- Аналітика

- Новини та інструменти

- Новини ринків

- GBP/JPY edges higher after UK housing data

GBP/JPY edges higher after UK housing data

- GBP/JPY rises after data shows UK house prices recovering for the sixth consecutive month.

- The Yen side of the pair weakens as bets of a BoJ rate hike in March fade.

- Technically GBP/JPY is threatening to pullback in the midst of a strong uptrend.

The GBP/JPY is up almost two tenths of a percent, trading in the mid 189.00s during the European session on Thursday after the Pound Sterling (GBP) side of the pair was buoyed by the release of British data which revealed a recovery in UK house prices in February.

The data follows on from the UK’s positive monthly real GDP print released on Wednesday, which showed the UK economy growing by 0.2% in January after declining 0.1% in December. The data stoked hopes the country may be exiting from its technical recession triggered by the dismal growth performance in the last quarter of 2023.

An Englishman’s house is his castle

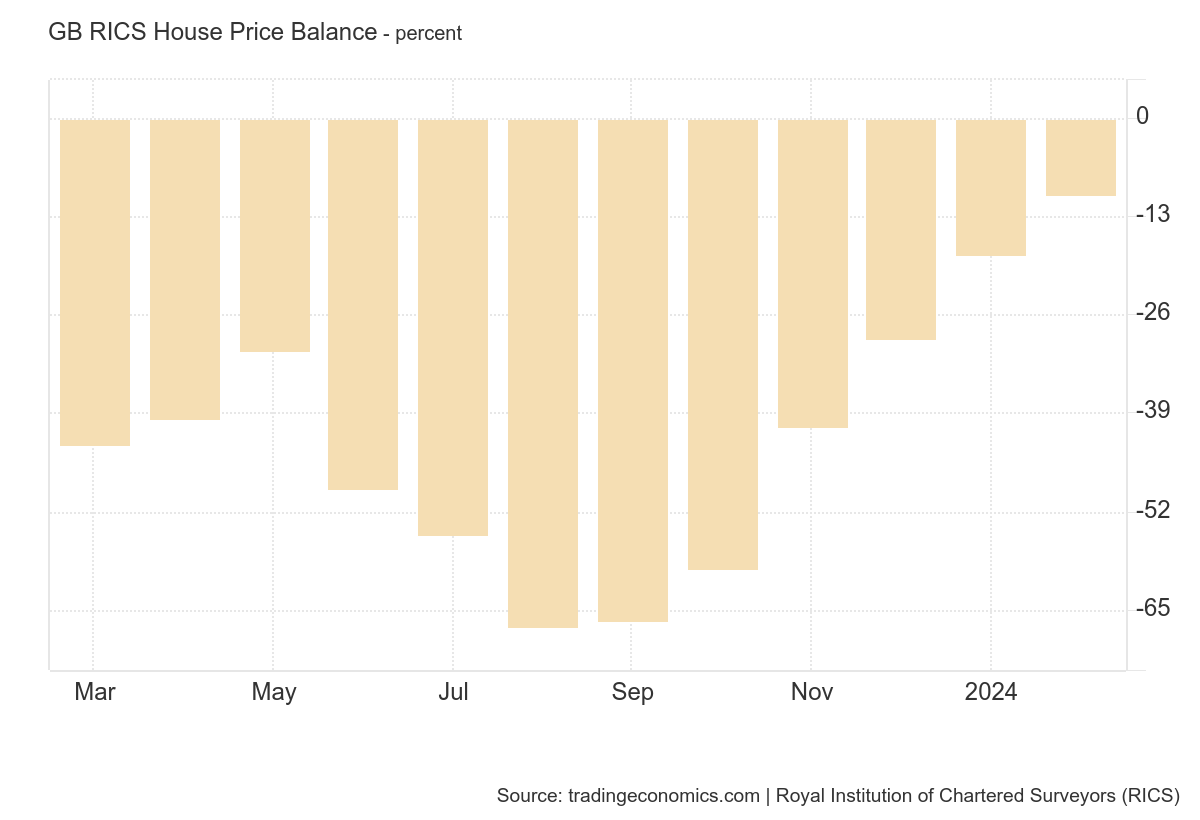

The RICS Housing Price Balance, a survey of surveyors conducted by the Royal Institute of Chartered Surveyors (RICS) showed a rise to minus 10 in February from minus 18 in January, and higher than the minus 11 forecast. It marks the sixth month in a row that house prices have recovered in the UK and is the least negative reading since October 2022.

GBP/JPY holds ground after Yen slides on fading BoJ bets

The Japanese Yen (JPY) side of GBP/JPY, meanwhile, remains on the defensive amidst a positive risk-on environment on Thursday and after traders reduced their bets the Bank of Japan (BoJ) would start to raise interest rates imminently.

The Japanese media had been reporting BoJ officials as indicating the March meeting, next Tuesday, was being earmarked as the moment for an interest rate hike.

Recent wage negotiations between Japanese unions and large corporations like Toyota have led to record wage increases, which are expected to be inflationary and further urge an increase in interest rates.

BoJ Governor Kazuo Ueda, however, said earlier this week that the central bank will seek an exit from easy policy only when achievement of 2% inflation is in sight, cooling bets for an early hike.

The Japanese Yen has become a favorite funding currency in which it is borrowed and sold to buy currencies that offer higher interest returns. If the BoJ begins putting up interest rates the Yen will lose its appeal as a funding currency, leading to less Yen selling and a stronger JPY.

Uptrend could see a pullback

GBP/JPY is in a long-term uptrend with peaks and troughs getting progressively higher. This favors bullish bets and the pair will probably continue rising, although there are some important caveats to that view.

Firstly, the weekly chart is showing bearish divergence between price action and Momentum. Price has been making higher highs since June 2023 whilst momentum, as measured by the Relative Strength Index (RSI), has not, reflecting underlying weakness, and suggesting an increased chance of a pullback evolving.

Pound Sterling versus Japanese Yen: Weekly chart

It’s too early to say a deeper correction will unfold but if this week prints red, it would form a Japanese Three Black Crows bearish reversal pattern which could indicate the possibility of more downside evolving.

If a pullback does evolve it would probably see GBP/JPY fall to support near the 50-week Simple Moving Average (SMA) at 181.60.

Another bearish sign is that GBP/JPY has formed an Ascending Broadening Wedge pattern, which suggests an increased risk of a reversal in the uptrend, if price breaks below the lower borderline of the pattern at 180.80-90.

A break above the 191.32 highs would provide confirmation the dominant bull trend was intact and continuing higher. Although it looks overstretched, such a move is still possible given the bullishness of the chart. The next upside target from there would be resistance expected at the 195.88 highs of 2015.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.