- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

USD/JPY takes the offers to refresh intraday low near 134.20 during early Friday in Asia as bears keep the reins.

In doing so, the Yen pair traces bearish signals from the options market to lure USD/JPY sellers. That said, the one-month risk reversal (RR), the gauge of call options versus the put options, drops for the third consecutive day, to -0.305.

That said, the one-month RR drops to -0.585 on weekly basis, printing the most bearish count since late December 2022, which in turn favor the USD/JPY sellers.

Hence, the major options market players are bearish on the USD/JPY prices even if the pair struggles amid off in Japan and ahead of the US Nonfarm Payrolls.

Also read: US April Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

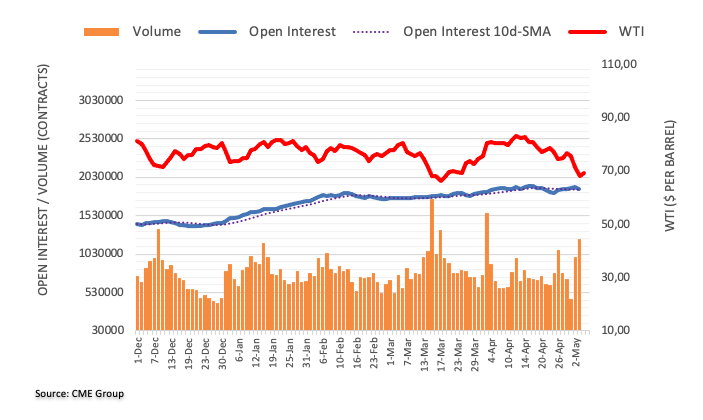

- WTI crude oil struggles to defend the previous day’s bounce off the lowest levels since December 2021.

- Multiple Doji candlesticks, sluggish MACD show dicey energy markets.

- Bulls have a bumpier road than the Oil sellers, 200-SMA holds the key for uptrend.

WTI crude oil prints mild gains around $68.70 as it takes a breather after the previous day’s stellar moves that initially dragged the Oil price to the lowest level since December 2021 before posting a daily positive close.

It’s worth noting that the black gold’s latest rebound could be linked to the oversold RSI (14) and the quote’s inability to stay below the six-week-old horizontal support, near $66.90-$67.10. Also supporting the corrective bounce is the looming bull cross on the MACD indicator.

However, the recent Doji candlesticks challenge the Oil price recovery amid typical pre-NFP anxiety on Friday.

That said, the $70.00 round figure appears the immediate upside hurdle for the WTI crude oil buyers to cross to defend the latest rebound.

Even so, a late March swing high of around $71.70 and a horizontal area comprising multiple levels marked since late March, around $73.90-$74.10, can challenge the energy benchmark’s run-up.

Following that, a downward-sloping resistance line from mid-April and the 200-SMA, respectively around $74.40 and $76.25, can challenge the commodity bulls.

Meanwhile, a downside break of the previously stated $67.10-$66.90 support zone can quickly drag the WTI crude oil price towards the recently flashed multi-month low of $64.31.

WTI crude oil: Four-hour chart

Trend: Corrective bounce expected

- US Dollar Index remains defensive after bouncing off one-week low, snapping two-day downtrend.

- Mixed US data, banking sector update allow US Dollar to pare Fed-inflicted losses.

- US employment report for April will be the key as NFP bears downbeat forecasts.

US Dollar Index (DXY) remains sidelined near 101.40 during the early hours of Friday, struggling after posting the first daily gain in three at the weekly low. In doing so, the greenback’s gauge versus the six major currencies portrays the typical pre-NFP anxiety amid mixed updates on the US banking sector and the unimpressive data.

On Thursday, Reuters quotes Fed data suggesting that a large part of the central bank's emergency lending activities in recent weeks were tied up with the now-shuttered First Republic Bank. On the same line was the news, shared via Reuters, “Pressure is growing on US regulators to take more steps to shore up the country's banking sector as a renewed rout in regional lenders' shares forced PacWest Bancorp to explore options to bolster its balance sheet.”

However, the Western Alliance's shares’ rebound after slumping by nearly 60%, backed by its rejection of concerns suggesting that the bank is exploring strategic options, challenged the previous pessimism.

Elsewhere, preliminary readings of Nonfarm Productivity and Unit Labor Cost for the first quarter (Q1) of 2023 came in mixed. That said, Nonfarm Productivity dropped to -2.7% in Q1 from 1.6% prior and -1.8% market forecasts whereas the Unit Labor Cost jumped to 6.3% versus 5.5% expected and 3.3% prior. Further, the US Goods and Services Trade Balance improved to $-64.2B from $-70.6B prior and $-63.3B market forecast. Further, Initial Jobless Claims edge higher to 242K for the week ended on April 28 versus 240K expected and 229K in previous readings.

Against this backdrop, Wall Street closed negative and the yields were pressured too but the US Dollar bounced off its weekly low.

Looking ahead, US Dollar may witness lackluster moves amid mixed signals but can extend the latest rebound as forecasts suggest downbeat prints of the headline Nonfarm Payrolls (NFP), expected 179K versus 236K prior.

Also read: US April Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

Technical analysis

Unless providing a daily close below a three-week-old ascending support line, near 101.20 by the press time, US Dollar Index remains off the bear’s radar.

- EUR/GBP has found a short-term cushion near 0.8750 as the impact of the ECB’s smaller rate hike has started fading.

- Eurozone’s subdued growth rate and reduced loan disbursement forced ECB to go light on interest rates.

- The BOE is expected to raise interest rates consecutively for the 12th time to curb stubborn inflation.

The EUR/GBP pair has gauged intermediate support after a sheer sell-off to near 0.8760 in the early Tokyo session. The cross witnessed a massive decline on Thursday after the European Central Bank (ECB) hiked interest rates by 25 basis points (bps) to 3.25%. ECB President Christine Lagarde made very clear that the policy-tightening spell is not concluded yet and more than one additional rate hikes are in the pipeline.

Investors were split about the pace at which the ECB will hike interest rates amid recent developments in Eurozone banking figures. In a recently published Bank Lending Survey (BLS), the European Central Bank (ECB) noted that a net 38% of Eurozone banks reported a fall in demand for credit from companies in the first quarter of the year. Also, banks have tightened their credit conditions amid a volatile environment. ECB stated, "The general level of interest rates was reported to be the main driver of reduced loan demand, in an environment of monetary policy tightening."

Meanwhile, the Eurozone economy posted a minimal growth rate of 0.1% in the first quarter. Subdued growth rate and reduced loan disbursement confirmed that the ECB is in the right direction so that the pace could be reduced to save the economy from falling into recession.

Analysts at Danske Bank stated, “The ECB is not done hiking and President Lagarde clearly said that its data-dependent approach warranted further hikes at the current outlook. We add a 25bp hike in September as well to our rate call, thereby keeping our 4% peak policy.”

On the Pound Sterling front, the Bank of England (BoE) is preparing for more interest rate hikes as United Kingdom’s inflation is showing reluctance for ditching the double-digit territory. BoE Governor Andrew Bailey is expected to raise interest rates consecutively for the 12th time to curb stubborn inflation. An interest rate hike by 25 basis points (bps) is widely expected, which will push borrowing costs to 4.5%.

- The GBP/JPY would resume upwards after a “quasi hammer” emerges nearby the 168.00 lows, with buyers eyeing 170.00.

- Bearish momentum builds if GBP/JPY fails to reclaim 169.00, as sellers would target a confluence of indicators at around 167.50.

The GBP/JPY achieved three days of losses, though buyers are moving in as the Asian Pacific session begins. After hitting a weekly low of 168.05, the GBP/JPY bounced off, is trading at around 168.85, and gains 0.07% as it’s approaching the 169.00 figure.

GBP/JPY Price Action

The GBP/JPY pair remains upward biased, although it dropped from year-to-date (YTD) highs at 172.32 toward testing the April 19 cycle high at 167.97 resistance-turned-support. Additionally, a one-month-old upslope support trendline drawn from April lows that passes nearby that area and above the 20-day EMA sitting at 167.55 was difficult to crack for GBP/JPY sellers. In fact, Thursday’s price action formed a “quasi” hammer candlestick, suggesting that buyers are moving in, which could pave the way for further gains.

Further cementing the previously mentioned is the Relative Strength Index (RSI) indicator, which shifted direction to the upside after falling towards its neutral area in the previous three trading days.

Therefore, if GBP/JPY reclaims 169.00, a rally toward 170.00 is on the cards. A breach of the latter will expose the May 3 daily high at 170.37 before challenging the YTD high of 172.32. Conversely, a bearish continuation would happen if GBP/JPY drops below the April 19 resistance-turned-support at 167.97, followed by the 20-day EMA at 167.54, which intersects with a support trendline. Downside risks will emerge at 167.00.

GBP/JPY Daily Chart

- USD/CHF struggles to defend the corrective bounce off the lowest levels since January 2021.

- Risk aversion allows US Dollar to pare Fed-induced losses.

- Banking woes, mixed US data contribute in sour sentiment.

- US NFP, Swiss Unemployment Rate and Swiss CPI will be crucial for immediate directions.

USD/CHF lacks clear direction around 0.8855 during early Friday in Asia, following a corrective bounce off a 28-month low, as traders await the key US and Swiss data. That said, sour sentiment underpins the US Dollar’s haven demand but a broad US Dollar weakness lure the pair sellers of late, especially amid the dovish Federal Reserve (Fed) interest rate hike.

Having witnessed the Fed’s hints for policy pivot, as well as the US Dollar’s fall despite the rate hike of 25 basis points, the USD/CHF pair traders cheered the risk-off mood to trigger a corrective bounce from the multi-month low.

The Swiss currency pair’s rebound could be linked to the US Dollar’s recovery amid mixed data and escalating fears surrounding the US banking sector and the debt ceiling expiry.

On Thursday, preliminary readings of Nonfarm Productivity and Unit Labor Cost for the first quarter (Q1) of 2023 came in mixed. That said, Nonfarm Productivity dropped to -2.7% in Q1 from 1.6% prior and -1.8% market forecasts whereas the Unit Labor Cost jumped to 6.3% versus 5.5% expected and 3.3% prior. Further, the US Goods and Services Trade Balance improved to $-64.2B from $-70.6B prior and $-63.3B market forecast. Further, Initial Jobless Claims edge higher to 242K for the week ended on April 28 versus 240K expected and 229K in previous readings.

It’s worth noting that Reuters quotes Fed data suggesting that a large part of the central bank's emergency lending activities in recent weeks were tied up with the now-shuttered First Republic Bank. “Pressure is growing on U.S. regulators to take more steps to shore up the country's banking sector as a renewed rout in regional lenders' shares forced PacWest Bancorp to explore options to bolster its balance sheet,” said Reuters.

While portraying the mood, Wall Street closed negative and the yields were pressured too but the US Dollar bounced off its weekly low.

Moving on, USD/CHF pair has a slew of Swiss data comprising April’s Unemployment Rate, Consumer Price Index and Foreign Reserves to watch before targeting the key US jobs report for the said month. Given the downbeat expectations from the US Nonfarm Payrolls (NFP), the odds of witnessing a surprise outcome and its magnified reaction are high.

Technical analysis

A three-week-old previous support line, near 0.8860 at the latest, restricts corrective bounce off the Swiss currency pair. Meanwhile, the latest bottom of around 0.8820 precedes the year 2021 trough of 0.8757 lures the USD/CHF bears.

- GBP/USD is showing a sideways performance around 1.2570 ahead of the release of the US NFP data.

- The street is worried that renewed US banking crisis could dent the financial lending system.

- UK businesses are comfortably passing the impact of higher employment costs to ultimate consumers.

The GBP/USD pair is demonstrating a back-and-forth action around 1.2570 in the early Asian session. The Cable has turned sideways as investors are awaiting the release of the United States Nonfarm Payrolls (NFP) data for further guidance. The US Dollar Index (DXY) has extended its recovery to near 101.45 as investors are worried that upbeat employment data could force the Federal Reserve (Fed) to continue its policy-tightening spell.

S&P500 futures have added some gains in Asia after three consecutive bearish settlements, portraying a minor recovery in the risk-on impulse. The street is worried that renewed US banking crisis could dent the financial lending system and impacts the confidence of investors. Therefore, the optimism about Fed’s neutral interest rate guidance has faded.

A preliminary US NFP report (April) shows that the economy added 179K jobs in April, lower than former additions of 236K. The Unemployment Rate is seen unchanged at 3.5%. Apart from them, the major catalyst will be Average Hourly Earnings data. Monthly and annual Average Hourly Earnings may remain steady at 0.3% and 4.2% respectively.

This indicates that the labor market conditions are still tight and the bargaining power is in the favor of job seekers. Higher earnings would allow households to make decent purchases, which will keep propelling inflationary pressures. If Fed says that further action will be more data-dependent then sticky wages could maintain pressure on the Fed for making monetary policy more restrictive.

On the Pound Sterling front, United Kingdom’s final S&P Global/CIPS Services PMI rose to 55.9 from 52.9 in March. Reuters reported that UK businesses are comfortably passing the impact of higher employment costs to ultimate consumers. The context is expected to create more troubles for the Bank of England (BoE), which is even struggling to bring down inflation from double-digit figures.

- USD/CAD remains pressured around two-week low, has been drilling 100-DMA in the last fortnight.

- Looming bear cross on MACD, steady RSI keep sellers hopeful of breaking the key support.

- Surprise recovery needs validation from two-month-old descending trend line.

- Mixed forecasts for US, Canada employment data for April keeps Loonie traders on their toes.

USD/CAD fades bounce off 100-DMA as it drops back to 1.3535 amid early Friday in Asia, after refreshing a two-week low the previous day. In doing so, the Loonie pair portrays the market’s anxiety ahead of the April month jobs report from the US and Canada while keeping the fortnight-long fight with an important moving average on.

Also read: USD/CAD plummets to the 1.3520s near prior week´s lows

Even if the 100-DMA continues to challenge the USD/CAD pair sellers in the last two weeks, the impending bear cross on the MACD and steady RSI suggests a clear break of the 1.3525 DMA support this time.

Following that, a quick drop toward the 61.8% Fibonacci retracement of the Loonie pair’s November 2022 to March 2023 upside, near 1.3465, can’t be ruled out.

However, the early April low of around 1.3400 and an upward-sloping support line from November 15, close to 1.3310 at the latest, can challenge the USD/CAD bears afterward.

On the contrary, the Loonie pair’s surprise bounce can’t convince the bulls unless crossing a descending resistance line from March 10, near 1.3640 by the press time.

Even if the quote rises past 1.3640, April’s peak of around 1.3670 may prod the USD/CAD bulls before giving them control.

USD/CAD: Daily chart

Trend: Further downside expected

- The Aussie Dollar rises amidst a 25 bps Federal Reserve rate hike.

- Australia’s Balance of Trade printed a surplus bolstered by exports to China.

- AUD/USD traders brace for the Australian economic agenda and US labor market data in focus.

The Australian Dollar (AUD) extended its gains against the US Dollar (USD) for four straight days after the US Federal Reserve (Fed) decided to boost rates by 25 bps amidst risk aversion on Wednesday. Sentiment remains fragile, as witnessed by Wall Street, which registered losses. The AUD/USD is trading at 0.6692, flat as Friday’s Asian session begins.

AUD Benefits from Trade Surplus and Weakening USD

The AUD/USD dipped as low as 0.6640 as the US financial banking turmoil continued. Australia’s Trade Balance printed a surplus bolstered by exports to China, as it hit a record high, sponsored by an increment in iron ore exports. The Trade Balance for March rose by A$15.3B above estimates of A$12.7B and exceeded February’s A$14.15B.

Additionally, the US Dollar weakened in the early North American session after Jerome Powell and Co hiked rates by 25 bps and signaled that a pause was possible. Nonetheless, the Fed’s Chair revealed that inflation is too high, the labor market remains tight, and that rate cuts are not expected this year.

Meantime, data revealed by the US Bureau of Labor Statistics (BLS) showed that Initial Jobless Claims for the week ending April 29, rose to 242K, above 240K expected by analysts, while Continuing Claims updated until April 22 dropped to 18.1 million.

Although the data showed that the jobs market is easing, aligned with the JOLSTs report that highlighted that vacancies moderated, Wednesday’s ADP Employment Change data witnessed the opposite, creating close to 300K private jobs in the economy.

Upcoming economic data to watch

On Friday, the Australian economic agenda will feature Home Loans for March and the Reserve Bank of Australia (RBA) Statement of Monetary Policy (SoMP). On the US front, the docket will feature the Nonfarm Payrolls, Average Hourly Earnings, and the Unemployment Rate on the labor market side. Fed speakers will begin to cross wires led by Lisa Cook.

AUD/USD Key Technical Levels

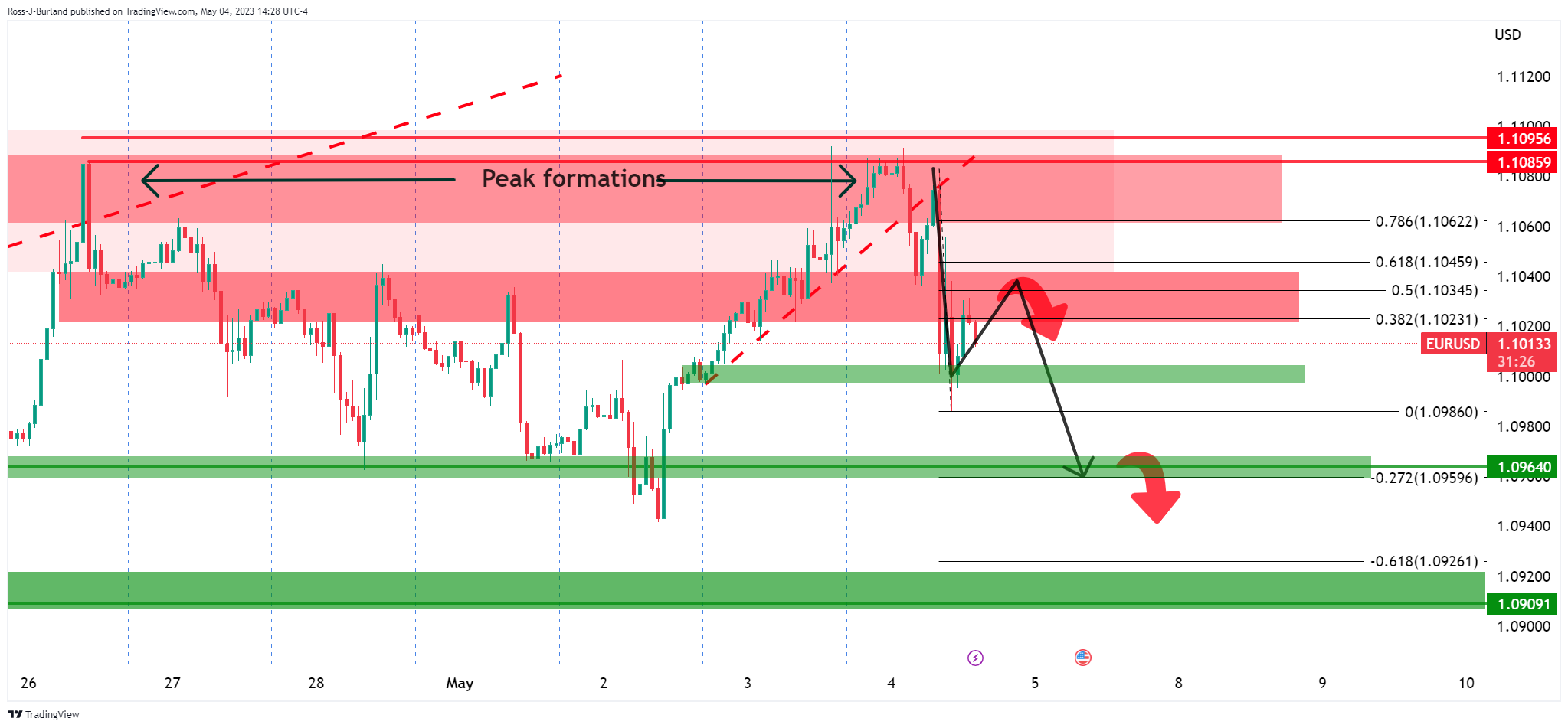

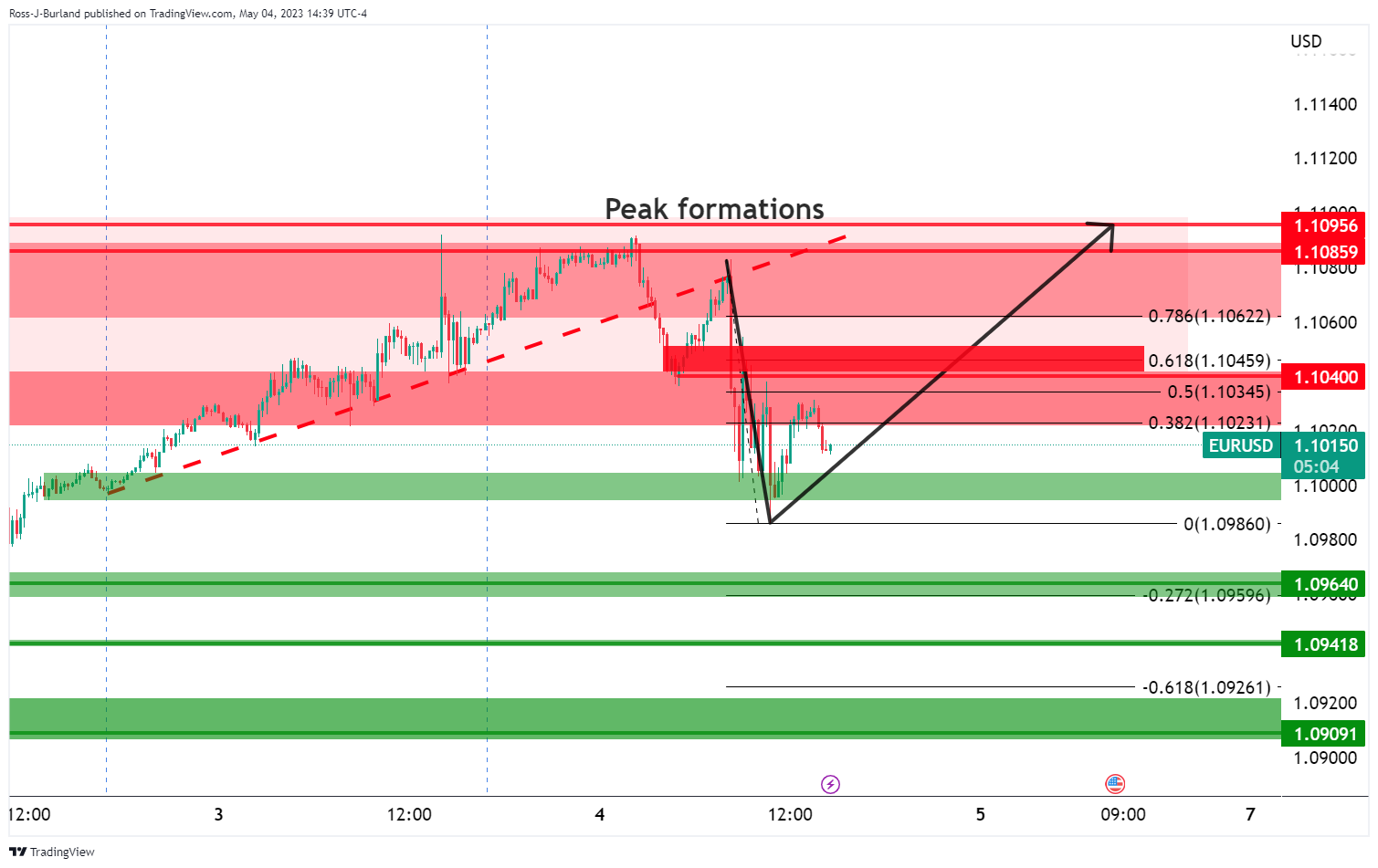

- EUR/USD remains depressed after snapping two-day winning streak.

- ECB announces 0.25% rate hike, fastens pace of APP but couldn’t defend Euro.

- US Dollar licks Fed-induced wounds on mixed US data, banking crisis.

- US employment data for April will be the last key catalyst of the volatile week

EUR/USD holds lower grounds near 1.1010 after failing to cheer the comparatively hawkish European Central Bank (ECB) decision than the Federal Reserve. Apart from the ECB’s failure to keep the Euro bulls on the table, after a two-day uptrend, the banking fears also weigh on the major currency pair during the early hours of Friday in Asia.

On Thursday, European Central Bank (ECB) matched market forecasts by announcing a 25 basis points (bps) increase in its benchmark rates. The ECB also announced faster dialing back of its Asset Purchase Programme (APP) to around EUR25 billion per month from July, from the current pace of EUR15 billion per month. In return for a smaller rate hike, the ECB chose to remain hawkish and shut the door for a rate hike pause while saying, “Inflation outlook continues to be too high for too long." Following the Interest Rate Decision, ECB President Christine Lagarde said, "We are not Fed-dependent in rate decisions, we can tighten if the Fed pauses."

On the other hand, the US Goods and Services Trade Balance improved to $-64.2B from $-70.6B prior and $-63.3B market forecast. Further, Initial Jobless Claims edge higher to 242K for the week ended on April 28 versus 240K expected and 229K previous readings.

More importantly, preliminary readings of Nonfarm Productivity and Unit Labor Cost for the first quarter (Q1) of 2023 came in mixed. That said, Nonfarm Productivity dropped to -2.7% in Q1 from 1.6% prior and -1.8% market forecasts whereas the Unit Labor Cost jumped to 6.3% versus 5.5% expected and 3.3% prior.

It’s worth noting that the Fed’s hints for policy pivot called the US Dollar bears despite the rate hike of 25 basis points.

Elsewhere, bank fears are on their roll as Western Alliance and PacWest both recently signaled jitters in the US banking sector. On the same line, the fears of the US debt ceiling expiration also weigh on the market sentiment and exert downside pressure on the EUR/USD pair due to the US dollar’s haven demand.

Amid these plays, Wall Street closed negative and the yields were pressured too but the US Dollar bounced off its weekly low.

Moving on, EUR/USD traders should pay attention to the monthly US jobs report for April to pare the weekly losses in case of a positive surprise from the headline Nonfarm Payrolls (NFP) data.

Also read: US April Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

Technical analysis

EUR/USD stays inside a three-week-old bullish channel, currently between 1.1115 and 1.0950, with the latest bearish signals from oscillators.

- NZD/USD has attempted recovery from 0.6280 as investors await US NFP for further action.

- Fed confirmed after a 25bp interest rate hike that further policy action will be more data-dependent.

- Investors dumped US equities as fears banking crisis overshadowed optimism built on neutral guidance delivered by the Fed.

The NZD/USD pair has shown a recovery move of around 0.6280 in the early Asian session. Earlier, the Kiwi asset dropped sharply after failing to hit the round-level resistance of 0.6300. The correction in the Kiwi asset came due to a recovery move in the US Dollar Index (DXY). The USD index has moved higher after defending its crucial support of 101.43.

The USD Index has gained traction as the focus has shifted to the United States Nonfarm Payrolls (NFP) data. Federal Reserve (Fed) chair Jerome Powell confirmed in the monetary policy statement after a 25 basis point (bp) interest rate hike that further policy action will be more data-dependent. US labor market conditions have broadly remained extremely tight, therefore, the NFP data holds significant importance as upbeat figures could force the Fed to reconsider its plan of pausing interest rate hikes from June.

According to the consensus, the US economy added 179K in April, lower than the former release of 236K. The Unemployment Rate is seen unchanged at 3.5%.

Meanwhile, S&P500 settled Thursday’s session on a negative note. A three consecutive bearish closing in S&P500 is indicating the poor risk appetite of the market participants. Investors dumped US equities as fears banking crisis inspired by consideration of strategic options for potential sale by PacWest Bancorp’s overshadowed optimism built on neutral guidance delivered by the Fed.

Also, a recovery in the USD Index provided some support to the US Treasury yields. The yields offered on 10-year US government bonds rebounded to near 3.38%.

On the New Zealand Dollar front, Caixin Services PMI (April) data will be keenly watched. The economic data is seen at 56.5 lower than the former release of 57.8. It is worth noting that New Zealand is one of the leading trading partners of China and weak Chinese service activity would impact the New Zealand Dollar.

- USD/JPY is testing key daily trendline support.

- Bears eye a break of support and 133.50,20,00 are key levels.

USD/JPY is flat into the close in FX on Thursday´s US session after correcting back into the trendline resistance area as the following charts on the 1-hour time frames and the daily chart will illustrate below:

USD/JPY H1 charts

The price was heavily offered in the Wall Street opening hours but the bulls scrambled back from the lows of the day down at 133.50 which now is a critical support into Friday as Nonfarm Payrolls looms. The chart above is a bearish scenario in this regard with 133.20-00 eyed as a near-term objective.

On the other hand:

We could see the bulls committing from between 133.50, or thereabout, and 133.80. this would leave the outlook uncertain albeit still on the front side of the trendline within a bearish environment.

USD/JPY daily chart

On the other hand, the daily chart´s bullish trendline is still intact:

- The Gold price is jammed into a resistance area near $2,050.

- $2,032.10 is a key support structure.

- On the upside, the all times highs will be a target of around $2,075.

Gold price is trading around $2,050 and higher by some 0.5% on the day. The bulls have been in the market in a risk-off period in higher volatility markets of late and it has been climbing for a third-straight session as safe-haven buying.

We have had interest-rate decisions and dovish rate hikes from the Federal Reserve and European Central Bank giving the Yellow Metal a boost as well. Both central banks raised interest rates by 25 basis points but both have signaled that they might be ready to pause.

Analysts at ANZ bank explained the on-goings of teh ECB:

´´The European Central Bank (ECB) raised its key policy rate by 25bp to 3.75%. The ECB also announced that it would increase the pace of the run-down of its asset purchase programme to around EUR25bn per month from July, from the current pace of EUR15bn per month,´´ the analysts said.

´´Ahead of the ECB meeting there was some expectation of a larger lift in rates. However, President Lagarde pointed to the weakness in monetary aggregates and tightening in bank lending standards as reasons for a more cautious approach. The ECB is still waiting to see the impact of previous tightening in the financial sector to be transmitted to the real economy. The lagged impact of monetary policy tightening makes it challenging for central banks to know exactly when sufficient tightening has been deployed to get the result they are aiming for.´´

Meanwhile, analysts at TD Securities warn not to sell into the gold rally.

´´Don't fade the rally in gold,´´the analysts started in a note.

´´The melt-up in prices overnight associated with ongoing stress in the banking sector revealed that traders are willing to deploy their hoard of dry-powder.´´

´´After all, our gauge of discretionary trader positioning still suggests this cohort has yet to participate in the rally in gold. Interestingly, discretionary trader positioning has historically lagged expectations for 12m forward fed funds rates by two to three months, suggesting the rates market view is still likely to translate to higher interest in gold,´´ the analysts explained.

´´Given our view that pricing for cuts is likely to firm into next year, this feeds the view that gold markets may have just entered into a new bull market with prices near all-time highs. In the meantime, algorithmic positioning may well be 'max long', but given the bar for liquidations has notably increased, CTA trend followers are unlikely to keep prices from printing new all-time highs. Further, retail demand for bullion remains resilient amid ongoing bank stress and the latest central bank data still shows little sign of buyer fatigue,´´ the analysts concluded.

Gold technical analysis

The price is jammed into a resistance area near $2,050 and supported by the micro trendline that rides the $40.00s. A break of the $47.00s opens the risk of a move to test $2,032.10 support structure. On the upside, the all times highs will be a target around $2,075.%

During the Asian session, the Reserve Bank of Australia will release its Monetary Policy Statement. Australia will also report Home Loans data, while China will release the Caixin Services PMI. The key event of the day will be the US employment report. The jobs number could be critical for the US Dollar that weakened on Thursday, even amid risk aversion.

Here is what you need to know on Friday, May 5:

Wall Street dropped again on the back of banking concerns, and US bond yields hit fresh monthly lows amid expectations of rate cuts from the Federal Reserve during the second half of the year. Although the US Dollar Index (DXY) rose modestly boosted by the decline in EUR/USD, the Greenback lost ground against most of its rivals, not helped by risk aversion.

Economic data from the US showed a 6.3% advance (annualized rate) in Unit Labor Costs (ULC) during the first quarter and an increase in Initial Jobless Claims to 242K. On Friday, the key report will be the Nonfarm Payrolls report. Market consensus points to an increase of 179K and the Unemployment Rate to stay at 3.5%.

Analysts at Wells Fargo:

Although ULCs are more volatile than other measures of labor costs, their continued menacing pace adds to last week's Employment Cost Index in dampening the nascent optimism that wage pressures are beginning to ease in a meaningful way. Inflation's road back to 2% continues to look long as a result.

The European Central Bank (ECB) raised its key interest rates by 25 basis points, marking a slowdown from the previous 50 basis points hikes. The central bank is expected to continue hiking rates in the future. Following the ECB event, the Euro lost ground against the US dollar, with EUR/USD dropping below 1.1000. The pair then rebounded but finished far from the key 1.1100 area.

EUR/GBP posted its lowest daily close in a month, near 0.8750. Meanwhile, GBP/USD rose marginally but was still unable to break above 1.2600, although it closed at its highest level since June 2022.

USD/CHF rose modestly, boosted by the slide of the Euro after the ECB, and settled around 0.8850. On Friday, Switzerland will report consumer inflation.

The Japanese Yen was among the top performers, boosted by risk aversion and lower US yields. USD/JPY trimmed losses late on Thursday, rebounding above 134.00.

AUD/USD rose for the fourth consecutive day but was struggling to retake 0.6700. The Reserve Bank of Australia (RBA) will release the Monetary Policy Statement on Friday.

NZD/USD jumped on Thursday, approaching 0.6300. The Kiwi is among the biggest gainers of the week.

USD/CAD dropped sharply to weekly lows at 1.3515 before consolidating at 1.3540. Canada will release crucial jobs data on Friday with a net change in employment expected to slow to 20K.

After surging earlier on Thursday, Gold pulled back and ended around $2,050 as it continues to look at all-time highs. Silver had the highest close in a year above $26.00. Cryptocurrencies rose, with BTC/USD gaining 1.3%. Crude oil prices finished flat after extreme volatility during the Asian session.

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bulls are eyeing a break towards 1.2660.

- Bears need to get below the 1.2570s.

GBP/USD was trading in a narrower range of around 50 pips on Thursday having hit an 11-month high the prior day after the Federal Reserve raised rates but signaled an end to its tightening cycle is in sight. The technicals are left bullish, however, while on the front side of the weekly dynamic support line as the following will illustrate:

GB/USD weekly chart

We have a resistance at 1.2600 that the bulls need to overcome that will open the way to 1.2660. There are prospects of a strong move up from there which makes the midpoint of the 1.26s potentially stubborn resistance.

GBP/USD H4 chart

The 4-hour time frame is compelling. A break of trendline support will be key and the 1.2570s are key in this regard. A break of the 1.2550s opens the risk of a deeper move lower for the days ahead. Nonfarm Payrolls will be a critical event on Friday and next week´s opening balance could be what counts, setting the tone for the week ahead after the NFP volatility.

- USD/CHF may be headed for an upward correction despite touching new lows.

- If buyers reclaim the 20-Day EMA at 0.8955, further upside is expected in the USD/CHF pair.

- USD/CHF at a brisk of falling towards 0.8800, once it falls beneath 0.8819.

The Swiss Franc (CHF) strengthened to a new high of the year against the US Dollar (USD), as the USD/CHF dropped towards 0.8819, the year-to-date (YTD) low, as risk aversion hit the markets. Nevertheless, the USD shrugged off its earlier losses, and the USD/CHF pair reversed its course, holding gains. At the time of writing, the USD/CHF is trading at 0.8858 and has gained 0.20%.

USD/CHF Price Action

Although the pair touched new lows, and the USD/CHF price action fell to a lower low, technically speaking, the USD/CHF might be headed for an upward correction. The Relative Strength Index (RSI) indicator is in bearish territory, though it has printed a series of successive higher troughs on each USD/CHF’s lower low. Therefore, a positive divergence is emerging, which could pave the way for further upside.

For that outcome to happen, USD/CHF buyers must reclaim the 20-day EMA at 0.8955. Once cleared, the pair must rally above the May 2 high, at around 0.9000. A decisive break of the figure would expose another resistance level at the 50-day EMA at 0.9067 before buyers can claim 0.9100.

Conversely, if USD/CHF collapses below 0.8819, a fall towards 0.8800 is on the cards.

USD/CHF Daily Chart

- Silver price pierces the $26.00 figure but fails to crack the YTD high of $26.08.

- A dovish perceived Federal Reserve underpinned the white metal.

- XAG/USD remains in a solid uptrend despite overbought RSI readings; a pullback is possible.

Silver price rallied but remained shy of cracking the previous year-to-date (YTD) high of $26.08, with XAG remaining supported by buyers keeping the white metal trading nearby the $26.00 figure. Data from the US flashed the labor market is easing amidst the ongoing US banking turmoil, which weighed on market sentiment. The XAG/USD is trading at $25.96 a troy ounce, up 1.40%.

Silver price nears YTD highs as Fed policy boosts uptrend, but overbought RSI signals potential pullback

The rise in the precious metals segment was sparked by traders seeking safety, amidst an ongoing deterioration in the United States (US) economy, alongside falling US Treasury bond yields. Reflection of the latter is investors seemed to price in rate cuts by the Federal Reserve in 2023.

On Wednesday, the Fed increased rates to the 5.00% - 5.25% area, 25 bps up from its March meeting level. It signaled that it would be data-dependent while removing “hawkish” language from its monetary policy statement.

Even though the Fed’s decision was perceived as dovish, when Fed Chair Jerome Powell was asked about rate cuts, he said, “Would not be appropriate to cut rates, given our view that inflation will take some time to come down.”

In the meantime, the labor market continued to ease, as shown by Initial Jobless Claims for the week ending on April 29, jumping above the estimated 240K and coming at 242K. Continuing Claims edged down by 38K, to 1.81 million, in the week ending on April 22.

In other data, the US Balance of Trade deficit narrowed in March as Exports increased, as the US Commerce Department reported.

Ahead of the week, the US economic calendar will include the Nonfarm Payrolls for April, which is expected to show 180K jobs added to the economy - less than the previous month’s 236K. The report will also include the Average Hourly Earnings, which are expected to remain at 0.3% MoM, and the Unemployment Rate, which is predicted to be 3.6%.

XAG/USD Technical Analysis

The XAG/USD remains in a solid uptrend, despite falling to crack $26.08, the YTD high. However, the high readings of the Relative Strength Index (RSI) indicator in the overbought territory could refrain Silver traders from opening new positions, as price action looks overextended. That could pave the way for a mean reversion toward the 20-day EMA, which intersects with the $25.00 figure, as buyers take a respite to lift XAG/USD to higher prices.

- EUR/USD bears are engaging again but the support could be solid ahead of Nonfarm Payrolls.

- EUR/USD 1.0980s are key for the day ahead.

The bias remains bearish with low-hanging fruit for the bears to pick off on a break below 1.1000 with eyes on the 1.0950s. However, should the bulls commit at the current support, the market could easily turn higher to the 1.1050s as a key resistance area that guards the recent highs near 1.1100:

EUR/USD was giving back some of its overnight gains after the European Central Bank eased the pace of its rate hikes, enabling the bears a free lunch from the top of the peak formation as the following technical analysis will illustrate:

EUR/USD H1 charts

EUR/USD met resistance in a 38.2% Fibonacci and a 50% mean reversion at the height of the correction following the slide from the ECB outcome.

The bias remains bearish with low-hanging fruit for the bears to pick off on a break below 1.1000 and 1.0980 with eyes on the 1.0950s. However, should the bulls commit at the current support, the market could easily turn higher to the 1.1050s as a key resistance area that guards the recent highs near 1.1100:

EUR/USD M15 chart

- US Dollar Index is trading sideways, with EMAs acting as resistance.

- The RSI indicator suggests bearish momentum may be losing steam for the DXY.

- USD buyers reclaiming 102.500 would pave the way to challenge 103.000; otherwise, the DXY could retest YTD lows.

The US Dollar Index (DXY), a gauge that measures the value of six peers against the American Dollar (USD), prints minuscule gains of 0.06% as risk aversion takes hold due to the US banking system turmoil, and also on a dovish rate hike by the Fed on Wednesday. At the time of writing, the DXY exchanges hand at 101.298 after hitting a low of 101.027.

DXY Price Action

The US Dollar Index continues to be trading sideways after bottoming at around 100.788 in April 14, capped on the upside by the 20 and 50-day Exponential Moving Average (EMA), which are acting as a dynamic resistance, each at 101.808 and 102.477, respectively.

The Relative Strength Index (RSI) indicator stays at bearish territory though it has not reached a lower trough, as price action has done it. So, it suggests that sellers are losing momentum.

If DXY buyers want to shift the bias to neutral, they must reclaim the 20 and 50-day EMAs, meaning that the DXY needs to be above 102.477. Once cleared, the next resistance would be the April 10 daily high at 102.807 before challenging 103.000. The uptrend will extend if buyers crack the 100-day EMA at 103.400.

Conversely, if the DXY drops below the May 4 daily low of 101.027, it would immediately expose the YTD low of 100.788 before challenging the 100.000 mark.

DXY Daily Chart

- USD/CAD drops into last week´s lows as CAD gets a boost from BoC chatter.

- If support holds, then the 1.3550s come into focus in a correction.

USD/CAD is falling as the market price in the Bank of Canada and Federal Reserve interest rate outlooks. At the time of writing, USD/CAD is trading in the 1.3520s after falling from a high of 1.3632.

In recent trade, the Bank of Canada´s Tiff Macklem stated, ´´ If we see signs inflation stuck materially above 2%, we could hike again.´´ When compared to the dovish statement from the Federal Reserve on Wednesday, this gives the CAD the edge and we are seeing USD/CAD as a consequence, despite the heavy drop in the price of oil.

Meanwhile, the attention will turn to the labour market reports from both the US and Canada. ´´US payrolls likely slowed for a third consecutive month to a still firm pace in April, though the slowest since 2020,´´ analysts at TD Securities said, adding, ´´we also look for the UE rate to rise to 3.6%, and wage growth to print 0.3% MoM.´As for In Canada, the analysts said that they look for a 15k print, well below the 6m trend and the weakest since September 2022. This should see the UE rate edging higher to 5.1% as wage growth cools to 4.7% YoY.´´

The data will be critical for both the US and Canada with the Federal Reserve data dependant after the Federal Open Market Committee raised the target range for the fed funds rate by 25bp to 5.00-5.25%, as widely expected. However, the accompanying statement saw changes from the March statement, with the most important being the removal of the line “the Committee anticipates that some additional policy firming may be appropriate,” signaling that further rate rises will no longer be the default choice at coming meetings.

USD/CAD technical analysis

USD/CAD is testing support in the 1.3520s and last week´s lows. a break here gives way to a move into the 1.3490s for the foreseeable future. However, a correction would be anticipated imminently.

The hourly chart shows the price heading into the support area and if this were to see a deceleration then a reasonable upside target would be the 1.3550s in a correction.

The Bank of Canada´s Governor Tiff Macklem said in a prepared speech at the Toronto Region Board of Trade that if they start to see signs that inflation is likely to get stuck materially above their 2% target, they are prepared to raise interest rates further. The BoC decided to pause interest rate hikes in March.

Key quotes from the speech:

“We’re forecasting inflation to fall quickly to about 3% this summer and to reach the 2% target near the end of 2024. The projected decline from 3% to 2% is both slower and more uncertain. With growth anticipated to be weak through the rest of the year before picking up gradually next year, we expect services price inflation to ease and overall inflation to converge on the 2% target. But several things still have to happen for services price inflation to moderate in line with our forecast, and we are watching these closely.”

“Last month, Governing Council decided to hold its policy rate steady at 4½% as we assess whether monetary policy is restrictive enough to return inflation to the 2% target. We know that monetary policy works with a delay, and the effects of the tightening we’ve undertaken to date have not yet fully worked their way through the economy. If we start to see signs that inflation is likely to get stuck materially above our 2% target, we are prepared to raise rates further.”

“At the same time, the financial system needs to adjust to higher interest rates. This underscores the importance of sound risk management in financial institutions and vigilant supervision to identify and manage risks as the economy slows and the cost of funding adjusts to higher interest rates.”

Market reaction:

The USD/CAD is trading at weekly lows, under 1.3530 on Thursday, with the Canadian dollar outperforming during the American session.

- XAU/USD hits new ATH high as Fed signals pause, though profit-taking weighed on Gold price.

- The labor market eases as US Initial Jobless Claims rise to 242K, but Continuing Claims fall to 1.81 M.

- XAU/USD Price Analysis: It could dip below $2050 with sellers eyeing $2000; otherwise, buyers could challenge the ATH.

Gold price remains trading in positive territory after hitting a new all-time high (ATH) at around $2081.82. Some profit-taking, risk aversion, and another central bank increasing rates dragged XAU/USD price towards the $2050 area. At the time of writing, XAU/USD exchanges hands at $205.92, holding to gains of 0.40%.

XAU/USD clings to its earlier gains, though at brisk of losing $2050

The financial turmoil around the US banking system continues, as PacWest and Western Alliance Bank are under solid selling pressure, which triggered flows towards safety. Therefore, XAU/USD continues to hold its ground, despite recent US Dollar (USD) strength.

The economic agenda in the United States (US) revealed that unemployment claims for the week ending on April 29 jumped to 242K, exceeding estimates of 240K, a report cheered by US Federal Reserve (Fed) officials. Continuing claims, which include citizens receiving unemployment benefits for a week or more, fell by 38K, to 1.81 million, in the week ending on April 22.

The XAU/USD reached its new ATH high after the Fed increased rates above the 5% threshold and signaled that it would be data-dependent, opening the door for a pause. However, Fed Chair Jerome Powell reiterated that inflation remains high and that the labor market is tight. He kept the chances for additional tightening on the table and pushed back against cutting rates amidst inflation levels, twice the Fed’s goal.

On Thursday, the US Dollar Index (DXY), which measures the value of six currencies against the buck, fluctuates between gains and losses at 101.340, influenced by US Treasury bond yields. The US 10-year Treasury bond yield is losing eight bps, down to 3.315%, a tailwind for XAU/USD’s price.

What to watch?

On Friday, the US economic docket will feature the US Nonfarm Payrolls report for April, expected at 180K, less than the prior’s month 236K jobs added to the economy. Additionally, Average Hourly Earnings are expected to remain unchanged at 0.3% MoM, while the Unemployment Rate is foreseen at 3.6%.

XAU/USD Technical Analysis

From a daily chart perspective, the XAU/USD is still upward biased, though Thursday’s price action opens the door for a mean reversion move. If XAU/USD’s Thursday daily candle closes beneath $2050, that will exacerbate a correction. Initially, XAU/USD could fall towards $2030.50, May 4 low, followed by the March 20 swing high, which turned support at $2009.75. A breach of the latter will expose the $2000 figure.

Conversely, a bullish continuation could happen if XAU/USD buyers hold prices above $2050 as they eye the $2100 barrier.

Citing four sources familiar with the matter, Reuters reported on Thursday that all European Central Bank (ECB) policymakers but one, Robert Holzmann, agreed to slowing down the pace of rate increases at May policy meeting.

Policymakers reportedly wanted forward guidance for more rate hikes ahead. According to the sources, some ECB policymakers except two or three more rate increases.

Market reaction

EUR/USD struggled to stage a rebound following this headline. As of writing, EUR/USD pair was down 0.35% on a daily basis at 1.1020.

On Thursday, the European Central Bank (ECB) raised its key interest rates by 25 basis points. Analysts at Danske Bank were expecting a 50 basis points hike. They pointed out that the central bank is not done hiking, and President Lagarde clearly stated that its data-dependent approach warranted further hikes based on the current outlook.

Key quotes:

“The inflation assessment was broadly unchanged with ‘inflation outlook continues to be too high for too long’. Against this background, we assess that the bank lending survey has ‘spooked’ the GC members to slow the pace to 25bp.”

“The ECB is not done hiking and President Lagarde clearly said that its data dependent approach warranted further hikes at the current outlook. We add a 25bp hike in September as well to our rate call, thereby keeping our 4% peak policy.”

“Lagarde repeated several times that it is a journey and not the destination and hence an open mind to the rate decisions is kept. With our current inflation and growth assessment we warrant that this tightening cycle will be slightly longer but still end around the 4% level.”

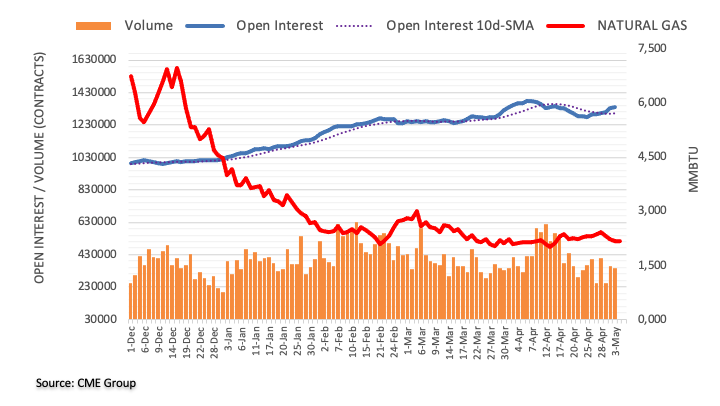

- WTI grinds higher after hitting a new YTD low at around $63.00.

- Global central bank tightening puts stress on oil prices with recession fears and lower demand potential.

- WTI Price Analysis: Analysis suggests relief for buyers with a rally above $70 but a potential fall to $60 is on the cards.

Western Texas Intermediate (WTI), the US crude oil price, had shrugged off a $6.00 fall during the Asian session and is trading above its opening price. Two major central banks’ decisions weighed WTI’s price, though buyers moved in and lifted prices. At the time of writing, WTI is exchanging hands at $68.72 PB, gains almost 1%.

Oil prices pressured by a global economic slowdown looming

Sentiment is still sour, blamed on the US regional bank turmoil. Further losses in the segment keep the US financial markets under stress, though a lending hand from the US Federal Reserve (Fed) could calm investors.

On Wednesday, the Fed hiked rates by 25 bps and signaled it’s ready to hold rates at the 5.00%-5.25% range. Nevertheless, Powell and Co. emphasized that inflation is elevated, the jobs market remains tight, and the Fed is ready to act if needed.

WTi reacted negatively, finishing Wednesday’s session with more than 4.50% losses. During the Asian session, risk aversion weighed on oil prices as WTI plunged to its year-to-date (YTD) low of $63.73 before bouncing off those levels.

Another factor that weighed on WTI price was that manufacturing activity in China slid, according to Caixin Global. China’s Manufacturing PMI slumped into contractionary territory, falling to 49.5 from 50 in March, and 51.6 in February, signaling that the largest Asian economy is slowing down.

Of late, the European Central Bank (ECB) increased its interest rates to 3.75%, slowing its pace of 50 bps of tightening to 25. However, the ECB’s President Christine Lagarde reiterated that the central bank is not pausing, just slowing the rhythm of tightening.

Meanwhile, given that the Organization of Petroleum Export Countries and its allies (OPEC+) began to cut its output in May, it served as a cushion for the US crude oil benchmark to stay afloat above the $60.00 mark.

Regarding US stockpiles, inventories shrank as reported by official data released by the US Energy Information Administration (EIA) on Wednesday, falling just one million barrels last week.

WTI Technical Analysis

WTI is in a downtrend, and despite recovering from its earlier losses, the $60.00 mark is eyed by sellers. Unless WTI buyers reclaim last year’s low of $70.10 PB, further downside is expected. WTI’s first support would be the March 24 low of $66.86, followed by its prior’s YTD low of $64.41. Conversely, a rally above $70.00 could offer buyers a respite, though downside risks remain as it remains below $75.00.

- US yields hit fresh weekly lows due to risk aversion.

- Japanese yen benefits from falling equity prices in the US amid banking concerns.

- USD/JPY drops for the third consecutive day, below the 20-day SMA.

The USD/JPY has broken lower and tumbled to 133.79, reaching its lowest level in six days. The pair remains under pressure amid risk aversion, with US regional banks taking a hit.

Although the US Dollar experienced a modest rebound following US Q1 productivity report, it quickly faded after Wall Street's opening bell. US stocks are falling again, with regional banks tumbling. Wednesday's Federal Reserve rate hike seems like old news already.

The deterioration in market sentiment is driving demand toward Treasury bonds. The US 10-year yield is at 3.33%, while the 2-year is at 3.79%, both at one-month lows.

The context of lower US yields and risk aversion is boosting the Japanese yen across the board during the American session, pushing USD/JPY down, extending weekly losses.

The pair is falling for the third consecutive day. From Tuesday's top, it lost almost 400 pips. The price is testing levels below 134.00 and under the 20-day Simple Moving Average (SMA). The next strong support area is seen around 133.50. A recovery above 135.00 would alleviate the bearish pressure.

Technical levels

Economists at Credit Suisse discuss GBP outlook and expect Cable to extend its gains.

Break below support at 1.2344 to warn of a deeper setback

“We still see scope for one final leg higher to our core target at 1.2668/1.2758 – the May 2022 high, 61.8% retracement of the 2021/2022 fall and long-term downtrend from May 2021. Our bias would then be to look for an important top here.”

“Below support at 1.2344 stays seen needed to mark a minor top to warn of a deeper setback to the 55-DMA and price support at 1.2255/1.2190, but with this ideally holding.”

Brent Crude Oil is under heavy pressure after recently rejecting key resistance levels, suggesting a resumption of the downtrend is likely, with next supports at $65.72 and $63.02, analysts at Credit Suisse report.

Key resistance at $86.41/89.37 still expected to cap

“With medium-term momentum still negative and short-term momentum crossing back into outright bearish territory, we look for a break below current year-to-date low at $70.12 imminently, which would open up a move to the major cluster of supports between $65.72 and $63.02 next.”

“Key resistance at the 200-DMA and key highs at $86.41/89.37 is still expected to cap should the market stabilize and turn back higher, but even this is not our base case.”

The European Central Bank (ECB) downshifted to a 25 bps hike as expected. The EUR/USD pair came off a bit on the announcement. Economists at TD Securities expect the 1.0950 mark to provide solid support.

Positioning squeeze but remain firm dip buyers

“Ultimately, we think the EUR reaction boils down mostly to disappointed positioning. Markets had to reprice some lingering expectations of a 50 bps hike.”

“We continue to look for a break of 1.10 and would look to buy short-term dips towards 1.0950.”

EUR/CHF has turned back lower over the past couple of days within its broad ~0.9700- 1.0101 range. Economists at Credit Suisse expect further weakness in EUR/CHF.

Renewed phase of risk-off

“Weekly MACD momentum is turning freshly lower back into negative territory. This, along with our risk-off stance, leaves us biased towards further CHF appreciation.”

“We believe a range breakdown below 0.9712/00 is likely in due course, which would open up a move to 0.9559 next and potentially the 0.9411 low.”

“Key resistance at the range top at 1.0101 is expected to cap.”

- Canada Ivey PMI retreats less than expected in April.

- USD/CAD moves toward daily lows after data.

The Ivey Purchasing Managers Index (PMI), which measures the month-to-month variation in economic activity in Canada, dropped to 56.8 (seasonally adjusted) in April from 58.2 in March. However, this was a smaller drop than the market had expected, with the consensus forecast at 54.8.

The Employment Index also edged lower to 55.8 from 60.3, and the Prices Index fell to 59.0 from 62.0.

Market reaction

Following the release of the data, USD/CAD initially moved towards daily lows but later largely ignored the figures. The pair was last seen trading modestly higher on the day at 1.3615. Bank of Canada Governor Macklem is set to deliver a speech later on Thursday.

- GBP/USD is seen consolidating its recent gains to the highest level since June 2022.

- A modest USD recovery from over one-week low acts as a headwind for the pair.

- The downside seems limited, warranting some caution before placing bearish bets.

The GBP/USD pair enters a bullish consolidation and oscillates in a narrow trading range just below its highest level since June 2022 touched this Thursday. The pair holds steady just above the mid-1.2500s through the early North American session, awaiting a fresh catalyst before the next leg of a directional move.

In the meantime, a modest US Dollar (USD) recovery from over one-week low acts as a headwind and keeps the GBP/USD pair below the 1.2600 round-figure mark. Signs of stress at another US regional bank, PacWest Bancorp, sparks fears of a full-blown banking crisis in the US, which, along with looming recession risks, temper investors' appetite for riskier assets. This is evident from a generally weaker tone around the equity markets and helps revive demand for the safe-haven Greenback.

The USD bulls, however, seem reluctant to place aggressive bets in the wake of the Federal Reserve's (Fed) less hawkish outlook. It is worth recalling that the US central bank raised interest rates by 25 bps on Wednesday and opened the door for a possible pause in June. Apart from this, concerns over the US debt ceiling continue to act as a headwind for the US Treasury bond yields, which should further contribute to keeping a lid on the buck and limiting the downside for the GBP/USD pair, at least for now.

On the economic data front, the US Initial Weekly Jobless Claims rose more than expected, to 242K during the week ending April 29 from the previous week’s 229K (revised from 230K) and fails to provide any meaningful impetus. Traders now seem to have moved to the sidelines and keenly await the closely-watched US monthly jobs data on Friday. The popularly known NFP report will play a key role in influencing the USD price dynamics and determine the near-term trajectory for the GBP/USD pair.

Technical levels to watch

The GBP/USD pair eeks out marginal gains to a new cycle high. Economists at Scotiabank expect Cable to enjoy further gains.

Support aligns at 1.2475/1.2525

“New cycle highs, however marginal today, keep the broader backdrop for Cable positive.”

“Last week’s firm close through 1.2445/50 remains a key feature of the GBP charts from my point of view and suggest topside pressure continues to develop (towards 1.27/1.28) even if gains remain very slow.”

“GBP/USD support is 1.2475/1.2525.”

See: GBP/USD could trade up to 1.2650/2750 – ING

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in May.

Key takeaways

"Saving a little bit of optionality on APP reinvestment."

"The ultimate goal is to reduce APP bond holdings to zero."

"Rate hiking is a journey, we are not there yet."

"Data dependency is not forward guidance."

"We had lengthy debates about core inflation."

"We are particularly concerned about food inflation."

"We are not Fed-dependent in rate decisions, we can tighten if the Fed pauses."

"We are not making any commitment to cut rates at any point in time."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- EUR/USD loses some ground and revisits 1.1000.

- ECB President Christine Lagarde said inflation pressures remain strong.

- Many board members suggested a 50-basis-points interest-rate raise.

EUR/USD accelerates the corrective decline and probed the boundaries of the key 1.1000 level on Thursday, where solid contention appears to have emerged.

EUR/USD: Gains remain capped by 1.1100 so far

EUR/USD comes under pressure and faces some increased volatility as President Lagarde’s press conference is under way on Thursday.

So far, the pair probed once again the boundaries of the 1.1100 barrier just to give away all those gains and poke with the 1.1000 neighbourhood, managing to stage a rebound afterwards.

At her press conference, Lagarde argued that price pressures remain strong, while services prices are pushed up by pent up demand amidst a strong growth in the sector and in contrast with a worsening outlook for manufacturers.

Lagarde also noted that there are still significant upside risks to inflation, which remain bolstered by energy and supply bottlenecks, while wage pressure has gathered further traction as of late.

Lagarde reiterated that the bank maintains a meeting-by-meeting approach when it comes to decide on the next moves on rates as well as the performance of inflation and key fundamentals.

At the Q&A session, Lagarde stressed that all participants agreed that more tightening was needed, while many of them even leant towards a 50 bps hike. She added the bank still has further work to do in terms of reaching a sufficiently restrictive stance.

EUR/USD levels to watch

So far, the pair is down 0.17% at 1.1040 and faces the next support at 1.0941 (monthly low May 2) followed by 1.0909 (weekly low April 17) and finally 1.0831 (monthly low April 10). On the other hand, the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

USD is narrowly mixed versus majors as markets digest the FOMC decision. Economists at Scotiabank expect the US Dollar Index (DXY) to remain stable.

Fed outcome largely in line with market expectations

“The overall outcome was largely in line with market expectations and priced in; as such, the USD is likely to remain soft but, on the basis of current interest rate differentials, it looks close to fair value in broad terms at this point.”

“If a further, major decline is unlikely at this point, a significant rebound is unlikely.”

“Range trading, with a soft bias appears likely for the DXY in the near-term.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in May.

Key takeaways

"Some ECB governors thought 50 bps hike was appropriate."

"Nobody advocated unchanged rates."

"There was a very strong consensus."

"I don't have a numerical estimate for sufficiently restrictive."

"We are not yet seeing the complete impact desired to get to target."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- NZD/USD climbs to a multi-week high on Thursday, albeit struggles to capitalize on the move.

- A goodish USD bounce, along with a softer risk tone cap the upside for the risk-sensitive Kiwi.

- The fundamental backdrop favours bulls and supports prospects for further near-term gains.

The NZD/USD pair prolongs its uptrend for the third successive day on Thursday, also marking the fifth day of a positive move in the previous six, and climbs to a nearly three-week high. The pair maintains its strong bid tone, around the 0.6260-0.6265 area through the early North American session, with bulls looking to build on the momentum beyond a technically significant 200-day Simple Moving Average (SMA).

The New Zealand Dollar (NZD) continues to draw support from the upbeat domestic jobs data released on Wednesday, which backs the case for further interest rate hikes by the Reserve Bank of New Zealand (RBNZ). Adding to this, hawkish remarks by RBNZ Deputy Governor Christian Hawkesby, saying that the underlying economy has strength and New Zealand banks are well-positioned to support customers, act as a tailwind for the NZD/USD pair. That said, a goodish US Dollar (USD) recovery from over a one-week low touched earlier this Thursday keeps a lid on any further gains, at least for the time being.

Signs of stress at another US regional bank, PacWest Bancorp, sparks fears of a full-blown banking crisis in the US. Apart from this, looming recession risks temper investors' appetite for riskier assets. this is evident from a generally weaker tone around the equity markets, which helps revive demand for the safe-haven Greenback. That said, the Federal Reserve's (Fed) less hawkish outlook might hold back the USD bulls from placing aggressive bets and continue to lend some support to the NZD/USD pair. As was widely expected, the US central bank on Wednesday opened the door for a possible pause in June.

In fact, Fed Chair Jerome Powell, speaking at the post-meeting press conference, signalled that the US central bank was close to hitting the terminal rate of the current hiking cycle. Furthermore, data released this Thursday showed that the US Initial Weekly Jobless Claims rose more than expected, to 242K during the week ending April 29 from the previous week’s 229K (revised from 230K). This, in turn, suggests that the path of least resistance for the USD is to the downside and supports prospects for a further near-term appreciating move for the NZD/USD pair ahead of the US monthly jobs report (NFP) on Friday.

Technical levels to watch

Economists at Credit Suisse discuss S&P 500 outlook. They expect the index to move downward.

Move above 4195 to clear the way for a test of 4312/4325

“S&P 500 has retested and again rejected key resistance from the 4195 YTD high and with daily RSI and MACD momentum having turned lower, we think the broader risk is shifting towards a ‘risk off’ phase.”

“Below support from the recent low and 63-day average at 4054/49 is needed to confirm a near-term top for a fall to test the 200-day average, now at 3968. Indeed, a close below 4049 this Friday would also see a bearish “reversal week” established.”

“Above 4195 though would be seen to clear the way for a test of the summer 2022 high and 61.8% retracement of the entire 2022 fall at 4312/4325. We look for this to then prove a much tougher barrier and for a fresh top to be found here for a turn lower in the broader range later in Q2.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in May.

Key takeaways

"Mood in the meeting was determined."

"We were attentive to Bank Lending Survey."

"There were a variety of views expressed, everybody agreed that raising rates was needed."

"Not pausing, we have more ground to cover."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in May.

Key takeaways

"Resilince of labour market could lead to higher growth."

"There are still significant upside risks to inflation."

"Recent wage deals added to upside risks."

"The Euro area banking sector has proved resilient."

"Higher pay growth or profit margins could increase inflation."

"According to a recent survey, bank lending may continue to decline."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- US Goods and Services Trade Balance came in at -$64.2 billion in March.

The goods and services deficit was $64.2 billion in March, down $6.4 billion from $70.6 billion in February, the US Bureau of Economic Analysis revealed on Thursday. This reading came in slightly above the market expectation for a deficit of $63.3 billion.

Key takeaways from the report:

March exports were $256.2 billion, $5.3 billion more than February exports. March imports were $320.4 billion, $1.1 billion less than February imports.

The March decrease in the goods and services deficit reflected a decrease in the goods deficit of $6.4 billion to $86.6 billion and a decrease in the services surplus of less than $0.1 billion to $22.4 billion.

Year-to-date, the goods and services deficit decreased $77.6 billion, or 27.6 percent, from the same period in 2022. Exports increased $61.4 billion or 8.7 percent. Imports decreased $16.2 billion or 1.6 percent.

Exports of goods increased $5.2 billion to $174.3 billion in March.

Imports of goods decreased $1.2 billion to $260.9 billion in March.

Exports of services increased $0.1 billion to $81.8 billion in March.

Imports of services increased $0.1 billion to $59.5 billion in March.

The deficit with China decreased $2.3 billion to $22.9 billion in March. Exports increased $1.3 billion to $14.4 billion and imports decreased $0.9 billion to $37.3 billion.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 25 basis points in May.

Key takeaways

"Domestic demand, consumption, remained weak."

"We see divergence among sectors of the economy."

"Manufacturing prospects are worsening."

Government should roll back energy support measures."

"Price pressure remain strong."

"Services prices pushed up also by pent up demand."

"Wage pressures have strengthened further."

"Some firms also increased profit margins."

"Longer term inflation expectations warrant monitoring."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- Unit Labor Costs in the US increased at a stronger pace than expected in Q1.

- US Dollar Index turns positive after the report rising above 101.50.

“Unit labor costs (ULC) in the nonfarm business sector increased 6.3% in the first quarter of 2023, reflecting a 3.4% increase in hourly compensation and a 2.7% decrease in productivity. Unit labor costs increased 5.8% over the last four quarters”, the US Bureau of Labor Statistics (BLS) reported on Thursday. The increase in ULC was higher than the 5.5% increase expected.

“Nonfarm business sector labor productivity decreased 2.7% in the first quarter of 2023, the US Bureau of Labor Statistics reported today, as output increased 0.2% and hours worked increased 3.0%. From the same quarter a year ago, nonfarm business sector labor productivity decreased 0.9%, reflecting a 1.3% increase in output and a 2.3% increase in hours worked.”

“The 0.9% productivity decline is the first time the four-quarter change series has remained negative for five consecutive quarters; this series begins in the first quarter of 1948.”

Market reaction

The US Dollar rose across the board after the report. The DXY climbed above 101.50 while EUR/USD tumbled toward 1.1020 as traders await European Central Bank President Lagarde press conference.

- Initial Jobless Claims in the US advanced by 13,000 in the week ending April 29.

- Continuing Jobless Claims declined by 38,000 in the week ending April 22.

- US Dollar Index rises after economic reports.

Initial Jobless claims totaled 242,000 in the week ending April 29, the weekly data published by the US Department of Labor (DOL) showed on Thursday. The print follows the previous week’s 229,000 (revised from 230,000) and came in above market expectations of 240,000.

“The 4-week moving average was 239,250, an increase of 3,500 from the previous week's revised average. The previous week's average was revised down by 250 from 236,000 to 235,750.”

Continuing Claims decreased by 38,000 in the week ended April 22 to 1.805 million, below the 1.863 million of market consensus. It is the lowest level in three weeks.

“The 4-week moving average was 1,828,250, a decrease of 4,500 from the previous week's revised average. The previous week's average was revised down by 3,750 from 1,836,500 to 1,832,750.”

On Friday, the US official employment report is due with market expectations pointing to an increase in payrolls of 179,000. ADP surprised on Wednesday with higher-than-expected figures.

Market reaction

The US Dollar rose following the release of Jobless Claims and Labor Cost figures. Market participants focus on the European Central Bank which has just announced a 25 basis points rate hike. The EUR/USD is falling, trading at daily lows near 1.1020.

- EUR/USD keeps the trade within the daily range near 1.1040.

- ECB matched consensus and raised rates by 25 bps.

- Investors now shift their attention to Lagarde’s press conference.

Some disappointment emerges after the ECB’s interest rate decision and relegates EUR/USD to trade around the 1.1050/40 band on Thursday.

EUR/USD shifts the focus to Lagarde

EUR/USD maintains the inconclusive bias after the well-anticipated rate hike by the ECB.

Indeed, the central bank raised the interest rate on the main refinancing operations, the interest rate on the marginal lending facility and the deposit facility to 3.75%, 4.00% and 3.25%, respectively.

The ECB stressed that underlying inflation remains strong despite the loss of momentum seen in past months. In addition, the lags and strength of transmission of past rate raises to the real economy remain uncertain.

The ECB also noted that future decisions will make rates sufficiently restrictive.

Moving forward, market participants will now closely follow the usual press conference by Chairwoman Lagarde and the subsequent Q&A session.

EUR/USD levels to watch

So far, the pair is down 0.17% at 1.1040 and faces the next support at 1.0941 (monthly low May 2) followed by 1.0909 (weekly low April 17) and finally 1.0831 (monthly low April 10). On the other hand, the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

- EUR/GBP drifts lower for the second straight day and retreats further from the weekly top.

- The ECB’s 25 bps rate hike fails to impress the Euro bulls or lend any support to the cross.

- Investors now look to ECB President Lagarde's comments for some meaningful impetus.

The EUR/GBP cross extends the overnight retracement slide from the 0.8835 region, or the weekly low and remains under some selling pressure for the second successive day on Thursday. The cross remains on the defensive below the 0.8800 mark through the mid-European session and moves little after the European Central Bank (ECB) announced its policy decision.

As was widely expected, the ECB raises its benchmark interest rates by 25 bps at the end of the May monetary policy meeting and noted that the inflation outlook continues to be too high for too long. In the accompanying policy statement, the central bank reiterated that it stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its 2% target over the medium term. In the absence of any hawkish surprise, the outlook fails to impress the Euro bulls and exerts downward pressure on the EUR/GBP cross.

The British Pound, on the other hand, continues to draw support from rising bets for another 25 bps rate hike by the Bank of England (BoE). This is seen as another factor weighing on the EUR/GBP cross, though the downside remains cushioned. Traders seem reluctant to place aggressive bets and prefer to wait for ECB President Christine Lagarde's comments at the post-meeting press conference. Investors will look for fresh cues about the future rate-hike path, which will drive the shared currency and provide a fresh impetus to the cross.

Technical levels to watch

The European Central Bank (ECB) announced on Thursday that it raised its key rates by 25 basis points (bps) following the May policy meeting, as expected.

With this decision, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 3.75%, 4% and 3.25%, respectively.

Follow our live coverage of the market reaction to the ECB's policy announcements.

Key takeaways from policy statement

"Inflation outlook continues to be too high for too long."

"Overall, incoming information broadly supports assessment of medium-term inflation outlook that ECB formed at its previous meeting."

"ECB's future decisions will ensure that policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to 2% medium-term target and will be kept at those levels for as long as necessary."

"ECB's policy rate decisions will continue to be based on its assessment of inflation outlook in light of incoming economic and financial data, dynamics of underlying inflation, and strength of monetary policy transmission."

"Interest rates remain ECB’s primary tool for setting monetary policy stance."

"In line with these principles, ECB expects to discontinue reinvestments under APP as of July 2023."

"The APP portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all of the principal payments from maturing securities."

"The decline will amount to €15 billion per month on average until the end of June 2023."

Market reaction

EUR/USD came under modest bearish pressure and declined to the 1.1050 area with the initial reaction to the ECB's policy announcements.

EUR/USD’s rally is clearly slowing but economists at Credit Suisse still see scope for one final leg higher to the 1.1185/1.1275 zone.

Move below support at 1.0963 to mark a near-term top

“EUR/USD uptrend is clearly slowing with strength again essentially capped at the shallow uptrend channel from the beginning of January. We would still though not rule out one final leg higher to our 1.1185/1.1275 core target – the 61.8% retracement and March 2022 high. Our bias would then be to look for an important top here.”

“Below support at 1.0963 is now needed to mark a near-term top for a test of the April low and 55-DMA at 1.0806/1.0788, which ideally holds on a closing basis. Below though would warn of a potentially more important downturn and a test of support at 1.0540/1.0483.”