- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 45.99 +0.55%

Gold 1,087.00 -0.34%

(index / closing price / change items /% change)

Hang Seng 24,406.12 -5.30 -0.02 %

S&P/ASX 200 5,697.9 +18.56 +0.33 %

Shanghai Composite 3,756.54 +133.64 +3.69 %

Topix 1,659.83 +0.23 +0.01 %

FTSE 100 6,686.57 -2.05 -0.03 %

CAC 40 5,112.14 -8.38 -0.16 %

Xetra DAX 11,456.07 +12.35 +0.11 %

S&P 500 2,093.32 -4.72 -0.22 %

NASDAQ Composite 5,105.55 -9.84 -0.19 %

Dow Jones 17,550.69 -47.51 -0.27 %

(pare/closed(GMT +3)/change, %)

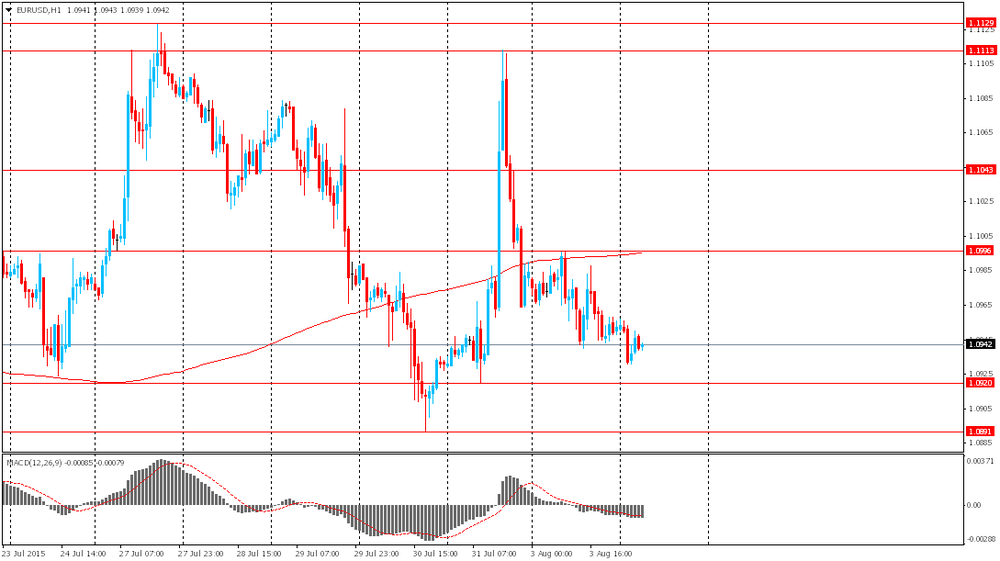

EUR/USD $1,0889 -0,58%

GBP/USD $1,5564 -0,13%

USD/CHF Chf0,9775 +0,87%

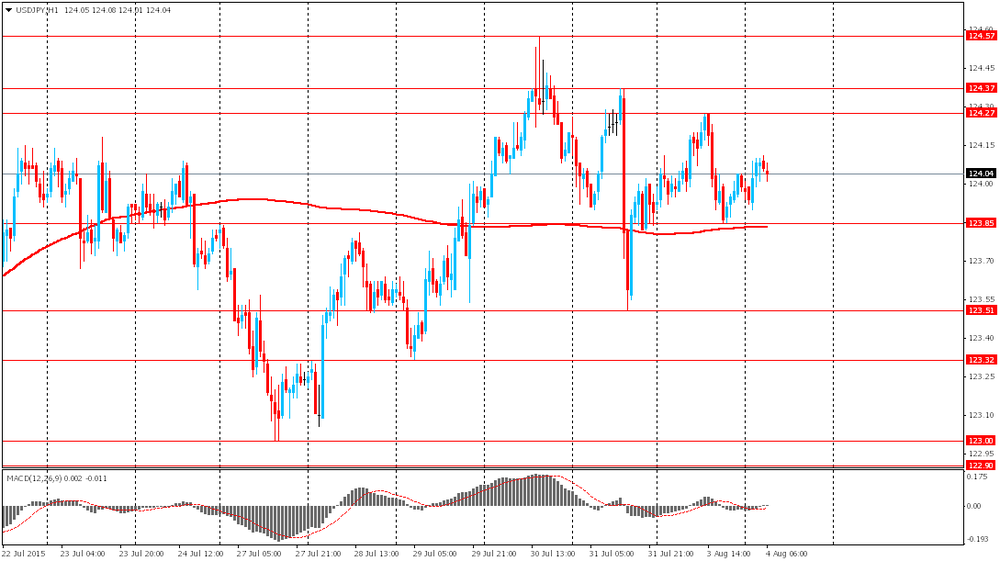

USD/JPY Y124,36 +0,30%

EUR/JPY Y135,42 -0,27%

GBP/JPY Y193,56 +0,18%

AUD/USD $0,7379 +1,44%

NZD/USD $0,6547 -0,23%

USD/CAD C$1,3186 +0,23%

(time / country / index / period / previous value / forecast)

01:45 China Markit/Caixin Services PMI July 51.8

07:15 Switzerland Consumer Price Index (YoY) July -1.0%

07:15 Switzerland Consumer Price Index (MoM) July 0.1%

07:50 France Services PMI (Finally) July 54.1 52

07:55 Germany Services PMI (Finally) July 53.8 53.7

08:00 Eurozone Services PMI (Finally) July 54.4 53.8

08:30 United Kingdom Purchasing Manager Index Services July 58.5 58

09:00 Eurozone Retail Sales (MoM) June 0.2% -0.2%

09:00 Eurozone Retail Sales (YoY) June 2.4% 1.9%

11:00 U.S. MBA Mortgage Applications July 0.8%

12:15 U.S. ADP Employment Report July 237 220

12:30 Canada Trade balance, billions June -3.34 -2.6

12:30 U.S. International Trade, bln June -41.87 -42.5

13:45 U.S. Services PMI (Finally) July 54.8 55.2

14:00 U.S. ISM Non-Manufacturing July 56 56

14:30 U.S. Crude Oil Inventories July -4.203

U.S. stocks fluctuated, after two days of declines, amid quarterly results from Regeneron Pharmaceuticals Inc. to Allstate Corp. while Apple Inc. slipped further into a correction.

Allstate lost 10 percent as the insurer's profit plunged on a surge in auto claims. CVS Health Corp. fell 1.4 percent after narrowing its earnings forecast. Apple sank 2.2 percent to a six-month low. Regeneron and Sprint Corp. gained more than 5.3 percent as their earnings exceeded analysts' forecasts. Baxalta Inc. surged 14 percent after Shire Plc offered to buy the company for about $30 billion.

The Standard & Poor's 500 Index lost 0.1 percent to 2,095.06 at 3:04 p.m. in New York, after falling as much as 0.5 percent. The Dow Jones Industrial Average lost 36.72 points, or 0.2 percent, to 17,561.48. The Nasdaq Composite Index was little changed.

"There's some concern over Apple -- it's a big stock that has a big impact on all the indexes," said Randy Warren, who manages more than $100 million at Exton, Pennsylvania-based Warren Financial Service & Associates Inc. "We've seen a lot of companies struggling this earnings season. There are a lot of global growth concerns out there."

The S&P 500 rose 2 percent in July, the best monthly gain since February, as earnings from Amazon.com Inc. and Google Inc. countered declines by energy and mining stocks. The index closed Monday 1.5 percent below a record set in May.

Some 31 S&P 500-listed companies are scheduled to release financial results today. Almost three-quarters of the benchmark's members have reported earnings this season, with 74 percent beating profit estimates and about half exceeding sales projections. Analysts now forecast a 2.8 percent drop in second-quarter earnings, shallower than calls for a 6.4 percent fall about three weeks ago.

"When investors look at the tail-end of earnings season, you've had some companies come out and disappoint, and they've been punished for it," said Bill Schultz, who oversees $1.2 billion as chief investment officer at McQueen, Ball & Associates Inc. in Bethlehem, Pennsylvania.

Data today showed factory orders rose 1.8 percent in June from the month before, in line with forecasts from economists surveyed by Bloomberg, and rebounding from two months of declines. Reports on the services industries and monthly payrolls are also due later this week, giving investors a gauge on the strength of the economy.

The jobs report Friday will show an increase of 225,000 in July with the unemployment rate holding at 5.3 percent, according to economists surveyed by Bloomberg.

Federal Reserve policy makers have expressed a desire to see signs of a further pickup in the labor market before raising interest rates. Fed Chair Janet Yellen said in July she expected the central bank to raise its benchmark rate this year, while emphasizing the pace of increases will probably be gradual.

The Chicago Board Options Exchange Volatility Index rose 0.7 percent Tuesday to 12.65. The gauge, known as the VIX, on Friday posted its biggest monthly drop since February, down more than 33 percent.

Six of the S&P 500's 10 main groups declined, led by utilities, energy and technology stocks. Raw-materials and consumer discretionary shares increased the most.

Technology companies lost 0.5 percent as Apple fell for a fifth day, extending its decline over the period to 6.4 percent. The stock's retreat yesterday pushed it below the 200-day moving average, a level of resistance commonly watched by market technicians, for the first time since 2013.

A group of semiconductor stocks in the benchmark U.S. equity gauge slipped for the third time in four sessions. Skyworks Solutions Inc. and Avago Technologies Ltd. decreased more than 2.1 percent.

The US dollar rose against other major currencies, supported by data on factory orders and comments from Fed Lockhart.

The volume of new orders for manufactured goods increased markedly at the end of June, thus offsetting the May decline. This was reported in the Ministry of Commerce.

The report noted that factory orders rose in June by 1.8% or $ 8.7 billion., Reaching $ 478.5 billion. This change followed a 1.1% drop in May, which was revised from -1.0 %. Excluding transportation, orders rose 0.5% compared with a fall of 0.1% in April and May.

Also, the data showed that the supply of industrial goods increased $ 2.2 billion., Or 0.5%, to $ 483.5. We recall that in the previous month delivery fell by 0.2%.

Unfilled orders, which declined in the previous two months, he added in June, less than $ 0.1 million., Reaching a level of $ 1194.7 billion. This followed a 0.5 percent decline in May. Meanwhile, the ratio of unfilled orders to shipments in June was 6.94 compared with 6.99 in the previous month.

The Ministry of Commerce said that inventories increased by $ 3.6 billion., Or by 0.6% to $ 653.6 billion. This change followed 0,1protsentnyh increase in May.

The ratio of inventories to shipments amounted to 1.35 in June, unchanged compared with May.

In turn, the Atlanta Fed President Lockhart said the Fed is "close" to the short-term readiness to increase interest rates. In this September may be "appropriate" time to raise interest rates. At the same time, he noted that "a significant deterioration" of data can convince him of the need to postpone the rate hike.

The euro came under pressure earlier data for the euro area. Statistical Office, Eurostat reported, on the basis of producer prices in June evrzone and the EU decreased by 0.1% compared with the previous month. Recall that in May, prices remained stable in the euro area and increased by 0.1% among the 28 EU countries. In annual terms, the producer price index fell in July by 2.2% in the euro area and fell by 2.7% in the EU. It should be emphasized at the end of May prices in the euro area decreased by 2.0%. The monthly change in the index was due to a decrease in prices in the sector of industrial production (-0.1%) and in the energy sector (-0.2%). In the field of production of consumer non-durable goods. and intermediate goods prices remained unchanged. Meanwhile, the rise in prices of 0.1% was recorded in the sector of capital goods and consumer durables. In general, prices in the industry, excluding energy remained stable. The largest decline in industrial producer prices was observed in Lithuania (-1.5%), Denmark, Slovakia and Sweden (by -0.9%), while the highest growth rates were recorded in Spain (+ 0.9%), Estonia (+0 6%), Hungary (+ 0.5%) and Poland (+ 0.4%).

The pound fell against the dollar under the influence of data on Britain, showed that the growth of business activity in the construction sector unexpectedly slowed in July, hurt by the loss of momentum in the field of housing and civil construction. According to the monthly index of purchasing managers in the construction sector fell in July to 57.1 points against 58.1 points in June (four-month high). Analysts had expected the index to rise to the level of 58.4 points. "The slowdown in July, is the first in three months, and possibly an indication that the impact of the election on building the confidence began to decline," - said Tim Moore, senior economist at Markit. Companies that reported an increase in business activity mainly recorded strong inflows of new orders. Meanwhile, the data pointed to a general slowdown in employment growth in the construction sector. Nevertheless, looking ahead, the construction companies of the country spoke very optimistic about their growth prospects over the next 12 months, with more than half of expected growth in business activity.

Markets are waiting for a meeting of the Bank of England, which will take place on Thursday. For the first time the central bank at the same time announce a decision on interest rates and to publish the minutes of its meetings, and new forecasts for the UK economy.

Polish equity market advanced on Tuesday. The broad market measure, the WIG Index, added 0.25%. Sector-wise, construction sector (+3.54%) and chemicals (+2.49%) fared the best, while materials (-1.42%) lagged behind.

The large-cap companies' measure, the WIG30 Index, inched up 0.08%. Within the index components, ENEA (WSE: ENA) and GRUPA AZOTY (WSE: ATT) led the gainers, recording advances of a respective 4.72% and 4.47%. Other major outperformers were PKN ORLEN (WSE: PKN), BZ WBK (WSE: BZW), LOTOS (WSE: LTS) and PGNIG (WSE: PGN), surging by 1.56%-1.58%. On the other side of the ledger, BOGDANKA (WSE: LWB) continued to plunge, losing 2.63% on gloomy outlook for the coal sector. It was followed by LPP (WSE: LPP), ENERGA (WSE: ENG) and PKO BP (WSE: PKO), declining 2.38%, 2.05% and 1.65% respectively.

Major U.S. stock-indexes fell on Tuesday as Apple's shares remained under pressure, hitting their lowest in more than six months, and investors digested earnings reports from a host of companies. While there was no clear trigger for the selloff, traders said worries over China slowdown. With a bulk of the S&P 500 companies having reported results, investors are taking to the sidelines ahead of Friday's monthly jobs data.

Dow stocks are mixed (15 in positive area, 15 in negative area). Top looser - Apple Inc. (CVX, -2.95%). Top gainer - Microsoft Corporation (MSFT, +1.31).

S&P index sectors are mixed. Top looser - Utilities (-0.8%). Top looser - Basic Materials (+0.4%).

At the moment:

Dow 17503.00 -8.00 -0.05%

S&P 500 2090.25 -0.75 -0.04%

Nasdaq 100 4557.25 -15.75 -0.34%

10 Year yield 2,18% +0,03

Oil 46.10 +0.93 +2.06%

Gold 1091.00 +1.60 +0.15%

Stock indices closed mixed on corporate earnings.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

Meanwhile, the economic data from the Eurozone was weak. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,686.57 -2.05 -0.03 %

DAX 11,456.07 +12.35 +0.11 %

CAC 40 5,112.14 -8.38 -0.16 %

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

Concerns over the global oil oversupply still weigh on oil prices as OPEC continue to raise its oil output, and Iran may raise its oil output after reaching a nuclear deal.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for September delivery increased to $46.23 a barrel on the New York Mercantile Exchange.

Brent crude oil for September rose to $50.25 a barrel on ICE Futures Europe.

Gold price rose after the yesterday's 0.52% decline. Speculation that the Fed starts raising interest rate soon weighed on gold price. St. Louis Federal Reserve President James Bullard said on Friday that the Fed may start raising interest rates in September due to the latest U.S. economic growth data.

Market participants are awaiting the release of the U.S. labour market data.

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. rose 1.8% in June, in line expectations, after a 1.1% decrease in May. May's figure was revised down from a 1.0% decline.

The increase was driven by a rise in demand for commercial aircraft.

October futures for gold on the COMEX today increased to 1093.80 dollars per ounce.

The European Central Bank (ECB) purchased €61.3 billion of public and private debt under its quantitative-easing program in July, compared to €63.2 billion in June.

ECB Executive Board member Benoit Coeure said on May 18 that the central bank would raise the pace of asset-buying due to lower liquidity in July and August.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €51.4 billion of government and agency bonds in July, €9.0 billion of covered bonds, and €944 million of asset-backed securities.

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. rose 1.8% in June, in line expectations, after a 1.1% decrease in May. May's figure was revised down from a 1.0% decline.

The increase was driven by a rise in demand for commercial aircraft.

Durable goods increased by 3.4% in June.

Orders for transportation equipment jumped by 9.3% in June.

EUR/USD: $1.0800(E721mn), $1.0835/40(E500mn), $1.0900(E308mn), $1.1095/00(E2.1bn)

USD/JPY: Y123.00($391mn), Y123.85($250mn), Y124.45($200mn)

USD/CHF: Chf0.9550 ($210mn)

AUD/USD: $0.7400(A$230mn)

USD/CAD: Cad1.3100 ($315mn)

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Tuesday. Labour cash earnings in Japan dropped at an annual rate of 2.4% in June, after a 0.7% rise in May.

May's figure was revised up from a 0.6% gain.

The decline was partly driven by a fall in bonuses. Bonuses in June plunged 6.5% year-on-year.

Wages, excluding bonuses and overtime, climbed 0.4% in June.

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 20,520.36 -27.75 -0.14%

Hang Seng 24,406.12 -5.30 -0.02%

Shanghai Composite 3,756.54 +133.64 +3.69%

FTSE 6,685.7 -2.92 -0.04%

CAC 5,093.77 -26.75 -0.52%

DAX 11,423.27 -20.45 -0.18%

Crude oil $46.02 (+1.88%)

Gold $1093.50 (+0.37%)

(company / ticker / price / change, % / volume)

| Wal-Mart Stores Inc | WMT | 72.21 | +0.04% | 1.6K |

| Goldman Sachs | GS | 204.79 | +0.05% | 0.2K |

| AT&T Inc | T | 34.72 | +0.17% | 0.5K |

| Exxon Mobil Corp | XOM | 78.27 | +0.27% | 18.5K |

| Caterpillar Inc | CAT | 77.48 | +0.28% | 2.8K |

| Merck & Co Inc | MRK | 59.24 | +0.32% | 11.1K |

| Yahoo! Inc., NASDAQ | YHOO | 36.85 | +0.44% | 14.8K |

| Starbucks Corporation, NASDAQ | SBUX | 58.29 | +0.45% | 2.2K |

| Chevron Corp | CVX | 86.00 | +0.47% | 4.3K |

| Walt Disney Co | DIS | 121.70 | +0.48% | 29.9K |

| Google Inc. | GOOG | 634.30 | +0.49% | 0.1K |

| Barrick Gold Corporation, NYSE | ABX | 06.84 | +2.09% | 41.4K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.44 | +2.14% | 24.3K |

| ALCOA INC. | AA | 09.87 | +2.39% | 119.4K |

| American Express Co | AXP | 75.98 | 0.00% | 1.0K |

| Johnson & Johnson | JNJ | 100.02 | 0.00% | 1.1K |

| The Coca-Cola Co | KO | 41.54 | 0.00% | 1.1K |

| United Technologies Corp | UTX | 99.42 | 0.00% | 1.0K |

| Hewlett-Packard Co. | HPQ | 30.02 | 0.00% | 1.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 259.95 | -0.02% | 5.2K |

| Microsoft Corp | MSFT | 46.79 | -0.04% | 19.6K |

| Procter & Gamble Co | PG | 76.36 | -0.05% | 1.1K |

| General Motors Company, NYSE | GM | 31.66 | -0.06% | 0.4K |

| Ford Motor Co. | F | 14.93 | -0.07% | 4.4K |

| Amazon.com Inc., NASDAQ | AMZN | 534.30 | -0.14% | 2.6K |

| Intel Corp | INTC | 29.00 | -0.17% | 2.9K |

| General Electric Co | GE | 25.82 | -0.19% | 2.0K |

| JPMorgan Chase and Co | JPM | 68.40 | -0.19% | 1.0K |

| Cisco Systems Inc | CSCO | 28.30 | -0.21% | 0.1K |

| Citigroup Inc., NYSE | C | 58.32 | -0.21% | 1.5K |

| ALTRIA GROUP INC. | MO | 54.51 | -0.27% | 0.1K |

| Facebook, Inc. | FB | 93.88 | -0.28% | 57.4K |

| Verizon Communications Inc | VZ | 46.81 | -0.34% | 1.1K |

| Twitter, Inc., NYSE | TWTR | 29.13 | -0.48% | 44.0K |

| Apple Inc. | AAPL | 117.40 | -0.88% | 526.9K |

| AMERICAN INTERNATIONAL GROUP | AIG | 63.41 | -1.15% | 1.2K |

Upgrades:

Alcoa (AA) upgraded to Buy from Neutral at UBS

Downgrades:

Other:

Cisco Systems (CSCO) initiated with a Underperform at Macquarie, target $26

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M June 0.4% Revised From 0.3% 0.5% 0.7%

01:30 Australia Trade Balance June -2.68 Revised From -2.75 -3.1 -2.93

01:30 Japan Labor Cash Earnings, YoY June 0.7% Revised From 0.6% -2.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index July -0.2% 0.4% 0.4%

06:00 United Kingdom Nationwide house price index, y/y July 3.3% 3.5% 3.5%

08:30 United Kingdom PMI Construction July 58.1 58.4 57.1

09:00 Eurozone Producer Price Index, MoM June 0% 0% -0.1%

09:00 Eurozone Producer Price Index (YoY) June -2% -2.2% -2.2%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. factory orders data. The U.S. factory orders are expected to increase 1.8% in June, after a 1.0 drop in May.

The euro traded higher against the U.S. dollar despite the weak producer price index from the Eurozone. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

The British pound traded higher against the U.S. dollar despite the weaker-than-expected the construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

The Nationwide Building Society released its house prices data for the U.K. on Tuesday. UK house prices rose 0.4% in July, in line with expectations, after a 0.2% decline in June.

On a yearly basis, house prices increased to 3.5% in July from 3.3% in June, in line with expectations.

"The outlook on the demand side remains encouraging. Employment growth has remained relatively robust in recent quarters, and, after a prolonged period of subdued growth, wage growth is also edging up. With consumer confidence buoyant and mortgage rates still close to all-time lows, demand for housing is likely to firm up in the quarters ahead," Nationwide's chief economist, Robert Gardner, said.

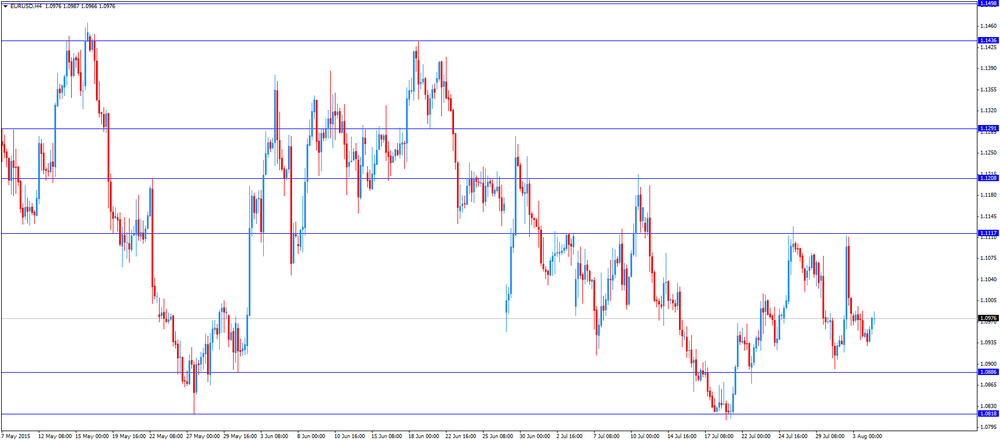

EUR/USD: the currency pair increased to $1.0987

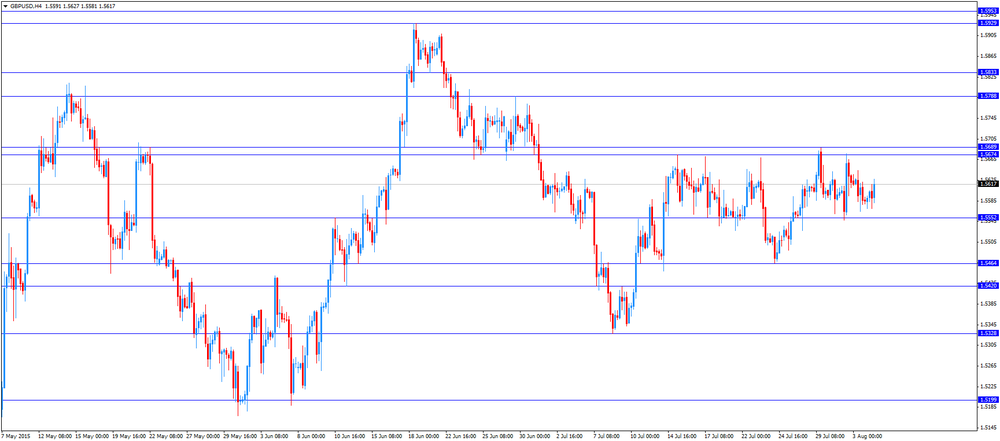

GBP/USD: the currency pair rose to $1.5627

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Factory Orders June -1% 1.8%

22:45 New Zealand Unemployment Rate Quarter II 5.8% 5.9%

22:45 New Zealand Employment Change, q/q Quarter II 0.7% 0.5%

EUR/USD

Offers 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100 1.1120 1.1160 1.1185 1.1200

Bids 1.0925-30 1.0900 1.0880 1.0860 1.0820-25 1.0800 1.0780 1.0750

GBP/USD

Offers 1.5620-25 1.5650 1.5680 1.5700-10 1.5725-30 1.5750 1.5785 1.5800

Bids 1.5570-75 1.5550 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7030-35 0.7050 0.7080 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.7000 0.6975-80 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 136.50 136.80 137.00 137.30 137.50

Bids 136.00 135.80 135.60 135.30 135.00 134.85 134.50 134.30 134.00

USD/JPY

Offers 124.25-30 124.50 124.75 125.00 125.30 125.50

Bids 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7385 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids 0.7350 0.7320 0.7300 0.7280 0.7250 0.7230 0.7200 0.7180 0.7150

Stock indices traded mixed, while Greek stocks dropped again after the reopening on Monday.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

Meanwhile, the economic data from the Eurozone was weak. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,699.76 +11.14 +0.17 %

DAX 11,459.5 +15.78 +0.14 %

CAC 40 5,103.98 -16.54 -0.32 %

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

EUR/USD: $1.0800(E721mn), $1.0835/40(E500mn), $1.0900(E308mn), $1.1095/00(E2.1bn)

USD/JPY: Y123.00($391mn), Y123.85($250mn), Y124.45($200mn)

USD/CHF: Chf0.9550 ($210mn)

AUD/USD: $0.7400(A$230mn)

USD/CAD: Cad1.3100 ($315mn)Spain's labour ministry release its labour market figures on Tuesday. The number of registered unemployed people fell 74,028 in July. It was the sixth consecutive decline.

Unemployment among youth people below 25 years decreased by 8,989 in July.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

A reading above 50 indicates expansion in the construction sector.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

The Nationwide Building Society released its house prices data for the U.K. on Tuesday. UK house prices rose 0.4% in July, in line with expectations, after a 0.2% decline in June.

On a yearly basis, house prices increased to 3.5% in July from 3.3% in June, in line with expectations.

"The outlook on the demand side remains encouraging. Employment growth has remained relatively robust in recent quarters, and, after a prolonged period of subdued growth, wage growth is also edging up. With consumer confidence buoyant and mortgage rates still close to all-time lows, demand for housing is likely to firm up in the quarters ahead," Nationwide's chief economist, Robert Gardner, said.

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He said that the economic growth was "below longer-term averages", growth of employment was stronger, and "domestic inflationary pressures have been contained".

The central bank removed the sentence that the further interest rate cut is "both likely and necessary".

The Australian Bureau of Statistics released its trade data on Tuesday. Australia's trade deficit widened to A$2.93 billion in June from A$2.68 billion in May, beating expectations for a rise to a deficit of A$3.1 billion.

May's figure was revised up from a deficit of A$2.75 billion.

Exports rose by 3.0% in June, while imports climbed by 4.0%.

The Australian Bureau of Statistics released its retail sales data on Tuesday. Retail sales in Australia rose 0.7% in June, exceeding expectations for a 0.5% gain, after a 0.4% increase in May.

May's figure was revised up from a 0.3% rise.

Food retailing climbed 0.2% in June and household goods retailing rose 0.8%, while department stores sales dropped 0.2%, clothing, footwear and personal accessory retailing was up 0.1% and cafes, restaurants and takeaway food services sales increased 0.3%.

Australian retail sales climbed 0.8% in the second quarter of 2015.

West Texas Intermediate futures for September delivery rebounded to $45.46 (+0.64%), while Brent crude climbed to $49.68 (+0.32%) after yesterday's sharp declines, which were triggered by weak U.S. data.

A report by the Institute for Supply Management showed that activity in the industrial sector of the U.S. economy weakened sharply despite forecasts of a slight improvement. The ISM manufacturing index fell to 52.7 in July from 53.5 reported previously. The index was expected to come in at 53.6.

Intensive oil production in OPEC and the U.S. continues to keep prices under pressure.

Gold is currently at $1,083.60 (-0.53%). Expectations of an imminent rate hike in the U.S. continued weighing on the non-interest bearing precious metal, although the first rate increase in almost ten years may happen later this year, not in September when Fed policymakers meet next, because the latest data on the U.S. economy showed some weakness.

Demand in top consumers China and India remained weak. However South Koreans are on track to buy $860 million in gold this year as investors are concerned about stock markets.

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1160 (2516)

$1.1078 (2293)

$1.1018 (1646)

Price at time of writing this review: $1.0955

Support levels (open interest**, contracts):

$1.0909 (4646)

$1.0858 (6338)

$1.0823 (4059)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 55758 contracts, with the maximum number of contracts with strike price $1,1200 (4581);

- Overall open interest on the PUT options with the expiration date August, 7 is 68560 contracts, with the maximum number of contracts with strike price $1,0800 (6483);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from August, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1212)

$1.5801 (1701)

$1.5702 (1219)

Price at time of writing this review: $1.5616

Support levels (open interest**, contracts):

$1.5496 (1604)

$1.5399 (1301)

$1.5299 (1342)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22193 contracts, with the maximum number of contracts with strike price $1,5750 (3178);

- Overall open interest on the PUT options with the expiration date August, 7 is 23405 contracts, with the maximum number of contracts with strike price $1,5250 (2275);

- The ratio of PUT/CALL was 1.05 versus 1.06 from the previous trading day according to data from August, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Major U.S. stock indices ended lower on Monday amid declines in oil prices and after data showed that the U.S. economy lost momentum at the end of the second quarter.

The Dow Jones Industrial Average fell 91.66 points, or 0.5%, to 17598.20. The S&P 500 declined 5.8 points, or 0.3%, to 2098.40. The Nasdaq Composite dropped 12.90 points, or 0.3%, to 5115.38.

S&P's energy companies dropped 2%. Meanwhile utilities and real-estate investment trusts, which are considered more defensive, gained.

The U.S. Bureau of Economic Analysis reported that growth of personal spending slowed down significantly in June, suggesting that weak wage growth puts pressure on consumers. Personal spending rose by 0.2% m/m in June (the smallest gain since February). May reading was revised to +0.7% from +0.9%. Personal income rose by 0.4% in June after the 0.4% increase in May (revised from +0.5%). All changes were in line with expectations.

This morning in Asia Hong Kong Hang Seng fell 0.13%, or 32.59 points, to 24,378.83. China Shanghai Composite Index gained 1.34%, or 48.59 points, to 3,671.49. The Nikkei lost 0.36%, or 73.76 points, to 20,474.35.

Asian stocks mostly fell following declines in U.S. equities. However the Shanghai Composite gained amid new rules, which would make it more difficult to profit from hourly fluctuations in stock prices. Major stock exchanges have announced that they will temporarily suspend their short-selling services.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Retail Sales, M/M June 0.4% Revised From 0.3% 0.5% 0.7%

01:30 Australia Trade Balance June -2.68 Revised From -2.75 -3.1 -2.93

01:30 Japan Labor Cash Earnings, YoY June 0.7% Revised From 0.6% -2.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index July -0.2% 0.4% 0.4%

06:00 United Kingdom Nationwide house price index, y/y July 3.3% 3.5% 3.5%

The euro slightly declined in Asian trade as the dollar advanced ahead of publication of employment data. Investors expect a strong report, which could shift expectations for a Federal Reserve rate increase to an earlier date.

The Australian dollar sharply advanced against the greenback after the Reserve Bank of Australia left its key interest rate unchanged at 2.0%. RBA Governor Glenn Stevens said that lower interest rates could spur housing price growth, which is already substantial in Sydney and Melbourne, and affect the economy in a negative way in general. This year the RBA has already lowered its benchmark rate twice amid declines in commodity prices and weak inflation. This time the bank reiterated that further cuts are possible in case the economy weakens. Nevertheless recent data showed that business confidence improved and unemployment fell, while it was expected to grow.

EUR/USD: the pair fell to $1.0930 in Asian trade

USD/JPY: the pair rose to Y124.10

GBP/USD: the pair traded around $1.5570-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PMI Construction July 58.1 58.4

09:00 Eurozone Producer Price Index, MoM June 0% 0%

09:00 Eurozone Producer Price Index (YoY) June -2% -2.2%

14:00 U.S. Factory Orders June -1% 1.8%

20:30 U.S. API Crude Oil Inventories July 1.9

22:45 New Zealand Unemployment Rate Quarter II 5.8% 5.9%

22:45 New Zealand Employment Change, q/q Quarter II 0.7% 0.5%

23:30 Australia AIG Services Index July 51.2

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.