- Аналітика

- Новини та інструменти

- Новини ринків

- Germany inflation expected to ease further as another ECB rate cut hangs in the balance

Germany inflation expected to ease further as another ECB rate cut hangs in the balance

- Germany’s statistics agency, Destatis, will publish the CPI data on Thursday.

- Headline CPI is set to rise by 2.1% YoY in August.

- The ECB is still far from decided over a move on rates in September.

The European Central Bank (ECB) is scheduled to meet next month for its monetary policy review, making the upcoming Harmonized Index of Consumer Prices (HICP) inflation data from Germany, set to be released on Thursday, particularly significant for its potential impact on the central bank’s policy decisions.

Meanwhile, the Euro (EUR) may relinquish part of its recent strong upward trend, particularly against the US Dollar (USD), if the inflation data from Eurozone economies, especially Germany, indicates a persistent disinflationary trend.

What can we expect from the upcoming German inflation report?

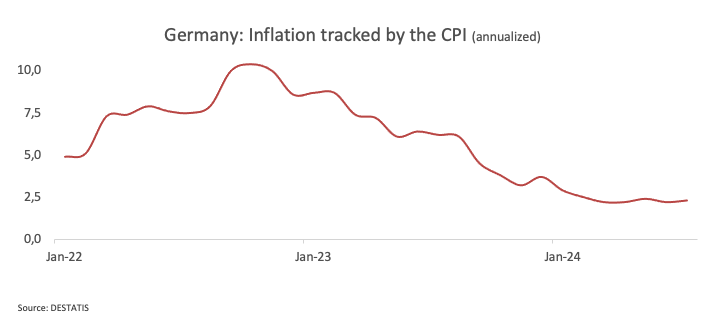

The Federal Statistical Office of Germany (Destatis) will release the official data on Thursday. The annual German Consumer Price Index (CPI) is projected to rise by 2.1% in August, down from the 2.3% increase reported in the previous month. Monthly CPI inflation is expected to show a humble increase of 0.1% during the reported period.

Germany’s annual Harmonized Index of Consumer Prices (HICP), in the meantime, is anticipated to drop to 2.3% in August, down from 2.6% in July. The monthly HICP is likely to come in flat last month, compared to a 0.5% increase in July.

A further cooling of inflation in Europe’s largest economy could suggest softer inflation readings for the entire Eurozone, which will be published on Friday. On this, the headline Eurozone headline CPI is expected to rise by 2.2% in the year to August, a slowdown from the 2.6% increase seen in July, while the core inflation, which strips food and energy costs, is also projected to decrease to 2.8% during the same period, down from a 2.9% uptick in the previous month.

On Tuesday, Dutch policymaker Klaas Knot argued that the European Central Bank (ECB) could gradually lower interest rates as long as inflation is expected to reach its 2% target by the end of 2025 at the latest. He expressed his comfort with gradually easing off the brakes, provided that the disinflation path continues to align with a return to 2% inflation by that time. Knot also mentioned that he would need to wait for the complete set of data and information before deciding his position on whether a rate cut in September would be appropriate.

This cautious tone followed comments from ECB Chief Economist Philip Lane over the weekend, who remarked that it is not yet guaranteed that the central bank will successfully reduce inflation back to its 2% target, indicating that a restrictive monetary policy remains necessary. Lane also emphasized that the monetary stance must remain in restrictive territory for as long as necessary to guide the disinflation process towards a timely return to the target. However, he also cautioned against maintaining high rates for an extended period, as this could result in persistently below-target inflation.

Ahead of the release, TD analysts noted: “Heavy base effects in the energy components will help headline inflation get close to target in the eurozone—in the EZ, the headline rate will likely come down all the way to 2.1% y/y, whereas German HICP inflation should fall to 2.2% y/y. Core inflation should remain sticky though, but remain on a disinflationary path."

When will the HICP inflation report be released, and how could it affect EUR/USD?

The preliminary HICP inflation report for Germany is scheduled for release at 12:00 GMT. In the lead-up to this inflation data release, EUR/USD seems to have lost some upside impulse after hitting fresh 2024 tops just above 1.1200 the figure at the beginning of the week.

Markets have now pencilled in around 100 bps of easing by the US Federal Reserve (Fed) in the latter part of the year, with the kick-start of its easing cycle coming as soon as September. However, it is not that clear that the ECB will follow suit, as per recent prudent comments from rate-setters. So far, the broader debate seems to have shifted towards the health of both economies, where the US clearly exhibits a decent advantage.

If the headline and core inflation data come in hotter than expected, it could bolster expectations for one more ECB rate hike in the next few months, lending support to the European currency and therefore opening the door to the continuation of the ongoing uptrend in EUR/USD. On the flip side, a negative surprise, that is, an acceleration of the disinflationary trend, will carry the potential to remove some strength from the Euro and thus unveil a probable reversal to lower levels.

Pablo Piovano, Senior Analyst at FXStreet.com, notes that the surpass of the 2024 peak at 1.1201 (August 26) could prompt the pair to embark on a probable trip to the 2023 high of 1.1275 (July 18), seconded by the 1.1300 milestone.

In case of bearish attempts, Pablo suggests that there should be initial contention at the weekly low of 1.0881 (August 8), which appears reinforced by the provisional 55-day SMA at 1.0879 and comes before the critical 200-day SMA of 1.0851.

All in all, the pair’s constructive bias is expected to persist as long as it trades above the key 200-day SMA, concludes Pablo.

Economic Indicator

Consumer Price Index (MoM)

The Consumer Price Index (CPI), released by the German statistics office Destatis on a monthly basis, measures the average price change for all goods and services purchased by households for consumption purposes. The CPI is the main indicator to measure inflation and changes in purchasing trends. The MoM figure compares the prices of goods in the reference month to the previous month. A high reading is bullish for the Euro (EUR), while a low reading is bearish.

Read more.Last release: Fri Aug 09, 2024 06:00

Frequency: Monthly

Actual: 0.3%

Consensus: 0.3%

Previous: 0.3%

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.