- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- USD/JPY continued to trade near recent highs around 161.45 in Tuesday’s early Asian session.

- The US ISM Manufacturing PMI was weaker than expected, declining to 48.5 in June from 48.7 in May.

- The potential FX intervention from Japanese authorities might cap the pair’s upside.

The USD/JPY pair extends upside near 161.45 on Tuesday during the early Asian trading hours. The modest recovery of the Greenback provides some support to the pair. However, there are expectations that Japanese authorities could soon intervene in the foreign exchange market to prevent the Japanese Yen (JPY) from depreciating.

US manufacturing contracted for a third consecutive month in June amid subdued demand and higher interest rates. The US ISM Manufacturing Purchasing Managers Index (PMI) dropped to 48.5 in June from 48.7 in May. This figure came in below the market consensus of 49.1. Nonetheless, the hawkish comments from Fed officials continue to underpin the Greenback despite the weaker-than-expected US economic data.

On Friday, San Francisco Fed President Mary Daly said that monetary policy is working, but it’s too early to tell when it will be appropriate to cut the interest rate. Daly further stated that if inflation remains sticky or comes down slowly, interest rates would need to be higher for longer.

On the other hand, Japanese Finance Minister Shunichi Suzuki said that authorities are concerned about the impact of "rapid and one-sided" FX moves on the economy, adding that excessive volatility in the currency market is undesirable and that authorities will respond appropriately to such moves. This, in turn, might support the JPY in the near term and cap the upside for the pair. OCBC analysts said “USD/JPY continued to trade near recent highs. This is also near the highest level since 1986. There are expectations that Japanese authorities could soon intervene. While the level of JPY is one factor to consider, officials also focus on the pace of depreciation as the intent of intervention is to curb excessive volatility.”

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- EUR/USD briefly tested above 1.0770 on Monday before settling back.

- A packed economic data docket awaits the Fiber this week.

- EU HICP inflation, US NFP data looms ahead.

EUR/USD clipped into a fresh multi-week high above 1.0770 on Monday before getting forced back down by a broad-market reversal in investor sentiment. Bullish momentum was cut short after US activity figures flashed warning signs of a steepening economic downturn. Investors will be buckling down for the wait to key economic figures on both sides of the Atlantic throughout the week, culminating in a fresh print of US Nonfarm Payrolls (NFP) slated for Friday.

Forex Today: All the attention shifts to Powell and Lagarde

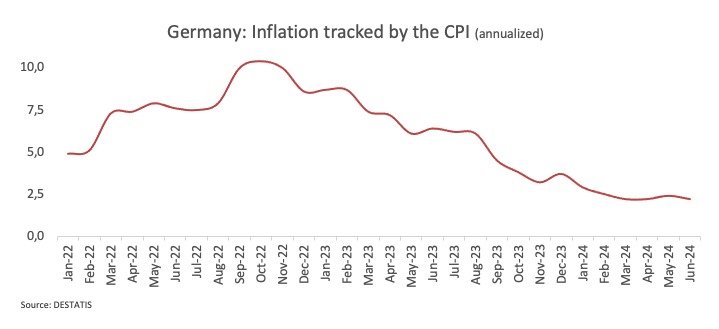

German Consumer Price Index (CPI) figures broadly missed the mark early Monday, with annualized German CPI easing to 2.2% in June, falling from the previous 2.4% and backsliding through the forecast 2.3%. US data also missed expectations on Monday; US ISM Manufacturing Purchasing Manager Index (PMI) figures declined in June, falling to 48.5 from 48.7 and entirely missing the forecast increase to 49.1. US ISM Manufacturing Prices Paid also declined sharply in June, falling to 52.1 from the previous 57.0, falling even further beyond the forecast decline to 55.9.

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Mon Jul 01, 2024 14:00

Frequency: Monthly

Actual: 48.5

Consensus: 49.1

Previous: 48.7

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.

US markets were abruptly jolted into fresh risk concerns over the upcoming November presidential election. A recent public debate left the waters murky on who the clear frontrunner would be, and the US Supreme Court released a ruling on Monday stating that courts have limited capacity to levy criminal charges against sitting Presidents.

A fresh batch of key European data will drop on markets on Tuesday, with a slate of speeches from European Central Bank (ECB) policymakers including another appearance from ECB President Christine Lagarde. Pan-European Harmonized Index of Consumer Prices (HICP) inflation is expected to tick down slightly, with Core EU HICP inflation forecast to tick down to 2.8% YoY from the previous 2.9%. European Producer Price Index (PPI) inflation data is due Wednesday, followed by EU-wide Retail Sales figures early Friday.

On the US side, investors will be looking ahead to Tuesday’s appearance from Federal Reserve (Fed) Chairman Jerome Powell, followed by ADP Employment Change figures on Wednesday and Friday’s latest iteration of US Nonfarm Payrolls (NFP) and Average Hourly Earnings for June.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | 0.03% | -0.02% | 0.02% | 0.09% | 0.16% | 0.06% | |

| EUR | -0.04% | -0.01% | -0.05% | -0.02% | 0.06% | 0.11% | 0.02% | |

| GBP | -0.03% | 0.00% | -0.04% | -0.00% | 0.04% | 0.11% | 0.02% | |

| JPY | 0.02% | 0.05% | 0.04% | 0.03% | 0.13% | 0.15% | 0.07% | |

| CAD | -0.02% | 0.02% | 0.00% | -0.03% | 0.08% | 0.13% | 0.04% | |

| AUD | -0.09% | -0.06% | -0.04% | -0.13% | -0.08% | 0.05% | -0.04% | |

| NZD | -0.16% | -0.11% | -0.11% | -0.15% | -0.13% | -0.05% | -0.09% | |

| CHF | -0.06% | -0.02% | -0.02% | -0.07% | -0.04% | 0.04% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD technical outlook

The Fiber kicked off the new trading week with a fresh push into 12-day peaks above 1.0770 before crumpling risk appetite dragged the pair back down to 1.0735. Intraday price action continues to lean into the midrange as EUR/USD grapples with the 200-hour Exponential Moving Average (EMA) at 1.0722.

EUR/USD found technical support from a demand zone priced in below 1.0680, but bullish momentum remains limited as technical indicators weigh bids down. Daily candlesticks remain pinned below the 200-day EMA at 1.0786, and Fiber remains trapped on the low end of a recent decline from June’s early bids above 1.0900.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Stats NZ noted another month-on-month decline in New Zealand building consents in May, with Building Permits falling -1.7% MoM, adding to the previous month's revised -2.1% decline.

Stats NZ highlighted that May's figure is a sharp -23% decline YoY, with 34.8K new Building Permits issued for the year ended May.

New Zealand Building Consents hit a record peak of 51K YoY in May 2022, and have done nothing but decline since. Stats NZ reported that all tracked multihome categories declined sharply over the annual period, with apartment buildings falling -52%.

Economic Indicator

Building Permits s.a. (MoM)

The Building Permits s.a. released by the Statistics New Zealand show the number of permits for new construction projects. It is considered as a leading indicator for the housing market. The more growing number of permits, the more positive (or bullish) for the NZD, while a low reading is seen as negative, or bearish.

Read more.Last release: Mon Jul 01, 2024 22:45

Frequency: Monthly

Actual: -1.7%

Consensus: -

Previous: -1.9%

Source: Stats NZ

About Stats NZ's Building Permits

The Building Permits s.a. released by the Statistics New Zealand show the number of permits for new construction projects. It is considered as a leading indicator for the housing market. The more growing number of permits, the more positive (or bullish) for the NZD, while a low reading is seen as negative, or bearish.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- NZD/USD remains under some selling pressure around 0.6070 in Tuesday’s early Asian session.

- US manufacturing activity continued to decline in June.

- NZIER New Zealand Business Confidence extends decline in Q2.

The NZD/USD pair extends the decline near 0.6070 during the early Asian session on Tuesday. The renewed US Dollar (USD) demand and a further decline in New Zealand’s business activity outlook surveys drag the pair lower. Market players will keep an eye on Federal Reserve (Fed) Chairman Jerome Powell's speech on Tuesday for fresh impetus, followed by the Fed’s latest monetary policy minutes on Wednesday.

Growth in activity in the United States manufacturing sector continued to contract in June, according to the Institute for Supply Management (ISM) on Monday. The US ISM Manufacturing Purchasing Managers Index (PMI) declined to 48.5 in June from 48.7 in May, below the market expectation of 49.1.

The weaker-than-expected US Manufacturing PMI data, along with the US Personal Consumption Expenditures (PCE) Price Index data last week, have spurred speculation that the Fed would start an easing cycle this year, which might weigh on the Greenback. Traders are now pricing in nearly 59.5% chance of 25 basis points (bps) of Fed rate cut in September, up from 58.2% last Friday, according to CME FedWatch Tool.

On the Kiwi front, the latest data from the New Zealand Institute of Economic Research (NZIER) showed on Tuesday that the country’s Business Confidence deteriorated in the second quarter (Q2), falling 44% QoQ from the previous reading of a 25% fall. The downbeat reading undermines the New Zealand Dollar (NZD). Additionally, the expectation that the Reserve Bank of New Zealand (RBNZ) will cut rates earlier than projected exerts some selling pressure on the Kiwi.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- GBP/USD briefly broke above 1.2700 before slumping back to opening bids.

- US data sparks rate cut hopes, then recession fears.

- Investor confidence jolted by US election risks, volatility ensues.

GBP/USD rallied briefly above the 1.2700 handle on Monday before US markets knocked back investor confidence, sparking a risk-off bid into the US Dollar and dragging Cable back down to the day’s opening bids near 1.2650.

Forex Today: All the attention shifts to Powell

US data broadly missed the mark. US ISM Manufacturing Purchasing Manager Index (PMI) figures declined in June, falling to 48.5 from 48.7 and entirely missing the forecast increase to 49.1. US ISM Manufacturing Prices Paid also declined sharply in June, falling to 52.1 from the previous 57.0, falling even further beyond the forecast decline to 55.9.

US markets were abruptly jolted into fresh risk concerns over the upcoming Presidential election slated for November. A recent public debate left the waters murky on who the clear frontrunner would be, and the US Supreme Court released a ruling on Monday stating that courts have limited capacity to levy criminal charges against sitting Presidents.

The UK has a thin economic data docket this week, though GBP traders will be keeping an eye out for Parliamentary elections on the book for Thursday. On the US side, investors will be looking ahead to Tuesday’s appearance from Federal Reserve (Fed) Chairman Jerome Powell, followed by ADP Employment Change figures on Wednesday and Friday’s latest iteration of US Nonfarm Payrolls (NFP) and Average Hourly Earnings for June.

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Mon Jul 01, 2024 14:00

Frequency: Monthly

Actual: 48.5

Consensus: 49.1

Previous: 48.7

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.

GBP/USD technical outlook

Despite a near-term bull run to kick off the new trading week, Cable bidders were unable to keep the pressure up, and GBP/USD tumbled back below the 200-hour Exponential Moving Average (EMA) at 1.2665. Price action still favors shorts, and downside targets will be set below last week’s late low near 1.2615.

Daily candlesticks remain mired in a volatility trap between the 50-day and 200-day EMAs at 1.2668 and 1.2592, respectively. Near-term momentum still leans bearish as GBP/USD continues to drift lower after mid-June’s brief peak above 1.2850.

GBP/USD hourly chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver rallies over 1% from a daily low of $28.95.

- Technicals suggest upward bias; potential 'double bottom' pattern forming.

- Resistance levels: $30.00 (trendline), $30.84 ('double bottom' neckline), $32.29 (May 29 high), $32.51 (YTD high).

- Support points: $29.00, $28.57 (June 26 low), $27.59 (April 15 low).

Silver recovered on Monday, registering a gain of more than 1% courtesy of broad US Dollar weakness even though US Treasury bond yields climbed. Economic data from the United States (US) was mixed, while US equities fluctuated between gainers and losers. The XAG/USD trades at $29.44 after hitting a daily low of $28.95.

XAG/USD Price Analysis: Technical outlook

From a daily chart standpoint, the grey metal is upward biased and still trading within the boundaries of a descending channel. Traders remain cautious, as shown by the Relative Strength Index (RSI), which is wavering around the 50-neutral line and indicates that neither buyers nor sellers are gathering momentum.

However, price action shows a formation of a ‘double bottom,’ though XAG/USD might clear key resistance levels, to confirm its validity.

Silver buyers need to clear the downslope trendline drawn from May highs, which is around $30.00. Once done, the ‘double bottom neckline’ will emerge at $30.84, the June 21 high. If cleared, this would confirm the bullish chart pattern. On further strength, XAG/USD could test the May 29 high of $32.29, ahead of the year-to-date (YTD) high of $32.51.

On the flip side, if XAG/USD falls below $29.00, the next support would be the June 26 low of $28.57. Once cleared, the next stop would be the April 15 swing low of $ 27.59.

XAG/USD Price Action – Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

According to the New Zealand Institute of Economic Research (NZIER), Business Confidence aggregates revealed a further decline in business activity outlook surveys. NZIER noted that a full 35% of New Zealand firms expect the economic outlook to deteriorate on a seasonally-adjusted basis.

Firm trading activity declined, with 28% of respondents noting a decline in business activity through the June quarter.

According to Christina Leung, NZIER's Deputy Chief Executive (Auckland) & Head of Membership Services, "With around 60 percent of mortgages due for repricing within the coming 12 months and the softening labour market, we expect these developments will weigh on consumer confidence and retail spending over the coming year. This environment of higher interest rates and heightened uncertainty about the outlook has made businesses much more cautious about hiring and investment."

Economic Indicator

NZIER Business Confidence (QoQ)

The NZIER Business Confidence released by the New Zealand Institute of Economic Research shows the business outlook in New Zealand. The Business Confidence allows analysis of economic situation in the short term. Increasing numbers indicates increases in business investment that lead to higher levels of output. Thus, a high reading is seen as positive (or bullish), while a low reading is seen as negative (or bearish).

Read more.Last release: Mon Jul 01, 2024 22:00

Frequency: Quarterly

Actual: -44%

Consensus: -

Previous: -25%

About New Zealand NZIER Business Confidence (QoQ)

The NZIER Business Confidence released by the New Zealand Institute of Economic Research shows the business outlook in New Zealand. The Business Confidence allows analysis of economic situation in the short term. Increasing numbers indicates increases in business investment that lead to higher levels of output. Thus, a high reading is seen as positive (or bullish), while a low reading is seen as negative (or bearish).

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- NZD/JPY's bullish trajectory extends and rose near 98.80, setting fresh highs since 2007.

- Bulls start to show some signs of exhaustion.

- The robust bullish outlook is maintained, although a consolidation appears imminent.

On Monday, the NZD/JPY cross recorded a modest gain of 0.31%, pushing its value up to a high of 98.80 and then retreating to 98.10. This increase marks the pair's highest position in over a decade, further solidifying the ongoing bullish bias. However, due to the overbought conditions indicated by the daily Relative Strength Index (RSI), a necessary correction may be on the horizon.

The daily chart's RSI has tipped over into overbought territory, signaling the continued advance of the bullish run seen since last week. Although the bullish momentum is still the driving force in this pair, the Moving Average Convergence Divergence (MACD) is not generating green bars. This suggests that the current bullish pace may be leveling off.

NZD/JPY daily chart

Moving forward, in case of a correction immediate support is now at 97.00 near the 20-day Simple Moving Average (SMA), with additional support at the previous low of 95.00. Buyers should now target the next psychological levels at 98.50 and 99.00 for additional resistance in case they have more gas left in their tanks.

- GBP/JPY marches to a fresh 16-year high above 204.00.

- Guppy taps highest bids since August of 2008.

- UK heads into Parliamentary elections later this week.

GBP/JPY tipped into yet another 16-year high on Monday, peaking at 204.75 as the Yen continues to deteriorate across the board. Investors are snubbing a continuous stream of intervention rhetoric from the Bank of Japan (BoJ) and Japan’s Ministry of Finance (MoF). With the BoJ stubbornly entrenched in a hyper-easy monetary policy stance, the Yen is set to continue declining as the interest rate differential between the Yen and other major currencies shows no signs of narrowing.

Economic data remains thin for both the Yen and the Pound Sterling this week, leaving GBP traders to focus on the UK’s upcoming Parliamentary elections slated for Thursday. Japan’s Tankan Large Manufacturing Index rose to 13.0 in Q2, up from the previous quarter’s 11.0.

Q1 UK Gross Domestic Product (GDP) rose to 0.7% QoQ last Friday, clipping above the forecast hold at 0.6%, bolstering the Pound Sterling. Japanese Tokyo Consumer Price Index (CPI) inflation also increased to 2.3% YoY through June compared to the previous 2.2%, but the figure wasn’t enough to spark any signs of hawkishness from the BoJ.

GBP/JPY technical outlook

The Guppy has accelerated into the top end as bidding pressure continues to build, clipping into a fresh 16-year peak at 204.75. GBP/JPY has closed in the green for eleven consecutive trading days.

The pair has climbed 14.55% bottom-to-top from 2024’s early low bids of 178.14, and one-sided price action has dragged GBP/JPY deep into bull country. The pair has no meaningful technical resistance levels overhead, and the pair is trading well into the north side of the 200-day Exponential Moving Average (EMA) at 190.35.

GBP/JPY hourly chart

GBP/JPY daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/JPY rises to 0.38%, pushed by higher US Treasury yields and weak ISM data.

- Resistance levels: 162.00, 163.00, 164.87 (Nov 1986 high).

- Support points: 160.22 (April 29 high), 155.66 (Tenkan Sen), 158.90 (Senkou Span A).

The USD/JPY has broken the 161.00 barrier as US Treasury bond yields climbed sharply on Monday after US economic data showed that manufacturing activity, as measured by the ISM PMI, contracted for the third straight month in June. The pair trades at 161.49, gains 0.38%.

USD/JPY Price Analysis: Technical outlook

The major is upward biased, and Japanese authorities and the Bank of Japan (BoJ) lack of action could propel the USD/JPY higher. Despite that, the next key resistance level would be the November 1986 monthly high of 164.87, but traders must reclaim key resistance levels on their way north.

Momentum favors buyers, even though the Relative Strength Index (RSI) is overbought, but due to the nature of a strong move, the most extreme condition would be the 80 level.

With that said, the USD/JPY first resistance would be 162.00, followed by the 163.00 mark. A breach of the latter will expose 164.00 and November’s 1986 high.

Conversely, if sellers drag the exchange rates below 161.00, the first support would be the April 29 high at 160.22. Once hurdle, the next line of defense for bulls would be the Tenkan Sen at 155.66, followed by the Senkou Span A at 158.90.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- USD/CHF rose to 0.9030, reaching late May's highs.

- Fresh ISM PMI data showed contraction in the US manufacturing sector activity for June.

- The market odds for a September interest-rate cut by both the Fed and Swiss SNB have increased in the last session.

On Monday, the USD/CHF pair rose significantly, driven by market anticipation of the Federal Open Market Committee (FOMC) minutes release and other key labor market figures from the US due later in the week. The major mover in the session was the ISM Manufacturing PMI from the US, which despite showing a continued contraction in the country's manufacturing sector the Greenback held its ground. US Treasury yields remain high and provide a cushion to the USD.

The spotlight of Monday was the slightly disappointing ISM Manufacturing PMI from the US for June. The PMI edged lower to 48.5 from 48.7 in April. The Employment Index of the PMI fell to 49.3 from 51.1 in May, while the New Orders Index improved to 49.3 from 45.4. The Prices Paid Index, the inflation component, dropped to 52.1 from 57 in the preceding period. As a result, the markets are betting on a 70% probability of a September interest rate cut by the Federal Reserve (Fed) but the bank’s officials aren’t entirely embracing the rate cuts.

In addition to the FOMC minutes, the US labor market figures are a highlight for this week, particularly Friday's June jobs data. Bloomberg consensus anticipates 190k compared to 272k in May. The unemployment rate is not expected to change from 4.0% despite a possible increase in the participation rate. The average hourly earnings are forecast to rise by 0.3% MoM, potentially pushing the YoY rate down to 3.9%. Markets will also pay attention to the ADP and JOLTs figures to be released on Tuesday and Wednesday.

On the other hand, The Swiss June Consumer Price Index (CPI), due to be reported on Thursday, is projected to remain stable at 1.4% YoY for the third consecutive month.

USD/CHF technical analysis

Regarding the technical analysis, the USD/CHF pair's outlook brightens. It has jumped to its highest level since late May, which along with a strong position above the 20, 100, and 200-day Simple Moving Average (SMA), lends a significantly positive outlook for the future. In addition, the pair tallied seven winning days out of the last eight which calls for a positive outlook.

USD/CHF daily chart

- Gold remains steady unaffected by rising US Dollar and Treasury yields.

- Mixed US manufacturing data: S&P PMI expands, ISM PMI contracts for third consecutive month.

- US 10-year Treasury yield climbs nearly 9 bps to 4.489%, bolstering Dollar's rebound.

Gold prices remain virtually unchanged on Monday even though the Greenback registers minuscule gains propelled by elevated US Treasury bond yields, following a release of softer-than-expected US economic data. That, along with a shortened week in observance of Independence Day in the US and an eventful week, keeps the XAU/USD trading within familiar levels at around $2,327 flat.

The US economy revealed business activity figures on the manufacturing front, with mixed readings. The S&P Global Manufacturing PMI stood at expansionary territory, contrary to the ISM one, which contracted for the third straight month in June.

Market participants remained cautious, with US equity indices performing mixed in the mid-North American session. Meanwhile, the US 10-year Treasury yield rose almost nine basis points to 4.489%, lending a lifeline to the Greenback, down 0.33% earlier in the day before staging a comeback, gaining 0.09%.

Traders are eyeing the Federal Reserve Chairman Jerome Powell's speech on Tuesday, followed by the Fed’s latest monetary policy minutes on Wednesday. After that, the US economic schedule will feature Services PMIs from S&P and the ISM, followed by Friday’s US Nonfarm Payrolls.

Daily digest market movers: Gold price prints minimal gains in post PMIs

- June’s US S&P Global Manufacturing PMI was 51.6, slightly higher than the previous month but missing the forecast of 51.7.

- ISM Manufacturing PMI for June was 48.5, lower than the estimates of 49.1 and down from May’s 48.7.

- According to the CME FedWatch Tool, odds for a 25-basis-point Fed rate cut in September are at 59.5%, up from 58.2% last Friday.

- The December 2024 fed funds rate futures contract implies that the Fed will ease policy by just 35 basis points (bps) toward the end of the year.

Technical analysis: Gold price hovers around Head-and-Shoulders neckline

Gold price remains upward biased, though consolidated near the Head-and-Shoulders neckline, at around $2,320-$2,350. Although the bearish chart pattern remains in play, momentum shifted neutral, with the Relative Strength Index (RSI) bracing to its 50-neutral line, hinting that neither buyers nor sellers are in control.

For a bearish continuation, sellers need to push prices below $2,300. Once done, the next support would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie underneath, with sellers eyeing the Head-and-Shoulders chart pattern objective from $2,170 to $2,160.

On the other hand, if buyers stepped in and conquered $2,350, that would expose additional key resistance levels like the June 7 cycle high of $2,387, ahead of challenging the $2,400 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

European Central Bank (ECB) President Christine Lagarde expressed a need for caution from the ECB late Monday, highlighting that downside risks remain a threat despite a firm labor market.

Key highlights

A Soft landing for the euro zone economy is not guaranteed.

It will take time to be certain that inflation is on track.

A strong labour market means we have time to gather information.

The strong labor market allows the ECB to gather enough data.

European Central Bank (ECB) Governing Council member Pierre Wunsch noted late on Monday that it would take a notable turn in economic data to convince the ECB to deliver more than two more rate trims in 2024.

Key highlights

We would need convincing to cut more than twice this year.

The Transmission Protection Instrument is to be used if the situation is unwarranted or disorderly.

The ECB won't solve fiscal problems with the use of TPI.

A July cut is an option in theory, in practice we must be cautious.

Market pricing on the ECB rate path looks reasonable.

- WTI climbs nearly $3 per barrel amid Monday's Crude Oil surge.

- Crude rising on Middle East geopolitical tensions, fears of cross-border spillover.

- Obscure hopes for rising Crude Oil demand in the future also pressuring barrel bids.

West Texas Intermediate (WTI) US Crude Oil rose sharply on Monday, climbing nearly $2 per barrel, as energy markets found fresh bidding pressure amid ongoing Middle East geopolitical tensions and hopes that unseasonally hot temperatures across the US would bolster demand enough to eat up supply.

The Israel-Palestinian Hamas conflict continues to broil in Gaza, and Crude Oil markets are increasingly concerned that the altercation could spill over borders to drag neighboring countries that are critical to global energy production into the conflict. With Iran backing Palestinian Hamas, concerns are mounting that Israel may step too far in their campaign and cause Tehran to step into matters with military force, destabilizing global Crude Oil supply lines.

Crude Oil markets also hope that an impending increase in domestic US average temperatures will bolster fuel demand for cooling. Investors are expecting that an uptick in demand will help to sop up US Crude Oil production that continues to threaten to swamp out domestic supply lines.

Energy market expectations of future demand increases are running counter to the predictions of financial analysts, who anticipate prices to soften moving forward with one-year price forecasts expected to closely mirror recent price action.

WTI technical outlook

WTI US Crude Oil is accelerating into the high end on Monday, climbing $2 per barrel to kick off the new trading week. WTI pierced near-term technical resistance and broke into fresh nine-week peaks near $83.00. WTI has climbed nearly 15% from June’s early bottom bids near $72.50, gaining ten dollar per barrrel.

WTI is already on pace to close in the green for a fourth consecutive week, but with a long wait to Friday and a US holiday on the cards this week, there is still plenty of room for bulls to flub the bid, and send WTI back into $80.00 per barrel if momentum dried up.

WTI hourly chart

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- AUD/USD mildly declines to 0.6660 on Monday.

- Markets await latest RBA and Fed meeting minutes for additional guidance.

- On Monday, the US reported ISM PMIs that showed no surprises.

Monday's session recorded a moderate slip in the Australian Dollar (AUD) value against the US Dollar. As a result of persistently high inflation in Australia and some signs of softening in the US, meeting minutes from both the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA) will be closely watched this week. Labor market figures from June from the US are also due.

The Australian economy demonstrates some signs of weakness. However, the stubbornly high inflation is prompting the RBA to delay potential rate cuts. The RBA is one of the last G10 country central banks expected to issue rate cuts. This delay might further strengthen the Aussie.

Daily digest market movers: Aussie observes slight losses as market holds breath for packed week

- Australian Dollar's value saw a slight increase because of the stubbornly high inflation figures that prevent the RBA from initiating rate cuts.

- Market predicts around 40% odds of a 25-basis-point rate hike on the September 24 RBA meeting, extending to 50% leading up to November 5.

- In Australia, the May's Retail Sales data will be closely observed, which is scheduled for release on Wednesday. The expectation is for a 0.3% MoM rise compared with 0.1% in April.

- Prospect of a Fed interest rate cut in September is now at 70% and will be guided by the data in the week ahead and Powell’s speech on Tuesday.

Technical analysis: AUD/USD sways between 0.6600-0.6700

From a technical outlook, the AUD/USD pair has been trading sideways since mid-May in the 0.6600-0.6700 range. Traders on either side are struggling to dominate the direction, while indicators remain flat. The 20-day Simple Moving Average (SMA) at 0.6640 is acting as a robust support level, with further support seen below at 0.6620 and 0.6600. Descriptive resistance levels are situated at 0.6660, 0.6690, and 0.6700.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

The Greenback managed to stage a comeback after a pessimistic start to the week amidst a generalized appetite for the risk complex and rising prudence prior to the speech by Chair Powell, and the ECB’s Lagarde on Tuesday.

Here is what you need to know on Tuesday, July 2:

The USD Index (DXY) left behind two consecutive sessions of losses and refocused on the key 106.00 barrier. The Fed’s Chair J. Powell will participate at an event at the ECB Forum in Portugal. On the docket, the RCM/TIPP Economic Optimism Index is only due on July 2.

EUR/USD kept its constructive stance well in place and rose to three-week tops around 1.0780 as investors assessed the results from the French snap elections on Sunday. On July 2, preliminary Inflation Rate in the euro bloc is expected prior to the speech by the ECB’s C. Lagarde at the bank’s forum in Sintra (Portugal).

GBP/USD gave away an earlier move to the area just past the 1.2700 hurdle on the back of the resumption of the buying interest in the US Dollar towards the end of the NA session. There will be no data releases across the Channel on July 2.

USD/JPY advanced further and reached new highs in the proximity of the 162.00 region. The Japanese docket will be empty on July 2.

The resurgence of the downward bias in AUD/USD left the pair navigating within the so far unchanged consolidative theme around 0.6650. The RBA Minutes are only expected in Oz on July 2.

Rising optimism regarding the start of the US driving season and supply fears in the second half of the year lifted WTI prices to new highs north of the $83.00 mark per barrel.

Gold prices remained stuck within their recent range near the $2,330 zone per ounce troy, while Silver prices rose for the third session in a row, although still below the key $30.00 mark per ounce.

- Mexican Peso dips, starting 2024’s second half on a weak note.

- Political uncertainty in Mexico and US election speculation fuel risk-aversion, overshadowing strong economic fundamentals.

- Banxico Governor Rodriguez Ceja maintains a dovish stance, noting economic resilience and openness to rate adjustments.

The Mexican Peso begins the second half of the year on the back foot against the US Dollar, tumbling more than 0.40% after posting its worst first semester since the COVID-19 pandemic. Investors' uncertainty hurts the Peso after the ruling political party, Morena, might control the Mexican Congress and push bills that threaten the status quo. The USD/MXN trades at 18.39 after hitting a daily low of 18.25.

Mexico’s currency would likely continue to be driven by domestic politics and threats that former US President Donald Trump could win November’s elections. Therefore, the Mexican Peso would be hurt by risk-aversion even though the economy remains solid. According to Goldman Sachs analyst Teresa Alves, “Mexico’s macroeconomic and FX fundamentals are in a healthier position now.”

Bank of Mexico (Banxico) Governor Victoria Rodriguez Ceja gave dovish responses to an interview by El Financiero. She emphasized, “The Mexican economy is in a solid position to face any external or internal challenges that may arise,” adding that volatility in Mexico’s financial markets had subsided, which caused a sharp depreciation of the Mexican currency in early June.

She mentioned that the Peso’s depreciation influenced the Governing Board from easing policy and said the progress in disinflation “allows us to continue discussing downward adjustments in our rate, and I consider that this is what we will be doing in our next monetary policy meetings.”

Consequently, the Peso extended its losses on Monday despite US economic data being softer.

Daily digest market movers: Mexican Peso edges lower on strong US Dollar

- Citibanamex survey reveals that economists are now expecting fewer rate cuts by the central bank. They have also revised the Gross Domestic Product (GDP) growth for 2024 downward from 2.2% to 2.1% YoY and anticipate the USD/MXN exchange rate will end the year at 18.70, up from the previously reported 18.00.

- Mexico’s Business Confidence deteriorated from 53.7 to 53 in June, according to the National Statistics Agency (INEGI).

- S&P Global Manufacturing PMI for June was 51.1, a tenth lower from May’s 51.2.

- June’s US S&P Global Manufacturing PMI was 51.6, higher than the previous month yet missing forecasts of 51.7.

- ISM Manufacturing PMI for June was 48.5, lower than estimates of 49.1 and May’s 48.7.

- Greenback’s recovery, as measured by the US Dollar Index (DXY), gains from 105.42 to 105.87, underpinning the USD/MXN pair.

- CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut at 58.2%, down from 59.5% last Friday.

Technical analysis: Mexican Peso falls as USD/MXN rallies past 18.30

The USD/MXN is consolidating in the 18.00-18.40 range after hitting a daily low of 18.25. Momentum favors buyers, as shown by the Relative Strength Index (RSI) being bullish. Despite that, buyers must reclaim the June 28 high of 18.59 if they would like to extend their gains and challenge the year-to-date (YTD) high of 18.99.

In that event, further gains are seen, including the March 20, 2023, high of 19.23. Once cleared, it will expose 19.50.

For a bearish continuation, sellers must reclaim the April 19 high turned support at 18.15, which would pave the way toward 18.00. The next support would be the 50-day Simple Moving Average (SMA) at 17.37 before testing the 200-day SMA at 17.23.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Dow Jones kicks off the new trading week with overcorrection in both directions.

- US data missed the mark on Monday, sparking a brief rally on rate cut hopes.

- Too-big of a dip in US data, plus a muddy election outlook, reignites recession fears.

The Dow Jones Industrial Average (DJIA) briefly rallied on Monday after a broad miss in key US data sparked a risk rally on renewed rate cut hopes. Still, the steep decline in manufacturing figures proved too much for investors to stomach. Equities gave up early gains and tumbled back into the day’s opening range.

June’s US ISM Manufacturing Purchasing Managers Index (PMI) broadly missed the mark on Monday, ticking down to 48.5 from the previous 48.7 and missing the forecast step up to 49.1. The economic indicator has spent a third consecutive month below the key 50.0 level, flashing ongoing warning signs of a broader slowdown creeping up within the US domestic economy.

ISM Manufacturing Prices Paid also declined in June, tumbling to a six-month low of 52.1 from the previous 57.0, falling well below the forecast decline to 55.9. With inflationary pressures easing, US markets initially jumped at the outset of the new trading week as investors continue to hope for softening economic figures to push the Federal Reserve (Fed) into an accelerated pace of rate cuts. However, too-steep of a drag in US data points could easily tip the US into a recession that rate cuts won’t overcome, sparking risk-off fears and trimming Monday’s early gains.

Dow Jones news

The Dow Jones is split down the middle on Monday, with half of the index’s constituent securities in the red for the day. Merck & Co Inc. (MRK) leads the gainers, climbing 3.5% and gaining 4.3 points to trade into $128.11 per share. On the low side, Unitedhealth Group Inc. (UNH) fell back 2.66%, falling 13.78 points to $495.48 per share.

Dow Jones technical outlook

Sideways churn is the name of the game for the Dow Jones as the major equity index grinds out a rough near-term lateral channel. The DJIA is cycling just above the 39,000.00 handle as bidders refuse to let the Dow decline but lack the necessary momentum to reclaim higher chart territory.

Daily candles continue to churn out a growing consolidation pattern as the Dow Jones gets strung along the 50-day Exponential Moving Average (EMA) at 38,908.22. The DJIA continues to hold on the high side of late May’s bottom near 38,000.00, but topside momentum remains unable to recover ground back to all-time highs set just north of the 40,000.00 major price handle in May.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Gediminas Šimkus, head of the central bank of Lithuania and sitting member of the European Central Bank's (ECB) Governing Council, warned on Monday that despite decent odds of a few more rate cuts in 2024, a July rate cut is unlikely to materialize.

Key highlights

The case for a July interest-rate cut has gone.

Two more 2024 cuts are possible if the data is as expected.

I don't see disorderly moves in French bonds.

We shouldn't limit rate moves to projection meetings.

- US Dollar recovers after slight losses following ISM PMIs data.

- Dollar finds cushion on high US Treasury yields.

- Signs of disinflation have begun to surface in the US economic landscape, which might justify bringing cuts forward.

As the week begins, the US Dollar based on the DXY Index has cleared daily losses and currently sits near 105.90, following the recent ISM Manufacturing PMI figures. The sustained levels of high US Treasury yields continue to lend strength to the DXY.

Distinct signs of disinflation are beginning to emerge within the US economic climate, bolstering confidence among market players for a rate cut in September. Federal Reserve (Fed) officials, however, are treading carefully and continue to abide by their data-dependent stance.

Daily digest market movers: US Dollar recovers despite weak ISM PMIs, eyes on labor market data

- ISM Manufacturing PMI recorded a drop, shifting to 48.5 in June from 48.7 in April. This fell below the projected market expectation of 49.1.

- The Employment Index, part of the PMI survey, also marked a dip from 51.1 in May to 49.3.

- New Orders Index, on the other hand, witnessed an improvement from 45.4 to 49.3.

- High anticipation for the week comes for June's Nonfarm Payrolls to be released this Friday. According to Bloomberg's consensus, it is expected to be 190K versus 272K in May.

- Equally important will be Wednesday's report on ADP private sector jobs expected at 158K versus 152K in May.

- The release of May’s FOMC minutes will provide deeper insights into the Fed's cautious stance.

DXY technical outlook: Persistent positive momentum, index eyes higher levels

Maintaining a positive outlook, despite minor fluctuations, both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) depict a stable terrain. The RSI continues to hold above 50 with a marginal flattening, while MACD sustains its green bar projections, indicating minor traction in the bullish momentum.

Resolutely above its 20, 100 and 200-day Simple Moving Averages (SMAs), the DXY continues trading in high levels observed since May, with the 106.50 and 106.00 zones in its sightline. However, observers should also keep an eye on the 105.50 and 105.00 zones in case of potential drawdowns.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- Canadian Dollar sheds half of a percent against the Greenback.

- Canada Day holiday leaves CAD markets in the dark for Monday.

- Canadian data remains limited this week until NFP Friday.