- Аналітика

- Новини та інструменти

- Новини ринків

- Canada Interest Rate Decision Preview: BoC set to cut interest rates for third consecutive meeting

Canada Interest Rate Decision Preview: BoC set to cut interest rates for third consecutive meeting

- Bank of Canada (BoC) is seen reducing its policy rate to 4.25%.

- Canadian Dollar started the month on the back foot vs. the US Dollar.

- Headline inflation in Canada dropped further in July.

- Swaps markets see around 36 bps of easing this week.

There is widespread expectation that the Bank of Canada (BoC) will lower its policy rate for the third consecutive meeting on September 4. Mirroring previous decisions by the central bank, this move would most likely be of 25 basis points, taking the benchmark interest rate to 4.25%.

Since the year began, the Canadian Dollar (CAD) has been weakening against the US Dollar (USD), taking USD/CAD to fresh highs near 1.3950 in early August. Since then, however, the Canadian currency has started a period of sharp appreciation, dragging the pair around 5 cents lower by the epilogue of the previous month.

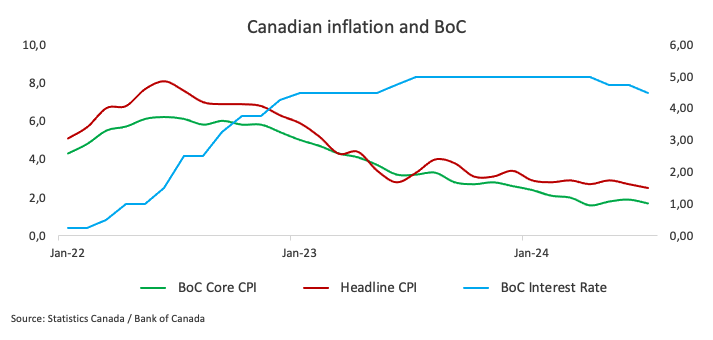

In July, the annual rate of domestic inflation, as measured by the headline Consumer Price Index (CPI), declined further to 2.5% vs. the same month in 2023, and the BoC's core CPI fell further below the 2.0% target, recording a 1.7% increase over the last twelve months. The expected rate cut by the central bank seems linked to the ongoing decrease in consumer prices and anticipated further easing in the Canadian labour market.

Inflation has stayed under 3% since January, aligning with the central bank's forecast for the first half of 2024, with key core consumer price metrics also showing a consistent decrease. Additionally, the BoC is likely to continue basing its future rate decisions on economic data. Current swaps markets suggest around 36 basis points of easing in September.

The BoC could maintain its dovish narrative

Despite the anticipated rate cut, the central bank's overall stance is expected to lean towards the bearish side, particularly against the backdrop of declining inflation (which suggests that the headline CPI could hit the bank’s target anytime soon) and growing slack in the labour market.

Following the rate cut in July, BoC Governor Tiff Macklem argued that the economy is experiencing excess supply, with slack in the labour market contributing to downward pressure on inflation. He explained that their assessment indicates there is already enough excess supply in the economy, and the necessary conditions are increasingly in place to bring inflation back to the 2% target. He also emphasized that rather than needing more excess supply, there is a need for growth and job creation to start picking up to absorb the excess supply and achieve a sustainable return to the inflation target.

Macklem added that the central bank aims to balance the risks on both sides, expressing a determination to bring inflation back to 2% without excessively weakening the economy and causing inflation to fall below the target. He noted that these considerations would be weighed carefully moving forward, and decisions would be made one meeting at a time.

In light of the upcoming interest rate decision by the BoC, Taylor Schleich and Warren Lovely at the National Bank of Canada said:

“The Bank of Canada is set to lower the target for the overnight rate by 25 basis points on Wednesday, the third such move in as many meetings. The only data point that had the potential to derail a cut — the July CPI report — offered encouraging news on the core inflation front, allowing policymakers to ease without controversy.

“Meanwhile, even though the July employment report revealed an unchanged unemployment rate, the labour market outlook remains challenged. Consensus expectations for the unemployment rate (and those implied by the Bank of Canada’s rosy growth projections) are too optimistic, and we still see the jobless rate hitting ~7% by year-end.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, September 4, followed by Governor Macklem’s press conference at 14:30 GMT.

Eliminating any potential surprises, the impact on the Canadian currency is expected to come mainly from the message of the bank rather than the move on the interest rate per se. Taking a conservative approach may result in more support for CAD and a subsequent dip in USD/CAD. If the bank indicates that it intends to decrease interest rates further, the Canadian Dollar may suffer and open the door to further gains in USD/CAD.

According to Pablo Piovano, Senior Analyst at FXStreet.com, "USD/CAD has been on a strong downward path since the beginning of August, taking spot to monthly lows near 1.3640 last week. The rebound since then came mainly on the back of the recovery in the US Dollar (USD), prompting the pair to reclaim the 1.3500 barrier and beyond so far.

Pablo adds:

“The immediate target emerges at the 200-day SMA, currently at 1.3589. Once this region is cleared, the pair might revisit the 1.3665-1.3680 band, where the interim 55-day and 100-day SMAs converge. Further up, there are no resistance levels of note until the 2024 peak at 1.3946 recorded on August 6.

“If bears regain the initiative, USD/CAD might revisit its August low of 1.3436 (August 28) prior to the March low of 1.3419 (March 8). A deeper decline beyond the latter exposes a move to the December 2023 bottom of 1.3177 (December 27)”, Pablo concludes.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Jul 24, 2024 13:45

Frequency: Irregular

Actual: 4.5%

Consensus: 4.5%

Previous: 4.75%

Source: Bank of Canada

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.