- Аналітика

- Новини та інструменти

- Новини ринків

- Canadian Dollar eases from Tuesday highs after markets pivot into Greenback

Canadian Dollar eases from Tuesday highs after markets pivot into Greenback

- Canadian Dollar pares back recent gains, but price action remains nearby.

- Canada sees GDP figures on Wednesday, Manufacturing PMI on Thursday.

- US JOLTS beat trims rate cut bets ahead of Wednesday’s FOMC policy statement.

The Canadian Dollar (CAD) shed some points on Tuesday after a moderate data-beat for December’s US JOLTS Job Openings pushed investors back into the US Dollar (USD).

Canada brings November’s Gross Domestic Product (GDP) figures on Wednesday, which will be followed by the Canadian S&P Global Manufacturing Purchasing Managers Index (PMI) data on Thursday.

The broad market focus this week continues to be Wednesday’s US Federal Reserve (Fed) rate call. Friday brings another print for the US Nonfarm Payrolls (NFP).

Daily digest market movers: Canadian Dollar pulls back from near-term highs

- Canadian Dollar is largely mixed on Tuesday but moderately down against Tuesday’s top performers in the US Dollar and the Euro (EUR).

- US JOLTS Job Openings in December came in at 9.026 million versus the expected decline to 8.75 million from November’s 8.925 million (revised from 8.79 million).

- Initial prints in US labor figures continue to see revisions on an ongoing basis, JOLTS has been revised every month since at least October 2013.

- JOLTS data to see further adjustments from March 6 when the Bureau of Labor Statistics (BLS) incorporates annual updates to current employment statistics as seasonal adjustment factors.

- JOLTS print pushes rate cut expectations further down, rate swaps now see 62% chance of no rate cut from the Fed in March, 17% chance of no rate move in April, according to CME’s FedWatch Tool.

- Investors will be looking for a firmer pivot from Fed Chairman Jerome Powell on Wednesday.

- Fed Monetary Policy Statement slated for 19:00 GMT Wednesday, Federal Open Market Committee (FOMC) Press Conference scheduled for 30 minutes later.

- Canadian GDP forecast to tick up slightly from 0.0% to 0.1% in November.

- Friday’s US NFP forecast to slip to 180K in January from December’s 216K.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.06% | 0.40% | 0.11% | 0.44% | 0.26% | 0.31% | 0.24% | |

| EUR | 0.06% | 0.46% | 0.18% | 0.51% | 0.32% | 0.37% | 0.30% | |

| GBP | -0.40% | -0.45% | -0.28% | 0.05% | -0.13% | -0.09% | -0.15% | |

| CAD | -0.10% | -0.15% | 0.30% | 0.33% | 0.16% | 0.21% | 0.14% | |

| AUD | -0.43% | -0.49% | -0.03% | -0.32% | -0.18% | -0.12% | -0.18% | |

| JPY | -0.25% | -0.30% | 0.15% | -0.14% | 0.16% | 0.06% | -0.02% | |

| NZD | -0.29% | -0.35% | 0.10% | -0.18% | 0.15% | -0.03% | 0.01% | |

| CHF | -0.24% | -0.30% | 0.15% | -0.12% | 0.21% | 0.03% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar pulls back from recent highs against US Dollar

The Canadian Dollar (CAD) is moderating on Tuesday, gaining a quarter to a third of a percent against the Pound Sterling (GBP) and the Australian Dollar (AUD), while declining around a sixth of a percent against the US Dollar and the Euro.

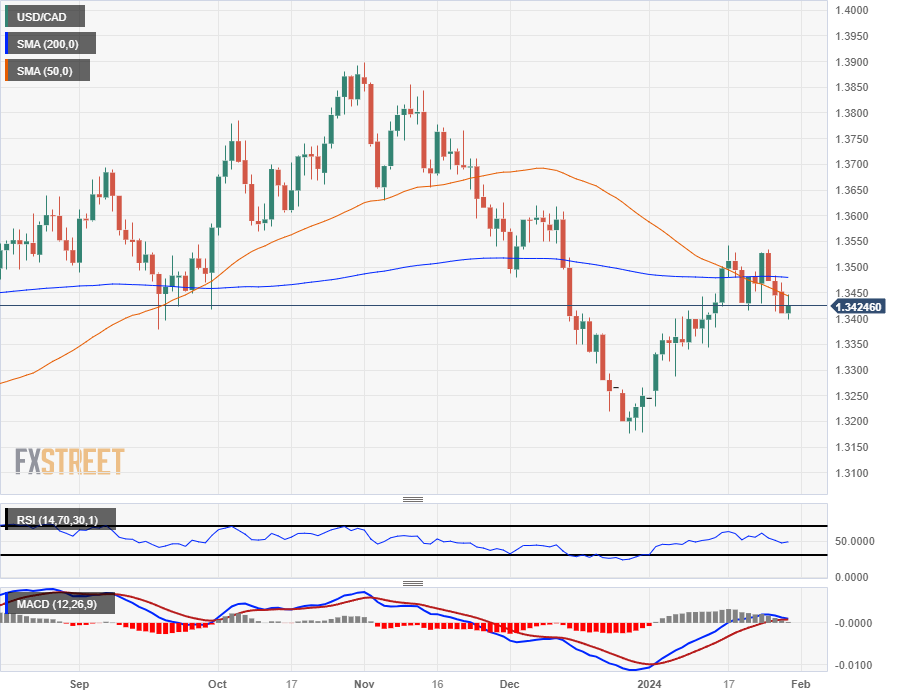

The USD/CAD tested into the low side at the 1.3400 handle early Tuesday before a Greenback rally made up for near-term losses as USD/CAD splashes around the familiar 1.3430 level.

USD/CAD continues to drift into the low side as the pair grapples with a bearish crossover of the 50-day and 200-day Simple Moving Averages (SMA), pricing in a near-term technical ceiling near the 1.3500 handle.

A continued drag down will see the USD/CAD crack through 1.3400 to make a fresh run at the last swing low near December’s bottom bid of 1.3177.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.