- Аналітика

- Новини та інструменти

- Новини ринків

- EUR/USD Price Analysis: Oscillates in a range above 100-day SMA ahead of Eurozone macro data

EUR/USD Price Analysis: Oscillates in a range above 100-day SMA ahead of Eurozone macro data

- EUR/USD consolidates in a range above a two-and-half-week low touched on Monday.

- September Fed rate cut bets keep the USD bulls on the defensive and act as a tailwind.

- A sustained break below 100-day SMA is needed to support prospects for further losses.

The EUR/USD pair struggles to build on the overnight bounce from the 1.0800 neighborhood, or a two-and-half-week low and oscillates in a narrow range during the Asian session on Tuesday. Spot prices currently trade around the 1.0820-1.0825 region, nearly unchanged for the day as traders opted to wait for important macro releases from the Eurozone before positioning for a firm intraday direction.

Tuesday's economic docket features the flash German consumer inflation figures, along with the prelim German and Eurozone GDP. The focus will then shift to the flash Eurozone CPI report on Wednesday, which will be followed by the outcome of a two-day FOMC policy meeting. Apart from this, key US macro data scheduled at the start of a new month, including the Nonfarm Payrolls (NFP) report on Friday, will be looked for cues about the Federal Reserve's (Fed) rate-cut path, which, in turn, will influence the USD and the EUR/USD pair.

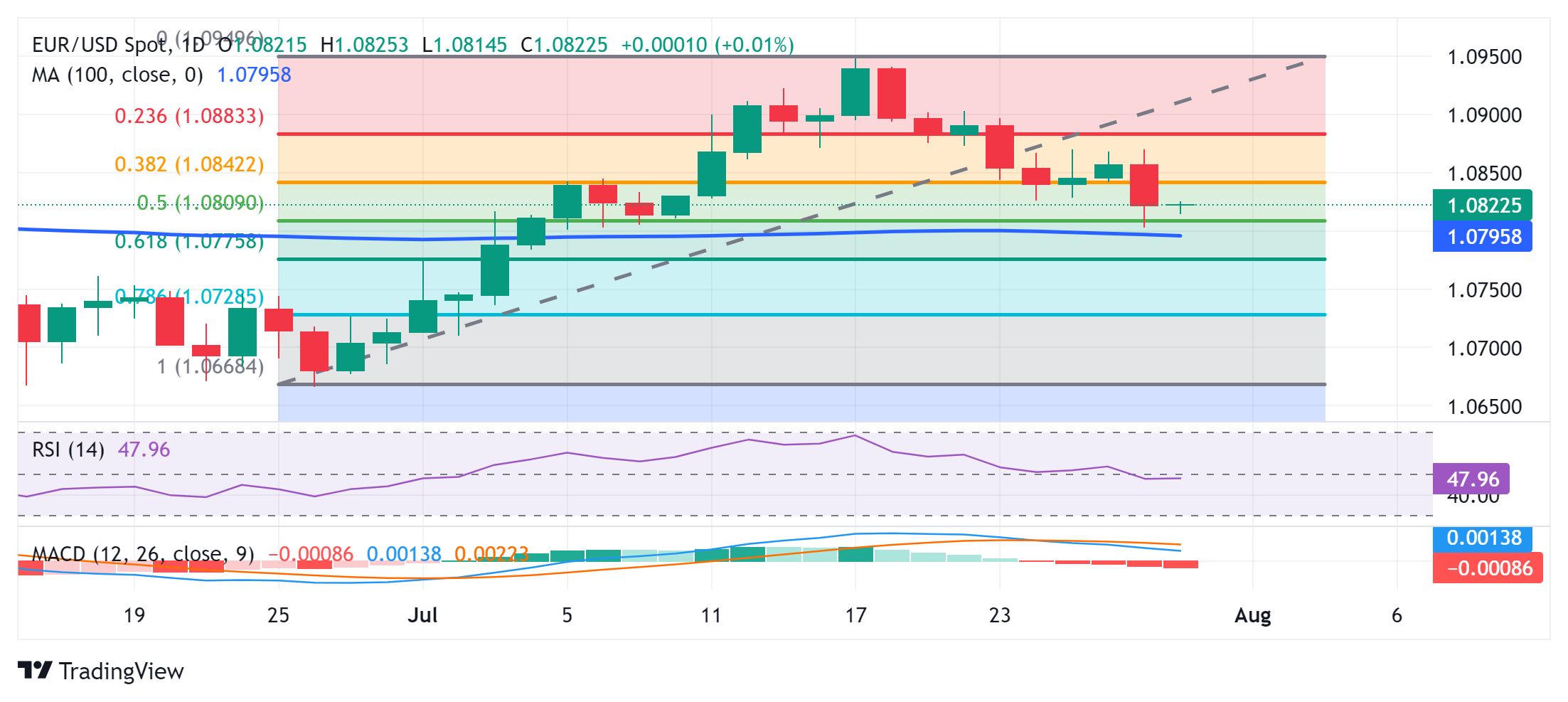

From a technical perspective, spot prices showed resilience below the 50% Fibonacci retracement level of the June-July rally on Monday, though the lack of any meaningful buying warrants caution for bulls. Moreover, oscillators on the daily chart have started gaining negative traction, suggesting that the path of least resistance for the EUR/USD pair is to the downside. That said, acceptance below the 100-day SMA is needed to support prospects for an extension of the recent pullback from a four-month peak, around mid-1.0900s touched on July 17.

Spot prices might then weaken further below the 61.8% Fibo. level near the 1.0775 region and test the next relevant support near the 1.0745 horizontal zone. This is closely followed by the 78.6% Fibo. level near the 1.0730 area, below which the EUR/USD pair is likely to challenge the June monthly swing low, around the 1.0660 region, with some intermediate support near the 1.0700 round-figure mark.

On the flip side, any subsequent move up is likely to confront resistance near the 1.0840-1.0845 region or the 38.2% Fibo. level. A sustained strength beyond the latter could lift the EUR/USD pair above the 1.0865 horizontal barrier, towards the 1.0885-1.0890 region. Some follow-through buying beyond the 1.0900 mark should allow bulls to aim back towards resting the multi-month peak, around mid-1.0900s.

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by the German statistics office Destatis on a monthly basis, measures the average price change for all goods and services purchased by households for consumption purposes. The CPI is the main indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is bullish for the Euro (EUR), while a low reading is bearish.

Read more.Next release: Tue Jul 30, 2024 12:00 (Prel)

Frequency: Monthly

Consensus: 2.2%

Previous: 2.2%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.