- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Consumer Confidence | September | 37.1 | |

| 06:30 | Switzerland | Consumer Price Index (MoM) | September | 0% | 0.1% |

| 06:30 | Switzerland | Consumer Price Index (YoY) | September | 0.3% | 0.3% |

| 08:30 | United Kingdom | PMI Construction | September | 45 | 45 |

| 12:15 | U.S. | ADP Employment Report | September | 195 | 153 |

| 13:00 | U.S. | FOMC Member Harker Speaks | |||

| 14:30 | U.S. | Crude Oil Inventories | September | 2.412 | |

| 14:50 | U.S. | FOMC Member Williams Speaks | |||

| 22:30 | Australia | AIG Services Index | September | 51.4 |

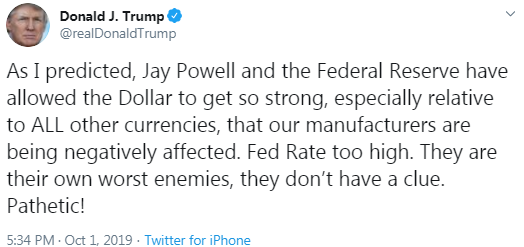

The main US stock indices fell significantly, as ISM data showed that activity in the US manufacturing sector continued to deteriorate in September, which provoked concerns about the slowdown in the world's largest economy.

A report published by the Institute for Supply Management (ISM) showed that the manufacturing PMI fell in September to 47.8 points from 49.1 points in August. The latter value was the lowest since June 2009. Analysts had expected the figure to rise to 50.1 points.

ISM Chairman Timothy Fiore in a report pointed out that trade confrontation with China has a negative impact on US production.

Representatives from the United States and China will meet in Washington next week to discuss a potential trade deal between the two largest economies in the world.

Additional pressure on the market was provided by McDonald's (MCD), which fell 2.53% after warning JPMorgan analysts that the company's comparable US sales in the third quarter could be below Wall Street forecast.

Most of the DOW components completed trading in the red (26 of 30). Outsiders were shares of 3M Company (MMM; -3.42%). The biggest gainers were Visa Inc. (V; + 1.37%).

All S&P sectors recorded a decline. The largest decline was shown in the industrial goods sector (-2.1%).

At the time of closing:

Dow 26,573.04 -343.79 -1.28%

S&P 500 2,940.25 -36.49 -1.23%

Nasdaq 100 7,908.69 -90.65 -1.13%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Consumer Confidence | September | 37.1 | |

| 06:30 | Switzerland | Consumer Price Index (MoM) | September | 0% | 0.1% |

| 06:30 | Switzerland | Consumer Price Index (YoY) | September | 0.3% | 0.3% |

| 08:30 | United Kingdom | PMI Construction | September | 45 | 45 |

| 12:15 | U.S. | ADP Employment Report | September | 195 | 153 |

| 13:00 | U.S. | FOMC Member Harker Speaks | |||

| 14:30 | U.S. | Crude Oil Inventories | September | 2.412 | |

| 14:50 | U.S. | FOMC Member Williams Speaks | |||

| 22:30 | Australia | AIG Services Index | September | 51.4 |

The Commerce

Department said on Tuesday that construction spending edged up 0.1 percent

m-o-m in August after a revised flat m-o-m performance in July (originally a 0.1

percent m-o-m gain).

Economists had

forecast construction spending increasing 0.4 percent m-o-m in August.

According to

the report, investment in public construction rose 0.4 percent m-o-m, while

spending on private construction was unchanged m-o-m.

On a y-o-y

basis, construction spending dropped 1.9 percent in August.

A report from

the Institute for Supply Management (ISM) showed on Tuesday the U.S.

manufacturing sector’s activity contracted further in September.

The ISM's index

of manufacturing activity came in at 47.8 percent last month, down 1.3

percentage points from the August reading of 49.1 percent, and missed economists'

forecast for a 50.1 percent reading. The latest reading pointed to the sharpest

contraction in the manufacturing sector since June 2009.

A reading above

50 percent indicates expansion, while a reading below 50 percent indicates

contraction.

According to

the report, Production Index came in at 47.3 percent, down 2.2-percentage points

from August, while the Employment Index registered 46.3 percent, a fall of 1.1

percentage points from the August reading, and the Inventories Index was at 46.9

percent, down 3 percentage points from the August reading. At the same time, the

New Orders Index stood at 47.3 percent, up 0.1 percentage point from the August

reading and the Prices Index registered 49.7 percent, a 3.7-percentage point

increase from the August reading

Timothy R.

Fiore, Chair of the ISM Manufacturing Business Survey Committee said, “The past

relationship between the PMI and the overall economy indicates that the PMI for

September (47.8 percent) corresponds to a 1.5-percent increase in real gross

domestic product (GDP) on an annualized basis."

Josh Nye, the senior economist at Royal Bank of Canada (RBC), notes that Canadian GDP was flat in July following four months of gains with goods output declining for a second straight month and services sector witnessing another broadly-based increase.

- “The Canadian economy’s best growth streak since 2017 came to an end in July thanks to a broadly-based decline in the goods sector. Oil and gas was the main source of weakness.

- Manufacturing output was down only slightly, though the sector’s earlier outperformance relative to countries like the US and Germany does seem to be gradually fading. The good news is that there continues to be little evidence of spillover into the larger services economy, which has posted above-trend gains in four of the last five months.

- Today’s data are consistent with the BoC’s view that growth over the second half of the year is likely to be slightly slower than the first half. But again, there are few signs of a broader slowdown in today’s data.”

U.S. stock-index futures rose on Tuesday, as investors awaited data on activity in the U.S. manufacturing sector (14:00 GMT), which are expected to show the sector rebounded in September after contracting in August.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,885.24 | +129.40 | +0.59% |

Hang Seng | - | - | - |

Shanghai | - | - | - |

S&P/ASX | 6,742.80 | +54.50 | +0.81% |

FTSE | 7,402.51 | -5.70 | -0.08% |

CAC | 5,665.54 | -12.25 | -0.22% |

DAX | 12,411.23 | -16.85 | -0.14% |

Crude oil | $54.53 | +0.85% | |

Gold | $1,471.00 | -0.13% |

Analysts at TD Securities are forecasting a rebound in the U.S. ISM index to 50.8, as they expect easing trade tensions to have marginally boosted business sentiment in September.

- “Although the regional surveys continue to give mixed signals, the average of the ISM-adjusted versions is pointing to some improvement since August. In addition, a recent spate of stable capex orders, improving China PMIs and a firmer Markit manufacturing index also boost the odds for a positive surprise, in our view.”

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 40.25 | 0.12(0.30%) | 713923 |

Amazon.com Inc., NASDAQ | AMZN | 1,724.36 | -1.09(-0.06%) | 22887 |

Apple Inc. | AAPL | 220.55 | 1.73(0.79%) | 179617 |

AT&T Inc | T | 37.55 | 0.12(0.32%) | 26002 |

Boeing Co | BA | 382 | -0.86(-0.22%) | 5920 |

Chevron Corp | CVX | 118.3 | -0.30(-0.25%) | 2129 |

Cisco Systems Inc | CSCO | 49 | 0.16(0.33%) | 3541 |

Citigroup Inc., NYSE | C | 69.6 | 0.14(0.20%) | 4578 |

E. I. du Pont de Nemours and Co | DD | 70.26 | 0.01(0.01%) | 100 |

Exxon Mobil Corp | XOM | 71.25 | -0.23(-0.32%) | 1256 |

Facebook, Inc. | FB | 177.18 | 0.08(0.05%) | 23161 |

FedEx Corporation, NYSE | FDX | 145.25 | 0.29(0.20%) | 1209 |

Ford Motor Co. | F | 9.1 | 0.02(0.22%) | 3729 |

General Electric Co | GE | 9.05 | 0.01(0.11%) | 26077 |

Google Inc. | GOOG | 1,228.00 | 2.91(0.24%) | 2761 |

Hewlett-Packard Co. | HPQ | 18.57 | 0.04(0.22%) | 150 |

Home Depot Inc | HD | 231.14 | 1.28(0.56%) | 504 |

Intel Corp | INTC | 50.82 | 0.04(0.08%) | 1441 |

International Business Machines Co... | IBM | 143.03 | -0.21(-0.15%) | 1357 |

Johnson & Johnson | JNJ | 128.94 | 0.34(0.26%) | 710 |

JPMorgan Chase and Co | JPM | 118.01 | 0.29(0.25%) | 5384 |

McDonald's Corp | MCD | 213.74 | 0.58(0.27%) | 363 |

Merck & Co Inc | MRK | 83.12 | 0.21(0.25%) | 4834 |

Microsoft Corp | MSFT | 137.99 | 0.26(0.19%) | 60809 |

Nike | NKE | 92.3 | -0.01(-0.01%) | 7658 |

Pfizer Inc | PFE | 36.3 | 0.08(0.22%) | 5849 |

Procter & Gamble Co | PG | 124.7 | 0.13(0.10%) | 1618 |

Starbucks Corporation, NASDAQ | SBUX | 88.51 | 0.14(0.16%) | 2813 |

Tesla Motors, Inc., NASDAQ | TSLA | 242.36 | 0.23(0.10%) | 38834 |

The Coca-Cola Co | KO | 54.42 | 0.11(0.20%) | 4217 |

Twitter, Inc., NYSE | TWTR | 41.46 | 0.11(0.27%) | 17121 |

UnitedHealth Group Inc | UNH | 213.14 | -2.12(-0.98%) | 8950 |

Verizon Communications Inc | VZ | 60.59 | 0.29(0.48%) | 2452 |

Visa | V | 174.55 | 0.55(0.32%) | 2628 |

Wal-Mart Stores Inc | WMT | 118.55 | 0.10(0.08%) | 784 |

Walt Disney Co | DIS | 130.2 | 0.24(0.18%) | 7861 |

Yandex N.V., NASDAQ | YNDX | 35.4 | 0.14(0.40%) | 299353 |

Statistics

Canada announced on Tuesday that the country’s gross domestic product (GDP) was

unchanged m-o-m in July, following a 0.2 m-o-m advance in June.

That was below economists’

forecast for a 0.1 percent growth.

In y-o-y terms,

the Canadian GDP rose 1.3 percent in July.

According to

the report, the mining, quarrying, and oil and gas extraction sector recorded a

3.5 percent m-o-m decline in July, its largest monthly decrease since May 2016.

Meanwhile, the construction sector dropped 0.7 percent m-o-m, the

transportation and warehousing sector contracted 0.5 percent m-o-m and manufacturing

edged down 0.1 percent m-o-m. At the same time, utilities increased 1.5 percent

m-o-m in July, while the wholesale sector rose 1.1 percent m-o-m and retail

trade edged up 0.1 percent m-o-m.

Overall,

goods-producing industries fell 0.7 percent m-o-m, while, services-producing

industries rose 0.3 percent m-o-m.

- Any deal must avoid whole of part of Northern Ireland being trapped in a position where they are a rule-taker

- No infrastructure checks or controls will be put in at the border

TD Securities' analysts are expecting Canada’s industry-level GDP to rise by a muted 0.1% in July, in line with the market consensus, as a large drag from the goods-producing sector weighs on growth.

- “If realized, this would be the weakest print since the 0.3% contraction in February and leave Q3 tracking in the low 1% range. While this is slightly below BoC projections from the July MPR, on-target inflation and a robust labour market still support keeping rates on hold through the rest of 2019.

- Markit PMI for September will be released shortly after GDP at 9:30 ET where markets will look for any sign of a recovery following four contractionary readings over the last five months.”

James Smith, a developed market economist at ING, notes that the latest PMI signals that UK manufacturing is being partially boosted by pre-Brexit stock building, although high inventory levels and lack of warehousing space means this effect will be much smaller than before the original March Brexit deadline.

- "At 48.3, the latest Markit/CIPS UK manufacturing PMI is far from cheery. Admittedly this is a little better than expected – and this comes amid some, albeit limited, evidence that firms are rebuilding stocks of inputs ahead of the October 31 Brexit deadline.

- Remember back in the first quarter, firms initiated significant stockpiling ahead of the original exit date. And while much of this by definition involved higher European imports, this gave associated UK manufacturing a boost too. It’s unlikely, however, any boost will be on the same scale this time around. Inventory levels are still perceived to be fairly high, but also warehousing space is becoming more constrained given the close proximity to Black Friday and Christmas.

- While we suspect the recent negativity in the manufacturing data has been to some extent exaggerated by the post-March 31 correction in production, output is also unlikely to meaningfully rebound in the near-term. Alongside all the Brexit uncertainty, the global growth story is also weighing on demand, particularly from the eurozone."

Inge Klaver, an analyst at Nordea Markets, notes that Eurozone’s headline HICP inflation continued to lose momentum and came out at 0.9% y/y in September, below expectations.

- “Headline inflation continues the downward course of the last few months. The y/y reading came in at 0.9%. Headline is trending down on the back of lower energy prices, while food prices contributed positively.

- As expected, Euro-area core inflation bounced back up to 1.0% y/y in September. This was mainly driven by an increase in service price inflation, which partly stems from an increase in package holiday prices as suggested by preliminary data from Germany released yesterday.

- We continue to expect underlying inflationary pressures to build, but very gradually.

- The September inflation is unlikely to be a key variable when the ECB makes its next moves. The economic outlook is requiring more attention than short-term movements in the inflation rate right now. Current weak growth numbers will weaken price pressures in the future and are posing downside risks to the already-well-below-target ECB staff inflation projections.

- For now, markets are awaiting Lagarde’s first speech as an ECB president. We still expect another easing package in December.”

- Strong dollar usually puts downward pressure on inflation; that's something to take into account

UOB Group's analysts have ruled out any significant announcement regarding monetary policy by the ECB this month at their Quarterly Global Outlook.

- “In his penultimate meeting as ECB President, Mario Draghi unveiled a fresh package of stimulus measures. This was Draghi’s final “whatever it takes”, whereby it wasn’t just a return to QE, but QE in perpetuity. However, the ECB declined to discuss whether it would lift the cap on the proportion of a country’s bonds it is allowed to hold (a limit it is already close to hitting).

- Furthermore, the question remains whether what has just been unveiled will be sufficient to get Eurozone growth and inflation back on track as fiscal policy remains a huge issue.

- The September meeting will not be Draghi’s last, but we do not expect any major announcements at the October meeting. Whilst Draghi has certainly left plenty of room for maneuver to his successor Christine Lagarde, her first policy meeting in December is also unlikely to be groundbreaking”.

- Says progress on employment, inflation goals slower than liked; today's rate cut should help

- Repeats economy is at a gentle turning point

- Part of effort to restore business confidence could be structural measures to lift productivity

- Expecting return to around trend growth for Australia over next year.

- Low rates, tax cuts, infra spending, housing stabilization, resources outlook basis for expected improvement.

- Resilience of domestic financial system has steadily improved; banks well placed to withstand wide range of shocks

- Lenders should not be so scared of making a loan that goes bad that they don’t provide credit

- Need to make sure bank systems are safe and resilient against cyber and technology risks

- Household sector has high level of debt, has also built up substantial buffers at aggregate level

- Estimates almost 4% of borrowers have loan balance exceeding property value

The possibility of a fiscal crisis is the biggest risk to doing business globally, according to a survey of World Economic Forum business leaders published on Tuesday, though there were strong regional differences in views of the biggest risk.

In North America and Europe, cyber attacks were considered the biggest risk. Environmental risks were the top concern in South Asia, which highlighted water crises, and in East Asia and the Pacific, which identified natural catastrophes.

Overall, the executives put fiscal crises as the top risk over the next 10 years, followed by cyber attacks and unemployment or underemployment, the WEF’s Executive Opinion Survey showed.

The survey of 12,897 business leaders from 133 countries makes up part of the WEF's global competitiveness report, published before the January Davos forum.

The survey was published by WEF together with Marsh & McLennan and Zurich Insurance.

Trade tariffs between the U.S. and Europe would precipitate a “snowball effect” and the world may soon enter “very precarious waters” if we don’t acknowledge the benefits that stem from international cooperation, the head of the UN agency for workers and employers told CNBC.

Guy Ryder, director general of the International Labour Organization (ILO), said that when world leaders threaten retaliatory measures, business owners and workers lose confidence in the benefits of trade, and trust is eroded.

“I can’t think of a time when people felt more uncertain about their futures,” said Ryder, adding that this unpredictability has “dripped into our political life, as well as our economic and social interaction.”

Danske Bank analysts note that yesterday the BoJ signalled further willingness to re-steepen yield curves, as the October purchase plan under the QE programme showed cuts to purchases in maturities longer than 3 years and even showed a potential end to purchases above 25y maturities.

“On top of this, Japan's Government Pension Investment Fund in a statement this morning said that it would re-categorize FX hedged foreign currency bond holdings into domestic debt, effectively freeing up JPY 1.3tn, that the fund can now invest in foreign debt. JGB yields are generally higher this morning as the curve steepens 5-6bp 2s10s. The 2s10s curve is at its steepest level since February. It will be interesting to see whether the recent curve steepening can remain intact despite a lack of inflation and growth expectations.”

According to a flash estimate from Eurostat, euro area annual inflation is expected to be 0.9% in September 2019, down from 1.0% in August. Economists had expected a 1.0% increase. Meanwhile, the core figure arrived at 1.0% in the reported month when compared to 1.0% expectations and 0.9% previous.

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in September (1.6%, compared with 2.1% in August), followed by services (1.5%, compared with 1.3% in August), non-energy industrial goods (0.3%, stable compared with August) and energy (-1.8%, compared with -0.6% in August).

According to the report from IHS Markit/CIPS, the downturn in the UK manufacturing sector continued in September. Although the contraction was shallower than the prior survey month, levels of output, new orders, new export business and employment nonetheless fell further. Stocks of purchases and input buying volumes also rose for the first time in recent months, as some companies restarted their Brexit preparations.

The headline seasonally adjusted PMI rose slightly to 48.3 in September, up from August's six-and-a-half year low of 47.4. The headline index has now remained below the neutral 50.0 mark for five successive months, its longest sequence below that mark since mid 2009.

Manufacturing production continued to contract in September, as companies cut back output in response to a further reduction in new order intakes. The investment goods sector was by far the weakest performer, seeing the steepest drops in both output and new business. This reflected, at least in part, a reluctance among clients to commit to capital expenditure due to ongoing market uncertainties (economic, political and Brexit related). The consumer goods sector was the only category to see output rise in September, as production in the intermediate goods industry stagnated. The outlook for both sectors remained lacklustre however, as intakes of new work decreased in both during September. Companies reported lower inflows of new work from the domestic and overseas markets, with the trend in the former especially weak.

According to the report from IHS Markit, operating conditions in the euro area’s manufacturing economy deteriorated in September to the greatest degree in just under seven years.

After accounting for seasonality, the Eurozone Manufacturing PMI fell to 45.7, down from 47.0 in August and its lowest reading since October 2012. Latest data indicated the eighth successive month that the PMI has posted below the 50.0 no-change mark.

All three market groups covered by the survey showed a deterioration in operating conditions. Investment goods producers registered the sharpest deterioration, followed by intermediate goods. Consumer goods recorded a PMI reading below the 50.0 no-change mark for the first time since November 2013.

The region’s manufacturing downturn was led in the main by rapidly deteriorating operating conditions in Germany, with the respective PMI falling to its lowest level since June 2009. Austria also experienced a notable deterioration, whilst Spain, Italy, and Ireland also recorded sub-50.0 PMI readings during September. Meanwhile, France barely grew whilst there was only modest growth in the Netherlands. Greece remained the best-performing of all countries, despite the rate of expansion slipping to a three-month low.

According to analysts at TD Securities, consensus is looking for Eurozone HICP to hold steady at 1.0% y/y in September, but TD see downside risks with a forecast of 0.9% y/y (its first time below the 1.0% mark in nearly 3 years).

“This is supported by downside surprises for HICP to France, Spain, Italy, and Germany over the last couple of days. We are in line with consensus though in looking for core CPI to edge a tenth higher to 1.0% y/y, although with the widespread weakness across the area, the risks there likely lie to the downside as well.”

Japan rolled out a twice-delayed increase in the sales tax to 10% from 8% on Tuesday, a move that is seen as critical for fixing the country's tattered finances but that could tip the economy into recession by dampening consumer sentiment.

The government has already applied measures to mitigate the pain on consumption, mindful of avoiding the effects of the last increase, in 2014, which led to a severe economic downturn.

When the government raised the tax to 8% from 5% in April 2014, a last-minute buying spree and a subsequent pullback in demand caused a big downward swing in consumer spending.

The bitter memory led Prime Minister Shinzo Abe to twice delay the increase to 10% until Oct. 1. But the higher tax rate will still hit an economy suffering from slowing global demand and bitter trade tensions.

Abe said the tax hike would help pay for social security services in an ageing society, such as making preschool education free, lowering nursing care insurance premiums, and providing payouts to the elderly with low pension benefits.

The government and central bank policymakers expect the impact from the 2%-point tax hike to be much smaller than that of the previous increase. To ease the pain on low-income households, some food and non-alcoholic beverages will be exempt from the higher tax rate. The government has also set aside 2 trillion yen for discounts and shopping vouchers as well as public works spending. Another 300 billion yen will be spent on tax breaks for housing and car purchases.

Analysts at ANZ note that New Zealand’s Quarterly Survey of Business Opinion (QSBO) for Q3 has deteriorated further.

“Activity indicators suggest downside risk to our (already subdued) growth forecasts. Headline confidence remains in pessimistic territory, slipping further to its lowest level since March 2009. Domestic trading activity, which has been providing a decent steer on economic growth lately, suggests growth could disappoint in Q3. In fact, taken at face value it suggests annual growth of close to 1%. That said, some indicators for Q4 did bounce, including activity, profitability, and employment intentions, suggesting activity may stabilise towards the end of the year. Several measures of capacity eased, which doesn’t bode well for the inflation outlook. Profitability continues to be squeezed, although both costs and pricing intentions eased in Q3, suggesting little pipeline inflationary pressure.”

Federal Statistical Office (FSO) said, turnover adjusted for sales days and holidays rose in the retail sector by 1.3% in nominal terms in August 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month.

Real turnover adjusted for sales days and holidays fell in the retail sector by 1.4% in August 2019 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered a decline of 1.6%.

Adjusted for sales days and holidays, the retail sector excluding service stations showed a 0.7% decrease in nominal turnover in August 2019 compared with August 2018 (in real terms –0.9%). Retail sales of food, drinks and tobacco registered a decline in nominal turnover of 0.4% (in real terms –0.8%), whereas the non-food sector registered a nominal negative of 1.2% (in real terms

–1.0%).

Excluding service stations, the retail sector showed a seasonally adjusted decline in nominal turnover of 1.4% compared with the previous month (in real terms –1.5%). Retail sales of food, drinks and tobacco registered a nominal minus of 1.0% (in real terms –1.0%). The non-food sector showed a minus of 2.1% (in real terms –2.1%).

According to the report from Nationwide Building Society, annual house price growth in UK dipped to 0.2% in September compared to +0.6% in August. Economists had expected a 0.5% increase. On a monthly basis, home prices fell 0.2% after stabilizing in August. Economists had expected a 0.1% increase.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “UK annual house price growth almost ground to a halt in September, at just 0.2%. This marks the tenth month in a row in which annual price growth has been below 1%. Indicators of UK economic activity have been fairly volatile in recent quarters, but the underlying pace of growth appears to have slowed as a result of weaker global growth and an intensification of Brexit uncertainty. However, the slowdown has centred on business investment household spending has been more resilient, supported by steady gains in employment and real earnings. The underlying pace of housing market activity has remained broadly stable, with the number of mortgages approved for house purchase continuing within the fairly narrow range prevailing over the past two years. Healthy labour market conditions and low borrowing costs appear to be offsetting the drag from the uncertain economic outlook.

Analysts at TD Securities note that the RBA cut the cash rate by 25bps to 0.75% in line with our expectations.

“Although the RBA inserted ‘a gentle turning point, however, appears to have been reached…”, the RBA tells us that they are prepared to ease monetary policy further if needed, so the Bank retains its contingent easing bias. The motive for cutting today was to support employment and income growth. Looking ahead though, the Board indicates the bias to cut is to ‘support sustainable growth in the economy, full employment and the achievement of the inflation target over time’, which is in contrast to the Sep statement where the Bank highlights just ‘sustainable growth’ and ‘inflation’. Our read is that if we get a poor print on jobs another cut could materialise in Dec, which is a risk to our forecast.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1102 (2793)

$1.1055 (1302)

$1.1014 (1784)

Price at time of writing this review: $1.0891

Support levels (open interest**, contracts):

$1.0846 (2053)

$1.0798 (552)

$1.0749 (538)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 4 is 92712 contracts (according to data from September, 30) with the maximum number of contracts with strike price $1,1050 (6904);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2460 (1136)

$1.2421 (798)

$1.2389 (661)

Price at time of writing this review: $1.2291

Support levels (open interest**, contracts):

$1.2231 (936)

$1.2190 (1192)

$1.2145 (1170)

Comments:

- Overall open interest on the CALL options with the expiration date October, 4 is 17543 contracts, with the maximum number of contracts with strike price $1,2500 (1758);

- Overall open interest on the PUT options with the expiration date October, 4 is 19518 contracts, with the maximum number of contracts with strike price $1,1900 (1315);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from September, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.18 | -2.98 |

| WTI | 54.1 | -3.31 |

| Silver | 16.98 | -3.03 |

| Gold | 1472.194 | -1.55 |

| Palladium | 1673.32 | -0.8 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -123.06 | 21755.84 | -0.56 |

| Hang Seng | 137.46 | 26092.27 | 0.53 |

| KOSPI | 13.12 | 2063.05 | 0.64 |

| ASX 200 | -27.8 | 6688.3 | -0.41 |

| FTSE 100 | -18 | 7408.21 | -0.24 |

| DAX | 47.14 | 12428.08 | 0.38 |

| Dow Jones | 96.58 | 26916.83 | 0.36 |

| S&P 500 | 14.95 | 2976.74 | 0.5 |

| NASDAQ Composite | 59.71 | 7999.34 | 0.75 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67488 | -0.21 |

| EURJPY | 117.772 | -0.31 |

| EURUSD | 1.08976 | -0.4 |

| GBPJPY | 132.814 | 0.08 |

| GBPUSD | 1.229 | 0.01 |

| NZDUSD | 0.62571 | -0.51 |

| USDCAD | 1.32382 | 0.02 |

| USDCHF | 0.99762 | 0.69 |

| USDJPY | 108.064 | 0.08 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.