- Аналітика

- Новини та інструменти

- Новини ринків

- USD/MXN surpasses 17.45 on high US T-bond yields, risk aversion

USD/MXN surpasses 17.45 on high US T-bond yields, risk aversion

- USD/MXN is on an uptrend, with the pair trading at 17.4904, driven by the hawkish stance of the US Federal Reserve.

- US Federal Reserve's projections indicate higher interest rates in the coming years, with rates expected to be 5.6% in 2023 and 5.1% in 2024.

- USD/MXN traders are eyeing Thursday's Bank of Mexico (Banxico) interest rate decision.

The Mexican Peso (MXN) slips further against the US Dollar (USD) amid risk aversion and high US bond yields, driving price action in the Forex markets. Expectations that interest rates in the United States (US) would remain higher for an extended period underpins the USD. The USD/MXN is trading at 17.4904 after hitting a new two-week high.

USD/MXN hits a new two-week high on the Fed’s hawkish stance, while Banxico is set to keep rates unchanged

The USD/MXN resumed its uptrend after the US Federal Reserve (Fed), despite holding rates unchanged, delivered a hawkish hold, as revealed by the “dot-plots” in the Summary of Economic Projections. Fed officials foresee rates at 5.6% in 2023 and 5.1% in 2024, higher than the 4.6% projected in June 2023.

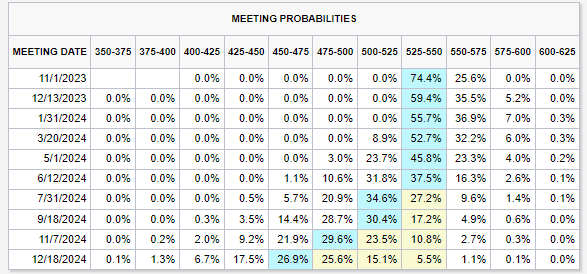

Consequently, US Treasury bond yields have skyrocketed since Wednesday, with the US 10-year benchmark note rate gaining 4.34% or 19 basis points, currently at 4.548%. Although the CME FedWatch Tool does not price in another hike by the US central bank, Fed’s policymakers emphasized that curbing inflation towards its 2% goal is their primary objective.

Source: CME FedWatch Tool

Recently, Fed officials stressed that although a soft landing could be achieved, further tightening is needed, as the Minnesota Fed President Neil Kashkari expressed on Tuesday. He said, “After potentially one more 25-basis-point federal funds rate increase later this year, the FOMC holds policy at this level long enough to bring inflation back to target in a reasonable period of time.”

Data-wise, Consumer Confidence, as the Conference Board (CB) reported, reached a four-month low. This decline is attributed to a deteriorating economic outlook for the overall economy.

Earlier, housing data was revealed, as August’s Building Permits in the US increased from July's 1.443 million to 1.541 million, indicating continued growth in construction. However, the housing market shows signs of weakness as New Home Sales plummeted by -8.7% compared to the 8% increase in July. The decline is mainly due to higher mortgage rates, as the Federal Reserve embarked on an aggressive tightening cycle that witnessed interest rates hit the 5.25%-5.505 area.

On the Mexican front, the lack of economic data left USD/MXN traders adrift to US Dollar dynamics. However, ahead of the week, the agenda will feature the Balance of Trade, Unemployment Rate, and the Bank of Mexico (Banxico) interest rate decision. On the US front, the docket would feature Fed speakers led by Bowman, Durable Goods Orders, GDP, Initial Jobless Claims, and the Fed’s preferred gauge for inflation, Core PCE.

USD/MXN Price Analysis: Technical outlook

From a technical standpoint, the USD/MXN is neutral-biased but slightly tilted to the upside, but it remains shy of registering a break to a new cycle high. That would be achieved with the exotic pair claiming the September 7 high of 17.7074, exposing the 200-day moving average (DMA) on the upside at 17.8604, followed by the psychological 18.0000 figure. Once cleared, the next resistance would emerge at the April 5 high at 18.4010, followed by the March 24 high at 18.7968.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.