- Analytics

- News and Tools

- Market News

Новини ринків

Japan's Current Account for the month of August broadly missed market estimate, printing at ¥2,279.7B, well below the forecast ¥3,090.9B and completely reversing direction on the previous reading of ¥2,771.7B.

Japan's Current Account is a comprehensive reading of the overall flow of both goods & services and financial transactions into and out of the country, capturing both import and export, as well as the flow of foreign investment into and out of Japan.

Japanese Yen FAQs

What key factors drive the Japanese Yen?

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

How do the decisions of the Bank of Japan impact the Japanese Yen?

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

How does the differential between Japanese and US bond yields impact the Japanese Yen?

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

How does broader risk sentiment impact the Japanese Yen?

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- EUR/GBP falls into familiar lows near 0.8630 as Euro slips a new bottom into near-term consolidation.

- The BoE's Mann shows her hawkish feathers during a speech in Dallas.

- EU Sentix Investors Confidence fails to inspire Euro bull run, ECB Lagarde speech in the barrel for Tuesday.

The EUR/GBP fell off recent consolidation to etch in a new October low near 0.8631, and the pair is pinned into the low end heading into the Tuesday trading session.

The European Sentix Investor Confidence reading for October couldn't prop up the Euro (EUR) meaningfully, despite a better-than-expected print of -21.9, a slight downtick from the previous read of -21.5 but significantly better than the market forecast of -24.

On the UK side, the Bank of England (BoE) policymaker and Monetary Policy Committee (MPC) member Catherine Mann made a hawkish showing at an event in Dallas on Monday. Mann noted that central banks need to be more aggressive in the face of inflation, because policy measures need to not only overcome inflation, but "drift" in inflation expectations that develop over time.

Mann remains concerned about how deeply-embedded inflation has become, and that too-little moves from the BoE could mean future policy mechanism adjustments would have a limited effect.

Tuesday sees a speech from European Central Bank (ECB) President Christine Lagarde who will be delivering talking points at the International Monetary Fund's (IMF) latest annual meeting, currently being hosted in Morocco.

On Wednesday, it's UK production day, with Industrial and Manufacturing Production on the docket, alongside Gross Domestic Product (GDP) for the third quarter and Trade Balance figures.

Wednesday will also see speeches from the ECB's Elderson and Panetta, followed by the ECB's latest meeting minutes, to be published at 11:30 GMT.

EUR/GBP Technical Outlook

The Euro is down 0.83% against the Pound Sterling from September's peak of 0.8706, constrained by technical resistance from the 200-day Simple Moving Average near the 0.8700 handle, while the 50-day SMA rests near 0.8610, with chart action sandwiched in the middle.

Technical indicators are turning softly bearish, with the Moving Average Convergence-Divergence (MCAD) indicator flashing a bearish rollover of the fast and slow indicator lines from overbought conditions.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

- EUR/GBP encounters resistance, lingering below the pivotal 200-DMA of 0.8700, spotlighting downside risks.

- A breach below 0.8605 could unlock further descent, targeting September lows and potentially the YTD low.

- Recovery above 0.8658 may pave the way for a test of the crucial 0.8700 psychological and technical barrier.

The EUR/GBP extended its losses to five straight trading days and hovers at around the September 28 swing low of 0.8629, amidst a risk-off impulse courtesy of the escalation of the fight between Hamas and Israel, set to extend for the fourth straight day. Therefore, the EUR/GBP edges lower by 0.05%, and exchanges hands at around 0.8635.

The daily chart portrays the pair as neutral biased, but it appears to have bottomed, as shown by price action; nevertheless, as EUR/GBP’s price action remains trading below the 200-day moving average (DMA) of 0.8700, downside risks remain. For a bearish continuation, sellers mist break below the 50-DMA at 0.8605. A breach of the latter and the 0.8600 figure would expose the September 15 daily low of 0.8569, followed by the September 5 low of 0.8523. Once those levels are cleared, up next would be the year-to-date (YTD) low of 0.8492.

Conversely, If EUR/GBP buyers reclaim the October 9 daily high at 0.8658, that would open the door to test the confluence of the figure and the 200-DMA at 0.8700. A decisive break would expose the May 3 high at 0.8834.

EUR/GBP Price Action – Daily chart

EUR/GBP Key Technicals

- The AUD/NZD caught a late-Monday bump to 1.0680, but quickly fell back into familiar territory.

- The Aussie is slightly down for Monday against the Kiwi, settling near 1.0650 after opening the trading week near 1.0665.

- Next up on the calendar: Aussie Westpac Consumer Confidence.

The AUD/NZD spent most of Monday waffling to the downside, hitting a new five-month low before catching a late-day rebound into 1.0680. The chart run-up was short-lived, however, and the pair is now flubbing back below 1,0650.

The Aussie (AUD) has steadily bled chart space to the Kiwi (NZD) since September's peak near 1.0900, and the AUD/NZD is down almost 2.5% after declining for three straight weeks.

Next up on the economic calendar data docket will be Australian Westpac Consumer Confidence for October, which last printed at -1.5%.

The rest of the trading week has no high-impact figures slated for release for either the AUD or the NZD, though Aussie bulls will be keeping an eye out for a speech from the Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent on Wednesday.

Thursday brings mid-tier data for both the Aussie and the Kiwi, with Australian Consumer Inflation Expectations for October (last print: 4.6%), followed by the New Zealand Business NZ Purchasing Manager Index (PMI) for September, which last came in at 46.1.

AUD/NZD Technical Outlook

The AUD/NZD has fallen back into five-month lows below 1.0650 as the Aussie-Kiwi pairing slumps far away from the 200-day Simple Moving Average, all the way back at 1.0820.

Previous resistance-turned-support is parked at previous swing lows near 1.0750, and the downside sees little in the way of technical support until May's swing lows into 1.0570.

AUD/NZD Daily Chart

AUD/NZD Technical Levels

- EUR/JPY saw 0.60% losses and closed below the 20-day SMA of 157.36.

- Indicators on the daily chart have turned flat, slightly favouring the bears.

- The 20- and 100-day SMAs are about to perform a bearish cross.

The EUR/JPY declined on Monday near the 156.90 area after initially rising near the 157.70 area, above the 20-day Simple Moving Average (SMA).

Observing the daily chart, the cross displays a neutral-to-bearish technical outlook for the short term as the bears start to gain momentum, but they still have work to do. Since September, the pair has been trading sideways between the 154.70 - 157.00 range, with the trajectory slightly tilted to the downside.

The daily Relative Strength Index (RSI) displays a flat slope below the 50 middle point. At the same time, the Moving Average Convergence (MACD) prints stagnant red bars, suggesting that bearish momentum is modestly growing with sellers dominating. On the four-hour chart, indicators also show signs of a neutral outlook and a slight command by the bears. In the broader context, the pair is below the 20-day Simple Moving Average (SMA) but above the 100- and 200-day SMAs, suggesting that the bears struggle to challenge the overall bullish trend. That being said, the 100- and 20-day SMAs seem to be converging towards the 156.00 area to perform a bearish cross, which could fuel a downward leg for the EUR/JPY.

Support levels: 156.50, 155.90 (100-day SMA), 155.00.

Resistance levels: 157.36 (20-day SMA), 158.00, 159.00.

EUR/JPY Daily Chart

- AUD/JPY holds steady as Tuesday’s Asian session unfolds, maintaining a near-flat trading position.

- Eyes on 95.55 for potential bullish continuation, while 95.00 poses a threat to ongoing stability.

- A breakthrough above 95.55 could unlock paths to September highs, with 97.00 in sight.

AUD/JPY resumed its uptrend on Monday but failed to crack last Friday’s high of 95.55 due to a risk-off impulse, given the resurgence of fights between Israel and Hamas after the latter delivered an attack during the Yom Kippur holidays. The AUD/JPY is trading at 95.16, almost flat as Tuesday’s Asian session begins.

The daily chart portrays the pair as neutral biased, though it formed a ‘bearish-harami’ two-candlestick pattern, which could open the door for further losses. Yet if AUD/JPY breaks above last Friday’s high of 95.55, that would open the door for further upside, exposing the September 29 daily high of 96.92. Once cleared, the 97.00 figure would be up for grabs.

Short term, the AUD/JPY is set to extend its gains, as price action is above the Ichimoku Cloud (Kumo) set to extend its gains. First, resistance would emerge at 95.55, followed by the 96.00 threshold. On the other hand, if the pair extend its losses below the intersection of the Kijun and Tenkan-Sen levels at around 95.00, that would exacerbate the AUD/JPY downtrend. First support would be the Senkou-Span B at 94.94, followed by the 94.68 mark and the October 6 daily low of 94.33.

AUD/JPY Price Action – Hourly chart

AUD/JPY Technical Levels

- S&P 500 hits its highest prices in two weeks as equities rally off weekend Gaza jitters.

- US equities dipped to kick off the trading week after Hamas rocket attacks over the weekend, but investors recovered their mood into the midday.

- Markets will be turning their eyes ahead to US inflation figures due in the mid-week.

The Standard & Poor's (S&P) 500 equity index is trading near $4,330, a two-week high for the index after markets recovered from an early Monday spat of risk aversion sparked by escalating tensions in the Gaza Strip over the weekend.

Palestine's Hamas launched a deadly rocket attack over the weekend that left over 700 Israelis dead, with at least 12 American citizens confirmed killed in the altercation; Israel's retaliation saw nearly 700 Palestinians slain following the rocket attack, and broader markets are concerned that the largest exchange of violence for the region in over a decade will hamper trade and production in the region.

Oil markets were particularly exposed to risk aversion on the Gaza conflict, with concerns that nearby Iran and Saudi Arabia would get pulled into the conflict politically, which could threaten crude oil production that is already slated to drastically undershoot global demand through the remainder of the year.

The S&P 500 hit a daily low of $4,266.90 in early Monday trading before recovering back over the $4,300 handle and heads into the Tuesday trading session testing territory north of $4,330.

Forex Today: US Dollar weakens despite Middle East concerns

Concerns about a rebound in US inflation pushing the Federal Reserve (Fed) further away from making any interest rate cuts in the near future remain a constant concern for investors, and markets will be looking ahead to this week's smattering of inflation data and US consumer sentiment figures.

Tuesday brings a collection of speeches from Fed officials, including Waller, Kashkari, and Daly; on Wednesday the latest Producer Price Index drops, with the annualized period into September expected to show a slight uptick into 2.3% from 2.2%.

Thursday will see US Consumer Price Index (CPI) figures, forecast to decline softly for the same period to 4.1% from 4.3%, which would see inflation still well above the Fed's 2% inflation target.

Friday will close out the trading week with the Michigan Consumer Sentiment Index, which is forecast to fall back slightly from 68.1 to 67.4.

S&P 500 Technical Outlook

The S&P 500 is on the high side near $4,333.90 after rebounding from last week's low of $4,199.80.

Hourly candles succeeded in vaulting over the 200-hour Simple Moving Average, and now bulls will be looking to turn recent swing-high points near $4,320.00 into technical support for a further move high.

Daily candlesticks have the S&P 500 building out a technical rebound from a rejection of the 200-day SMA near $4,200.00, but market moves may run aground technical resistance from the 50-day SMA which sees bearish momentum into $4,400.00.

S&P Daily Chart

S&P 500 Technical Levels

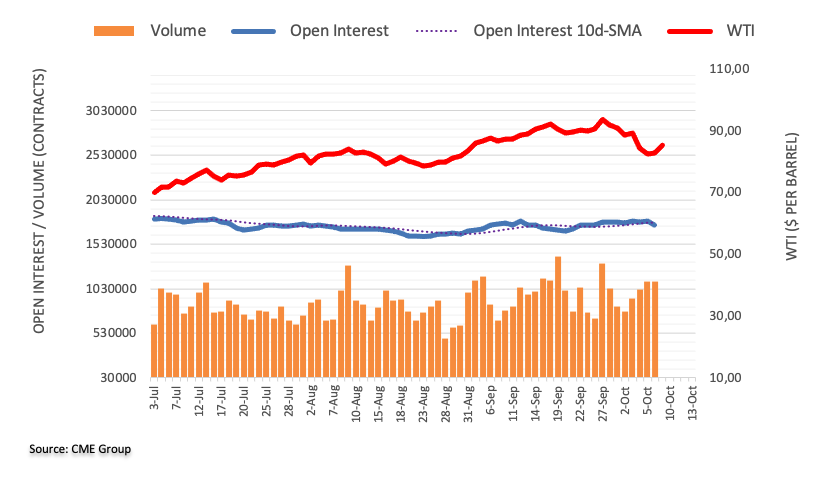

- DXY initially rose to 106.60 and then settled near 106.05.

- Fed’s Logan words contributed to a significant increase in US bond yields.

- Focus shifts to FOMC minutes on Wednesday and Thursday’s inflation figures from the US.

In Monday’s session, the DXY index declined for a fourth consecutive day towards the 106.05 area after rising to a daily high of 106.60 earlier in the session. In line with that, the index continues consolidating the gains, which took it to a multi-month high of 107.35 last week, driven by high US Treasury yields and expectations of a more aggressive Federal Reserve (Fed).

Data-wise, investors are still assessing last Friday’s Nonfarm Payroll report, which saw job creation accelerating in September as well as the unemployment rate while wage inflation decelerated. Markets will now set their sight on Wednesday’s Federal Open Market Committee (FOMC) minutes of the September meeting and, on Thursday, the Consumer Price Index (CPI) figures from the US to continue modelling their expectations regarding the Fed’s next steps.

That being said, Lorie Logan from the Fed showed a dovish stance on Monday and stated that there may be “less need” for continuing hiking, which caused short-term US Treasury yields to decline to multi-week lows. In that sense, the US Dollar faced selling pressure, but hawkish clues on the FOMC minutes or hot inflation reading may reignite the Greenback’s momentum as the Fed has clearly stated that their stance is still data-dependant.

In addition, the escalation of the conflict between Israel and the Hamas terrorist group in the Middle East may boost demand for the USD as investors may take refuge in it.

DXY Levels to watch

The daily chart analysis indicates a neutral to a bearish outlook for DXY, as the bears show signs of taking control but still face challenges ahead. The Relative Strength Index (RSI) exhibits a negative slope above its midline, while the Moving Average Convergence (MACD) histogram lays out larger red bars. That said, the index is above the 20,100,200-day Simple Moving Average (SMA), indicating buyers command the broader perspective.

Support levels: 106.00, 105.85 (20-day SMA), 105.50.

Resistance levels: 106.30, 107.00, 107.30.

DXY Daily Chart

Eyes remain on the Middle East. During the Asian session, the Australian Westpac Consumer Confidence Index and the NAB Business Conditions survey are due. The key report of the week will be the US CPI on Thursday.

Here is what you need to know on Tuesday, October 10:

The US Dollar Index experienced a modest decline near the 106.00 level on Monday, after trading mostly in positive territory throughout the day. The DXY initially started the week on a positive note due to developments in the Middle East that impacted market sentiment. However, the Greenback lost momentum later in the day as the market stabilized and US yields continued to decline.

On Tuesday, no top-tier reports from the US are scheduled for release. The focus for the week in terms of economic data will be on inflation figures, with the Producer Price Index (PPI) on Wednesday and the Consumer Price Index (CPI) on Thursday.

Analysts at ANZ on US CPI:

The outsized payroll number raises the prospect the Fed may hike again, but it’s not a clincher. September Consumer Price Index data out this week should be more revealing. We expect core inflation to rise by 0.2% m/m, which should be well received by the Fed.

The situation in the Middle East has the potential to impact markets, with further escalation possibly damaging market sentiment and increasing demand for safe haven currencies and crude oil prices. The unfolding events could become a "Black Swan" event that significantly alters the outlook.

The Japanese Yen was among the best-performing currencies, supported by the decline in global bond yields. German 10-year yields dropped by almost 5% to 2.76%. USD/JPY declined from below 149.00 to 148.35.

EUR/USD trimmed its losses during the American session, rising above 1.0560. The pair maintains a modest bullish bias in the short term but remains limited below 1.0600. The Euro underperformed on Monday and was the weakest among G10 currencies. German Industrial Production dropped 0.2% in August, and Eurozone Sentix Investor Confidence declined to -21.9, against an expected -24.

GBP/USD finished flat consolidating around the 1.2240 area, supported by some weakness in the US Dollar. The pair remains below but near the 20-day Simple Moving Average (SMA) at 1.2270.

AUD/USD gained momentum late on Monday, rising above the 20-day SMA and surpassing 0.6400. On Tuesday, the Westpac Consumer Confidence for October and the National Australian Bank's Business survey are scheduled.

The rally in crude oil prices boosted the Canadian Dollar. USD/CAD dropped for the third day in a row, reaching a one-week low below 1.3600.

NZD/USD registered its highest daily close in almost two months, above 0.6000. The weaker US Dollar and improved risk sentiment supported the pair's strength on Monday.

Like this article? Help us with some feedback by answering this survey:

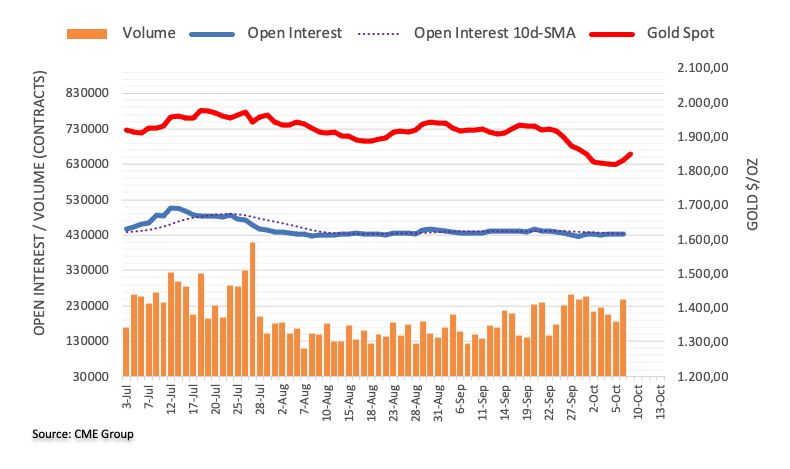

- Gold price to remain bid if geopolitical unrest escalates.

- Federal Reserve officials adopt a cautious and nimble approach toward mitigating high inflation.

- XAU/USD’s traders eye US inflation data and Fed commentary.

Gold price hit a weekly high of $1857.69, with the financial markets being hit by geopolitical unrest due to the conflict between Israel and Palestinian Islamist group Hamas during the weekend and bolstering the appetite for Gold’s safe-haven status. XAU/USD is trading at $1856.63, gains more than 1.30%, after printing a daily low of $1843.80.

Safe-haven appeal of Gold bolstered by Israel-Hamas fight and dovish Fed remarks

Investors' mood remains downbeat as the fight continues. US Federal Reserve (Fed) officials crossed newswires, led by Vice-Chair Philip Jefferson and the Dallas Fed President Lorie Logan.

Fed Vice-Chair Jefferson said that current monetary policy is restrictive, though emphasized “we need to do our work” to bring inflation down. He added they need to be nimble “with regards to what is happening in the economy.” Earlier, Dallas Fed President Logan commented she is focused on inflation risks and added they have more work to do. She stated the surprising strength of the economy creates upside risks on inflation.

Another reason that is sponsoring a leg-up in Gold prices is the drop in US Treasury bond yields, particularly real yields. the yield in the US 10-year Treasury Inflation-Protected Securities (TIPS), remains at 2.47% with the US bond markets closed, while the 10-year yield plummets 15-baiss points from 4.797% to 4.657%.

Aside from this, the US economic agenda was absent in the observance of Columbus Day. Ahead in the week, US inflation data on the producer and the consumer side would be crucial in dictating the US Federal Reserve’s next move.

Gold Price Analysis (XAU/USD): Technical outlook

After bottoming at around $1810.00, the XAU/USD has resumed its uptrend due to risk aversion, with buyers eyeing the next resistance level, the 20-day moving average (DMA) at $1884.00. A breach of the latter will expose the 50-DMA at $1905.52, followed by the 100-DMA at $1925.73 and the 200-DMA at $1928.75. Conversely, failure to crack the 20-DMA would open the door for a pullback. First support would be the last week’s low of $1810, followed by the $1800.00 figure.

- XAG/USD rose to $21.85, up by more than 1%.

- Lorie Logan's dovish words made US yields plunge by more than 2%.

- Despite lower Treasury yields, the US Dollar holds its ground.

On Monday, the Silver Spot price XAG/USD gained momentum, mainly driven by US yields taking a big hit after Federal Reserve’s Lorie K. Logan hinted at “less need” to hike rates this cycle. In the meantime, investors are still assessing Friday’s jobs report from the US with their eyes set on Thursday’s inflation figures. As no relevant data will be released during the session, the green currency may benefit from risk aversion.

Following Logan’s words, the 2,5 and 10-year rates took a big hit and declined to 4.95%, 4.60% and 4.67%, respectively, to multi-week lows. That being said, the Federal Reserve’s stance is still data-dependent, and inventors are still digesting Friday’s jobs report from the US with their eyes set on Thursday’s inflation figures to continue modelling their expectations.

The September US NonFarm Payrolls report continued the trend seen in August. Job creation exceeded expectations, with 336,000 jobs added in all non-agricultural sectors, significantly surpassing the anticipated 170,000 and the previous month's 270,000. However, wage inflation, as measured by Average Hourly Earnings, was slightly lower than expected at 0.2% MoM, as opposed to the expected 0.3%. The Unemployment rate also increased to 3.8% YoY. Regarding the inflation readings, the Consumer Price Index (CPI) is expected to decelerate to 3.6% YoY, and the Core measure is seen to have fallen to 4.1% YoY.

XAG/USD Levels to watch

The daily chart analysis suggests a neutral to bullish outlook for XAG/USD, with the bulls gaining strength, although challenges persist. With a positive slope below its midline, the Relative Strength Index (RSI) signals a strengthening bullish sentiment, while the Moving Average Convergence (MACD) displays lower red bars. Moreover, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), pointing towards the prevailing strength of the bears in the larger context and the buyers facing a challenging situation.

Support levels: $20.95,$20.80,$20.60.

Resistance levels: $22.00,$22.15,$22.45 (20-day SMA).

XAG/USD Daily Chart

-638324757796792179.png)

- GBP/JPY dips 0.45% to 181.80, as rising Israel-Hamas conflict propels Yen’s safe-haven appeal.

- Technical outlook reveals potential bearish bias, with eyes on critical support and resistance levels.

- Short-term neutrality may pivot to bearishness or bullishness, contingent on geopolitical and economic updates.

The GBP/JPY recovery stalls on Monday, following developments during the weekend, as the conflict between Hamas and Israel escalated. Hence, the Japanese Yen (JPY) was favored on safe-haven status, stalled last week’s rally, with the pair trading at around 181.80, down 0.45%.

The daily chart portrays the cross as neutral to downward biased, hovering towards the bottom of the Ichimoku Cloud (Kumo), which, if broken, would confirm the bearish bias and open the door to test the October 3 daily low of 178.03. If that level is broken, that could pave the way towards the July 28 swing low of 176.30.

Short term, the GBP/JPY pair is neutral biased, about to break above the Kumo, which could pave the way to test the Kijun-Sen at 182.11. An extension of its gains past the latter would expose 183.00. On the other hand, if the GBP/JPY breaks below the Kumo, the next support would emerge on today’s daily low of 181.25. Once cleared, the next stop would be 181.00, followed by last Friday’s 180.84.

GBP/JPY Price Action – Hourly chart

GBP/JPY Technical Levels

- The EUR/USD started Monday with a dip to 1.0519 before edging back.

- The Euro still remains down against the US Dollar for Monday, but losses are paring back.

- Market sentiment is rebalancing after getting knocked off-kilter by geopolitical escalations in the Gaza Strip.

The EUR/USD is testing upwards into 1.0570 after slipping down into 1.0520 to kick off the trading week. Market sentiment soured following a Hamas rocket attack in the Gaza Strip that killed over 700 people and spurred the Israeli government to mobilize an additional 100,000 troops into the region.

Concerned that nearby Iran and Saudi Arabia could get pulled into the escalating Gaza conflict, markets went risk-off in early Monday trading, but investor sentiment appears to have recovered and the Euro is easing back towards the day's opening bids.

Euro investors will be looking ahead to an upcoming speech from European Central Bank (ECB) President Christine Lagarde on Tuesday, who will be delivering talking points during the International Monetary Fund's (IMF) annual meeting currently underway in Morocco.

Forex Today: Safe-haven flows dominate as geopolitical tensions escalate on Israel-Hamas conflict

Wednesday sees US Producer Price Index (PPI) figures, with the annualized period into September forecast to increase from 2.2% to 2.%. Wednesday will also see the Federal Reserve's (Fed) latest meeting minutes getting published at 18:00 GMT.

In the late week will be a collection of speeches from ECB officials followed by the ECB's own published meeting minutes, followed by the US Consumer Price Index (CPI) printing, which is expected to decline slightly from 4.3% to 4.1% over the annualized period into September.

To close out the trading week will be the Michigan Consumer Sentiment Index for October, which is seen declining, albeit slightly, from 68.1 to 67.4.

EUR/USD Technical Outlook

The Euro is seeing some twisting intraday action with hourly candles cycling the 50-hour Simple Moving Average (SMA) that is rising into 1.0550, and the EUR/USD is currently testing 1.0565, down a scant 0.08% from the day's highs set early in the day at the market open.

EUR/USD daily candles remain notably bearish, with current price action trading far below the 50-day SMA, which has confirmed a bearish cross of the 200-day SMA near 1.0825. A declining trendline from July's tops near 1.1275 remains firmly in place, and the Euro's three-day rebound from 1.0448 still sees the EUR/USD trading near 2023's lows.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

- The USD/CHF initially rose to 0.9123 and then settled near 0.9070 below the 20-day SMA.

- The US Dollar measured by the DXY also cleared gains and retreated to 106.12.

- Falling US yields after Lorie Logan’s words from the Fed explain the USD’s weakness.

- Eyes on Thursday’s inflation data from the US from September while investors still asses Friday’s NFPs from the US.

In Monday’s session, the USD/CHF reversed its course after peaking at a high of 0.9123 and settling around 0.9055 below the 20-day Simple Moving Average. On the US Dollar’s side, it lost steam, driven by a significant decline of the US yields after Lorie Logan from the Federal Reserve (Fed) commented that there may be “less need” to hike rates. In addition, US traders will remain on the sideline on Monday, celebrating the Columbum’s holiday and no relevant data is expected during the rest session.

Following Logan’s words, investors seem to be betting on a less aggressive Fed as the 2,5 and 10-year Treasury Bond yields declined to 4.95%,4.60% and 4.67%, adding downward pressure on the pair.

On the data front, Nonfarm payrolls (NFP) from the US from September showed a similar tendency as August results. Job creation ticked up as the number of employed people in the US in all non-agricultural businesses in the US came in at 336,000, much higher than the 170,000 expected and the previous 270,000. Wage inflation measured by the Average Hourly Earning came in at 0.2% MoM vs the 0.3% expected, while the Unemployment rate rose to 3.8% YoY.

On Thursday, the US will release inflation readings from September, and the headline and core measures are expected to have declined to 3.6% and 4.1% YoY. In line with that, a soft inflation reading could pave the way for more downside for the US Dollar via lower bond yields and dovish bets on the Federal Reserve.

In addition, the geopolitical conflict between the Hamas terrorist group and Israel could make investors refrain from making significant moves and instead seek refuge in the green currency, limiting the downside for the pair.

USD/CHF Levels to watch

Based on the daily chart, the USD/CHF exhibits a bearish outlook for the short term. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain in negative territory. Additionally, the pair is above the 100 and 200-day Simple Moving Average (SMA), indicating that despite bears gaining momentum in the shorter time frames, the buyers command the broader perspective.

Support levels: 0.9050, 0.9030, 0.9000.

Resistance levels: 0.9073 (20-day SMA), 0.9150, 0.9170.

USD/CHF Daily Chart

- NZD/USD trying to hold onto territory north of 0.6000 as Kiwi catches a Monday bid.

- Further upside likely to remain constrained as investors await further input from RBNZ.

- US Dollar flows to dictate directional momentum with little meaningful data on the economic calendar for the Kiwi.

The NZD/USD caught an early morning bid on Monday, getting lifted into the 0.6000 handle, pushing the pair back into the top end of recent consolidation.

The Kiwi (NZD) has largely avoided broad-market safe haven flows for Monday, with the US Dollar seeing gains against the majority of the board.

Forex Today: Safe-haven flows dominate as geopolitical tensions escalate on Israel-Hamas conflict

The Reserve Bank of New Zealand (RBNZ) was last seen holding steady on interest rates, but with a "higher-for-longer" narrative lean to the RBNZ's latest showings, investors will be looking ahead to more inflation figures from New Zealand, as well as the Kiwi's central bank next showing due in November.

It's a thin week for the Kiwi on the economic calendar, with Visitor Arrivals on Tuesday, final Food Price Index figures on Wednesday, and Business NZ's Purchasing Manager Index (PMI) slated for Thursday.

The US data docket is likely to be the main driver for the NZD/USD this week, with Wednesday bringing Producer Price Index (PPI) figures along with the latest Federal Reserve's (Fed) meeting minutes publishing; Thursday will follow up with a Consumer Price Index (CPI) release, and Friday will cap off the week with the Michigan Consumer Sentiment Index for October.

The US PPI is expected to tick upwards to 2.3% from 2.2%, while CPI is seen stepping down from 3.7% to 3.6%, and the Michigan sentiment index is expected to decline from 68.1 to 67.4.

NZD/USD Technical Outlook

The Kiwi is getting pushed into the top end for Monday, pinning into the 0.6020 level after the day's opening bids near 0.5967.

Monday's bullish push is seeing the Kiwi tapping into the ceiling of recent consolidation on the daily candlesticks, and NZD/USD bidders will be looking for a decisive break of late September's peak at 0.6050.

There's nowhere to go but up for the NZD/USD, with the pair still well off July's swing high into 0.6413, with the 200-day Simple Moving Average (SMA) far above current price action near 0.6175.

NZD/USD Daily Chart

NZD/USD Technical Levels

Federal Reserve (Fed) Vice Chair Philip N. Jefferson stated on Monday that he will take into account the recent rise in bond yields when evaluating the future direction of monetary policy.

Speaking at the 65th Annual Meeting of the National Association for Business Economics in Dallas, Texas, Jefferson acknowledged the potential delayed impact of previous interest rate increases when determining the necessity for additional policy tightening. He anticipates a further moderation in core consumer inflation and a gradual improvement in labor market conditions.

Key takeaways from the speech:

“I believe that core PCE prices will moderate further as the labor market comes into better balance.”

“Despite the strong September labor market data we received last week, there is evidence that the imbalance between labor demand and labor supply continues to narrow, as labor demand cools while labor supply improves. Even so, the labor market remains tight.”

“Slowing labor demand and improving labor supply have eased pressure in the labor market, and my expectation is for further gradual easing in labor market conditions, as restrictive monetary policy continues to slow labor demand without causing an abrupt increase in layoffs or the unemployment rate.”

“Real long-term Treasury yields have risen recently. In part, the upward movement in real yields may reflect investors' assessment that the underlying momentum of the economy is stronger than previously recognized and, as a result, a restrictive stance of monetary policy may be needed for longer than previously thought in order to return inflation to 2 percent. But I am also mindful that increases in real yields can arise from changes in investor's attitudes toward risk and uncertainty.”

“Looking ahead, I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy.”

“I will be taking financial market developments into account along with the totality of incoming data in assessing the economic outlook and the risks surrounding the outlook and in judging the appropriate future course of policy.”

Market reaction

During the American session, the US Dollar weakened as US stocks reversed losses and moved into positive territory. The US Dollar Index (DXY) is relatively unchanged for the day, hovering around 106.10, after briefly trading above 106.50 earlier on Monday.

- GBP/USD dips 0.30% to 1.2199, influenced by geopolitical tensions and contrasting economic indicators.

- Dallas Fed President Lorie Logan underscores restrictive policy and inflation focus, while UK data signals slowdown.

- GBP/USD lacks direction with upcoming UK GDP and US inflation data to provide a fresh impetus.

GBP/USD snaps three days of consecutive gains slumps on risk aversion spurred by the clash between Israel and Hamas after the latter struck an attack during the weekend. Consequently, risk-perceived currencies depreciated to the benefit of safe-haven peers, including the Greenback (USD). The GBP/USD is trading at around 1.2199, down 0.30%, after hitting a daily high of 1.2224.

Risk aversion dominates amid geopolitical unrest, divergent economic data weighed on GBP, as USD got boosted on safe-haven status

Wall Street is trading with losses, while the Volatility Index (VIX), also known as the fear index, climbs 5.28% to 18.41. recently, Dallas Fed President Lorie Logan commented that she’s focused on driving inflation down while adding that policy needs to be restrictive, although higher US yields could forgo another rate increase.

The latest week’s data in the US and UK front, favors GBP/USD downside. A hot US Nonfarm Payrolls report justifies the need to keep monetary policy at a restrictive level. Meanwhile, the UK’s economic data warrants the economy is slowing down, reigniting recession fears amongst analysts. Sources cited by Reuters commented that “no further rate hikes by the BoE” are expected.

Money market futures see it otherwise, with odds for December and February at 40% and 50%, respectively, that the Bank of England (BoE) would raise its Bank Rate. On the US side, the CME Fed Watch Tool portrays investors who remain skeptical. In fact, traders expect the US Federal Reserve’s (Fed) first rate cut by May 2024, with odds standing at 51.97%.

Aside from this, GBP/USD trades would take cues from economic data, with UK revealing its GDP figures for August, Industrial Production, Trade Balance, and Manufacturing Production. On the US Front, the docket will feature Fed speakers, September’s Producer Price Index (PPI), the Consumer Price Index (CPI), the latest Fed minutes, and Consumer Sentiment.

GBP/USD Technical Levels

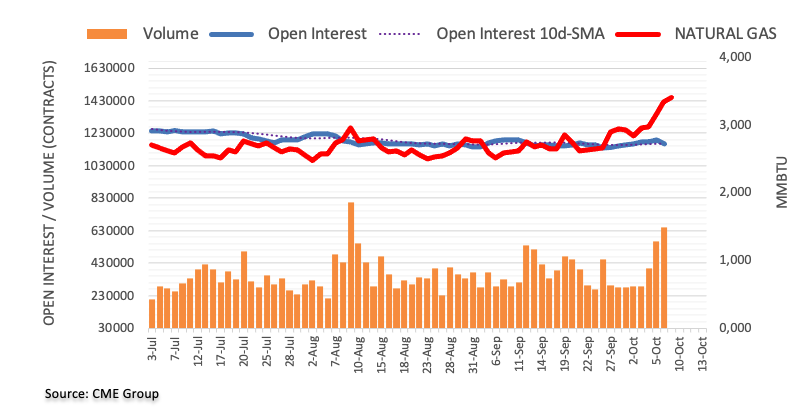

- WTI sees a topside jump to kick off the trading week.

- Middle East stability concerns are threatening oil prices, sending barrels higher.

- Israel ordered Chevron to freeze production at Tamar natural gas field, adding upside pressure to fossils.

West Texas Intermediary (WTI) Crude Oil caught a Monday bid on rising geopolitical tensions following a Hamas rocket attack on Israel in the Gaza Strip over the weekend. At least 700 people are dead and Israel has deployed approximately 100,000 additional troops to the region.

Crude oil markets are seeing rising concerns that an escalation of the Gaza conflict could destabilize Crude Oil supply, sending barrel costs higher for the new trading week and halting an extended decline that has seen oil prices close in the red five of the last six consecutive trading days and shedding nearly 15% peak-to-trough.

Gaza Strip escalation increases supply concerns

The Israeli government ordered US oil giant Chevron to temporarily halt production at its Tamar natural gas field just off the Israeli northern coast. The Tamar facility has frequently been closed down during periods of heightened unrest in the past.

Oil prices are pinning higher on concerns that the Gaza Strip escalation could spill over into additional geopolitical tensions in the Middle East and draw in nearby Iran and Saudi Arabia.

Analysts still expect crude oil supplies to undershoot demand for the last quarter of the year, which will see Crude Oil prices bolstered even further looking forward.

WTI technical outlook

WTI Crude Oil soared nearly 5.5% from the week's opening bids, just barely tipping over the $86.00 level before settling back into softer territory just south of $85.00, and is currently trading near $84.70.

Crude Oil reached a low of 80.63 in early trading before markets kicked off their supply-constraint rally, bringing the decline from September's tail-end peak of $93.98 over 14%.

Technical traders will note that WTI bids are currently getting hung up on the 50-day Simple Moving Average (SMA), and last week's decline through the rising trendline from June's bottom of $67.14 will see Crude Oil prices face additional downside pressure if bullish momentum can't be spooled up high enough.

WTI daily chart

WTI technical levels

- Canadian Dollar sees gains for holiday Monday as Crude Oil catches a bid on Israeli-Hamas conflict concerns.

- Canada markets are dark for Canadian Thanksgiving, in conjunction with the US Columbus Day holiday.

- It’s a quiet week on the economic calendar for the Canadian Loonie, investors to focus on US CPI inflation figures in the back half of the week.

The Canadian Dollar (CAD) is finding some lift on Monday, extending the Loonie’s rebound against the US Dollar (USD). The USD/CAD is trading back into familiar territory after tapping into a seven-month high last week on broad-market risk aversion flows that sent investors piling into the safe haven Greenback.

Canada is taking Monday off for the Thanksgiving national holiday, but geopolitical tensions around the Gaza Strip have sent global markets into an alert state. Crude Oil prices have lept higher on Middle East stability concerns, helping to prop up the oil-backed Loonie.

Daily Digest Market Movers: Canadian Dollar extends gains against the Greenback on Crude boost

- A rocket attack by Hamas claimed over 700 lives in the Gaza Strip over the weekend, prompting Israel to deploy approximately 100,000 additional troops in the region and igniting market concerns about Crude Oil supply destabilization in the Middle East.

- Oil barrel prices spiked on Monday, with West Texas Intermediary (WTI) Crude Oil up over 4% for the day to trade near $86 a barrel.

- The Canadian Dollar is getting pulled upwards (USD/CAD lower) by lifting barrel costs, extending the Loonie’s rebound from last week’s USD/CAD seven-month peak of 1.3785.

- The US Dollar is down around 0.33% against the CAD for Monday.

- The economic calendar is notably thin on the Canadian data side, leaving market flows to focus predominantly on geopolitical issues, as well as inbound US inflation figures due in the latter half of the trading week.

- US Producer Price Index (PPI) and Consumer Price Index (CPI) figures are due on Wednesday and Thursday, respectively.

- The Canadian exchanges are closed for the Canadian Thanksgiving holiday celebrations, further reactions could be expected when Loonie-based markets reopen on Tuesday.

Technical Analysis: Canadian Dollar extends rebound against US Dollar, trading into 1.3620

The USD/CAD is sliding back into the 1.3600 level after clipping a seven-month high of 1.3785 last week and is down 1.2% from that level.

The pair opened the new trading week near 1.3660, only managing to eke out a minor climb to a daily high of 1.3676 before falling back down the charts to trade into the 200-hour Simple Moving Average (SMA) near 1.3630.

The 200-day SMA is holding flat just above 1.3450, and a continued decline in the USD/CAD will see bids set to make a run at the 50-day SMA, which has confirmed a bullish cross of the longer moving average and is rising into the 1.3550 region.

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- USD/JPY drops 0.36% amidst escalating Israel-Palestine conflict, bolstering the Yen’s safe-haven status.

- Dallas Fed President Lorie Logan emphasizes restrictive monetary policy, spotlighting inflation as a primary concern.

- Upcoming economic data from Japan and the US, including Current Account and inflation figures, to influence the pair’s trajectory.

The Japanese yen (JPY) appeals to its status as a safe haven and appreciates against the Greenback (USD) in the mid-North American session as tensions between Israel and Palestine grow. Fighting during the weekend increased after Hamas claimed an attack on Israel during the Yom Kippur festival. At the time of writing, the USD/JPY is trading at 148.70, down 0.36%.

Safe-haven appeal of JPY intensifies amidst geopolitical strife

Global equities are set to remain pressured as Middle East tensions rise. Dallas Fed President Lorie Logan commented that monetary policy needs to remain restrictive, adding that higher US bond yields would diminish the need to increase interest rates and that her focus is bringing inflation down. Logan added that financial conditions are tightening but in an orderly fashion.

Although US Treasury bond yields remain high, they had dipped as of Monday. The US 10-year Treasury bond yield drops fourteen basis points and oscillates at 4.674%.

In the meantime, last week’s September US Nonfarm Payrolls report portrays the labor market remains hot and justifies the need for more rate hikes, but the CME Fed Watch Tool portrays investors who remain skeptical. In fact, traders expect the US Federal Reserve’s (Fed) first rate cut by May 2024, with odds standing at 51.97%.

USD/JPY are eyeing the current week's data. On the Japanese front, the economic agenda would feature the Current Account. In the US, the Fed parade continues, along with inflation figures on the producer and consumer side. After that, unemployment claims and consumer sentiment would update the status of the US economy.

USD/JPY Price Analysis Technical outlook

The USD/JPY remains neutral to upward bias, with price action remaining above the Ichimoku Cloud (Kumo). However, if the pair drops below the latest cycle high of 147.87 and achieves a daily close below the latter, the major could challenge the top of the Kumo at around 145.50. On the other hand and the path of least resistance, the USD/JPY could test the 150.00 figure, but first it needs to conquer 149.00

- Mexican Peso approaches last week’s high of 18.48; USD/MXN bulls target 18.50.

- Mexico’s inflation slows as core CPI rate drops below 6%, headline inflation near Banxico’s target.

- USD/MXN trading within the 18.20-18.40 range amid a US holiday.

Mexican Peso (MXN) loses territory against the US Dollar (USD) as risk aversion takes its toll after the resurgence of a Middle East conflict that involves Israel and Hamas. Therefore, the safe-haven status of the Greenback (USD) spurred demand, though high Oil prices have capped the USD/MXN pair rise as the fight intensifies, exchanging hands at around 18.30 for a gain of 0.86%.

Geopolitics is the main driver of Monday’s session, which also features a holiday in the United States (US) in observance of Columbus Day. Mexico’s inflation continues its downtrend, as reported by the National Statistics Agency known as INEGI on Monday, which could influence the Bank of Mexico’s (Banxico) decisions in the last two meetings of 2023. However, market participants estimate Banxico to hold rates for the remainder of the year at 11.25%.

Daily Digest Market Movers: Mexican Peso on the defensive as inflation dips amid risk-off impulse

- Mexico’s Consumer Price Index (CPI) grew by 4.45% YoY in September, below the 4.47% of estimates.

- The core CPI inflation in Mexico stood stickier at 5.76% YoY, as widely estimated, but has broken below the 6% threshold.

- A Citi Banamex poll showed economists estimate headline inflation at 4.70% and core at 5.09% for the year’s end.

- Analysts polled by Citi Banamex foresee the USD/MXN to end 2023 at 17.80, up from 17.60, and for 2024 at 18.86, up from 18.70 two weeks ago.

- On October 4, 2023, the IMF raised Mexico’s growth projection in 2023 from 2.6% to 3.2% and from 1.5% foreseen in July to 2.1% for 2024.

- Banxico’s September poll amongst economists reported that interest rates are expected to remain at 11.25% while inflation would dip to 4.66%.

- The same poll shows the USD/MXN exchange rate is set to finish at around 17.64, down from 17.75.

- Mexico’s S&P Global Manufacturing PMI for September came at 49.8, sliding to contractionary territory and below August’s 51.2, as the economy loses steam.

- The Bank of Mexico (Banxico) held rates at 11.25% in September and revised its inflation projections from 3.5% to 3.87% for 2024, above the central bank’s 3% target (plus or minus 1%).

- Banxico’s Government Board highlighted Mexico’s economic resilience and the strong labor market as the main drivers to keep inflation at the current interest rate level.

Technical Analysis: Mexican Peso at the brisk of depreciating to 19.00

The USD/MXN daily chart portrays the exotic pair as bullish-biased after hitting a new cycle high of 18.48 on Friday, above the April 5 high of 18.40. If buyers reclaim 18.50, that will extend the Mexican Peso’s losses with the pair aiming towards the March 24 swing high at 18.80, which, if cleared, would expose the 19.00 figure. On the other hand, if sellers reclaim the 200-day Simple Moving Average (SMA) at 17.79, that would pave the way to challenge the September 30 low of 17.34.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- AUD/USD prints a fresh intraday high at 0.6380 as the risk appetite of the market mood improves.

- The broader risk profile is still cautious due to deepening Middle East tensions.

- The USD index finds selling pressure near 106.60 as the focus shifts to US inflation data.

The AUD/USD pair refreshes intraday high at 0.6380 as investors pare shorts in risk-perceived assets executed due to the Middle East crisis amid bellicose between Israel and Palestinian military group. The recovery move in the Aussie asset could be a short-lived pullback as the market sentiment is still downbeat.

S&P500 futures recovered the majority of losses generated in the European session, portraying a recovery in the risk-appetite of the market participants. The 10-year US Treasury yields dropped sharply to near 4.70%. The US markets are closed on Monday on account of Columbus Day.

The US Dollar Index (DXY) faces selling pressure after a pullback move to near 106.60 as Dallas Federal Reserve (Fed) Bank President Lorie Logan draws less emphasis on raising interest rates further If long-term interest rates remain elevated because of higher term premiums. About the inflation outlook, Fed Logan cited "Progress on inflation is encouraging but it's too early to be confident it is headed to the Fed's 2% target in a sustainable, timely way."

Meanwhile, investors shift focus to the US Consumer Price Index (CPI) data for September, which will be published on Thursday at 12:30 GMT. As per the consensus, the core CPI that does not include volatile food and oil prices is seen expanding at a steady pace of 0.3%. Hotter-than-anticipated inflation report could elevate hopes of one more interest rate increase from the Fed.

On the Australian Dollar front, investors see one more interest rate increase from the Reserve Bank of Australia as inflation rebounded in August due to rising oil prices. Deepening tensions between Israel and Hamas have improved the oil price outlook, which could lift inflationary pressures in the Australian economy further. The RBA could lift interest rates by 25 basis points (bps) to 4.35% by the year-end.

- USD/CAD is exposed to more downside as higher oil prices strengthen the Canadian Dollar.

- Fed Bowman reiterated this weekend that further policy tightening is appropriate.

- Canada’s upbeat labor market data has prompted hawkish BoC bets.

The USD/CAD pair sets for a breakdown to near the round-level support of 1.3600 as deepening Middle East tensions due to Israel-Hamas bellicose has ramped up global oil prices. The Loonie asset has been exposed to more downside as the oil price rally has strengthened the Canadian Dollar.

S&P500 futures have generated losses in the early New York session as geopolitical tensions have dampened market sentiment. The appeal for the US Dollar improves significantly as investors rush for safe-haven assets amid a highly volatile environment.

The US Dollar Index (DXY) recovers to near 106.60 but struggles to extend the upside. The broader USD Index outlook is bullish due to the collective effort of risk-off impulse and rising odds of one more interest rate increase prompted by strong labor demand and decent wage growth.

Fed Governor Michelle Bowman reiterated this weekend that further policy-tightening by the central bank is appropriate. She is willing to support one more interest rate hike at a future policy meeting if incoming data conveys that progress in inflation easing to 2% has stalled.

On the Canadian Dollar front, upbeat labor market data for September improved odds of an interest rate hike from the Bank of Canada (BoC). Canadian employers hired 63.8K job-seekers in September, significantly higher than expectations of 20K and the former release of 39.9K. The Unemployment Rate remained steady at 5.5% while investors anticipated nominally higher at 5.6%. The annual wage rate accelerated to 5.3% against the former release of 5.2%.

- EUR/USD comes under pressure following Friday’s tops.

- Extra weakness could prompt the pair to drop to 1.0450.

EUR/USD revisits the 1.0520 region following renewed downside pressure and following Friday’s climb to as high as the 1.0600 region.

In case bulls regain the initiative, the pair should initially retarget the minor barrier at 1.0617 (September 29) ahead of the weekly peak of 1.0767 (September 12). On the flip side, if bears regain the upper hand, the pair could slip back to the area of yearly lows around 1.0450 (October 3).

Meanwhile, further losses remain on the table as long as the pair navigates the area below the key 200-day SMA, today at 1.0823.

EUR/USD daily chart

Continued restrictive financial conditions will be necessary to bring down inflation, Dallas Fed President Lorie Logan said on Monday, per Reuters.

"If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate," Logan added. "However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more."

Key quotes

"We are attentive to risks on both sides of fed's mandate, but high inflation is the most important risk."

"Progress on inflation is encouraging but it's too early to be confident it is headed to the Fed's 2% target in a sustainable, timely way."

"Labor market is still very strong, wages are still solid."

"Output, spending have been surprisingly strong; outlooks for consumer are mixed."

Market reaction

The US Dollar Index stays retreated from daily highs following these comments and was last seen gaining 0.2% on the day at 106.32.

- DXY reverses three consecutive daily drops on Monday.

- The continuation of the rebound shifts the attention to the 2023 top.

DXY regains composure and manages to partially reverse the recent three-day decline so far at the beginning of the week.

Considering the ongoing price action, extra gains appear likely in the dollar for the time being. Once the index clears the 2023 top of 107.34 (October 3), it could encourage bulls to challenge the weekly peak at 107.99 (November 21 2022) just ahead of the round level at 108.00.

In the meantime, while above the key 200-day SMA, today at 103.17, the outlook for the index is expected to remain constructive.

DXY daily chart

- EUR/JPY trades in an inconclusive fashion around 157.00.

- Extra range bound looks likely for the time being.

EUR/JPY trades in a consolidative range around the 157.00 region following Friday’s strong gains.

In the meantime, the cross remains stuck within the consolidative range and the breakout of it exposes a visit to the so far monthly high of 158.65 (September 13) prior to the 2023 top at 159.76 (August 30), which precedes the key round level at 160.00.

On the downside, the so far monthly low of 154.34 (October 3) emerges as the initial contention in case of bearish attempts.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 149.90.

EUR/JPY daily chart

UOB Group’s Economist Enrico Tanuwidjaja and Junior Economist Agus Santoso review the latest FX reserves figures in Indonesia.

Key Takeaways

Indonesia’s foreign exchange reserves fell by USD2.2bn to USD134.9bn in Sep 2023.

The latest reserves level was equivalent to financing 6.1 months of imports or 6 months’ worth of imports and external government debt servicing, well above the international adequacy standard of 3 months of imports.

The figure reaffirms that exports revenue in Sep is expected to be flattish. Some indicators we looked at in Sep were commodity prices declining and lower demand from India and China as Indonesia’s main trading partners. Going forward, we maintain our forecast of Indonesian FX reserves to remain in high levels of around USD135bn to USD145bn at the end of this year on the back of better outlook especially from coal demand and inflows into the bond market.

- NZD/USD juggles around 0.5980 after a corrective move, propelled by a risk-off impulse.

- The US Dollar Index recovers to near 106.53 as investors shift focus to the inflation data for September.

- NZD/USD trades in a 0.5840-0.6050 range from the past two months, indicating a sheer volatility squeeze.

The NZD/USD pair turns sideways below the psychological resistance of 0.6000 as tensions deepening in the Middle East over the Israel-Hamas crisis have dampened market sentiment. The Kiwi asset drops to near 0.5980 as investors rush to safe-haven assets. It is worth noting that a sell-off in the Asia-Pacific currencies is slower against selling pressure in Europe.

The appeal for the US Dollar improves significantly due to the risk-off impulse propelled by Israel-Hamas tensions and rising odds of one more interest rate increase from the Federal Reserve (Fed) prompted by strong labor demand.

The US Dollar Index (DXY) recovers to near 106.53 and is expected to extend upside as investors shift focus to the Consumer Price Index (CPI) data for September, which will be published on Thursday. The core CPI that strips off volatile food and oil prices is seen growing at a steady pace of 0.3%.

NZD/USD trades in a 0.5840-0.6050 range from the past two months, indicating a sheer volatility squeeze. A prolonged consolidation is generally followed by wider ticks and heavy volume after a volatility explosion.

The Kiwi asset remains sticky with the 20-period Exponential Moving Average (EMA) around 0.5960, portraying a sideways performance.

Meanwhile, the Relative Strength Index (RSI) (14) hovers near 60.00. A breakout above the same would activate the bullish impulse.

Going forward, a decisive break above the psychological resistance of 0.6000 would drive the major toward September 29 high around 0.6050. A breach of the latter would send the major toward August 09 high at 0.6096

On the flip side, a breakdown below the round-level support of 0.5900 would drag the major toward September 7 low at 0.5847. A slippage below the latter would expose the asset to the round-level support at 0.5800.

NZD/USD four-hour chart

Citing six sources familiar with the matter, Reuters reported on Monday that European Central Bank (ECB) policymakers consider the rise in Italian bond yields is justified by deteriorating budget fundamentals.

"I think Italy's troubles are entirely self-inflicted, so the market reaction is quite justified. But there is a lesson for us in that Pandemic Emergency Purchase Programme's (PEPP) flexibility is valuable that we shouldn't give up without thorough analysis," one of the sources told Reuters.

Market reaction

The EUR/USD pair stays under bearish pressure following this headline and the was last seen losing 0.52% on the day at 1.0532.

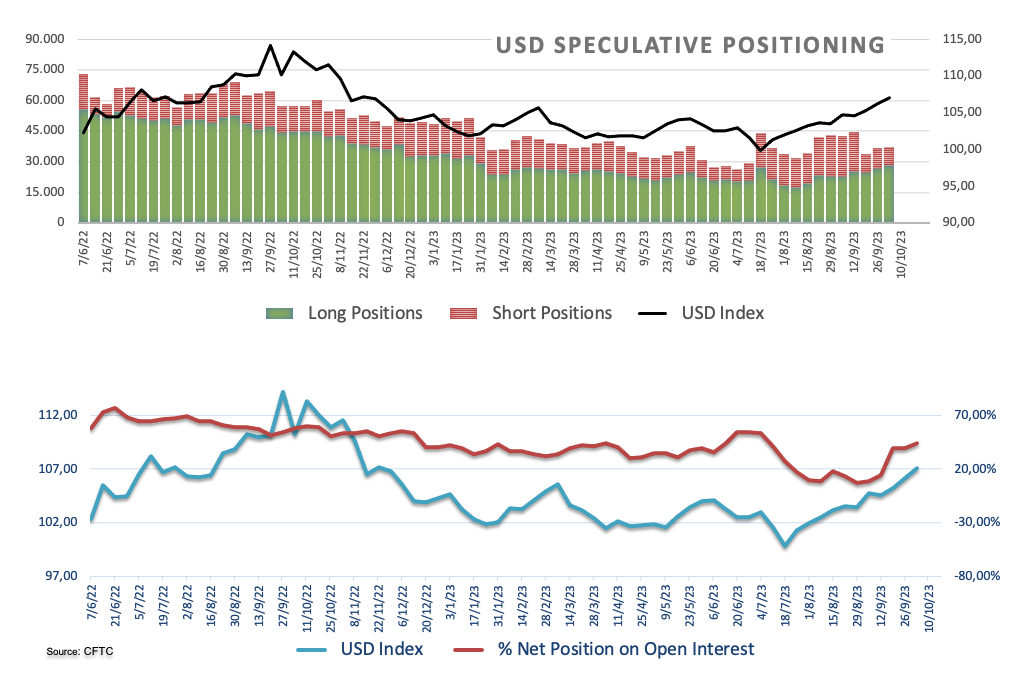

- The Greenback starts its week on a high note after breaking its weekly winning streak.

- Traders run for safety as Hamas attacked Israel over the weekend in its biggest offence in two decades.

- The US Dollar Index breaks back above 106.00 and looks primed to head higher.

The US Dollar (USD) is not able to enjoy the US public holiday on Monday. Despite Columbus Day, the Greenback is soaring higher after it gapped up on Sunday night amidst headlines from Hamas attacking Israel with a major offensive not seen in decades. All bets are off with safe havens seeing massive inflows.

With an empty economic calendar, expect this Monday’s moves to be driven by the Israel-Gaza conflict. Several headlines from world leaders and organisations like OPEC+ are driving safe havens higher. Israel is preparing for retaliation while it proclaimed that Iran is behind the attacks, with Western leaders not yet confirming or backing these findings, showing the sensitivity of the matter and the interest in Crude Oil supply out of the region.

Daily digest: US Dollar to remain elevated

- Amidst all the headlines around Israel and Hamas, two US Federal Reserve members are due to speak this Monday: Near 13:00 GMT, Dallas Fed President Lorie Logan is due to speak. Near 16:45 GMT, Fed Governor Philip Jefferson will also speak.

- Israel has issued a statement saying that Iran is behind the coordinated attacks. Thus far, Western leaders have refrained from backing this statement. Meanwhile, US naval ships are on route to the region to provide support for Israel.

- Equities are down, though starting to pare losses as market participants get a grip on the situation at hand. If this recovery continues, expect to possibly even see green numbers near the end of this Monday.

- The CME Group FedWatch Tool shows that markets are pricing in a 78.9% chance that the Federal Reserve will keep interest rates unchanged at its meeting in November.

- The benchmark 10-year US Treasury yield is closed for the US holiday. Expectations would be that yields will drop as bids for safe US bonds will soar to enormous proportions.

US Dollar Index technical analysis: Week 13

The US Dollar is remorseless in its winning streak after a squeeze on Friday snapped its winning streak, which lasted for twelve weeks. The US public holiday keeps US bond markets closed, though where it was open, it would have triggered even more safe-haven flow into the Greenback. Expect for the US Dollar Index to still remain in its uptrend and look to reboot its weekly winning streak.

The US Dollar Index opened around 106.29, with the Relative Strength Index (RSI) easing down a touch after the DXY snapped its weekly winning streak on Friday. On the topside, 107.19 is important to see if the DXY can get a daily close above that level. If this is the case, 109.30 is the next level to watch.

On the downside, the recent resistance at 105.88 should be seen as first support. Still, this barrier has just been broken to the upside, so it isn’t likely to be strong. Instead, look for 105.12 to keep the DXY above 105.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

European Central Bank (ECB) policymaker Klaas Knot said on Monday that he was comfortable with the current interest rate levels but added that elevated oil price due to the conflict in Israel could present a new shock to inflation, per Reuters.

"For now, inflation risks are more balanced than they have been for a long time," he said and noted that they will monitor meeting by meeting whether this remains the case.

Market reaction

EUR/USD showed no immediate reaction to these comments and was last seen losing 0.52% on the day at 1.0532.

Assessing the September jobs report, analysts at TD Securities noted that Nonfarm Payrolls surprised expectations notably to the upside in September, with the economy adding a whopping 336k net jobs.

We still expect the Fed to stay on hold

"With that said, the large swings in revisions make the report increasingly unreliable as a policy signal in the short term. On the other hand, the unemployment rate stayed unchanged at 3.8%, maintaining the unexpected three-tenth jump from the last report. Average hourly earnings surprised expectations to the downside for a second consecutive month, with the momentum in wage growth still pointing lower."

"We still think that the Fed would prefer to gather additional data before making a decision to hike rates again, particularly after the sharp trek higher in yields. With that said, we still expect the Fed to stay on hold unless the totality of the data undeniably supports the strength seen in today's jobs report. Key Fedspeak early next week will provide an update to current Fed views."

- Oil (WTI) jumps back above $82 after its steep decline last week.

- The US Dollar jumps higher with safe-haven flows in the Greenback and Japanese Yen.

- Expect to possibly see further upticks in oil prices as tensions are set to rise with US military ships being dispatched to the region.

Oil prices are in for a wild ride after the surprise raids and attacks on Israel from Hamas. The Wall Street Journal was quite quick to issue a report saying that the attacks were the hand of Iranian officials. Although no Western officials have backed these statements, it points to a high risk of spillover for a global escalation in the region.

Meanwhile, the US Dollar is firmly in the green. This time there is no rate-driven move as US bond markets are closed for the US public holiday. The Greenback is seeing ample demand from investors looking for shelter from another war in the Middle East that might only escalate further with Israel already carrying out retaliatory airstrikes.

Crude Oil (WTI) trades at $84.02 per barrel, and Brent Oil trades at $86.13 per barrel at the time of writing.

Oil news and market movers

- Oil prices are jumping higher, together with Gold and Copper, on fears the biggest attack on Israel in decades could broaden the turmoil in the wider Middle East. The Middle East accounts for nearly one third of global Oil supply.

- Israel has pointed the finger at Iran after reports from The Wall Street Journal. No Western officials have come out backing those arguments.

- Oil refiners across China are confident that flows from the Islamic Republic will continue unabated. Chinese involvement in the conflict or region does not look to be on the table. Furthermore, China is able to shortcut any supply disruptions by buying more oil from partner Russia.

- In an overall market move, with US Treasury bond markets closed for the US holiday, firm upticks are seen in Gold, Copper, Crude Oil, and safe havens like the US Dollar, Japanese Yen and Chinese Renminbi.

Oil Technical Analysis: Wild ride

Oil prices were dropping like a stone last week as demand faded quickly. Despite the recent turmoil, overall expectations are that the US will try not to trigger any supply hiccups in the region by getting involved too much. Expect a wild ride with headline-driven moves higher, though a retest at $94 looks highly unlikely with supply being undisrupted.

On the upside, the double top from October and November of last year at $93.12 remains the level to beat. Although it got breached on Thursday, the level never got a daily close above it. Should $93.12 be taken out, look for $97.11, the high of August 2022.

On the downside, traders are bracing for the entry of that region near $78. That area should see ample support for buying. Any further drops below that area might see a firm nosedive move, which would sink oil prices below $70.

-638324416397863863.png)

US Crude (Daily Chart)

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- EUR/GBP declined toward 0.8600 as the ECB’s higher interest rates dented the economic outlook.

- ECB Lagarde vowed to keep interest rates higher to bring inflation to 2% in a timely manner.

- BoE Bailey is confident about bringing down inflation to 5% or lower by the year-end.

The EUR/GBP pair remains under pressure from the last week after the Eurozone’s consumer spending data slowed at a higher pace in August as high inflation squeezes the real income of households. The cross is expected to extend its downside as the confidence of investors in the Eurozone economy is declining due to an uncertain economic outlook.