- Аналітика

- Новини та інструменти

- Новини ринків

- Euro attempts some consolidation around 1.1230, Dollar rebounds

Euro attempts some consolidation around 1.1230, Dollar rebounds

- Euro keeps the trade above 1.1200 against the US Dollar.

- Stocks in Europe opened on a positive foot on Wednesday.

- EUR/USD bounces off earlier lows in the sub-12.00 yardstick.

- Final EMU CPI rose 5.5% YoY in June, Core CPI rose 5.5% YoY.

- US housing data will take centre stage later in the session.

The Euro (EUR) manages to stage a recovery after initially dropping against the U.S. Dollar (USD), allowing EUR/USD to climb back above 1.1200 amid an overall risk-off market environment.

The strengthening dollar, as evidenced by the Dollar Index (DXY) retaking the 100.00 level to hit multi-day highs around 100.30, underpins the pair’s uptick.

This comes alongside falling US yields across the board and new lows for German bund yields, suggesting rising demand for safe havens.

Looking ahead, though the Fed is perceived as nearing the end of its tightening cycle, the broad view of another 25 bps hike in July could keep the dollar supported.

Meanwhile, a rate increase by the European Central Bank (ECB) later this month is widely anticipated, but ECB officials have sounded less hawkish recently on the prospects of additional hikes beyond summer, hinting more consensus may be needed for that.

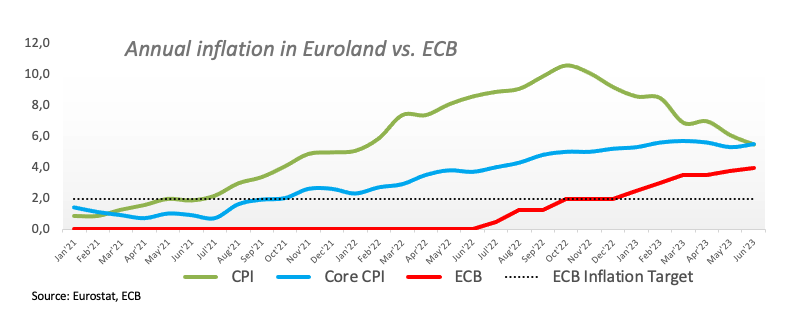

Data-wise in the region, EMU final inflation data for June showed headline inflation at 5.5% YoY and core inflation at 5.5% YoY.

In the US, Mortgage Applications and Housing Starts/Building Permits will be in focus.

Daily digest market movers: Euro bounces off lows below 1.1200

- The EUR rebounds from the sub-1.1200 area against the USD.

- EMU Final CPI, Core CPI rose 5.5% in the year to June.

- The USD Index picks up pace and surpasses the 100.00 hurdle.

- Speculation that the Fed’s July hike could be the last one runs high.

- US, German yields keep the downside well in place for yet another session.

- Traders now see the BoE’s interest rate peaking below 6%.

- UK inflation loses upside traction in June.

Technical Analysis: Euro appears supported around 1.1200

The ongoing price action in EUR/USD hints at the idea that further gains might be in store in the short-term horizon.

The pair printed a new 2023 high at 1.1275 on July 18. Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 recorded on February 10.

On the downside, the 1.1000 region emerges as a psychological support seconded by provisional support at the 55-day and 100-day SMAs at 1.0893 and 1.0871, respectively, ahead of the July low of 1.0833 (July 6). The breakdown of this region should meet the next contention area at the key 200-day SMA at 1.0674 prior to the May low of 1.0635 (May 31). South from here emerges the March low of 1.0516 (March 15) before the 2023 low of 1.0481 (January 6).

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Of note, however, is that the current pair’s overbought condition (as per the daily RSI near 75) carries the potential to spark a technical correction in the short-term horizon.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.