- Аналітика

- Новини та інструменти

- Новини ринків

- EUR/USD jumps to 1.0880 ahead of Eurozone/US Inflation test

EUR/USD jumps to 1.0880 ahead of Eurozone/US Inflation test

- EUR/USD rises further to 1.0880 as the US Dollar extends its downside.

- The US Dollar weakens even though investors see the Fed returning to policy normalization in the last quarter of the year.

- ECB policymakers refuse to commit to more rate cuts after June.

EUR/USD posts a fresh weekly high at 1.0880 in Tuesday’s European session. The major currency pair strengthens amid soft US Dollar (USD) and deepening uncertainty over the pace at which the European Central Bank (ECB) will reduce key borrowing rates after the June meeting.

The US Dollar Index (DXY), which tracks the US Dollar’s value against six major currencies, extends its decline to 104.40. The US Dollar is facing the heat even though investors’ expectations for the Federal Reserve (Fed) reducing interest rates from the September meeting have faded significantly. The CME FedWatch tool shows that the probability of the Fed maintaining the current policy framework in September has increased to 50% compared with the roughly 35% seen a week before.

The strong United States (US) economic outlook and policymakers’ hawkish guidance on interest rates have forced traders to pare rate bets. This week, market speculation for Fed rate cuts will be guided by the core Personal Consumption Expenditure price index (PCE) data for April, which will be published on Friday. The core PCE inflation data, which is the Fed’s preferred inflation measure, is estimated to have remained steady on a monthly and annual basis.

Daily digest market movers: EUR/USD capitalizes on soft US Dollar

- EUR/USD extends its winning streak for the third trading day on Tuesday. The shared currency pair jumps to 1.0880 as debate over the path of rate cuts by the European Central Bank has deepened. The ECB is all set to deliver an interest rate cut in its monetary policy meeting on June 6, barring no surprise. Therefore, investors discuss how far and at what pace the ECB will ease its monetary policy after June.

- ECB policymakers refuse to commit to any pre-defined rate-cut path and prefer to remain data-dependent. Meanwhile, market speculation for ECB rate cuts for the entire year has also been impacted as a few policymakers have warned that the adaptation of an aggressive policy easing could revamp price pressures again. Investors now expect that the ECB will lower key borrowing costs one more time after June. A week ago, investors were expecting three rate cuts in 2024 while expecting six rate cuts at the beginning of the year.

- On Monday, ECB policymaker and Governor of the French central bank François Villeroy de Galhau said in an interview with German newspaper Boersen Zeitung that the June rate cut is a done deal and discussions are about how far and fast interest rates will come down. Villeroy pushed back suggestions of one rate cut each quarter and said: "I don't say that we should commit already in July, but let us keep our freedom on the timing and pace."

- On the same day, ECB Chief economist Philip Lane said in a speech in Dublin that the pace at which interest rates will be reduced depends on the strength of the underlying inflation demand, Reuters reported. The absence of upward surprises in inflation and demand will allow the ECB to deploy an aggressive rate-cut approach, while upside risks to inflation and demand would force the ECB to ease interest rates gradually.

- This week, the major trigger for the Euro’s price action will be the Eurozone preliminary inflation data for May, which will be published on Friday. The inflation data will provide fresh cues about whether the ECB will extend the rate-cut spell to July. But before that, investors will focus on the preliminary May inflation reading for Germany, which will be released on Wednesday. Monthly headline and harmonized inflation is expected to have grown at a slower rate by 0.2%. The annual headline inflation is estimated to have accelerated to 2.7% from 2.4% in April.

Technical Analysis: EUR/USD prints a fresh weekly high at 1.0880

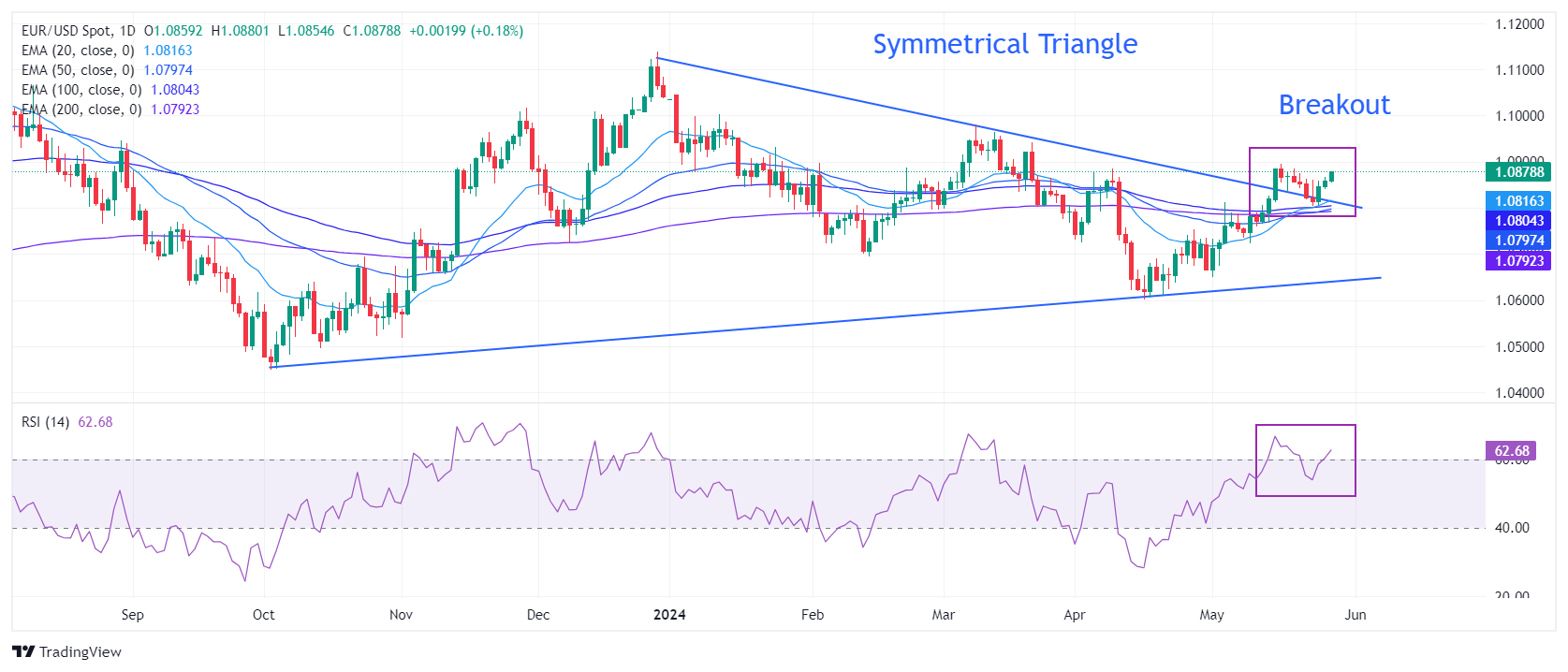

EUR/USD climbs to 1.0880 ahead of crucial Eurozone/US inflation data. The major currency pair indicates broader strength as it firmly holds the breakout of the Symmetrical Triangle chart pattern formed on a daily timeframe.

The shared currency pair’s near-term outlook remains firm as it trades well above all short-to-long-term Exponential Moving Averages (EMAs).

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside, has faded for now.

The major currency pair is likely to recapture a two-month high around 1.0900. A decisive break above this level would drive the asset towards the March 21 high at around 1.0950 and the psychological resistance of 1.1000. However, a downside move below the 200-day EMA at 1.0800 could push it further down.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.