- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Japanese Gross Domestic Product (GDP) for the third quarter (Q3) came in at -0.7% QoQ versus -0.5% expected and -0.5% prior, the Cabinet Office showed on Friday.

Furthermore, the Annualized GDP contracted 2.9% versus the 2.1% drop expected and 2.1% contraction prior.

Market reaction

Following the Japanese growth numbers, the USD/JPY pair is up 0.39% on the day to trade at 144.29

About Japan’s Gross Domestic Product (GDP)

The Gross Domestic Product (GDP), released by Japan’s Cabinet Office on a quarterly basis, is a measure of the total value of all goods and services produced in Japan during a given period. The GDP is considered as the main measure of Japan’s economic activity. The QoQ reading compares economic activity in the reference quarter to the previous quarter. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

- Spot Gold has traded comparatively thin through the week after Monday’s massive surge.

- XAU/USD peaked just above $2,140 to kick off the week, holding steady just above $2,020.

- Risk markets will be clamping down on positioning ahead of Friday’s US NFP print.

Gold set new all-time highs this week at $2,144.48 in a hard bid rally early Monday, and the XAU/USD has spent the rest of the week in thin trading after paring away Monday’s opening gains.

Spot Gold has bid slightly lower on the week, down a little over 2% from Monday’s opening prices as investors head into the Friday trading session. Traders will be looking ahead to the latest US Nonfarm Payrolls (NFP) report due in the upcoming American trading session to close out the week.

The US NFP is forecast to see a slight improvement from October’s 150K to 180K new job additions in November, and markets will be hinging on the report with investors hoping for a weak report to help boost odds of a Federal Reserve (Fed) rate cut. Money markets have leaned into a “sooner rather than later” narrative on Fed rate cuts, and investors have run far ahead of policy structure, haggling bids based on whether or not the Fed will cut rates next March.

XAU/USD Technical Outlook

Gold is currently down nearly five and a half percent from Monday’s all-time record bids above $2,140, trading tightly near $2,020.

The 50-day Simple Moving Average (SMA) is confirming a bullish cross of the 200-day SMA near $1,950, and downside action could see a technical bounce from the level as long as bidders maintain control.

The XAU/USD finds itself bidding into a rising trendline from October’s low bids near $1,810, but the week’s downside pressure knocking Spot Gold off of newly-minted all-time highs sees the XAU/USD coiling on the south side of a significant technical barrier from $2,050.

XAU/USD Daily Chart

XAU/USD Technical Levels

- AUD/USD remains confined near 0.6600 in the early Monday session.

- US weekly Initial Jobless Claims surged to 220K, Continuing Claims dropped to 1.861M vs. 1.925M prior.

- The Australian trade surplus narrowed to 7,129M in October from 6,184 in September.

- US Nonfarm Payrolls will be in the spotlight on Friday.

The AUD/USD pair oscillates in a narrow range around the 0.6600 psychological mark during the early Asian session on Friday. The weaker-than-expected Australian data and the pessimism about China’s economic outlook weigh on the Australian Dollar. AUD/USD currently trades near 0.6599, down 0.09% on the day.

The US weekly Initial Jobless Claims for the week ending December 1 surged to 220K, below the market expectation of 222K. Continuing Claims dropped to 1.861M from 1.925M, worse than the 1.919M expected. Traders will take more cues from the US employment data on Friday. The US Nonfarm Payrolls are expected to rise by 180K and the Unemployment Rate is estimated to remain steady at 3.9%. The stronger-than-expected data might boost the US Dollar (USD) and act as a headwind for the AUD/USD pair.

On the Aussie front, the October Trade Data failed to lift the Australian Dollar (AUD). The trade surplus narrowed to 7,129M in October from 6,184 in the previous reading, below the market estimation of 7,500M. Furthermore, China’s commodity imports for November raised concern about the economic slowdown in the world’s second-largest economy. The downbeat data and renewed worries about China's economy could convince the Reserve Bank of Australia (RBA) to cut rates in 2024, which might drag the AUD lower.

Looking ahead, market participants will closely watch the US Nonfarm Payrolls, due later on Friday. Also, the Unemployment Rate, Average Hourly Earnings, and the University of Michigan’s Consumer Sentiment Index will be released. These events could trigger the volatility in the market and keep a clear direction to the AUD/USD pair.

- EUR/JPY starts Friday flat at 155.62 after Thursday's sharp plunge; downward bias sustained post-BoJ Governor Ueda's remarks.

- Cross pair remains bearish, as technical indicators signal further losses; Tenkan-Sen below Kijun-Sen.

- Key support levels lie at 155.00, followed by October 3 low of 154.34, and December 7 low of 153.11.

The EUR/JPY begins Friday’s Asian session almost flat after plunging sharply on Thursday, following perceived hawkish remarks by the Bank of Japan (BoJ) Governor Kazuo Ueda. At the time of writing, the pair exchanges hands at 155.62, virtually unchanged.

After Thursday’s 290-plus pip drop, the EUR/JPY remains downward biased. The cross pair shifted bearish after breaking key support levels. The cross slide below a fourth-month-old support trendline, and the Ichimoku Cloud (Kumo).

In addition to that, the Tenkan-Sen crossed below the Kijun-Sen, opening the door for further losses. Hence, the bearish bias remains intact, and the EUR/JPY first support would be the 155.00 figure. Further downside emerges if the pair drops below the October 3 swing low of 154.34, followed by the December 7 low of 153.11.

If EUR/JPY buyers would like to regain control, they must reclaim the bottom of the Kumo at 157.58, followed by the 158.00 mark.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

- The Yen went on a tear on Thursday, climbing over 4% against the US Dollar.

- Markets have pared back over-eager Yen bids fueled by a potential end of BoJ negative rates.

- US NFP Friday still looms over broader markets, high-impact data to close out the week.

The USD/JPY plunged over 4% on Thursday, briefly declining below 142.00 before broader markets staged a moderate rebound, pulling the Japanese Yen (JPY) back into reasonable gain territory. The USD/JPY finished Thursday down around 2%, with the Yen heading into Friday’s market session deep in the green for the week.

The Yen saw a broad-market rally sparked by uncharacteristically hawkish comments from Bank of Japan (BoJ) Governor Kazuo Ueda, who unexpectedly began hinting at an eventual end of the BoJ’s negative rate regime, potentially early next year.

Hawkish BoJ sends Yen bets through the roof on Thursday

Japan’s Core Consumer Price Index (CPI) inflation hit 2.9% in October, and Japanese inflation has spent 19 consecutive months overshooting the BoJ’s 2% inflation target. The BoJ has avoided tightening policy because the Japanese central bank currently expects inflation to slump below 2% sometime in 2025.

With Japanese wages expected to see outsized gains next year as employers step up pay increases to combat rising prices, the BoJ appears prepared to begin discussing a reversal of its long-running negative rate policy mechanism, which has seen a slight cost associated with holding Japanese debt for the past seven years.

Especially overeager money markets are currently pricing in a 20% chance of a BoJ rate increase at the Japanese central bank’s upcoming policy meeting on December 18 & 19. The BoJ’s next quarterly growth and interest rate review is slated for the end of January.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.27% | -0.25% | 0.01% | -0.71% | -2.06% | -0.48% | 0.09% | |

| EUR | 0.26% | -0.03% | 0.28% | -0.45% | -1.80% | -0.22% | 0.32% | |

| GBP | 0.28% | -0.01% | 0.29% | -0.44% | -1.80% | -0.20% | 0.35% | |

| CAD | -0.04% | -0.28% | -0.27% | -0.73% | -2.09% | -0.49% | 0.07% | |

| AUD | 0.71% | 0.45% | 0.44% | 0.72% | -1.35% | 0.22% | 0.79% | |

| JPY | 1.99% | 1.80% | 1.76% | 2.03% | 1.30% | 1.56% | 2.10% | |

| NZD | 0.47% | 0.22% | 0.21% | 0.51% | -0.28% | -1.58% | 0.54% | |

| CHF | -0.09% | -0.35% | -0.40% | -0.08% | -0.84% | -2.15% | -0.59% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

USD/JPY Technical Outlook

The USD/JPY pinned into four-month lows on Thursday, plunging over 4% peak-to-trough before ending the day at a comparatively reasonable -2%, hitting four-month lows below 142.00 before recovering to close out the day just above 144.00.

Despite the intraday recovery, the USD/JPY saw one of its worst-performing days in over a year, when the pair fell below the 140.00 handle last November.

Over the course of Thursday’s trading the USD/JPY went from softly bearish to collapsing into the 200-day Simple Moving Average, and a bullish rebound will need to make significant headway before recovering the 147.00 handle. The 50-day SMA is rotating into a bearish stance well above Thursday’s price action, pushing down into the 1149.00 region.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

- AUD/JPY shifts bearish, after the pair dropped more than 130 pips on Thursday.

- Daily time frame shows bears in control as Chikou Span turns bearish while Kijun-Sen crosses above Tenkan-Sen.

- Key support levels lie at 95.00 initial support, followed by 94.00 and December 7 low of 93.70, October 3 low of 93.01.

On Thursday, the AUD/JPY plummeted more than 1.30%, shifting bearish, after finally breaching the top of the Ichimoku Cloud, signaling the downtrend is gathering pace. Nevertheless, traders must be aware of solid support levels seen at around the 93.70 area, the day’s low. At the time of writing, the cross exchanges hands at 95.11.

The daily time frame portrays the bears as in charge, though registering a daily close inside the Kumo keeps up and downside risks balanced. However, the Chikou Span shifted bearishly, while the crossing of the Kijun-Sen above the Tenkan-Sen provides two signals that suggest the downtrend remains in place.

With that said, AUD/JPY's first support would be the 95.00 figure. Once cleared, the next support is seen at the 94.00 mark, followed by December’s 7 daily low of 93.70, ahead of the October 3 low of 93.01.

On the other hand, in the event of bulls lifting prices above the Kumo’s top at around 95.40/59, that could pave the way to challenge the Tenkan-Sen at 96.04

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels

- NZD/JPY experienced a 1.60% downslope, consolidating at 88.90 after falling to 87.70.

- Hawkish bets on the BoJ and speculations of a liftoff are responsible for the strength of the JPY.

- The daily chart reveals a negative RSI slope and increasing red MACD Bars, suggesting a strong bearish momentum.

In Thursday's session, the NZD/JPY pair is trading bearish at around 88.90 after hitting a low of around 87.70. As indicated by the daily and four-hour charts, bears are currently dominating with their strength becoming more evident in shorter time frames.

In that sense, the Relative Strength Index (RSI) suggests that selling pressure is dominant given its negative trajectory currently within a negative range, while the Increasing red bars on the Moving Average Convergence Divergence (MACD) also indicate that the bearish momentum might be picking up speed.

Concerning Simple Moving Averages (SMAs), the pair lies below the 20-day average but above the 100-day and 200-day SMAs. This indicates that in the short term, there is bearish pressure but that in the larger time frame, bulls are still in command.

Switching the focus to the smaller timeframes, the four-hour chart also implies that the sellers are building force. The Relative Strength Index (RSI) shows an oversold condition but is currently flat, while the MACD is demonstrating rising red bars, adding more weight to the bearish viewpoint.

Support Levels: 88.55, 88.15 (100-day SMA), 87.70.

Resistance Levels: 89.25, 89.80, 90.00 (20-day SMA).

NZD/JPY daily chart

-638375829694392495.png)

- The EUR/GBP has drawn tight as both currencies mix on Thursday.

- The Euro remains steeply off of recent highs against the Pound Sterling.

- EUR lacking momentum after a miss on Eurozone GDP.

The EUR/GBP has been trading in a tight range through the week just above 0.8550 after a step decline in recent weeks dragged the Euro (EUR) down two and a third percent against the Pound Sterling (GBP), driven lower by weakening economic data from the Eurozone and a dovish European Central Bank (ECB) grappling with middling policy.

Eurozone Gross Domestic Product (GDP) for the third quarter mixed on market forecasts, with the QoQ figure coming in as expected at a contractionary -0.1% and the annualized figure for the year ending in the third quarter showing a flat 0.0% versus the forecast 0.1% uptick.

Euro traders are finding little reason to bid up the EUR as economic data continues to sour for the European bloc, after Wednesday’s Eurozone Retail Sales also missed expectations to decline 1.2% over the year into October, rebounding less than the expected -1.1% after dropping 2.9% for the annualized period in September.

The rest of the trading week is a thin showing on the economic calendar for both the Euro and the Pound Sterling, but next week kicks things off with labor figures from the UK.

EUR/GBP Technical Outlook

The EUR/GBP sees a tight range between 0.8580 and 0.8560 forming up this week, with the pair trading closely to the middle ground with little bounceback from recent weeks’ declines from the 0.8760 region.

Looking further out on the daily candlesticks, the EUR/GBP is trading directly into a heavy congestion zone that mired the pair through much of 2023’s middle quarters, and hopeful bidders will have a significant hill to climb if they’re going to push the Euro back up towards the 200-day Simple Moving Average (SMA) currently heading down towards 0.8650.

EUR/GBP Hourly Chart

EUR/GBP Daily Chart

EUR/GBP Technical Levels

The key event of the day will be the US official employment report. Before that, during the Asian session, Japan's data is due, including GDP, current account, and the trade balance. The Bank of England will publish the Consumer Inflation Expectation survey.

Here is what you need to know on Friday, December 8:

The US Dollar Index (DXY) dropped 0.60%, sliding from 104.20 to 103.50. The 10-year Treasury yield initially moved higher but pulled back during the American session from 4.17% to 4.11%.

Data released on Thursday showed that Initial Jobless Claims rose to 220,000, slightly below the market expectation of 220,000, while Continuing Claims dropped sharply from 1.925 million to 1.861 million, below the expected 1.919 million. The figures briefly boosted the US Dollar, but the impact was limited. The economic data released during the week had a modest impact, likely because it did not significantly alter expectations regarding the Federal Reserve's decision next week, including its guidance.

The official US employment report is due on Friday. Payrolls are expected to increase by 180,000, which would be an acceleration from the 150,000 recorded in October. The Unemployment Rate is expected to remain steady at 3.9%. The report could add to evidence of a more balanced labor market. A significantly positive surprise could trigger further gains for the US Dollar, while a negative report could weaken the currency. However, despite these fluctuations, the economic outlook for the US remains stronger than that of European countries.

The other major event of the week will be the preliminary December reading of the University of Michigan Consumer Sentiment Index.

EUR/USD rose modestly, supported by a weaker US Dollar, and settled around 1.0800. The final reading of the German November Consumer Price Index is due, which is expected to confirm the preliminary reading of annual inflation at 3.2%.

GBP/USD held above the 20-day Simple Moving Average (SMA) and rose to the 1.2600 zone. The Bank of England Consumer Inflation Expectation survey is due.

The Japanese Yen had its best day in a month, rising across the board after Bank of Japan (BoJ) Governor Ueda discussed policy options after exiting the current monetary policy stance. Developments around USD/JPY moved at an impressive pace, with the pair's long-term target hit within hours. It rebounded from 141.50 to 143.60. After the significant decline, some consolidation could take place. On Friday, data to be released from Japan includes Labor Cash Earnings, Current Account, Q3 GDP, and trade balance.

The Swiss Franc lost momentum during the American session but previously reached the highest level against the Euro since January 2015, with EUR/CHF failing to break above 0.9420 after rising towards 0.9460, as markets anticipate the ECB cutting rates more times than the Swiss National Bank (SNB) in 2024. USD/CHF ended the day flat, hovering around 0.8750.

The Canadian Dollar failed to benefit from a weaker US Dollar, with USD/CAD holding around 1.3600 and closing the day flat, likely affected by subdued crude oil prices.

Gold continues to trade sideways around the $2,030 level, supported by the $2,020 area and limited on the upside by $2,040. Silver hit a fresh low at $23.58 and trimmed losses, rising to $23.80, but the bias remains on the downside.

Like this article? Help us with some feedback by answering this survey:

- The USD/SEK is down by 0.35%, hovering near the 10.370 level.

- US reports Initial Jobless Claims at 220,000 for the week ending December 2.

- US bond yields are rising ahead of Friday’s NFPs.

The USD/SEK pair shows a downward course in Thursday's session, falling towards the 10.370 mark. The primary driver of this movement is a broad US Dollar weakness, which is consolidating weekly gains ahead of key labor market data on Friday.

On the data front, the U.S. Department of Labor reported that Initial Jobless Claims for the week ending in December 2 stood at 220,000. The figure was somewhat lower than the forecasted 222,000 but increased from its previous 218,000 claims, suggesting a marginally positive outlook in the labor market.

On Friday, the US will disclose a series of key labor market indicators that will shape the expectations for the next Federal Reserve (Fed) decisions. The Nonfarm Payrolls, Unemployment Rate and Average Hourly Earnings from November will be released by the U.S. Bureau of Labor Statistics, and while the Payroll figures are projected to reach 180,000, moving up from the previous 150,000, the wage growth ratio is anticipated to decrease to 4% YoY from the former 4.1%. The Unemployment rate is seen remaining steady at 3.9%.

Meanwhile, US Treasury yields are on an ascent. The 2-year yield is trading at 4.6o%, while the 5-year and 10-year yields both stand at around 4.12%. A rise in these yields positively influences the USD value, so the pair's losses may be limited. However, the rhetoric that dominates the market is that the Fed will take a less aggressive approach in light of the recent readings of cooling inflation and evidence of the labor market rebalancing. However, those expectations will be shaped by the incoming data as the bank still remains data-dependent and didn’t rule out further tightening.

USD/SEK levels to watch

According to the daily chart, the USD/SEK has a bearish outlook for the short term. The Relative Strength Index (RSI) shows a negative slope yet remains in positive territory, a hint of selling pressure being supported by the rising red bars of the Moving Average Convergence Divergence (MACD), suggesting a strengthening selling momentum.

In addition, the pairs reside below the 20,100 and 200-day Simple Moving Averages (SMAs), which suggests that the sellers are in command in the broader outlook.

Support Levels: 10.360, 10.350, 10.327.

Resistance Levels: 10.492 (20-day SMA), 10.500, 10.520.

USD/SEK daily chart

-638375784733312950.png)

- GBP/JPY tumbles to an eight-week low at 178.53 after BoJ Ueda's comments; trades at 180.69.

- Technical shift to bearish, pending daily close below Ichimoku Cloud (Kumo) at around 181.80, for further confirmation.

- Downside potential: 180.00 support; breach opens doors to 178.53, 178.03, and July 28 low of 176.31.

The GBP/JPY plummets more than 2.30% courtesy of comments by the Bank of Japan (BoJ) Ueda, which ultimately dragged the pair to an eight-week low of 178.53 before reversing toward the current exchange rate. At the time of writing, the cross trimmed some of its losses and trades at 180.69.

From a technical perspective, the pair has shifted bearishly, though pending registering a daily close below the Ichimoku Cloud (Kumo), which could open the door for further losses. On its way south, the GBP/JPY pierced a five-month-old support trendline, which capped the downtrend.

If GBP/JPY ends the day below the bottom of the Kumo, last seen at 181.80/85, that would confirm its bearish bias. As of writing, the first support is seen at the 180.00 mark. A breach of the latter will expose the current session low of 178.53, ahead of the October 3 swing low of 178.03. Once those levels are taken out, the next support would be a July 28 daily low of 176.31.

If GBP/JPY reclaims the 181.80 area, the pair will turn sideways, awaiting for a fresh catalyst.

GBP/JPY Price Analysis – Daily Chart

GBP/JPY Technical Levels

- EUR/USD climbs on Thursday to retake the 1.0800 handle.

- Markets turned on the USD as investors step up bets of a rate cut early next year.

- The EUR/USD is up 0.33% on the day.

The EUR/USD is on the climb in Thursday trading, lifting into the 1.0800 handle as the Euro (EUR) gains a third of a percent against the US Dollar (USD).

Market bets of a rate cut from the Federal Reserve (Fed) are on the rise, pushing the US Dollar broadly lower, and the Greenback is now on pace to be the worst-performing currency of the FX majors bloc heading into Friday’s US Nonfarm Payrolls (NFP) print to close out the trading week.

Before Friday’s US NFP lands on markets, Germany’s Harmonized Index of Consumer Prices (HICP) is due early Friday. German HICP inflation is expected to hold steady at 2.3% for the year ending in November, in-line with October’s YoY print.

Up Next: German HICP inflation, US NFP slated for Friday

Friday will also bring US Average Hourly Earnings for November, with the MoM figure forecast to tick up slightly from 0.2% to 0.3%. Meanwhile, latest US NFP is forecast to show a net gain of 180K new jobs in November, versus October’s 150K net employment gain.

Friday’s trading action will close out with the University of Michigan’s Consumer Sentiment Index for December, which is expected to show that US consumers are seeing an improving outlook on the domestic economy. The UoM’s Consumer Sentiment Index is expected to tick up from 61.3 to 62.0.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.35% | -0.28% | -0.03% | -0.83% | -2.58% | -0.56% | -0.07% | |

| EUR | 0.33% | 0.02% | 0.31% | -0.48% | -2.23% | -0.21% | 0.27% | |

| GBP | 0.29% | -0.05% | 0.27% | -0.53% | -2.26% | -0.26% | 0.22% | |

| CAD | 0.03% | -0.31% | -0.26% | -0.80% | -2.55% | -0.53% | -0.04% | |

| AUD | 0.83% | 0.48% | 0.52% | 0.78% | -1.72% | 0.27% | 0.74% | |

| JPY | 2.51% | 2.19% | 2.22% | 2.47% | 1.69% | 1.98% | 2.44% | |

| NZD | 0.55% | 0.20% | 0.25% | 0.52% | -0.28% | -2.00% | 0.47% | |

| CHF | 0.06% | -0.28% | -0.24% | 0.03% | -0.77% | -2.51% | -0.50% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

EUR/USD Technical Levels

The EUR/USD’s Thursday climb sees the pair breaking through the 50-hour Simple Moving Average (SMA) after slipping below the short-term moving average last week, but gains remain limited with the 200-hour SMA above 1.08075 and drifting bearish, dropping through 1.0900.

Daily candlesticks have the EUR/USD getting snagged on the 200-day SMA as the pair gears up to snap a six-day losing streak.

Technical support is looking thin at the 50-day SMA near 1.0700, with the moving average lifting into a bullish stance after the EUR/USD bottomed out near 1.0450 back in October, and has been climbing ever since.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

- GBP/USD rebounds from weekly lows, buoyed by positive sentiment diminishing the Greenback's safe-haven appeal.

- US labor market easing supports Fed rate cut speculations, shifting market narrative.

- ECB, Fed, and BoE rate cut expectations in swaps markets: ECB at 140 bps, Fed at 120 bps, BoE at 75 bps; UK economic data mixed.

The GBP/USD capped its three-day decline, rose from weekly lows reached at around 1.2544, and exchanges hands near the 1.2600 figure, posting modest gains of 0.23% late in the North American session.

Upbeat market sentiment and Fed rate cut speculations, a tailwind for the GBP/USD

Sentiment is one of the main drivers of the session, which remains positive to the detriment of the safe-haven status of the Greenback (USD). The GBP/USD remains underpinned by the drop of the buck, which, according to the US Dollar Index (DXY), drops 0.67% and trades at 103.48.

Meanwhile, the labor market continues to ease pressure off the US Federal Reserve. Data during the current week, witnessed the rise in unemployment claims of 220K, exceeding the previous reading of 218K, despite missing estimates for a higher print. The US Challenge Job Cuts, smashed October’s figure by 24% and rose to 45,510 vs. 38,836 reported in the last month.

Given the Fed's fundamental backdrop and forward guidance, the financial markets narrative shifted from high inflation to rate cuts, which would be the first central bank to ease policy. Speculations suggest that the European Central Bank (ECB) could be the first to pull the trigger by March, followed by the Federal Reserve in May, and the Bank of England (BoE) in July.

Rate cut estimates for each central bank according to swaps markets, for the ECB at 140 bps, the Fed at 120 bps, and the BoE at 75 bps.

Aside from this, the UK’s economic data in the week showed that business activity in the services sector improved. However, the S&P Global/CIPS Construction PMI dropped sharply, compared to October’s 45.6, at 45.5. this contrasts with the Composite PMI, which suggests the economy is expanding slower.

Meanwhile, GBP/USD traders are eyeing the US Nonfarm Payrolls report on Friday for a green light to continue to extend its gains if data supports the thesis of the US economy slowing down. If it’s not the case, further downside is expected, as markets had early anticipated the beginning of the Fed’s easing cycle.

GBP/USD Price Analysis: Technical outlook

The major remains upward biased unless it breaches the latest support level at 1.2506, the November 14 swing high. Despite trading in the green, the cross of the 100-day moving average (DMA) below the 200-DMA is opening the door for a bearish resumption. However, as the GBP/USD stays above the above-mentioned support area, bulls can remain hopeful of higher prices. Key resistance levels lie at 1.2600, followed by December’s 5 high at 1.2651, ahead of the psychological 1.2700. On the flip side, the first support is 1.2500, followed by the 200-DMA at 12481 and the 100-DMA at 1.2465.

- USD/JPY is on track for its single-worst performing day in 13 months.

- The Japanese Yen is rally hard across the board, gaining ground against the entire FX market.

- Hints of possible tightening from BoJ Governor Ueda sparked the Yen’s rally on Thursday.

The USD/JPY is on pace to see it’s single worst trading day since November of 2022 after plunging over four percent on Thursday with a broad-market rally for the Japanese Yen (JPY). The USD/JPY tipped into its lowest bids in since August below 142.00 after the Bank of Japan’s (BoJ) Governor Kazuo Ueda hinted that further policy tightening could be on the cards, with an end of the BoJ’s long-running negative rate policy on the table.

Boj Governor Ueda noted that Japan faces an “even more challenging” scenario heading into 2024, highlighting that the BoJ has “several options” on how the Japanese central bank might approach targeting interest rates moving forward.

BoJ finally edging closer to lifting rates?

Japan’s core inflation rate hit 2.9% in October, and Japanese inflation has exceeded the BoJ’s main inflation target rate for well over a year, and the BoJ itself doesn’t anticipate inflation receding below the central bank’s own 2% until sometime in 2025.

Japan’s Core Consumer Price Index (CPI) inflation has hit above the BoJ’s target band for 19 consecutive months. Markets are rapidly increasing their bets that the BoJ will finally be pushed off of their hyper-easy monetary policy perch sooner rather than later, on expectations that wages will begin to finally see moderate wage gains as Japanese workers and consumers grapple with inflation running much hotter for much longer than many expected, eclipsing long-running wage stagnation.

The BoJ next meets for another rate review on December 18 & 19, followed by a quarterly growth and inflation forecast review in late January. Investors will be keeping eyes glued closely to statements coming from the BoJ in the weeks to come as traders look for signs of more than just verbal movement from Japanese policymakers.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.40% | -0.28% | -0.01% | -0.86% | -2.81% | -0.63% | -0.09% | |

| EUR | 0.41% | 0.11% | 0.40% | -0.45% | -2.40% | -0.22% | 0.33% | |

| GBP | 0.30% | -0.09% | 0.29% | -0.55% | -2.50% | -0.32% | 0.21% | |

| CAD | -0.01% | -0.40% | -0.29% | -0.85% | -2.83% | -0.62% | -0.08% | |

| AUD | 0.87% | 0.48% | 0.57% | 0.86% | -1.92% | 0.25% | 0.77% | |

| JPY | 2.74% | 2.37% | 2.43% | 2.70% | 1.85% | 2.14% | 2.65% | |

| NZD | 0.64% | 0.24% | 0.35% | 0.62% | -0.24% | -2.09% | 0.55% | |

| CHF | 0.09% | -0.30% | -0.20% | 0.08% | -0.77% | -2.72% | -0.54% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

USD/JPY Technical Outlook

The USD/JPY has accelerated towards the downside, pulling away from intraday levels and pinning near-term technical indicators deep in oversold territory. The pair plunged into touch distance of 141.50, extending declines during the American market session, and the pair is seeing a limited pullback above the 143.00 handle.

Despite paring away some of the day’s more extreme losses, the pair still remains steeply off highs on Thursday, down nearly 2.75% from opening bids near 147.20.

In a single day the USD/JPY went from softly bearish to collapsing into the 200-day Simple Moving Average, and a bullish rebound will need to make significant headway before recovering the 147.00 handle. The 50-day SMA is rotating into a bearish stance well above Thursday’s price action, pushing down into the 1149.00 region.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

Bank of Canada Deputy Governor Toni Gravelle said on Thursday that they welcome the improvement in October inflation figures but warned that they need to see further progress on restoring price stability.

On Wednesday, the Bank of Canada kept its key rate unchanged at 5%, as expected. Gravelle reiterated that “overall, the economy no longer looks to be in excess demand.”

Key takeaways from the speech:

While we saw some welcome improvement in inflation measures in October, we must remember it's just one month. We need to see further progress.

The economy is now roughly in balance, but we are closely watching inflation expectations, wage growth and corporate pricing behaviour. These indicators are helping us assess whether inflation is on a sustained path to 2%.

The recent increase in immigration boosted consumption in the near term, but we estimate that that alone did not have a significant impact on inflation. However, due to Canada’s existing housing supply challenges, population growth has added to the pressure on shelter price inflation. Had builders been able to respond more flexibly to the increased demand, it would have helped reduce upward pressure on rent and housing prices.

Newcomers have helped loosen tight labour markets and have significantly improved our country’s potential growth, which will help keep a lid on inflationary pressures in the long run. But Canada needs more homes. And we need to make our housing supply more responsive to increases in demand. This will allow us to properly welcome new arrivals and to ensure all Canadians have an affordable place to live.

Market reaction

Comments from Gravelle had no impact on the Loonie. The USD/CAD remained moving sideways hovering around 1.3600, marginally higher for the day.

- The DXY Index trades with significant losses on Thursday, remaining below the 20-day SMA near 103.30.

- Speculation emerges for a policy pivot by the BoJ after Ueda’s comments drive demand away from the USD to the JPY.

- Investors gear up for US Nonfarm Payrolls data on Friday.

The US Dollar (USD) has been navigating turbulent waters, trading at 103.30, with significant losses registered below the 20-day Simple Moving Average (SMA). The primary drivers pushing down the Greenback include the Bank of Japan's rate hike discussions and failure to capitalize on the positive Initial Jobless Claims for the week ending December 1.

Alongside cooling inflation, mixed labor market conditions fuel cautious optimism within the Federal Reserve (Fed), which nonetheless hints at the need for further tightening in case data justifies it. High expectations are set for the upcoming labor market data release on Friday that will shape market expectations and set the pace of USD price dynamics.

Daily Market Movers: US Dollar Index trades lower near 103.00 on BoJ rate hike talk, eyes on NFPs

- The DXY Index has seen losses, with the US Dollar broadly trading below the 20-day SMA near 103.30.

- The US Initial Jobless Claims for the week ending December 1, reported by the US Department of Labor, came out at 220K. This is slightly below the market consensus of 222K.

- Investors await a host of economic activity reports due on Friday. These include Average Hourly Earnings for November on a yearly and monthly basis, as well as the Unemployment Rate and Nonfarm Payrolls data for November.

- US bond yields are down across the board, with the 2-year yield at 4.60%, while both the 5-year and 10-year yields stand at 4.12%.

- According to the CME FedWatch Tool, the market is not pricing in a hike for the December meeting. Meanwhile, rate cuts are being expected by mid-2024.

- Regarding Bank of Japan (BoJ) Governor Ueda’s comments, the central bank explored the possibility of leaving the negative interest rate policy. He added that there are various options when the tightening cycle begins that have boosted hawkish bets on the bank, benefiting the JPY and driving demand away from the USD.

Technical Analysis: US Dollar momentum flattens, DXY loses 20-day SMA

The Relative Strength Index (RSI) is currently on a flat slope in negative territory, while the Moving Average Convergence Divergence (MACD) prints flat green bars, suggesting that the bulls are losing traction.

However, exploring the position of the DXY relating to its 20, 100 and 200-day Simple Moving Averages (SMAs), it is evident that the outlook favors buyers on the long-term trend but the sellers in the short term. As long as the index doesn’t consolidate above the 20-day SMA, more downside may be in play to retest the 200-day SMA at 103.60.

Support levels: 103.20, 103.15, 103.00.

Resistance levels:104.00 (20-day SMA), 104.40 (100-day SMA), 104.50.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- NZD/USD stages recovery, as Bank of Japan Governor Ueda's hawkish comments impact the Greenback.

- US equities rebound on softer-than-expected jobs data; speculations of over 100 basis points Fed rate cut impact the US Dollar.

- BoJ's Ueda suggests various policy rate options, triggering a 2.20% Yen rally against the Greenback.

The NZD/USD stages a recovery on Thursday as the Greenback (USD) remains under pressure, courtesy of hawkish comments by Bank of Japan (BoJ) Governor Kazuo Ueda. That, along with soft US economic data revealed in the day, sponsored the pair’s leg up to the current exchange rate at 0.6187 and gains 0.87%.

The US Dollar Index falls more than 0.50% an NZD/USD’s tailwind

US equities rebounded during the North American session, fueled by softer-than-expected US jobs data. Speculations the US Federal Reserve would slash rates by more than 100 basis points mount, a headwind for the Greenback. Hence, the US Dollar Index (DXY), which tracks the currency’s value against six rivals drops 0.57%, at 103.56, weighed by a strong Japanese Yen (JPY).

Comments by the BoJ Governor Ueda stated that there are various options for the policy rate, such as normalizing monetary policy and paving the way to end negative interest rates. That roiled up the markets, with the Yen rallying against the Greenback more than 2.20%.

Delving into US data, Initial Jobless Claims for the last week missed estimates of 222K, which came at 220K but exceeded two weeks’ data of 219K. The US Challenge Job Cuts revealed companies trimmed job posts by 45K, 24% more than October’s 38.826K. Today’s data and previously released data keep investors' hopes high that the US central banks will cut rates in the first half of 2024.

The economic docket was absent on the New Zealand front and would finish the week that way. However, NZ is seen as a proxy for China, one of its largest trading partners. China’s Exports grew for the first time in six months, rising by 0.5%, while Imports fell by 0.6%.

NZD/USD Price Analysis: Technical outlook

The NZD/USD downtrend halts on Thursday, though downside risks remain unless buyers reclaim the high of December 6 at 0.6177. A breach of the latter will open the door to challenge the 0.6200 figure. Once cleared, there would be a clear path to test the July 31 high at 0.6225. On the other hand, a bearish resumption is the most likely scenario, as the 200-day moving average (DMA) acts like a magnet. Firstly, the sellers must drag prices toward 0.6100, ahead of the 200-DMA at 0.6088.

- The AUD/USD rallied from ten-day lows to retest the 0.6600 handle on Thursday.

- Moderating US Initial Jobless Claims is seeing a recovery in market sentiment.

- The Australian Dollar is rebounding against the broader FX market.

The AUD/USD is finding topside bids on Thursday, climbing three-quarters of a percent to retest the 0.6600 handle as market sentiment sees a late recovery heading into the US Nonfarm Payrolls (NFP) print slated for Friday to close out the trading week.

The Australian Dollar (AUD) slipped in the early Thursday market session, dipping into a two-week low near 0.6530 before catching a ride on a broad-market risk rally to bound back within reach of 0.6600.

US Initial Jobless Claims helped to fuel the broader market’s risk recovery, showing fewer than expected jobless benefits seekers. Initial Jobless Claims for the week ending December 1 printed 220K, slightly less then the market expectation of 222K. Initial Jobless Claims came in below the 4-week average of 220.75K, and saw only a minor uptick from the previous week’s 218K.

US NFP to close out the week as investors focus on the major data release

The Aussie will next have to grapple with the US NFP data drop slated for Friday’s American market session, and the median market forecast expects November’s NFP to show a net gain of 180K compared to October’s 150K print.

The University of Michigan’s Consumer Sentiment Index will also be printing on Friday, and is expected to show a similar moderate improvement from 61.3 to 62.0.

AUD/USD Technical Outlook

The AUD/USD’s Thursday rally sees intraday action capped off by the 200-hour Simple Moving Average (SMA) near 0.6610, and the pair’s rise back into 0.6600 is set to face difficulties on the charts as Aussie momentum remains limited.

Thursday’s Aussie rally also sees the AUD/USD strung along the 200-day SMA on the daily candlesticks, after a firm rebound from Thursday’s bottom bids of 0.6525.

Looking further out, the AUD/USD is approaching a significant technical barrier, with 0.6600 serving as a major support level through much of early 2023’s chart action.

AUD/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Technical Levels

- The Canadian Dollar is lower on the day against most of its peers.

- Crude Oil prices appear to have found a floor for now, easing downside CAD pressure.

- Friday’s US NFP remains the key closer for the trading week.

The Canadian Dollar (CAD) continues to pare back recent gains, shedding weight or flattening against all of its major currency peers, save for the Swiss Franc (CHF), which takes pride of place as the market’s biggest loser on Thursday.

The Bank of Canada (BoC) held interest rates steady at 5% on Wednesday, in-line with market expectations and bolstering the Canadian Dollar on the day. Now that investors have had time to chew on the BoC’s statement, it seems the Canadian central bank wasn’t as hawkish as it initially appeared.

The Canadian Dollar is paring back gains on Thursday as investors readjust their CAD exposure heading into another bumper US Nonfarm Payrolls (NFP) print to close out the trading week on Friday.

Daily Digest Market Movers: Canadian Dollar softer as markets focus on US NFP ahead

- Thin data on the docket for Thursday as markets get a breather before Friday’s NFP print.

- Canadian Building Permits recovered less than markets were hoping for in October, rebounding 2.3% versus the forecast of 2.9%.

- September Building Permits declined -8.1% after getting revised down from -6.5%.

- US Initial Jobless Claims for the week ending December 1 slightly beat expectations, helping to bolster equities and risk appetite in general, limiting CAD losses.

- US Initial Jobless Claims saw 220K new jobless benefits seekers last week, slightly less than the forecasted 222K and coming in just under the 4-week average of 220.75K.

- Crude Oil markets have flattened on Thursday but remain steeply off of recent bids, providing little support for the Canadian Dollar.

- Markets to focus on Friday’s upcoming US Nonfarm Payrolls report for November, expected to climb from October’s 150K to 180K MoM.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.21% | -0.12% | 0.02% | -0.63% | -2.08% | -0.38% | 0.20% | |

| EUR | 0.21% | 0.06% | 0.23% | -0.42% | -1.87% | -0.17% | 0.40% | |

| GBP | 0.13% | -0.07% | 0.15% | -0.49% | -1.90% | -0.25% | 0.33% | |

| CAD | -0.02% | -0.23% | -0.16% | -0.65% | -2.11% | -0.40% | 0.17% | |

| AUD | 0.62% | 0.41% | 0.48% | 0.64% | -1.45% | 0.24% | 0.81% | |

| JPY | 2.03% | 1.85% | 1.91% | 2.05% | 1.42% | 1.68% | 2.23% | |

| NZD | 0.38% | 0.17% | 0.24% | 0.40% | -0.25% | -1.70% | 0.57% | |

| CHF | -0.20% | -0.41% | -0.33% | -0.18% | -0.83% | -2.29% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

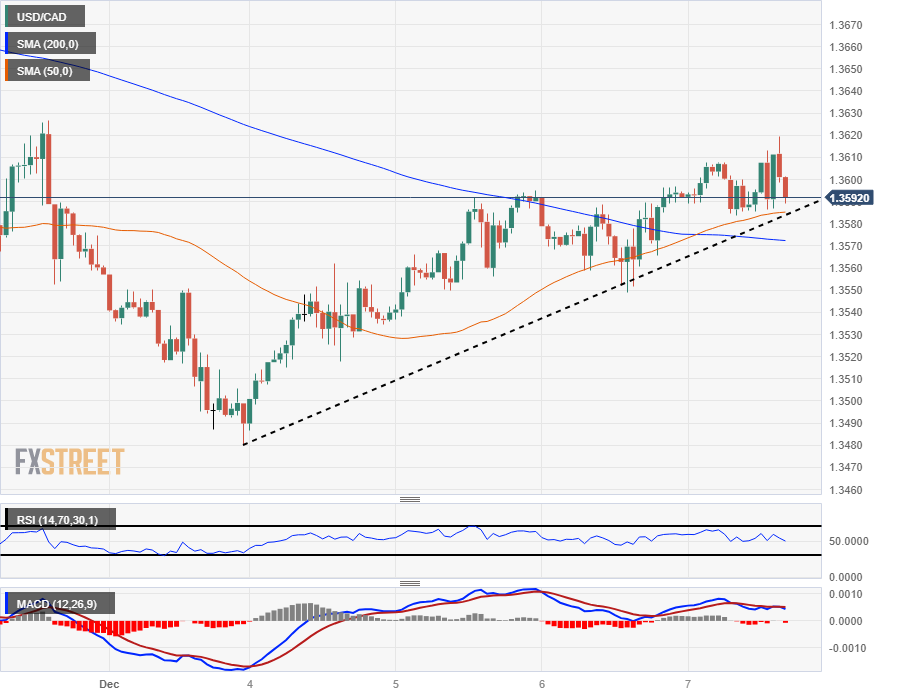

Technical Analysis: Canadian Dollar sees downside on Thursday, USD/CAD testing 1.3600

The USD/CAD pushed back into the 1.3600 handle during Thursday trading, and the pair is running into some resistance in the bids at the technical level. A rebound in the Loonie looks unlikely with intraday action finding support from the 200-hour Simple Moving Average (SMA) near 1.3570.

On the daily candlesticks, the USD/CAD is being pushed higher following a rejection from the 200-day SMA just above the 1.3500 handle. Near-term action sees the 50-day SMA testing 1.3700, which could draw bids higher.

A sustained bearish rejection from 1.3600 will see downside momentum gather for a run back down to 1.3500, where sellers will want to regather efforts for an attempt at breaking through the week’s low near 1.3480.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- USD/CHF records 0.80% gains in the week after buyers regain 0.8700.

- US labor market data remains soft, justifying market participants' rate cuts for 2024.

- Up next: Traders focus shifts to US Nonfarm Payrolls report.

USD/CHF prints decent gains of 0.12% in the day as the North American session begins, extending its weekly gains to 0.80% as buyers reclaim the 0.8700 figure. At the time of writing, the major is exchanging hands at 0.8764 after hitting a daily low of 0.8729.

The USD/CHF aims higher ahead of US NFP data

A busy economic calendar in the United States (US) keeps USD/CHF traders entertained. Firstly, the US Challenge Job Cuts revealed that US employers slashed 45.51K employees from the workforce, exceeding October figures, while the US Department of Labor revealed unemployment claims. Initial Jobless Claims for the week ending December 2 missed projections of 222K, rose by 220K but exceeded the previous week’s 219K.

All that said, there’s just one report linked to employment in the week. The US Nonfarm Payrolls on Friday is expected to show the US economy created 180K jobs in November, above October’s 150K, while the Unemployment Rate is estimated to stay around 3.9%.

Given the latest JOLTs and ADP figures suggested the labor market has cooled, if tomorrow’s employment report comes weaker than expected, it could be the last nail in the coffin for the US Federal Reserve (Fed), as investors seem convinced the Fed’s finished to tighten monetary conditions.

Fed Interest Rate Expectations

In the meantime, money market futures had priced 135 basis points of rate cuts by the Fed for the next year, which would likely begin in May, according to the Chicago Board of Trade (CBOT) data.

Aside from this, the Unemployment Rate in Switzerland hit 2.1%, exceeding October’s 2%, though it barely moved the needle. USD/CHF traders remain heavily focused on US Dollar dynamics.

USD/CHF Technical Levels

- The XAG/USD continued its downward path and fell to $23.75, below its 20-day SMA.

- US Initial Jobless Claims for the first week of December were better than expected.

- US bond yields are rising ahead of key labor reports on Friday.

In Thursday's session, Silver price (XAG/USD) continued declining and tallied a third consecutive day of losses, falling to $23.75. The precious metal price is being pushed down after US yields rose following the release of US jobless claims, which came in lower than predicted. The performance was further boosted by a steady US Dollar (USD).

In line with that, the U.S. Department of Labor revealed that the Initial Jobless Claims for the week ending on December 2 came in at 220K, vs. the 222K expected, and still accelerated from its previous 218K.

Following the data, US bond yields rose as strong labor market data favors the case of a more aggressive Fed. The 2-year rate is at 4.60%, whereas the 5-year and 10-year yields are at 4.15%. The rising rates further pressure the non-yielding metals as US Treasury bond yields are typically viewed as their opportunity cost of holding.

That being said, the U.S. Bureau of Labor Statistics is scheduled to report Average Hourly Earnings, Unemployment Rate, and Nonfarm Payrolls on Friday. These reports will shape the expectations of the next Decisions of the Federal Reserve (Fed) as the Bank closely monitors them. It's worth noticing that the officials signaled that they need to see more evidence of the economy cooling down so the outcome of the data may shape the short-term trajectory of the pair.

As for now, markets are forecasting that the Nonfarm Payrolls have accelerated in November while wages decelerated and the Unemployment rate remains steady at 3.9%.

XAG/USD levels to watch

The technical indicators on the daily chart reflect a neutral picture. Despite a negative slope in the Relative Strength Index (RSI) indicating increasing selling momentum, it remains in positive territory, suggesting that buying pressure still exists. However, rising red bars in the Moving Average Convergence Divergence (MACD) histogram echoes that the bears are gaining momentum, which contributes to a somewhat mixed picture..

Concerning Simple Moving Averages (SMAs), the price is below the 20-day SMA, displaying a near-term bearish bias. Nevertheless, the position above the 100 and 200-day SMAs shows that the bulls have the upper hand in the larger timeframe.

Support Levels: $23.50, $23.30,$23.00

Resistance Levels: $24.00, $24.30, $24.50.

XAG/USD daily chart

-638375617987119777.png)

- The Swiss Franc strengthens versus the Euro after more negative data for the region.

- Euro weakens to 2023 lows versus the Swiss Franc after GDP grinds to a halt in Europe, hammering the single currency.

- US Dollar continues righting itself against the pack including Swissie; Pound recovers vs. CHF on brighter financials.

The Swiss Franc (CHF) trades mixed on Thursday – rising versus the Euro which sees losses after a slew of more unfavorable figures, but falling to the strengthening US Dollar, and to a lesser extent the Pound Sterling, which was briefly buoyed by a less morbid financial outlook.

EUR/CHF hits new lows for 2023 of 0.9403 and threatens to enter uncharted price territory below after Eurozone growth and employment data for Q3 disappoints, weighing on the Single Currency. USD/CHF and GBP/CHF show technical short-term reversal insignia, which suggests bulls may have taken charge in the short term.

Daily digest market movers: USD/CHF rises as Dollar recovery continues unabated

- The Swiss Franc weakens against the US Dollar, which continues to recover after investors wake up to the fact the US may not have reached peak interest rates unilaterally, but rather be reflecting a wider global phenomenon.

- The latest US employment data shows a marginally better-than-expected result.

- Data out on Thursday shows an unexpected fall in Continuing Jobless Claims, which fell to 1.861 million in the week of November 24. A figure of 1.910 million had been expected.

- Initial Jobless Claims for week of December 1 undershot expectations, coming out at 220K when 222K had been forecast.

- The data slightly improves on the negative ADP employment data out on Wednesday.

- The next big release for the US Dollar is Nonfarm Payrolls out on Friday, December 8.

Swiss Franc technical analysis: USD/CHF posts short-term reversal insignia

USD/CHF – the number of Swiss Francs that one US Dollars can buy – is trading higher for the fourth day in a row on Thursday.

The pair found a floor at key long-term range lows and then formed a bullish Piercing Line Japanese candlestick reversal pattern on Monday, December 4 (rectangle on chart below). This was then confirmed by Tuesday’s bullish follow-through.

-638375613739891623.png)

US Dollar vs Swiss Franc: Daily Chart

It appears the pair has formed a measured move price pattern since the October 3 highs. Measured moves are three wave patterns that look like large zig-zags. The first and third waves are usually of a similar length. Wave C has completed after achieving the same length as A. This further reinforces the bullish reversal signaled by the Piercing Line.

The MACD has completed a bullish cross (circled) in negative territory, adding more evidence, signaling potentially more upside on the horizon.

The short-term trend is bullish, and more gains are possible. The next target is at 0.8825, which offers soft resistance. Then comes the confluence of major moving averages residing at 0.8900, where tougher resistance is expected.

A break below the 0.8667 lows would negate the recovery and see bears back in charge, with likely losses to the 0.8552 July lows.

Daily digest market movers: EUR/CHF hits new low for the year

- The Swiss Franc rises against the Euro after Eurozone economic data shows a deteriorating outlook for the region.

- The Euro weakened considerably on Thursday after GDP data showed that the Eurozone failed to grow in Q3 and registered a 0.1% decline on a quarter-on-quarter basis when compared to Q2.

- Employment Change data in the Eurozone was also disappointing, growing by a lower-than-expected 0.2% QoQ, when 0.3% had been expected, and 1.3% YoY in Q3 when experts had forecast 1.4%.

- Last week, HICP inflation data for the Eurozone showed a greater-than-expected slowdown in price rises, which was a further sign of a slowdown.

- The data suggested a risk the European Central Bank (ECB) might consider cutting interest rates to stimulate growth, which is weighing heavily on the Euro.

- Lower interest rates tend to weaken a currency as they reduce capital inflows.

Swiss Franc technical analysis: EUR/CHF makes new year-to-date lows at 0.9403

EUR/CHF – the number of Swiss Francs that one Euro can buy – has fallen to its lowest level for the year at 0.9403 on Thursday. It has temporarily found its feet at a major support and resistance level but remains vulnerable to weakening to unprecedented levels – lows not seen for decades.

-638375614492887736.png)

Euro vs Swiss Franc: Weekly Chart

The pair is in a downtrend on all timeframes, suggesting bears have the upper hand and prices should continue lower.

A break below the 0.9403 lows would further confirm the bearish bias and see prices fall into uncharted territory, with major whole numbers then expected to provide support at 0.9300, 0.9200, and so on.

Daily digest market movers: GBP/CHF supported by stable financial outlook

- The Swiss Franc weakens versus the Pound Sterling pair, possibly as a result of the publication of a report by the Bank of England (BoE) suggesting the UK financial system has grown more resilient.

- The Bank of England released its Financial Policy Summary and Record – December 2023, on Wednesday, December 6. The report concludes that UK businesses and households are showing greater resilience to the higher debt repayments associated with high-interest rates than was expected back in the summer.

- The greater stability of the UK financial system suggests the BoE will be able to keep interest rates higher for longer without negatively impacting the economy. The UK is experiencing relatively high inflation so maintaining interest rates at current levels may be necessary to bring it down.

- Higher interest rates are generally positive for a currency as they attract greater inflows of foreign capital.

- This comes after a string of officials maintained a hawkish line supporting the Pound.

- Interest rate-setter Megan Greene, for example, expressed concerns about persistently high inflation last week, indicating that interest rates might need to remain elevated for an extended duration.

- The market view of the course of future interest rates in the UK, however, has turned more dovish in line with most of the rest of the world. Traders in interest rate futures now see a relatively high chance of the BoE cutting interest rates by 0.75% in 2024.

Swiss Franc technical analysis: GBP/CHF bouncing from range lows

GBP/CHF – the number of Swiss Francs that one Pound Sterling can buy – is in a sideways trend on short and long timeframes, whilst the medium-term trend could be classified as very marginally bullish.

The pair is bouncing up and down within the parameters of a range-corridor between 1.0990 and 1.1155 on the 4-hour chart used for short-term chart analysis.

-638375615192706901.png)

Pound Sterling vs Swiss Franc: 4-hour Chart

It has probably found a floor at the lows of this range after a string of bearish days. The pair turned around on Thursday after posting a bullish Doji Star Japanese candlestick formation (rectangle in chart above). This is a short-term bullish signal.

It is possible to see the outline of a complete measured move in the zig-zag of price action down from the November 29 high, with wave C completing at the low of the Doji Star pattern.

The MACD has risen above its signal line whilst well below the zero-line, further adding weight to the short-term bullish outlook. Indeed, looked at throughout December, the MACD looks like it might have formed a wide double-bottom bullish reversal pattern, further amplifying the strength of the current crossover buy signal.

All in all, the short-term chart suggests the GBP/CHF pair is turning around at the bottom of a range and beginning a bullish ascent back up to the range highs at 1.1155. A break above the 1.1040 level would provide increased confirmatory evidence a new leg higher was underway.

Swiss Franc FAQs

What key factors drive the Swiss Franc?

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

Why is the Swiss Franc considered a safe-haven currency?

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

How do decisions of the Swiss National Bank impact the Swiss Franc?

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

How does economic data influence the value of the Swiss Franc?

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

How does the Eurozone monetary policy affect the Swiss Franc?

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

- Mexican Peso reverses its course and registers losses as the USD/MXN hovers near the 100-day Simple Moving Average (SMA).

- Mexico's inflation ticked up in November, which could prevent Banxico from easing policy as soon as they projected.

- US labor market data revealed during the week continued to cool down; USD/MXN traders eye US Nonfarm Payrolls.

Mexican Peso (MXN) is dipping modestly against the US Dollar (USD) in early trading during Thursday's New York session. Economic data from Mexico suggests the Bank of Mexico (Banxico) would likely need to keep interest rates higher, not just for “some time,” as the central bank stated in its latest monetary policy statement, which could keep the USD/MXN trading below the 18.00 figure. At the time of writing, the exotic pair changes hands at 17.32 and gains 0.30%.

Mexico's National Statistics Agency (INEGI) revealed that inflation rose in November, though core readings dipped. The USD/MXN has been underpinned by a rise in US Treasury bond yields. However, the Greenback (USD) remains weak, as shown by the US Dollar Index (DXY), which is down 0.33% on the day at 103.81.

Daily digest market movers: Mexican Peso on the backfoot despite rising inflation in Mexico

- Mexico's Consumer Price Index (CPI) in November rose 4.32% YoY, exceeding September’s 4.26%, though still below the forecast of 4.40%. The Core CPI, usually sought by central banks as a more stable measure of price stability, slowed from 5.5% to 5.30% in the twelve months to November, below forecasts of 5.34%.

- In recent interviews, Banxico's Governor Victoria Rodriguez Ceja and Deputy Governor Jonathan Heath commented that they could ease policy if the disinflation process advances. Contrarily to that, Deputy Governor Irene Espinosa pushed back and said inflationary risks remain and are growing.

- In the US, the labor market continues to cool down due to recently released data. The US Challenger Job Cuts revealed that US employers cut 45.51K jobs, exceeding October’s 36.836K.

- In the same tenor, Initial Jobless Claims for the week ending December 2 came at 220K, below estimates of 222K but above the prior week’s 219K.

- Jobless claims, summed to the latest JOLTs and ADP figures, added to softer inflation readings, led financial markets to conclude the Federal Reserve (Fed) has ended its tightening cycle. Therefore, market participants had already begun to price in more than 100 bps of cuts for 2024

- Money market futures projects the US Federal Reserve would slash rates by 135 basis points toward December 2024.

Technical Analysis: Mexican Peso weakens against the US Dollar as the USD/MXN struggles around the 100-day SMA, key resistance level

The USD/MXN edges up and meanders at around the 100-day SMA at 17.38, which, once cleared, could open the door for a move toward the psychological 17.50 figure. If buyers reclaim the latter, the 200-day SMA at 17.55 will be exposed, followed by the 50-day SMA at 17.67.

Conversely, if USD/MXN remains below the 100-day SMA, the downtrend would remain intact, with the first support level seen at the current week’s low of 17.16. Once cleared, the next demand area would be the 17.00/05 range.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The Dollar extends its reversal as US Jobless Claims increase.

- These figures confirm the view that the US labor market is deteriorating.

- EUR/USD remains bearish while below 1.0850.

The Euro bounced up ahead of Thursday’s session opening times with the US Dollar extending its reversal. US Jobless claims have confirmed that the labor market is losing steam.

Claims for unemployment insurance in the US increased to 220,000 in the last week of November, up from 218,000 claims in the previous week.

This confirms the trend suggested by the US Jolts openings and the ADP report earlier this week and backs the narrative of softer economic growth and weaker employment consistent with the theory that the Federal Reserve might start to roll back its tightening cycle in the first quarter of 2024.

From a wider perspective, the picture remains little changed, with the near-term bearish bias intact while below 1.0800 and 1.0860. On the downside, 1.0750 is likely to provide support ahead of 1.0660.

Technical levels to watch

- Initial Jobless Claims in the US increased by 1,000 in the week ending December 2.

- US Dollar Index stays under modest bearish pressure slightly below 104.00.

There were 220,000 initial jobless claims in the week ending December 2, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 219,000 (revised from 218,000) and came in slightly better than the market expectation of 222,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average stood at 220,750, an increase of 500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending November 25 was 1,861,000, a decrease of 64,000 from the previous week's revised level." the publication read.

Market reaction

The US Dollar Index stays in its daily range above slightly below 104.00 after this data.

- The USD keeps trimming losses against a weaker CAD.

- The Bank of Canada kept rates on hold for the fourth consecutive time

- Lower Oil prices are increasing negative pressure on the loonie.

The US Dollar keeps trimming recent losses with the Canadian Dollar weighed by the low oil prices and the decision of the Bank of Canada to keep rates on hold for the fourth consecutive time.

US employment data on focus

Investors are now looking to the US Jobless claims, which are expected to have increased to 222.000 last week from 218,000 in the previous one, confirming that the US labour market is losing strength.

The impact on the US Dollar, however, is expected to be limited, with traders likely to remain on the sidelines, awaiting Friday’s Nonfarm Payrolls report for more info about the Federal Reserve’s monetary policy plans.

In Canada, the BoC reaffirmed its commitment to hike rates further if necessary although it toned down its hawkish message observing that the slowdown in the economy is cooling inflationary pressures. This has been seen as a sign that interest rates may have peaked.

The immediate bias remains positive with bulls likely to meet an important resistance at 1.3620 ahead of 1.3660. Supports are 1.3550 and the mentioned low at 1.3480.

Technical levels to watch

- Hopes that the BoJ will exit its-ultra-loose policy have boosted the Yen.

- BoJ governor Ueda meets the Japanese PM after discussing options for a major policy shift.

- The Euro might see some recovery from heavily oversold levels.

The Euro extended losses on Thursday, with the Japanese Yen boosted by speculation about a BoJ pivot which has pushed the pair to two-month lows ruth below 156.00, with RSI showing oversold levels in most timeframes.

Ueda’s comments fuel hopes of a BoJ pivot

Investors have ramped up bets that the Bank of Japan would be ready to put an end to its negative rate policy after Governor Ueda commented the diverse options available to exit its ultra-loose policy.

Somewhat later the head of the Japanese Central Bank visited Prime Minister Kishida, which boosted hopes that the bank might signal the policy shift at December’s meeting.

In contrast, the dovish remarks from ECB member and Governor of the Bank of France, François Villeroy have heightened hopes that the European Central Bank has reached its terminal rate, adding negative pressure on the Euro.

Technical indicators show the pair under strong bearish pressure although the strongly overbought levels allow for a corrective rebound. Resistances are at 157.00 and 157.75. Supports remain at 155.55 and 154.20.