- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

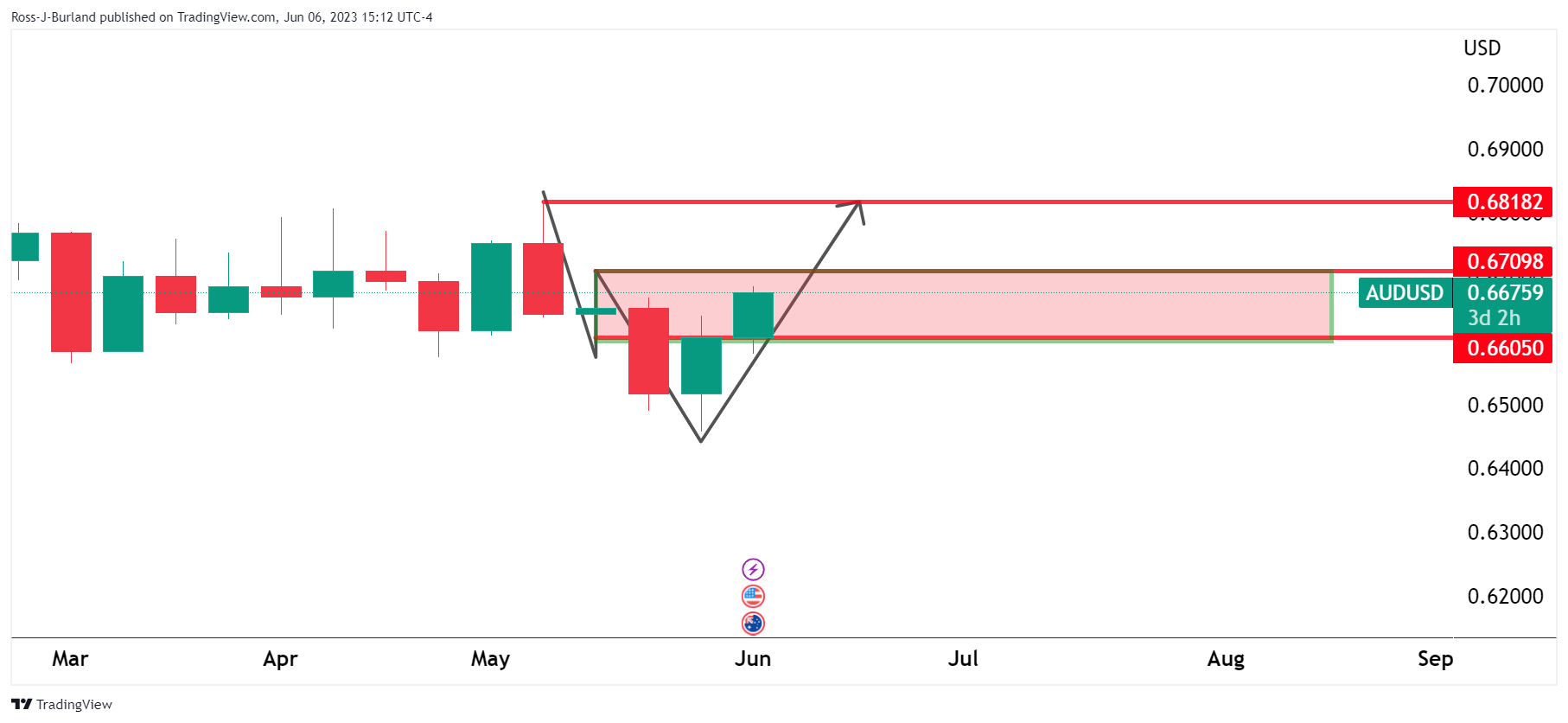

- AUD/USD stays firmer at the highest levels in three weeks, prints five-day uptrend.

- RBA’s Lowe backs 0.25% surprise rate hike by citing inflation fears, hints at more rate increase if needed.

- Australia’s Q1 GDP, China monthly trade data eyed for clear directions.

- Mixed Fed clues, previously downbeat data and pre-FOMC blackout prod US Dollar buyers.

AUD/USD justifies hawkish comments from Reserve Bank of Australia (RBA) Governor Philip Lowe, as well as the RBA’s surprise rate lift, as it grinds higher past 0.6650 during Wednesday’s Asian session. In doing so, the Aussie pair rises for the fifth consecutive day while making rounds to the highest levels in three weeks, marked the previous day, amid cautious mood ahead of Australia’s first quarter (Q1) Gross Domestic Product (GDP).

Earlier in the day, RBA Governor Lowe defended the Aussie central bank’s second consecutive hawkish surprise by saying that June rate rise followed information suggesting greater upside risks to bank’s inflation outlook. The policymaker also stated, “Some further tightening of monetary policy may be required, depending on how economy and inflation evolve.”

It’s worth noting that Australian Treasurer Jim Chalmers also backed the RBA’s surprise rate hike announcement at a press conference on Tuesday by saying that, “It is ‘not our expectation the economy will head into recession.’”

On a different page, hopes of improving the US-China and the Canberra-Beijing ties join the market’s cautious optimism, as well as receding hawkish Fed bets to also underpin the AUD/USD pair’s run-up.

Late on Tuesday, Reuters said that Fed funds futures traders see the Fed as likely to then resume rate increases, with a 65% chance of an at least 25 basis-point increase in July, according to the CME Group's FedWatch Tool. It’s worth mentioning that the interest rate futures show a nearly 15% probability of a June rate hike. The reason could be linked to downbeat United States activity data released on Monday, as well as the previously dovish comments from the Federal Reserve (Fed) Officials ahead of the pre-Fed blackout.

Amid these plays, S&P500 Futures grind higher as the technology stocks remained firmer but the manufacturing ones weighed on the sentiment and pared Wall Street’s gains. Even so, the US equities closed with minor gains.

Moving on Aussie Q1 GDP, expected to ease to 0.3% QoQ from 0.5% prior, may allow the AUD/USD buyers to catch a breather. However, any surprise positive won’t be taken lightly. Also important to watch will be the monthly trade numbers from China and the Fed concerns.

Technical analysis

An upside break of the previous support line stretched from early March, around 0.6620 by the press time, joins successful trading beyond the 50-DMA of around 0.6665 to enable the AUD/USD bulls to aim for the 200-DMA hurdle of near the 0.6700 threshold.

- US Dollar Index picks up bids to reverse previous weekly loss amid sluggish session.

- Increasing odds of Fed rate hike in July joins bond market moves, softer rival currencies to propel DXY.

- US trade numbers, risk catalysts are the key for clear directions.

US Dollar Index (DXY) consolidates the previous weekly losses with mild gains around 104.15 amid an inactive Asian session on Wednesday. Adding strength to the greenback’s gauge versus the six major currencies is the sluggish markets and the US policymakers’ ability to avoid the ‘catastrophic’ default. The same increased bond market moves and fuels the odds of a rate hike by the Federal Reserve (Fed) in July, if not in June.

That said, a resolution to the United States default fears propelled bond offerings from the government but marked a mixed response on the yields as the 10-year coupons remain sluggish at around 3.69% whereas the two-year counterparts rose a bit to 4.50%. It should be noted that the US Treasury increased bond sales by around $42 billion at the latest due to the debt-ceiling extension bill.

With this in mind, Reuters said, "Fed funds futures traders see the Fed as likely to then resume rate increases, with a 65% chance of an at least 25 basis-point increase in July, according to the CME Group's FedWatch Tool." It’s worth mentioning that the interest rate futures show a nearly 15% probability of a June rate hike. The reason could be linked to downbeat United States activity data released on Monday, as well as the previously dovish comments from the Federal Reserve (Fed) Officials ahead of the pre-Fed blackout.

It’s worth noting that the ex-Fed Vice Chairman Richard Clarida mentioned on Tuesday that one or two Fed rate hikes ahead is a close call.

Elsewhere, the downbeat performance of the Euro and the Cable, due to disappointing economic performances, allow the US Dollar to grind higher as traders rush to risk safety.

Against this backdrop, S&P500 Futures grind higher as the technology stocks remained firmer but the manufacturing ones weighed on the sentiment and pared Wall Street’s gains. Even so, the US equities closed with minor gains.

Looking forward, a light calendar and the absence of the Fed policymakers' speeches highlight risk catalysts as the key to watching for clear directions.

Technical analysis

US Dollar Index bulls appear to run out of steam amid a looming bear cross on the MACD and above 50.0 RSI conditions. However, a clear downside break of the 200-day Exponential Moving Average (EMA), near 103.85 at the latest, becomes necessary for the DXY sellers to retake control.

“Too early to declare victory in the battle against inflation,” said Reserve Bank of Australia (RBA) Governor Philip Lowe while speaking at the Morgan Stanley Australia Summit early Wednesday in Asia.

Additional comments

June rate rise followed information suggesting greater upside risks to bank’s inflation outlook.

Some further tightening of monetary policy may be required, depending on how economy and inflation evolve.

Ambition is to navigate narrow path where inflation returns to target and economy grows.

Still possible to navigate, but it is narrow path and likely to be bumpy, risks on both sides.

Evidence indicates that higher interest rates are working and that inflation is coming down.

April CPI reading has not changed assessment inflation is trending lower.

Job at central bank is to make sure period of high inflation is only temporary; important we succeed.

Acknowledge interest rate effects felt unevenly across community, but not a reason to avoid using them.

If we had not tightened policy, the cost of living would be higher for longer.

Desire to preserve job market gains does not mean board will tolerate higher inflation persisting.

Path back to 2–3% inflation is likely to involve a couple of years of relatively slow growth.

AUD/USD remains firmer

Despite showing little reaction to the news, AUD/USD stays firmer at the highest levels in three weeks by keeping the post-RBA rally during a five-day uptrend.

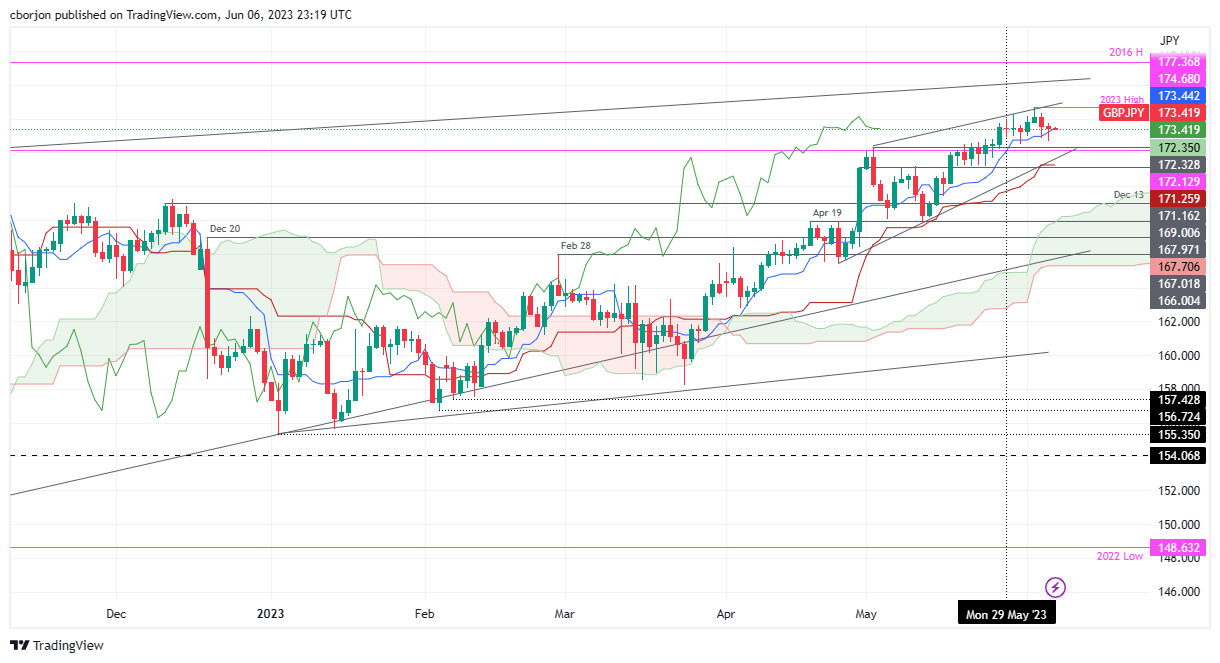

- Despite technical indicators predicting further upside, GBP/JPY sees consecutive negative sessions; it currently trades at 173.44.

- Potential pullback looms, with immediate support at the Tenkan-Sen line of 173.43 and further at 173.00.

- For bullish continuation, GBP/JPY needs to claim the 174.00 mark.

GBP/JPY registers back-to-back negative sessions, sponsored by risk aversion; though technical indicators suggest further upside, price action means the rally is losing steam. As the Asian session begins, the GBP/JPY trades at 173.44, up a minuscule 0.01%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is upward biased thought; it could be subject to a pullback, as the GBP/JPY is forming a rising wedge. On the downside, prices remain capped by the Tenkan-Sen line at 173.43, which would act as immediate support, but with a decisive break below the latter, the GBP/JPY could dive towards the 173.00 figure. The following support would be the May 2 high at 172.33, followed by the Kijun-Sen line at 171.26.

The GBP/JPY must claim the 174.00 mark for a bullish continuation. A breach of the latter will expose the YTD high at 174.68, with buyers eyeing 2016 high at 177.37.

GBP/JPY Price Action – Daily chart

- GBP/USD stays defensive after three-day losing streak, rebounds of late.

- Pound Sterling’s recovery from fortnight-old support line, improving oscillators lure buyers.

- 200-SMA, one-month-long horizontal resistance area challenge Cable bulls.

GBP/USD licks its wounds near 1.2425 during early Wednesday morning in Asia, after declining in the last three consecutive days. In doing so, the Cable pair rebounds from a two-week-old ascending support line to consolidate the weekly loss, after snapping a three-week downtrend in the last.

That said, the steady RSI (14) line joins the receding bearish bias of the MACD signals to back the latest run-up in the Pound Sterling price.

However, the 200-bar SMA level of 1.2475 by the press time challenges GBP/USD bulls.

Even if the quote manages to remain firmer past the key SMA, a horizontal area comprising multiple tops marked since early May, close to 1.2540-45, quickly followed by the 1.2550 psychological level, will act as an extra filter towards the north.

Should the GBP/USD buyers manage to cross the 1.2550 hurdle, the 1.2600 round figure and the previous monthly high of 1.2680 can lure them.

Meanwhile, the GBP/USD pair sellers need validation from the aforementioned support line, close to 1.2400 at the latest. Following that, a quick fall to May’s bottom of 1.2308 can’t be ruled out.

Though, multiple levels marked during February and March highlight 1.2300-2270 as a tough nut to crack for the Pound Sterling sellers to break afterward.

Overall, GBP/USD is likely to recover but the upside room appears limited.

GBP/USD: Four-hour chart

Trend: Limited upside expected

- The NZD/AUD pair sets a fifth consecutive day of gains and stands in the overbought area.

- RBA surprised the markets by announcing a 25 bps hike to the 4.10% level.

- Australian bond yields give traction to the Australian Dollar.

The NZD/AUD gained more than 60 pips closing at 1.0975 on Tuesday following the Reserve Bank of Australia (RBA) decision which exceeded economist expectations. In that sense, the main reason for the Aussie’s upward trend is the rise in Australian bond yields. For Wednesday’s session, eyes will be on RBA Governor Lowe's speech and Q1 GDP data from Australia.

A hawkish stance from the RBA gives the Aussie traction

Following a pause in April’s meeting, the Reserve Bank of Australia (RBA) has recently announced consecutive unexpected moves towards a more hawkish stance with a 25 basis point (bps) hike. According to the bank, this decision comes in light of the persistently tight labour market conditions and elevated levels of inflationary pressures and hinted that ongoing rate hikes might be necessary.

As a reaction, the 2-year Australian bond yield surged to its highest level since 2012, giving further traction to the Aussie.

On the Kiwi’s hand, investors will eye Chinese economic data on Wednesday. As China is one of the main trading partners of New Zealand, the outcome of the data may have a further impact on the NZD price dynamics.

Levels to watch

According to the daily chart, the AUD/NZD holds a bullish outlook for the short term as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that the buyers are in control while the pair trades above its the 20,100 and 200-day Simple Moving Averages (SMA). However, the RSI standing in overbought conditions, suggest that the pair is poised for a downward technical correction.

On the downside, immediate support for AUD/NZD is seen at the 1.0939 level, followed by the 1.0900 zone and the 200-day SMA at 1.0882. On the upside, the resistances lineup at the daily high at 1.0992 followed by the 1.1020 area and the 1.1050 zone.

- EUR/USD stays depressed despite latest corrective bounce, remains sidelined overall.

- Downbeat German data, easing inflation expectations prod ECB hawks.

- Fed policymakers observe pre-FOMC silence period, light calendar adds to the market’s indecision.

- Receding hawkish bets on FOMC fails to inspire Euro bears despite downbeat EU signals.

EUR/USD licks its wounds around 1.0700 as bulls and bears jostle during a sluggish week comprising unimpressive data and the Fed blackout. That said, the Euro price pared intraday losses during late Tuesday but remains sidelined as the early Asian session morning restricts the market’s moves.

That said, the quote dropped the previous day amid downbeat EU data and receding hawkish concerns from the European Central Bank (ECB). However, a lack of inspiration for the US Dollar bulls put a floor under the EUR/USD price.

On Tuesday, Germany’s Factory Orders slumped to -9.9% YoY in April versus -8.9% expected and -11.2% (revised). Elsewhere, Eurozone Retail Sales for April improved on YoY to -2.6% from -3.3% (revised) prior and -3.0% expected but marked an unimpressive monthly figure of 0.0% compared to 0.2% market forecasts and -0.4% previous readings (revised).

Furthermore, results of the European Central Bank’s (ECB) monthly survey of consumer expectations for inflation unveils that inflation expectations among Eurozone consumers decreased significantly in April, to 4.1% for the next 12 months from 5.0% expected in March. However, the growth expectations improved to -0.8% versus -1.0% expected in March.

It should be noted that European Central Bank (ECB) policymaker Klaas Knot said on Tuesday, “We will keep tightening policy until we see inflation returning to 2% but this must be done step by step.”

On a different page, the US Dollar Index (DXY) rose 0.13% on a day to 104.12 by the end of Tuesday as a resolution to the United States default fears propelled bond offerings from the government but marked a mixed response on the yields as the 10-year coupons remain sluggish at around 3.69% whereas the two-year counterparts rose a bit to 4.50%. However, downbeat United States activity data released on Monday, as well as the previously dovish comments from the Federal Reserve (Fed) Officials ahead of the pre-Fed blackout, restrict the US Dollar moves.

Amid these pays, the technology stocks remained firmer but the manufacturing ones weighed on the sentiment and pared Wall Street’s gains. Even so, the US equities closed with minor gains.

Looking ahead, German Industrial Production and the US foreign trade numbers decorate today’s economic calendar but major attention should be given to the risk catalysts for clear directions.

Technical analysis

Despite the latest inaction, the EUR/USD pair remains above the previous resistance line stretched from early May, as well as the 200-day Exponential Moving Average (EMA), respectively near 1.0650 and 1.0690, which in turn keeps the Euro buyers hopeful.

- AUD/JPY sees a sharp rally, buoyed by RBA’s surprise rate hike to 4.10%; the pair trades flat above 93.00.

- The technical analysis projects a bullish bias, with key resistance at the December 19 high of 93.35.

- Risk aversion could trigger pullback, with initial support found at the May 19 high of 92.35.

AUD/JPY rallied sharply on Tuesday after the Reserve Bank of Australia (RBA) surprisingly raised rates by 25 bps, lifting the cash rate to 4.10%. Therefore, the AUD/JPY jumped from 92.30, toward 93.14, before retracing some of those gains, but buyers moving in, lifted the AUD/JPY toward the current spot price. At the time of writing, the AUD/JPY is trading at 93.14, flat as the Asian session begins.

AUD/JPY Price Analysis: Technical outlook

After rallying sharply, the AUD/JPY remains upward biased, as it sits above the Ichimoku Cloud and the Chikou Span. Additionally, the Tenkan-Sen line is above the Kijun-Sen line, each at 91.76 and 91.21, respectively, another bullish signal. Nevertheless, the nature of the cross-currency pair indicates that its subject-to-market sentiment swings, which could shift the pair’s direction.

The Relative Strength Index (RSI) indicator and the 3-day Rate of Change (RoC) further cement the bias, as the RSI sits in bullish territory, while the RoC indicates buyers remain in charge.

Therefore, the AUD/JPY first resistance would be the December 19 high at 93.35. A breach of the latter will expose a top-trendline of an ascending channel at around 93.70/85 before challenging the 94.00 figure.

In the event of risk aversion, the AUD/JPY pair may be subject to a pullback, and the first support would be the May 19 high at 92.35 before diving to the 92.00 figure. Once cleared, the next support would be the Tenkan-Sen line at 91.76, ahead of sliding toward the Kijun-Sen line at 91.21.

AUD/JPY Price Action – Daily chart

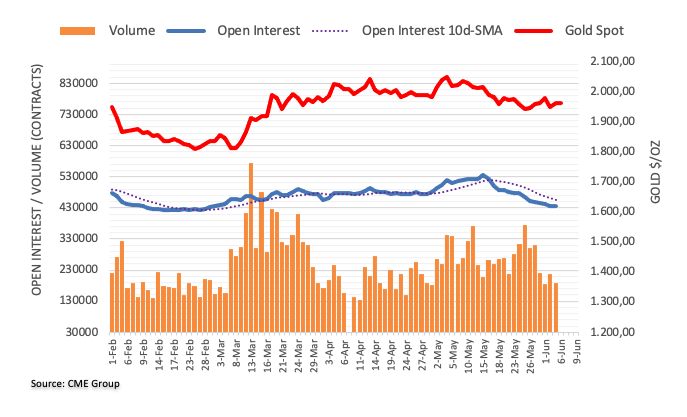

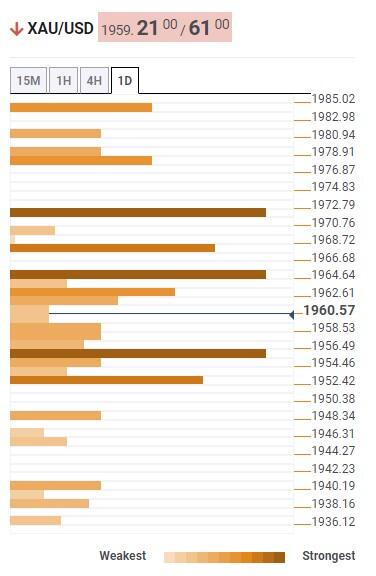

- Gold Price approaches top of three-week-old trading range during sluggish markets.

- XAU/USD price improves amid dicey Federal Reserve concerns on mixed United States data, market bets.

- Upbeat headlines surrounding China, cautious optimism puts a floor under the Gold Price.

- Risk catalysts are the key for short-term directions amid light calendar, pre-Fed blackout.

Gold Price (XAU/USD) seesaws around $1,963 amid the early hours of Wednesday’s Asian session, after a two-day rebound within a short-term trading range. In doing so, the XAU/USD pays little heed to the US Dollar’s slightly positive performance as sluggish markets and lack of major data/events direct traders towards the Gold as a safe investment. Also, looming uncertainty about the Federal Reserve’s (Fed) next move joins risk-positive headlines from China adding strength to the Gold Price.

Gold Price remains sturdy amid sluggish markets, US Dollar

Gold Price rose in the last two consecutive days while bouncing off a three-week-old trading range’s bottom even as the global markets remain sluggish. The reason could be linked to the downbeat United States activity data released on Monday, as well as the previously dovish comments from the Federal Reserve (Fed) Officials ahead of the pre-Fed blackout. That said, the US Purchasing Managers’ Indexes (PMIs) for May came in softer than expected and raised concerns that the US central bank has lesser scope to extend the rate hike trajectory.

Furthermore, upbeat headlines surrounding China, one of the world’s biggest Gold consumers, also favor the XAU/USD Price. After witnessing disappointment from the activity data in the last week, Beijing reported an upbeat Caixin Services PMI for May. Also positive was the news suggesting China’s measures to enable major banks in the nation to unleash more lending capacity. Additionally, concerns that the diplomatic talks between the US and Chinese policymakers were positive in the last round also underpin the Gold Price rebound.

Elsewhere, the US Dollar prints mild gains amid sluggish markets with no major data/events and an absence of the Federal Open Market Committee (FOMC) members’ speeches due to the pre-Fed blackout period. With this, the US Dollar Index (DXY) rose 0.13% on a day to 104.12 by the end of Tuesday.

A resolution to the United States default fears propelled bond offerings from the government but marked a mixed response on the yields as the 10-year coupons remain sluggish at around 3.69% whereas the two-year counterparts rose a bit to 4.50%. On the same line, the technology stocks remained firmer but the manufacturing ones weighed on the sentiment and pared Wall Street’s gains. Even so, the US equities closed with minor gains. With this, the market’s indecision drives traders towards the Gold buying.

Looking forward, a light calendar can keep the Gold traders troubled but today’s China and US trade numbers, as well as developments surrounding the Federal Reserve (Fed) bets, currently suggest a 24% chance of a 25 bps rate hike in June, can direct the XAU/USD price.

Gold Price Technical Analysis

Gold Price fades bounce off a three-month-old horizontal support area, recently sidelined, while staying within a trading range established since mid-May.

That said, the precious metal’s weakness takes clues from the near-50 level of the steady Relative Strength Index (RSI) line, placed at 14. However, the looming bull cross on the Moving Average Convergence and Divergence (MACD) indicator challenges the XAU/USD bears.

Hence, the bullion’s downside appears limited to the previously mentioned broad support region surrounding $1,937-33.

Following that, the 61.8% Fibonacci retracement of the metal’s March-May upside, near $1,912, can act as the last defense before dragging the Gold Price to the $1,900 round figure.

Meanwhile, recovery moves have a comparatively bumpier road to travel as the stated three-week-old trading range’s peak joins the 200-SMA to highlight $1,990 as a tough nut to crack for the XAU/USD bulls.

In a case where the Gold Price crosses the $1,990 hurdle, the $2,000 round figure may act as an extra check towards the north.

Gold Price: Four-hour chart

Trend: Limited downside expected

- NZD/USD bulls are in riding the AUD´s coattails.

- Focus will turn domestic with NZ GDP coming up.

NZD/USD has been range bound in the prior day following the Reserve Bank of Australia´s surprise hawkish hike. NZD/USD is steady in early Asia, sitting near 0.6075.

´´The Kiwi is little changed this morning and most crosses, with the exception of NZD/AUD, are likewise following a fairly muted night on global FX markets,´´ analysts at ANZ Bank explained.

The analysts explained with the RBA behind us and the AU market now pricing in a follow-up hike, the focus returns to local data and events.

In this regard, markets will be looking to New Zealand's first quarter Gross Domestic Product partials, the analysts said, like manufacturing (tomorrow) out and the Fed in blackout ahead of its meeting next week.

´´We continue to think about carry but are beginning to ask if NZ’s external position might suddenly become a sticking point when current account data is published next week.´´

- USD/CHF registers minor gains, benefiting from a robust US Dollar despite falling Treasury bond yields.

- Buyers are targeting the 100-day EMA at 0.9123, aiming to reach the 200-day EMA at 0.9250.

- The bearish extension is possible, with support found at the confluence of the 50 and 20-day EMAs.

USD/CHF is set to finish Tuesday’s session with minuscule gains, boosted by a strong US Dollar (USD), which held to its gains, as US Treasury bond yields fell late as Wall Street closes. At the time of writing, the USD/CHF exchanges hands at 0.9073, a gain of 0.16%.

USD/CHF Price Analysis: Technical outlook

From a technical perspective, the USD/CHF trades sideways, trapped within the short/long-term daily Exponential Moving Averages (EMAs). The Relative Strength Index (RSI) indicator, as well as the 3-day Rate of Change (RoC), portrays buyers are in charge, but they would need to clear the 100-day EMA at 0.9123, so they can rally towards the 0.9200 handle, as they target the 200-day EMA at 0.9250.

Otherwise, the USD/CHF could extend its losses past the confluence of the 50 and 20-day EMAs, each at 0.9039 and 0.9034, respectively, followed by the 0.9000 figure. If USD/CHF stumbles past the figure, the next support would be the May 22 daily low of 0.8940, followed by the YTD low of 0.8820.

USD/CHF Price Action – Daily chart

After Tuesday's 25 basis points rate hike, Australia will report Q1 GDP. RBA Governor Lowe will deliver a speech. Chinese trade data is due, and in Japan, the Leading Economic Index will be released. Later on Wednesday, German Industrial Production data is due. The key event during the American session will be the Bank of Canada decision.

Here is what you need to know on Wednesday, June 7:

The US Dollar posted mixed results on Tuesday in a cautious market ahead of a crucial week. The USD Dollar Index rose 0.15% but was unable to break the 104.40 area again. US Treasury yields held relatively steady. There are no Federal Reserve speakers ahead of next week's FOMC meeting. The US central bank is expected to pause its hiking cycle; however, the May Consumer Price Index number next Tuesday is seen as a determinant.

April Eurozone Retail Sales and German Factory Orders came in below expectations. On Wednesday, more data is due with German industrial production. EUR/USD dropped on Tuesday but remains below but near 1.0700. Risks are tilted to the downside, and support awaits at 1.0650.

GBP/USD dropped again but managed to close above 1.2400. EUR/GBP fell modestly to the 0.8600 area.

On Tuesday, the Australian Dollar was the top performer in the currency markets, following the Reserve Bank of Australia's (RBA) decision to raise the cash rate by 25 basis points to 4.1%. This marks the second consecutive hike, defying market consensus. RBA Governor Lowe will speak at the Morgan Stanley Australia Summit.

AUD/USD posted the highest daily close since mid-May, above 0.6650; the pair has gained almost two hundred pips from a week ago. On Wednesday, Australia is scheduled to release its Q1 GDP data, which is expected to show a positive growth rate of 2.7%. This is an improvement from the previous quarter's growth rate of 2.4%.

USD/CAD posted the lowest close in a month near 1.3400. On Wednesday, the Bank of Canada will announce its decision. The BoC is expected to keep the key rate at 0.5%, but analysts warn of the risk of a hawkish surprise. A pause may weigh on the Loonie.

It was a quiet session for metals, with Gold moving sideways around $1,960 and Silver around $23.65. Cryptocurrencies rebounded on Tuesday amid increasing volatility triggered by the action taken by the US Securities and Exchange Commission (SEC), which sued the crypto exchange Coinbase. Bitcoin gained more than 5%, rising toward $27,000.

The Turkish Lira continues to depreciate, even after President Erdogan appointed Simsek as the new Treasury and Finance Minister. USD/TRY climbed to a fresh record high near 21.50.

Like this article? Help us with some feedback by answering this survey:

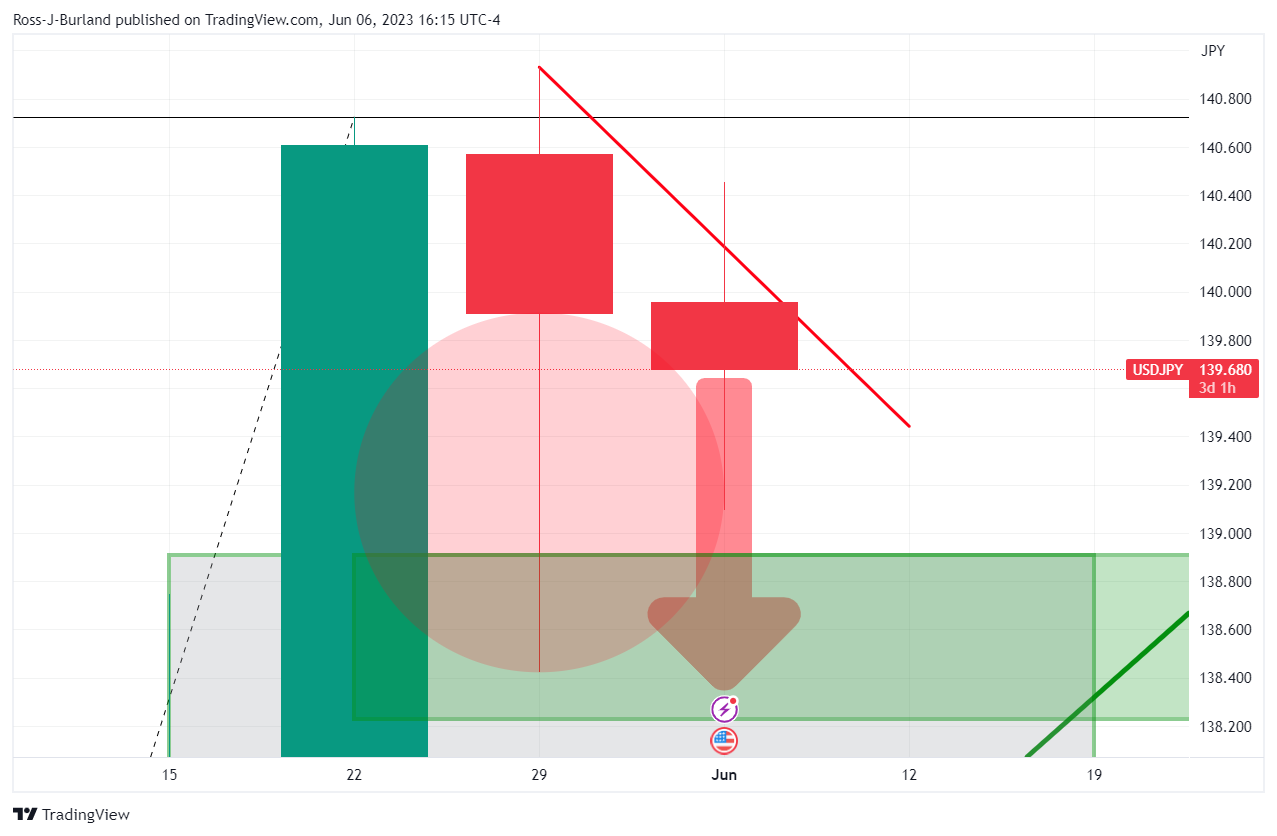

- USD/JPY bears eye a break of 4-hour support to encourage more offers.

- Bears eye the weekly wick and a firmer correction beyond.

USD/JPY is under pressure as the bullish rally starts to decelerate. The bears are in the market and eye a correction that targets the trendline supports as the following will illustrate.

USD/JPY weekly chart

The weekly charts show that the price was capped last week and has since deteriorated. The wick on the last week´s candle could be filled this week as follows:

USD/JPY daily chart

This leaves a bearish bias for the days ahead and the daily chart sees the price sandwiched between the support and the resistance line, currently.

USD/JPY H4 chart

The Bears are flexing but need to do more. On the 4-hour chart, we can see prospects of a correction of the midday London spike. A move below support to target, say, the 61.8% Fibonacci could be encouraging and motivating the bears to commit below 139.70.

- EUR/JPY trades with losses for a second consecutive day.

- Weak EU data weights on the Euro.

- Expectations about BoJ's monetary policy stance following wage data from Japan may limit the JPY's upside potential.

The Euro weakened against its major pairs on Tuesday fueled by weak economic data from the European Union (EU) and Germany. On the other hand, the Yen gains may be limited by de BoJ's (Bank of Japan)stance following Wage data from Japan which suggests that the bank will maintain its loose monetary policy.

Poor EU and German data weakened the Euro

In April, Germany experienced a decline in factory orders and retail sales, which was a cause for concern. Factory orders dropped by 0.4% month-on-month, falling short of the expected growth of 2.8%. This decline followed a revised decrease of 10.9% in March (initially reported as -10.7%). On the other hand, Retail Sales, stagnated in April vs the 0.2% expansion expected and after a 0.4% contraction in March.

German yields weakened across the curve as European Central Bank (ECB) president Christine Lagarde, commented on Monday that monetary policy decisions will remain data dependent. In that sense, weak economic data may make ECB officials reconsider further rate hikes following the June meeting. For next week, a rate hike is already priced in. That being said, the 10-year bond yield fell to 2.35% seeing a 0.86 % fall on the day, while the 2-year yield sits at 2.87% with a 0.97 % decline and the 5-year yielding 2.36% with a 0.86 % slide respectively.

On the other hand, Labor Cash Earning data from Japan indicated that wages rose by only 1.0% annually, down from 1.3% in March, and significantly below the consensus forecast of 1.8% growth. “The latest wage data from Japan will have been disappointing for the BoJ who are looking for stronger wage growth to support a sustained pick-up in inflation towards their 2.0% target”, said MUFG Bank analysts. They see the numbers reiforzing expectations that the central bank will maintain its currency loose monetary policy in June.

Levels to watch

The EUR/JPY has a neutral outlook for the short term as indicators turned flat on the daily chart. The Relative Strength Index (RSI) stands above its midline but the Moving Average Convergence Divergence (MACD) continues to print red bars, indicating that there is not a clear dominance in the market.

On the upside, a move above the 149.60 zone would suggest a continuation of the bullish trend for the EUR/JPY, with the next resistances at the 149.85 area and the 150.00 zone. On the downside, immediate support levels are seen at the 20-day Simple Moving Average (SMA) at 149.12, followed by the 148.50 area and the 148.00 zone.

-638216773290831759.png)

- USD/MXN pair tumbles past YTD low, despite potential shifts in Federal Reserve policy on the horizon.

- US economic deceleration prompts recession fears, despite the addition of 339K jobs in Nonfarm Payrolls.

- Mexican auto sector thrives, propelling production by 25% YoY, with exports advancing 14.2%.

The Mexican Peso (MXN) achieved another multi-year high against the US Dollar (USD), as the USD/MXN pair tumbled past the previous year-to-date (YTD) low of 17.4038 and dived toward 17.3993 before reversing its course toward the 17.40 area. An absent US economic docket keeps traders looking forward to the upcoming Federal Reserve meeting and leaning on the market mood. The USD/MXN is trading at 17.4009, down 0.37%.

USD/MXN plunges despite mixed US labor market signals; auto sector fuels Mexican economy

Sentiment shifted mixed but remains fragile amidst the lack of economic data in the United States. However, recession fears reignited after business activity slowed, as May’s Manufacturing PMI came into contractionary territory, while the services PMI stood above 50. Nevertheless, the latter is following a downward path, indicating that consumer spending is weakening; therefore, the economy is decelerating.

Aside from this, the labor market gave mixed signals, as May Nonfarm Payrolls created 339K jobs, but the unemployment rate ticked from 3.4% to 3.7%. Although that’s a sign the Federal Reserve (Fed) sought that spending could edge lower, creating more jobs than expected would likely deter the Fed from cutting rates in 2024.

Last week, Federal Reserve officials were vocal about skipping an interest rate increase in June to assess the conditions of cumulative tightening. But given that some other central banks are struggling to see inflation moving downward, like the Reserve Bank of Australia (RBA) lifting rates 50 bps in the last two meetings after pausing, it could influence the Fed from committing the same mistake.

Even though the US Dollar Index (DXY), which tracks the performance of the buck against a basket of its rivals, climbs toward 104.142, up 0.10%, the Mexican Peso remains resilient to give back some of its yearly gains of 10.60%.

The Mexican agenda featured Auto Production, which rose by 25%, crushing April’s 14% YoY, while Auto Exports advanced 14.2%, exceeding the prior’s month 5% YoY. Given the latest data revealed, the USD/MXN extended its losses to new yearly lows

USD/MXN Price Analysis: Technical outlook

After piercing the previous YTD low, the USD/MXN could pose a threat to fall toward the 2016 yearly lows of 17.0500, ahead of the 17.00 figure. Even though the Relative Strength Index (RSI) indicator remains in bearish territory suggesting further downside is expected, price action looks overextended. The 3-day Rate of Chang (RoC) means that sellers remain in charge, but compared to the last week through at -1.97, it’s closing towards a neutral area, indicating that traders are booking profits. Conversely, if the USD/MXN reclaims the 17.5000 psychological price level, that could pave the way to the 20-day EMA at 17.6628, followed by the 50-day EMA at 17.8802.

- AUD/USD bulls could be about to throw in the towel in a test of 0.6700.

- Bears eye risks of a move lower into the Federal Reserve.

AUD/USD has rallied to the highest since mid-May following the Reserve Bank of Australia (RBA) meeting that raised interest rates. The cash rate is now at an 11-year high of 4.1%. This leaves the technical outlook bullish but there is a risk of a correction, in the meanwhile, as the following illustrates. The major catalyst, if there is going to be a further upside, will be from the Federal Reserve interest rate decision on June 14 and the outcome. A dovish resolve would be expected to support AUD/USD bulls on their path higher.

AUD/USD weekly chart

The weekly trajectory is to the upside in a W-formation with the last leg with plenty still to go as it takes on the neckline resistance currently:

AUD/USD daily chart

Zooming in, the daily chart shows the price in a W-formation also, but this could be about to complete with a pullback to restest the commitment of the bulls. A declaration of the momentum with a creeping correction into the Fed meeting could be on the cards.

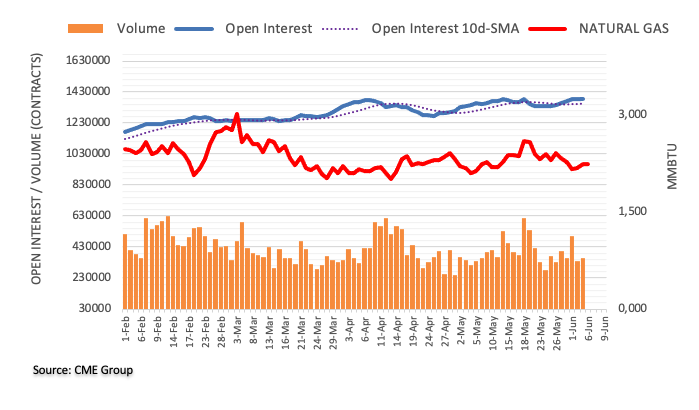

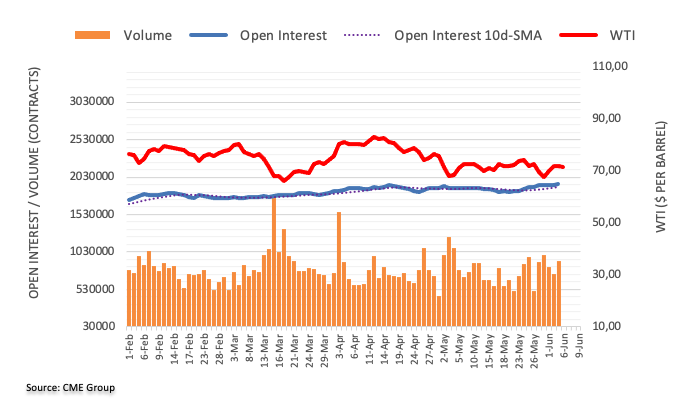

- WTI rebounded at a daily low of $70.17 and managed to recover the 20-day SMA at $71.67

- Rumors of further production cuts by the OPEC give traction to the bulls.

- the gloomy economic outlook ahead of fresh rate-hike cycles limits de WTI gains.

The West Texas Intermediate (WTI) oil price trades neutral at the $71.90 area on Tuesday’s American session after clearing daily losses as the prospects of more production cuts by Saudi Arabia seem to be giving traction to the black gold. On the other hand, the gloomy economic outlook is the main factor responsible for pushing prices lower.

Global economic downturn fears to limit bulls momentum

Next week, the Federal Reserve (Fed), the European Central Bank (ECB) and the Bank of England (BoE) will announce their monetary policy decisions. For the US central bank, market expectations regarding the decision are mixed while a rate hike from the ECB is widely expected. Interest rates tend to be negatively correlated with economic activity and hence, may weigh on Oil prices. In addition, the latest economic data from the S&P Global and Institute for Supply Management (ISM) revealed weak US figures while Germany reported a technical recession following Q1 Gross Domestic Product (GDP) figures.

On the upside, the prospects of further production cuts by the Organisation of the Petroleum Exporting Countries (OPEC) give traction to the black gold. Saudi Energy Minister Prince Abdulaziz bin Salman stated on Sunday that Saudi Arabia's reduction of one million barrels per day (bpd) in oil production could be prolonged if deemed necessary, extending beyond July.

Levels to watch

The WTI price has a neutral outlook for the short term as indicators turned flat on the daily chart, suggesting that the markets are awaiting a fundamental driver for direction.

On the upside, upcoming resistance for WTI is seen at the $72.00 level, followed by $72.25 and the $73.50 area. On the downside, the next support levels to watch are the 20-day Simple Moving Average at $71.60, followed by the $71.00 level and the daily low at $70.17.

- EUR/USD bulls need to commit or face a significant slide toward 1.0520s.

- Bears eye a break of the 1.0670 support area.

EUR/USD has traded down on the day and is lowing some 0.27% at the time of writing, traveling between a high of 1.0732 and a low of 1.0667 so far.

The daily chart shows that the price is pressured below the longer-term bullish trendline that is now considered to be a counter-trendline resistance.

EUR/USD daily chart

The price is also pressured below horizontal resistance, although it is sliding sideways out of the bearish trend.

EUR/USD H4 charts

Moving down to the 4-hour charts for a closer inspection, we can see the price is trading sideways between 1.0670ish and 1.0730ish. While below resistance, 1.0770ish, the focus is on the downside and a test of the 1.0670ish support area. A break of here will open risk to test a daily 1.0520ish support area.

On the other hand, given we are on the backside of the old bearish trend, the market could just as easily stall at this juncture, or lower down, and turn higher as the above schematic illustrates.

- The USD/CAD pair fell to its lowest level since May 11 at 1.3390.

- Investors await BoC's decision, expected to maintain rates at 4.5%.

- Canadian yields increase, giving support to the CAD.

The USD/CAD stretched lower on Tuesday trading in the 1.3389 - 1.3452 range despite the US dollar maintaining its foot versus other peers, with the DXY index trading with gains at the 104.20 level. Ahead of Wednesday’s Bank of Canada (BoC) interest rate decision, Canadian yields are edging higher, giving the Canadian Dollar traction.

Canadian yields rise ahead of BoC decision

On Wednesday, investors will eye BoC's interest rate decision where Governor Tiff Macklem and the rest of the policymakers are expected to keep interest rates at 4.5%. In that sense, the clear deceleration in the previous inflation figures gives room for the BoC to keep rates steady. In addition, the Canadian Ivey PMI came in weak in May, retreating to 53.5 vs the 57.2 expected, supporting expectations of a no-hike as economic activity shows weakness.

Meanwhile, Canadian bond yields are advancing across the curve. The 10-year bond yield rose to 3.33%, while the 2-year yield stands at 4.42% and the 5-year yield stands at 3.57%.

Taking into account the upcoming Federal Reserve (Fed) decision, according to the CME FedWatch Tool, investors are betting on a 73.6% probability of the Fed not hiking rates at their next meeting in June and maintaining the target rate at 5.25%. However, the decision will rely heavily on upcoming May Consumer Price Index (CPI) data, where the headline inflation is expected to decelerate to 4.2% (YoY) from 4.9%, while the Core rate to accelerate to 5.6% (YoY) from the last 5.5% reading. In that sense, the expectations of the upcoming decision may have an impact on the US Dollar.

Levels to watch

Technically speaking, the USD/CAD maintains a bearish outlook for the short term, as per indicators on the daily chart. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both showing weakness standing in negative territory, and the pair trades below its main moving averages indicating that the sellers have the upper hand. The shorter-term charts as the 4-hour also suggest bears' dominance with technical indicators deep in the red.

On the downside, the next support levels to watch are the daily low at the 1.3389 zone, followed by the 1.3350 and 1.3335 areas. On the other hand, a move above the 1.3450 zone may reignite the bulls' momentum, with next resistances at 1.3470 and the convergence of the 20-,100- and 200-day Simple Moving Averages (SMAs) around the 1.3500 area.

- GBP/USD swings in a 60-pip range, impacted by US bond yields and lack of domestic data.

- The World Bank ups 2023 US growth forecast to 1.1% but slashes projections for 2024 amidst the manufacturing slump.

- Central bank policy decisions are in the spotlight as RBA hikes rates; BoC takes center stage, Fed decision awaited.

GBP/USD hovers around the 1.2420s area after traveling around a 60-pip range on Tuesday, capped by the lack of economic data from the United States (US) and mixed market sentiment. Factors linked to US bond yields and the greenback, weighed on the Pound Sterling (GBP), set to register back-to-back days of losses. At the time of writing, the GBP/USD is trading at 1.2420.

Sterling pressured; Wall Street mixed as central banks navigate inflation uncertainty

Wall Street is trading mixed. Traders ignored data during the European session, as the construction PMI for the United Kingdom (UK) came in at 51.6 in May, exceeding the prior’s month reading of 51.1. Yet, the GBP/USD failed to gain traction as the US dollar rose.

Earlier in the North American session, the World Bank improved the economic outlook for the US, forecasting the economy will grow 1.1%, double January’s forecast of 0.5% in 2023. Even though it’s a good sign, projections for 2024 were slashed to 0.8%.

Meanwhile, the latest ISM PMIs release revealed that the economy is worsening as the manufacturing PMI contracted for the seven-straight month. Even though the services PMI expanded, the trend leans downward, increasing woes for a recession in the US.

Contrarily to weakening PMIs, was the latest jobs data, which further reinforces the thesis of doing more by the Federal Reserve. May Nonfarm Payrolls have added 339K jobs to the economy, portraying a resilient labor market. But the jump in the Unemployment Rate keeps the Fed at crossroads as it scrambles to curb sticky inflation at around double its target.

Given the backdrop, investors’ expectations for a hold at the June meeting lie at 76%, as shown by the CME FedWatch Tool. However, traders must be aware of the current week’s central banks’ monetary policy decisions amongst the G10, as the Reserve Bank of Australia (RBA) raised rates, while the Bank of Canada (BoC) took center stage on Wednesday. The latest round of inflation in Australia and Canada showed that inflation stabilized but later resumed upwards, pressuring the central banks.

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD remains supported by long-term daily EMAs below the exchange rate, depicting an uptrend but capped by the 20-day EMA at 1.2439. In addition, the 1.2500 handle is well defended by solid resistance with a bearish-harami formation around that area, which spurred a retracement from the late May rally, towards the June 2 high of 1.2544, before the ongoing pullback. Upside risks lie above 1.2459 and once cleared, the GBP/USD could test 1.2500. On the other hand, the GBP/USD could extend its losses below the 50-day EMA at 1.2409 and challenge the 100-day EMA at 1.2312.

- Rising US bond yields curtail Silver’s momentum as it moves between key daily Exponential Moving Averages.

- XAG/USD breaking resistance at around $23.88 may propel Silver to challenge $24.00.

- A drop below the 100-day EMA and the June 5 low of $23.25 could trigger a steeper decline.

Silver price stopped its fall amidst rising US Treasury bond yields, cushioned by the 100-day Exponential Moving Average (EMA) lying at $23.47. Still, it also failed to rally, capped by solid resistance at around the $23.74-88 area, where the 20 and 50-day EMAs lie. Therefore, XAG/USD is trading at $23.52, almost flat.

Must read: Gold Price Forecast: XAU/USD steadily around $1960s amid higher US bond yields

XAG/USD Price Analysis: Technical outlook

From a daily chart perspective, the XAG/USD path remains unclear, trapped between daily EMAs, pending cracking resistance at around $23.74-88, which would pave the way to challenge the June 2 high of $24.01. A breach of the latter would shift Silver upwards and open the door to test the April 25 low turned resistance at $24.49 before aiming towards February 2 high at $24.63.

Conversely, XAG/USD falling below the 100-day EMA and sliding beneath the June 5 low of $23.25 could exacerbate a more profound fall toward the May 30 daily low of $22.93. Once broken, the XAG/USD next challenge will be the 200-day EMA at $22.87

The Relative Strength Index (RSI) indicator is in bearish territory, while the 3-day Rate of Change (RoC) followed suit. Therefore, in the near term, Silver’s path could be downwards.

XAG/USD Price Action – Daily chart

- Gold’s rise was capped by US bond yields despite concerns for a gloomy economic outlook in the US sparked by weakness in business activity.

- The US Federal Reserve is expected to maintain interest rates unchanged at the June reunion, but recent central bank decisions worldwide suggest tightening monetary conditions loom.

- Technical analysis of XAU/USD suggests a potential inverse head-and-shoulders pattern, with a crucial resistance confluence of the 50 and 20-day EMAs to validate it.

Gold price retreats after hitting a daily high of $1966.34 as US bond yields edge higher, a headwind for the yellow metal. Investors sentiment is negative after reports of business activity in the United States (US) raised worries about a recession, underpinned the US Dollar (USD) by last week’s Federal Reserve (Fed) dovish comments, cushioned XAU/USD fall. At the time of writing, XAU/USD is trading at $1959.40, with losses of 0.10%.

Investor sentiment cools Gold’s rally as increasing US bond yields and signs of persistent inflation pressure the precious metal.

Sentiment improvement keeps the Gold price pressured. After dropping sharply on Monday, US Treasury bond yields recover, with the 10-year note rate at 3.708%, two basis points higher than the open, while US 10-year TIPS, a proxy for real yields, are at 1.521%, above the 1.50% mark, after Monday’s close below the latter.

Gold witnessed an increase in flows after the Institute for Supply Management’s (ISM) May figures for manufacturing and services painted a gloomy scenario in the United States (US). Even though the US jobs report was outstanding, with May Nonfarm Payrolls printing 339K jobs added to the economy, the Unemployment Rate advancing 0.3% to 3.7%, eased the Fed’s job of tackling stubbornly sticky inflation. That triggered a jump in US bond yields as investors disregarded a possible rate hike in June.

Traders expect a 76% chance that the US Federal Reserve would keep rates unchanged at the June 13-14 reunion, as shown by the CME Fed Watch Tool. Nevertheless, it should be noted that some central banks that paused rate hikes earlier re-engaged toward tightening monetary conditions as inflation proves to be persistent.

Amongst those, the latest surprise happened Tuesday early in the Asian session, with the Reserve Bank of Australia (RBA) lifting rates for the second straight meeting. Gold traders should remember that the RBAs skipped a meeting, just to witness a jump in inflation and wages. After that, 50 bps of tightening had been added to its cash rate, now at 4.10%.

On Wednesday’s Bank of Canada (BoC) decision, which also paused its tightening cycle but sounded more hawkish than expected on the latest meeting. TDS analysts noted, “We look for the BoC to hike by 25bp in June and 25bp in July. Ongoing economic resilience will lengthen the path back to 2.0% inflation, and as such, we believe the BoC needs to tighten further.” Furthermore, “Recent data have cleared the bar to additional hikes.”

Given the backdrop, we will see what the Federal Reserve decides the next week, but current central bank decisions could delineate what the Fed could do.

XAU/USD Price Analysis: Technical outlook

XAU/USD daily chart suggests the yellow metal is trading sideways, but an inverse head-and-shoulders could be forming. However, to validate the chart pattern, XAU/USD must rally past the confluence of the 50 and 20-day Exponential Moving Averages (EMAs) at $1969.90 and $1970.41, respectively. Once cleared, that would pave the way for the last week’s high of $1983.44, before aiming toward the May 12 low-shifted resistance at $1985.43, on XAU’s path toward the $2000 mark. Conversely, the pattern would be negated if XAU/USD tumbles below the 100-day EMA at $1937.19, followed by the May 30 daily low of $1932.20.

Economists at Commerzbank analyze Gold price outlook ahead of the central bank meetings that are scheduled to take place next week.

Prospect of rising interest rates likely to cap Gold for now

Though it seems certain that the ECB will hike its rates again, it is unclear what interest rate decision will be taken by the Fed. The market sees the chance of another rate increase, whereas our economists still believe that interest rates have peaked in the US.

Yesterday’s weaker-than-expected ISM index for the service sector did sow some seeds of doubts on the market with respect to its rate hike expectation next week; all the same, it appears unlikely that it will be completely priced out again. The prospect of rising rates will presumably weigh on the Gold price until the meeting, in other words.

However, a more pronounced and lasting correction is then on the cards after the Fed’s interest rate decision – assuming our experts are right – because the market’s positioning would then turn out to have been too hawkish.

USD/JPY in May had ranged from a low of 133.50 on the 4th to a high of 140.93 on the 30th. Economists at MUFG Bank discuss the pair’s outlook.

Room to rise to around 145

A return to the high of 142.25 on 22 November last year could be a temporary target. However, a break past this point would bring 145.00 into view, partly because there was a sharp decline at the time. We have therefore concluded that it is necessary to raise the upper limit of our forecast range.

USD/JPY is already overshooting if we consider only the difference in interest rates. The stance of the Japanese authorities also makes it hard to imagine that the yen will rise further and reach the 150 level again. Rather, we see the risk of a sharp decline in the USD/JPY going forward.

With a US rate cut still some time away, we, therefore, expect the BoJ will play a leading role in pushing down the USD/JPY over the next few months.

USD/JPY: Jun 2023 135~145 Jul-Sep 129~145 Oct-Dec 127~143 Jan-Mar 2024 125~141

Period-end forecast: Jun 2023 138 Jul-Sep 133 Oct-Dec 131 Jan-Mar 2024 129

Being bearish on the Dollar is ING’s baseline view.

A weaker Dollar can export lower US rates around the world

Our baseline view in FX markets is that the Dollar over the coming months will be entering a cyclical bear trend. This is premised on tighter US credit conditions adding to tighter monetary conditions and delivering the long-awaited US disinflation story.

Should the Fed be in a position to cut rates sharply later this year, we are convinced that the dollar would trade lower. Under that scenario, we think EUR/USD should be somewhere in the 1.15+ area by year-end, while USD/JPY should be below 130.

A weaker USD should be a positive story for global growth. Many countries, especially emerging market countries, have had to support local currencies with higher rates. A turn in the broad Dollar trend should give them some breathing room and perhaps attract to emerging markets the kind of positive portfolio inflows not seen since late 2020.

- USD/TRY extends the upside to the 21.5000 region.

- There seems to be no respite for the lira meltdown so far.

- Inflation in Türkiye dropped below 40% YoY in May.

Further weakness in the Turkish currency props up a new record high in USD/TRY, this time hitting the 21.5000 zone on Tuesday.

USD/TRY: Next target… the moon?

USD/TRY keeps the march north unabated, in the meantime, as investors continue to dump the lira following President Erdogan’s win at the general elections on Sunday and despite the appointment of well-known orthodox M. Simsek.

Recently, finmin Simsek emphasized the crucial importance for Turkey to bring down inflation to single digits once more in the medium term. Additionally, he stressed the need to accelerate the process of structural transformation, which would help alleviate the current account deficit.

It is worth recalling that Monday saw the CPI rise 39.59% YoY in May and 0.04% vs. the previous month.

The lira has lost already more than 15% since the beginning of the year and nearly 150% since the Turkish central bank (CBRT) embarked on its easing cycle in August 2021.

What to look for around TRY

USD/TRY maintains its upside bias well in place, always underpinned by the relentless meltdown of the Turkish currency.

In the meantime, investors are expected to closely monitor upcoming decisions on monetary policy, particularly after President R. T. Erdogan named former economy chief M. Simsek as the new finance minister following the cabinet reshuffle in the wake of the May 28 second round of general elections.

The appointment of Simsek has been welcomed with optimism by market members in spite of the fact that it is not yet clear whether his orthodox stance on monetary policy can survive within Erdogan’s inclination to battle inflation via lower interest rates.

In a more macro scenario, price action around the Turkish lira is supposed to continue to spin around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine, broad risk appetite trends, and dollar dynamics.

Key events in Türkiye this week: Industrial Production (Friday).

Eminent issues on the back boiler: Persistent skepticism over the CBRT credibility/independence. Absence of structural reforms. Bouts of geopolitical concerns.

USD/TRY key levels

So far, the pair is gaining 1.27% at 21.4938 and faces the next hurdle at 21.5136 (all-time high June 5) followed by 22.00 (round level). On the downside, a break below 19.5815 (55-day SMA) would expose 19.2495 (100-day SMA) and finally 18.8910 (200-day SMA).

Economists at Société Générale analyze EUR/USD outlook.

Short-term rate differentials are helping the Dollar

EUR/USD has continued to track short-term rates, which now discounts the same ECB-Fed rate differential in December 2023 as when we were heading into the US regional bank crisis in March. On that basis alone, a fall in EUR/USD towards the year’s low above 1.05 wouldn’t be unreasonable, and only a change in the outlook for Fed and/or ECB rate prospects can turn the trend around.

So far, softer-than-expected eurozone (headline) CPI data and another robust US labour market report don’t suggest a major change in trend and do therefore suggest caution.

The economy is slowing, the Fed is near the end of its hiking cycle, and neither the global energy backdrop nor the US balance of payments is a supportive factor anymore. So, we’ll wait for a better chance to buy the EUR.

- EUR/GBP edges lower on Tuesday, albeit manages to hold above the 0.8600 mark.

- Expectations for additional ECB rate hikes underpin the Euro and offer support.

- The fundamental backdrop warrants some caution for aggressive bullish traders.

The EUR/GBP cross attracts some intraday sellers near the 0.8625 region, albeit lacks any follow-through and manages to hold above the 0.8600 mark through the mid-European session.

The shared currency continues to draw support from rising bets for additional interest rate hikes by the European Central Bank (ECB), which, in turn, is seen as a key factor acting as a tailwind for the EUR/GBP cross. Against the backdrop of the recent hawkish comments by several ECB officials, President Christine Lagarde indicated on Monday that additional interest rate rises were likely as there is no clear evidence that underlying inflation has peaked.

This, in turn, reaffirms expectations that the central bank is not done raising rates despite a fall in inflationary pressures. It is worth recalling that the headline Eurozone CPI decelerated more than anticipated to the 6.1% YoY rate in May from 7.0% previous. Moreover, Core CPI slowed from 5.6% YoY to 5.3% last month. That said, resurgent US Dollar (USD) demand is weighing on the Euro and exerting some pressure on the EUR/GBP cross.

Furthermore, speculations that the Bank of England (BoE) will be far more aggressive in policy tightening to contain stubbornly high inflation further contributes to capping the upside for the EUR/GBP cross. This, in turn, makes it prudent to wait for strong follow-through buying before confirming that spot prices have formed a near-term bottom and positioning for any meaningful recovery from a fresh YTD low, around the 0.8565 region touched last week.

Technical levels to watch

USD/JPY has continued to trade at just below the 140.00 level. Economists at MUFG Bank analyze Yen outlook.

Wage data disappoints further dampening expectations for BoJ shift

The latest wage data from Japan will have been disappointing for the BoJ who are looking for stronger wage growth to support a sustained pick-up in inflation towards their 2.0% target. The report revealed that labour cash earnings increased by an annual rate of just 1.0% in April down from 1.3% in March, and much lower than the consensus forecast for an increase of 1.8%.

The report is a setback for the BoJ and will reinforce market expectations for the BoJ to maintain current loose policy settings at this month’s policy meeting on 16th June and for the rest of this year unless evidence of much stronger wage growth emerges in the coming months.

Without a shift in BoJ policy, the Yen is more likely to continue trading at weak levels.

- USD/CAD had extended its recovery above 1.3440 amid strength in the US Dollar.

- The overall market mood is cautious despite the improving United States-China trade relationship.

- A continuation of a steady interest rate policy is anticipated by the BoC.

The USD/CAD pair has stretched its recovery to near 1.3440 in the early New York session. The Loonie asset rebounded firmly from near the round-level support of 1.3400 amid strength in the US Dollar Index (DXY). The USD Index has sensed marginal selling pressure after printing a fresh day high to near 104.40.

S&P500 is expected to open on a flat note considering cues from overnight performance. A volatile action is widely anticipated amid voting for a US debt-ceiling raise in Congress. The overall market mood is cautious despite the improving United States-China trade relationship. Reuters reported on Tuesday, China's Vice Foreign Minister and a senior US State Department official had a frank, constructive, and fruitful communication on promoting Sino-US relations and properly managing differences.

A solid recovery from the USD Index has supported the US Treasury yields. The yields offered on 10-year US government bonds have climbed above 3.7%.

Going forward, the interest rate decision by the Bank of Canada (BoC) will remain in focus. BoC Governor Tiff Macklem is expected to keep interest rates steady at 4.5% as Canada’s inflationary pressures are steadily decelerating. Canada’s inflation has already slowed to 4.4% from its recent high of 8.1%. Therefore, the BoC has the luxury of keeping interest rates steady.

On the oil front, oil prices have found intermediate support near $70.00 after a vertical sell-off. More downside in the oil price seems solid as global central banks are preparing for a fresh interest rate hike cycle. It is worth noting that Canada is the leading exporter of oil to the United States and a rebound in the oil price might support the Canadian Dollar.

- USD/JPY reverses an intraday dip and draws support from the emergence of USD dip-buying.

- A goodish intraday pickup in the US Treasury bond yields helps revive demand for the buck.

- Intervention fears, a softer risk tone could underpin the JPY and cap the upside for the major.

The USD/JPY pair attracts some dip-buying in the vicinity of the 139.00 mark on Tuesday and stalls the overnight retracement slide from a multi-day peak. Spot prices build on the steady intraday ascent through the early North American session and climb to a fresh daily high, back closer to the 140.00 psychological mark in the last hour.

As investors look past Monday's disappointing release of the US ISM Services PMI, the US Dollar (USD) regains positive traction and turns out to be a key factor acting as a tailwind for the USD/JPY pair. The intraday USD uptick could be attributed to an intraday uptick in the US Treasury bond yields, though is likely to remain limited in the wake of rising bets for an imminent pause in the Federal Resreve's policy tightening cycle.

In fact, the markets are pricing in a greater chance that the US central bank will leave interest rates unchanged at the end of a two-day policy meeting on June 14. This might hold back the USD bulls from placing aggressive bets. Apart from this, the prospect of Japanese authorities intervening in the markets might further contribute to keeping a lid on any meaningful appreciating move for the USD/JPY pair, at least for the time being.

Furthermore, the prevalent cautious mood - as depicted by a softer tone around the equity markets - could benefit the JPY's relative safe-haven status. That said, a more dovish stance adopted by the Bank of Japan (BoJ) might continue to undermine the JPY and limit the downside for the USD/JPY pair. In the absence of any relevant macro data from the US, the mixed fundamental backdrop warrants caution for aggressive traders.

Technical levels to watch

Economists at Société Générale analyze S&P 500 Index technical outlook.

Beyond 4320, next objectives are 4400/4420 and 4510

S&P 500 Index is heading towards last August high of 4320 which is also close the 61.8% retracement of the whole decline during 2022. In case the move falters around this level, an initial pullback is not ruled out however upper end of previous range at 4200/4180 should be first layer of support.

Beyond 4320, next objectives are located at 4400/4420 and projections of 4510.

GBP/USD trades a little weaker but downside potential looks limited in the short run, in the view of economists at Scotiabank.

Weakness through the mid-1.23 area could signal more downside risk in the short run

Positive price action last week suggests firm support for the GBP should emerge on modest weakness through the upper 1.23 area but trends are not well defined at the moment and weakness through the mid-1.23 area could signal more downside risk for the Pound in the short run.

Gains above 1.2460 are needed to drive Sterling higher.

- EUR/USD has displayed a sheer downside to near 1.0670 posts the release of weak German Factory Orders and Eurozone Retail Sales.

- US firms are facing the wrath of higher interest rates by the Federal Reserve and tight credit conditions by regional banks.

- The European Central Bank is expected to raise interest rates further despite a decline in overall demand.

- EUR/USD is expected to retrace the entire placement of the Fibonacci retracement tool plotted from March 15 low at 1.0516 to April 26 high at 1.1095.

EUR/USD witnessed a vertical fall after retreating from 1.0733 in the early New York session. The major currency pair has dropped to near 1.0670 after the release of weaker-than-anticipated German Factory Orders, Eurozone Retail Sales, and an upbeat US Dollar. The shared currency pair is expected to extend its downside further.

S&P500 futures are holding nominal losses in the late London session. US equities were mildly offered on Monday after the release of the downbeat United States Services PMI reported by the Institute of Supply Management (ISM) agency.

The overall market mood is extremely cautious as weak US economic activities have raised hopes of a recession in the economy ahead. However, Goldman Sachs has shared distinct views about the US recession. The giant investment banking firm has slashed the probability of the US economy reporting recession to 25% from prior chances of 35%. The catalysts behind receding fears of the US recession are a strong labor market and improved business sentiment, as reported by Bloomberg.

Meanwhile, the US Dollar Index (DXY) has extended its resilient recovery to near 104.26 despite mixed cues about Federal Reserve’s (Fed) June monetary policy. Going forward, the lack of US economic indicators releases would keep the entire focus on macroeconomic events.

Contrary to that, the demand for US government bonds has increased ahead of voting for US debt-ceiling bill in Parliament. This has led to a fall in 10-year US Treasury yields to near 3.68%. A poll from Reuters showed that neither US President Joe Biden's Democrats nor Republicans in Congress emerged as a clear winner in the battle to raise the $31.4 trillion debt ceiling.

Mixed responses to Federal Reserve’s policy

The puzzle of whether the Federal Reserve will raise interest rates in June or will keep the monetary policy steady has remained the talk of the town. And, now the release of weak US Services PMI on Monday has added to uncertainty.

On Monday, US ISM Services PMI managed to dodge the 50.0 threshold that separates the boundary of expansion from the contraction phase. The Service PMI for May landed lower at 50.3 vs. the consensus of 51.5. This indicates that the economic indicator has hardly defended the contraction phase and a mild expansion is being recorded in service activity.

Last week, the US Manufacturing PMI contracted for the seventh straight month. It is highly likely that a collaborative impact of contracting factory activity and mildly expanded service activity could push the United States economy into recession.

It seems that firms in the United States region are facing the wrath of higher interest rates by the Federal Reserve and tight credit conditions by US regional banks, which has led to a decline in their overall productivity.

On the other side, the number of fresh talent additions in the labor market is significantly growing each month, which could keep consumer spending at elevated levels and accelerate demand-pull inflation. Therefore, the street is divided about Federal Reserve’s interest rate policy stance for June.

Euro faces pressure after weak German Factory Orders and Eurozone Retail Sales

Economic indicators belonging to Eurozone released in the early London session have uncovered its economic conditions. Deutsche Bundesbank reported a contraction in monthly Factory Orders by 0.4% while the street was anticipating an expansion by 3.8%. Annual Factory Orders contracted significantly by 9.9% vs. the estimates of 8.4% contraction.

Also, Eurozone Retail Sales (April) displayed a poor show. Monthly Retail Sales remained stagnant while the street was anticipating an expansion by 0.2%. Annual Retail Sales contracted by 2.6% vs. expectations of -1.8%. Weak spending and Factory Orders that indicate forward demand indicate that the overall demand in the economy is losing its resilience, which will weigh more pressure on inflation ahead.

In spite of contracting activities, the European Central Bank (ECB) is expected to raise interest rates further to tame stubborn inflation. European Central Bank (ECB) President Christine Lagarde reiterated on Monday that price pressure remains strong in the Euro area.

Economists at Nomura expect the European Central Bank to raise rates twice more from here, i.e. 2x25 bps hikes in June and July for a terminal rate of 3.75%. Thereafter, assuming core price momentum has slowed sufficiently, we think the ECB may call it a day on the hiking cycle.

EUR/USD technical outlook

EUR/USD has retreated after a mean-reversion to near the 89-period Exponential Moving Average (EMA) at 1.0758 on a four-hour scale. The major currency pair is expected to retrace the entire placement of the Fibonacci retracement tool plotted from March 15 low at 1.0516 to April 26 high at 1.1095.

Investors might see a downside momentum if the Relative Strength Index (RSI) (14) drops into the bearish range of 20.00-40.00.

- EUR/USD retreats to the sub-1.0700 region on Tuesday.

- Further weakness could challenge the 1.0630 region.

EUR/USD comes under fresh downside pressure and drops below the key support at 1.0700 the figure on turnaround Tuesday.

The pair remains well under pressure and the continuation of the selling bias should prompt a probable test of the May low at 1.0635 (May 31) to emerge on the horizon in the short term. If spot clears the 1.0600 support it could then open the door to a deeper decline to the March low at 1.0516 (March 15).

Extra losses to the 2023 low of 1.0481 (January 6) would likely need a sharp deterioration of the outlook, which appears not favoured for the time being.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0505.

EUR/USD daily chart

- AUD/USD spikes to its highest level since mid-May in reaction to the RBA’s surprise 25 bps lift-off.

- The cautious market mood revives the USD demand and caps gains for the risk-sensitive Aussie.

- The fundamental backdrop favours bullish traders and supports prospects for additional gains.

The AUD/USD pair gains strong positive traction for the fourth successive day on Tuesday and jump to its highest level since mid-May. Spot prices, however, trim a part of intraday gains and trade around mid-0.6600s, still up nearly 0.50% for the day heading into the North American session.

The Australian Dollar (AUD) strengthens across the board in reaction to the Reserve Bank of Australia's (RBA) surprise 25 bps rate-hike and provides a goodish lift to the AUD/USD pair. The unexpected lift-off for the second straight month pushes the benchmark interest rates above 4% for the first time in nearly 12 years. Moreover, RBA Governor Philip Lowe acknowledged that inflation is still too high and that high prices would cause more economic damage than a near-term rise in interest rates.

Adding to this, the central bank maintains a hawkish bias and said that some further tightening of monetary policy may be required to bring inflation back to its target range within a reasonable timeframe, which further underpins the Aussie. That said, the prevalent cautious mood around the equity markets helps revive demand for the safe-haven US Dollar (USD), which holds back bullish traders from placing fresh bets around the AUD/USD pair and caps any further upside, at least for the time being.

Any meaningful upside for the USD, however, seems limited amid expectations for an imminent pause in the Federal Reserve's (Fed) policy tightening cycle. In fact, the current market pricing indicates a greater chance that the US central bank will leave interest rates unchanged at its upcoming monetary policy meeting on June 13-14. This leads to a further decline in the US Treasury bond yields, which, in turn, should act as a headwind for the Greenback and supports prospects for a further appreciating move for the AUD/USD pair.

The aforementioned fundamental backdrop suggests that the path of least resistance for spot prices is to the upside and any meaningful pullback might still be seen as a buying opportunity. There isn't any relevant market-moving economic data due for release from the US on Tuesday. Hence, market participants now look forward to RBA Governor Philip Lowe's speech and the release of the first quarter GDP report from Australia for some meaningful impetus during the Asian session on Wednesday.

Technical levels to watch

EUR/USD drifts around 1.07. Economists at Scotiabanka nalyze the pair’s technical outlook.

EUR’s undertone remains soft from a short-term technical point of view

EUR’s undertone remains soft from a short-term technical point of view, with spot failing to hold gains overnight and retreating fairly easily back under 1.07. However, the USD itself is struggling to build on gains and really can’t break away from the 1.07 area at this point.

More range trading around the figure seems likely in the short run. The longer the EUR can hold around the 1.07 point, the harder it will be for the USD to strengthen further.

- NZD/USD has attempted a recovery move after correcting to near 0.6070.

- The street is in a tug of war between weak US economic activities and bumper employee additions in the labor market.

- NZD/USD is forming an Inverted Head and Shoulder chart pattern whose breakout propels a bullish reversal.

The NZD/USD pair has attempted a recovery move after correcting to near 0.6070 in the London session. The Kiwi asset is expected to show volatile moves amid an absence of critical triggers.

The US Dollar Index (DXY) has extended its solid recovery to near 104.20 despite the street is mixed about interest rate policy by the Federal Reserve (Fed) for June’s meeting. The street is in a tug of war between weak economic activities and bumper employee additions in the labor market.

Meanwhile, world’s second largest economy has asked its biggest banks to slash down deposit rates in order to boost the economic prospects. Higher liquidity flush into the economy would allow firms to utilize their full capacity. It is worth noting that New Zealand is one of the leading trading partners of China and higher factor and service activities in China will support the New Zealand Dollar.

NZD/USD is forming an Inverted Head and Shoulder chart pattern on an hourly scale, which indicates a prolonged consolidation, and a breakout of the same results in a bullish reversal. The neckline of the aforementioned chart pattern is plotted from May 25 high at 0.6110.

The 20-period Exponential Moving Average (EMA) at 0.6076 is providing cushion to the Kiwi bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is making efforts for shifting into the bullish range of 60.00-80.00. An occurrence of the same will trigger an upside momentum.

A confident break above May 25 high at 0.6110 will drive the Kiwi asset toward May 01 low at 0.6160 followed by the round-level resistance at 0.6200.

Alternatively, a downside move below the intraday low at 0.6015 will expose the asset for a fresh six-month low toward 11 November 2022 low at 0.5984. A slippage below the latter would expose the asset toward 02 November 2022 high at 0.5941.

NZD/USD hourly chart

CAD gets a minor lift ahead of tomorrow’s BoC decision. Economists at Scotiabank analyze USD/CAD outlook.

USD/CAD to retest the low 1.33 zone once below 1.34

A minority of forecasters (including a couple of other Canadian banks and two, large Wall St firms) have joined Scotia’s call for a 25 bps hike this week but this remains a non-consensus call.

Markets may hold intraday – considering tomorrow’s nontechnical event risk – before a move develops but the technical pointers are tilted lower.

Resistance is 1.3465 and 1.3525/50.

Below 1.34, spot should retest the low 1.33 zone.

- DXY reverses the negative price action seen at the beginning of the week.

- Extra recovery could see the May high around 104.80 revisited.

DXY manages to regain some composure following Monday’s retracement and revisits the 104.20 region on Tuesday

Considering the current price action, another visit to the May peak of 104.79 (May 31) should remain on the table in the relatively near term. From here, the index could target the minor hurdle at the round level of 105.00 ahead of the crucial 200-day SMA, today at 105.53.

Looking at the broader picture, while below the 200-day SMA, the outlook for the index is expected to remain negative.

DXY daily chart

Economists at Société Générale analyze EUR/USD technical outlook.

Upside capped at 1.0860/1.0900

The pair has formed an interim trough near 1.0630. An initial bounce is underway, however, it would be interesting to see if it can reclaim 1.0860/1.0900, the 61.8% retracement of the down move. Failure could mean possibility of one more down leg.

Next important support zone is located at 1.0510/1.0480 representing low of March and the 200-DMA. In case the pair fails to defend it, there would be risk of a larger downtrend.

- GBP/JPY has rebounded back above 173.00 as the odds for an interest rate hike by the BoE remain upbeat.

- The BoJ is committed to continuing quantitative easing to push inflation steadily above 2%.

- UK’s consumer spending for durables has dropped as households are facing the burden of higher interest rates and stubborn inflation.

The GBP/JPY pair has shown a V-shape recovery after printing an intraday low of 172.68 in the European session. The cross witnessed a stellar buying interest as the Bank of Japan (BoJ) is committed to continuing quantitative easing to push inflation steadily above 2%.

Inflation in Japan is majorly derived from higher imported goods while less dependent on domestic demand and higher wages. The BoJ is consistently making efforts for increasing wages in order to increase domestic demand to keep inflation higher.

This week, Japan’s Gross Domestic Product (GDP) will be keenly watched. Thursday’s GDP data is expected to expand by 0.5% vs. prior expansion of 0.4% on a quarterly basis. Annualized Q1 GDP is seen steady at 1.6%.

Meanwhile, the headline came that the Bank of England (BoE) has allotted 10 million Pound Sterling in six-month Indexed Long-Term repo (ILTR) operations to match banks’ bids. Investors should note that LTRs allow market participants to borrow central bank reserves for a six-month period in exchange for less liquid assets.

In the United Kingdom, consumer spending for non-essential items has dropped as households are facing the burden of higher interest rates and stubborn inflation. Households are restricting themselves from purchasing durables as interest obligations are higher over time.