- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- EUR/USD edges higher past convergence of 21-DMA, 50-DMA amid sluggish session.

- US ISM Manufacturing drops to the lowest level in three years and test hawkish Fed concerns.

- ECB’s Nagel defends hawkish bias despite downbeat Eurozone, German HCOB Manufacturing PMIs for June.

- US Independence Day holiday to restrict intraday moves, German trade numbers will decorate the calendar.

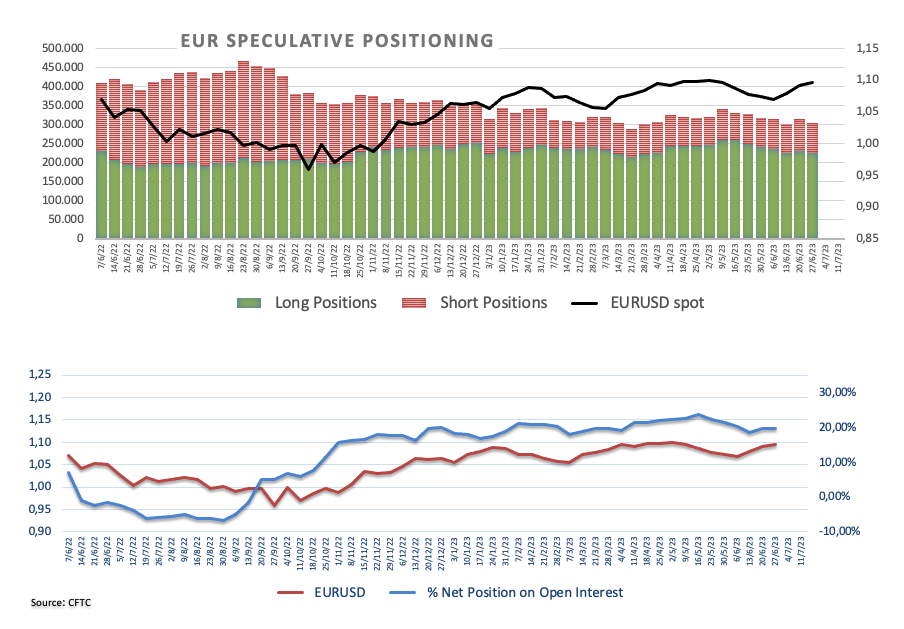

EUR/USD seesaws around 1.0915-20 amid a sluggish start to Tuesday’s trading day, following a mildly positive performance on Monday. It’s worth noting that the softer US Dollar and the key technical support near 1.0870-65, as well as hawkish comments from the European Central Bank (ECB) policymaker, favored the Euro pair buyers the previous day. However, the downbeat PMIs from Germany and Eurozone join the firmer US Treasury bond yields to prod the upside momentum.

On Monday, US ISM Manufacturing PMI for June dropped to the lowest level in three years, as well as stayed below the 50.0 level for the seventh consecutive month, as it marked 46.0 figure versus 47.2 expected and 46.9 prior. On a different page, S&P Global Manufacturing PMI for June confirmed 46.3 figure, the lowest in five months, whereas the Construction Spending improved 0.9% MoM for May, versus 0.5% expected and 0.4% previous readouts.

It should be noted that the US Gross Domestic Product (GDP) and Durable Goods Orders, released the last week, improved but failed to gain support from the Fed’s preferred inflation gauge, namely the US Personal Consumption Expenditure (PCE) Price Index. Additionally, personal spending also eased and hence challenges the hawkish Fed bias.

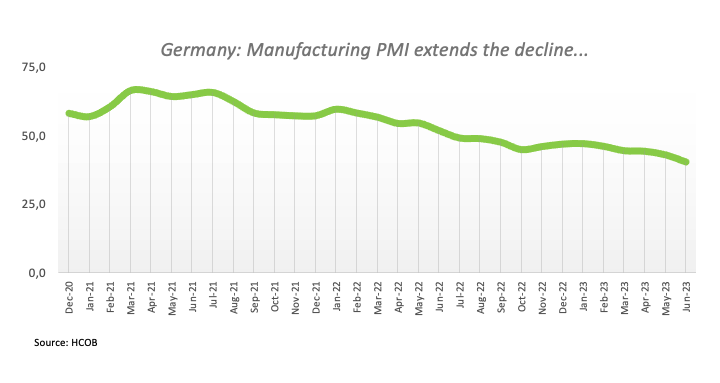

On the other hand, the final readings of June’s German HCOB Manufacturing PMI and the same manufacturing gauge for the Eurozone came in softer-than-expected respective figures of 41.0 and 43.6 to 40.6 and 43.4.

Even so, European Central Bank (ECB) policymaker Joachim Nagel said that monetary policy signals are clearly pointing in the direction of further tightening. The policymaker also added that they will have "a way to go" with regard to additional rate increases, per Reuters.

Against this backdrop, Wall Street closed with minor gains and the yields grind higher while the US Dollar Index (DXY) dropped for the second consecutive day, which in turn favored the EUR/USD bulls.

Looking ahead, the US Independence Day holiday will offer the EUR/USD pair a lackluster trading day ahead. However, Germany’s Exports, Imports and Trade Balance figures for May will entertain the traders. Above all, receding challenges for the ECB hawks contrast with the likely bumpier road for the Fed optimists to suggest further upside of the Euro pair.

Technical analysis

A convergence of the 21-DMA and the 50-DMA, around 1.0870-65 by the press time, put a floor under the EUR/USD price. However, a descending trend line from June 22, close to 1.0920 at the latest, restricts the immediate upside of the Euro pair.

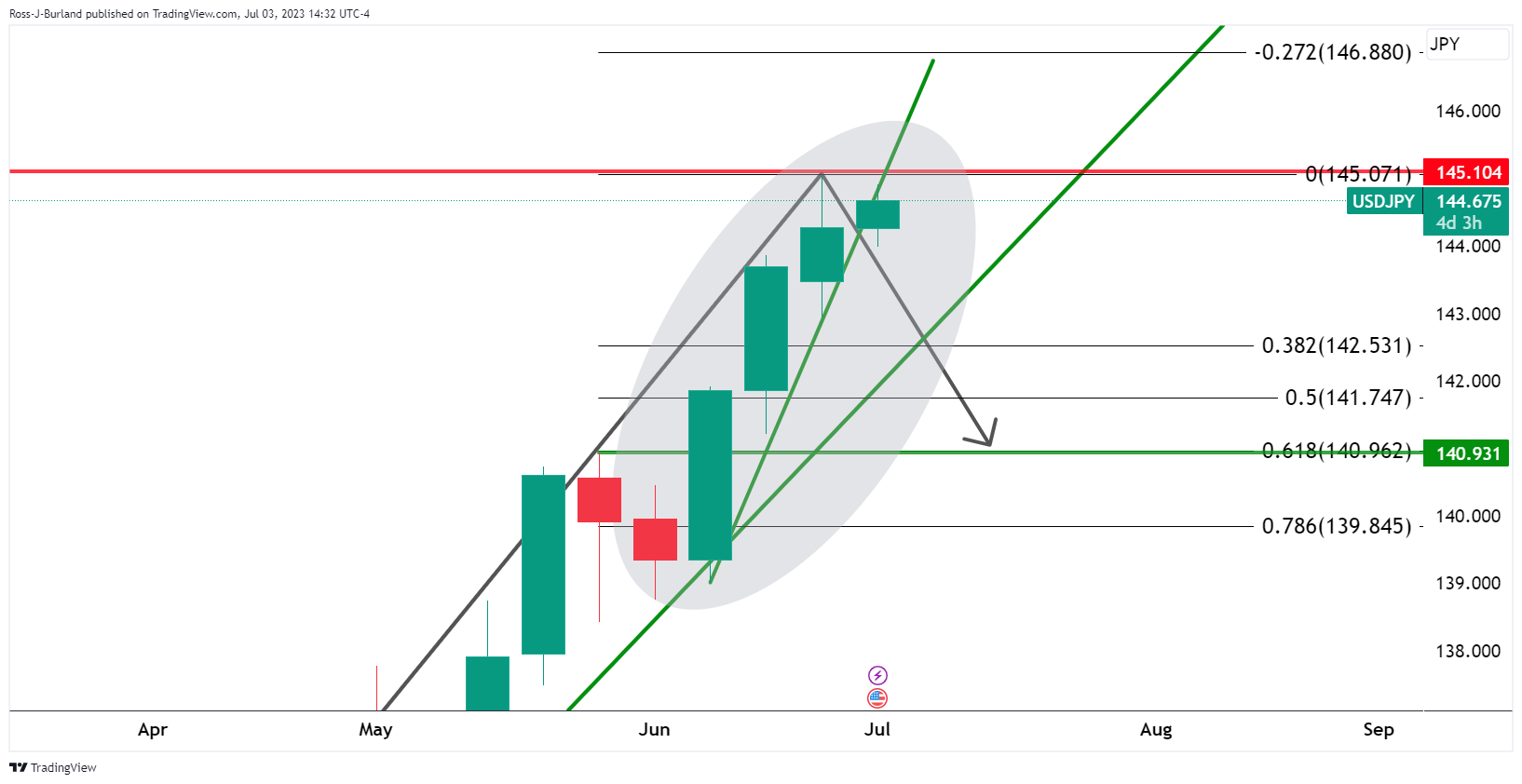

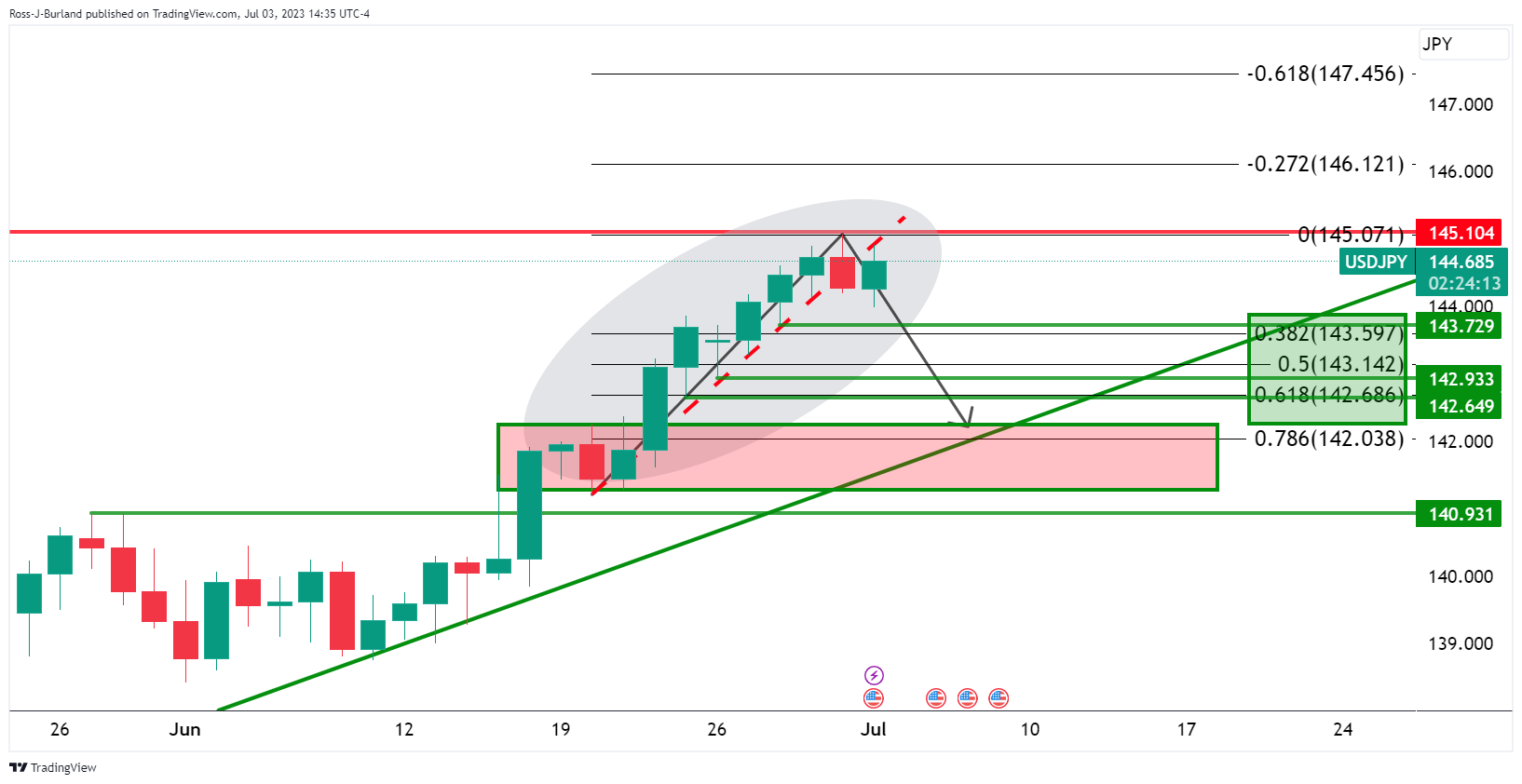

Japan's top currency diplomat Masato Kanda said early Tuesday that he is communicating with various countries including the US over currencies, per Reuters.

It’s worth noting that Japan Chief Cabinet Secretary Hirokazu Matsuno and Finance Minister (FinMin) Shunichi Suzuki have also recently flagged concerns about the Asian major’s market intervention as the USD/JPY stays near the multi-month high of around 145.00.

Apart from the Japan intervention, US Treasury bond yields renew fears of recession and also weigh on the risk-barometer pair, not to forget the recently softer US data. However, the Bank of Japan’s (BoJ) defense of easy-money policy joins the recently softer Japan statistics to propel the USD/JPY pair.

Even so, the Yen pair began the week on a firmer footing with a daily gain of 0.26% while ending Monday’s North American trading session at around 144.65.

Also read: USD/JPY Price Analysis: Bears are chipping away at daily dynamic support

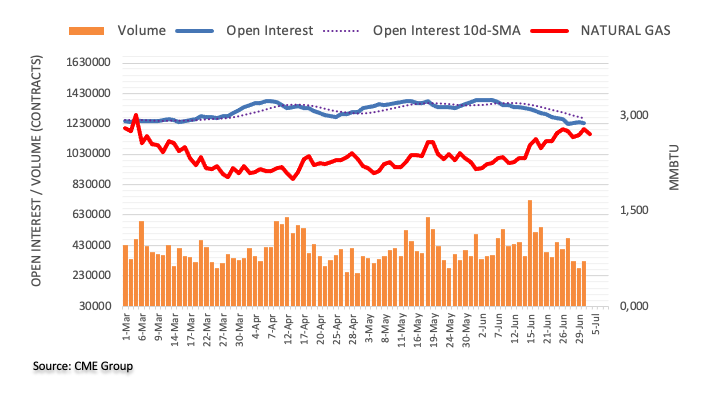

- Natural Gas remains sidelined after snapping two-day winning streak within fortnight-old symmetrical triangle.

- Steady oscillators suggest further grinding of XNG/USD price within $2.77 and $2.64 key technical levels.

- 100-SMA adds strength to $2.64 support, bulls need validation from June’s high to keep the reins.

- Softer US Dollar, hopes of more stimulus from China, India favor XNG/USD bulls.

Natural Gas Price (XNG/USD) licks its wounds near $2.70 amid Tuesday’s sluggish Asian session, after printing the first daily loss in three the previous day.

In doing so, the energy instrument remains within a two-week-old symmetrical triangle, recently approaching the bottom line.

It’s worth noting, however, that the steady RSI (14) line and mildly bullish MACD signals, despite being sluggish of late, keep the Natural Gas buyers hopeful.

Adding strength to the XNG/USD price are the headlines suggesting a likely improvement in the US-China ties and more investments in India. Considering Asia’s major energy consumption, upbeat news about China and India underpins optimism about the XNG/USD price.

That said, the 100-SMA adds strength to the $2.64 support comprising the stated triangle’s bottom line.

Following that, a quick fall toward the late June swing low of near $2.52 can’t be ruled out. However, a horizontal area comprising multiple levels marked since May 31, close to $2.43-44, can challenge the Natural Gas sellers afterward.

Meanwhile, the XNG/USD upside hinges on a clear break of the stated triangle’s top line, currently around $2.77. Even so, the previous monthly high of near $2.93 and the $3.00 psychological magnet will test the Natural Gas buyers.

Natural Gas Price: Four-hour chart

Trend: Further upside expected

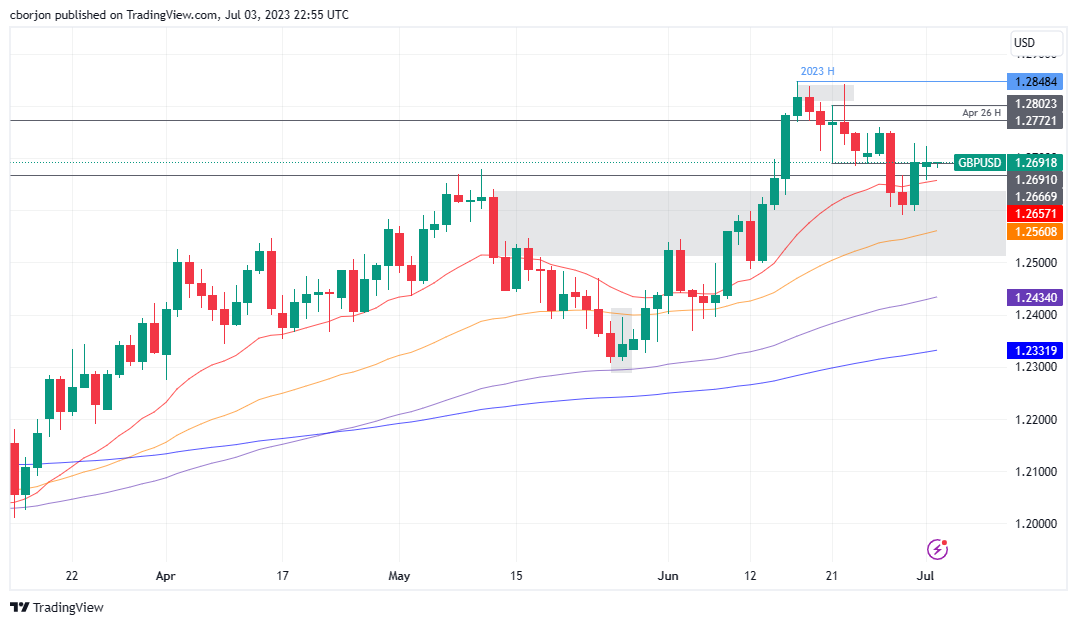

- GBP/USD remains in the 1.2690s range, showing a neutral to an upward bias in technical analysis.

- Daily EMAs indicate a potential bullish continuation, with resistance levels at 1.2728, 1.2750, and 1.2800.

- Downside pressure if GBP/USD fails to reclaim 1.2700, with support levels at 1.2590, 1.2561, and 1.2500.

GBP/USD stays at around the 1.2690s area as the Tuesday Asian session gains; after trading within a 70-pip range on Monday, the pair seesawing around the 1.2658/1.2722 daily high-low. At the time of writing, the GBP/USD exchanges hands at 1.2692.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD remains neutral to upward biased, though Monday’s price action formed a spinning top, meaning indecision surrounding the pair. However, a bullish continuation is expected as the daily Exponential Moving Averages (EMAs) lie below the current exchange rates.

Therefore, the GBP/USD first resistance would be June 30 daily high at 1.2728, followed by the 1.2750 psychological level. Once cleared, the next resistance would be 1.2800, ahead of challenging the year-to-date (YTD) high of 1.2848.

Nonetheless, further downside is expected if GBP/USD fails to reclaim 1.2700 and drops past the 20-day EMA at 1.2657. The GBP/USD next support would be the June 29 daily low of 1.2590, followed by the 50-day EMA at 1.2561 and the 1.2500 figure.

GBP/USD Price Action – Daily chart

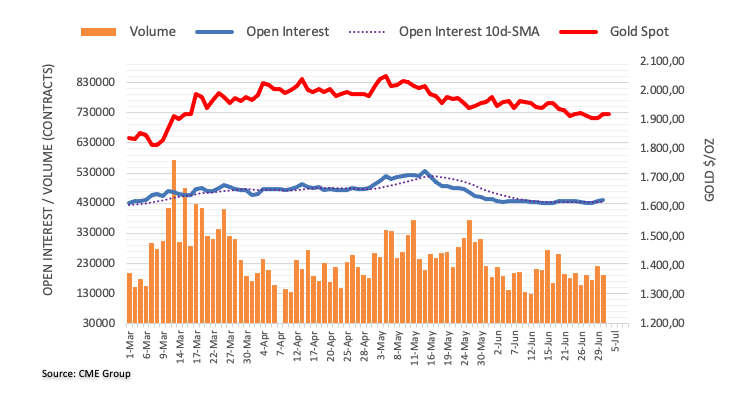

- Gold Price remains sidelined after refreshing one-week high, approaching short-term key resistance after three-day uptrend.

- XAU/USD bulls benefit from softer US Dollar as downbeat United States data fails to back hawkish Federal Reserve bias.

- Mixed concerns about China, pullback in US Treasury bond yields also underpin the Gold Price upside.

- US Holiday may restrict XAU/USD moves but bullish move towards $1,945 resistance confluence appears intact.

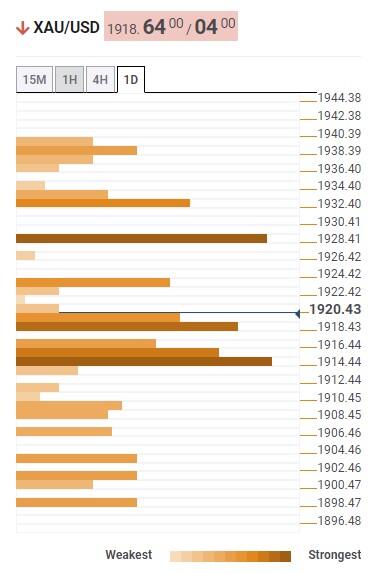

Gold Price (XAU/USD) remains sidelined around $1,921, after rising to the highest level in a week, as markets seek more clues during early Tuesday in Asia after witnessing a softer start to the week. It’s worth noting that the United States Independence Day holiday restricts the market performance but the recently downbeat US data weigh on the greenback and keeps the Gold Price on the bull’s radar. Adding strength to the XAU/USD price could be the hopes of witnessing improvement in the US-China ties and optimism in India, one of the world’s top Gold customers.

Gold Price marches as softer United States data weigh on US Dollar

Gold Price cheer downbeat United States statistics while paying no attention to the hawkish Federal Reserve (Fed) bets as the US Dollar retreats from a three-week high.

On Monday, US ISM Manufacturing PMI for June dropped to the lowest level in three years, as well as stayed below the 50.0 level for the seventh consecutive month, as it marked 46.0 figure versus 47.2 expected and 46.9 prior. Further details reveal that the ISM Manufacturing Employment Index slide to a three-month low of 48.1 in June from 51.4 previous readings but the New Orders Index improved to 45.6 from 42.6 marked in May and 44.0 maket forecasts. Additionally, the ISM Manufacturing Prices Pair nosedived to the lowest since April 2020, to 41.8, during the said month from 44.2 previous readings.

On a different page, S&P Global Manufacturing PMI for June confirmed 46.3 figure, the lowest in five months, whereas the Construction Spending improved 0.9% MoM for May, versus 0.5% expected and 0.4% previous readouts.

It should be noted that the US Gross Domestic Product (GDP) and Durable Goods Orders, released the last week, improved but failed to gain support from the Fed’s preferred inflation gauge, namely the US Personal Consumption Expenditure (PCE) Price Index. Additionally, personal spending also eased and hence challenges the hawkish Fed bias while fueling the Gold Price.

That said, the interest rate futures suggest 85% probability of witnessing a 25 basis points (bps) of Fed rate hike in July. On the same line, Reuters said, “Futures markets had reflected rate cuts at the Fed's September meeting as recently as May, and are now projecting that the first cuts will come in January.” The market's hawkish Fed bets could be linked to the last week’s hawkish comments from the Federal Reserve Officials at the European Central Bank (ECB) Forum in Sintra, which in turn caps the Gold Price despite the XAU/USD bull’s optimism.

China, India headlines lure XAU/USD bulls

While softer US data and downbeat US Dollar propel the Gold Price, upbeat catalysts surrounding the world’s top two XAU/USD customers, namely India and China, add strength to the metal’s run-up. Recently, a jump in the Foreign Portfolio Investors (FPIs) rush toward India raised concerns about major Gold demand from the Asian nation. As per the latest update, the FPIs have parked the biggest sum in 10 months in India, not to forget marking the fourth consecutive advance.

On the other hand, the US Treasury Secretary Janet Yellen’s China visit during July 06-09 period witnessed mixed responses from the Gold traders. While the news appears positive for the sentiment on the front, the details seem less impressive as US Treasury Secretary Yellen is likely to flag concerns about human rights abuses against the Uyghur Muslim minority, China's recent move to ban sales of Micron Technology memory chips, and moves by China against foreign due diligence and consulting firms, per Reuters.

It should be noted that the better-than-forecast China’s Caixin Manufacturing PMI, to 50.5 for June versus 50.9 prior and 50.2 market expectations, favor the odds of witnessing more stimulus from Beijing, which in turn can help the Gold Price to remain firmer.

US holiday to restrict Gold Price moves but bulls can keep the reins

While most of the aforementioned catalysts are in favor of the Gold buyers, the United States Independence Day holiday will restrict the XAU/USD moves. The same highlights headlines surrounding China and India to watch carefully for clear directions while allowing the Gold buyers to keep the reins. It should be noted that this week’s Federal Reserve (Fed) Monetary Policy Meeting Minutes and Nonfarm Payrolls (NFP) are the key data that will determine the near-term Gold Price directions.

Gold Price Technical Analysis

Gold Price run-up justifies the previous week’s upside break of a fortnight-old resistance line, now support around $1,911. Adding strength to the bullish bias about the XAU/USD is Thursday’s Dragonfly Doji candlestick.

Furthermore, the impending bull cross on the Moving Average Convergence and Divergence (MACD) indicator joins an upward-sloping Relative Strength Index (RSI) line, placed at 14, to also favor the Gold buyers.

With this, the Gold Price appears well-set to confront a convergence of the 100-DMA and a downward-sloping resistance line from early June, around $1,945.

However, the XAU/USD’s upside past $1,945 appears bumpy as multiple resistances near $1,985 and the $2,000 psychological magnet will challenge the bullion buyers before giving them control.

On the flip side, the Gold sellers could return to the table on witnessing a downside break of the previous resistance line, close to $1,911. Though, an eight-month-old horizontal support region, close to $1,985-92, appears a tough nut to crack for the XAU/USD bears afterward.

Gold Price: Daily chart

-04072023-638240210748986650.png)

Trend: Further upside expected

- EUR/GBP rebounds after two consecutive losses but struggles to close above 0.86, indicating potential selling pressure.

- Technical analysis shows the pair as neutral to downward biased, with EMAs acting as resistance levels.

- Bearish scenario if EUR/GBP breaks below 0.8576 and targets June’s low of 0.8536, with further support at the YTD low of 0.8518.

The EUR/GBP snaps two days of consecutive losses, gained some 0.13% on Monday but failed to print a daily close above the 0.86 figure. Therefore, the EUR/GBP could be exposed to selling pressure. At the time of writing, the EUR/GBP is trading at 0.8598 post modest gains of 0.02%.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP daily chart portrays the pair as neutral to downward biased. On the upside is capped by the 50, 100, and 200-day Exponential Moving Averages (EMAs), each at 0.8643, 0.8689, and 0.8693, respectively. Conversely, the 20-day EMA 0.8596 acts like a magnet, with the EUR/GBP cross wavering around it as the pair struggles to get direction.

Of note, the EUR/GBP printed successive series of higher-highs, higher-lows, but until the pair cracks the 50-day EMA and above June’s 28 swing high of 0.8658, the EUR/GBP could be subject to selling pressure and extending its losses.

A EUR/GBP bearish scenario could happen if the pair breaks below the June 30 daily low of 0.8576 and extends its losses past the June 23 low of 0.8536. Once cleared, the next support into lay would be the year-to-date (YTD) low of 0.8518.

Conversely, the EUR/GBP would turn bullish above 0.8658, with the confluence of the 100/200-day EMAs around 0.8689-93, ahead of the 0.8700 figure. A decisive break will expose 0.8800.

EUR/GBP Price Action – Daily chart

- NZD/USD grinds near weekly high, lacks upside momentum despite firmer Q2 Business Confidence.

- NZIER Business Confidence improves to -63.0% in Q2 but Capacity Utilization deteriorates.

- Softer US Dollar defends Kiwi buyers but pre-RBA anxiety seems to prod traders.

- RBA can offer notable volatility but US holiday will restrict the moves afterward.

NZD/USD remains sidelined near 0.6150 despite upbeat business confidence from New Zealand, after refreshing a one-week high around 0.6170, as market players await the key Reserve Bank of Australia (RBA) decision amid early Tuesday. Apart from the pre-RBA anxiety, the US Independence Day holiday also restricts the Kiwi pair’s reaction to the data.

That said, the New Zealand Institute of Economic Research's (NZIER) quarterly survey of business opinion (QSBO), mostly known as NZIER Business Confidence, improved in the second quarter to -63.0% versus -66.0% prior. The reason could be linked to the deterioration in the Capacity Utilization data, down to 81.7% versus 94.0% prior. NZIER said, per Reuters, "While demand continues to soften, the marked decline in capacity utilization amongst builders and manufacturers and the proportion of firms reporting difficulty in finding labour, especially unskilled labour, point to a considerable easing in capacity pressures in the New Zealand economy." The news also quotes NZIER report saying that the downbeat mood was broad-based across sectors, but retailers are particularly bearish about the general economic outlook.

It’s worth noting that upbeat New Zealand Building Permits and risk-on mood joined hawkish hopes from the RBA to propel the NZD/USD price on Monday. That said, the NZ Building Permits improved to -2.2% MoM for May from -2.6% prior.

Apart from that, the downbeat US data and hopes of an improvement in the US-China ties also underpinned the NZD/USD run-up the previous day.

On Monday, US ISM Manufacturing PMI for June dropped to the lowest level in three years, as well as stayed below the 50.0 level for the seventh consecutive month, as it marked a 46.0 figure versus 47.2 expected and 46.9 prior. Further, S&P Global Manufacturing PMI for June confirmed 46.3 figures, the lowest in five months, whereas the Construction Spending improved 0.9% MoM for May, versus 0.5% expected and 0.4% previous readouts.

Amid these plays, Wall Street closed on the positive side and the yields grind higher while the US Dollar Index (DXY) dropped for the second consecutive day.

Moving on, NZD/USD traders should pay attention to the RBA details and risk catalysts for clear directions amid the US holiday. Markets expect the RBA to keep the rates unchanged after two consecutive hawkish surprises and due to the softer inflation data. However, there is a thin line among the hawks expecting RBA’s 0.25% rate hike and no rate change, making the event more interesting.

Technical analysis

Although the 21-DMA breakout lures the NZD/USD buyers, the 200-DMA level of around 0.6170 limits the Kiwi pair’s immediate upside. Following that, a two-month-old descending resistance line, close to 0.6190 will be in the spotlight.

- AUD/JPY maintains an upward bias, breaking resistance levels and distancing from the Ichimoku cloud.

- Failure to surpass June 23 daily high may limit the immediate upside, while the next resistance lies at 97.00 and YTD high at 97.67.

- Potential downside targets include 95.74, 94.98, and 93.96 support levels if the Tenkan-Sen line is breached.

AUD/JPY began the year's second half on a bullish tone, extending its gains to three straight days, breaking the technical resistance levels and distancing from the Ichimoku cloud, a sign that the uptrend remains intact. As the Asian session begins, the AUD/JPY trades at 96.49, gaining 0.01%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart portrays the pair as upward biased, surpassing the Tenkan-Sen line at 95.99, exacerbating a rally to the psychological 96.50 area. However, AUD buyers failed to challenge the June 23 daily high at 96.84, which, if cleared, would send the rally to test the next resistance level at 97.00 before challenging the year-to-date (YTD) high of 97.67.

Conversely, if AUD/JPY drops below the Tenkan-Sen, that could open the door for further losses, with first support seen at the October 21 daily high of 95.74. Once that level is broken, the Senkou Span A line will emerge at 94.98, just below the 95.00 figure, followed by the Kijun Sen line at 93.96.

AUD/JPY Price Action – Daily chart

- USD/CAD bears eye a correction in the daily 61.8% Fibo.

- USD/CAD bulls eye a move higher to test the weekly bearish run.

The Canadian Dollar weakened against the greenback on Monday despite poor US data as the yield on the Canadian benchmark government debt fell. USD/CAD was trading at 1.3244 and between the day's range of 1.3244 and 1.3248 in early Asia following a 42 pip opening balance on Monday. Meanwhile, from a technical perspective, the bulls are taking control and eye a significant correction as the following will illustrate:

USD/CAD weekly charts

The price is heading into a 38.2% Fibonacci on the weekly bearish impulse, but there is some way to go yet.

USD/CAD daily charts

Zooming down on the daily chart, we can see the price correcting into the prior bullish impulse and the bulls will look to the prior highs that meet with the 61.8% Fibonacci retracement level.

- AUD/USD traded in a 55-pip range on Monday and held to daily gains.

- The USD weakened after the release of US ISM Manufacturing PMI from June.

- RBA’s decision to be the highlight of the early Asian session.

The AUD/USD maintained its upward momentum and traded within a range of 0.6691 to 0.6636. The US dollar faced weakness following the release of the June Institute Supply Management (ISM) Manufacturing PMI data while market participants await the Reserve Bank of Australia (RBA) decisions. The central bank is expected to raise rates to 4.35%.

The AUD traded with gains against most of its rivals ahead of the RBA decision

Ahead of the RBA decision in the early Asian session on Tuesday, the Aussie strengthened against most of its rivals. In that sense, it gained ground against the USD, EUR, GBP, JPY and CHF while investors await an announcement of a 25 basis points (bps) hike. However, according to a Reuters poll, economists expect this decision to be a close call as falling inflation supports a dovish decision. Still, the surprise hike in early June opens the door for another hike.

On the other hand, the USD lost traction after the June ISM Manufacturing PMI fell below expectations and the previous reading. With a reading of 46, it came in lower than the anticipated 47.2 and the previous figure of 46.9. Eyes are now on labour data to be released Thursday and Friday, including June’s Non-Farm Payrolls and ADP Employment change figures.

AUD/USD Levels to watch

According to the daily chart, the technical outlook for the AUD/USD is neutral as indicators turned flat and seem to await a catalyst to determine short-term trajectory. That said, traders should eye 0.6700, where the 200- and 100-day Simple Moving Average (SMA) are about to perform a bullish cross.

Resistance levels: 0.6693 (200-day SMA), 0.6720, 0.6730 (20-day SMA).

Support levels: 0.6640, 0.6600, 0.6595.

AUD/USD Daily chart

After a quiet start, the second day of the second half of the year will offer the decision of the Reserve Bank of Australia, which will be the key event. The US market will remain closed due to Independence Day.

Here is what you need to know on Tuesday, July 4:

On a quiet Monday, US stocks finished modestly higher on a shortened session. On Tuesday, Wall Street will remain closed due to Independence Day. The low volume could lead to consolidation and/or erratic moves.

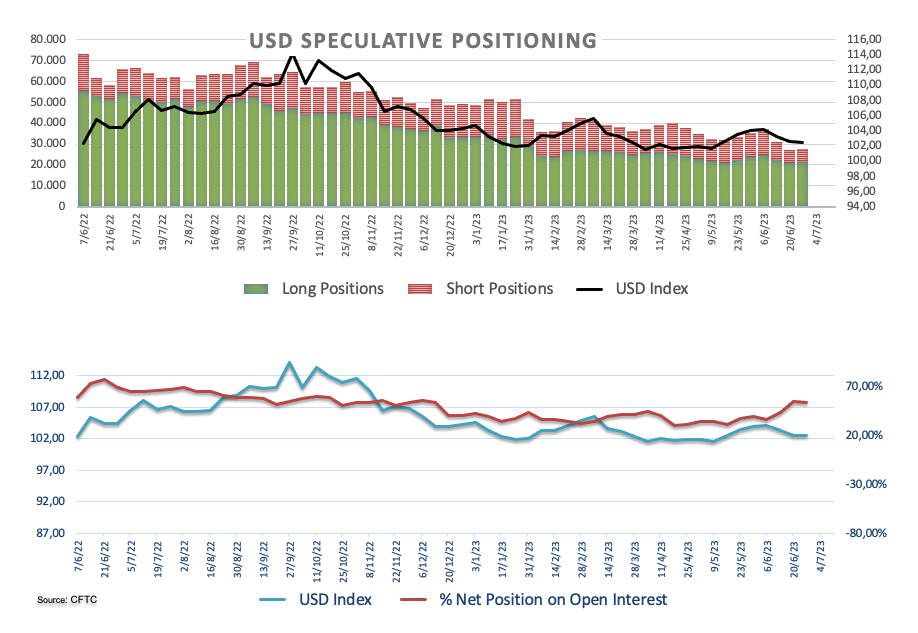

The US dollar lost momentum on Monday following the release of the ISM Manufacturing PMI, which came in below expectations. The ISM Manufacturing PMI dropped from 46.9 to 46, against expectations of a modest increase to 47.2.; the Prices Paid Index fell from 44.2 to 41.8, and the Employment declined from 51.4 to 48.1. The DXY bottomed and then rebounded to end the day flat at around 103.00.

The J.P. Morgan Global Manufacturing PMI dropped to the lowest level in six months:

Conditions in the global manufacturing sector worsened at the end of the second quarter. June saw output fall back into contraction territory following a further decrease in new order intakes. This led to a more cautious approach from manufacturers, with purchasing cut back sharply, inventory destocking, employment broadly flat and business optimism dipping to a seven-month low.

After the holiday, on Wednesday the Fed will release the FOMC June meeting minutes. Later, attention will turn to US employment data with ADP, Jobless Claims, and JOLTS on Thursday, and the Nonfarm Payrolls on Friday.

EUR/USD finished flat, hovering around 1.0900. The pair peaked at 1.0935 after US data and then pulled back. It is currently trading sideways, without a clear direction. Germany will release trade data on Tuesday.

GBP/USD failed to make a clear run above 1.2700 and finished flat around 1.2690. EUR/GBP rose modestly but closed below 0.8600.

USD/CHF continued to move sideways below 0.9000. The Swiss franc lagged on Monday on the back of softer-than-expected Switzerland inflation data. The Consumer Prices Index dropped to 1.7% YoY.

USD/JPY ended higher around 144.70 on a volatile Monday after testing levels under 144.00 following US data. A rebound in government bond yields weighed on the Japanese yen.

AUD/USD rose for the third consecutive day as it extended its recovery from weekly lows, but it still settled below 0.6700. On Tuesday, the Reserve Bank of Australia (RBA) will announce its decision on monetary policy. The uncertainty is whether the RBA will hike its key rate by 25 basis points or stay on hold. A no-hike decision could weigh down on the Aussie.

NZD/USD rose, boosted by risk appetite and a weaker US dollar, rising above 0.6150. The NZIER Q2 Business Confidence is due.

USD/CAD continues to move sideways around 1.3250. On Tuesday, the Bank of Canada will release its Business Outlook Survey.

Crude oil prices reached weekly highs and then reversed. The WTI dropped 0.40%, around $70.00. Cryptocurrencies performed mixed, with Bitcoin gaining 2% and rising above $31,200, while Ethereum rose 2.30% approaching $2,000.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD bulls come up for air but stay below key resistance.

- Bears eye a lower high for prospects of a break below 1.0840s.

EUR/USD has ranged between 1.0870 and 1.0331 on Monday as the markets soaked up the dreary final euro zone PMI manufacturing index and the US Manufacturing PMI dropped to 46.0 from 46.9 in May, the lowest reading since May 2020. The US ISM survey was consistent with an economy in recession, suggesting US inflation is coming under control, negative for the Greenback.

The following illustrates EUR/USD attempting to come up for air on the 4-hour chart:

EUR/USD H4 chart

The potential of a lower high, however, doe snot bode well for the bulls and the weak lows could be targeted again in the coming days. A break of the 1.0840s opens risk to a run to test the 1.0635s on the downside at the swing lows.

A break of the 1.0970s, however, opens the risk of a run to test 1.1000 in the days ahead.

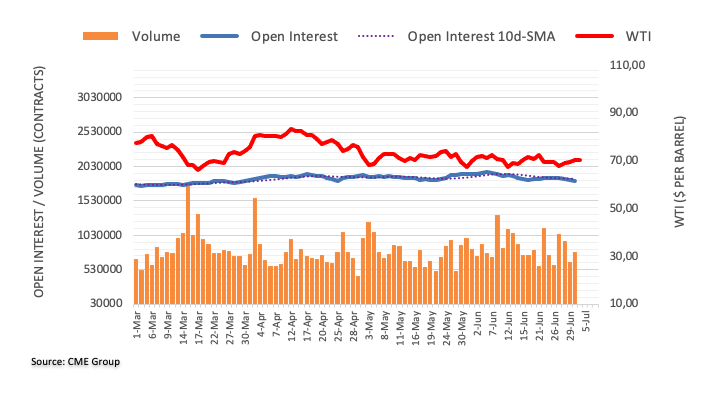

- WTI crude oil is down 0.55% at $70 per barrel amid fears of a global economic slowdown impacting oil demand.

- Saudi Arabia and Russia’s supply cut announcement fails to offset concerns over manufacturing activity slowdown worldwide.

- Deceleration in China, Eurozone, and the US manufacturing PMI data contribute to the downward pressure on WTI prices.

Western Texas Intermediate (WTI), the US crude oil benchmark, slides towards the end of the New York session, down 0.55% at $70 per barrel, as worries for a global economic slowdown might dent oil’s demand, despite Saudi Arabia and Russia’s supply cut announcement. At the time of writing, WTI exchanged hands at $70.01 after hitting a daily high of $71.72.

Worldwide economic slowdown fears overshadow Saudi Arabia, and Russia cut announcements as WTI dives

WTI remained under pressure despite Saudi Arabia’s intentions to cut oil output by one million barrels in July, extending it to August. Although it triggered an upward reaction, WTI edged lower as manufacturing activity worldwide slowed down, as revealed by S&P Global PMIs.

China’s Caixin PMI expanded modestly by 50.5, exceeding estimates of 50.2, but continues to decelerate as June’s data trailed May’s 50.9. That, alongside Eurozone’s (EU) deceleration, Germany’s technical recession, and recently revealed ISM Manufacturing PMI data in the US staying at recessionary readings, capped WTI rally.

The ISM Manufacturing PMI for June came at a recessionary area at 46.0, below estimates and the prior’s month reading, suggesting the US economy is decelerating. That could refrain the US Federal Reserve from increasing rates twice towards the end of 2023 as investors brace for July’s 25 basis points rate hike.

Aside from this, Russia’s intent to boost oil prices reported that it would reduce its exports by 500,000 bpd in August, revealed Deputy Prime Minister Alexander Novak.

Meanwhile, the total crude oil output brings the Organization of Petroleum Exporting Countries (OPEC) and its allies production to 5.16 million barrels per day (bpd). It should be said that Riyadh and Moscow have been trying to bolster prices, though China’s reopening after Covid-19 is failing to gather pace.

WTI Price Analysis: Technical outlook

WTI remains neutral to downward biased after failing to crack the 50-day Exponential Moving Average (EMA) at $71.63, though capped on the downside by the 20-day EMA at $70.22. However, late in the US session, WTI slipped below the latter, opening the door for a re-test of the $70.00 figure. A breach of the latter will expose immediate support at $67.10, followed by the March 20 daily low of $64.41. Once cleared, WTI would dive to the year-to-date (YTD) low of $63.61.

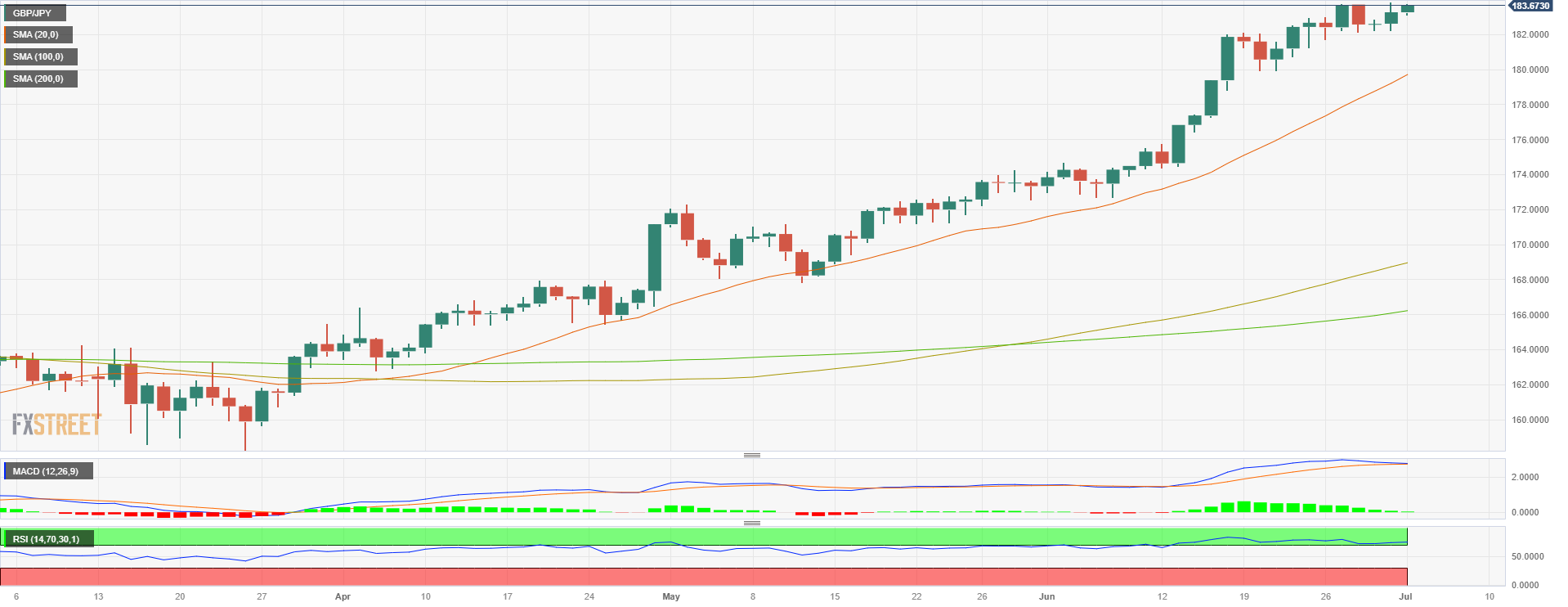

- The GBP/JPY cross jumps above the 183.60 area on Monday, its highest level since 2015.

- British Manufacturing PMI saw a contraction but one that was lower than expected, giving the Pound traction.

- Japanese Takan Index came in better than expected, still the BoJ may remain dovish.

At the start of the week, the GBP/JPY gained ground after the release of the Manufacturing PMI from the UK, which contracted but not as much as expected. In response, rising British yields gave traction to Sterling while the Yen remined vulnerable amid the Bank of Japan’s (BoJ) dovish stance. Despite Takan indexes improving in Q2, BoJ officials may need more evidence to pivot.

The UK reported a better-than-expected Manufacturing PMI

The S&P Global/CIPS Manufacturing PMI for the UK in June recorded a reading of 46.5, which was higher than the previous figure of 46.2. As a reaction, British yields saw more than 1% increases, with the 2,5, and 10-year rates jumping to 5.35%, 4.73% and 4.44%, respectively.

In Japan, the Tankan Large Manufacturing Index for Q2 exceeded expectations, reaching 5 compared to the consensus of 3 and the previous reading of 1. The Tankan Large Manufacturing Outlook for Q2 also showed a notable improvement, reaching 9 versus the consensus of 5 and the previous reading of 3. While these positive figures suggest a strengthening economy, the Bank of Japan (BoJ) may require further evidence of robust economic activity before considering a shift in its dovish monetary policy stance. Meanwhile, its likely that the Yen will continue to weaken agains most of its rivals.

GBP/JPY Levels to watch

The daily chart suggests that the outlook is bullish for GBP/JPY even though the cross has shown overbought conditions since mid-June. In addition, the Moving Average Convergence Divergence (MACD) shows signs of exhaustion of the bullish momentum. Yet for a confirmed sell signal, the Relative Strength index would have to break back down below 70, and in the absence of such a break the outlook remains bullish.

On the upside, resistances levels to monitor line up at 183.70, 184.00 and 185.00.

In a downward correction, the next support levels are seen at 183.15, followed by 183.00 and 182.00.

- USD/JPY bears are staring to lick their lips.

- The price is breaking daily dynamic support.

USD/JPY is up some 0.3% on the day trading at around 144.70 having travelled up from a low of 143.98 to a high of 144.91 so far. at this juncture, the Yen that's under intervention watch after the Japanese finance minister warned last week of excessive moves in the currency market.

Data on the day in the US from the Institute for Supply Management (ISM) showed that manufacturing PMI dropped to 46.0 from 46.9 in May, the lowest reading since May 2020. It marked the eighth straight month that the PMI has been below the 50 threshold indicating contraction. Consequently, USD/JPY's current bullish trend could continue to decelerate as we have seen over the last few days.

The following illustrates the prospects of a correction in a top-down analysis:

USD/JPY monthly charts

The W-formation is a reversion pattern that could play out to the downside in time.

USD/JPY weekly

The current weekly highs could be the highest pot we will see for some time and as correction back to old highs neat 140.90 could be on the cards. The 61.8% Fibonacci aligns with those as well.

USD/JPY daily chart

\

\

Nearer term, the daily chart is breaking the trendline support and a target of 142.00 aligns with old highs and a 78.6% Fibonacci level.

- GBP/USD remains stable around 1.2690 despite the US manufacturing activity slowdown.

- UK data shows slight improvement but remains in recessionary territory, raising economic concerns.

- Speculations of the Fed’s interest rate increases impact GBP/USD, while the US Dollar strengthens against a basket of currencies.

GBP/USD stayed firm at the beginning of the year’s second half, at around the 1.2690s area; post-data release in the United States (US) showed manufacturing activity slowed down. Meanwhile, UK data portrayed a slight improvement but remained in recessionary territory. At the time of writing, the GBP/USD is trading at 1.2690, almost unchanged.

US manufacturing slowdown and UK recessionary concerns influence GBP/USD stability

The Institute for Supply Management (ISM) revealed its June Manufacturing PMI poll, which showed that business activity is deteriorating further, as data stood at contractionary territory at 46.0, below May’s 46.9 and estimates of 47.0. The data highlighted that input prices continued to slow down, signaling inflation edges down amidst 500 basis points of rate increases by the US Federal Reserve (Fed).

The GBP/USD reacted upwards to the data, trimming speculations of the Fed’s two interest rate increases. Chances for July’s 25 bps lift remained at 89.3%, above last Friday’s peak, as reported by the CME FedWatch Tool, while for November, odds slumped from 37% to 34%.

Last week’s data pushed aside recession fears in the United States (US), after Q1’s Gross Domestic Product (GDP) crushed the advance and preliminary readings, opening the door for further tightening. Nonetheless, US inflation data was softer than estimated; hence traders braced for a less aggressive Federal Reserve.

The US Dollar Index, a gauge of the buck’s value against a basket of six currencies, climbs 0.08% and is back above 103.002, a headwind for the GBP/USD pair.

On the UK front, the S&P Global/CIPS Manufacturing PMI for June came at 46.5, above estimates of 46.2, but trailed May’s 47.1, flashing signs of an economic slowdown. Recession fears had increased in the UK, with the Bank of England (BoE) expected to continue to tighten monetary conditions. Money market futures estimate the BoE would raise rates by at least 6%, representing the most aggressive tightening cycle among the majors. Even though the Sterling (GBP) could appreciate in the short term, the recession risks increased, suggesting that despite higher rates, the GBP/USD could depreciate, as traders seeking safety would likely buy the US Dollar.

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains upward biased, although it’s forming a doji after failing to break above the 1.2700 figure, suggesting that in the near term, a dip toward the 20-day Exponential Moving Average (EMA) at 1.2683 or below could pave the way for buyers to post new bets, as the GBP/USD could re-test the year-to-date (YTD) highs at 1.2848. On its way north, GBP/USD buyers must surpass 1.2700 and the June 21 daily high at 1.2802. Conversely, if GBP/USD bears drag prices below the June 29 swing low, seen as intermediate support at 1.2590, that will pave the way for a test of 1.2500 and probably the 100-day EMA at 1.2428.

- EUR/JPY trades with gains for a second consecutive day near 157.90.

- European PMIs from June came in weak.

- Japan’s Tankan Manufacturing Index improved in Q2.

The EUR/JPY tallies a consecutive day of gains standing near the 157.90 zone. The European Purchasing Managers' Index (PMI) data for June revealed weakness, contrasting with the improved performance of Japan's Tankan Manufacturing Index in the second quarter released during the Asian session. However, the Yen is still vulnerable on dovish expectations on the BoJ after soft inflation figures were reported last Friday.

European PMIs came in weak, while Japan’s Economic Outlook improved in Q2

The Manufacturing PMI data for June was released for four European countries. In Germany, the HCOB Manufacturing PMI came in at 45.5, slightly below the consensus expectation of 46 and unchanged from the previous reading. Meanwhile, in France, the survey was reported at 41, missing the consensus of 41.6 and showing a decline from the previous figure 40.6. Finally, the index was recorded in Italy at 43.6, in line with the consensus and slightly lower than the previous reading of 43.4, while Spain's figure came in at 48, matching expectations.

Despite weak PMI figures, the Euro seems to find support in hawkish bets on the European Central Bank (ECB). As indicated by the WIRP (World Interest Rate Probability), it suggests that markets are betting on a strong likelihood of a 25 basis points hike by 90% on July 27 while the odds of another 25 basis points increase to stand at approximately 60% on September 14 meeting.

On the Japanese, the Tankan Large Manufacturing Index for Q2 for Japan came in at 5, surpassing both the consensus of 3 and the previous reading of 1. Additionally, the Tankan Large Manufacturing Outlook for Q2 significantly improved, reaching 9 compared to the consensus of 5 and the previous reading of 3. However, the BoJ may need more evidence of strong economic activity to pivot its dovish monetary policy stance, so monetary policy divergences may continue to weaken the Yen agains most of its rivals.

EUR/JPY Levels to watch

Based on the daily chart analysis, the bullish momentum in the EUR/JPY pair appears to be losing steam, with signs of exhaustion from the bulls. In addition, the Relative Strength Index (RSI) remains in overbought territory, suggesting that a technical correction may come soon.

Regarding potential support levels in case of a correction, traders should monitor the 157.00, 156.50, and 156.00 levels. On the other hand, if the bulls manage to extend their control, resistance levels to watch out for are located at 158.00, 158.50, and 159.00.

EUR/JPY Daily chart

- USD/MXN was down by 0.30% in H2 2023 following weak US manufacturing data and yield curve inversion.

- US manufacturing activity slows for an eighth consecutive month, impacting USD performance.

- Recession fears rise as the US yield curve experiences pronounced inversion, signaling a potential economic slowdown.

USD/MXN begins the second half of 2023 with losses of almost 0.30% after hitting a daily high of 17.1485 after data from the United States (US) showed manufacturing activity continues at depressed levels. Furthermore, a deep inversion of the US yield curve sparked recession fears, a headwind for the US Dollar (USD). At the time of writing, the USD/MXN is trading at 17.0467.

Sluggish US manufacturing and yield curve inversion weigh on USD/MXN exchange rate outlook

US manufacturing activity slowed for eight straight months, as revealed by the Institute for Supply Management (ISM), with June data coming below May 46.9 at 46.0. Digging into the report, prices paid by manufacturers slowed down for the third month In a row, contrarily to services, though it remains above December 2022 through of 39.40. In the services sector, input prices remain high due to wage growth, reflecting a tight labor market.

Regarding traders, expectations for a 25 bps rate hike in July remained unchanged compared to last Friday’s odds at 87%, as shown by the CME FedWatch Tool. Nevertheless, today’s data released pushed the odds lower for the November FOMC meeting to 33%.

Of note, USD/MXN must be wary that recent data pushed aside woes for a recession, but last Friday’s US inflation report lowered expectations the Federal Reserve (Fed) would hike two times toward the end of 2023. Nevertheless, the US Dollar Index (DXY), which measures the buck’s performance against a basket of peers, advanced 0.03%, up at 102.951, as US Treasury bond yield recovered.

The US yield curve has experienced its most pronounced inversion since March 2023, with a negative spread of -1.078%. This development arises from the US 2-year yield reaching 4.923%, while the 10-year yield stands at 3.843%. This inversion indicates that investors anticipate the potential impact of continued tightening measures by the Fed, potentially leading to a slowdown in economic growth and even the risk of a recession.

Across the border, the latest employment report in Mexico on Friday was a headwind for the Mexican Peso (MXN). Meanwhile, data revealed on Monday by S&P Global showed the Manufacturing PMI for June came at 50.90, exceeding May’s 50.50.

In the meantime, the Bank of Mexico (Banxico) reported that remittances in May, came to $5.7 billion, breaking a monthly record, according to the central bank. Aside from this, Banxico’s poll showed that most analysts estimate interest rates will finish at 11.00% in 2023 while revising inflation lower. Regarding the USD/MXN exchange rate, most analysts expect the pair to end the year at 18.33 pesos per dollar, below the prior’s poll figure of 18.96.

Hence, the interest rate differential is still favoring USD/MXN downside, as the Fed is expected to lift rates to 5.25%-5.50%, as shown by money market futures, while Banxico is estimated to end at 11%. That would likely keep potential USD/MXN gains capped.

USD/MXN Price Analysis: Technical outlook

From a technical perspective, the USD/MXN would likely extend its downtrend as it approaches the 17.00 barrier, threatening to reach levels last seen in October 2015, at 16.3267, before USD/MXN sellers edge toward the 16.00 figure. On the flip side, USD/MXN buyers remain unable to reclaim the 20-day Exponential Moving Average at 17.2113, which, once cleared and the USD/MXN pair could rally toward the May 26 low turned resistance at 17.4038 before testing the 50-day EMA at 17.4912.

- XAG/USD stands with nearly 0.50% gains near $22.90 after reaching a daily high of $23.70.

- US Manufacturing PMI fell to 46 in June, a contraction worse than expected.

- Falling US Treasury yields gave room for the precious metal to rise.

Silver prices (XAG/USD) are rising, showing gains of approximately 0.70% and trading near $22.90, following a surge that led to a daily high of $23.70. This upward momentum comes in response to the weak US Manufacturing Purchasing Managers' Index (PMI) for June, which recorded a contractionary figure of 46, falling short of expectations. The decline in US Treasury yields has allowed the precious metal to advance, although it is worth noting that yields are still in positive territory, which can limit the XAG/USD’s upside potential.

US reported weak Manufacturing PMI; yields hold their ground

The most recent release of the Institute for Supply Management's (ISM) Manufacturing Purchasing Managers Index (PMI) for June revealed a reading of 46, falling short of the expected 47.2 and the previous figure of 46.9.

Despite a broad retreat in US yields (which could be seen as the opportunity cost of holding Silver), the Federal Reserve's (Fed) hawkish expectations for July have remained firm. The CME FedWatch Tool indicates that a 25 basis points (bps) hike in the upcoming July 31 meeting is practically priced in, while the likelihood of another 25 bps hike in 2023 has increased to around 40%. Furthermore, market participants eagerly await the release of Non-Farm Payroll (NFP) data on Friday, as it will continue shaping expectations regarding the Fed's future decisions.

That being said, it's worth noticing that higher interest rates tend to weaken precious metal prices, so traders should be aware that a hot NFP reading may trigger further downside for the XAG/USD.

XAG/USD Levels to watch

According to the daily chart, the technical outlook for the XAG/USD remains neutral with a bearish bias. The 20 and 100-day Simple Moving Averages (SMAs) are about to perform a bearish cross while indicators remain in negative territory.

If the metal continues to gain ground, resistance levels to consider are seen at the daily high of around $23.05, followed by $23.10 and the mentioned bearish cross at $23.30. Conversely, support levels are seen at the $22.80 level and below at the 200-day SMA at $23.55 and the $23.55 area.

XAG/USD Daily chart

- The USD/CHF rises to a daily high of 0.9000, above the 20-day SMA, then retreats towards the 0.8960 area.

- Soft Swiss inflation figures from June weakened the Swiss Franc during the European session.

- US Manufacturing PMI dropped to 46 in June, weighing on the US Dollar.

At the start of the week, the USD/CHF saw some volatility but remained in positive territory. Soft inflation figures from Switzerland weakened the Swiss Franc leading USD/CHF to rise initially while falling Treasury yields made the USD lose interest following a soft Manufacturing Purchasing Managers Index (PMI) release. The pair remains in positive territory, however, but has erased its daily gains which had seen the pair jump to a high of 0.9000 during the European session.

US yields fall after weak US Manufacturing PMI

The latest release from the Institute for Supply Management's (ISM) Manufacturing Purchasing Managers Index (PMI) for June showed a reading of 46, coming in below the 47.2 expected and the previous figure of 46.9.

Despite US yields retreating across the board, the Federal Reserve’s (Fed) hawkish expectations for July remain steady. According to the CME FedWatch Tool, a 25 basis points (bps) hike at the next meeting on July 31 is almost priced in, while the odds of another 25 bps hike in 2023 have risen to around 40%. In addition, markets await Non-Farm Payroll (NFP) data on Friday, which will continue modelling the expectations for the next Fed decision.

On the other hand, Switzerland's Consumer Price Index (CPI) declined to 1.7% in June, falling from 2.2% in May and falling short of the forecasted 1.8%. This drop brought the Swiss CPI back within the Swiss National Bank's (SNB) target range of 0% to 2%, marking the first time it has been within this range since January 2022. In that sense, dovish bets on the SNB seem to have weakened the CHF, but markets still discount at least one more hike this year.

USD/CHF Levels to watch

According to the daily chart, the technical outlook still favours the CHF despite daily losses. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) still hold in negative territory. In addition, the pair trades below the 20, 100 and 200-day Simple Moving Averages, suggesting that the sellers are in control.

Resistance Levels to watch: 0.8978 (20-day SMA), 0.9000, 0.9050.

Support Levels to watch: 0.8940, 0.8915,0.8900.

USD/CHF Daily chart

- Manufacturing activity weakened for the eighth month, weighing on the US Dollar.

- Investors expect a July rate hike by the Fed despite weak data, while chances of a November hike decline.

- The New Zealand Dollar (NZD) is expected to take cues from the Reserve Bank of Australia’s (RBA) upcoming monetary policy decision, with expectations of a 25 bps rate increase to 4.35%.

NZD/USD advances as the third quarter, the second half of the year begins, due to worse-than-expected data in the United States (US) reignited recession fears, as business activity slows down. That, alongside a deep inversion of the US 10s-2s yield curve, signs traders are bracing for a recession amidst a cycle of central banks increasing borrowing costs to curb inflation. The NZD/USD is trading at 0.6156 after hitting a daily low of 0.6115.

Worse-than-expected US data reignited recession worries, supports the NZD/USD; yield curve inversion raises concerns

The Institute for Supply Management (ISM) in the US revealed that manufacturing activity weakened further in June, to 46.0 below May’s 46.9, missing estimates of 47. According to the report, it’s the eighth straight month of losses. The data showed that prices paid in the manufacturing front are deflating, contrarily to services, which remained higher due to stronger wage growth from a tight labor market.

Despite weaker-than-expected data, investors see the US Federal Reserve (Fed) raising rates in July, as the CME FedWatch Tool odds for a 25 bps lift stood at around 87%. However, chances for November slipped to 33% after the data.

NZD/USD traders should be aware that recent data pushed aside woes for a recession, but last Friday’s US inflation report tempered speculations the Fed will hike twice toward the end of the year. That weighed on the greenback, which according to the US Dollar Index (DXY), stays firm at 102.979, even though yields continued to drop.

The US yield curve inverted the most since March of 2023, at -1.078%, as the US 2-year yield 4.923%, while the 10-year yields 3.843%, a sign that market players expect further Fed tightening would decelerate the economy, and it might tip it into a recession.

Meanwhile, the New Zealand economic agenda was light, with no data reported. However, the New Zealand Dollar (NZD) is expected to get cues from the Reserve Bank of Australia (RBA) monetary policy decision. On Tuesday, the RBA is expected to raise rates by 25 bps to 4.35%, though odds are 50%, according to a Reuters poll, with 16 of 31 economists expecting the increase, while the rest foresee a pause.

Upcoming events

During the week, the New Zealand agenda will feature the NZIER Business Confidence. ISM and S&P Global PMIs would be revealed on the US front, alongside Fed speakers, Factory Orders, May’s FOMC minutes, and crucial labor market data.

NZD/USD Price Analysis: Technical outlook

The NZD/USD daily chart shows investors tested the 50-day Exponential Moving Average (EMA) at 0.6164 but failed to stay above, suggesting that sellers remain in charge. Furthermore, NZD buyers could not break a two-week-old downslope resistance trendline, an additional sign that the NZD/USD would stay exposed to sellers. In that outcome, the NZD/USD first support would be the 20-day EMA 0.6144, followed by the 0.6100 mark, before testing the June 30 daily low of 0.6059. On the flip side, if NZD/USD buyers reclaim the 50-day EMA, that will expose key resistance levels, like the 100-day EMA at 0.6187, the 0.6200 figure, and the 200-day EMA at 0.6222.

- Gold gains momentum after US ISM Manufacturing.

- XAU/USD extends rebounds from monthly lows, tests $1,930/oz.

- US Dollar erases gains, US yields pullback from weekly highs.

Following the release of weaker-than-expected US economic data, Gold price jumped to $1,931, reaching the highest level in a week. The weaker data triggered a decline of the US Dollar and boosted Treasury bonds.

US ISM Manufacturing below expectations

The US ISM Manufacturing PMI dropped from 46.9 to 46.0, falling short of expectations for a modest recovery to 47.2. The Prices Paid Index also fell, declining from 44.2 to 41.8, while Employment dropped from 51.4 to 41.8.

These numbers indicate ongoing problems in the manufacturing sector and softer price pressures, which weighed on the US dollar. As a result, the DXY fell to 102.75, testing Friday's lows, while the 10-year US bond yield pulled back from 3.86% and bottomed at 3.78%.

Following the report, XAU/USD jumped to $1,931 but failed to hold above $1,930. It is currently hovering around $1,926, up for the second consecutive trading day.

Gold continues to rebound after falling on Thursday to $1,982, the lowest level since March. While the technical outlook for the yellow metal has improved in the short-term, the bias on the daily chart remains to the downside, and the price remains well below the 20-day Simple Moving Average (SMA) that stands at $1,936.

Technical levels

Gold fell last week as investors bet on further rate hikes by the Fed. Economists at TD Securities analyze XAU/USD outlook.

High probability of another 25 bps in late-July

Investors are worried that a lack of economic weakness in the US and core inflation trending more than double the US central bank's inflation target will force policymakers to deliver on additional rate hikes in the coming months. Indeed, the futures market is pricing a high probability of another 25 bps in late July.

While there are fewer price pressures in the economy, recent data suggest that rates will move higher on the front end of the curve and stay at elevated levels for some time, which implies that Gold will continue to have little reason to move significantly higher anytime soon.

The S&P 500 gapped higher on Friday. Analysts at Credit Suisse analyze the index's technical outlook.

S&P 500 stays seen on course for key resistance at 4513/4535

The immediate risk stays seen higher for a test of key resistance at 4513/4535 – the 78.6% retracement of the 2022 downtrend, ‘reversal day’ high from late April 2022 and now also the top of the uptrend channel that has been in place from March this year. We continue to look for a fresh attempt for a cap here and for a retracement lower/consolidation phase to emerge. Should strength directly extend though, we would see resistance next at 4593, then the March 2022 high at 4637.

Support is seen at 4422 initially, with the immediate risk seen higher whilst above the lower end of the price gap from Friday and 13-day average at 4398/80. A close below here would suggest we may be getting close to a near-term peak, but only back below the 4328 low of last week would be seen to mark a near-term top.

The Australian Dollar has been trading on a softer footing going into tomorrow’s RBA policy meeting after correcting lower throughout the second half of last month. Economists at MUFG Bank analyze how the monetary policy decision could impact the Aussie.

RBA to leave rates on hold

The Australian rate market is currently pricing in only 4 bps of hikes for tomorrow’s RBA policy meeting. We agree with current market pricing and expect the RBA to leave rates on hold tomorrow.

If the RBA leaves rates on hold as we expect, then market attention will quickly shift to future rate guidance from the RBA. The Australian market is pricing in around 40 bps of hikes by the end of this year with the next hike expected in either August or September.

Current pricing highlights that a hawkish hold is expected, and anything less would weigh on the Australian Dollar.

See – RBA Preview: Banks split between a pause and 25 bps hike after softer inflation

- US ISM Manufacturing PMI continued to decline in June.

- US Dollar Index stays in the red below 103.00.

The economic activity in the US manufacturing sector continued to contract at an accelerating pace in June, with the ISM Manufacturing PMI dropping to 46 from 46.9 in May. This reading came in worse than the market expectation of 47.2.

Further details of the publication revealed that the New Orders Index improved to 45.6 from 42.6, while the Employment Index fell to 48.1, revealing a decline in the sector's payrolls. .4 from 50.2. Finally, the inflation component, Prices Paid Index, dropped to 41.8 from 44.2.

Assessing the survey's findings, "demand remains weak, production is slowing due to lack of work, and suppliers have capacity," said Timothy R. Fiore, Chair of the Institute for Supply Management. "There are signs of more employment reduction actions in the near term. Seventy-one percent of manufacturing gross domestic product (GDP) contracted in June, down from 76 percent in May."

Market reaction

The US Dollar Index edged lower with the initial reaction and was last seen losing 0.1% on the day at 102.85.

Economists at Credit Suisse continue to look for EUR/USD to hold below retracement resistance at 1.0998 for a test of its uptrend from last September at 1.0778

EUR/USD is in the process of constructing a major top

EUR/USD has been capped at the 78.6% retracement of the 2022/2023 fall at 1.0998, now also the location of near-term downtrend and with the 10yr US/Germany bond yields spread seen in the process of constructing a large base we believe EUR/USD may be in the process of building a large top.

We take a negative bias looking for a fall back to the low of last week at 1.0835 initially, then a test of the uptrend from last September at 1.0778/74. A break below this latter area is needed to add weight to a topping story for a test of the 1.0732 next, then the 1.0634 May low.

Resistance is seen at 1.0934/43 initially, with 1.0998 ideally capping on a closing basis.

CAD lost ground against a generally stronger USD last week but losses were duly limited to around 0.4% on the week, a little worse than most of its G10 peers. Economists at Scotiabank analyze USD/CAD outlook.

CAD downside limited

Fundamental risks appear neutral to mildly positive for the CAD.

Our week-ahead model anticipates a 1.3170/1.3430 range for USD/CAD.

Technical pointers correctly highlighted upside risks for the USD last week but signals are now more nuanced in terms of guidance for the week ahead. Trends still rather suggest to me that upside potential in the USD is limited and gains may not exceed key resistance at 1.3315/25. An overshoot, given positive weekly price action, is hard to rule out, however.

Support is 1.3200/10, with USD losses below here liable to extend back to 1.3150/75 quickly.

- AUD/USD is showing non-directional performance around 0.6660 ahead of US PMI data.

- The Australian Dollar would show a power-pack action ahead of the interest rate decision by the RBA.

- AUD/USD has delivered a breakout of Wyckoff’s Accumulation phase.

The AUD/USD pair is showing topsy-turvy moves around 0.6660 in the early New York session. The Aussie asset has turned sideways as investors are awaiting the release of the United States ISM Manufacturing PMI data.

S&P500 is set to open on a flat note following choppy cues from US 500 futures. Overall market mood has turned quiet as investors are keeping an eye on the upcoming quarterly result season. The US Dollar Index (DXY) has extended its downside journey marginally below 103.00.

The Australian Dollar would show a power-pack action ahead of the interest rate decision by the Reserve Bank of Australia (RBA). Analysts at Bank of America (BofA) expect the RBA will keep rates unchanged at 4.1% in July due to softer monthly inflation. This gives the RBA an opportunity to wait for Q2 CPI data due on July 28th, as well as another labor force release on July 20th. But there is a potential for a 25 bps hike in August, taking the cash rate to 4.35%.

AUD/USD has delivered a breakout of Wyckoff’s Accumulation phase in which inventory is shifted from retail participants to institutional investors. The Aussie asset is consolidating for now but is expected to deliver further breakout. The 50-period Exponential Moving Average (EMA) at 0.6646 is providing support to the Aussie bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has dropped into the 40.00-60.00 range, which indicates that the upside momentum has faded but the upside bias is still intact.

A decisive break above the intraday high at 0.6680 would expose the asset to June 27 high at 0.6720 followed by June 23 high at 0.6767.

On the flip side, a confident break June 29 low at 0.6595 would drag the asset toward June 02 low at 0.6565 and the round-level support at 0.6500.

AUD/USD hourly chart

USD/JPY pushed higher again last week. Credit Suisse’s 145.00/12 next target has been achieved, but their broader outlook stays bullish for the “measured base objective” at 148.57.

Support is seen at 144.22/12, then 143.30/20

USD/JPY achieved our next target at the ‘neckline’ to the October/November 2022 top at 145.00/12. With trend channel resistance from last December seen here also at 145.17, we continue to look for a fresh cap here for a consolidation phase. Big picture though we look for 145.12/17 to be conclusively cleared in due course with resistance then seen next at 146.66 and with the ‘measured base objective’ at 148.57.

Support is seen at 142.22/12 initially, below which can ease the immediate upside bias for a pullback to the 13-day exponential average and price support at 143.30/20, but with this ideally holding on a closing basis.

- EUR/USD struggles to gather traction above 1.0900.

- Extra gains should challenge the area above 1.1000.

EUR/USD reverses the earlier pullback and looks to consolidate the break above 1.0900 the figure on Monday.

Price action around the pair looks firmer for the time being. That said, the next resistance level of note comes at the psychological 1.1000 barrier ahead of the June peak at 1.1012 (June 22). North from here, the pair is expected to embark on a move to the 2023 top just below 1.1100 (April 26).

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0596.

EUR/USD daily chart

- DXY attempts a mild recovery and retakes 103.00.

- Next on the upside comes the weekly high around 103.50.

DXY kicks in the new trading with on a positive foot and regains the 103.00 hurdle and beyond on Monday.

The index manages to pick up upside traction and looks to extend the rebound north of 103.00 the figure on Monday. Immediately to the upside now emerges the weekly high at 103.54 (June 30). The breakout of this level could open the door to a move to the May high at 104.69 (May 31).

Looking at the broader picture, while below the 200-day SMA at 104.84 the outlook for the index is expected to remain negative.

DXY daily chart

The Reserve Bank of Australia (RBA) will announce its next monetary policy decision on Tuesday, July 4 at 04:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming central bank's decision.

At the June meeting, the RBA raised the cash rate by 25 bps to 4.10%. The consensus is for the bank to keep interest rates unchanged; however, it is a close call.

ANZ

We don’t think the RBA will be swayed to pause by this month’s inflation result, with other data from the month less encouraging for the inflation outlook. We think the strength in this month’s employment data should outweigh any optimism on inflation. We think the quarterly CPI result in Q2, released in July, will be key to the RBA raising the cash rate in August.

BofA

We expect that the RBA will keep rates unchanged at 4.1% in July due to softer monthly inflation. This gives the RBA an opportunity to wait for Q2 CPI data due on July 28th, as well as another labor force release on July 20th. But there is a potential for a 25 bps hike in August, taking the cash rate to 4.35%. If the RBA holds rates in July, it may weigh on the AUD in the near term. However, the AUD's downside would be limited if the RBA signals that further tightening is likely.

ING

Following the surprisingly large fall in May headline CPI inflation to 5.6% YoY from 6.8% in April, there seems little prospect of the RBA hiking rates again following what, by its own admission, was a finely balanced decision in June. That hike only got over the line because of the large upward spike in April inflation, so it would seem extremely odd to hike again if inflation surprises on the downside. We are keeping an open mind on one final hike this cycle, and the September meeting looks like the most likely candidate to us. July CPI will have to absorb a large electricity tariff spike of 20% YoY, or more by some estimates, and the base effects are less helpful over the third quarter too. But that will probably be it for the RBA.

Standard Chartered

We expect the RBA to pause in July, but to hike by 25 bps each in August and September. The RBA meets every month (except in January) compared to the longer break between meetings for other developed market central banks. Hence, we think it is unlikely to hike at a trot.

TDS

Another line-ball call with cons. expecting no hike and OIS market pricing in ~50% prob of a 25 bps hike. Contrary to cons., we expect the RBA to hike. The labour market is too tight, upside retail sales beat for May, rebound in domestic housing prices in June and elevated household savings provides room for the RBA to continue its hike to return inflation back to target.

UOB

We continue to emphasize that every meeting in the near term will be live. Following the latest employment data, we are now penciling in a 25 bps hike at the next monetary policy meeting on 4 Jul.

SocGen

We expect the RBA to maintain its cash rate target of 4.10% at its 4 July policy meeting, after the two 25 bps hikes in May and June, as in our view, it would be difficult for policymakers to implement such a rate hike for three months in a row following the significant decline in monthly inflation in May. We maintain our base-case scenario, in which we assume a terminal policy rate of 4.35%, under the assumption that the RBA will opt to ‘pause’ with no meaningful changes in policy statement in July. The likelihood of the terminal rate being higher than 4.35% would increase in the event of a rate hike and/or hawkish changes in the policy statement.

BMO

We still expect another rate hike on July 4, bringing the cash rate from 4.10% to 4.35%. Credit demand and job growth are still very strong, and 5.6% inflation, though at a 13-month low, is still well above the 2%-to-3% target. The debate will, once again, be between 25 bps and holding rates steady. (Will 15 bps finally make it into the discussion? Here's hoping... I'm not giving up.) It will likely be even more ‘finely balanced’ than it was in June but will tip over to the 25 bps hike camp. (Expect a more dovish tone, though.)

Wells Fargo

Despite the slowing in the latest inflation print, we still lean toward the RBA raising rates 25 bps to 4.35% at the July meeting. Our forecast is distinct from the consensus forecast, which is for the policy rate to remain unchanged at the July meeting, though we acknowledge it is a close call and would not be surprised if the RBA paused at this meeting.

Citi

The RBA will likely deliver another 25 bps hike. Although the decision will be once again ‘finely balanced’, we believe that the economic data has surprised on the upside. The most crucial upside surprise was the labour force survey in May, which saw the unemployment rate decline despite a record increase in the labour force participation rate. Elsewhere, services inflation remains sticky and house prices have rebounded further, implying that financial conditions need to tighten further. We believe the Bank should hike further by 25 bps in July and August.

The prospects for copper remain surrounded by uncertainty in the near-to-medium term, as suggested by UOB Group’s Quarterly Global Outlook.

Key Takeaways

Over the past quarter, increasing worries of disappointing growth slowdown in China weighed down on Copper. As 2Q23 progressed, it became apparent that the much-anticipated post Covid recovery for China did not materialize as most investors had hoped for. Instead, together with other high frequency activities, China’s Manufacturing PMI started to turn south yet again, amidst the further slowdown in industrial production, and renewed pullback in credit growth.

Despite the near term weak dynamics, as we have highlighted over the past year, the longer term prospects for Copper is not so dire. Slowing mine production volumes add to potential longer term supply bottlenecks. In addition, the longer term transition to electric vehicles (EV) adds to longer term demand for Copper. E.g. China’s demand for refined copper has kept pace with its increasing electricity consumption.

Overall, given near term uncertainty with China’s economic recovery, we maintain our mild negative outlook for LME Copper, forecasting USD 8,000 / MT in 2H23 and USD 7,000 / MT in 1H24.

- USD/JPY is marching towards its previous week’s high at 145.00 ahead of US factory activity data.

- Investors are turning cautious ahead of the quarterly result season.

- A stealth intervention by the BoJ in the FX moves is widely anticipated as the Japanese Yen is consistently depreciating.

The USD/JPY pair is looking to recapture the previous week’s high of 145.00 in the early London session. The asset is broadly having strength despite the sheer correction in the US Dollar Index (DXY). The USD Index has surrendered the majority of gains added in the Asian session as investors are cautious about United States Manufacturing PMI data.

S&P500 futures have surrendered their gains and have turned negative, portraying a decline in the risk appetite of the market participants. Investors are turning cautious ahead of the quarterly result season. Banking and technology stocks are likely to be under pressure due to tight credit conditions and higher interest rates by the Federal Reserve (Fed).

The US Dollar Index has corrected to near 103.00 ahead of the key PMI figures. According to the estimates, Manufacturing PMI is seen expanding to 47.2 vs. the former release of 46.9. Investors should note that factory activities have been contracting straight for the past seven months and are expected to continue their contracting spell due to higher interest rates from the Fed. Apart from that, New Orders Index is expected to jump to 44.0 vs. the former release of 42.6.

Later this week, Federal Open Market Committee (FOMC) minutes will remain in focus. The minutes will provide a detailed explanation of the steady interest rate policy. However, Fed chair Jerome Powell has conveyed that two small interest rate hikes are appropriate this year.

On the Japanese Yen front, a stealth intervention by the Bank of Japan (BoJ) in the FX moves is widely anticipated as the Japanese Yen is consistently depreciating. BoJ Deputy Governor Ryozo Himino stated last week that signs of cost-push inflation are easing and demand-driven inflation is taking some place. This could be the outcome of an expansionary interest rate policy and rising wages.

EUR/USD is now close to where it was at the start of the COVID pandemic. Economists at Société Générale analyze the pair’s outlook.

A rally but no change in long-term trend yet

What seems clear is that at this point, major currencies (and EUR/USD in particular) are very sensitive to changes in short-term rate differentials, probably because there is so much uncertainty around the bigger picture.

We expect the gap between ECB and Fed rates to continue narrowing in the second half of this year and into 2024, and the 1-year rate differential seems set to narrow further than it did in 2020 – and it dragged EUR/USD above 1.20 that time.

Even if we see rate convergence, it seems unlikely a new major Euro uptrend will start without stronger growth.

- EUR/JPY adds to Friday’s gains above 157.00.

- Further upside remains in the pipeline near term.

EUR/JPY extends the rebound to the boundaries of 158.00 the figure at the beginning of the week.

Considering the ongoing price action, extra upside appears likely in the very near term. That said, the continuation of the uptrend should meet the next hurdle of significance not before the weekly high of 163.09 (August 22 2008).

The ongoing overbought conditions of the cross, however, are indicative that a deeper knee-jerk should not be ruled out at some point in the short-term horizon.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 145.25.

EUR/JPY daily chart

The GBP/USD uptrend continues to lose momentum, and economists at Credit Suisse look for a test and then break of key uptrend support at 1.2594.

The immediate risk is shifting lower

With weekly RSI momentum unable to confirm the new highs and with daily MACD momentum turning lower we believe the immediate risk is shifting lower.

Key support is seen from the uptrend from September last year and last week's low at 1.2594/90, below which should see downside pressure increase further for a test of the 55-DMA next, currently at 1.2542. A close below here would then be seen to expose 1.2485 next.

Resistance is seen at 1.2729 initially, with a break above 1.2761 seen needed to ease the immediate downside bias for strength back to 1.2843/50. Above here can clear the way for strength to 1.2894/1.2900 next, then what we look to be tougher resistance at the March/April 2022 lows at 1.2973/1.3000.

European Central Bank (ECB) policymaker Joachim Nagel said on Monday that monetary policy signals are clearly pointing in the direction of further tightening and added that they will have "a way to go" with regard to additional rate increases, per Reuters.

Nagel further argued that they need to significantly reduce the Eurosystem's balance sheet in the coming years.

Market reaction

These comments don't seem to be impacting the Euro's performance against its rivals. As of writing, the EUR/USD pair was trading at 1.0900, losing 0.1% on a daily basis.

The US Dollar sold off at the end of last week following the release of the weaker-than-expected US PCE deflator report for May. Economists at MUFG Bank analyze USD outlook.

Softer US inflation takes the wind out of the USD’s sails

At this stage, the softer US PCE deflator report has mainly put a dampener on upward momentum for the US yields and the US Dollar in the near term rather than triggering a more sustained reversal lower.

Further weaker US inflation data will be required to trigger a more sustained reversal lower.

- Oil prices have concluded their corrective move as Saudi proposes an extension in oil cuts.

- Better-than-expected Caixin Manufacturing PMI data has supported the oil price.

- WTI is looking for a breakout of the Rising Channel chart pattern.

West Texas Intermediate (WTI), futures on NYMEX, have rebounded after concluding its corrective move to near $71.00 in the London session. The oil price is expected to reclaim the intraday high of $71.60 as discussions about further extension in oil production cuts have deepened.

Saudi Arabia's Ministry for Energy announced it would be extending its production cut for crude for an extra month, as reported by Newswires.

Meanwhile, better-than-expected Caixin Manufacturing PMI data has supported the oil price. The economic data landed at 50.5 higher than the expectations of 50.2 but remained lower than the prior release of 50.9. It is worth noting that China is the largest oil importer in the world and decent factory activities have improved the oil demand outlook.

WTI is looking for a breakout of the Rising Channel chart pattern on an hourly scale in which each pullback is considered as buying opportunity for the market participants. The rally in the oil price will be further strengthened after a pattern breakout.

The 50-period Exponential Moving Average (EMA) is consistently providing support to the oil bulls.

The Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that the upside momentum has been activated.

Should the asset break above the intraday high at $71.83, oil bulls would drive the asset towards June 08 high at $73.23 followed by the crucial resistance around $75.00.

On the flip side, a downside move below May 31 low at $67.12 will drag the asset toward the $65.00 support followed by the ultimate support around $64.31.

WTI hourly chart

-638239828711111081.png)

Economists at Société Générale analyze AUD outlook.

RBA needs to become more hawkish if we are to see AUD/USD trade back above 0.70

We now expect a protracted range-bound period where buying AUD should be a frustrating exercise.

At the end of this year, we expect RBA rates to be 75 bps below Fed rates, almost exactly what is currently priced into the market. The RBA needs to become more hawkish if we are to see AUD/USD trade back above 0.70.

Australia’s iron exports to China are on a declining trend since the start of the year. With contracting demand for metal production and thus for the currency, the Aussie is gradually losing its sparkle.

Saudi Arabia will extend its voluntary oil output cut of one million barrels per day by one more month to include August, the state news agency reported on Monday, per Reuters.

Meanwhile, Russia's Deputy Prime Minister Alexander Novak's office stated that Russia will reduce oil output by an additional 500,000 barrels per day in August.

Market reaction

Crude oil prices continued to push higher following these headlines. As of writing, the barrel of West Texas Intermediate was trading at $71.35, gaining 1.4% on a daily basis.

Economists at HSBC expect another 25 bps hike in Canada on 12 July. The BoC’s forward guidance will play a crucial role in determining whether the CAD could capitalise on the gain.

Positive risk appetite could also support the CAD

Given the hawkishness of the BoC statement, our economists expect a follow-up rate hike of 25 bps at the 12 July meeting, bringing the policy rate to 5.0%. The market is currently priced for 15 bps of tightening at that meeting (Bloomberg, 29 June 2023), so there may be some modest upside for the CAD in terms of a knee-jerk reaction.