- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/CHF is expected to extend the downside to near 0.8900 amid weak appeal for the USD Index as safe-haven.

- A consecutive 25 bps interest rate hike is expected to be followed by neutral guidance from the Fed.

- US yields are under immense pressure after Treasury estimated that it would be out of funds for payments by early June.

The USD/CHF pair is struggling to defend the immediate support of 0.8920 in the early Asian session. The Swiss franc asset has faced immense selling pressure after a perpendicular dive in the US Dollar Index (DXY). The major is expected to decline further towards the round-level support of 0.8900 as debt-ceiling concerns have faded the appeal of the USD Index as safe-haven.

S&P500 futures are subdued in Asia after a bearish Tuesday. Investors dumped United States equities amid uncertainty over the interest rate policy of the Federal Reserve (Fed). Also, the market mood is quite risk averse as a raise in the debt ceiling will impact the long-term outlook of the US economy.

The US Treasury yields are under immense pressure after US Treasury Secretary Janet Yellen estimated that Treasury would be out of funds for payments by early June. Concerns over the debt ceiling stemmed after US President Joe Biden showed reluctance in meeting with US Senate McCarthy as House Republicans demanded big cuts in the President’s spending initiatives against the raising of the debt ceiling. At the time of writing, the 10-year US Treasury yields have dropped to near 3.43%.

As per the CME Fedwatch tool, Fed chair Jerome Powell is expected to raise interest rates by 25 basis points (bps) to 5.00-5.25%. A consecutive 25 bps interest rate hike is expected to be followed by neutral guidance as US Manufacturing PMI is consistently showing contraction, the growth rate has slowed down, and labor market conditions are losing resilience.

On the Swiss franc front, Friday’s inflation data (April) will be keenly watched. The monthly Consumer Price Index (CPI) is expected to accelerate by 0.5% at a higher pace than the prior recording of 0.2%. While annual CPI is expected to soften to 2.8% vs. the prior release of 2.9%.

- US Dollar Index remains pressured after reversing from three-week high.

- Fears of easing US job market strength, limited scope for Fed hawks amid recession woes challenge DXY bulls.

- Banking sector fears, hopes of no policy pivot in 2023 put a floor under greenback.

- US ADP Employment Change, PMIs for April may also entertain traders but FOMC will be the key.

US Dollar Index (DXY) takes offers to extend the previous day’s U-turn from a three-week high while refreshing intraday low near 101.85 during the early hours of Wednesday’s Asian session. In doing so, the greenback’s gauge versus the six major currencies bears the burden of mixed US data, as well as a cautious mood ahead of today’s Federal Open Market Committee (FOMC) monetary policy meeting announcements.

On Tuesday, US Factory Orders for March improved to 0.9% versus 0.8% expected and -1.1% (revised) previous readings. However, the US JOLTS Job Openings for the said month eased to 9.59M from 9.974M prior and 9.775M market forecasts.

It’s worth noting that the easing of the US Gross Domestic Product (GDP) joined mixed ISM PMI details to prod the DXY bulls previously. However, upbeat inflation clues defend the Fed hawks, which in turn suggests the US central bank is all set for a 0.25% rate hike. As a result, traders are more interested in hearing about the Fed’s policy pivot, previously anticipated to take place in 2023, for clear US Dollar Index guidance.

Elsewhere, fresh selling of PacWest Bancorp and Western Alliance Bancorp shares triggered banking fears across the board and put a floor under the US Dollar price, especially amid hawkish Fed bets. Additionally weighing on the market sentiment and challenging the US Dollar could be the US policymakers’ struggle to avoid debt ceiling expiration, looming in June versus previous expectations of July expiry.

Amid these plays, Wall Street closed in the red and the US Treasury bond yields also dropped whereas S&P 500 Futures also print mild losses at the latest.

Looking ahead, the US ADP Employment Change for April and the ISM Services PMI for the said month can entertain DXY traders. However, major attention will be given to the Federal Reserve (Fed) announcements and the banking headlines for clear guidance.

Also read: FOMC Meeting Preview: Powell to keep every door open, surprises not out of the table after RBA

Technical analysis

Despite the latest retreat, the US Dollar Index (DXY) price remains beyond the 101.80-75 support confluence comprising the 21-DMA and previous resistance line from late March, which in turn keeps the buyers hopeful.

US Senate Banking Committee announces May 18 hearing on State of the banking and credit union industry

More to come

- GBP/USD is displaying a sideways auction as the focus has shifted to Fed policy.

- The BoE policymakers are preparing for a 12th consecutive interest rate hike to tame double-digit UK inflation.

- The current variation of the Rising Channel lacks strength and is signaling a loss in the upside momentum.

The GBP/USD pair is demonstrating a sideways performance after around 1.2470 after a recovery move from 1.2440 in the early Toyo session. The Cable has defended its crucial support of 1.2440 for now, however, uncertainty will remain ahead of the interest rate policy by the Federal Reserve (Fed).

S&P500 futures have added more losses in early Asia after an extremely bearish Tuesday as concerns over a delay in the United States debt ceiling and deepening fears of a recession ahead of the Fed policy have dented the confidence of investors.

The US Dollar Index (DXY) is consolidating below 102.00 after a healthy correction from 102.30 as an extension in the debt ceiling would impact the long-term outlook of the US economy.

On the Pound Sterling front, Bank of England (BoE) policymakers are preparing for a 12th consecutive interest rate hike to tame double-digit United Kingdom inflation.

GBP/USD is auctioning in a Rising Channel chart pattern on a two-hour scale. The current variation of the Rising Channel lacks strength and is signaling a loss in the upside momentum. The upper portion of the aforementioned chart pattern is plotted from April 04 high at 1.2525 while the lower portion is placed from April 03 low at 1.2275.

The Cable is below the 20-period Exponential Moving Average (EMA) at 1.2488, indicating that US Dollar bulls have an upper hand.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, signaling an action only after the Fed’s monetary policy.

A decisive move above April 14 high at 1.2546 will drive the asset towards a fresh 10-month high at 1.2597, which is 08 June 2022 high. A breach of the latter will expose the asset to May 27 high at 1.2667.

On the flip side, a slippage below April 10 low at 1.2345 will expose the asset to March 30 low at 1.2294 followed by March 27 low at 1.2219.

GBP/USD two-hour chart

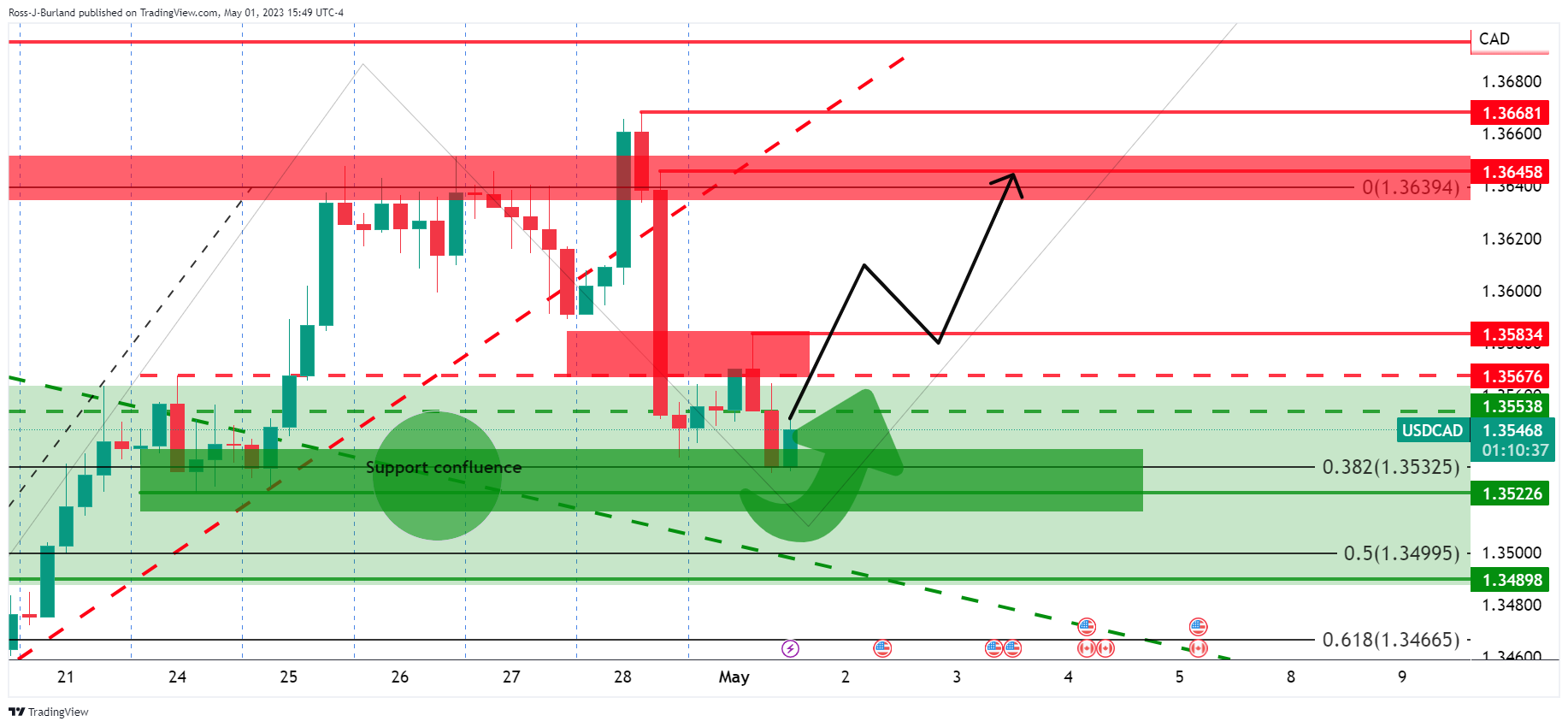

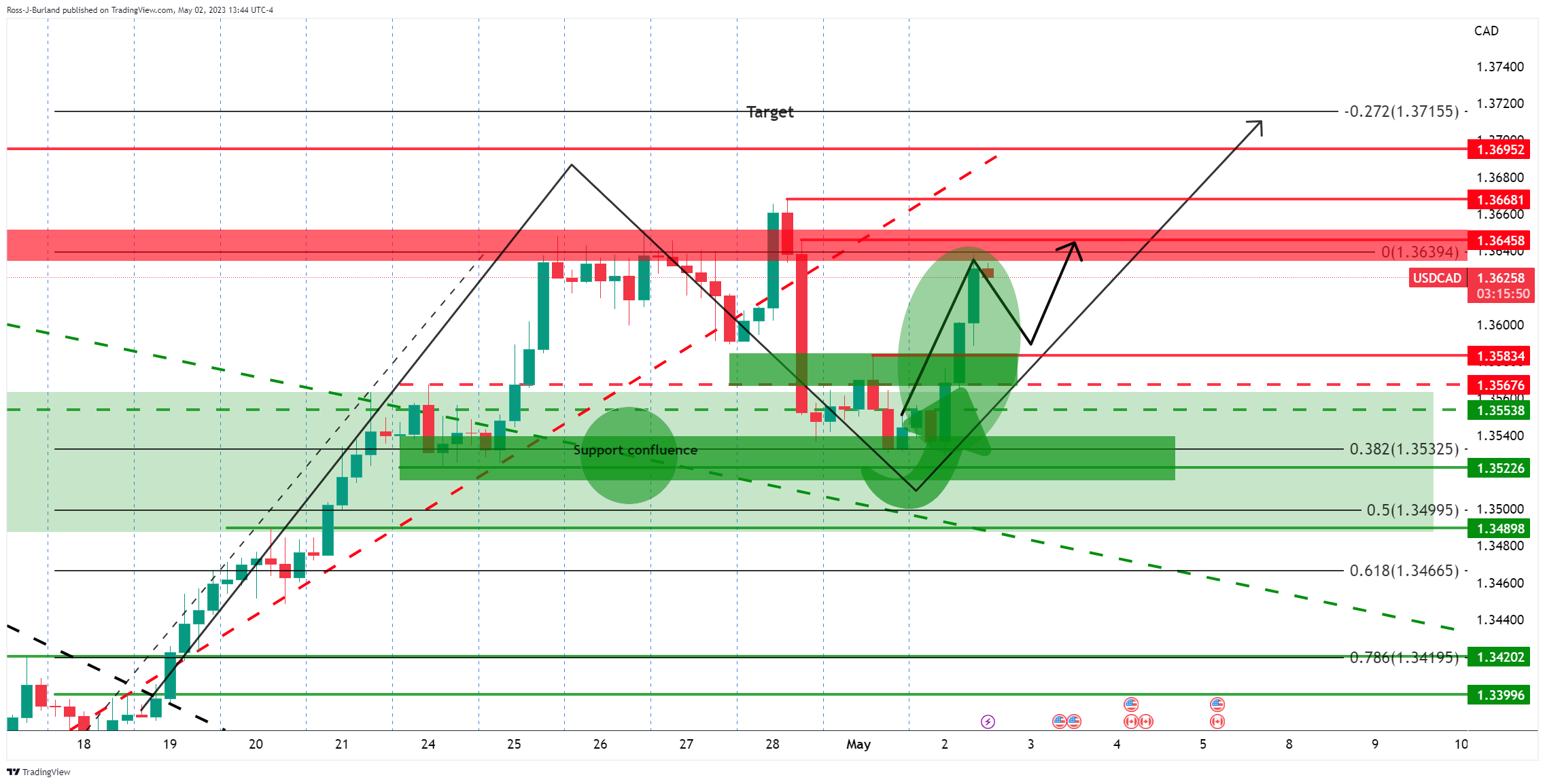

- USD/CAD remains sidelined after rising the most in a week and snapping three-day downtrend.

- Oil price slumps to five-week low on risk aversion, API inventories.

- US ADP Employment Change, ISM Services PMI can entertain traders ahead of FOMC.

- Loonie sellers seek Fed’s policy pivot hints to retake control as 0.25% rate hike is almost given.

USD/CAD seesaws around 1.3625-30 during the initial hours of Wednesday’s Asian trading session, following the heaviest daily jump in a week, as traders await the key US data/events. That said, the Loonie pair cheered a slump in the WTI crude oil prices, Canada’s main exports, together with the risk-off mood, the previous day.

WTI crude oil remains depressed at the lowest levels in five weeks, licking its wounds near $71.50 by the press time, amid a generally lackluster early trading session of the day. The energy benchmark dropped the most in eight months the previous day as the market’s fears from banking fallouts and hawkish central bank actions joined the slower-than-previous draw of the weekly Oil inventories per the industry report. That said, the American Petroleum Institute (API) said that the Weekly Crude Oil Stock declined by -3.939M during the week ended on April 28 versus -6.083M prior.

Talking about the risks, fresh selling of PacWest Bancorp and Western Alliance Bancorp shares triggered banking fears across the board and put a floor under the US Dollar price, especially amid hawkish Fed bets. However, mixed US data and softer US Treasury bond yields prod the greenback buyers ahead of the key US factors up for publishing.

On the other hand, the US Dollar Index (DXY) initially rushed to refresh a three-week high before retreating to 102.00 amid mixed US data. That said, US Factory Orders for March improved to 0.9% versus 0.8% expected and -1.1% (revised) previous readings. Elsewhere, the US JOLTS Job Openings for the said month eased to 9.59M from 9.974M prior and 9.775M market forecasts.

Against this backdrop, Wall Street closed in the red and the US Treasury bond yields also dropped. On the same line, S&P 500 Futures also print mild losses at the latest.

Moving on, the US ADP Employment Change for April and the ISM Services PMI for the said month can entertain USD/CAD traders. However, major attention will be given to the Federal Reserve (Fed) announcements and the banking headlines for clear guidance.

Also read: FOMC Meeting Preview: Powell to keep every door open, surprises not out of the table after RBA

Technical analysis

USD/CAD remains on the bull’s radar as it bounced off the 100-DMA support of around 1.3525 by the press time, suggesting another attempt to cross the key resistance line from early March, near 1.3635 at the latest.

- AUD/NZD seesaws, after NZ Employment data came aligned with estimates.

- The AUD/NZD rally to weekly highs after the RBA’s decision was short-lived, as the cross paired those gains.

- Traders await the release of S&P Global PMIs for Australia at around 23:00 GMT.

The AUD/NZD floats at around the 1.0730 area, after Tuesday’s session, witnessed the pair hitting a high of 1.0834. However, it retraced those gains and finished the day with losses of 0.17%.

Futures in Asia are trading with minimal losses. The Reserve Bank of New Zealand (RBNZ) revealed the Financial Stability Report, which showed the New Zealand (NZ) financial system is solid and well prepared to handle higher interest rates, and “international financial disruptions,” said the RBZN’s Governor Adrian Orr.

In the meantime, employment data from New Zealand revealed that the Unemployment Rate stood unchanged at 3.4%, while the Participation Rate had an uptick from 71.7% to 72%. The Labour Cost Index, a measure of Wages, rose 4.5% Q1 YoY compared to 4.3%.

On the Australian side, the Reserve Bank of Australia (RBA) surprised the market by hiking rates 25 bps, to 3.85%, adding that inflation is too high, signaling that higher rates might be needed to curb inflation. The RBA Governor Philip Lowe said, “Looking forward, some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.”

After the RBA’s rate hike, the swaps market is pricing a 50% chance of a 25 bps rate hike to 4.10% in August.

Aside from this, the Australian economic docket will feature S&P Global PMIs, alongside the AIG Construction PMI, at around 23:00 GMT.

AUD/NZD Technical Levels

- NZD/USD has printed a fresh day’s high of 0.6222 on solid NZ Employment data.

- NZ Employment Change has jumped to 0.8% while the jobless rate remains steady at 3.4% vs. the consensus of 3.5%.

- The Fed is expected to announce an interest rate hike by 25 bps to continue to maintain pressure on stubborn US inflation.

The NZD/USD pair has scaled above the critical resistance of 0.6220 as Statz NZ has reported better-than-projected Employment data (Q1). The Employment Change has landed at 0.8% higher than the consensus of 0.4% and the former release of 0.2%. While the Unemployment Rate has remained steady at 3.4% as reported in the previous quarter but lower than the estimates of 3.5%.

Apart from them, quarterly Labor Cost Index data accelerated at a pace of 0.8% lower vs. the estimates and the prior release of 1.1%. The annual Employment Cost Index has landed lower at 4.5% from the expectations of 4.6% but higher than the former release of 4.3%.

A continuation of a tight labor market may force the Reserve Bank of New Zealand (RBNZ) to remain hawkish ahead as consumer spending could remain resilient due to higher employment.

Investors should note that RBNZ Governor Adrian Orr pushed its Official Cash Rate (OCR) higher surprisingly by 50 basis points (bps) to 5.25% in April to strengthen its defense against persistent inflation.

Later this week, Caixin Manufacturing PMI (April) data will be keenly watched. The economic data is expected to land at 50.3 lower than the former figure of 50.0.

On the US Dollar front, a power-pack action is expected amid the release of the monetary policy by the Federal Reserve (Fed). The Fed is expected to announce an interest rate hike by 25 basis points (bps) to continue to maintain pressure on stubborn United States inflation.

In addition to the Fed policy, US ISM Services PMI (April) data will be keenly watched. As per the consensus, ISM Services PMI (April) is seen higher at 53.1 from the former release of 51.2. Also, New Orders Index is expected to jump to 57.0 vs. the prior release of 52.2.

Statistics New Zealand unveils the first quarter (Q1) 2023 employment report around 22:45 GMT on Tuesday to entertain the NZD/USD traders. The headline results are as follows:

- New Zealand Unemployment Rate Q1: 3.4% (estimated 3.5%; previous 3.4%).

- Employment Change (QoQ) Q1: 0.8% (expected 0.4%; prior 0.2%).

- Labor Cost Index (YoY) Q1: 4.5% (market forecasts 4.6%; prior 4.3%).

- Participation Rate Q1: 72.0% (anticipated to remain unchanged at 71.7%)

NZD/USD reaction

Following the updates New Zealand (NZ) employment report, the NZD/USD pair extends the previous day’s run-up towards refreshing a two-week top near 0.6223, before retreating to 0.6212 by the press time. The reason for the Kiwi pair’s latest hesitance in cheering the upbeat employment data could be linked to the the Reserve Bank of New Zealand’s (RBNZ) bi-annual Financial Stability Report (FSR), as well as cautious mood ahead of the top-tier data/events from the US.

Also read: RBNZ FSR: New Zealand financial system resilient but household pressures growing

NZD/USD: 15-minute chart

Trend: Further upside expected

About New Zealand unemployment rate and employment change

The quarterly report on New Zealand's Unemployment Rate and Employment Change is being released by Statistics New Zealand.

The unemployment rate is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).

On the other hand, employment change is a measure of the change in the number of employed people in New Zealand. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. A high reading is seen as positive (or bullish) for the NZ dollar, while a low reading is seen as negative (or bearish).

“New Zealand's financial system remains resilient but cash-flow pressures in households are growing and buffers are likely to be tested,” the Reserve Bank of New Zealand (RBNZ) said on Wednesday, via its bi-annual Financial Stability Report (FSR).

The bank is currently looking at easing loan-to-value ratio restrictions on home loans, reflecting the bank's assessment that current lending activity presents less risk to financial stability.

The FSR added that cash-flow pressures were growing and buffers were likely to be tested, while a large rise in unemployment remained the biggest risk to domestic financial stability.

"Overall, consumer and business confidence is low, pointing to a weaker outlook for household consumption and business investment, and reflecting the dampening effects of higher debt servicing costs," also mentioned the RBNZ FSR.

The update also conveys statements from RBNZ Governor Adrian Orr and Deputy Governor Christian Hawkesby alongside the FSR.

"To date, there have been limited signs of distress in banks’ lending portfolios, with only a small share of borrowers falling behind on their payments," RBNZ Governor Adrian Orr said initially before adding, "This reflects the ongoing strength of the labor market and that borrowers have been able to adjust their spending or use previous savings and repayment buffers."

On the other hand, RBNZ Deputy Governor Christian Hawkesby said house prices had continued to decline and were closer to being at sustainable levels than had been the case in recent years.

Also read: NZD/USD bulls move in on key weekly resistance into the NZ jobs data

- AUD/USD stays defensive after reversing from one-week high.

- RBA’s surprise 0.25% rate hike pleased buyers before sour sentiment prods upside.

- US Dollar’s struggle to remain firmer, mainly on mixed data, push back bears.

- US ADP Employment Change, ISM Services PMI and banking updates are extra catalysts to watch for clear directions.

AUD/USD stays pressured around 0.6650, consolidating the Reserve Bank of Australia-inspired gains by retreating from a one-week high during early Wednesday in Asia. In doing so, the Aussie pair portrays the market’s cautious mood ahead of the top-tier data/events. Additionally, fears surrounding the banking fallouts and mixed US data also weigh on the Aussie pair prices.

That said, fresh selling of PacWest Bancorp and Western Alliance Bancorp shares triggered banking fears across the board and put a floor under the US Dollar price, especially amid hawkish Fed bets. However, mixed US data and softer US Treasury bond yields prod the greenback buyers ahead of the key US factors up for publishing.

At its May monetary policy meeting, the Reserve Bank of Australia (RBA) board members decided to lift the Official Cash Rate (OCR) by 25 basis points (bps) to 3.85%. In doing so, the Aussie central bank officials defied market expectations of keeping the rates unchanged. Not only does the RBA announce a 0.25% rate hike but the Aussie central bank also expects further tightening of the monetary policy. That said, the RBA also revised its inflation and Gross Domestic Product (GDP) forecasts in the latest policy document. Additionally, RBA Governor Philip Lowe repeated that some further tightening may be required to bring inflation back to the 2-3% target within a reasonable timeframe.

On the other hand, US Factory Orders for March improved to 0.9% versus 0.8% expected and -1.1% (revised) previous readings. Elsewhere, the US JOLTS Job Openings for the said month eased to 9.59M from 9.974M prior and 9.775M market forecasts.

Amid these plays, Wall Street closed in the red and the US Treasury bond yields also dropped. However, the US Dollar Index (DXY) failed to cheer the risk aversion as the greenback’s gauge versus the six major currencies extend the previous day’s U-turn from a three-week high.

Looking forward, AUD/USD pair traders may initially pay attention to Australia Retail Sales for March, expected to print stagnant growth of 0.2% MoM, before waiting for the US ADP Employment Change for April and the ISM Services PMI for the said month. However, major attention will be given to the Federal Reserve (Fed) announcements and the banking headlines for clear guidance.

Also read: FOMC Meeting Preview: Powell to keep every door open, surprises not out of the table after RBA

Technical analysis

Unless providing a daily closing beyond a three-month-old descending resistance line, around 0.6720 by the press time, AUD/USD remains on the bear’s radar.

- EUR/USD is looking for shifting its auction above 1.1000 as USD Index has failed to sustain above 102.00.

- The risk profile is quite negative ahead of Fed policy and rising concerns over the debt ceiling.

- A continuation of the 50bp interest rate hike announcement is anticipated from ECB as Eurozone inflation is severely persistent.

The EUR/USD pair has climbed above the psychological resistance of 1.1000 in the early Asian session. The major currency pair is aiming to sustain confidently above 1.1000 as the US Dollar Index (DXY) has sensed immense selling pressure after failing to shift above the two-week-old resistance of 102.20.

S&P500 was heavily dumped by the market participants ahead of the monetary policy from the Federal Reserve (Fed) and fears of default by the United States administration as the debt ceiling has not been raised yet. Market sentiment is negative as more rate hikes from the Fed will deepen fears of a recession in the US economy.

The demand for US government bonds rose sharply as US Treasury stated that they won’t be able to make payments if the debt ceiling does not get raised after June 01. The yields offered on 10-year US Treasury bonds dropped sharply to near 3.43%.

The USD Index has slipped sharply below 102.00 and is expected to remain on tenterhooks as Fed chair Jerome Powell will provide a further roadmap for arresting stubborn inflation. Neutral guidance is anticipated from the Fed as US labor market conditions seem losing strength. On Monday, Morgan Stanley announced a planned lay-off of 3K more jobs as deals have slumped. Also, March JOLTs Job Openings data dropped sharply to 9.59M from the consensus of 9.775M.

On the Eurozone front, mixed inflation data supports a bumper interest rate hike from the European Central Bank (ECB). Preliminary headline inflation surprisingly jumps to 7.0% from the consensus of 6.9% while core inflation softened marginally to 5.6% vs. the estimates of 5.7%. A continuation of a 50 basis point (bp) interest rate hike announcement is anticipated from ECB President Christine Lagarde as inflation is severely persistent.

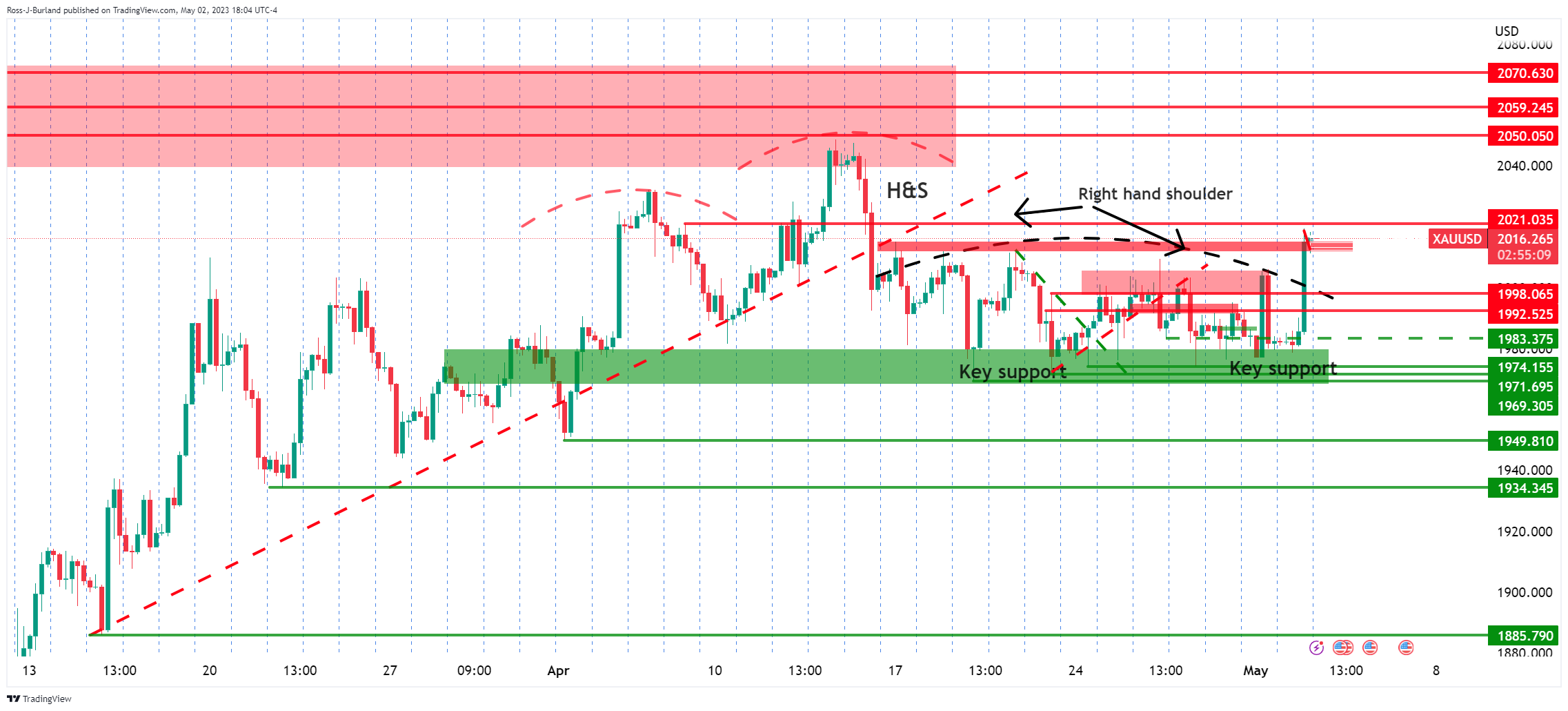

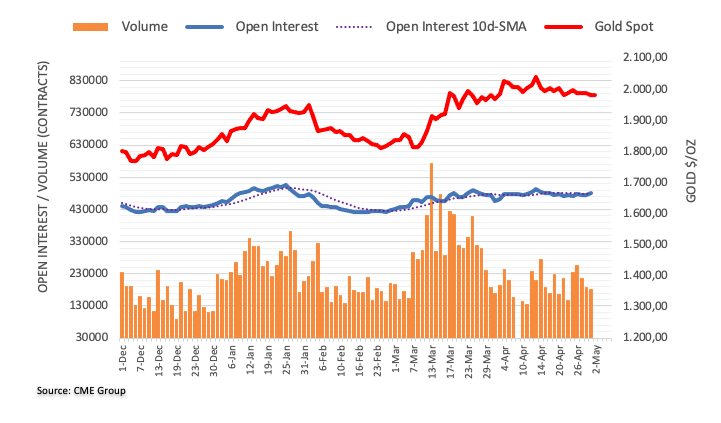

- Gold price rallies into a key resistance area.

- Gold price bears on the look-out for a break lower around the Fed.

Gold price has rallied on the day in a parabolic move ahead of the Federal Reserve using the JOLTS disappointment as the trigger. The yellow metal jumped through the prior channel resistance and rallied from a low of $1,978 to a high of $2,019.

´´Job openings in the US eased to 9.590m in March, down from 9.974m in February. Job openings are now at their lowest level in two years. Demand for labour is continuing to soften, indicating the aggressive tightening is rates is starting to curb demand for workers,´´ analysts at ANZ Bank explained.

In other date, the analysts explained that ´´factory orders in the US increased by 0.9% m/m in March, following a downward revision of the February data to -1.1% MoM. However, orders excluding transportation were down 0.7% m/m indicating there is still some weakness in the manufacturing sector.´´

The weaker US Dollar on Tuesday was positive for the yellow metal while the decline in global bond yields Tuesday was also bullish. Gold has come one of the go-to places in the banking system worries and concerns over the U.S. government heading towards default without an extension of the debt ceiling.

Meanwhile, the focus will be on the Federal Reserve. Analysts at TD Securities are expecting a 25 bp hike ´´and anticipate that post-meeting communication will: (i) emphasize that disinflation has been evolving slower than expected, leaving open the possibility of additional tightening, and (ii) acknowledge the more uncertain economic environment, especially with regard to credit conditions post SVB collapse,´´ the analysts said.

Gold technical analysis

While the move into resistance was sharp, there are still prospects of a downside move below key support and this may only be part of the schematic of the right-hand shoulder still. It all comes down to the Fed and Nonfarm Payrolls.

New Zealand quarterly employment report overview

Early Wednesday in Asia, at 22:45 GMT Tuesday the world over, the global market sees the first quarter (Q1) 2023 employment data from Statistics New Zealand.

With the Reserve Bank of Australia’s (RBA) surprise rate lift, as well as robust inflation and hopes of tighter monetary policy from other major central banks, today’s jobs report becomes crucial for the NZD/USD traders, mainly due to the wage prices index data.

Market consensus suggests a slight increase in the headline Unemployment Rate to 3.5% from 3.4% while the Employment Change figure is likely to increase to 0.4% from 0.2%. Further, the Participation Rate may remain unchanged at 71.7% but the Labour Cost Index could rise to 4.6% QoQ from 4.3% prior.

Ahead of the data, ANZ said,

Today's data is expected to show a tight labor market in New Zealand. While signs of slowing domestic demand are emerging these are not yet expected to be reflected in the employment data, which tends to lag the economic cycle. Given the ongoing strength of labor demand and the high participation rate, we’re expecting unemployment to tick down slightly to 3.3% driven by a 0.5% q/q lift in employment growth. We expect wage growth to remain accelerated.

How could it affect the NZD/USD?

NZD/USD edges higher around 0.6200, defending the previous day’s upbeat performance led by the US Dollar’s retreat and upbeat catalysts surrounding China.

That said, the Kiwi pair is likely to mark a kneejerk positive reaction in case the New Zealand job numbers arrive strong, which more is likely considering the tight labor market in Auckland. However, the NZD/USD prices may not remain firmer for long unless the data is extremely positive, mainly due to the current risk-off mood. Furthermore, the doubts about the hawkish mood of the Reserve Bank of New Zealand (RBNZ) could please sellers in case the data disappoints.

Technically, a daily closing beyond the 50-DMA hurdle, now immediate support near 0.6200, keeps the NZD/USD buyers hopeful.

Key Notes

NZD/USD bulls move in on key weekly resistance into the NZ jobs data

About New Zealand unemployment rate and employment change

The quarterly report on New Zealand's unemployment rate and employment change is being released by Statistics New Zealand.

The unemployment rate is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).

On the other hand, employment change is a measure of the change in the number of employed people in New Zealand. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. A high reading is seen as positive (or bullish) for the NZ dollar, while a low reading is seen as negative (or bearish).

- USD/MXN snaps three-day losing streak as sentiment sours over possible US debt default.

- The Federal Reserve is expected to raise rates, while Banxico is estimated to keep rates on hold.

- US job openings for March fall, while US Factory Orders increased.

The Mexican Peso (MXN) erased some of its earlier gains during the North American session, as the USD/MXN pair climbs 0.20%, but it remains shy of conquering the 18.00 figure. US equities closed on a lower note as the US debt ceiling narrative takes center stage amongst the US banking turmoil. The USD/MXN is trading at 17.9792 after hitting a low of 17.8972.

USD/MXN reverses course on US debt default concerns as Banxico could pause rate increases

The USD/MXN snapped three days of losses as sentiment shifted sour. Nervousness around a possible US debt default, as the US Treasury Secretary Janet Yellen commented that the government might run out of money by June 1, kept investors uneasy. The US Federal Reserve (Fed) is expected to raise rates above the 5% threshold, while the Mexican central bank, known s Banxico, is estimated to keep rates on hold.

Earlier, after Wall Street opened, the US Department of Labor revealed that job openings for March fell to 9.590 million, below estimates of 9.775 million, according to the JOLTs report. At the same time, the US Department of Commerce revealed that Factory Orders increased by 0.09% MoM, exceeding estimates, well above February’s data, which showed a contraction of 1.1%.

The USD/MXN shrugged off the fall of US Treasury bond yields, weakening the US Dollar. Nevertheless, when the market mood shifts sour, high beta currencies, like the Mexican Peso (MXN), weaken against the US Dollar.

The US Dollar Index (DXY), a gauge of the buck’s value against a basket of rivals, slides 0.18%, down at 101.927, bracing to the 20-day EMA.

USD/MXN Technical Analysis

The USD/MXN remains downward biased despite erasing last Monday’s losses. As long as the pair remains below the 20-day Exponential Moving Average (EMA) at 18.0633, further downside is expected. On the other hand, if USD/MXN buyers reclaim the latter, a rally to the 50-day EMA at 18.2539 is on the cards. Once cleared, the USD/MXN could threaten the 100-day EMA at 18.5746.

- NZD/USD bears are lurking in a key resistance zone.

- All eyes turn to the NZ jobs data today.

NZD/USD is pressured to the upside as we head towards the main events this week, starting today, Wednesday. On Tuesday, the pair rallied to 0.6218, and is now meeting resistance. The pair was up 0.68% into the close in Wall Street and had moved up from a low of 0.6163.

´´The Kiwi was one of the better performers overnight, having extended or held up on most crosses. It even clawed back losses against the AUD in the wake of the surprise RBA hike yesterday, which was an initial catalyst for Antipodean currency strength,´´ analysts at ANZ Bank said.

All about NZ jobs data

´´Volatility is picking up as US regional bank wobbles deepen, with markets split as to implications for monetary policy (and the Fed decision due at 6am tomorrow). But today is all about local labour market data, and our picks for the various readings are on the stronger side,´´ the analysts added.

´´Labour market data is lagging, and so are often dismissed late-cycle, but the data are notoriously hard to pick and it’ll ultimately come down to how strong the data really are.´´

NZDUSD technical analysis

The M-formation on the weekly chart is compelling. The bears could be lurking around the neckline resistance and while on the front side of the trendline resistance, the bias is bearish.

A busy day lies ahead. Early on Wednesday, the Reserve Bank of New Zealand will release the Financial Stability Report, followed by the NZ Employment Report. Australia reports Construction and Service PMI, followed by March Retail Sales. The main event of the day will be the Fed decision. Also important will be the ADP Employment Report.

Here is what you need to know on Wednesday, May 3:

Volatility is set to remain elevated on Wednesday following a sharp decline in equity prices on Wall Street and large swings in the FX market. Banking concerns remain in place despite the takeover of First Republic Bank, as shares of two regional banks sell off. The key event on Wednesday will be the Federal Reserve's (Fed) decision. Market participants are waiting for a 25 basis points rate hike. The focus will be on the statement and Chair Powell's press conference.

The US Dollar Index failed to hold its gains and turned negative during the American session, despite risk aversion. The DXY retreated from three-week highs back below 102.00, driven by a rally in US Treasury bonds. The US 10-year yield dropped more than 4% and settled at 3.42%, while the 2-year fell below 4%. The move started after the release of US data (JOLTS and Durable Goods Orders), amid rising bets of rate cuts from the Fed by the fourth quarter.

The FOMC's two-day meeting ends on Wednesday, with the Fed expected to raise the Fed Funds rate by 25 basis points to 5.00% - 5.25%. This would match the 2007 peak rate. There won't be updated projections. Market participants will focus on the statement and then on Chair Powell’s press conference. Before the Fed's decision, ADP will release its private employment report.

Strategists at Brown Brothers Harriman wrote:

We believe that any easing by the major central banks is a 2024 story. Period. In particular, we continue to believe that the markets are underestimating the Fed’s capacity to tighten policy and to then keep it there for an extended period. This should be a huge, huge wakeup call for investors that have become way too complacent about a Fed pivot

EUR/USD rebounded sharply during the American session, rising from weekly lows below 1.0950 to the 1.1000 area. Euro area inflation data was slightly above expectations in April, with core inflation running at 5.6% YoY. On Thursday, the European Central Bank (ECB) will announce its decision on monetary policy, with a rate hike expected. A 25 bps hike is priced in, but a 50 bps hike is also possible.

The Reserve Bank of Australia (RBA) unexpectedly hiked rates on Tuesday, boosting the Australian Dollar, and it also showed there is room for hawkish surprises, as inflation remains stubbornly high. The Aussie initially outperformed but then weakened, giving up gains. AUD/USD traded momentarily above 0.6700 and then pulled back to 0.6665. The outlook for the pair improved, but not dramatically; it remains sideways.

NZD/USD continued to move higher, retaking 0.6200. The Kiwi outperformed, with AUD/NZD erasing all RBA gains, retreating from 1.0835 to 1.0735. Wednesday will be a busy day with the Reserve Bank of New Zealand Financial Stability Report and later, the NZ employment report.

The Loonie lost ground across the board, with USD/CAD rebounding at the 100-day Simple Moving Average at 1.3530 to 1.3630. A 5% drop in crude oil prices weighed on CAD. The gloomy global growth outlook is keeping crude under pressure.

The decline in US yields boosted Gold, which jumped toward $2,020/oz posting the highest daily close in three weeks. Silver climbed from $24.60 to $25.35. Cryptocurrencies soared, with BTC/USD rising 3.50% to $28,700.

Like this article? Help us with some feedback by answering this survey:

- USD/CHF bulls eye a move into the M-formation´s neckline.

- Bears seek a break of key trendline support.

USD/CHF has slid into support and is meeting a trendline that is coming under pressure and exposing the 0.8915 and 0.8905 support structures as the following will illustrate.

USD/CHF daily chart

The price is trying to break out of the trendline resistance as shown above, which makes for a bullish bias while above the micro trendline support structure. 0.900 is key in this regard as the bulls need to get above there.

USD/CHF H4 chart

Meanwhile, the 4-hour chart is seeing resistance as 0.8950 as being the neckline of the M-formation:

- XAG/USD bounced off the weekly lows below the 20-day EMA and reclaimed $25.00.

- A sour sentiment, and falling US T-bond yields, triggered flows to XAG.

- XAG/USD would remain upwards above $25.50; otherwise, sellers can drag prices to the 20-day EMA.

Silver price advanced late in the North American session, gaining more than 1%, as US Treasury bond yields dropped. Consequently, a softer US Dollar (USD) increased flows toward the white metal amidst a risk-off impulse. The XAG/USD is trading at $25.28 after hitting a low of $24.58.

XAG/USD Price Analysis

The XAG/USD daily chart shows the white metal edged toward its May high at $25.90 on Monday before reversing its course and closing below the $25.00 figure, a tick above the 20-day Exponential Moving Average (EMA). Even though the Silver price was headed to continue to fall, it jumped off the daily low of $24.58, $0.30 below the 20-day EMA, and climbed to the bottom of an upslope support trendline drawn from March 2023 lows.

If XAG/USD buyers reclaim $25.50, that could pave the way to May’s high before challenging the YTD high at $26.08.

Conversely, if sellers stepped in around resistance at $25.50, it could exacerbate a test of the $25.00 mark before dropping to the 20-day EMA. Once cleared, the next support in play would be the February 2 high at $24.63.

XAG/USD Daily Chart

- AUD/SD traders await the Federal Reserve for next cues.

- Bears digging into support in a firm correction.

AUD/USD lept over 1% against the US Dollar on Tuesday after a surprise rate hike by the Reserve Bank of Australia, RBA, reaching a high of 0.6717 from a low in the 0.6620s.

The RBA hiked 25bp to 3.85%. ´´Given our own concerns about the stickiness of services and non-tradable price inflation, plus the robustness in the labor market and the business sector, we expect another 25bp rate hike in August,´´ analysts at ANZ Bank explained.

The RBA began hiking rates back in May 2022 and has made 375 bp of tightening so far. According to analysts at Brown Brothers Harriman, there are ´´no more hikes priced in and the easing cycle is priced to start Q1 2024 with 25 bp of easing seen over the next 12 months and 50 bp over the next 24 months.´´

Meanwhile, the US Dollar is bid ahead of main events of the week that begin Wednesday with the Federal Reserve that began its own tightening cycle in March 2022 with 475 bp of tightening so far. the markets are pricing in another 25 bp with the easing cycle priced to start in November.

´´We expect a 25bp rate hike at next week's FOMC meeting and anticipate that post-meeting communication will: (i) emphasize that disinflation has been evolving slower than expected, leaving open the possibility of additional tightening, and (ii) acknowledge the more uncertain economic environment, especially with regard to credit conditions post SVB collapse,´´ analysts at TD Securities explained.

AUD/SD technical analysis

AUD/USD is holding in support but there could be another thrust from the bulls in the coming days with 0.6750 eyed. However, it depends on the outcome of the Federal Reserve and markets will be data-dependent.

- GBP/USD falls on risk-off impulse as the US bank crisis worsens.

- US job openings for March were below estimates, while Factory Orders rose by 0.09% MoM, beating expectations

- GBP/USD Price Analysis: A break below the 20-day EMA leads to the downside, else re-test of the YTD high is likely.

The Pound Sterling (GBP) lost some ground against the US Dollar (USD) spurred by risk aversion amidst growing fears that the banking crisis in the United States (US), while the US debt ceiling theme, take the spotlight ahead of the Federal Reserve (Fed) decision. At the time of typing, the GBP/USD is trading at around the 1.2470-80 areas after dipping towards 1.2435.

Investors mood turning sour, weighed on the Pound Sterling

Sentiment deteriorated, even though JP Morgan acquired the First Republic Bank on Monday. The US bank crisis continues, as the KBW Regional Banking Index, dropped more than 6%, at its lowest level since November 2020.

The GBP/USD dropped on a risk-off impulse, triggered by the US Secretary of Treasure Janet Yellen commenting that her office would not meet all the US government obligations by the beginning of June, wrote in a letter to the US Congress.

Nevertheless, the GBP/USD’s fall was cushioned, as data from the United States (US) revealed by the Bureau of Labor Statistics (BLS) flashed that job openings for March dropped to 9.590 million, below estimates of 9.775 million, according to the JOLTs report. At the same time, the US Department of Commerce revealed that Factory Orders increased by 0.09% MoM, exceeding estimates and distancing from February’s drop of 1.1%.

On the UK front, British factory output and new orders contracted at the beginning of Q2, though the report showed that input costs rose to their weakest level since May 2020.

In the meantime, the GBP/USD uptrend might stall as investors brace for the Fed’s May meeting that ends on Wednesday. Money market futures odds for a 25 bps rate increase are 87.3%. Nevertheless, traders estimate three rate cuts by the end of 2023, contrary to expectations for further tightening by the Bank of England (BoE)

GBP/USD Technical Analysis

After dipping to a weekly low of 1.2435, the GBP/USD found support at the 20-day Exponential Moving Average (EMA) at 1.2437. Although the pair printed back-to-back bearish candlesticks, a daily close below the latter will exacerbate a fall to the last week’s low, April’s 21 cycle low at 1.2367. Conversely, if GBP/USD buyers reclaim the 1.2500 figure, a re-test of the YTD high at 1.2583 is likely to happen, ahead of 1.2600.

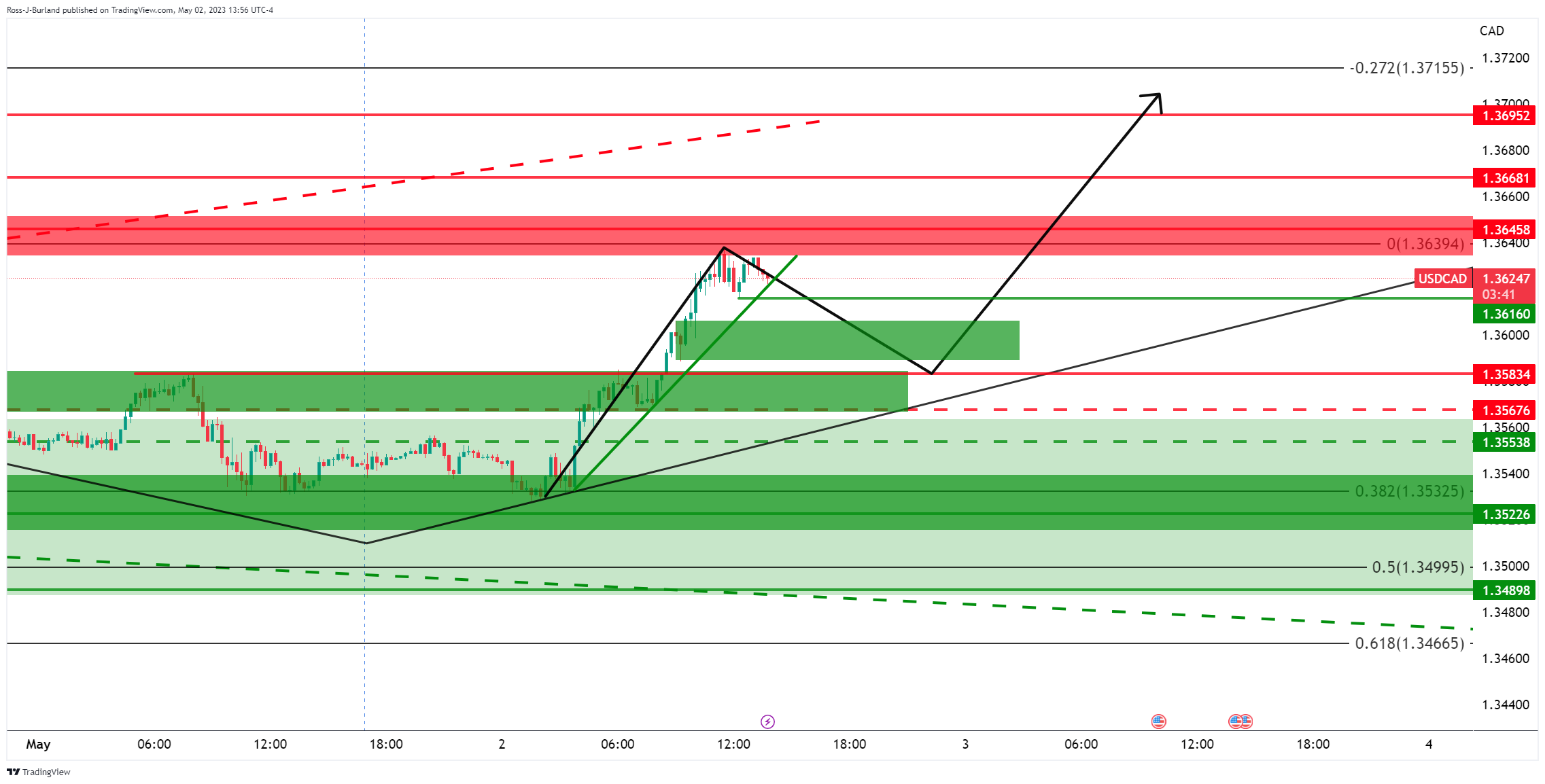

- Bears eye a break of the support line and the horizontal structure around 1.3616.

- Bulls eye a run into 1.3700 as the bullish building blocks stack up.

As per the prior analysis, USD/CAD Price Analysis: Bulls are guarding critical support structures and eye 1.3700, the bulls remain in control and continue to eye a move higher as the following will illustrate.

USD/CAD prior analysis

´´The bulls are starting to engage at the start of the week and the 1.3520s could be key in this regard where the counter trendlñinme support meets horizontal structures as illustrated above.´´

USD/CAD H4 chart

´´On the lower time frames, we can identify key levels as illustrated above. In this regard, the bulls really need to get above the 4-hour 1.3580 structure and then 1.3650-70.´´

USD/CAD live updates

As seen, the market has rallied into the resistance area. A pullback into prior resistance could be on the cards where it meets the 1.3580s.

USD/CAD M15 chart

The market is still in an uptrend but a break of the support line and the horizontal structure around 1.3616 could be the signal that the market is headed lower.

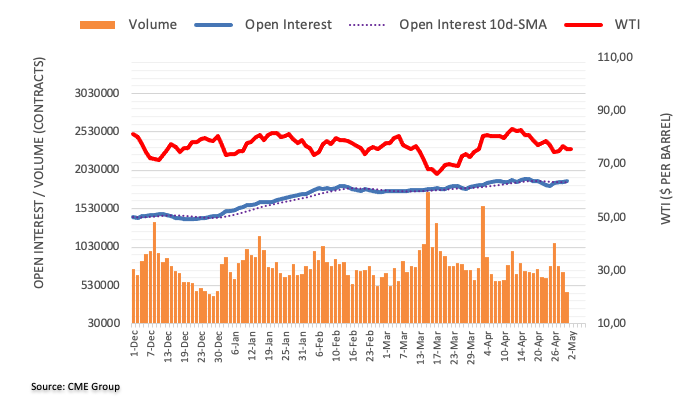

- WTI loses ground for a fourth consecutive day as Wall Street reacts to Yellen’s debt obligation warning.

- Oil prices are pressured by weak manufacturing activity in China.

- OPEC production cuts cushioned WTI price amidst economic uncertainty and falling demand.

Western Texas Intermediate (WTI), the US crude oil benchmark, plunges more than 4%, reaching a five-week low, on risk aversion spurred by fears of contagion amongst US regional banks, alongside worries about the debt ceiling in the US. The latest report on business activity in China showed that the economy dipped. Therefore, WTI is trading at $71.99 per barrel, down 4.94%.

WTI extended its losses for four straight days. Wall Street registers losses after US Treasury Secretary Haney Yellen commented that the US government could not pay its debt obligations by June 1.

Oil prices came under pressure as China’s manufacturing activity shrank in April, as the National Bureau of Statistics (NBS) revealed. Manufacturing PMI dropped from 51.9 to 49.2 in April, while the Non-Manufacturing PMI edged down to 56.4 vs. 58.2 in March. The Composite figure stood at 54.4 from 57.0.

Zhao Qinghe, a Senior NBS statistician, said, “A lack of market demand and the high-base effect from the quick manufacturing recovery in the first quarter” was among the factors that led to the contraction in April.”

Reuters cited sources commented, “The unpredictable action of central banks in their mission to tame elevated consumer and producer prices, the rhetoric and action of consuming and producing nations have all cast a rather long shadow of doubt on prospects going forward.”

Two major central banks are expected to hike rates in the week: the Federal Reserve (Fed) and the European Central Bank (ECB).

Aside from this, WTI was cushioned as the Organization of Petroleum Exporting Countries (OPEC) cut its output by 190K bpd in March. The cartel agreed to cut production in late 2022 as the economic outlook worsened. For April, OPEC agreed to cut output by 1.27 million bpd, part of a 2 million reduction by the OPEC+ last year.

WTI Technical Levels

- Japanese Yen rises across the board amid lower US yields and risk aversion.

- Dow Jones falls 1.50%, US 10-year yield drops to 3.44%.

- USD/JPY slides more than a hundred pips after the beginning of the US session.

The Japanese Yen gained momentum during the American session amid risk aversion, causing the USD/JPY to drop from the highest level in seven weeks near 137.75 to 136.36, hitting a fresh daily low.

US regional bank stocks are under pressure on Tuesday, weighing on market sentiment, despite the takeover of First Republic Bank.

US data came in a little softer than expected ahead of Wednesday's FOMC decision. Market participants still expect a 25 basis point rate hike, but bets of a rate cut later in the year have risen during the last hours. The US 10-year Treasury yield is falling more than 4% to 3.43%, while the 2-year fell from 4.14% to 3.94%, reaching the lowest levels since last Thursday.

The decline in government yields is helping the Japanese Yen. Wall Street indexes are falling by more than 1.5%, and the VIX has jumped 20%.

USD/JPY worst day in weeks

The USD/JPY pair is experiencing its largest daily loss in a month. The reversal is occurring from the 200-day Simple Moving Average (SMA), which is presently at 137.00. The next level of support could be found around 136.00, followed by 135.20. If the pair recovers above 137.20, it would ease the current bearish pressure.

Considering current price action in financial markets and upcoming key events such as the FOMC and ECB decisions, as well as the NFP, volatility is expected to remain high.

Technical levels

Data released on Tuesday showed the number of job openings decreased to 9.59 million in March. Analysts at Wells Fargo point out that although still high, this was the lowest level since April 2021.

Key quotes:

“The Job Openings and Labor Turnover Survey (JOLTS) for March offered additional evidence that supply and demand in the labor market are coming into better balance.”

"The quit rate edged lower and the layoffs and discharges rate ticked higher, trends that are consistent with a labor market that continues to incrementally cool.”

“In an absolute sense, the labor market remains tight with openings and quits still above pre-pandemic levels and involuntary separations just getting back to what prevailed in 2018-2019. But a clear trend is emerging, and we expect labor demand to keep receding in the months to come.”

“We look for another step down in the pace of job growth in Friday's employment report, with more weakness to come later this year and into 2024.”

- The gold price jumped over $20.00 on a risk-off impulse, lowering US T-bond yields.

- Sentiment deteriorated as US Treasury Secretary Yellen warns of obligation shortfall.

- US job openings decline for the third consecutive month, as shown by the JOLTs report.

Gold price breaks the barrier of the $2000 figure on woes surrounding a banking crisis in the United States (US) while market players wait for the US Federal Reserve (Fed) decision about raising rates. After hitting a daily low of $1978.58, the XAU/USD exchanges hands at $2008.52, gaining more than 1%.

XAU/USD surges on risk-off impulse on Yellen’s warning about hitting the debt ceiling

Risk aversion was one of the reasons behind the $25.00 gains in Gold. JP Morgan’s acquisition of First Republic Bank easied worries in the banking industry. However, fiscal policy, mainly the rise of the debt ceiling in the US, keeps investors nervous. The US Treasury Secretary Janet Yellen commented in a letter to the US Congress that the office would not meet all US government obligations by June 1.

Aside from this, the US economic agenda revealed that job openings fell for the third straight month in March, though they remained at steady levels. The US Department of Labor (DoL) announced the JOLTs report, which came at 9.590 million, below the 9.775 million estimated by analysts.

In other data, Factory Orders for March jumped to 0.9%, above estimates of 0.8% and better than February’s contraction of 1.1%. Despite Monday’s ISM Manufacturing PMI report in contractionary territory, orders improved.

Additionally, XAU/USD found a bid, sponsored by lower US Treasury bond yields, across the board. US 2-year T-note yields are plunging 20 bps at 3.935%, while the 10-year benchmark note rate yields 3.431%, plummeting 14 bps.

Meanwhile, the Federal Reserve Open Market Committee (FOMC) two-day meeting begins today. The swaps markets, as shown by the CME FedWatch Tool, with traders expecting an 81.8% chance of a 25 bps rate hike to the Federal Funds Rate (FFR). Nevertheless, probabilities for a rate cut, uptick with investors estimating three 25 bps rate cuts by the year’s end.

Ahead of the week, XAU/USD traders await the FOMC’s decision, followed by Fed’s Chair Jerome Powell’s press conference at around 18:30 GMT.

XAU/USD Technical Analysis

The XAU/USD continued to trade sideways, but the jump above the 20-day EMA at $1990.12 exacerbated a test of the $2000 figure. The Relative Strength Index (RSI) oscillator tested the 50-midline but widened its distance, as it’s aiming up, while the Rate of Change (RoC) confirms that buyers are gathering momentum ahead of the FOMC’s decision. Upwards key resistance levels lie the April 5 high at $2032.13, followed by the YTD high at $2048.79. On the flip side, the $2000 will be the first line of defense for Gold buyers, followed by the 20-day EMA at around $1990.

- US JOLTS comes in below expectations while Factory Orders rise 0.9% versus the expected 0.8%.

- The FOMC meeting kicks off, with a 25 basis points rate hike already priced in.

- EUR/USD turns flat for the day amid a weaker US Dollar.

The EUR/USD erased losses after the release of US economic data, rising from its weekly lows to levels above 1.0970. The pair is now flat for the day, ending a three-day negative streak, ahead of crucial central bank meetings.

Mixed US data after EZ inflation, ahead of FOMC

The final reading of US Factory Orders showed a rise of 0.9% in March, slightly above the market consensus of 0.8%. The JOLTS report showed that "the number of job openings decreased to 9.6 million on the last business day of March," softer than the expected 9.7 million.

The US Dollar lost momentum after the reports, and EUR/USD rebounded rising more than 25 pips. The US Dollar Index is up for the day, trading at 102.25. US yields have plunged to new lows, with the US 10-year yields falling to 3.47% and the 2-year to 4.04%.

Attention now turns to the central banks. The FOMC will announce its decision on Wednesday, with a 25 basis point rate hike already priced in, while the European Central Bank (ECB) will have its meeting on Thursday. Prior to the FOMC, ADP will release its employment report on Wednesday.

Short-term outlook

The EUR/USD pair currently holds a bearish bias in the short term and is challenging an important support level around 1.0950. It bottomed on Tuesday at 1.0941, the lowest level since April 21, but has since bounced back toward 1.0980.

If the Euro recovers levels above 1.0970, it could change the intraday bias to positive; resistance levels above are located at 1.0990 and 1.1005. Under 1.0950, further weakness seems likely, with the next crucial support level at 1.0930.

Technical levels

- JOLTS Job Openings in the US continued to decline in March.

- US Dollar Index holds above 102.00 in the American session.

The data published by the US Bureau of Labor Statistics (BLS) revealed on Tuesday that the number of job openings on the last business day of March stood at 9.59 million, compared to 9.97 million in February. This reading came in below the market expectation of 9.77 million.

"Over the month, the number of hires and total separations were little changed at 6.1 million and 5.9 million, respectively," the BLS further noted in its publication. "Within separations, quits (3.9 million) changed little, while layoffs and discharges (1.8 million) increased."

Market reaction

The US Dollar Index showed no immediate reaction to this data and was last seen rising 0.1% on the day at 102.21.

- Factory Orders in the US rose more than expected in March.

- US Dollar Index stays in positive territory above 102.00.

The data published by the US Census Bureau revealed on Tuesday that new orders for manufactured goods, Factory Orders, increased $4.9 billion, or by 0.9%, to $539 billion in March. This print followed February's decline of 1.1% and came in slightly better than the market expectation for an increase of 0.8%.

"New orders for manufactured durable goods in March, up following two consecutive monthly decreases, increased $8.5 billion or 3.2 percent to $276.2 billion, unchanged from the previously published increase," the publication further read.

Market reaction

The US Dollar Index clings to modest daily gains above 102.00 after this data.

Analysts at Nordea offer their take on the flash Eurozone CPI print released earlier this Tuesday, showing that the Harmonized Index of Consumer Prices (HICP) edged higher to 7% YoY rate in April from 6.9% and the Core HICP ticked down to 5.6%.

Key quotes:

“Inflation remains much too high and while base effects from last year’s energy price increases will lead to lower headline inflation in the coming months, core inflation remains a huge concern at the ECB. The economic outlook is weak, which was underscored by banks reporting lower loan demand and by Q1 GDP, but the banking stress at the end of Q1 does not seem to have added to expectations of faster tightening of credit conditions. Thus, the ECB has more ground to cover and the preview for the May ECB meeting on Thursday with a 25bp policy rate hike and hawkish comments still stands. Further ahead, the ECB probably needs to see a clear improvement in the outlook for core inflation or a significant weakening of the economic outlook to stop hiking rates. Our baseline forecast has three more 25bp rate hikes including one this week.”

The Global Strategy Team at TD Securities (TDS) offers a brief preview of the upcoming release of the quarterly employment details from New Zealand, scheduled during the Asian session on Wednesday.

Key quotes:

“We expect labour market tightness to show signs of easing in Q1, with the unemployment rate edging higher to 3.6% (RBNZ: 3.5%) from 3.4% in the previous quarter. We expect some disruption to the jobs market in Q1 given the impact of Cyclone Gabrielle and see flat employment growth over the quarter. However, a fall in the participation rate could help cap a rise in the unemployment rate. We expect private wages to rise at a still-firm pace of 1.0% q/q, bringing the annual increase in the Labour Cost Index (LCI) to 4.6% y/y, a new record. After its surprise 50bps hike, the RBNZ has shown its resolve to tame inflation and a softer labour market print may not be enough to dissuade them from hiking another 25bps in May.”

Senior Economist at UOB Group Alvin Liew assesses the latest BoJ event.

Key Takeaways

“The Bank of Japan (BOJ) kept its policy measures unchanged at the Apr Monetary Policy Meeting (MPM) helmed by new BOJ Governor Ueda. The decision was unanimous, as the BOJ kept steadfastly to its easing stance but made adjustments to its forward guidance in the MPM statement via, 1) removal of the reference to Covid-19, and more importantly, 2) scrapping the forward guidance on interest rates. The BOJ also announced it will be conducting a broad perspective review of BOJ’s monetary policy which will take 1 to 1.5 years.”

“The revisions in the latest Apr 2023 Outlook for economic activity and prices (The Bank’s View) were more about trimming GDP growth further in FY2022 to FY2024 while making material upward adjustments to the price forecasts during the same period. According to BOJ, the growth downgrades in FY 2022 and FY2023 were due to weaker private consumption projections, while the upward inflation revisions for FY2023 and FY2024 were due to “higher projections for wages”. It is noted that FY2024 CPI inflation forecast was revised higher to 2.0% (from previous estimate of 1.8%), touching the BOJ price objective.”

“BOJ Outlook – Buying Time With Broad Policy Review, So No Change To Negative Rates & YCC In The Interim: While there were already various segments of the markets speculating that one of the first course of actions under Governor Ueda could be undertaking a policy review, the announcement of one that would span between 12 and 18 months still came as a surprise. With the policy review now in place, this has likely secured “policy inaction” in the interim. This also reinforces our belief that policy normalisation/unwinding under Governor Ueda will be carried out at a gradual, well-telegraphed pace, and not a sharp and sudden reversal. We had expected to see it in two broad steps, 1) protracted adjustment to its forward guidance on YCC and interest rates (Apr to Dec 2023) and 2) scrapping of YCC and lifting of the negative policy rate in early 2024. With the broad perspective policy review, there is now the possibility of an even longer runway (till Apr 2024) before any material policy unwinding will take place.”

Economists at BBH offer a brief insight into the US Dollar price action and a preview of the highly-anticipated FOMC policy meeting starting this Tuesday.

Key quotes:

“DXY is trading higher for the fourth straight day near 102.294, the highest since April 11 and on track to test the April 10 high near 102.807. Break above that would set up a test of the April 3 high near 103.058.”

“The Reserve Bank of Australia sent a message that should reverberate across global markets. By hiking rates unexpectedly today, the RBA action underscored just how difficult it is proving to get stubbornly high inflation back to target. Simply put, it is obvious that interest rates around the world will go higher for longer. It’s really that simple and so any notions of quick monetary policy pivots are misguided. We believe that any easing by the major central banks is a 2024 story. Period. In particular, we continue to believe that the markets are underestimating the Fed’s capacity to tighten policy and to then keep it there for an extended period. This should be a huge, huge wakeup call for investors that have become way too complacent about a Fed pivot.”

“Chair Powell acknowledged that the Fed considered a pause but added that it was too soon to say how Fed policy has been impacted by the banking crisis. We think that still holds true now and so we expect the Fed to leave the door wide open to further hikes. Updated forecasts and Dot Plots will come at the June meeting, which we believe is more in play than markets believe. Of note, WIRP now suggests 25% odds of another hike June 14 and we think this is likely to move higher. Yet the market is still pricing in a cut by year-end and we continue to view this as highly unlikely.”

- EUR/USD extends the leg lower and retests the mid-1.0900s.

- The weekly low near 1.0910 awaits in case losses pick up pace.

EUR/USD loses the grip and drops to multi-session lows near 1.0950 on turnaround Tuesday.

The continuation of the corrective retracement should not be ruled out in the very near term. That said, the next support of note emerges at the weekly low at 1.0909 (April 17) ahead of another weekly low at 1.0831 (April 10).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0420.

EUR/USD daily chart

- USD/CAD rebounds swiftly from the 100 DMA, a one-week low touched this Tuesday.

- Sliding Oil prices undermines the Loonie and lends support amid a modest USD uptick.

- Bets for another 25 bps Fed rate hike and a softer risk tone benefit the safe-haven buck.

The USD/CAD pair attracts fresh buying near the 100-day Simple Moving Average (SMA) for the second successive day and stages a solid recovery from a one-week low, around the 1.3530-1.3525 region touched this Tuesday. The intraday positive move lifts spot prices to the 1.3600 neighbourhood during the early North American session and is sponsored by a combination of factors.

Crude Oil prices remain under some selling pressure for the second straight day and languish near a one-month low touched last week amid worries about economic headwinds stemming from rising borrowing costs, which might dent fuel demand. This, in turn, is seen undermining the commodity-linked Loonie and acts as a tailwind for the USD/CAD pair. The US Dollar (USD), on the other hand, touches a fresh two-week high amid the prospects for additional intraday rate hikes by the Federal Reserve (Fed) and provides an additional boost to the major.

In fact, the markets now seem to have fully priced in another 25 bps rate hike at the end of the two-day meeting on Wednesday. Moreover, the US ISM report released on Monday showed that there was a build-up of inflation pressures last month and kept alive the possibility of a further hike in June. This, along with looming recession fears and a generally weaker tone around the equity markets, further benefit the Greenback's relative safe-haven status and remains supportive of the USD/CAD pair's strong intraday rally of around 75 pips.

Next on tap is the release of the JOLTS Job Openings and Factory Orders data from the US. Apart from this, the broader risk sentiment will drive the USD demand and provide some impetus to the USD/CAD pair. Traders will further take cues from Oil price dynamics to grab short-term opportunities. The focus, however, will remain glued to the highly-anticipated FOMC decision, which, along with the US monthly employment details (NFP) on Friday, will help investors to determine the next leg of a directional move for the major.

Technical levels to watch

- USD/JPY edges lower on Tuesday, albeit lacks any follow-through selling.

- A softer risk tone underpins the JPY and acts as a headwind for the pair.

- The Fed-BoJ policy divergence lends support and helps limit the downside.

The USD/JPY pair pulls back from a nearly two-month high, around the 137.75-137.80 region touched earlier this Tuesday and remains on the defensive heading into the North American session. The pair is currently placed just below the mid-137.00s, down less than 0.10% for the day, and seems poised to prolong its recent appreciating move.

A softer risk tone drives some haven flows towards the Japanese Yen (JPY) and is seen as a key factor exerting some downward pressure on the USD/JPY pair amid subdued US Dollar (USD) price action. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, struggles to capitalize on its intraday uptick to a two-week high touched on Tuesday. A fresh leg down in the US Treasury bond yields, dragged down by expectations that the Federal Reserve (Fed) will signal a pause in its policy-tightening cycle, acts as a headwind for the buck.

The markets, however, have fully priced in another 25 bps rate hike at the end of the two-day policy meeting on Wednesday. Moreover, the US ISM report released on Monday showed that there was a build-up of inflation pressures last month data kept alive the possibility of a further hike in June and continue to lend support to the Greenback. This marks a big divergence in comparison to the Bank of Japan's (BoJ) dovish stance, which supports prospects for the emergence of some dip-buying around the USD/JPY pair and should help limit the downside.

Even from a technical perspective, the overnight sustained move and close above the very important 200-day Simple Moving Average (SMA) add credence to the near-term positive outlook. Bullish traders, however, might refrain from placing aggressive bets ahead of the highly-anticipated FOMC monetary policy decision on Wednesday. The focus will then shift to the release of the closely-watched US monthly employment details, popularly known as the NFP report on Friday, which should help determine the near-term trajectory for the USD/JPY pair.

Technical levels to watch

Extra losses in USD/IDR should meet tough contention around 14,440 for the time being, notes Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

“USD/IDR dropped to a low of 14,620 last week. Downward momentum is building and USD/IDR is likely to weaken further.”

“However, oversold conditions suggest any decline is likely to be at a slower pace and is unlikely to break the major support at 14,440. Resistance is at 14,790; a breach of 14,880 would indicate that the weakness in USD/IDR has stabilized.”

- DXY extends the breakout of the 102.00 level on Tuesday.

- The continuation of the bounce could see 102.80 revisited.

DXY maintains the recovery well in place for the fourth consecutive session and looks to consolidate the recent breakout of the 102.00 hurdle on Tuesday.

If the index breaks above the current range bound trade, it could then confront the weekly high at 102.80 (April 10) prior to the April peak at 103.05 (April 3), an area still propped up by the provisional 55- and 100-day SMAs.

Looking at the broader picture, while below the 200-day SMA, today at 106.03, the outlook for the index is expected to remain negative.

DXY daily chart

- Pound Sterling vs US Dollar falls back after US bank rescue means Fed will almost certainly hike interest rates on Wednesday.

- Bearish two-bar reversal pattern suggests short-term downside pressure for GBP/USD.

- JOLTS Job Openings the main data release ahead of May’s FOMC meeting.

The Pound Sterling (GBP) continues bleeding against the US Dollar (USD) during the European session on Tuesday, as USD gains support from the news of the emergency rescue of First Republic Bank over the weekend. This calms markets and suggests the Federal Reserve is much more likely to hike rates at its meeting concluding Wednesday.

From a technical perspective, the GBP/USD pair continues to pull back from new year-to-date highs in the 1.2580s formed on April 28, and forms a two-bar reversal pattern that bodes follow-through lower in the very short-term, though the overarching trend remains bullish.

GBP/USD market movers

- The US Dollar gains support from the news that JP Morgan has come to the rescue of troubled US regional lender, First Republic Bank (FRB), as it will buy up FRB after fears it would be taken over by the Federal Deposit Insurance Corporation (FDIC) over the weekend.

- The US Dollar is still supported by high-than-expected PCE inflation data – the Federal Reserve’s preferred inflation gauge – after last week’s data showed prices remain sticky in the United States.

- Expectations have crystallized for a 25 bps rate hike by the Federal Reserve (Fed) at the upcoming FOMC meeting on Wednesday May 3 – according to Feds Funds Futures data, probabilities for a quarter percent hike have risen from the 85% last week to 97% at the time of writing.

- That said, data for March continued to show UK inflation above 10% for the seventh consecutive month suggesting the Bank of England (BoE) is far from done with putting up interest rates.

- This contrasts with the US Federal Reserve (fed) which is seen nearing the end of its rate-hiking cycle. The prospect of comparatively higher UK interest rates, therefore, favors the Pound Sterling over the Greenback, since it will attract more capital inflows.

- GBP gains underpinning support from an unexpected MoM rise in UK house prices by 0.5% in April versus the negative figure expected, according to data from the UK’s biggest mortgage lender, Nationwide.

- Data from the Commodity Futures Trading Commision (CFTC) shows speculative investor flows have become increasingly supportive of the Pound over recent weeks, with non-commercial traders increasing their long bets above those of commercial traders who have been increasing short bets.

- JOLTS jobs reports data for March, scheduled for release at 14:00 GMT, could impact on the pair. After the release of last month’s JOLTS, for example, the US Dollar declined in as job openings fell from 10.4M to 9.9M.

GBP/USD technical analysis: Correcting within an uptrend

GBP/USD has been a broad sideways trend since the beginning of the year within a longer-term uptrend that began at the September 2022 lows. Despite the volatile ups and downs of recent months, the pair did manage to make new higher highs in the upper 1.25s in late April and the overall trend remains marginally bullish. Thus, Pound Sterling longs are marginally favored over shorts.

-638186242299271023.png)

GBP/USD: Daily Chart

That said, a pullback may be unfolding at the moment after a two-bar bearish reversal pattern formed at the recent highs. Two-bar reversals are fairly reliable patterns which occur when a long green full-bodied candle that makes new highs as formed on April 28 is immediately reversed the following day by a long red-down candle of a similar length. They are bearish short-term signals.

It is possible the two-bar pattern will now be followed by a leg lower which could see GBP/USD retest the 1.2350 April-range lows.

Given the dominant trend remains bullish-to-sideways, however, pressure to the upside is likely to re-emerge, and could see the price recover and rally, before breaking to fresh highs.

A decisive break above the year-to-date 1.2583 highs of April 28, would probably lead to a continuation higher to the next key resistance level at circa 1.2680.

Decisive breaks are usually characterized by moves that begin with a strong green daily bar that breaks above the ceiling or resistance level, with price closing near the highs, or, alternatively by three green consecutive bars forming that break above the ceiling or resistance level. These provide added confirmation that the break is not a ‘false break’ or bull trap.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which < href="https://fxssi.com/the-most-traded-currency-pairs">accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

While commenting on the Reserve Bank of Australia's (RBA) policy outlook at a post-policy meeting dinner in Perth, RBA Governor Philip Lowe repeated that some further tightening may be required to bring inflation back to 2-3% target within a reasonable timeframe.

Additional takeaways

"We will do what is necessary to bring inflation back to target."

"Board is not on pre-set course, paying attention to consumption, inflation, jobs, global economy."

"We don’t need to get inflation back to target straight away, but can't take too long."

"We are taking a bit more time than some other countries, but there is a limit."

"Since April pause in hikes, house prices and A$ had responded to the changing rate outlook."

"Labour market is still tight, services inflation proving stubborn."

"Experience abroad points to upside risk for services inflation."

"Board is aware higher rates, inflation are squeezing people's budgets."

"Board discussed RBA review recommendations, broadly speaking they make sense."

Market reaction

AUD/USD clings to strong daily gains that it registered following the RBA's unexpected 25 basis points rate hike. As of writing, the pair was trading at around 0.6700, where it was up 1% on a daily basis.

Analysts at TD Securities note that the Reserve Bank of Australia (RBA) surprised the market by raising its policy rate by 25 basis points to 3.85%.

Will assess RBA call following the SoMP on Friday

"We expected the Bank to remain on hold at 3.60% after last week's Q1 CPI release revealed inflation fell by more than the RBA expected."

"The preliminary forecasts provided in today's Statement on balance do not appear significantly different from the February Statement of Monetary Policy (SoMP) forecasts and on balance supported the Bank remaining on hold in our view."

"While the minutes of the April meeting were hawkish and read as more supportive of a hike than a pause at that meeting, today's Statement suggests the Bank may have a few more hikes up its sleeve to deliver. We will assess our RBA call following the SoMP on Friday and potentially after the 9th May Federal Budget."

Commerzbank analysts share a brief assessment of the latest inflation data from the Eurozone.

Inflation rate is likely to fall further

"In the euro area, the inflation rate's downward slide was interrupted in April. As the sharp fall in energy prices in April 2022 dropped from the year-on-year comparison, the inflation rate rose again slightly from 6.9% to 7.0%."

"In the coming months, the inflation rate is likely to fall further, however, especially since the inflationary impulse from food prices is also easing. Underlying inflation has not increased further. The inflation rate excluding the strongly fluctuating prices of energy, food, alcohol and tobacco declined slightly from 5.7% to a still very high 5.6%. In this respect, the pressure on the ECB to raise key interest rates further remains high."

In the view of Markets Strategist Quek Ser Leang at UOB Group, USD/MYR is likely to extend the current upside momentum in the short term.

Key Quotes

“In our latest update from last Tuesday (25 Apr, spot at 4.4360), we highlighted that ‘The underlying appears to be firm, and the bias for USD/MYR this week is still on the upside’. We noted that ‘there are a couple of strong resistance levels at 4.4410 and 4.4550’. The anticipated USD/MYR strength exceeded our expectations as it rose to a high of 4.4625 last Wednesday. Upward momentum has improved, albeit not by much.”

“This week, USD/MYR could strengthen further but a sustained rise above 4.4850 appears unlikely this week. On the downside, a breach of 4.4200 would indicate that USD/MYR is not strengthening further.”

- EUR/JPY rose to fresh tops well past 151.00.

- Next on the upside comes the September 2008 high near 159.60.

EUR/JPY advances further and surpasses the 151.00 mark for the first time since September 2008 on Tuesday.

The underlying strong upside momentum in the cross appears unchallenged for the time being. Against that, the continuation of the upward bias should meet the next hurdle of note at the September 2008 high at 159.62 (September 1).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.55.

EUR/JPY daily chart

- US Dollar starts the month of May on a firm footing, gathers strength against its major rivals.

- US Dollar Index climbed to its highest level in three weeks above 102.0.

- Federal Reserve's policy meeting could significantly influence the US Dollar's valuation this week.

The US Dollar gathered bullish momentum on Monday and the US Dollar Index (DXY) rose more than 5% on a daily basis, fueled by a more than 4% increase seen in the benchmark 10-year US Treasury bond yield. The DXY continues to push higher on Tuesday and trades at its strongest level since April 11 above 102.00.