- Аналітика

- Новини та інструменти

- Новини ринків

- Swiss Franc set to weaken as SNB drops strong-Franc policy

Swiss Franc set to weaken as SNB drops strong-Franc policy

- The Swiss Franc is forecast to fall as the Swiss National Bank (SNB) drops its strong FX policy.

- The central bank had previously strengthened the Franc as a means of subduing inflation.

- The SNB is jettisoning the approach as it considers the CHF is “too strong” for Swiss exporters.

The Swiss Franc (CHF) trades in a range in the upper 0.8700s against the US Dollar (USD) on Wednesday. Overall the outlook is not particularly positive for the Swiss Franc given the policy stance of its central bank, the Swiss National Bank (SNB), which does not want to encourage a strong Franc any longer.

Risk appetite is recovering during the European session with the DAX, CAC 40 and FTSE 100 all up on the day. The positive-risk backdrop is also not helpful to the Swiss Franc as it is a safe-haven.

Swiss Franc at risk from SNB policy approach

Swiss Franc’s upside is likely to be capped as the Swiss National Bank (SNB) changes its policy to the currency. Previously it had strengthened the CHF to subdue inflation, however, recently SNB Chairman Thomas Jordan said the Franc has become unpalatably strong for Swiss businesses, many of whom are exporters.

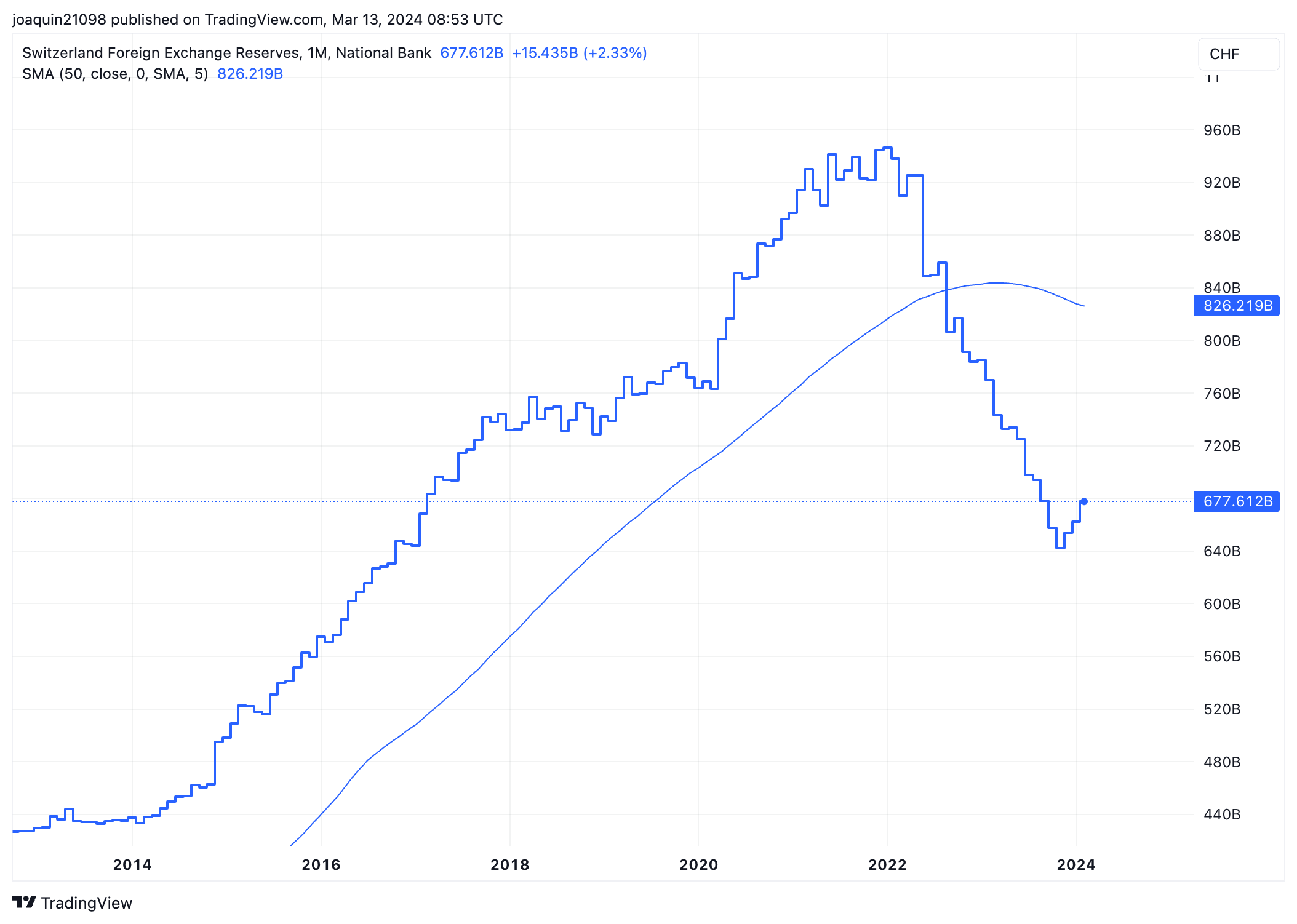

His comments reflect the data on Switzerland Foreign Exchange Reserves (CHFER), which shows non-CHF FX reserves have been recovering since the autumn of 2023. This could be a sign the SNB is selling the Swiss Franc to purchase other currencies, with the aim of dampening CHF’s value.

Switzerland Foreign Exchange Reserves: Monthly chart

According to analysts at HSBC, the Swiss Franc is likely to weaken against the US Dollar over the near term, since “FX strength is no longer a tool or policy aspiration,” for the SNB, and global equity markets are going from strength to strength.

On the Horizon

Swiss Producer and Import Prices for February are the next key release for the Swiss Franc, although they do not generally have a big impact on the exchange rate. An unexpected rise in the metric, however, which comes out at 7:30 GMT on Thursday, would support the Swiss Franc and vice versa for a fall. Previous results showed a 2.3% fall YoY and a 0.5% decline MoM in January.

US Producer Prices Ex Food & Energy for February, released on Thursday at 12:30 GMT, could also impact the US Dollar and USD/CHF. Current expectations are for a slowdown to 1.9% YoY from the 2.0% increase seen in January. Similarly, US Retail Sales data, released at the same time, could also rock US pairs.

Technical Analysis: Swiss Franc versus US Dollar pinned below trendline

The USD/CHF – the number of Swiss Francs one US Dollar can buy – is stuck below several key technical levels.

The first of these is the falling trendline of a descending channel at around 0.8780. The second, the key 50-week Simple Moving Average (SMA) at 0.8850 (not shown in the chart). These are touch resistance levels and it is possible this could mark the inflection point of a reversal where the pair starts moving down again.

US Dollar vs Swiss Franc: 4-hour chart

USD/CHF has pierced below the key February 22 low of 0.8742 but failed to close below. Nevertheless, this suggests weakness and raises the possibility of a deeper decline unfolding to 0.8645.

A break below that level would probably indicate a reversal of the short-term trend. The next target to the downside would be 0.8645, followed by the January 31 lows of 0.8551.

There is still a fairly strong possibility USD/CHF could recover and resume its trend higher. A break above the trendline and the 0.8892 high would indicate a continuation of the short-term uptrend to a possible target at 0.9056.

Swiss Franc FAQs

What key factors drive the Swiss Franc?

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

Why is the Swiss Franc considered a safe-haven currency?

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

How do decisions of the Swiss National Bank impact the Swiss Franc?

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

How does economic data influence the value of the Swiss Franc?

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

How does the Eurozone monetary policy affect the Swiss Franc?

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.