would emerge.

The first support would be the Tenkan-Sen at183.62, followed by the Senkou-Span A at 183.49, followed by the Kijun-Sen at 183.36. Once those levels are cleared, the 183.00 psychological figure would be up next

GBP/JPY Price Analysis – Daily Chart

GBP/JPY Technical Levels

- The AUD/USD accelerated intraday losses on Thursday.

- RBA's Monetary Policy Statement due early in the Friday session.

- Hawkish comments from Fed Chairman Powell driving US Dollar flows.

The AUD/USD backslid on Thursday after a bullish rebound failed to materialize, with Aussie (AUD) bulls getting pushed away from the table by US Dollar (USD) flows that saw the Greenback rise after Federal Reserve (Fed) Chairman Jerome Powell delivered hawkish comments that caught the market off-guard.

Forex Today: Hawkish Powell boosts the Dollar and ends positive Streak in Wall Street

The Reserve Bank of Australia (RBA) has developed into a question mark for markets following Tuesday's dovish rate hike. Despite a 25 basis point hike, the RBA appears hesitant on the back of softening data from the Australian economy, and investors are going to have a more difficult time successfully drawing a bead on where the RBA might step next.

Australia: RBA is seen keeping rates unchanged in December – UOB

Fed Chair Powell struck a surprisingly hawkish tone during a speech late Thursday, where the Fed head noted that the Fed has some concerns that they may not have achieved a suitably restrictive policy level in order to constrain inflation low enough, soon enough. Markets have broadly overloaded on their bets that the Fed has reached the end of its tightening cycle, and investors will have to grapple with a US central bank leaning heavier than most expected.

Fed’s Powell: We are not confident we are at a sufficiently restrictive stance

AUD/USD Technical Outlook

The Aussie's bull run from last week looks truly over as the AUD/USD pares back all gains and sends the Greenback back on top. The AUD/USD is now falling below near-term median prices below the 200-hour Simple Moving Average (SMA) currently rotating into 0.6420, and the 50-hour SMA is set to confirm a bearish crossover of the longer moving average as price action accelerates into the downside.

The AUD/USD is now threatening to collapse back into a rough consolidation range that plagued intraday action through October's trading, while a bullish recovery will first need to develop enough momentum to re-crack the 0.6400- handle.

AUD/USD Hourly Chart

AUD/USD Technical Levels

- NZD/JPY met resistance at a daily high of around 89.863 and then declined towards 89.245.

- Indicators turned flat in positive territory on the daily chart.

- The cross is still bullish in the long term as it trades above the 20, 100 and 200-day SMAs.

The NZD/JPY failed to hold its momentum, which took the cross to a multi-week high of around 89.865 and then closed at around 89.200.

The technical analysis of the daily chart suggests a shift towards a neutral to a bearish outlook for NZD/USD, with indicators flashing signs of bullish exhaustion. The Relative Strength Index (RSI) maintains a flat slope above 50, while the Moving Average Convergence (MACD) presents lower green bars. On the four-hour chart, the bearish momentum is more evident, with the RSI and MACD plunging into the negative zone.

That said, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating a favourable position for the bulls in the bigger picture. In addition, the 100-day SMA seems to be converging towards the 20-day average to perform a bullish cross in the 88.150-88.300 area, which could reignite the momentum for the buyers in the short term.

Support levels: 89.000, 88.700,88.500.

Resistance levels: 89.500, 89.850, 90.000.

NZD/USD Daily Chart

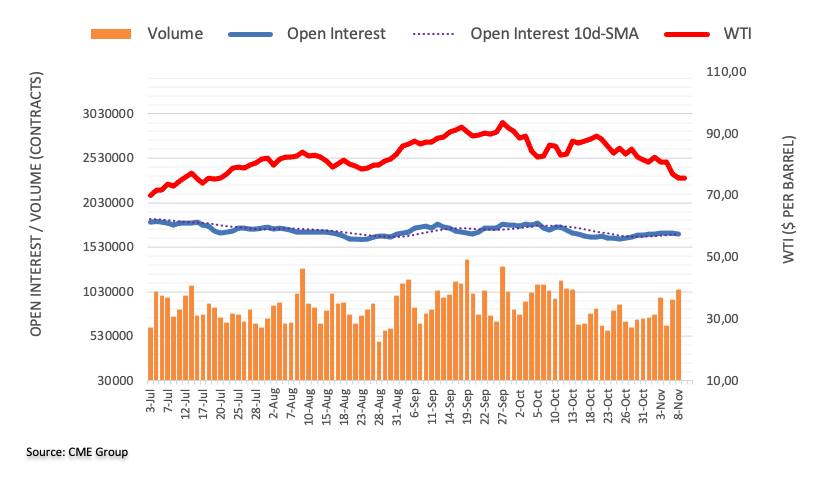

- Crude Oil saw a minor relief bid on Thursday before getting pushed back down.

- WTI ticked into $77.00 before slipping back to $75.00.

- US hits all-time highs on Crude Oil production.

West Texas Intermediate (WTI) Crude Oil continues to get pushed into recent lows as barrel bids struggle to find the floor on bearish price pressures.

WTI climbed Thursday, recovering the $77.00 handle before getting pushed back down towards $75.00 in the back half of the trading day.

the overarching market narrative of chronic undersupply that has been shooting through energy markets are running up against a hard barrier as reality sets into Crude Oil markets; despite strategic, long-running cuts from oil-producing nations, expectations of global undersupply are failing to materialize.

A lack of a surge in Crude Oil demand is certainly helping things as China's economy recovery continues to falter and oil demand remains much more tepid than most investors expected, but the US also hit an important milestone this week.

US Crude Oil production hit an all-time high in reporting figures, with the US pumping over 404 million barrels of oil through August according to data from the Energy Information Administration (EIA). This broke the US' previous barrel production record of 402 million barrels produced in December of 2019.

Monthly Crude Oil production in the US

WTI Technical Outlook

With Crude Oil falling back from the 50-hour Simple Moving Average (SMA) on the intraday charts, there's a real risk of a bearish extension if short sellers can push WTI back below the $75.00 handle.

WTI chart losses are accelerating away from the median, accelerating short momentum as price action drops away from the 200-hour SMA currently dropping into the $80.00 region.

WTI bids saw a rejection from the 200-day SMA last Friday, and technical resistance barriers are piling up in the near term, creating friction for any Crude Oil bidders looking to step into the markets.

WTI Hourly Chart

WTI Technical Levels

During the Asian session, the Reserve Bank of Australia will publish its Monetary Policy Statement following Tuesday's rate hike. The New Zealand BusinessNZ Manufacturing Index is due. Later in the day, the focus will shift to UK growth data and the University of Michigan Consumer Sentiment survey.

Here is what you need to know on Friday, November 10:

The US Dollar jumped on Thursday after Federal Reserve Chairman Jerome Powell's hawkish remarks. Powell expressed that they are not confident that they have achieved a "stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time".

Powell's comments further boosted US yields, which were already rising due to a weak 30-year bond auction. The 10-year yield reached 4.65%, and the 2-year yield surpassed 5%. The US Dollar Index climbed toward 106.00. Stocks in Wall Street dropped, ending a seven-day positive streak.

US data showed that Initial Jobless Claims totaled 217,000 in the week ending November 4, while Continuing Claims rose for the seventh consecutive week to 1.83 million, the highest level since mid-April. On Friday, the University of Michigan Consumer Sentiment survey is scheduled for release.

EUR/USD dropped to test the weekly low area around 1.0660. The pair is moving with a bearish bias ahead of the Asian session, driven by a stronger US Dollar.

GBP/USD continued to decline for the fourth consecutive day, falling towards 1.2200. The Pound faces a critical day with the release of UK economic data on Friday, including Q3 Gross Domestic Product growth and September industrial production. The forecast suggests a 0.1 percent contraction during the fifth quarter.

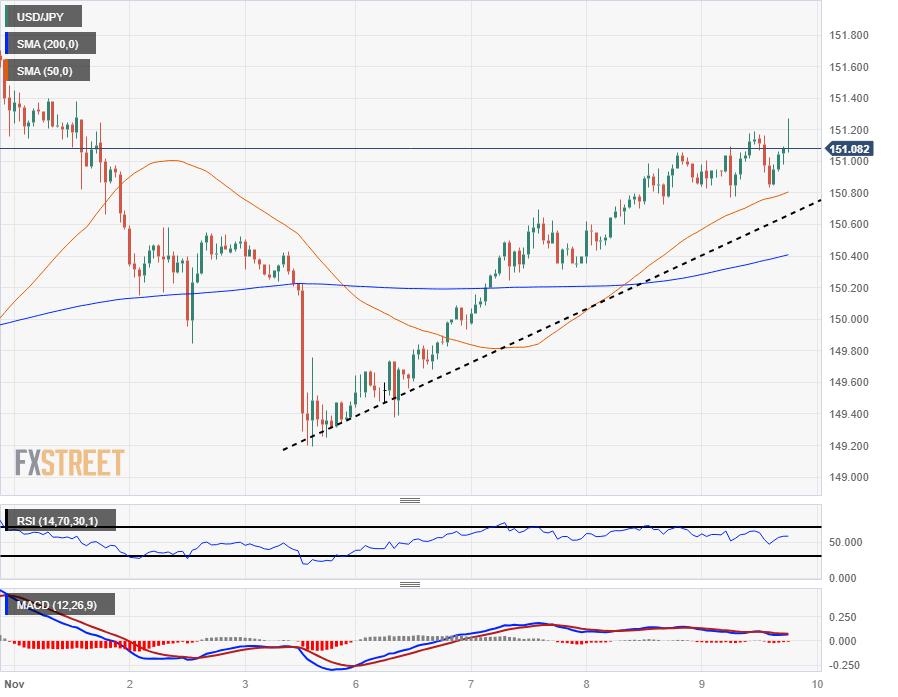

USD/JPY rose boosted by higher yields, climbing above 151.50. Further gains are likely to put Japanese authorities on alert.

AUD/USD tumbled to the 20-day Simple Moving Average (SMA) at 0.6370. The pair continues to give up last week's gains. The Reserve Bank of Australia (RBA) will release its Monetary Policy Statement after raising the official cash rate (OCR) by 25 basis points on Tuesday.

NZD/USD failed to hold onto gains and struggled to stay above 0.5900, affected by risk aversion and the strength of the US Dollar. The BusinessNZ Manufacturing Index is due on Friday.

The correlation between gold and US yields has deteriorated in recent sessions. On Thursday, the yellow metal remained relatively steady when yields jumped. XAU/USD posted gains, ending around $1,955, while Silver flirted with $23.00 but retraced back to $22.55.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD retreats from 1.0725, as Fed Chair Powell's comments and higher bond yields strengthen the US Dollar.

- Powell's hawkish shift, emphasizing the need for potentially tighter monetary policy, propels the Dollar Index by over 0.30%.

- The EUR/USD's technical analysis suggests a continued downtrend, with key levels to watch at 1.0659 and the 50-DMA at 1.0624, while a move above 1.0700 could signal an upward correction.

EUR/USD retreats from daily highs reached at 1.0725, dives some 0.37% as the Greenback was underpinned by hawkish remarks of Federal Reserve Chairman Jerome Powell and elevated US Treasury bond yields following a 30-year bond auction. The EUR/USD is trading at 1.0666.

EUR/USD drops on a hawkish Federal Reserve outlook and a spike in US Treasury yields

Jerome Powell turned hawkish on Thursday, commented they’re not confident the Fed’s monetary policy is sufficiently restrictive, and said they would not hesitate to tighten monetary conditions if needed. Powell said they will carefully decide meeting-by-meeting and adding that inflation remains well above the 2% target despite slowing down.

Powell’s remarks spurred a jump in US Treasury bond yields of more than 10 basis points along the whole curve, while the American Dollar (USD) climbs as the US Dollar Index is gaining more than 0.30%, up at 105.91.

Data in the United States (US) showed that Initial Jobless Claims in the United States for the week ending November 4, rose by 217K, below estimates of 218K, and last week’s 220K. Even though the data paints a tight labor market, last Friday’s Nonfarm Payrolls report showed the economy added 150K jobs, below forecasts of 180K, while witnessing a jump in the unemployment rate to 3.9%.

Across the pond, recent data from the Eurozone (EU) portrays a stagflationary scenario, with business activity on the manufacturing side and industrial production slowed. Nevertheless, the rise in German yields is capping the EUR/USD recent fall after Powell’s remarks.

What to watch?

A scarce EU economic docket would feature a speech by the European Central Bank (ECB) President Christine Lagarde on Friday. The US calendar will feature the University of Michigan Consumer Sentiment and additional Federal Reserve speakers.

EUR/USD Price Analysis: Technical outlook

The daily chart shows that the EUR/USD downtrend is intact, with the pair testing the week's lows at around 1.0659. A breach of the latter could drag prices to the 50-day moving average (DMA) at 1.0624, before diving to 1.0600. On the flipside, the major could shift upward, if it reclaims 1.0700, followed by the November 6 high at 1.0756.

- The United Kingdom's Gross Domestic Product is foreseen posting a modest contraction in Q3.

- The Bank of England downgraded its forecast for economic growth in the November meeting.

- GBP/USD needs to recapture the 1.2400 mark and run past the 1.2427 peak to gain substantial upward momentum.

The United Kingdom (UK) will release the Q3 Gross Domestic Product (GDP) preliminary estimate on Friday. Ahead of the announcement, the Pound Sterling is under selling pressure against its American rival, with GBP/USD trading at around the 1.2300 level after peaking this month at 1.2427.

Market participants are trying to assess central bank announcements, as most banks have paused monetary tightening. The return from the Coronavirus pandemic had the unexpected effect of sending inflation to multi-decade highs globally, catching policymakers off-guard. As a result, central banks engaged in an aggressive monetary tightening in early 2022, which proved effective in taming price pressures well into 2023. However, inflationary levels remain above central banks’ targets, with worldwide policymakers reaffirming the battle against inflation is not over.

Yet, as Issac Newton said, every action has a reaction. Monetary tightening put pressure on economic growth, and fears of a global recession had been the main theme for over a year.

The United States (US) Federal Reserve and the Bank of England (BoE) have refrained from hiking rates in their last two meetings, as the risks to growth from super-high rates are far more concerning than inflation itself. The Fed benchmark rate currently stands at 5.25%-5.50%, while the BoE lifted the Bank Rate to 5.25%.

UK Gross Domestic Product forecast: What numbers could tell us

The Office for National Statistics (ONS) reported that the UK economy grew 0.2% QoQ in the previous quarter, compared with the 0.3% advance posted in the first quarter of the year. In the three months to June, the economy expanded 0.6% on year, improving from the previous 0.5%.

In its latest meeting, the Bank of England downgraded its forecast for economic growth. The BoE now expects GDP to grow just 0.1% in the last quarter of the year, while policymakers expect inflation to return to its 2% target by the end of 2025.

Meanwhile, the UK Consumer Price Index (CPI) remains among the highest within major economies. According to the latest ONS report, the CPI increased 6.7% YoY in September, the same rate as in August, while core inflation was marginally lower to 6.1% YoY from 6.2% in August.

Lacklustre growth in a high-inflation, restrictive-rates scenario should be no surprise. At this point, nobody doubts there will be a setback, with speculation rotating around whether major economies will face soft landings or steep economic downturns. The odds for a UK economic downturn are at 60% by the end of 2024, according to the National Institute of Economic and Social Research (NIESR).

When will the UK release Q3 GDP, and how could it affect GBP/USD?

The UK will release the Q3 Gross Domestic Product (GDP) preliminary estimate on Friday, November 10, at 7:00 GMT. The economy is expected to have shrunk 0.1% in the three months to September, while the annual comparison is foreseen at 0.5%, slightly below the 0.6% posted in the second quarter of the year. On a monthly basis, the GDP is foreseen at -0.1% in September, declining from 0.2% in August.

An outcome aligned with the market’s expectations should reaffirm the BoE’s decision to stay put. Tepid growth, and even more a slight economic contraction, somehow grants caution among policymakers, now pledging to keep rates higher for longer.

Nevertheless, financial markets anticipate roughly 75 basis points (bps) rate cuts by mid-2024, despite BoE Governor Andrew Bailey repeating on Wednesday that officials need to keep fighting inflation and that monetary policy will need to be restrictive for an extended period. His words followed comments from Chief Economist Huw Pill, who said that a rate cut by 2024 “doesn't seem totally unreasonable,” lifting the odds for a cut from 30 bps to the aforementioned 75 bps.

Sterling Pound buyers will likely welcome an upbeat surprise, although the chances of such a scenario are limited. Should the outcome miss expectations, GBP/USD would fall, particularly considering the US Dollar is somehow stronger ahead of the event.

Valeria Bednarik, Chief Analyst at FXStreet, says: “After bottoming at 1.2037 in October, GBP/USD is looking to turn north, although US Dollar bulls are fighting back. The pair has a long way to go before turning north, as the wider perspective keeps the risk skewed to the downside. A bearish 100 Simple Moving Average (SMA) in the weekly chart provided dynamic resistance on the run past 1.2400, rejecting the pair. Furthermore, technical indicators in the mentioned time frame have lost their positive momentum within negative levels and are slowly resuming their slides.”

Bednarik adds: “The weekly low at 1.2241 offers immediate support, followed by the 1.2180 price zone. GBP/USD bulls will get discouraged if the pair slides below the latter, resulting in a firmer decline towards the aforementioned October low. The pair needs to recapture the 1.2400 threshold, and extend gains beyond the 1.2427 peak to increase the odds of a bullish continuation, with buyers then aiming to test the 1.2500 mark.”

Economic Indicator

United Kingdom Gross Domestic Product (MoM)

The Gross Domestic Product released by the National Statistics is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

Read more.Next release: 11/10/2023 07:00:00 GMT

Frequency: Monthly

Source: Office for National Statistics

GDP FAQs

What is GDP and how is it recorded?

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022.

Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

How does GDP influence currencies?

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency.

When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

How does higher GDP impact the price of Gold?

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

- The USD/NOK rose towards 11.219, seeing 0.30% gains.

- The US Treasury yields are rising after Powell’s hawkish words.

- Swaps markets are pushing rate cuts to June from May 2024.

- Weekly Jobless Claims from the US came in lower than expected.

The USD/NOK is finding some lift on Thursday's session and advanced to 11.219, seeing 0.35% gains. The daily market movers included hawkish bets on the Federal Reserve (Fed) after Jerome Powell’s words and rising US bond yields, which made the pair gain traction.

Chair Powell commented on Thursday that he is not confident that the Fed has achieved a sufficient restrictive stance and warned that stronger growth could undermine the progress on inflation. As a reaction, swaps markets are starting to price in higher interest rates for a longer period of time, which is making the USD gain traction as investors are pushing rate cuts from May to June of 2024. That being said, the odds of a hike in the December meeting are still low, and the CME FedWatch tool indicates that markets are only placing 10% odds of an increase.

In addition, US yields rose, which contributed to the strength of the USD. The 2,5 and 10-year rates show more than 1.50% gains standing at 5% and 4.60%, respectively.

On the data front, the weekly US Jobless Claims from the first week of November came in lower than expected but didn’t trigger any reaction on the pair. Markets focus will now shift to next week’s Consumer Price Index (CPI) figures from the US from September.

USD/NOK Levels to watch

Based on the daily chart, USD/NOK maintains a bullish outlook for the short term, as indicators have gathered enough momentum on the daily chart which made the pair approach multi-month highs around 11.276. The Relative Strength Index (RSI) points north, above 50, while the Moving Average Convergence Divergence (MACD) prints higher green bars.

Supports: 11.105 (20-day SMA), 11.094, 11.085.

Resistances: 11.225, 11.2550, 11.276.

USD/NOK daily chart

-638351559197797908.png)

- The USD/CHF is catching some bids to reclaim the 0.9000 handle.

- Hawkish statements from Powell are helping to bid the US Dollar late Thursday.

- Friday set to close out the trading week with US consumer sentiment reading.

The USD/CHF is marching itself back over the 0.9000 handle in Thursday's trading as the US Dollar (USD) grinds higher on a relatively quiet trading day. Market sentiment is drawing taught as investors react to headlines as they roll out.

US Federal Reserve (Fed) Chairman Jerome Powell made some surprisingly hawkish comments while participating in a panel discussion at the Jacques Polak Annual Research Conference, in Washington DC.

Fed Chair Powell focused on the risk of factors that could spark inflation again, with labor markets remaining tight and GDP growth moderating, albeit slowly.

USD/CHF Technical Outlook

The US Dollar's intraday spike on Thursday has sent the USD/CHF back over the 200-hour Simple Moving Average (SMA) as the pair rotates out of a near-term bearish stance. The immediate target for bullish momentum will be the 0.9100 handle, a price level the pair lost after declining from November's early bids.

The USD/CHF has reached its highest bids on the week, stepping closer to 0.9050. The pair's recovery from October's swing low into 0.8900 is seeing momentum recover to the bullish side, and the 50-day SMA is confirming a bullish cross of the longer 200-day SMA.

Monday's sharp decline into the 0.8950 region could see the USD/CHF etch in a higher low is upside momentum maintains through the remainder of the trading week.

USD/CHF Daily Chart

USD/CHF Technical Levels

Federal Reserve Chairman Jerome Powell said on Thursday that they are no confident that they have achieved a “stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time”. He is participating in a panel discussion on monetary policy challenges in a global economy organized by the International Monetary Fund.

Key takeaways:

My colleagues and I are gratified by this progress but expect that the process of getting inflation sustainably down to 2 percent has a long way to go.

The labor market remains tight, although improvements in labor supply and a gradual easing in demand continue to move it into better balance. Gross domestic product growth in the third quarter was quite strong, but, like most forecasters, we expect growth to moderate in coming quarters. Of course, that remains to be seen, and we are attentive to the risk that stronger growth could undermine further progress in restoring balance to the labor market and in bringing inflation down, which could warrant a response from monetary policy.

The Federal Open Market Committee (FOMC) is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time; we are not confident that we have achieved such a stance.

We know that ongoing progress toward our 2 percent goal is not assured: Inflation has given us a few head fakes. If it becomes appropriate to tighten policy further, we will not hesitate to do so.

We are making decisions meeting by meeting, based on the totality of the incoming data and their implications for the outlook for economic activity and inflation, as well as the balance of risks, determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time. We will keep at it until the job is done.

Market reaction

The US Dollar rose across the board after Powell’s initial comments. The DXY climbed toward daily highs near 105.80 and EUR/USD dropped back toward 1.0660.

- The USD/JPY is pushing higher on Thursday. testing territory north of 151.00.

- Late break in USD fueled by spike in US Treasuries.

- Japan trade balance data missed the mark, further eroding Yen.

The USD/JPY is twisting for further gains on Thursday, looking for further bids above the 151.00 handle.

A topside break in US Treasuries is seeing the US Dollar find a fresh round of bidding on Thursday, and the USD/JPY notched in a fresh intraday high near 151.30. Treasury yields knocked higher on reaction following lower-than-expected institutional demand in a 30-year US bond auction.

St. Louis Federal Reserve (Fed) President Kathleen Paese is also hitting newswires with concerns that overall public expectations may be misaligned with the current path of Fed policy moving forward. St. Louis Fed President Paese's comments are likely to have limited effect, with Paese acting as an interim replacement with no voting power in the Federal Open Market Committee (FOMC).

Japan Current Account figures failed to meet expectations early Thursday, with the non-seasonally-adjusted headline Current Account for September printing at JPY 2.723 trillion, falling short of the expected 3 trillion but still managing to squeeze out a small improvement over August's 2.279 trillion.

USD/JPY Technical Outlook

The Dollar-Yen pairing is currently in play around the 151.00 handle, looking for a topside continuation as the USD continues to push up and over the JPY.

Near-term action has the pair slowing down from its recent pace of bullish momentum, with the 50-hour Simple Moving Average (SMA) beginning to catch up to intraday bids, but the pair remains in a firmly bullish tilt with the 200-hour SMA down near 150.40, with enough space in between for a pullback to signal a potential bidding opportunity for investors looking to jump in and make a fresh challenge.

USD/JPY Hourly Chart

USD/JPY Technical Levels

- The DXY index slightly rose to 105.70.

- Jobless Claims from the first week of November 3 came in lower than expected.

- Fed’s Barkin delivered hawkish comments during the session. Still, bets on a hike in December are low.

The US Dollar (USD) is seeing gains against its rivals on Thursday, with the DXY Index ascending to 105.70. The Greenback price dynamics were set by strong Jobless Claims data and rising US bond yields, which seem to be limiting the downside for the USD. All eyes are now on Inflation next week, which could set the direction of the US Dollar in the short term.

Markets remain quiet this week as investors await fresh catalysts to place their bets on the next Federal Reserve (Fed) decision in December. Several officials were on the wires on Monday and Tuesday but didn’t provide any highlights. The focus seems to have turned to next week’s October inflation figures from the US. On Wednesday, Thomas Barkin commented that he wasn’t satisfied with the current inflation outlook, commenting that the job isn’t done.

Daily Digest Market Movers: US Dollar struggles to gain momentum despite Fed hawk’s rhetoric

- The US Dollar Index stands with mild gains at 105.70, with the bulls struggling to make a significant move.

- No high-tier reports will be released this week. Markets await next week’s inflation figures from the US and are still digesting last Friday’s US Nonfarm Payrolls report.

- The Initial Jobless Claims from the week ending November 3 came in at 217,000, lower than the expected 218,000 and fell in relation to its last reading of 220,000.

- As a reaction, the 2-year Treasury rate rose to 4.96%, while the longer-term 5 and 10-year rates increased to 4.55%, which seems to be limiting downside for the USD.

- Investors continue to be on the sidelines, awaiting high-tier reports to continue placing their bets on the next Fed decision.

- According to the CME FedWatch Tool, the odds of a 25-basis-point hike in December are extremely low, below 10%.

Technical Analysis: US Dollar Index momentum flatens, bears gather for downside

According to the daily chart, the technical outlook for the DXY Index remains neutral to bearish as the bulls are struggling to gather momentum with bears being around the corner. With a flat slope below its midline, the Relative Strength Index (RSI) suggests a period of stability in negative territory, while the Moving Average Convergence (MACD) displays stagnant red bars.

What gives the outlook neutrality is the index staying below the 20-day Simple Moving Average (SMA) but above the 100 and 200-day SMAs, indicating that the bulls still have the upper hand in the broader picture. As long as the bear manage to hold the index below this level, the index will remain vulnerable for further downside.

Support levels: 105.50,105.30,105.00.

Resistance levels: 105.80, 106.00, 106.10 (20-day SMA).

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- GBP/USD continues its downward trajectory, losing 0.25% despite conflicting comments from Bank of England's Chief Economist and Governor.

- US jobless claims outperform expectations, hinting at a resilient labor market and adding to the debate among Fed policymakers.

- The British Pound braces for the UK's Q3 GDP report while investors await insights from Fed Chair Powell's IMF panel discussion.

The British Pound (GBP) extended its losses against the US Dollar (USD), and for the fourth straight day, fell 0.25% after the pair hit a daily high of 1.2308. Nevertheless, dovish remarks by the Bank of England’s (BoE) Chief Economist Huw Pill on Tuesday, weakened the Pound due to rate cut speculations. The GBP/USD trades at 1.2249.

GBP/USD dips to 1.2249 amid mixed signals from BoE officials and a robust US job claims report

On Wednesday, BoE Governor Andrew Bailey poured cold water on Pill’s comments, regarding that market pricing a rate cut in August 2024 seemed reasonable, commenting that it’s too early to cut rates. Earlier in the European session, Huw Pill crossed the wires, backpedaling its Monday comments, and stated that monetary policy must stay tight to lower inflation.

Aside from this, unemployment claims in the United States (US) decelerated compared to the previous week’s Initial Jobless Claims report, which showed claims rising 220K, it came at 217K, below estimates of 218K. Even though the data paints a tight labor market, last Friday’s Nonfarm Payrolls report showed the economy added 150K jobs, below forecasts of 180K, while witnessing a jump in the unemployment rate to 3.9%.

Consequently, a division among the Federal Reserve’s policymakers has begun, with most members adopting a more neutral stance. Still, next week’s inflation report could shift current views on the FOMC’s members.

Recently, a US 30-year bond auction hit a yield of 4.769%, sending US Treasury bond yields soaring. Thus, the Greenback is solidly rising, with the US Dollar Index (DXY) gaining 0.19%, at 105.72.

Up next, the UK economic docket would feature the Gross Domestic Product (GDP) for Q3, which is expected to contract by 0.1% QoQ. On the US front, Fed Chair Jerome Powell would cross the wires on an International Monetary Fund (IMF) discussion panel.

GBP/USD Technical Levels

- EUR/GBP edges higher to 0.8724, marking a slight 0.08% increase, as it sustains momentum above the 200-day moving average.

- The pair's advance slows, indicated by a lower Average True Range, pointing to decreased market volatility.

- The next bullish milestones are set at the recent peak of 0.8754 and the psychological 0.8800 level, while a dip below 0.8700 could challenge the 200-DMA support.

The EUR/GBP rallies for the fourth straight day in the mid-North American session, gains a minimal 0.08%, trading at 0.8724 after hitting a daily low of 0.8693.

The cross-pair is upward biased once it reclaimed the 200-day moving average (DMA) at 0.8687. Nevertheless, the uptrend appears to have lost some steam, as the Average True Range (ATR) at 37 pips suggests volatility is shrinking.

For a bullish resumption, EUR/GBP buyers must reclaim the October 11 high at 0.8754, followed by the 0.8800 figure. On the other hand, if sellers’ step in and pull the exchange rate below 0.8700, that would open the door to test the 200-DMA at 0.8687, which would exacerbate a drop to the 50-DMA at 0.8653.

EUR/GBP Price Analysis – Daily Chart

EUR/GBP Technical Levels

- The EUR/JPY is squeezing into 161.80 as the Yen continues to slump against the Euro.

- ECB President Lagarde dual speeches today and tomorrow.

- Japan trade balance data missed expectations.

The EUR/JPY pinged another 15-year high as a recovering Euro (EUR) takes another step over the Japanese Yen (JPY).

European Central Bank (ECB) President Christine Lagarde will be delivering a speech today and a speech tomorrow; today's speech will be at the House of the Euro, a collaborative working space for different European central banks. No significant comments on monetary policy are likely at the event.

Meanwhile, President Lagarde's second showing in as many days sees the ECB head spending Friday participating in a 'fireside chat' at the Financial Times' Global Boardroom in London.

Japan Current Account figures missed the mark early Thursday, with the non-seasonally-adjusted headline Current Account for September coming in at JPY 2.723 trillion, flubbing the forecast 3 trillion but still squeaking out above August's 2.279 trillion.

EUR/JPY Technical Outlook

The Euro is grinding ever-higher into 15-year highs against the Yen, and technical patterns towards the topside are entirely absent. Technical framework is strictly limited to pullbacks and any recovery patterns in the Yen, should they ever come.

The pair saw some rough consolidation through the past four to five months, but the most recent bullish snap in the EuR/JPY is taking the pair further above the 50-day Simple Moving Average (SMA) currently rising from the 158.00 handle, while current price action soars far above median prices near the 200-day SMA currently rising into 152.00.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

- Canadian Dollar regains traction after getting knocked down by US Dollar rally.

- Canada economic calendar data has wrapped up for the week.

- Crude Oil softly bounces after getting pummeled.

The Canadian Dollar (CAD) is finally catching some relief, digging in its heels and clawing back losses from its three-day backslide against the US Dollar (USD). The Loonie is finding some bids as the Greenback eases slightly heading into the back half of the trading week.

There is little of note remaining on the economic calendar for Canada this week, and USD flows will be in the driver’s seat through Friday.

Fed officials delivered dovish comments, jobless claims were mixed, and investors await another appearance from Federal Reserve (Fed) President Jerome Powell later in the day.

Daily Digest Market Movers: Canadian Dollar bounces back as US Dollar slips

- The CAD is catching a mild relief rally on Thursday as broader markets trim USD bids.

- US Fed Presidents Harker and Barkin gave mildly dovish comments early Thursday, both see potential for downside risks.

- Fed Chairman Jerome Powell speaks later today, investors to be focusing intently.

- Crude Oil prices are finding a slight lift heading into the back half of the week.

- CAD discovers support from recovering Crude bids, accelerating the rebound.

- US Michigan Consumer Sentiment data on Friday to close out the trading week.

Technical Analysis: Canadian Dollar rebounds but shows some weak points

The Canadian Dollar (CAD) is finding enough bullish spark to push the USD/CAD pair back down the charts, but plenty of upside potential remains in the Greenback, and the pair is currently catching a recovery bounce from 1.3750.

1.3800 is set to be the main battleground for the back half of the trading week, with the pair slipping from an intraday high of 1.3807. A bearish continuation from this region will see a new technical ceiling baked into the USD/CAD.

Intraday action is getting hung up with returns to near-term medians. Most daily price action is sticking close to the 200-hour Simple Moving Average (SMA).

Daily candlesticks see the USD/CAD still on the high side of a higher low pattern firming up from a bullish bounce off the 200-day SMA back in late September. The last swing low saw a topside rebound from the 50-day SMA near 1.3650 just last week.

USD/CAD Daily Chart

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.00% | 0.07% | -0.19% | -0.23% | 0.11% | -0.58% | 0.03% | |

| EUR | 0.00% | 0.08% | -0.18% | -0.22% | 0.12% | -0.57% | 0.04% | |

| GBP | -0.09% | -0.08% | -0.27% | -0.32% | 0.03% | -0.66% | -0.06% | |

| CAD | 0.19% | 0.18% | 0.28% | -0.02% | 0.30% | -0.39% | 0.23% | |

| AUD | 0.24% | 0.25% | 0.31% | 0.05% | 0.35% | -0.34% | 0.26% | |

| JPY | -0.11% | -0.10% | -0.04% | -0.31% | -0.34% | -0.69% | -0.09% | |

| NZD | 0.55% | 0.60% | 0.65% | 0.36% | 0.34% | 0.66% | 0.62% | |

| CHF | -0.05% | -0.05% | 0.04% | -0.22% | -0.27% | 0.07% | -0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Gold prices rebound sharply from weekly lows, marking a 0.43% increase as traders digest the latest U.S. jobless claims report.

- A divided Federal Reserve and the anticipation of Chairman Powell's speech keep investors on edge, with a dovish tilt currently in the lead.

- The geopolitical tensions following the Hamas attack and subsequent Israeli military actions contribute to the safe-haven asset's appeal.

Gold price (XAU/USD) rebounds in early morning trading during the North American session, bounces from weekly lows of $1944.80, prints solid gains of 0.43%, and exchanges hands at $1958.00.

XAU/USD climbs to $1958 amid mixed Fed signals and a cautious bond yield recovery

Market sentiment is positive, with Wall Street shrugging off a solid employment report. Initial Jobless Claims revealed by the US Bureau of Labor Statistics (BLS) slowed to 217K last week, below expectations for a 218K increase and below the previous reading of 220K, snapping three weeks of consecutive exceeding previous numbers.

Meanwhile, US Treasury bond yields remain adrift to interest rate expectations and the Federal Reserve’s commentary. The split amongst Fed officials between saying that rates are already restrictive and the need for additional hikes is growing. Nevertheless, the doves appear to have the upper hand so far unless next week’s inflation report takes them off guard, along with market participants estimating the first rate cut toward the second half of 2024. In that regard, Fed Chairman Jerome Powell will cross the wires later at 19:00 GMT.

US Treasury bond yields halted their last week plunge and are climbing but failing to weigh on Gold prices. The US 10-year benchmark note increases five basis points (bps) up to 4.553%. On the other hand, the Greenback remains on the defensive, losing 0.02%, as shown by the US Dollar Index (DXY) sitting at 105.50.

Investors see 91% odds the Fed would keep rates unchanged, while the firs cut is foreseen at June 2024, with chances lying at 42%.

XAU/USD rallied since October 9, due to the Hamas attack on Israel, which escalated to a conflict that witnessed the Israeli army entering the Gaza Strip while the international community looked for a peaceful exit to the hostilities.

XAU/USD Price Analysis: Technical outlook

Gold’s daily chart portrays the yellow metal as neutral to upward biased despite dipping below the 20-day moving average (DMA), which sits at $1969.33. Once buyers reclaim the latter, XAU/USD’s uptrend could resume, as the $2000 figure would emerge as the next resistance. A breach of the latter would expose October’s high at $2009.42. On the other hand, if XAU/USD stays below $1970, XAU/USD could slip further and test the 200-DMA at $1934.70 before challenging the 100-DMA at $1926.84.

- The XAG/USD soared more than 1.50% to $22.90, just above the 20-day SMA.

- Amid hawkish words from Fed’s Barking, US yields are rising, which could limit the upside.

- Weekly Jobless Claims from the US came in lower than expected.

- A sour market mood an escalating tensions in the Middle East.

On Thursday, the XAG/USD spot price rose back above the 20-day Simple Moving Average, towards $22.90, seeing sharp gains. That being said, US yields rose after lower-than-expected US weekly Jobless Claims and hawkish words from the Federal Reserve’s (Fed) Thomas Barking, which may limit the upside for the rest of the session.

On the data front, the U.S. Department of Labor revealed that the Initial Jobless Claims from the week ending on November 4 missed the consensus. The people filling for unemployment benefits came in at 217,000, lower than the consensus of 218,000 and fell in relation to it last reading of 220,000. In addition, during the American session, Thomas Barkin commented that in his perspective, inflation is “too high” and that he isn’t convinced that it is not on a smooth path towards the 2% goal.

As a reaction, the US Treasury yields, often seen as the cost of holding non-yielding metal, are edging higher, with the 2,5 and 10-year yields advancing towards 4.96% and 4.55%, respectively. Still, according to the CME FedWatch Tool, the odds of a 25 basis points hike in the Fed’s December meeting remain low, around 10%, and markets seem to be awaiting high-tier data to continue placing their bets on the next decisions. The US will report inflation figures from October next week.

XAG/USD Levels to watch

Observing the daily chart, the XAG/USD Index displays a neutral to bearish technical outlook for the short term as despite gaining significant traction, the bullish momentum is still weak. The Relative Strength Index (RSI) indicates a neutral stance below its midline, displaying a flat slope in the negative territory, while the Moving Average Convergence (MACD) prints stagnant red bars. Furthermore, the price is above the 100 and 200-day Simple Moving Averages (SMAs), suggesting that the bulls are in command over the bears on the bigger picture.

Resistance levels: $23.00, $23.15,$23.30 (100 and 200-day SMA convergence).

Support levels: $22.90 (20-day SMA), $22.70, $22.50.

XAG/USD Daily chart

-638351436735907367.png)

Richmond Federal Reserve Bank President Thomas Barkin said on Thursday it remains to be seen whether the Fed needs to tighten the policy further, per Reuters.

Key quotes

"We have time to see what path inflation takes, with rates now restrictive, financial conditions tightened."

"We are making real progress on inflation."

"The US economy is remarkably healthy."

"The job isn't done; inflation remains too high."

"The Fed has to walk a fine line."

"Not yet convinced inflation is on a smooth glide path to 2%."

"Will need economic slowing to beat inflation."

"Any downturn may be less severe than past recessions."

Market reaction

The US Dollar showed no immediate reaction to these comments. At the time of press, the US Dollar Index was virtually unchanged on the day at 105.50.

Economists at ANZ Bank expect NZD/USD to appreciate gradually.

Long-term fair value at 0.63

Our currency forecasts have the NZD/USD holding steady until the end of the year, and then gradually appreciating to 0.63 by the end of next year.

Our expectation for mild strength over 2024 remains guided by our fair value analysis, which puts long-term fair value at 0.63, and is further supported by our expectation of another OCR hike.

See: EUR/AUD to drop back to 1.59, AUD/NZD to edge towards 1.12 in a six-month view – Rabobank

- Mexican Peso shows resilience and appreciates against the US Dollar, as participants expect Banxico to hold rates unchanged.

- Mexico’s inflation reports a slight decrease, though supports the central bank’s restrictive stance.

- Mixed messages from Federal Reserve officials keep market participants on their toes, as they eye Fed Chairman Jerome Powell's speech.

Mexican Peso prints modest gains against the US Dollar in early trading on Thursday, with traders awaiting the Bank of Mexico (Banxico) monetary policy decision. Banxico is not expected to rock the boat, as analysts estimate it will keep rates at 11.25%. Therefore, the USD/MXN is trading at 17.50, down a decent 0.18%, portraying some Peso strength.

Mexico’s economic docket witnessed inflation coming in a tick lower than expected, and below previous readings, though the pace of the deflationary process is losing steam. That would refrain Banxico from adopting a dovish posture in its statement. Meanwhile, economic data in the United States (US) showed that unemployment claims for the last week fell, indicating strength in the labor market.

Aside from this, Federal Reserve (Fed) officials continued to strike mixed signals, as Philadelphia Fed Patrick Harker emphasized that rates need to remain higher for longer. On the contrary, Chicago’s Fed Goolsbee turned dovish as he saw risks of overshooting rates. Late in the day, Fed Chair Jerome Powell would take the stand at around 19:00 GMT.

Daily digest movers: Mexican Peso remains firm as inflation in Mexico slows down

- Mexico’s Consumer Price Index (CPI) was 4.26% YoY in October, below forecasts of 4.28%, and the previous reading of 4.45%.

- On a monthly basis, inflation rose 0.39%, above the 0.38% consensus and September’s 0.44%.

- Core inflation in Mexico stood high at 5.5% YoY as expected and below September’s data; while prices on a monthly basis ticked up from the 0.39% MoM estimated, above last month’s data and the 0.38% forecast.

- Initial Jobless Claims in the United States for the week ending November 4, rose by 217K, below estimates of 218K, and last week’s 220K.

- USD/MXN gains remain capped even though the American Dollar falls as shown by the US Dollar Index (DXY), a gauge that tracks the buck´s value against a basket of six currencies, retreating 0.05%, down at 105.47.

- Money market futures have priced in a 25 bps rate cut by the Federal Reserve in July 2024.

- Mexico´s economy remains resilient after October’s S&P Global Manufacturing PMI improved to 52.1 from 49.8, and the Gross Domestic Product (GDP) expanded by 3.3% YoY in the third quarter.

- On October 24, Mexico's National Statistics Agency, INEGI, reported annual headline inflation hit 4.27%, down from 4.45% at the end of September and below forecasts of 4.38%.

- Banxico revised its inflation projections from 3.50% to 3.87% for 2024, which remains above the central bank’s 3.00% target (plus or minus 1%). The next decision will be announced on November 9 at 19:00 GMT

Technical Analysis: Mexican Peso appreciates though USD/MXN could aim higher as golden cross formation looms

The USD/MXN remains neutrally biased, though about to form a golden cross with the 50-day Simple Moving Average (SMA) crossing above the 200-day SMA, each at 17.67 and 17.68, respectively. That could pave the way for further upside. However, buyers need to lift the exchange rate above the 17.70 area, so they can challenge the 20-day SMA at 17.95, ahead of the psychologically 18.00 figure.

On the flip side, key support levels lie at Monday’s low of 17.40, followed by the 100-day Simple Moving Average (SMA) at 17.32. A breach of the latter will expose the 17.00 figure before the pair aims to test the year-to-date (YTD) low of 16.62.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Economists at CIBC Capital Markets still see further upside for the US Dollar over the coming quarters.

USD dips should be bought into

For now, the focus remains on incoming data – especially the October CPI print that is due next week.

Despite the surprisingly cautious tone taken by Fed Chair Powell last week, we’re of the mind that stronger activity in the US is more likely to persist. That suggests that USD dips should be bought into, and CAD investors should pare hedges on USD inflows over the coming months.

Towards H2 of next year, we expect USD valuation to peak as markets reassess the viability of the Fed’s QT program while the much anticipated JPY rally starts to take hold across the FX space.

DXY – Q4 2023: 108.88 | Q1 2024: 109.19

Banxico will announce its rate decision later today. Economists at ING analyze Mexican Peso’s outlook ahead of the meeting.

Banxico should remain hawkish

Survey respondents unanimously expect unchanged rates at 11.25%. Equally, we think Banxico will be more than happy to keep the 600 bps policy rate premium over Fed rates – a position that has kept USD/MXN relatively stable, reduced implied volatility and contributed to the Peso's attractiveness for carry trade strategies.

Loose fiscal and tight monetary policy is normally a very positive environment for a currency and this is why we think USD/MXN will be trading comfortably below 17.00 into 2024.

The appreciation of the trade-weighted US Dollar Index (DXY) has stalled over the past month. Economists at the National Bank of Canada analyze USD outlook.

A soft landing for the US economy would imply a weaker USD going forward

If you believe, as the Fed does, that a soft landing for the economy is on the horizon, this scenario would imply a weaker USD going forward. This is not our forecast.

In our view, the US Dollar is likely to strengthen on fears of a global recession and renewed geopolitical tensions in the Middle East, which will drive safe-haven demand until the Fed is able to pivot and announce an easing of monetary policy.

- EUR/USD struggles for direction around the 1.0700 neighbourhood.

- Bouts of weakness should meet initial support near 1.0650.

EUR/USD trades in an inconclusive fashion around the 1.0700 region on Thursday.

In case the downward bias picks up extra pace, the 55-day SMA at 1.0645 should offer temporary contention prior to the weekly low of 1.0495 (October 13).

In the meantime, while below the 200-day SMA at 1.0801, the pair’s outlook should remain negative.

EUR/USD daily chart

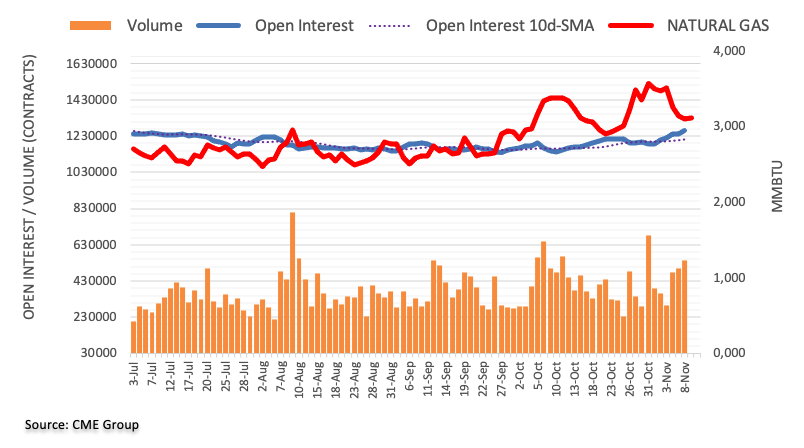

Europe’s benchmark TTF Gas futures have dropped by ~5% over the past week. Economists at Rabobank analyze Natural Gas markets outlook.

New supply disruptions emerge against healthy inventories

Natural Gas benchmarks brace for volatility as new supply disruptions emerge against healthy inventories – expect crucial TTF support levels at €43/MWh and resistance at €54/MWh.

Henry Hub weakness is expected as cash prices trade at a $1 discount to futures on warm weather, see downside to $3/MMbtu, with a break below on continued warmth.

- DXY trades within a narrow range around 105.60 on Thursday.

- The continuation of the upside momentum should retest the 106.00 zone.

DXY alternates gains with losses around 105.60 on Thursday.

In case the buying interest gathers extra pace, the index should face the initial hurdle at the weekly high of 105.87 (November 8). The surpass of this level could open the door to a rapid visit to the November top at 107.11 (November 1) prior to the 2023 peak of 107.34 (October 3).

In the meantime, while above the key 200-day SMA, today at 103.57, the outlook for the index is expected to remain constructive.

DXY daily chart

- EUR/JPY prints fresh tops near 161.70 on Thursday.

- Extra gains could advance to the 2008 top near 170.00.

EUR/JPY struggles to advance further despite printing new YTD peaks in the 161.70/75 band on Thursday.

Further upside appears well on the cards for the cross in the short-term horizon. Against that, the surpass of the 2023 high of 161.74 (November 9) is expected to face the next significant resistance level not before the 2008 top of 169.96 (July 23)

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 152.03.

EUR/JPY daily chart

Regardless of whether the Eurozone falls into recession, economists at Wells Fargo see enough growth headwinds to suggest that the European Central Bank's (ECB) monetary tightening is done.

Eurozone rate hikes are done

The underwhelming growth outlook means ECB rate hikes are very likely done, with the most recent progress on the inflation front reinforcing the view that the peak in policy rates has already been reached. However, we believe the ECB will still want to see underlying inflation trends move closer to, and remain near, its 2% inflation target before it becomes comfortable embarking on a monetary easing cycle.

We do not forecast an initial ECB rate cut until the June 2024 meeting, although a steady series of rate cuts after that should see the ECB lower its Deposit Rate by a cumulative 150 bps to 2.50% between mid-2024 and early 2025. Overall, we view the risks as skewed toward the ECB lowering interest rates earlier, or more aggressively than generally expected.

USD picks up a little support. Economists at Scotiabank analyze USD/JPY outlook.

Narrower US-Japan interest rate differentials are not having any major impact on USD/JPY

It is notable that lower US yields/narrower US-Japan interest rate differentials are not having any major impact on USD/JPY. The US/Japan 10Y spread has fallen around 50 bps over the past three weeks to reach levels last seen in August when USD/JPY was trading nearer 145.

Spot is knocking on the door of recent highs but Fair Value based on spreads, equity returns and terms of trade (weaker crude oil prices are helping boost Japan’s still soft terms of trade) suggest the USD is quite significantly overvalued and should be trading closer to 144.50.

The European Central Bank's (ECB) monetary policy is working and it's helping them bring inflation down, ECB Governing Council member Mario Centeno said on Thursday, pre Reuters.

"We are at a plateau in terms of interest rates," Centeno added.

Earlier in the day, “we are not there yet” ECB Vice President Luis de Guindos said when asked about reducing interest rates.

Market reaction

These comments don't seem to be having a noticeable impact on the Euro's performance against its major rivals. As of writing, the EUR/USD pair was virtually unchanged on the day at 1.0705.

- AUD/USD drops close to 0.6400 amid caution ahead of Powell’s speech.

- Fed Powell may deny rate cuts in the near term as robust retail demand and stable labor market.

- The Australian Dollar faced pressure as the Chinese economy shifted into deflation.

The AUD/USD pair remains on the backfoot near the crucial support of 0.6400 as investors await for Federal Reserve (Fed) Chair Jerome Powell’s remarks on interest rates and the outlook on the US economic performance in the fourth quarter of 2023.

The S&P500 opens on a cautiously positive note as investors worry about the Fed’s guidance on the last monetary policy meeting of 2023. Fed Powell is expected to lean towards keeping interest rates higher for a longer period to ensure that inflation must come down to 2%.

The US Dollar Index (DXY) aims to recapture the immediate resistance of 106.00 on hopes that the Fed Powell would deny rate cuts in the near term as robust retail demand and stable labor market conditions could keep fears of higher consumer inflation expectations unabated. 10-year US Treasury yields hold recovery near 4.56% ahead of Powell’s speech.

This week, investors focused on commentaries from Fed policymakers due to the light economic calendar. Next week, the US inflation data for October will remain in the spotlight. The impact of inflation data would be light as one more inflation report will be released before December’s monetary policy meeting.

Meanwhile, the Australian Dollar faced pressure as the Chinese economy shifted into a deflation in October. The annual deflation rose by 0.2% against 0.1% as expected. Producers cut prices of goods and services at factory gates due to weak consumer spending. Being a proxy to China’s economic prospects, the Australian Dollar remains on the backfoot of deflation pressures.

- Initial Jobless Claims in the US decreased by 3,000 in the week ending November 4.

- US Dollar Index stays in daily range above 105.50.

There were 217,000 initial jobless claims in the week ending November 4, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 220,000 (revised from 217,000) and came in slightly better than the market expectation of 218,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average stood at 212,250, an increase of 1,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending October 28 was 1,834,000, an increase of 22,000 from the previous week's revised level" the publication read.

Market reaction

The US Dollar Index stays in its daily range above 105.50 following this data.

Economists at Société Générale analyze USD/MXN technical outlook.

A sharp pullback has taken shape

USD/MXN failed to reclaim the trend line drawn since November 2021 at 18.48/18.60 recently; a sharp pullback has taken shape after this test.

The USD/MXN pair has once again given up its 200-DMA and re-integrated within the previous base. This denotes the possibility of persistence in decline.

Holding below the Moving Average near 17.70, there is a risk of continuation in decline towards 17.00 and July/August lows near 16.60.

USD/CAD is steady near 1.38. Economists at Scotiabank analyze the pair’s outlook.

Hawkish BoC deliberations

BoC’s summary of deliberations dwelt on the ‘considerable concern’ around core inflation, noted that some senior policymakers thought that rates would need to rise again and mulled over the potential for the neutral rate to drift higher.

Intraday price action suggests the topside move in spot is stalling around the 1.38 point but trend momentum remains USD-positive on the six-hour chart and more obvious weakness (below 1.3750/1.3760 intraday) is needed to signal a more definitive short-term peak at least.

Resistance is 1.3810/1.3820.

Sterling is a little lower in the session. Economists at Scotiabank analyze GBP outlook.

Cable retains a heavy technical tone

Four days of consecutive losses for the GBP are showing scant signs of slowing or reversing.