- Analytics

- News and Tools

- Market News

Новини ринків

- The strong downtrend in USD/MXN continues as emerging market currencies advance against the US Dollar.

- USD/MXN eyes 17.5000 support; bullish potential remains limited, with key resistance at 17.9492 and 18.2263.

The USD/MXN fell to fresh six-year lows of 17.7462, hit in the middle of the New York session even though the US economy revealed upbeat data, which failed to strengthen the US Dollar (USD). At the time of writing, the USD/MXN pair is trading at 17.7480, down 0.92%.

A goodish employment report in the United States (US) improved market sentiment. Therefore, high beta currencies, alongside emerging markets peers, advanced sharply against their counterpart, the US Dollar.

USD/MXN Price Action

The USD/MXN pair remains in a strong downtrend, registering more than 9% losses from year-to-date (YTD). Notably, since the USD/MXN pair fell below the 19.00 figure, the USD/MXN has tested the level for ten days, though buyers could not crack it. In fact, traders remain short in the USD/MXN pair, even though speculations around the Bank of Mexico’s (Banxico) pausing its tightening cycle in May, have not triggered outflows from the emerging market currency.

Momentum indicators, like the Relative Strength Index (RSI), remain to push downwards, with space before turning oversold. The 3-day Rate of Change (RoC) shifted neutral and resumed to the downside as sellers stepped in. Therefore, the USD/MXN path of least resistance is downwards.

That said, the USD/MXN next support would be 17.5000. A breach of the latter will expose the July 2017 swing low of 17.4515 before dropping to 17.0000.

Conversely, if USD/MXN reclaims the May 5 daily high of 17.9492, that could form a bullish-engulfing candle pattern, which could warrant further upside. The buyer’s next stop would be 18.00, followed by the 50-day Exponential Moving Average (EMA) at 18.2263.

USD/MXN Daily Chart

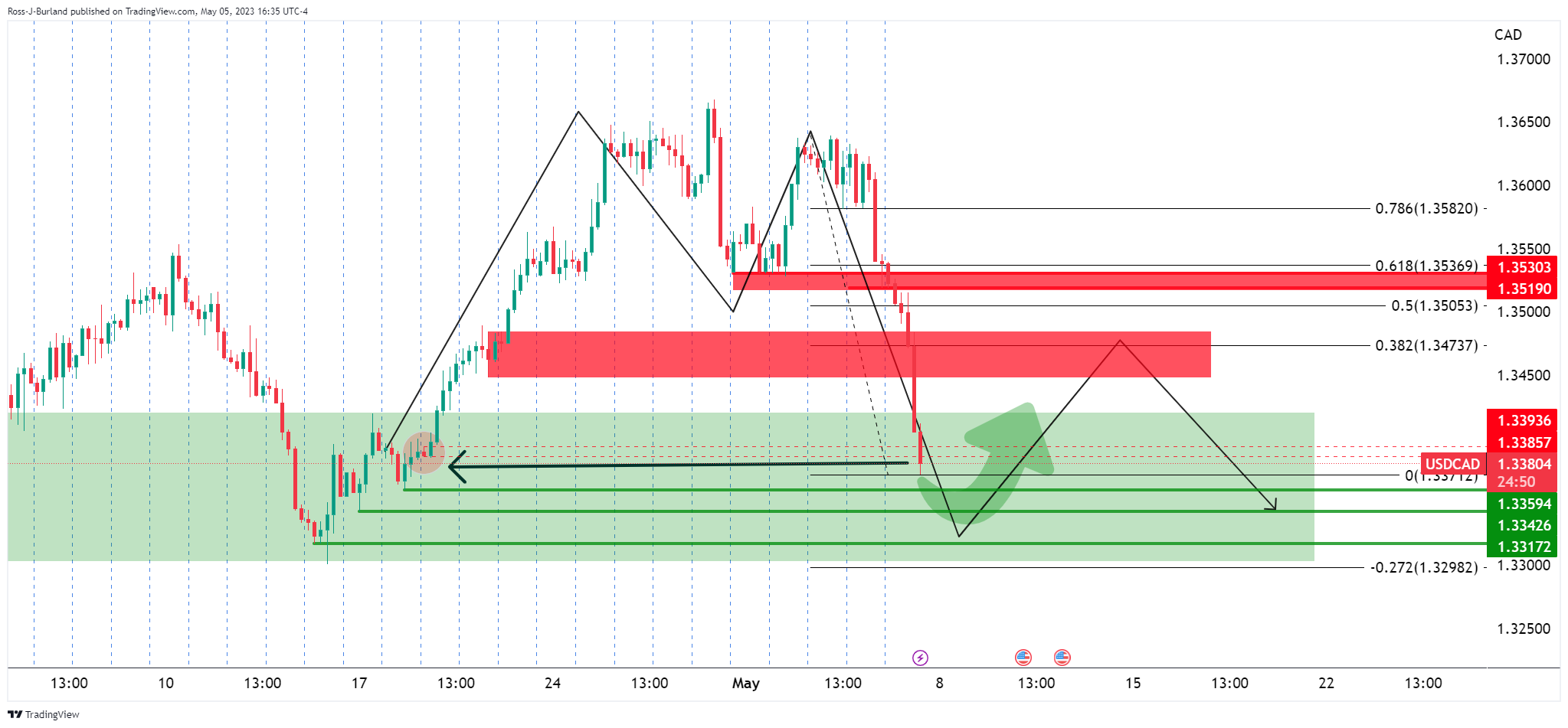

- USD/CAD bears stay strong and the bulls are pressured to below a key structure.

- A move to 1.3320 is eyed for the sessions ahead.

USD/CAD is heading lower on the day and is down some 1.17% as we head towards the forex close in New York. The pair has been pressured below 1.3500 to a low of 1.3371 on Friday.

There are eyes on a move back into the supply, however, as the pair has painted an M-formation on the charts as the following daily chart illustrates:

USD/CAD daily chart

The price, however, has taken out a key structure and for that, we can zoom down to the lower time frames:

As we can see, the market is below 1.3393 and 1.3385 4-hour structure. This was a 4-hour bar where the price rallied from previously. Therefore, this is regarded as a key area so it will be interesting to see if the bears can stay below it for longer:

If the bears managed to do so, then the 1.3350s and 1.3320 levels will be eyed:

- XAU/USD plunges, shedding 1.68% as rate hikes and soaring bond yields dull gold’s allure.

- US Nonfarm Payrolls beat estimates with 253K new jobs, pushing Treasury bond yields higher.

- Gold demand dips in Q1 2023, with the central bank and Chinese consumer purchases offset by investor buying.

Gold price slides sharply as the XAU/USD failed to hold to its gains nearby the year-to-date (YTD) high at $2081.46, as two major central banks increased rates, boosting bond yields. Additionally, a better-than-expected jobs report in the United States (US), triggered a jump on US T-bond yields. At the time of writing, the XAU/USD is trading at $2015.51, below its opening price by 1.68%.

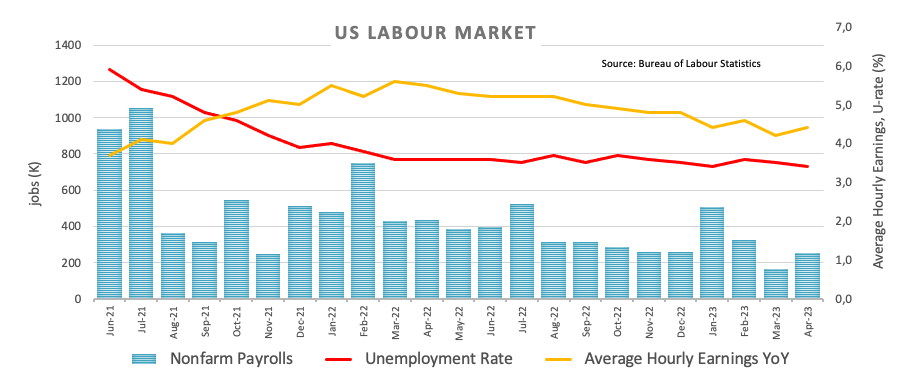

Gold’s rally dented by US data, lower demand

US equities continued to recover some ground after the US banking turmoil dented mood. The US Department of Labor revealed the April US Nonfarm Payrolls, which showed that the labor market remains tight, with the economy adding 253K jobs, crushing forecasts of 180K. Additionally, the report revealed that wages are increasing, as shown by the Average Hourly Earnings jumping 0.5% MoM, above the 0.3% forecasts, while the Unemployment Rate continued to slump past 3.5%, at 3.4%.

XAU/USD plunged on the US jobs data release, from around $2038 to $2007, but later pierced below the $2000 figure, hitting a three-day low of $1999.57. This resulted from short-term futures traders pairing Federal Reserve (Fed) rate cuts, as could be seen in US Treasury bond yields, which are skyrocketing, following the NFP report.

Must read: Breaking: US Nonfarm Payrolls rise by 253,000 in April vs. 179,000 expected

The US 2 and 10-year Treasury notes are climbing sharply 19 and 9 basis points each, yielding 3.924% and 3.443%, respectively. Despite the previously mentioned, the greenback remains downward pressured, registering modest losses.

The US Dollar Index (DXY) measures the performance of six currencies vs. the greenback, dropping 0.15%, down to 101.25.

Of late, St. Louis Federal Reserve President James Bullard commented that a soft landing is possible, adding that the labor report was “impressive.” Bullard said he’s open-minded about raising or holding rates at the FOMC’s next meeting in June, as he joined the “data-dependant” posture. Nonetheless, Bullard feels that rates need to “grind higher.”

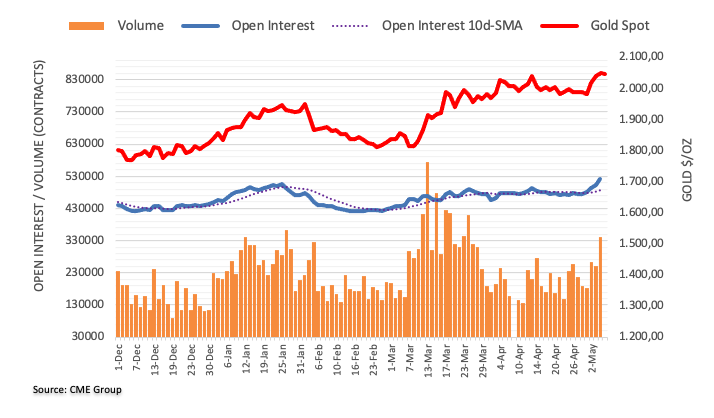

Another reason that weighed on XAU/USD’s prices is that global demand for Gold fell during the first quarter of 2023, as large purchases made by central banks and Chinese consumers were offset by investors buying, as reported by the World Gold Consortium (WGC).

Upcoming events

The calendar is pretty much light, with the Fed Governor Lisa Cook pending to cross newswires.

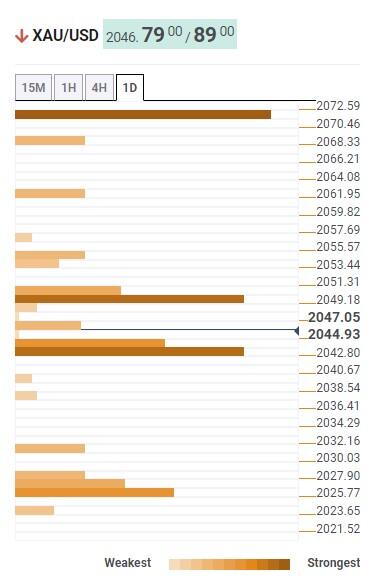

XAU/USD Daily Chart

After hitting a new ATH, XAU/USD retreated below the 61.8% Fibonacci retracement and was $2 shy of hitting the 78.6% Fibonacci level. Nevertheless, Gold bounced from its daily low of $1999.57, above the 61.8% Fibonacci retracement at $2015.26. Notably, the Relative Strength Index (RSI) indicator remains in bullish territory, although it’s moving down. The 3-day Rate of Change (RoC) turned neutral in a possible sign of buyers booking profits ahead of the weekend.

For a bullish continuation, XAU/USD buyers must reclaim the 50% Fibonacci level at $2028. Break above will expose the 38.2% Fib retracement at $2040.60 before clearing the path toward the ATH. Conversely, a fall below $2000 would expose a one-month-old support trendline that passes around the $1970-80 area.

The US official employment report showed better-than-expected numbers with payrolls rising by 253,000 above the 179,000 expected. Analysts at RBC Economics Research point out that the solid momentum in employment data is not expected to continue later on this year, given signs of moderating hiring demand.

Key quotes:

“Despite ultra-low unemployment rates, signs of weakening labour demand continue to emerge elsewhere - job openings have been trending lower since last spring. And slower quit rates are flagging less confidence in hiring conditions among workers.”

“Solid momentum in U.S. employment reports not expected to continue later on this year, given signs of moderating hiring demand. Slower wage growth should also make currently tight labour market conditions less of a concern for the Federal Reserve. We continue to expect the rate hike this week was the last one in the current cycle, with tightening U.S. credit conditions adding to downside growth concerns.”

Analysts at MUFG Bank point out the Norwegian Krone could rebound after a heavy sell-off. They have a trade idea of shorting USD/NOK at 10.620, with a target at 10.150.

Key Quotes:

“The NOK has become deeply undervalued and out of line with short-term fundamental drivers such as the price of oil, investor risk sentiment and yield spreads. The Norges Bank has signalled greater sensitivity to NOK weakness at this week’s policy meeting. If NOK weakness persists, it will encourage the Norges Bank to hike rates further than planned. The Norges Bank is already planning to keep hiking rates in June while we are more confident that the Fed has reached the end of their hiking cycle after this week’s FOMC meeting.”

“The ongoing loss of confidence in US regional banks and US debt ceiling stand-off should deter the Fed from further hikes in the coming months. Yield differentials between Norway and the US should narrow further weighing down on USD/NOK.”

“The main risk to our trade idea is that our timing could be too early to establish NOK longs in anticipation of a more sustained rebound.”

“With the USD having peaked out more broadly, we expect the October high for USD/NOK at around the 11.000-level to hold.”

Data released on Friday showed the Canadian economy added 41,000 jobs in April, more than the 20,000 of market consensus. Analysts at CIBC point out the labor market remained strong in April and warned the still-strong wage inflation will be particularly worrisome for the Bank of Canada (BoC).

Key quotes:

“The Canadian labour market remained strong in April, with employment rising by more than expected, the unemployment rate remaining near all time lows and wage inflation failing to decelerate. The still-strong wage inflation will be particularly worrisome for the Bank of Canada, as policymakers have expressed concern regarding a pass through to services inflation which could see headline inflation failing to fall all the way back to the 2% target, suggesting that a hawkish tone will remain in upcoming communications.”

“Employment growth may not be able to match that of the working population for much longer, with job vacancies down from their peaks and service industries that have been hiring recently now closer to fully staffed relative to pre-pandemic norms. That should see the unemployment rate rise modestly in the second half of the year, easing some of the wage pressures that remain in place and enabling the Bank of Canada to gradually cut interest rates in 2024.”

“Bond yields rose after the release, with markets pricing in a slightly greater chance of another 25bp rate hike from the Bank of Canada before July.”

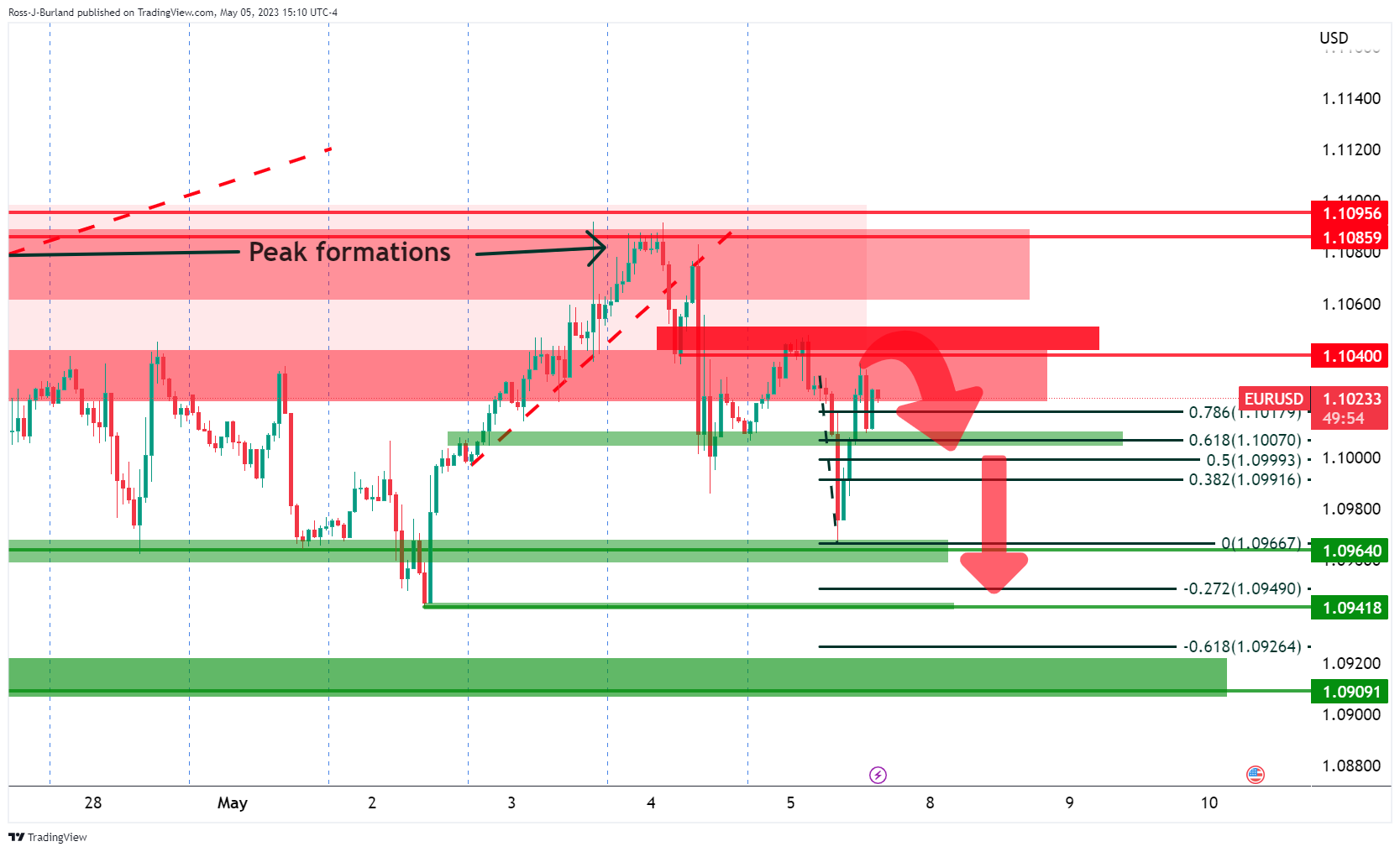

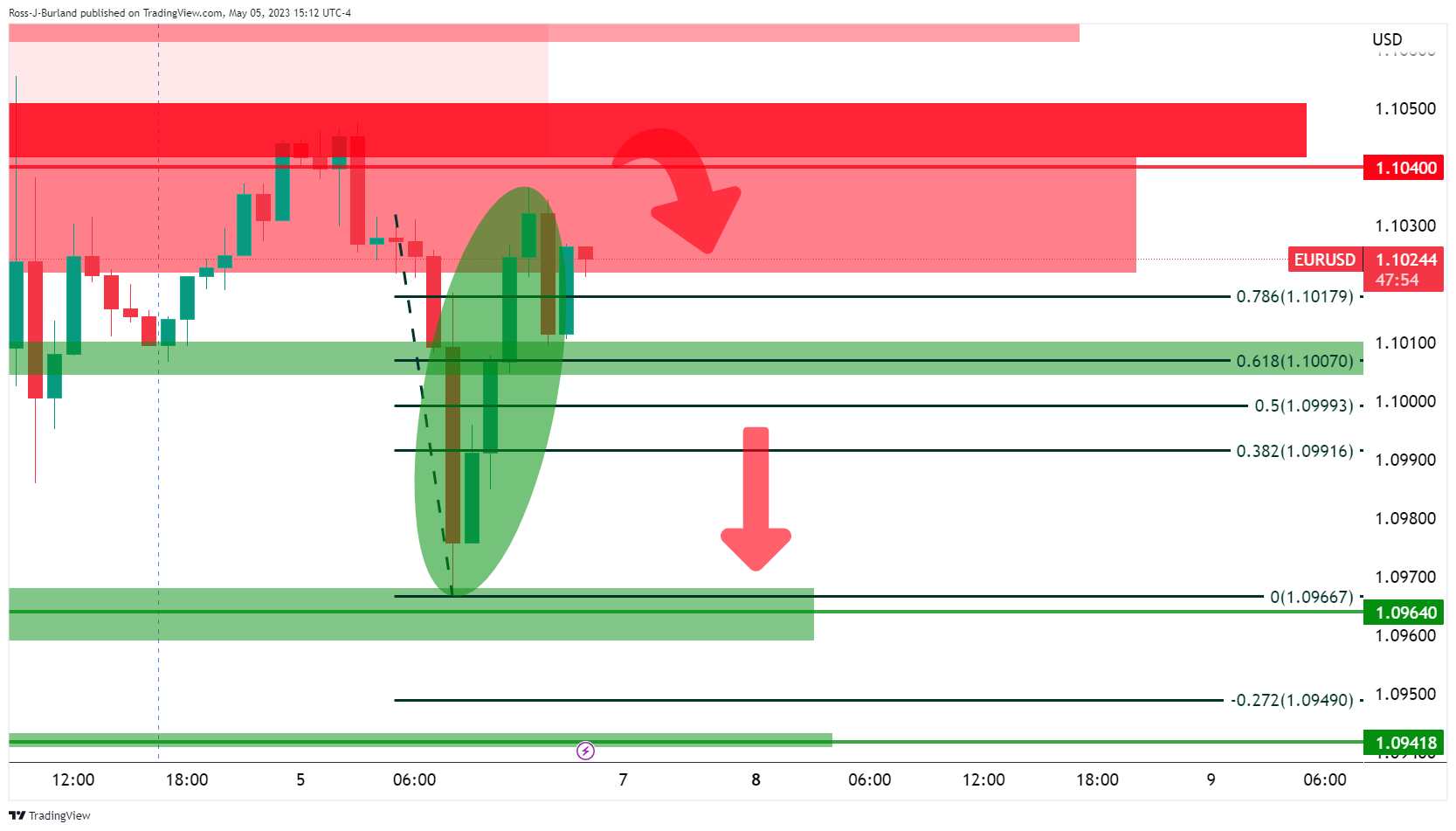

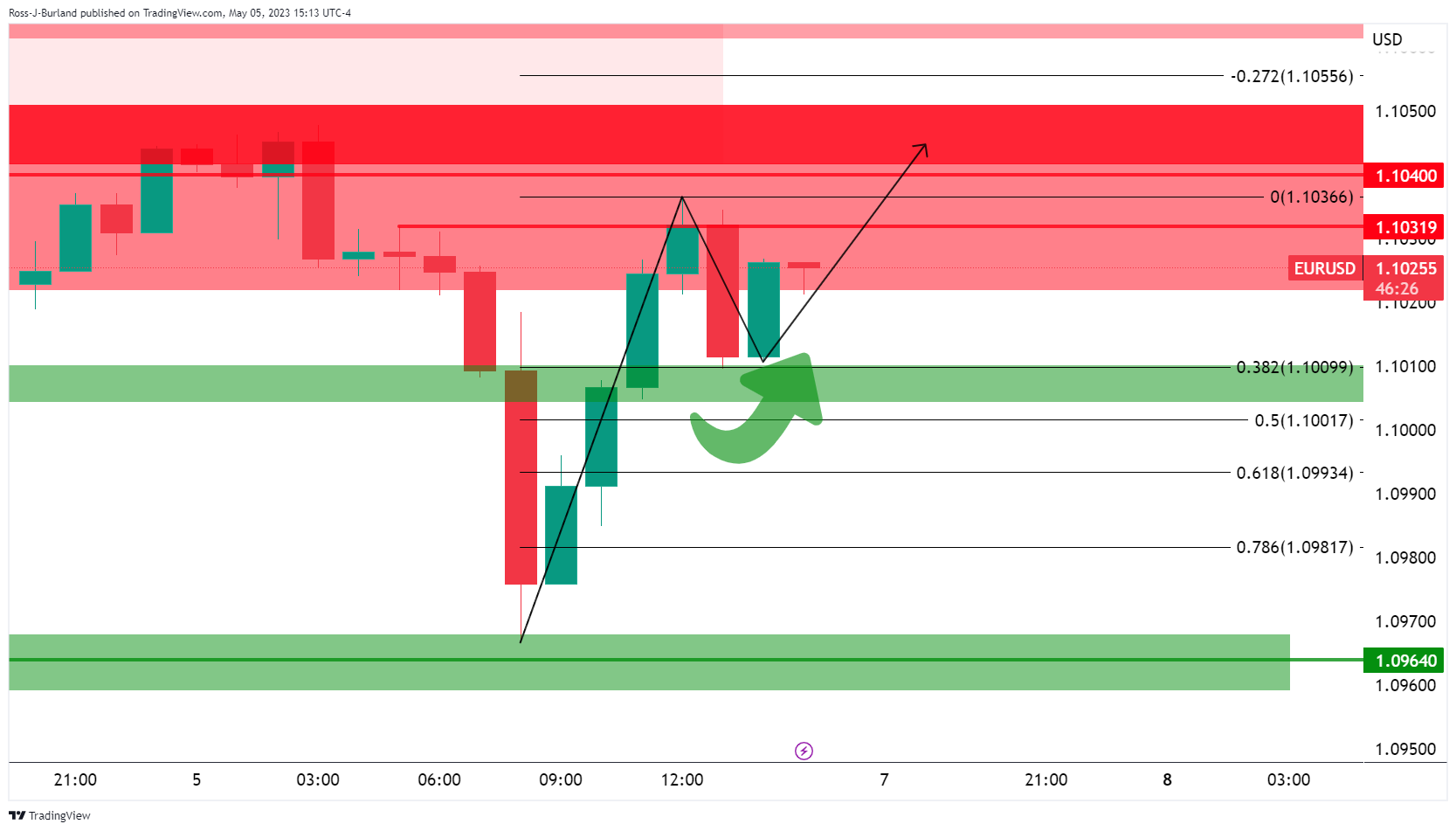

- EUR/USD bulls are back in the market and sitting pretty above 1.000.

- The bears need to get involved or face further pressure on Monday.

EUR/USD is holding up at around 0.1% higher and has rallied back into resistance after traveling between 1.0966 and 1.1047 on the day so far. The US Dollar rallied early doors on Friday after the Nonfarm Payrolls data showed that US employers added more jobs than expected in April. Most importantly, wages also grew more than the expectations as well.

NFP showed that there were 253,000 added jobs, well above economists' forecasts for a gain of 180,000. US average hourly earnings climbed at an annual rate of 4.4%, above expectations for a 4.2% increase. However, data for March was revised lower to show 165,000 jobs added instead of 236,000 as previously reported. This diluted the punchy headline although markets were already wrongly footed and needed to scramble back US Dollar shorts, exacerbating the move in EUR/USD lower.

However, the turnaround came on Wall Street when stocks rallied and the bulls moved back in. EUR/USD popped above 1.1000 again and has managed to hold above the psychological number for the rest of the day. Traders still expect that the Federal Reserve is at or near the end of its tightening cycle which is keeping a lid on the Greenback.

´´WIRP now suggests around 50% odds of a 50 bp hike at the March 21-22 FOMC meeting, down from over 70% pre-SVB,´´ analysts at Brown Brothers Harriman explained in respect to the banking crisis. ´´Looking ahead, 25 bp hikes in May and June are priced in that would take Fed Funds to 5.50-5.75%.´´

The analysts said that the ´´odds of a last 25 bp hike in Q3 have evaporated vs. over 30% odds pre-SVB. A strong jobs report today should bring the market focus back to the US economy rather than the US banking system. For now, we believe the uptrends in US yields and the US Dollar remains intact.´´

Meanwhile, analysts at Rabobank explained that ´´given that further European Central Bank rate hikes are already priced in, reasons to buy the EUR may be running dry.´´

´´In our view, EUR/USD may be in the process of peaking. We see scope for a move lower in the months ahead potentially towards the EUR/USD1.06 area,´´ the analysts said.

EUR/USD technical analysis

The price is now meeting resistance in this bearish schematic with a focus on a move towards 1.0900. the bears need to show up at this juncture, however, considering the bulls managed to clear the 78.6% Fibonacci ratio on the rally on Wall Street:

This makes for a bullish bias, at least for the time being:

Here is what you need to know for next week:

On the same day that the Federal Reserve (Fed) raised interest rates and signaled a potential pause, banking concerns dominated headlines. Next week, the central bank will release the Senior Loan Officer Opinion Survey on Bank Lending Practices, which will be used for the next FOMC meeting. The report addresses changes in the standards and terms of the banks' lending, as well as the state of business and household demand for loans; crucial figures in the current environment with the Fed tightening and concerns about the banking sector.

The key reports next week will be the US Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday. These numbers will contribute to interest rate market expectations and will be crucial for the next direction of the US Dollar and for Treasury bond yields.

The US 10-year yield briefly hit a three-week low before rebounding to 3.45%, while the US 2-year yield ended lower below 4.0%. Bond yields remain within their recent range. The overall trend remains bearish, but ongoing uncertainty surrounding the US debt ceiling could contribute to increasing market volatility. Meanwhile, the US Dollar Index closed the week at a one-year low but is still holding above the key support level of 101.00.

USD/JPY had its worst week since March, despite a rebound in US yields and improvement in market sentiment. On Friday, the pair trimmed losses and rose toward 135.00 after the release of US jobs data. Volatility is expected to remain high in Yen crosses due to large fluctuations in Fed rate expectations and as Wall Street wavers.

EUR/USD finished the week flat after the European Central Bank (ECB) meeting, where the ECB raised rates as expected. The pair approached 1.1100 but then pulled back. Although the correction was limited, it continues to trade sideways in the short term around 1.1000.

GBP/USD posted another weekly gain, closing at its highest level since April 2022. Despite some strength in the US Dollar, the pair broke above 1.2600 on Friday. The UK will have a holiday on Monday to celebrate the coronation of King Charles III. On Thursday, the Bank of England (BoE) is widely expected to raise interest rates by 25 basis points. The focus will be on whether the BoE signals a pause or keeps the door open to more hikes. On Friday, the UK will report its monthly GDP.

USD/CAD was trending downwards but collapsed on Friday due to the strong Canadian jobs report, causing the pair to fall below 1.3400 to the lowest in two weeks with the April bottom in sight.

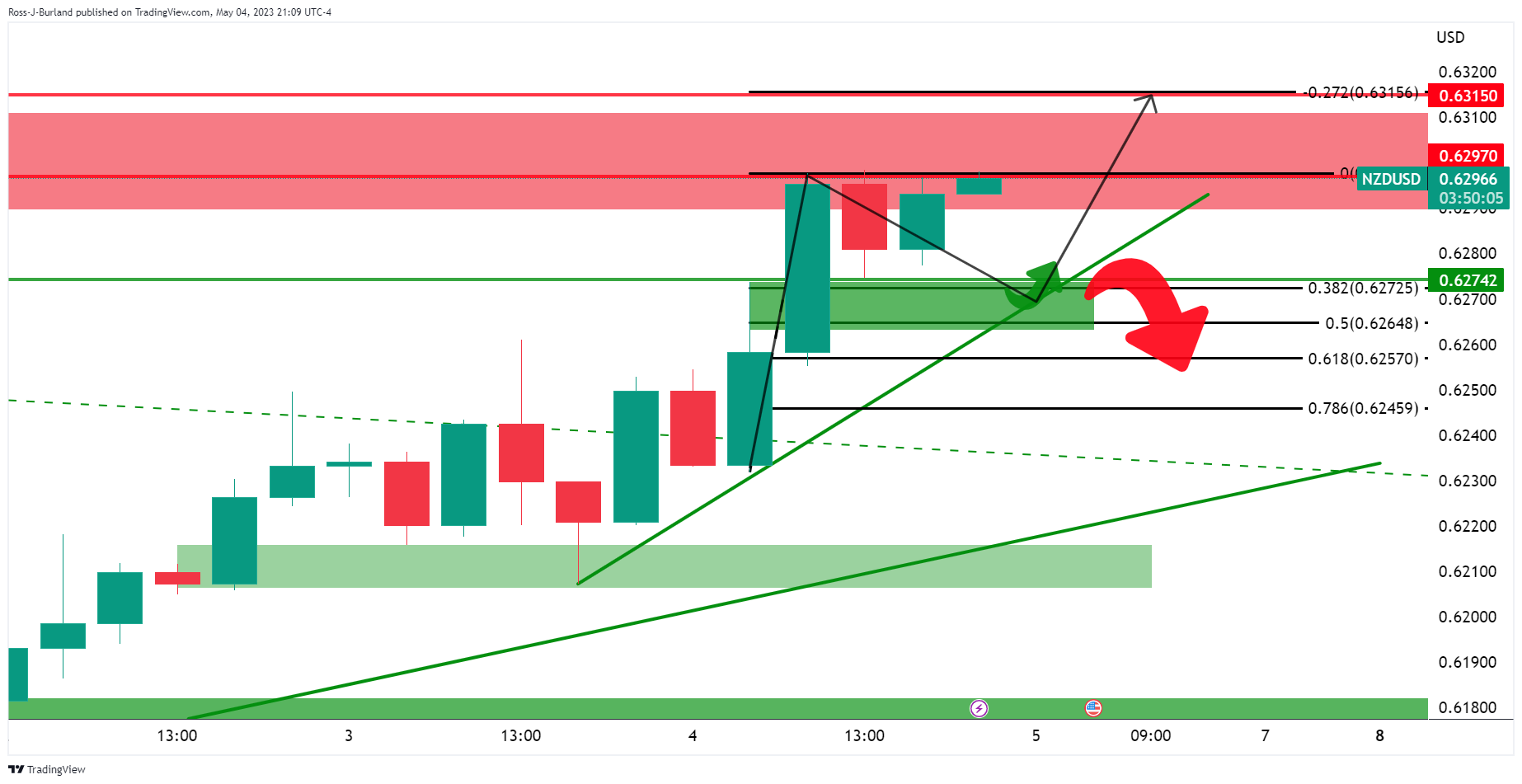

AUD/USD rose for the fifth consecutive day on Friday, reaching 0.6750, the highest level in three weeks; the crucial resistance is still 0.6800. The Australian dollar was the best-performing currency among majors after the unexpected rate hike by the Reserve Bank of Australia (RBA). NZD/USD also rose sharply, ending the week at around 0.6300, the strongest level in months.

Gold had a volatile week with mixed signs after a sharp reversal from the record high of around $2,075 towards $2,000 following the Nonfarm Payroll report. Silver rose for most of the week but tumbled 1.70% on Friday, retreating below $26.00.

The Colombian Peso was the best-performing currency of the week, with USD/COP falling 2.80%, erasing all the gains of the previous week. The South African Rand was the worst, with USD/ZAR closing at 18.40.

Bitcoin rose more than 2% on Friday and turned positive for the week, retaking $29,500. Crude oil prices ended the week with losses but far from the lows. WTI rose more than 4% on Friday, not sufficient to erase weekly losses but enough to improve the outlook.

Like this article? Help us with some feedback by answering this survey:

- XAG/USD risks a bearish-engulfing pattern and double-top formation as the price retreats from a 12-month high.

- A downward path is anticipated, with crucial support levels at $25.00 and $24.00 amid fading buying momentum.

Silver price retreats after reaching a 12-month new high at $26.13 in the New York session. An improvement in the US labor market due to an upbeat US jobs report trumped XAG’s chances to test last year’s high. At the time of writing, the XAG/USD is trading at $25.60, down 1.69%.

XAG/USD Price Action

As of writing, XAG/USD is still upward biased but at the brisk of a pullback. If XAG/USD registers a daily close below the May 4 daily low of $25.44, that could form two bearish signals: firstly, a bearish-engulfing candle pattern which suggests that downward action is warranted. The second is the possible formation of a double-top, a major reversal chart pattern, which could drive prices toward the $24.00 figure.

The Relative Strength Index (RSI) indicator added another signal to the mix, forming a negative divergence. This means that as XAG/USD’s price action reached successive higher highs, the RSI peaked at lower highs as buying momentum faded. Additionally, the 3-day Rate of Change (RoC) shows that buying pressure is waning as sellers move into action.

Therefore, XAG/USD’s path of least resistance is downwards. The first support would be the $25.00 mark. A breach of the latter would expose the April 25 swing low of $24.49, followed by the 50-day Exponential Moving Average (EMA) at $24.11, which, once cleared and XAG/USD’s will challenge the $24.00 figure.

XAG/USD Daily Chart

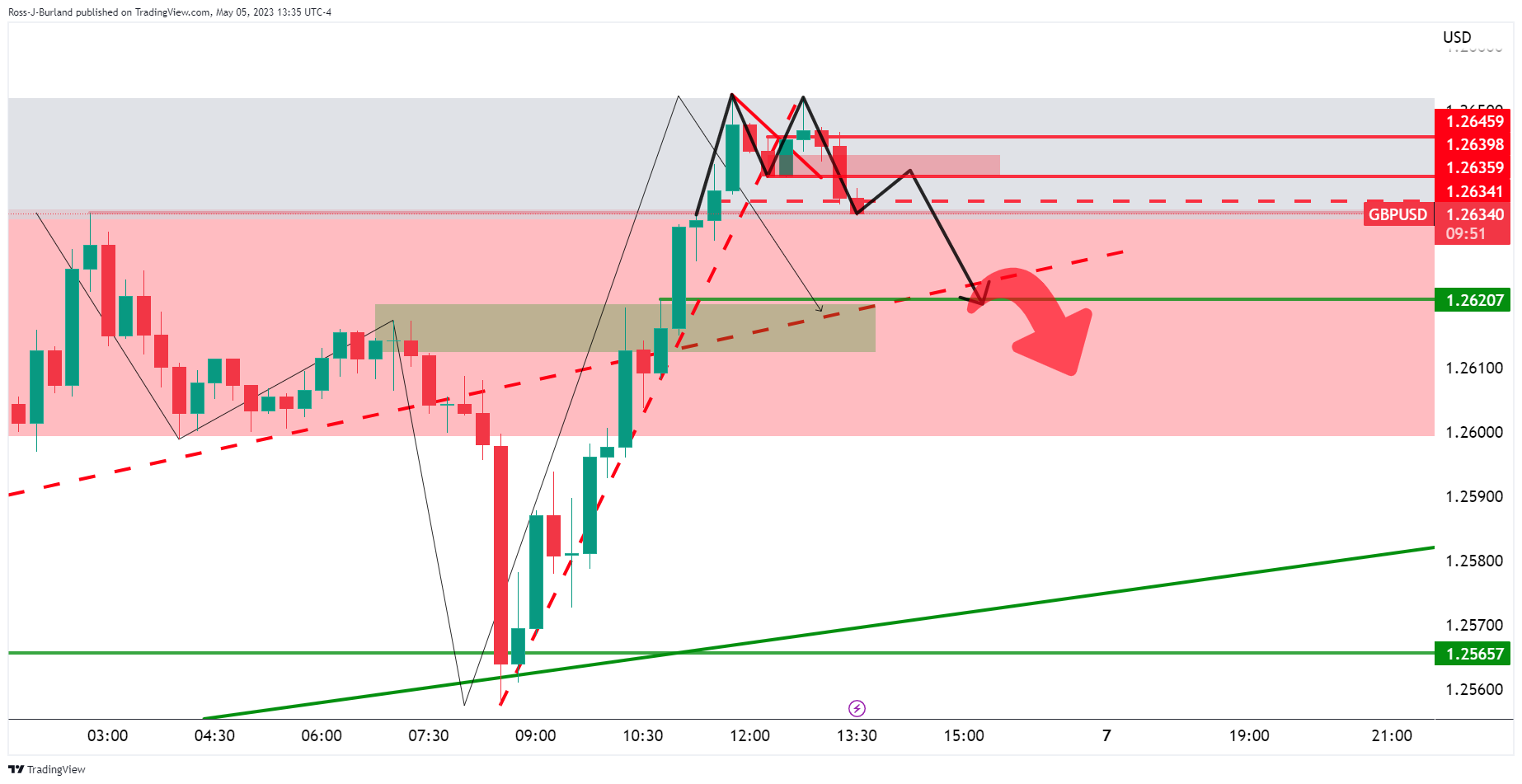

- GBP/USD is sliding and forming a peak formation.

- Bears are seeking a move down to test the 1.2620s.

GBP/USD is being pressured to the downside in lunchtime NY trade and is taking on a support structure that could lead the way to a move into test the 1.2020s and lower for the remainder of the day.

GBP/USD H1 chart

The hourly chart shows GBP/USD peaking in the 1.2650s and this gives rise to a test of the neckline of the W-formation as illustrated in the above chart.

GBP/USD M15 chart

On the 15 and 5-min charts, we can see the price taking on a support structure.

The 5-min chart shows the price action up close and the break in structure offers prospects of a move lower whereby resistance could come in near 1.2640 if there is going to be a retest of the prior lows as illustrated in the chart above.

- USD/JPY tests 50-day EMA at 133.85; bullish-engulfing pattern hints at a potential uptrend.

- Downside risks loom, with the 100-day EMA at 132.83 in sight if 134.00 support breaks.

The USD/JPY rises after dropping to a weekly low of 133.50, advances 0.42%, spurred by buyers stepping in at around solid technical support level. An upbeat April Nonfarm Payrolls report also lifted the US Dollar (USD) vs. the Japanese Yen (JPY) safety. At the time of writing, the USD/JPY is trading at 134.81 after dipping to a low of 133.88.

USD/JPY Price Action

From a daily chart perspective, the USD/JPY remains neutrally biased, though testing the 50-day Exponential Moving Average at 133.85, as the pair battles on closing above the May 4 daily high of 134.85. If USD/JPY achieves a daily close above the latter, the major will form a bullish-engulfing candlestick pattern, keeping buyers hopeful of higher prices.

In that outcome, the USD/JPY next resistance would be 135.00, and the March 15 daily high at 135.11. Once cleared, the USD/JPY would have a clear path to 136.00 until testing the 200-day EMA at 136.99.

Oscillators, like the Relative Strength Index (RSI) indicator, aim up and is still above neutral territory. The Rate of Change (RoC) of the last three days suggests that sellers are losing momentum. Therefore, the USD/JPY would continue to uptrend.

However, if USD/JPY falls below 134.00, it would expose the 50-day EMA at 133.85, followed by the 133.00 figure. Downside risks would pave the way toward the 100-day EMA At 132.83.

USD/JPY Daily Chart

St. Louis Federal Reserve President James Bullard supported the 25 basis point rate hike that the Fed took this week, calling it "a good next step." He stated that there is a significant amount of inflation in the economy.

In terms of the economic outlook, Bullard's base case is not a recession, but rather slow growth and declining inflation. He also noted that the labor market remains "very tight" and will take time to cool.

Analysts at Rabobank point out the EUR/USD pair may be in the process of peaking. They see scope for a move lower in the months ahead potentially towards the 1.06 area.

Key quotes:

“Looking ahead, we are expecting the Eurozone economy to stagnate in H2 2023. Given that further ECB rate hikes are already priced in, reasons to buy the EUR may be running dry. In our view, EUR/USD may be in the process of peaking.”

“Any broadening in financial sectors stress is likely to result in the safe-haven bid for the greenback. Either way, in view of widespread fears of a US recession and Eurozone stagnation in H2, in addition to evidence that the post-pandemic recovery in China is disappointingly patchy, we expect the USD find support due to risk aversion. We see risk of dips as low as EUR/USD1.06 in H2.”

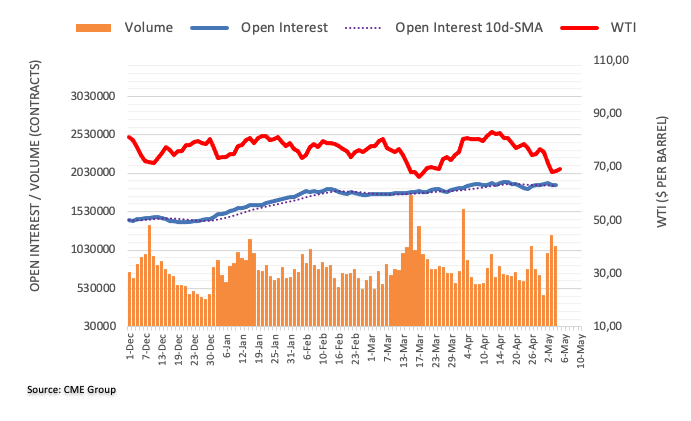

- WTI rebounds with a 3% gain, but rate hike fears loom large on the oil market.

- US hiring surge supports Wall Street recovery, softens greenback’s impact on oil prices.

- China’s weakening manufacturing activity weighs on WTI despite OPEC+ output cuts.

Western Texas Intermediate (WTI), the US crude oil benchmark, climbed more than 3% on Friday but remained set to finish with more than 7% losses on fears for further rate hikes and a global economic slowdown. Hence, WTI is trading at $70.96 PB after hitting a low of $68.54.

WTI fights for traction amid economic uncertainties

Wall Street is posting a recovery after the US Bureau of Labor Statistics (BLS) revealed that hiring in the US is picking up, adding 253K jobs in April, as shown by the Nonfarm Payrolls (NFP) report. Although it triggered a jump in US Treasury bond yields, the greenback is weakening, offering some cushion to WTI prices.

WTI’s plunged after a report from the National Bureau of Statistics (NBS) in China revealed that manufacturing activity in April continued to weaken, later confirmed by the Caixin PMI report. That comes even after the Organization of Petroleum Exporting Countries and its allies, the OPEC+, moved to reduce its crude oil output by more than 1 million barrels per day in an effort to underpin oil prices.

Although it spurred a jump of more than 6% at the beginning of April, WTI erased those gains and some more.

Sources cited by Reuters said, “Crude is trying to reverse the recent washout in prices triggered by higher interest rates and recession fears mostly in the banking sector.”

WTI Technical Analysis

From a technical perspective, WTI is downward biased, but the May 4 price action formed a large hammer preceded by a downtrend, suggesting that WTI could rally soon. The Relative Strength Index (RSI) indicator is approaching the neutral level, aiming higher, suggesting that buyers are gathering strength.

If WTI achieves a daily close above the May 3 daily high of $71.74, that will form a morning star, a bullish three-candle pattern, which could pave the way for further gains. That said, WTI will face solid resistance at the confluence of several EMAs, with the 20-day EMA At 74.86, followed by the 50-day EMA at $75.94, before testing the 100-day EMA at $77.54.

- US hiring soars in April: 253K jobs added, smashing the 180K forecast.

- Market rethinks rate cut expectations as Nonfarm Payrolls beat estimates.

- Aussie Dollar remains resilient amid a surprising RBA rate hike earlier this week.

The AUD/USD is climbing sharply after a stellar jobs report in the United States (US), which triggered an improvement in market sentiment, as troubled stocks from regional banks rose after the recent turmoil in the US banking system. The AUD/USD is trading at 0.6737, gaining 0.68% after hitting a low of 0.6607.

Solid US employment report leaves no room for rate cuts at Fed’s June meeting

The latest employment report in the US, the Nonfarm Payrolls, showed that hiring in April exceeded estimates as the economy added 253K above forecasts of 180K, in the aftermath of the US Federal Reserve (Fed) 25 bps rate hike on Wednesday. Following the Fed’s decision, market participants quickly began to price in rate cuts. Nevertheless, today’s market data has traders scrambling, as shown by the short-term interest rate futures dropping as they pare rate cut expectations.

The US jobs report revealed that Average Hourly Earnings rose 0.5% MoM, exceeding 0.3% forecasts, while the Unemployment Rate edged down to 3.4% from 3.5% in March. Once the data is in the rearview mirror, investors expect the Fed to hold rates unchanged for June’s decision.

Must read: Breaking: US Nonfarm Payrolls rise by 253,000 in April vs. 179,000 expected

In the meantime, the US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, trim some of its weekly losses and gains 0.02%, at 101.473. The US 10-year Treasury bond yield jumped eight bps, up at 3.439%, offering a cushion to AUD/USD sellers.

Nevertheless, the Aussie Dollar (AUD) is still resilient after a surprising rate hike early in the week. On Friday, the Statement of Monetary Policy (SoMP) revealed by the Reserve Bank of Australia (RBA) highlighted that risks for inflation were tilted on the upside, given low productivity and higher energy bills. RBA officials added that interest rates might have to rise further to curb inflation.

Upcoming events

the Fed parade will begin led by St. Louis Fed President James Bullard, Minnesota’s Neil Kashkari, and Fed Governor Lisa Cook.

AUD/USD Technical Analysis

The AUD/USD is still neutral biased but tilted upwards with the 200-EMA lying at around 0.6788, probing to be solid resistance. Although, the Relative Strength Index (RSI) indicator is aiming up, and buyers must reclaim the April 20 swing high at 0.6771 before challenging the trend-setter 200-day EMA. In that outcome, the AUD/USD should have no problems rallying towards 0.6800, which, once cleared, would open the door towards the February 21 daily high at 0.6919. On the other hand, downside risks lie below the 100-day EMA At 0.6735, followed by the 50-day EMA at 0.6707.

Gold price is continuing to hold its own just above the $2,000 mark. Economists at Commerzbank expect the yellow metal to remain stable before rising toward the end of the year.

XAU/USD at roughly $2,000 over the next two quarters

“Over the next two quarters, we envisage XAU/USD at roughly $2,000, and thus only marginally below its current levels (as compared to our previous forecast of $1,900-1,950).”

“As soon as the Fed raises a clearer prospect of an interest rate turnaround, the Gold price is likely to climb lastingly and more noticeably above the $2,000 mark, though we only expect this to happen towards the end of this year.”

Source: Commerzbank Research

The US gained 253K jobs in April, beating expectations. The market is still trying to digest the implications of the report for the FX market, economists at TD Securities report.

USD positioning and short-term valuations are mostly clean

“The USD liked the headline upside surprise. Good data has helped the USD, while bad data has pulled it lower. The knee-jerk was to buy the surprise, though some caveats in the details highlight the limited enthusiasm, or at least the continued confusion on the next big move in FX. A few of the caveats in the data are important, reflecting some watering down of the headline reaction.”

“That said, the tactical setup probably should lean in the USD favors at least until next week’s inflation report. The NFP number was strong enough to keep the market guessing on the Fed’s next move and the start of the easing cycle.”

“USD positioning and short-term valuations are also mostly clean, meaning there’s not a high conviction or lopsided positioning to price out.”

The Brazilian Real and the Mexican Peso benefited from the signal of a pause in US interest rates. Economists at Commerzbank expect both currencies to remain strong against the US Dollar.

BRL and MXN remain attractive

“Both central banks have been so hawkish of late that I think the Fed's rate pause was a necessary condition for the BCB and Banxico to consider moving away from their ultra-hawkish stance. Given the high real interest rates in Brazil and Mexico, slightly lower policy rates seem justified.”

“However, with inflation still elevated, both central banks are likely to be careful to keep monetary policy sufficiently tight to avoid the risk of additional inflationary pressures from a weaker currency. Accordingly, we see the BRL and MXN remaining at strong levels against the Dollar.”

GBP/USD extends gains. Economists at Scotiabank expect the pair to retain a positive undertone.

Ongoing pressure for more GBP strength

“Recall that the Pound managed to close above 1.2445 on a weekly basis last week – a level that had clearly restrained gains in this move up – to give the bull move a little more impetus and put 1.27/1.28 on the radar.”

“Intraday support is 1.2580, with firmer support now at 1.2540/50.”

“Solid trend momentum signals suggest firm support on minor dips and ongoing pressure for more GBP strength.”

- GBP/USD pulls back from a nearly one-year high amid a goodish pickup in the USD demand.

- The upbeat US jobs data pushes the US bond yields higher and provides a boost to the buck.

- The risk-on impulse caps gains for the USD and limits any meaningful downfall for the major.

- Traders also seem reluctant ahead of next week’s US CPI report and the BoE policy meeting.

The GBP/USD pair drops to a fresh daily low in reaction to the better-than-expected US monthly employment details, albeit manages to find some support ahead of the mid-1.2500s. Spot prices bounce back to the 1.2585-1.2590 region during the early North American session and trade with a mild positive bias for the third straight day, just below a nearly one-year high touched earlier today.

The US Dollar (USD) strengthens across the board following the release of the upbeat US NFP report, which turns out to be a key factor acting as a headwind for the GBP/USD pair. In fact, the US Bureau of Labor Statistics (BLS) reported that the US economy added 253K new jobs in April, much higher than the 179K anticipated and the previous month's downward revised reading of 165K. Further details revealed that the Unemployment Rate unexpectedly edged lower to 3.4% from 3.5 and Average Hourly Earnings rose to 4.4% from 4.3%.

The upbeat data, meanwhile, points to sustained labor market strength and could force the Federal Reserve (Fed) to keep interest rates higher for some time. This, in turn, pushes the US Treasury bond yields sharply higher, which underpins the Greenback and exerts some pressure on the GBP/USD pair. That said, the risk-on impulse - as depicted by a strong opening in the US equity markets - keeps a lid on the safe-haven buck. Apart from this, rising bets for a 25 bps rate hike by the Bank of England (BoE) help limit the downside for the major.

Hence, the market focus will remain glued to the highly-anticipated BoE monetary policy meeting next Thursday. Heading into the key central bank event risk, investors will take cues from the latest US consumer inflation figures on Wednesday. This will play a key role in determining the near-term trajectory for the GBP/USD pair. Nevertheless, spot prices remain on track to register gains for the third straight week.

Technical levels to watch

USD/CAD has slipped under 1.35. Economists at Scotiabank expect the pair to remain under downside pressure.

More weakness ahead

“The USD is holding losses below 1.3520 short-term support (now resistance) which points to more weakness ahead and the breakdown from late Apr/early May range suggests losses could extend towards the low/ mid 1.34s in the next week or so.”

“A low USD close on the week would boost prospects for more USD softness ahead.”

“With the US swaps curve pricing in nearly 100bps of cuts, the CAD should be getting some more obvious support from yield spreads in the next few months, if market pricing is any guide.”

- The index regains composure and advances to 101.80.

- US Nonfarm Payrolls exceeded estimates in April.

- The US jobless rate ticked lower during last month.

The greenback, in terms of the USD Index (DXY), grabs fresh oxygen and moves to 2-day highs near 101.80 on Friday.

USD Index stronger on firm Payrolls

The index makes a U-turn and rapidly revisits the 101.80 region – or 2-day highs – in the wake of another solid prints from the US jobs report for the month of April.

Indeed, the US economy added more jobs than initially anticipated during April (253K), while the unemployment rate unexpectedly slipped back to the 3.4% (from 3.5%).

Also collaborating with the move higher in the Buck, Average Hourly Earnings topped consensus and rose 0.5% MoM and 4.4% over the last twelve months, while the Participation rate remained unchanged at 62.6%.

What to look for around USD

The index now looks bid well north of the 101.00 zone following a better-than-expected Nonfarm Payrolls, as investors continue to assess of the last FOMC event.

Looking at the broader scenario, the US Dollar seems to be facing downward pressure in light of the Fed’s recent indication that it will probably pause its normalization process in the near future. That said, the future direction of monetary policy will be determined by the performance of key fundamentals (employment and prices mainly).

In favour of a Fed’s pause appears the persevering disinflation – despite consumer prices remain well above the target - and nascent easing in the labour market, all amidst steady speculation of a a probable recession.

Key events in the US this week: Balance of Trade, Initial Jobless Claims (Thursday) – Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change.

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.14% at 101.60 and the break above 102.40 (monthly high May 2) would open the door to 102.80 (weekly high April 10) and then 103.05 (monthly high April 3). On the flip side, initial contention comes at 101.01 (weekly low April 26) prior to 100.78 (2023 low April 14) and finally 100.00 (psychological level).

Economists at Rabobank believe that the AUD/USD pair is unlikely to rise sustainably until the next year.

Further range trading around current levels in the months ahead

“The fall in iron ore prices from their March high and concerns over the pace of growth in China could weigh on the AUD in the months ahead. That said, the easing in trade tensions with China, Australia’s good budget and current account positions combined with a still hawkish RBA should provide support.”

“We expect further range trading around current levels in the months ahead.”

“We see the potential for a move back above AUD/USD 0.70 in 2024 as growth regains traction.”

- Gold price extends the overnight pullback from an all-time high and drifts lower on Friday.

- The downward trajectory picks up pace following the release of the upbeat US NFP report.

- Rising US bond yields lift the US Dollar and exert heavy downward pressure on the metal.

Gold price comes under heavy selling pressure on Friday and extends the previous day's sharp retracement slide from an all-time high, around the $2,078-$2,079 region. The downward trajectory picks up pace in reaction to the upbeat US monthly jobs data and drags the XAU/USD to a three-day low, below the $2,010 level during the early North American session.

The US Dollar (USD) strengthens across the board after the headline NFP print showed that the US economy added 253K new jobs in April, much higher than the 179K anticipated and the previous month's downward revised reading of 165K. Further details revealed that the Unemployment Rate unexpectedly edged lower to 3.4% from 3.5 and Average Hourly Earnings rose to 4.4% from 4.3%. This, in turn, allows the USD Index (DXY), which tracks the Greenback against a basket of currencies, to recover further from over a one-week low touched on Thursday and weighs heavily on the US Dollar-denominated Gold price.

The upbeat labor market report, meanwhile, might have dashed hopes for an imminent pause in the Federal Reserve's (Fed) rate-hiking cycle in June. This, in turn, leads to an intraday spike in the US Treasury bond yields, which further underpins the buck and contributes to driving flows away from the non-yielding yellow metal. Apart from this, a positive turnaround in the global risk sentiment - as depicted by a recovery in the equity markets - further contributes to a steep intraday fall in the Gold price. With the latest leg down, the XAU/USD has snapped a three-day winning streak, though seems poised to register weekly gains.

It will now be interesting to see if the commodity can attract any buyers at lower levels or if the ongoing slide marks the end of over a six-month-old uptrend, which constitutes the formation of an ascending channel on the daily chart. Hence, it will be prudent to wait for strong follow-through selling before confirming that the Gold price has formed a near-term top and positioning for any meaningful corrective decline.

Technical levels to watch

- US payroll rise by 253,000 against 179,000 expected.

- Canadian Unemployment Rate remains at 5%.

- USD/CAD steady near 1.3500, at weekly lows.

The USD/CAD held relatively steady, trading near the weekly low near 1.3480 following the release of labor market data in Canada and the US. While US Non-farm Payroll (NFP) figures showed positive results, they were balanced out by an equally positive report from Canada.

Strong labor markets

In April, the US economy added 253,000 jobs, surpassing the expected 179,000. Additionally, the Unemployment Rate decreased to 3.4%, below the expected 3.5%. However, the March payrolls were revised downwards from 236,000 to 165,000.

In Canada, the Unemployment Rate remained steady at 5%, slightly better than the market consensus of 5.1%. The Net Change in Employment was 41,400, surpassing the expected 20,000.

After the release of the NFP, the US Dollar appreciated against most currencies, but the Canadian Dollar outperformed due to the positive Canadian numbers.

The USD/CAD initially rose to 1.3507 before turning downwards and falling below 1.3490. The pair is currently trading near at its lowest levels in two weeks, looking at the 1.3475/80 support.

Technical levels

UOB Group’s Economist Enrico Tanuwidjaja and Junior Economist Agus Santoso review the latest release of inflation figures in Indonesia.

Key Takeaways

“Somewhat uncanny during a festive month, Indonesia's headline inflation bucked its typical trend, easing to 4.3% y/y in Apr from 5% in Mar, chiefly due to lower and stable food & transportation prices as the government managed better the logistics last month.”

“This was duly reflected with food and transportation inflation moderating markedly to 4.6% and 12% y/y viz the previous month's 6.1% and 13.7% y/y.”

“April’s inflation data reinforces our 2023 inflation forecast of 4% (2022: 4.2%). Our view remains for inflation to edge back to be within BI’s target range of 2-4% in 2H23.”

- USD/JPY gains strong positive traction on Friday and draws support from a combination of factors.

- The upbeat US NFP report provides a goodish lift to the USD and acts as a tailwind for the major.

- A positive risk tone undermines the safe-haven JPY and provides an additional boost to the pair.

The USD/JPY pair catches aggressive bids during the early North American session and jumps to the 135.00 psychological mark in reaction to the stellar US monthly employment details.

In fact, the headline NFP print showed that the US economy added 253K new jobs in April against 179K anticipated, offsetting the downwardly revised reading of 165K. Adding to this, the unemployment rate unexpectedly fell to 3.4% during the reported month from 3.5% in March, which assists the US Dollar (USD) to regain strong positive traction and provides a goodish lift to the USD/JPY pair.

Apart from this, a positive turnaround in the global risk sentiment - as depicted by a goodish recovery in the equity markets - undermines the safe-haven Japanese Yen (JPY) and further contributes to the bid tone surrounding the USD/JPY pair. That said, the Federal Reserve's (Fed) less hawkish stance holds back the USD bulls from placing aggressive bets and keeps a lid on any further gains, at least for now.

Nevertheless, the USD/JPY pair, for now, seems to have snapped a three-day losing streak and stalled this week's sharp retracement slide from the 137.75-137.80 region, or a two-month high. Spot prices, however, remain on track to register losses for the first time in the previous four weeks. This makes it prudent to wait for strong follow-through buying before placing fresh bullish bets around the major.

Technical levels to watch

- EUR/USD now reverses initial gains and revisits 1.0980.

- US Non-farm Payrolls surprised to the upside in April.

- The unemployment rate dropped to 3.4%.

EUR/USD comes under further downside pressure and rapidly gives away the initial optimism, returning to the sub-1.1000 region in the wake of another solid prints from the US jobs report on Friday.

EUR/USD: Gains appear limited near 1.1100 so far

EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 253K jobs during April, surpassing initial estimates for a gain of 180K jobs. In addition, the March reading was revised down to 165K (from 236K).

Further data saw the Unemployment Rate ticking lower to 3.4% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.5% MoM and 4.4% from a year earlier. Additionally, the Participation Rate increased held steady at 62.6%.

Later in the session, the attention will be on the release of the Consumer Credit Change for the month of March.

What to look for around EUR

EUR/USD trims earlier gains and adds to the moderated pullback seen in the wake of the ECB gathering on Wednesday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Construction PMI, EMU Retail Sales.

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.19% at 1.0989 and faces the next support at 1.0941 (monthly low May 2) followed by 1.0909 (weekly low April 17) and finally 1.0831 (monthly low April 10). Conversely, the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

- Unemployment Rate in Canada held steady at 5% in April.

- Net Change in Employment: 41,400 vs 20,000 expected.

- USD/CAD rises above 1.3500 as US jobs numbers surpassed expectations.

The data published by Statistics Canada revealed on Friday that the Unemployment Rate stayed unchanged at 5% in April. This reading came in slightly better than the market expectation of 5.1%.

Further details of the publication revealed that the Net Change in Employment rose by 41,500, surpassing analysts' estimate of 20,000. The Participation Rate stay unchanged at 65.6% and the annual wage inflation remained at 5.2% in March.

Key takeaways from the report:

- The unemployment rate was 5.0% in April, unchanged since December 2022.

- Employment increased in wholesale and retail trade (+24,000; +0.8%); transportation and warehousing (+17,000; +1.6%); information, culture and recreation (+16,000; +1.9%); as well as in educational services (+15,000; +1.0%). Employment decreased in business, building and other support services (-14,000; -1.9%).

- On a year-over-year basis, average hourly wages rose 5.2% (+$1.66 to $33.38) in April (not seasonally adjusted).

- Employment rose by 41,000 (+0.2%) in April. Since February, monthly employment growth has averaged 33,000, following cumulative increases of 219,000 in December 2022 and January 2023.

- Part-time employment increased by 48,000 (+1.3%) in April, while full-time employment held steady. This was the first notable increase in part-time work since October 2022.

- Compared with 12 months earlier, the number of private sector employees rose by 299,000 (+2.3%) in April 2023, while there were 81,000 (+2.0%) more people working in the public sector.

Market reaction

The USD/CAD rose initially to 1.3505 after the jobs reports from Canada and the US, and then pulled back toward the 1.3490 area.

EUR/USD is firm but little changed in the low 1.10s on the day. Economists at Scotiabank expect the pair to test levels above 1.12 on a break past 1.11.

EUR should remain well-supported on minor dips

“The EUR should remain well-supported on minor dips in the short run at least.”

“Near-term momentum looks neutral but the broader bull tone in this market remains intact.”

“Look for support on dips to 1.0975/1.1025 range in the near-term.”

“A push above 1.11 could still see the rally extend to test 1.12+.”

- DXY navigates with small losses in the low-101.00s on Friday.

- Once 101.00 is cleared, the index could revisit the YTD low near 100.80.

DXY manages to rebound from earlier lows after bears failed to retest/breach the 101./00 support on Friday.

The index remains under pressure despite Thursday’s bullish move. Against that, the next support of note appears at the weekly low at 101.01 (April 26), while the breakdown of this zone could open the door to a probable visit to the 2023 low at 100.78 (April 14)

Looking at the broader picture, while below the 200-day SMA, today at 105.95, the outlook for the index is expected to remain negative.

DXY daily chart

The MXN rallied to a trend high of 17.83 against the USD. Economists at Société Générale expect the USD/MXN pair to extend its move downward.

Signals of reversal are not yet visible

“USD/MXN has broken the lows of March denoting persistence in downtrend.”

“Daily MACD is at a higher level as compared to those lows forming a positive divergence however, signals of reversal are not yet visible.”

“The 50-DMA near 18.20 is first resistance. Break above this hurdle is essential to affirm a short-term up move. Failure could mean continuation in downside towards the low of 2017 near 17.60/17.45 which is also the lower limit of a multi month channel.”

- EUR/JPY struggles for direction just below the 148.00 mark.

- Further losses could see the 146.30 area revisited in the near term.

EUR/JPY seems to have met some initial contention around the 147.00 zone so far this week (low May 4).

The strong downside seen in the last sessions appears to have dented the bullish outlook. Against that backdrop, the ongoing correction carries the potential to extend to the weekly low at 146.30 (April 25), where bears are expected to meet decent support.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.71.

EUR/JPY daily chart

USD/CNH faces scarce chances to break below the key support around 6.8500 for the time being, note Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Yesterday, USD traded in a range of 6.8966/6.9279 before closing largely unchanged. Despite the relatively quiet price action, the underlying tone appears to be soft. We see room for USD to weaken but a sustained decline below 6.8900 is unlikely. Resistance is at 6.9220, followed by 6.9280.”

Next 1-3 weeks: “Our latest narrative was from Tuesday (02 May, spot at 6.9580) wherein ‘while upward momentum has improved, USD has to break and stay above the major resistance at 6.9650 before a move to 7.0000 is likely’. However, USD did not break 6.9650 and instead, it fell sharply over the past few days. USD could continue to weaken but short-term conditions are deeply oversold the chance of it breaking the formidable support at 6.8500 is low for now. Overall, USD is likely to trade under pressure for now unless it can break above the ‘strong resistance’ level, currently at 6.9400.”

The Fed hiked rates by 25 bps and signalled the end of the cycle was closer but left the door open for further hikes if data required. Economists at HSBC see further USD weakness.

Fed hikes rates by 25 bps, signals closer to the end

“The Fed delivered a widely expected 25 bps hike in May. More importantly, the Fed signalled the end of the tightening cycle was closer.”

“Most of the key US data points have been decelerating in recent months, albeit gradually. If these trends persist, the USD is likely to see further gradual weakness, as the peak in Fed rates for this cycle would become increasingly clear. Any sign that these activity data are rebounding or that price pressures are becoming more persistent could create room for some further tightening to be priced in, potentially providing some respite for the USD.”

“Recent lending data showed a stalling in commercial bank loan growth. Should this trend continue, or even accelerate, then it would increase the downside risks to the US economy and help to confirm a peak in Fed rates, weighing on the USD. Other economies face similar risks, but likely over a more extended horizon.”

- Pound Sterling vs US Dollar stabilizes above the key 1.2600 level prior to Nonfarm Payrolls data on Friday.

- The Pound benefits from monetary policy divergence with the US Dollar as elevated inflation suggests more hikes in the UK.

- Is the break above April highs in the upper 1.25s decisive enough to extend? Friday’s close could be critical in deciding.

The Pound Sterling (GBP) finally establishes a foothold above the 1.2600 handle against the US Dollar (USD) ahead of the Nonfarm Payrolls (NFP) release on Friday. The Pound Sterling benefits from the UK monetary policy divergence with the US, the after effects of positive UK PMI data, and early local election results to climb to fresh year-to-date highs. The US Dollar retreats, meanwhile, on renewed banking crisis fears as more regional lenders flag concerns.

From a technical perspective, GBP/USD continues to make new highs in a broadly bullish long-term uptrend. Given the old adage that “the trend is your friend” longs are, therefore, favored over shorts.

GBP/USD market movers

- The Pound Sterling is profiting from outflows from the US Dollar and the Euro as the US Federal Reserve (Fed) and European Central Bank (ECB) are seen as having reached or nearly having reached (in the case of the ECB) peak interest rates in the current hiking cycle.

- With data continuing to show UK inflation above 10% for the seventh consecutive month and robust PMI data, as well as a recent uptick in house prices, those inflationary forces do not look like they are about to ebb away.

- This suggests the Bank of England (BoE), unlike its counterparts, is far from done with hiking interest rates, and may have to hike more than once to get inflation back under control. If so, this is a medium-term bullish factor for Pound Sterling.

- Next Thursday’s Bank of England (BoE) monetary policy meeting, therefore, could be a key driver as it will reveal the BoE’s intent regarding future policy trajectory. If it is particularly hawkish it will highlight this divergence with the Fed and result in increased flows to Pound Sterling.

- The so-far poor performance of the Conservative government in local elections is seen by some as a factor aiding the Pound Sterling as it could be indicative of a change of government at the next general election. The Pound Sterling declined to historic lows under the mismanagement of the economy by previous Prime Minister Lizz Truss and her Chancellor Kwazi Kwarteng, leading to a loss of faith in the Conservative party as a safe pair of hands when it comes to the economy.

- UK S&P Global Services PMI out on Thursday showed a higher-than-expected result of 55.9 versus the 54.9 no-change forecast. Construction PMI out on Friday also beat expectations, coming out at 51.1 versus the 50.7 of the previous month. This suggests inflation will continue to rise in the UK and the Bank of England (BoE) will need to do substantially more to combat it.

- The US Dollar is suffering after renewed banking crisis fears in the US on the back of the news two more regional banks, PacWest and Western Alliance are in trouble, with the latter announcing that it is exploring strategic options including a potential sale of all or part of its business.

- The Nonfarm Payrolls release out at 12:30 GMT on Friday could be a major mover for the US Dollar as it will reveal the health of the jobs market and act as an acid test for Powell’s hawkish rhetoric at the recent FOMC press conference, in which he said the labor market in the US remained “tight”.

- A below-expectations result (i.e. below 150K) would hurt the US Dollar and see GBP/USD rally higher – a higher-than-expected result (more than 200K) would see the US Dollar rally and the Cable decline.

GBP/USD technical analysis: Pushing to new highs

GBP/USD has pushed to new year-to-date highs above 1.2600 overnight, extending the established uptrend that began at the September 2022 lows. The overall trend remains bullish favoring Pound Sterling longs over shorts.

-638188810365973436.png)

GBP/USD: Daily Chart

It is still difficult to determine whether the recent break above the 1.2593 April 28 highs can be classed as ‘decisive’ and therefore indicative of further gains to come. If Friday ends on a strong bullish close near its highs it will suggest the break has been decisive, as it will complete three bullish green up days in a row that have in aggregate breached the April resistance highs. This would suggest the break is not ‘false’ or a bull trap and embolden bulls to push higher. A weak close, however, will bring into doubt the validity of the breakout and could lead to declines.

If the breakout is decisive and price runs higher then the next key resistance level at circa 1.2680 provides an upside target for the pair.

Decisive breaks are usually characterized by moves that begin with a strong green daily bar that breaks above the ceiling level or key resistance high in question. Such breaks may be completed by a single long-green bar with price closing near the highs of the day, or alternatively, three consecutive green bars that break higher. Such insignia provide confirmation that the break is not a ‘false break’ or bull trap.

The Relative Strength Index (RSI) remains below the overbought level and is creeping higher breaking the slight bearish divergence of recent days. This is a mildly supportive sign for the pair and may be indicative of further gains to come.

Nonfarm Payrolls FAQs

What are Nonfarm Payrolls?

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

How does Nonfarm Payrolls influence the Federal Reserve monetary policy decisions?

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

How does Nonfarm Payrolls affect the US Dollar?

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

How does Nonfarm Payrolls affect Gold?

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Sometimes NonFarm Payrolls trigger an opposite reaction than what the market expects. Why is that?

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Economists at Commerzbank expect Gold to remain at a high level.

New prospects for Gold

“New record highs are in reach on the Gold market. All the same, we see only limited potential for any (further) price rises for now. This is because the market is likely over the next few months to fluctuate back and forth (driven by the data) while it attempts to guess whether the Fed’s next interest rate adjustment will be up or down.”

“Investors with more of a long-term horizon have also become more cautious again of late: following significant inflows into Gold ETFs in the second half of March, buying interest has dwindled again.”

- Gold price extends the overnight pullback from an all-time high and continues losing ground on Friday.

- Rebounding US bond yields drives flows away from the XAU/USD ahead of the key US NFP report.

- The Federal Reserve’s less hawkish outlook and a softer US Dollar should help limit further losses.

Gold price comes under some selling pressure on the last day of the week and retreats further from the all-time high, around the $2,078-$2,079 region touched on Thursday. The XAU/USD extends its descent through the first half of the European session and drops to the $2,037 area, or a fresh daily low in the last hour.

Gold price drifts lower ahead of Nonfarm Payrolls (NFP) report

A sharp intraday rise in the United States (US) government bond yields turns out to be a key factor driving flows away from the non-yielding Gold prices. This, along with some repositioning trade ahead of the closely-watched US monthly jobs data, exerts some pressure on the XAU/USD. The popularly known Nonfarm Payrolls (NFP) report is due for release later during the early North American session and is expected to show that the US economy added 179K jobs in April, down from 236K in the previous month. The jobless rate, meanwhile, is anticipated to hold steady at 3.5% during the reported month. Apart from this, investors will take cues from Average Hourly Earnings for fresh insight into the possibility of any further rise in inflationary pressures, which, in turn, should provide some meaningful impetus to the metal.

A combination of factors should help limit any further losses

In the meantime, concerns about the US banking sector and the Federal Reserve's (Fed) less hawkish outlook should help limit the downside for Gold price. Investors remain worried about a full-blown banking crisis in the US and that regional lender PacWest Bancorp could be the next potential domino to fall. The US central bank, meanwhile, outlined a more stringent and data-driven approach to hiking rates further. Moreover, Fed Chair Jerome Powell earlier this week signalled that the central bank was close to hitting the terminal rate. Investors took this as a sign that the central bank could pause its year-long rate-hike cycle sooner rather than later. This, along with the concerns over the US debt ceiling, attracts fresh sellers around the US Dollar (USD) and could further lend some support to the US Dollar-denominated commodity.

XAU/USD remains on track to register strong weekly gains

Nevertheless, Gold price, for now, seems to have snapped a three-day winning streak, though remains on track to register strong weekly gains of nearly 3%. Moreover, the aforementioned fundamental backdrop makes it prudent to wait for strong follow-through selling before confirming that a near-term top has been formed and positioning for any meaningful corrective decline.

Gold price technical outlook

From a technical perspective, the overnight swing low, around the $2,030 level, might protect the immediate downside ahead of the $2,020 region and the $2,012-$2,010 resistance breakpoint, now turned support. This is followed by the $2,000 psychological mark, which should act as a pivotal point. Failure to defend the said support level might prompt some technical selling and drag the Gold price back towards the $1,980-$1,970 strong horizontal support.

On the flip side, the $2,050-$2,053 area now seems to have emerged as an immediate hurdle. Some follow-through buying has the potential to lift the Gold price back towards the all-time high, around the $2,078 region touched on Thursday. The momentum could get extended further and allow bullish traders to aim to capture the $2,100 round-figure mark.

Key levels to watch

Economists at ING expect the US Dollar to embark on a bearish trend.

Tense markets, but Dollar bear trend should win out

“Continued focus on the health of the US regional banks has seen levels of money market stress edge higher.”

“US policymakers will be looking at ways to patch things up, but the clear overall trend should be one of tighter credit conditions and weaker US growth. This should help take the steam out of inflation and send the Dollar lower.”

“DXY has the lows of the year at the 100.75/85 area.”

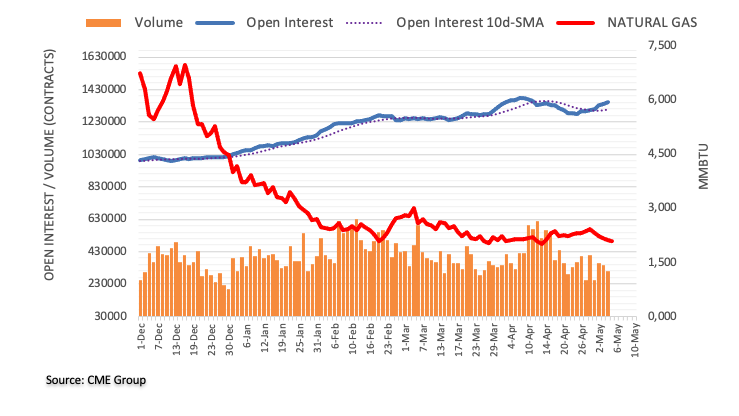

Considering advanced prints from CME Group for natural gas futures markets, open interest rose further on Thursday, this time by around 7.7K contracts. On the flip side, volume contracted for the second consecutive session, now by around 33.5K contracts.

Natural Gas poised to visit the 2023 low

Prices of the natural gas extended the weekly leg lower on Thursday. The negative performance was accompanied by rising open interest, which is indicative that extra losses look favoured in the very near term. Against that, another move to the YTD low at $1.967 (February 22) should not be surprising.

Further selling bias in USD/JPY appears in the pipeline for the time being, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “USD dropped to 133.49 yesterday and then rebounded. The rebound in deeply oversold conditions suggests that USD is unlikely to weaken much further. To look at it another way, after dropping sharply the past few days, today, USD is likely to take a breather and trade in range, expected to be between 133.40 and 135.00.”

Next 1-3 weeks: “After rising close to the March high of 137.91, USD staged a swift drop as it plummeted and closed lower for the third straight day yesterday. While USD could continue to decline, short-term conditions are severely oversold and it left to be seen if USD has enough momentum to break the solid support level near 133.00. However, the downside risk is intact as long as USD stays below 136.05 (‘strong resistance’ level).”

Economists at ING expect the Norwegian Krone to recover in the second half of the year and forecast EUR/NOK below 11.00 by end-2023.

Norges Bank might come to the Krone's rescue

“Norges Bank tightening is falling short of supporting NOK, and while larger cuts to daily FX purchases look warranted in June, it now seems increasingly likely that NB will need to raise rates beyond the projected summer peak of 3.5%.”

“We still expect volatility and vulnerability in the Krone in the near term, but then a recovery in the second half of the year.”

“EUR/NOK should be able to sustainably return below 11.00 by year-end.”

- GBP/USD gains traction for the third straight day and climbs to a one-year top on Friday.

- The emergence of fresh selling around the USD is seen lending some support to the pair.

- Traders now look forward to the release of the crucial US NFP report for a fresh impetus.

The GBP/USD pair scales higher for the third successive day on Friday and climbs to its highest level since May 2022, around the 1.2635 region. The pair, however, trims a part of its strong intraday gains and trades around the 1.2600 mark during the first half of the European session, still up over 0.20% for the day.

The US Dollar (USD) struggles to capitalize on the overnight modest bounce from a one-week low and meets with some supply on the last day of the week, which, in turn, is seen as a key factor pushing the GBP/USD pair higher. Against the backdrop of the Federal Reserve's (Fed) less hawkish outlook, a modest recovery in the global risk sentiment - as depicted by a generally positive risk tone - undermines the safe-haven Greenback. It is worth recalling that the US central bank on Wednesday outlined a more stringent and data-driven approach to hiking rates further.

Moreover, Fed Chair Jerome Powell signalled that the central bank was close to hitting the terminal rate of the current tightening cycle. This, along with fears of a full-blown US banking crisis and debt ceiling, continues to weigh on the buck. The British Pound, on the other hand, continues to draw support from rising bets for an additional 25 bps rate hike by the Bank of England (BoE) in May, which, in turn, lends additional support to the GBP/USD pair. That said, a further recovery in the US Treasury bond yields acts as a tailwind for the USD and caps gains for the major.

Traders also seem reluctant to place aggressive bets and await the release of the closely-watched US monthly employment data, due later during the early North American session. The popularly known NFP report will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the GBP/USD pair. Nevertheless, spot prices remain on track to register modest gains for the third successive week. Moreover, the aforementioned fundamental backdrop favours bulls and supports prospects for a further appreciating move.

Technical levels to watch

Swiss National Bank (SNB) Chairman Thomas Jordan said on Friday, “we cannot exclude further tightening of monetary policy.”

“Inflation is still an issue in Switzerland,” Jordan added.

Market reaction

At the time of writing, USD/CHF is consolidating the latest rally above 0.8920. The pair is advancing 0.73% on the day.

- EUR/USD regains some composure following Thursday’s drop.

- Retail Sales in the euro area surprised to the downside in March.

- Markets’ attention will be on the US Nonfarm Payrolls.

The European currency regains the smile and encourages EUR/USD to revisit the 1.1050 region at the end of the week.

EUR/USD focuses on the US docket

EUR/USD manages to regain buying interest and maintains well in place the multi-week uptrend in place since mid-March, which it has so far met decent resistance near the 1.1100 zone.

In the meantime, investors continue to adjust to Thursday’s hawkish message from the ECB, which now appears reinforced by earlier comments from Board members Simkus and Müller, who advocated for extra rate hikes at the next meetings.

Still around the ECB, the Survey of Professional Forecasters (SPF) for Q2 revised down the projections for inflation and now sees the HICP rising 5.6% in 2023 and 2.6% in 2024 vs. 5.9% and 2.7%, respectively. Additionally, the SPF predicts the economy in the euro region to expand 0.6% this year and 1.2% in 2024 vs. 0.2% and 1.4%, respectively.

In the domestic calendar, Retail Sales in the euro bloc contracted 3.8% in the year to March, while the Construction PMI in Germany receded to 42.0 in April (from 42.9).

What to look for around EUR

EUR/USD picks up some pace and leaves behind part of the moderated pullback seen in the wake of the ECB gathering on Wednesday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Construction PMI, EMU Retail Sales.

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is up 0.17% at 1.1027 and the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022). In opposition, the next support is seen at 1.0941 (monthly low May 2) followed by 1.0909 (weekly low April 17) and finally 1.0831 (monthly low April 10).

The US labor market data is due for publication today. However, it might be overshadowed by the central bank decisions which we saw this week, economists at Commerzbank report.

US labor market data overshadowed by events

“Today’s report is not likely to be suited to challenge the Fed’s expectation of Wednesday that the end of the rate hike cycle should have been reached. Not even a strong labor market report is likely to be sufficient to challenge the entire picture of a slowly cooling US economy so the market will probably stick to its expectations of Fed rate cuts.”

“Even though the labor market report is always good for a surprise, it is unlikely to cause more than a short-term reaction following the publication – if that.”

See – US Nonfarm Payrolls Bank Preview: Smaller, but still positive change in employment

- USD/CAD drops to a two-week low on Friday and is weighed down by a combination of factors.

- A further recovery in Oil prices underpins the Loonie and exerts pressure amid a fresh USD slide.

- Traders now look to the monthly jobs data from the US and Canada for some meaningful impetus.

The USD/CAD pair remains under some selling pressure for the third successive day on Friday and extends its steady descent through the first half of the European session. The downward trajectory drags spot prices below a technically significant 100-day Simple Moving Average (SMA) and the 1.3500 psychological mark, to a two-week low in the last hour.

Crude Oil prices gain some follow-through traction and look to build on the recovery from a 17-month low touched on Thursday. Apart from this, the Bank of Canada (BoC) Governor Tiff Macklem's hawkish comments overnight underpin the commodity-linked Loonie. This, in turn, is seen exerting some downward pressure on the USD/CAD pair amid the emergence of fresh selling around the US Dollar (USD).

In a prepared speech at the Toronto Region Board of Trade, Macklem reiterated the central bank’s commitment to restore price stability and showed readiness to raise interest rates further if inflation remains materially above the 2% target. In contrast, Federal Reserve (Fed) Chair Jerome Powell signalled earlier this week that the central bank was close to hitting the terminal rate of the current tightening cycle.

Moreover, the US central bank outlined a more stringent and data-driven approach to hiking rates further. This, along with fears of a full-blown US banking crisis and debt ceiling, continues to weigh on the buck. Apart from this, a modest recovery in the US equity futures also seems to dent the Greenback's relative safe-haven status, though a further recovery in the US Treasury bond yields could limit losses.

Furthermore, worries about weakening US economy and slowing Chinese demand might keep a lid on any meaningful upside for Oil prices, which, in turn, could lend support to the USD/CAD pair. Traders might also refrain from placing aggressive bets ahead of the closely-watched monthly employment details (NFP) from the US, which is likely to overshadow the simultaneous release of the Canadian jobs data.

From a technical perspective, a convincing break and acceptance below the 100-day SMA could be seen as a fresh trigger for bearish traders. Moreover, technical indicators on the daily chart have just started drifting into the negative territory and support prospects for a further near-term depreciating move. This, in turn, suggests that the path of least resistance for the USD/CAD pair remains on the downside.

Technical levels to watch

Economists at ING expect the Swiss Franc to strengthen and forecast EUR/CHF at the 0.9700 zone.

Swiss Franc in demand

“We think the defensive (non-correlated) properties of the Swiss Franc are in demand. Expect that to continue to be the case until the dust starts to settle in the US regional banking crisis.”

“With Swiss inflation (today released at 2.6% YoY for April) still dramatically lower than that in the Eurozone, the SNB will continue to seek nominal CHF appreciation.”

“We favour EUR/CHF to grind down to the 0.9700 area – lows seen when the US banking crisis first broke.”

Economists at ING see potential for a break past 1.1100 in the EUR/USD pair.

EUR/USD to find some good demand near 1.0900

“In addition to what should clearly be supportive interest rate trends for EUR/USD this year should be much lower energy prices which have delivered a vast improvement in the euro's terms of trade. This is a complete reversal of conditions that were weighing on EUR/USD in the third quarter of last year.”

“We suspect EUR/USD finds some good demand near 1.0900 now and we are just waiting for some softer US activity or price data to unlock a break of 1.1100.”

- AUD/USD gains some follow-through traction on Friday and touches a two-week high.

- The USD comes under renewed selling pressure and lends some support to the major.

- Traders seem reluctant to place fresh bets and keenly await the release of the US NFP.

The AUD/USD pair climbs to a two-week high on Friday, albeit struggles to capitalize on the momentum beyond a technically significant 200-day Simple Moving Average (SMA). The pair, however, maintains its bid tone through the early European session and trades around the 0.6725-0.6730 region, still up over 0.50% for the day.

A combination of factors prompts fresh selling around the US Dollar, which, in turn, allows the AUD/USD pair to prolong its upward trajectory witnessed since the beginning of the current week. Concerns about the banking sector in the US, along with the Federal Reserve's (Fed) less hawkish outlook, fail to assist the USD to build on the previous day's bounce from over a one-week low.

Investors remain worried about a full-blown US banking crisis and now fear that regional lender PacWest Bancorp could be the next potential domino to fall. The US central bank, meanwhile, outlined a more stringent and data-driven approach to hiking rates further. Moreover, Fed Chair Jerome Powell signalled that the central bank was close to hitting the terminal rate of the current tightening cycle.

Apart from this, concerns over the US debt ceiling, along with a modest recovery in the US equity markets, undermine the safe-haven Greenback and benefit the risk-sensitive Aussie. That said, a further recovery in the US Treasury bond yields helps limit losses for the USD and keeps a lid on the AUD/USD pair ahead of Friday's release of the closely-watched US monthly employment details.

The popularly known Nonfarm Payrolls (NFP) report is due for release later during the early North American session. This will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the AUD/USD pair. Nevertheless, spot prices remain on track to register strong weekly gains and snap a two-week losing streak heading into the key data risk.

Technical levels to watch