- Аналітика

- Новини та інструменти

- Новини ринків

- Gold price dips amid strong US Dollar, rising US yields

Gold price dips amid strong US Dollar, rising US yields

- Gold slides as DXY cleared 110.00 for the first time since November 2023.

- Traders trimmed Fed rate cut odds, after US jobs data, CPI eyed.

- XAU/USD sellers eye $2,650 and 100-day SMA near $2,630.

Gold price retreats during the North American session as traders seeking safety bought the Greenback as United States (US) Treasury bond yields rose to their highest level since November 2023. At the time of writing, the XAU/USD trades at $2,657 after failing to clear $2,700, down 1.20%.

A scarce economic docket on Monday keeps investors digesting the latest US Nonfarm Payrolls figures for December. Although the economy has fared better than expected, with figures rising by 256K exceeding forecasts of 160K and November's 212K, traders are eyeing the release of US inflation data.

On Wednesday, the Consumer Price Index (CPI) for December will be announced, with estimates at around 2.8% YoY, up from November 2.7%. The Core CPI, which excludes volatile items, is projected to remain unchanged at 3.3% YoY, unchanged from the latest three-months readings.

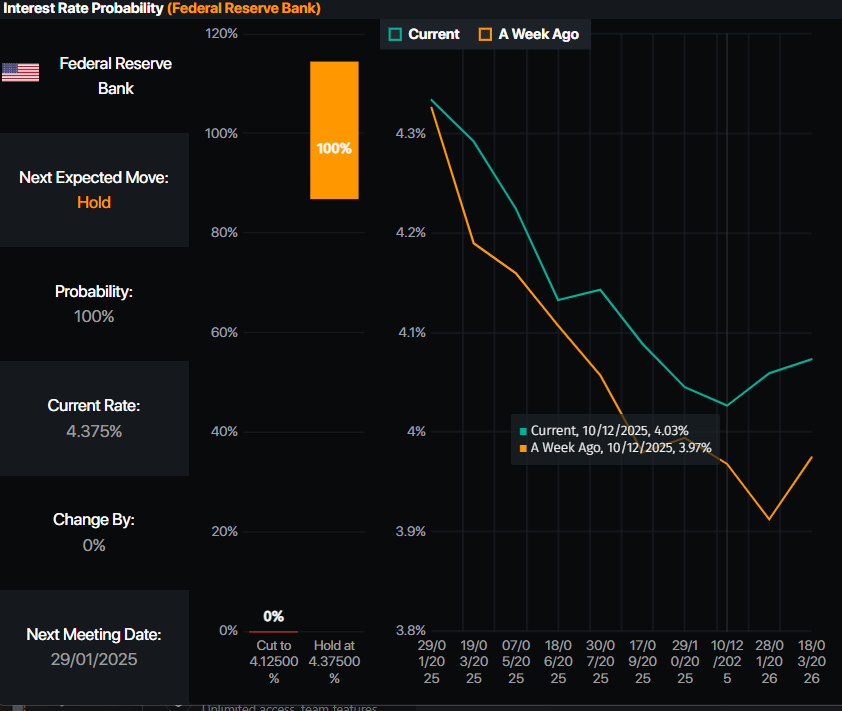

Inflation data could shifttraders expectations of Fed easing. Meanwhile, money market futures data has shown that most investors are expecting just 25 basis points of easing, leaving the fed funds interbank rate at 4.00%, down from the current 4.25% - 4.50% range.

Federal Reserve - Interest rate probability. Source: Prime-Market Terminal

Meanwhile, US Treasury bond yields cling to minimal gains, while the Greenback, after breaking the 110.00 mark, has retraced below the latter but it remains in the green.

Bullion prices are also taking a hit amid good news of a possible deal that could end Gaza's war, via Reuters, citing an official briefed on the matter.

In seven days, US President-elect Donald Trump will be sworn as the 47th President. The financial markets are awaiting its first executive orders, with some speculation growing that he would impose the first tariffs. Recently he said that he has to do something regarding trade with Mexico and Canada.

In the US, key data releases include inflation figures on the producer and consumer sides, alongside Retail Sales and jobless claims for the week ending January 11.

Daily digest market movers: Gold price falls as US Dollar advances

- Gold price faces headwinds amid high US real yields, which rise three and a half basis points by two bps to 2.30%. At the same time, the US 10-year T-note yield soared seven and a half bps to 4.767%.

- The US Dollar rose sharply to multi-month highs according to the US Dollar Index (DXY). The DXY hit 110.17 before trimming gains and is at 109.85, up 0.20%.

- The US 10-year Treasury bond yields rises two basis points, up at 4.786%.

- Easing expectations of the Federal Reserve continued to edge lower. The December Fed funds futures contract is pricing in 30 basis points of easing.

XAU/USD technical outlook: Gold price clings above $2,650 despite retracing

Gold's uptrend halted on Monday as a 'bearish-engulfing' pattern emerges in the daily chart, an indication that sellers are gathering some momentum. This is slightly confirmed by the Relative Strength Index (RSI), which despite remaining bullish, edges down towards its neutral level. Hence, in the short term further downside is seen.

If XAU/USD drops below $2,650, the next support would be the 50-day Simple Moving Average (SMA) at $2,643, followed by the 100-day SMA at $2,633.

On the other hand, if XAU/USD reclaims $2,700, the next resistance would be the December 12 high of $2,726 and the all-time high (ATH) at $2,790.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.