- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/CAD holds steady around 1.3500 in Friday’s early Asian session.

- US ISM Services PMI came in stronger than expected, while private sector payrolls grew the smallest gain since 2021 in August.

- The US and Canadian employment reports will be the highlights on Friday.

The USD/CAD pair trades on a flat note near 1.3500 during the early Asian session on Friday. The US Dollar Index (DXY) extends its decline to near the 101.00 psychological support level. Traders prefer to wait on the sidelines ahead of the key events on Friday. The US and Canadian employment reports will take center stage later in the day.

Data released by Automatic Data Processing (ADP) on Thursday showed that private sector employment increased by 99,000 in August and annual pay was up 4.8% year-over-year. This figure followed the 111,000 (revised from 122,000) increase seen in July and below the estimation of 145,000 by a wide margin.

Meanwhile, the weekly US Initial Jobless Claims rose to 227,000, compared to the previous reading of 232,000 (revised from 231,000) and below the initial consensus of 231,000). On the positive side, US ISM Services PMI rose to 51.5 in August from 51.4 in July, above the market expectation of 51.1.

A rise in the US Unemployment Rate in July sparked fears of a looming recession in the United States and triggered the expectation of a larger rate cut by the Federal Reserve (Fed). The employment data will be released on Friday, including Nonfarm Payrolls (NFP), Unemployment Rate and Average Hourly Earnings. These reports could significantly influence the size and pace of the Fed’s easing cycle. Any signs of a weaker US labor market could exert some selling pressure on the Greenback in the near term.

On the other hand, the speculation that the Bank of Canada (BoC) will cut additional interest rates this year might undermine the Loonie and cap USD/CAD’s downside. The BoC cut its benchmark interest rate for the third consecutive time on Wednesday. The BoC governor Tiff Macklem said “If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in our policy rate.” Looking ahead, the Canadian employment data will also be in the spotlight on Friday.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD rose on Thursday, climbing back over 1.1100.

- Gains remain limited after miss in EU Retail Sales.

- US NFP print due on Friday takes the center stage for the week.

EUR/USD stepped into a second straight day of gains on Thursday, recapturing the 1.1100 handle as markets broadly sell off the Greenback in advance of Friday’s hotly-anticipated US Nonfarm Payrolls (NFP) jobs report. Markets are looking for further signs that the Federal Reserve (Fed) is on pace to deliver an initial rate trim and kick off a rate cutting cycle in September, but US data will need to continue softening to keep rate cut hopes on the high side.

European economic data did little to provide additional support for the Fiber after July’s EU Retail Sales missed the mark. YoY Retail Sales came in worse than expected, printing at -0.1% for the year ended in July and missing the expected rebound to 0.1% compared to the revised last -0.4% contraction.

According to payroll processor ADP, the US added 99K net new jobs in August, down from July’s revised 111K and well below the expected 145K. August’s ADP additions are the lowest print since early 2021, sparking a fresh round of risk aversion and reigniting investor concerns that the US could be heading into a recession.

The ADP jobs report serves as a bellwether for what markets can expect from Friday’s upcoming US NFP report, albeit one with a wobbly track record for accuracy. August’s NFP print represents the last significant labor update before the Federal Reserve’s (Fed) upcoming rate call on September 18, when Fed policymakers are broadly expected to kick off a rate-cutting cycle. Friday’s NFP print is slated to come in at 160K compared to the previous month’s 114K.

According to the CME, rate markets are currently betting on 40% odds that the Fed will blow the doors open with a 50 bps cut later in the month. The remaining 60% are betting on a more demure 25 bps opening rate trim. Investors are anticipating using this Friday’s NFP print as a way to gauge the depth of the Fed’s first rate cut since the Fed slashed 100 bps in March of 2020.

EUR/USD price forecast

Bidders continue to come out of the woodwork to keep bids on balance even if they can’t quite pull out a bullish recovery. EUR/USD popped into a 13-month high just above 1.1200 early last week, and a near-term pullback in Greenback flows sees bids scrambling to hold onto bullish chart paper.

The pair still trades well north of the 200-day Exponential Moving Average (EMA) at 1.0845. Despite holding deep in the bull country, EUR/USD still faces a steepening bearish pullback as shorts congregate targets just above the 50-day EMA at 1.0956.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD found a second day of gains as bidders return to Cable.

- Despite a miss in US early US jobs data, sentiment remains high on rate cut hopes.

- US NFP data on Friday to serve as a dipstick on the depth of upcoming Fed rate trim.

GBP/USD climbed for a second straight day on Thursday, setting up for a bullish recovery despite failing to recapture the 1.3200 level. Market sentiment held on the high side as a decline in new jobs growth kept hopes for an extended rate cut from the Federal Reserve (Fed) pinned to the ceiling.

UK data remains thin on the economic docket as markets wind into Friday. US Nonfarm Payrolls (NFP) jobs additions due in the last US market session of the week promise to be a big event that will draw plenty of investor eyes.

According to payroll processor ADP, the US added 99K net new jobs in August, down from July’s revised 111K and well below the expected 145K. August’s ADP additions are the lowest print since early 2021, sparking a fresh round of risk aversion and reigniting investor concerns that the US could be heading into a recession.

The ADP jobs report serves as a bellwether for what markets can expect from Friday’s upcoming US NFP report, albeit one with a wobbly track record for accuracy. August’s NFP print represents the last significant labor update before the Federal Reserve’s (Fed) upcoming rate call on September 18, when Fed policymakers are broadly expected to kick off a rate-cutting cycle. Friday’s NFP print is slated to come in at 160K compared to the previous month’s 114K.

According to the CME, rate markets are currently betting on 40% odds that the Fed will blow the doors open with a 50 bps cut later in the month. The remaining 60% are betting on a more demure 25 bps opening rate trim. Investors are anticipating using this Friday’s NFP print as a way to gauge the depth of the Fed’s first rate cut since the Fed slashed 100 bps in March of 2020.

GBP/USD price forecast

Despite an second intraday recovery in a row on Wednesday, Cable remains down from multi-month highs above 1.3250. The pair is sticking stubbornly to recent highs after vaulting to a peak 29-month bid in August. Price action is still tilted firmly into the bullish side above the 200-day Exponential Moving Average (EMA) at 1.2725, while the immediate downside technical target for shorts will be the 50-day EMA just above the 1.2900 handle.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/JPY remains pressured near 143.39, with momentum indicators favoring a bearish continuation toward 143.00 and 142.50 support levels.

- Failure to decisively clear 143.44 may offer a recovery opportunity for USD bulls if US Nonfarm Payrolls data impresses.

- Key resistance sits at 145.03 (Tenkan-Sen), with further hurdles at 145.73 (Kijun-Sen) and the 150.00 figure.

USD/JPY extended its losses for the third consecutive day, hitting a four-week low of 142.85, yet traders lifted the pair, which closed Thursday's session with losses of 0.21%. As Friday’s Asian session begins, the pair trades at 143.39, virtually unchanged.

USD/JPY Price Forecast: Technical outlook

The USD/JPY fell toward multi-week lows but failed to decisively clear the August 26 swing low of 143.44. This can pave the way for a recovery for USD bulls, who struggled with the drop in the US 10-year T-note yield.

Despite this, momentum favors further downside, as shown by the Relative Strength Index (RSI). With this and first-tier US August’s Nonfarm Payrolls report looming, the path of least resistance is for a bearish continuation.

The USD/JPY's first support would be the August 26 daily low of 143.44. A breach of the latter would expose key psychological support levels, like the 143.00 mark. This would be followed by the current week's low of 142.85, ahead of key psychological levels, the 142.50 mark and 142.00.

Conversely, an upbeat US jobs report will expose key resistance levels. First, the Tenkan-Sen will be at 145.03, followed by the Kijun-Sen at 145.73, before reclaiming the 150.00 figure above the latest cycle high of 149.39.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.00% | 0.02% | -0.04% | -0.00% | -0.01% | 0.00% | 0.03% | |

| EUR | 0.00% | 0.02% | -0.06% | -0.02% | 0.02% | -0.01% | 0.02% | |

| GBP | -0.02% | -0.02% | -0.06% | -0.02% | -0.02% | -0.01% | 0.00% | |

| JPY | 0.04% | 0.06% | 0.06% | 0.05% | 0.05% | 0.03% | 0.07% | |

| CAD | 0.00% | 0.02% | 0.02% | -0.05% | -0.01% | 0.00% | 0.02% | |

| AUD | 0.00% | -0.02% | 0.02% | -0.05% | 0.00% | -0.01% | 0.01% | |

| NZD | -0.00% | 0.00% | 0.01% | -0.03% | -0.01% | 0.00% | 0.01% | |

| CHF | -0.03% | -0.02% | -0.01% | -0.07% | -0.02% | -0.01% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- NZD/USD is consolidating around 0.6225 with bullish traction flat.

- The RSI is rising at 60 while the MACD flat green bars paint a neutral to bullish outlook.

The NZD/USD continues consolidating around 0.6225 with bulls taking a breather but seeming to be gathering strength before their next upwards leg. Bears made a stride at the beginning of the week pushing the pair down by nearly 1% but those movements seem to have been only corrective as the overall outlook is on the bull's side.

The Relative Strength Index (RSI) has risen to 60 while the Moving Average Convergence Divergence (MACD) is flat green bars suggesting that while momentum is positive, it seems to be flattening favoring the side-ways movements. The volume is also average, which suggests that the bullish momentum may be limited

NZD/USD daily chart

Looking at the support and resistance levels, the pair is facing resistance at the 0.6250 level. A break above this level could open the door for further gains. On the downside, the pair is facing support at the 0.6200-0.6180 level. A break below this level could shift the tide in favor of the bears.

- USD/CHF retreats 0.20%, testing support levels after US labor data fuels expectations of aggressive Fed rate cuts.

- The pair eyes a retest of the year-to-date low of 0.8400, with further downside targeting 0.8332 and 0.8300.

- For a bullish recovery, USD/CHF must clear the August 15 swing high at 0.8748.

The USD/CHF retreated late in the New York session, down 0.20%, as US jobs data revealed the labor market is cooling, which could warrant the Federal Reserve's (Fed) “aggressive” rate cuts. At the time of writing, the pair trades at 0.8447 after hitting a daily high of 0.8490.

USD/CHF Price Forecast: Technical outlook

USD/CHF's failure to clear the key resistance trendline around 0.8530-50 sponsored a leg-down on the pair. On its path toward the current exchange rate, the pair cleared the 0.8500 figure, tested today.

Momentum favors sellers, as the Relative Strength Index (RSI) shows. This could help refresh the year-to-date (YTD) low of 0.8400, hit on August 29.

If USD/CHF clears 0.8400, the next support would be last year’s low of 0.8332 before challenging 0.8300.

The USD/CHF pair must clear the August 15 swing high at 0.8748 for a bullish recovery.

USD/CHF Price Action – Daily Chart

Swiss Franc PRICE Today

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.23% | -0.24% | -0.02% | -0.22% | -0.41% | -0.32% | |

| EUR | 0.25% | 0.03% | 0.02% | 0.27% | 0.04% | -0.11% | -0.07% | |

| GBP | 0.23% | -0.03% | -0.02% | 0.23% | 0.00% | -0.15% | -0.10% | |

| JPY | 0.24% | -0.02% | 0.02% | 0.22% | 0.02% | -0.15% | -0.07% | |

| CAD | 0.02% | -0.27% | -0.23% | -0.22% | -0.19% | -0.36% | -0.31% | |

| AUD | 0.22% | -0.04% | -0.01% | -0.02% | 0.19% | -0.17% | -0.10% | |

| NZD | 0.41% | 0.11% | 0.15% | 0.15% | 0.36% | 0.17% | 0.06% | |

| CHF | 0.32% | 0.07% | 0.10% | 0.07% | 0.31% | 0.10% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

- AUD/USD gains on soft US data and RBA’s hawkish outlook.

- RBA Bullock reiterates hawkish stance, signaling no near-term rate cuts.

- Monetary policy diveargence favors the Aussie as US data softens and RBA remains hawkish.

The AUD/USD pair traded in a tight range on Thursday but tallied daily gains after the USD was seen weak after mixed US data.

The Australian economy's uncertain prospects and the Reserve Bank of Australia's (RBA) aggressive stance on interest rates have led to a shift in market expectations. However, the bank hasn't yet embraced cuts in the near term.

Daily digest market movers: Australian Dollar gains slightly after trade figures and hawkish RBA

- Australian exports rose 0.7% MoM and 1.4% YoY in July, while imports fell by 0.8% MoM and 3.0% YoY.

- Exports to China slumped significantly in July, with coal and iron ore prices continuing to decline.

- On Thursday, RBA Governor Bullock maintained a hawkish stance, reiterating that the Board does not expect to cut rates in the near term.

- Across the Pacific, US labor market data disappointed, while ISM Services PMI figures helped the USD recover some losses.

- Monetary policy divergence continues to favor the Aussie, with RBA cash rate futures pricing in a high probability of a 25 bps cut by December.

AUD/USD technical outlook: Indicators flash mixed signals, overall outlook remains positive

On the daily chart, the Relative Strength Index (RSI) points up while the Moving Average Convergence Divergence (MACD) prints a red bar, and both flash mixed signals. However, with the pair above the Simple Moving Average (SMA), the overall outlook is positive, with the pair set to retest the zone above 0.6780.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Gold rises above $2,500, peaking at $2,523 before profit-taking ahead of key US economic data.

- Traders price in over 104 bps of Fed easing, expecting rate cuts to maintain labor market stability.

- Falling US Treasury yields and a weaker US Dollar support further upside in Gold prices.

Gold prices rallied sharply during the North American session, above the $2,500 figure on Thursday, yet remain shy of their daily peak of $2,523 as traders booked profits ahead of first-tier United States (US) data. At the time of writing, XAU/USD trades at $2,516, gaining over 0.80%.

In the early morning, US jobs data showed mixed readings, though it confirmed that the labor market is cooling, fueling speculation for a 50-basis-point (bps) interest rate cut by the Federal Reserve (Fed) in two weeks. On the other hand, the economy remains resilient as business activity in the services segment improved against projections of a slowdown.

However, Gold traders lifted the yellow metal above $2,500, as they priced in over 104 bps of Fed easing, according to the December 2024 Chicago Board of Trade (CBOT) fed funds futures contract.

What is almost certain is that the Fed may lower borrowing costs, according to San Francisco Fed President Mary Daly. She commented that the Fed needs to cut rates to keep the labor market healthy.

US Treasury yields fell after the data with the 10-year Treasury note down three basis points to 3.727%, undermining the buck. The US Dollar Index (DXY), a measure of the Greenback’s value against the other six currencies, tumbles over 0.21% to 101.05.

In the meantime, Gold traders are preparing for the release of the August Nonfarm Payrolls (NFP) report.

Daily digest market movers: Gold price surges ahead of US NFP data

- Figures of the ADP National Employment Change showed that private companies hired fewer people than expected, adding just 99K in August, well beneath the 145K expected and downwardly revised July figures.

- Initial Jobless Claims for the week ending August 31, hit 227K, below the 230K projected and the previous 232K.

- ISM Services Purchasing Managers Index (PMI), a measure of business activity, improved. The index hit 51.5 vs 51.4 in July and above the 51.1 projected by the consensus.

- August’s NFP figures are expected to rise from 114K to 163K, while the Unemployment Rate could dip, according to the consensus, from 4.3% to 4.2%.

Technical outlook: Gold price buyers reclaim $2,500

Gold prices had risen to new two-week highs above $2,500 before the NFP report's release. Price action shows buyers are gathering momentum as demonstrated by the Relative Strength Index (RSI), aiming for the upside in bullish territory.

That said, the XAU/USD path of least resistance is tilted to the upside, and it might challenge the year-to-date (YTD) high at $2,531. If surpassed, the next stop would be the psychological $2,550, followed by the $2,600 mark.

Conversely, if XAU/USD drops below $2,500, the next support would be the August 22 low at $2,470. Once cleared, the next demand zone would be the confluence of the April 12 high, which turned support, and the 50-day Simple Moving Average (SMA) at $2,435-$2,431.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The Greenback added to the weekly leg lower and pierced the key 101.00 barrier against the backdrop of persistently low US yields across the curve and steady speculation of a potential half-point interest rate cut by the Fed.

Here is what you need to know on Friday, September 6:

The US Dollar Index (DXY) added to previous losses and put the 101.00 support to the test amidst rising cautiousness prior to the release of the US labour market report on Friday. The crucial Nonfarm Payrolls, and the Unemployment Rate are due on September 6, along with the speech by the Fed’s Williams (New York).

EUR/USD built on Wednesday’s gains and reclaimed the 1.1100 barrier and beyond on the back of a continuous downward bias in the US Dollar. The German Balance of Trade results and Industrial Production are expected on September 6, followed by the third estimate of the Q2 GDP Growth Rate and final Employment Change data in the broader Euroland.

GBP/USD rose further in line with the rest of its risk peers, coming close to the key 1.3200 hurdle amidst persistent Dollar weakness. On September 6, the Halifax House Price Index is due, along with the BBA Mortgage Rate.

USD/JPY retreated to new four-week lows after breaking below the key 143.00 support following a weaker Dollar, lower yields, and hawkish remarks from a BoJ official. Household Spending data and preliminary Coincident Index and Leading Economic Index will be published on September 6.

AUD/USD rebounded further, maintaining the trade above the key 0.6700 barrier following the selling pressure in the Greenback, a recovery in commodity prices, and the cautious tone from the RBA’s Bullock. Home Loans and Investment Lending for Homes will be unveiled on September 6.

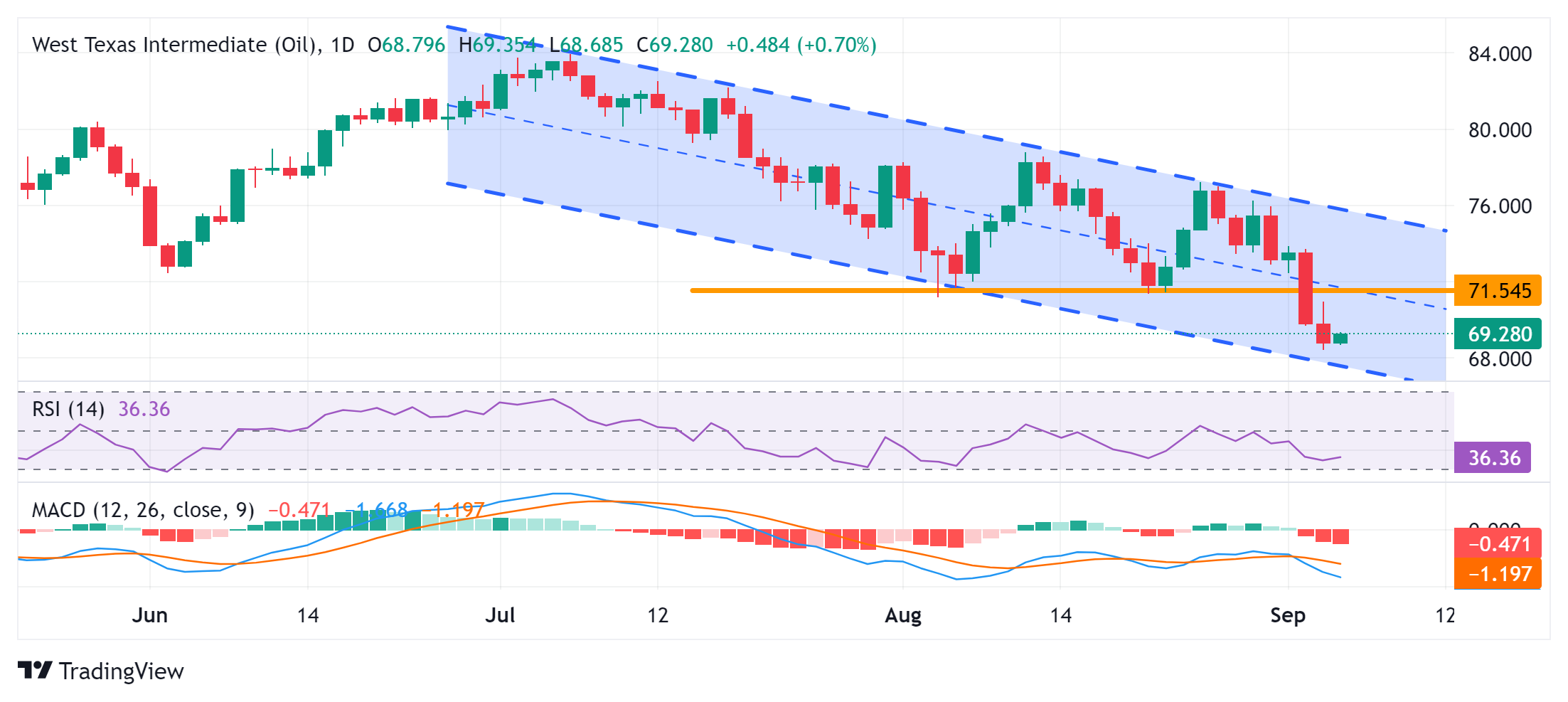

Quite a volatile day saw prices of WTI clinch a new 2024 low near $68.80, although regaining some upside momentum afterwards in response to positive news from the OPEC+ as well as a bullish report from weekly US crude oil inventories by the EIA.

Prices of Gold climbed past the $2,520 mark per ounce troy, adding to Wednesday’s advance on the back of further downside pressure in the US Dollar and shrinking US yields. Silver rallied to weekly tops, surpassing the $29.00 mark per ounce and flirting with the interim 55-day and 100-day SMAs.

- The Dow Jones backslid 400 points on Thursday as economic concerns persist.

- Investors are growing increasingly worried about a recession as hiring slows.

- Friday’s NFP jobs data dump looms over the horizon as investors begin to stress.

The Dow Jones Industrial Average (DJIA) ground 400 points lower on Thursday, shedding weight for the second time this week after US jobs data came in below expectations. Equities have since recovered from the day’s initial shock selloff, but the Dow Jones is struggling to return to flat for the day. ADP Employment Change showed its slowest rate of job additions since February of 2021, sparking a fresh round of risk aversion as investors grapple with the threat of a possible recession within the US economy.

According to payroll processor ADP, the US added 99K net new jobs in August, down from July’s revised 111K and well below the expected 145K. August’s ADP additions are the lowest print since early 2021, sparking a fresh round of risk aversion and reigniting investor concerns that the US could be heading into a recession.

The ADP jobs report serves as a bellwether for what markets can expect from Friday’s upcoming US Nonfarm Payrolls (NFP) report, albeit one with a wobbly track record for accuracy. August’s NFP print represents the last significant labor update before the Federal Reserve’s (Fed) upcoming rate call on September 18, when Fed policymakers are broadly expected to kick off a rate-cutting cycle.

According to the CME, rate markets are currently betting on 40% odds that the Fed will blow the doors open with a 50 bps cut later in the month, with the remaining 60% betting on a more demure 25 bps opening rate trim. Investors are anticipating using this Friday’s NFP print as a way to gauge the depth of the Fed’s first rate cut since the Fed slashed 100 bps in March of 2020.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Sep 05, 2024 12:15

Frequency: Monthly

Actual: 99K

Consensus: 145K

Previous: 122K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Dow Jones news

The Dow Jones plunged around 400 points on Thursday before recovering to a more modest 150 point decline. Despite a broad-base recovery bid, the DJIA was still tilted heavily towards the bearish side, with all but five of the equity index’s constituent securities testing into the red. Merch & Co (MRK) managed to squeeze out a 3.28% gain despite Thursday’s bearish overtones, rising to $119.60 per share, while biotech firm Amgen (AMGN) declined 1.62% to $325.28 per share as traders take a breather from bidding up the medical tech firm ,which is still up over 28% for the past year.

Elswhere on the Dow Jones, Verizon (VZ) stumbled after stockholders reacted poorly to the news that VZ will be forking over $20 billion to acquire Frontier Communications (FYBR).

Dow Jones price forecast

Despite a fresh intraday test into the low end, the Dow Jones continues to play in a technical range just south of the 41,000 handle. The DJIA is still trading on the south side of recent all-time highs above 41,500, but the odds of an extended bearish pullback are draining out of the index as bidders continue to challenge downside momentum.

The long-term trend still clearly favors the high side, and even a determined push from collecting short positions will run into trouble at the 50-day Exponential Moving Average (EMA) rising through 40,300.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- US Dollar weakened on Thursday after mixed US economic data.

- S&P Global Services PMI and ISM Services PMI showed expansion in the service sector.

- Labor data showed some signs of weaknesses.

On Thursday, the US Dollar Index (DXY), a measure of the USD against a basket of six currencies experienced volatility following the release of mixed economic data from the United States. Labor data showed weakness in the sector, while Services figures were strong.

With the US economic outlook mixed, signs of cooling in the labor market are making investors put some bets on a larger cut in September.

Daily digest market movers: US Dollar stands weak after labor figures, steady dovish bets

- ADP Employment Change missed estimates, falling to 99,000 from 122,000, while the prior month was revised down to 111,000.

- Initial Claims came in at 227,000 from 232,000 previously, while Continuing Claims fell from 1.860 million to 1.838 million.

- In addition, Nonfarm Productivity saw a small uptick to 2.5% from 2.3%, while Labor Cost fell from 0.9% to 0.4%.

- S&P Global's Services PMI rose from 55.2 to 55.7, and the Composite PMI increased from 54.1 to 54.6. The ISM's Services PMI improved slightly from 51.4 to 51.5.

- Contributing to the cooling labor market, the Employment Index in the ISM Services PMI declined from 51.1 to 50.2.

- Following the data, the CME Fedwatch Tool indicates a 55% chance of a 25 bps rate cut in September and a 45% chance of a 50 bps cut, with further cuts expected thereafter.

DXY technical outlook: Technicals suggest continued bearish momentum, testing support at 100.50

The DXY index's technical indicators have resumed their downward trajectory and remain in negative territory. Despite a recent recovery attempt, the index encountered resistance at its 20-day Simple Moving Average (SMA), resulting in a rejection of buyers.

As a result, the DXY is poised to revisit the 100.50 (August lows) support level. Above, support levels include 101.30, 101.15, and 101.00, while resistance levels are located at 101.80, 102.00, and 102.30.

Indicators-wise, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) continue to suggest bearish momentum as they are still in negative terrain.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- USD/MXN rises 0.20% to 19.97, hitting a four-week low of 20.14 amid ongoing political turmoil in Mexico.

- Judicial reform bill awaits Senate approval with potential consequences for US-Mexico relations and market sentiment.

- Mexico’s upcoming inflation data and US NFP are key factors that could influence further Peso movement.

The Mexican Peso fell against the Greenback during the New York session, hitting a four-week low of 20.14. The financial markets continued to digest the lower house decision to approve President Andres Manuel Lopez Obrador's (AMLO) bill to make changes to the judicial system. The Peso extended its losses for the third straight day and finally cracked the psychological barrier of 20.00 as traders began to ditch the Mexican currency. The USD/MXN trades at 20.01, up 0.40%.

Mexico’s economic docket is scarce with investors eyeing the release of automobile industry data on Friday. Next week, inflation figures will garner attention after the Bank of Mexico (Banxico) decided to lower borrowing costs despite revising their inflation projections upward.

Back to political developments, two-thirds of the Senate must now approve the judicial reform bill. Morena’s ruling party is shy of one vote, but if the bill is cleared, it will be passed to 32 local congresses for their approval. Once the bill is approved in 17 of those states, the changes to the Mexican Constitution will be officially made.

On Tuesday, the US Ambassador in Mexico, Ken Salazar, expressed that the approval of the judiciary reform could damage relations between Mexico and the United States.

Across the border, the US docket has been busy releasing jobs and the ISM and S&P Global Services PMI data. The ADP National Employment Change for August was dismal with missed estimates and a downward revision of July’s numbers.

Even though the Greenback weakened, it was a short-lived dip. Data released by the US Department of Labor showed that the number of Americans filing for unemployment benefits was lower than expected.

According to the CME FedWatch Tool, odds for a 50 bps Fed rate cut are at 39%; while for a quarter of a percentage point, 61%.

Now that most of the data is out of the way, traders will focus on the release of the August Nonfarm Payrolls (NFP) report.

Daily digest market movers: Mexican Peso extended its losses despite mixed US data

- Mexico’s data revealed during the week show the economy is slowing due to higher interest rates set by the Bank of Mexico.

- Most banks expect the Bank of Mexico (Banxico) to reduce rates by at least 50 basis points (bps) for the remainder of 2024. This would pressure the Mexican currency, which has depreciated 17.38% year to date.

- US ADP Employment Change for August dipped from 111K to 99K, missing estimates of 145K. Contrarily, Initial Jobless Claims for the week ending August 31 slid from 232K to 227K, lower than the 230K expected.

- ISM Services PMI for August was better than projections, increasing by 51.5 from 51.4 in July, above the consensus for a 51.1 drop.

- US Nonfarm Payrolls in August are expected to grow from 114K to 163K, while the Unemployment Rate is foreseen ticking lower from 4.3% to 4.2%.

- Data from the Chicago Board of Trade (CBOT) suggests the Fed will cut at least 104 basis points this year, up from a day ago’s 103 bps, according to the fed funds rate futures contract for December 2024.

Technical outlook: Mexican Peso weakens as USD/MXN rallies above 20.00

Politics is the driver of the USD/MXN exchange rate. As traders digested the lower house approval of the bill, foreign investors had grown worried about changes to the Mexican Constitution.

Therefore, the USD/MXN cleared the 20.00 psychological barrier as buying momentum began to build as seen on the Relative Strength Index (RSI). The RSI registered a new peak, and if the uptrend gains steam, it will exert additional pressure on the Peso.

If USD/MXN clears the YTD high at 20.22, the next stop would be the September 28, 2022, daily high at 20.57. If those two levels are surrendered, the next stop would be August 2, 2022 swing high at 20.82, ahead of 21.00.

Conversely, if USD/MXN weakens further, the first support would be 19.50. A breach of the latter will expose the August 23 swing low of 19.02 before giving way for sellers eyeing a test of the 50-day Simple Moving Average (SMA) at 18.65.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The EUR/GBP pair faces a mixed outlook despite trading above 0.8400.

- Bearish signals from RSI and MACD, but momentum is flattening.

- The pair might consolidate within a range between 0.8400 and 0.8450.

In Thursday's session, the EUR/GBP pair mildly declined to 0.8425 while the pair faced a mixed technical outlook with indicators flat in negative terrain. It all points out to bears taking a breather after shedding more than 1% in August.

The Relative Strength Index (RSI) remains in negative territory, around 39, with a mildly declining slope, signaling flattening bearish momentum. The Moving Average Convergence Divergence (MACD) prints flat red bars, further reinforcing the flattening bearish traction. Additionally, volumes have been decreasing over the last few sessions.

The EUR/GBP pair is consolidating above the 0.8400 level after August's sharp downward movements, which acts as immediate support, with resistance at 0.8430. If the pair breaks above this level, it could target 0.8450 and 0.8470. On the downside, immediate support is seen at 0.8400, followed by 0.8350.

EUR/GBP Daily chart

- GBP/USD remains above 1.3100, with RSI showing buyers in control and eyeing 1.3200 resistance.

- Clearing 1.3179 would open the door to challenge the March 2022 high of 1.3298, with further upside to 1.3437.

- A pullback below 1.3150 could lead to testing key support at 1.3100 and 1.3044, with the 50-DMA at 1.2914.

The GBP/USD aims up during the North American session, after jobs data from the United States (US) was mixed, while business activity expanded. Despite this, the pair clings to its gains and trades at 1.3166 above its opening price by 0.15% at the time of writing.

GBP/USD Price Forecast: Technical outlook

The GBP/USD has remained above the 1.3100 figure but has been capped on the upside so far as traders await the release of August’s Nonfarm Payrolls on Friday. The Relative Strength Index (RSI) shows that buyers are in charge and could sponsor a leg-up towards 1.3200.

If GBP/USD resumes to the upside and clears 1.3179, a move to 1.3200 will be made on the cards. A breach of the latter and will expose the March 23, 2022, peak at 1.3298 before challenging the March 1, 2022, cycle high at 1.3437.

Conversely if sellers step in and push GBP/USD below 1.3150, look for a pullback to 1.3100. Despite this, bears must clear the September 3 low of 1.3087 if they remain hopeful of lower exchange rates. The next key support levels would be July 17, high at 1.3044, followed by the 1.3000 figure and the 50-day moving average (DMA) at 1.2914.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.03% | -0.09% | 0.14% | 0.06% | 0.04% | -0.11% | 0.22% | |

| EUR | -0.03% | -0.10% | 0.16% | 0.06% | 0.01% | -0.09% | 0.19% | |

| GBP | 0.09% | 0.10% | 0.23% | 0.17% | 0.11% | 0.00% | 0.29% | |

| JPY | -0.14% | -0.16% | -0.23% | -0.09% | -0.13% | -0.27% | 0.06% | |

| CAD | -0.06% | -0.06% | -0.17% | 0.09% | -0.02% | -0.16% | 0.14% | |

| AUD | -0.04% | -0.01% | -0.11% | 0.13% | 0.02% | -0.12% | 0.18% | |

| NZD | 0.11% | 0.09% | -0.01% | 0.27% | 0.16% | 0.12% | 0.30% | |

| CHF | -0.22% | -0.19% | -0.29% | -0.06% | -0.14% | -0.18% | -0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Signs of extreme upside asymmetry are playing out in Platinum markets, TDS Senior Commodity Strategist Daniel Ghali notes.

CTAs to buy 5% of their max size this session

“We highlighted that even a small reversal in prices can now spark massive CTA buying activity in Platinum markets over the coming week, and today's price action should help to spark the first such CTA buying program. We expect CTAs to buy 5% of their max size this session, which represents only a fraction of the total +60% they could plausibly buy over the coming sessions in an uptape.”

“At current levels, even in a flat tape, CTAs would be set to completely cover their shorts over the coming week. This set-up for algo flows bodes very well for additional upside on the horizon, reinforcing our view that Platinum prices have now already printed their local lows.”

“A substantial increase in SGE Platinum volumes amid the recent slump further suggests dip buyers have emerged in physical markets, in line with our view.”

- ISM Services PMI stood in expansion territory above 50 in August.

- US Dollar Index turns flat on the day above 101.00.

The economic activity in the US service sector expanded at a moderate pace in August, with the ISM Services PMI edging higher to 51.5 from 51.4 in July. This reading came in above the market expectation of 51.1.

Other details of the report showed that the Prices Paid Index, the inflation component, rose to 57.3 from 57, while the Employment Index declined to 50.2 from 51.1.

Assessing the survey's findings, "low-to-moderate growth was cited across many industries, while ongoing high costs and interest-rate pressures were often mentioned as negatively impacting business performance and driving softness in sales and traffic," said Steve Miller, Chair of the Institute for Supply Management (ISM) Services Business Survey Committee.

"Although the Inventories Index increased by 3.1 percentage points into expansion territory in August, many respondents indicated their companies are still actively managing down their inventories," Miller added.

Market reaction

The US Dollar Index recovered modestly with the immediate reaction to the PMI data and was last seen flat on the day at 101.24.

Gold is trading near all-time highs, awaiting the NFP release just weeks ahead of the highly-anticipated start of a rate cutting cycle, TDS Senior Commodity Strategist Daniel Ghali notes.

Gold is trading near all-time highs

“Today's miss on ADP doesn't bode well for a directional beat in NFP, but that is not a necessary condition for Gold prices to fizzle out. Certainly, the beat TD Securities expects on NFP could help catalyze a shift in positions, but our read on positioning dynamics is now already at extreme levels that have historically marked significant turning points in Gold markets.”

“Macro fund positioning is now at levels only seen during the Brexit referendum in 2016, the "stealth QE" narrative in 2019, or in the peak panic of the Covid-19 crisis in March 2020. This time around, physical markets have already fizzled out, whereas we also see extremes in Shanghai trader positions alongside CTA trend followers. Downside risks are more potent.”

- Silver price jumps sharply to near $29.00 as the Fed is expected to deliver a bigger interest rate cut this month.

- Weak private sector employment data weighs on the US Dollar and bond yields.

- Investors await the US NFP data for August, which will be published on Friday.

Silver price (XAG/USD) delivers a vertical upside move to near $29.00 in Thursday’s North American session. The white metal witnesses a strong buying interest as surprisingly weak United States (US) ADP Employment Change data for August renewed fears of deteriorating labor market conditions.

The private employment data that came in the early American session showed that fresh payrolls were lower at 99K than the downwardly revised figure of 111K from 122K in July. Economists estimated fresh private payrolls to have increased to 145K.

Weak private sector employment data has prompted market speculation that the Federal Reserve (Fed) will start the policy-easing cycle this month aggressively. Signs of slowing labor market demand have weighed heavily on the US Dollar (USD) and bond yields.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, declines to near 101.00. 10-year US Treasury yields plunge to near 3.73%. Lower yields on interest-bearing assets strengthen the appeal of non-yielding assets, such as Silver, given that they reduce the opportunity cost of holding investment in them.

Going forward, the US Nonfarm Payrolls (NFP) data for August will be keenly watched, which will be published on Friday. Meanwhile, investors await the US ISM Services PMI data for August, which will be published at 14:00 GMT.

Silver technical analysis

Silver price trades in a Channel formation on a daily timeframe, which is slightly sloping downwards. The asset recovers sharply and attempts to break above the 20-day Exponential Moving Average (EMA), which trades around $28.80.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a consolidation ahead.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- EUR/GBP saw a steep decline in August but it appears to have found a floor and is consolidating.

- Whilst the trend remains bearish there are signs bears may be exhausted and a reversal could be on the horizon.

EUR/GBP continues its counter-trend reaction after its accelerated decline during the month of August took it temporarily outside the bounds of its falling channel (shaded circle). This breakout is often a sign of exhaustion of the downtrend, however, it is a little too soon to tell.

EUR/GBP has now bottomed out and is evolving a sideways rangebound market mode.

EUR/GBP 4-hour Chart

So far the recovery has been quite shallow and it is currently capped by resistance from the 50-period Simple Moving Average (SMA).

EUR/GBP has not been able to break decisively above the SMA or the line of highs at 0.8435 suggesting a reversal remains elusive.

The pair will probably continue sideways until it reaches resistance from the upper channel line at roughly 0.8450.

The medium-term trend remains bearish, however, suggesting there is still a chance of an extension lower, although the channel exhaustion break lowers the odds.

That said, a break below 0.8406 (September 3 low) would pave the way for further weakness to a downside target at 0.8385 (July 17 lows).

In order to reverse the short-term trend, bulls would have to decisively break above the 50 SMA. A decisive break would be one accompanied by a long green candle that closed near its high or three green candles in a row that closed above the SMA.

The long-term trend (weekly chart) is still bearish whilst the medium-term trend is bullish.

UK inflation expectations remain sticky, the latest BoE Decision Maker Panel survey suggests, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

BoE survey data supports cautious rate view

“While the panel expects 3m output prices to moderate slightly (3.6%, down from 3.7% in the last survey), 1Y CPI expectations edged up to 2.6%, from 2.5%. The survey suggested no change in elevated wage growth trends and support the outlook for cautious reductions in UK rates in the next few months.”

“Sterling’s gains yesterday look a little more persuasive from a technical point of view. A sold gain on the day reflects signs of steady accumulation of the pound on dips over the past few sessions. Trend resistance off the late August high was broken yesterday and now serves as support (1.3095). Gains through 1.3175 target 1.3200/25 in the short run.”

- USD/JPY has broken below a key support level and is falling lower.

- The August 5 lows are the next target at 141.69.

USD/JPY is resuming its mid-term downtrend after a punctuated pause during August.

The pair has broken below the key 143.45 swing lows (August 26 low) – a bearish sign that flips the trend. Sellers now have the key August 5 lows at 141.69 in their sights.

USD/JPY 4-hour Chart

USD/JPY is probably in a short-term downtrend and given the saying “the trend is your friend” the odds favor more downside.

The pair will probably reach the 141.69 lows. A break below that would probably lead to further weakness towards the next support level at 140.44.

The Relative Strength Index (RSI) momentum indicator is oversold, however, so traders are advised not to add to their short positions. If RSI exits oversold it will be a signal a counter-trend correction higher is unfolding.

- Initial Jobless Claims rose to 227K, below the previous week's 232K.

- Continuing Jobless Claims increased to 1.838M in the week ending August 24.

US citizens that newly applied for unemployment insurance benefits reached 227K in the week ending August 31, according to the US Department of Labor (DoL) on Thursday. The prints came in below initial consensus (231K) and were lower than the previous weekly figure of 232K (revised from 231K).

Further details of the publication revealed that the advance seasonally-adjusted insured unemployment rate was 1.2% and the 4-week moving average was 230K, a decrease of 1.750K from the previous week's revised average.

In addition, Continuing Claims decreased by 22K to 1.838M in the week ending August 24.

Market reaction

The US Dollar Index (DXY) remains under constant downside pressure and challenges the key support at 101.00.

- CAD/JPY weakens as BoC cuts interest rates for the third meeting in a row.

- The Yen gains support from a rise in real wages in Japan that bolsters the outlook for growth.

- A decline in the price of WTI crude Oil below $70.00 a barrel further weighs on the CAD/JPY.

CAD/JPY trades a quarter of a percent lower in the 106.10s on Thursday, as the Canadian Dollar (CAD) weakens from a combination of falling Oil prices – crude is the country’s largest export – and expectations the Bank of Canada (BoC) will continue cutting interest rates after a 0.25% reduction at its September meeting. Lower interest rates are negative for a currency as they reduce foreign capital inflows.

The CAD/JPY sees its third straight day of losses after declining sharply on Wednesday following the BoC’s decision to cut interest rates by 0.25% for the third meeting in a row, amid falling inflation and growth concerns.

In his press conference after the meeting, Governor Tiff Macklem struck a dovish tone, saying “We need to increasingly guard against the risk that the economy is too weak and inflation falls too much.” Adding, “If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further rate cuts.”

CAD/JPY saw further downside after data out of Japan showed a rise in real wages, which increased for the second straight month in July and reinforced expectations that the Bank of Japan (BoJ) will raise interest rates again before the year ends. Inflation-adjusted real wages in Japan rose 0.4% year-over-year in July as total cash earnings increased 3.6%.

BoJ Board Member Hajime Takata struck a moderate, data-dependent tone in a speech on Thursday morning, however, that will have tempered downside for CAD/JPY. Takata said that “based on our hearings we expect more rate hikes in October,” but qualified this by adding, “though that was when the Yen was weakening.”

Apart from that Takata remained ambivalent saying, “We (the BoJ) Don't have a preset idea on pace of rate hikes, or on whether we will hike rates several times,” and adding, “We have no choice but to scrutinize at each policy meeting how market moves affect corporate balance sheets, earnings and risks to economy.”

CAD/JPY lost further ground after WTI crude Oil fell below the $70.00 level amid rumors of OPEC+ production increases and the slowdown in China. Lower Oil prices are negative for CAD as its a major crude exporter but positive for Japan which is a major Oil importer.

German Factory Orders rose 2.9% in July—a surprising gain which followed an upwardly revised rise of 4.6% for June.

Intraday chart is leaning a bit more EUR-bullish

“It’s a rare piece of good news for the economy which has shown signs of losing momentum recently. Orders data are volatile, however, and broader economic trends, reflected in recent surveys are clearly soft.”

“That is not subduing the EUR right now, however. Short term volatility is firm and demand for EUR bullish structures is reflected in the bounce in 1 week risk reversal pricing (0.3975 vol premium for calls).”

“Similar considerations apply to the EUR’s technical outlook. Limited movement is likely ahead of Friday morning but the picture on the intraday chart is leaning a bit more EUR-bullish. Solid gains yesterday took the EUR above short-term retracement resistance and target additional gains to the 1.1120/40 area. Support is 1.1070.”

- USD/CAD sees downside below 1.3500 as weak US ADP private payrolls data sent the US Dollar inside the woods.

- Fresh private payrolls surprisingly come in lower at 99K than estimates of 145K.

- The BoC is expected to soften its interest rate policy further.

The USD/CAD pair faces pressures in holding the psychological support of 1.3500 in Thursday’s New York session. The Loonie asset senses selling pressure as the United States (US) Automatic Data Processing (ADP) Employment has surprisingly come in weaker-than-expected.

The agency reported that there were 99K fresh payrolls in the private sector in August. Investors anticipated that private employers hired 145K job-seekers, higher than July’s reading of 111K, downwardly revised from 122K. This has deepened fears of deteriorating labor market conditions and has prompted expectations that the Federal Reserve (Fed) will begin reducing interest rates aggressively this month.

Surging Fed large rate cut bets have weighed heavily on the US Dollar (USD). The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slumps to near 101.00.

Going forward, investors will focus on the US ISM Services PMI data for August, which will be published at 14:00 GMT.

Meanwhile, the Canadian Dollar (CAD) remains under pressure as market participants see the Bank of Canada (BoC) continuing its policy-easing spell further. The BoC reduced its interest rates by 25 basis points (bps) to 4.25% on Wednesday. This was the third straight interest rate cut announcement of 25 bps by the BoC. Analysts at ING said in a note on Wednesday, “We essentially see the BoC cutting rates 25 bps at each meeting until next summer, by which time the policy rate is expected to be down at 3%.”

Going forward, the Canadian Dollar will be influenced by the labor market data for August, which will be published on Friday. The employment report is expected to show that Canadian employers hired fresh 26.5K job-seekers after laying off 2.8K workers in July. The Unemployment Rate is seen rising further to 6.5% from the former release of 6.4%.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Sep 05, 2024 12:15

Frequency: Monthly

Actual: 99K

Consensus: 145K

Previous: 122K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

The Canadian Dollar (CAD) is unchanged on the session after shrugging off domestic developments with ease yesterday, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

CAD holds Wednesday’s gains

“The BoC rate cut was no surprise and while the policy spread over the Fed is a yawning 125bps now, markets are expecting the Fed to catch up with the BoC’s easing process quickly in the coming months. Meanwhile, the end of the NDP’s “supply and confidence” support agreement with the minority Liberal government failed to move the CAD. The agreement was supposed to last into mid-2025.”

“The breakup does not necessarily accelerate the next federal election but the Liberals will need the support of the NDP or the Bloc on a case-by-case basis to pass legislation and/or avoid losing a confidence vote. Parliament returns on September 16th. Near-term CAD trends hinge primarily on the US jobs report.”

“Markets are unlikely to move too far in the next 24 hours or so but the technical feel of USDCAD is a little softer after spot dropped sharply from resistance in the upper 1.35 area yesterday and cracked short-term trend/consolidation support, now close resistance, at 1.3530/35. Intraday weakness below 1.3495 may see USD losses leak a little more in the short run.”

The USD is tracking a little softer overall but trends across G10 FX are relatively subdued. Broader markets are relatively calm as market participants await Friday’s US jobs data, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

USD mixed as markets steady ahead of Friday’s jobs data

“Stocks are narrowly mixed and major bond markets are little changed on the session. US 10Y Treasury yields have backed up fractionally. But yields fell sharply yesterday after weak JOLTS data added to concerns that the US labour market is slowing while the Beige Book noted flat or weaker activity across most Federal Reserve districts.”

“We get more data this morning in the form of the ADP data and the latest weekly claims figures. The ADP has proven to be a poor guide to the NFP but a weak report today is likely to increase market anxiety ahead of NFP. ISM Services data are out at 10ET. Japan reported stronger than expected wage gains for July overnight; a 3.6% Y/Y rise in Labour Cash earnings was well ahead of forecasts, bolstering expectations that the BoJ will push ahead with another mild rate increase before year end.”

“Lower US short rates (US2Y yields fell 10bps or so in response to yesterday’s developments) will—if sustained—weigh on the USD in the short run at least and may help pull the DXY broadly lower towards our spread-driven fair value estimate of 100.0. Short-term technical pointers are tilting lower again for the index which may have peaked on Tuesday as the late August/early September rebound in the dollar peters out. DXY support is 100.8 and—stronger—100.5.”

- The US Dollar trades sideways ahead of a very chunky data release on Thursday.

- Markets are still worried about headwinds for Europe and the Nvidia subpoena.

- The US Dollar Index retreats and flirts with a break below 101.00.

The US Dollar (USD) trades softer on Thursday, with a lot of data points set to be released in a condensed time span. The Greenback already eased on the back of the JOLTS Job Openings report on Wednesday, when the previous number was revised and the recent print for July came in below the estimation. It was enough for markets to price in more rate cuts by the Federal Reserve (Fed) and devalue the US Dollar on the back of narrowing the interest rate gap between the US and other countries.