- Аналітика

- Новини та інструменти

- Новини ринків

- Bank of Japan expected to keep rates on hold for second consecutive time after historic hike

Bank of Japan expected to keep rates on hold for second consecutive time after historic hike

- The Bank of Japan is largely expected to keep its policy rate unchanged.

- Markets’ attention will be on a potential hawkish message by Governor Kazuo Ueda.

- Further announcements could be around JGB purchases.

The Bank of Japan (BoJ) is expected to maintain its short-term rate target between 0% and 0.1% on Friday, June 14, after concluding its two-day monetary policy review meeting for June.

The decision will be announced at 3:00 GMT on Friday. It is worth recalling that, in March, the BoJ raised the interest rate for the first time in 17 years, ending the negative interest rate policy that had been in place since 2016.

What can we expect from the BoJ interest rate decision?

With a steady policy widely expected at this gathering, market participants will keep their attention on the probable changes in the policy statement for fresh hints on the timing of the bank’s next rate increase.

So far, money markets see around 16 bps of hiking in October and nearly 22 bps at the December 19 meeting, according to Reuters.

Data released on Wednesday revealed that Japan's wholesale inflation surged in May at the fastest annual rate in nine months. This indicates that the weak Yen is driving up the cost of raw material imports, thereby exerting upward pressure on prices.

This development complicates the central bank’s decision on the timing of raising interest rates, as price increases driven by cost pressures might reduce consumption, undermining the possibility of achieving the demand-driven inflation the BoJ aims for before further scaling back its stimulus measures.

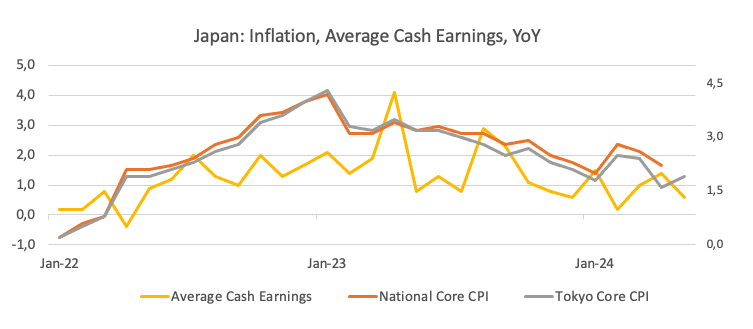

Also pouring cold water over expectations of extra rate hikes, the National Core CPI approached the bank’s target in April (2.2% YoY), while the Tokyo Core CPI navigated below the inflation goal for the second month in a row in May (1.9% YoY).

Last week, Governor Ueda stated that it would be appropriate to scale back the central bank's bond-buying as it progresses towards ending its extensive monetary stimulus. Ueda also emphasized that the BoJ will proceed "cautiously" in deciding the timing and extent of short-term interest rate increases "to avoid making any significant errors."

In addition, board member Toyoaki Nakamura also argued last week that the central bank should not raise interest rates solely to slow the Yen's decline. He explained that attempting to address the weak Yen through interest rate adjustments would negatively impact the economy, as higher borrowing costs would dampen demand.

Analysts at TD Securities comment: “We expect the BoJ to keep the policy balance rate unchanged at 0% and announce a reduction of their JGB monthly purchases to likely around JPY5tn/mth”

How could the Bank of Japan interest rate decision affect USD/JPY?

A hawkish surprise by the BoJ could certainly give the Japanese Yen fresh legs and, therefore, sponsor a knee-jerk drop in USD/JPY. The opposite is likely to happen if the central bank disappoints expectations and signals that the next rate hike is still some time away or that the focus remains on achieving the bank’s inflation target before a move higher on rates.

A glimpse at the broader picture shows Fed-BoJ policy divergence remains at center stage. Following the cautious hold by the Federal Reserve (Fed) at its June 12 event and prospects of just one interest rate cut this year (most likely in December), a sustainable move lower in spot does not appear as the most favourable scenario for the time being.

Looking at the techs surrounding USD/JPY, Senior Analyst at FXStreet.com Pablo Piovano suggests that “further advances are expected to target the weekly high of 157.71 recorded on May 29, followed by the 2024 top of 160.20 from April 29.”

On the downside, “the June low of 154.52 (June 4) emerges as the initial target, ahead of the weekly low of 153.60 reached on May 16 and the provisional 100-day SMA at 152.55”, Pablo adds.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Last release: Fri Apr 26, 2024 03:20

Frequency: Irregular

Actual: 0%

Consensus: 0%

Previous: 0%

Source: Bank of Japan

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. Still, the Bank judges that the sustainable and stable achievement of the 2% target has not yet come in sight, so any sudden change in the current policy looks unlikely.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.