- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- The GBP/JPY catches a soft bid to challenge 182.00 after a week of stubborn losses.

- The Yen surged on the week, bolstered by a hawkish BoJ.

- The Guppy heads into next week’s central bank showdown on the low side.

The GBP/JPY eked out a small gain on Friday, finishing the day up a slim tenth of a percent to cap off a trading week of firm declines. The Guppy ends the trading week down a firm two and a third percent from the week’s opening bids near 186.60, hitting a nine-week low of 178.58 amidst Thursday’s broad-market Yen rally.

The Bank of Japan (BoJ) kicked off a wild surge in the Japanese Yen after BoJ Governor Kazuo Ueda struck unusually hawkish tones in the mid-week, hinting that the BoJ could be on pace to begin tightening monetary policy, specifically highlighting the Japanese central bank’s negative rate regime.

Despite the BoJ fearing a collapse in Japanese inflation sometime in 2025, Japanese Core Consumer Price Index (CPI) inflation continues to run hotter than expected, hitting 2.9% for the year into October and chalking in a nineteenth straight consecutive month of inflation outrunning the BoJ's 2% upper target band.

Yen traders picked up the BoJ’s hawkish tone and ran with it, sending the JPY surging across the board. The GBP/JPY tumbled nearly three and a half percent top-to-bottom on Thursday, pushing the pair down into new lows below 178.60.

Next week sees UK labor figures, followed by Japanese manufacturing figures, culminating in 2023’s last rate call from the Bank of England (BoE).

GBP/JPY Technical Outlook

The GBP/JPY’s tumble left the pair knocking into fresh multi-week lows, and Friday’s thin rebound has the Guppy rebounding from the 180.00 major handle.

Near-term momentum still leans in favor of the bulls, with technical support coming from the still-untouched 200-day Simple Moving Average (SMA) near 178.00, but the last swing high into 188.66 represents a significant peak that bidders will struggle to retake.

The GBP/JPY is at risk of re-entering a consolidation phase around the 50-day SMA near the 184.00 price level, and short sellers will have their work cut out for them to try and cut the recovery rally short.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

GBP/JPY Technical Levels

- NZD/JPY tallied a 2.60% weekly decline, its worst since December 2022.

- On the daily chart, indicators favor the bears in the short term.

- On the four-hour chart, bears stepped out to consolidate their recent movements.

At the end of the week, the NZD/JPY declined to 88.75, seeing nearly 0.25% losses, after reaching a low of around 87.95 at the 100-day Simple Moving Average (SMA).

Overall, the outlook is bearish for the short term, but bulls dominate the larger time frames. The daily Relative Strength Index (RSI) printed a negative slope below 50, while the rising red bars on the Moving Average Convergence Divergence (MACD) indicate that the bears are gaining ground.

Concerning Simple Moving Averages (SMAs), the cross stands below the 20-day average but above the 100-day and 200-day SMAs which indicates that on the broader scale, the bulls are still in command in the broader scale, and as long as the bears fail to conquer those averages their momentum won’t be enough to reverse the overall trend.

Zooming, the four-hour chart indicators flattened in negative territory. The Relative Strength Index (RSI) stands neutral just above the oversold threshold, while the MACD prints flat red bars which suggest that bears seem to be consolidating the recent downward movements.

Support Levels: 88.55, 88.15 (100-day SMA), 87.70.

Resistance Levels: 89.25, 89.80, 90.00 (20-day SMA).

NZD/JPY daily chart

-638376672064302186.png)

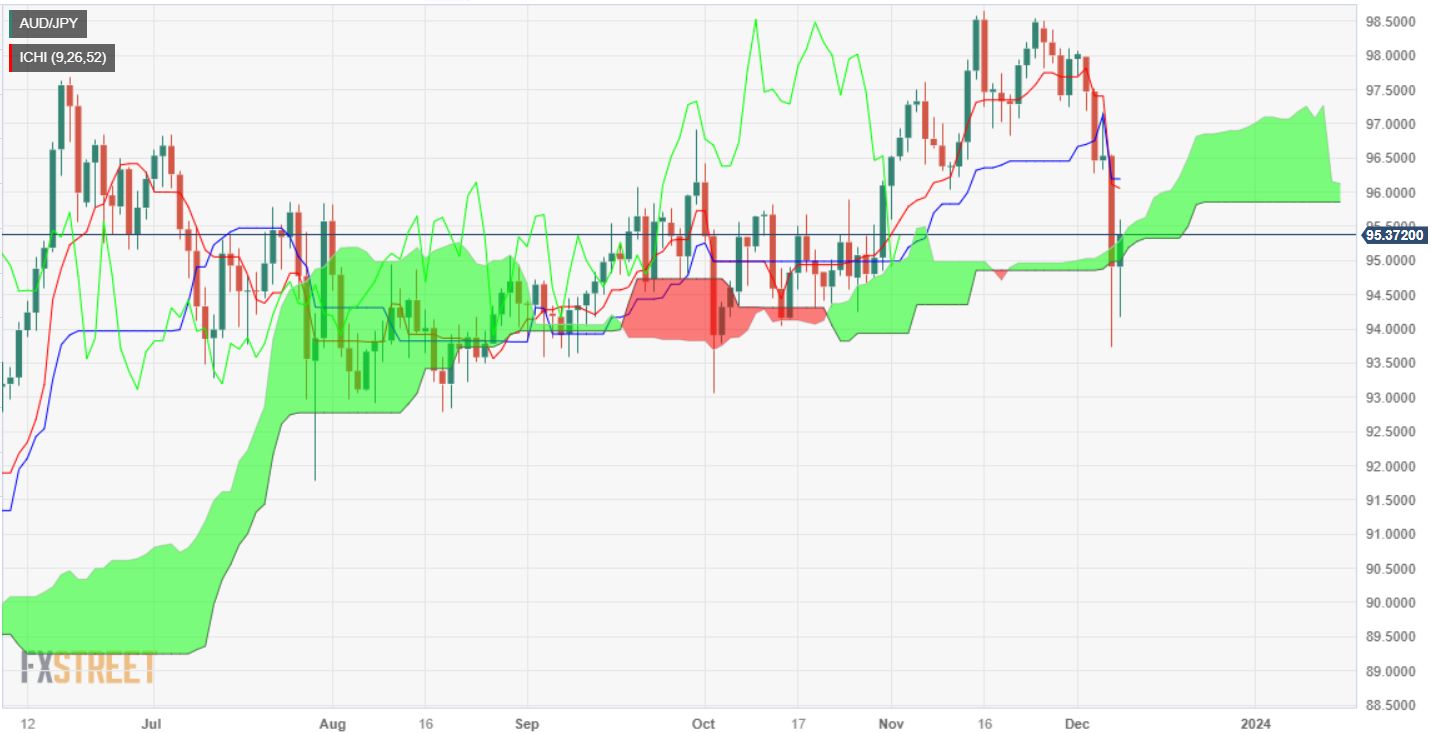

- Despite printing daily gains, the AUD/JPY is set to finish the week down by more than 2%.

- Daily chart suggests a neutral to downward bias for the pair, with potential upside risks if a daily close is within Ichimoku Cloud boundaries.

- A daily close occurs below the top of the Kumo, the potential for further losses; with key support seen at 95.00, followed by a December 8 low of 94.17.

- Upside resistance includes November 10 swing low-turned resistance at 95.85, ahead of the 96.00 figure, and the Kijun-Sen at 96.14.

The AUD/JPY trimmed some of its Thursday’s losses on Friday, and aims higher 0.27% in late trading during the North American session. Even though the pair is up daily, would finish the week with losses of more than 2.50%, a consequence of comments by Bank of Japan’s (BoJ) Governor Ueda. Therefore, the cross is trading at 95.40, after hitting a daily low of 94.17.

The daily chart portrays the pair as neutral to downward biased, though upside risks remain. If AUD/JPY achieves a daily close within the Ichimoku Cloud (Kumo) boundaries, that could pave the way for further losses; otherwise, the pair could challenge the December 7 high of 96.49.

If AUD/JPY achieves a daily close below the top of the Kumo, the first support would be the 95.00 figure. A breach of the latter will expose the December 8 low of 94.17, ahead of the 94.00 mark

On the upside, if the pair edges above the peak of the Kumo, the first resistance would be the November 10 swing low-turned resistance at 95.85, ahead of the 96.00 figure. The next resistance would be the Kijun-Sen at 96.14.

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels

- NZD/USD tumbles more than 0.70%, trading at 0.6124, erasing gains from Thursday's session.

- US jobs data was better than expected, spurring a dip in the unemployment rate.

- University of Michigan Consumer Sentiment Index rises to 69.0, its highest level since August, with revised lower inflation expectations.

NZD/USD is dropping and erased Thursday’s gains on Friday after US economic data sent traders scrambling to pare dovish bets on the US Federal Reserve as November’s Nonfarm Payrolls exceeded estimates. That shows the economy’s resilience; hence, the pair tumbles more than 0.70% and trades at 0.6124.

NZD/USD finished the week down, traders eye next week’s FOMC meeting

As previously mentioned, the US Department of Labor released November’s Nonfarm Payrolls report, which depicted the labor market is in better shape than previously released data in the week. The economy added 199,000 jobs, more than the 150,000 in October, and exceeded forecasts of 180,000. As a consequence, the unemployment rate dipped from 3.9% to 3.7%, and Average hourly earnings stood at 4% during the last 12 months to date, suggesting a wage-price spiral is out of discussion.

Following the data release, the NZD/USD seesawed on a wide range and dived to its low of the day at 0.6103 before recovering some ground. Nevertheless, the damage is done, with the pair set to finish the week with losses.

Besides that, the University of Michigan (UoM) revealed its latest consumer poll, which showed American households are more optimistic regarding the economic outlook, as the Consumer Sentiment Index rose by 69.0, its highest level since August, while inflation expectations were revised lower.

The US Dollar Index (DXY), which tracks the buck’s performance against six rivals, rose by 0.30%, at 104.01, underpinned by a jump in US yields. The US 10-year bond yield climbed 8 basis points and is set to finish the week at 4.236%.

In the meantime in New Zealand, next week’s economic docket will feature the Current Account alongside the Gross Domestic Product (GDP) figures for the third quarter. Estimates lie at 0.2%, less than the previous quarter's growth of 0.9%. On the US front, Traders focus on the following week's US inflation report and the Federal Open Market Committee (FOMC) meeting.

NZD/USD Technical Levels

- WTI's Friday bounce still sees Crude Oil down for a seventh straight week.

- US Crude Oil fell to a near-term floor of $69.01 on Thursday.

- OPEC's pumping caps are seeing little impact as Chinese demand slumps.

Crude Oil markets are seeing a moderate recovery on Friday with West Texas Intermediate (WTI) climbing two percent on the day, but pressured oil markets are still set for a seventh straight week of declines.

The Organization of the Petroleum Exporting Countries (OPEC) scrambled to solidify a group-wide agreement on production cuts after member states came to loggerheads over pumping quotas. Key OPEC members, headed up by Saudi Arabia, have aggressively pursued tighter production caps in order to keep Crude Oil prices bid. However, flagging fuel demand, specifically from China, and disobedient OPEC member states decrying production caps are throwing a wrench in OPEC’s efforts to intentionally undersupply global Crude Oil Markets.

OPEC’s current production caps see the oil cartel agreeing to a combined 2.2 million bpd cut to total Crude Oil production through the first quarter of 2024, but fossil markets remain skeptical about OPEC’s ability to enforce the loose agreement.

OPEC currently has no mechanism of enforcing Crude Oil production quotas, and there is currently no punishment for member countries that choose to flaunt pumping limits and sell more oil than OPEC agreements allow.

Adding fuel to the fire, Chinese imports of Crude Oil declined by 9% in November compared to last year as Chinese demand for fossil fuels sumps alongside China’s growth metrics.

Despite OPEC’s production-limiting efforts, Crude Oil supplies remain well-stocked with barrel inventories at healthy levels, sending the price of Crude down into multi-month lows.

WTI Technical Outlook

Despite Friday’s rebound after finding a floor on Thursday at $69.01, Crude Oil remains firmly under-bid after closing in the red for five consecutive days into Tuesday, and WTI is on pace to end in the red for a seventh straight week.

WTI Crude Oil daily candlesticks remain firmly capped by the 200-day Simple Moving Average (SMA) near $78.00, with the 50-day SMA accelerating into the downside at $80.00.

Seven straight weeks of declines have dragged WTI down nearly twenty percent plus a half from the last peak of $89.64, and US Crude Oil is down nearly twenty-seven percent from September’s peak just below $94.00 per barrel.

WTI Daily Chart

WTI Technical Levels

- The USD/SEK rose towards the 10.470 level, threatening the 20-day SMA.

- US November Job reports: Unemployment Rate declined while Nonfarm Payrolls Average Hourly Earnings accelerated.

- All eyes are now on next week’s US November CPI and the Fed’s decisions.

In Friday's trading session, the USD/SEK edged higher, primarily driven by strong labor market data from the US and rising American yields, resulting in a 0.80% uptick. Consequently, the USD/SEK now threatens the 20-day SMA of 10.470, a short-term solid resistance.

The US Bureau of Labor Statistics reported that the Unemployment rate for November declined to 3.7%. On the positive side, Nonfarm payrolls defied expectations, climbing to 199K against the foreseen 180K and the previous 150K figure. Meanwhile, Average Hourly Earnings marked up 0.4% for November, overshooting the predicted 0.3% and distinctly surpassing the preceding 0.2% rate.

Its worth noticing that recent hints from Federal Reserve (Fed) officials on potential further regulatory tightening have subdued dovish expectations, which pushed the pair downwards in the last sessions. In that sense, robust labor market data reinforce this caution as the bank seeks additional confirmation of the economy cooling down. Next week, the Consumer Price Index (CPI) figures from November may provide markets with further guidance, but the highlight will be the Fed decision, where investors will seek clues on the bank's next plans.

USD/SEK levels to watch

The technical indicators on the daily chart reflect a certain dominance of the selling momentum. The Relative Strength Index (RSI) is in negative territory with a positive slope, suggesting a potential short-term momentum shift, although it is limited while under the 50-midline. The Moving Average Convergence Divergence (MACD) shows flat green bars, suggesting a temporary pause in the selling pressure.

Yet, the broader picture is tilted toward the bears. The pair are lingering below the 20, 100, and 200-day Simple Moving Averages (SMAs), representing that the bears have the command in the bigger picture. Despite the bearish breather, the selling pressure remains the prominent force, especially after the sellers pushed the price to lows since July last week. Therefore, the short-term technical outlook is inclined toward the sellers.

Support Levels: 10.365, 10.275, 10.180.

Resistance Levels: 10.471 (20-day SMA),10.503, 10.540.

USD/SEK daily chart

-638376612790812488.png)

- XAG/USD confirms a downtrend by breaking below 200, 100, and 50-day moving averages.

- Downtrend signals potential testing of November 13 swing low at $21.88 unless buyers intervene to lift the spot price.

- On the upside, buyers must reclaim $23.00 to challenge and surpass broken DMAs, potentially targeting $24.00.

Silver price is collapsing more than 3% in the day, breaking key support levels on its way south, set to finish the week with losses of more than 9.50%. At the time of writing, XAG/USD is trading at $22.97 after hitting a daily high of $23.89.

XAG/USD’s daily chart confirms the grey metal’s downtrend after breaching the 200, 100, and 50-day moving averages (DMAs), each at $23,49, $23.24, and $23.06. That said unless buyers lift the spot price, that would set the stage for a test of the November 13 swing low of $21.88.

Firstly, XAG/USD sellers must drag prices below a support trendline that passes at around $22.69. Once cleared, the next stop would be $22.00, ahead of the November 13 daily low mentioned above.

Conversely, if Silver buyers reclaim the $23.00 figure, that could pave the way for reclaiming each DMA previously broken. Once those levels are cleared, up next would bet the $24.00 mark.

XAG/USD Price Analysis – Daily Chart

XAG/USD Technical Levels

- GBP/USD hits a new low on Friday after a week of rough downside action.

- Next week sees back-to-back central bank appearances from the Fed and BoE.

- Downside momentum remains a key risk for the GBP heading into the year's final CB rate calls.

The GBP/USD is trying to hold onto 1.2550 heading into the Friday market close after dropping into a new low for the week near the 1.2500 handle after a better-than-expected US Nonfarm Payrolls (NFP) gave the US Dollar (USD) one last bump across the board to round out the trading week.

The Pound Sterling (GBP) spent most of the week underwater, waffling against its higher-profile peers and seeing only moderate gains against its weaker competitors. The GBP/USD pair is down one and a third percent from Monday’s opening bids as US economic releases dominated the data docket this week with a thin showing from the UK.

Market reactions centered around Federal Reserve (Fed) positioning this week, with investors weighing increased odds of Fed rate cuts coming sooner rather than later on a case-by-case basis, flipping into and out of risk bids as US economic figures beat or miss market data forecasts from one release to the next.

US NFP beats the street, thin UK data keeps the GBP pinned

Friday ended on a USD-positive note after US Nonfarm Payrolls beat expectations once again, showing the US added a net 199K new jobs to the already-tight labor market, above the market forecast of 180K and climbing above October’s print of 150K payroll additions.

November’s ADP Employment Change released earlier in the week showed a below-expectation performance, with ADP reporting a slower pace of new payroll employees of 103K compared to October’s 106K and missing median market forecasts of 130K. The ADP pullback set up over-eager market participants for disappointment with investors leaning heavier into Fed rate cut bets on the back of softening pre-NFP labor data, but Friday’s employment beat muddied the rate expectations waters to wrap up the trading week.

Next week sees a slew of central bank action through the midweek, with the US Fed giving one last rate call for 2023 and updating their inflation outlook dot plot, to be followed by the Bank of England (BoE) and its latest interest rate decision. Both central banks are expected to keep interest rates steady to close out 2023, at 5.5% and 5.25% respectively.

Before central bank action gets underway, next Tuesday brings UK Average Earnings and Claimant Count Change figures; annualized quarterly average earnings are expected to decline from 7.7% to 7.4% in the third quarter, while November is expected to show a slight increase in the number of unemployment benefits seekers from 17.8K to 20.3K.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.16% | 1.25% | 0.76% | 1.55% | -1.01% | 1.42% | 1.42% | |

| EUR | -1.18% | 0.10% | -0.40% | 0.39% | -2.22% | 0.28% | 0.26% | |

| GBP | -1.29% | -0.10% | -0.50% | 0.28% | -2.30% | 0.17% | 0.17% | |

| CAD | -0.76% | 0.41% | 0.51% | 0.80% | -1.79% | 0.68% | 0.67% | |

| AUD | -1.56% | -0.40% | -0.29% | -0.80% | -2.61% | -0.11% | -0.12% | |

| JPY | 0.95% | 2.15% | 2.40% | 1.77% | 2.55% | 2.42% | 2.40% | |

| NZD | -1.44% | -0.27% | -0.17% | -0.68% | 0.11% | -2.47% | 0.00% | |

| CHF | -1.46% | -0.26% | -0.17% | -0.67% | 0.11% | -2.46% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

GBP/USD Technical Outlook

The Pound Sterling shed the 200-hour Simple Moving Average (SMA) early in the week, descending below the 1.2600 handle to remain capped on the low side for the rest of the trading week. The GBP/USD pressed into a new weekly low near 1.2500 on Friday, and heads into the market close struggling to hold onto 1.2550 below the 50-hour SMA.

The GBP/USD fell 1.75% peak-to-trough on the week, and still remains down 1.33% despite a soft rebound from Friday’s new low, although GBP bulls will note that daily candlesticks are seeing technical support from the 200-day SMA rising into the 1.2500 handle, with the 50-day SMA accelerating into the upside from 1.2300.

Despite the week’s declines the GBP/USD is still up 4.3% from October’s early low of 1.2037, and the challenge for bullish bidders will be to stage a technical recovery and muscle the pair back over last week’s high bids just beyond the 1.2700 handle.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

- Gold slips below $2,000 down 0.50% spurred by elevated US bond yields as a consequence of solid data.

- US Bureau of Labor Statistics (BLS) revealed the Nonfarm payrolls surpassed estimates, while the Unemployment Rate ticks down to 3.7%.

- University of Michigan (UoM) data shows increased optimism among American households, inflation expectations downward revised.

- Federal Reserve’s rate-cut expectations for 2024 decline to 118 basis points, according to the Chicago Board of Trade (CBOT).

Gold price retreats below the $2,000 mark for the first time since November 24, extending its losses to 0.50%, spurred by solid data from the United States (US). The XAU/USD is trading at $1996 after hitting a daily high of $2034.00.

XAU/USD’s retreated below $2,000, which could push prices further downwards

XAU/USD’s decline follows the latest US employment report showing the labor market is improving in contrast to recent data revealed during the week. The US Bureau of Labor Statistics (BLS) showed the economy created 199K jobs, exceeding forecasts of 180K, while the Unemployment Rate ticked down from 3.9% to 3.7%.

That spurred a rally in the Greenback (USD), as shown by the US Dollar Index (DXY), remaining firm 0.40% above its opening price of 104.03, making dollar-denominated commodities more expensive. The US 10-year benchmark note yields 4.237%, eight basis points higher than Thursday’s close.

Additional data from the University of Michigan (UoM) showed that American households remain more optimistic about the economy while seeing an improvement in the battle against inflation as they downward revised inflation expectations.

All that said, traders paired slashed rate-cut bets on the Federal Reserve’s for the following year. Data from the Chicago Board of Trade (CBOT) suggests investors expect 118 basis points of rate cuts for 2024, below last week’s 140 bps. This means market participants see the Fed as less dovish than the previous week.

Aside from this, traders focus on the following week's US inflation report and the Federal Open Market Committee (FOMC) meeting. Inflation is expected to stay at 3.1% in twelve months, and monthly inflation will likely remain at 0%. The Core Consumer Price Index (CPI) is forecasted to stay at 4% unchanged YoY and 0.3% in monthly readings. Regarding the Fed, traders expect the US central bank to keep rates intact.

XAU/USD Technical Levels

- DXY Index is above the 20-day SMA at 104.05.

- US NFPs from November accelerated, as did Average Hourly Earnings. The Unemployment Rate declined.

- US is set to report CPI inflation next Tuesday.

The US Dollar (USD) continued to command the financial markets as it soared to the 104.05 mark, primarily because of positive labor market cues and a surge in yields, which suggests that markets are delaying rate cuts in 2024. The gains for the USD Index (DXY) were fueled by economic reports from November, prominently Average Hourly Earnings, Unemployment Rate and Nonfarm Payrolls, all of which collectively fuelled hawkish bets on the Federal Reserve (Fed).

Moderating US inflation figures from October fuelled dovish expectations regarding the Federal Reserve's stance at the beginning of November. However, Fed officials' signals considering further tightening are dampening these expectations, and strong labor market data reaffirms this cautious stance by the bank, which is requesting further evidence on the economy cooling down. The upcoming inflation data from November and the Fed meeting next week will be critical determinants for the USD’s short-term trajectory.

Daily Market Movers: US Dollar rising on the strength of labor market data

- The US dollar is making gains today, riding on a wave of strong labor market data and climbing yields.

- According to the US Bureau of Labor Statistics, November's Average Hourly Earnings MoM figures revealed a better-than-expected increase of 0.4%, exceeding both consensus and previous numbers of 0.3% and 0.2%, respectively.

- The Nonfarm Payrolls for November showed 199K new jobs were added to the US economy, surpassing consensus expectations of 180K and the preceding number of 150K jobs.

- The Unemployment Rate came in at 3.7%, lower than the anticipated figure of 3.9%.

- US bond yields are rising, with rates for 2-year, 5-year and 10-year bonds rising to 4.72%, 4.24%, and 4.23%, respectively.

- As per the CME FedWatch Tool, the market expects no rate hike in the December Fed meeting but anticipates less easing in 2024.

- Next week will see Tuesday's release of the Headline and Core Consumer Price Index (CPI) for November, which will likely shape the expectations for the next Fed decisions.

Technical Analysis: US Dollar bulls step in, but bears are still in command

The indicators on the daily chart reflect a short-term conflicted landscape for the US Dollar. The Relative Strength Index (RSI) position is on a positive slope, albeit in negative territory. This signals growing buying momentum, but it isn't robust enough to draw a definitive recovery. On the other hand, the histogram of the Moving Average Convergence Divergence (MACD) indicator paints a similar picture with green bars, which suggests that the selling pressure is declining.

Regarding the Simple Moving Averages (SMAs), the index sits above the 20-day SMA, yet below the 100-day SMA. Nonetheless, with respect to the 200-day SMA, it is clear that the index is operating in a generally bullish zone.

The resilience of bulls, in combination with bears taking a breather, insinuates that the selling force could be losing dominance over the buying force. However, the US Dollar Index needs to make a sustained move above the 100-day SMA for a change in the prevailing selling momentum. Until then, the overall technical outlook remains tentatively balanced toward the downside.

Support levels: 104.00 (20-day SMA), 103.50, 103.30.

Resistance levels: 104.40 (100-day SMA), 104.50,104.70.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The USD/JPY is paring back some of Thursday's losses, climbing back into the 145.00 handle.

- The US Dollar is fighting back after a steep decline sparked by a hawkish BoJ.

- US NFP figures beat expectations, keeping the Greenback bid through Friday market action.

The USD/JPY is back on the rebound for Friday after posting an extreme backslide on Thursday, climbing four-tenths of a percent from the day's opening bids and looking to pare back losses. The US Dollar (USD) traded flat against the Japanese Yen (JPY) through the early half of the trading week before getting knocked back after the Yen caught a broad-market rally on the back of unusually hawkish comments from Bank of Japan (BoJ) Governor Kazuo Ueda.

Friday sees the Greenback attempting to claw back chart paper, rising back into the 145.00 handle after a brief dip back into 142.50 at the start of the final trading session of the week.

US Nonfarm Payrolls (NFP) broadly beat the street on Friday, posting a net gain of 199K jobs through November versus the forecast 180K, and climbing over October's net jobs gain of 150K. Broader markets have been ramping up bets of an accelerated path towards rate cuts from the Federal Reserve (Fed), with many market participants expecting the first rate cut from the Fed by as early as next March.

A still-tight US labor market continuing to add more jobs than expected throws a small wrench in the works, bolstered by accelerating Average Hourly Earnings in November, which came in at 0.4% MoM compared to the forecast 0.3%. Worker earnings appear to be gaining in the near term after October printed 0.2% MoM.

Read More: US Nonfarm Payrolls increase by 199,000 in November

Despite the Dollar-positive NFP release, the USD/JPY remains deep in the red for the trading week after the Yen surged in one of its single best trading days in 13 months, fueled by speculation that the BoJ could finally be ending its negative rate regime as the Japanese central bank moves towards tighter monetary policy.

Despite the BoJ fearing a collapse in Japanese inflation sometime in 2025, Japanese Core Consumer Price Index (CPI) inflation continues to run hotter than expected, hitting 2.9% for the year into October and chalking in a nineteenth straight consecutive month of inflation outrunning the BoJ's 2% upper target band.

BoJ Governor Ueda hinted that the BoJ may begin moving to tighten monetary policy if wage growth begins to accelerate heading into 2024, sparking a broad-market bid splurge that sent the USD/JPY tumbling over 4% peak-to-trough on Thursday. The US Dollar recovered some ground, and continues to see a moderate climb heading into the Friday market close, but still remains well off the week's high bids.

Next week will be another Fed watch scenario, with the Federal Reserve delivering their last rate call of 2023, followed by an update to the Fed's 'dot plot', or summary of forward-looking inflation expectations. Any kind of decline in Fed inflation forecasts will likely spark a mark risk relief rally, and could send the US Dollar tumbling even further as investors chomp at the bit for Fed rate cuts.

Japanese Yen price this week

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this week. Japanese Yen was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.30% | 1.42% | 0.84% | 1.76% | -1.07% | 1.60% | 1.50% | |

| EUR | -1.33% | 0.13% | -0.46% | 0.47% | -2.41% | 0.30% | 0.19% | |

| GBP | -1.45% | -0.12% | -0.58% | 0.35% | -2.52% | 0.17% | 0.07% | |

| CAD | -0.85% | 0.46% | 0.59% | 0.93% | -1.94% | 0.76% | 0.64% | |

| AUD | -1.79% | -0.47% | -0.34% | -0.93% | -2.91% | -0.15% | -0.27% | |

| JPY | 1.02% | 2.36% | 2.63% | 1.92% | 2.82% | 2.66% | 2.52% | |

| NZD | -1.61% | -0.29% | -0.17% | -0.75% | 0.17% | -2.68% | -0.09% | |

| CHF | -1.52% | -0.18% | -0.05% | -0.64% | 0.28% | -2.58% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

USD/JPY Technical Outlook

The US Dollar is up four-tenths of a percent against the Yen on Friday, and looking for further upside momentum after climbing from Friday's early low of 142.50. Topside technical resistance from the 50-hour Simple Moving Average sits nearby just beyond the 145.00 handle, with further pressure from the 200-hour SMA descending into 146.75.

Thursday's dip and Friday's moderate recovery sees the USD/JPY setting up a technical bounce from the 200-day SMA just above 142.00, and the trick for Greenback bidders will be to push the pair back towards the 147.00 handle, where they can take a fresh run at the 50-day SMA parked just below the 150.00 major price level.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

- EUR/USD declines over 0.20%, hits daily low of 1.0723 post-US Nonfarm Payrolls; trims losses to 1.0767 after upbeat UoM Consumer Sentiment.

- US Bureau of Labor Statistics reveals a resilient job market, adding 199K employees, lowering the Unemployment Rate to 3.7%.

- University of Michigan (UoM) Consumer Sentiment beats estimates while inflation expectations slide.

The EUR/USD fell decently more than 0.20% during the North American session after it dived to a daily low of 1.0723 courtesy of a slid US Nonfarm Payrolls report. However, after a better-than-expected University of Michigan Consumer Sentiment report, the pair has trimmed some earlier losses. The major is trading at 1.0747.

EUR/USD dropped as US Nonfarm Payrolls exceed estimates, but UoM Consumer Sentiment provides relief

A busy economic calendar in the United States (US) keeps EUR/USD traders entertained. Initially, the Bureau of Labor Statistics (BLS) revealed the economy remains resilient, as the workforce added 199K employees, exceeding the forecast of 180K. At the same time, the Unemployment Rate dropped from 3.9% to 3.7%, while the Average hourly earnings stood unchanged at 4%.

The US Dollar gathered traction on the data’s release, as the EUR/USD dropped toward its daily low before pairing those losses. The US Dollar Index (DXY), which tracks the currency’s performance against six others, registers gains of 0.40%, up at 103.07

The University of Michigan (UoM) Consumer Sentiment recently showed that American households had grown optimistic, snapping four months of declines. The index rose by 69.4, the highest since August, exceeding estimates of 62.0 while inflation expectations slid. Americans estimate inflation in twelve months at 3.1%, down from 4.5%, while for five years, is foreseen at 2.8%, less than November’s 3.2%.

Across the Atlantic, the inflation in Germany slowed to 2.3% as measured by the HICP, below forecasts prior’s month 3%. That has opened the door for a less hawkish reaction by the European Central Bank (ECB), which is expected to hold its monetary policy meeting next week.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart portrays the pair as neutral to downward biased, with sellers in charge, as they dragged the exchange rate below the 100-day moving average (DMA) at 1.0762. A daily close below that level can pave the way toward the 50-DMA at 1.0700. A breach of the latter will expose the November 10 swing low of 1.0655. Conversely, an uptrend resumption could happen if traders reclaim the 100-DMA, opening the door for a rally to 1.0800.

- The Canadian Dollar follows a broad-market risk bid to higher ground on Friday.

- Economic data from Canada is thin on Friday, as well as all next week.

- Crude Oil takes a little off the top, paring back recent losses and helping to prop up the CAD.

The Canadian Dollar (CAD) is up on Friday, gaining ground across the FX board. Still, gains are thin and the charts remain choppy as investors readjust their positions and expectations after the US Nonfarm Payrolls (NFP) for November surprised to the upside. At the time of writing, the CAD is up a little over a tenth of a percent against the US Dollar (USD), while the Loonie’s strongest performance is against the Kiwi (NZD), climbing over seven-tenths of a percent.

Canada brings little significant economic data on Friday, and the same rings true for next week with next to nothing on the calendar docket for the CAD until next Friday’s appearance from Bank of Canada (BoC) Governor Tiff Macklem. BoC Governor Macklem is expected to answer audience questions after speaking at the Canadian Club of Toronto.

Daily Digest Market Movers: Canadian Dollar in the green for Friday despite rough ride from US NFP

- The Canadian Dollar is up across the broader FX market on Friday, gaining ground against every other major currency, with the US Dollar taking a tight second place.

- The US Dollar climbed ahead of Friday’s US Nonfarm Payrolls before falling back post-release.

- US November NFP figure beats expectations on Friday, coming in at a hair under 200K, well above the forecast for 180K and clearing further ground above October’s 150K showing.

- Despite the swing in risk sentiment after a better-than-expected NFP print, investors will be keeping a close eye on recent figures heading into 2024 and be on the lookout for revisions.

- Of the last twelve consecutive NFP releases, all but four have been revised lower after the fact. Of the four, only two were revised higher; the two most recent prints have yet to fall under the red pen’s stroke.

- The University of Michigan’s Consumer Sentiment Index also came in well above expectations, printing at 69.4, well above the forecasted 62.0 and climbing even further above November’s print of 61.3.

- Next week brings US Consumer Price Index (CPI) inflation figures as well as the Federal Reserve’s (Fed) final Interest Rate Decision, and markets will be keen to see what updates are made to the Fed’s ‘dot plot’ of interest rate projections.

- Crude Oil is seeing a moderate bounceback after declining through most of the week. West Texas Intermediate (WTI) Crude Oil has climbed back to $71.50 per barrel on Friday after declining nearly 8% from Monday’s opening bids, falling to $69.01 per barrel on Thursday.

- A rebound in Crude Oil, even a thin one, is a welcome bump for the Canadian Dollar, which is still down eight-tenths of a percent against the US Dollar from Monday’s open.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.19% | 0.30% | -0.13% | 0.11% | 0.10% | 0.57% | 0.44% | |

| EUR | -0.21% | 0.09% | -0.32% | -0.09% | -0.10% | 0.37% | 0.26% | |

| GBP | -0.33% | -0.14% | -0.47% | -0.23% | -0.24% | 0.23% | 0.12% | |

| CAD | 0.14% | 0.32% | 0.45% | 0.25% | 0.23% | 0.71% | 0.58% | |

| AUD | -0.11% | 0.09% | 0.21% | -0.24% | 0.00% | 0.46% | 0.35% | |

| JPY | -0.10% | 0.11% | 0.23% | -0.24% | 0.01% | 0.49% | 0.36% | |

| NZD | -0.56% | -0.37% | -0.25% | -0.70% | -0.45% | -0.47% | -0.10% | |

| CHF | -0.46% | -0.26% | -0.15% | -0.62% | -0.36% | -0.37% | 0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar looking for gains on Monday, USD/CAD hampered by 1.3600

The USD/CAD saw some back-and-forth action on Friday, pointing to 1.3550 before rallying back towards the 1.3600 handle. Intraday action is getting squeezed into the midrange, with technical support coming from the 200-hour Simple Moving Average (SMA) near 1.3570.

Bullish momentum looks set to stall after a bounce from the 200-day SMA just above the 1.3500 handle, and daily candles have been closing in the middle for the back half of the trading week.

A bullish break will take the USD/CAD back toward the 50-day SMA near 1.3700, while a downside retest of the 200-day SMA will clear the way for another bearish run at September’s swing lows into 1.3400.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The AUD/USD is oscillating around the 0.6580 level, reflecting a decline of 0.25%.

- US Labor market data from November showed that wages and job creation increased while Unemployment declined.

- US bond yields made the US Dollar gain interest.

The Aussie dollar (AUD) experienced a dip in its Friday trading session, with the AUD/USD trading lower at approximately 0.6580. The downward movement can primarily be attributed to robust American labor market data, coupled with escalating U.S. yields, which drove demand to the Greenaback

The US Bureau of Labor Statistics data indicated that the November Average Hourly Earnings increased by 0.4% MoM, higher than the 0.3% expected and the previous 0.2%. Moreover, US Nonfarm Payrolls surprisingly jumped to 199K in November from the former 150K, surpassing the forecast of 180K, while the Unemployment rate declined to 3.7% from 3.9%.

As a reaction, the US Treasury yields are on the rise. The 2-year rate is at 4.70%, while the 5 and 10-year rates are trading at 4.24% and 4.25%, respectively, which favors the strengthening of the USD. In that sense, the strong employment figures have spurred speculations surrounding the Federal Reserve's monetary policy regarding how long the bank will maintain rates at restrictive levels. It's worth noticing that Fed officials left the door open for further tightening as they haven’t seen enough evidence of the economy cooling down, so strong data may delay rate cuts.

Next week, the US will release Consumer Price Index (CPI) figures from November, which will be closely watched by markets.

AUD/USD levels to watch

The AUD/USD daily chart is delivering mixed signals. Despite the negative slope in the Relative Strength Index (RSI) indicating lowered buying momentum in the short term, the indicator is still within the positive territory, suggesting that, overall, bullish sentiment has not entirely dissipated. However, the Moving Average Convergence Divergence (MACD) prints rising red bars, indicating growing bearish momentum.

Although bears appear to be gaining ground recently, the index's placement above its 20-day, 100-day, and 200-day Simple Moving Averages (SMAs) can't be overlooked. This position illustrates that despite short-term selling pressures, the overall trend remains bullish, indicating that the latter maintains a stronghold in the wider context in this tug-of-war between bears and bulls.

Support Levels: 0.6575 (200-day SMA), 0.6560 (20-day SMA), 0.6530.

Resistance Levels: 0.6600, 0.6630, 0.6650.

AUD/USD daily chart

-638376493599832898.png)

- Mexican Peso recovers from around weekly lows, and reclaims the 100-day SMA.

- Mexico’s Producer Price Index was softer than estimated, keeping Banxico’s hopes of easing policy next year alive.

- US Nonfarm Payrolls in November were better than foreseen, in contrast to previously released jobs data.

Mexican Peso (MXN) rallies against the US Dollar (USD) during the North American session on Friday, although data from the United States (US) showed the labor market is not as soft as suggested by previously released data during the week. Consequently, traders pared bets on rate cuts by the US Federal Reserve (Fed) for the next year while the Greenback rose. Nevertheless, the Mexican currency remains strong, as depicted by the USD/MXN trading at 17.32, losing 0.80% on the day.

Mexico’s economic docket revealed that inflation on the producer side was softer compared to October’s data, revealed the National Statistics Agency (INEGI). That reinforces the thesis that prices are slowing down, which leaves the Bank of Mexico (Banxico) officials scratching their heads as consumer inflation rises.

Across the border, the US Bureau of Labor Statistics (BLS) revealed the labor market remains strong, with the economy adding more jobs than estimated by market participants, pushing the Unemployment Rate further away from projections of the Federal Reserve.

Daily digest market movers: Mexican Peso on the offensive despite solid US jobs report

- Mexico’s Produce Price Index (PPI) rose by 1.20% YoY in November, below October’s 1.30%. In month-over-month figures, the PPI rate plunged from 0.5% in October to -0.4% in November.

- The latest consumer inflation report in Mexico missed forecasts and exceeded October’s reading.

- Banxico’s officials recently expressed their desire to ease monetary policy, though the divergence in consumer and producer inflation could prevent a rate cut by the first quarter of 2024.

- Nevertheless, there is a dissenter as Deputy Governor Irene Espinosa pushed back and said inflationary risks remain and are growing.

- US Nonfarm Payrolls exceeded forecasts of 180K and rose by 199K in November, while the Unemployment Rate slid to 3.7% from 3.9%.

- Average Hourly Earnings, seen as a measure of inflation, grew as expected by 4%, while monthly data advanced by 0.4%, above previous month's 0.2%.

- Following the US employment report, jobs data suggests the labor market is cooling, but at a slower pace than expected by traders. Per the market’s reaction, investors were overly aggressive on the Fed rate cut expectations, with market participants pairing the Federal Reserve’s rate-cut bets for the next year. According to data from the Chicago Board of Trade (CBOT), 120 basis points of rate cuts are estimated, 20 bps less than a week ago.

Technical Analysis: Mexican Peso buyers regain control as the USD/MXN slumps below the 100-day SMA

The USD/MXN shifted gears and is sliding below the 100-day Simple Moving Average (SMA), which lies at 17.39, suggesting that sellers are in charge but they would need a daily close below that level to extend its losses. The first support level is seen at the current week’s low of 17.16, followed by the area within the 17.00/05 range.

On the other hand, if USD/MXN buyers reclaim the 100-day SMA, that could open the door to challenging the 17.50 psychological level. A breach of the latter will expose the 200-day SMA at 17.55 will be exposed, followed by the 50-day SMA at 17.67.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The Swiss Franc is weakening in most of its pairs, but especially against the USD and GBP after the release of US Payrolls.

- Nonfarm Payrolls in November rose by 199K, higher than the 180K expected; Unemployment dropped to 3.7% and wages rose.

- The data supported the US Dollar and riskier currencies against the safe haven Franc.

The Swiss Franc (CHF) trades lower in most of its major pairs on Friday after the release of a better-than-expected US jobs report supports risk appetite, driving flows away from the safe-haven Franc.

Daily digest market movers: USD/CHF rises as Dollar gains boost from labor report

- The Swiss Franc is weakening versus the US Dollar on Friday after the release of the US Nonfarm Payrolls report shows the US created a higher-than-expected number of jobs in November, reflecting a strong labor market.

- 199K new positions were filled, according to the US Bureau of Labor Statistics report, when a figure of 180K had been expected by economists.

- The report also showed that the US Unemployment Rate fell to 3.7% in November, from 3.9% in October. No change had been expected.

- Average Hourly Earnings came out at 0.4%, beating expectations of 0.3% and suggesting wage inflation pressures could be building. Hours Worked also rose, suggesting more full-time positions filled.

- The higher wage data and stronger employment metrics in general indicate the US economy is healthier than thought and that fresh inflationary pressures may yet emerge.

- The data could make the Federal Reserve keep interest rates higher for longer and think twice before cutting interest rates.

- Higher-for-longer interest rates will benefit the US Dollar since they are a magnet for capital inflows.

- The next big release for the US Dollar is the preliminary Michigan Consumer Sentiment Index out at 15:00 GMT, which is estimated to show a rise to 62 from 61.3 in December.

Swiss Franc technical analysis: USD/CHF posts short-term reversal insignia

USD/CHF – the number of Swiss Francs that one US Dollar can buy – is trading higher on Friday after the release of Nonfarm Payrolls.

The pair is rising after having completed a Measured Move price pattern during October and November. Measured Moves are three wave patterns that look like large zig-zags. The first and third waves are usually of a similar length. Wave C completed after achieving the same length as A. This further reinforces the bullish reversal since the December 4 lows.

-638376441859350614.png)

US Dollar vs Swiss Franc: Daily Chart

The MACD has completed a bullish cross (circled) in negative territory, adding more evidence, signaling potentially more upside on the horizon.

The short-term trend is bullish, and more gains are possible. The next target is at 0.8825, which offers soft resistance. Then comes the confluence of major moving averages residing at 0.8900, where tougher resistance is expected.

A break below the 0.8667 lows would negate the recovery and see bears back in charge, with likely losses to the 0.8552 July lows.

Daily digest market movers: Haven Franc weakens after German inflation data, US jobs

- The Swiss Franc falls against the Euro on Friday as risk appetite pivots on better-than-expected jobs data from the US.

- German inflation data comes out in line with expectations, with the country’s Harmonized Index of Consumer Prices (HICP) rising 2.3% YoY in November but falling 0.7% MoM, according to data from the Federal Statistics Office of Germany.

- Following lower-than-expected Eurozone inflation data as a whole, the German figures suggest a risk the European Central Bank (ECB) will cut interest rates, which is weighing on the Euro and limiting its gains.

- Lower interest rates tend to weaken a currency as they reduce capital inflows.

Swiss Franc technical analysis: EUR/CHF rebounds from 2023 lows

EUR/CHF – the number of Swiss Francs that one Euro can buy – has rebounded after touching its lowest level for the year.

Thursday saw the formation of a Bullish Engulfing Japanese candlestick reversal pattern (see rectangle on chart below) at a major support and resistance level, after the pair recovered from record lows. For the candlestick pattern to be confirmed, it would have to be followed by a green bullish day on Friday. This would provide a short-term bullish reversal signal.

-638376443227078793.png)

Euro vs Swiss Franc: Daily Chart

The pair is in a downtrend on all key timeframes (weekly, daily, 4hr), however, suggesting bears have the upper hand overall and prices remain at risk of capitulation.

A break below the 0.9403 lows would reconfirm the bearish bias and see prices fall into uncharted territory, with major whole numbers then expected to provide support at 0.9300, 0.9200, and so on.

Daily digest market movers: GBP/CHF declines after BoE survey

- The Swiss Franc falls versus the Pound Sterling pair on Friday after the US posts better-than-expected labor market data, easing global recession fears. This supports riskier currencies like the Pound Sterling over safe-havens such as the Swiss Franc.

- Earlier on Friday, the Franc had risen against the Pound after the Bank of England (BoE) published its Consumer Inflation Expectations survey, showing that the British public foresees inflation rising at a slower 3.3% pace in the year ahead, compared to the 3.6% recorded in the August survey.

- The report reflects hopes that inflation may be coming down, and if materialized will mean the BoE will have more incentive to decrease interest rates.

- Lower interest rates are generally negative for a currency as they deter inflows of foreign capital.

- The market view of the course of future interest rates in the UK has turned more dovish recently in line with most of the rest of the world. Traders in interest rate futures saw a relatively high chance of the BoE cutting interest rates by 0.75% (three 0.25% cuts) in 2024, as per data reported on Thursday, December 7.

Swiss Franc technical analysis: GBP/CHF trading at range lows

GBP/CHF – the number of Swiss Francs that one Pound Sterling can buy – is in a sideways trend on short and long timeframes, whilst the medium-term trend could be classified as very marginally bullish.

On the 4-hour chart used to analyze the short-term trend, the pair is bouncing up and down within the parameters of a range-corridor between 1.0990 and 1.1155.

-638376444884104481.png)

Pound Sterling vs Swiss Franc: 4-hour Chart

More recently it seems to have found a floor at the lows of this range. The pair has just formed a bullish Hammer Japanese candlestick formation (see rectangle in chart above) and is seeing strong bullish follow-through in the period that follows. This provides confirmation of the short-term bullish signal.

It is possible to see the outline of a complete measured move in the zig-zag of price action down from the November 29 high, with wave C completing at the November 7 low.

The MACD has risen above its signal line whilst well below the zero-line, further adding weight to the short-term bullish outlook. Indeed, looked at throughout December, the MACD looks like it might have formed a wide double-bottom bullish reversal pattern, further amplifying the strength of the current crossover buy signal.

All in all, the short-term chart suggests the GBP/CHF pair is turning around at the bottom of a range and beginning a bullish ascent back up to the range highs at 1.1155. A break above the 1.1040 level would provide further confirmatory evidence a new leg higher was underway.

Swiss Franc FAQs

What key factors drive the Swiss Franc?

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

Why is the Swiss Franc considered a safe-haven currency?

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

How do decisions of the Swiss National Bank impact the Swiss Franc?

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

How does economic data influence the value of the Swiss Franc?

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

How does the Eurozone monetary policy affect the Swiss Franc?

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

- GBP/USD traded volatile in the data release, though resumed its downtrend.

- US Nonfarm Payrolls figures exceeded estimates; hence traders priced out one Fed rate cut for 2024.

- Traders are eyeing the release of the University of Michigan Consumer Sentiment poll.

The GBP/USD dives 0.50% in early trading during the North American session, sponsored by news showing the economy in the United States (US) remained resilient as the workforce added more jobs than expected. At the time of writing, the major trades at 1.2505, after trading volatile within 1.2578/1.2511 at the news release.

US economy remains stronger than expected, hence the GBP/USD tumbles to new weekly lows

The US Bureau of Labor Statistics (BLS) revealed that 199K jobs were created in November, according to the Nonfarm Payrolls report. Market participants estimated a 180K increase, mainly driven by healthcare gains and auto workers. Digging into the data, the Unemployment Rate ticked lower from 3.9% to 3.7%. Average Hourly Earnings rose as the expected 4% on yearly readings, while month-over-month figures were up to 0.4% from 0.2% a month earlier.

Following the data release, trades had paired US Federal Reserve’s rate cut expectations for the following year. According to data from the Chicago Board of Trade (CBOT), 120 basis points of rate cuts are estimated, 20 bps less than a week ago.

Meanwhile, the Greenback is recovering from Thursday’s losses, as the US Dollar Index (DXY) is up by 0.50%, at 104.15. US Treasury bond yields are climbing from the short to the long end of the curve. The 10-year benchmark note rate is 4.235%, gaining eight basis points.

On the UK front, a scarce economic docket has traders awaiting the Bank of England’s (BoE) next week meeting. Economists expect the BoE to stay pat, though rate cut estimates for 2024 project 80 bps of monetary policy easing.

Ahead in the day, GBP/USD traders are eyeing the release of the University of Michigan (UoM) Consumer Sentiment poll and inflation expectations.

GBP/USD Price Analysis: Technical outlook

Friday’s price action has taken the GBP/USD near the 200-day moving average (DMA), at 1.2488, though it remains above the 1.25 figure. A decisive breach of the latter will expose the previously-mentioned support level, immediately followed by the 100-DMA at 1.2462. Downside risks will be reinforced once those two support levels are taken out, opening the door toward 1.2400. On the flip side, if buyers keep the exchange rate above 1.2500, they could threaten to regain 1.2550.

- The EUR/USD spikes down after better-than expected US payrolls data.

- Nonfarm payrrolls and hourly earnighs increase bayond expectatios in November.

- US data cools holes of Fed cuts and sends the USD higher.

The Euro has dropped more than 40 pips to hit a fresh three-week low below 1.0750 as the US Nonfarm Payrolls report has cooled hopes of Fed rate cuts in early 2024.

Nonfarm Payrolls data cools hopes of Fed cuts

The US economy created 199,000 jobs in November, well above the 1800,00 reading forecasted by market analysts, and up from the 150,000 jobs created in October.

Beyond that, hourly earnings increased at a 0.3% pace, somewhat faster than the 0.2% expected by the market. This reveals that the US labour market remains strong, tackling the doubs triggered by the weak JOLTs and ADP and dampening investors' hopes that the Fed might start easing its monetary policy in March.

The market reaction has supported the US Dollar, sending the EUR/USD to fresh lows below 1.0750 although the pair has trimmed some losses shortly afterwards.

Technical levels to watch

- The US Dollar (Index) dropped over 0.50% overnight after the Yen appreciated 4% in one day.

- Traders brace for Nonfarm Payrolls this Friday.

- The US Dollar Index has broken back below 104, though still holds gains for this week.

The US Dollar (USD) was having a crisis on Thursday after an outside event tripped the US Dollar Index (DXY) 0.50% into the red. The outside pressure came from the Japanese Yen which appreciated at one point nearly 4% intraday against the Greenback, and which is a major part of the basket of FX that makes up the US Dollar Index. The situation has stabilised for now, as traders focus on the US Jobs Report to be published later in the day.

On the economic front, the US Jobs Report will be the main event and will draw up all the attention. Traders will also need to be mindful of the University of Michigan Preliminary numbers coming out at the end of the European trading session. These numbers could either confirm or contradict the earlier Nonfarm Payroll (NFP) numbers and trigger volatility on the last trading day of the week.

Daily digest: NFP and Michigan catalysts

- A standstill in the markets until 13:30 GMT when the US Nonfarm Payrolls report comes out:

- Nonfarm payrolls number for November is expected to rise from 150,000 to 180,000.

- Monthly Average Hourly Earnings are expected to head from 0.2% to 0.3.%.

- Yearly Average Hourly Earnings are to head from 4.1% to 4%.

- The US Unemployment Rate for November is to remain unchanged at 3.9%.

- A bit more detail on the Nonfarm Payroll number: Expectations by economists range from 45,000 to 275,000. Expect thus a much stronger US Dollar and an upward move in the DXY when the NFP number snaps above 275,000. Any number below 45,000 will trigger substantial US Dollar weakness with a devaluing Greenback across the board and a DXY which will be sinking lower.

- Near 15:00 GMT the University of Michigan will release its preliminary data findings for December:

- The Sentiment Index is expected to head from 61.3 to 62.

- The Inflation expectations are set to head from 3.2% to 3.1%.

- Equities in Asia are falling out of bed for a second straight day in the aftermath of the possible decision by the Bank of Japan to increase the benchmark rate, which has been negative for decades. European equities are going the other way and are mildly in the green. US equity futures are flat.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 97.7% chance that the Federal Reserve will keep interest rates unchanged at its meeting next week.

- The benchmark 10-year US Treasury Note drops to 4.17%.

US Dollar Index technical analysis: Where to go from here

The US Dollar is stuck on a crucial crossroads that might trigger either substantially more and longer-term US Dollar appreciation or devaluation. In the runup towards Super Wednesday and Super Thursday when markets will hear from no less than four of the biggest central banks in the world, it looks like the Greenback might reestablish its label as King Dollar. Traders looking for clues would best keep an eye on the spread between the US 2-year yield and the German 2-year yield, which has been getting wider – a situation which is correlated with a stronger US Dollar.

The DXY is bouncing back up again after the decline on Thursday where the Japanese Yen appreciation was just too much to bear. The DXY could still make it further up, should employment data trigger a spike in US yields again. A two-tiered move – first with NFP and then University of Michigan numbers – could move the DXY back above 104.28, with the 200-day and 100-day Simple Moving Averages (SMA) turned over to support levels.

To the downside, the 200-day SMA has done a tremendous job in supporting the DXY with buyers coming in below 103.56 and pushing it back towards that same level near the US closing bell. If it fails this Friday, the lows of November near 102.46 is a level to watch. More downside pressure could bring into view the 100 marker, in a case where US yields sink below 4%.

Nonfarm Payrolls FAQs

What are Nonfarm Payrolls?

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

How does Nonfarm Payrolls influence the Federal Reserve monetary policy decisions?

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

How does Nonfarm Payrolls affect the US Dollar?

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

How does Nonfarm Payrolls affect Gold?

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Sometimes Nonfarm Payrolls trigger an opposite reaction than what the market expects. Why is that?

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

- The US Dollar pulls back ahead of the NFP report

- The uptick in Oil prices is providing support to the CAD.

- Longer term, the pair is in a corrective move after November’s sell-off.

The US Dollar is losing ground on Friday, calling an end to a 4-day rally as the loonie trims losses, favoured by higher Oil prices ahead of the US Nonfarm payrolls report.

The Dollar recovery lost steam on Thursday after the increase on last week’s Jobless Claims confirmed the softer US labour market anticipated by the JOLTs Job Openings and the ADP report and heightened speculation of Fed rate cuts in 2024.

In Canada, The BoC left rates on hold on Wednesday, keeping the doors open to further tightening although the comments about the cooling inflationary pressures have acted as a headwind for the CAD.

US Nonfarm Payrolls are likely to boost USD volatility

The main focus today is the US Nonfarm Payrolls, which are expected to show a moderate increase in employment and hourly wages. Investors will look at these figures with a special interest for confirmation that the Fed’s rate hikes have come to an end, which might boost volatility on US Dollar crosses.

The technical picture shows the pair is correcting higher, after a 3% sell-off in November. The next resistances are likely to be at the 4h 100SMA, at 1.3600, the November 30 high, 1.3622 and 1.3700.

Supports are 1.3520 and the December 4 low at 1.3475.

Technical levels to watch

- WTI Oil trades near $70 and briefly broke below it on Wednesday and Thursday.

- Oil outlook supports more downside as recent API and EIA data revealed substantial exports from the US

- The US Dollar (Index) dropped Thursday as Yen soared 4% at one point against the Greenback.

Oil prices are taking a small breather around $70, after their firm decline earlier this week. When looking at the Oil price and events at hand, it all boils down to simple supply and demand. At the moment there is too much supply, which OPEC+ looks unable to control or limit. Meanwhile the United States is dumping every barrel available on the market to take the wind out of the sales of Russia and locally trying to push gasoline prices lower with a presidential election coming up in 2024.

Meanwhile, the US Dollar (USD) got a kick in the back from the Japanese Yen which weighed on the US Dollar Index (DXY). The Yen was up 4% in value against the US Dollar, on the back of comments from the Bank of Japan that alluded to the end of decades of negative yields. With that substantial shift in monetary policy from the Bank of Japan, traders are braced this Friday for the delayed US Jobs Report where any number below expectations might trigger another substantial amount of weakness for the US Dollar and the DXY.

Crude Oil (WTI) trades at $70.56 per barrel and Brent Oil trades at $75.30 per barrel at the time of writing.

Oil news and market movers: US floods markets

- Traders remain sceptical of the promised supply cuts from OPEC+ as these promises remain non-binding and are not obliged.

- The International Energy Agency (IEA) remains bearish on its outlook for Oil, pointing to still muted demand from China.

- Meanwhile US Shale production has been growing substantially and is one of the main reasons for the massive number in exports from the country on the Oil market.

- Markets and traders need to be on the lookout for any emergency meetings taking place by OPEC or OPEC+, and where more severe measures could be outlined that might trigger a substantial turnaround in the price action.

- Closing off Friday will be with the Baker Hughes US Oil Rig Count near 18:00 GMT. Previous was 505 with no forecast foreseen.

Oil Technical Analysis: Traders do not believe OPEC+

Oil prices are facing issues, image issues to be precise. Traders are placing further bearish bets on Oil prices after OPEC+ was unable to put firm measures in place that could support the Oil prices and rather move the needle upwards instead of downwards. As long as OPEC+ can not make a united front, more downside is the only outcome with arch nemesis, the US, dumping millions of barrels per day in an already flooded Oil market.

On the upside, $80.00 is the resistance to watch out for. Should crude be able to jump above that again, look for $84.00 (purple line) as the next level to see some selling pressure or profit taking. Should Oil prices be able to consolidate above there, the topside for this fall near $93.00 could come back into play.

On the downside, the soft floor near $74.00 got broken and is gone for now. For now, $70.00 is trying to salvage the situation, though it has been breached already on Thursday and Wednesday. Watch out for $67.00, which aligns with a triple bottom from June, as the next support level to trade at.

-638376336457343529.png)

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

What is WTI Oil?