- Analytics

- News and Tools

- Market News

Новини ринків

- Saudi Arabia expected to extend its 1 million bpd output cut into October.

- Russia agrees with OPEC to cut exports next month.

- Positive business activity reports from China improve the oil demand outlook.

- US unemployment rate rises, wage growth slows, potentially pausing interest rate hikes.

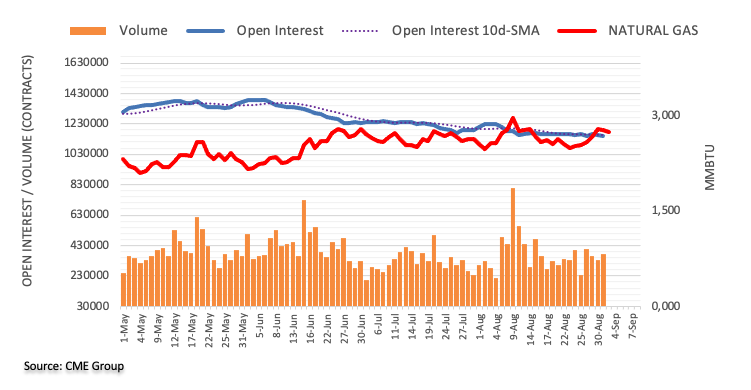

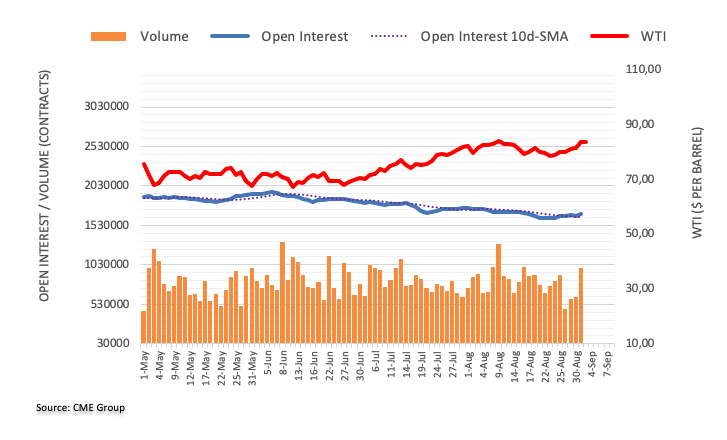

Western Texas Intermediate (WTI), the US crude oil benchmark, rose to a new year-to-date (YTD) high of $85.57, snapping a two-week losing streak due to additional supply cuts led by Saudi Arabia and Russia. WTI is trading at $85.56. gains 2.79%.

Saudi Arabia and Russia lead supply cuts as US commercial crude inventories drop, boosting WTI prices

Saudi Arabia is expected to extend its 1 million barrels per day (bpd) output into October. According to its Deputy Prime Minister Alexander Novak, Russia has already agreed with the Organization of the Petroleum Exporting Countries (OPEC) and allies to cut its exports next month.

In the meantime, commercial crude inventories in the US dropped in five of the last six weeks, suggesting demand for WTI is increasing, as revealed by the US Energy Information Administration (EIA).

In the meantime, better-than-expected reports of business activity in China improved oil’s demand outlook, which was already battered by soft PMI readings across Europe and in the UK.

A closely monitored US report on Friday revealed an increase in the unemployment rate and a slowdown in wage growth. These developments reinforce anticipations of pausing the trajectory of interest rate hikes.

As a sign of potential future supply, the count of US oil rigs remained steady at 512 for the current week. According to energy services company Baker Hughes, this figure is at its lowest since February 2022.

WTI Technical Levels

- XAG/USD peaked at a daily high of $24.80 then settled near the $24.15 area.

- US NFPs and PMI figures from August beat expectations. Still, wages decelerated, and Unemployment rose.

- The USD strength drove the grey metal downwards.

At the end of the week, the XAG/USD closed with losses but managed to hold some weekly gains, closing near $24.15. On the data front, the US released soft Average Hourly Earnings, while Nonfarm Payrolls (NFPs) and ISM Manufacturing PMI figures came in higher than expected, helping the USD to get a boost. US yields sharply declined during the American sessions but then recovered, applying selling pressure on the Silver.

The US showed mixed economic data. On the bright side, the US Bureau of Labor Statistics released the Nonfarm Payrolls (NFPs) from August that came in at 187,000, higher than the expected 170,000 and the previous reading of 157,000. In addition, the Institute for Supply Management released the ISM Manufacturing PMI from the same month that came in at 47.6, while the expected figure was 47 and rose above the previous 46.4. On the other hand, wage inflation, measured by the Average Hourly Earnings, slowed to 4.3%, a bit lower than the consensus and the previous 4.4%. The Unemployment rate rose to 3.8% in the same month, higher than the market's consensus.

Following the NPF release, the US treasury bond yields sharply declined but then recovered some ground following the release of the ISM PMIs. The 2,5, and 10-year yields settled at 4.88%, 4.30% and 4.18%, respectively, after falling to their lowest level since August 10.

That being said, the CME FedWatch Tool suggests that investors expect the Fed won't hike in September, while the odds of a 25 basis points (bps) increase declined near 35% for November and December after rising near 46% last week. Regarding the decisions, it will all come down to the data, and investors will continue placing their bets depending on the signs the US economy gives

XAG/USD Levels to watch

Upon evaluating the daily chart, a neutral to bearish outlook is seen, with the balance starting to lean in favour of the bears, although they still have hurdles to overcome.With a negative slope above its midline, the Relative Strength Index (RSI) suggests a potential weakening of buying pressure, while the Moving Average Convergence (MACD) exhibits decreasing green bars. On the other hand, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating a favourable position for the bulls in the bigger picture.

Support levels: $24.00, $23.90 (100-day SMA), $23.50

Resistance levels: $24.30, $24.80, $25.00

XAG/USD Daily Chart

-638292000256105381.png)

- Bullish-engulfing candlestick pattern on the daily chart suggests buyers are in control.

- The first major resistance at 1.3600, followed by several key levels up to 1.3804.

- Downside risks include a drop below 1.3489, potentially targeting the 200-DMA at 1.3462 and the 50-DMA at 1.3345.

The Canadian Dollar (CAD) losses ground against the US Dollar (USD) sponsored on weaker than expected Canadian economic growth in the second quarter, alongside a mixed US jobs report and improvements in business activity. Hence, the USD/CAD is trading at 1.3595 after hitting a daily low of 1.3489, above its opening price by 0.65%.

USD/CAD Price Analysis: Technical outlook

The daily chart portrays the pair as neutral to upward biased, though the major reached a lower low at 1.3489, slightly below the August 8 daily high at 1.3502. However, the USD/CAD recovery was outstanding, forming a bullish-engulfing candlestick chart pattern, which engulfed the price action of the previous two days. Hence, buyers are in charge.

The USD/CAD first resistance would be the 1.3600 figure. A breach of the latter will expose the August 25 high at 1.3640, closely followed by the May 26 swing high at 1.3654 and the April 28 high at 1.3667. Once those levels are cleared, the 1.3700 figure would be up next before rallying towards the March 24 daily high at 1.3804.

Conversely, if the USD/CAD drops below 1.3489, the pair could shift downwards and extend its losses toward the 200-day Moving Average (DMA) at 1.3462. Once cleared, the next stop would be the psychological 1.3400 area, and up next, the 50-DMA at 1.3345.

USD/CAD Price Action – Hourly chart

- NZD/USD peaked at a daily high of 0.6015 and then plummeted to 0.5940.

- US NFPs from August showed a mixed picture, while the Manufacturing PMIs from the same month came in better than expected.

- The USD holds its ground despite investors betting on lower odds of a last hike by the Fed this cycle.

At the end of the week, the USD measured by the DXY index tallies daily gains after volatility seen in the markets after the release of August Nonfarm Payrolls and ISM PMI manufacturing figures. Still, the NZD/USD pair will record a weekly 0.70% increase. No relevant data was released on the Kiwi’s side.

The Nonfarm Payrolls from the US from August came a tick higher than expected at 187,000 vs. the 170,000 expected and from its previous downwardly revised 157,000. As per the Average Hourly Earning, wages increased by 0.2% (MoM), lower than the 0.3% expected, and the unemployment rate unexpectedly rose to 3.8%. Other data showed that the Institute for Supply Management (ISM) reported higher than anticipated PMIs, with the manufacturing index at 47.6, higher than the 47 expected. The Employment index also came strong at 48.5 but remains in contraction territory.

The USD saw volatility against its rivals as the mixed NFP report initially fuelled a sell-off, but after the ISM PMI, the Greenback somewhat recovered. The US Treasury yields saw the same movement, hinting that the markets are betting on a less aggressive Fed and investors hoping the tightening cycle ends as the labour market hinted at some softness. Focus now shifts to September 13, when the US will release the August Consumer Price Index (CPI) figures, which will be necessary for the next Fed decision expectations.

NZD/USD Levels to watch

The daily chart analysis indicates a neutral to a bearish outlook for NZD/USD, as the bears show signs of taking control but still face challenges ahead. Having turned flat in negative territory, the Relative Strength Index (RSI) suggests a potential market equilibrium with balanced selling and buying pressure. At the same time, the Moving Average Convergence (MACD) lays out stagnant green bars. On the other hand, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting that the bears are firmly in control of the bigger picture.

Support levels:0.5930, 0.5900, 0.5880.

Resistance levels: 0.5967 (20-day SMA), 0.5980, 0.6000.

NZD/USD Daily Chart

-638291976668531350.png)

Next week, the Reserve Bank of Australia (RBA) will announce its monetary policy decision. Analysts at Wells Fargo point out that due to clear signs of economic slowdown and indications of easing price pressures, they believe RBA policymakers will be comfortable maintaining the policy rate at 4.10%.

Key Quotes:

While RBA policymakers appeared concerned about the potential for services inflation to remain elevated, slower wage growth and the details of the July CPI figures offer some encouragement that underlying price pressures might be heading in the right direction.

Meanwhile, signs of a slowing in activity are more pronounced. Q2 real retail sales fell 0.5% quarter-over-quarter, marking a third straight quarterly decline. Employment dropped by 14,600 in July, and August PMIs staying in contraction territory points to subdued activity in both the manufacturing and services sectors.

The softening in China’s economy could also weigh on Australian growth, given extensive trade linkages between the two countries.

Monday is a holiday in the United States and Canada. Later in the week, the Reserve Bank of Australia and the Bank of Canada will announce their monetary policy decisions. Trade data from China, Australian GDP, and Canadian jobs data are among the most relevant reports to watch for.

Here is what you need to know for next week:

Chinese data will continue to be closely watched. National PMIs came in mostly above expectations, providing some relief. It is possible that additional stimulus measures could be announced. Trade data is scheduled to be released on Thursday.

US economic data did not bring many surprises during the week and provided arguments for the Federal Reserve to maintain unchanged rates at the next meeting. The Consumer Price Index on September 13 will be crucial ahead of the FOMC meeting on September 19-20. Key reports in the US next week include Factory Orders and revised Q2 Unit Labor Costs.

Despite mixed Nonfarm Payrolls data, the US Dollar Index jumped on Friday, surpassing 104.20 and it was heading towards the highest daily close since April. However, the 104.50 area remains a significant resistance level. The DXY need to consolidate above that area to open the doors to more gains, while below, it would be vulnerable to sharp corrections.

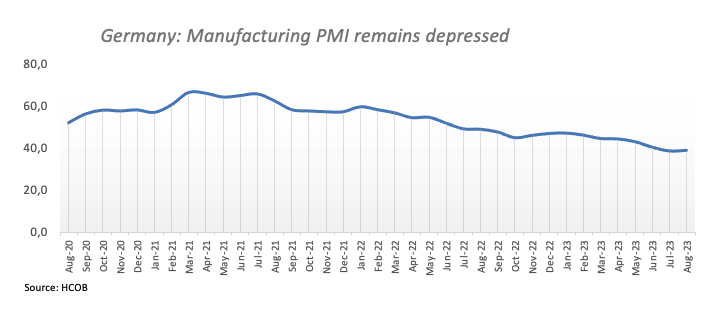

The latest data shows inflation slowing down in the Eurozone, although not as rapidly as anticipated, and the activity outlook is worsening. This places the next European Central Bank (ECB) meeting in a precarious position. The prospect of a less hawkish ECB weighed on the Euro, causing it to pull back sharply after reaching weekly highs against the US Dollar, Pound, and Yen. The common currency was among biggest losers. Next week, Eurostat will report the Producer Price Index and compensation per employee during the second quarter.

EUR/USD posted its seventh consecutive weekly decline after erasing gains on Friday. The bias remains to the downside. Meanwhile, EUR/GBP continues to move sideways within a wide range between 0.8500 and 0.8700.

GBP/USD closed the week around 1.2600. Just when it appeared poised for a more significant correction, the pair pulled back sharply, falling towards the monthly lows and below the 20-week Simple Moving Average. The bias is currently sideways with risks tilted to the downside. On Wednesday, Bank of England’s members will testify to the Treasury Select Committee.

On a volatile week, USD/JPY finished hovering around 146.00. The pair remains undecided as it hit fresh monthly highs but then pulled back sharply.

USD/CHF managed to post another week of gains after surging on Friday. However, it remains below the 20-week Simple Moving Average, which is currently near 0.8900. Failure to rise above that level could trigger a sharp correction, while a break above it would set the stage for further gains for the USD/CHF pair. Switzerland will report its Q2 GDP on Monday.

The Australian Dollar was the best performer among majors during the week. AUD/USD recorded weekly gains after six consecutive weeks of decline. However, the pair is still struggling to break above 0.6500.

The Reserve Bank of Australia will announce its monetary policy decision on Tuesday. No change is expected. The outgoing governor of RBA, Lowe, will deliver a speech on Wednesday, explaining the latest decision. More importantly, the central bank meeting could be overshadowed by the Q2 GDP report, which is expected to show a 0.3% expansion, surpassing the 0.2% recorded in the first quarter.

USD/CAD finished the week hovering around 1.3600, after surging on Friday following weaker-than-expected Canadian GDP data. The bias remains to the upside, but the 1.3650 barrier stays intact. Following Friday's negative GDP surprise, the Bank of Canada is widely expected to keep interest rates unchanged on Wednesday. On Friday, Canada will release the employment report.

Like this article? Help us with some feedback by answering this survey:

- Mixed US Nonfarm Payrolls data initially fails to boost USD, but ISM Manufacturing PMI lifts sentiment.

- UK business activity remains in contraction, but inflation nears 7%, complicating BoE’s next move.

- Office for National Statistics revises UK economic size, indicating a 0.6% growth in Q4 2021 compared to Q4 2019.

The Pound Sterling (GBP) slumped late in the New York session versus the Greenback (USD) as US Treasury bond yields rose and bolstered the USD, which is set to print its seven consecutive week printing gains. The GBP/USD hit a daily high of 1.2712 before reversing its course and diving toward the current exchange rate, trading at around 1.2590s.

GBP/USD drops as US business activity improves, while UK factory activity remains at recessionary levels

Financial markets have remained calm after a busy week in the US economic landscape. The August Nonfarm Payrolls data showed a mix, with 187,000 jobs added, beating the 177,000 estimate. However, the rise in the Unemployment rate to 3.8% YoY, above the forecasted 3.5%, surprisingly didn’t boost the US Dollar. Investors speculate that the Federal Reserve might delay tightening monetary conditions in September, leading to reduced bets on rate hikes by November.

Consequently, the GBP/USD initially surged towards its daily peak. However, a business activity report surpassing expectations triggered a reversal, causing the Pound to relinquish those gains. The ISM Manufacturing PMI increased from 46.4 to 47.6 in August, exceeding the projected 47. Most subcomponents of the report improved, indicating a more optimistic perspective on business activity in the US.

Another reason that underpinned the buck was US bond yields recovering some lost ground, which underpinned the US Dollar Index (DXY) back above the 104.000 figure, a tailwind for the USD/CHF pair.

Earlier data in the UK showed that British business activity remained in contractionary territory, dropping for six consecutive months below the 50 threshold, as revealed by the S^&P Global/CIPS Manufacturing PMI, coming at 43.0 from 45.3 in July. That makes the case for a Bank of England (BoE) pause on its tightening cycle, but inflation remains close to 7%. Nevertheless, traders foresee a 25 bps rate increase in the upcoming meeting.

However, there is a silver lining. The Office for National Statistics has revised its assessment of the UK economy, indicating that it was 0.6% larger in the fourth quarter of 2021 than in the final quarter of 2019. This contrasts with the prior estimate of a 1.2% reduction in size.

GBP/USD Price Analysis: Technical outlook

The daily chart portrays the pair as neutral to downward biased, but it could shift downward if the GBP/USD achieves a daily close below the June 29 low of 1.2590. Once cleared, the next support would be an upslope trendline drawn from May lows at around 1.2550/75, followed by the August 23 swing low of 1.2548. A decisive break and the pair could test the 200-day Moving Average (DMA) at 1.2414. Upside risks lie at the August 30 daily high at 1.2746, shy of the 50-DMA at 1.2774.

- XAU/USD rose to a daily high of $1,952 and then got rejected by 100-day SMA, retreating to $1,940.

- US yields initially dropped after mixed US NPFs but recovered after strong US ISMs from August.

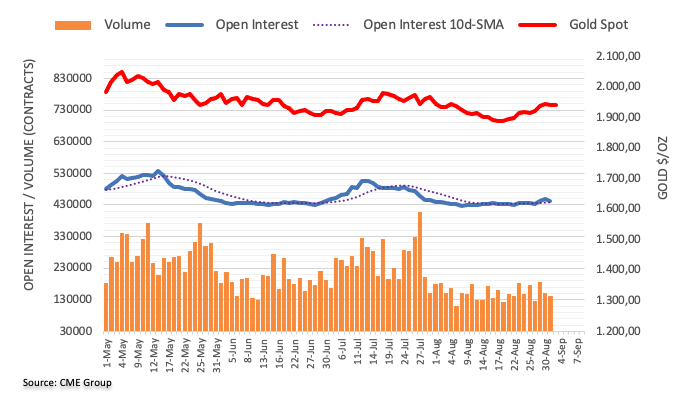

At the end of the week, the Gold spot price XAU/USD erased daily gains, retreating towards the $1,940 area. After initially retreating, the US yields recovered during the American session, but still the yellow metal will set a winning week of more than 1%.

The highly anticipated US Nonfarm Payrolls report from August showed mixed figures. On a positive note the headline’s NFPs rose to 187,000, higher than the 170,000 expected and the previous 157,000. Average Hourly Earnings came in soft, increasing by 0.2% MoM vs. the 0.3% expected. Unemployment rose to 3.8% in the same month, against all forecasts.

Regarding economic activity, the Institute for Supply Management (ISM) Manufacturing PMI figures from the United States came in above the consensus in August, with the actual figure coming in at 47.6, higher than the expected figure of 47 from the previous 46.4.

The US bond yields, often seen as the opportunity cost of holding gold, were volatile following the employment and economic activity figures. The 2-year yield dropped to a three-week low around the 4.76% area, settling at 4.85%. Likewise, the 5 and 10-year yields dropped to their lowest level since August 10 and settled at 4.27% and 4.15%, respectively. Regarding the next Federal Reserve (Fed) expectations, markets lowered their bets for an additional hike in 2023. According to the CME FedWatch tool, investors are still confident that the Fed won’t hike in the September meeting, and the odds of a hike in November and December dropped to nearly 35%

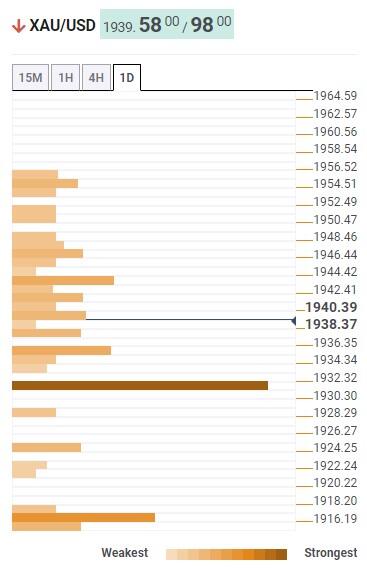

XAU/USD Levels to watch

According to the daily chart, the technical outlook for XAU/USD leans neutral to bearish as signs of bullish exhaustion emerge. The Relative Strength Index (RSI) displays a negative slope above its midline, and the Moving Average Convergence Divergence (MACD) shows fading green bars. With a downward trend below its midline, the Relative Strength Index (RSI) suggests a bearish sentiment, while the Moving Average Convergence (MACD) displays weaker green bars. On the other hand, the pair is below the 100-day Simple Moving Averages (SMAs) but above the 20 and 200-day averages, suggesting that the buyers may still have some gas left in the tank.

Support levels: $1,930, $1,915 (20 and 200-day SMA convergence), $1,900.

Resistance levels: $1,950 (100-day SMA), $1,970, $2,000.

XAU/USD Daily Chart

-638291889766968784.png)

- Mixed US Nonfarm Payrolls data initially fails to boost USD, but ISM Manufacturing PMI lifts sentiment.

- Swiss inflation exceeds estimates, but weak Retail Sales could deter SNB from tightening.

- The upcoming Federal Reserve meeting on September 14 could be a key event for the pair.

The Swiss Franc (CHF) losses traction against the American Dollar (USD) in the mid-New York session on Friday after a tranche of economic data from the United States (US) bolstered the USD. The USD/CHF dived towards a daily low of 0.8795 before resuming its latest three-day uptrend and exchanging hands at around 0.8850s, above its opening price by 0.28%.

Swiss Franc losses ground as improvement in US business activity and bond yields support the USD

The financial markets remain calm after a busy week in the US economic docket. August’s Nonfarm Payrolls figures came mixed, with the US economy adding 187K jobs, above estimates of 177K, which surprisingly failed to boos the Greenback, as the Unemployment rate rose by 3.8% YoY, above forecasts of 3.5%. The US Dollar weakness was because investors speculated the Fed would not tighten monetary conditions on September, while reducing bets the US central bank would do it by November.

However, USD/CHF sellers were caught off guard, as the ISM Manufacturing PMI improved to 47.6 from 46.4 in July and topped expectations of 47. Most of the subcomponents of the report strengthened, painting a more positive outlook for business activity in the US.

Another reason that underpinned the buck was US bond yields recovering some lost ground, which underpinned the US Dollar Index (DXY) back above the 104.000 figure, a tailwind for the USD/CHF pair.

In Switzerland, inflation rose by 1.6%, exceeded estimates of 1.5%, and was unchanged compared to July’s figures. Although the data reinforces the chances for additional tightening by the Swiss National Bank (SNB), a worse than expected Retail Sales report in July could deter the central bank from tightening monetary policy. Traders should be aware the SNB’s current interest rate sits at 1.75%, and chances for keeping them unchanged loom 70%.

Given the backdrop, the USD/CHF could resume its uptrend and test the 0.9000 figure, but the upcoming US Federal Reserve meeting on September 14 can shift the perspective ahead of the Fed’s decision.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the pair as entering a consolidation phase, though tilted to the upside, once buyers reclaimed the 50-day Moving Average (DMA) at 0.8782. In addition, the major has crossed above a downslope resistance trendline drawn from March 2023 highs, a five-month-old relevant trendline, which, once broken, the pair would have a straightforward way to test 0.9000. A breach of the latter will expose the confluence of a previous support trendline turned resistance and the 200-DMA at around 0.9040/65 before buyers set their sights on the May 31 high of 0.9147. Contrarily, downside risks emerge below the current week’s low of 0.8744.

- AUD/USD retreated below the 20-day SMA towards 0.6450.

- The August NFP report from the US sent mixed signals from the US labour market.

- The Greenback benefited from higher-than-expected ISM PMIs.

In Friday’s session, the USD initially dropped and found support at the 20-day Simple Moving Average (SMA) of 103.30 but then managed to recover towards 104.20. The US reported mixed Nonfarm Payrolls figures and strong PMI figures, while the Australian calendar had nothing relevant to offer, so the USD’s movements primarily directed the pair’s movements.

The Nonfarm Payrolls report, which measures the employment change in non-agricultural business, showed that the US added 187,000 jobs in August, a tick higher than the 170,000 expected and from the previous downwardly revised 157,000. On the negative side, Average Hourly Earnings increased, but slower than expected, while the Unemployment rate rose to 3.8% in the same month.

What drove the USD upwards was the data from the Institute for Supply Management (ISM), which reported higher than expected PMIs from August, with the manufacturing index at 47.6, higher than the 47 expected. The Employment Index also came strong at 48.5 but remains in contraction territory.

As a reaction, the 2,5 and 10-year US Treasury yields fell to their lowest levels in three weeks but then managed to clear their declines after the release of the ISM PMIs. In line with that, the CME FedWatch tool shows that the odds of a hike in the November meeting of the Fed declined to 33% after being around 40% in the last few days. It's worth highlighting that the market’s volatility on Friday was driven by investors digesting key economic data. Chair Powell from the Federal Reserve (Fed) stated that the ongoing decisions will be decided “carefully” depending on the incoming data.

AUD/USD Levels to watch

The AUD/USD daily chart analysis points to a bearish sentiment for the short term. The Relative Strength Index (RSI) is situated below its midline in negative territory, displaying a southward trajectory. Likewise, the Moving Average Convergence Divergence (MACD) reveals red bars, signifying a growing bearish momentum for AUD/USD. Additionally, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), indicating that on the broader picture, the bears are still in command, and the buyers have work to do.

Support levels: 0.6430, 0.6400, 0.6390.

Resistance levels: 0.6460 (20-day SMA), 0.6480, 0.6500.

AUD/USD Daily Chart

-638291850567716673.png)

- USD/MXN trades at 17.1222, up by 0.56%, recovering from a daily low of 16.9699.

- US Nonfarm Payrolls for August meet expectations, but the Unemployment Rate rise spurred an initial drop in USD/MXN.

- ISM Manufacturing PMI shows signs of improvement, helping the USD recover.

The American Dollar (USD) recovered some ground against the Mexican Peso (MXN), gaining earlier in the session, diving to a daily low of 16.9699. Still, recent economic data from the United States (US) and high US yields weighed on the emerging market currency, which trims its gains to 12.09% in the year. The USD/MXN is trading at 17.1222, edges high by 0.56%.

MXN trims yearly gains as US bond yields and economic data from the US weigh on the emerging market currency

Before Wall Street opened, the US Department of Labor revealed the US economy added 187K jobs to the economy, the same number as July, which could have been positive for the Greenback but wasn’t. The Unemployment Rate ticked up by 0.3% from 3.5% to 3.8%, approaching the Federal Reserve’s (Fed) target of 4.1% throughout 2023.

Initially, the USD/MXN dropped like a stone from daily highs of around 17.2000, below the 17.0000 figure, as investors weighed that Jerome Powell and Co would not continue to tighten monetary policy. However, traders booked profits ahead of additional market-moving data.

After the employment report, the ISM Manufacturing PMI for August showed signs of improvement, rising to 47.6 from 46.4 in July, yet remained in contractionary territory. Most of the subcomponents rose, except for new orders, which remained depressed, but factory inventories remaining at lower levels could spur a jump in orders in the near term.

The markets reacted oppositely, following the business activity report, even though traders pared additional rate hikes by the Fed, and as of today, expect the first rate cut by May 2024, as shown by the CME FedWatch Tool. The USD/MXN reversed its course and climbed towards 17.1500 but failed to gain traction to lift the exchange rates to new weekly highs above 17.2012.

On the Mexican front, the Bank of Mexico (Banxico) decided to cut its hedging program and reported over $5.65 billion in remittances in July, edging near the monthly record of $5.70 billion hit last May. Also, the August S&P Global Manufacturing PMI report came at 51.2 vs. 53.2 in July, portraying slight weakness in the sector.

USD/MXN Price Analysis: Technical outlook

From a technical standpoint, the USD/MXN has broken to the upside, set to register its most significant weekly gain of more than 2.40%. Buyers are eyeing a break of a downslope resistance trendline drawn from April 2023 highs of 18.4010, which, once cleared, could put the May 17 swing low of 17.4038 as crucial resistance. A breach of the latter would put a challenge of the 18.0000 figure into the table.

- After initially rising to 1.0880, the EUR/USD declined to 1.0785, below the 200-day SMA of 1.0815.

- Manufacturing PMIs from the US showed better than expected results.

- The US DXY index and Treasury yields significantly recovered following the release.

Following the release of a mixed Nonfarm Payrolls report, which saw employment rising higher than expected, wages decelerating and the unemployment rate rising above expectations in August, the USD reversed its course on the back of stronger Institute for Supply Management (ISM) PMIs.

The manufacturing index rose above expectations but showed that the sector remains in a contraction area, coming in at 47.6 vs. the 47 expected. The Employment index also beat expectations at 48.5 vs. the 44.2 expected.

The USD’s DXY index dropped to 103.27 after the NFPs but recovered after the better-than-expected PMI towards 104.22. US yields also saw volatility falling to lows since August 10 but cleared some losses. The decline of the yields hints at investors betting on lower odds of a Federal Reserve (Fed) hike this year. The CME FedWatch tool depicts that the likelihood of a 25 basis point (bps) increase declined to nearly 35% in November and December after rising nearly 50% this week. Ongoing data will continue helping investors model their expectations towards the upcoming September 20 meeting and as long as investors continue betting for no hikes for the remainder of 2023, the USD’s upside is limited.

EUR/USD Levels to watch

Based on the daily chart, the EUR/USD exhibits a bearish outlook for the short term. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain in negative territory, with the RSI below its midline and showing a southward slope. The MACD is also displaying red bars, indicating a strengthening bearish momentum. Additionally, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), pointing towards the prevailing strength of the bears in the larger context and the buyers facing a challenging situation.

Support levels:1.0780, 1.0760, 1.0730.

Resistance levels: 1.0815 (200-day SMA), 1.0830, 1.0890 (20-day SMA)

EUR/USD Daily Chart

-638291818821952283.png)

- USD/JPY trades nearly flat at 145.46 after dropping to a three-week low of 144.44.

- US Nonfarm Payrolls for August beat estimates, but Unemployment Rate misses, keeping the pair in check.

- Rising US Treasury bond yields lend some support to the USD.

The Greenback (USD) stages a recovery against the Japanese Yen (JPY) after dropping to a three-week low of 144.44 amid a busy schedule in the United States (US) economic docket. US Treasury bond yields advance, boosting the USD. The USD/JPY is trading at 146.196, gains of 0.45%.

Greenback recovers from three-week low vs. Yen, despite mixed signals in US labor market

The busiest US economic docket finalized, as the latest employment report, namely the Nonfarm Payrolls for August, was above estimates of 177K, with the economy adding 187K, unchanged compared to July’s data. Even though the report was good, and the Greenback should have witnessed a more robust appreciation, it did not. The Unemployment Rate closed towards the US Federal Reserve’s forecast of 4.1% for 2023, which was 3.8% YoY, missing estimates of 3.5%, the highest level since February 2022.

In other data, manufacturing business activity improved, as shown by the ISM Manufacturing PMI for August, rose by 47.6, smashed July’s 46.4 drop, and above estimates of 47. Most subcomponents of the index rose, except for new orders, which are set to improve as factory inventories remained at lower levels.

On the Japanese front, manufactury activity shrank, blamed on costs as revealed by the Jibun Bank Manufacturing PMI, which dropped to 49.6, below the prior month’s 49.7, and the third month the index was below the 50 threshold that separated expansion from contraction.

Given the fundamental backdrop, the USD/JPY remains bullish but subject to an FX intervention by Japanese authorities, which has remained vigilant. On this theme, Japanese Finance Minister Shunichi Suzuki said markets should set currencies, though sudden moves are undesirable, and added that’s closely watching currency moves.

USD/JPY Price Analysis: Technical outlook

Price action depicts the pair dipping to a lower low than the previous one, at 144.53, opening the door for a deeper correction, but unless sellers stepped in and dragged the USD/JPY towards the 145.00 figure, bulls remain in control. Next resistance emerges at 146.00, followed by the year-to-date (YTD) high at 147.38.

The Canadian economy unexpectedly contracted during the second quarter, as indicated by data released on Friday. Analysts at CIBC point out that the decline in consumption is likely to hinder any future interest rate hikes by the Bank of Canada.

Key Quotes:

Forest fires may be taking a few decimal places off the data, but the Canadian economy is hardly on fire in terms of growth, casting doubts on claims that it can shrug off the impact of higher interest rates.

After what looks like a one quarter flash in the pan, GDP contracted in the second quarter, making the last rate hike seem like overkill, and virtually ruling a further hike next week.

Adding to the dismal report was the advance GDP estimate for July, which suggested a flat month after a decline in June, setting the stage for a weak third quarter in which the rise in the unemployment rate will likely weigh on consumer activity further.

Data released on Friday showed that Nonfarm Payrolls rose by 187K in August, surpassing expectations. Analysts at TD Securities consider that recent labor-market and consumer prices data should be judged as positive news by Federal Reserve officials. They continue to view July as the last hike of the Fed's tightening cycle.

Key Quotes:

This is the third consecutive report where employment growth records a below-200k number. On the other hand, the UE (Unemployment) rate surprisingly jumped an eye-popping three tenths to 3.8%, as the labor force surged. Average hourly earnings surprised expectations to the downside for the first time since February.”

Data out this week supports the idea of an economy that is gradually losing momentum as it continues to normalize after a rapid tightening of monetary policy and the easing of a large Covid-driven supply shock.

We think this week's labor-market and consumer prices data should be judged as positive news by Fed officials, and we continue to view July as the last hike of the Fed's tightening cycle.

Data is likely to remain choppy in the next several months and markets are unlikely to move in a straight line.

- ISM Manufacturing PMI recovered in August but remained below 50.

- US Dollar Index clings to small daily gains above 103.50.

The economic activity in the US manufacturing continued to contract in August, albeit at a softer pace than July, with the ISM Manufacturing PMI advancing to 47.6 from 46.4 in July. This reading came in slightly better than the market expectation of 47.

Further details of the publication revealed that the New Orders Index edged lower to 46.8 from 47.3, while the Employment Index rose to 48.5 from 44.4. Finally, the inflation component - Prices Paid Index, advanced to 48.4 from 42.6.

"Demand remains soft, but production execution is consistent with new, reduced output levels based on panelists’ companies order books," said Timothy R. Fiore, Chair of the Institute for Supply Management.

"Prices are generally stable. Sixty-two percent of manufacturing gross domestic product (GDP) contracted in August, down from 92 percent in July, a positive trend for the economy," Fiore added.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen posting small daily gains at 103.70.

Loretta J. Mester, President of the Federal Reserve Bank of Cleveland, stated on Friday, following the NFP (Nonfarm Payrolls) report, that the job market remains strong despite signs of rebalancing. She downplayed the increase in the Unemployment Rate to 3.8%, stating that this level "is still low."

Speaking at an event in Germany, Mester mentioned that the main debate at the Fed is how restrictive policy needs to be and for how long. She explained that the Fed must balance risks when determining its policy rate.

Regarding inflation, Mester noted that it remains elevated, but she acknowledged that progress has been made.

- Silver price delivers a volatile action as investors carefully examine the US NFP report.

- The US Dollar dropped as investors hoped that slower wage growth would ease the consumer spending momentum.

- Silver price faces some selling pressure in its upside journey toward the horizontal resistance plotted around $25.27.

Silver price (XAG/USD) demonstrates a volatile action above $24.50 as investors carefully examine the United States Nonfarm Payrolls (NFP) data for August. The US Bureau of Labor Statistics reported that fresh payrolls were 187K, outperformed estimates of 170K, and downwardly revised July’s reading of 157K.

The Unemployment Rate rose sharply to 3.8% vs. estimates and the former print of 3.5%. Monthly Average Hourly Earnings grew at a slower pace of 0.2% while investors anticipated a 0.3% pace in wage growth. In July, the labor cost index gained at a 0.4% pace. The annual Average Hourly Earnings decelerated nominally to 4.3% against the estimates and the former release of 4.4%.

Slower wage growth might offset the impact of higher-than-anticipated fresh payrolls, which would allow the Federal Reserve (Fed) to keep the interest rate policy unchanged on September 20. Meanwhile, investors still await the US ISM manufacturing PMI, which will be released at 14:00 GMT.

The US Dollar Index (DXY) drops marginally to near 103.40 as investors hope that slower wage growth will ease the consumer spending momentum and bring inflation under control. Also, 10-year US Treasury yields dropped to near 4.10%.

Silver technical analysis

Silver price faces some selling pressure in its upside journey toward the horizontal resistance plotted from the July 20 high around $25.27 on a two-hour scale. Upward-sloping 20-period Exponential Moving Average (EMA) continues to provide support to the Silver bulls.

The Relative Strength Index (RSI) (14) drops into the 40.00-60.00 range from the bullish range of 60.00-80.00, which indicates that the upside momentum has faded.

Silver two-hour chart

-638291731290400655.png)

- EUR/USD fades Thursday’s downtick and approaches 1.0900.

- Immediate up-barrier remains near 1.0950 so far.

EUR/USD manages to set aside part of Thursday’s sharp pullback and gradually approaches the 1.0900 mark on Friday.

Despite the daily knee-jerk, the pair’s current momentum seems to be favouring the continuation of the march north for the time being. That said, the next hurdle emerges at the weekly top at 1.0945 (August 30), prior to the interim 55-day SMA at 1.0965 and the psychological 1.1000 mark.

In the meantime, the pair is likely to keep the bullish outlook unchanged while above the 200-day SMA, today at 1.0816.

EUR/USD daily chart

- The Canadian economy unexpectedly contracted during the second quarter.

- The Loonie tumbles across the board after Canadian GDP data.

- USD/CAD jumps towards 1.3550 despite broad-based Greenback weakness after NFP.

The USD/CAD broke above 1.3520 and surged to 1.3556, approaching Thursday's highs, following the release of the US employment and Canadian Q2 reports.

Canada's real Gross Domestic Product (GDP) unexpectedly contracted at an annual rate of 0.2% in the second quarter, against expectations of a 1.2% expansion. Growth figures from the first quarter were revised lower, from a 3.1% expansion to 2.6%.

The disappointing data weighed on the Loonie, which weakened across the board after the release. Next week, the Bank of Canada (BoC) is set to meet, and no change in policy is expected, especially considering the growth figures. The upside move in USD/CAD was limited due to some weakness in the US dollar following the official US employment report.

Nonfarm Payrolls expanded by 187,000 in July, surpassing the market's expectation of 170,000. The Unemployment Rate rose from 3.5% to 3.8%. Average Hourly Earnings increased 4.3% from a year ago, below the expected 4.45%. The US Dollar Index dropped to 103.25, hitting a fresh daily low, but later trimmed losses to rise to 103.50.

Holding above the 20-day SMA

Early on Friday, USD/CAD bottomed at 1.3489, the lowest level since August 16. It then rebounded moderately, gaining upside momentum after the data.

The pair is currently rising after falling for four consecutive days and is holding above the 20-day Simple Moving Average (SMA) that stands at 1.3515.

On the weekly chart, USD/CAD is still down and is on track to post its first weekly decline after six consecutive weeks of gains.

Technical levels

- Canadian economy contracts 0.2% against expectations of a 1.2% expansion.

- USD/CAD stays in positive territory above 1.3500 after the data and US NFP.

Canada's real Gross Domestic product (GDP) contracted at an annual rate of 0.2% in the second quarter, Statistics Canada reported on Friday. This reading followed the 2.6% expansion (revised from 3.1%) recorded in the first quarter and came in worse than the market expectation for growth of 1.2%.

On a quarterly basis, real GDP stagnated compared to analysts' estimate of a 0.3% expansion. During the first quarter, it expanded 0.6% (revised from 0.8%).

On a monthly basis, real GDP contracted in June 0.2%, in line with expectations. In May, the economy expanded 0.2% (revised from 0.3%).

Key takeaways:

Real gross domestic product (GDP) was nearly unchanged in the second quarter, following a 0.6% rise in the first quarter. The slowdown was attributable to continued declines in housing investment, smaller inventory accumulation, as well as slower international exports and household spending. Increased business investment in engineering structures and higher government spending were among the few components that contributed to growth.

The GDP deflator rose 0.7% in the second quarter, as consumer inflation remained elevated.

Real gross domestic product (GDP) decreased 0.2% in June, following a 0.2% increase in May. Both services-producing industries (-0.2%) and goods-producing industries (-0.4%) contracted in June with 12 of 20 industrial sectors posting decreases.

Market reaction

The Loonie weakened in the market after the data. Not only did the Canadian economy contract unexpectedly during the second quarter, but previous numbers were revised lower.

USD/CAD rose modestly to fresh daily highs above 1.3520. At the same time, the US official employment report was released,and it triggered a decline of the US Dollar limiting the upside of the pair.

- DXY trades in an inconclusive fashion near 103.50 on Friday.

- Bouts of weakness could see the index drop below 103.00.

DXY keeps hovering around the mid-103.00s following Thursday’s robust rebound to the 103.70 zone.

The resumption of the selling mood could prompt the index to revisit the key 200-day SMA at 103.05 prior to the weekly low of 102.93 (August 30). Down from here emerges the temporary 100-day and 55-day SMAs at 102.52 and 102.38, respectively.

While above the key 200-day SMA, the outlook for the index is expected to remain constructive.

DXY daily chart

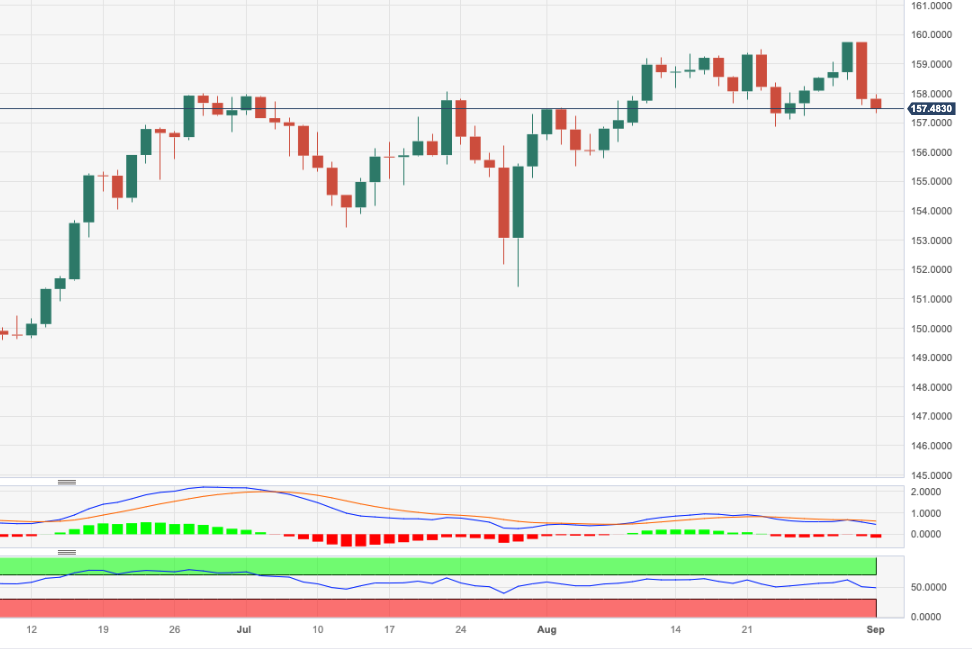

- EUR/JPY adds to Thursday’s strong pullback and tests 157.30.

- Immediately to the downside comes the weekly low near 156.80.

Further selling pressure forces EUR/JPY to add to Thursday’s losses and print multi-day lows near 157.30 on Friday.

In case the downward bias picks up extra pace, the cross risks an initial drop to the minor support at the weekly low of 156.86 (August 23), which appears so far propped up by the provisional 55-day SMA (156.90).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 147.98

EUR/JPY daily chart

- AUD/USD trades back and forth below 0.6500 ahead of the US labor market data.

- US ADP Employment report released on Wednesday indicated that labor demand remained soft in August.

- The RBA is expected to keep interest rates unchanged at 4.10% on Tuesday.

The AUD/USD strives for a decisive move as investors as investors sidelined ahead of the United States Nonfarm Payrolls (NFP) data, which will be published at 12:30 GMT. The Aussie asset continued to oscillate below the psychological resistance of 0.6500, however, a power-pack action after the US labor market data cannot be ruled out.

S&P500 futures post some decent gains in Europe, portraying an upbeat market mood ahead of the US NFP report. US ADP Employment report released on Wednesday indicated that labor demand remained soft in August due to a hiring slowdown in the leisure and hospitality sector. Also, wage growth was slow as firms heavily worked on retaining the current laborforce.

The US Dollar Index (DXY) clings to gains of around 103.60 as investors need a clear picture of the current status of the labor market. The US NFP is expected to set an undertone for the Federal Reserve’s (Fed) September monetary policy. As per the CME Fedwatch tool, the Fed is expected to keep interest rates unchanged at 5.25-5.50% but Fed Powell could reiterate a hawkish commentary on the interest rate outlook.

Meanwhile, the Australian Dollar fails to capitalize on the surprisingly upbeat Caixin Manufacturing PMI for August. The economic data landed above the 50 threshold that separates contraction at 51.0 vs. the estimates of 49.3 and the former release of 49.2. The Australian Dollar didn’t strengthen despite being a proxy for Chinese economic prospects.

Going forward, the focus will be on the interest rate decision by the Reserve Bank of Australia (RBA), which will be announced on Tuesday. According to a Reuters poll, RBA Governor Philip Lowe will keep interest rates unchanged at 4.10% but will keep doors open for more hikes.

- US Dollar price action expected to stay fairly muted at the start of Friday.

- US Nonfarm Payrolls and ISM Manufacturing are bound to make waves.

- The US Dollar Index is off its weekly low, though any headwind could snap the summer rally in the Greenback.

The US Dollar (USD) is at a make-or-break moment as the scale has been reset to even after a volatile week where data points whiplashed the Greenback back and forth . Traders looking back to assess the possible outcome at the end of this Friday will have seen that Wednesday’s data with JOLTS and GDP missing estimates made the scale tip in favor of a weaker US Dollar and quicker rate cuts from the US Federal Reserve. The scale got completely tipped to the other side on Thursday where the preferred inflation gauge of the Fed – the Personal Consumption Expenditures index (PCE) – proved that inflationary forces are still present.

With the US Nonfarm Payrolls (NFP) number for August and the Institute for Supply Management (ISM) printing its Manufacturing numbers, traders will get a clear picture of where the scale will tip to at the end of this eventful week. The change in the NFP will be the crucial factor, and expectations are that it will land somewhere between 120k and 230k. Any print lower than 120k will be seen as a contraction and thus raise bets for quicker rate cuts and a weaker US Dollar as a result. Any number above 230k will be seen as a tight labor market, which would confirm the stance of the Fed in not cutting interest rates anytime soon. This would then result in a firmly stronger Greenback.

Daily digest: US Dollar faces moment of truth

- The US jobs report exists out of several key components. Here are the ones you need to look out for at 12:30 GMT: The change in the NFP is expected to head from the previous 187k to 170k. The average MoM Hourly Earnings change is expected to slow down a touch from 0.4% to 0.3%. The overall unemployment rate is expected to stay steady at 3.5%.

- Around 13:45 GMT, the S&P Global Manufacturing Purchasing Managers Index (PMI) wil be released for the month of August. Expectations are for an unchanged print at 47, which means a contractionary posture remains.

- Final confirmation from the earlier move on the back of the US Nonfarm Payrolls will come from the ISM Manufacturing PMI for August, which is expected to head from 46.4 to 47. This amounts to a continuation within contraction territory. The Employment Index is expected to stay steady from 44.4 to 44.2 for the next month. The New Orders Index is forecast to head from 47.3 to 46.3; and, the Prices Paid Index from 42.6 to 43.9.

- A similar picture to Thursday unfolds in the equity markets with the Japanese Topix index closes at +0.76%. The Hong Kong Hang Seng heads lower by 0.5%. European and US equities are marginally higher but looking for direction.

- The CME Group’s FedWatch Tool shows that markets are pricing in an 89% chance that the Federal Reserve will keep interest rates unchanged at its meeting in September. The prior 78% probability was quickly reassessed after the downbeat data from the JOLTS report.

- The benchmark 10-year US Treasury bond yield trades at 4.10% and has halted its decline from earlier this week.

US Dollar Index technical analysis: left or right

The US Dollar is not expected to make any moves until the main event this Friday – the August NFP. A very tight range is expected with possibly a mild tone of US Dollar weakness triggered by a handful of traders that will be trying to pre-position with the idea that the NFP will be weaker. This is due to earlier this week when the ADP private payrolls number was weaker as well. Support at 103 is there and will either trigger another bounce or break and see a lower US Dollar Index for the coming weeks.

On the upside, 103.74, the high of August 31, comes into play as the level to beat in order to halt this downturn. Once that level is broken and consolidated, look for a surge to 104.00, where 104.35 (the peak of August 29) is an ideal candidate for a double top. Should the Greenback go on a tear, expect a test at 104.47 – the six-month high.

On the downside, the summer rally of the DXY is set to be broken as only one element now supports the US Dollar. That is the 200-day SMA, and it could mean substantially more weakness to come once the DXY starts trading further below it. The double belt of support at 102.38 with both the 100-day and the 55-day SMA are the last lines of defence before the US Dollar sees substantial and longer-term devaluation.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Oil (WTI) price flirts with a new yearly high.

- US Dollar slips ahead of a key US jobs report.

- Baker Hughes Oil rig count data due this Friday.

Oil prices have rallied firmly this week and could still go higher once official confirmation of more supply cuts hits the wires. Talk of the town, though still unconfirmed, is that Saudi Arabia and Russia are due to announce that they will do more in terms of supply control. Riyadh is expected to extend its 1 million barrel-per-day curb. Meanwhile, Russian Deputy Prime Minister Alexander Novak mentioned that a 300,000 barrel cut per day will be materialising this month.

This shakes up the supply side in oil, meaning that market participants need to dig deeper into their wallets. At the beginning of the week, Crude was just barely below $80, while it currently trades above $83. A new yearly high could be in reach, depending on the official announcements of both Saudi Arabia and Russia in the coming days.

At the time of writing, Crude Oil (WTI) price trades at $83.55 per barrel and Brent Oil at $86.98.

Oil news and market movers

- The refinery outage at Garyville, Louisiana, is solved and back online.

- Shanghai weekly medium Sour Crude Stockpiles dropped by 15%.

- India refineries are dealing back with traditional suppliers as the lucrative cheap Russian oil supply looks to be abating.

- The key US jobs report, or Nonfarm Payrolls (NFP), will be released at 12:30 GMT. From all its components, some have more potential than others to affect markets. The change in the NFP is the key figure, and it is expected to decline from the previous 187K to 170K. The average MoM Hourly Earnings change, which gauges wage growth, is expected to slow down a touch from 0.4% to 0.3%. Meanwhile, the overall unemployment rate is expected to stay steady at 3.5%.

- Final confirmation from the earlier move on the back of the US Nonfarm Payrolls will come from the ISM Manufacturing PMI for August, which is expected to increase slightly from 46.4 to 47.0. Despite the rise, this would still signal a contraction in US factory activity. The Employment Index is expected to stay broadly steady from 44.4 to 44.2. The New Orders Index is forecast to fall from 47.3 to 46.3;, and the Prices Paid Index is seen increasing from 42.6 to 43.9.

- Data from the Baker Hughes US Oil Rig Count is expected to close off this week at 17:00 GMT. The previous number was at 512, and a lower number could possibly become an 18-month low.

- Equity markets are mixed this Friday as investors await more guidance from the US jobs report on Friday.

Oil Technical Analysis: double top to overcome

Oil price has snapped its losing streak with a fourth consecutive day of gains this week. Crude is flirting with a new yearly high. In case supply cuts are higher than expected, with more drawdowns in strategic stockpiles in the coming weeks, Oil might be heading back to $92.

On the upside, $84.28, the high of August 10, is the one to beat in order to have that bullish breakout confirmation. Should WTI continue to rally on the back of lower supply and more demand, not many elements could be standing in the way of reaching that blue line at $92.80. Of course, the $90 big figure psychological level needs to be faced first.

On the downside, a temporary bottom is being formed around $77.50, which acted as a base for this week. Should the Baker Hughes Rig Count jump substantially higher, expect to see the floor tested as more supply is bound to come online. Once bears make it through that yellow box level, expect to see more downside toward $74 before finding ample support to slow down the sell-off.

-638291576374554364.png)

WTI US OIL (daily chart)

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- EUR/GBP falls back as expectations of more interest rates from the ECB threaten the economic outlook.

- Eurozone inflation expanded in August due to the hot labor market.

- Two more interest rate hikes of bps from the BoE are expected this year as investors see the interest rate peak at 5.75%.

The EUR/GBP pair falls back as a pullback move to near 0.8570 meets offers in the European session. The cross continues to bleed as investors hope that the European Central Bank (ECB) has to raise interest rates further so that inflation can be tamed and the trading bloc can avoid potential risks of a recession.

Eurozone preliminary Harmonized Index of Consumer Prices (HICP) for August expanded as the labor market remained hot, making it difficult for policymakers to convince workers to shift to slower wage growth.

Eurostat reported that monthly headline inflation expanded at a higher pace of 0.6% while investors anticipated a deflation of 0.1% as recorded for July. Core inflation that excludes volatile food and oil prices expanded at a 0.3% pace as expected by market participants. In July prices of core goods were softened by 0.1%. On an annual basis, the economic data softened to 5.3% as expected from July’s reading of 5.5%.

About the interest rate outlook, ECB policymaker Francois Villeroy de Galhau said the central bank is open to various options at the next and upcoming rate meetings. He further added keeping rates high long enough matters more than the level.

Meanwhile, the Pound Sterling remains in the driving seat as more interest rate hikes from the Bank of England (BoE) cannot be ruled out. Two more interest rate hikes of 25 basis points (bps) are expected this year as investors see the interest rate peak at 5.75%.

On the economic front, S&P Global reported the Manufacturing PMI for August at 43.0, higher than expectations and July’s reading of 42.5.

- Gold price awaits key economic data for further action.

- US PCE remained stubborn in July due to steady wage growth.

- US inflation has become more responsive to the job market.

Gold price (XAU/USD) remains calm before the US Nonfarm Payrolls (NFP) and ISM Manufacturing PMI data for August, which will set an undertone for the Federal Reserve’s (Fed) interest-rate decision to be taken on September 20. Fed Chair Jerome Powell at the Jackson Hole Symposium that further policy action will depend on incoming data and cited that inflation has become more responsive to the job market.

The precious metal struggles for a decisive move as investors wait for a clear picture of labor market conditions for making an informed trade. The US ADP Employment Change report released on Wednesday suggested that labor demand softened and wage growth momentum slowed in August. Firms appear to be reluctant to expand their labor force to avoid excess production due to a deteriorating demand outlook.

Daily Digest Market Movers: Gold price awaits US NFP data

- Gold price continues to trade sideways. The upside remains restricted around $1,950.00 due to stubborn Personal Consumption Expenditure (PCE) Price Index data, while the downside remains supported near $1,940.00 inspired by soft labor demand.

- The precious metal is expected to deliver a power-pack action after the release of the US Nonfarm Payrolls data, which will be published at 12:30 GMT.

- Gold price traded inside Wednesday’s price range on Thursday as the impact of the soft ADP Employment report was offset by still-high numbers from the Federal Reserve’s preferred inflation tool, the PCE Price Index.

- The US PCE price index remained sticky in July. The monthly headline and core PCE grew at a stable pace of 0.2%. Also, the annual headline and core PCE accelerated marginally to 3.3% and 4.2%, respectively, as expected by market participants.

- Meanwhile, the US labor market is delivering mixed cues. ADP Employment report for August suggested lower employment creation, while Jobless Claims for the week ending August 25 were lower.

- The US Department of Labor reported that individuals claiming jobless benefits dropped to 228K, less than the 235K expected and the former reading of 232K.

- The ADP report for August showed the US private sector added 177K employees, lower than expectations of 195K and less than half of the upwardly revised July’s reading of 371K.

- A slowdown in job growth majorly came from the leisure and hospitality sector. Job creation by hotels, restaurants, and other employers in the sector fell by 30K in August after months of strong hiring.

- Wage growth also slowed in August. Job stayers saw an annual pay growth of 5.9%, while job changers' pay growth slowed to 9.5%.

- Going forward, investors will keep focus on the NFP data as Fed Chair Jerome Powell said that further policy action will be data-dependent and inflation is getting more responsive to the job market.

- US employers are expected to have added 170K labor employees in August, a decline from July’s reading of 187K. The Unemployment Rate is seen unchanged at 3.5%.

- Apart from the job market data, investors will focus on the Average Hourly Earnings. Labor costs are expected to grow 0.3% on the month, slowing from the 0.4% increase seen in July. On an annual basis, growth in Average Hourly Earnings is seen unchanged at 4.4%.

- Strong wage growth has been a major catalyst behind stubborn inflationary pressures. US households’ spending remains solid due to higher disposable income.

- Amid the data-packed week, ISM Manufacturing PMI will also be on the investors’ radar. The index, which gauges activity in the US factory sector, is expected to come in at 47.0, higher than July’s print of 46.4. Still, a figure below the 50.0 threshold suggests a contraction in activity.

- August Manufacturing PMI could remain below 50.0 for a ninth straight month. US factories are operating at lower capacity due to a deteriorating demand environment.

Technical Analysis: Gold price juggles below $1,950

Gold price demonstrates a lackluster performance below $1,950.00 as investors await the US labor market data for further action. The precious metal oscillates near the upper portion of the Rising Channel chart pattern formed on a small term frame. The yellow metal stabilizes above the 20- and 50-day Exponential Moving Averages (EMAs), which indicates that the mid-term trend has turned positive.

The Relative Strength Index (RSI) climbs to near 60.00. A decisive break into the range of 60.00-80.00 will likely activate the bullish impulse.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- USD/CHF trades lower around 0.8830 on the back of resilient Swiss CPI.

- US Dollar (USD) suffers to protect gains from the previous day.

- Investors await US data releases, seeking further cues on the economic situation in the country.

USD/CHF trades lower around 0.8830, retreating from the previous day’s gains during the European session on Friday. The Swiss Franc is experiencing upward support against the US Dollar (USD), which is attributed to Switzerland’s Consumer Price Index (YoY) for August, which showed that Swiss inflation remained consistent at the rate of 1.6% against the market expectations of declining to 1.5%.

The US Dollar Index (DXY), which gauges the performance of the Greenback against the six other major currencies, treads waters around 103.60 at the time of writing. However, the US Dollar (USD) gained ground on Thursday due to the US inflation data released on Thursday, which is considered to be the preferred gauge index of inflation by the Federal Reserve (Fed). However, market participants seek fresh impetus on monetary policy tightening in the September meeting by the US Federal Reserve (Fed).

As said, the US Core Personal Consumption Expenditures (PCE) - Price Index (MoM) advanced to 4.2% in July as per the market expectations, from 4.1% prior. While, US Initial Jobless Claims for the week ending on August 25, fell to the reading of 228K, against the expected rise to 235K from the previous 232K figure.

The US Dollar (USD) is experiencing downward pressure ahead of the upcoming releases of macroeconomic data from the United States (US). US docket includes US Nonfarm Payrolls Average Hourly Earnings, and ISM Manufacturing PMI are scheduled to be released later in the day. These datasets could provide further cues on the economic outlook, which may help USD/CHF traders strategize their bets.

- EUR/JPY oscillates in a narrow trading band through the early European session on Friday.

- Bets for more rate hikes by the ECB underpin the Euro and act as a tailwind for the cross.

- The BoJ’s dovish outlook suggests that the path of least resistance remains to the upside.

The EUR/JPY cross struggles to gain any meaningful traction on Friday and consolidates the previous day's sharp retracement slide from the 159.75 region, or its highest level since August 2008. Spot prices remain confined in a narrow band through the early part of the European session, albeit manage to hold above mid-157.00s.

The shared currency draws some support from hawkish-sounding remarks by the European Central Bank (ECB) policymaker, Francois Villeroy de Galhau, keeping the door open for more interest rate hikes. De Galhau noted that the underlying inflation has peaked since April and appears to have begun its decline, but this encouraging sign is still far from sufficient. He added that options are open at the next and upcoming rate meetings, though interest rates may be very close to a peak.

This comes on the back of the overnight comments by Isabel Schnabel, who is considered one of the most hawkish members of the ECB, saying that a slower-than-predicted Euro Zone growth does not necessarily void the need for more rate hikes. Adding to this, ECB Vice-President Luis de Guindos said that the central bank is nearing the end of its hiking rate cycle but the decision on whether to further tighten its monetary policy at its next meeting in two weeks is still open for debate.

This marks a big divergence in comparison to a more dovish stance adopted by the Bank of Japan (BoJ), which is seen as another factor behind the Japanese Yen's (JPY) relative underperformance and contributes to limiting the downside for the EUR/JPY cross. In fact, the BoJ is the only central bank in the world to maintain negative interest rates Moreover, the recent remarks by BoJ officials ensure that the central bank will stick to its ultra-easy monetary policy settings until next summer.

The aforementioned fundamental backdrop favours the EUR/JPY bulls and suggests that the path of least resistance is to the upside. Hence, any subsequent fall might still be categorized as a corrective decline and is more likely to get bought into. This, in turn, makes it prudent to wait for strong follow-through selling before confirming that spot prices have formed a near-term top and placing aggressive bearish bets.

Technical levels to watch

- USD/JPY is experiencing losses due to China’s fiscal measure and upbeat PMI.

- PBoC reduced FX RRR to 4% to slow down the weakening pace of the Chinese Yuan.

- Greenback retreats from the recent gains ahead of the US economic data.

USD/JPY trades lower around 145.40, extending losses for the second consecutive day during the European session on Friday. The pair is experiencing downward pressure as a result of an announcement by the People's Bank of China (PBoC) regarding the recent fiscal measures.

The central bank decided to reduce the Forex Reserve Requirement Ratio (FX RRR) to 4% from 6% prior, starting from September 15. This would improve the ability of local banks to release more US Dollars (USD) in terms of slowing down the weakening pace of the Chinese Yuan.

Additionally, China’s upbeat Caixin Manufacturing PMI for August contributed to improving the market optimism. The data posted a reading of 51.0, compared to the market consensus of 49.3, from the previous reading of 49.2 figure in July.

The US Dollar Index (DXY), which measures the performance of the US Dollar (USD) against the six other major currencies, trades lower around 103.50 at the time of writing. The Greenback retreats from the previous day’s gains ahead of the ahead of upcoming releases of macroeconomic data from the United States (US). These datasets include US Nonfarm Payrolls Average Hourly Earnings, and ISM Manufacturing PMI are scheduled to be released later in the day.

However, the buck experienced upward support attributed to the US inflation data released on Thursday, which is considered to be the preferred gauge index of inflation by the Federal Reserve (Fed). The US Core Personal Consumption Expenditures (PCE) - Price Index (MoM) rose to 4.2% in July as per the market consensus, from 4.1% prior. US Initial Jobless Claims for the week ending on August 25, reported 228K figure against the expectations of 235K and the previous 232K.

- The Euro bounces off lows near 1.0830 vs. the US Dollar.

- Stocks in Europe start the session in an upbeat mood.

- EUR/USD rebounds from 1.0830 as risk appetite improves.

- The USD Index (DXY) looks offered in the mid-103.00s.

- US and German yields trade without a clear direction.

- No surprises from the final Manufacturing PMIs in Germany, EMU.

- US Nonfarm Payrolls, ISM manufacturing are next of note.

Following a drop to the 1.0830 region, the Euro (EUR) now manages to regain some balance vs. the US Dollar (USD) and motivates EUR/USD to retake the 1.0850 region at the end of the week.

The so far modest advance in the pair comes in line with the offered stance in the Greenback, while the USD Index (DXY) gyrates around the 103.50 zone amidst the lack of a clear direction in US yields across different maturities.

In the meantime, investors continue to reprice a pause by the Federal Reserve in its tightening campaign, while the upcoming release of the Nonfarm Payrolls for the month of August should lend further insight into this current view.

Back to the European Central Bank (ECB), there is a great deal of uncertainty regarding the potential steps beyond the summer, all amidst a pretty divided Council and rising speculation that a stagflation scenario could be brewing in the region.

Data-wise in the region, final Manufacturing PMIs in Germany and the euro area came in at 39.1 and 43.5, respectively, for the month of August.

Later in the NA session, Nonfarm Payrolls, Unemployment Rate and the ISM Manufacturing PMI will take centre stage, followed by Construction Spending and the final S&P Global Manufacturing PMI.

Daily digest market movers: Euro bounces off three-day lows

- The EUR gathers some fresh oxygen vs. the USD.

- Final PMIs in Europe broadly matched the preliminary prints.

- China’s Caixin Manufacturing PMI returned to expansionary territory.

- PBoC reduced the FX RRR to 4% to support the Chinese yuan.

- Investors’ focus shifts to NFP, ISM Manufacturing.

- Investors now see the Fed on hold for the remainder of the year.

Technical Analysis: Euro could advance further once 1.0950 is cleared

EUR/USD regains some upside traction following Thursday’s strong pullback and three-day lows near 1.0830.

In case bulls regain the upper hand and EUR/USD surpasses the weekly top of 1.0945 (August 30), the pair is expected to meet the provisional 55-day SMA at 1.0965 prior to the psychological 1.1000 barrier and the August top at 1.1064 (August 10). Once the latter is cleared, spot could challenge the weekly peak at 1.1149 (July 27). If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 (July 18). Further up comes the 2022 high at 1.1495 (February 10), which is closely followed by the round level of 1.1500.

The resumption of the downward bias could motivate the pair to initially test the key 200-day SMA at 1.0815 ahead of the August low of 1.0765 (August 25). The breach of the latter exposes the May low of 1.0635 (May 31) prior to the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (January 6).

Furthermore, sustained losses are likely in EUR/USD once the 200-day SMA is breached in a convincing fashion.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?