- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

GBP/USD holds onto the previous day’s upside momentum while picking up bids to 1.2745 amid the early hours of Friday’s Asian session. That said, the Pound Sterling pair marked a stellar move on Thursday while rising the most in more than a week to refresh a fortnight-high before paring some gains by the day’s end while reversing from 1.2781.

It’s worth noting that the market’s cautious mood ahead of the US employment report for June, including the Nonfarm Payrolls (NFP), could be held responsible for the Cable pair’s latest struggles. Adding to that is the latest downbeat print of the options market signal.

A one-month risk reversal (RR) of the GBP/USD price, a gauge of the spread between the call and put options, prints the first negative closing in the last six days while marking the -0.090 figure at the latest, per Reuters options market data.

It’s worth noting, however, that the weekly RR braces for the strongest positive close in a month with the latest prints of 0.125 by the end of Thursday’s North American session.

Also read: GBP/USD Price Analysis: Traders are positioned flat ahead of NFP, breakout eyed

- NZD/USD picks up bids to refresh intraday high, prints the first daily gain in three.

- Convergence of 21-EMA, four-month-old rising trend line puts a floor under Kiwi price.

- Seven-week-old symmetrical triangle limits short-term moves, 200-EMA adds to upside filters.

- Sellers have a bumpy road towards the south unless breaking 0.5985; US NFP eyed.

NZD/USD refreshes intraday high around 0.6165 as it reverses losses made in the last two days amid early Friday in Auckland. In doing so, the Kiwi pair bounces off a short-term key support confluence comprising the 21-Exponential Moving Average (EMA), as well as an upward-sloping support line from early March.

The latest rebound of the Antipodeans can be considered as the positioning for the US employment report for June, including the Nonfarm Payrolls (NFP). That said, the bullish MACD signals also underpin the pair’s recovery.

Also read: NZD/USD slides towards 0.6155 following strong US data

However, a seven-week-old symmetrical triangle, currently between 0.6210 and 0.6065, restricts the NZD/USD pair’s short-term moves.

Even if the quote defies the triangle formation by crossing the 0.6210 hurdle, the 200-EMA level of around 0.6220 will challenge the pair buyers before giving them control.

It’s worth noting that the US jobs report need to support the quote’s upside break of the 200-EMA to convince the NZD/USD bulls.

On the flip side, a daily closing below the 0.6150 support confluence comprising the 21-EMA and the aforementioned multi-day-old rising trend line could drag the quote towards the 0.6100 round figure before directing it to the stated triangle’s bottom line surrounding 0.6065.

Following that, multiple supports near 0.6030, the 0.6000 psychological magnet and the yearly low marked in May around 0.5985 could challenge the NZD/USD bears.

NZD/USD: Daily chart

Trend: Limited recovery expected

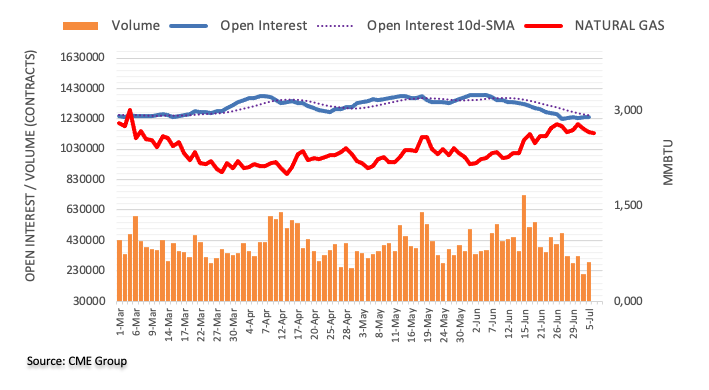

- Gold Price languishes near three-month low, on the way to posting fourth consecutive weekly loss.

- Mostly upbeat United States data, challenges to sentiment underpin US Dollar strength and weigh on XAU/USD.

- Fresh fears from China markets, Sino-American tussles join recession woes to constitute risk-off mood.

- Hawkish Federal Reserve bets also keep Gold bears hopeful as markets braces for US Nonfarm Payrolls.

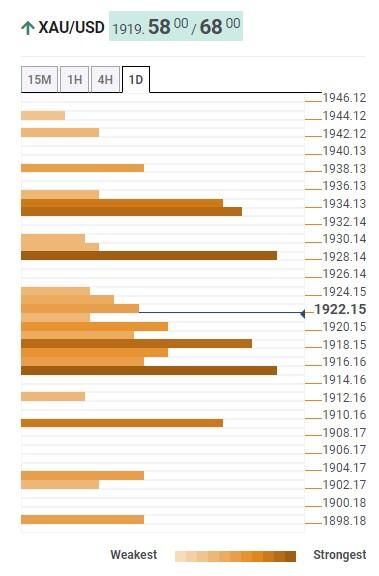

Gold Price (XAU/USD) remains on the bear’s radar despite the latest corrective bounce off the weekly low, licking its wounds near $1,911 amid early Friday morning in Asia. In doing so, the XAU/USD justifies risk aversion, as well as upbeat United States data, to underpin the bullish bias about the Gold Price. Adding strength to the Gold Price downside are the fears surrounding China.

Gold Price eyes further downside amid sour sentiment, hawkish Fed concerns

Gold Price lures sellers as mostly upbeat United States jobs data underpin hawkish Federal Reserve (Fed) bets while China-linked headlines aren’t impressive. Additionally, the US-China tension and positioning before Friday’s US employment report also weigh on the sentiment and the XAU/USD price.

That said, China witnesses a heavy outflow of funds amid fresh fears emanating from the housing giants, including government-backed organizations. Adding strength to the downbeat mood could be the recently softer activity data from Beijing and the US-China trade war, not to forget the cautious mood as US Treasury Secretary Janet Yellen is in the dragon nation.

Elsewhere, US ADP Employment Change marked the largest one-month increase since February 2022, to 497K for June versus 228K expected and 267K prior (revised). That said, the ISM Services PMI also improved to 53.9 for the said month from 50.3 in May, versus the market expectation of 51.0. Further, the Challenges Job Cuts also slumps to 40.709K from 80.089K previous readings. However, the JOLTS Job Openings drops to 9.8M from 10.103M, compared to analysts’ estimation of 9.93M. It should be noted that the Initial Jobless Claims also rises to 248K for the week ended on June 30, versus 245K expected and 236K previous readings (revised).

It should be noted that market players expect the Fed to increase interest rates in its next policy meeting on July 26. The probability of a 25-basis-points rate hike is at 91.8%, according to data from the CME Group FedWatch tool, up slightly from 90.5% a day earlier.

Against this backdrop, Wall Street benchmarks dropped while the US Treasury bond yields refreshed a multi-day high.

Moving on, Gold traders may witness consolidation in prices ahead of the top-tier US employment data for June. Among them, the headline Nonfarm Payrolls (NFP), expected to ease to 225K from 339K, will gain major attention considering the previous day’s upbeat signals from ADP Employment Change. Should the jobs report arrive as positive, the XAU/USD can have a further downside to witness.

Also read: US June Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

Gold Price Technical Analysis

Although one-week-old horizontal support restricts the immediate downside of the Gold Price around the $1,900 round figure, a six-week-old bearish channel and the XAU/USD’s sustained trading below the 200-SMA keep the metal sellers hopeful.

Adding strength to the downside bias are the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator and the downbeat Relative Strength Index (RSI) line, placed at 14.

It’s worth noting, however, that the RSI conditions are weak and hence suggest bottom-picking of the Gold price, which in turn highlights the support line of the stated descending trend channel, around $1,880 by the press time, as the short-term key support.

Following that, the 61.8% Fibonacci Expansion (FE) of the XAU/USD moves from June 02 to July 05, close to $1,879, as well as the 78.6% FE level of near $1,863, can act as extra filters towards the south.

Meanwhile, the Gold Price recovery remains elusive unless it stays below the aforementioned bearish channel’s top line, around $1,938 at the latest.

Even if the XAU/USD manages to defy the bearish chart formation by crossing the $1,938 hurdle, the 200-SMA level of around $1,943 can challenge the Gold buyers before giving them control.

Gold Price: Four-hour chart

Trend: Bearish

- AUD/JPY experiences a plunge due to rising risk aversion; global business indicators hint at a potential slowdown.

- Despite an upward medium-term bias, the pair could extend its pullback towards the Senkou Span A level at 95.19.

- Key resistance levels are at the Tenkan-Sen line at 95.99 and the year-to-date high at 97.67.

AUD/JPY plunges due to risk aversion, as solid data from the United States (US) increased the odds for further tightening by the US Federal Reserve (Fed). That, alongside worldwide business activity indicators showing signs of slowing down, ignited recession risks. The AUD/JPY is trading at 95.44, down 0.83%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY remains upward biased from a medium-term perspective, though the ongoing pullback could extend toward the Senkou Span A at 95.19. If AUD/JPY slides below that level, the cross-currency pair would test the 95.00 psychological level. A breach of the latter will expose the Kijun-Sen line at 94.39, followed by the 94.00 figure.

If AUD/JPY aims toward 95.00 and bounces off that level, the first resistance would be the Tenkan-Sen line at 95.99. If that level is surpassed, the AUD/JPY first resistance would be 97.00. Once broken, the next ceiling level would be the year-to-date (YTD) high at 97.67.

AUD/JPY Price Action – Daily chart

Bank of Japan (BOJ) Deputy Governor Shinichi Uchida crossed wires via Japan’s Nikkei news, reported Reuters, as he ruled out an early end to the ultra-easy monetary policy while also defending the Yield Curve Control (YCC) policy.

BoJ’s Uchida cites current economic conditions while turning down talks of exiting negative rate policy.

“BOJ ‘strongly acknowledges’ the side-effects of YCC such as the impact on market function,” said Uchida per Nikkei reported Reuters.

It should be noted, however, that the policymaker also signaled the need for the bank to react to the signs of change in corporate wage and price-setting behavior.

BoJ’s Uchida was quoted saying that the risk of missing the opportunity to achieve our 2% target with a premature policy shift is bigger than that of being too late in tightening policy and allowing inflation to continue running above 2%.

USD/JPY implications

While the BoJ official tried to defend the Japanese central bank’s easy-money policy, the recent US data backs the odds of witnessing higher rates from the Federal Reserve (Fed). That said, market players expect the Fed to increase interest rates in its next policy meeting on July 26. The probability of a 25-basis-points rate hike is at 91.8%, according to data from the CME Group FedWatch tool, up slightly from 90.5% a day earlier.

Also read: USD/JPY Price Analysis: Pullback from YTD highs, intervention threats weight on the USD

- AUD/USD licks its wounds at weekly low, after two-day losing streak.

- US Dollar trades mixed but rose versus Antipodeans amid China-inspired risk aversion, mostly upbeat US data and hawkish Fed bets.

- Strong Australia trade numbers failed to impress bulls for long, despite upbeat start.

- Absence of major data at home may allow AUD/USD to pare recent losses ahead of key US employment report.

AUD/USD struggles to defend the corrective bounce off the weekly low around 0.6625 amid the early hours of Friday morning in Asia. That said, the Aussie pair dropped in the last two consecutive days while refreshing the weekly low on Thursday. In doing so, the risk-barometer pair aptly justifies the market’s sour sentiment while also taking clues from upbeat US data and hawkish Fed bets as the top-tier US jobs report looms.

The market’s risk aversion escalates as mostly upbeat US jobs data underpin hawkish Fed bets while China-linked headlines aren’t impressive. Additionally, the US-China tension and this week’s Reserve Bank of Australia (RBA) meeting are extra burdens on the AUD/USD, which in turn stopped the quote from cheering upbeat Aussie data at home.

While portraying the mood, Wall Street benchmarks dropped while the US Treasury bond yields refreshed a multi-day high.

It’s worth noting that China witnesses a heavy outflow of funds amid fresh fears emanating from the housing giants, including government-backed organizations. Adding strength to the downbeat mood could be the recently softer activity data from Beijing and the US-China trade war, not to forget the cautious mood as US Treasury Secretary Janet Yellen is in the dragon nation.

On the other hand, the RBA paused its two-time rate hike trajectory but showed readiness for further rate increases. On Thursday, Australia’s trade surplus rises to 11,791M MoM for May, compared with the expectations of 10,500M and 11,158M prior. Further, Exports grow 4.0% on a monthly basis while reversing the previous contraction of 5.0%. On the same line, imports rises 2% MoM and seasonally adjusted vs. 2.0% booked in April.

Elsewhere, US ADP Employment Change marked the largest one-month increase since February 2022, to 497K for June versus 228K expected and 267K prior (revised). That said, the ISM Services PMI also improved to 53.9 for the said month from 50.3 in May, versus the market expectation of 51.0. Further, the Challenges Job Cuts also slumps to 40.709K from 80.089K previous readings. However, the JOLTS Job Openings drops to 9.8M from 10.103M, compared to analysts’ estimation of 9.93M. It should be noted that the Initial Jobless Claims also rises to 248K for the week ended on June 30, versus 245K expected and 236K previous readings (revised).

Moving on, markets are likely to witness consolidation and can allow the AUD/USD pair to extend the latest rebound from the weekly low ahead of the top-tier US employment data for June. Among them, the headline Nonfarm Payrolls (NFP), expected to ease to 225K from 339K, will gain major attention considering the previous day’s upbeat signals from ADP Employment Change. Should the jobs report arrive as positive, the AUD/USD can have a further downside to witness.

Technical analysis

A daily closing below a five-week-old rising support line, now immediate resistance near 0.6635, keeps AUD/USD bears hopeful. However, the previous weekly bottom prods intraday sellers around 0.6595.

- USD/JPY trades lower, retreating from its year-to-date (YTD) high amid signals of potential intervention by Japanese authorities.

- Despite the upward bias, USD/JPY may extend its losses below the 144.00 mark, potentially reaching the 20-day Exponential Moving Average (EMA) at 142.95.

- Resistance levels lie at the YTD high of 145.07 and the May 10 high of 146.59.

USD/JPY retreats from the year-to-date (YTD) high of 145.07, extending its losses below the 144.10 area, as the US Dollar (USD) weakens despite US Treasury bond yields, particularly the 10-year benchmark note rate edged above the 4.00% threshold. At the time of writing, the USD/JPY exchanges hand at 144.06, down 0.40%.

USD/JPY Price Analysis: Technical outlook

USD/JPY price action suggests the pair is headed for a deeper pullback after Japanese authorities threatened to intervene in the Forex market. The USD/JPY remains upward biased, but the pullback could extend past the 144.00 mark toward the 20-day Exponential Moving Average (EMA) at 142.95.

Of note, the USD/JPY achieved a daily close below the July 3 daily open of 144.08. That could exacerbate a drop below 144.00, exposing the 143.50 psychological level, followed by the 20-day EMA at 142.95. Downside risks will emerge at the June 21 daily high of 142.37, followed by the 142.00 mark.

On the upside, immediate resistance lies at the year-to-date (YTD) high of 145.07, followed by the May 10 high at 146.59.

USD/JPY Price Action – Daily chart

- EUR/USD bulls are building positons ahead of key NFP.

- A blow off to the downside could be in order sooner than later.

EUR/USD has been carving out the upside on Thursday and this could be teeing up a set-up for Friday as volumes start to get trapped up high within the week's range. More on that below. Meanwhile, the US Dollar eased after a brief rebound on Thursday as data showed the US labour market remains strong. This comes ahead of Friday's Nonfarm Payrolls data on Friday.

Forex is being driven by the sentiment in the futures markets that have raised the probability of the Fed hiking interest rates by 25 basis points to 92.4% when policymakers conclude a two-day meeting on July 26, the CME Group's FedWatch Tool showed on Thursday.

Meanwhile, going to the charts, we can see that the bulls are in the market:

EUR/USD H4 chart

We have seen the price rally from an area that could turn out to be weak lows. We have started to build up a long market from here and that leaves the length vulnerable to a squeeze for the days ahead.

EUR/USD H1 charts

However, zooming in on the hourly chart, should 1.0900 territories hold up, after a move into trendline liquidity, then we could be facing a break to the downside for the day ahead based on the weekly template.

The first three days of the week that reset as a new three-day cycle on Wednesday saw a blow-off from below-trapped volumes up high and we could be seeing the same phenomenon play out for Friday as illustrated above. A drop below the higher volumes and trendline support will target low-hanging fruit, LHF, below.

- USD/CAD rose more than 0.60% on Thursday towards the 1.3370 level.

- ADP and ISM Service data from the US fueled a rising in US bond yields.

- Eyes on Canadian and American employment data on Friday.

The USD/CAD gained momentum in Thursday’s session and jumped to its highest since mid-June to 1.3370. On the other hand, the DXY index still trades in the red but cleared some daily losses, trading at the 103.10 area.

According to the Employment Change report from Automatic Data Processing, Inc., the US economy added 497K new jobs in June, surpassing expectations of 228K and showing an increase from the previous month's figure of 278K and fueling hawkish bets in the Federal Reserve (Fed).

It's worth mentioning that at the European Central Bank (ECB) forum in late June, Chair Powell from the Fed warned that a tight labour market could justify additional hikes, so ADP figures support a more aggressive stance from the Fed. That being said, Nonfarm Payrolls (NFPs) figures, expected to increase by 225K (previous 339K), will be the highlight of Friday’s session, providing additional information to markets regarding the US labour market.

Canada will also release labour market data. The Net Employment change is expected to come in at 20k from its previous figure of -17.3K, while Average Hourly Earnings to expand by 0.3% MoM and the Unemployment rate to rise to 5.3% from its prior 5.2%.

USD/CAD Levels to watch

The daily chart suggests that the USD/CAD’s outlook has turned neutral to bullish for the short term. In that sense, technical indicators are gaining ground, with the Relative Strength Index pointing north and jumping to positive territory and the Moving Average Convergence Divergence (MACD) printing green bars. However, the pair still has some work to do as it trades below the 100- and 200-day Simple Moving Averages (SMAs).

Resistance Levels to watch: 1.3380, 1.3390, 1.3340.

Support Levels to watch: 1.3280, 1.3250 (20-day SMA), 1.3220.

USD/CAD Daily chart

-638242760754990947.png)

- The EUR/GBP pair shows signs of stabilization in the 0.8540s region after falling to a weekly low.

- Technical patterns suggest a possible double-bottom formation, hinting at a potential upside if confirmed by further price action.

- A break below year-to-date lows could push the EUR/GBP toward the 0.8500 mark, whereas surpassing 0.8555 could open doors for a rally to the 20-day EMA at 0.8584.

In a volatile trading session, EUR/GBP hovers around the 0.8540s area, which witnessed the cross pair falling to a weekly low of 0.8521 but later recovering toward 0.8560 before settling around current exchange rates. As of writing, the EUR/GBP exchanges hands at 0.8548, gains 0.06%.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP is neutral to downward bias, with the exchange rate below the daily Exponential Moving Averages (EMAs). After the EUR/GBP dropped below the 20-day Exponential Moving Average (EMA), it exacerbated a fall to test the year-to-date (YTD) low of 0.8520, but later, the EUR/GBP stabilized at around 0.8540s.

Of note, the EUR/GBP’s daily chart portrays a double bottom formation, but it would need a daily close above the July 5 open of 0.8555 to pave the way for further upside. Additionally, the price action of the last two days would form a bullish engulfing candle pattern.

In that outcome, the EUR/GBP first resistance would be the 20-day EMA at 0.8584. A breach of the latter will expose the 0.8600 figure, followed by the 50-day EMA at 0.8634, before testing the June 28 daily high of 0.8658.

Conversely, the EUR/GBP would extend its losses if it cracks to new year-to-date (YTD) lows, past the current 0.8518, exposing the 0.8500 figure for a test.

EUR/GBP Price Action – Daily chart

After some upbeat US economic reports on Thursday, Friday marks the release of the highly anticipated Nonfarm Payrolls report. During the Asian session, Japan is set to release data, including Household Spending, Bank Lending, and the Leading Index. Later in the day, Germany will release Industrial Production data. Canada will also report labor market data.

Here is what you need to know on Friday, July 7:

The US Dollar posted mixed results, weakening versus the Euro, the Pound, and the Yen, and rising sharply against commodity currencies. Upbeat US data boosted expectations of another interest rate hike from the Federal Reserve (Fed) and weighed on US stocks. The deterioration in market sentiment and lower commodity prices drove the AUD, CAD, and NZD to the downside.

The Dow Jones lost 1.07%, and the Nasdaq tumbled 0.82% on Friday. The decline was accelerated by upbeat US data, as market participants anticipate more monetary tightening ahead. Meanwhile, US Treasury Secretary Yellen is currently in China, and there is a new social platform called Threads by Meta.

The Automatic Data Processing (ADP) report showed an increase in private payrolls of 497K, surpassing the market consensus of 228K. Initial Jobless Claims rose to 248K, while Continuing Claims fell to 1.72 million, the lowest level since February. The ISM Services PMI rose from 50.3 to 53.9 in June, and the Employment Index improved to 54.4. On the negative front, JOLTS Job Openings dropped slightly below expectations in May, falling from 10.3 million to 9.8 million.

Analysts at Wells Fargo:

The service sector continues to benefit from robust demand; that is pushing many businesses to staff up in a way that has been lacking in recent months. Factoring in the jump in the employment component, we have lifted our June payrolls forecast to 260K from 245K.

Following the data, government bond yields rose in both Europe and the US. The 10-year Treasury bond yield climbed to 4.06%, matching the year-to-date high, while the 2-year yield hit the highest intraday level since 2007 at 5.11%.

On Friday, the US official employment report is due. Market consensus expects the economy to have created 225K jobs in June; however, after the release of recent data, market participants are looking at the possibility of a positive surprise. The unemployment rate is expected to tick lower from 3.7% to 3.6%. Market participants will also be looking at income data. If the numbers confirm that the labor market remains tight, it could cement the likelihood of another interest rate hike from the Fed. However, equally important will be next week's US inflation data.

Data released on Thursday showed that German Factory Orders rebounded more than expected by 6.4%, while Eurozone (EZ) retail sales dropped by 2.3% in May. German data is due on Friday with the release of May Industrial Production figures. European Central Bank's De Guindos is scheduled to speak during the European session. The EUR/USD pair tested the 1.0830 region twice and rebounded towards 1.0900. The Euro benefited from higher EZ yields.

The GBP/USD pair posted its highest daily close in a week near 1.2750, despite negative US data and risk aversion. However, the EUR/GBP pair rebounded from weekly lows to 0.8550.

The Yen held up well and outperformed on Thursday, despite rising government bond yields. The currency was supported by the decline in equity markets. USD/JPY dropped but finished far from the lows, consolidating slightly above 144.00. It was the worst day for the pair in a month. Japan is set to release Household Spending, Bank Lending, and the Leading Economic Index on Friday.

The AUD/USD pair dropped for the second day in a row but found support at the 0.6600 area. The NZD/USD pair pulled back from weekly highs and was rejected again from above 0.6200.

The Loonie lagged on Thursday, with USD/CAD rising for the second day in a row and accumulating a 150-pip gain as it approached 1.3400. Canadian trade data surprised with the largest swing on record, from a CAD 0.89 billion surplus in April to a deficit of 4.3 billion in May, against expectations of a 1.5 billion surplus. The Canadian Employment Report is due on Friday. A positive net change in employment of 20K in June is expected, and the unemployment rate is expected to rise slightly from 5.2% to 5.3%.

Analysts at TD Securities:

We look for the labour market to bounce back with 25k jobs added in June after the 17k decline the prior month. Services should drive hiring, while a pullback in manufacturing employment weighs on the goods sector. Our forecast would leave the unemployment rate stable at 5.2%, although wages are set to decelerate sharply as base effects offset another large (0.4%) m/m increase.

The USD/MXN surged on Thursday, having its best day in months. It climbed from the lowest level in years under 17.00 to 17.38.

Metals dropped on the back of higher yields. Gold lost $10 but held above $1,900, while Silver lost 1.75%, falling to as low as $22.50, erasing weekly gains. Cryptocurrencies weakened after the release of negative US data. Bitcoin fell 0.65% to $30,260, and Ethereum dropped to $1,880.

Like this article? Help us with some feedback by answering this survey:

- EUR/JPY tallies a third consecutive day of losses as the pair continues to correct overbought conditions.

- Retail Sales from the EZ remained unchanged in May.

- Rising German and American yields to limit the JPY’s advance.

On Thursday, the EUR/JPY trades with losses and fell to it lowest point in seven days of 155.84 and then stabilised at 156.90, still holding daily losses. In that sense, the Euro lost traction after weak Retail Sales data, but rising German yields limit the European currency downside potential. In addition, hot labour market from the US fueled a rise in American yields and provide further challenges for the Yen to advance.

Retail Sales from the Eurozone remained unchanged in May while the markets expected a 0.2% increase, and the yearly measure now shows a 2.9% contraction. However, the 2,5 and 10-year German yields are advancing today, showing more than 1.5% increases and providing further support to the Euro. In addition, Factory Orders from Germany came in strong as they increased 6.4% in May vs the 1.5% expected by the markets and may also limit the Euro’s losses in the session.

Across the pond, the US reported hot labour market data. The Employment Change released by Automatic Data Processing, Inc showed that generally speaking, the US economy added 497K newly employed people in June, exceeding by far the expectations of 228K and accelerating from its previous figure of 278K. As a reaction, the 2-year American bond yield rose to its highest level since 2007 to 5.08% as these figures support a more aggressive Federal Reserve and provide another challenge for the Yen. Focus now shifts to Friday’s Nonfarm Payrolls (NFP) , expected to drop 225K from the previous 339K.

EUR/JPY Levels to watch

As expected, the EUR/JPY seems to have entered in a period of consolidation after more than two weeks showing overbought conditions. In that sense, the Relative Strength Index (RSI) points south and retreated from the overbought threshold while the Moving Average Convergence Divergence (MACD) printed a red bar suggesting that bears are gaining strength. However, looking at the bigger picture, the cross still holds a positive outlook as it trades above its main Simple Moving Averages of 20,100 and 200 days.

Support Levels: 155.85, 155.25 (20-day SMA), 154.00.

Resistance Levels: 157.00, 157.50,158.00.

-638242718440664572.png)

- USD/CHF bears need to get below trendline support on the daily chart.

- USD/CHF's dynamic resistance is holding, so far.

Despite the slowing price growth in the Swiss economy that has limited the possibility of further rate hikes by the Swiss National Bank, USD/CHF is offered on the day and has fallen from a high of 0.8997 to a low of 0.8950. Markets are jittery ahead of Friday's Nonfarm Payrolls event and we have seen swings from top to bottom in the US Dollar on Thursday. This leaves a clouded technical outlook for the pair as the following will illustrate:

USD/CHF monthly chart

From a longer-term viewpoint, USD/CHF is wedged between support and resistance leaning with a downside bias.

USD/CHF weekly charts

There is a case of both bullish and bearish on the weekly chart as illustrated above.

USD/CHF daily chart

The daily chart's outlook is mildly bearish as the correction is long in the tooth which indicates the bears are reluctant but at least holding the price below dynamic resistance. A break of trendline support opens the risk of a downside continuation.

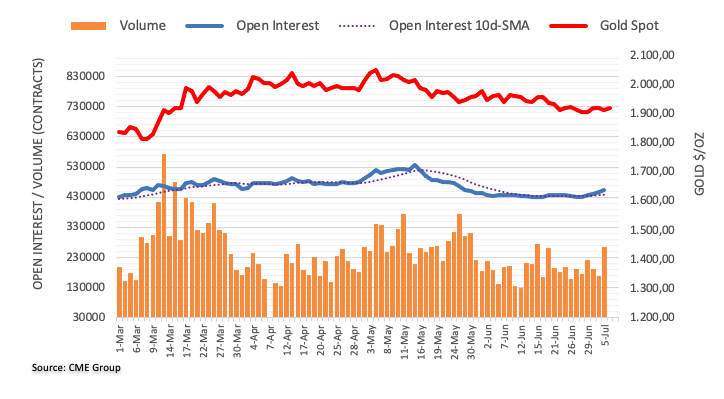

- Gold suffers a 0.20% loss as robust US job figures and mounting rate hike prospects drive US Treasury yields higher.

- Hawkish comments from Dallas Fed President Lorie Logan and a strong ADP report underpin expectations of a July rate hike.

- Traders anticipate further clues from the upcoming US Nonfarm Payrolls report, which could impact Gold’s trajectory.

Gold price slides for two consecutive days after a busy economic calendar in the United States (US) emphasized the resilience of the economy, which justifies the Federal Reserve (Fed) 25 bps rate hike at the upcoming July meeting. On Thursday, the XAU/USD, after reaching a daily high of $1927.55, prints losses of 0.20% and exchanges hands at $1910.70.

Gold continues downward slide: US economic resilience and imminent Fed tightening dampen bullish appeal

The yellow metal is under pressure as the latest US ADP National Employment report surprised market participants, as private hiring witnessed the creation of 497,000 jobs in the US economy, surpassing the 228,000 foreseen by analysts. The report came before the US Department of Labor announced that unemployment claims (Initial Jobless Claims) for the week ending July 1 climbed to 248K, exceeding 245K estimates, but the ADP report overshadowed the data.

After the data, XAU/USD’s dropped from around $1928 to $1902, as US Treasury bond yields skyrocketed. The US 10-year Treasury note rises 4.045%, gaining 10 basis points. The US real yields soared to a new yearly high of 1.821%, though, as of writing, it sits at 1.781%, a headwind for the non-yielding metal.

Gold traders will get more clues about the yellow metal’s direction on Friday, as the US Bureau of Labor Statistics (BLS) will reveal the US Nonfarm Payrolls report. Analysts estimate the US economy addd 225K jobs to the economy, and the Unemployment rate is estimated to dip to 3.6%,

The Federal Reserve (Fed) meeting minutes showed that most officials wanted to raise rates but agreed to wait as they assessed the impact of cumulative tightening. Additionally, “almost all” FOMC members agreed that further tightening will be needed this year, suggesting July’s rate hike is almost inevitable.

Regarding that theme, the Dallas Fed President Lorie Logan at a Columbia University event in New York, stated she favored June’s hike, adding “two-thirds of FOMC participants projected at least two more rate increases this year.”

XAU/USD Price Analysis: Technical outlook

The XAU/USD daily chart depicts Gold as neutral to downward biased, with the 20, 50, and 100-day Exponential Moving Average (EMAs) remaining above the current spot price. For a bearish resumption, XAU/USD must drop below the 200-day EMA at $1896.93, and once done, the XAU/USD next support would be the March 6 daily high at $1879.45, followed by the March 8 swing low at $1809.48.

If XAU/USD remains above $1900, the first resistance would be the 20-day EMA at $1928.88. Once cleared, the next supply zone would be the 50-day EMA at $1945.75.

- After jumping to a high of 0.6218, the NZD/USD retreated to 0.6155 as bulls struggle to gain momentum.

- ADP and ISM Services PMI came in above expectations.

- Hawkish bets on the Federal Reserve made the 2-year yield jump to their highest level since 2007.

The NZD/USD pared daily gains and fell towards the 0.6155 area as expectations of further tightening by the Federal Reserve (Fed) underpined the USD. In that sense, the hot ADP figures and strong Service sector data from the US favored a more aggressive stance by the Fed.

The latest Employment Change report from Automatic Data Processing, Inc. revealed that the US economy added 497K new jobs in June, surpassing expectations of 228K and showing an increase from the previous month's figure of 278K. In addition, the Institute Supply Management (ISM) reported that its Service PMI came in at 53.9 vs the 51 expected and accelerated from its previous figure of 50.3.

The release of the data caused a significant surge in US Treasury yields. The 2-year bond yield reached its highest level since 2007, rising to 5.08%. Likewise, the 5-year and 10-year rates increased to 4.40% and 4.03%, respectively, showing gains of over 2.50%. This spike in yields contributed to a recovery of the US Dollar, as reflected in the DXY Index. After hitting a daily low of 102.87, which aligned with its 20-day Simple Moving Average (SMA), the index rebounded to 103.25, although it remains in negative territory.

On Friday, investors will eye the release of the Nonfarm Payrolls (NFP) report for June in the US anticipated to show a decline to 225K from the previous figure of 339K.

On New Zealand’s side, the gloomy economic outlook means the Kiwi is losing interest. United Overseas Bank (UOB) said the economy has entered a technical recession as the Gross Domestic Product (GDP) contracted by 0.1% QoQ in the first quarter of 2023, significantly lower than the Reserve Bank of New Zealand (RBNZ) expectations. Its worth noting that in Q4 of 2022, a 0.7% contraction was recorded, so consecutive GDP contractions is considered an indication of a technical recession.

NZD/USD Levels to watch

The technical outlook for the NZD/USD, according to the daily price chart, is neutral with a slightly bearish tone, with technical indicators somewhat flat in negative territory. The 20, 100 and 200-day SMA converge towards the 0.6200 area still suggesting that the pair is waiting for a fundamental catalyst to define the short-term trajectory.

Support Levels to watch: 0.61350, 0.6100,0.6090.

Resistance Levels to watch: 0.6160 (20-day SMA), 0.6170 (200-day SMA), 0.6190 (100-day SMA).

NZD/USD Daily chart

-638242684795574835.png)

- GBP/USD bulls are riding dynamic trendline support.

- The market is now trading at the middle of the range ahead of NFP on Friday.

GBP/USD has shown signs of a classic pre-Nonfarm Payroills clear out as the pair sweeps liquidity on both sides of the bulk of this week's range. GBP/USD rallied in Asia from the lows and reached as high as 1.2781 before collapsing to the day's lows in late US morning trade of 1.2673, taking out Tuesday's inside day's lows.

GBP/USD H4 chart

GBP/USD is pretty much at the equilibrium of the range for this week ahead of Nonfarm Payrolls while riding the trendline support and leaning against the prior bearish trendline that is now acting as counter-trendline support.

The low for the week is at 1.2658 and is a keen area of interest as this guards space to a test below 1.2600 as a target area on the downside. On the upside, a break of 1.2781 opens the risk of a run to test the 1.2850s upside target area.

- Silver slides 1.82% as soaring US Treasury bond yields and heightened odds of a Fed rate hike in July weigh heavy.

- Silver’s drop below the 200-day EMA may trigger further losses unless the $22.53 swing low offers a reprieve.

- A possible rebound could see Silver testing the $23.00 mark and, if breached, a recovery to the 20-day EMA at $23.06.

Silver price dropped below the $23.00 mark as US Treasury bond yield soared after the latest Fed’s minutes and a tranche of US economic data increased the odds for Fed’s July rate hike. At the time of writing, the XAG/USD is trading at $22.69, down 1.82%.

XAG/USD Price Analysis: Technical outlook

XAG/USD turned bearish during Thursday’s session. Silver’s price dropping below the 200-day Exponential Moving Average (EMA) at $22.93 opened the door for further losses, though so far failed to crack the May 26 swing low of $22.53.

If XAG/USD stays above the latter, the white metal could consolidate at around the $22.50-$22.90 range. Otherwise, Silver’s sliding below the bottom of the range will expose the June 22 swing low of $22.11 before testing $22.00. Once cleared, the XAG/USD next support will be the March 16 swing low of $21.47.

Conversely, if XAG/USD stages a comeback and reclaims the 200-day EMA, the XAG/USD’s next resistance will be the $23.00 psychological level. A breach of the latter will increase the odds for a recovery to the 20-day EMA at $23.06.

XAG/USD Price Action – Daily chart

- GBP/JPY fell towards the 182.50 level and then stabilised above 183.00.

- Rising British and American yields limit the Yen’s advance.

- Eyes on Labor Cash Earnings data from Japan and NFP data from the US.

On Thursday, the GBP/JPY trades with losses after three consecutive gains as the cross retreats from overbought conditions. After falling towards 182.50, the pair jumped back towards 183.30, but further downside shouldn’t be ruled out.

That being said, the rising British due to UK Debt Management Office selling bond yielding 5.668% will limit the GBP’s losses. The 2-year gilt stands rose to 5.55%, its highest level since 2007, while the 5 and 10-year yields stand at 4.95% and 4.70%, respectively, more than 3% increases.

Moreover, ADP’s hot employment figures from the US fueled an increase of US Treasury yields which also limited the JPY advance.

On Friday, at the early Asian session, investors will eye Labor Cash Earnings data from Japan from May, expected to decelerate to 0.7% YoY from the previous 1%. In addition, the focus will be Non-Farm Payrolls (NFP) from June from the US, which are expected to slip to 225K from the previous 339K. In that sense, the outcome of the NFP figures may fuel volatility in the US bond market and hence affect the JPY and GBP’s price dynamics.

GBP/JPY Levels to watch

According to the daily chart, the cross is still poised for further downside. Technical indicators, specifically the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), show weakness, indicating that the bears are starting to take the lead.

On the downside, support levels for the cross line up at the daily low of 182.50, followed by the 182.00 zone and the 181.50 area. On the flip side, resistances to monitor line up at 183.50 and the cycle high at 184.00.

-638242594328593546.png)

May's trade data from Canada may surprise with a large unexpected trade deficit and weigh on the Loonie. Analysts at CIBC point out that the numbers suggest that net trade won't be a big positive contributor to Q2 GDP, as had seemed likely prior to the release.

Key quotes:

“The $3.44bn deficit was the largest since October 2020 and followed a downwardly revised $0.9bn surplus in the prior month.”

“The large swing relative to the prior month reflected both a decline in exports (-3.8%) and a rise in imports (+3.0%).”

“Today's large swing in the trade balance suggests that net trade won’t be the big positive contributor to GDP in Q2 that seemed likely prior to today's release. That doesn't necessarily guarantee that the flash estimate of 0.4% growth for monthly GDP in May is an overestimation, because inventory accumulation could be stronger than previously assumed, although today's data does heighten downside risks.”

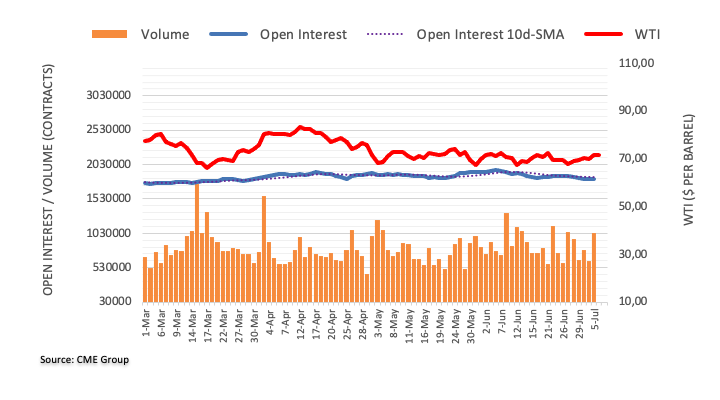

- WTI drops more than 1% as a stronger US Dollar and Fed tightening speculations weigh on dollar-denominated commodities.

- Mixed signals from US labor market data and improved business activity intensify prospects of a June rate hike.

- Recession fears sparked by business activity measures in China and Europe threaten to dampen oil demand.

Western Texas Intermediate (WTI) slumps more than 1%, as speculations for further tightening by the US Federal Reserve (Fed) underpins the greenback, a headwind for dollar-denominated assets. At the time of writing, WTI is trading at $70.94 after hitting a daily high of $72.30.

WTI pressured: Fed speculations and global economic jitters dent oil’s upward trajectory

US data revealed on Thursday gave mixed signals about the labor market. US unemployment claims rose above estimates, while a drop in job vacancies, as revealed by the JOLTs report, flashed the labor market is cooling. Nonetheless, the ADP National Employment Report for June crushing estimates could refrain the Fed from pausing for a second straight meeting.

In the meantime, a measure of business activity in the US in the services sector improved. That keeps traders braced for a 25 bps rate hike in June, as the CME FedWatch Tool shows odds remaining above 90%.

Additionally, the latest Fed minutes showed that policymakers agreed to pause the ongoing tightening cycle, despite most officials wanting to raise rates in June.

Meanwhile, global measures of business activity in China and Europe sparked recessionary fears, which could dent oil demand.

The US Energy Information Administration (EIA) revealed that US crude stockpiles fell more than estimates last week. Inventories dropped by 1.5 million barrels in the last week, above forecasts of 1 million.

OPEC ministers and oil company executives told a two-day Vienna conference that governments needed to turn their attention from supply to demand.

WTI Technical Levels

- The AUD/USD retreated near the 0.6615 area posting more than 0.50% losses.

- The US added nearly 500K jobs in June, and the ISM Services PMI rose to 53.9.

- Rising US yields give the US traction.

At the time of writing the AUD/USD stands at the 0.6615 area, posting a 0.59% loss on the day. In that sense, the DXY index cleared losses as hawkish bets on the Federal Reserve (Fed) strengthened the USD via rising US yields.

The Employment Change released by Automatic Data Processing, Inc showed that generally speaking, the US economy added 497K newly employed people in June, exceeding by far the expectations of 228K and accelerating from its previous figure of 278K. On the other hand, Initial Jobless Claims for the week ending in June 30, increased as expected but came in slightly higher than the consensus at 248K vs the 245K expected. Other data showed that ISM Services PMI came in at 53.9 vs the 51 expected from its previous figure of 50.3.

As a reaction, US Treasury yields soared across the board following the data. The 2-year bond yield led the way, jumping to its highest level since 2007 at 5.08%. The 5 and 10-year rates also increased to 4.40% and 4.03%, respectively, showing more than 2.50% increases. Focus will now shift to Friday’s Non-Farm Payrolls (NFP), expected to drop 225K from the previous 339K. In that sense, the outcome could provide further volatility in the bond market and the AUD/USD price dynamics.

It's worth mentioning that FOMC (Federal Open Market Committee) minutes revealed that some members considered appropriate hiking as a tight labor market would contribute to high inflation. That being said, a 25 basis point (bps) hike in July is priced in, while the odds of an additional hike stand around 40%.

AUD/USD Levels to watch

According to the daily chart, the AUD/USD appears to be bearish in the short term. The Relative Strength Index (RSI) points south, and Moving Average Convergence Divergence (MACD) stands deep in negative territory, indicating that the bears are in command. In addition, traders should eye the 0.6700 area where the 20, 100 and 200-day Simple Moving Averages seem to be converging.

In case of more downside, support levels are seen at 0.6600, 0.6585 and 0.6550. On the flip side, the mentioned 0.6700 stands as the main resistance to recover for the bull with next targets at 0.6730 and 0.6750.

AUD/USD Daily chart

-638242564288525373.png)

- USD/MXN rebounds off year-to-date lows, climbing towards 17.20, fueled by positive US economic data.

- Private hiring data and upbeat consumer sentiment in the US signal economic resilience, hinting at a potential Fed rate hike.

- Comments from Dallas Fed President Lorie Logan further support the USD/MXN rally, as she voices favor for a June rate hike.

USD/MXN rebounds off year-to-date (YTD) lows reached beneath the 17.00 figure, rises steadily past the 17.10 mark on solid data from the United States (US), showing the economy’s resilience despite 500 bps of tightening and expectations for more aggressive monetary policy. Hence, the USD/MXN moved upwards from a YTD low of 16.9761 to the 17.20 region at the time of writing.

US economy demonstrates tenacity: A catalyst for USD/MXN’s leap from yearly lows

A busy US economic calendar on Thursday began with the ADP National Employment report from June, which shows that private hiring skyrocketed to 497K, above estimates of 228K. The latest consumer sentiment poll showed that Americans were upbeat about the labor market in the last month, relative to May. Further data showed that Initial Jobless Claims exceeded 245K estimates and rose by 248K in the week ending July 1. Although it showed signs of easing, private hiring revealed by ADP could be a prelude to Friday’s US Nonfarm Payrolls, reported to be announced on July 7.

JOLTs data revealed that job vacancies dropped in May though they remained high, with figures rising by 9.824M, falling almost 500K, and missing the 9.935M estimated.

Aside from labor market data, the US ISM Non-Manufacturing PMI for June came above estimates of 51 and climbed to 53.9. Digging deep into the report, a measure of prices paid showed signs of deflation.

After the data, money market futures showed odds for a 25 bps hike by the Federal Reserve (Fed) increased to 95%, while for the November meeting increased to 38%. Consequently, US Treasury bond yields advanced above 4% for the first time since March 2023.

The USD/MXN resumed its uptrend on higher US Treasury bond yields. Also, comments from the Dallas Fed President Lorie Logan that she favored a rate hike in June were a catalyst for USD/MXN to lift the exchange rate from 17.12 toward the 17.20s area.

USD/MXN Price Analysis: Technical outlook

The USD/MXN remains downward biased but jumped above the 20-day Exponential Moving Average (EMA) at 17.1802. If USD/MXN achieves a daily close above the latter, the USD/MXN can rally toward the May 17 daily low of 17.4039, a crucial resistance level that, once cracked, can pave the way to challenge the 50-day EMA at 17.4460 before challenging 17.5000. Conversely, if USD/MXN drops beneat 17.1802, the pair could test the 17.00 mark.

Canada’s employment data for June will be reported by Statistics Canada on Friday, July 7 at 12:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers at five major banks regarding the upcoming jobs figures.

The North American economy is expected to have added 20K jobs vs. -17.3K in May, with the Unemployment Rate expected to rise a tick to 5.3%. Meanwhile, the Participation Rate is expected to have remained stable at 65.5%.

TDS

We look for employment to rise by 25K, leaving the UE rate stable at 5.2%. Services should drive hiring, while wage growth is expected to fall 0.6pp to 4.5% YoY.

RBC Economics

We still look for a 20K increase in employment in June. But with population growth also surging, this won’t be enough to prevent another uptick in the unemployment rate to 5.3%.

NBF

After a slight hiccup the prior month, we expect job creation to have resumed in June. But an expected gain of 20K may not be enough to prevent a further rise in the unemployment rate in a context where the labour force is growing at a strong pace. Indeed, we expect the jobless rate to increase from 5.2% to 5.3%, assuming that the participation rate rises by a tenth to 65.6%.

CIBC

We expect a modest rebound of 20K in June which, with a slight recovery in participation as well, would keep the unemployment rate steady at 5.2%. Wage growth could have edged down slightly, but will have remained firm at around 5% YoY. Hours worked have been starting to lag the trend in employment again recently, partly because excess hours lost due to illness have been climbing again, and that trend could have continued into June. While a rebound in June may be enough to prevent the unemployment rate from rising further, the underlying trend within the labour market still appears to be weakening. We continue to expect that job growth for the remainder of the year will fall short of the rapid increase in population, seeing the jobless rate climb to around 6% by yearend.

Citi

We expect a modest 15K bounce-back in employment in the Labor Force Survey in June, the last key release ahead of the BoC July rate decision in a few weeks. May employment data was likely in part impacted by some technical and seasonal adjustment issues, as the decline was entirely in self-employment and corresponded with a similar decline in self-employed workers in the household employment survey in the US as well. This suggests the possibility of some common issue that could be impacting the two similar datasets in both countries in May that is unlikely to repeat.

The Canadian Dollar was the second best performing G10 currency in June. Economists at MUFG Bank analyze USD/CAD outlook.

US recessionary conditions tend to result in CAD weakness

We believe CAD performance reflects the ongoing resilience of equity markets but suspect that we could soon see a correction to the downside which will increasingly weigh on CAD. History of CAD movement also indicates US recessionary conditions tend to result in CAD weakness.

The strong inter-linkage for the Canadian economy means expectations of weaker growth in Canada will intensify, helping drag CAD lower.

Given the scale of drop in USD/CAD of late, we have altered our USD/CAD forecast profile to show a clearer path higher given our view of the limits of CAD strength from current levels.

USD/CAD – Q3 2023 1.31 Q4 2023 1.32 Q1 2024 1.34 Q2 2024 1.35

The US Bureau of Labor Statistics (BLS) will release the June jobs report on Friday, July 7 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 12 major banks regarding the upcoming employment data.

Nonfarm Payrolls are expected to add 225K jobs in June vs. 339K in May with the Unemployment Rate expected to fall a tick to 3.6%. Average Hourly Earnings are also seen a tick lower to 4.2% year-on-year.

Commerzbank

The labor market is probably neither as strong as the job gain suggests, nor is it just collapsing as other indicators signal. Accordingly, we forecast a job gain of 240K in the June report, which would be less than in May, but still well above the 100K expected on trend based on population trends. Moreover, measured against the consensus forecast of 213K, it would be the 15th consecutive month in which consensus expectations were exceeded. We also expect the unemployment rate to partly reverse May's jump: we forecast a slight decline to 3.6%. Such a report would probably not make the Fed believe that the labor market is already almost back in balance. Accordingly, we still consider a rate hike of 25 bps at the next meeting at the end of July to be likely.

Danske Bank

We forecast June NFP at 180K, and if we do see further signs of wage inflation cooling followed by a lower Core CPI release on 12 July, we think the Fed could still end up staying on hold in the next meeting.

ING

Last month, the rise in NFP was immensely strong at 339K, but we do expect to see a moderation this month with something closer to the 225K mark. The unemployment rate jumped to 3.7% from 3.4% last month given the household survey data painted a very different picture to the payrolls data – with households reporting that employment actually fell. We see this reversing part of the jump and coming in at 3.6%. Meanwhile, average hourly earnings should soften a touch with another 0.3% MoM print, which would bring the annual rate of wage growth down to 4.2%.

TDS

Payrolls likely remained above-trend in June, registering a firm 240K gain but the data will still represent slowing vs the still booming 317K expansions, on average, in April-May. That is at least directionally what the Fed would be looking for. We also look for the UE rate to drop a tenth to 3.6% and for wage growth to print 0.3% MoM. age growth also likely printed 0.3% MoM again, keeping the YoY pace unchanged at 4.3%.

Credit Suisse

We expect payroll gains to slow to 190K in June, as in our view, all evidence points to a slower, but still historically robust, rate of job gains. We expect the unemployment rate to tick lower to 3.6%, while average hourly earnings should remain at 0.3% MoM.

Deutsche Bank

We expect headline (consensus +225K, DB +200K vs. +339K previously) and private (consensus +200K, DB +175K vs. +283K) payroll gains to slow relative to their three-month averages of +283K and +231K, respectively. This should still edge unemployment back down a tenth to 3.7% (consensus 3.6%) after a surprise spike last month. Hours worked were weak last month and we expect that to bounce from 34.3 to 34.4hrs. Hourly earnings are expected to be steady at 0.3%.

RBC Economics

US jobs report in June likely saw 260K increase in payroll employment, down from the +339K in May, but still at a high level. We expect the unemployment rate likely edged up to 3.8% (calculated separately from the household survey), from 3.7% in May.

NBF

We expect job creation to have slowed to 175K in the month. The household survey could show a slightly bigger gain following May’s unexpected drop, but this should not lead to a change in the unemployment rate (3.7%).

SocGen

We again expect strong employment readings. Our forecast is for a 250K NFP increase and a decline in the unemployment rate to 3.6%.

CIBC

Initial jobless claims jumped in early June, suggesting that hiring could have slowed to a 185K pace over the month. That’s also in line with the decline in aggregate hours worked seen in several industries lately including information, manufacturing, retail trade, and transportation and warehousing. The household survey showed a sizable drop in jobs in May and a return to job growth in that survey would keep the unemployment rate at 3.7%, in line with potentially more progress in participation in the core 25-54 age group, which would have also left room for further job gains without additional wage pressures. We’re below the consensus on hiring which could put pressure on bond yields.

Wells Fargo

We expect NFP growth to moderate in June. Demand for workers continues to subside, with initial jobless claims moving up between survey weeks and the four-week average up nearly 20% over the past year. Meanwhile, job postings in June continued to slide. However, cooling in the jobs market remains incremental rather than abrupt. Therefore, we look for what we would consider to be a still robust gain of 245K new jobs in June, but will be closely watching revisions to May given the 22-year low in the survey response rate. After shooting up 0.3 percentage points in May, we look for the unemployment rate to tick back down to 3.6% in anticipation of some bounce-back in the household measure of employment. The recent trend in average hourly earnings is likely little changed, leading us to expect another 0.3% monthly increase that would push down the 12-month change only slightly to 4.2%.

Citi

After a surprisingly strong 339K increase in nonfarm payrolls in May, we expect a slowing in employment growth in June, although to a still-solid 170K jobs added during the month. This could also be a temporarily softer month of payroll growth with upside risks again to payrolls from July through September. After the unemployment rate unexpectedly rose to 3.7% in May, we expect a decline to 3.6% in June with downside risks. While the expectation for a 170K increase in NFP in June would be the softest since December 2020, not all elements of the June employment report would be indicative of a loosening labor market. Indeed, some of the weakness in June hiring relative to strong seasonal patterns could still be indicative of labor shortages, especially in sectors leisure and hospitality where employment is still below pre-pandemic levels. This would imply upward pressure on wages, and we expect a solid 0.4% MoM increase in average hourly earnings in June.

- US ISM Services PMI climbed to 53.9 in June.

- US Dollar Index continues to push higher toward 103.50.

The business activity in the US service sector continued to expand at a strengthening pace in June, with the ISM Services PMI rising to 53.9 in June from 50.3 in May. This reading came in above the market expectation of 51.

Further details of the publication revealed that the Prices Paid Index edged lower to 54.1 from 56.2 and the Employment Index climbed to 53.1 from 49.2.

Commenting on the survey's findings, “there has been an uptick in the rate of growth for the services sector," noted Anthony Nieves, Chair of the Institute for Supply Management (ISM) Services Business Survey Committee.

"This is due mostly to the increase in business activity, new orders and employment. Increased capacity, backlog reduction and continued improvements in logistics have impacted delivery times (resulting in a decrease in the Supplier Deliveries Index)," Nieves further explained. "The majority of respondents indicate that business conditions remain stable; however, they are cautious relative to inflation and the future economic outlook.”

Market reaction

The US Dollar Index extended its daily rebound after this report and was last seen posting small daily gains at 103.40.

USD/JPY has spent the last 18 months tracking US-Japanese yield differentials with impressive consistency. Economists at Société Générale analyze the pair’s outlook.

The Yen has not been this cheap since the 1970s

Our rates strategists expect the US 5y yield to fall to 2.66% by this time next year, which would suggest USD/JPY would break below 130 if JGB yields stay at current levels and reach 125 if there were one further small adjustment to the band.

Correlations are there to be broken, but the current level of USD/JPY bears little relation to the performance of the economy, and in real effective terms, the yen is cheaper today relative to the USD than it has been at any point since the 1970s. Bigger mispricing can last longer than we ever used to think, but this one is extraordinary, and once rates start to re-converge, the Yen will surely rally.

- Gold price has faced immense selling pressure as US Employment conditions have tightened further.

- The US labor market has been flooded with fresh 497K fresh talent in June, higher than the expectations of 228K and the former release of 278K.

- S&P is expected to open on a bearish note as investors have turned extremely cautious ahead of the quarterly reason season.

Gold price (XAU/USD) has tumbled to near the round-level support of $1,900.00 in the early New York session. The precious metal faced an intense sell-off as the labor market conditions in the United States tightened significantly.

The US Automatic Data Processing (ADP) agency has reported that payroll figures doubled in June vs. expectations. In June, the US labor market has been flooded with fresh 497K fresh talent, higher than the expectations of 228K and the former release of 278K.

Contrary to the US ADP Employment report, the number of individuals filing for initial jobless claims has jumped to 248K for the week ending June 30 vs. expectations of 245K and the former release of 236K.

Meanwhile, S&P is expected to open on a bearish note as investors have turned extremely cautious ahead of quarterly reason season and tight labor market conditions. The higher addition of Employment numbers is going to infuse confidence among Federal Reserve (Fed) policymakers for raising interest rates further.

The US Dollar Index (DXY) has rebounded after dropping to near 103.00 as hopes of further interest rate hikes from the Fed have solidified. The yields offered on 10-year US Treasury bonds have jumped to near 4.04%.

Gold technical analysis

Gold price has faced severe selling pressure while attempting to surpass the 100-period Exponential Moving Average (EMA) plotted around $1,929.00. The precious metal failed to sustain above the downward-sloping trendline plotted from May 03 high at $2,079.76.

The Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00. Bearish momentum would trigger if it drops below 60.00.

Gold four-hour chart

The Brazilian Real has shown its strong side so far this year. Economists at Commerzbank analyze BRL outlook.

Real should continue to be supported by an attractive real interest rate for the foreseeable future

The BCB's credible monetary policy argues for a prudent approach, which is why the Real should continue to be supported by an attractive real interest rate for the foreseeable future. For the time being, we, therefore, see the BRL at a sustained high level.

Towards the end of next year, however, we fear growing doubts about a continued hawkish stance as the term of the current BCB governor expires and there is speculation about a more pro-government successor. This is likely to weigh on the Real next year.

Source: Commerzbank Research

- EUR/USD reverses three consecutive daily pullbacks.

- The pair’s bullish attempt faltered just ahead of 1.0900.

EUR/USD manages to leave behind part of the recent decline and trades with decent gains near the 1.0900 barrier on Thursday.

The inability of the pair to regain a convincing upside traction, ideally in the very near term, could motivate sellers to force the pair to revisit recent lows near 1.0830 ahead of the interim support at the 100-day SMA at 1.0824.

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0613.

EUR/USD daily chart

USD/MXN traded below 17 on Wednesday. Economists at Société Générale analyze the pair’s technical outlook.

Signals of a meaningful rebound are not yet visible

USD/MXN has experienced a relentless downtrend after breaking below the sideways consolidation during 2021/2022. The move is a bit stretched however signals of a meaningful rebound are not yet visible.

Next potential supports are located at projections of 16.95 and 16.60/16.40.

The 50-DMA at 17.50 is short-term hurdle. The pair must re-establish above this to affirm an extended bounce.

- DXY comes under some selling pressure and tests 102.90.

- Extra gains meet the next target of note around 103.50.

DXY comes under some moderated selling pressure after three consecutive daily advances on Thursday.

While further consolidation seems probable in the very near term, the continuation of the uptrend in place since mid-June could challenge the weekly high at 103.54 (June 30) prior to the May high at 104.69 (May 31), which appears reinforced by the 200-day SMA.

Looking at the broader picture, while below the 200-day SMA at 104.70, the outlook for the index is expected to remain negative.

DXY daily chart

- EUR/JPY adds to the weekly knee-jerk and breaches 156.00.

- Further pullbacks could retest the 154.00 region in the near term.

EUR/JPY extends the weekly bearish note to the sub-156.00 region on Thursday, where some initial support seems to have turned up.

The cross continues to retreat from overbought levels and further decline should not be ruled out for the time being. Against that, the door now appears open for the cross to challenge the weekly low at 154.04 (June 20).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 145.50.

EUR/JPY daily chart

- AUD/USD has fallen back swiftly to 0.6640 as US payroll additions were doubled in June than expected.

- The US labor market was added with fresh 497K fresh talent, higher than the expectations of 228K and the former release of 278K.

- Volatility in the USD Index is expected to remain elevated ahead of the US ISM Services PMI data.

The AUD/USD pair has retreated swiftly from 0.6688 as the United States Automatic Data Processing (ADP) Employment report has posted sharply higher payroll additions in June than expected. According to the ADP report, the US labor market added fresh 497K fresh talent, higher than the expectations of 228K and the former release of 278K.

Stellar additions of fresh Employment indicate that the US labor market conditions are upbeat and sufficient to propel inflationary pressures. On Wednesday, released Federal Open Market Committee (FOMC) minutes showed that all policymakers are favoring more interest rate hikes, and now upbeat Employment data have strengthened the need for extremely restrictive monetary policy.

Meanwhile, S&P500 futures have extended losses dramatically as fears of more interest rates from the Fed have propelled. The overall market mood has turned quite negative and has improved the appeal of the US Dollar Index (DXY).

The USD Index has rebounded strongly after vertically correcting to near 102.92. Also, the 10-year US Treasury yields have jumped swiftly to near 4.03%.

Volatility in the USD Index is expected to remain elevated as investors are now shifting their focus toward the release of the US ISM Services PMI data. The economic data is seen higher at 51.0 vs. the former release of 50.3. While New Orders Index is seen declining to 53.3 against the prior release of 56.2.

On the Australian Dollar front, the Reserve Bank of Australia (RBA) kept the interest rate decision unchanged at 4.10%. RBA Governor Philip Lowe kept monetary policy steady but kept doors open for further interest rate hikes. Investors should note that Australia’s monthly Consumer Price Index (CPI) softened sharply to 5.6% vs. the prior release of 6.8%.

- Initial Jobless Claims in the US increased 12,000 in the week ending July 1.

- US Dollar Index holds above 103.00 after the data.

There were 248,000 initial jobless claims in the week ending July 1, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 236,000 (revised from 239,000) and came in slightly higher than the market expectation of 245,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 253,250, a decrease of 3,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending June 24 was 1,720,000, a decrease of 13,000 from the previous week's revised level," the DOL further added in its press release.

Market reaction

The US Dollar Index holds above 103.00 following this data.

- Oil prices are holding gains built near $72.00 as US Dollar has dropped sharply.

- Investors have digested fears of more interest rate hikes from the Fed.

- WTI has delivered a breakout of the Descending Triangle chart pattern, which indicates an expansion in volatility.

West Texas Intermediate (WTI), futures on NYMEX, are holding gains built near $72.00 in the London session. The oil price is expected to continue to rally as Russia and Saudi have announced voluntary cuts to stabilize prices. However, UAE has denied supporting production cuts.

The US Dollar Index (DXY) has fallen like a house of cards as investors have digested fears of more interest rate hikes from the Federal Reserve (Fed). Going forward, investors will keep an eye on the United States labor market data.

Meanwhile, fears of a bleak global outlook are solid as central banks are preparing for a fresh rate hike cycle to sharpen their monetary policy tools in the fight against stubborn inflation.

WTI has delivered a breakout of the Descending Triangle chart pattern on a four-hour scale, which indicates an expansion in volatility. The downward-sloping trendline of the aforementioned pattern is plotted from June 04 high at $74.36 while the horizontal support is placed from May 31 low at $67.12.

The black gold is confidently trading above the 200-period Exponential Moving Average (EMA) at $71.00, which indicates that the long-term trend is bullish.

Meanwhile, the Relative Strength Index (RSI) (14) is aiming to shift into the bullish range of 60.00-80.00, which indicates that the upside momentum is activating.

Should the oil price break above the intraday high at $72.35, bulls will strengthen and approach upcoming resistances to June 04 high at $74.36 and April 28 high at $76.85.

On the flip side, a downside move below May 31 low at $67.12 will drag the asset toward the $65.00 support followed by the ultimate support around $64.31.

WTI four-hour chart

-638242425727492279.png)

- Employment in the US private sector rose sharply in June.

- US Dollar Index recovered above 103.00 after the upbeat data.

Private sector employment in the US rose 497,000 in June, the data published by Automatic Data Processing (ADP) showed on Thursday. This reading marked the largest one-month increase since February 2022 and surpassed the market expectation for an increase of 228,000 by a wide margin.

Assessing the findings of the report, “consumer-facing service industries had a strong June, aligning to push job creation higher than expected,” said Nela Richardson, chief economist, ADP. “But wage growth continues to ebb in these same industries, and hiring likely is cresting after a late-cycle surge.”

"Job stayers saw a year-over-year pay increase of 6.4 percent, down from 6.6 percent in May," the ADP further noted in its publication. "For job changers, pay gains slowed for the 12th straight month, to 11.2 percent, the slowest pace of growth since October 2021."

Market reaction

The US Dollar gathered strength against its rivals on the upbeat ADP jobs report and the US Dollar Index recovered above 103.20 from below 103.00 ahead of the data.

EUR/USD recovers from low 1.08s support. Economists at Scotiabank analyze the pair’s technical outlook.

EUR/USD is forming a bullish reversal

Short-term charts suggest a major rejection of the low 1.08 area has developed. Recall that the 40-Day Moving Average sits at 1.0826 currently.

Intraday price action shows the EUR forming a bullish reversal (outside range on the 6-hour chart) off the earlier low.

Major trend resistance sits at 1.0905; a break above here puts 1.10 in reach again.

See: EUR/USD to have a chance to get back closer to the pandemic peak level – SocGen

GBP/USD gains strongly. Economists at Scotiabank analyze the pair's technical outlook.

GBP/USD has formed an inverse Head & Shoulders pattern

The GBP/USD pair has formed an inverse Head & Shoulders pattern over the turn of the month following the sharp rebound from the 1.26 zone.

Intraday gains have pushed through the neckline trigger (1.2730, now support) and look poised to push on to retest the 1.2800/50 range.

See: EUR/GBP may find some support around current levels and even converge back to 0.8600 – ING

- USD/CHF has slipped strongly as investors have shrugged-off uncertainty associated with the Fed interest rate outlook.

- Investors have shrugged-off uncertainty associated with the hawkish interest rate outlook from Fed policymakers.

- SNB Maechler commented that further hikes in interest rates cannot be ruled out.

The USD/CHF pair has witnessed an intense sell-off, following the footprints of the declining US Dollar Index (DXY) in the European session. The Swiss Franc asset has slipped sharply to near 0.8950 as investors have shrugged-off uncertainty associated with the hawkish interest rate outlook from Federal Reserve (Fed) policymakers and upcoming Employment data.

S&P500 futures have recovered nominal losses posted in London, however, the overall market sentiment is bearish. The US Dollar Index (DXY) has slipped vertically to near 103.00 despite more interest rate hikes from the Fed being highly likely.

Federal Open Market Committee (FOMC) minutes showed that all policymakers have favored more interest rate hikes as inflation is extremely stubborn. Fed policymakers decided to skip policy-tightening in June as the central bank would get sufficient time to assess monetary policy conditions and the impact of interest rate hikes yet made.

Meanwhile, New York Fed Bank President John Williams crossed showed support for slowing down on the rate hike trajectory. Fed policymaker also showed his data dependency for future central bank decisions.

Apart from that, the United States Automatic Data Processing (ADP) Employment report will be keenly watched. As per the estimates, the US ADP report will show fresh additions of 228K in June vs. the former addition of 278K.

On the Swiss Franc front, Swiss National Bank (SNB) governing board member, Andrea Maechler, commented “It cannot be ruled out that we will need to further hike interest rates.” Investors should note that the Swiss Consumer Price Index (CPI) slipped below 2% in May.

Economists at Scotiabank analyze USD/CAD outlook after the pair tested the 1.33 area earlier in the day.

Markets may shy away from moving the CAD too far on the day ahead of Friday’s data reports

Canada releases Merchandise Trade data today but the jobs (and wages) data tomorrow should be important influences on the CAD’s near-term direction. Markets may shy away from moving the CAD too far on the day ahead of Friday’s data reports.

The pair nudged briefly above 1.33 earlier in the day, keeping a test of noted resistance at 1.3315/25 on the radar.

Short-term trend momentum is positive, which may limit scope for USD losses in the short run to support in the upper 1.32s.

Key USD support is 1.3200/05.

USD trades mixed versus majors. Economists at Scotiabank analyze how US data could impact the greenback.

Firm data may give the USD a lift

US data reports are dominated by employment figures – ADP data is expected to reflect a gain of 225K in private sector jobs in June (down from 278K in May) while weekly claims are forecast to rise modestly. We also get Trade numbers, final S&P PMI Services and Composite data and the June ISM Services Index.

Firm data may give the USD a lift but short-term patterns in the DXY suggest gains are becoming a bit of a grind and the Dollar may find it hard to extend through the 103.50 area.

Support for the index is 103.00/05 and may come under pressure if the labour market data disappoint.

Economists at MUFG Bank analyze CHF outlook.

SNB continues to favour stronger CHF

The rhetoric of the SNB is indicative of ongoing concerns over price stability. The hawkish rhetoric from the SNB looks to us to be in part an attempt to ensure there is no perception of divergence that could fuel CHF weakness.

Another 25 bps rate hike in September seems more likely than not at this stage. Another rate hike with core CPI unchanged at the current level (1.9%) or lower would take the SNB’s policy rate in real terms into positive territory – joining the RBNZ, the Fed and the BoC.

The SNB lowered its forecast for inflation this year from 2.6% to 2.2% but raised the 2024 and 2025 forecasts by 0.2ppt and 0.1ppt to 2.2% and 2.1%. This underlines the SNB’s bias to tighten further which will help support CHF.

Given our view of EUR/USD moving modestly higher and the ECB hiking in July and September, the scope for EUR/CHF to move higher will be relatively limited over the forecast period.

EUR/CHF – Q3 2023 0.9750 Q4 2023 0.9850 Q3 2024 1.0100 Q2 2024 1.0000

USD/CHF – Q3 2023 0.8860 Q4 2023 0.8790 Q3 2024 0.8940 Q2 2024 0.9090

EUR/USD is currently stuck in a range. Economists at Société Générale analyze the pair’s outlook.

More ECB than Fed tightening in H2

We expect more ECB than Fed tightening in H2, Fed easing in H1 2023 as the US slips into a mild recession, and EUR/USD to have a chance to get back closer to the pandemic peak level (1.23, Jan 2021).

The biggest risk is that we stay in a much narrower range, i.e., EUR/USD meanders in a 1.05-1.15 range for the foreseeable future, in the face of a synchronised global slowdown.

Looking at the G10 currencies in June shows that the Dollar weakened, but that the Yen softened even further. Yen selling is likely to continue in the short term, in the view of economists at MUFG Bank.

A policy shift by the BoJ could result in a considerable strengthening of the Yen

We expect USD/JPY to come under downward pressure from moves by the BoJ and the Japanese authorities in the short term and by changes in the Fed's monetary policy over the medium term.

A policy shift by the BoJ could result in a considerable strengthening of the Yen. However, in the immediate term, or if the BoJ does not shift gears at the July monetary policy meeting, we see the risk of the Yen weakening further.