- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:50 | Japan | BOJ Governor Haruhiko Kuroda Speaks | |||

| 01:30 | Australia | ANZ Job Advertisements (MoM) | August | 0.8% | |

| 01:30 | Australia | Gross Domestic Product (QoQ) | Quarter II | 0.4% | 0.5% |

| 01:30 | Australia | Gross Domestic Product (YoY) | Quarter II | 1.8% | 1.4% |

| 01:45 | China | Markit/Caixin Services PMI | August | 51.6 | |

| 07:50 | France | Services PMI | August | 52.6 | 53.3 |

| 07:55 | Germany | Services PMI | August | 54.5 | 54.4 |

| 08:00 | Eurozone | Services PMI | August | 53.2 | 53.4 |

| 08:30 | United Kingdom | Purchasing Manager Index Services | August | 51.4 | 51 |

| 09:00 | Eurozone | Retail Sales (YoY) | July | 2.6% | 2% |

| 09:00 | Eurozone | Retail Sales (MoM) | July | 1.1% | -0.6% |

| 12:30 | Canada | Labor Productivity | Quarter II | 0.3% | 0.3% |

| 12:30 | Canada | Trade balance, billions | July | 0.14 | -0.4 |

| 12:30 | U.S. | International Trade, bln | July | -55.2 | -53.5 |

| 13:30 | U.S. | FOMC Member Williams Speaks | |||

| 14:00 | Eurozone | ECB's Yves Mersch Speaks | |||

| 14:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 14:00 | Canada | BOC Rate Statement | |||

| 16:30 | U.S. | FOMC Member Bowman Speaks | |||

| 16:30 | U.S. | FOMC Member James Bullard Speaks | |||

| 17:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 18:00 | U.S. | Fed's Beige Book | |||

| 19:15 | U.S. | FOMC Member Charles Evans Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:50 | Japan | BOJ Governor Haruhiko Kuroda Speaks | |||

| 01:30 | Australia | ANZ Job Advertisements (MoM) | August | 0.8% | |

| 01:30 | Australia | Gross Domestic Product (QoQ) | Quarter II | 0.4% | 0.5% |

| 01:30 | Australia | Gross Domestic Product (YoY) | Quarter II | 1.8% | 1.4% |

| 01:45 | China | Markit/Caixin Services PMI | August | 51.6 | |

| 07:50 | France | Services PMI | August | 52.6 | 53.3 |

| 07:55 | Germany | Services PMI | August | 54.5 | 54.4 |

| 08:00 | Eurozone | Services PMI | August | 53.2 | 53.4 |

| 08:30 | United Kingdom | Purchasing Manager Index Services | August | 51.4 | 51 |

| 09:00 | Eurozone | Retail Sales (YoY) | July | 2.6% | 2% |

| 09:00 | Eurozone | Retail Sales (MoM) | July | 1.1% | -0.6% |

| 12:30 | Canada | Labor Productivity | Quarter II | 0.3% | 0.3% |

| 12:30 | Canada | Trade balance, billions | July | 0.14 | -0.4 |

| 12:30 | U.S. | International Trade, bln | July | -55.2 | -53.5 |

| 13:30 | U.S. | FOMC Member Williams Speaks | |||

| 14:00 | Eurozone | ECB's Yves Mersch Speaks | |||

| 14:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 14:00 | Canada | BOC Rate Statement | |||

| 16:30 | U.S. | FOMC Member Bowman Speaks | |||

| 16:30 | U.S. | FOMC Member James Bullard Speaks | |||

| 17:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 18:00 | U.S. | Fed's Beige Book | |||

| 19:15 | U.S. | FOMC Member Charles Evans Speaks |

Analysts at Rabobank are expecting the Bank of Canada (BoC) to leave the policy rate unchanged at 1.75% on Wednesday, 4th September.

- “CAD OIS implies less than 10% chance of a cut.

- We maintain the view that the Bank of Canada is reticent to cut rates but will be forced to as a result of external headwinds and a weak domestic backdrop when looking below the headline numbers which paint a somewhat misleadingly robust picture.

- We now expect the BoC to begin its easing cycle with a 25bp cut in January before taking rates down to 0.50% by the end of 2020.”

The Commerce

Department said on Tuesday that construction spending edged up 0.1 percent

m-o-m in July after a revised 0.7 percent m-o-m drop in June (originally a 1.3

percent m-o-m decline).

Economists had

forecast construction spending increasing 0.3 percent m-o-m in July.

According to

the report, investment in public construction increased 0.4 percent m-o-m,

while spending on private construction fell 0.1 percent m-o-m.

On a y-o-y basis,

construction spending declined 2.7 percent in July.

U.S. manufacturing

activity contracts in August - ISM

A report from

the Institute for Supply Management (ISM) showed on Tuesday the U.S.

manufacturing sector’s activity contracted in August.

The ISM's index

of manufacturing activity came in at 49.1 percent last month, down 2.1

percentage points from the July reading of 51.2 percent, and missed economists'

forecast for a 51.1 percent reading.

A reading above

50 percent indicates expansion, while a reading below 50 percent indicates

contraction.

According to

the report, the Employment Index registered 47.4 percent, a fall of 4.3

percentage points from the July reading, while the New Orders Index stood at 47.2

percent, a drop of 3.6 percentage points from the July reading, and the Production

Index came in at 49.5 percent, down 1.3-percentage point from July. At the same

time, the Inventories Index was at 49.9 percent, up 0.4 percentage point from

July and the Prices Index reached 46 percent, a 0.9-percentage point increase

from July.

Timothy R.

Fiore, Chair of the ISM Manufacturing Business Survey Committee said, “The past

relationship between the PMI and the overall economy indicates that the PMI for

August (49.1 percent) corresponds to a 1.8-percent increase in real gross

domestic product (GDP) on an annualized basis."

- Many also support QE, but opposition from some northern states complicates discussion

- Any ECB rate cut is likely to be accompanied by tearing

- New ECB guidance will emphasize conditions needed for rate lift-off, deemphasized date component

- Discussion about ECB stimulus package open, ongoing, no decision made

U.S. stock-index futures fell on Tuesday, as trade concerns increased again after the U.S. and China began imposing new tariffs on one another’s goods.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,625.16 | +4.97 | +0.02% |

Hang Seng | 25,527.85 | -98.70 | -0.39% |

Shanghai | 2,930.15 | +6.05 | +0.21% |

S&P/ASX | 6,573.40 | -6.00 | -0.09% |

FTSE | 7,273.33 | -8.61 | -0.12% |

CAC | 5,474.25 | -18.79 | -0.34% |

DAX | 11,928.65 | -25.13 | -0.21% |

Crude oil | $53.81 | -2.34% | |

Gold | $1,540.80 | +0.75% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 160.75 | -0.97(-0.60%) | 2908 |

ALCOA INC. | AA | 17.61 | -0.32(-1.78%) | 1804 |

ALTRIA GROUP INC. | MO | 43.79 | 0.05(0.11%) | 8095 |

Amazon.com Inc., NASDAQ | AMZN | 1,774.40 | -1.89(-0.11%) | 42197 |

American Express Co | AXP | 119.97 | -0.40(-0.33%) | 1002 |

AMERICAN INTERNATIONAL GROUP | AIG | 52.29 | 0.25(0.48%) | 872 |

Apple Inc. | AAPL | 206.71 | -2.03(-0.97%) | 154818 |

AT&T Inc | T | 35.16 | -0.10(-0.28%) | 12302 |

Boeing Co | BA | 355.3 | -8.79(-2.41%) | 50208 |

Caterpillar Inc | CAT | 118 | -1.00(-0.84%) | 4182 |

Chevron Corp | CVX | 116.51 | -1.21(-1.03%) | 3770 |

Cisco Systems Inc | CSCO | 46.55 | -0.26(-0.56%) | 5490 |

Citigroup Inc., NYSE | C | 63.9 | -0.45(-0.70%) | 6922 |

E. I. du Pont de Nemours and Co | DD | 67.5 | -0.43(-0.63%) | 415 |

Exxon Mobil Corp | XOM | 67.85 | -0.63(-0.92%) | 24380 |

Facebook, Inc. | FB | 184.54 | -1.13(-0.61%) | 36523 |

FedEx Corporation, NYSE | FDX | 157.31 | -1.30(-0.82%) | 1743 |

Ford Motor Co. | F | 9.08 | -0.09(-0.98%) | 38295 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 8.91 | -0.28(-3.05%) | 63519 |

General Electric Co | GE | 8.16 | -0.09(-1.09%) | 149900 |

Goldman Sachs | GS | 202 | -1.91(-0.94%) | 2512 |

Hewlett-Packard Co. | HPQ | 18.2 | -0.09(-0.49%) | 501 |

Home Depot Inc | HD | 226.75 | -1.16(-0.51%) | 8338 |

Intel Corp | INTC | 47.05 | -0.36(-0.76%) | 13463 |

International Business Machines Co... | IBM | 134.5 | -1.03(-0.76%) | 2342 |

Johnson & Johnson | JNJ | 127.73 | -0.63(-0.49%) | 1470 |

JPMorgan Chase and Co | JPM | 109.01 | -0.85(-0.77%) | 4816 |

McDonald's Corp | MCD | 217.52 | -0.45(-0.21%) | 2067 |

Merck & Co Inc | MRK | 85.82 | -0.65(-0.75%) | 806 |

Microsoft Corp | MSFT | 137 | -0.86(-0.62%) | 55837 |

Nike | NKE | 83.91 | -0.59(-0.70%) | 4623 |

Pfizer Inc | PFE | 35.45 | -0.10(-0.28%) | 4027 |

Procter & Gamble Co | PG | 119.62 | -0.61(-0.51%) | 2017 |

Starbucks Corporation, NASDAQ | SBUX | 96.25 | -0.31(-0.32%) | 2697 |

Tesla Motors, Inc., NASDAQ | TSLA | 225.4 | -0.21(-0.09%) | 53694 |

The Coca-Cola Co | KO | 54.8 | -0.24(-0.44%) | 3168 |

Twitter, Inc., NYSE | TWTR | 42.33 | -0.32(-0.75%) | 35697 |

United Technologies Corp | UTX | 129.4 | -0.84(-0.65%) | 1024 |

UnitedHealth Group Inc | UNH | 233.26 | -0.74(-0.32%) | 1698 |

Visa | V | 179.75 | -1.07(-0.59%) | 3994 |

Wal-Mart Stores Inc | WMT | 113.64 | -0.62(-0.54%) | 6109 |

Walt Disney Co | DIS | 136.75 | -0.51(-0.37%) | 12893 |

Yandex N.V., NASDAQ | YNDX | 36.6 | -0.50(-1.35%) | 3824 |

Snap (SNAP) upgraded to Outperform from In-line at Evercore ISI

Amazon (AMZN) target was raised to $2600 from $2250 at RBC Capital Markets

- Hopes two sides seek common ground while setting aside differences

- Hopes the issues can be solved with mutual respect

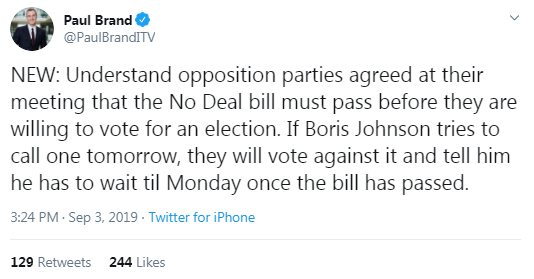

- We have the lawmakers to support it, we expect Labour MPs to back it

- Our priority remains to stop a no-deal Brexit

- Сould call no-confidence vote when time is right

Rabobank's analysts say that today’s main economic data release is the ISM manufacturing index for August, which is the longest running PMI for the U.S. and is seen as an important indicator of the U.S. business cycle.

- “After peaking at 60.8 in August last year the index has fallen to 51.2 in July. The Bloomberg consensus expectation is for the index to remain unchanged. However, the preliminary estimate for the ISM’s lesser-known alternative, the Markit US manufacturing PMI, already dropped below the neutral level of 50 in August, to 49.9. Today also sees the final estimate for this index in August.

- The Bloomberg consensus is 50.0. What is clear from both surveys is that the US manufacturing sector has come to a standstill, most likely because of the global economic slowdown and the uncertainty about international trade policy.”

FX Strategists at UOB Group notes the USD/JPY is seen keeping the broader consolidative theme in the next week.

- "24-hour view: Expectation for USD to “test 105.80 first before stabilizing” did not materialize as USD traded in a relatively quiet manner. The current movement is viewed as part of consolidation and USD is likely to trade sideways for today, expected to be within a 105.90/106.40 range.

- Next 1-3 weeks: USD surrendered some of Thursday’s gain as it closed lower by -0.19% (106.29) last Friday (30 Aug). The price action offers no fresh clues and we continue to expect USD to “trade sideways and within a broad range” for now. In other words, the outlook remains mixed and USD trade between 105.00 and 107.00 for a while more."

- The Speaker, John Bercow, will consider the motion later today

- If successful, the debate takes precedence over today's scheduled business under Standing Order 24

- Working assumption is that Brexit happens on 31 October

- No-deal Brexit is a distinct possibility, but remains a scenario we don't want

- Whenever there is progress in technical talks to be announced, we will announce it

- But still needs concrete proposals to replace backstop

Karen Jones, the analyst at Commerzbank, suggests that USD/JPY has recently sold off to and reversed from the 104.55/10 January low and the 2013-2019 uptrend and this support is reinforced by the 200-month ma at 104.44 and this should act as a near term floor for the market.

- “It has now also eroded the 20-day ma and we would allow for further gains to the 107.21 18th July low. A recovery above here is needed to alleviate immediate downside pressure. This guards the 108.99/109.32 recent highs.

- Failure at 104.10 would target 99.00 the 2016-low, but for now, we would allow for consolidation and look for the market to hold at circa 104.50/10.”

Analysts at ANZ note that after the release of key partial indicators of Australian economy this week, they are expecting a growth in GDP of 0.5% q/q in Q2, which would see annual growth edge down to 1.4% which would be the slowest pace since the GST.

- “This is a slightly better outcome than we thought last week. The main new pieces of information since our preliminary forecast last week are stronger government spending, net exports and profits, which more than offset the weakness in inventories.”

Analysts at TD Securities note that this month's RBA Statement reads as pretty much a copy of last month's statement.

- “For now, the RBA is keeping the faith that growth is expected to pick up, which is what they said last month and they repeated that domestic consumption outlook remains uncertain, which we will only get some more clarity on when GDP is published tomorrow.

- As such, the RBA kept room to ease monetary policy further 'if needed'. While the RBA is in no perceived rush to cut given commentary from RBA Gov ("gentle turning point) and Assistant Gov Kent stating that financial conditions should ease, the mkt will look to tomorrow's read on private consumption in GDP to validate and confirm the RBA's view.”

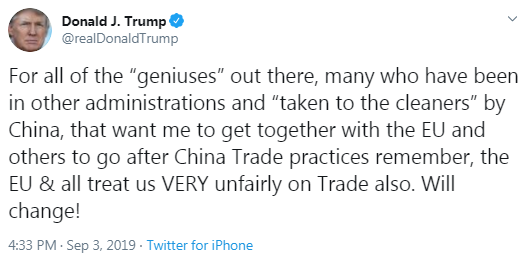

Danske Bank's analysts note that Bloomberg reports the U.S. and China are struggling to get a face-to-face meeting in place in September, as the new round of tariffs imposed on Sunday is hurting trust between the two sides.

- “Washington did not meet a Chinese request to delay the tariff hike on 1 September. The fact that the two sides struggle to agree even on the conditions for a new meeting is in our view indicative of how far the two sides are from each other despite US President Donald Trump's frequent messages that the talks are going fine.

- Trust may have been hampered further by Trump referring to a call from Beijing negotiators that apparently never took place. For now, the correspondence is in our view more a matter of damage control and avoiding further escalation than getting any closer to a deal.”

Eurostat, the

statistical office of the European Union (EU), reported on Tuesday that

industrial producer prices in the Eurozone rose by 0.2 percent m-o-m in July,

following an unrevised 0.6 decrease m-o-m in June.

In y-o-y terms,

industrial producer prices rose by 0.2 percent, following an unrevised 0.7

percent increase in June. The figure was the lowest since November 2016.

Economists had

forecast the Eurozone’s industrial producer prices in June would increase 0.2

percent both in m-o-m y-o-y terms.

According to

the report, the July increase was due to gains in the energy sector (+1.0

percent m-o-m and for capital goods (+0.1 percent m-o-m), which, however, were partially

offset by decline in prices for intermediate goods (-0.3 percent m-o-m). Meanwhile,

prices for durable consumer goods and non-durable consumer goods were stable. Prices

in total industry excluding energy fell by 0.1 percent m-o-m.

The annual

growth in industrial producer prices was underpinned by increases in prices for

capital goods (+1.5 percent y-o-y), for durable consumer goods (+1.4 percent y-o-y)

and for non-durable consumer goods (+1.0 percent y-o-y). These gains, however,

were partially offset by decreases in prices in the energy sector (-1.7 percent

y-o-y) and for intermediate goods (-0.2 percent y-o-y). Prices in total industry

excluding energy rose by 0.6 percent y-o-y.

ANZ analysts note that Australia's retail sales dropped by 0.1% in July and the negative result suggests that it is too early to see the effects of tax cuts, the earliest of which would have been received in mid-July.

- “Sales went backwards in a number of non-food categories, including recreation goods, clothing, dining out and furniture/homewares. This suggests that households are delaying non-essential purchases – partially due to squeezed budgets and partially in anticipation of receiving the tax cuts in late July/August.

- We expect to see stronger retail growth in August, as substantial tax cut refunds are received and spent. Our recent insight has more detail on how tax cuts spur on household spending.

- Annual growth fell to 2.4%. This is the lowest annual growth result since January 2018, and we have only seen lower growth five times in the last five years.”

The report from

IHS Markit and Chartered Institute of Procurement & Supply (CIPS) showed

that activity in the construction sector of the UK’s economy in August declined

for the fourth consecutive month and at a slightly steeper rate than in July.

According to

the report, the Markit/CIPS Purchasing Managers' Index (PMI) for the UK’s

construction sector fell to 45.0 in August from an unrevised 45.3 in July.

Economists had

forecast the indicator to increase to 45.9. The 50 mark divides contraction and

expansion.

According to

the report, the new work recorded the sharpest reduction since March 2009.

However, despite a sustained reduction in new orders, employment trends were

relatively resilient during August. The latest survey pointed to only a

marginal decline in staffing levels, with the rate of decline the slowest since

the downturn in payroll numbers began in April. Meanwhile, business optimism

slid for the second month running in August, with the degree of positive

sentiment the weakest since December 2008. On the price front, input cost inflation

moderated to its lowest since March 2016.

Tim Moore,

Economics Associate Director at IHS Markit, which compiles the survey, noted: “Domestic

political uncertainty continued to hold back the UK construction sector in

August, with survey respondents indicating that delays to spending decisions

had contributed to the sharpest fall new work for over 10 years.”

Bill Evans, an analyst at Westpac, notes that the RBA Board kept the cash rate on hold for another month and retained the theme that rates can be cut “if needed”.

- “We think that case has already been made and expect that to be recognized at the October meeting.

- General commentary in the decision statement is very similar to the August decision statement. The most important changes are to be somewhat guarded on housing markets, “further signs of a turnaround in established housing markets”, but to also point out that construction activity has weakened.

- There is also less apparent confidence in the growth and unemployment forecasts. The 2½ percent forecast for GDP growth in 2019, which was explicitly noted in August, was not mentioned, although the expected return to trend growth “over the next couple of years” is noted.

- With less confidence around the economic forecasts and recognition about the weakening activity in the residential construction sector, this decision statement is marginally more downbeat than the statement in August.

- With the emphasis consistently on the labour market in both statements, the monthly employment reports remain important. However, other factors are also key to the October decision.”

- U.S. should stop abusing concept of national security

Analysts at Danske Bank note that focus is again on Brexit with the UK House of Commons returning to the session and it looks like we are heading for a snap election sooner than expected.

- “Today there will be an emergency debate on a bill trying to force PM Johnson to ask and accept another Brexit extension until 31 January in case no deal is reached no later than at the EU summit 17-18 October. A government official has said PM Johnson will start the process for 14 October general election if he loses the vote (needs two-third majority). PM Johnson will make a public statement at 19:00 CEST.

- A key economic release today is the US ISM manufacturing survey for August. Weighted regional PMIs suggest that ISM manufacturing is set to come in stronger, but Markit PMI suggests a decline. We expect ISM manufacturing to fall slightly to 50.8 but given the mixed signals it is not a high conviction call.

- The ISM survey is one out of a few important gauges for Fed policymakers ahead of the crucial September meeting in two weeks. Tonight we will hear Fed's Rosengren's (voter, hawk, dissented first cut) views on the US economy and Fed policy.”

The Federal

Statistical Office (FSO) reported on Tuesday the Swiss Consumer Price Index

(CPI) was flat m-o-m in August at 102.1 points (December 2015 = 100).

Economists had

expected the CPI would edge down 0.1 percent m-o-m, following a 0.5 percent

m-o-m drop in July.

In y-o-y terms,

the CPI rose 0.3 percent in August, the same pace as in the previous month. That

matched economists’ forecast.

According to

the report, airfares (-10.7 percent m-o-m) as well as prices for international

package holidays (-1.6 percent m-o-m) and in-patient hospital services (-1.0

percent m-o-m) declined. In contrast, prices for clothing and footwear (+0.3

percent m-o-m), and housing rental (+0.3 percent m-o-m) increased.

The Swiss

Harmonised Index of Consumer Prices (HICP) stood at 101.94 points (base 2015 =

100). This corresponds to a rate of change of +0.1 percent m-o-m and of +0.5

percent y-o-y.

- There will not be another Brexit extension

- We are showing Europe the detail of our plans on the backstop

- The handbrake is the lingering sense in Brussels that parliament will cancel Brexit

The Australian

Bureau of Statistics (ABS) reported on Tuesday that Australia’s current account

turned to a surplus of AUD5.85 billion in the second quarter of 2019 compared

to a revised AUD1.12 billion gap in the prior quarter. That was Australia's

first current account surplus since the second quarter of 1975.

Economist

forecast a surplus of AUD1.4 billion.

According to

the ABS report, the goods and services surplus surged 34 percent q-o-q to AUD19.90

billion, while the primary income gap narrowed by 10 percent q-o-q to AUD13.93

billion and the secondary income deficit fell by 74 percent q-o-q to AUD 0.12

billion.

Australia's net

international investment position was $1.00 trillion at June 30, up from the

revised March 31 position of $992.3 billion. Its net foreign debt liability

position increased 2 percent q-o-q to AUD1.14 trillion, while its net foreign

equity asset position rose 8 q-o-q to AUD141.90 billion.

The Reserve

Bank of Australia (RBA) decided to leave the cash rate unchanged at 1.00

percent at its September monetary policy meeting. The move was widely expected

by the markets.

In its

statement accompanying the decision, the regulator noted it will ease monetary

policy further if needed to support sustainable growth in the economy and the

achievement of the inflation target over time. It also added that “it is

reasonable to expect that an extended period of low interest rates will be

required in Australia to make progress in reducing unemployment and achieve

more assured progress towards the inflation target”.

According to

the RBA, “the outlook for the global economy remains reasonable, although the

risks are tilted to the downside”. In regard to outlook on Australia, the growth

“is expected to strengthen gradually to be around trend over the next couple of

years”, supported by the low level of interest rates, recent tax cuts, ongoing

spending on infrastructure, signs of stabilization in some established housing

markets and a brighter outlook for the resources sector. However, “the main

domestic uncertainty continues to be the outlook for consumption”, the bank

added. The Australian central bank also noted that “the Australian dollar is at

its lowest level of recent times”, while “wages growth remains subdued and

there is little upward pressure at present, with strong labour demand being met

by more supply”.

The Australian

Bureau of Statistics (ABS) reported on Tuesday that Australia’s retail sales edged

down 0.1 percent m-o-m in July, following an unrevised 0.4 percent m-o-m advance

in June. That was the first monthly drop in retail sales since April.

Economists had

forecast retail sales would increase 0.2 percent m-o-m in July.

According to

the ABS, there were declines in four of the six industries, with cafes,

restaurants and takeaway services (-0.6 percent m-o-m) leading the falls. There

were also decreases in Clothing, footwear and personal accessory retailing

(-1.0 percent m-o-m), Other retailing (-0.4 percent m-o-m) and Department

stores (-0.2 percent m-o-m). Meanwhile, Food retailing (+0.3 percent m-o-m) and

Household goods retailing (+0.1 percent m-o-m) posted gains in July.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.35 | -0.82 |

| WTI | 54.56 | -0.6 |

| Silver | 18.44 | 0.49 |

| Gold | 1529.306 | 0.39 |

| Palladium | 1533.18 | 0.25 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -84.18 | 20620.19 | -0.41 |

| Hang Seng | -98.18 | 25626.55 | -0.38 |

| KOSPI | 1.4 | 1969.19 | 0.07 |

| ASX 200 | -24.8 | 6579.4 | -0.38 |

| FTSE 100 | 74.76 | 7281.94 | 1.04 |

| DAX | 14.5 | 11953.78 | 0.12 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67165 | -0.24 |

| EURJPY | 116.475 | -0.2 |

| EURUSD | 1.09683 | -0.17 |

| GBPJPY | 128.122 | -0.75 |

| GBPUSD | 1.20637 | -0.76 |

| NZDUSD | 0.6307 | 0 |

| USDCAD | 1.33195 | 0.07 |

| USDCHF | 0.99002 | 0.04 |

| USDJPY | 106.178 | 0 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.