- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- Gold price recovers its losses around $2,060, up 0.14% for the day.

- The US ISM Manufacturing PMI came in at 47.4 vs. 46.7 prior, better than the expectation of 47.1.

- Market players will monitor the US ADP Employment Change and weekly Initial Jobless Claims on Thursday.

Gold price (XAU/USD) bounces off the multi-day lows near $2030 per ounce and hovers around $2,042 during the early Asian session on Thursday. The stronger US Dollar (USD) and higher US Treasury bond yields weigh on the yellow metal.

Meanwhile, the US Dollar Index (DXY), a measure of the value of the USD against a weighted basket of currencies used by US trade partners, surges to its highest in three weeks around 102.42. The Treasury yields edge higher, with the 10-year yield standing at 3.92%.

The minutes of the FOMC meeting were not dovish like the press conference at its December meeting, which lift the US Dollar (USD) broadly. The participants emphasized the need to maintain a cautious and data-driven approach, and they added that policy should remain restricted for some time.

The Institute for Supply Management (ISM) revealed on Wednesday that US Manufacturing PMI contracted further in December, even though the figure showed improvement in production and factory employment. The Manufacturing PMI rose to 47.4 from 46.7 in the previous reading, above the market consensus of 47.1.

Later on Thursday, the US ADP Employment Change and weekly Initial Jobless Claims will be released. Traders will take more clues from the US employment data on Friday, including Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings, due on Friday.

- GBP/USD clings to mild losses near 1.2665 on the firmer USD.

- Richmond Fed Barkin said the potential for additional rate hikes remains on the table.

- The fear of recession in the UK economy weighs on the British pound (GBP).

- Investors await the UK Composite PMI and the US ADP Employment Change.

The GBP/USD pair posts modest losses during the early Asian session on Thursday. The recovery of the US Dollar (USD) and US Treasury bond yields exerts some selling pressure on the pair. At the press time, GBP/USD is trading at 1.2665, up 0.01% on the day. Meanwhile, the US Dollar Index (DXY) surges to 102.45, the highest in three weeks.

On Wednesday, the US ISM Manufacturing PMI arrived at 47.4 versus 46.7 prior, better than the expectation of 47.1. Additionally, the labour market gauge of JOLTs Job Openings came in weaker than the estimation of 8.79M in November.

The minutes of the FOMC meeting in December indicated that participants believe the policy rate to be at or near its peak for this tightening cycle, while they cautioned that the exact policy path would depend on how the economy evolves. Richmond Fed President Thomas Barkin said earlier Wednesday that interest rate hikes remain on the table despite the progress in inflation control. This, in turn, lifts the Greenback against its rivals and acts as a headwind for the GBP/USD pair.

On the other hand, the fear of recession and a weakened manufacturing sector in the UK economy have diminished the appeal of the British pound (GBP). S&P Global revealed on Tuesday that Manufacturing PMI eased to 46.2 in December from the previous reading of 46.4.

Looking ahead, market players will keep an eye on the UK S&P Global/CIPS Composite PMI and Services PMI for December. Also, the US ADP Employment Change, weekly Initial Jobless Claims will be released on Thursday.

- AUD/NZD briefly sagged below 1.0770 in early Thursday trading.

- Long-term congestion around the 200-day SMA continues below 1.0800.

- 2024 kicks off with continued sideways grind between familiar peaks and lows.

The AUD/NZD pair waffled on Wednesday, drifting from a near-term peak just below 1.0830 to sink back into familiar near-term lows near 1.0770, briefly testing into 1.0760 in early Thursday trading.

The Antipodean pair has been earmarked by congestion through the entirety of 2023 following a drastic rebalancing from 2022’s peak of 1.1490, sinking nearly 9% to a December 2022 low of 1.0470. The AUD/NZD has been caught in long-term consolidation ever since, cycling the 1.0800 handle as the 200-day Simple Moving Average (SMA) treads water in the familiar price zone.

Intraday action has the pair drifting into the low side of the 200-hour SMA near 1.0790, set for a bounce from chart territory near the last swing low at 1.0750, and the immediate topside technical ceiling sits at 1.0830, 2024’s early swing high.

Australian Dollar price this week

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies this week. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.21% | 0.51% | 0.76% | 1.22% | 1.50% | 1.12% | 0.97% | |

| EUR | -1.07% | -0.54% | -0.31% | 0.17% | 0.29% | 0.06% | -0.15% | |

| GBP | -0.53% | 0.54% | 0.26% | 0.71% | 1.07% | 0.61% | 0.39% | |

| CAD | -0.76% | 0.28% | -0.07% | 0.44% | 0.74% | 0.34% | 0.16% | |

| AUD | -1.24% | -0.18% | -0.71% | -0.48% | 0.11% | -0.10% | -0.30% | |

| JPY | -1.50% | -0.26% | -0.93% | -0.53% | -0.09% | -0.21% | -0.59% | |

| NZD | -1.13% | -0.06% | -0.63% | -0.36% | 0.11% | 0.20% | -0.20% | |

| CHF | -0.92% | 0.15% | -0.39% | -0.13% | 0.33% | 0.57% | 0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

- AUD/JPY edges down to 96.35 after a 0.46% gain, with bullish-harami pattern suggesting potential upside momentum.

- Buyers aim for the January 2 high of 96.71 and the 97.00 mark, with subsequent resistance levels at 97.67 and 98.00.

- If the upside is capped, sellers might target Senkou Span B at 96.14 and Kijun Sen at 95.90, with 94.58 as further support.

The AUD/JPY registered moderated gains on Wednesday of 0.46%, though it begins Thursday’s session on a lower note, trading below yesterday’s close of 96.42. Nevertheless, buyers reclaiming the Kijun-Sen and stepping in around the bottom of the Ichimoku Cloud (Kumo) has opened the door for further gains. At the time of writing, the cross-pair exchanges hands at 96.35, down 0.07%.

The daily chart portrays the pair range-bound, though the formation of a ‘bullish-harami’ candlestick pattern could pave the way for further upside. For a bullish resumption, buyers must conquer the January 2 high of 96.71, followed by the 97.00 figure. Once those two levels are cleared, the next resistance level would be the June 19 high at 97.67. Up next would be the 98.00 psychological level.

On the other hand, if sellers capped the AUD/JPY advance above 96.71, sellers could step in and drag prices toward th Senkou Span B at 96.14, followed by the Kijun Sen at 95.90. Once that is achieved, the next demand area to test would e the December 14 low of 94.58.

AUD/JPY Price Action – Daily Chart

AUD/JPY Technical Levels

- Judo Bank’s Australian Services PMI sinks to second-lowest print in 23 months.

- Australian Composite PMI also slipped to 46.9 from 47.4.

The Australian Services sector contracted once more, according to the latest Purchasing Managers’ Index (PMI) data from Judo Bank.

Despite the seasonally-adjusted figure rising from November’s 46.0 to 47.1 in December, a third consecutive reading below 50.0 points towards a full quarter of services activity contraction.

This marks the fastest pace of services contraction since the third quarter of 2021.

According to Matthew De Pasuale, Economist at Judo Bank: “The composite output index ended the year with a reading of 46.9, a slight improvement from November. Readings over the past two months suggest that while the economy is slowing down, the slowdown is not accelerating. The new orders index softened for the third consecutive month to 46.7 in December, the lowest level since late 2021. Despite households facing ongoing pressure from elevated interest rates, the output and new order indexes remain at levels consistent with the RBA's forecast soft-landing for the Australian economy.”

Market reaction

The Australian Dollar is broadly unmoved by the figures, with the AUD/USD cycling the 0.6730 level with an ongoing economic downturn in the domestic Australian economy broadly priced into market expectations already.

About the Judo Bank Services PMI

The Services Purchasing Managers Index (PMI), released on a monthly basis by Judo Bank and S&P Global, is a leading indicator gauging business activity in Australia’s services sector. The data is derived from surveys of senior executives at private-sector companies from the services sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), employment and inflation. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity among service providers is generally declining, which is seen as bearish for AUD.

- The NZD/JPY stands elevated after a rally towards 89.40, giving it a breather from its recent trailing losses.

- Daily chart indicators like the hint at potential buying momentum despite being in negative territory.

- Regardless of the short-term negative outlook, above 20,100,200-day SMAs indicates a broader bullish control.

In Wednesday's session, the NZD/JPY clocked an uptick of 0.70%, seeing the pair rally to 89.40. An inconsistent journey was seen on the daily chart, hinting at neutral to slightly bullish momentum, with sellers taking a break after four out of the last five days of losses. Despite the upside, in the immediate short term, the four-hour chart indicators have flattened, hinting at a potential shift to the downside as investors may be set to take profits.

Surveying the indicators on the daily chart shows that the buying momentum currently holds the upper hand. Despite the Relative Strength Index (RSI) showing an increasing trend while in negative territory and the Moving Average Convergence Divergence (MACD) displaying steady red bars suggesting a potentially bearish signal, the dominant force is nevertheless the buying side. This is largely attributable to the fact that the pair remains above its 20, 100, and 200-day Simple Moving Averages (SMAs). Such positioning implies a strong bullish dominance over the broader time horizon.

With respect to the shorter time frame, the four-hour chart exposes a somewhat different dynamic. Momentum indicators appear to have reached an equilibrium, slightly favoring the downside. The four-hour RSI, despite sitting in positive territory, is exhibiting a downsloping trend, which typically signals a decrease in buying pressure. Correspondingly, the four-hour MACD, with its flat red bars, reiterates this neutral sentiment.

NZD/JPY daily chart

-638399156401418411.png)

- USD/JPY took a step back from Wednesday’s grind higher after failing to claim 143.75.

- Yen selling pressure eased off after Fed’s latest meeting minutes poised to disappoint markets.

- China Services PMI to drive market sentiment in early Thursday market session.

The USD/JPY drove higher on Wednesday as the US Dollar (USD), the day’s single best-performing currency clambered over the Yen (JPY), the day’s biggest loser. The USD/JPY climbed one and a third percent bottom-to-top for the midweek market session, slipping back from just below 143.75 to wrap up Wednesday’s trading just above the 143.00 handle.

FOMC Minutes: Interest rates seem to be at or near peaks

The Federal Reserve’s (Fed) meeting minutes from the US central bank’s December discussion revealed that Fed policymakers may not be as far along the path towards rate cuts as market have been hoping for. Fed officials noted that, while rates appear to be “at or near” the peak, the main policy rate could hold higher for longer than market participants are currently expecting. The meeting minutes stand in stark contrast to the market’s broad risk-on reaction following Fed Chairman Jerome Powell’s surprise pivot in December which sent market expectations of rate cuts through 2024 skyrocketing.

The upcoming Thursday Asia market session is set for the second half of Purchasing Managers’ Index (PMI) figures from China with the China Caixin Services PMI slated to drop early at 01:45 GMT, and markets are expecting a slight uptick from November’s 51.5 to 51.6 in December.

China’s Caixin Manufacturing PMI on Tuesday came in above expectations, surprising to the upside and ticking higher from 50.7 to 50.8 in December, easily clearing the median market forecast of 50.4. A matching beat for Thursday’s Services PMI will help bolster risk appetite as markets kick off the back half of the first trading week of 2024.

High-impact data will wrap up the trading week with Friday’s US Nonfarm Payrolls, expected to slip back slightly from 199K to 168K in December.

USD/JPY Technical Outlook

The USD/JPY’s rally on Wednesday took the pair cleanly through the 200-hour Simple Moving Average (SMA) just above 142.00, sending the pair just shy of 143.75 before settling back towards the 143.00 handle.

Daily candlesticks have the pair running directly into technical resistance from the 200-day SMA just above 143.00, and the pair’s 7.5% peak-to-trough decline from November’s peak of 151.91 remains intact.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

The beginning of the new trading year continued to see the greenback on the positive foot. Moving forward, Asian markets should closely follow the Chinese calendar, where Caixin Services and Composite PMIs are due. In Japan, the final Manufacturing PMI tracked by Jibun Bank is due, while nothing is scheduled in Oz on Thursday.

Here is what you need to know on Thursday, January 4:

The US Dollar Index (DXY) climbed to the area of three-week tops around 102.70 on the back of the persevering selling bias in the risk-associated universe. In addition, US yields rose further to multi-week peaks across different maturities, reinforcing at the same time the constructive tone around the dollar.

US stocks probed the area of multi-day lows, extending the corrective move after hitting a new all-time high just below the 38000 yardstick when gauged by the reference Dow Jones.

Data released on Wednesday showed an improvement in the always relevant US ISM Manufacturing PMI to 47.4 in the last month of 2023, while the labour market gauge of JOLTs Job Openings missed estimates at 8.79M in November, showing further cooling of the US labour market prior to key releases of the ADP and weekly Initial Jobless Claims (Thursday) and the December Nonfarm Payrolls (Friday).

EUR/USD sank to the sub-1.0900 region for the first time since mid-December against the backdrop of the stronger greenback and generalized weakness in the risky assets.

GBP/USD was a kind of exception after revisiting the upper-1.2600 amidst decent gains and following three consecutive sessions of losses.

Another negative session for the Japanese yen saw USD/JPY climb to the 143.70 region on the back of the continuation of the upside momentum of US yields and a directionless patter in JGB 10-year yields.

AUD/USD remained well on the defensive and retreated for the fourth session in a row against the backdrop of further pressure surrounding the high-beta currencies and the generalized bearish session in the commodity complex.

Speaking about the commodity universe, the Canadian dollar lost ground for the fifth consecutive session, lifting USD/CAD to the 1.3370 zone, or two-week highs.

The intense move higher in the greenback and US yields weighed on gold and sponsored a drop to multi-day lows near $2030 per ounce. In the same line, silver prices added to the pessimistic start of the year and broke below the $23.00 mark per ounce to clinch a new two-week lows.

No news from the FOMC Minutes left the positive momentum in the US Dollar unchanged after the committee's belief that rates are nearing their peak cycle and projections indicating a lower rate by 2024 were already widely anticipated. Moreover, some participants expressed the view that it may be necessary to maintain the policy rate at its current level for a longer period than initially anticipated.

- AUD/USD's downward trajectory influenced by strong US Dollar, dropping to 0.6701 following 'hawkish' Fed release.

- Potential golden cross on the horizon as 50-day moving average nears 200-DMA, hinting at possible uptrend to 0.6800.

- Staying below 0.6800 could lead AUD/USD towards further support levels, with 0.6650 and 0.6576/82 as key targets.

The AUD/USD dropped to a nine-day low of 0.6701 and extended its losses to four straight days, courtesy of broad US Dollar (USD) strength across the board. US economic data revealed on Wednesday, alongside the release of “hawkish” meeting minutes by the Federal Reserve, kept the pair downward pressured, trading at around 0.6724 and losing close to 0.50%.

The daily chart portrays the pair printed a three-dark-crowds chart pattern, which found support at around the 0.6700 figure. Since reaching that level, the AUD/USD trimmed some of its losses, at the same time the 50-day moving average (DMA) approaches the 200-DMA to form a golden cross. In that outcome, the pair could resume its uptrend and test the 0.6800 figure, followed by December’s monthly high of 0.6871. A breach of the latter will expose the 0.6900 mark.

On the flip side, if the AUD/USD stays below 0.6800, that could open the door to test the 0.6700 figure. Once surpassed, the next support would emerge at 0.6650, followed by the confluence of the 50 and 200-DMAs at around 0.6576/82.

AUD/USD Price Action – Daily Chart

AUD/USD Key Technical Levels

- EUR/USD looking for a foothold after backsliding into the 1.0900 handle.

- Latest meeting minutes see Fed officials attempt to cool market rate cut expectations.

- An absence of EU data on Wednesday leaves markets focusing on US PMI figures.

The EUR/USD slid into the 1.0900 handle on Wednesday after an equivocating Federal Reserve (Fed) put significant effort into not moving too far in either direction on rate cuts, keeping the US Dollar (USD) propped up amidst a broad-market recovery in the USD.

FOMC Minutes: Interest rates seem to be at or near peaks

The Fed successfully slid a softer package of rate discussions past the markets with little volatile reaction, with Fed officials noting that while rates appear to be at or near the peak, the main policy rate could hold higher for longer than markets are currently anticipating. While Fed officials agree that 2024 will see the start of the next rate cut cycle, cuts could come much later in the year than currently expected.

The Fed’s minutes from its December meeting reveal a US central bank that is much less dovish than market participants initially expected after Fed chairman Jerome Powell’s unexpected pivot at the last rate statement.

The meeting minutes, in conjunction with comments from Richmond Fed President Thomas Barkin early Wednesday, will give investors betting on a fast pace of rate cuts through 2024 plenty of food for thought to chew on as 2024 gears up for a fresh print of the US Nonfarm Payrolls (NFP) on Friday.

Friday’s US NFP is expected to show a slight downtick in jobs additions, forecast to print at 170K for December versus November’s print of 199K.

Before that, Eurozone inflation figures are due earlier Friday, and the annualized Harmonized Index of Consumer Prices (HICP) for the year ended December is expected to rebound slightly from 2.4% to 3.0% as inflation continues to grip the European continent.

EUR/USD Technical Outlook

The EUR/USD’s late-Wednesday rebound from the 1.0900 handle sees the pair bouncing from a two-week low near 1.0893. Intraday action is firmly on the low side after the EUR/USD slid straight through the 200-hour Simple Moving Average (SMA) near 1.1020, sending the pair below the 1.1000 major handle on Monday and the pair is struggling to find the bullish momentum necessary to stage a corrective recovery.

Downside momentum looks increasingly likely with daily candles slipping back towards the 200-day SMA near 1.0850 with the 50-day SMA set to confirm a bullish crossover of the longer moving average. The EUR/USD has slid nearly 2% from last week’s peak bids of 1.1195, with technical support sitting at the last swing low into 1.0750.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

- Gold slumps to two-week low after Fed minutes show no dovish tilt, despite acknowledging inflation progress.

- XAU/USD struggles with over 1% loss as US Dollar Index surges 1.11%, reflecting robust USD performance.

- Market eyes upcoming US ADP Employment data, Jobless Claims, and PMIs, with focus on December's Nonfarm Payrolls report.

Gold price slid during the last hour on Wednesday after the US Federal Reserve (Fed) released December’s meeting minutes, which didn’t deliver any dovish hints. Therefore, the Greenback resumed to the upside and reached a new 11-day high before retracing somewhat. At the time of writing, XAU/USD is trading at $2040 per troy ounce, down by more than 0.90%.

Gold prices to remain pressured as Fed officials didn’t discussed about rate cuts

The minutes suggest most of the Fed officials see rates are likely or near their peak, though “a number of participants highlighted uncertainty around how long restrictive policy would need to be maintained.” Even though participants observed progress on inflation, core services are still elevated. It should be said that several participants might want to keep rates at current levels longer than they currently anticipate.

Given the backdrop, Gold slumped to a new two-week low at around $2030.30 before jumping $6.00, to $2036, but it remains changing hands with losses of more than 1%. At the same time, the US 10-year Treasury bond yield fell two basis points, though it clings to the 3.90% threshold, while the US Dollar (USD), as measured by the US Dollar Index (DXY), gains 1.11%, sits at 102.45.

Earlier, economic data revealed by the Institute for Supply Management (ISM) showed that Manufacturing activity remained at a recessionary level for 14 straight months, while the JOLTS report revealed by the US Department of Labor showed the jobs market is cooling down.

Meanwhile, expectations for rate cuts by the Fed remained unchanged for December 2024, with market players betting the US central bank would slash rates by more than 150 basis points.

Ahead of the week, the US economic docket will feature the ADP Employment Change report, followed by Initial Jobless Claims and Flash PMIs revealed by S&P Global; all the data will be announced by Thursday. After that, Gold traders' focus will shift towards the December Nonfarm Payrolls report.

XAU/USD Price Analysis: Technical outlook

Even though the technical picture suggests the yellow metal remains bullish, a drop below the confluence of the October 27 cycle high of $2009.42 and the 100-day moving average (DMA) around that area would pave the way for testing the $2000 threshold. A breach of the latter would expose the December 13 swing low of $1973.13.

- The NZD/USD currently recovered near the 0.6245 level, trimming practically all of its daily losses.

- ISM December Manufacturing PMIs came in better than expected.

- FOMC minutes from the December meeting revealed a hawkish tilt, indicating prolonged higher rates.

The New Zealand Dollar (NZD) encountered a downtrend in Wednesday's trading, forfeiting gains against a strong US Dollar (USD), with the NZD/USD landing near 0.6225 but then recovering towards 0.6245, above the 20-day Simple Moving Average (SMA). The pair's slight slipping is primarily attributable to the strength of the USD and the influence of the Federal Open Market Committee (FOMC) minutes from the December meeting, which sounded hawkish. Strong ISM data from the US outshined weak JOLTs Job Opening figures from November.

The U.S. Bureau of Labor Statistics indicated a slight decrease in JOLT job Openings in November, falling short of the consensus estimate of 8.85M to 8.79M, despite it being marginally higher than the previous figure of 8.852M. On the positive side, the US Institute for Supply Management (ISM) Manufacturing PMI for December came in at 47.4, higher than 47.1, while the Employment index for the same month posted a figure of 48.1, exceeding the anticipated 46.1, which shows resilience in the Manufacturing sector.

In addition, the FOMC December minutes showed that policymakers acknowledged that monetary policy may be at or nearing its peak but that they consider it prudent to hold current rates for a longer period. Meanwhile, according to the CME FedWatch Tool, dovish bets on the Fed eased somewhat, but the odds of cuts in March and May are still high, above 50%. A hold in January is priced in.

NZD/USD levels to watch

The daily chart suggests the pair harbors a neutral to bearish outlook. Despite being in positive territory, the negative slope of the Relative Strength Index (RSI) can be construed as a sign of dwindling buying momentum, giving rise to a potential retreat. This is supported further by the rising red bars of the Moving Average Convergence Divergence (MACD), which generally reflects a stronger inclination towards the sellers' side.

However, examining the larger context reveals a rather bullish undertone. The pair continues to stand above the 20,100,200-day Simple Moving Averages (SMAs), indicating that the overarching control seems to be with the buyers. Despite the near-term bearish signals, the medium-to-long-term perspective shed by the position of the Simple Moving Averages (SMAs) leans more toward the optimistic end.

NZD/USD daily chart

-638399071016194325.png)

- GBP/JPY looking to reclaim 182.00 as Yen-based pairs recover ground.

- A thin economic calendar has markets focusing on broad directional flows.

- China Services PMI early Thursday could drive Asia market session risk appetite.

The GBP/JPY has climbed over 1.3% on Wednesday as the Pound Sterling (GBP) recovered recently lost ground against the Japanese Yen (JPY), rising from a two-week low near 178.75 to come within challenge range of the 182.00 handle.

FX market flows are broadly pivoting out of JPY bets, driving the Japanese Yen down across the board and making the JPY handily the worst performer of the major currency bloc for the mid-week.

The Yen is kicking off 2024 with a broad-base selloff as equity pours out of the Yen in favor of higher-yielding assets with the Bank of Japan (BoJ) firmly entrenched in their hypereasy monetary policy stance.

The Asia market session saw moderating risk appetite on Tuesday following China’s unexpected beat in Chinese Manufacturing Purchasing Managers’ Index (PMI) figures, coming in at 50.8 for December compared to November’s 50.7, a small gain but upending market forecasts of a decline to 50.4. With the Chinese Services PMI due early Thursday, a joint beat of PMI figures could see risk sentiment broadly hold higher heading into the back half of the first trading week of 2024.

GBP/JPY Technical Outlook

The Guppy’s Wednesday surge has the GBP/JPY easily clearing the 200-hour Simple Moving Average (SMA) near 180.50 as the pair gears up for a fresh run at the 182.00 handle. Despite the mid-week surge, the GBP/JPY remains firmly down from recent swing highs into 184.00 from mid-December.

Daily candlesticks reveal potential for an extended topside run after a bounce from the 200-day SMA near 179.50. The GBP/JPY could be geared for a challenge of the 50-day SMA near the 184.00 handle with the pair seeing a bullish rejection from the 200-day SMA for the first time since breaking into the high side of the long-term moving average back in April of 2023.

GBP/JPY Hourly Chart

GBP/JPY Daily Chart

GBP/JPY Technical Levels

- EUR/JPY gains traction, rising to 156.47, as JPY weakens in a quiet Eurozone and Japanese economic setting.

- For sustained upward momentum, EUR/JPY buyers need to surpass the Tenkan-Sen and 157.00 resistance levels.

- Sideways trading likely if pair remains below 157.00, with potential support at 153.85 and December low of 153.11.

The EUR/JPY bounced off Tuesday’s lows of 155.06, and rallied more than 0.70% during Wednesday's session, trading at 156.47, as the Japanese Yen (JPY) began the year on the back foot. A scarce economic docket in the Eurozone (EU) and Japan would likely leave traders adrift to market sentiment swings in the first trading week of the year.

The cross-pair remains neutral to downward biased despite registering a leg-up on Wednesday, exacerbated by a bullish-engulfing candle pattern. Nevertheless, buyers must reclaim the Tenkan-Sen at 156-72, followed by the 157.00 mark, if they want to remain hopeful of higher prices in the EUR/JPY pair. In that outcome, the EUR/JPY's next resistance would be the Kijun-Sen at 158.02. A breach of the latter will expose the Senkou Span B at 158.71.

On the flip side, if sellers keep prices below 157.00, the pair will remain trading sideways, within the 155.00-156.70 mark. Once the bottom of the range is broken, the first support would emerge at 153.85, the December 14 low, followed by the latest cycle low at 153.11, reached on December 7.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels

According to the FOMC Minutes:

- Members generally perceived the inclusion of the word "any" in remarks about potential additional firming as a way to convey their assessment that rates were probably at or close to the peak of the cycle.

- According to the projections, nearly all participants indicated that their baseline suggested a lower federal funds rate would be suitable by the conclusion of 2024.

- Additionally, several participants noted that situations could justify maintaining the policy rate at its current level for a longer duration than their current expectations.

- Silver's sharp decline to $22.89 was driven by US bond yield fluctuations and USD strength before the release of key Fed minutes.

- A potential break below the three-month support trendline could lead XAG/USD towards $22.00 and previous lows.

- Recovery above the 100-day moving average might fuel a rally, targeting key resistances at $23.64 and $24.00.

Silver plunged more than 3% on Wednesday, as US Treasury bond yields pare their earlier gains, while the Greenback (USD) exploits to the upside ahead of the release of the Federal Reserve’s December meeting minutes. At the time of writing, the XAG/USD is trading at $22.89 after hitting a daily high of $23.72.

The daily chart portrays the grey metal as neutral-biased, but if it prints a daily close below the three-month-old upslope support trendline drawn from the lows of October 2023, that could pave the way for further losses. In that outcome, the XAG/USD could dive below the $22.00 figure and test the November 13 low of $21.88, followed by the October monthly low of $20.69.

On the other hand, if Silver trims some of today’s losses and buyers reclaim the 100-day moving average (DMA) at around $23.29, that would keep buyers hopeful of higher prices, with the first resistance level emerging at the confluence of the 50 and 200-DMAs, each at $23.64 and $23.66, respectively. Once those levels are surpassed, the next resistance would be the $24.00 mark.

XAG/USD Price Action – Daily Chart

XAG/USD Technical Levels

- WTI climbed back into $73 per barrel, recovering ground from early week declines.

- OPEC is set for further supply drawdowns in the face of renewed oversupply.

- USD Crude Oil slumped to a two-week low of $69.50 before rallying 5%.

Further gains are on the cards for West Texas Intermediate (WTI) US Crude Oil after a recovery rally on Wednesday propped up barrel bids to retest the $73.00 handle as the Organization of the Petroleum Exporting Countries (OPEC) is set to bring about further production cuts in an effort to bolster flagging Crude Oil prices.

OPEC pumped an average of 28.05 barrels per day through December according to survey reporting by Bloomberg, and OPEC is expected to pursue an additional 900K bpd in production cuts, but energy markets remain unsure whether or not OPEC production caps will be enough to stave off Crude Oil oversupply from the US and other non-OPEC rivals.

Crude Oil continues to whipsaw amidst shaky production cuts

Many member nations of the 22-country OPEC+ extended alliance are already stretched to their breaking point on the amount of production cuts their government budgets can shoulder, and with OPEC lacking any mechanisms to reinforce production quotas or to punish members that flout production limits, Crude Oil traders remain concerned that production will continue to outpace slumping global crude demand.

OPEC+ will be holding a monitoring meeting to review activities in Crude Oil markets on February 1, to be followed up by a meeting of OPEC+ ministers in early June. Confidence in OPEC's ability to provide benefits for all members came under scrutiny recently after member nation Angola left the oil cartel in favor of pursuing uncapped Crude Oil production.

Crude Oil continues to catch support in the near term from Federal Reserve (Fed) rate cut expectations, and an overly dovish/hawkish showing from the Fed’s latest meeting minutes due later on Thursday could further bolster barrel bids, or send Crude Oil back down again as investors readjust expectations following the Fed’s latest meeting update.

WTI Technical Outlook

Wednesday’s rebound in WTI further highlights just how far Crude Oil has fallen; WTI remains down an eye-watering 22% from September’s peak of $93.98. Daily candlesticks remain below the 200-day Simple Moving Average (SMA) at $78.00, and a bearish cross of the 50-day SMA has baked in a technical ceiling near $76.00.

Intraday action remains capped below the 200-hour SMA near $73.50, and a bullish break to the topside will see additional technical resistance from last week’s peak near the $76.00 handle.

WTI Hourly Chart

WTI Daily Chart

WTI Technical Levels

- The USD/CHF is navigating towards the 0.8515 level, registering a modest gain of 0.3% after jumping to a daily high of 0.8555.

- The US JOLTs Job Openings for November were reported at 8.79M by the US Bureau of Labor Statistics, lower than expected.

- The US ISM Manufacturing PMI for December reported lower at 47.4, better than the 47.1 expected.

- FOMC minutes might provide additional guidance to the markets.

In Wednesday's trading session, the USD/CHF pair exhibited a bullish stance but failed to hold its momentum, which took it to a high of around 0.8555 and stabilized at 0.8515. This upward surge is largely attributed to a strengthened US Dollar following the release of mid-tier economic data from the US, which drove investors to the US Dollar. Later in the session, the Federal Reserve (Fed) will release the December meeting minutes, which may affect the pair's dynamics.

The US labor market demonstrated a slightly negative outlook, with the JOLT's Job Openings falling short of expectations. As reported by the U.S. Bureau of Labor Statistics, the figures for November came in at 8.79M, failing to meet the 8.85M consensus, while slightly lower than the previous figure of 8.85M. However, the situation of the labor sector will be better portrayed by the Nonfarm Payrolls alongside the Average Hourly Earnings and the Unemployment rate from December, to be reported on Friday.

The US dollar is regaining some of its losses as, despite the soft JOLTs figures, the US is still showcasing the strength of its economy. In that sense, December's ISM Manufacturing PMI came in at 47.4, from November's 46.7, further lagging behind market expectations of 47.1, while the Manufacturing employment index also beat expectations coming in at 48.1 vs the 46.1 expected. However, the Dollar susceptibility persists until market easing expectations adjust.

USD/CHF levels to watch

On the daily chart, indicators suggest that bears are losing ground but haven't given up yet. The positive slope in the Relative Strength Index (RSI), albeit in negative territory, suggests that buying momentum may slowly build up despite being in an overall bearish zone. This could potentially hint at a possible transition from selling to buying pressure.

In line with that, the Moving Average Convergence Divergence (MACD) prints decreasing red bars, an indication that selling pressure, despite receding, it seems to be maintaining its grip. This means that sellers still have some momentum on their side and could possibly hinder any bullish advancement in the short term.

Regarding the broader perspective of the market, bears are in command as the pair remains well below its 20,100 and 200-day Simple Moving Averages (SMAs).

USD/CHF daily chart

-638399008492723154.png)

- EUR/USD trades at around the 1.0900 lows, reacting to upbeat US ISM Manufacturing PMI and JOLTS job openings data.

- Market anticipates potential policy easing in Fed's December FOMC minutes; six rate cuts priced in by futures data.

- Germany's stable unemployment rate at 5.9% contrasts with busy EU and US economic calendars, including upcoming PMIs and jobs data.

The EUR/USD remained on the defensive since the first trading day of 2024, falling 0.27% on the day after economic data from the United States (US) suggests the economy remains robust, though the labor market cooled down. At the time of writing, the major is trading at 1.0910 after posting a daily high of 1.0965.

Euro struggles as US data signals robust economy

The US economic agenda revealed upbeat data. The Institute for Supply Management (ISM) announced December’s Manufacturing PMI improved to 47.4, above forecasts and November’s readings, but it remained in recessionary territory for 14 straight months. At the same time, the US Bureau of Labor Statistics (BLS), revealed the JOLTS report, which showed a slight increase to 8.79 million, below the anticipated 8.85 million.

Aside from this, traders are awaiting the release of December’s Federal Open Market Committee (FOMC) minutes. In that meeting, Fed officials opened the door to ease monetary policy in 2024, with the majority projecting three 25 basis points rate cuts toward the end of the year. Nevertheless, according to futures data from the Chicago Board of Trade (CBOT), market participants had priced in six rate cuts.

Meanwhile, Federal Reserve’s (Fed) speakers had begun to cross newswires, led by the Richmond Fed President Thomas Barkin. He said that although the US central bank is making real progress on curbing stickier inflation, and the economy remains robust, the risks of missing a soft landing remain.

Across the pond, the Eurozone’s (EU) economic docket featured Germany’s employment data, which showed the unemployment rate stood pat at 5.9%, as estimated by economists polled by Reuters.

Ahead of the week, the EU’s calendar will feature S&P Services and Composite PMIs on Thursday. In the US, Flash PMIs would be updated, and jobs data could rock the boat, with ADP and Initial Jobless Claims pending to be released.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart depicts the formation of a golden cross, which could pave the way for further gains, but a three-dark crows chart pattern could keep the pair downward pressured. Nevertheless, sellers failure to push prices below 1.0900, and buyers could lift the exchange rate to test a 32-month-old downslope trendline that passes around 1.1025/40.

- GBP/USD struggles to find momentum for a recovery after Tuesday’s backslide.

- UK data is thin this week, with investors focusing on US labor and output figures.

- US ISM PMI beat the street, underlying manufacturing costs outlook eases further.

The GBP/USD is cycling near 1.2650, holding steady despite a lack of recovery from Tuesday’s sharp decline. Broader markets are largely focused on US data on Wednesday, with the US ISM Manufacturing Purchasing Managers’ Index (PMI) leading the charge.

The US USM Manufacturing PMI for December beat expectations, but still remains in contraction territory after printing at 47.4 versus the forecast 47.1 in a slight rebound from November’s 46.7.

Read More: US ISM Manufacturing surprised to the upside in December

The US ISM Manufacturing Employment Index for December also beat expectations, coming in at 48.1 against the forecast 46.1, a healthy uptick from the previous four-month low of 45.8. ISM Manufacturing Prices Paid settled lower than expected, coming in at 45.2 compared to the forecast 47.5, and easing back even further from November’s 49.9 as producer inflation continues to cool.

Wednesday’s big data beat will come from the Federal Reserve’s (Fed) latest meeting minutes, slated to release towards the end of the US session at 19:00 GMT. Fed officials have been working overtime trying to throw cold water on red-hot market expectations that broke off the chain after Fed Chairman Jerome Powell’s perceived rate pivot in December, but results have been mixed and market expectations of a more furious pace of rate cuts in 2024 have only slightly subsided.

With the meeting minutes drafted after Fed chair Powell’s latest public appearance, investors can expect the meeting review to come in a carefully wrapped expectations-managing package.

Thursday brings another round of ADP Employment Change numbers for December as a preview of Friday’s US Nonfarm Payrolls (NFP), but the indicator has had a shaky relationship with the larger, heftier, and later data release as of late, and investors should expect the numbers to mix on their respective results.

Thursday’s ADP Employment Change is forecast to tick upwards from 103K to 115K, while Friday’s NFP data is expected to soften from 199K to 168K. Revisions to older data should be expected.

GBP/USD Technical Outlook

The Pound Sterling remains sharply off near-term highs against the US Dollar, with the GBP/USD down nearly 1.5% from last week’s peak of 1.2828. Intraday action is set to face bearish technical pressure following a downside cross of the 50-hour and 200-hour Simple Moving Averages (SMA), and the 1.2700 handle represents the level for bulls to beat.

Things are notably more bullish on the daily candlesticks with the GBP/USD trading on the high side of the 200-day SMA near 1.2550, and the 50-day SMA is set for a bullish cross of the longer moving average. On the low side, technical indicators have been softening since the start of December, and further topside momentum sees growing headwinds with higher highs making notably less progress than at the outset of the bullish rollover from October’s lows near 1.2050.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

- The DXY Index sees strong gains and recovers above the 20-day SMA.

- US JOLTs Jobs Openings from November came in below expectations, while ISM’s December Manufacturing PMI came in higher than anticipated.

- Dovish bets on the Fed eased somewhat but are still high.

The US Dollar (USD) Index trades with noteworthy gains at 102.60, having successfully reclaimed the 20-day Simple Moving Average (SMA). This comes after the dovish bets on the Federal Reserve (Fed) eased somewhat following the release of the Institute Supply Management (ISM) Manufacturing PMI for December and the JOLTs Job Openings data for November. At 19:00 GMT, the Fed will release the minutes from its December meeting.

The Fed's dovish stance in its last 2023 meeting, welcoming cooling inflation and dismissing rate hikes in 2024, was positively received by markets that dumped the US Dollar in the last session. However, despite investors anticipating high odds of rate cuts in March and May 2023, incoming data could modify these expectations and focus shifts to December labor reports.

Daily digest market movers: US Dollar gains momentum ahead of FOMC minutes, labor market data eyed

- The ISM's Manufacturing PMI for December climbed to 47.4, slightly above the consensus of 47.1.

- JOLTs Job Openings reported by the U.S Bureau of Labor Statistics came in at 8.75M, below the expected 8.85M.

- Market participants are eagerly awaiting reports such as US Nonfarm Payrolls, Average Hourly Earnings, Unemployment Rate, and the Automatic Data Processing Inc. (ADP) Employment Change from December to continue placing their bets on the Fed.

- The Federal Open Market Committee (FOMC) minutes might provide additional guidance to investors.

- Market speculation, as inferred from the CME FedWatch Tool, suggests that the odds of rate cuts in March and May have eased but are still high. A hold in January is priced in.

Technical Analysis: DXY index short-term indicators gain traction, outlook still fragile

The Relative Strength Index (RSI), with its position in positive territory and positive slope, indicates a strengthening buying momentum in the DXY, showing that buyers may continue pushing up the currency index price. This is reinforced by the rising green bars of the Moving Average Convergence Divergence (MACD), which suggest a shift towards bullish territory.

However, the picture isn't entirely optimistic, as seen in the Simple Moving Averages (SMAs). The index's position above the 20-day SMA underscores the short-term buying momentum, but its position below the 100 and 200-day SMAs serves as a reminder of the sustained selling strength that continues to prevail on broader time frames. This suggests a bearish undercurrent that may need to gain more momentum before the situation could tip in favor of sellers.

Support levels: 102.40 (20-day SMA),102.00, 101.50.

Resistance levels: 102.70, 102.90, 103.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Canadian Dollar slips further on Wednesday as US Dollar bids firm up.

- Canada economic data on hold until Friday, to be overshadowed by US NFP.

- US ISM PMI beat expectations but still on the contractionary side.

The Canadian Dollar (CAD) is falling for the fifth consecutive trading day against the US Dollar (USD), with the Greenback getting bolstered against the broader FX market after the US ISM Manufacturing Purchasing Managers’ Index (PMI) for December came in above expectations, despite still printing in contractionary territory below the 50.0 midline.

Economic data from Canada is once again absent from the data docket on Wednesday, and Friday’s Canadian Unemployment Rate and Average Hourly Wages are set to be entirely eclipsed by the US Nonfarm Payrolls (NFP) for December.

Daily digest market movers: Canadian Dollar giving up further ground amidst USD push

- Despite declines against the outperforming Greenback and Pound Sterling (GBP), the CAD is in a firm position against the rest of the majors.

- The Canadian Dollar is down around a fifth of a percent against the USD and a third of a percent against the GBP.

- The Aussie (AUD) has given up around 0.4% against the Loonie, while the Yen (JPY) has retreated nearly three-quarters of a percent against the Canadian Dollar.

- The US ISM Manufacturing PMI for December printed at 47.4, beating the market forecast of 47.1 and climbing over November’s print of 46.7.

- The US JOLTS Job Openings in November showed less hiring potential than expected, with 8.79 million jobs available versus the forecast 8.85 million. October’s JOLTS openings were also revised up slightly from 8.733 million to 8.852 million.

- Investors will note that JOLTS has a small sample size that leaves the data prone to volatility, as well as the published figures being subject to revision up to five years after publication.

- Wednesday’s key data release comes towards the end of the US trading session when the Federal Reserve (Fed) drops their latest meeting minutes at 19:00 GMT.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.31% | -0.12% | 0.20% | 0.70% | 0.92% | 0.25% | 0.29% | |

| EUR | -0.31% | -0.44% | -0.12% | 0.38% | 0.61% | -0.07% | -0.02% | |

| GBP | 0.12% | 0.44% | 0.32% | 0.82% | 1.04% | 0.37% | 0.41% | |

| CAD | -0.19% | 0.12% | -0.31% | 0.51% | 0.74% | 0.07% | 0.11% | |

| AUD | -0.70% | -0.36% | -0.82% | -0.50% | 0.24% | -0.45% | -0.40% | |

| JPY | -0.93% | -0.64% | -1.06% | -0.73% | -0.22% | -0.70% | -0.63% | |

| NZD | -0.26% | 0.06% | -0.37% | -0.05% | 0.44% | 0.68% | 0.05% | |

| CHF | -0.29% | 0.03% | -0.42% | -0.10% | 0.40% | 0.63% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar heading for a fifth straight day of losses

The Canadian Dollar (CAD) is slipping back against the US Dollar, extending recent declines and driving the USD/CAD pair further above the 200-hour Simple Moving Average (SMA). The pair is set for a fresh challenge of the 1.3400 level, provided near-term action continues to catch support from the bullish crossover of the 50-hour and 200-hour SMAs near 1.3275.

Daily candlesticks have the USD/CAD extending a bullish correction into a fifth consecutive trading day, but the pair remains firmly below the 200-day SMA near 1.3500. Despite this, technical indicators are still recovering from getting pinned deep into oversold territory after the pair’s multi-week decline from November’s peak of 1.3899. Further room to run could be uncovered before the 50-day SMA manages to make a bearish cross of the 200-day SMA.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- USD/JPY climbs to 143.66, buoyed by US 10-year bond yield surpassing 4% and positive ISM Manufacturing PMI data.

- JOLTS report shows slight job opening increase; market anticipates December FOMC minutes for Fed's rate cut insights.

- Japan's financial markets to reopen post-holiday, facing challenges from a recent earthquake and awaited Manufacturing PMI data.

The USD/JPY rises sharply during the North American session after economic data from the United States (US) prompted investors to extend the US bond sell-off, as the US 10-year bond yield is back above the 4% threshold. Therefore, the major is prolonging its gains of more than 1.20%, trading at 143.66.

USD/JPY gains more than 1.20% as the US 10-year bond yield surpasses 4%, market await Fed minutes

The US economic calendar revealed that business activity is recovering slightly, as the ISM Manufacturing PMI was 47.4, exceeding forecasts of 47.1 November’s 46.7 reading. According to the ISM, a PMI reading below 48.7 over some time generally indicates a contraction of the economy as a whole.

The November Job Openings and Labor Turnover Survey (JOLTS) report indicated a slight increase to 8.79 million, below the anticipated 8.85 million. Additionally, the data for October was revised upwards to 8.852 million.

Meanwhile, Federal Reserve’s (Fed) speakers had begun to cross newswires, led by the Richmond Fed President Thomas Barkin. He said that although the US central bank is making real progress on curbing stickier inflation, and the economy remains robust, the risks of missing a soft landing remain.

Even though the USD/JPY is skyrocketing during Wednesday’s session, upside risks remain, with additional US economic data pending to be released. The Federal Reserve is expected to reveal December’s Federal Open Market Committee (FOMC) minutes, which would be digested by investors looking for rate cut discussions or any pushback by the “hawks” left at the US central bank.

In the meantime, traders remain aggressively pricing in more than 150 basis points of rate cuts by the Fed, according to futures data provided by the Chicago Board of Trade (CBOT). The odds for a rate cut in March stand at around 80%, but for May, it is fully priced in.

In Japan, the financial markets would re-open following a holiday and a bumpy start to 2024, as the country was hit by a 7.6 magnitude earthquake on January 1. Its economic docket will feature the release of the Jibun Bank Manufacturing PMI for December.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart depicts the pair as downward biased despite posting a leg-up of more than 140 pips, above the 143.00 figure. On the upside, buyers need to reclaim the 144.00 figure to remain hopeful of higher prices but would face strong resistance at the Kijun-Sen price level at 144.54. On the flip side, if sellers step in and drag prices below 143.00, that would pave the way for a resumption of the ongoing downtrend, with the next support seen at December 28 low of 140.24.

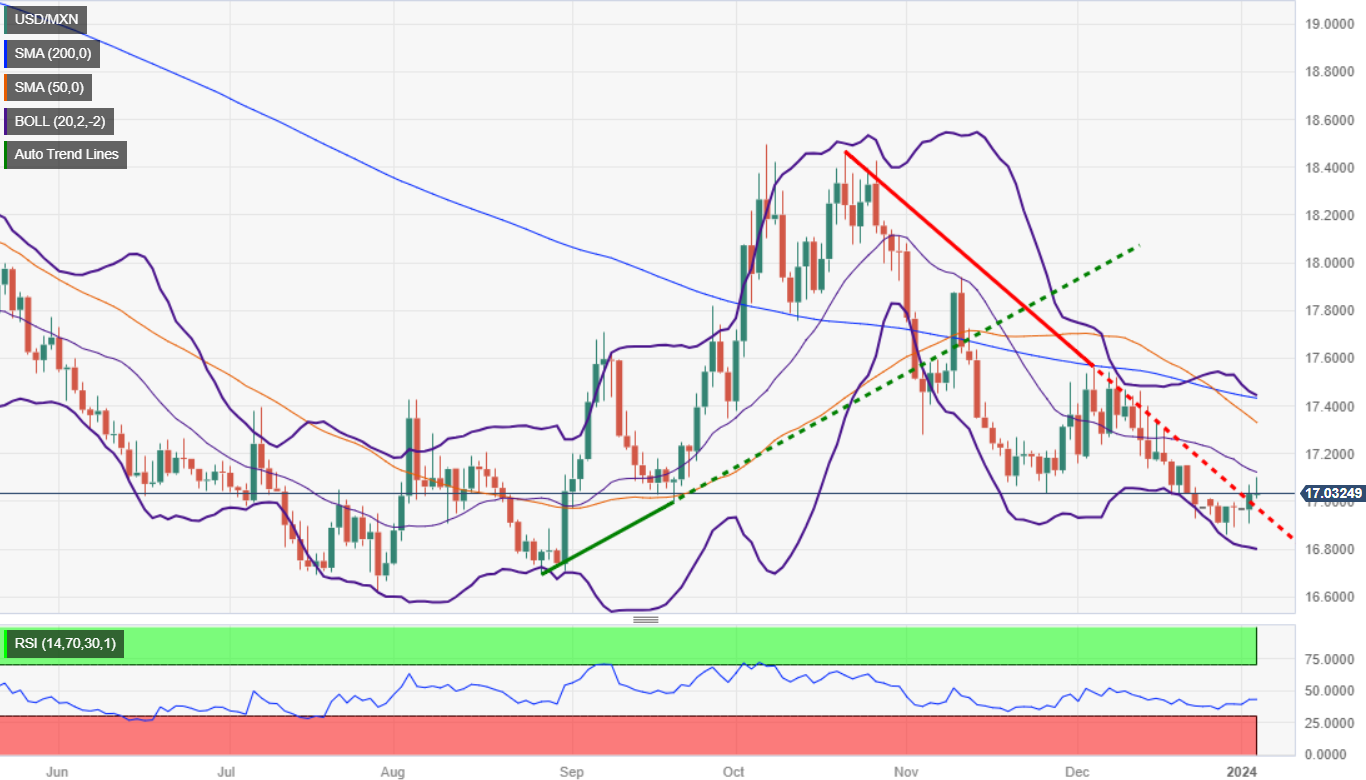

- Mexican Peso at the mercy of US economic data, with traders waiting for the Fed’s last meeting minutes.

- Mexico's Manufacturing PMI dips to 52.0, exerting pressure on the Peso amid positive business confidence data.

- USD/MXN recovers to over 17.00 after a dip, fueled by a rise in US Treasury yields and strong sentiment towards the US Dollar

The Mexican Peso (MXN) began the year on a lower note against the US Dollar (USD) after the exotic pair dipped to a three-month low on December 28 of 16.86. Nevertheless, a rise in US Treasury Bond yields and overall bullish sentiment towards the Greenback (USD) underpins the pair above the 17.05 area for a 0.21% daily gain.

On Tuesday, Mexico’s economic docket featured the S&P Global Manufacturing PMI for December, which printed 52.0, below November’s 52.5, and weighed on the Mexican currency. During the day, business confidence improved while USD/MXN traders digested economic data from the United States (US) revealed at around 15:00 GMT. However, market players await the release of the latest Federal Reserve’s (Fed) meeting minutes.

Daily digest market movers: Mexican Peso losses steam on positive US data

- Commentary from Richmond Federal Reserve (Fed) President Thomas Barkin supported the US Dollar after he stated the US central bank is making real progress in taming inflation. He added that although the economy is headed for a soft landing, risks remain, adding that the potential for additional rate hikes is on the table.

- US economic docket revealed the ISM Manufacturing PMI came in at 47.4, exceeding expectations of 47.1, while the prior reading was 46.7.

- At the same time, the November Job Openings and Labor Turnover Survey (JOLTS) report rose less than estimates of 8.85 million to 8.79 million, while October’s figures were upwardly revised to 8.852 million.

- Later, December’s Federal Open Market Committee (FOMC) minutes will be scrutinized by traders, following Federal Reserve Chairman Jerome Powell’s dovish pivot that fueled a stock rally towards the end of 2023. Fed officials estimate three rate cuts toward the end of December 2024, as depicted by the Summary of Economic Projections (SEP).

- Money market futures data provided by the Chicago Board of Trade (CBOT) shows that traders remain confident the Fed would slash rates by 150 basis points towards the year’s end.

Technical analysis: Mexican Peso stays bearish despite USD/MXN buyers' effort

From a technical perspective, the USD/MXN remains bearishly biased, though sellers need a daily close below the November 27 low of 17.03 to increase their chances of pushing the price back below the 17.00 figure. Once achieved, that could pave the way to test the waters at around 16.86, ahead of falling toward last year’s low of 16.62.

On the flip side, if USD/MXN stays above the 17.00 figure, that could pave the way for a move toward the 17.37-17.43 area, the confluence of the 50, 100, and 200-day Simple Moving Averages (SMAs). If that area is surpassed, expect the USD/MXN to reach the psychological 17.50 area, ahead of the November 10 high at 17.93.

Also read: Mexican Peso Price Annual Forecast: Which factor would impact most in 2024, economics or politics?

USD/MXN Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Economic activity in the manufacturing sector expanded in December for the second straight month. The ISM Manufacturing PMI improved to 47.4 from 46.7 in the previous month, surpassing at the same time market consensus at 47.1.

Extra details of the release showed the ISM Manufacturing Employment rose to 48.1 (from 45.8), ISM Manufacturing New Orders eased to 47.1 and finally ISM Manufacturing Prices decreased to 45.2.

Market reaction

The USD Index (DX) pulled back from the highest level in almost three weeks near 102.60 to the 102.30 region soon after the release. The knee-jerk also followed the lower-than-expected reading from the November’s JOLTs Job Openings (8.79M).

- Silver price plunges to near $23.15 as appeal for bullions fade ahead of FOMC minutes.

- Investors reconsider Fed’s rate cut bets amid robust US economic prospects.

- More downside in Silver is likely amid a H&S breakdown.

Silver price (XAG/USD) fell vertically to near $23.15 as investors rush for safe-haven assets in the early New York session. The white metal is heavily dump by the market participants as investors have started reconsidering their bets in favour of early rate cuts by the Federal Reserve (Fed).

The S&P500 is expected to open on a weak note, portraying a significant decline in the risk-appetite of the market participants. The US Dollar Index (DXY) has rebounded to near its two-week high around 102.55 as investors turn cautious ahead of the Federal Open Market Committee (FOMC) minutes and the United States Manufacturing PMI to be reported by the Institute of Supply Management (ISM) for December.

As per the CME Fedwatch tool, chances for the Fed reducing interest rates by 25 basis points (bps) to 5.00-5.25% in the March monetary policy meeting have dropped to 65% vs. 72% recorded on Tuesday.

Investors have reconsidered Fed’s early rate bets as they mulls over resilient US economic prospects, which could delay ‘rate-cut’ campaign.

On the economic data front, investors await the US ISM Manufacturing PMI, which is seen higher at 47.1 vs. the former reading of 46.7.

Silver technical analysis

Silver price witnesses a steep fall after a breakdown of the Head and Shoulder chart pattern formed on a four-hour scale. The Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates that a bearish momentum has been triggered.

Silver four-hour chart

-638398875619522808.png)

Richmond Federal Reserve President Thomas Barkin said on Wednesday that they are making real progress on inflation while the economy remains healthy, per Reuters.

Barkin added that they can see the case for a soft landing developing in the data but noted that it was not 'inevitable.'

He further explained that risks to soft landing include delayed impact of high interest rates on credit, outside shocks, services inflation getting stuck at a high levels and demand remaining strong. "That's why the potential for additional rate hikes remains on the table," Barkin said.

Market reaction

The US Dollar preserves its strength following these comments and the US Dollar Index was last seen rising 0.3% on the day at 102.52.

- USD/CAD advances to near 1.3350 as investors’ risk-appetite fades.

- The FOMC minutes will provide outlook on inflation and interest rates.

- Canadian jobless rate is seen higher at 5.9% vs. 5.8% in November.

The USD/CAD pair jumps to near the crucial resistance of 1.3350 in the late London session. The Loonie asset recovers swiftly, following footprints of the US Dollar Index (DXY) amid caution among market participants ahead of the Federal Open Market Committee (FOMC) minutes and the United States ISM Manufacturing PMI for December.

S&P500 futures have generated nominal losses in the European session, portraying further decline in the risk-appetite of the market participants. The USD Index advances to near 102.50 as chances of a likely rate cut decision by the Federal Reserve (Fed) from March have eased slightly. The 10-year US Treasury yields have extended their upside to near 4%.

The FOMC minutes will demonstrate how much policymakers are interested in reducing interest rates. Meanwhile, the US factory data will be keenly watched. As per the preliminary estimates, the Manufacturing PMI is seen higher at 47.1 from the prior reading of 46.7 but will remain below the 50.0 threshold consecutively for 14th month.

In addition to that, US JOLTS Job Openings for November will be in focus. Investors have projected that US employers posted 8.85M jobs, which are higher than 8.733M postings recorded in October.

On the Canadian Dollar front, investors await the employment data for December, which will be published on Friday. As per the estimates, the Unemployment Rate rose to 5.9% against the former reading of 5.85. Number of job-seekers employed by Canadian employers were 13.5K, lower than 24.9K additions in November.

- USD/CHF advances above 0.8500 amid a sharp recovery in the US Dollar.

- Investors’ risk-appetite trims ahead of the FOMC minutes.

- USD/CHF aims stabilization above 0.8500 for further upside.

The USD/CHF pair delivers a decisive break above the psychological resistance of 0.8500 in the European session. The Swiss franc asset has extended its recovery to near 0.8520 amid a sharp rebound by the US Dollar Index (DXY) ahead of the Federal Open Market Committee (FOMC) minutes and the Manufacturing PMI data for December by the Institute of Supply Management (ISM).

The market mood has turned risk-averse amid caution that absence of discussions of interest rate cuts from policymakers in the FOMC minutes of December’s monetary policy could spoil recent recovery in risk-perceived assets.

For the ISM Manufacturing PMI, investors see a nominal recovery to 47.1 vs. the former reading of 46.7. The economic data is expected to remain below the 50.0 threshold for the 14th straight month.

On the Swiss Franc front, the Manufacturing PMI for December improved to 43.0 vs. the former reading of 42.1.

USD/CHF advances swiftly after delivering a breakout of the consolidation formed in a narrow range around 0.8500. The Swiss Franc asset has climbed above the horizontal resistance plotted from 22 December 2023 low at 0.8514. Sustainability above the same would strengthen the US Dollar bulls.

Upward-sloping 50-period Exponential Moving Average (EMA) indicates strength in the near-term trend.

The Relative Strength Index (RSI) (14) oscillates in the bullish range of 60.00-80.00, indicating strength in the upside momentum.

Further upside above December 26 high near 0.8580 would drive the asset towards the round-level resistance of 0.8600, followed by December 21 high at 0.8633.

On the contrary, a downside move below December 28 high around 0.8450 would drag the asset towards the round-level support of 0.8400 and December 29 low of 0.8357.

USD/CHF hourly chart

-638398752715416950.png)

- Gold price pares intraday gains as bets in favour of early rate cuts by the Fed drop slightly.

- Action in the FX domain could turn volatile as FOMC Minutes and Manufacturing PMI are due for release.

- The US Dollar Index recovers as upbeat sentiment-based rally pauses.

Gold price (XAU/USD) surrenders gains generated in the early Asian session amid caution ahead of the Federal Open Market Committee (FOMC) minutes and crucial data from the United States, namely the Institute for Supply Management (ISM) Manufacturing PMI for December and JOLTS Job Openings data for November.

The precious metal faces selling pressure as investors reconsider their bets in favour of a rate cut by the Federal Reserve (Fed) in March. An absence of significant discussions about rate cuts by Fed policymakers in the FOMC minutes will dampen the near-term appeal for Gold and support the US Dollar (USD) and Treasury yields.

On the economic data front, the ISM PMI is expected to signal that the US manufacturing sector remained in a contraction trajectory for the 14th month in a row. Meanwhile, higher job postings by US employers will indicate a steady labor demand.

Daily Digest Market Movers: Gold price surrenders gains ahead of FOMC minutes

- Gold price surrenders the majority of gains generated on early Wednesday as prospects of early rate cuts by the Federal Reserve have trimmed slightly ahead of the publication of the FOMC minutes.

- As per the CME Fedwatch tool, chances of an interest rate cut by 25 basis points (bps) in March have dropped to 67% from 72%.

- The FOMC minutes will provide a detailed explanation about the decision to maintain rates on hold in December’s monetary policy for the third time in a row.

- Apart from that, the outlook on interest rates and the underlying inflation for 2024 and 2025 will be keenly watched.

- Less discussions about rate cuts among policymakers may dampen the near-term appeal for Gold and demand for safe-haven assets will heat up.

- Fed Chair Jerome Powell, in its monetary policy statement, said rate cuts will be a topic of discussion going forward. Cues favouring a delay in rate cuts may stem a dismal market mood.

- In addition to the FOMC minutes, investors will keep an eye on the ISM Manufacturing PMI for December, which will be published at 15:00 GMT.

- The Manufacturing PMI is seen at 47.1, below the 50.0 threshold for the 14th straight month, but higher than the former reading of 46.7. A figure below 50.0 signals contraction in the manufacturing sector.

- Investors will also focus on the fresh orders for the manufacturing sector, which will provide the outlook for 2024.

- Apart from that, the US Bureau of Labor Statistics will publish the JOLTS Job openings data for November. Estimates indicate that job postings were higher at 8.85M against the former reading of 8.733M.

- Meanwhile, a sharp recovery in the US Treasury yields has capped the upside in Gold prices. The 10-year US Treasury yields have recovered to nearly 4.0% as investors are realizing that robust strength in the United States economy in 2024 could delay rate cuts.

- The US Dollar Index (DXY) clings to gains near 102.20 as investors are uncertain in a data-packed week.

- After the ISM factory data, investors will look for the crucial labour market data for December. On Thursday, the Automatic Data Processing (ADP) Employment data will provide fresh cues about labour demand.

- As per estimates, private US employers added 115K job-seekers in December against 103K payrolls created in November.

Technical Analysis: Gold price falls to near $2,060

Gold price falls back slightly below the crucial support of $2,060 after failing to sustain above the $2,080 resistance. The precious metal trades at make or a break ahead of crucial US events. A breakdown below Tuesday’s low of $2,056 could unveil fresh downside for the Gold price towards $2,045. Upward-sloping 20-day and 50-day Exponential Moving Averages (EMAs) indicate that the overall trend is still bullish.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- EUR/USD gains ground amid upbeat US Dollar.