- Аналітика

- Новини та інструменти

- Новини ринків

- Euro remains under pressure and revisits 1.0550, new six-month lows

Euro remains under pressure and revisits 1.0550, new six-month lows

- The Euro maintains the bearish tone vs. the US Dollar.

- Stocks in Europe open Wednesday’s session in a mixed tone.

- EUR/USD slips back to new lows near 1.0550.

- The USD Index (DXY) extends its rally to new 2023 peaks.

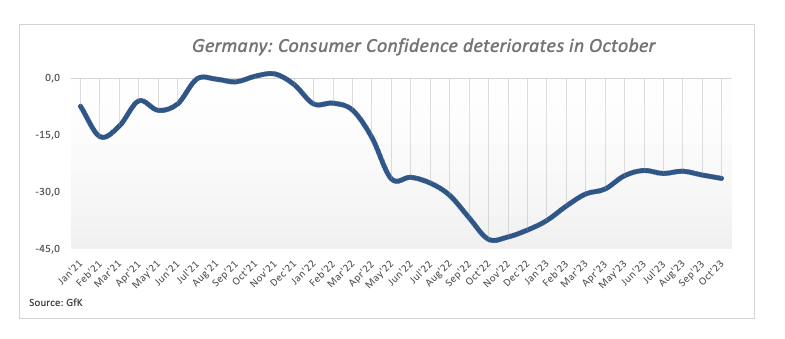

- Consumer Confidence in Germany worsens in October.

- US Durable Goods Orders take centre stage across the pond.

The Euro (EUR) experiences an increasing bearish sentiment against the US Dollar (USD), prompting the EUR/USD to decline and reach fresh six-month lows near 1.0550 on Wednesday.

Conversely, the Greenback continues to strengthen for the fourth consecutive session, reaching new highs for 2023 around 106.30 when gauged by the USD Index (DXY), an area last seen in late November 2022.

The further decline in the pair this time is accompanied by a corrective move in US and German yields, which abandon the area of recent multi-year highs despite unchanged expectations in the monetary policy scenario.

Regarding the latter, investors persist in factoring in an additional 25 bp rate increase by the Federal Reserve (Fed) by year-end. Meanwhile, discussions in the market continue to lean towards an impasse at the European Central Bank (ECB), even in light of persistent inflation levels significantly surpassing the bank's target and concerns about a recession.

In the domestic calendar, Consumer Confidence in Germany weakened to -26.5, according to GfK.

In the US, Mortgage Applications tracked by MBA are due in the first turn, seconded by the more relevant Durable Goods Orders for the month of August.

Daily digest market movers: Euro leaves the door open to extra losses

- The EUR keeps the offered stance unchanged vs. the USD.

- US and German yields correct lower across different maturities.

- Investors continue to see the Fed raising rates by 25 bps before end of 2023.

- Markets speculate on probable interest rate cuts by the Fed in Q3 2024.

- Market chatter over a pause by the ECB remain on the rise.

- ECB’s Frank Elderson says rates haven’t necessarily peaked.

- Intervention concerns remain well and sound around USD/JPY.

- BoJ Minutes favoured the continuation of the current monetary stance.

Technical Analysis: Euro trades closer to 1.0516

The EUR/USD continues to demonstrate signs of weakness and is trading in close proximity to the March low, around 1.0515.

On the downside, immediate support for the EUR/USD can be found at the March low of 1.0516 (March 15), followed by the 2023 low of 1.0481 (January 6).

Regarding potential resistance levels, there is a minor obstacle at the weekly high of 1.0767 (September 12), and a more significant barrier at the 200-day SMA at 1.0828. If the pair manages to break above this level, it could pave the way for further recovery, targeting the temporary 55-day SMA at 1.0879, with the possibility of reaching the weekly high of 1.0945 (August 30). Surpassing this level could shift the focus towards the psychological level of 1.1000, followed by the August peak of 1.1064 (August 10). Beyond that, the pair may retest the weekly top at 1.1149 (July 27) and potentially reach the 2023 high at 1.1275 (July 18).

However, it is essential to note that as long as the EUR/USD remains below the 200-day SMA, there is a possibility that downward pressure will persist.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.