- Аналітика

- Новини та інструменти

- Новини ринків

- Dow Jones Industrial Average tumbles 300 points after ISM PMI miss

Dow Jones Industrial Average tumbles 300 points after ISM PMI miss

- Dow Jones backslides as investors balk at softening US data.

- Markets have shifted to bets of a November Fed rate cut.

- Monday kicks off NFP week with a sharp pullback in equities.

The Dow Jones Industrial Average (DJIA) fell around 300 points on Monday after investors took a backstep after US ISM Manufacturing Purchasing Managers Index (PMI) figures unexpectedly declined in May. Softening US data knocked risk appetite lower as markets rethink their outlook on the US economy.

Despite an uptick in May’s S&P Global Manufacturing PMI, which rose to 51.3 compared to the expected flat hold at 50.9, investors are balking after the ISM Manufacturing PMI for the same period eased lower. May’s ISM Manufacturing PMI eased back to 48.7 from the previous month’s 49.2, falling away from the market forecast increase to 49.6.

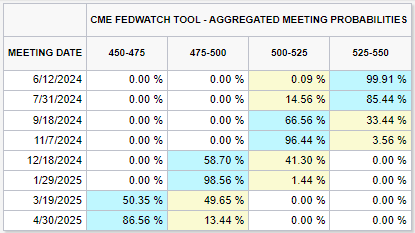

According to the CME’s FedWatch Tool, rate markets have fully priced in a first rate cut from the Federal Reserve (Fed) in November, with interest rate traders seeing over 96% odds of an initial 25-basis-point decline in the Fed Funds Rate by the Federal Open Market Committee’s (FOMC) November rate decision.

Dow Jones news

The Dow Jones initially plunged 400 points in early Monday trading, recovering slightly to -300 points on the day as investors try to recover their footing. Around two-thirds of the DJIA’s constituent equities are in the red on Monday, with losses lead by Chevron Corp. (CVX) which fell -3.35% to $156.71 per share. CVX is closely followed by Dow Inc. (DOW), which fell -3% to %55.91 per share on Monday.

Boeing Co. (BA) rebounded 2.34% on Monday, climbing to $181.91 per share. Merch & Co Inc. (MRK) followed closely behind, gaining 1.85% and rising to $127.85 per share.

Dow Jones technical outlook

Monday’s pullback chewed throw a significant portion of last Friday’s much-needed rebound, keeping the Dow Jones pinned below 39,000.00. The major equity index is still down over 4% from record highs set just above 40,000.00.

The Dow Jones is on pace to close down once more on Monday, and the index’s pullback has seen the DJIA close in the red for all but three of the last ten consecutive trading sessions. The Dow Jones still remains firmly in bull territory, but bids are edging closer to the 200-day Exponential Moving Average (EMA) at 37,247.44.

Dow Jones five minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.