- Аналітика

- Новини та інструменти

- Новини ринків

- Mexican Peso struggles as US Dollar gains momentum

Mexican Peso struggles as US Dollar gains momentum

- Mexican Peso at the mercy of US economic data, with traders waiting for the Fed’s last meeting minutes.

- Mexico's Manufacturing PMI dips to 52.0, exerting pressure on the Peso amid positive business confidence data.

- USD/MXN recovers to over 17.00 after a dip, fueled by a rise in US Treasury yields and strong sentiment towards the US Dollar

The Mexican Peso (MXN) began the year on a lower note against the US Dollar (USD) after the exotic pair dipped to a three-month low on December 28 of 16.86. Nevertheless, a rise in US Treasury Bond yields and overall bullish sentiment towards the Greenback (USD) underpins the pair above the 17.05 area for a 0.21% daily gain.

On Tuesday, Mexico’s economic docket featured the S&P Global Manufacturing PMI for December, which printed 52.0, below November’s 52.5, and weighed on the Mexican currency. During the day, business confidence improved while USD/MXN traders digested economic data from the United States (US) revealed at around 15:00 GMT. However, market players await the release of the latest Federal Reserve’s (Fed) meeting minutes.

Daily digest market movers: Mexican Peso losses steam on positive US data

- Commentary from Richmond Federal Reserve (Fed) President Thomas Barkin supported the US Dollar after he stated the US central bank is making real progress in taming inflation. He added that although the economy is headed for a soft landing, risks remain, adding that the potential for additional rate hikes is on the table.

- US economic docket revealed the ISM Manufacturing PMI came in at 47.4, exceeding expectations of 47.1, while the prior reading was 46.7.

- At the same time, the November Job Openings and Labor Turnover Survey (JOLTS) report rose less than estimates of 8.85 million to 8.79 million, while October’s figures were upwardly revised to 8.852 million.

- Later, December’s Federal Open Market Committee (FOMC) minutes will be scrutinized by traders, following Federal Reserve Chairman Jerome Powell’s dovish pivot that fueled a stock rally towards the end of 2023. Fed officials estimate three rate cuts toward the end of December 2024, as depicted by the Summary of Economic Projections (SEP).

- Money market futures data provided by the Chicago Board of Trade (CBOT) shows that traders remain confident the Fed would slash rates by 150 basis points towards the year’s end.

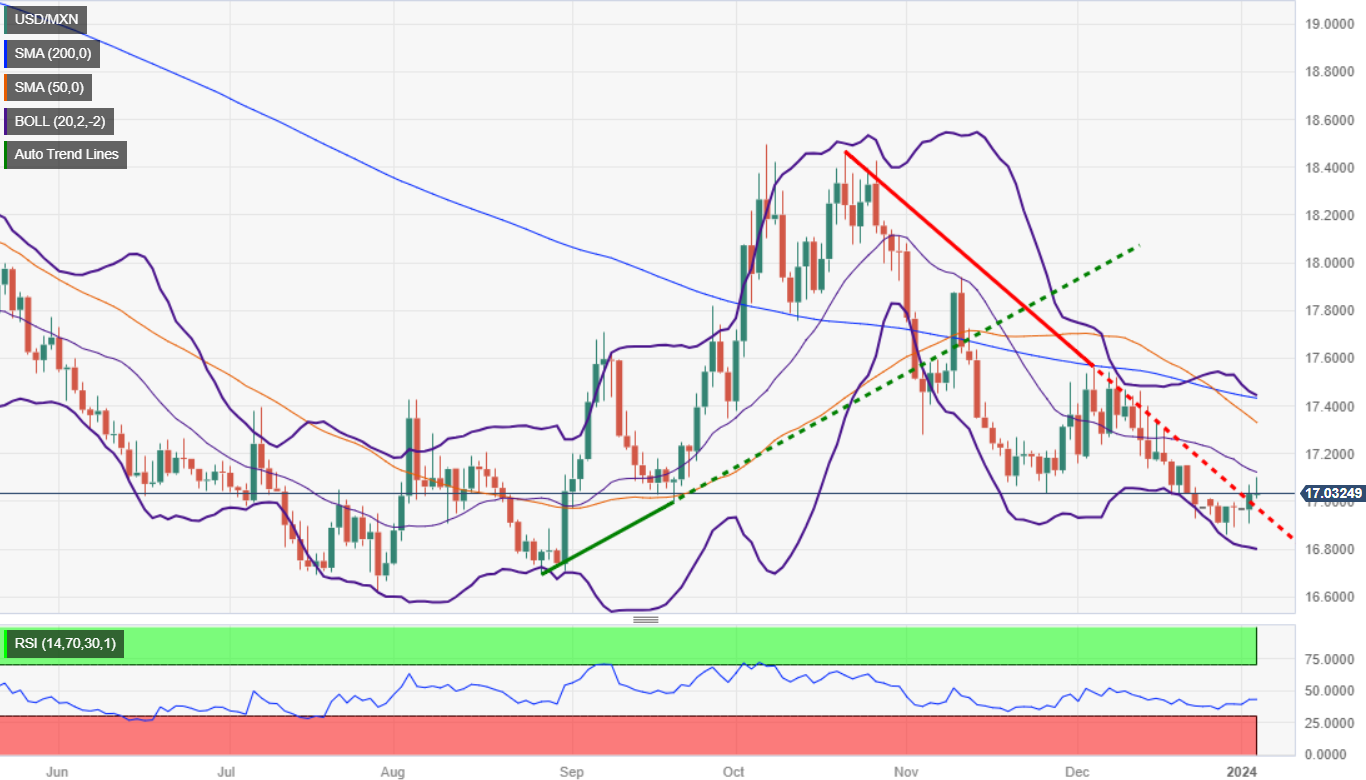

Technical analysis: Mexican Peso stays bearish despite USD/MXN buyers' effort

From a technical perspective, the USD/MXN remains bearishly biased, though sellers need a daily close below the November 27 low of 17.03 to increase their chances of pushing the price back below the 17.00 figure. Once achieved, that could pave the way to test the waters at around 16.86, ahead of falling toward last year’s low of 16.62.

On the flip side, if USD/MXN stays above the 17.00 figure, that could pave the way for a move toward the 17.37-17.43 area, the confluence of the 50, 100, and 200-day Simple Moving Averages (SMAs). If that area is surpassed, expect the USD/MXN to reach the psychological 17.50 area, ahead of the November 10 high at 17.93.

Also read: Mexican Peso Price Annual Forecast: Which factor would impact most in 2024, economics or politics?

USD/MXN Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.