- Аналітика

- Новини та інструменти

- Новини ринків

- USD Index remains offered around 100.30 ahead of US data

USD Index remains offered around 100.30 ahead of US data

- The index trades in levels last seen in April 2022.

- The sell-off in the dollar accelerates post-US CPI.

- Producer Prices, weekly Claims take centre stage later.

The USD Index (DXY), which tracks the greenback vs. a basket of its main rival currencies, remains well on the defensive and tests fresh lows in the 100.30 region.

USD Index now looks at US data

The index so far retreats for the sixth consecutive session on Thursday and trades closer to the psychological support at 100.00 on the back of the persistent sell-off in the dollar, diminishing US yields across the curve and the generalized upbeat tone in the risk-linked galaxy.

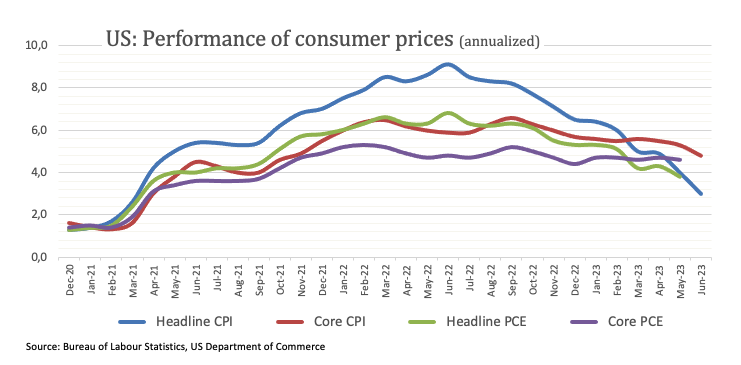

Indeed, USD has particularly accelerated its losses in response to the lower-than-expected US inflation figures during June (released on Wednesday), which in turn seem to have reignited market chatter around the likelihood that the Federal Reserve might end its tightening campaign in the near term.

In addition, the release of the Fed’s Beige Book appears to prop up the above, as it was noted that employment had increased modestly since late May and labour demand had remained healthy during the survey period. It was also reported that prices had increased at a modest pace overall, and several districts had observed some slowing in the pace of increase.

Still around US inflation, investors are expected to closely follow the publication of Producer Prices for the month of June along with the usual weekly Initial Claims.

What to look for around USD

The index continues to shed ground and gradually approaches the key support at 100.00 the figure on Thursday.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high and supported by the still tight US labour market and despite the persevering disinflationary pressures.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: Producer Prices, Initial Jobless Claims (Thursday) – Advanced Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is down 0.16% at 100.39 and faces the next support at 100.34 (2023 low July 13) followed by 100.00 (round level) and finally 99.81 (weekly low April 21 2022). On the other hand, the breakout of 103.54 (weekly high June 30) would open the door to 104.44 (200-day SMA) and then 104.69 (monthly high May 31).

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.