- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- GBP/USD trades in negative territory near 1.2535 on a stronger USD.

- US ISM Services PMI came in at 53.4 in January vs. 50.5 prior.

- BoE’s Pill said rates will come down this year, but only with progress on inflation.

The GBP/USD pair drops to the multi-week low of 1.2518 and rebounds to 1.2535 during the early Asian session on Tuesday. The expectations of an early Federal Reserve (Fed) interest rate cut fade, and this lifts the US Dollar (USD) across the board. Meanwhile, the US Dollar Index (DXY) holds above 104.40 after retracing from a yearly high of 104.60.

The Institute for Supply Management (ISM) reported on Monday that the US ISM Services PMI climbed to 53.4 in January from 50.5 in December. The Services PMI data, along with the labor market data, suggested that the fourth quarter's economic growth momentum carried over into the new year and reduced the possibility of an interest rate cut in March.

The Bank of England (BoE) Chief Economist Huw Pill stated on Monday that interest rates could drop this year as a reward to the economy for bringing inflation down. Pill added that monetary policy is now on a different path than it was over the course of last year, and rates will only decline as long as progress continues with inflation.

Later on Monday, the UK BRC Retail Sales and S&P Global/CIPS Construction PMIs for January will be due. In the absence of top-tier economic data released from the UK and US, risk sentiment will likely play a pivotal role for GBP/USD.

Japan's annualized Labor Cash Earnings and Overall Household Spending came in below market forecasts for the year ended in December, with labor earnings growing by 1% versus the forecast 1.3% and seeing scant wage growth over the previous period's 0.7% which saw a sharp upside revision from 0.2%.

Overall Household Spending for the year through December declined 2.5%, missing the market's expected -2.1% and seeing only a meager recovery from the previous period's -2.9%.

Market reaction

USD/JPY is trading near 148.60 heading into the early Tuesday market session as the pair remains bid into the high side after last week's late rally above the 148.00 handle.

About Japan Labor Cash Earnings

This indicator, released by the Ministry of Health, Labor and Welfare, shows the average income, before taxes, per regular employee. It includes overtime pay and bonuses but it doesn't take into account earnings from holding financial assets nor capital gains. Higher income puts upward pressures on consumption, and is inflationary for the Japanese economy. Generally, a higher-than-expected reading is bullish for the Japanese Yen (JPY), while a below-the-market consensus result is bearish.

About Overall Household Spending

The Overall Household Spending released by the Ministry of Internal Affairs and Communications is an indicator that measures the total expenditure by households. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth. A high reading is positive (or Bullish) for the JPY, while a low reading is negative (or bearish).

- AUD/USD stabilizes at 0.6483, rebounding from three-month low post-Powell's comments on future rate cuts.

- Powell's talk of three 2024 rate cuts, excluding March, boosts USD, affecting AUD sentiment.

- Strong ISM Services PMI and rising US Treasury yields further underpin the Dollar's strength versus the Aussie.

- Attention turns to RBA's meeting, with a dovish outlook expected due to slowing inflation.

The AUD/USD plunged to a three-month low due to hawkish comments from Federal Reserve Chair Jerome Powell and expectations of a dovish rate held by the Reserve Bank of Australia (RBA). Therefore, the hands of the major exchange at 0.6483 are virtually unchanged.

Aussie Dollar stabilized as traders brace for RBA decision

The pair extended its losses on Monday as market participants digested Powell’s comments. He added that the Fed is committed to getting to its 2% goal and that he and his colleagues eyed three interest rate cuts in 2024. Powell added it’s too soon to begin easing in March, adding that the beginning of the easing cycle could begin in the first half of 2024.

Additionally, AUD/USD traders got cues from data revealed in the New York session, with the ISM Services PMI rising above estimates and the prior month’s reading, up from 50.5 to 53.4, exceeding estimates of 52.

In the meantime, the Greenback was underpinned by upbeat ISM data, and the jump in US Treasury yields. The US 10-year benchmark note rose by 13 basis points, up to 4.16%, while the US Dollar Index (DXY) closed at 104.45, up 0.47%.

Traders are eyeing the release of the Reserve Bank of Australia (RBA) monetary policy meeting. The RBA is expected to hold rates unchanged at 4.35%, based on the latest inflation data, which was softer than expected. Market participants are eyeing a dovish monetary policy statement and would look for the removal of “further tightening is needed.”

In regard to that, ANZ analysts commented, “The Q4 CPI data cemented our view that there will be no change in rates. We think the RBA will retain a tightening bias in the post-meeting statement, although it is likely to acknowledge the general slowdown in the economy since the last Board meeting and the softer CPI data. “

AUD/USD Price Analysis: Technical outlook

The daily chart depicts the AUD/USD is downward biased, and after breaching the 100-day moving average (DMA) at 0.6531, it opened the door to breach the 0.6500 mark. If sellers push prices below the February 5 low of 0.6468, that could open the door toward the 0.6400 figure, followed by the November 10 low of 0.6338.

Conversely, if buyers reclaim the 0.6500 figure, that could pave the way towards the 100-DMA at 0.6531, followed by the 200-DMA at 0.6572.

- NZD/USD trades on a weaker note for the third consecutive day, near 0.6052 on Tuesday.

- The US ISM Services PMI came in better than expected in January.

- Chinese service sector activity grew less than anticipated in January.

The NZD/USD pair remains on the defensive around the mid-0.6000s during the early Asian session on Tuesday. The robust US economic data and the hawkish remarks from the Federal Reserve (Fed) officials lift the US Dollar and weigh on the NZD/USD pair. At press time, the pair is trading at 0.6052, down 0.02% on the day.

On Monday, the US ISM Services PMI rose to 53.4 in January from 50.5 in December, better than the market expectation of 52.0. New Orders rose to a three-month high of 55.0. The Employment Index rebounded into expansionary territory, rising to 50.5. Finally, the Prices Index jumped to 64.0.

Minneapolis Fed president Neel Kashkari said on Monday that a strong economy and a possibly higher neutral rate of interest mean the Fed can take time before deciding to cut the benchmark interest rate. On Sunday, Fed Chair Jerome Powell stated that the central bank will proceed carefully with interest rate cuts this year. The markets are now pricing less than a 20% chance of a March rate cut. The hawkish tone from the Fed provides some support to the Greenback broardly.

The services sector in China grew less than expected in January. Data released by Caixin on Monday revealed that China's Services PMI remained in expansionary territory for 13 straight months. The Chinese Caixin Services PMI came in at 52.7 in January from the previous reading of 52.9. A property crisis and a sluggish economic recovery in China might exert some pressure on the China-proxy New Zealand Dollar (NZD).

Looking ahead, the New Zealand market is closed on Waitangi Day. Traders will take more cues from the Fed’s Mester speech on Tuesday. Later this week, the Chinese Consumer Price Index (CPI) and Producer Price Index (PPI) for January will be released.

- Market rate expectations remains de-coupled from Fed language.

- US Services PMI and service provider inflation remain elevated.

- Markets left to chew on rate-cut potential with little high-impact data remaining.

.

US equity markets saw red on Monday, driven to early declines after Federal Reserve (Fed) Chairman Jerome Powell dashed broad-market rate cut hopes on the rocks of reality even further after the central bank head made a rare mainstream media appearance during an interview with 60 Minutes early Monday. US data further pinned rate cut expectations to the floorboards as US Services Purchasing Managers’ Index (PMI) figures show a four-month uptick in activity, while services providers saw an uptick in inflation as prices rise on economic activity.

Fed Chairman Jerome Powell chilled market rate cut hopes even further during an interview with ‘60 Minutes’, noting that the “job’s not quite done” on inflation, with the US central bank head striking a cautious tone an reiterating recent warnings that market expectations for rate cuts have outrun what the Fed is both willing and able to deliver.

US economic data further complicated matters for rate-cut shoppers after January’s US ISM Services PMI ticked into a four-month high of 53.4, clearing the forecast 52.0 and vaulting over the previous month’s 50.5 (revised from 50.6). US ISM Services Prices Paid also ripped higher in January, with the index climbing to 64.0 compared to the previous month’s 56.7 (revised from 57.4).

With the rest of the week’s economic data docket showing strictly mid-tier releases from the US, markets will be shifting to earnings releases from major equities to drive sentiment. According to the CME’s FedWatch Tool, markets are now pricing in only a 16% chance of a rate cut from the Fed in March, down significantly from December’s 80%-plus money market bets. May’s rate cut chances have also been revised sharply lower, with markets nearly split on whether or not the FEd will trim rates at the May meeting.

The NASDAQ Composite index declined 0.2%, or 31.28 points, to close Monday at $15,597.68, while the S&P 500 shed over 15 points to close down 0.32% at $4,942.81. The DJIA saw the heaviest index declines of the day, falling 0.71% and shedding 274 points to end thew day at $38,380.12.

S&P 500 technical outlook

The Standard & Poor’s (S&P) 500 major equity index got capped below the $4,960.00 level on Monday, falling back from last Friday’s peak at $4,973.10. Intraday action remains well-bid, trading on the bullish side of the 200-hour Simple Moving Average (SMA) near $4,870.00.

Despite near-term bearish pressure, the major index remains firmly planted in bull country, with the S&P index continuing to grind towards the $5,000.00 major handle on daily candlesticks, and it would take a 10% decline to drag the S&P into bearish territory on the low side of the 200-day SMA below $4,500.00.

S&P 500 hourly chart

S&P 500 daily chart

- GBP/JPY drops over 0.50% to 186.32 amid cautious sentiment following Powell's rate cut hints.

- New lower low suggests further possible decline to 185.22, contingent on breaking below current supports.

- Recovery above Tenkan-Sen (186.89) could open path to resistances up to 189.00.

The GBP/JPY finished the North American session in negative territory, down more than 0.50%, after hitting a daily high of 187.61. A risk-off impulse following Federal Reserve Chair Jerome Powell's Sunday interview, in which he emphasized they would likely cut three times and begin to ease policy toward the first half of the year. At the time of writing, the pair exchanges hands at 186.32.

GBP/JPY edged lower on Monday, registering a lower low, which could open the door to test last week’s low of 185.22, but traders must clear the first support level seen at the 186.00 figure. Once cleared, the former would be up next, followed by the Kijun-Sen at 183.83.

Conversely, the pair could resume its uptrend if buyers regained the Tenkan-Sen at 186.89, followed by the 187.00 figure. A breach of the latter will expose the January 19 high at 188.93, followed by the 189.00.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels

- USD/JPY ascends to mid-148s, propelled by Powell's comments and rising US Treasury yields.

- Powell hints at three rate cuts this year, bolstering the Dollar, despite ruling out a March cut.

- January's ISM Services PMI rise indicates stronger US Non-Manufacturing activity, boosting economic optimism.

- US 10-year Treasury yield climbs to 4.16%, with the Dollar Index up 0.52%, reflecting the dollar's dominance.

- Japanese earnings and spending data, alongside Fed officials' remarks, awaited for more market insights.

The USD/JPY gained modestly late in the New York session, trading at around the 148.70s area, sponsored by the strong US Dollar and higher US Treasury bond yields. Over the weekend, comments by the US Federal Reserve (Fed) Chair Jerome Powell spurred flows toward the Greenback while US Treasury yields skyrocketed.

Comments from Fed Chair Powell and strong services PMI, fuels USD/JPY rally

Fed Chair Jerome Powell said that most policymakers expect three rate cuts in the year, and added that “nothing has happened in the meantime that would lead me to think that people would dramatically change their forecasts.” He pushed back against a March rate cut, adding that if inflation continues to edge lower, the US Central Bank could reduce rates faster.

Aside from this, the Institute for Supply Management (ISM) revealed that Non-Manufacturing activity, also known as Services PMI, picked up in January, increasing from 50.5 In December to 53.4 last month.

The USD/JPY edged higher as the US 10-year Treasury note yield is soaring close to 14 basis points (bps), at 4.16%. At the same time, the US Dollar Index (DXY), an index that tracks the buck’s performance against the other six currencies, advanced 0.52%, up at 104.50.

The Japanese economic calendar will be light, featuring Average Cash Earnings on a yearly basis, along with -Household Spending numbers, expected to improve, following November data. On the US front, the calendar will feature Fed speakers led by Cleveland Fed President Loretta Mester, Minnesota’s Fed President Neil Kashkari, and Susan Collins from the Boston Fed.

USD/JPY Price Analysis: Technical outlook

A bullish engulfing pattern formed above the crossover of the Senkou Span A and B, opened the door for further gains, but USD/JPY buyers need to reclaim 149.00, which could open the door to challenge the 150.00 figure. On the flip side, if sellers step in, they need to drag the exchange rate below 148.00 to test the Tenkan-Sen at 147.39.

Stronger US fundamentals and the hawkish tone from Chief Powell over the weekend were more than enough to lift the Greenback to fresh yearly highs and put the risk-associated universe under heightened pressure at the beginning of a new trading week.

Here is what you need to know on Tuesday, February 5:

The greenback rose to new yearly highs well past the 104.00 barrier in response to investors’ assessments of the latest NFP figures and the hawkish tilt from Chief Powell, all amidst the marked pick-up in US yields. On February 6, the US docket includes the TIPP Economic Optimism Index and the speech by Cleveland Fed L. Mester.

EUR/USD remained well on the defensive and slipped back to the 1.0730 region to print new two-month lows against the backdrop of the intense upward bias in the US Dollar and the absence of surprises from the final Services PMI across the euro bloc. The release of Retail Sales in the broader Euroland will be in the limelight on Tuesday.

GBP/USD followed its risk-linked peers and retreated to multi-week lows well south of 1.2600 the figure amidst the generalized strong tone in the Greenback and a final UK Services PMI still below the 50 threshold. Across the Channel, the BRC Retail Sales Monitor and the Construction PMI are due on Tuesday.

The combination of the sharp advance in the Greenback and higher yields lent legs to USD/JPY and bolstered a move to a new 2024 top in the 148.80/85 band on Monday. Next on tap in Japan will be the December Household Spending figures due on February 6.

The continuation of the leg lower saw AUD/USD break below the 0.6500 support and print fresh three-month lows at the beginning of the week. All the attention will be on the RBA meeting on Tuesday, when the central bank is seen maintaining its cash rate intact at 4.35%.

USD/CAD surpassed the key 200-day SMA and climbed to multi-day highs above 1.3500, adding to Friday’s strong advance. On Tuesday, Building Permits and the Ivey PMI are due ahead of the speech by BoC’s T. Macklem.

WTI prices dropped for the fourth session in a row and approached the $71.00 mark per barrel, as dwindling bets for a rate cut by the Fed in March weighed on traders’ sentiment. Next on tap for the commodity will be the report on US crude oil inventories by the API and the EIA on Tuesday and Wednesday, respectively.

The stronger Dollar kept prices of both Gold and Silver under pressure, sparking a marked decline to the $2010 zone and the $22.20 area, respectively.

- The AUD/JPY is currently trading at 96.32, recording a loss of 0.30%.

- According to daily chart indicators, negative RSI trajectory and ascending red MACD histogram hint bearish momentum.

- Hourly chart indicators imply bearish pressure has eased with a rebound in bulls evident in positive RSI slope and flat MACD bars.

In Monday's session, the AUD/JPY pair lost ground, with a low of 96.32 following a previous high of 96.80 earlier in the day. On the fundamental side, markets await the Reserve Bank of Australia meeting on Tuesday where investors will look for clues for forward guidance which could set the pace of the cross for the week. The technical outlook for the pair remains neutral to bearish on the daily chart, although recent activity shows the bulls regaining some ground on the hourly chart.

AUD/JPY levels to watch

According to the daily chart, it is showing a neutral to bearish outlook. The negative territory and declining slope of the Relative Strength Index (RSI) indicates a bearish momentum. Simultaneously, the Moving Average Convergence Divergence (MACD) histogram showcases increasing sake of red bars which signals the short-term downward pressure. Nevertheless, despite the shorter-term momentum suggesting bearish sentiment, when looking at the Simple Moving Averages (SMAs), the pair is evidently below the 20-day SMA but bulls are presenting battle at the 100-day SMA and is still above the 200-day average. This indicates that in the larger picture, bulls maintain a stronghold.

Moving onto the shorter-term outlook given by the hourly chart, it presents a slightly different picture. On this timeframe, despite the bears taking a step back and allowing for some recovery, the bullish force is merely reflected as a retaliation rather than a comeback. The Relative Strength Index (RSI) although in negative territory, boasts a positive slope indicative of some bullish pushback. The Moving Average Convergence Divergence (MACD) echoes this sentiment with flat red bars. However, the buying momentum is not sufficient to negate the dominant selling sentiment, but it does put forth a pause in the bearish outlook of the session.

- EUR/USD slides as German Imports tumble, pan-EU PPI slips further.

- EUR/USD tested into 12-week lows in Monday’s decline.

- German Trade Balance rises on accelerating Import declines.

The EUR/USD fell another half-percent on Monday, dragging the pair into 12-week lows near 1.0723 after EU economic data failed to inspire investor confidence. The OECD sees pan-European inflation holding above the European Central Bank’s (ECB) 2% until sometime after 2025, hampering money market’s expectations for rate cuts from the ECB, further suppressing upside potential in the Euro (EUR).

This week still brings European Retail Sales for December as well as the ECB’s latest Economic Bulletin, with Friday rounding out the economic calendar with Germany’s Harmonized Index of Consumer Prices (HICP) for January.

Daily digest market movers: EUR/USD extends declines as investors look for reasons to buy

- Germany’s Trade Balance rose to €22.2 billion after German Imports tumbled to multi-year lows, declining 6.7% in December versus the forecast -1.5%, engulfing the previous month’s 1.5%.

- Germany’s HCOB Composite Purchasing Manager’s Index (PMI) also slid in January, printing at 47.0 versus the forecast steady hold at 47.1.

- Pan-European Producer Price Index (PPI) figures also declined for the year ended in December, coming in at -10.6% versus the forecast -10.5%, falling even further away from the previous period’s -8.8%.

- Tuesday brings December’s euro area Retail Sales, forecast to tick upwards slightly to -0.9% for the year ended in December versus the previous period’s -1.1%.

- MoM Retail Sales are expected to see accelerated declines of -1.0% compared to the previous month’s -0.3%.

- The ECB drops their latest Economic Bulletin on Thursday, investors will be looking for tonal shifts regarding interest rate cuts from the ECB but hopes are waning.

- Friday rounds out the European economic calendar with Germany’s HICP inflation for January, forecast to hold steady at 3.1%.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.32% | 0.67% | 0.45% | 0.29% | 0.08% | 0.10% | 0.34% | |

| EUR | -0.32% | 0.35% | 0.13% | -0.03% | -0.24% | -0.21% | 0.01% | |

| GBP | -0.67% | -0.35% | -0.22% | -0.39% | -0.60% | -0.57% | -0.34% | |

| CAD | -0.45% | -0.13% | 0.22% | -0.17% | -0.38% | -0.35% | -0.12% | |

| AUD | -0.29% | 0.03% | 0.39% | 0.17% | -0.21% | -0.18% | 0.04% | |

| JPY | -0.09% | 0.23% | 0.57% | 0.38% | 0.21% | 0.01% | 0.25% | |

| NZD | -0.10% | 0.22% | 0.57% | 0.35% | 0.19% | -0.05% | 0.23% | |

| CHF | -0.34% | -0.01% | 0.33% | 0.12% | -0.05% | -0.27% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD looking to springboard off chart territory near 1.0720

EUR/USD shed further weight after opening the trading week near 1.0780, dipping into multi-week lows near 1.0720 as the pair accelerates into the bearish side of the 200-hour Simple Moving Average (SMA) descending through 1.0840.

Despite EUR/USD recovering late Monday, the pair remains steeply off of recent consolidation around the 200-day SMA near 1.0850, and the pair is running into old technical support from December’s swing low. EUR/USD is set for a bearish challenge of the 1.0700 handle, while the topside sees technical congestion waiting for buyers as the 200-day and 50-day SMA consolidate near 1.0850 and 1.0900, respectively.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver drops over 1.40% hit by rising US Treasury yields and Powell's hawkish stance.

- XAG/USD dips below December 13 low, eyeing $22.00 for further decline risk.

- Failure to retake 100-DMA at $23.13 signals potential extended losses, next support at November 13 low of $21.88.

- A bounce above $22.50 may revive buying towards $23.00 and key daily moving averages.

Silver price dives to a new two-week low of $22.25 and tumbles more than 1.40% in the day as US Treasury bond yields climb. Federal Reserve Chair Jerome Powell's hawkish commentary, disregarding a rate cut in March and signaling three interest rate cuts, were enough to keep the Greenback bid. Therefore, precious metals fell and are extending their losses. The XAG/USD trades at $22.36 after hitting a high of $22.73.

XAG/USD pushed lower below the December 13, 2023 swing low of $22.51, aiming toward the $22.30 area. Even though the grey metal bounced off the 78.6% Fibonacci retracement, failing to reclaim the 100-day moving average (DMA) at $23.13 opened the door for further losses. If Silver drops below $22.00 per troy ounce, look for a challenge of the November 13 low of $21.88.

On the opposite side, if buyers regain $22.50 and the $23.00 figure, they could challenge the 100-DMA, followed by the 200-DMA at $23.41.

XAG/USD Price Action – Daily Chart

XAG/USD Technical Levels

- GBP/USD falls 0.74% to 1.2535, influenced by Powell's rate stance and strong US jobs data.

- Powell's emphasis on inflation control tempers early rate cut expectations.

- US Nonfarm Payrolls' substantial job growth supports optimism for the US economy, boosting the Dollar.

- Rising US Treasury yields post-Powell and solid economic data prompt Fed rate cut reassessment.

- UK services sector's positive start overshadowed by US monetary policy and economic outlook focus.

The GBP/USD tumbles in the mid-North American session trade with losses of 0.74% and exchanges hands at 1.2535. Factors like last Friday's US economic data and over-the-weekend comments of Federal Reserve Chair Jerome Powell keep the US Dollar bid amid a risk-off impulse.

Jerome Powell pushes back against March rate cuts

Jerome Powell commented in an interview that it is premature to consider cutting rates, highlighting that the objective of driving inflation toward its 2% goal has not been fully fulfilled. Nevertheless, he left the door open to begin easing policy toward the year's first half.

Last week the January Nonfarm Payrolls report revealed an addition of 353K Americans to the workforce, while the unemployment rate remained stable at 3.7%. This data suggests that the labor market continues to be robust, supporting the Goldilocks narrative.

Data-wise, business activity in the services sector improved, according to S&P Global and the Institute for Supply Management (ISM), after the release of January´s reports.

US Treasury yields remain high during the day and underpin the Greenback as investors re-calibrate their bets for Fed rate cuts. Last week, they estimated the Federal Funds rate (FFR) to hit 3.96%, but following over-the-weekend Powell’s remarks, they expect it to end at 4.26%. Consequently, the US Dollar Index (DXY) rises 0.44%, up to 104.42.

Other data showed that British services businesses began the year positively.

GBP/USD Price Analysis: Technical outlook

Given the fundamental backdrop, the GBP/USD has fallen below the 200-day moving average (DMA) of 1.2560, aiming to extend its losses further below the 1.2500 figure. A decisive break will expose the 100-DMA at 1.2467, followed by the 1.2400 mark. On the upside, the pair first resistance would be the 200-DMA. If cleared, the next supply zone will emerge at 1.2600, followed by the 50-DMA at 1.2675.

- The DXY rose by more than 0.50% to 104.50 on Monday.

- The US service sector continues to show robustness, making markets disregard an interest rate cut in March.

- US Treasury yields continue to rise, boosting the Greenback.

The US Dollar (USD) measured by the DXY index rose on Monday to 104.50, its highest level since mid-November. This upswing has been attributed to the fortifying ISM Services PMI for January, giving the Dollar Index an advantageous boost via markets giving up on hopes of an interest rate cut in March.

The US Federal Reserve's hawkish hold, justified by a robust jobs report and continuous strong growth in Q1, is making any imminent rate cuts implausible, contradicting previous market expectations. Federal Reserve (Fed) Chair Powell maintains cautiousness, emphasizing the need to observe inflation’s sustained drop toward the 2% core target.

Daily digest market movers: US Dollar gains additional ground as Services PMI comes in higher than expected

- January's ISM Services PMI recorded 53.4, beating the consensus figure of 52 and last month's 50.5, as reported by the Institute for Supply Management (ISM).

- US bond yields continue to rise to monthly highs with 2-year, 5-year and 10-year bonds trading at rates of 4.45%, 4.11% and 4.15%, respectively. All three rates are up by more than 2%, which is making the US Dollar attractive for foreign investors.

- CME's FedWatch Tool hints at lesser odds for a rate cut in March, currently standing at 15%. Those odds rise to 50% in May, but the probabilities of a hold are also high.

Technical analysis: DXY bulls extend gains and recover the 20-day SMA

The indicators on the daily chart reflect a potential shift in momentum in the short term. The Relative Strength Index (RSI) is nearing overbought conditions, which typically suggests that buyers may be losing their grip, although it does not immediately indicate a trend reversal.

However, evaluating the broader scale technical outlook paints a slightly different picture. The index now stands above the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting a strong and sustained push from the bulls. This can be interpreted as a bullish signal on a broader outlook.

The overall combination of these indicators suggests that despite the RSI nearing overbought territory, the buying momentum, backed up by the rise in the Moving Average Convergence Divergence (MACD) and the position above the SMAs, is the more dominating force. Bulls look set to maintain control for now, especially as they continue recovering, which can often incite additional buying interest. That being said, traders should eye a potential reversal, due to indicators nearing overbought conditions.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- European data mixed, investors begin to reassess central bank expectations.

- EU PPIs turn lower, German Trade Balance rises as Imports collapse.

- Hefty earnings reports this week alongside EU Retail Sales, ECB Bulletin.

European equities shifted around the centerline on Monday before settling slightly in the red to kick off the new trading week as investors await another raft of earnings data while pan-European economic data continues to get stuck in the mire.

Germany’s Trade Balance rose to a nearly three-year high of €22.2 billion in December with both Imports and Exports declining sharply MoM. December’s German Exports fell -4.6% versus the forecast -2.0%, erasing the previous month’s 3.5% uptick, and German Imports tumbled to an almost four-year low of -6.7%, far below the -1.5% expected and backsliding sharply from the previous month’s 1.5%.

The pan-euro area Producer Price Index (PPI) in December fell to -10.6%, missing the forecast -10.5% and falling even further from the previous month’s -8.8%. Investors latch onto a glimmer of hope from the Sentix Investor Confidence Index for February, which saw a moderate rebound to -12.9 from the previous -15.8.

Retail stocks overall declined over 2% ahead of Tuesday’s EU Retail Sales figures, forecast to improve but still print negative at -0.9% versus the previous -1.1% for the year ended in December, while the MoM figure is forecast to accelerate to the downside at -1.0% compared to the previous month’s -0.3%.

The European Central Bank’s (ECB) latest Economic Bulletin lands on Thursday, and Friday will wrap up the European trading week with German inflation which is forecast to hold steady at 3.1% for the year ended January.

European equities broadly closed lower, but only mildly, with the pan-European STOXX600 declining 0.05% to close down a quarter of a point at €483.69.

France’s CAC40 fell a scant 0.03%, down 2.3% at €7,589.96 while Germany’s DAX shed 0.08% to end at €16,904.06, down 14 points.

London’s FTSE index also fell nearly 3 points to end Monday at £7,612.86, in the red by a svelte 0.04%.

DAX technical outlook

The German DAX index, tightly correlated to the pan-European STOXX600 major equity index, continues to waffle on the south side of the €17,000.00 handle on Monday. Intraday action got squeezed into the midrange near €16,890.00 as the index drifts into the near-term middle.

Daily candles have the DAX strung along near-term congestion, but remaining pinned firmly into bear country with the equity index well-supported in striking distance of all-time highs with a firm technical floor priced in at the 200-day Simple Moving Average (SMA) rising into €16,000.00.

DAX hourly chart

DAX daily chart

The Bank of England's (BoE) Chief Economist and Executive Director for Monetary Analysis Huw Pill hit newswires on Monday with a measured tone, noting that while interest rates are overwhelmingly pointed down looking forward, rate cut expectations might be somewhat premature as the BoE looks for firmer evidence that UK inflation will continue to recede in the coming months.

Key highlights

- February would have been far too premature of a rate cut.

- BoE's Pill is not yet confident that inflation is low enough to immediately reduce rates.

- BoE rates will only decline as long as progress continues with inflation.

- Rates will remain restrictive even after initial cuts.

- It's still too early to declare inflation fully suppressed, still more work to be done.

- BoE's Pill sees a slight uptick in UK Gross Domestic Product (GDP).

- Overall growth remains limited by supply constraints.

- UK activity remains overall quite weak.

- Interest rate in Australia set to remain steady at 4.35%.

- Reserve Bank of Australia Governor Michele Bullock not expected to change the tone.

- The Australian Dollar is poised to extend its slump against the US Dollar.

The Reserve Bank of Australia (RBA) will announce its monetary policy on Tuesday and is widely anticipated to keep the Official Cash Rate (OCR) unchanged at a 12-year high of 4.35%.

The RBA has changed the number of monetary policy meetings in 2024, reducing the number of the Board’s meetings from eleven to just eight times a year. Officials decided to cut back the number of meetings so the Board could have more time to assess economic developments.

Incoming data since the December decision has shown inflation retreated sharply while growth remains tepid, justifying market expectations of a no-chance in the OCR.

Reserve Bank of Australia to stand pat as inflation eases, growth weakens

With the OCR seen steady at record highs, the focus will be on the accompanying statement and Governor Michele Bullock's press conference. Back in December, the RBA statement noted: “Inflation had continued to decline but remained high. Wages growth had reached 4 per cent a little sooner than had been expected but the staff judged that wage growth was unlikely to rise much further. Output growth had continued below trend and the labour market was tight but easing gradually. Members agreed that financial stability considerations were not a constraint on monetary policy at the current meeting.”

Australian policymakers maintained the wording related to additional rate hikes amid expectations inflation would remain above target for a prolonged period. However, the latest figures were quite encouraging. The Consumer Price Index (CPI) rose 0.6% in Q4, easing from 1.2% in the previous quarter and below the 0.8% expected, according to the Australian Bureau of Statistics (ABS). The central bank’s favorite gauge, the RBA Trimmed Mean CPI rose 0.8% in the same period and 4.2% from a year earlier, the latter easing from 5.1% in Q3. Finally, the Monthly Consumer Price Index was up 3.4% YoY in December after printing at 4.3% in the previous month.

The RBA then has easing inflation but also softening economic activity as the base case for the January decision. In such a scenario, most economists expect no changes to the statement wording, with policymakers maintaining the door open for additional hikes if needed. Rate cuts will most likely remain out of the table. Money markets are not looking into a pivot in monetary policy in the first half of the year.

The Australian Dollar (AUD) may come under selling pressure if policymakers choose a more dovish tone to express their view of the future of monetary policy. Yet retaining the hawkish stance may not give fresh impetus to the Aussie, as lately, investors prefer to bet on rate cuts and ignore central bankers.

Governor Bullock has warned about the upside risks of inflation and may ease the tone there, but given the labor market remains tight, she most likely will maintain the cautious tone. Recent data showed a sharp slide in the number of employed individuals, with the monthly report indicating a 65.1K decline in job positions in December, while the Unemployment Rate held steady at 3.9%. Also, the Participation Rate slid from 67.3% to 66.8%.

How will the RBA interest rate decision impact AUD/USD?

The AUD/USD pair trades at its lowest since last November on Monday, amid broad US Dollar demand. The Australian Dollar (AUD) has fallen against its American rivals in the last five weeks, and started this one by extending its slump. The pair trades below the 0.6500 threshold, and in the long run, it has room to extend the slide.

Valeria Bednarik, Chief Analyst at FXStreet says: “The bearish momentum is evident in the daily chart, as the pair finally slid below its 100 SMA (Simple Moving Average) for the first time since mid-November, and after buyers battled throughout January to defend the area. At the same time, the 20 SMA accelerated its decline above the longer one, reflecting persistent selling interest. Finally, technical indicators suggest bears are willing to keep selling, as per aiming south within negative levels.”

Furthermore, Bednarik notes: “The current price zone seems lacking a relevant level that could provide support. Sellers will be looking for a downward extension towards 0.6450, aiming then to reach the 0.6370/80 area. Given the US Dollar’s broad strength, AUD/USD could extend its slide towards 0.6300/30 following the event. To the upside, the level to watch is the aforementioned daily 100 SMA, currently at around 0.6530. Once above the latter, the recovery could continue towards 0.6600, where sellers are expected to jump back in.”

RBA FAQs

What is the Reserve Bank of Australia and how does it influence the Australian Dollar?

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

How does inflation data impact the value of the Australian Dollar?

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

How does economic data influence the value of the Australian Dollar?

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

What is Quantitative Easing (QE) and how does it affect the Australian Dollar?

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

What is Quantitative tightening (QT) and how does it affect the Australian Dollar?

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Economic Indicator

Australia RBA Interest Rate Decision

The Reserve Bank of Australia (RBA) announces its interest rate decision at the end of its eight scheduled meetings per year. If the RBA is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Australian Dollar (AUD). Likewise, if the RBA has a dovish view on the Australian economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for AUD.

Read more.Next release: 02/06/2024 03:30:00 GMT

Frequency: Irregular

Source: Reserve Bank of Australia

- Mexican Peso begins the week on the back foot, driven by Fed Chair Jerome Powell disregarding Mexico's quiet Constitution Day shifts focus to inflation data and Banxico's upcoming rate decision.

- US's strong Services PMI and Nonfarm Payrolls hint at the Fed's achievable soft-landing.

- Expectations lean towards Banxico holding rates at 11.25%, with eyes on Fed speakers for more insights.

The Mexican Peso loses ground against the US Dollar (USD) courtesy of Federal Reserve Chairman Jerome Powell's interview during the weekend, sponsoring a jump in US Treasury bond yields. Along with a holiday in Mexico, that boosts the Greenback amid a risk-off impulse. At the time of writing, the USD/MXN exchanges hands at 17.21, up 0.51%.

Mexico´s economic docket is empty due to Mexico’s Constitution Day observance. This week, inflation data will be released on Wednesday, followed by the Bank of Mexico (Banxico) monetary policy decision, on Thursday. Rates are expected to remain unchanged at 11.25%.

In the meantime, the US economy continues to shine as the release of Services PMI by S&P Global and the Institute for Supply Management (ISM) showed that business activity is improving. That, along with last Friday's US Nonfarm Payrolls data, increases the odds of the Fed achieving a soft landing.

Meanwhile, some Federal Reserve speakers had begun to cross the wires following the Fed’s decision last Wednesday.

Daily digest market movers: Mexican Peso on the defensive ahead of Banxico’s decision

- Inflation in Mexico would be featured on Thursday before Banxico´s decision. The Consumer Price Index (CPI) in December was 4.66% YoY, and core CPI stood at 5.09% year-over-year.

- US S&P Global Services PMI came at 53.4, exceeding estimates and the previous reading, while Composite was 52, up from 50.9.

- The ISM Non-Manufacturing PMI, also known as services, edged up from 50.5 to 53.4, exceeding estimates.

- S&P Global confirmed Mexico´s BBB foreign currency rating and BBB+ local currency long-term debt rating.

- S&P Global affirmed that stable macroeconomic conditions, with a real growth in Gross Domestic Product above 3% in 2023 that is supported by solid domestic demand and moderating inflation, prepare the way for the general elections in June.

- Minnesota Fed President Neil Kashkari commented that a strong economy means the Fed is in no hurry to make interest rate cuts. Kashkari acknowledged that inflation is making “rapid progress” towards the Fed’s 2% target and added that policy could not be sufficiently restrictive.

- Chicago’s Fed President Austan Goolsbee noted that inflation could remain falling amid a strong US economy,

Technical Analysis: Mexican Peso weakens further as USD/MXN buyers target 17.20

The USD/MXN is neutral-biased and jumped off the 50-day Simple Moving Average (SMA) at 17.13, though it has fallen short of reclaiming the 200-day SMA at 17.32. A daily close above the 17.20 strong resistance buyers could challenge the 200-day SMA, followed by the 100-day SMA at 17.40. Further upside lies at the 17.50 figure.

On the other hand, if sellers drag prices below the 50-day SMA at 17.13, look for a challenge of the February 2 daily low at 17.03, before slumping to 17.00.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar hits eight-week low after US PMI surge.

- Canada sees BoC Governor Macklem slated for Tuesday.

- US Fed policymaker statements weigh on Monday markets.

The Canadian Dollar (CAD) is broadly lower on Monday after a broad market dogpile into the US Dollar (USD) after US ISM Services Purchasing Managers Index (PMI) figures came in well above expectations. Additionally, mixed comments from US Federal Reserve (Fed) policymakers risk investor outlooks, hampering risk appetite.

Bank of Canada (BoC) Governor Tiff Macklem is slated to speak and answer questions regarding monetary policy transmission in Quebec on Tuesday, leaving the Canadian Dollar absent meaningful domestic releases on Monday.

Daily digest market movers: Canadian Dollar backslides as markets readjust expectations

- US data, Fedspeak dominates currency flows on Monday with Canada absent on the economic calendar.

- The US ISM Services PMI for January climbed to 53.4 versus the forecast of 52.0, accelerating above the previous month’s 50.5, which saw only minor revisions.

- US ISM Services Prices Paid hit an 11-month high as businesses continue to see inflationary pressure in January, up sharply from December’s 56.7 (revised down from 57.4).

- US ISM Services New Orders Index rebounds to 55 in January from December’s 52.8 as economic activity continues to stubbornly vex markets, which hope for earlier rate cuts.

- Minneapolis Fed President Neel Kashkari noted on Monday that higher neutral rates might mean that monetary policy may not be as tight as previously thought.

- Fed’s Kashkari also noted that despite broadly positive US data, some weak points remain, notably rising consumer delinquencies.

- Chicago Fed President Austan Goolsbee pulled up short of Fed Kashkari’s earlier statements, noting that while he needs to see more inflation progress in the data itself, he won’t rule out a March rate cut entirely.

- The CME’s FedWatch Tool sees money markets pricing in barely a 15% chance of a rate cut in March.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.45% | 0.75% | 0.50% | 0.43% | 0.16% | 0.24% | 0.47% | |

| EUR | -0.45% | 0.32% | 0.04% | 0.00% | -0.28% | -0.18% | 0.02% | |

| GBP | -0.76% | -0.31% | -0.27% | -0.34% | -0.61% | -0.51% | -0.29% | |

| CAD | -0.49% | -0.04% | 0.27% | -0.05% | -0.32% | -0.23% | -0.02% | |

| AUD | -0.46% | 0.00% | 0.30% | 0.05% | -0.30% | -0.21% | 0.01% | |

| JPY | -0.19% | 0.26% | 0.55% | 0.33% | 0.25% | 0.06% | 0.28% | |

| NZD | -0.28% | 0.18% | 0.48% | 0.23% | 0.15% | -0.12% | 0.19% | |

| CHF | -0.47% | -0.02% | 0.29% | 0.01% | -0.03% | -0.30% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: Canadian Dollar softens across the board, USD/CAD tests eight-week highs

The Canadian Dollar (CAD) sees broad losses on Monday as the Loonie sheds weight against nearly all of its major currency peers in the new trading week. The CAD is sharply lower against the US Dollar, down half a percent on Monday, with the CAD shedding a third of a percent against the Japanese Yen (JPY) and a quarter of a percent against the New Zealand Dollar (NZD). Despite broad selling pressure, the CAD still gained a quarter of a percent against the Pound Sterling (GBP), Monday’s weakest-performing currency, forcing the Canadian Dollar to settle for second-worst.

The Canadian Dollar’s declines on Monday sees the USD/CAD testing back over the 1.3500 handle, running into near-term technical resistance at familiar intraday swing highs near 1.3540.

Monday’s USD/CAD surge sees the pair trading back into the high end of the 200-day Simple Moving Average (SMA) below the 1.3500 handle, and the pair is pushing into eight-week highs with an immediate technical ceiling weighing down from 1.3600.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The EUR/GBP stands at 0.8560, marking a 0.25% increase in the session.

- European PMIs from January where upwards revised but remained still in contraction territory.

- Hourly indicators hint at potential consolidation after bulls got rejected near overbought area.

In Monday's session, the EUR/GBP pair was seen trading at 0.8560, gaining a 0.25% and seems to be marching towards the 20-day Simple Moving Average (SMA) at 0.8565 . Despite pressures from a stagnant Euro Area economy and anticipations of ECB's rate cut, the daily chart indicates the dominance of buyers. On the hourly chart, however, indicators hint at a possible pullback as they got rejected near the overbought territory.

During the European session, the Hamburg Commercial Bank (HCOB) PMIs from January where upwards revised which gave some traction to the EUR but they still remain deep in contraction area. This situation may push the ECB to initiate a rate cut by June 2024, assuming the economies continue to weaken. Conversely, the UK economy shows signs of potential firmness with the Bank of England (BoE) shifting from assessing the need for restrictive monetary policy to sustaining the current stance. Following the bank's decision to hold rates, market anticipates around 100 bps of rate cuts for 2024, which might be moderated due to expected fiscal amendments. On the ECB side, markets expect between 125 and 150 bps of easing in 2024 and this divergences may eventually limit any upwards movements by the cross.

EUR/GBP levels to watch

Assessing the daily chart indicators, the Relative Strength Index (RSI) is glimpsing a positive gradient despite being within negative territory. This exhibits a potential shift towards an upward trend as bulls start to conquer additional ground. In addition, the Moving Average Convergence Divergence (MACD) is exhibiting increased green bars, suggesting that the upward force is taking control. The shift in momentum may come into fruition in case the buyers manage to push the pair back above the 20-day Simple Moving Average (SMA) .

Switching to the hourly chart for the more immediate perspective, the scenario seems to be a bit more complicated for the bulls. Even though indicators have been rebuffed near overbought territory, the RSI portrays a downward slope positioned within positive territory, indicating some selling momentum as buyers seem to be taking profits. However, the sustained growth in the green bars of the MACD identifies a continuous buying pressure in the shorter timeframe.

EUR/GBP daily chart

The Reserve Bank of Australia (RBA) will announce its next Interest Rate Decision on Tuesday, February 6 at 03:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of eight major banks regarding the upcoming central bank's decision.

The traditional rate decision and post-meeting statement will now be accompanied by the simultaneous release of the Statement on Monetary Policy (SoMP). Governor Michele Bullock will hold a press conference an hour later.

The RBA is expected to leave the cash rate target at 4.35%. The risk is that the RBA delivers a dovish hold because of weak Australian economic activity and slower inflation. Markets will be watching the inflation forecasts profile closely.

ANZ

We expect the post meeting statement to acknowledge the broader slowdown now evident across the economy since the December Board meeting. Similarly, the RBA will acknowledge the lower-than-expected Q4 CPI outturn. When it comes to the stance of policy, however, the RBA will likely lag the turn evident in the economy. In our view, the RBA will want to be very confident that inflation is coming back to the band in a sustainable fashion before changing its rhetoric. As a result, we expect the post meeting statement to contain a tightening bias. In the SoMP, we expect downward revisions to GDP and inflation forecasts with the June 2026 inflation forecast to be around the mid-point of the target band. We suspect the press conference might aim to communicate to the public more than the market. That and its likely free-flowing nature suggests there may be less information content for markets in the press conference versus the other communication elements on Tuesday.

Standard Chartered

We expect the RBA to keep rates unchanged at 4.35% at its first meeting of the year. We think recent CPI prints may allow some breathing room for the RBA to wait and see. November CPI inflation eased to 4.3% YoY from 4.9%. That said, services CPI remains sticky at 4.7%, though lower than 5% earlier. Similarly, the labour market softened slightly (unemployment rate picked up to 3.9% in December), albeit remaining at tight levels.

Westpac

The RBA will keep the cash rate on hold and it is unlikely to raise rates further this cycle.

TDS

We expect the RBA to leave the cash rate on hold at 4.35% and expect to endorse an ‘on hold for longer’ policy stance rather than entertaining the possibility of earlier rate cuts. While the Q4 CPI report shows that the RBA is making good progress on its inflation battle, the underlying details suggest stickier domestic price pressures and the RBA may be wary of making an abrupt shift of signalling a rate cut this early in the year. We expect the Bank to cut in August and a trimmed mean inflation forecast at 3% in Q4’24, 2 quarters ahead compared to their Nov forecasts, bolstering our view for a cut. Unless the RBA predicts a sharp rise in the unemployment rate in the forecasts, we doubt the possibility of an earlier cut before August.

ING

There is virtually no prospect of any change. Cash rate futures are now pricing in a more than 50% chance of easing by May, helped by recent inflation data. However, we think that the inflation picture is less impressive than it appears, and is largely base effect-driven, while monthly run rates remain high. We expect inflation to start heading higher over January and February, which may lead to some pull back – much like we have seen in the US. The RBA may use the opportunity to push back a bit at market pricing, which could speed this adjustment along.

SocGen

The RBA will probably stay on hold, but we believe the policymakers will not remove the tightening bias in the statement.

Citi

The RBA is expected to keep the cash rate unchanged at 4.35%, which represents the peak of the hiking cycle. The main focus of the new forecasts will be when the RBA expects inflation to drop back into its 2%-3% target band, following weaker-than-expected inflation in Q4. Crucially, the RBA is unlikely to make a dovish pivot and signal rate cuts anytime soon. Instead, we expect a 25 bps rate cut in Q3 followed by 25 bps in Q4 for a year-end cash rate of 3.85%.

Wells Fargo

We suspect policymakers will opt to hold rates steady at 4.35% for a second consecutive meeting. Although the RBA's December announcement left the door open for further rate hikes, our view is that the RBA's tightening cycle is over although we do not think rate cuts are coming just yet. For now, inflation and wage growth are likely at levels still too high to be consistent with the 2%-3% inflation target. As a result, we do not forecast an initial rate cut until Q3 of this year.

In January, the Japanese Yen (JPY) was the worst performing G10 currency. Economists at MUFG Bank analyze JPY outlook.

Carry attractiveness of the Yen will be diminished as volatility picks up

We maintain that the Yen will strengthen in 2024 as the drivers of JPY depreciation start to reverse – falling global inflation and yields, a rate hike and an end to YCC by the BoJ and a shrinking of the energy trade deficit will all add to Yen demand.

The carry attractiveness of the Yen will be diminished as volatility picks up, encouraging a liquidation of JPY short positions.

The Mexican Peso (MXN) is the only Latin currency to be up against the Dollar on a total return basis in 2024. Economists at ING analyze USD/MXN outlook.

The market is looking for signals that Banxico is ready to pull the trigger

On Thursday, we have a rate meeting in Mexico. With trading partners to the south slashing interest rates, the market is looking for signals that Banxico is ready to pull the trigger. Even if it sent some signals to that effect – e.g. one member of the Governing Board voted for a cut – we doubt the Peso would have to sell off too hard.

Investors are quite rightly at this very early stage, ignoring the threat of a new Trump administration, and are happy to pick up an 11% yield on a currency powered by loose fiscal and tight monetary policy.

- EUR/USD drops 0.40% to 1.0742, influenced by Powell's hawkish remarks and rising US Treasury yields.

- Powell emphasizes Fed's inflation target commitment, suggesting mid-year policy tweaks.

- US January labor market strength bolsters USD, contrasting with Eurozone's economic fragility.

- Euro falters as US Dollar Index climbs, with ECB policy easing expectations and focus on central bank moves.

The Euro (EUR) extended its losses against the Greenback (USD) in early trading during the New York session, down 0.40%, sponsored by high US Treasury yields and the strong US Dollar. Federal Reserve Chair Jerome Powell's Sunday interview delivered a hawkish message to the detriment of other G10 FX currencies. At the time of writing, the EUR/USD trades at 1.0742 after hitting a high of 1.0785.

EUR/USD faces downward pressure as Powell’s reiterate focus on inflation

Over the weekend, Powell commented that it was too early to ease policy while emphasizing the job is not done – driving inflation toward its 2% target. The Fed Chair added the first cut could happen in the middle of the year.

Meanwhile, data revealed last week struck a pleasant surprise for the US economy, as the Nonfarm Payrolls report for January showed the jobs market added 353K Americans to the workforce while the unemployment rate stood at 3.7%. That indicates the labor market remains strong, maintaining the soft-landing narrative in play.

US Treasury yields climbed sharply following the Fed’s Chair Powell interview, while the US Dollar Index (DXY), a gauge to track the performance of the buck against other currencies, rose 0.41%, at 104.39.

The Euro weakened as Flash PMIs in the Eurozone (EU) stood at recessionary territory despite signaling the economy slightly recovered. In addition to that, the Producer Price Index (PPI) for the block edged lower. Given the backdrop of the disinflation process in the EU, that could pave the way for the European Central Bank (ECB) to begin to ease policy.

EUR/USD Price Analysis: Technical outlook

The EUR/USD has fallen below the 100-day moving average (DMA) at 1.0783, diving to a new year-to-date (YTD) low of 1.0725, about to pierce the December 8 low of 1.0723. A breach of the latter will clear the path to 1.0700. On the flip side, buyers could recover some territory past the 1.0750, followed by the 100-DMA and the 1.0800 figure.

- ISM Services PMI for January came in above the market expectation.

- US Dollar Index clings to strong gaily gains at around 104.50.

Business activity in the US service sector expanded at a stronger pace than anticipated in January, with the ISM Services PMI rising to 53.4 from 50.5 (revised from 50.6) in December to beat the market expectation of 52.0.

The Employment Index advanced to 50.5 from 43.8, while the Prices Paid Index - the inflation component - climbed to 64.0 from 57.4.

Assessing the survey's findings, "the overall growth rate increase in January is attributable to faster growth of the New Orders, Employment, and Supplier Deliveries indexes," said Anthony Nieves, Chair of the Institute for Supply Management (ISM) Services Business Survey Committee.

"The majority of respondents indicate that business is steady," Nieves added. "They are optimistic about the economy due to the potential impact of interest rate cuts; however, they are cautious due to inflation, associated cost pressures and ongoing geopolitical conflicts."

Market reaction

The US Dollar preserves its strength after this report. At the time of press, the US Dollar Index was up 0.55% on the day at 104.55.

Gold climbed to its highest level since early January above $2,060 but corrected sharply lower following strong US labour market report. Economists at TD Securities analyze the yellow metal’s outlook.

XAU/USD could trend down toward $2,005-$2,014 support

The January US jobs report outperformed expectations, with employment increasing nearly double consensus, and wages surging. This drove Gold down to $2,030, from around $2,060 previously. We suspect there will be more selling pressure for Gold, as a result of the robust data.

It would not be a surprise to see the yellow metal trend down toward $2,005-$2,014 support.

Despite this, we do still expect the Fed to cut rates in May (and for markets this will dispel hopes for an earlier March cut), and along with strong central bank and Asian physical buying, prices should rebound higher. As such, we continue to be happy with our projection of $2,200 in the next quarter.

USD’s jobs rebound extends on Powell caution, economists at Scotiabank report.

DXY’s rebound is overstating the improvement in yield differentials in USD’s favour to some extent

The USD rallied hard on the back of Friday’s US jobs data as US yields popped sharply higher and the currency has built on those gains on Monday following Fed Chairman Powell’s ‘60 Minutes’ interview which further doused market expectations for a March rate cut.

Fed repricing plus USD-positive seasonal trends (through Q1) plus building technical momentum (with the DXY testing the 50% retracement of its Q4 slide) point to gains extending a little more in the next few weeks, although the rebound in the DXY is overstating the improvement in yield differentials in the USD’s favour to some extent at the moment.

- USD/CAD rallies above 1.3500 as downbeat market sentiment improves safe-haven appeal.

- The US ISM Services PMI is seen increasing to 52.0 from 50.6 in December.

- Investors await the timing of when the BoC will start reducing interest rates.

The USD/CAD pair has climbed above the psychological resistance of 1.3500 in the early New York session. The Loonie asset has witnessed stellar interest as an appeal for safe-haven assets has significantly improved due to fading expectations of a rate cut by the Federal Reserve (Fed) in March.

Considering negative overnight futures, the S&P500 is expected to open on a bearish note. The US Dollar Index (DXY) has rallied above 104.40 as the market sentiment is downbeat. 10-year US Treasury yields have soared 4.085%.

Investors see the Fed reducing interest rates from May as fears of persistent price pressures have deepened due to robust labor demand and wage growth. Also, Fed policymakers have been arguing in favor of restrictive interest rates for somewhat longer to achieve confidence that inflation will return to the 2% target sustainably.

On Friday, Fed Governor Michelle Bowman warned that premature rate cuts could delay the decline in price pressures toward the 2% target, forcing policymakers to raise interest rates again.

Meanwhile, investors await the US Institute of Supply Management (ISM) Services PMI for January, which will be published at 15:00 GMT. Investors anticipate that the Services PMI was up to 52.0 from 50.6 in December.

On the Canadian Dollar front, investors await the speech from Bank of Canada (BoC) Governor Tiff Macklem, which is scheduled for Tuesday. Tiff Macklem is expected to provide fresh guidance on interest rates. Investors want to know when the BoC plans to cut down interest rates this year.

EUR/USD has slowly trended lower since its late December high in the region of 1.1139. Economists at Rabobank analyze the pair’s outlook.

USD strength to moderate in the second half of the year

We maintain our one-month EUR/USD forecast of 1.0700 and our three-month target of 1.0500.

We expect USD strength to moderate in the second half of the year as the Fed’s rate cutting cycle kicks off.

Assuming that CPI inflation in the Eurozone can be kept under control, it is likely that Germany would benefit from a relatively weak EUR whilst it tackles structural reforms. For this reason, we see risk of EUR/USD being more comfortable in a 1.0400 to 1.1200 range over the next couple of years than at levels closer to 1.2000.

EUR/USD’s break under support in the upper 1.0700s means more losses are likely, economists at Scotiabank say.

Resistance is 1.0795/1.0800

Spot losses through recent support around 1.0785/1.0795 (100-Day Moving Average and 50% retracement support from the EUR’s Q4 rally) suggest more, corrective EUR losses towards 1.0712 (61.8% Fibonacci).

Trend momentum signals are aligned bearishly for the EUR on the intraday and daily DMIs which will limit the scope for EUR gains.

Resistance is 1.0795/1.0800.

See – EUR/USD: The direction of travel lies to the 1.0700 area – ING

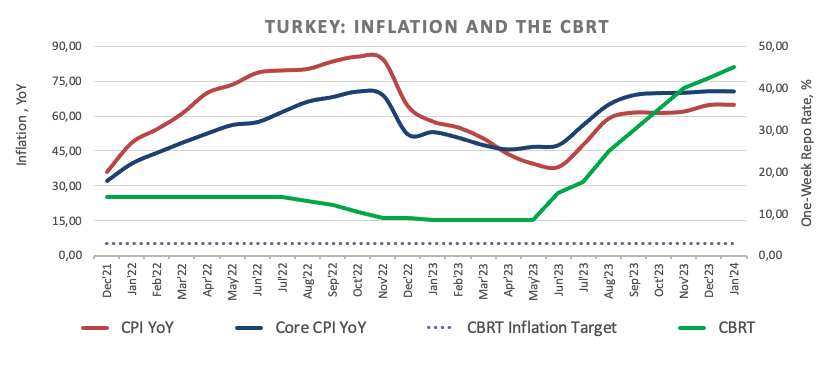

- The lira depreciates further north of 30.0000.

- Inflation rose more than estimated in January.

- H. G. Erkan resigned as CBRT Governor on Friday.

Further selling pressure keeps hurting the lira and propels USD/TRY to a new record high near 30.6000 at the beginning of the week.

USD/TRY: Never-ending uptrend?