- Аналітика

- Новини та інструменти

- Новини ринків

- Canada CPI expected to rise 1.9% in October, bolstering BoC to further ease policy

Canada CPI expected to rise 1.9% in October, bolstering BoC to further ease policy

- The Canadian Consumer Price Index is seen ticking higher by 1.9% YoY in October.

- The Bank of Canada has reduced its policy rate by 125 basis points so far this year.

- The Canadian Dollar navigates multi-year lows against its American counterpart.

Statistics Canada is gearing up to release its latest inflation report for October, tracked by the Consumer Price Index (CPI), on Tuesday. Expectations point to a potential 1.9% rise in headline inflation compared to the same month last year.

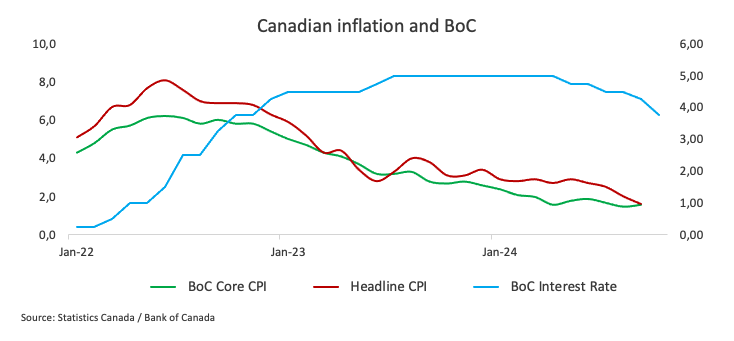

Alongside this, the Bank of Canada’s (BoC) core CPI figures, which strip out more volatile items like food and energy, will also be published. In September, core CPI came in flat compared with the previous month but was up 1.6% year-over-year. The headline CPI for September showed a modest 1.6% increase over the past 12 months – the lowest since February 2021 – and actually declined by 0.4% from a month earlier.

Investors and analysts are watching these inflation numbers closely, as they could sway the Canadian Dollar (CAD), especially given the BoC’s current stance on interest rates. It’s worth noting that the BoC has already lowered its policy rate by 125 basis points since it started its easing cycle in May, bringing it down to 3.75%.

On the currency front, the Canadian Dollar has had a rough ride. This depreciation of the Canadian currency has pushed USD/CAD to levels not seen since May 2020, north of the 1.4100 barrier.

What can we expect from Canada’s inflation rate?

Consensus among market participants appears to favour an uptick in Canadian inflation in October, although the metric should remain below the BoC’s 2.0% target. In the unlikely case that there’s an unexpected and substantial jump in prices, the underlying trend of easing inflation should keep the central bank on track with its rate-cutting strategy.

In the wake of the clear consensus that ensued the BoC’s 50-basis-point rate cut on October 23, Governor Tiff Macklem acknowledged that inflation “has come down a little faster than expected.”

In addition, Macklem noted that headline inflation has seen a significant drop recently, attributing part of this decline to falling global Oil prices, especially in gasoline. However, he pointed out that the improvement isn’t just about volatile energy costs. He explained that core inflation – which strips out those more unpredictable factors – has also been easing gradually, much as the bank had anticipated. He added that, while shelter price inflation remains high, it has started to come down, boosting the bank's confidence that this trend will continue in the months ahead.

Previewing the data release, Assistant Chief Economist Nathan Janzen at Royal Bank of Canada noted: “We expect some upward seasonal price moves in categories like clothing and footwear as well as travel tours. Another component to watch for is property taxes and other special charges, as this component is released only in October. The BoC‘s preferred median and trim core measures (for a better gauge of where inflation is going rather than where it’s been) both likely ticked higher in October on a three-month rolling average.”

When is the Canada CPI data due, and how could it affect USD/CAD?

Canada's inflation report for October is set to be released on Tuesday at 13:30 GMT, but the Canadian Dollar's reaction is likely to depend on whether the data delivers any big surprises. If the figures come in line with expectations, it’s unlikely to sway the Bank of Canada’s current rate outlook.

In the meantime, USD/CAD has been navigating a strong upward trend since October, hitting multi-year tops just beyond the 1.4100 hurdle at the end of last week. This rise has mainly been fuelled by a robust rebound in the US Dollar (USD), almost exclusively on the back of the so-called “Trump trade," keeping risk-sensitive currencies like the Canadian Dollar under heavy pressure.

Pablo Piovano, Senior Analyst at FXStreet, suggests that under the current scenario of persistent gains in the Greenback and heightened volatility in crude Oil prices, further weakness in the Canadian Dollar should well remain on the cards in the near to medium terms.

“If the rally continues, the next resistance level for USD/CAD emerges at the weekly peak of 1.4265 (April 21, 2020), ahead of the highest level reached that year at 1.4667 (March 19),” Piovano adds

On the downside, there is an initial contention zone at the November low of 1.3823 (November 6), prior to the provisional support zone in the 1.3710-1.3700 band, where converge both interim 55-day and 100-day Simple Moving Averages (SMAs), all prior to the more significant 200-day SMA at 1.3663. If USD/CAD breaks below the latter, it could spark an extra bout of selling pressure to, initially, the September low at 1.3418 (September 25), Piovano says.

Economic Indicator

BoC Consumer Price Index Core (MoM)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The MoM figure compares the prices of goods in the reference month to the previous month. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Tue Nov 19, 2024 13:30

Frequency: Monthly

Consensus: -

Previous: 0%

Source: Statistics Canada

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.