- Analytics

- News and Tools

- Market News

Новини ринків

- WTI bulls take a breather after four-day uptrend, sidelined of late.

- US SPI refill concerns, geopolitical woes join sluggish US Dollar to favor Oil buyers.

- Mixed sentiment, recession fears and US debt-ceiling jitters weigh on commodity price.

- US CPI, EIA inventories will be eyed for clear directions.

WTI crude oil remains static around mid-$73.00s amid the early hours of Wednesday’s Asian session, after portraying a four-day rebound from the lowest levels since December 2021.

In doing so, the black gold price portrays the market’s cautious mood ahead of the key US inflation data, as well as mixed clues from the ongoing US debt-ceiling talks in the White House. However, talks of the US readiness to refill the US Strategic Petroleum Reserves (SPR) allow the WTI buyers to remain hopeful.

Reuters quotes a report by Bloomberg released on Tuesday afternoon that said that US President Joe Biden's administration plans to begin purchasing crude oil to fill strategic crude oil reserves after completing maintenance later this year. The news also added, “The start of summer season in the Northern Hemisphere and voluntary production cuts by members of the Organization of the Petroleum Exporting Countries (OPEC) are expected to bolster oil prices.”

Alternatively, the weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data and firmer US Dollar prod the energy benchmark prices as the key lure buyers. That said, the weekly API inventories for the period ended on May 05 rose to 3.618M versus -3.939M prior.

Elsewhere, US Senate Majority Leader Chuck Schumer conveyed the absence of progress in the key debt-ceiling talks at the White House while International Monetary Fund (IMF) Chief Economist Pierre-Olivier Gourinchas said on Tuesday, “We are a bit concerned about recent banking sector turbulence.” The same could be heard from the Fed's quarterly survey of bank loan officers, released on Monday.

While portraying the mood, the S&P 500 Futures remain sluggish whereas US Treasury bond yields grind higher and the US Dollar Index (DXY) struggles to extend the two-day rebound near 101.50.

Moving on, the US Consumer Price Index (CPI) for April and the official Weekly Crude Oil Stocks Change data from the US Energy Information Administration (EIA) will be crucial for clear directions.

Technical analysis

A daily closing beyond the three-week-old descending resistance line, now immediate support near $72.65, keeps WTI buyers hopeful.

- DXY faces resistance at the 20-day EMA, with bulls needing to reclaim this level and the 102.000 mark to break the sideways trend.

- DXY support lies at a weekly low of 101.041, with further levels under 101.000, including the YTD low of 100.788.

The US Dollar Index (DXY), a gauge of the greenback’s value against a basket of six currencies, registers minuscule gains of 0.26% as the Asian session begins. The DXY exchanges hands at around 101.654 after hitting a daily low of 101.359.

Must read: US Dollar Index: Could a double bottom at the weekly chart drive the DXY to 111.000?

US Dollar Index Price Analysis: Technical outlook

The US Dollar continues to overextend nearby yearly lows, unable to drop to fresh year-to-date (YTD) lows, and capped on the upside by the 20-day Exponential Moving Average (EMA) at 101.728. The DXY is set to remain trading sideways, unable to break below/above the range.

Even though the double-bottom in the weekly chart remains in play, US Dollar bulls must reclaim the 20-day EMA, followed by the 102.000 mark. If that scenario plays out, the DXY will test the confluence of a six-month-old resistance trendline and the 50-day EMA at around 102.300-400. A decisive break could trigger an acceleration toward the 103.000 area, with the 100 and 200-day EMAs resting at 103.290 and 103.843, respectively.

Conversely, DXY’s first support would be the weekly low of 101.041. Support levels lie underneath the 101.000 figure, with the February 2 swing low of 100.820, followed by the year-to-date (YTD) low of 100.788.

US Dollar Index Price Chart – Daily Chart

- USD/CAD fades the week-start bounce off the lowest levels since mid-April.

- Failure to cross five-week-old horizontal hurdle, downbeat oscillators keep sellers hopeful.

- Loonie pair buyers need to takeout 1.3620 to regain powers.

USD/CAD retreats to 1.3380 during early Wednesday in Asia, fading the previous two-day rebound from a monthly low, as traders await the key US inflation numbers for April. Also allowing the Loonie pair traders to consolidate recent gains can be the latest US debt-ceiling jitters are policymakers failed to solve the riddle in the first trial.

Also read: US President Biden, House Speaker McCarthy divided over debt ceiling but still talking

Apart from the risk catalysts, the quote’s failure to cross a horizontal resistance area comprising multiple levels marked since early April, around 1.3405-10, also weigh on the USD/CAD prices.

Furthermore, RSI (14) rebound from the oversold territory and sluggish MACD signals also prod the USD/CAD buyers

With this, the Loonie pair appears all set to challenge a one-month-old horizontal support zone surrounding 1.3315-3300.

Following that, lows marked in February and late 2022, near 1.3260 and 1.3225 in that order, will be in the spotlight.

Alternatively, the USD/CAD pair’s recovery moves past the 1.3410 immediate hurdle isn’t an open welcome to the Loonie pair buyers as the 200-SMA and five-week-old horizontal area, near 1.3510 and 1.3530 respectively, can check the upside moves.

It’s worth noting that a downward-sloping resistance line from March 10, close to 1.3620 by the press time, appears the last defense of the USD/CAD bears.

USD/CAD: Four-hour chart

Trend: Further downside expected

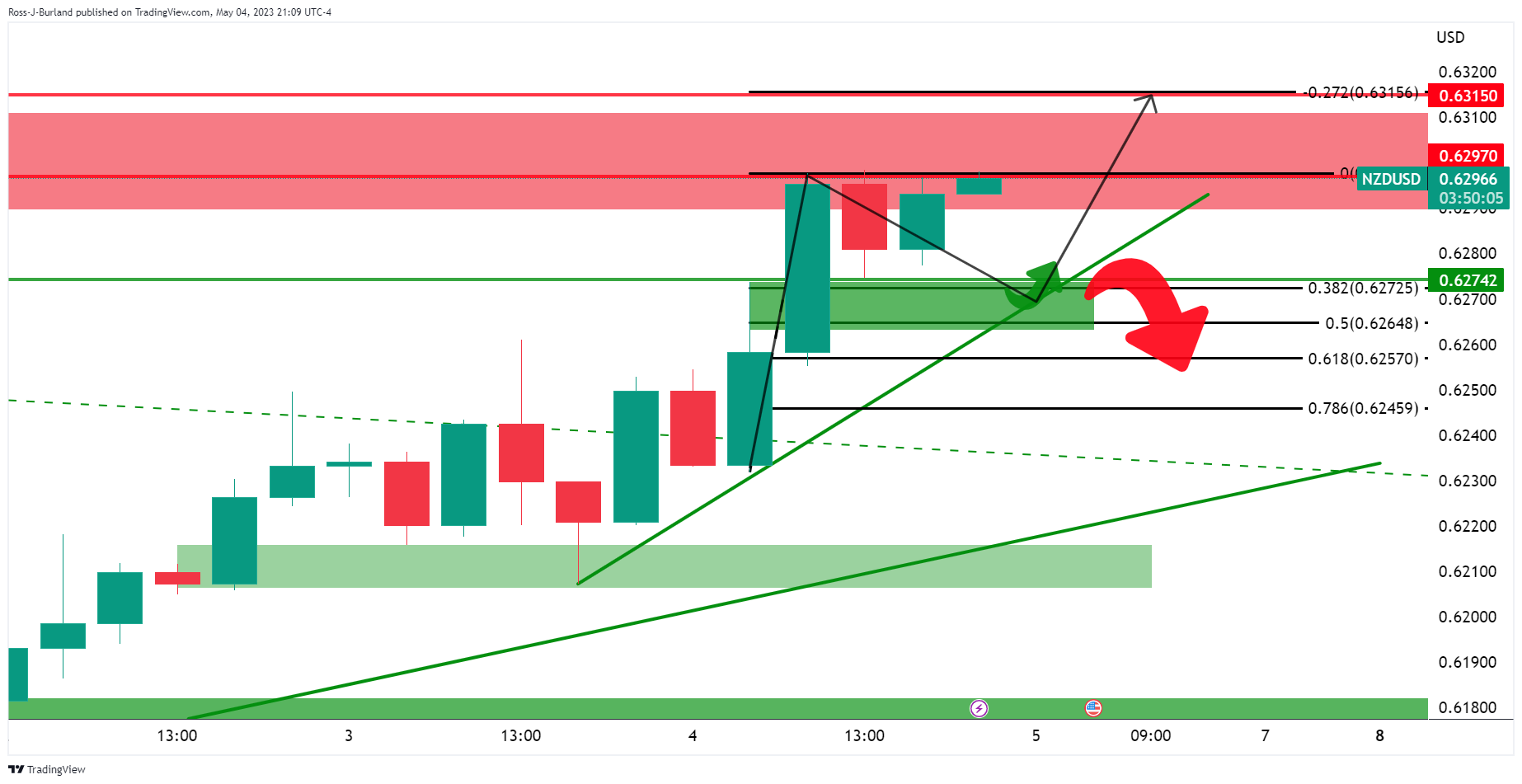

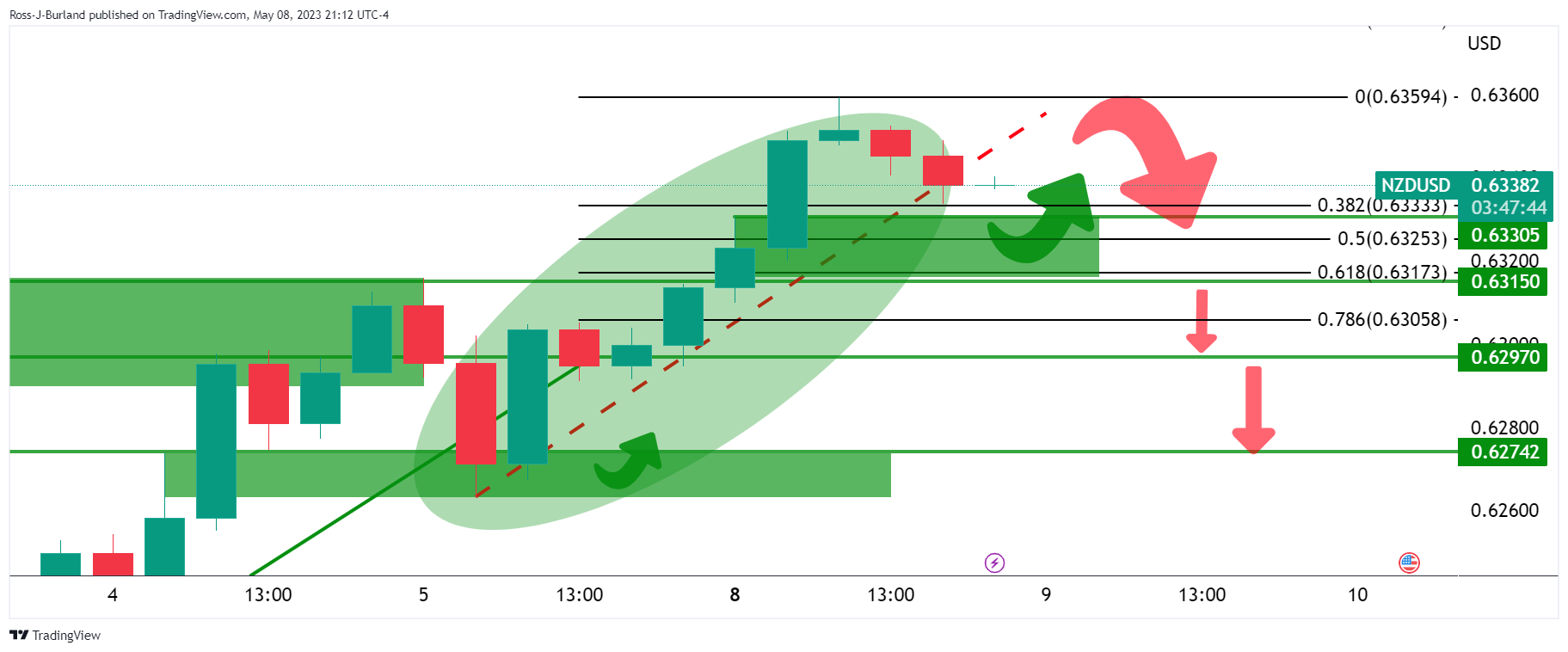

- NZD/USD is looking to reclaim 0.6360 as US debt ceiling talks are scheduled for Friday for further negotiations.

- US debt ceiling talks ended without a conclusion as Speaker McCarthy denied agreeing on default off the table.

- As per the consensus, China’s monthly inflation remained stagnant while annual inflation accelerated by 0.3%.

The NZD/USD pair has stretched its recovery to near 0.6336 in the early Asian session. The Kiwi asset is expected to remain on the tenterhooks as negotiations for US debt ceiling issues between US President Joe Biden and Speaker Kevin McCarthy are heating as the latter is not ready to agree to support debt ceiling raise without cutting spending initiatives.

At the White House official, US President Joe Biden has cited that McCarthy's spending cuts will hurt Americans. However, for a major development, investors have to wait till Friday as agreed but volatility will remain at elevated levels until both parties reach a conclusion.

Meanwhile, S&P500 futures have added minimal gains in the Asian session after a bearish Tuesday. Synergic uncertainty due to US debt ceiling talks and inflation figures capped the upside for US equities. The US Dollar Index (DXY) has recovered to near 101.65 and further action will be directed by inflation data. The overall market mood portrays caution as April’s US Consumer Price Index (CPI) data carries significant importance.

The Federal Reserve (Fed) has already conveyed that it will be more data-centric onwards. April’s Employment report has signaled that Fed chair Jerome Powell would keep interest rates higher for a longer period and now persistent inflationary pressures could fuel the need for more rate hikes ahead.

On Tuesday, New York Federal Reserve (Fed) Bank President John Williams cited that the central bank has not said that it’s done with raising rates. Fed policymaker doesn’t see any reason of rate cuts this year as tight credit conditions by commercial banks are not expected to knock out the economy.

On the New Zealand Dollar front, after recording slower growth in Chinese exports and weakness in domestic demand, investors are shifting their focus toward the inflation data (April). As per the preliminary report, monthly inflation is seen stagnant against March’s deceleration of 0.3%. Annual inflation is expected to accelerate by 0.3% at a slower pace vs. the prior release of 0.7%.

It is worth noting that New Zealand is one of the leading trading partners of China and higher inflation in China would signal strong domestic recovery, which might support the New Zealand Dollar.

President Joe Biden and top lawmakers failed to break a deadlock on Tuesday in face-to-face talks over raising the $31.4 trillion U.S. debt limit but vowed to meet again with just three weeks before the country may be forced into an unprecedented default.

More to come

- GBP/USD is looking to extend its recovery above 1.2630 as US debt ceiling negotiations ended without outcome.

- The Pound Sterling will remain in action ahead of the interest rate decision by the BoE.

- GBP/USD has rebounded after testing the breakout region near 1.2600 of the Rising Channel pattern.

The GBP/USD pair is looking to extend its recovery above the immediate resistance of 1.2630 in the early Tokyo session. The Cable is getting some traction as the ending of the US debt ceiling talks without any conclusion has increased uncertainty.

US President Joe Biden cited that Speaker Kevin McCarthy was not ready to approve default off the table. Further discussions will take place on Friday, which gets US inflation back into a major highlight. The US Dollar Index (DXY) extended its recovery to near 101.65 on expectations that the US inflation would remain stubborn further.

Meanwhile, the Pound Sterling will remain in action ahead of the interest rate decision by the Bank of England (BoE), which is scheduled for Thursday. BoE Governor Andrew Bailey is expected to raise interest rates further by 25 basis points (bps) to 4.50%.

GBP/USD has rebounded after testing the breakout region near 1.2600 of the Rising Channel chart pattern formed on a two-hour scale. A confident test of the Rising Channel breakout has stemmed confidence over the strength in the breakout.

The 50-period Exponential Moving Average (EMA) at 1.2600 is providing cushion to the Pound Sterling bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped into the 40.00-60.00 range after a mild correction. An upside break into the 60.00-80.00 range will activate the bullish momentum.

Further recovery above May 09 high at 1.2640 will drive the major toward the round-level resistance at 1.2700 followed by 26 April 2022 high at 1.2772.

On the flip side, a reversal move below May 05 low at 1.2561 will drag the Cable toward April 26 high at 1.2515 and May 02 low at 1.2436.

GBP/USD two-hour chart

- AUD/USD remains sidelined during early trading hours of the key day, after reversing from one-month high.

- Downbeat Aussie, China data and hawkish Fed talks joined risk-off mood to weigh on the Aussie pair.

- US CPI for April, debt-ceiling talks will be crucial, Australia’s Westpac Consumer Confidence for May eyed for immediate direction.

AUD/USD seesaws around 0.6760 while fading the late Tuesday’s corrective bounce off 0.6745 around the monthly high, following the first daily loss in seven. In doing so, the Aussie pair portrays the market’s anxiety ahead of the all-important US Consumer Price Index (CPI) data for April. Also keeping traders on their toes is a dramatic start of the US debt-ceiling talks and fears of tighter credit conditions in the US banks.

It’s worth noting that the downbeat statistics from Australia and China joined hawkish comments from the Federal Reserve (Fed) officials, as well as the risk-off mood, to supersede the Pacific major’s upbeat annual budget and weigh on the AUD/USD prices the previous day.

Australia’s first quarter (Q1) Retail Sales shrank 0.6% versus -0.4% market forecasts and -0.2% prior readings. Further, China’s headlines Trade Balance rose to $90.21B in April versus $71.6B expected and $88.19B prior while the CNY figures eased to 618.44B compared to 637.16B market forecasts and 601.01B prior. It’s worth noting, however, that the Exports and Imports declined in the said month on both the USD and Chinese Yuan (CNY) terms.

On the other hand, the US NFIB Small Business Optimism index dropped to the lowest level since 2013, to 89 in April. Following the data, Federal Reserve Bank of New York President John Williams said, per Reuters, "Fed has not said it's done raising rates."

Elsewhere, the Australian government forecasts a 2022/23 budget surplus of A$4.2 billion, 0.2% of GDP, making it the first balanced budget in many years.

Talking about the risks, International Monetary Fund (IMF) Chief Economist Pierre-Olivier Gourinchas said on Tuesday, “We are a bit concerned about recent banking sector turbulence.” The same could be heard from the Fed's quarterly survey of bank loan officers, released on Monday.

Recently, US Senate Majority Leader Chuck Schumer conveyed the absence of progress in the key debt-ceiling talks at the White House.

Against this backdrop, Wall Street closed with mild losses whereas the US Treasury bond yields remained firmer by the end of Tuesday’s North American session.

Looking ahead, Australia’s Westpac Consumer Confidence for May, expected to drop to -1.7% versus 9.4% prior, can offer immediate directions but major attention will be given to the US CPI for April, expected to print a minor MoM increase in the headline CPI and a softening in the Core CPI.

Also read: US April CPI Preview: How will inflation data influence Fed rate outlook?

Technical analysis

Failure to cross the 100-DMA hurdle, around 0.6790 by the press time, keeps AUD/USD bears hopeful.

- Silver price bounced off the weekly low after sliding below the $25.10 area, around last Friday’s low.

- Mixed signals keep traders cautious; bullish continuation requires a break above $25.73, while downside risks remain below $25.33.

Silver price prints minuscule gains as the Asian session begins after registering solid gains of 0.23% on Tuesday. Risk aversion is the game’s name; even though the US Dollar (USD) reported gains, so did the white metal. At the time of writing, the XAG/USD is trading at $25.60 per troy ounce.

XAG/USD Price Forecast

The XAG/USD last week’s pullback nearby the 20-day Exponential Moving Average (EMA) at $25.06 resumed since the beginning of the current week. Monday’s price action was dull, as the white metal traded within a $0.20 rally before dropping toward the weekly low of $25.33.

It should be said the XAG/USD recovery had shown no sign of buyers gathering momentum, as shown by the Relative Strength Index (RSI) indicator, which remains in bullish territory, but is almost flat. The 3-day Rate of Change (RoC) indicated that sellers are moving in. Mixed signals could refrain XAG/USD traders from opening new positions as the US Consumer Price Index (CPI) data looms.

For a bullish continuation, XAG/USD buyers need a clear break above $25.73. Once cleared, the next supply zone that would be tested is the year-to-date (YTD) high at $26.12. A breach of the latter will expose the April 18, 2022, daily high of $26.21.

On the other hand, the XAG/USD needs to drop below the weekly low of $25.33. A break below this support area and the next stop would be the 20-day EMA at $25.19 before falling to the $25.00 figure.

XAG/USD Price Chart – Daily Chart

After US Senate Majority Leader Chuck Schumer conveyed the absence of progress in the key debt-ceiling talks at the White House, the US Chamber of Commerce Officials also unveiled their disappointment with no movement. However, the diplomats also said, per Reuters, “Pleased US President Joe Biden, Congressional Leaders will meet again.”

“Clean bill cannot become law,” added US Chamber of Commerce Officials per the news while also saying that both parties should focus on areas where agreement is possible, like permitting and limits on future spending.

Also read: US Senate Democratic Leader Schumer: McCarthy refused to take default off the table

Market implications

The news exerts downside pressure on the sentiment and allows the US Dollar to remain firmer, especially ahead of the key US Consumer Price Index (CPI) data for April.

Also read: EUR/USD stays defensive near 1.0950 amid US default woes, hawkish Fed talks ahead of US inflation

- EUR/USD licks its wounds at the lowest levels in 13 days, prods two-day losing streak as the US inflation day begins.

- Fed’s Williams sounds hawkish despite downbeat US NFIB data.

- US debt-ceiling drama, banking woes keep weighing on sentiment.

- ECB hawks stay active but were mostly ignored as US Dollar defends recovery ahead of US CPI for April.

EUR/USD holds lower grounds near 1.0960 as the key Wednesday’s trading begins in Asia, following a two-day downtrend. That said, the Euro pair dropped to the fresh low in two weeks the previous day amid broad US Dollar strength as markets prepare for today’s US Consumer Price Index (CPI) for April.

US Dollar Index (DXY) rose in the last two consecutive days despite unimpressive data and looming fears from the US banking sector, as well as the debt ceiling expiration. On Monday, the Fed Bank Loan Survey showed the uninspiring findings while US Senate Democratic leader Schumer recently said that House Speaker Kevin McCarthy, a Republican, refused to take default off the table.

Further, the US NFIB Small Business Optimism index dropped to the lowest level since 2013, to 89 in April. Even so, Federal Reserve Bank of New York President John Williams said, per Reuters, "Fed has not said it's done raising rates."

On the other hand, European Central Bank (ECB) policymaker Peter Kazimir said on Tuesday, “Based on current data, the ECB will have to keep raising interest rates for longer than anticipated.” On the same line, ECB policymaker Martins Kazaks warned on Tuesday, “Rate-hiking may not be finished in July.

It’s worth noting that a dearth of major data/events joined pre-inflation anxiety and hawkish Fed talks, as well as fears emanating from the US debt ceiling expiration and banking sector, to weigh on the sentiment, which in turn favored the US Dollar and lured EUR/USD sellers.

That said, Wall Street closed with mild losses whereas the US Treasury bond yields remained firmer by the end of Tuesday’s North American session.

Moving on, final readings of Germany’s inflation gauge, per the

Harmonized Index of Consumer Prices (HICP) for April, expected to confirm 7.6% YoY forecasts, may entertain EUR/USD pair traders ahead of the all-important US CPI for the said month. Forecasts suggest a minor MoM increase in the headlines CPI and a softening in the Core CPI. However, any positive surprise or matching of the figures with the market consensus can allow the Fed to remain hawkish and the same can exert downside pressure on the major currency pair.

Also read: US April CPI Preview: How will inflation data influence Fed rate outlook?

Technical analysis

Although a triple bottom around 1.0940 highlights the levels as the key support, a daily close below the 21-DMA level of near 1.1000 keeps EUR/USD bears hopeful.

- Gold price has surpassed comfortably above $2,030.00 amid uncertainty over the outcome of US debt ceiling talks.

- The US Dollar Index has rebounded to near 101.64 ahead of the US Inflation data.

- Fed Williams is of the view that the central banks have not said it’s done with raising rates.

Gold price (XAU/USD) has climbed above the $2,030.00 resistance and has shifted its auction above the same in the early Asian session. The upside move in the precious metal is being supported by uncertainty over US debt ceiling talks between US President Joe Biden and some Republican leaders.

S&P500 went through some sell-off on Monday as investors were worried that the absence of any decisive outcome in the debt-ceiling negotiations would impact the outlook of the United States economy, portraying a risk-off mood. The US Dollar Index (DXY) has rebounded to near 101.64 as the downside seems defended ahead of the US inflation data.

At one place where US President Joe Biden was not interested in raising the debt ceiling at the cost of the President’s spending initiatives, Republican House of Representatives Speaker Kevin McCarthy already made clear that he won’t approve debt ceiling raise without cutting President’s spending initiative to safeguard escalating budget deficit.

Meanwhile, hawkish commentary from New York Federal Reserve (Fed) Bank President John Williams has also added to the overall uncertainty in the market. Fed policymakers cited that the central bank needs to be data-dependent with monetary policy and reminded that the Fed will raise rates again if needed. He further added that the Fed has not said it’s done with raising rates and see no reason for rate cuts this year.

Gold technical analysis

Gold price is auctioning in a Rising Channel chart pattern on a four-hour scale. The upper portion of the aforementioned chart pattern is placed from March 20 high at $2,009.88 while the lower portion is plotted from March 22 low at $1,934.34.

The 20-period Exponential Moving Average (EMA) at $2,027.58 is acting as a cushion for the Gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is making efforts for shifting into the bullish range of 60.00-80.00. An occurrence of the same will result in the activation of the upside momentum.

Gold four-hour chart

President Joe Biden and top lawmakers met face-to-face on Tuesday as a deadlock over raising the $31.4 trillion U.S. debt limit threatened to push the country into an unprecedented default in as soon as three weeks if Congress does not act, Reuters reported.

´´The Oval Office meeting between Biden, a Democrat, and House of Representatives Speaker Kevin McCarthy, a Republican, ended after just over an hour with no immediate sign progress was made, after both sides suggested earlier they would not agree to concessions to head off a default as early as June 1.´´

McCarthy refused to take default off the table, US Senate Democratic leader Schumer said.

Key notes

He gave us a plan to take default hostage.

We urge McCarthy to take default off the table.

Biden asked staff from both parties to sit down and find common ground around budget issues said and

he gave us a plan to take default hostage.

We urge McCarthy to take default off the table.

By not taking default off the table, mccarthy is endangering America.

- EUR/GBP bears are in the market but bulls could be lurking.

- Bulls eye a move towards 0.8750.

EUR/GBP is in freefall to fresh lows on the bearish cycle. The bears are moving in on 0.8670 with eyes on 0.8650. The following illustrates the price action and market structure over the daily and 4-hour time frame and argues the case for a deceleration in the suppl. In such a scenario, there will be the potential for a correction before further moves towards a key long-term trendline support area.

EUR/GBP daily charts

EUR/GBP H4 chart

The price is entering what could be a demand area considering the structure looking left as illustrated above. 0.8750/30 is a resistance area, potentially, where the bulls might have their eyes set. If the bears turn up again at that juncture, then there will be prospects of a deeper move toward the trendline support near 0.8600/20.

- GBP/JPY rebounds to 170.65, fueled by Yen’s weakness and the upcoming BoE decision.

- GBP/JPY targets 171.00, eyeing a year-to-date high of 172.33 if momentum holds.

The GBP/JPY recovered some ground after falling to weekly lows of 169.85, climbing sharply above the 170.00 figure, as overall Japanese Yen (JPY) weakness, as the main reason, alongside the Bank of England (BoE) monetary policy decision lurking. The GBP/JPY is trading at 170.65, above its opening price by 0.14%.

GBP/JPY Price Analysis

The GBP/JPY appears to have bounced from its weekly lows below the 170.00 figure but remains shy of testing the weekly high of 171.07. Given that a golden cross was witnessed in early April, the GBP/JPY bias is upward. Oscillators like the Relative Strength Index (RSI) indicator show buyers are gathering momentum. The 3-day Rate of Change (RoC) portrays its largest jump to the upside, suggesting that the GBP/JPY could re-test the year-to-date (YTD) high at 172.33.

But firstly, the GBP/JPY must reclaim the 171.00 mark. A breach of the latter would expose the 172.00 figure, followed by the YTD high.

However, further downside is warranted if GBP/JPY drops below 170.00. GBP/JPY’s first support would be the December 13 swing high-turned-support at 169.27. Once cleared, the next demand area would be the confluence of the 20-day EMA and the April 19 high, at around 168.20/167.97, respectively, immediately followed by the December 20 daily high at 167.01.

GBP/JPY Daily Chart

The Asian session will have a light economic calendar, with the highlight being the Australian Westpac Consumer Confidence for May, which is expected to decline from 9.4% to -1.7%. Japan will release the preliminary Leading Economic Index for March. Later in Europe, Germany will release the final reading of April inflation. The crucial report of the day will be the US Consumer Price Index for April, which will be closely watched by investors.

Here is what you need to know on Wednesday, May 10:

Wall Street dropped on a quiet session as market participants awaited US consumer inflation data. The Dow Jones fell by 0.17%, while the Nasdaq slid 0.63%. The ongoing debt ceiling impasse is weighing on market sentiment. Meanwhile, the US dollar rose against its main rivals, with the US Dollar Index (DXY) rising by 0.25% and posting gains for the second day in a row. However, the index still remains near the key support level of 101.00.

Data released on Tuesday showed the US NFIB Small Business Optimism index dropped to 89 in April, the lowest reading since 2013. On Wednesday, the US will release the Consumer Price Index (CPI) data for April, which is expected to have a significant impact. Market consensus see the CPI rising by 0.4% in April, which would be an acceleration from 0.1% in March. The annual rate is expected to stay at 5%. The Core CPI is forecast to match the 0.4% increase of April, with the annual rate dropping from 5.6% in March to 5.5% in April.

If the US inflation numbers come in line with expectations, it would indicate a modest slowdown, which is likely to maintain the Federal Reserve's (Fed) tightening bias. In the afternoon, the April fiscal numbers will be reported, and a significant surplus is anticipated for April. On Tuesday, US bond yields experienced a slight increase, with the 2-year yield remaining above 4.0% and the 10-year yield climbing above 3.50%.

EUR/USD experienced a decline for the third time in the past four days, dropping below the 20-day Simple Moving Average (SMA), for the first time since mid-March. The pair found support at 1.0940. Despite hawkish comments from European Central Bank (ECB) officials, the Euro lagged behind. Germany is set to release the final reading of April CPI, which is not expected to bring any surprises.

On Tuesday, GBP/USD managed to recover from its earlier losses and closed unchanged around 1.2620. The British Pound continues to exhibit strength ahead of Thursday's Bank of England decision. Meanwhile, EUR/GBP fell below 0.8700, reaching its lowest level since December.

USD/JPY has recorded a modest increase for the third consecutive day, benefiting from higher US yields, and ultimately closing above 135.00. In Japan, the release of the Leading Economic Index (March preliminary) is expected.

USD/CAD advanced further but it was unable to reclaim the 1.3400 level. On Wednesday, Canada is scheduled to release the Building Permits data for March. AUD/USD declined after a five-day streak, but managed to hold above 0.6750, while the critical resistance level at 0.6800 remains near. NZD/USD recorded modest losses, correcting from its monthly highs. Overall, the commodity currencies block maintains a positive bias.

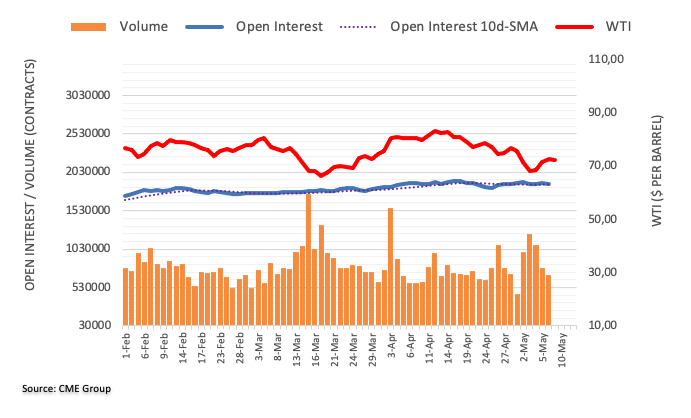

Gold maintained its gradual ascent, nearing the $2,040 mark, as market participants eagerly await US data. Silver, on the other hand, remained relatively stable, hovering around the $25.50 level. Crude oil prices managed to recover from earlier losses and recorded slight gains, with WTI (West Texas Intermediate) experiencing a 0.45% increase.

Like this article? Help us with some feedback by answering this survey:

- NZD/USD bulls burst to life in US session.

- All eyes will be on the US CPI data for next clues.

NZD/USD is on the backside of the prior bearish trend and is breaking higher from the double-bottom lows put in on the 15-minute chart in the US session on Tuesday. The pair have traveled from those lows of 0.6318 to a US session high of 0.6337 as the day draws to a close.

´´Being long the Kiwi remains one of the market’s preferred ways to fade USD strength as the US rate hike cycle matures, markets press for cuts and the USD loses some of its erstwhile richness to fair value,´´ analysts at ANZ Bank argued.

´´Tonight’s US Consumer Price Index data will be key as markets eye an end to the hiking cycle; if that thesis is refuted, there will be volatility.´´

US CPI in focus

´´Core prices likely stayed firm in April, with the index rising a strong 0.4% MoM for a second straight month, as goods inflation likely continued to strengthen,´´ analysts at TD Securities said.

´´Shelter prices likely remained the key wildcard (we look for a rebound), while rising gas prices (+2.6% MoM) will likely lift non-core inflation. Our MoM forecasts imply 5.0%/5.5% YoY for total/core prices,´´ the analysts explained.

- Bulls are on the backside of teh prior bearish trend.

- USD/CHF offers the prospects of a final push that could see a test of the 0.8970s.

USD/CHF is holding in and around the 0.8900 area following a series of tests of the trendline dynamic resistance that has been forming on the 4-hour chart in a series of lower highs.

There is, however, a bullish bias while the price accumulates on the backside of the prior bearish trendline as the following will illustrate.

USD/CHF weekly charts

Zooming in on the weekly chart,m we can see that the bulls are moving in. A weekly break of the bearish trendline will be encouraging for a move toward a 50% mean reversion of the bear trend near 0.91000.

USD/CHF H4 chart

The 4-hour chart shows the bulls rejected each time they try to take control but we have prospects of a final push that could see a test of the 0.8970s as follows:

- Mexico’s inflation slows for the third consecutive month, prompting expectations of a pause in rate hikes.

- US debt ceiling issues and Federal Reserve speakers take the spotlight, impacting market sentiment.

- USD/MXN’s future direction may hinge on upcoming US inflation data, with a breach of key levels possible.

USD/MXN slides towards the 17.7000 area after a better-than-expected inflation report in Mexico could open the door for a pause on Mexico’s central bank. Although it’s usually a sign that should weaken the currency, falling US bond yields underpinned the USD/MXN pair, albeit the overall US Dollar (USD) strength. The USD/MXN is trading at 17.7687, down 0.17%.

Mexican Peso stays resilient despite inflation decline, warranting a pause for Mexico’s central bank

USD/MXN resumed its downtrend after INEGI reported that inflation in Mexico slowed for the third straight month in April to 6.25% from 6.85% YoY. The Consumer Price Index (CPI) in Mexico plunged 0.02% MoM, while the core CPI rose 0.39% MoM, while annually based stood at 7.67%.

The Bank of Mexico (Banxico’s) hiked rates 25 bps in the March meeting to 11.25% while opening the door for a pause. Today’s inflation report could pave the way for a pause in the May 18 meeting, as shown by a poll by Citibanmes, which showed that most market participants estimate Banxico to keep rates unchanged.

Aside from this, the US debt ceiling theme in the United States (US) is taking all the headlines. On Monday, the US Secretary of Treasury Janet Yellen said that the government would run out of cash by June 1, adding that it would be a “huge hit” adding that a default would have “tremendously adverse effects” on the financial markets.

Meanwhile, Federal Reserve speakers Jefferson and the New York (NY) Fed President Williams crossed newswires. Jefferson commented about the banking system and added that inflation is slowing down in an “orderly fashion” but omitted to speak regarding his posture for the next meeting. Contrarily, John Williams of the NY Fed said, “We haven’t said we are done,” increasing interest rates, emphasizing that the only change is that the US central bank would be data dependent.

Given the backdrop, further upside in the USD/MXN was warranted, but the release of inflation data in the United States (US) would determine the fate of the USD/MXN. If April’s US CPI exceeds estimates to the upside, the USD/MXN would be bolstered by expectations for further tightening by the Fed. Otherwise, the USD/MXN could print another leg down and challenge the current year-to-date (YTD) low of 17.7392, on its way toward the July 2017 low of 17.45.

USD/MXN Technical Analysis

USD/MXN bounced off the YTD lows, printing a weekly high of 17.8404 before reversing its course. If USD/MXN buyers want to reclaim control, they must crack the 20-day EMA at 17.9722. A breach of the latter will expose the 18.00 handle, followed by the 50-day EMA at 18.1850, before posing a threat of the 100-day EMA At 18.5142. Conversely, USD/MXN could print a new six-year low beneath 17.7392, at around 17.50, followed by the July 2017 low.

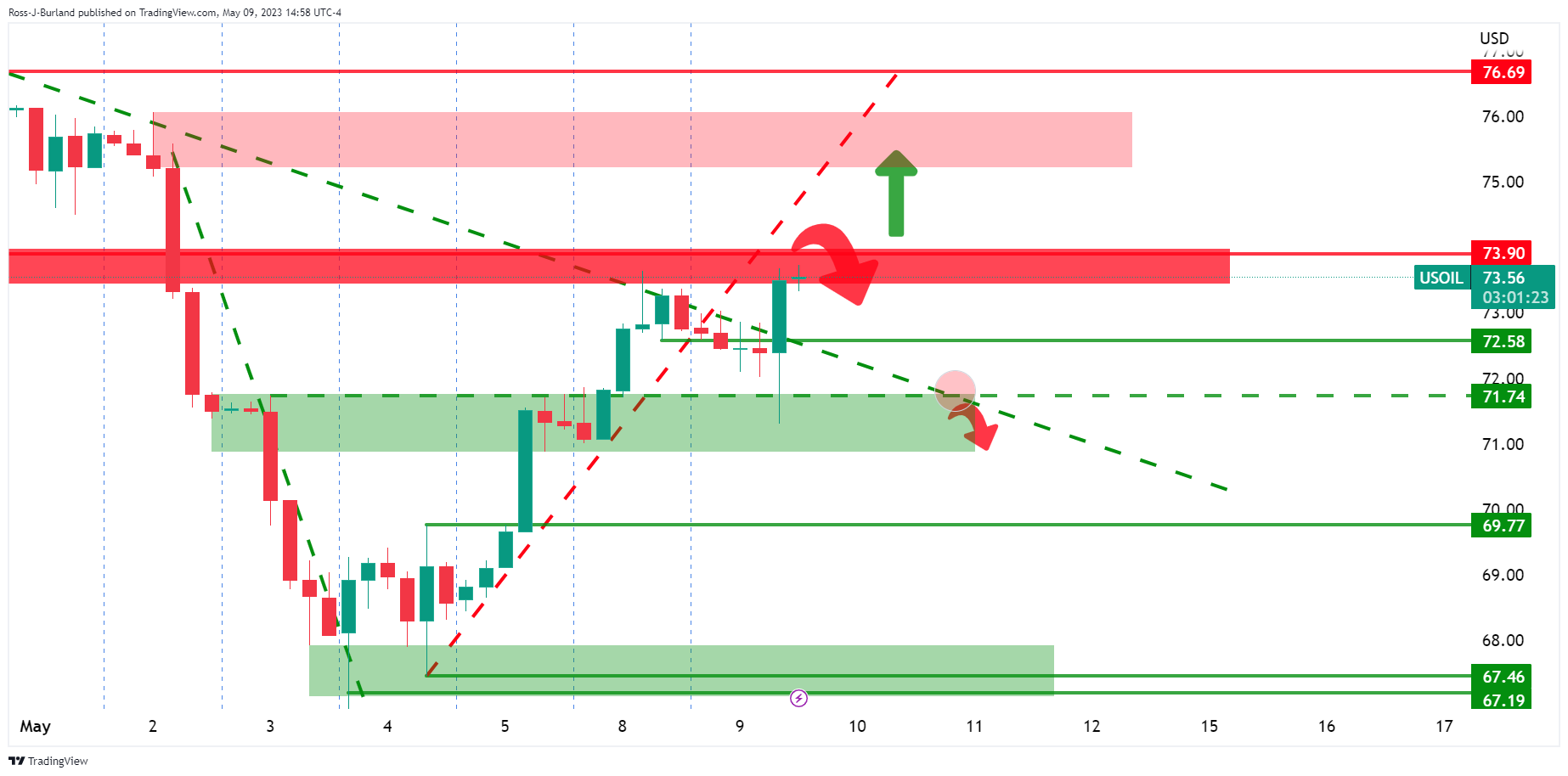

- WTI bulls eye a break of $73.90 to the upside.

- Bears need a break of the $71.70s to the downside in order to resume the broader downtrend.

As per the prior analysis, WTI bears are lurking in what could be a peak formation on the charts, the oil price has taken on resistance and is now at a critical juncture as the bulls flex their muscles. WTI is sandwiched between $73.90 on the backside of a longer-term bearish trend and the backside of a micro counter trend as the following illustrates:

WTI H4 chart, prior analysis

It was argued that the resistance of the trendline and horizontal $73.90 could play a role in a subsequent sell-off in the coming sessions. A break of $73.90, however, opened the risk of a move towards the $76.70s.

WTI updates

The structure sees the price needing a break of $73.90 to the upside of a break of the $71.70s to the downside in order to resume the broader downtrend.

- AUD/USD unmoved by Australia’s projected A$4.2 billion surplus for 2022/2023.

- US Treasury Secretary Janet Yellen warns of “tremendously adverse effects” if the government runs out of cash by June 1.

- Upcoming US CPI data may impact AUD/USD; further evidence of high inflation could lead to more losses in the pair.

AUD/USD reverses its Monday course after testing crucial technical indicators alongside the release of the Australian budget, which AUD/USD buyers ignored despite foreseeing a surplus. Contrarily worries about raising or suspending the US debt ceiling took center stage ahead of April’s US Consumer Price Index (CPI) report. At the time of writing, the AUD/USD is trading at 0.6765 after hitting a high of 0.6786.

AUD/USD creeps lower on US uncertainty, despite Australian budget surplus

AUD/USD buyers seem to be unimpressed by the Australian budget for 2023-2024. The Australian Federal Treasurer Jim Chaimers projects the first balanced annual budget in 15 years, anticipating a surplus of A$4.2 billion for 2022/2023. The AUD/USD hit a weekly high at 0.6803 but retraced as sellers stepped in around the 200-day EMA at 0.6788, which dragged the exchange rate toward the current price levels.

In the meantime, the US Secretary of Treasury Janet Yellen commented that the government would run out of cash by June 1, adding that it would be a “huge git” to the US economy. She said a default would have “tremendously adverse effects” on the financial markets.

Aside from this, Federal Reserve speakers led by Fed Governor Philip Jefferson and the New York Fed President John Williams crossed newswires. Jefferson spoke on the banking system, saying it was sound and resilient and that most banks raised their lending standards. He added that inflation is slowing down in an “orderly fashion,” adding that it would come down as the economy grows.

Later, NY Fed President Williams said, “We haven’t said we are done,” regarding hiking rates, and added that the Fed would be data dependent and could raise rates if needed.

Even though Williams sounded hawkish, the AUD/USD remained unfazed and has bounced off the day’s lows

Upcoming events

AUD/USD traders would get some cues on the release of April’s US Consumer Price Index (CPI), which is expected to trigger volatility in the financial markets. The CPI is estimated to remain unchanged at 5% on its annual readings, while core CPI is projected to dip from 5.6% to 5.5%. Further evidence that inflation remains higher could pave the way for further losses in the AUD/USD pair.

AUD/USD Technical Analysis

The AUD/USD is still downward biased, as the 50-day EMA crossed below the 200-day EMA since March 2023, which suggests that further downside is warranted. The aforementioned was confirmed by Tuesday’s price action, with the AUD/USD struggling to hurdle the 200-day EMA, which opened the door for a test of the 100-day EMA at 0.6736. If AUD/USD breaches the latter, its next demand area exposed would be the 50 and the 20-day EMA, each at 0.6712 and 0.6696. On the other hand, if AUD/USD surpasses the 200-day EMA, it would expose the 0.6800 handle.

Isabel Schnabel, a member of the European Central Bank's Executive Board, stated that there is no doubt that the ECB will have to take additional measures to bring inflation back to target. She made this statement on Tuesday during a lecture at Hessischer Kreis.

Schnabel mentioned that slower interest rate hikes allow the ECB to assess the impact of the measures they are taking. She clarified that core inflation has not seen a turnaround like the headline. According to her, rate cuts are unlikely for the foreseeable future.

Market reaction

The EUR/USD currency pair is falling on Tuesday, but it has moved off lows, rising back above 1.0960 as the US dollar loses momentum. However, the euro remains one of the worst-performing currencies in the G10 space.

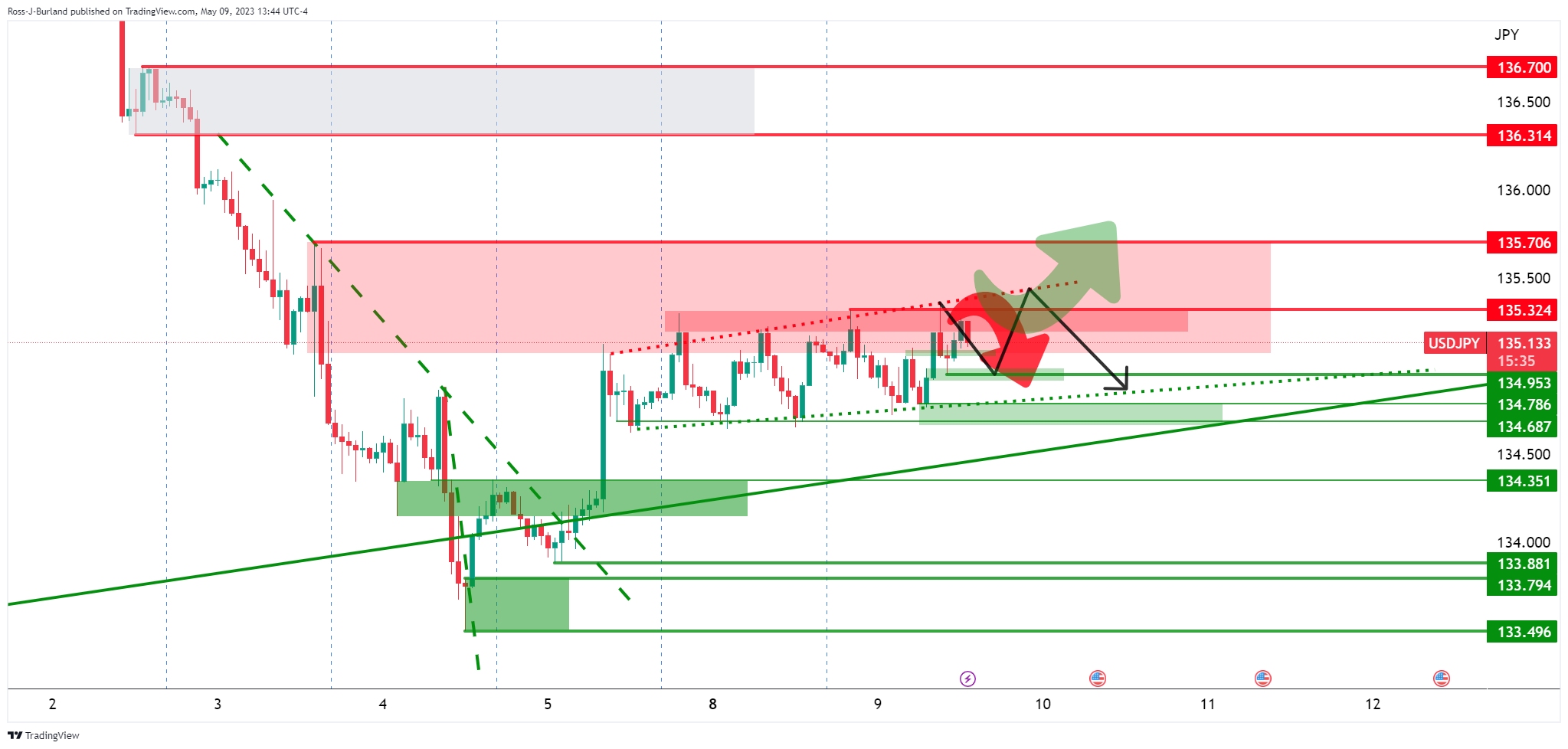

- USD/JPY bears eye a break of 134.95.

- 134.70 guards the longer-term trendline support area.

- A break of 135.32 and then 135.70 would be a bullish development.

USD/JPY was last seen trading at 135.17 with Bank of Japan (BOJ) Governor Kazuo Ueda signaling that the central bank may end its yield curve control policy and start shrinking its balance sheet.

The dollar remained rangebound as traders awaited U.S. debt ceiling talks and a closely-watched US inflation data due on Wednesday.

Technically, this leaves the pair range bound as the following illustrates:

USD/JPY H4 chart

The bulls are running into a potential resistance area on the chart and if the bears commit, then there could be a freefall into the lows of the broadening range. 134.95 could be key in this regard. A break of there opens the risk of a move into 134.70 and the longer-term trendline support area that guards 134.25 mand 133.88 to the downside. A break of 135.32 and then 135.70 would be a bullish development.

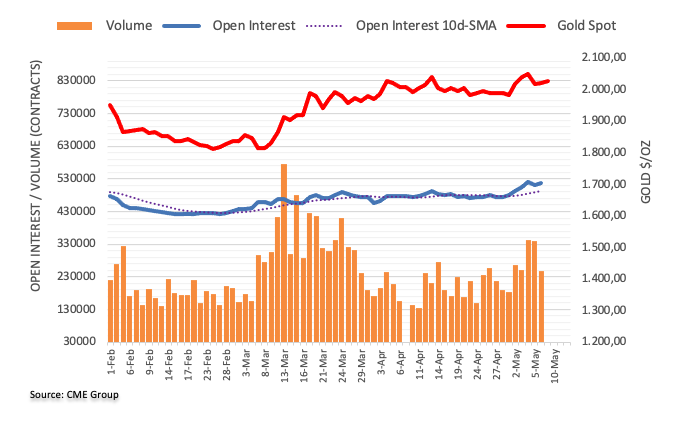

- XAU/USD rallies, benefiting from concerns over the US debt ceiling and slowing Chinese manufacturing activity.

- Falling US Treasury bond yields support gold prices despite strong US Dollar.

- Eyes on upcoming US CPI data, which has the potential to impact gold prices.

Gold price is printing back-to-back bullish days as the XAU/USD meanders nearby Monday’s high of $2029.40, bolstered by falling US Treasury bond yields despite a strong US Dollar (USD). The XAU/USD is underpinned by uncertainty around the US debt ceiling and a US inflation report looming. At the time of writing, the XAU/USD is trading at $2030.68, above its opening price by 0.48%.

XAU/USD bolstered by risk aversion, lower US bond yields

The negative tone is being reflected by Wall Street registering losses. Worries about politics, namely the debt ceiling, weighed on market sentiment. Credit conditions in the United States (US) began to tighten, as shown by the Fed’s Senior Loan Officer Opinion Survey (SLOOS), though “not as disastrous as many doomsayers had feared,” Analysts at Brown Brothers Harriman noted.

Another reason that bolstered appetite for XAU/USD was that China’s revealed that manufacturing activity slowed down. At the same time, its Trade Balance showed that Exports and Imports dropped from 14.8% to 8.5% in April and from -1.4% to -7.9%, respectively.

On Tuesday, US President Joe Biden will host US Congress officials to lay the ground around getting a consensus on the US debt ceiling.

In the meantime, the US Dollar Index (DXY), a gauge that tracks the performance of six currencies against the US Dollar, climbs 0.29%, up at 101.680, capping XAU/USD’s rally. US Treasury bond yields are mixed, though the short term, the most sensitive to interest rates, the 2-year note gains one bps, at 4.024%.

In the meantime, the Fed parade has begun, led by Fed Governor Philip Jefferson, who said the banking system was sound and resilient and that institutions had begun to raise lending standards. Regarding inflation, it has started to slow in an “orderly fashion” and will come down as the economy continues to grow.

Of late, the New York Fed President John Williams stated, “We haven’t said we are done,” adding that it would be data dependent and could raise rates if needed.

Upcoming events in the US economic calendar

On the US front, the Consumer Price Index (CPI) for April is expected at 5% YoY, while the core reading is at 5.5%.

XAU/USD Technical Analysis

The XAU/USD recovered some ground after testing the 20-day EMA at $2006.62, which also intersected with a one-month-old upslope support trendline. However, it’s facing solid resistance at around the April 5 high of $2032.13, which, if broken, would clear the way for XAU/USD to challenge the April 13 high at $2048.79.

On the flip side, the XAU/USD first support would be the 20-day EMA at $2006.83, followed by the $2000 figure. Once broken, it would expose the April 19 swing lows at $1969.34.

Federal Reserve Bank of New York President John Williams told the Economic Club of New York on Tuesday that the Fed needs to be data-dependent with monetary policy and reminded that the Fed will raise rates again if needed, as reported by Reuters.

Additional takeaways

"Fed has not said it's done raising rates."

"Fed has made incredible progress on monetary policy."

"I don't see any reason to cut rates this year."

"Generally speaking supply is still out of balance with economy."

"Fully confident Fed can get inflation back to 2%."

"Structural shifts will not impair Fed work to hit inflation target."

"I don't have recession in baseline forecast."

"Economy has risks to both up and downside."

"Expecting credit to be tighter, more expensive."

"Tighter credit may blunt how far Fed goes with rate hikes."

"I don't see tighter credit knocking economy totally off course."

Market reaction

The US Dollar preserves its strength following these comments and the US Dollar Index was last seen gaining 0.3% on the day at 101.70.

In a report prepared by National Bank Financial (National Bank of Canada) analysts forecast the USD/CAD pair will remain in the 1.33 to 1.38 range over the next quarter.

Key quotes:

“The Canadian dollar has strengthened in recent weeks, gaining nearly 5 cents against the U.S. dollar. The resilience of the Canadian economy and a less dovish BoC have led to a significant reduction in Canada-U.S. interest rate differentials since the fall of the SVB.”

“Looking ahead, we do not believe that the loonie will benefit from a continued narrowing of interest rate spreads. In light of the recent drop in commodity prices, we expect the USD/CAD to remain in the 1.33 to 1.38 range over the next few quarters.”

- EUR/USD struggles to gain ground as concerns on the debt ceiling turned sentiment sour.

- Fed and ECB officials crossed newswires, though EUR/USD traders are focused on the US dynamics.

- Upcoming data: Germany’s inflation and Italy’s industrial production for Eurozone, US CPI for April.

The EUR/USD extends its losses on Tuesday past the 1.10 handle, briefly testing last week’s low of 1.0942, but bounced off that price level, above the 1.0950 area. Worries about the United States (US) debt ceiling, and a strong US Dollar (USD), weakened the prospects for a higher Euro (EUR). At the time of writing, the EUR/USD is trading at 1.0955, down 0.44%.

EUR/USD falls ahead of US CPI release

Wall Street is posting losses after the Fed’s Senior Loan Officer Opinion Survey (SLOOS) showed that credit conditions are tightening, thought “not as disastrous as many doomsayers had feared,” wrote analysts at Brown Brothers Harriman. Discussions around the US debt ceiling could heat on Tuesday, as US President Joe Biden will meet with Republicans and Democrats to lay the ground around the theme. Hence, as sentiment shifted sour, the EUR/USD surrendered the 1.1000 figure.

In the meantime, the US Dollar Index (DXY), a gauge that tracks the performance of six currencies against the US Dollar, climbs 0.29%, up at 101.680, a headwind for the EUR/USD. US Treasury bond yields are mixed, though the short term, the most sensitive to interest rates, the 2-year note gains one bps, at 4.024%.

The lack of data in the US agenda left EUR/USD traders leaning on words from the Federal Reserve (Fed) Governor Philip Jefferson. Jefferson commented that the banking system was sound and resilient and that institutions had begun to raise lending standards. Regarding inflation, it has started to slow in an “orderly fashion” and will come down as the economy continues to grow.

On the European front, the latest economic data from Germany had increased worries about a recession in the bloc. Meanwhile, European Central Bank (ECB) speakers continued their hawkish remarks, as ECB Joachim Nagel said that the central bank has not finished raising rates. Echoing some of his comments was Martins Kazaks, who commented: “We still have quite some ground to cover.”

Upcoming events.

The Eurozone economic calendar will feature Germany’s inflation data and industrial production in Italy. On the US front, the Consumer Price Index (CPI) for April is expected at 5% YoY, while the core reading at 5.5%.

EUR/USD Technical Levels

The Euro is running uphill into a headwind, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

The wind is in the Euro’s face

“The equity market’s calling the bond market disparaging names, accusing the yield curve of sending false recession signals because of QE distortions. Against this backdrop, the Euro is running up a steep hill into a strong wind.”

“Market pricing looks for the ECB to continue raising rates in the second half of the year, and for the Fed to cut rates, resulting in the policy rate gap narrowing to under 1% by year-end from 2% now. Given the contrast between Friday’s payrolls and yesterday’s weak German industrial production data has been hard to narrow the gap further.”

Economists at TD Securities like BRL, CNH, and JPY as debt ceiling event risk hedges.

BRL provides a carry cushion

“Barring a red-hot CPI report this week, we think the rising US risks will probably reinforce a broad-based pullback in the USD.”

“For hedging the debt ceiling event risk, we like BRL, CNH, and JPY, where the first two provide the right beta to equities. While BRL provides a carry cushion, it is a bit more overvalued in some of our short-term models than CNH. The upside for CNH is likely viewed as reserve diversification hedge to the USD, especially if policymakers take the negotiations down to the wire.”

The conflict between the Brazilian government and the central bank is going into the next round. Thus, economists at Commerzbank expect the USD/BRL pair to stay above the 5.00 level.

The government is making the central bank’s task more difficult

“In the past, the Brazilian central bank contributed to the stability of the Brazilian real due to its determined fight against high rates of inflation, despite the fact that the government’s fiscal policy was often a thorn in the side of the financial markets. The course the government has recently taken is concerning in this context.”

“In effect, the government is making the central bank’s task more difficult. The significant fall in inflation could justify rate cuts, but the government’s demands make it almost impossible for the central bank to cut rates as it will not want to look as if it is giving in to the government’s demands. If the government had kept quiet that might have been a more successful strategy.”

“As long as the conflict between the two parties is brewing, BRL might struggle to ease below the 5.00 mark against USD on a sustainable basis.”

Economists at TD Securities expect Gold price to reach higher levels.

A new bull market in Gold may have just kicked off

“XAU/USD's drift higher after the strong US payrolls report underscores a rise in participation for the yellow metal.”

“Ongoing banking stress and the debt ceiling debacle continue to generate headwinds for the USD, especially as the global growth outlook dusts off last year’s stagflationary conditions.”

“Overall, the data continue to support our view that a new bull market in Gold may have just kicked off.”

- GBP/USD loses further ground and breaks below 1.2600.

- The better tone in the Greenback weighs on the risk complex.

- The UK BRC Retail Sales Monitor rose 5.2% YoY in April.

The British pound, along with the rest of the risk-associated universe, comes under pressure and motivates GBP/USD to dispute the 1.2600 region on Tuesday.

GBP/USD down on stronger Dollar, looks at BoE

GBP/USD retreats for the second consecutive session and pierces the key support at 1.2600 the figure amidst the generalized bearish note Cable in the first half of the week.

In fact, the Greenback extends the promising start of the week and keeps the risk complex under pressure against the backdrop of easing concerns over the US banking sector, particularly following the Fed’s Senior Loan Officer Survey late on Monday.

Moving forward, the Quid is expected to remain under the microscope in light of the upcoming BoE gathering on May 11, where consensus largely anticipates another 25 bps rate hike.

In the UK calendar, April releases saw the BRC Retail Sales Monitor increase 5.2% from a year earlier, while the House Price Index measured by Halifax contracted 0.3% MoM and rose 0.1% over the last twelve months. Finally, BBA Mortgage Rate ticked higher to 7.41% (from 7.22%).

GBP/USD levels to consider

As of writing, the pair is losing 0.09% at 1.2605 and faces the next support at 1.2435 (monthly low May 2) followed by 1.2344 (weekly low Aprl 10) and finally 1.2295 (55-day SMA). On the other hand, the surpass of 1.2668 (2023 high May 8) would open the door to 1.2865 (200-week SMA) nad then 1.3000 (psychological level).

- Silver remains on the defensive for the third straight day, albeit lacks follow-through selling.

- The technical setup still favours bulls and supports the prospects for further near-term gains.

- A convincing break below the $24.50-40 area is needed to negate the constructive outlook.

Silver recovers a part of its modest intraday losses, albeit struggles to capitalize on the move and trades with a mild negative bias for the third successive day on Tuesday, around mid-$25.00s.

From a technical perspective, the lack of any follow-through selling warrants some caution before confirming that the XAG/USD has formed a near-term top and positioning for any meaningful pullback from over a one-year high touched last Friday. Moreover, the recent repeated rebounds from the $24.50-$24.40 strong horizontal resistance breakpoint, now turned support, favours bullish traders.

This, along with positive oscillators on the daily chart, suggest that the path of least resistance for the white metal is to the upside. That said, the XAG/USD has been struggling to find acceptance above the $26.00 mark, warranting caution for bulls. The XAG/USD, nevertheless, seems poised to surpass the $26.25-$26.30 hurdle and climb to the $27.00 neighbourhood, or the March 2022 high.

On the flip side, Friday's swing low, around the $25.15 region, might now act as a support and protect the immediate downside. This is closely followed by the $25.00 psychological mark, below which the XAG/USD could extend the corrective slide towards testing the $24.50-$24.40 resistance-turned-support. A convincing break below the latter is needed to negate the near-term positive outlook.

The XAG/USD might then turn vulnerable to weaken further below the $24.00 mark and drop to the next relevant support near the $23.50-$23.30 confluence. The latter comprises the 50-day and the 100-day SMAs and is followed by support near the $23.00 round-figure mark.

Silver daily chart

Key levels to watch

Economists at OCBC Bank preview the Bank of England (BoE) and its implications for the Pound.

Buy rumour, sell rally

“Consensus and ourselves are looking for 25 bps hike. Potentially, it could be shaping up to be a buy rumour, sell on fact for GBP. Positive UK story is probably in the price of GBP for now.”

“Markets are pricing in about +65 bps hike for this year, especially after the double-digit inflation print for 7 straight months and the much better than expected labour market report. We opined that market pricing here may be too hawkish.”

“Any hawkish expectations not met could lead to profit-taking on GBP gains this week.”

- NZD/USD edges lower on Tuesday and snaps a five-day winning streak to over a one-month top.

- A combination of factors assists the USD to gain some follow-through traction and exerts pressure.

- The technical setup still favours bullish traders and supports prospects for further near-term gains.

The NZD/USD pair attracts some sellers on Tuesday and snaps a five-day winning streak to over a one-month high, around the 0.6355-0.6360 area touched the previous day. The pair maintains its offered tone through the early North American session and is currently placed near the daily low, still comfortably above the 0.6300 round-figure mark.

The US Dollar (USD) gains some positive traction for the second successive day and turns out to be a key factor exerting some downward pressure on the NZD/USD pair. The Federal Reserve's (Fed) Senior Loan Officer Opinion Survey (SLOOS) released on Monday eased fears of a full-blown banking crisis in the US. Apart from this, a generally weaker tone around the equity markets further benefits the safe-haven Greenback and contributes to the offered tone surrounding the risk-sensitive Kiwi.

That said, growing acceptance of an imminent pause in the Federal Reserve's (Fed) year-long rate-hiking cycle might hold back the USD bulls from placing aggressive bets. This, along with expectations for further rate hikes by the Reserve Bank of New Zealand (RBNZ), should limit losses for the NZD/USD pair. Market participants might also prefer to wait on the sidelines ahead of the release of the latest US consumer inflation figures, due on Wednesday, before positioning for the next directional move.

Even from a technical perspective, the overnight sustained break through a downward sloping trend line, extending from the YTD peak touched in February, favours bullish traders. Moreover, oscillators on the daily chart are holding in the positive territory and are still far from being in the overbought zone. This, in turn, supports prospects for an extension of the recent appreciating move witnessed over the past two weeks or so. Hence, the ongoing corrective slide is likely to get bought into.

The NZD/USD pair seems poised to climb back towards retesting the April monthly swing low, around the 0.6380 region, en route to the 0.6400 mark. Some follow-through buying should pave the way for additional gains and has the potential to lift spot prices towards the next relevant hurdle near the 0.6435-0.6440 region, above which bulls might aim to reclaim the 0.6500 psychological mark.

On the flip side, the aforementioned trend-line resistance breakpoint, currently around the 0.6300 round-figure mark, now seems to protect the immediate downside. Any further decline is likely to attract fresh buyers and remains limited near the 100-day Simple Moving Average (SMA), around the 0.6255 zone. The latter should act as a strong base for the NZD/USD pair, which if broken decisively will set the stage for a deeper corrective decline.

NZD/USD daily chart

-638192351407992601.png)

Key levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the latest release of inflation figures in the Philippines.

Key Takeaways

“The Philippines’ headline inflation decelerated further to an eight-month low of 6.6% y/y in Apr (from +7.6% in Mar). The pace of the easing came in faster than our estimate and Bloomberg consensus (both at 7.0%), largely credited to a persistent slowdown in prices of selected food items and fuels as well as lower electricity tariffs during the month. The ebbing of year-ago high base effects also played an essential role in pulling down the headline inflation in Apr.”

“Nevertheless, services related price inflation continued to edge higher last month while core inflation just showed a small blip to 7.9% (Mar: +8.0%). The return of El Niño could reverse the food price inflation downtrend over the next couple of months. Recognising this and other lingering upside risks to the inflation outlook (i.e. higher electricity rates, above-average wage adjustments, and impact of African Swine Fever infections), we maintain our 2023 full-year average inflation projection of 6.0% for now (BSP est: 6.0%, 2022: 5.8%).”

“Although headline inflation has come off faster than our expectations for two straight months in Mar-Apr, demand price pressures remain stubbornly high as revealed by both services and core inflation prints. The soon-to-be-released 1Q23 GDP outturn is also crucial to affirm the robustness of domestic demand. It will raise the risk of further broadening of price pressures and the emergence of additional second order effects should the BSP surrender its inflation fight too soon. With this and the US Fed’s 25bps rate hike yesterday (4 May), we expect BSP to press ahead with its interest rate hike of 25bps on 18 May.”

- Pound Sterling vs US Dollar drops to around the 1.26 handle ahead of key macroeconomic events for the week.

- The Pound Sterling is likely to be impacted by the Bank of England meeting on “Super Thursday”.

- The US Dollar will look for impetus from the US Consumer Price Index data for April on Wednesday.

The Pound Sterling (GBP) recovers back above the 1.2600 handle versus the US Dollar (USD) on Tuesday, as the Greenback slips on the back of slightly softer US Treasury bond yields.

Traders are gearing up for two big releases that will impact GBP/USD over the next two days – US Consumer Price Index (CPI) inflation data on Wednesday and the Bank of England (BoE) policy meeting on Thursday.

From a technical perspective, GBP/USD is in a broadly bullish long-term uptrend. Given the old adage that “the trend is your friend” this advantages long over short holders.

GBP/USD market movers

- The Pound Sterling will probably take direction from the outcome of the Bank of England (BoE) policy meeting on Thursday. A 25 bps interest rate hike is now expected with almost 100% certainty. What is less certain is the bank’s forward guidance, BoE Chairman Andrew Bailey’s comments in the press conference afterwards, and the distribution of member votes.

- Some observers see possible 60 bps of further rate hikes required to get inflation under control. If true, that would widen the monetary policy divergence between the Bank of England and the Federal Reserve (Fed) – which is widely expected not to raise rates any higher. This would favor the Pound Sterling, as higher interest rate expectations give currencies a ‘carry’ advantage. Carry is the difference between the interest rates of two currencies and measures the benefit of holding the one with the higher interest rate. It is also used in the pricing of many derivatives, such as futures and options.

- The distribution of voting at the BoE’s last meeting was 7-2, with seven policymakers voting for a 25 bps rate hike and two voting for no change. If the distribution changes either way that will impact GBP with a decrease in the ‘no-change’ camp lifting GBP/USD and vice versa for an increase.

- US Treasury bond yields have risen for three consecutive days, providing the US Dollar with some support, but yields are pulling back slightly on Tuesday, which could be a slight headwind for the USD.

- The Federal Reserve’s bank Lending Officer Survey (Q1), released on Monday, was broadly negative and suggested credit conditions had tightened due in part to the fallout from the banking crisis. Although the impact on the US Dollar at the time of release was minimal, it may be a factor impacting on yields.

- The release of US Consumer Price Index (CPI) data for April on Wednesday, May 10, at 12:30 GMT, will provide further data for the Federal Reserve to base its future policy trajectory on. Currently expectations are for CPI to increase by 0.4% MoM and 5% YoY. Core CPI is forecast to rise by 0.4% MoM and 5.5% YoY, and is the metric that has the greater impact. A higher-than-expected result would be negative for GBP/USD and vice versa for a lower-than-forecast print.

GBP/USD technical analysis: Shooting star hints at correction

GBP/USD broadly keeps extending its established uptrend making progressively higher highs and higher lows, and this is likely to continue favoring Pound Sterling longs over shorts.

-638192346250362518.png)

GBP/USD: Daily Chart

The GBP/USD peaked at 1.2669 on Monday, printing new year-to-date highs for the pair. It then declined on the same day and closed lower, forming what is known as a shooting star – a Japanese candlestick reversal pattern. If the shooting star is followed by a bearish day on Tuesday it could be a sign the pair is about to correct down. If the close of the day is below last Friday’s low of 1.2561 that would add further bearishness to the short-term outlook.

The GBP/USD pair is, at the time of writing, resting right on top of support from an upper channel line at 1.2600-05. A decisive break below the level would suggest further weakness on the horizon, possibly down to the lower channel line at around 1.2440.

Decisive bearish breaks are characterized by either a long red daily candle that breaks below the key resistance level in question, and closes near the day’s lows. Or alternatively, three consecutive red bars that break below the level. Such insignia provide confirmation that the break is not a ‘false break’ or bear trap.

It would require a decisive break below the 1.2435 May 2 lows to challenge the dominance of the uptrend and suggest the chance of a bear reversal.

Given this is not yet the case, there is still every chance the exchange rate could turn around at any time and start going up again. The May 2022 highs at 1.2665 provide the first target and resistance level, then at the 100-week Simple Moving Average (SMA) situated at 1.2713, and finally at the 61.8% Fibonacci retracement of the 2021-22 bear market, at 1.2758. All provide potential upside targets for the pair. Each level will need to be decisively breached to open the door to the next.

The Relative Strength Index (RSI) has fallen to 60 at the time of writing after peaking in the upper 60s close to overbought. RSI is more or less moving in tandem with price, therefore, providing little indication of underlying strength or weakness.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which < href="https://fxssi.com/the-most-traded-currency-pairs">accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes last week’s CFTC positioning data.

The wind is in the Euro’s face, but it’s kinder to Sterling

“Last week’s CFTC positioning data suggest the Euro will find further gains hard work. The net USD short against the EUR has increased again and remains bigger than the overall USD short. That means the market is long USD against the balance other currencies.”

“This morning’s soft Chinese export and import data haven’t done AUD any favours, but USD/CAD should continue to benefit from belief that the Fed has finished raising rates, as long as that doesn’t come into question.”

“The market remains (marginally) long GBP for a third week. If the Euro faces headwinds from what’s priced into the rate curve and from positions, then the Pound benefits from tailwinds for now.”

Economists at Commerzbank see the USD/RUB pair at 80 by year-end and at 90 by December 2024.

Not convertible

“Russia’s capital account is closed for major hard currencies. The absence of capital flows means that the exchange rate does not perform its forward-looking role based on expectations – it only reflects day to day trade flows, most of which is energy trade.”

“Due to the sanctions, the RUB exchange rate now only reflects current account flows. Hence, the Ruble is likely to depreciate medium-term due to the declining current account surplus.”

“We expect the USD/RUB fixing to reach around 90.00 by the end of 2024.”

Source: Commerzbank Research

- EUR/USD remains on the defensive so far this week.

- There is a tough resistance area near the 1.1100 mark.

EUR/USD faces increased selling pressure and breaks below the key support at 1.1000 the figure on Tuesday.

The inability of the pair to challenge/surpass the so far 2023 high at 1.1095 (April 26) carries the potential to spark a deeper corrective decline in the short-term horizon with the immediate targets at the monthly low at 1.0941 (may 2) and the weekly low at 1.0909 (April 17).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0440.

EUR/USD daily chart

- USD/CAD draws support from a combination of factors and climbs back closer to the 1.3400 mark.

- Retreating Oil prices undermines the Loonie and acts as a tailwind amid a modest USD strength.

- The Fed’s less hawkish outlook could cap the USD ahead of the key US CPI report on Wednesday.

The USD/CAD pair builds on the previous day's late rebound from the 1.3315 region, or over a three-week low and gains some follow-through traction on Tuesday. The steady intraday uptick lifts spot prices back closer to the 1.3400 mark during the mid-European session and is sponsored by a combination of factors.

Crude Oil prices edge lower amid some profit-taking following the recent strong recovery from a 17-month low, which, in turn, is seen undermining the commodity-linked Loonie. The US Dollar, on the other hand, scales higher for the second successive day amid hopes that the US banking sector is not headed for a wider crisis and provides an additional boost to the USD/CAD pair. In fact, the Federal Reserve's (Fed) Senior Loan Officer Opinion Survey (SLOOS) released on Monday showed that tightening credit conditions was due to the aggressive rate hikes rather than severe banking sector stress.

Apart from this, a softer risk tone - as depicted by a fresh leg down in the equity markets - further benefits the safe-haven buck and contributes to the bid tone surrounding the USD/CAD pair. That said, growing acceptance that the Fed is nearing the end of its year-long rate-hiking cycle might keep a lid on any meaningful upside for the Greenback. Apart from this, the latest optimism over a fuel demand recovery, led by easing concerns about an imminent recession, should act as a tailwind for Oil prices. This, in turn, should cap gains for the major and warrants caution before positioning for a further intraday move up.

Traders might also refrain from placing aggressive bets in the absence of any relevant market-moving economic releases, either from the US or Canada, and ahead of the latest US consumer inflation figures on Wednesday. The crucial US CPI report will play a key role in influencing expectations about the Fed's next policy move. This, in turn, should drive the USD demand in the near term and help determine the next leg of a directional move for the USD/CAD pair. This makes it prudent to wait for strong follow-through buying before confirming the spot prices have formed a bottom near the 1.3300 mark.

Technical levels to watch

Gold price is holding its own at $2,020-2,030 of the US inflation data. Economists at Commerzbank expect the yellow metal to remain elevated.

No scope for the Fed to implement rate cuts this year

“According to the Fed Fund Futures, the key rate expected at the end of the year is approx. 4.4%. It is doubtful whether the inflation figures will be able to shake this view.”

“We expect that the headline rate will have remained at 5% in April and that the core rate will have fallen slightly to 5.5%. This would still leave inflation well above the US Fed’s target level. This confirms our view that there is no scope for the Fed to implement rate cuts this year. It will probably take some time before the market likewise adopts this view, however. Gold is therefore likely to remain above the $2,000 mark.”

Sterling was able to stand up well against USD and EUR over the past weeks. You-Na Park-Heger, FX Analyst at Commerzbank, expects the GBP to correct lower following the Bank of England (BoE) meeting.

Rate expectations support Sterling ahead of BoE meeting

“An important positive driver is likely to have been market rate expectations. The market is now expecting at least two further rate hikes by the BoE.”

“It is almost certain that the BoE will hike its key rate by a further 25 bps to 4.5% this Thursday; it seems just an aside. What will be much more interesting will be how the individual members of the monetary policy committee will vote and what they have to say about recent economic data, as the market is likely to hope for indications on the future course of its monetary policy.”

“As the BoE has been quite hesitant and cautious as regards the fight against inflation it is difficult to believe that it will surprise with a hawkish stance on Thursday. I, therefore, see a certain potential for disappointment and thus the risk of a downside correction in Sterling as the market’s rate expectations seem quite ambitious. However, I am happy to be proven wrong.”

- DXY adds to the promising start of the week and revisits 101.60.

- Next on the upside comes the monthly high near 102.50.

DXY extends the upside bias seen on Monday and reclaims the 101.50/60 band, or 2-day highs, on Tuesday.

A more serious bullish attempt should clear the monthly high at 102.40 (May 2) to mitigate the downside pressure and allow for a potential advance to the provisional 55- and 100-day SMAs at 102.86 and 103.00, respectively.

Looking at the broader picture, while below the 200-day SMA, today at 105.91, the outlook for the index is expected to remain negative.

DXY daily chart

Economist at UOB Group Lee Sue Ann assesses the last ECB event on May 4.

Key Takeaways

“The European Central Bank (ECB) decided to raise its three key interest rates by 25bps. This is the smallest rate increase since the ECB started its current tightening cycle in Jul 2022. It also expects to discontinue the reinvestments under the Asset Purchase Programme (APP) as of Jul 2023. As for the Pandemic Emergency Purchase Programme (PEPP), guidance was left unchanged (reinvestments intended until at least end-2024).”

“The justification for hiking was clear, with the ECB stating that ‘the inflation outlook continues to be too high for too long’, and adding that while ‘headline inflation has declined over recent months, underlying price pressures remain strong’. The downshift from 50bps to 25bps was also justified by the ECB acknowledging that “past rate increases are being transmitted forcefully to euro area financing and monetary conditions”.

“In all, the ECB did not provide further guidance about upcoming rate decisions. At this juncture, we are penciling in one more 25bps hike at the next meeting on 15 Jun, since Lagarde highlighted that there is still ‘more ground to cover’. But the ECB clearly has every reason to stick to a data dependent approach. Whether Jun or Jul will be the last will depend crucially on inflation data scheduled for late-May.”

- EUR/JPY reverses two daily gains and challenges 148.00.

- The resumption of the buying pressure should target 150.00.

EUR/JPY comes under pressure and puts the 148.00 neighbourhood to the test on Tuesday.

It seems the bullish outlook now appears somewhat dented. Against that, the cross could move into a consolidative phase before resuming the uptrend and always with the immediate target at the key round level at 150.00 ahead of the 2023 peak at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.84.

EUR/JPY daily chart

Economists at ING note that the US Dollar Index (DXY) could challenge the 100.00 level.

Downside risks are non-negligible

“While the short-term outlook for the Dollar remains neutral in our view, thanks to positioning skewed to the short-side (more in the Euro section) and unstable risk sentiment, markets remain ready to price in more Fed rate cuts, so downside risks are non-negligible.”

“We favour a stabilisation around 101.50, but a drop below 101.00 and a test of 100.00 in DXY are tangible possibilities in the near term.”

- US Dollar manages to stay resilient against its major rivals on Tuesday.

- US Dollar Index clings to modest daily gains following Monday's rebound.

- April inflation data from the US could trigger the next big reaction in USD.

The US Dollar (USD) shook off the selling pressure at the beginning of the week with the US Dollar Index (DXY) closing in positive territory on Monday. Early Tuesday, the USD holds its ground as market participants refrain from taking large positions ahead of the highly-anticipated April inflation data from the United States (US), which will be released on Wednesday.

Later in the session, Federal Reserve (Fed) Governor Philip Jefferson and NY Fed President John Williams will be delivering speeches. The IBD/TIPP Economic Optimism Index will also be featured in the US economic docket. The USD's valuation, however, is likely to continue to be driven by risk perception, at least in the near term.

Daily digest market movers: US Dollar clings to modest recovery gains

- The NFIB Business Optimism Index declined to 89 in April from 90.1 in March. This reading came in slightly below the market expectation of 89.6.