- Аналітика

- Новини та інструменти

- Новини ринків

- Euro extends rebound, targets 1.0600 ahead of US key data

Euro extends rebound, targets 1.0600 ahead of US key data

- The Euro picks up extra pace against the US Dollar.

- Stocks in Europe open Monday’s session with decent gains.

- EUR/USD prints humble gains near 1.0580.

- The USD Index (DXY) meets initial hurdle near 106.30.

- Final Manufacturing PMIs in the euro zone come next.

- The ISM Manufacturing PMI takes centre stage across the pond.

The Euro (EUR) gains ground against the US Dollar (USD) on Monday, motivating the EUR/USD to reclaim the area around 1.0590 and advance for the third session in a row following the opening bell on the old continent.

Meanwhile, the Greenback appears under some pressure, just above the 106.00 hurdle when measured by the USD Index (DXY). This is followed by the extended recovery in the risk complex seen in the latter part of last week.

Looking at the fixed-income markets on both sides of the ocean, yields appear directionless.

The monetary policy forecast remains unaltered, with investors expecting the Federal Reserve (Fed) to raise interest rates by 25 bps before the end of the year. Meanwhile, market talks about a probable stalemate in policy changes at the European Central Bank (ECB) continue, despite inflation levels that surpass the bank's objective and rising fears about a potential recession.

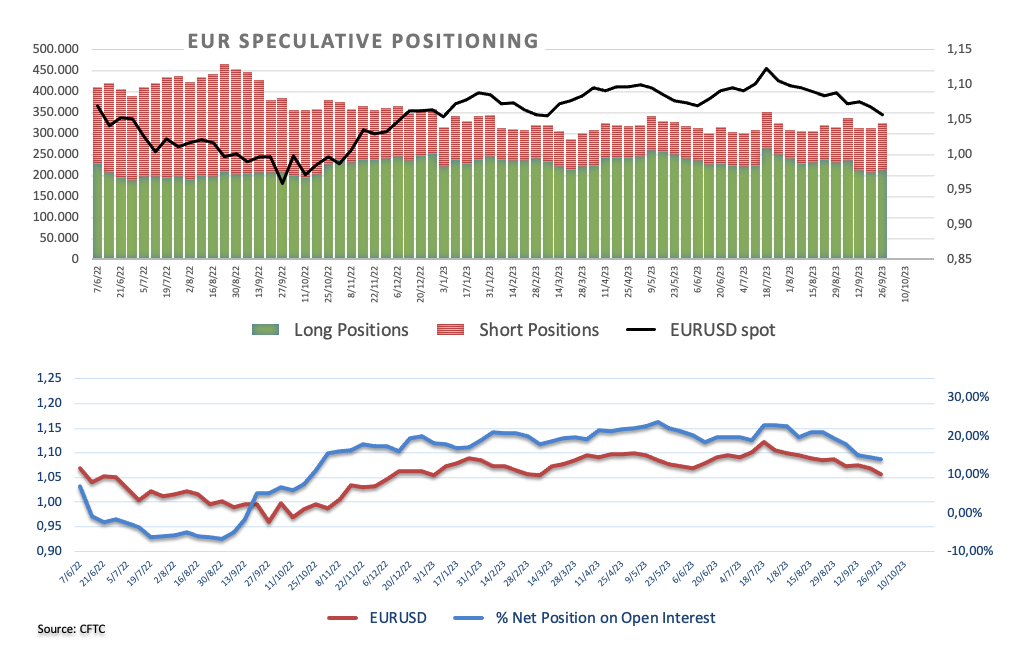

On the positioning front, EUR net longs extended the decline during the week ended on September 26, according to CFTC’s report, falling in line with the sharp sell-off observed in spot in the last few weeks.

In the domestic docket, the final Manufacturing PMIs in the eurozone are seconded by the bloc's Unemployment Rate.

In the US, all the attention is expected to be on the release of the ISM Manufacturing PMI, seconded by Construction Spending, the final S&P Global Manufacturing PMI, and speeches by Federal Reserve Bank of Philadelphia President Patrick Harker (voter, hawk), FOMC Governor Michael Barr (permanent voter, centrist), and Federal Reserve Bank of New York President John Williams (permanent voter, centrist).

Daily digest market movers: Euro appears supported by risk appetite trends

- The EUR extends the recovery against the USD.

- US and German yields show marginal price action.

- Markets factor in an extra rate hike by the Fed before year-end.

- Investors foresee an impasse at the ECB’s tightening campaign.

- Chinese PMIs came in mixed for September.

- FX intervention fears remain well and sound around USD/JPY.

Technical Analysis: Immediate support emerges at 1.0490-1.0480 band

EUR/USD looks to consolidate the rebound from last week’s lows around 1.0490.

If the EUR/USD rebound gets more serious, the pair should encounter the next up-barrier at the September 12 high of 1.0767, before reaching the crucial 200-day Simple Moving Average (SMA) at 1.0827. If the pair breaks beyond this level, it may set up a challenge of the transitory 55-day SMA at 1.0843, ahead of the August 30 top at 1.0945 and the psychological barrier of 1.1000. The surpass of the latter might prompt the pair to test the August 10 peak of 1.1064 ahead of the July 27 high of 1.1149 and the 2023 top of 1.1275 seen on July 18.

On the downside, the September 28 low of 1.0491 emerges as the next support prior to the 2023 low of 1.0481 from January 6.

As long as the EUR/USD remains below the 200-day SMA, the possibility of more negative pressure exists.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.